| Advancing a Proven Molecule Toward Full-Label Biosimilar Approval Fresh Data | New Capital | Simplified Structure – Positioned for Acceleration CORPORATE PRESENTATION / DECEMBER 2025 NYSEAMERICAN: AEON © 2 0 2 5 A E O N B I O P H A R M A |

| This presentation includes forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements concerning possible or assumed future actions, business strategies, events or results of operations, illustrative timelines and targets for financing and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may involve known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of AEON Biopharma, Inc. (“AEON”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. The forward-looking statements in this presentation are only predictions. AEON has based these forward-looking statements largely on AEON’s current expectations and projections about future events and financial trends that AEON believes may affect its business, financial condition and results of operations. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by AEON and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the outcome of any meetings with any regulatory authorities, including the FDA’s review of the Company's biosimilar meetings and document submissions, (ii) the outcome of any legal proceedings that may be instituted against AEON or others; (iii) AEON’s future capital requirements; (iv) AEON’s ability to raise financing in the future; (v) AEON’s ability to continue to meet continued stock exchange listing standards; (vi) the ability of AEON to implement its strategic initiatives, including the continued development of ABP-450 and potential submission of a Biologics License Application as a biosimilar for therapeutic uses of ABP-450; (vii) the ability of AEON to satisfy regulatory requirements; (viii) the ability of AEON to defend its intellectual property or avoid infringement of existing intellectual property; (ix) the possibility that AEON may be adversely affected by other economic, business, regulatory, and/or competitive factors; (x) AEON’s ability to receive stockholder approval for the transactions described herein; (xi) the FDA’s response to the primary structure and other functional analysis data; (xii) the ability of the Company to satisfy other customary closing conditions for the transactions; (xiii) the ability of the Company to finalize long-form documentation with Daewoong regarding the convertible note exchange; and (xiv) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in AEON’s Annual Report on Form 10-K for the year ended December 31, 2024 and any current or periodic reports filed with the Securities and Exchange Commission (the "SEC"), which are available on the SEC’s website at www.sec.gov. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond AEON’s control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in AEON’s forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, AEON operates in an evolving environment and a competitive industry. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties, nor can AEON assess the impact of all factors on AEON’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements AEON may make in this presentation. As a result of these factors, although AEON believes that the expectations reflected in its forward-looking statements are reasonable, AEON cannot assure you that the forward-looking statements in this presentation will prove to be accurate. Except as required by applicable law, AEON does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise. AEON qualifies all of its forward-looking statements by these cautionary statements. You should view this presentation completely and with the understanding that the actual future results, levels of activity, performance, events and circumstances of AEON may be materially different from what is expected. This presentation concerns anticipated products that are under clinical and analytical investigation, and which have not yet been approved for marketing by the FDA. These anticipated products are currently limited by Federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for which they are being investigated. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and AEON’s own internal estimates and research. AEON has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, AEON’s own internal estimates and research have not been verified by any independent source. AEON Biopharma and the AEON Biopharma logo are trademarks of AEON Biopharma, Inc. All other trademarks used herein are the property of their respective owners. Forward-Looking Statements © 2 0 2 5 A E O N B I O P H A R M A 2 |

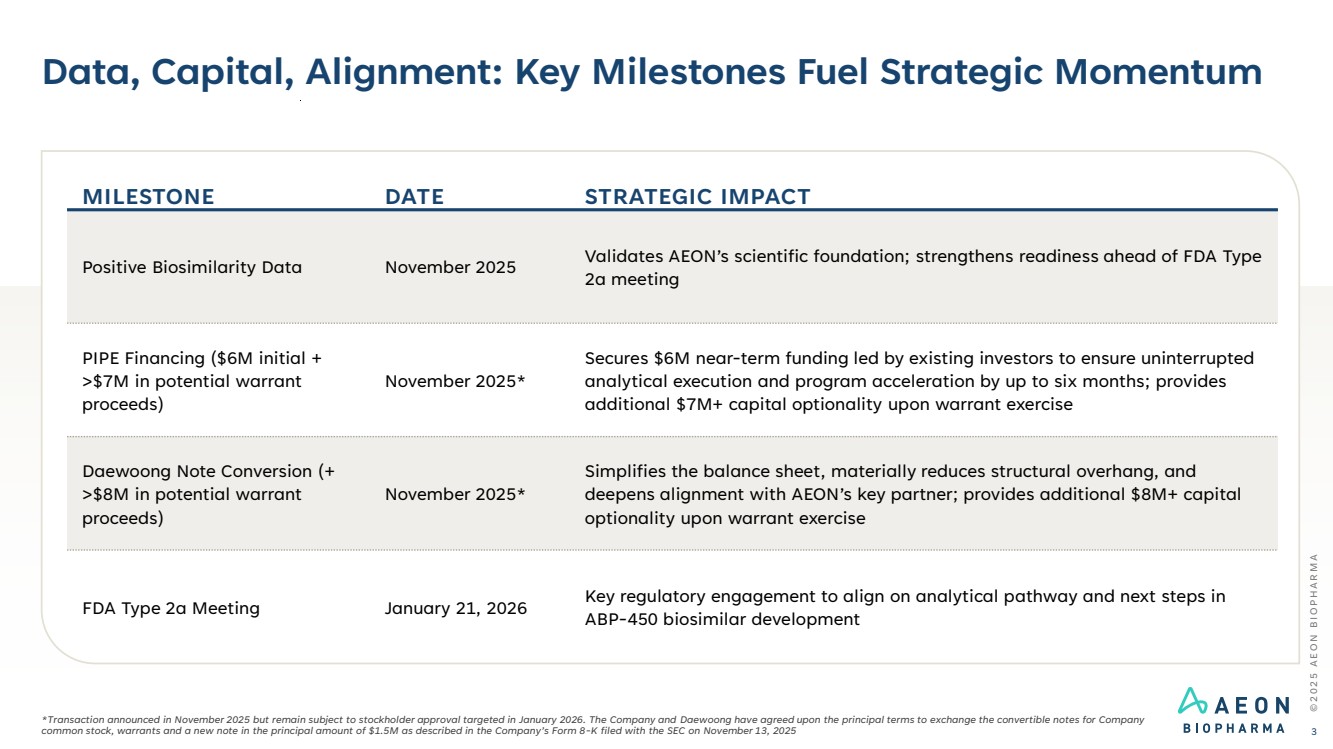

| Data, Capital, Alignment: Key Milestones Fuel Strategic Momentum © 2 0 2 5 A E O N B I O P H A R M A 3 MILESTONE DATE STRATEGIC IMPACT Positive Biosimilarity Data November 2025 Validates AEON’s scientific foundation; strengthens readiness ahead of FDA Type 2a meeting PIPE Financing ($6M initial + >$7M in potential warrant proceeds) November 2025* Secures $6M near-term funding led by existing investors to ensure uninterrupted analytical execution and program acceleration by up to six months; provides additional $7M+ capital optionality upon warrant exercise Daewoong Note Conversion (+ >$8M in potential warrant proceeds) November 2025* Simplifies the balance sheet, materially reduces structural overhang, and deepens alignment with AEON’s key partner; provides additional $8M+ capital optionality upon warrant exercise FDA Type 2a Meeting January 21, 2026 Key regulatory engagement to align on analytical pathway and next steps in ABP-450 biosimilar development *Transaction announced in November 2025 but remain subject to stockholder approval targeted in January 2026. The Company and Daewoong have agreed upon the principal terms to exchange the convertible notes for Company common stock, warrants and a new note in the principal amount of $1.5M as described in the Company’s Form 8-K filed with the SEC on November 13, 2025 |

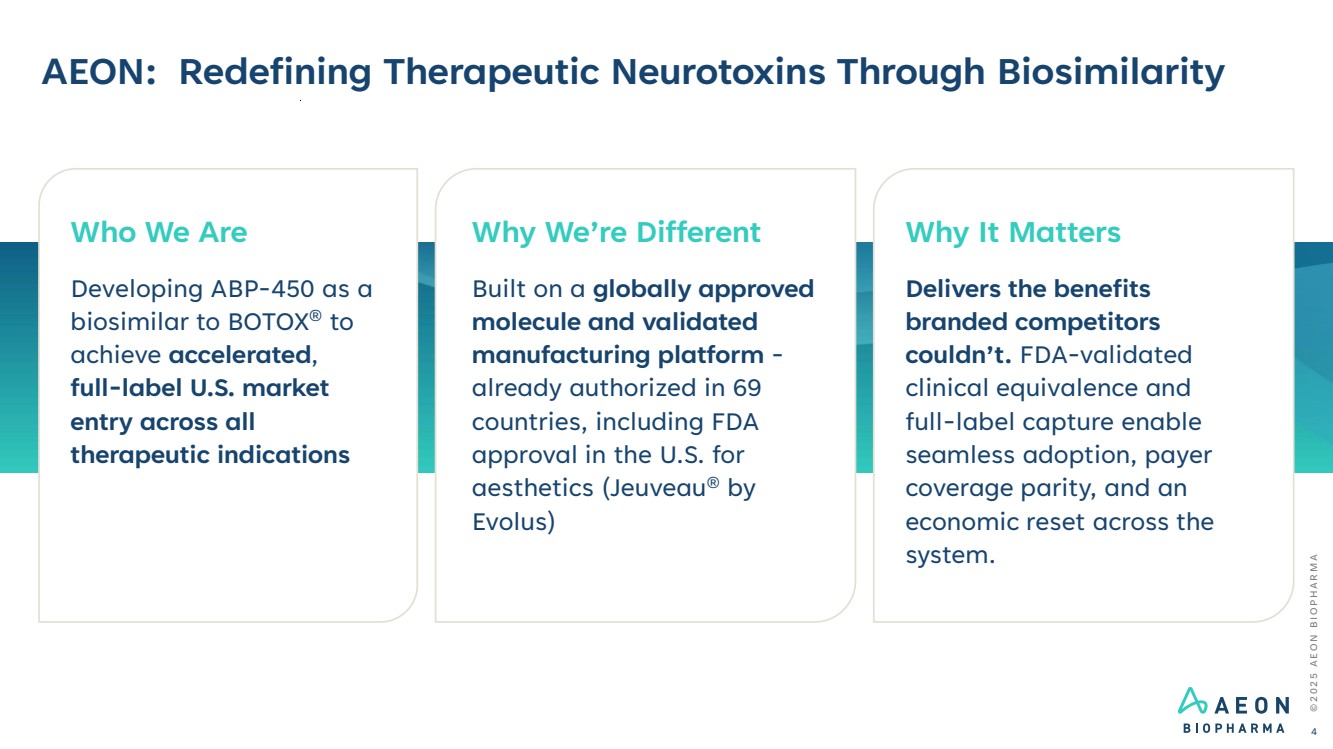

| © 2 0 2 5 A E O N B I O P H A R M A AEON: Redefining Therapeutic Neurotoxins Through Biosimilarity 4 Who We Are Developing ABP-450 as a biosimilar to BOTOX® to achieve accelerated, full-label U.S. market entry across all therapeutic indications Why We’re Different Built on a globally approved molecule and validated manufacturing platform - already authorized in 69 countries, including FDA approval in the U.S. for aesthetics (Jeuveau® by Evolus) Why It Matters Delivers the benefits branded competitors couldn’t. FDA-validated clinical equivalence and full-label capture enable seamless adoption, payer coverage parity, and an economic reset across the system. |

