1AlTi Global Second Quarter 2025 Earnings | August 11, 2025

2AlTi Global Notes and Important Disclosures About AlTi Global AlTi Global is a leading independent global wealth manager providing entrepreneurs, multi-generational families, institutions, and emerging next-generation leaders with fiduciary advisor services underscored by a commitment to impact or values-aligned investing. The firm currently manages or advises on approximately $97 billion in combined assets and has an expansive network with more than 500 professionals across three continents. Forward-Looking Statements Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward- looking, including statements regarding future financial results, long-term value goals, restructuring and resegmentation expectations. Words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “intend,” “may,” “plan” and “will” and similar expressions identify forward-looking statements. Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain. The inclusion of any forward- looking information in this presentation should not be regarded as a representation that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are subject to various risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, global and domestic market and business conditions, successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity and the risks and uncertainties described in greater detail under “Risk Factors” included in AlTi’s registration statement on Form 10-K filed March 17, 2025, and in the subsequent reports filed with the Securities and Exchange Commission (the “SEC”), as such factors may be updated from time to time. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any registration statement that may be filed by AlTi Global. Due to rounding, numbers presented throughout this Presentation may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures This Presentation (together with oral statements made in connection herewith, the “Presentation”) is for informational purposes only to assist interested parties in evaluating AlTi Global, Inc. (along with its consolidated subsidiaries, “AlTi Global” or the "Company"). . Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but AlTi Global, will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Industry and Market Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and AlTi Global’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while AlTi Global believes its internal research is reliable, such research has not been verified by any independent source and none of AlTi Global or any of its affiliates nor any of their respective control persons, officers, directors, employees or representatives make any representation or warranty with respect to the accuracy of such information. Use of Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation (including, without limitation, Adjusted Net Income (Loss), Adjusted EBITDA and EBITDA) are not GAAP measures of AlTi Global’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included in the Appendix of this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures, and the reasons management considers it appropriate for supplemental analysis. AlTi Global believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries.

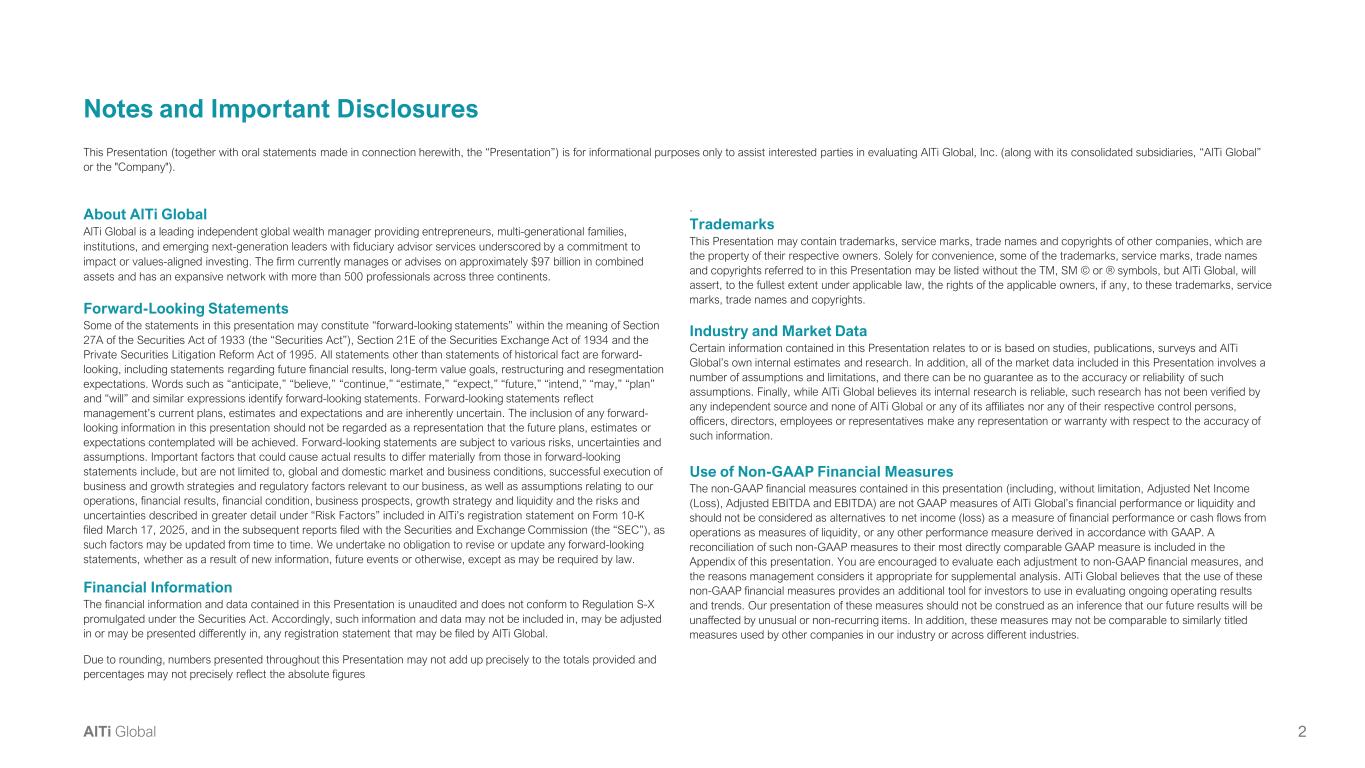

3AlTi Global at-a-glance U.S. vs. Non-U.S. Wealth Management AUM/AUA 59% vs. 41%$81B Wealth Management AUM/AUA 6 Acquisitions and integrations completed, or in process, globally since 2023 Client retention rate since 2021 96% 19 Offices across the globe in major financial centers Global strategic partnerships provide growth capital, access and relationships Years operating history focused on UHNW 20+ Note: Information as of June 30, 2025, unless otherwise noted 1) Excludes Kontora advisors Committed to impact strategies $5B 10 Years of average tenure for Wealth Management advisors1 96% Recurring revenues

4AlTi Global Comprehensive platform for UHNW families, foundations and endowments Large and expanding addressable market Uniquely global footprint Recurring revenue base Strong capital position underpinned by transformative strategic partners Identified pipeline of inorganic growth opportunities Skilled leadership team Becoming the preeminent, global UHNW wealth firm

