| Bringing Biosimilar Competition to a U.S. Therapeutic Neurotoxin Market Still Dominated by a Single Brand ABP-450 is being developed as a biosimilar to BOTOX®, aiming to become the first complete therapeutic alternative CORPORATE PRESENTATION / JANUARY 2026 NYSEAMERICAN: AEON © 2 0 2 6 A E O N B I O P H A R M A |

| This presentation includes forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements concerning possible or assumed future actions, business strategies, events or results of operations, illustrative timelines and targets for financing and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements may involve known and unknown risks, uncertainties and other important factors that may cause the actual results, performance or achievements of AEON Biopharma, Inc. (“AEON”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements may be preceded by, followed by or include the words “believes”, “estimates”, “expects”, “projects”, “forecasts”, “may”, “will”, “should”, “seeks”, “plans”, “scheduled”, “anticipates” or “intends” or similar expressions. The forward-looking statements in this presentation are only predictions. AEON has based these forward-looking statements largely on AEON’s current expectations and projections about future events and financial trends that AEON believes may affect its business, financial condition and results of operations. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by AEON and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the outcome of any meetings with any regulatory authorities, including the FDA’s review of the Company's biosimilar meetings and document submissions, (ii) the outcome of any legal proceedings that may be instituted against AEON or others; (iii) AEON’s future capital requirements; (iv) AEON’s ability to raise financing in the future; (v) AEON’s ability to continue to meet continued stock exchange listing standards; (vi) the ability of AEON to implement its strategic initiatives, including the continued development of ABP-450 and potential submission of a Biologics License Application as a biosimilar for therapeutic uses of ABP-450; (vii) the ability of AEON to satisfy regulatory requirements; (viii) the ability of AEON to defend its intellectual property or avoid infringement of existing intellectual property; (ix) the possibility that AEON may be adversely affected by other economic, business, regulatory, and/or competitive factors; (x) AEON’s ability to receive stockholder approval for the transactions described herein; (xi) the FDA’s response to the primary structure and other functional analysis data; (xii) the ability of the Company to satisfy other customary closing conditions for the transactions; and (xiii) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in AEON’s Annual Report on Form 10-K for the year ended December 31, 2024 and any current or periodic reports filed with the Securities and Exchange Commission (the "SEC"), which are available on the SEC’s website at www.sec.gov. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond AEON’s control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in AEON’s forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, AEON operates in an evolving environment and a competitive industry. New risks and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties, nor can AEON assess the impact of all factors on AEON’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements AEON may make in this presentation. As a result of these factors, although AEON believes that the expectations reflected in its forward-looking statements are reasonable, AEON cannot assure you that the forward-looking statements in this presentation will prove to be accurate. Except as required by applicable law, AEON does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances, or otherwise. AEON qualifies all of its forward-looking statements by these cautionary statements. You should view this presentation completely and with the understanding that the actual future results, levels of activity, performance, events and circumstances of AEON may be materially different from what is expected. This presentation concerns anticipated products that are under clinical and analytical investigation, and which have not yet been approved for marketing by the FDA. These anticipated products are currently limited by Federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for which they are being investigated. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and AEON’s own internal estimates and research. AEON has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, AEON’s own internal estimates and research have not been verified by any independent source. AEON Biopharma and the AEON Biopharma logo are trademarks of AEON Biopharma, Inc. All other trademarks used herein are the property of their respective owners. Forward-Looking Statements © 2 0 2 6 A E O N B I O P H A R M A 2 |

| © 2 0 2 6 A E O N B I O P H A R M A Introducing Meaningful Competition 1 Clarivate. Market Insights US Therapeutic Botulinum Toxin Market. 2025. Norstella / Evaluate Ltd. Evaluate Pharma® USA Product Sales. Accessed December 2025. 3 Who We Are Developing ABP-450 as a biosimilar to BOTOX® , with the goal of capturing all 12 therapeutic indications - creating label parity in a market where BOTOX’s sweeping indication advantage has dominated the market Why We’re Different Built on a globally validated toxin and manufacturing platform, already approved in 69+ countries and FDA-approved for aesthetics (Jeuveau® by Evolus), giving AEON’s biosimilar a unique head start on quality, safety, and supply reliability Why It Matters Delivers unique benefits over competitors. FDA-validated clinical equivalence and full-label capture unlock confident switching from BOTOX, enabling seamless adoption, payer coverage parity, and a systemwide economic reset. ABP-450 positioned to disrupt a market expected to grow to $5B+ by 20301 |

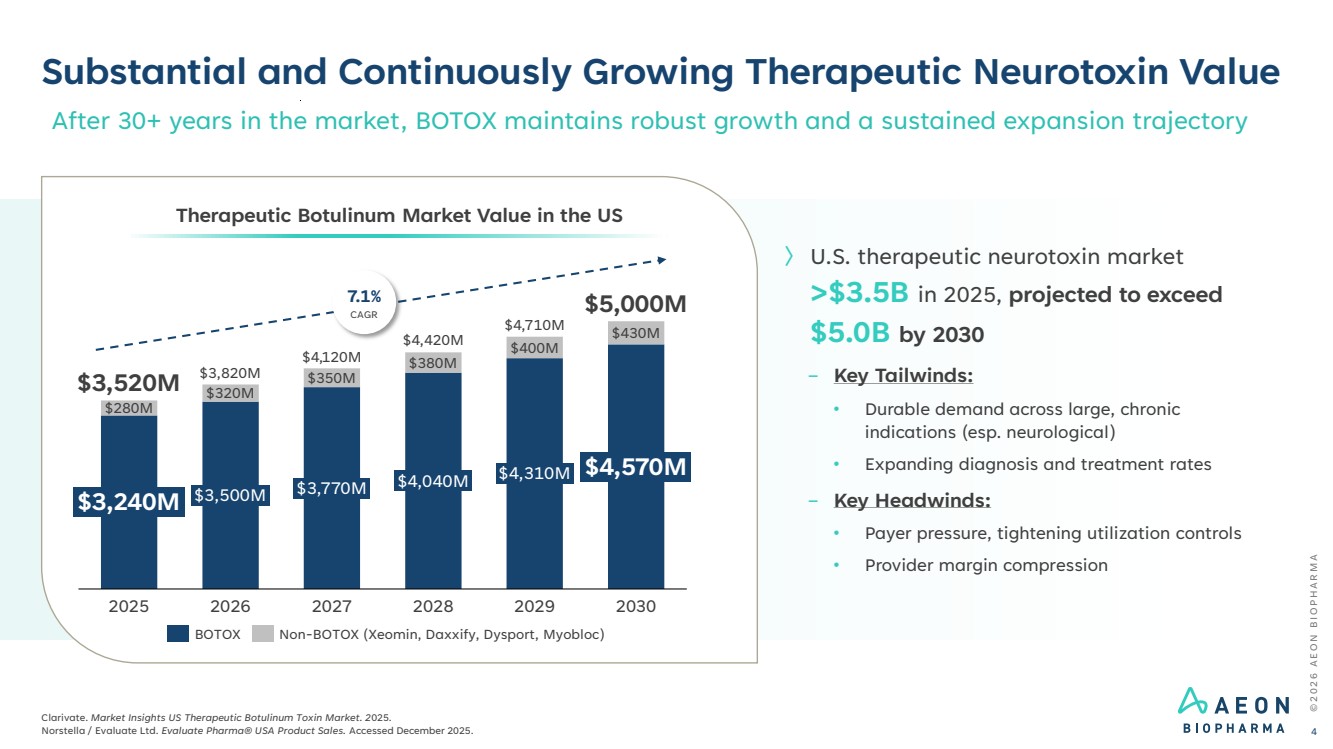

| Substantial and Continuously Growing Therapeutic Neurotoxin Value © 2 0 2 6 A E O N B I O P H A R M A Clarivate. Market Insights US Therapeutic Botulinum Toxin Market. 2025. Norstella / Evaluate Ltd. Evaluate Pharma® USA Product Sales. Accessed December 2025. 4 After 30+ years in the market, BOTOX maintains robust growth and a sustained expansion trajectory $280M $320M $350M $380M $400M $430M $3,240M 2025 $3,500M 2026 $3,770M 2027 $4,040M 2028 $4,310M 2029 $4,570M 2030 $3,520M $3,820M $4,120M $4,420M $4,710M $5,000M Therapeutic Botulinum Market Value in the US 7.1% CAGR BOTOX Non-BOTOX (Xeomin, Daxxify, Dysport, Myobloc) 〉 U.S. therapeutic neurotoxin market >$3.5B in 2025, projected to exceed $5.0B by 2030 − Key Tailwinds: • Durable demand across large, chronic indications (esp. neurological) • Expanding diagnosis and treatment rates − Key Headwinds: • Payer pressure, tightening utilization controls • Provider margin compression |

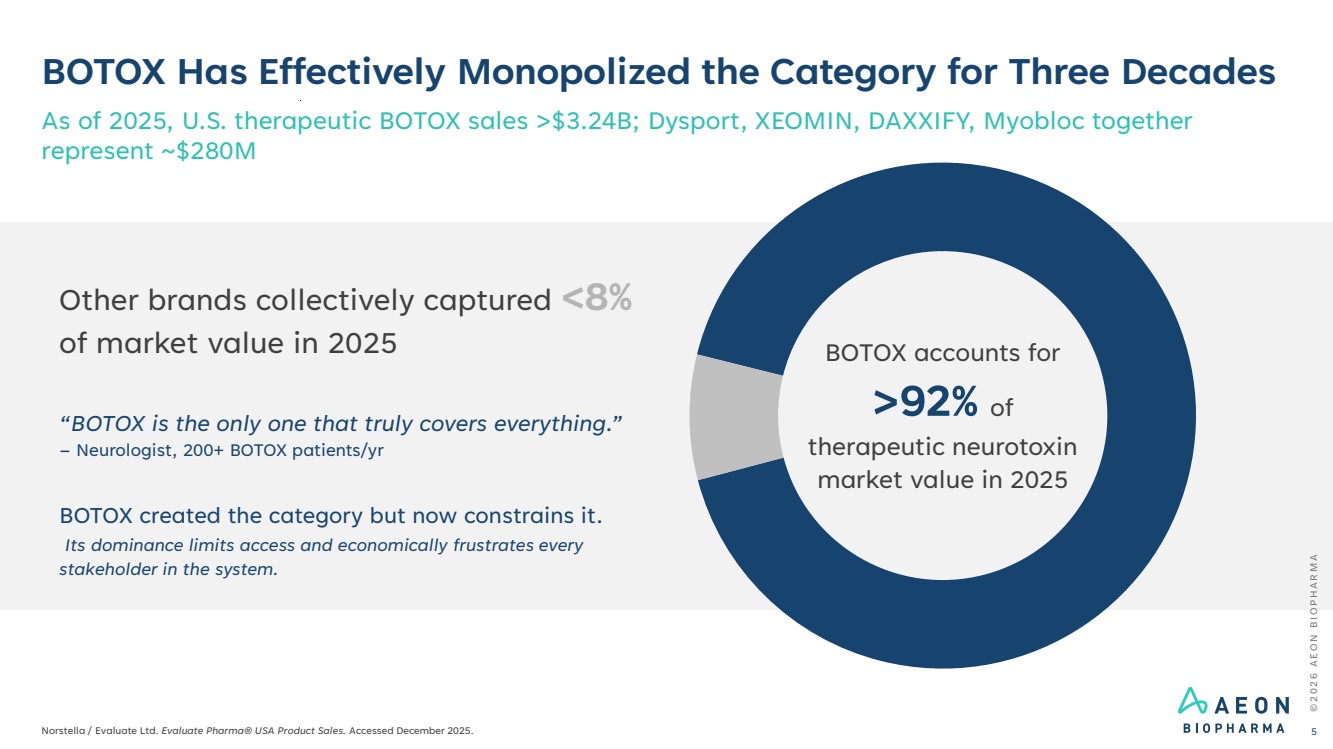

| BOTOX Has Effectively Monopolized the Category for Three Decades As of 2025, U.S. therapeutic BOTOX sales >$3.24B; Dysport, XEOMIN, DAXXIFY, Myobloc together represent ~$280M © 2 0 2 6 A E O N B I O P H A R M A Norstella / Evaluate Ltd. Evaluate Pharma® USA Product Sales. Accessed December 2025. 5 Other brands collectively captured <8% of market value in 2025 BOTOX accounts for >92% of therapeutic neurotoxin market value in 2025 “BOTOX is the only one that truly covers everything.” – Neurologist, 200+ BOTOX patients/yr BOTOX created the category but now constrains it. Its dominance limits access and economically frustrates every stakeholder in the system. |