| 〉 Proven leader in public company financial operations and reporting Jennifer Sy Chief Accounting Officer Proven Operators in Toxins, Biosimilars, and Capital Formation Collectively executed multiple equity, debt, and hybrid financings totaling more than $500 million 〉 Former Botox® leader responsible for competitive strategy and long-range asset maximization 〉 Led multiple therapeutic and buy-and-bill biologic launches Rob Bancroft Chief Executive Officer 〉 20+ years in clinical development and regulatory strategy – responsible for multiple IND, NDA, and BLA submissions Chad Oh, MD Chief Medical Officer 〉 20+ years in biotech and life sciences capital markets 〉 Over $500M in capital raised through a variety of equity, debt, and hybrid structures Alex Wilson EVP, Chief Legal Officer & Secretary © 2 0 2 5 A E O N B I O P H A R M A 5 |

| Shared Heritage, Distinct Missions 1Evolus, Inc. Form-10K for the year ended December 31, 2024, filed with the SEC on March 4, 2025 2US, EU, UK, CAN and other international markets 〉 FDA approval in moderate to severe glabellar (frown) lines 〉 $264.3m sales in 20241 9/30/2013 agreement Jeuveau 12/20/2019 agreement ABP-450 Aesthetics Therapeutics 〉 Exclusive therapeutic rights2 → biosimilar strategy to obtain all 12 FDA-approved indications for BOTOX© © 2 0 2 5 A E O N B I O P H A R M A 6 |

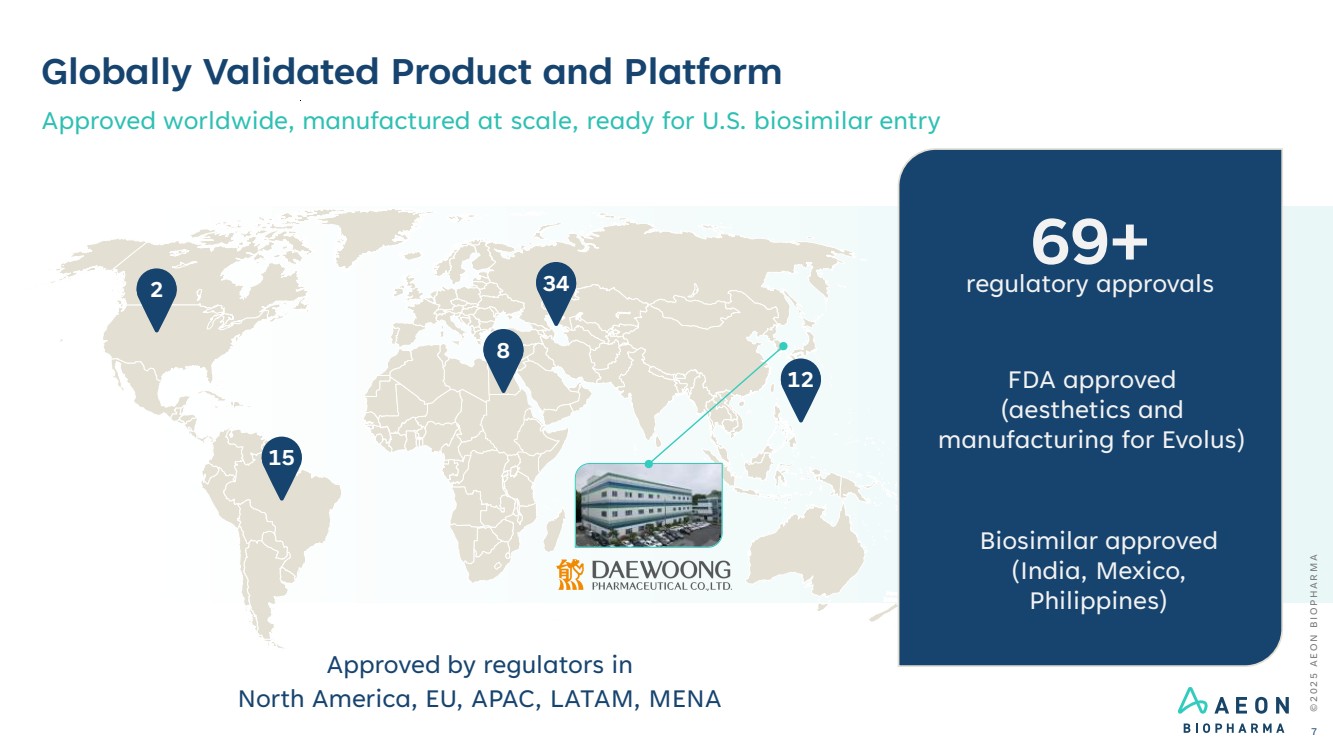

| Globally Validated Product and Platform Approved worldwide, manufactured at scale, ready for U.S. biosimilar entry 2 15 8 34 12 Approved by regulators in North America, EU, APAC, LATAM, MENA 69+ regulatory approvals FDA approved (aesthetics and manufacturing for Evolus) Biosimilar approved (India, Mexico, Philippines) © 2 0 2 5 A E O N B I O P H A R M A 7 |

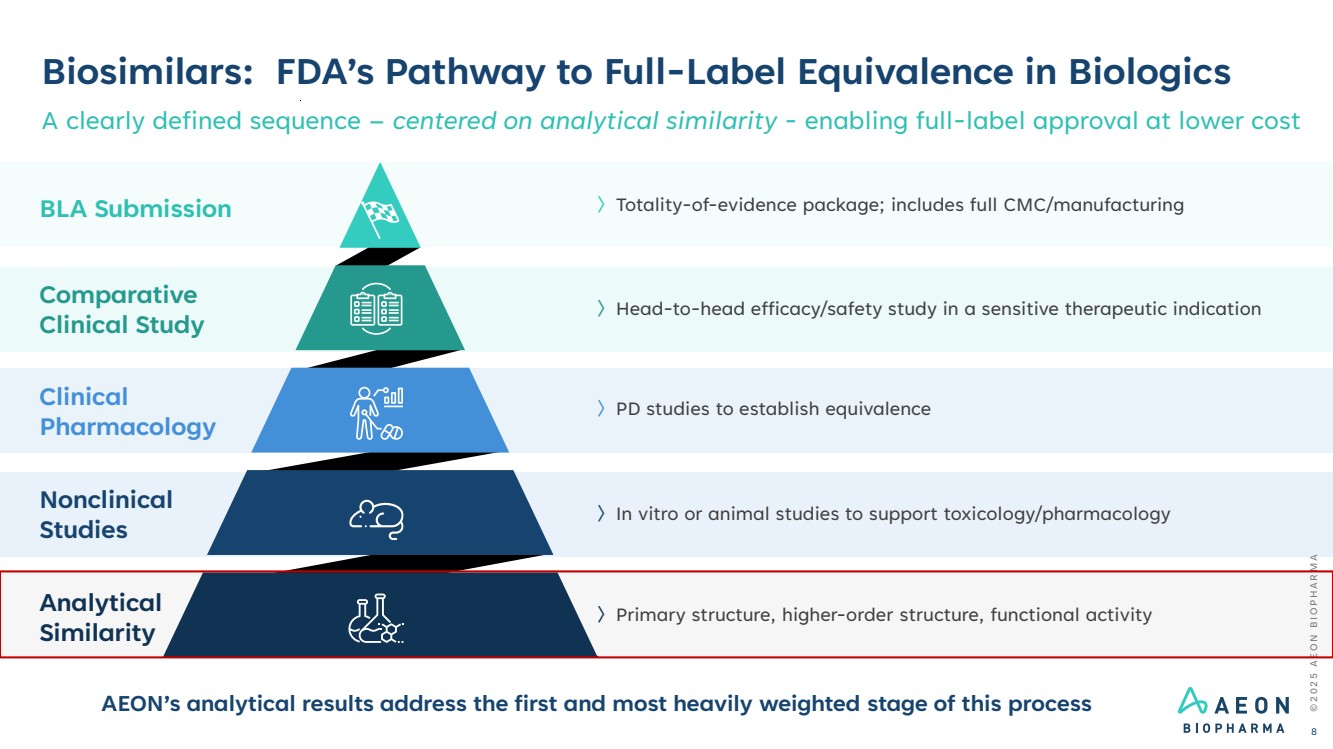

| Biosimilars: FDA’s Pathway to Full-Label Equivalence in Biologics A clearly defined sequence – centered on analytical similarity - enabling full-label approval at lower cost 〉PD studies to establish equivalence 〉Head-to-head efficacy/safety study in a sensitive therapeutic indication 〉In vitro or animal studies to support toxicology/pharmacology 〉Primary structure, higher-order structure, functional activity 〉Totality-of-evidence package; includes full CMC/manufacturing © 2 0 2 5 A E O N B I O P H A R M A 8 Clinical Pharmacology Comparative Clinical Study Nonclinical Studies BLA Submission Analytical Similarity AEON’s analytical results address the first and most heavily weighted stage of this process |