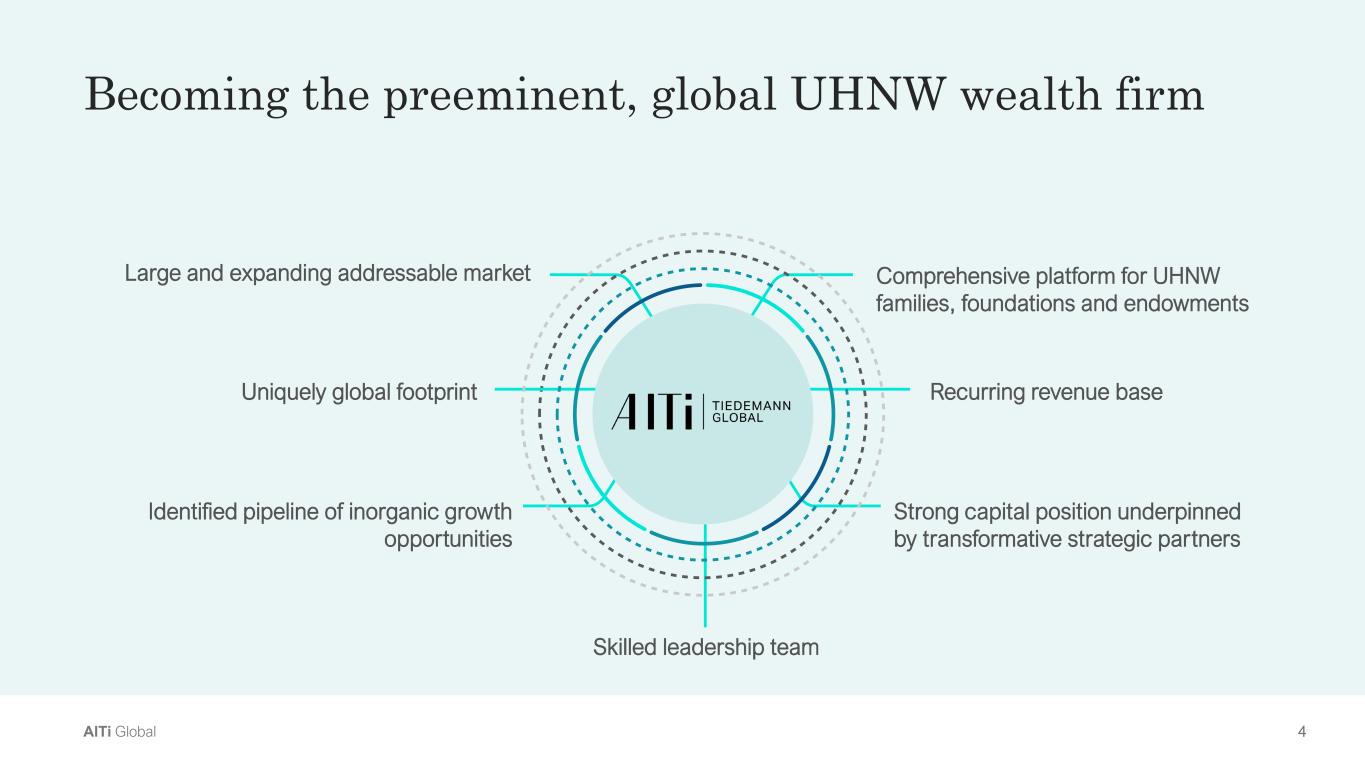

5AlTi Global Transformative strategic investments from two prominent institutional investors 1980 1999 2009 2023 2024 Establishment of Tiedemann Investment Group (“TIG”) Founded Tiedemann Trust Company (later rebranded as Tiedemann Wealth Management) Merger of entities and listed on NASDAQ on Jan 4, 2023 Rebrand to & Global multi-family office created via development and acquisitions Established the alternatives management firm focused on capital preservation & uncorrelated returns Enhanced suite of solutions by building a U.S.-focused multi-family office providing comprehensive financial advisory Offices in London, Paris, Geneva, Hong Kong, Lugano and Lisbon 2025 Operational efficiency and organic growth initiatives and exit of International Real Estate business Strategic investment to fuel AlTi’s M&A pipeline, accelerate its international expansion and drive AlTi’s organic growth Aimed to accelerate the growth, improve capital access and liquidity, and boost the market presence and credibility on a global scale Improved focus on the fast-growing wealth management sector and operating leverage of business How we got here Over the past 40+ years, we have grown into an independent, global Ultra-High-Net-Worth wealth management platform with differentiated Alts and Impact Investing capabilities Up to $450M (1) 1) Up to $450 million of strategic investment from Allianz X and Constellation Wealth Capital; As of June 30, 2025, AlTi has received $268 million investment from Allianz X and $150 million investment from Constellation Wealth Capital