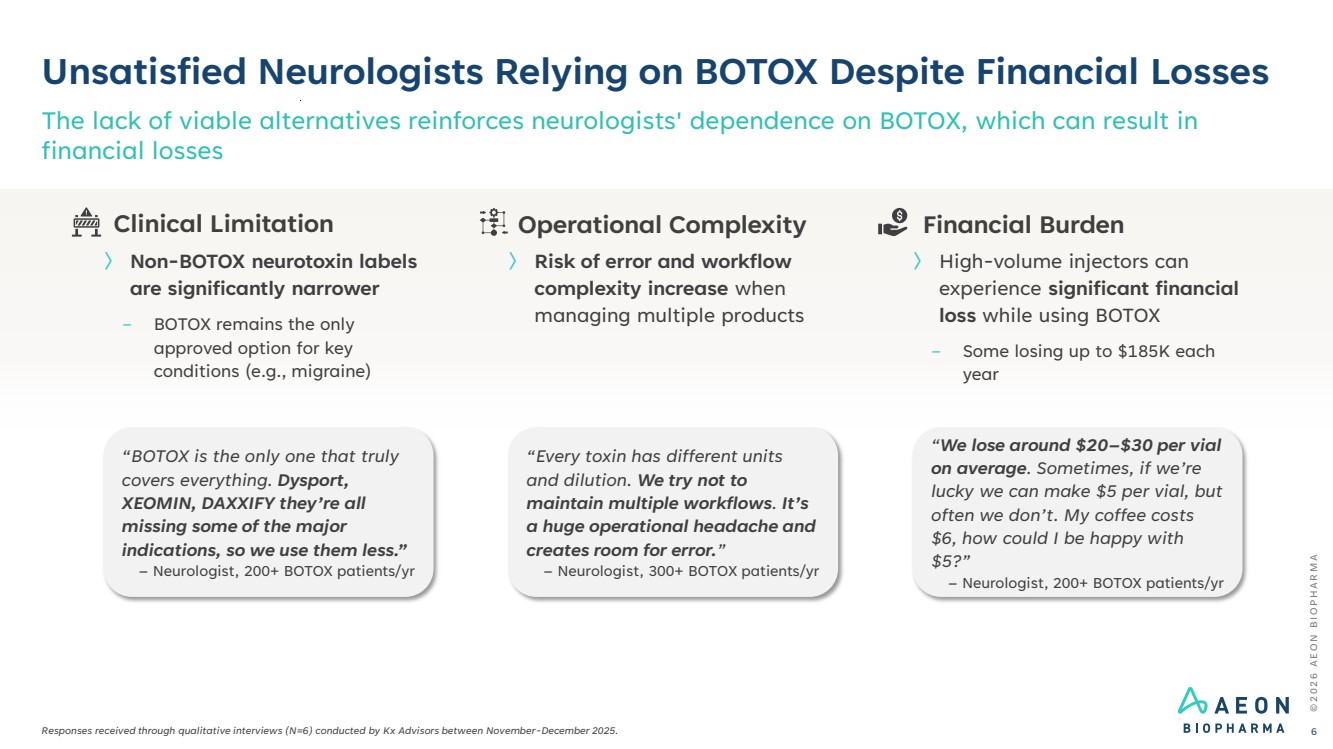

| © 2 0 2 6 A E O N B I O P H A R M A Unsatisfied Neurologists Relying on BOTOX Despite Financial Losses Responses received through qualitative interviews (N=6) conducted by Kx Advisors between November-December 2025. The lack of viable alternatives reinforces neurologists' dependence on BOTOX, which can result in financial losses 6 “We lose around $20–$30 per vial on average. Sometimes, if we’re lucky we can make $5 per vial, but often we don’t. My coffee costs $6, how could I be happy with $5?” – Neurologist, 200+ BOTOX patients/yr “Every toxin has different units and dilution. We try not to maintain multiple workflows. It’s a huge operational headache and creates room for error.” – Neurologist, 300+ BOTOX patients/yr “BOTOX is the only one that truly covers everything. Dysport, XEOMIN, DAXXIFY they’re all missing some of the major indications, so we use them less.” – Neurologist, 200+ BOTOX patients/yr Financial Burden 〉 High-volume injectors can experience significant financial loss while using BOTOX − Some losing up to $185K each year Operational Complexity 〉 Risk of error and workflow complexity increase when managing multiple products Clinical Limitation 〉 Non-BOTOX neurotoxin labels are significantly narrower − BOTOX remains the only approved option for key conditions (e.g., migraine) |

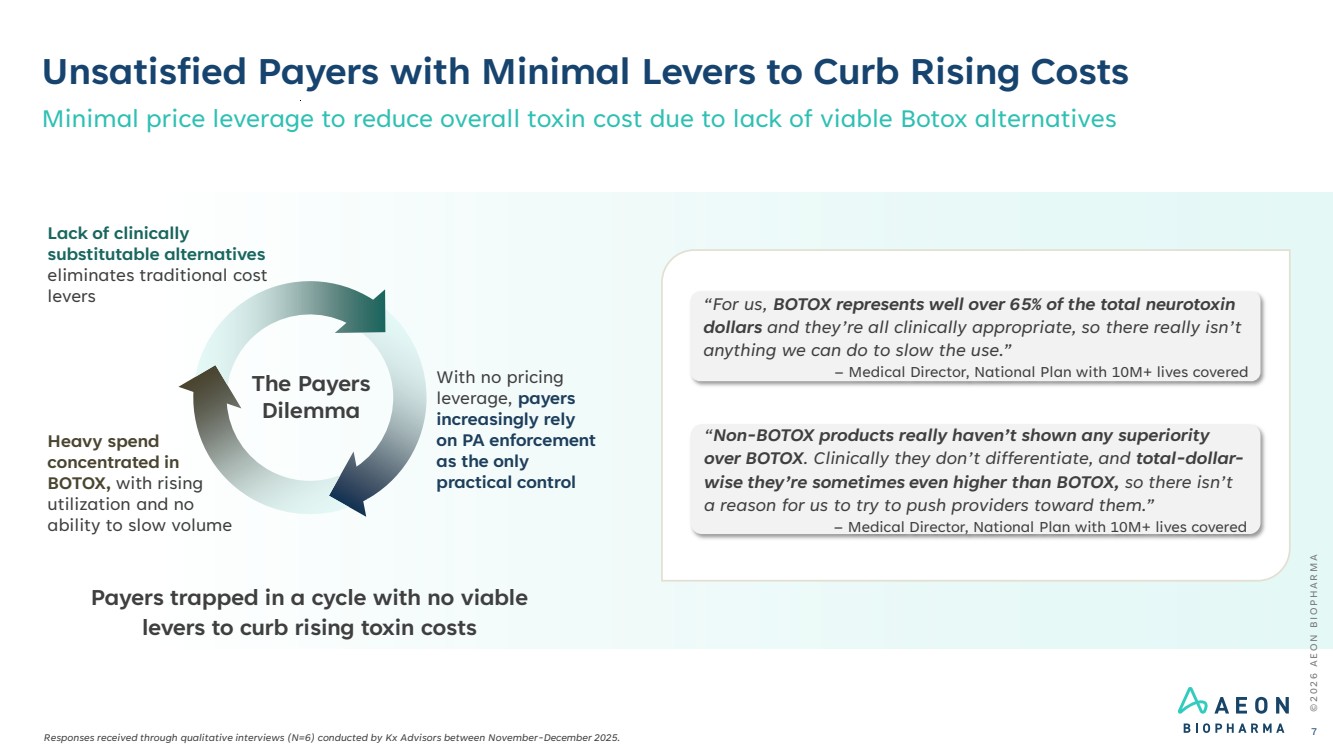

| Heavy spend concentrated in BOTOX, with rising utilization and no ability to slow volume The Payers Dilemma Unsatisfied Payers with Minimal Levers to Curb Rising Costs © 2 0 2 6 A E O N B I O P H A R M A 7 Payers trapped in a cycle with no viable levers to curb rising toxin costs “For us, BOTOX represents well over 65% of the total neurotoxin dollars and they’re all clinically appropriate, so there really isn’t anything we can do to slow the use.” – Medical Director, National Plan with 10M+ lives covered “Non-BOTOX products really haven’t shown any superiority over BOTOX. Clinically they don’t differentiate, and total-dollar-wise they’re sometimes even higher than BOTOX, so there isn’t a reason for us to try to push providers toward them.” – Medical Director, National Plan with 10M+ lives covered Minimal price leverage to reduce overall toxin cost due to lack of viable Botox alternatives Lack of clinically substitutable alternatives eliminates traditional cost levers With no pricing leverage, payers increasingly rely on PA enforcement as the only practical control Responses received through qualitative interviews (N=6) conducted by Kx Advisors between November-December 2025. |

| AEON is pursuing a different strategy Unlike current competitors to BOTOX, we’re not trying to be different We’re trying to be the same Clinically indistinguishable from BOTOX in every relevant dimension |