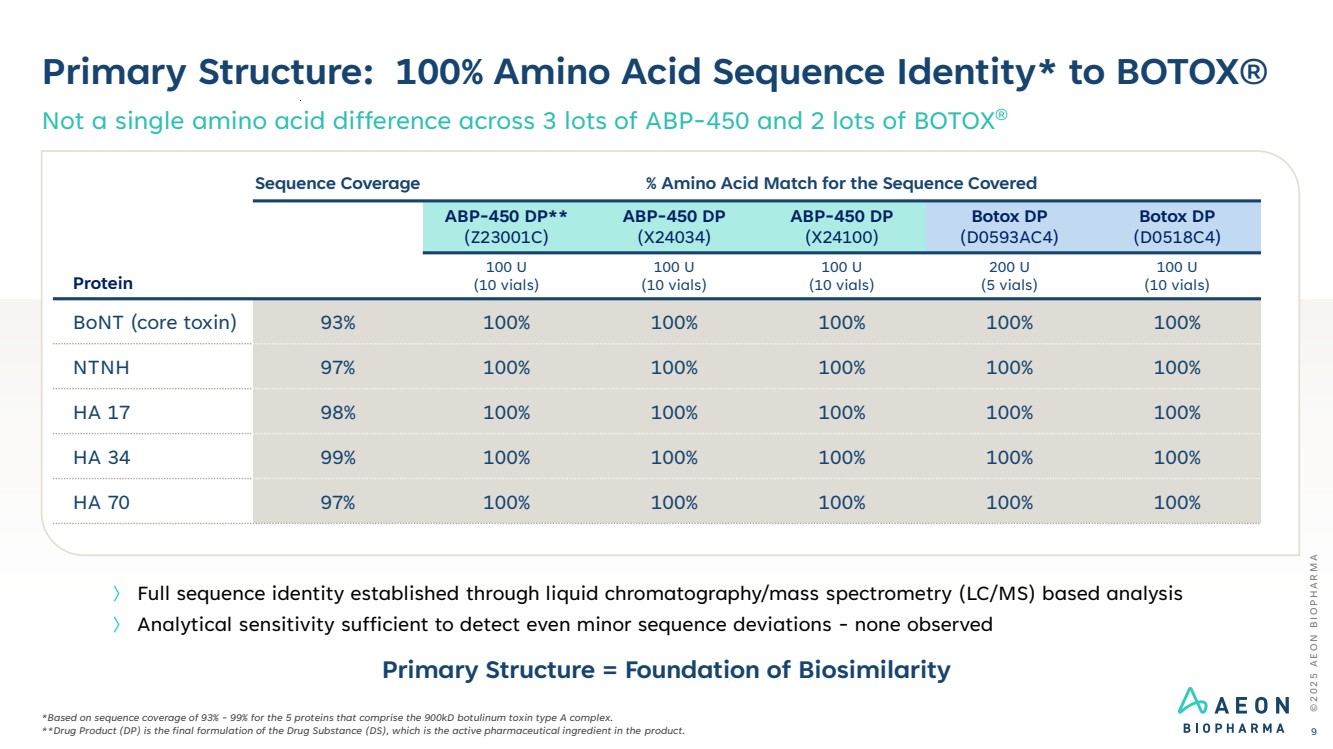

| Primary Structure: 100% Amino Acid Sequence Identity* to BOTOX® Not a single amino acid difference across 3 lots of ABP-450 and 2 lots of BOTOX® © 2 0 2 5 A E O N B I O P H A R M A 9 *Based on sequence coverage of 93% - 99% for the 5 proteins that comprise the 900kD botulinum toxin type A complex. **Drug Product (DP) is the final formulation of the Drug Substance (DS), which is the active pharmaceutical ingredient in the product. 〉 Full sequence identity established through liquid chromatography/mass spectrometry (LC/MS) based analysis 〉 Analytical sensitivity sufficient to detect even minor sequence deviations - none observed Protein Sequence Coverage % Amino Acid Match for the Sequence Covered ABP-450 DP** (Z23001C) ABP-450 DP (X24034) ABP-450 DP (X24100) Botox DP (D0593AC4) Botox DP (D0518C4) 100 U (10 vials) 100 U (10 vials) 100 U (10 vials) 200 U (5 vials) 100 U (10 vials) BoNT (core toxin) 93% 100% 100% 100% 100% 100% NTNH 97% 100% 100% 100% 100% 100% HA 17 98% 100% 100% 100% 100% 100% HA 34 99% 100% 100% 100% 100% 100% HA 70 97% 100% 100% 100% 100% 100% Primary Structure = Foundation of Biosimilarity |

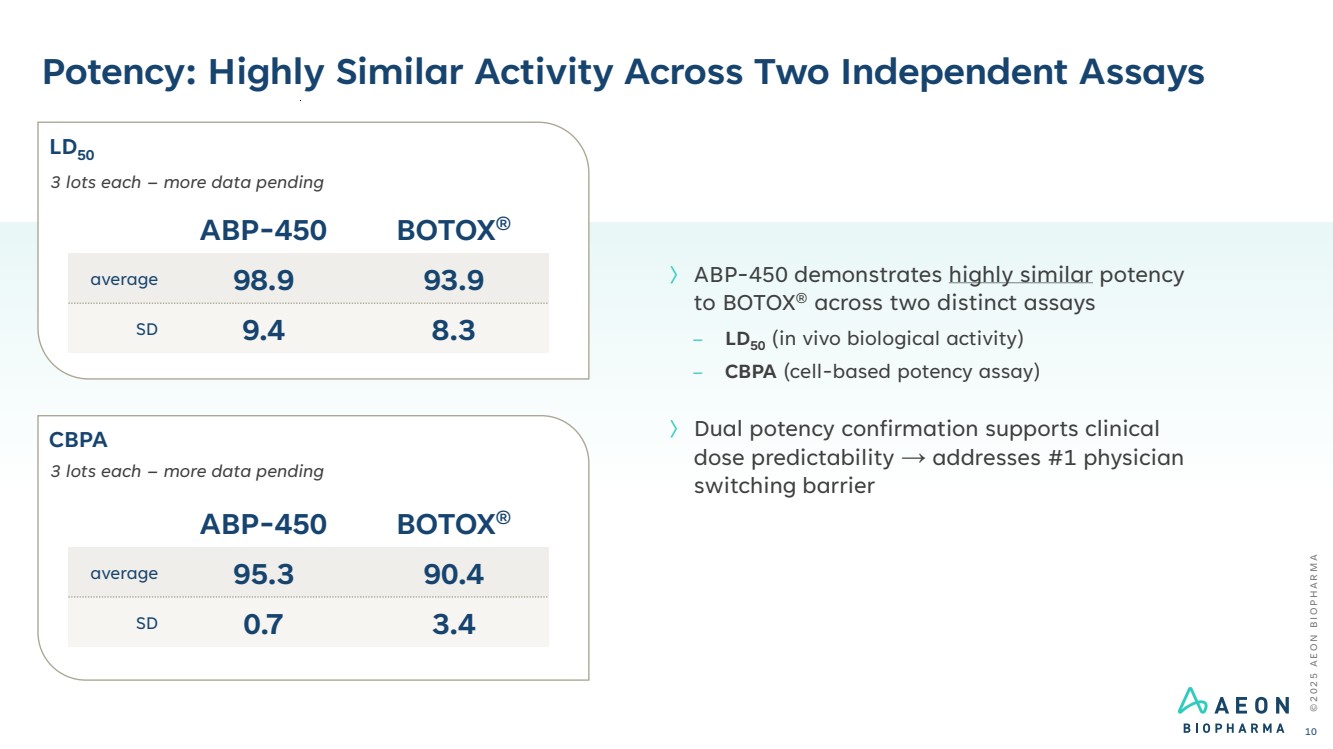

| Potency: Highly Similar Activity Across Two Independent Assays © 2 0 2 5 A E O N B I O P H A R M A 10 〉 ABP-450 demonstrates highly similar potency to BOTOX® across two distinct assays – LD50 (in vivo biological activity) – CBPA (cell-based potency assay) 〉 Dual potency confirmation supports clinical dose predictability → addresses #1 physician switching barrier ABP-450 BOTOX® average 98.9 93.9 SD 9.4 8.3 3 lots each – more data pending ABP-450 BOTOX® average 95.3 90.4 SD 0.7 3.4 3 lots each – more data pending LD50 CBPA |

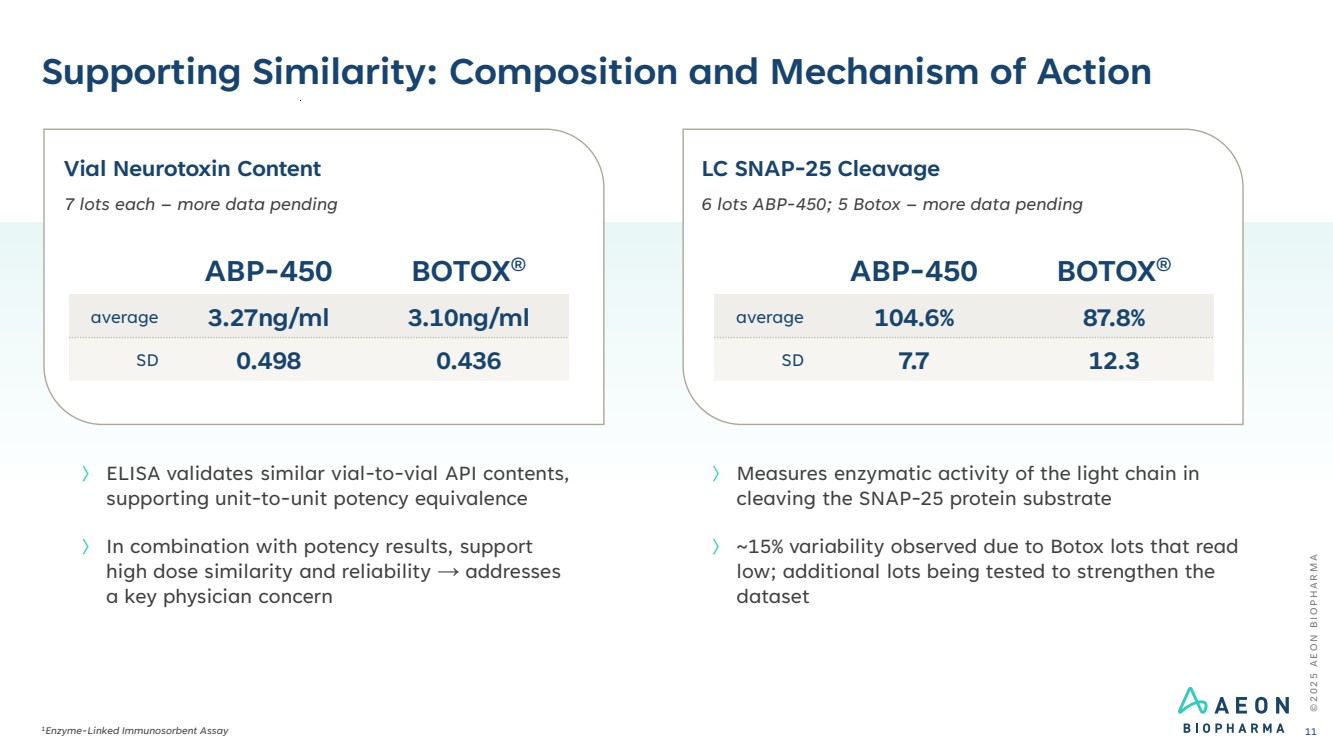

| © 2 0 2 5 A E O N B I O P H A R M A Supporting Similarity: Composition and Mechanism of Action 1Enzyme-Linked Immunosorbent Assay 11 〉 ELISA validates similar vial-to-vial API contents, supporting unit-to-unit potency equivalence 〉 In combination with potency results, support high dose similarity and reliability → addresses a key physician concern Vial Neurotoxin Content 7 lots each – more data pending ABP-450 BOTOX® average 3.27ng/ml 3.10ng/ml SD 0.498 0.436 LC SNAP-25 Cleavage 6 lots ABP-450; 5 Botox – more data pending ABP-450 BOTOX® average 104.6% 87.8% SD 7.7 12.3 〉 Measures enzymatic activity of the light chain in cleaving the SNAP-25 protein substrate 〉 ~15% variability observed due to Botox lots that read low; additional lots being tested to strengthen the dataset |

