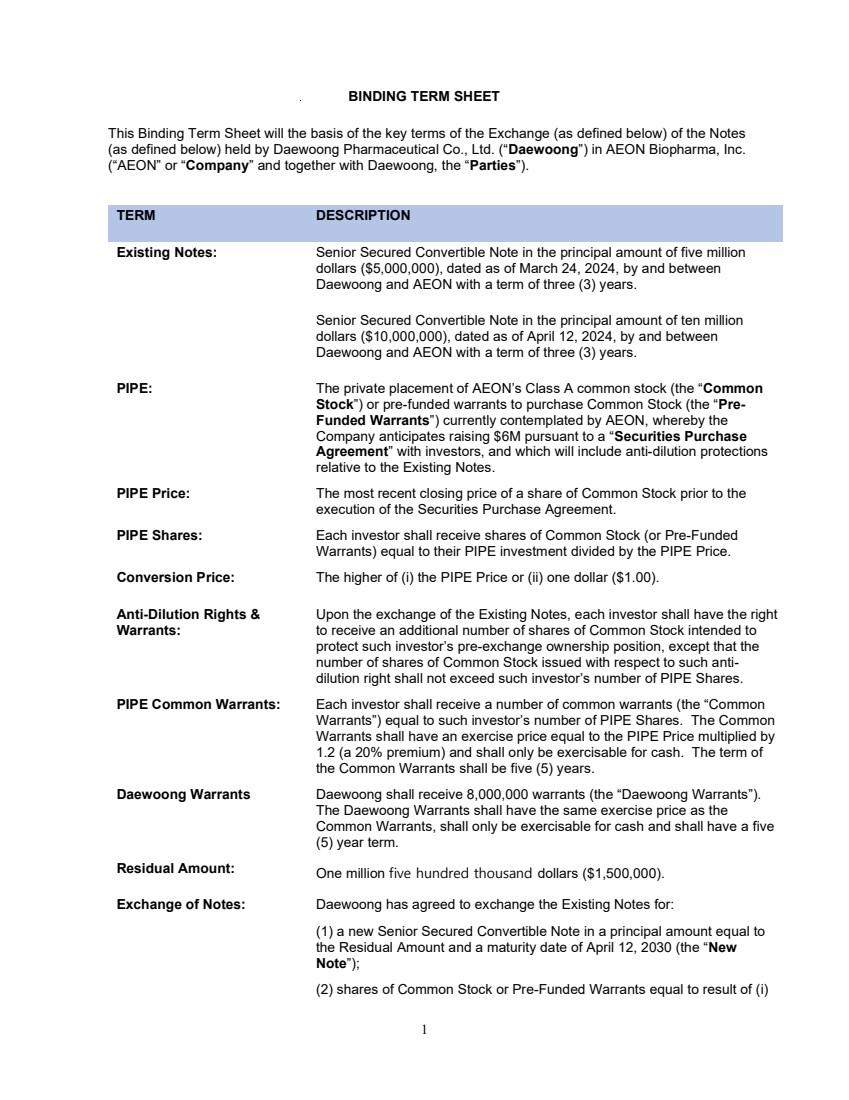

| 1 BINDING TERM SHEET This Binding Term Sheet will the basis of the key terms of the Exchange (as defined below) of the Notes (as defined below) held by Daewoong Pharmaceutical Co., Ltd. (“Daewoong”) in AEON Biopharma, Inc. (“AEON” or “Company” and together with Daewoong, the “Parties”). TERM DESCRIPTION Existing Notes: Senior Secured Convertible Note in the principal amount of five million dollars ($5,000,000), dated as of March 24, 2024, by and between Daewoong and AEON with a term of three (3) years. Senior Secured Convertible Note in the principal amount of ten million dollars ($10,000,000), dated as of April 12, 2024, by and between Daewoong and AEON with a term of three (3) years. PIPE: The private placement of AEON’s Class A common stock (the “Common Stock”) or pre-funded warrants to purchase Common Stock (the “Pre-Funded Warrants”) currently contemplated by AEON, whereby the Company anticipates raising $6M pursuant to a “Securities Purchase Agreement” with investors, and which will include anti-dilution protections relative to the Existing Notes. PIPE Price: The most recent closing price of a share of Common Stock prior to the execution of the Securities Purchase Agreement. PIPE Shares: Each investor shall receive shares of Common Stock (or Pre-Funded Warrants) equal to their PIPE investment divided by the PIPE Price. Conversion Price: The higher of (i) the PIPE Price or (ii) one dollar ($1.00). Anti-Dilution Rights & Warrants: Upon the exchange of the Existing Notes, each investor shall have the right to receive an additional number of shares of Common Stock intended to protect such investor’s pre-exchange ownership position, except that the number of shares of Common Stock issued with respect to such anti-dilution right shall not exceed such investor’s number of PIPE Shares. PIPE Common Warrants: Each investor shall receive a number of common warrants (the “Common Warrants”) equal to such investor’s number of PIPE Shares. The Common Warrants shall have an exercise price equal to the PIPE Price multiplied by 1.2 (a 20% premium) and shall only be exercisable for cash. The term of the Common Warrants shall be five (5) years. Daewoong Warrants Daewoong shall receive 8,000,000 warrants (the “Daewoong Warrants”). The Daewoong Warrants shall have the same exercise price as the Common Warrants, shall only be exercisable for cash and shall have a five (5) year term. Residual Amount: One million five hundred thousand dollars ($1,500,000). Exchange of Notes: Daewoong has agreed to exchange the Existing Notes for: (1) a new Senior Secured Convertible Note in a principal amount equal to the Residual Amount and a maturity date of April 12, 2030 (the “New Note”); (2) shares of Common Stock or Pre-Funded Warrants equal to result of (i) |