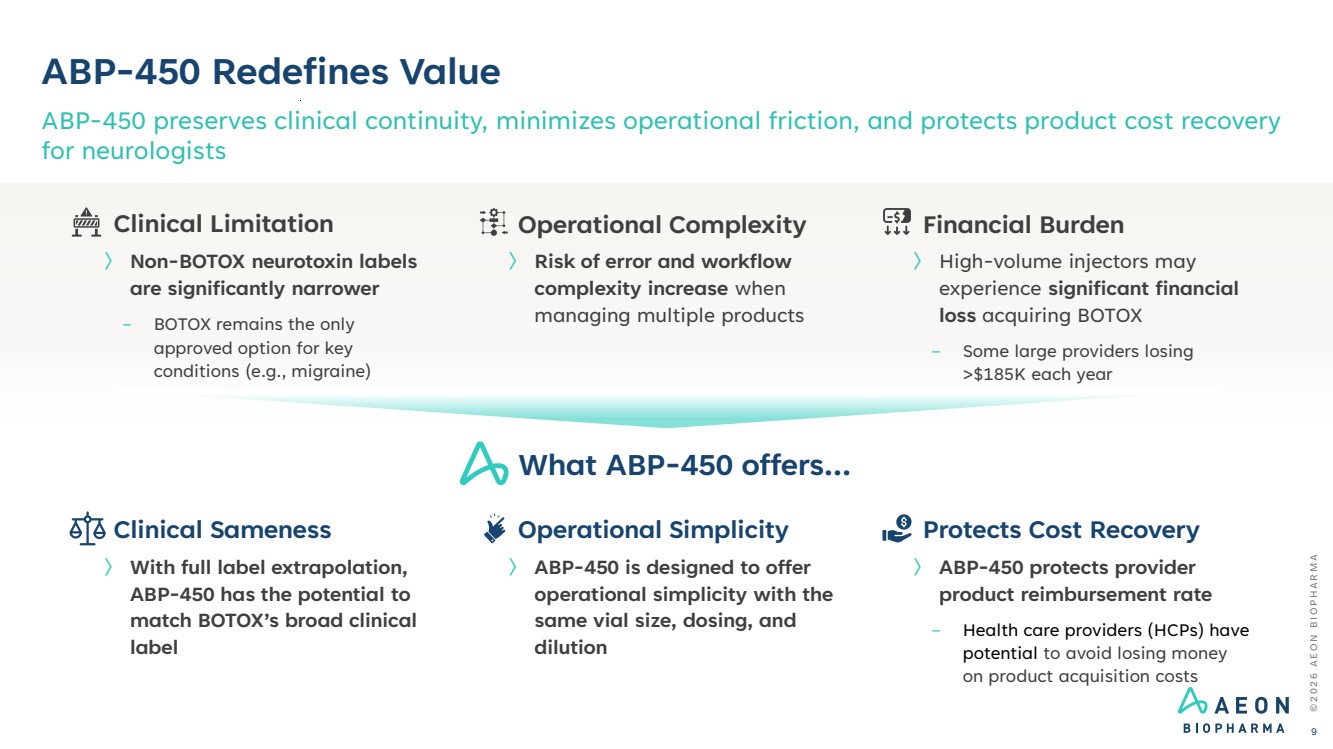

| ABP-450 Redefines Value ABP-450 preserves clinical continuity, minimizes operational friction, and protects product cost recovery for neurologists © 2 0 2 6 A E O N B I O P H A R M A 9 〉 With full label extrapolation, ABP-450 has the potential to match BOTOX’s broad clinical label 〉 ABP-450 is designed to offer operational simplicity with the same vial size, dosing, and dilution 〉 ABP-450 protects provider product reimbursement rate − Health care providers (HCPs) have potential to avoid losing money on product acquisition costs Financial Burden 〉 High-volume injectors may experience significant financial loss acquiring BOTOX − Some large providers losing >$185K each year Operational Complexity 〉 Risk of error and workflow complexity increase when managing multiple products Clinical Limitation 〉 Non-BOTOX neurotoxin labels are significantly narrower − BOTOX remains the only approved option for key conditions (e.g., migraine) What ABP-450 offers… Clinical Sameness Operational Simplicity Protects Cost Recovery |

| AbbVie Inc. Merz Pharma Ipsen Group Crown Laboratories Therapeutic Label (FDA Approved Indications) 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus With Full Extrapolation 1. Chronic migraine 2. Overactive bladder 3. Detrusor overactivity 4. Pediatric detrusor overactivity 5. Adult upper limb spasticity 6. Adult lower limb spasticity 7. Pediatric upper limb spasticity 8. Pediatric lower limb spasticity 9. Cervical dystonia 10. Axillary hyperhidrosis 11. Blepharospasm 12. Strabismus 1. Blepharospasm 2. Cervical dystonia 3. Adult upper limb spasticity 4. Chronic sialorrhea 1. Cervical dystonia 2. Spasticity 1. Cervical dystonia Turning Parity into Competitive Advantage Through the FDA 351(k) pathway, ABP-450 may gain full label extrapolation and trust in clinical efficacy Extrapolation turns regulatory efficiency into market power - unlocking AEON’s full potential to compete and win © 2 0 2 6 A E O N B I O P H A R M A 10 “What limits Dysport, XEOMIN is their label. If a product has the full BOTOX indications, and it’s identical and cheaper, I’d consider switching entirely” -Neurologist, 300+ BOTOX patients/year Clinical Sameness |

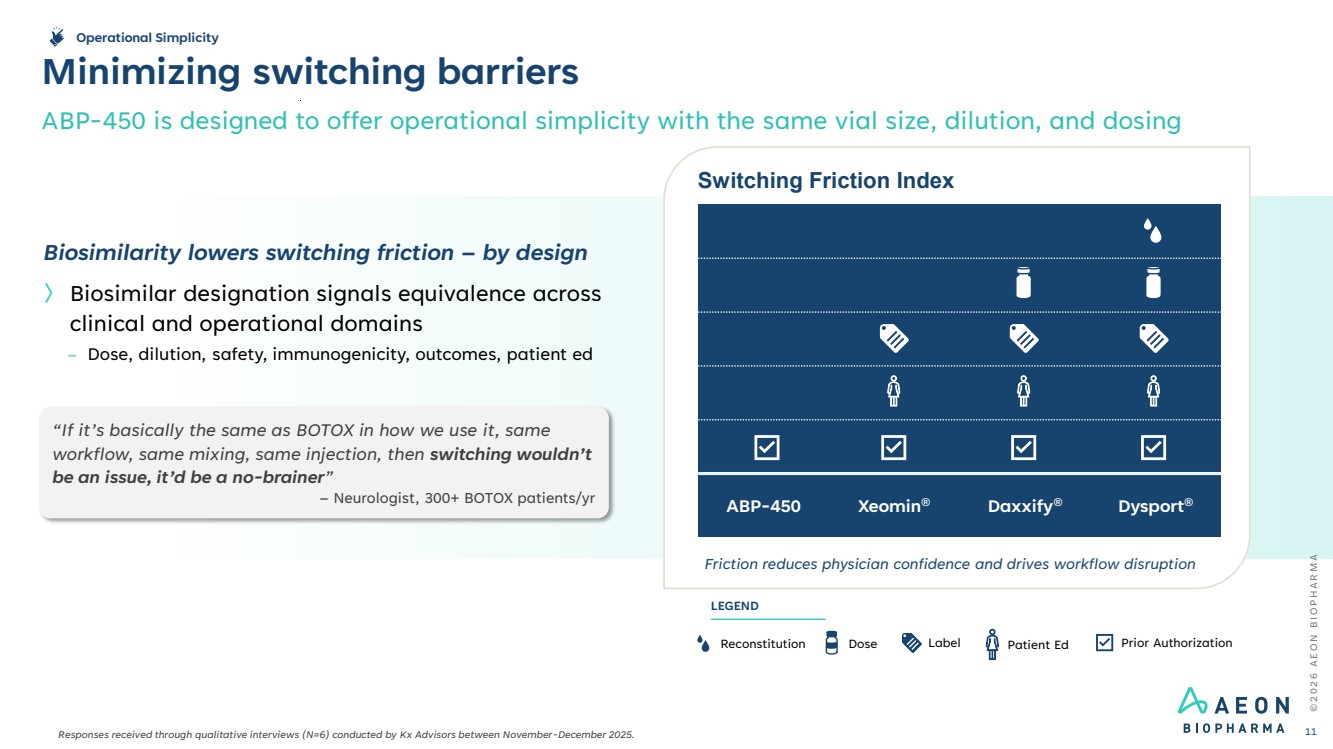

| © 2 0 2 6 A E O N B I O P H A R M A Minimizing switching barriers ABP-450 is designed to offer operational simplicity with the same vial size, dilution, and dosing 11 Switching Friction Index Friction reduces physician confidence and drives workflow disruption ABP-450 Xeomin® Daxxify® Dysport® Reconstitution Dose Label Prior Authorization LEGEND Patient Ed Biosimilarity lowers switching friction – by design 〉 Biosimilar designation signals equivalence across clinical and operational domains – Dose, dilution, safety, immunogenicity, outcomes, patient ed “If it’s basically the same as BOTOX in how we use it, same workflow, same mixing, same injection, then switching wouldn’t be an issue, it’d be a no-brainer” – Neurologist, 300+ BOTOX patients/yr Operational Simplicity Responses received through qualitative interviews (N=6) conducted by Kx Advisors between November-December 2025. |

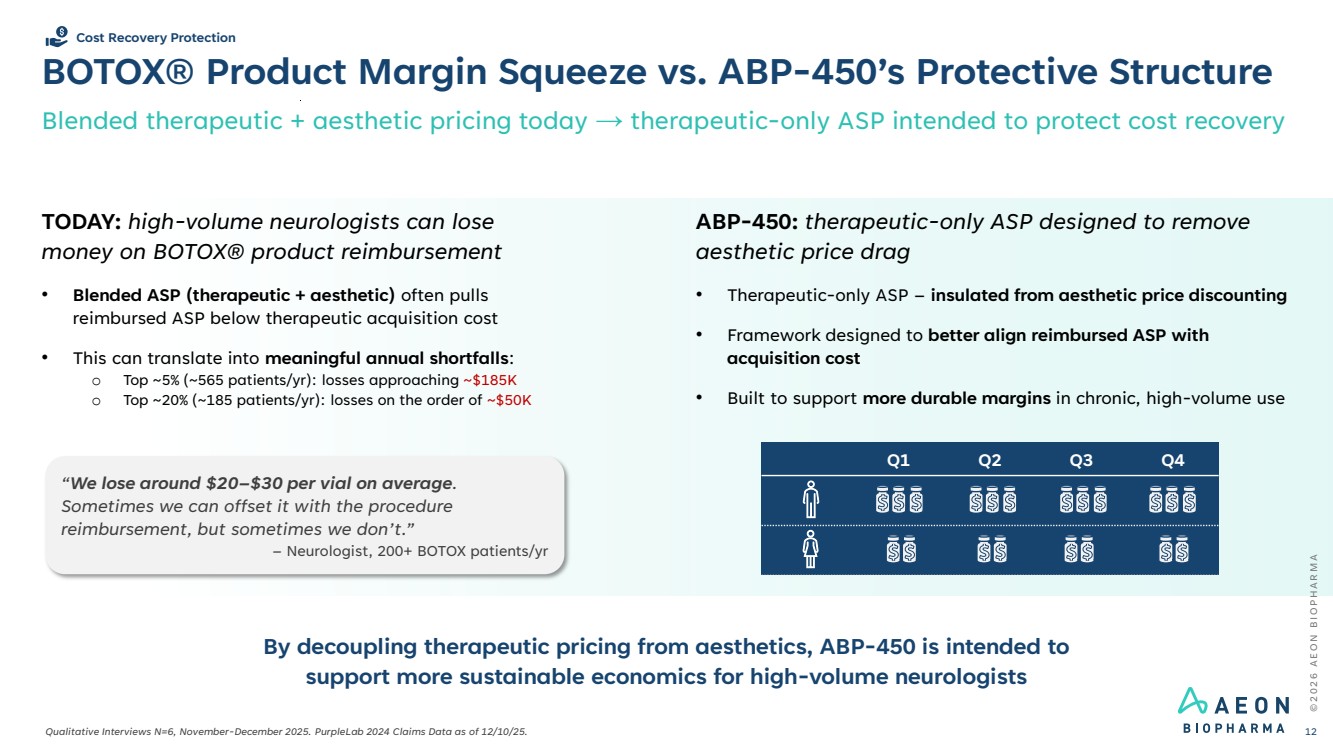

| BOTOX® Product Margin Squeeze vs. ABP-450’s Protective Structure Blended therapeutic + aesthetic pricing today → therapeutic-only ASP intended to protect cost recovery © 2 0 2 6 A E O N B I O P H A R M A 12 Cost Recovery Protection “We lose around $20–$30 per vial on average. Sometimes we can offset it with the procedure reimbursement, but sometimes we don’t.” – Neurologist, 200+ BOTOX patients/yr TODAY: high-volume neurologists can lose money on BOTOX® product reimbursement • Blended ASP (therapeutic + aesthetic) often pulls reimbursed ASP below therapeutic acquisition cost • This can translate into meaningful annual shortfalls: o Top ~5% (~565 patients/yr): losses approaching ~$185K o Top ~20% (~185 patients/yr): losses on the order of ~$50K Qualitative Interviews N=6, November-December 2025. PurpleLab 2024 Claims Data as of 12/10/25. By decoupling therapeutic pricing from aesthetics, ABP-450 is intended to support more sustainable economics for high-volume neurologists ABP-450: therapeutic-only ASP designed to remove aesthetic price drag • Therapeutic-only ASP – insulated from aesthetic price discounting • Framework designed to better align reimbursed ASP with acquisition cost • Built to support more durable margins in chronic, high-volume use Q1 Q2 Q3 Q4 |