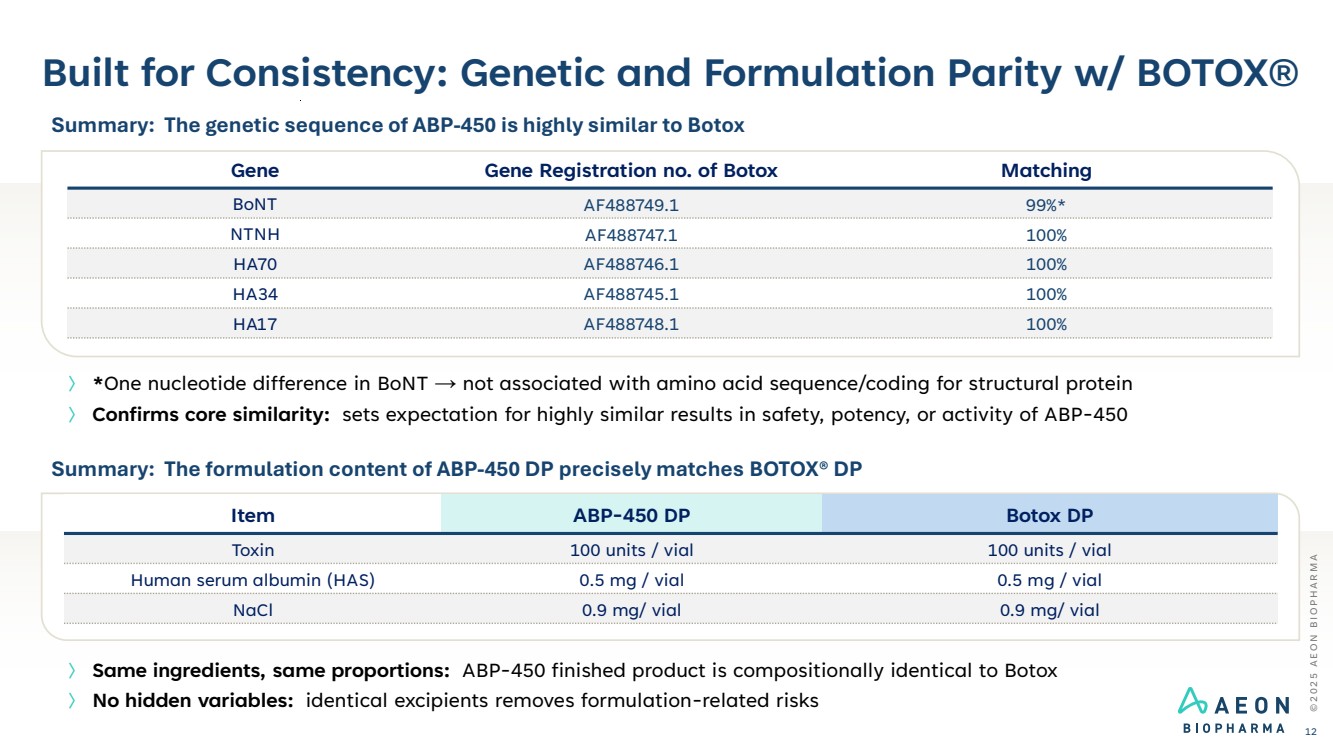

| Built for Consistency: Genetic and Formulation Parity w/ BOTOX® © 2 0 2 5 A E O N B I O P H A R M A 12 Gene Gene Registration no. of Botox Matching BoNT AF488749.1 99%* NTNH AF488747.1 100% HA70 AF488746.1 100% HA34 AF488745.1 100% HA17 AF488748.1 100% Summary: The genetic sequence of ABP-450 is highly similar to Botox 〉 *One nucleotide difference in BoNT → not associated with amino acid sequence/coding for structural protein 〉 Confirms core similarity: sets expectation for highly similar results in safety, potency, or activity of ABP-450 〉 Same ingredients, same proportions: ABP-450 finished product is compositionally identical to Botox 〉 No hidden variables: identical excipients removes formulation-related risks Summary: The formulation content of ABP-450 DP precisely matches BOTOX® DP Item ABP-450 DP Botox DP Toxin 100 units / vial 100 units / vial Human serum albumin (HAS) 0.5 mg / vial 0.5 mg / vial NaCl 0.9 mg/ vial 0.9 mg/ vial |

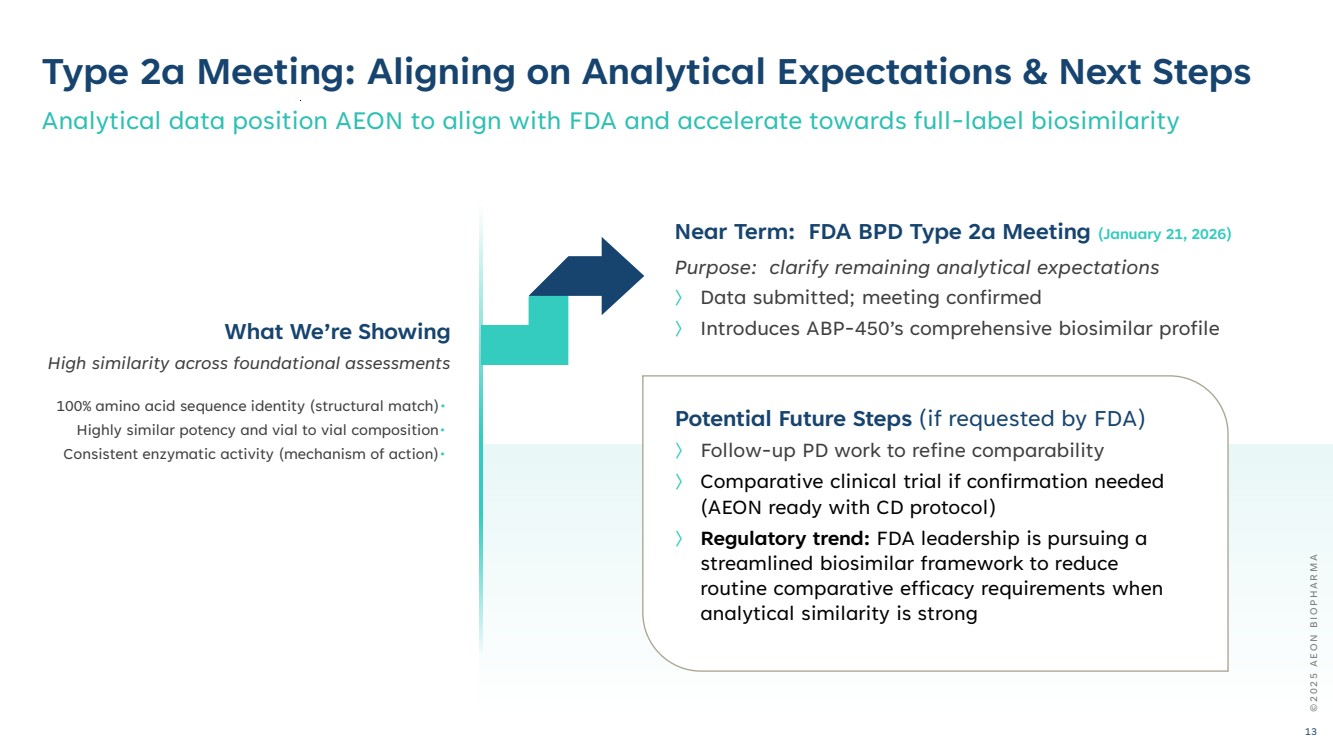

| Potential Future Steps (if requested by FDA) 〉 Follow-up PD work to refine comparability 〉 Comparative clinical trial if confirmation needed (AEON ready with CD protocol) 〉 Regulatory trend: FDA leadership is pursuing a streamlined biosimilar framework to reduce routine comparative efficacy requirements when analytical similarity is strong Type 2a Meeting: Aligning on Analytical Expectations & Next Steps Analytical data position AEON to align with FDA and accelerate towards full-label biosimilarity Near Term: FDA BPD Type 2a Meeting (January 21, 2026) Purpose: clarify remaining analytical expectations 〉 Data submitted; meeting confirmed What We’re Showing 〉 Introduces ABP-450’s comprehensive biosimilar profile High similarity across foundational assessments 100% amino acid sequence identity (structural match)• Highly similar potency and vial to vial composition• Consistent enzymatic activity (mechanism of action)• © 2 0 2 5 A E O N B I O P H A R M A 13 |