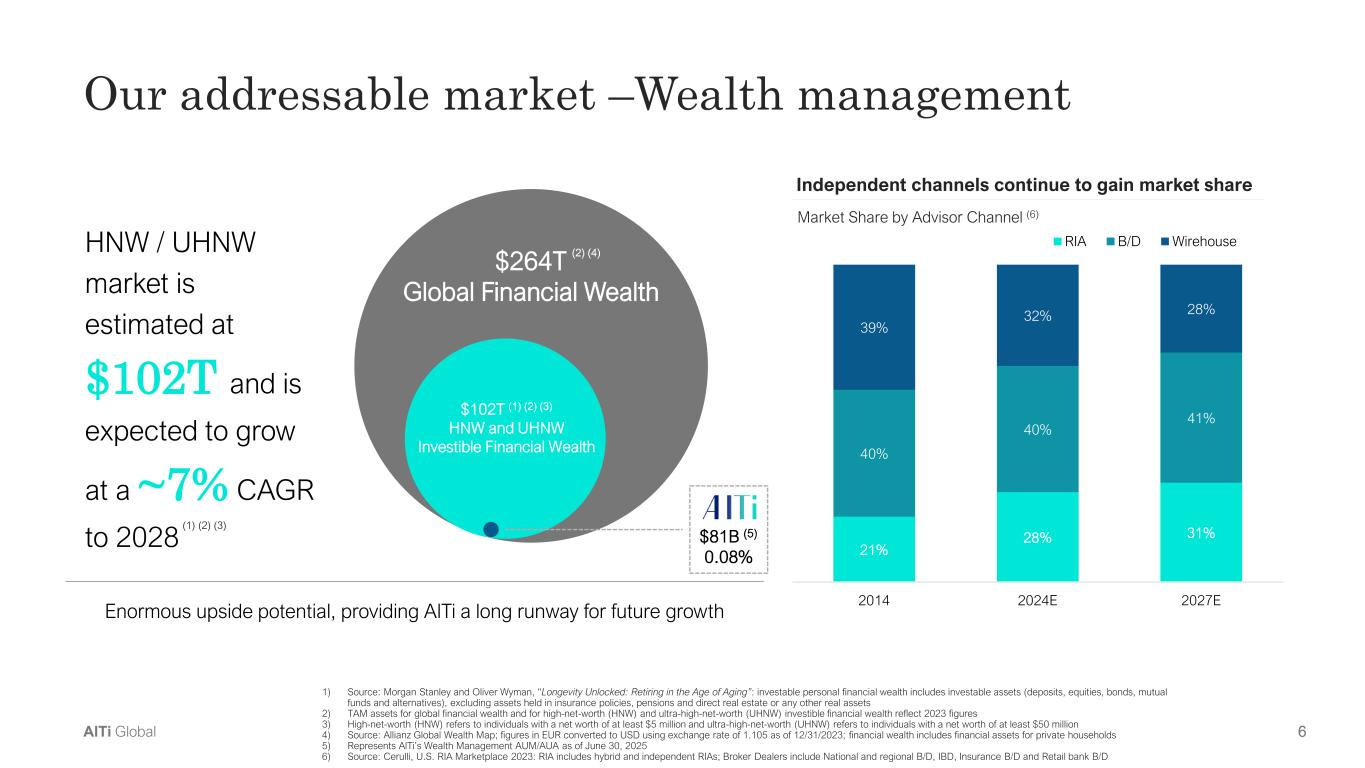

6AlTi Global Our addressable market –Wealth management Market Share by Advisor Channel (6) HNW / UHNW market is estimated at $102T and is expected to grow at a ~7% CAGR to 2028 Enormous upside potential, providing AlTi a long runway for future growth $81B (5) 0.08% 1) Source: Morgan Stanley and Oliver Wyman, “Longevity Unlocked: Retiring in the Age of Aging”: investable personal financial wealth includes investable assets (deposits, equities, bonds, mutual funds and alternatives), excluding assets held in insurance policies, pensions and direct real estate or any other real assets 2) TAM assets for global financial wealth and for high-net-worth (HNW) and ultra-high-net-worth (UHNW) investible financial wealth reflect 2023 figures 3) High-net-worth (HNW) refers to individuals with a net worth of at least $5 million and ultra-high-net-worth (UHNW) refers to individuals with a net worth of at least $50 million 4) Source: Allianz Global Wealth Map; figures in EUR converted to USD using exchange rate of 1.105 as of 12/31/2023; financial wealth includes financial assets for private households 5) Represents AlTi’s Wealth Management AUM/AUA as of June 30, 2025 6) Source: Cerulli, U.S. RIA Marketplace 2023: RIA includes hybrid and independent RIAs; Broker Dealers include National and regional B/D, IBD, Insurance B/D and Retail bank B/D $264T Global Financial Wealth $102T (1) (2) (3) HNW and UHNW Investible Financial Wealth (2) (4) Independent channels continue to gain market share 21% 28% 31% 40% 40% 41% 39% 32% 28% 2014 2024E 2027E RIA B/D Wirehouse (1) (2) (3)