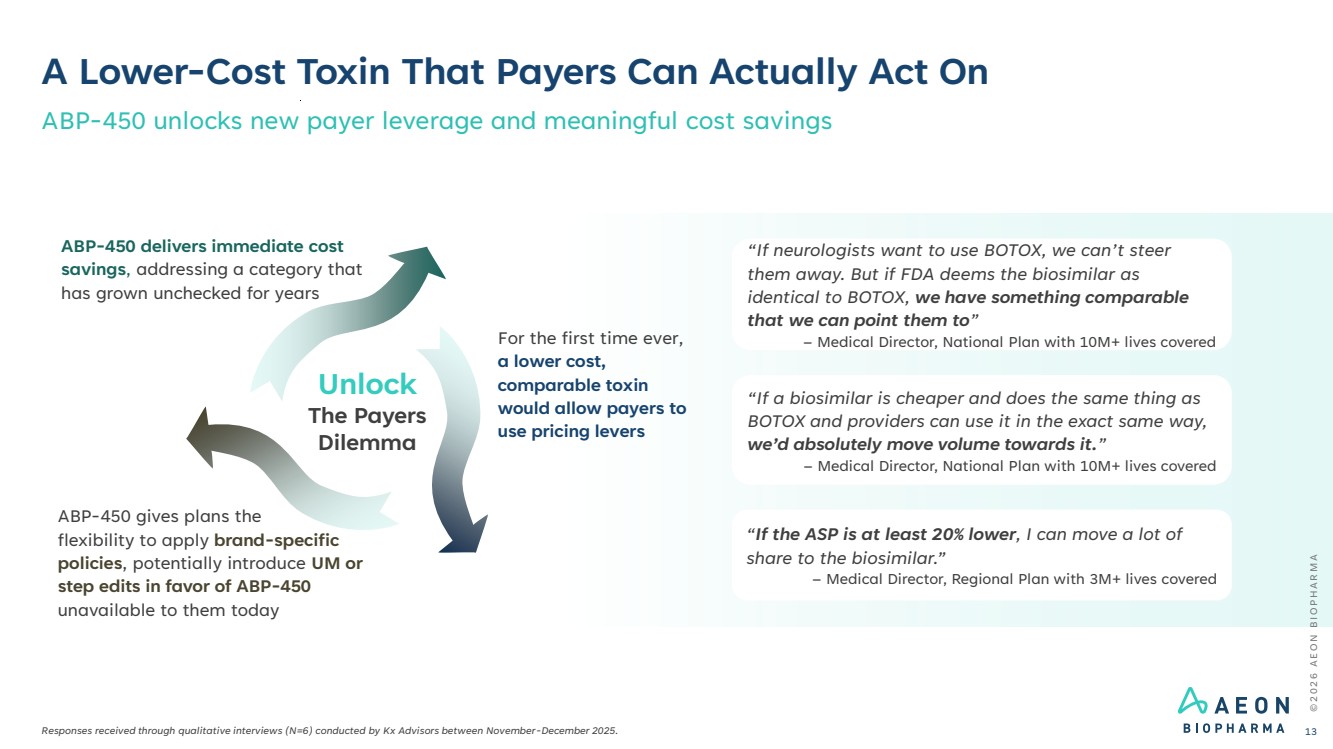

| © 2 0 2 6 A E O N B I O P H A R M A A Lower-Cost Toxin That Payers Can Actually Act On Responses received through qualitative interviews (N=6) conducted by Kx Advisors between November-December 2025. ABP-450 unlocks new payer leverage and meaningful cost savings 13 “If neurologists want to use BOTOX, we can’t steer them away. But if FDA deems the biosimilar as identical to BOTOX, we have something comparable that we can point them to” – Medical Director, National Plan with 10M+ lives covered “If a biosimilar is cheaper and does the same thing as BOTOX and providers can use it in the exact same way, we’d absolutely move volume towards it.” – Medical Director, National Plan with 10M+ lives covered “If the ASP is at least 20% lower, I can move a lot of share to the biosimilar.” – Medical Director, Regional Plan with 3M+ lives covered ABP-450 gives plans the flexibility to apply brand-specific policies, potentially introduce UM or step edits in favor of ABP-450 unavailable to them today For the first time ever, a lower cost, comparable toxin would allow payers to use pricing levers ABP-450 delivers immediate cost savings, addressing a category that has grown unchecked for years Unlock The Payers Dilemma |

| Why ABP-450 Wins: Value that Drives Systemwide Adoption Payers, physicians, patients each gain from the ABP-450’s advantage Payers: Restores cost control and formulary leverages through full label biosimilar competition Physicians: Preserves margin integrity and simplifies adoption workflows Patients: Lowers out-of-pocket costs while maintaining equivalent treatment effectiveness Same Science Same Outcomes Full Label Parity Better Economics © 2 0 2 6 A E O N B I O P H A R M A 14 |

| A Uniquely Advantaged Starting Point for Therapeutic Biosimilarity 1Evolus, Inc. Form-10K for the year ended December 31, 2024, filed with the SEC on March 4, 2025 2US, EU, UK, CAN and other international markets 〉 FDA approval in moderate to severe glabellar (frown) lines; $264.3m sales in 20241 9/30/2013 agreement Jeuveau 12/20/2019 agreement ABP-450 Aesthetics Therapeutics 〉 Exclusive therapeutic rights2 → seeking all 12 FDA-approved indications for BOTOX® © 2 0 2 6 A E O N B I O P H A R M A 15 The Daewoong 900 kD toxin powering Jeuveau® also anchors ABP-450’s therapeutic biosimilar strategy This shared toxin heritage means AEON is building its biosimilar strategy on a known molecule, known manufacturing, and known safety - not on a blank page |

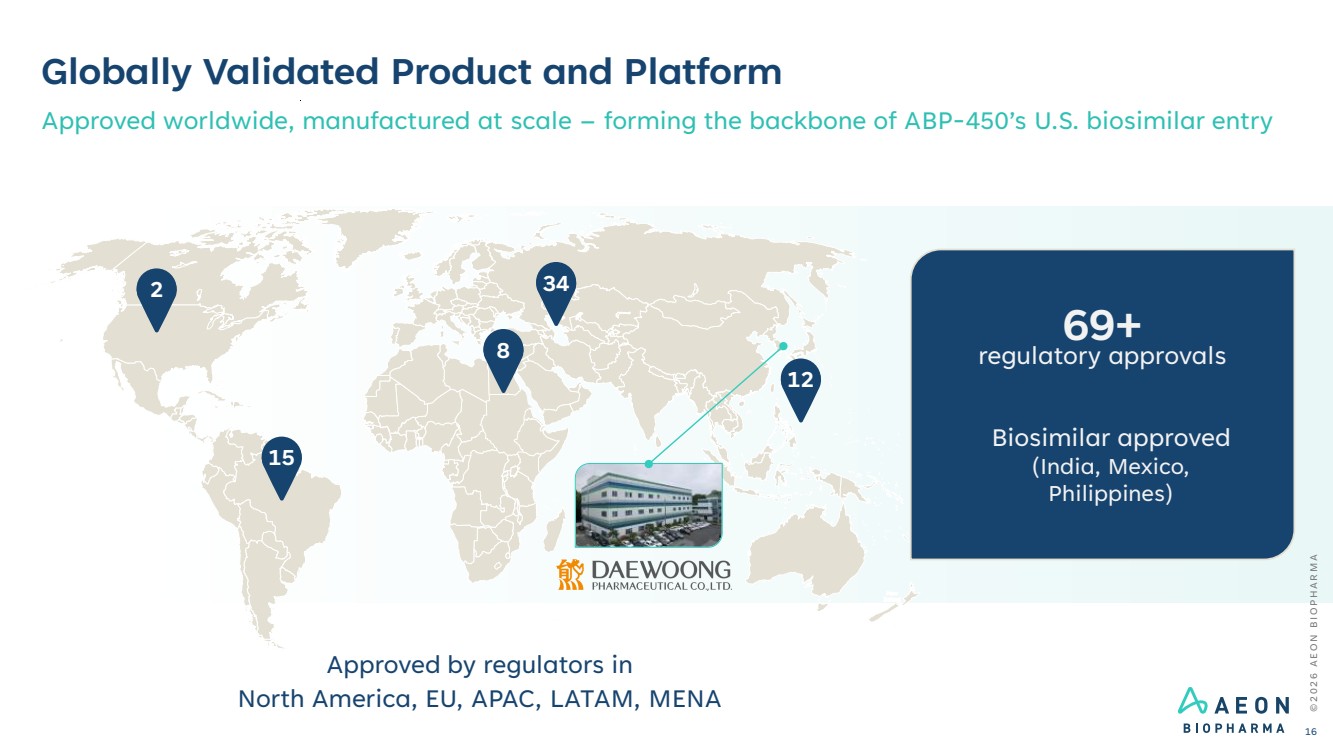

| Globally Validated Product and Platform Approved worldwide, manufactured at scale – forming the backbone of ABP-450’s U.S. biosimilar entry 2 15 8 34 12 Approved by regulators in North America, EU, APAC, LATAM, MENA 69+ regulatory approvals Biosimilar approved (India, Mexico, Philippines) © 2 0 2 6 A E O N B I O P H A R M A 16 |