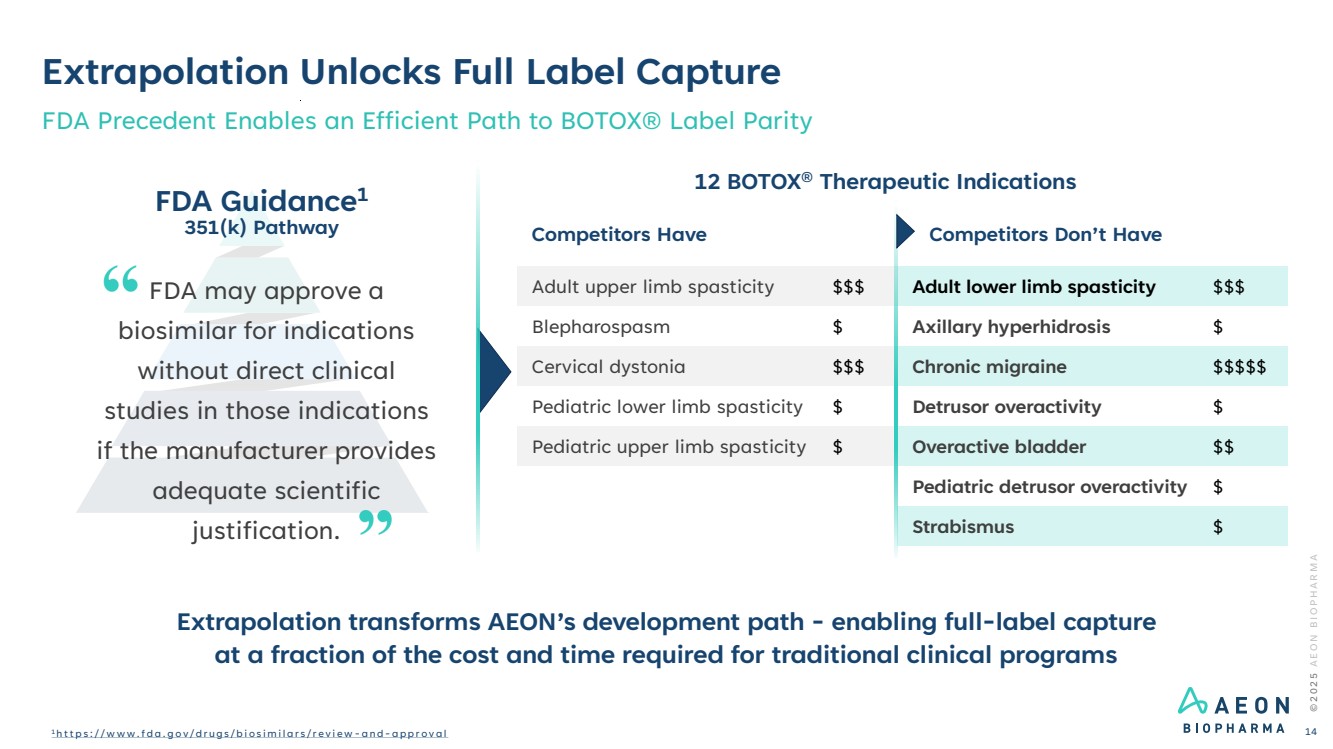

| Extrapolation Unlocks Full Label Capture FDA Precedent Enables an Efficient Path to BOTOX® Label Parity 12 BOTOX® Therapeutic Indications FDA Guidance1 351(k) Pathway FDA may approve a biosimilar for indications without direct clinical studies in those indications if the manufacturer provides adequate scientific justification. Competitors Have Competitors Don’t Have … Adult upper limb spasticity $$$ Adult lower limb spasticity $$$ Blepharospasm $ Axillary hyperhidrosis $ Cervical dystonia $$$ Chronic migraine $$$$$ Pediatric lower limb spasticity $ Detrusor overactivity $ Pediatric upper limb spasticity $ Overactive bladder $$ Pediatric detrusor overactivity $ Strabismus $ © 2 0 2 5 A E O N B I O P H A R M A 1 h t t p s : / / w w w . f d a . g o v / d r u g s / b i o s i m i l a r s / r e v i e w - a n d - a p p r o v a l 14 Extrapolation transforms AEON’s development path - enabling full-label capture at a fraction of the cost and time required for traditional clinical programs |

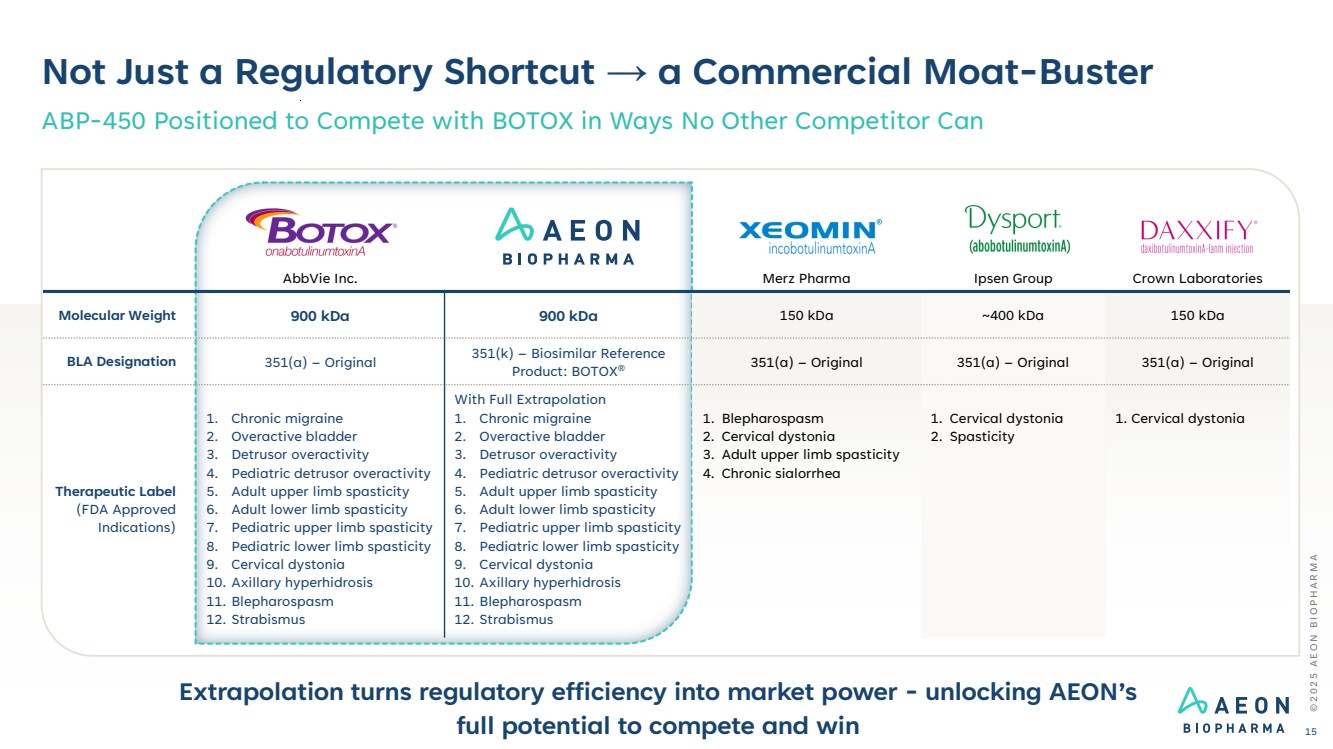

| AbbVie Inc. Merz Pharma Ipsen Group Crown Laboratories Molecular Weight 900 kDa 900 kDa 150 kDa ~400 kDa 150 kDa BLA Designation 351(a) – Original 351(k) – Biosimilar Reference Product: BOTOX® 351(a) – Original 351(a) – Original 351(a) – Original Therapeutic Label (FDA Approved Indications) 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus With Full Extrapolation 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus 1. Blepharospasm 2. Cervical dystonia 3. Adult upper limb spasticity 4. Chronic sialorrhea 1. Cervical dystonia 2. Spasticity 1. Cervical dystonia Not Just a Regulatory Shortcut → a Commercial Moat-Buster ABP-450 Positioned to Compete with BOTOX in Ways No Other Competitor Can Extrapolation turns regulatory efficiency into market power - unlocking AEON’s full potential to compete and win © 2 0 2 5 A E O N B I O P H A R M A 15 |

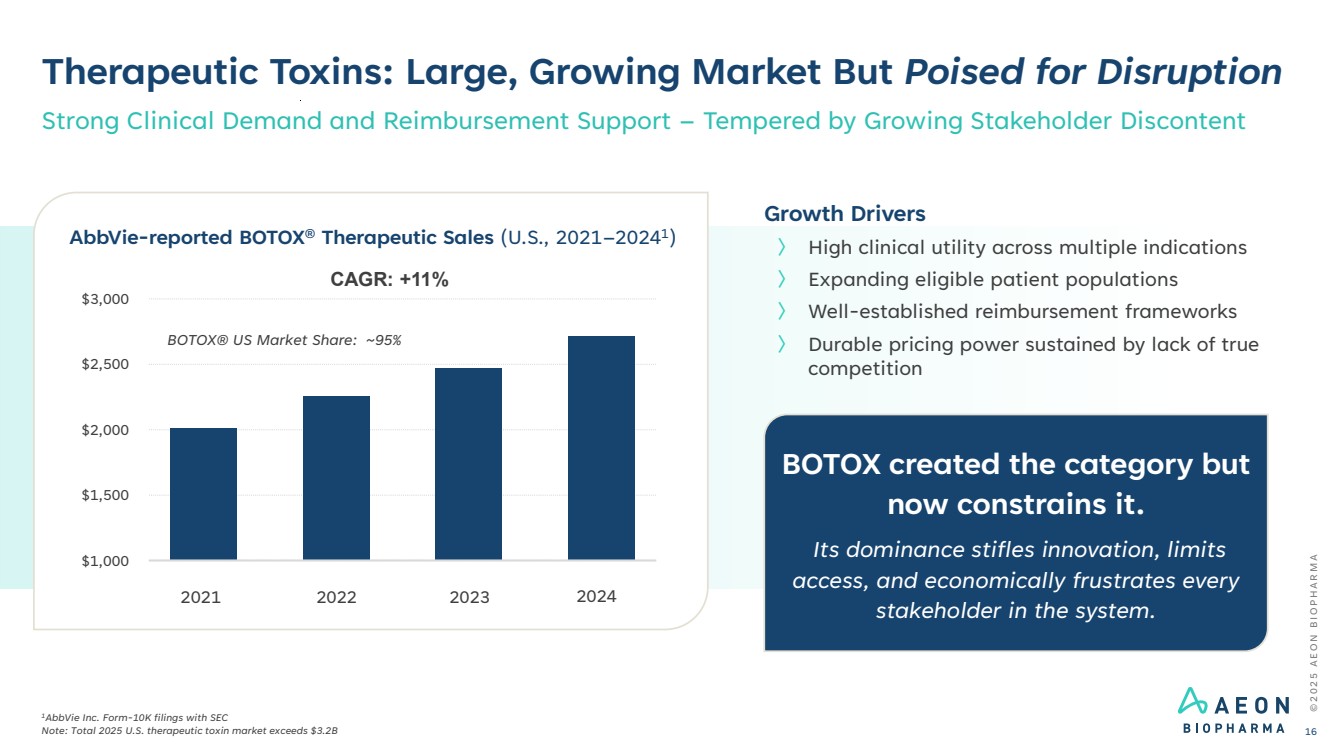

| BOTOX created the category but now constrains it. Its dominance stifles innovation, limits access, and economically frustrates every stakeholder in the system. Therapeutic Toxins: Large, Growing Market But Poised for Disruption 1AbbVie Inc. Form-10K filings with SEC Note: Total 2025 U.S. therapeutic toxin market exceeds $3.2B Strong Clinical Demand and Reimbursement Support – Tempered by Growing Stakeholder Discontent $1,000 $1,500 $2,000 $2,500 $3,000 AbbVie-reported BOTOX® Therapeutic Sales (U.S., 2021–20241 ) CAGR: +11% Growth Drivers 〉 High clinical utility across multiple indications 〉 Expanding eligible patient populations 〉 Well-established reimbursement frameworks 〉 Durable pricing power sustained by lack of true competition 2021 2022 2023 2024 © 2 0 2 5 A E O N B I O P H A R M A 16 BOTOX® US Market Share: ~95% |