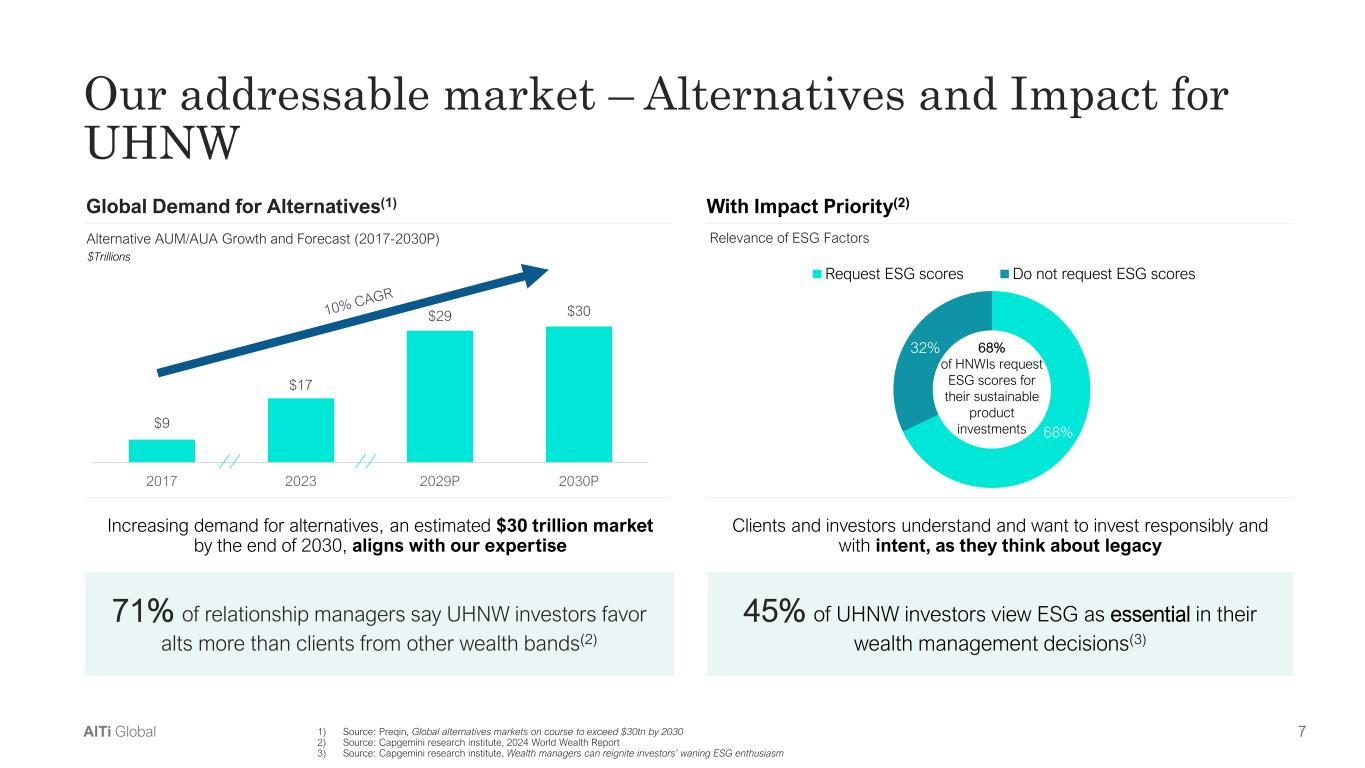

7AlTi Global $9 $17 $29 $30 2017 2023 2029P 2030P 1) Source: Preqin, Global alternatives markets on course to exceed $30tn by 2030 2) Source: Capgemini research institute, 2024 World Wealth Report 3) Source: Capgemini research institute, Wealth managers can reignite investors’ waning ESG enthusiasm Our addressable market – Alternatives and Impact for UHNW 71% of relationship managers say UHNW investors favor alts more than clients from other wealth bands(2) Alternative AUM/AUA Growth and Forecast (2017-2030P) Relevance of ESG Factors $Trillions Global Demand for Alternatives(1) Increasing demand for alternatives, an estimated $30 trillion market by the end of 2030, aligns with our expertise Clients and investors understand and want to invest responsibly and with intent, as they think about legacy 68% 32% Request ESG scores Do not request ESG scores 68% of HNWIs request ESG scores for their sustainable product investments 45% of UHNW investors view ESG as essential in their wealth management decisions(3) With Impact Priority(2)

8AlTi Global Business Overview

9AlTi Global - Tax optimization - Optimal wealth structures - Global trustee services - Administration of partnership structures How we serve our clients 1) General guidance; may differ based on specific client circumstance Trust & Fiduciary Family Office Services Philanthropy & Purposeful Giving Governance & Education Investment Advisory Services Estate & Wealth Planning - Customized portfolios - Differentiated expertise in alternatives and impact - Newly established private debt partnership with Allianz - Comprehensive, integrating reporting - Values and mission development - Wealth review and beneficiary alignment - Family engagement / family governance / meeting facilitation - Multigenerational education - Estate and succession planning - Event and asset planning - Tax management and mitigation - Mission and outcomes - Tax and planning strategies - Governance and board management - Foundation management - Accounting and financial modelling - Bill pay, payroll and benefits, reporting - Entity creation and management - Coordination with outside advisors Clients Minimum of ~$25M in investable assets1 UHNW individuals and families Foundations & endowments Sovereign Wealth Funds Single-family offices Multi-family offices Institutional investors Clients

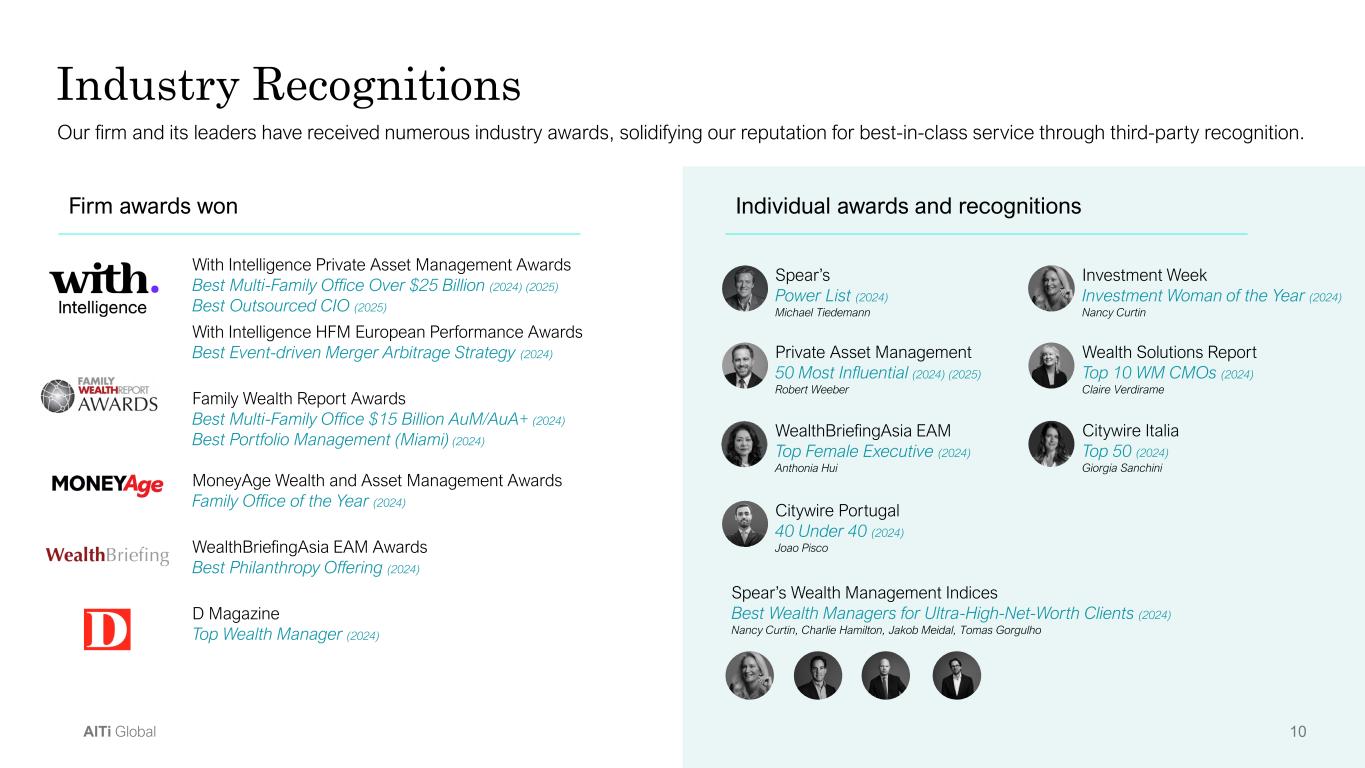

10AlTi Global Our firm and its leaders have received numerous industry awards, solidifying our reputation for best-in-class service through third-party recognition. Firm awards won With Intelligence Private Asset Management Awards Best Multi-Family Office Over $25 Billion (2024) (2025) Best Outsourced CIO (2025) With Intelligence HFM European Performance Awards Best Event-driven Merger Arbitrage Strategy (2024) Family Wealth Report Awards Best Multi-Family Office $15 Billion AuM/AuA+ (2024) Best Portfolio Management (Miami) (2024) MoneyAge Wealth and Asset Management Awards Family Office of the Year (2024) WealthBriefingAsia EAM Awards Best Philanthropy Offering (2024) D Magazine Top Wealth Manager (2024) Individual awards and recognitions Spear’s Power List (2024) Michael Tiedemann Industry Recognitions Citywire Portugal 40 Under 40 (2024) Joao Pisco Wealth Solutions Report Top 10 WM CMOs (2024) Claire Verdirame WealthBriefingAsia EAM Top Female Executive (2024) Anthonia Hui Citywire Italia Top 50 (2024) Giorgia Sanchini Spear’s Wealth Management Indices Best Wealth Managers for Ultra-High-Net-Worth Clients (2024) Nancy Curtin, Charlie Hamilton, Jakob Meidal, Tomas Gorgulho Investment Week Investment Woman of the Year (2024) Nancy Curtin Private Asset Management 50 Most Influential (2024) (2025) Robert Weeber