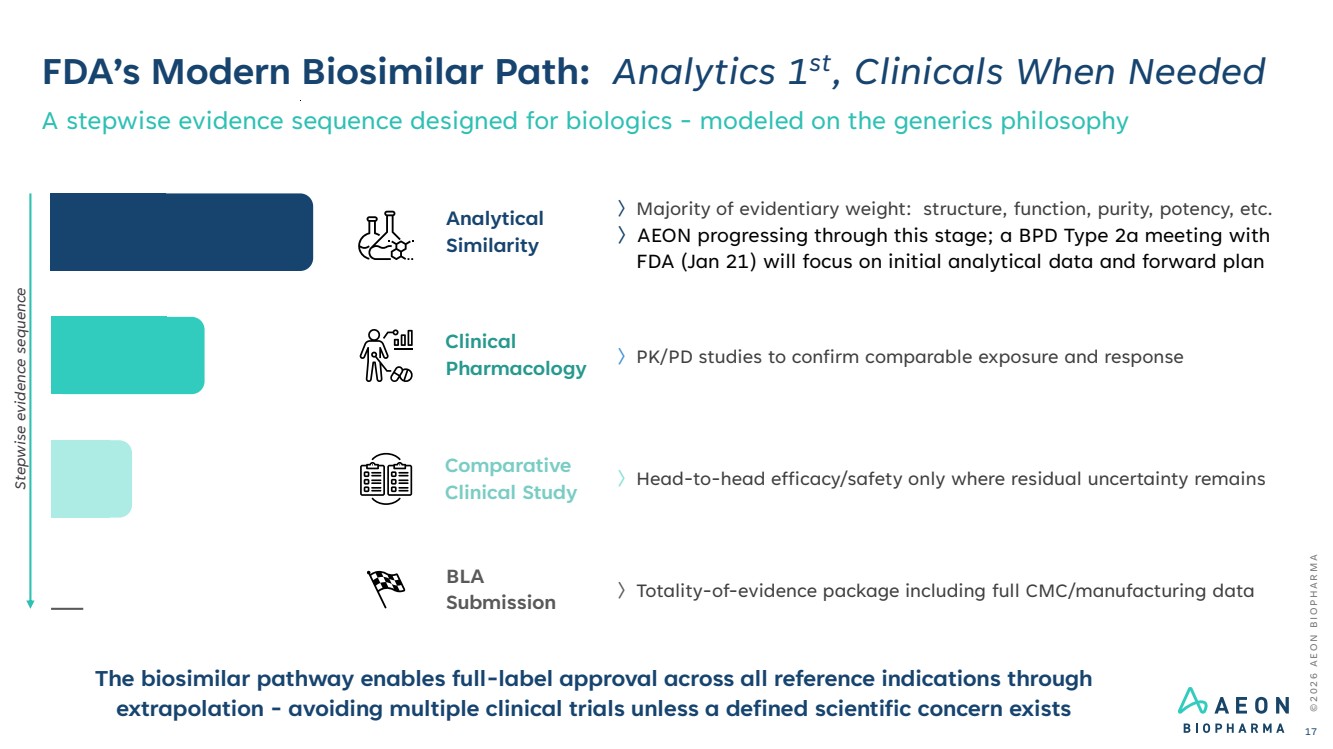

| FDA’s Modern Biosimilar Path: Analytics 1st, Clinicals When Needed A stepwise evidence sequence designed for biologics - modeled on the generics philosophy © 2 0 2 6 A E O N B I O P H A R M A 17 〉Majority of evidentiary weight: structure, function, purity, potency, etc. 〉AEON progressing through this stage; a BPD Type 2a meeting with FDA (Jan 21) will focus on initial analytical data and forward plan Analytical Similarity 〉PK/PD studies to confirm comparable exposure and response Clinical Pharmacology 〉Head-to-head efficacy/safety only where residual uncertainty remains Comparative Clinical Study 〉Totality-of-evidence package including full CMC/manufacturing data BLA Submission The biosimilar pathway enables full-label approval across all reference indications through extrapolation - avoiding multiple clinical trials unless a defined scientific concern exists Stepwise evidence sequence |

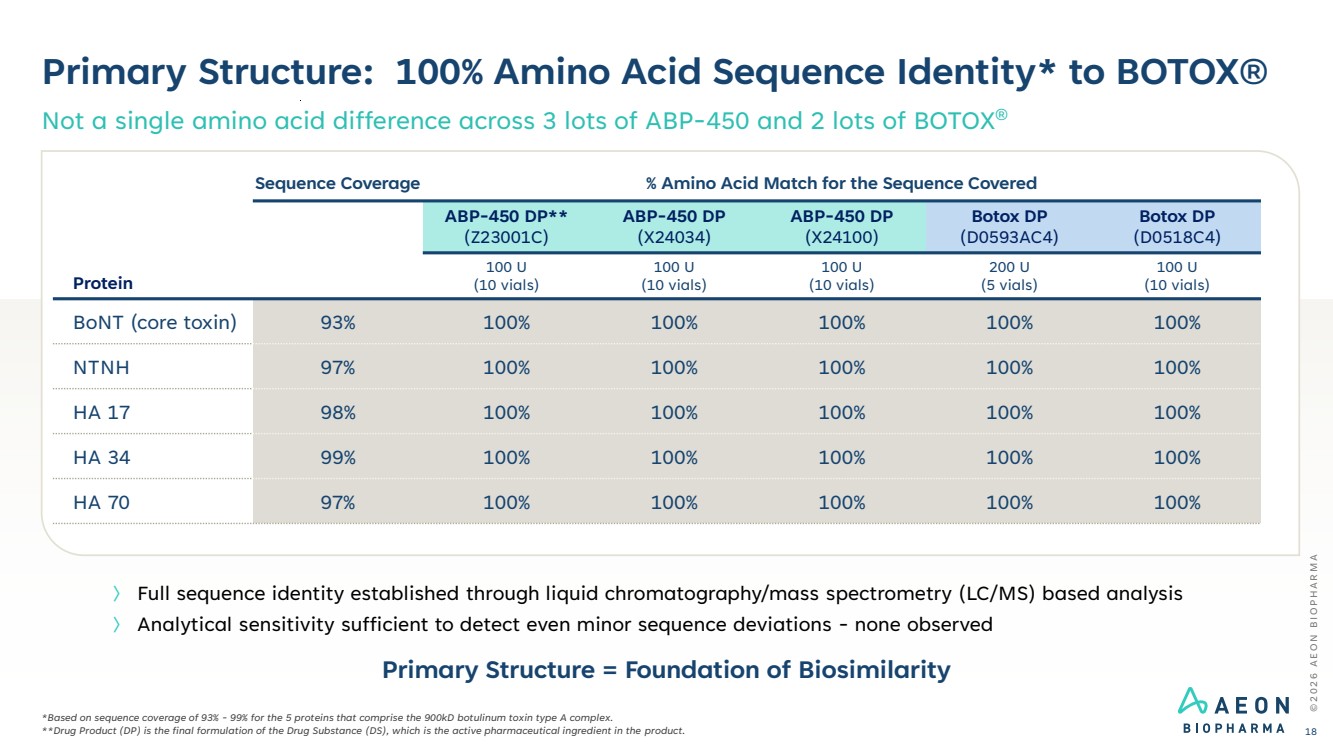

| Primary Structure: 100% Amino Acid Sequence Identity* to BOTOX® Not a single amino acid difference across 3 lots of ABP-450 and 2 lots of BOTOX® © 2 0 2 6 A E O N B I O P H A R M A 18 *Based on sequence coverage of 93% - 99% for the 5 proteins that comprise the 900kD botulinum toxin type A complex. **Drug Product (DP) is the final formulation of the Drug Substance (DS), which is the active pharmaceutical ingredient in the product. 〉 Full sequence identity established through liquid chromatography/mass spectrometry (LC/MS) based analysis 〉 Analytical sensitivity sufficient to detect even minor sequence deviations - none observed Protein Sequence Coverage % Amino Acid Match for the Sequence Covered ABP-450 DP** (Z23001C) ABP-450 DP (X24034) ABP-450 DP (X24100) Botox DP (D0593AC4) Botox DP (D0518C4) 100 U (10 vials) 100 U (10 vials) 100 U (10 vials) 200 U (5 vials) 100 U (10 vials) BoNT (core toxin) 93% 100% 100% 100% 100% 100% NTNH 97% 100% 100% 100% 100% 100% HA 17 98% 100% 100% 100% 100% 100% HA 34 99% 100% 100% 100% 100% 100% HA 70 97% 100% 100% 100% 100% 100% Primary Structure = Foundation of Biosimilarity |

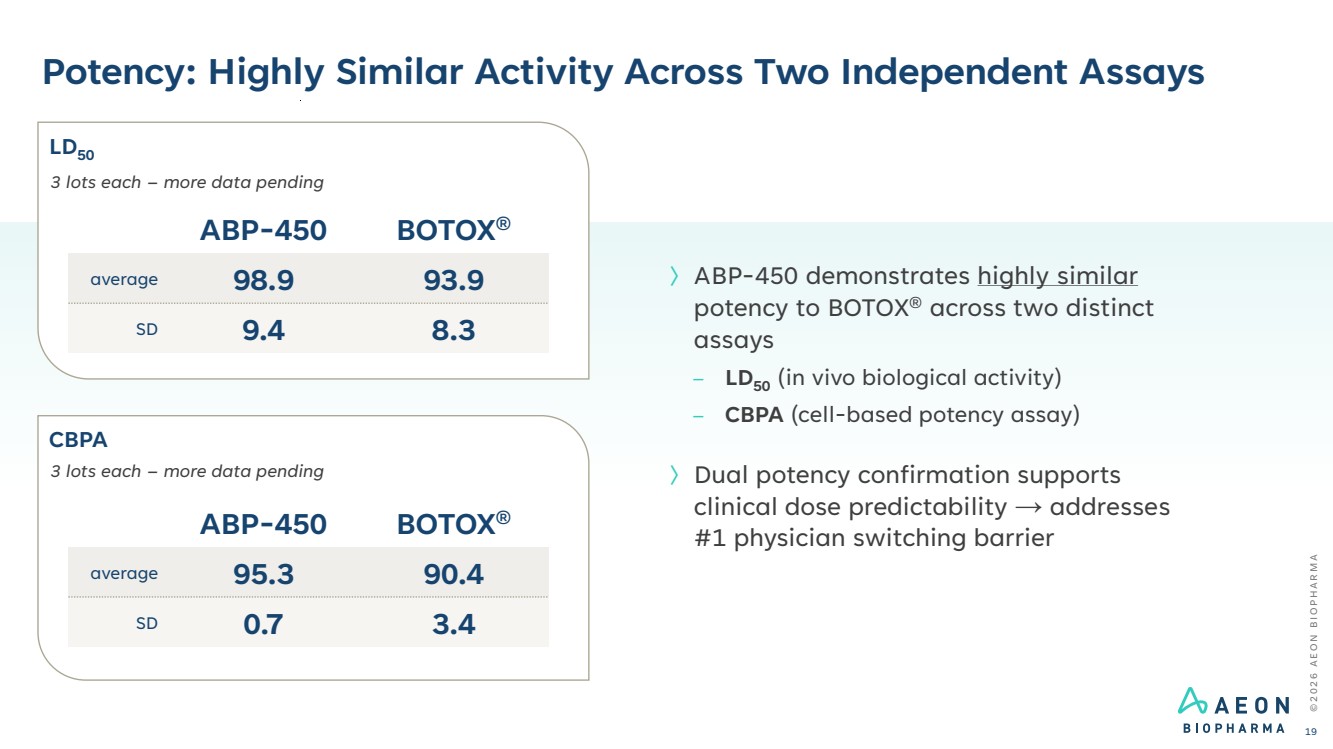

| Potency: Highly Similar Activity Across Two Independent Assays © 2 0 2 6 A E O N B I O P H A R M A 19 〉ABP-450 demonstrates highly similar potency to BOTOX® across two distinct assays – LD50 (in vivo biological activity) – CBPA (cell-based potency assay) 〉Dual potency confirmation supports clinical dose predictability → addresses #1 physician switching barrier ABP-450 BOTOX® average 98.9 93.9 SD 9.4 8.3 3 lots each – more data pending ABP-450 BOTOX® average 95.3 90.4 SD 0.7 3.4 3 lots each – more data pending LD50 CBPA |