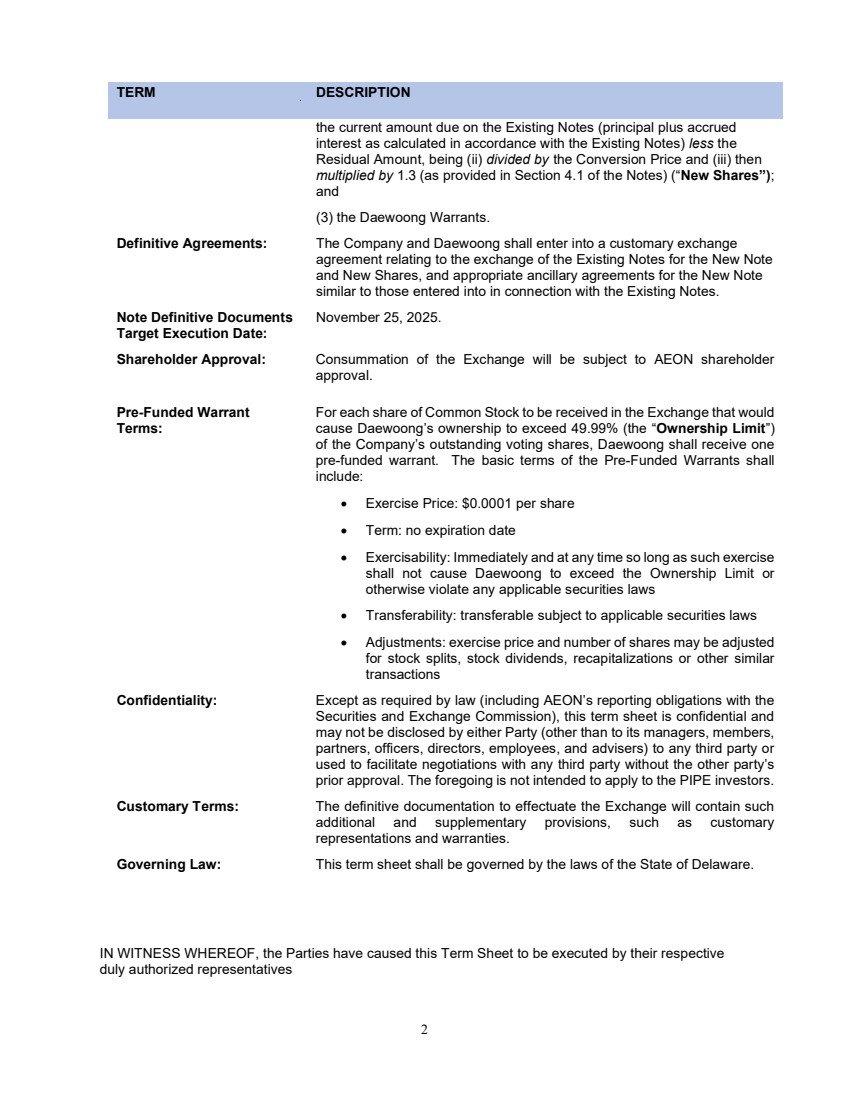

| 2 TERM DESCRIPTION the current amount due on the Existing Notes (principal plus accrued interest as calculated in accordance with the Existing Notes) less the Residual Amount, being (ii) divided by the Conversion Price and (iii) then multiplied by 1.3 (as provided in Section 4.1 of the Notes) (“New Shares”); and (3) the Daewoong Warrants. Definitive Agreements: The Company and Daewoong shall enter into a customary exchange agreement relating to the exchange of the Existing Notes for the New Note and New Shares, and appropriate ancillary agreements for the New Note similar to those entered into in connection with the Existing Notes. Note Definitive Documents Target Execution Date: November 25, 2025. Shareholder Approval: Consummation of the Exchange will be subject to AEON shareholder approval. Pre-Funded Warrant Terms: For each share of Common Stock to be received in the Exchange that would cause Daewoong’s ownership to exceed 49.99% (the “Ownership Limit”) of the Company’s outstanding voting shares, Daewoong shall receive one pre-funded warrant. The basic terms of the Pre-Funded Warrants shall include: Exercise Price: $0.0001 per share Term: no expiration date Exercisability: Immediately and at any time so long as such exercise shall not cause Daewoong to exceed the Ownership Limit or otherwise violate any applicable securities laws Transferability: transferable subject to applicable securities laws Adjustments: exercise price and number of shares may be adjusted for stock splits, stock dividends, recapitalizations or other similar transactions Confidentiality: Except as required by law (including AEON’s reporting obligations with the Securities and Exchange Commission), this term sheet is confidential and may not be disclosed by either Party (other than to its managers, members, partners, officers, directors, employees, and advisers) to any third party or used to facilitate negotiations with any third party without the other party’s prior approval. The foregoing is not intended to apply to the PIPE investors. Customary Terms: The definitive documentation to effectuate the Exchange will contain such additional and supplementary provisions, such as customary representations and warranties. Governing Law: This term sheet shall be governed by the laws of the State of Delaware. IN WITNESS WHEREOF, the Parties have caused this Term Sheet to be executed by their respective duly authorized representatives |

| 3 DAEWOONG PHARMACEUTICAL CO., LTD AEON BIOPHARMA, INC. /s/ Seongsee Park /s/ Robert Bancroft Name: Seongsee Park Name: Robert Bancroft Title: CEO & President Title: CEO & President Date: November 12, 2025 Date: November 12, 2025 |