11AlTi Global Family Office Operational Excellence Report AlTi’s second annual flagship report backed by global data, regional insights and actionable strategies Credible. Global. Actionable. 146 family offices surveyed across North America, Europe, and Asia- Pacific. In partnership with Campden Wealth, a global authority on family office research. Benchmarks the operational side of family offices, like talent, technology, service needs, governance, succession, AI, cybersecurity, and more. In addition to benchmark data, the report provides insights and actionable strategies from AlTi. Enables Insights-Driven Business Development. This is not just thought leadership, but a gateway to meaningful relationships. Since launch, the report has driven measurable engagement. 300+ downloads | 220+ family office leaders briefed | 25+ media placements. Hosted exclusive events in New York, London, Milan. Embedded into advisor conversations and prospect meetings. Reinforces AlTi’s value proposition It showcases our integrated capabilities, expertise, experience and high-caliber talent. It positions us as a strategic partner, not a vendor, to family offices. This global research initiative is a strategic investment in our brand, our insights, and our pipeline. It positions AlTi as a leader in the fast-growing family office segment and gives us direct access to qualified prospects across North America, Europe, and Asia Pacific.

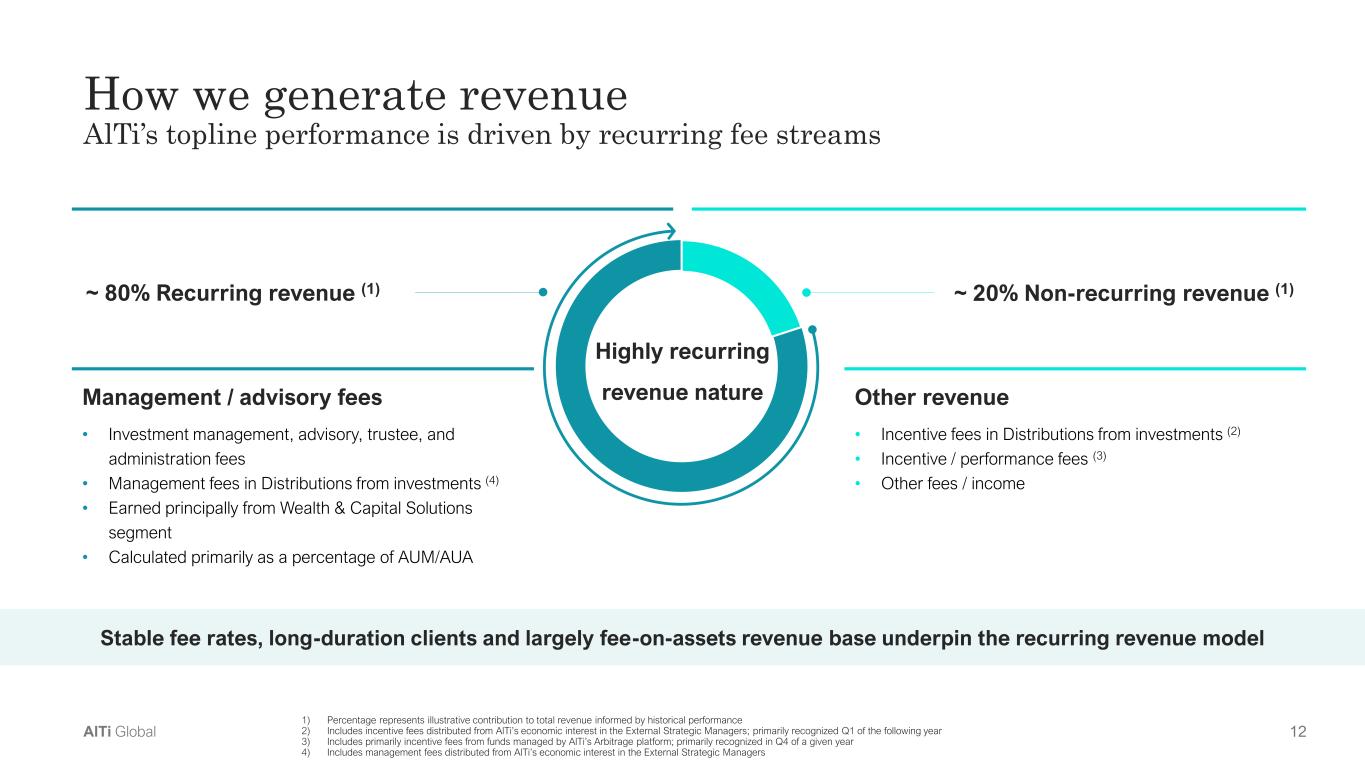

12AlTi Global How we generate revenue AlTi’s topline performance is driven by recurring fee streams ~ 80% Recurring revenue (1) ~ 20% Non-recurring revenue (1) Management / advisory fees • Investment management, advisory, trustee, and administration fees • Management fees in Distributions from investments (4) • Earned principally from Wealth & Capital Solutions segment • Calculated primarily as a percentage of AUM/AUA Other revenue • Incentive fees in Distributions from investments (2) • Incentive / performance fees (3) • Other fees / income 1) Percentage represents illustrative contribution to total revenue informed by historical performance 2) Includes incentive fees distributed from AlTi’s economic interest in the External Strategic Managers; primarily recognized Q1 of the following year 3) Includes primarily incentive fees from funds managed by AlTi’s Arbitrage platform; primarily recognized in Q4 of a given year 4) Includes management fees distributed from AlTi’s economic interest in the External Strategic Managers Stable fee rates, long-duration clients and largely fee-on-assets revenue base underpin the recurring revenue model Highly recurring revenue nature

13AlTi Global Note: Illustrative only; denotes general characteristics in each category Differentiated, comprehensive, and independent platform Well-positioned to meet and exceed the diverse needs of an expanding client base Boutique Multi-Family Offices Independent Wealth Managers End-market focus Platform approach HNW / UHNW expertise Tailored solutions Global Banks Size and scale International presence Independent, Integrated and International