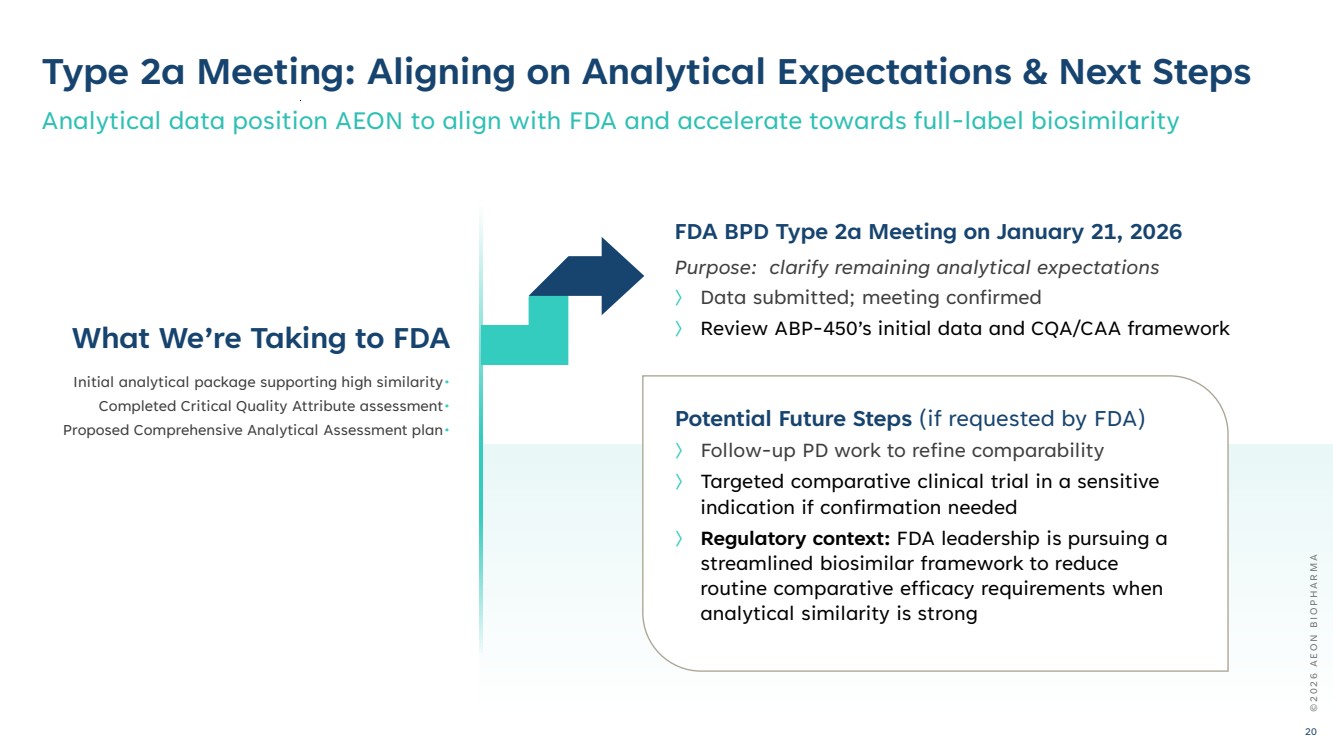

| Potential Future Steps (if requested by FDA) 〉 Follow-up PD work to refine comparability 〉 Targeted comparative clinical trial in a sensitive indication if confirmation needed 〉 Regulatory context: FDA leadership is pursuing a streamlined biosimilar framework to reduce routine comparative efficacy requirements when analytical similarity is strong Type 2a Meeting: Aligning on Analytical Expectations & Next Steps Analytical data position AEON to align with FDA and accelerate towards full-label biosimilarity FDA BPD Type 2a Meeting on January 21, 2026 Purpose: clarify remaining analytical expectations 〉 Data submitted; meeting confirmed What We’re Taking to FDA 〉 Review ABP-450’s initial data and CQA/CAA framework Initial analytical package supporting high similarity• Completed Critical Quality Attribute assessment• Proposed Comprehensive Analytical Assessment plan• © 2 0 2 6 A E O N B I O P H A R M A 20 |

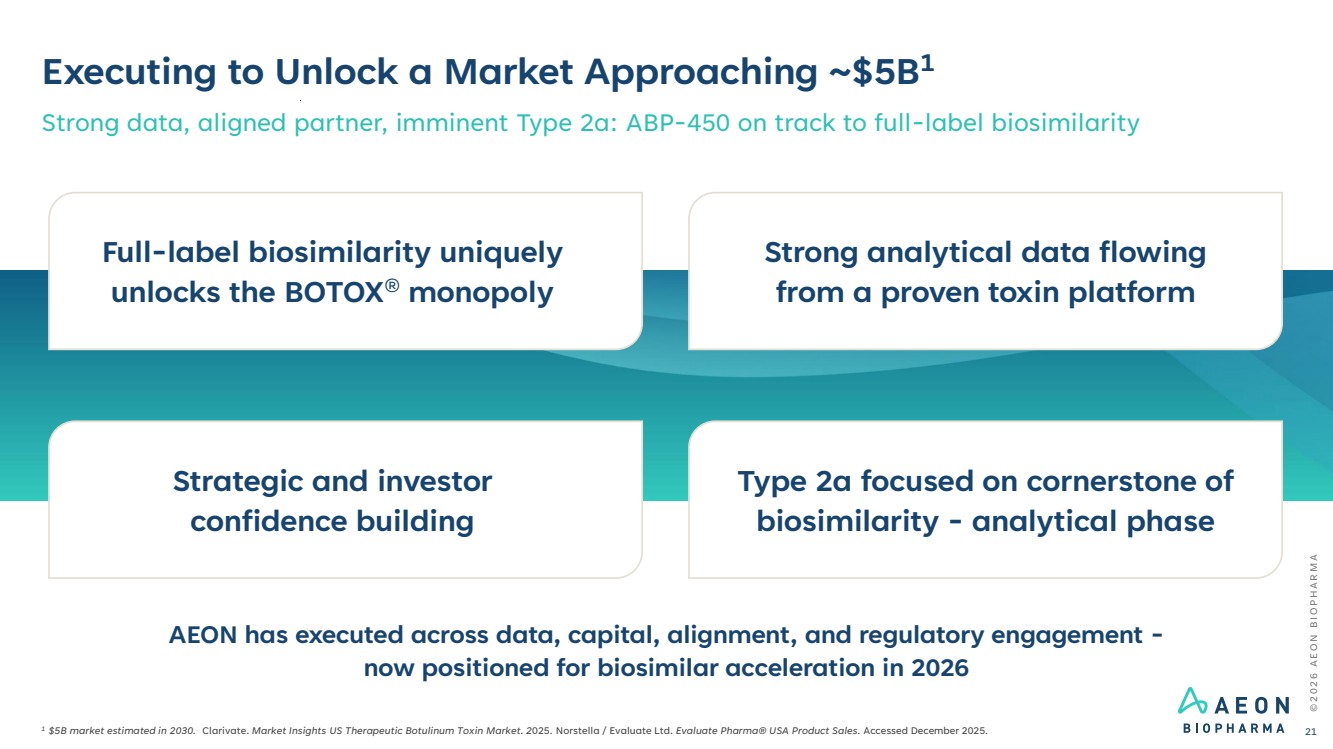

| Strong analytical data flowing from a proven toxin platform Type 2a focused on cornerstone of biosimilarity - analytical phase Strategic and investor confidence building Full-label biosimilarity uniquely unlocks the BOTOX® monopoly © 2 0 2 6 A E O N B I O P H A R M A 21 Executing to Unlock a Market Approaching ~$5B1 Strong data, aligned partner, imminent Type 2a: ABP-450 on track to full-label biosimilarity AEON has executed across data, capital, alignment, and regulatory engagement - now positioned for biosimilar acceleration in 2026 1 $5B market estimated in 2030. Clarivate. Market Insights US Therapeutic Botulinum Toxin Market. 2025. Norstella / Evaluate Ltd. Evaluate Pharma® USA Product Sales. Accessed December 2025. |

| Thank you NYSEAMERICAN: AEON © 2 0 2 6 A E O N B I O P H A R M A |

| Appendix © 2 0 2 6 A E O N B I O P H A R M A 23 |

| 〉 Proven leader in public company financial operations and reporting Jennifer Sy Chief Accounting Officer Proven Operators in Toxins, Biosimilars, and Capital Formation Collectively executed multiple equity, debt, and hybrid financings totaling more than $500 million 〉 Former Botox® leader responsible for competitive strategy and long-range asset maximization 〉 Led multiple therapeutic and buy-and-bill biologic launches Rob Bancroft Chief Executive Officer 〉 20+ years in clinical development and regulatory strategy – responsible for multiple IND, NDA, and BLA submissions Chad Oh, MD Chief Medical Officer 〉 20+ years in biotech and life sciences capital markets 〉 Over $500M in capital raised through a variety of equity, debt, and hybrid structures Alex Wilson Chief Legal & Strategy Officer; Corporate Secretary © 2 0 2 6 A E O N B I O P H A R M A 24 |

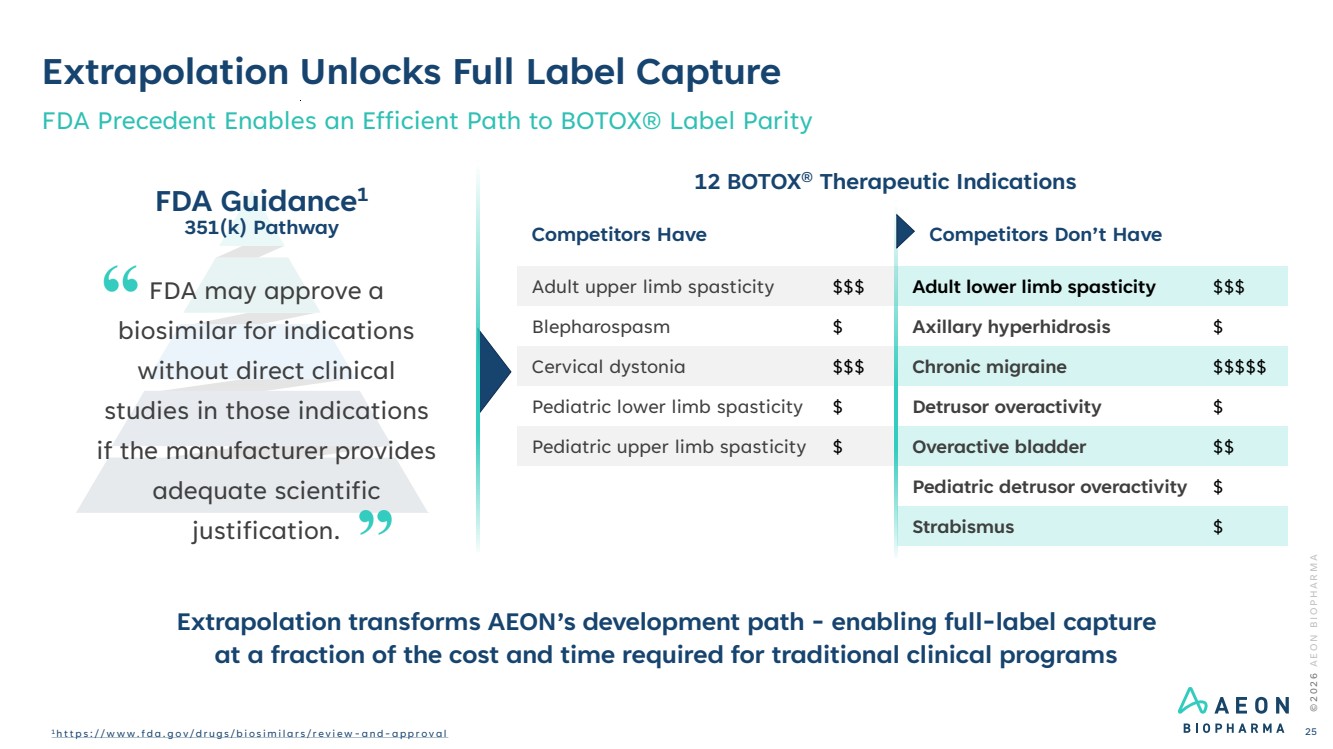

| Extrapolation Unlocks Full Label Capture FDA Precedent Enables an Efficient Path to BOTOX® Label Parity 12 BOTOX® Therapeutic Indications FDA Guidance1 351(k) Pathway FDA may approve a biosimilar for indications without direct clinical studies in those indications if the manufacturer provides adequate scientific justification. Competitors Have Competitors Don’t Have … Adult upper limb spasticity $$$ Adult lower limb spasticity $$$ Blepharospasm $ Axillary hyperhidrosis $ Cervical dystonia $$$ Chronic migraine $$$$$ Pediatric lower limb spasticity $ Detrusor overactivity $ Pediatric upper limb spasticity $ Overactive bladder $$ Pediatric detrusor overactivity $ Strabismus $ © 2 0 2 6 A E O N B I O P H A R M A 1 h t t p s : / / w w w . f d a . g o v / d r u g s / b i o s i m i l a r s / r e v i e w - a n d - a p p r o v a l 25 Extrapolation transforms AEON’s development path - enabling full-label capture at a fraction of the cost and time required for traditional clinical programs |