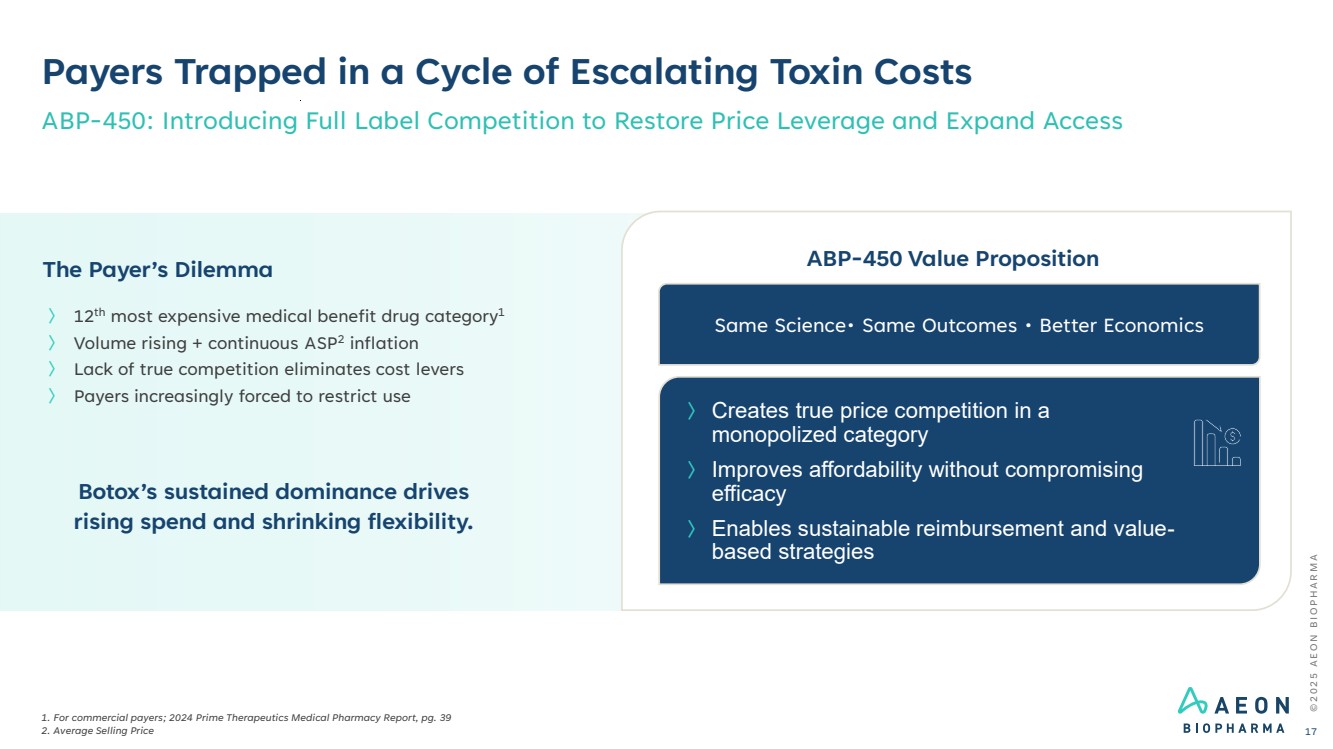

| 〉 12th most expensive medical benefit drug category1 〉 Volume rising + continuous ASP2 inflation 〉 Lack of true competition eliminates cost levers 〉 Payers increasingly forced to restrict use The Payer’s Dilemma Payers Trapped in a Cycle of Escalating Toxin Costs ABP-450: Introducing Full Label Competition to Restore Price Leverage and Expand Access 1. For commercial payers; 2024 Prime Therapeutics Medical Pharmacy Report, pg. 39 2. Average Selling Price ABP-450 Value Proposition 〉 Creates true price competition in a monopolized category 〉 Improves affordability without compromising efficacy 〉 Enables sustainable reimbursement and value-based strategies Same Science• Same Outcomes • Better Economics © 2 0 2 5 A E O N B I O P H A R M A 17 Botox’s sustained dominance drives rising spend and shrinking flexibility. |

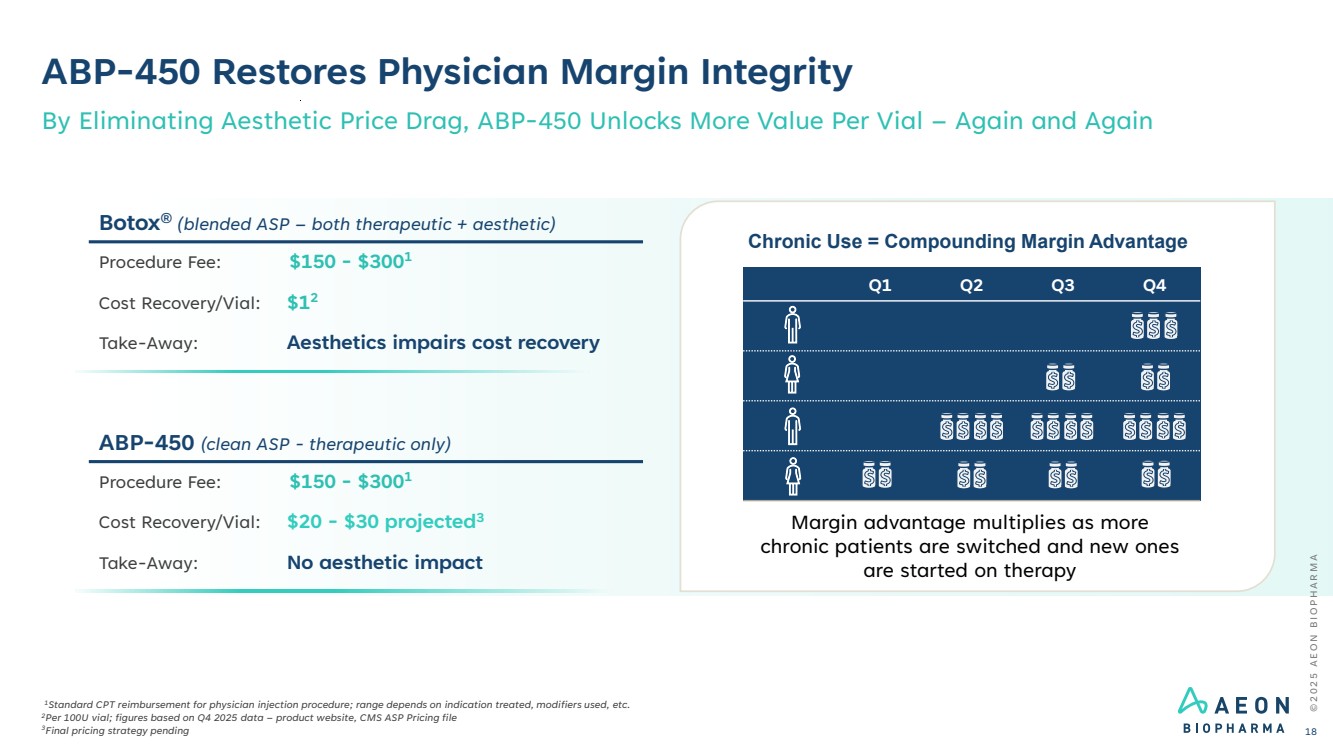

| ABP-450 Restores Physician Margin Integrity 1Standard CPT reimbursement for physician injection procedure; range depends on indication treated, modifiers used, etc. 2Per 100U vial; figures based on Q4 2025 data – product website, CMS ASP Pricing file 3Final pricing strategy pending By Eliminating Aesthetic Price Drag, ABP-450 Unlocks More Value Per Vial – Again and Again Botox® (blended ASP – both therapeutic + aesthetic) Procedure Fee: $150 - $3001 Cost Recovery/Vial: $12 Take-Away: Aesthetics impairs cost recovery ABP-450 (clean ASP - therapeutic only) Procedure Fee: $150 - $3001 Cost Recovery/Vial: $20 - $30 projected3 Take-Away: No aesthetic impact Margin advantage multiplies as more chronic patients are switched and new ones are started on therapy Chronic Use = Compounding Margin Advantage Q1 Q2 Q3 Q4 © 2 0 2 5 A E O N B I O P H A R M A 18 |