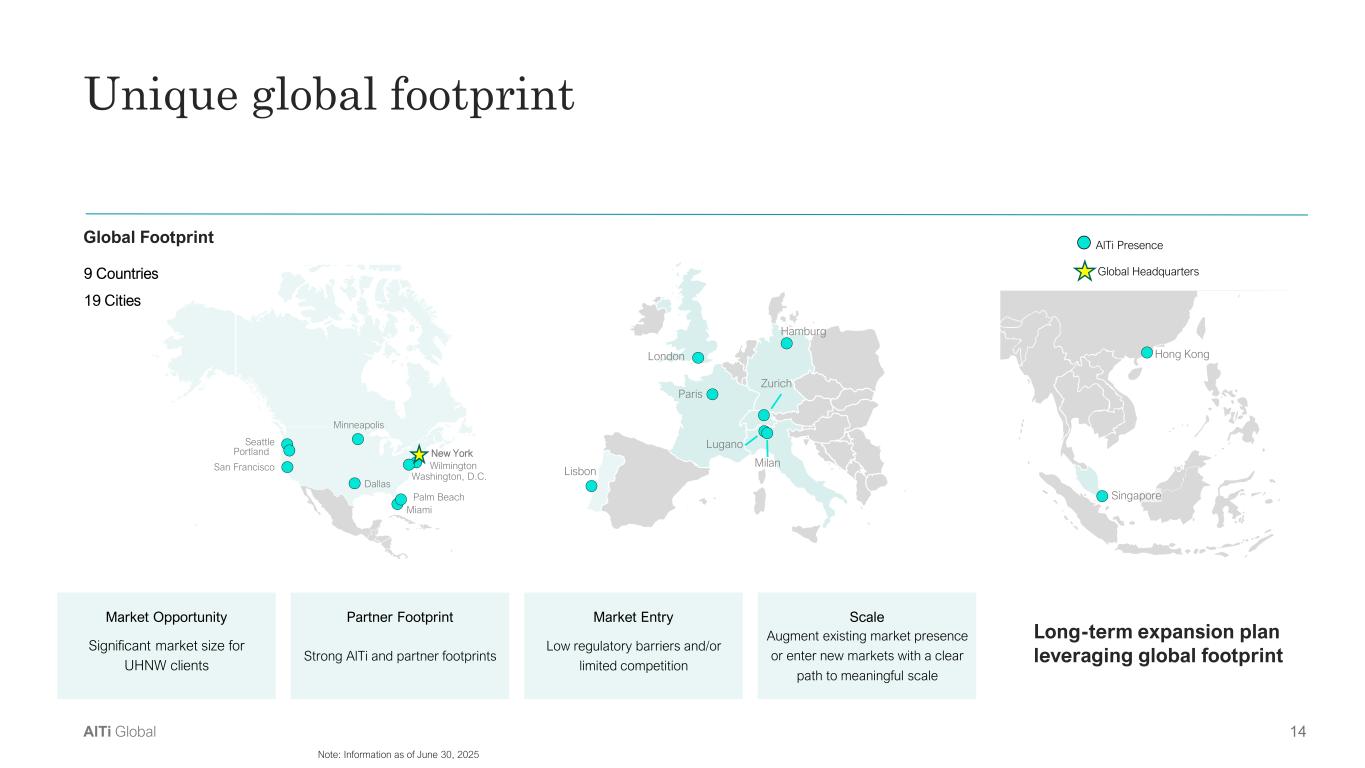

14AlTi Global Seattle Portland San Francisco Dallas Miami Minneapolis Washington, D.C. Palm Beach Wilmington New York Lisbon Lugano Zurich Milan London Paris Singapore Hong Kong Global Footprint Unique global footprint Long-term expansion plan leveraging global footprint 9 Countries 19 Cities Market Opportunity Significant market size for UHNW clients Partner Footprint Strong AlTi and partner footprints Market Entry Low regulatory barriers and/or limited competition Scale Augment existing market presence or enter new markets with a clear path to meaningful scale AlTi Presence Global Headquarters Note: Information as of June 30, 2025 Hamburg