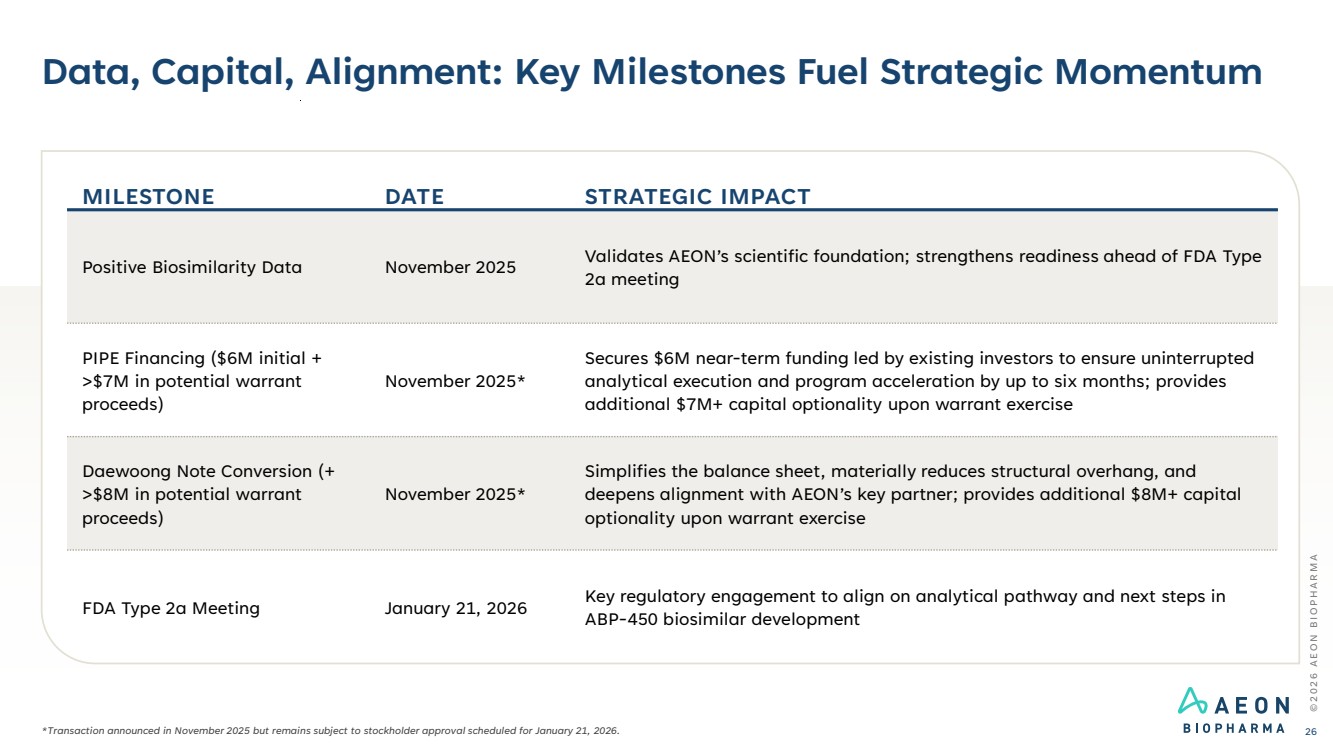

| Data, Capital, Alignment: Key Milestones Fuel Strategic Momentum © 2 0 2 6 A E O N B I O P H A R M A 26 MILESTONE DATE STRATEGIC IMPACT Positive Biosimilarity Data November 2025 Validates AEON’s scientific foundation; strengthens readiness ahead of FDA Type 2a meeting PIPE Financing ($6M initial + >$7M in potential warrant proceeds) November 2025* Secures $6M near-term funding led by existing investors to ensure uninterrupted analytical execution and program acceleration by up to six months; provides additional $7M+ capital optionality upon warrant exercise Daewoong Note Conversion (+ >$8M in potential warrant proceeds) November 2025* Simplifies the balance sheet, materially reduces structural overhang, and deepens alignment with AEON’s key partner; provides additional $8M+ capital optionality upon warrant exercise FDA Type 2a Meeting January 21, 2026 Key regulatory engagement to align on analytical pathway and next steps in ABP-450 biosimilar development *Transaction announced in November 2025 but remains subject to stockholder approval scheduled for January 21, 2026. |

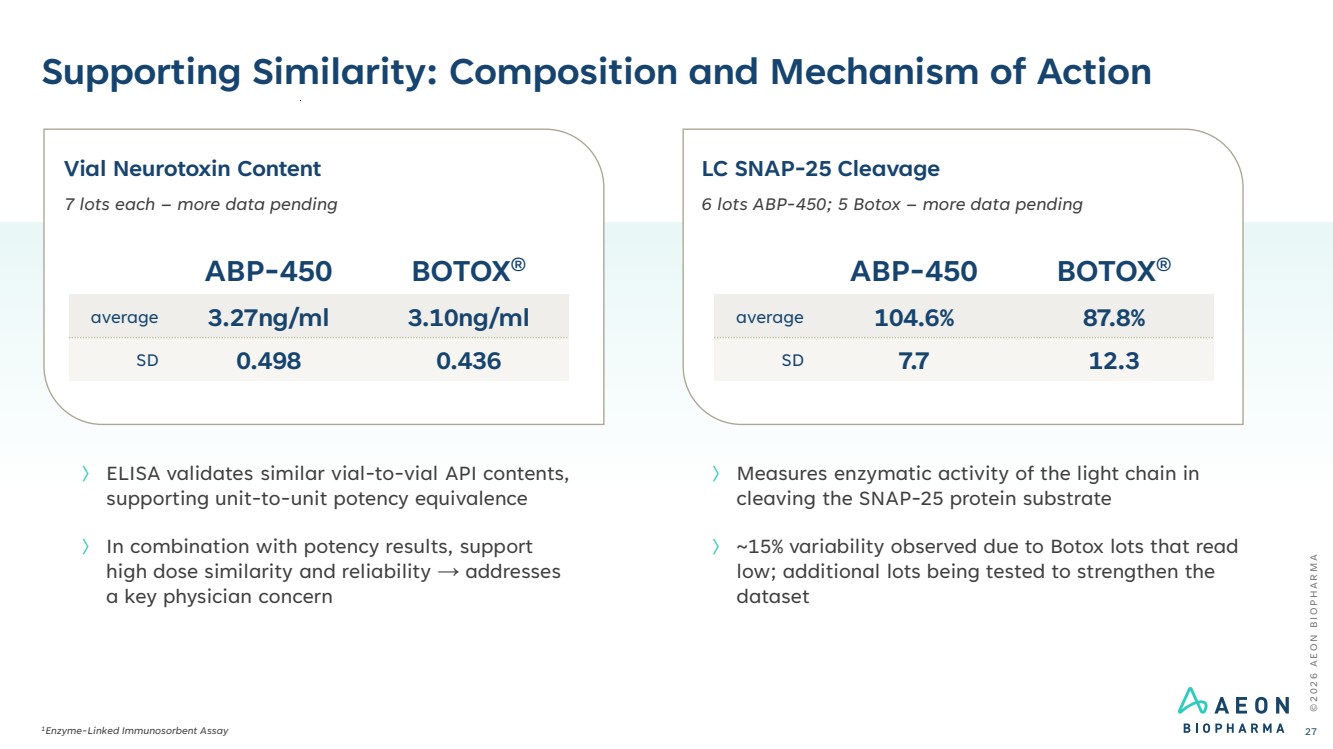

| © 2 0 2 6 A E O N B I O P H A R M A Supporting Similarity: Composition and Mechanism of Action 1Enzyme-Linked Immunosorbent Assay 27 〉 ELISA validates similar vial-to-vial API contents, supporting unit-to-unit potency equivalence 〉 In combination with potency results, support high dose similarity and reliability → addresses a key physician concern Vial Neurotoxin Content 7 lots each – more data pending ABP-450 BOTOX® average 3.27ng/ml 3.10ng/ml SD 0.498 0.436 LC SNAP-25 Cleavage 6 lots ABP-450; 5 Botox – more data pending ABP-450 BOTOX® average 104.6% 87.8% SD 7.7 12.3 〉 Measures enzymatic activity of the light chain in cleaving the SNAP-25 protein substrate 〉 ~15% variability observed due to Botox lots that read low; additional lots being tested to strengthen the dataset |