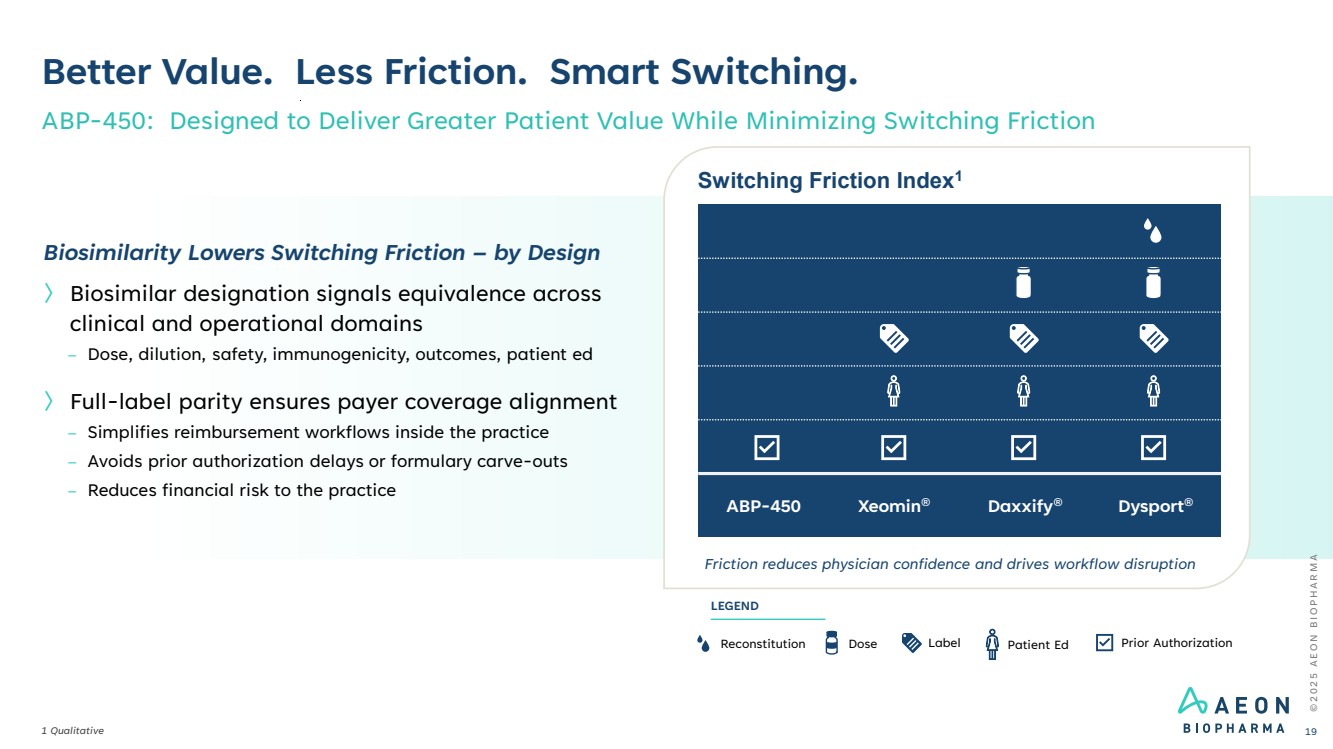

| © 2 0 2 5 A E O N B I O P H A R M A Better Value. Less Friction. Smart Switching. 1 Qualitative ABP-450: Designed to Deliver Greater Patient Value While Minimizing Switching Friction 19 Switching Friction Index1 Friction reduces physician confidence and drives workflow disruption ABP-450 Xeomin® Daxxify® Dysport® Reconstitution Dose Label Prior Authorization LEGEND Patient Ed Biosimilarity Lowers Switching Friction – by Design 〉 Biosimilar designation signals equivalence across clinical and operational domains – Dose, dilution, safety, immunogenicity, outcomes, patient ed 〉 Full-label parity ensures payer coverage alignment – Simplifies reimbursement workflows inside the practice – Avoids prior authorization delays or formulary carve-outs – Reduces financial risk to the practice |

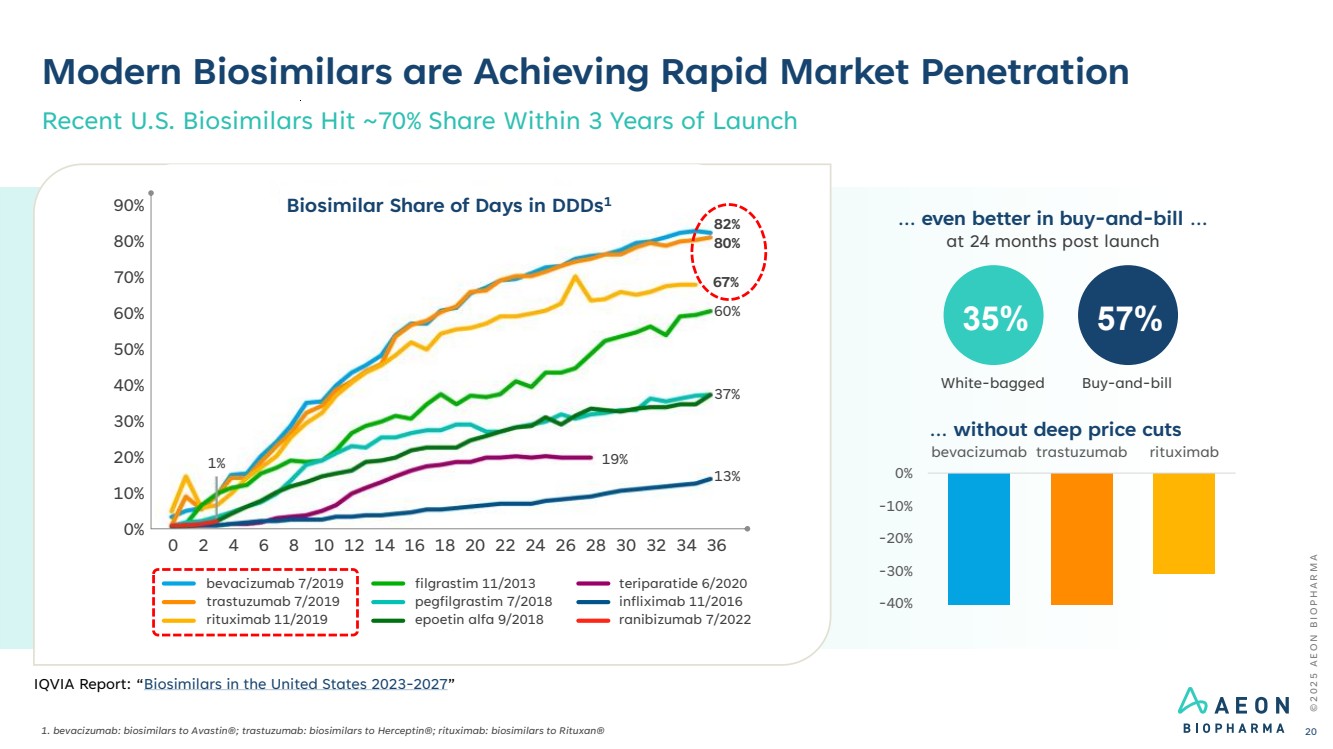

| Modern Biosimilars are Achieving Rapid Market Penetration 1. bevacizumab: biosimilars to Avastin®; trastuzumab: biosimilars to Herceptin®; rituximab: biosimilars to Rituxan® Recent U.S. Biosimilars Hit ~70% Share Within 3 Years of Launch bevacizumab 7/2019 trastuzumab 7/2019 rituximab 11/2019 filgrastim 11/2013 pegfilgrastim 7/2018 epoetin alfa 9/2018 teriparatide 6/2020 infliximab 11/2016 ranibizumab 7/2022 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 1% 19% 13% 37% 60% 67% 80% 82% Biosimilar Share of Days in DDDs1 at 24 months post launch 35% 57% White-bagged Buy-and-bill … even better in buy-and-bill … -40% -30% -20% -10% 0% bevacizumab trastuzumab rituximab … without deep price cuts © 2 0 2 5 A E O N B I O P H A R M A 20 IQVIA Report: “Biosimilars in the United States 2023-2027” |

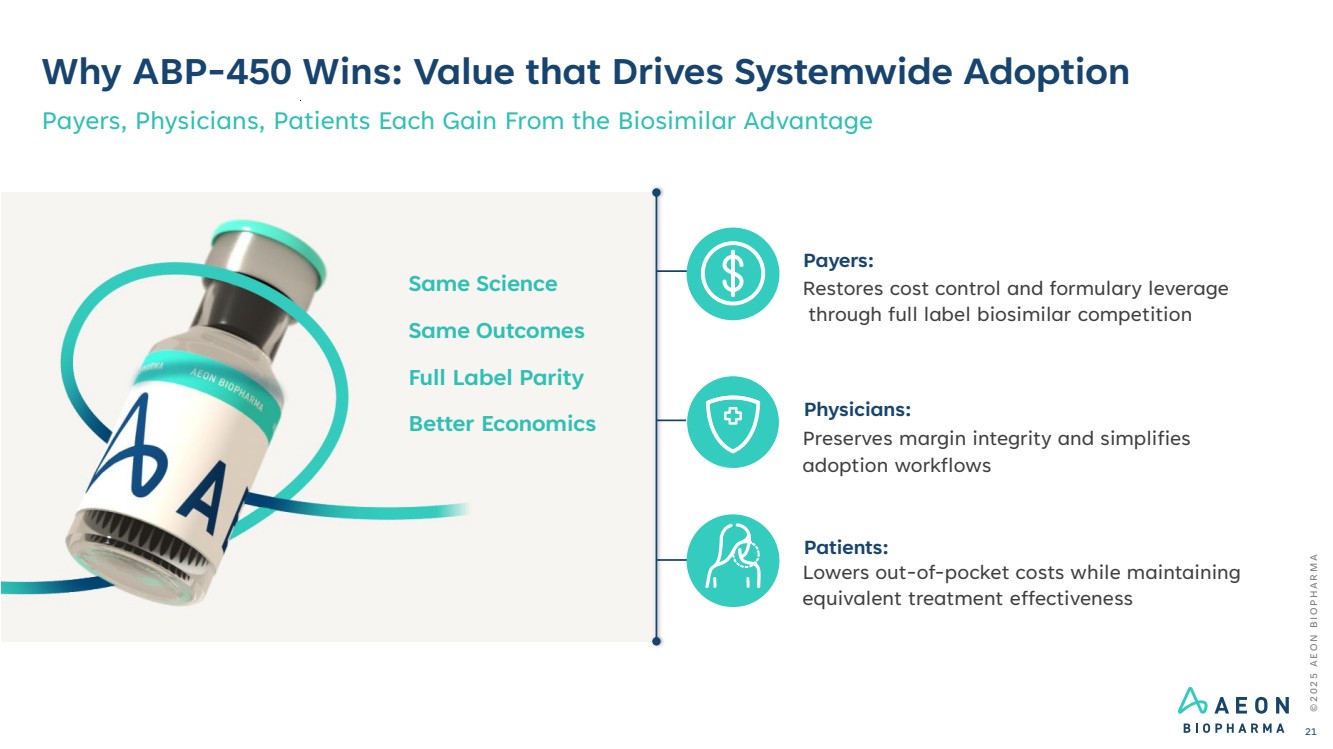

| Why ABP-450 Wins: Value that Drives Systemwide Adoption Payers, Physicians, Patients Each Gain From the Biosimilar Advantage Payers: Restores cost control and formulary leverage through full label biosimilar competition Physicians: Preserves margin integrity and simplifies adoption workflows Patients: Lowers out-of-pocket costs while maintaining equivalent treatment effectiveness Same Science Same Outcomes Full Label Parity Better Economics © 2 0 2 5 A E O N B I O P H A R M A 21 |