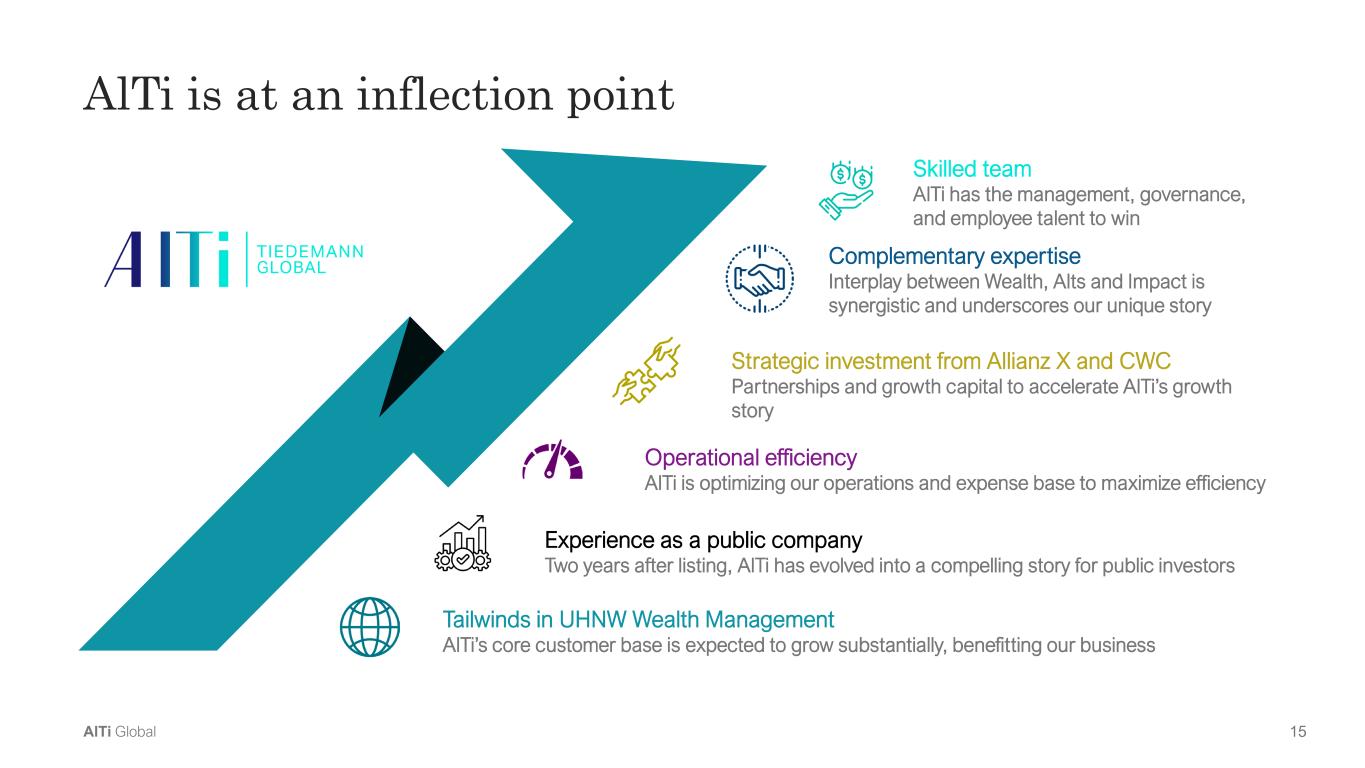

15AlTi Global AlTi is at an inflection point Strategic investment from Allianz X and CWC Partnerships and growth capital to accelerate AlTi’s growth story Skilled team AlTi has the management, governance, and employee talent to win Complementary expertise Interplay between Wealth, Alts and Impact is synergistic and underscores our unique story Operational efficiency AlTi is optimizing our operations and expense base to maximize efficiency Experience as a public company Two years after listing, AlTi has evolved into a compelling story for public investors Tailwinds in UHNW Wealth Management AlTi’s core customer base is expected to grow substantially, benefitting our business

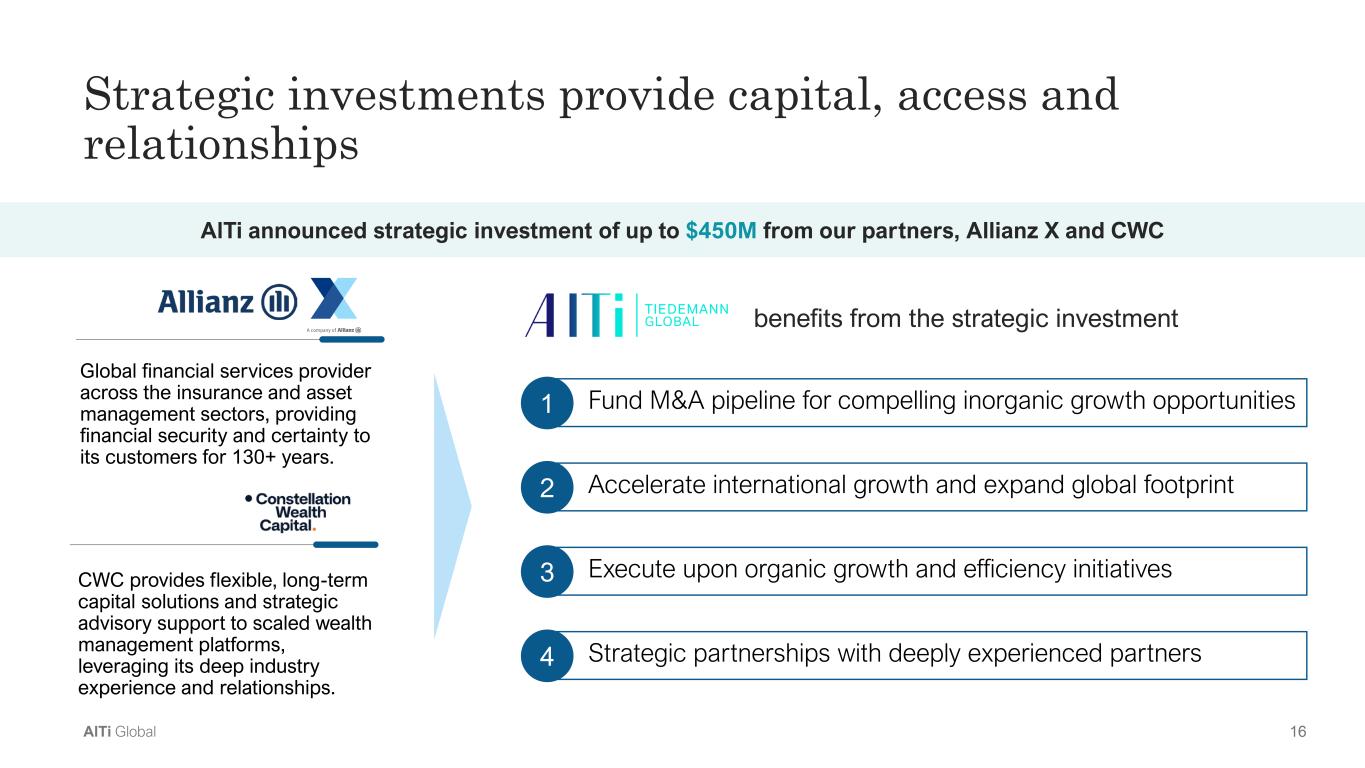

16AlTi Global Strategic investments provide capital, access and relationships Global financial services provider across the insurance and asset management sectors, providing financial security and certainty to its customers for 130+ years. CWC provides flexible, long-term capital solutions and strategic advisory support to scaled wealth management platforms, leveraging its deep industry experience and relationships. AlTi announced strategic investment of up to $450M from our partners, Allianz X and CWC Fund M&A pipeline for compelling inorganic growth opportunities1 benefits from the strategic investment Accelerate international growth and expand global footprint2 Execute upon organic growth and efficiency initiatives3 Strategic partnerships with deeply experienced partners4