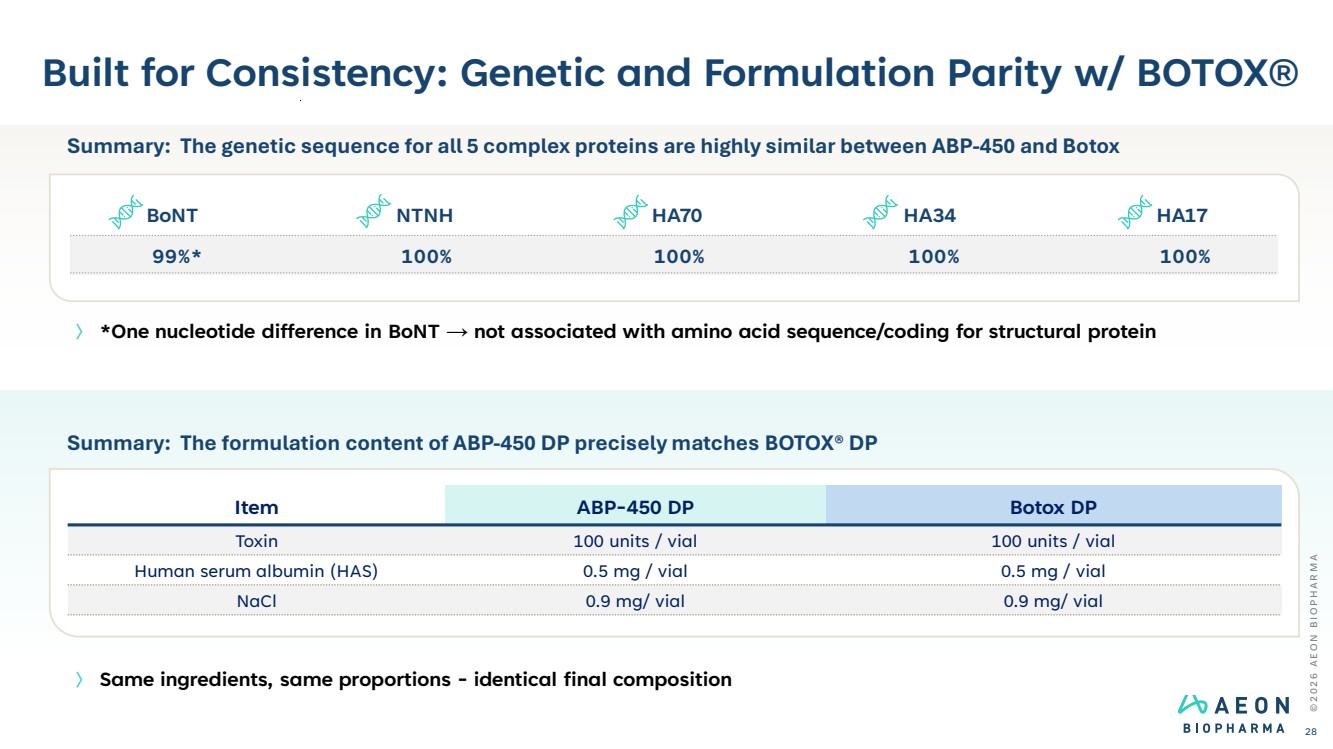

| Built for Consistency: Genetic and Formulation Parity w/ BOTOX® © 2 0 2 6 A E O N B I O P H A R M A 28 〉 *One nucleotide difference in BoNT → not associated with amino acid sequence/coding for structural protein 〉 Same ingredients, same proportions - identical final composition Summary: The formulation content of ABP-450 DP precisely matches BOTOX® DP Item ABP-450 DP Botox DP Toxin 100 units / vial 100 units / vial Human serum albumin (HAS) 0.5 mg / vial 0.5 mg / vial NaCl 0.9 mg/ vial 0.9 mg/ vial Summary: The genetic sequence for all 5 complex proteins are highly similar between ABP-450 and Botox BoNT NTNH HA70 HA34 HA17 99%* 100% 100% 100% 100% |

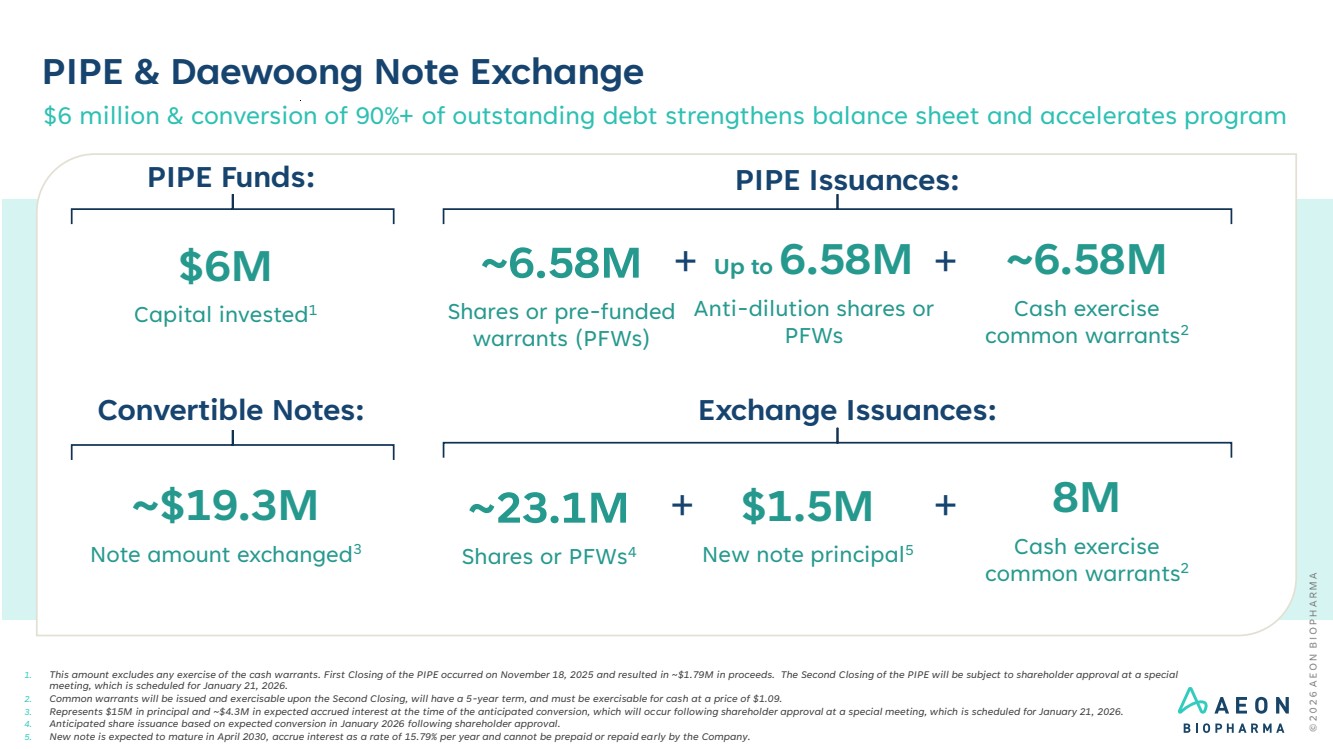

| PIPE & Daewoong Note Exchange 1. This amount excludes any exercise of the cash warrants. First Closing of the PIPE occurred on November 18, 2025 and resulted in ~$1.79M in proceeds. The Second Closing of the PIPE will be subject to shareholder approval at a special meeting, which is scheduled for January 21, 2026. 2. Common warrants will be issued and exercisable upon the Second Closing, will have a 5-year term, and must be exercisable for cash at a price of $1.09. 3. Represents $15M in principal and ~$4.3M in expected accrued interest at the time of the anticipated conversion, which will occur following shareholder approval at a special meeting, which is scheduled for January 21, 2026. 4. Anticipated share issuance based on expected conversion in January 2026 following shareholder approval. 5. New note is expected to mature in April 2030, accrue interest as a rate of 15.79% per year and cannot be prepaid or repaid early by the Company. PIPE Issuances: $6M Capital invested1 Up to 6.58M Anti-dilution shares or PFWs ~6.58M Cash exercise common warrants2 + PIPE Funds: ~6.58M Shares or pre-funded warrants (PFWs) + Exchange Issuances: ~$19.3M Note amount exchanged3 Convertible Notes: $6 million & conversion of 90%+ of outstanding debt strengthens balance sheet and accelerates program 8M Cash exercise common warrants2 ~23.1M Shares or PFWs4 $1.5M + New note principal5 + |

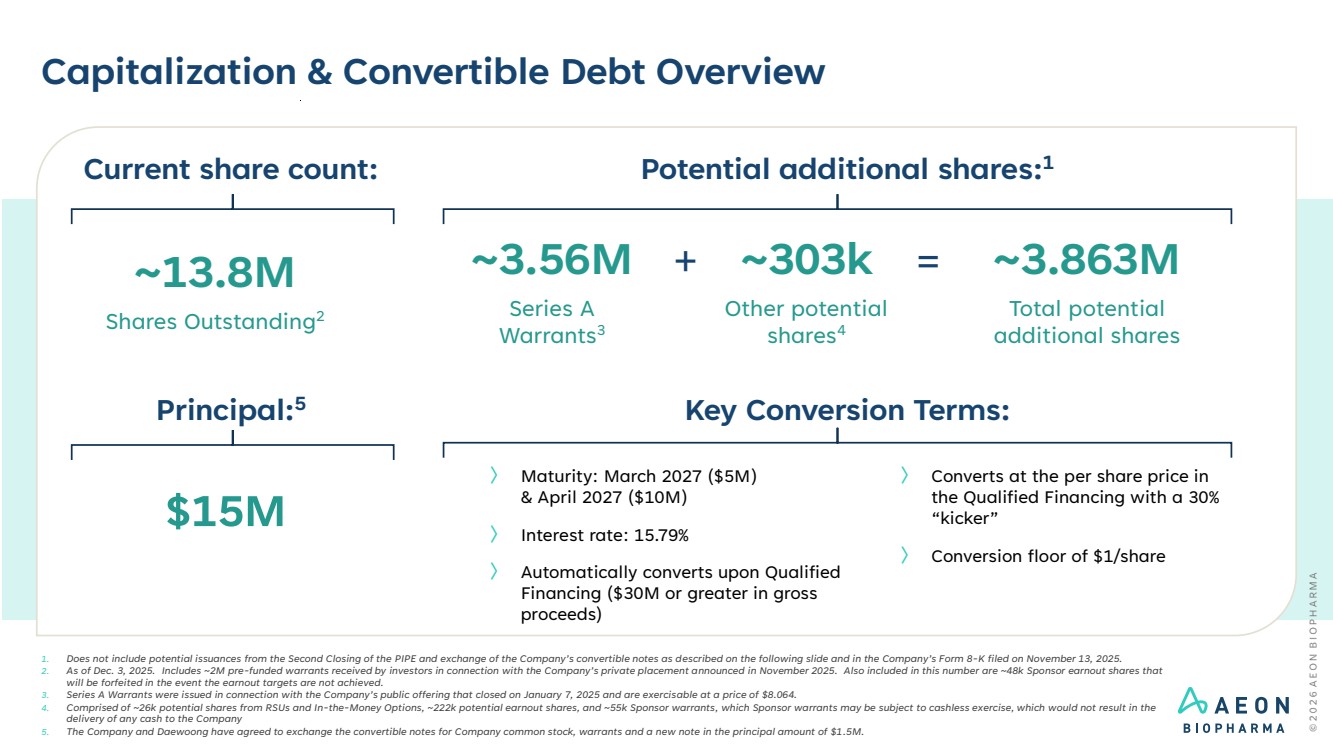

| Capitalization & Convertible Debt Overview 1. Does not include potential issuances from the Second Closing of the PIPE and exchange of the Company’s convertible notes as described on the following slide and in the Company’s Form 8-K filed on November 13, 2025. 2. As of Dec. 3, 2025. Includes ~2M pre-funded warrants received by investors in connection with the Company’s private placement announced in November 2025. Also included in this number are ~48k Sponsor earnout shares that will be forfeited in the event the earnout targets are not achieved. 3. Series A Warrants were issued in connection with the Company’s public offering that closed on January 7, 2025 and are exercisable at a price of $8.064. 4. Comprised of ~26k potential shares from RSUs and In-the-Money Options, ~222k potential earnout shares, and ~55k Sponsor warrants, which Sponsor warrants may be subject to cashless exercise, which would not result in the delivery of any cash to the Company 5. The Company and Daewoong have agreed to exchange the convertible notes for Company common stock, warrants and a new note in the principal amount of $1.5M. Potential additional shares:1 ~13.8M Shares Outstanding2 ~303k Other potential shares4 ~3.863M Total potential additional shares = Current share count: ~3.56M Series A Warrants3 + Key Conversion Terms: $15M Principal:5 〉 Converts at the per share price in the Qualified Financing with a 30% “kicker” 〉 Conversion floor of $1/share 〉 Maturity: March 2027 ($5M) & April 2027 ($10M) 〉 Interest rate: 15.79% 〉 Automatically converts upon Qualified Financing ($30M or greater in gross proceeds) |