| PIPE Financing & Warrant Capacity Daewoong Note Conversion FDA Type 2a Meeting Positive Analytical Data © 2 0 2 5 A E O N B I O P H A R M A 22 Executing Through the Milestone: Momentum Built, Pathway Clear Executed across science, capital, and partnerships → advancing next phase of value creation AEON has executed across data, capital, alignment, and regulatory engagement — now positioned for biosimilar acceleration in 2026 |

| Thank you NYSEAMERICAN: AEON © 2 0 2 5 A E O N B I O P H A R M A |

| Appendix © 2 0 2 5 A E O N B I O P H A R M A 24 |

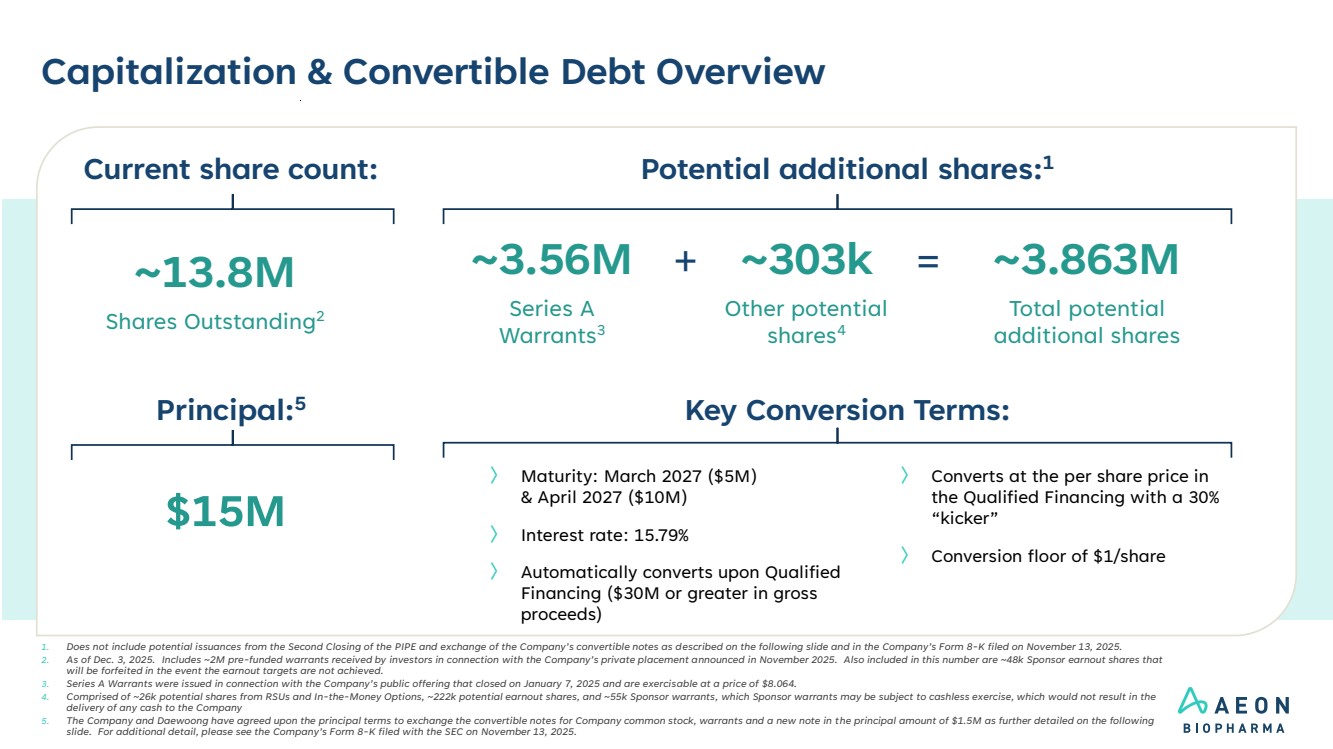

| Capitalization & Convertible Debt Overview 1. Does not include potential issuances from the Second Closing of the PIPE and exchange of the Company’s convertible notes as described on the following slide and in the Company’s Form 8-K filed on November 13, 2025. 2. As of Dec. 3, 2025. Includes ~2M pre-funded warrants received by investors in connection with the Company’s private placement announced in November 2025. Also included in this number are ~48k Sponsor earnout shares that will be forfeited in the event the earnout targets are not achieved. 3. Series A Warrants were issued in connection with the Company’s public offering that closed on January 7, 2025 and are exercisable at a price of $8.064. 4. Comprised of ~26k potential shares from RSUs and In-the-Money Options, ~222k potential earnout shares, and ~55k Sponsor warrants, which Sponsor warrants may be subject to cashless exercise, which would not result in the delivery of any cash to the Company 5. The Company and Daewoong have agreed upon the principal terms to exchange the convertible notes for Company common stock, warrants and a new note in the principal amount of $1.5M as further detailed on the following slide. For additional detail, please see the Company’s Form 8-K filed with the SEC on November 13, 2025. Potential additional shares:1 ~13.8M Shares Outstanding2 ~303k Other potential shares4 ~3.863M Total potential additional shares = Current share count: ~3.56M Series A Warrants3 + Key Conversion Terms: $15M Principal:5 〉 Converts at the per share price in the Qualified Financing with a 30% “kicker” 〉 Conversion floor of $1/share 〉 Maturity: March 2027 ($5M) & April 2027 ($10M) 〉 Interest rate: 15.79% 〉 Automatically converts upon Qualified Financing ($30M or greater in gross proceeds) |

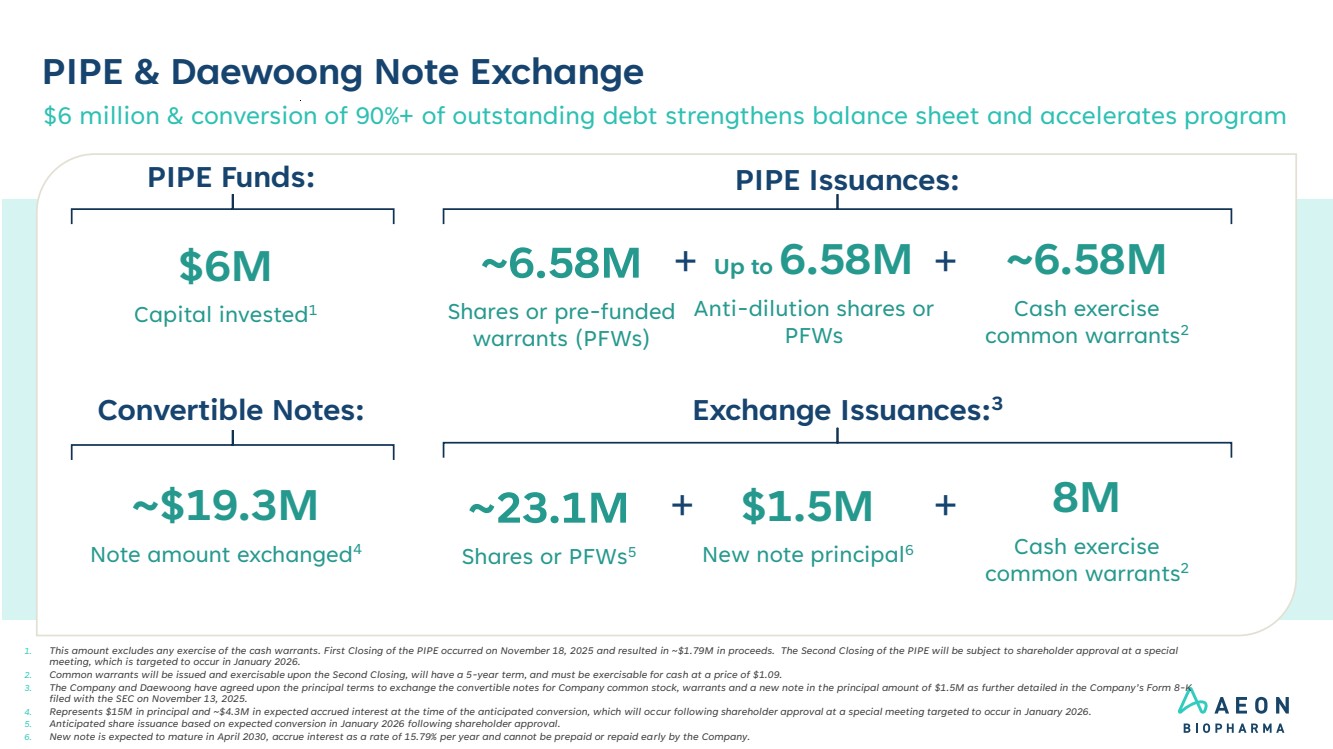

| PIPE & Daewoong Note Exchange 1. This amount excludes any exercise of the cash warrants. First Closing of the PIPE occurred on November 18, 2025 and resulted in ~$1.79M in proceeds. The Second Closing of the PIPE will be subject to shareholder approval at a special meeting, which is targeted to occur in January 2026. 2. Common warrants will be issued and exercisable upon the Second Closing, will have a 5-year term, and must be exercisable for cash at a price of $1.09. 3. The Company and Daewoong have agreed upon the principal terms to exchange the convertible notes for Company common stock, warrants and a new note in the principal amount of $1.5M as further detailed in the Company’s Form 8-K filed with the SEC on November 13, 2025. 4. Represents $15M in principal and ~$4.3M in expected accrued interest at the time of the anticipated conversion, which will occur following shareholder approval at a special meeting targeted to occur in January 2026. 5. Anticipated share issuance based on expected conversion in January 2026 following shareholder approval. 6. New note is expected to mature in April 2030, accrue interest as a rate of 15.79% per year and cannot be prepaid or repaid early by the Company. PIPE Issuances: $6M Capital invested1 Up to 6.58M Anti-dilution shares or PFWs ~6.58M Cash exercise common warrants2 + PIPE Funds: ~6.58M Shares or pre-funded warrants (PFWs) + Exchange Issuances:3 ~$19.3M Note amount exchanged4 Convertible Notes: $6 million & conversion of 90%+ of outstanding debt strengthens balance sheet and accelerates program 8M Cash exercise common warrants2 ~23.1M Shares or PFWs5 $1.5M + New note principal6 + |