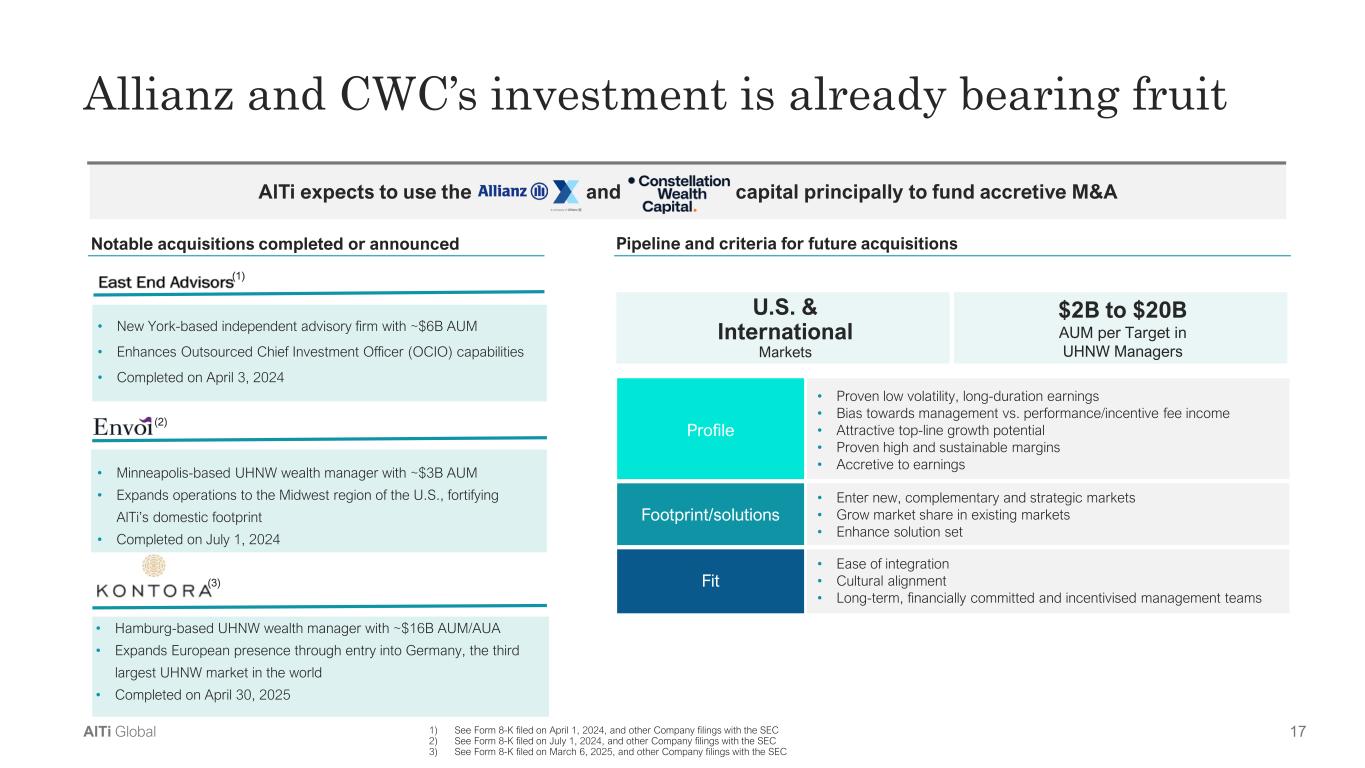

17AlTi Global U.S. & International Markets $2B to $20B AUM per Target in UHNW Managers Profile • Proven low volatility, long-duration earnings • Bias towards management vs. performance/incentive fee income • Attractive top-line growth potential • Proven high and sustainable margins • Accretive to earnings Footprint/solutions • Enter new, complementary and strategic markets • Grow market share in existing markets • Enhance solution set Fit • Ease of integration • Cultural alignment • Long-term, financially committed and incentivised management teams Pipeline and criteria for future acquisitions Allianz and CWC’s investment is already bearing fruit Notable acquisitions completed or announced 1) See Form 8-K filed on April 1, 2024, and other Company filings with the SEC 2) See Form 8-K filed on July 1, 2024, and other Company filings with the SEC 3) See Form 8-K filed on March 6, 2025, and other Company filings with the SEC • Minneapolis-based UHNW wealth manager with ~$3B AUM • Expands operations to the Midwest region of the U.S., fortifying AlTi’s domestic footprint • Completed on July 1, 2024 (2) • New York-based independent advisory firm with ~$6B AUM • Enhances Outsourced Chief Investment Officer (OCIO) capabilities • Completed on April 3, 2024 (1) AlTi expects to use the and capital principally to fund accretive M&A • Hamburg-based UHNW wealth manager with ~$16B AUM/AUA • Expands European presence through entry into Germany, the third largest UHNW market in the world • Completed on April 30, 2025 (3)

18AlTi Global Allianz partnership extends beyond growth capital AlTi and Allianz Global Investors established a private markets investment program for UHNW wealth segment To provide unprecedented access to leading third-party managers with low minimum ticket sizes and expanded investment opportunities across strategies including secondaries & co-investments. Market Focus on $1.5 trillion global private credit market, initially focused on private debt Experience Tapping Allianz’ established, 25-year track record in private markets Scale Allianz represents one of the largest global private debt investors Growth Opportunity to reach massive, complementary Allianz client base and expand program into additional private markets asset classes Key Attributes A majority-owned joint venture to pioneer UHNW wealth access to private credit

19AlTi Global Business Leads Broad, global industry experience Leadership Michael Tiedemann Chief Executive Officer Kevin Moran President / Chief Operating Officer Michael Harrington Chief Financial Officer Colleen Graham Chief Legal, Compliance and Risk Officer Claire Verdirame Chief Marketing Officer Executive Team US Europe Nancy Curtin CIO – Global WM Brooke Connell President – US WM Craig Smith Chair – Global WM Robert Weeber President – International WM Office Colin Peters Chief Human Resources Officer Phillip Dundas Chief Technology Officer

20AlTi Global Governance Timothy Keaney Bank of New York Board Chair Norma Corio American Express Global Business Travel Mark Furlong BMO Harris Bank Tracey Brophy Warson Citi Private Bank Independent Board Directors Trusted fiduciaries with strong individual track records Audit, Finance and Risk Environmental, Social, Governance and Nominating Human Capital and Compensation Transaction Board Committees Karl Heckenberg CWC Nazim Cetin (1) Allianz X Andreas Wimmer (1) Allianz SE Board Observer Ali Bouzarif IlWaddi representative Dependent Board Directors Michael Tiedemann Chief Executive Officer 1) Denotes Allianz Board Representatives

21AlTi Global Growth focused on stable, recurring revenue wealth management business Topline growth fueled by organic and inorganic growth strategy, supported by capital, relationships, scale and network of strategic partners Strong pipeline of strategic and accretive M&A opportunities globally Initiatives underway to reduce the cost basis using a zero-based budgeting (ZBB) approach In process of transforming the technology platform to enhance efficiency, productivity and scalability Focused on achieving economies of scale by leveraging global platform Financial flexibility to capitalize on future growth opportunities 01. Topline Growth 02. Margin Expansion 03. Balance Sheet Strength Expected financial drivers Well-defined path with a clear trajectory for long term growth

22AlTi Global Financial Highlights

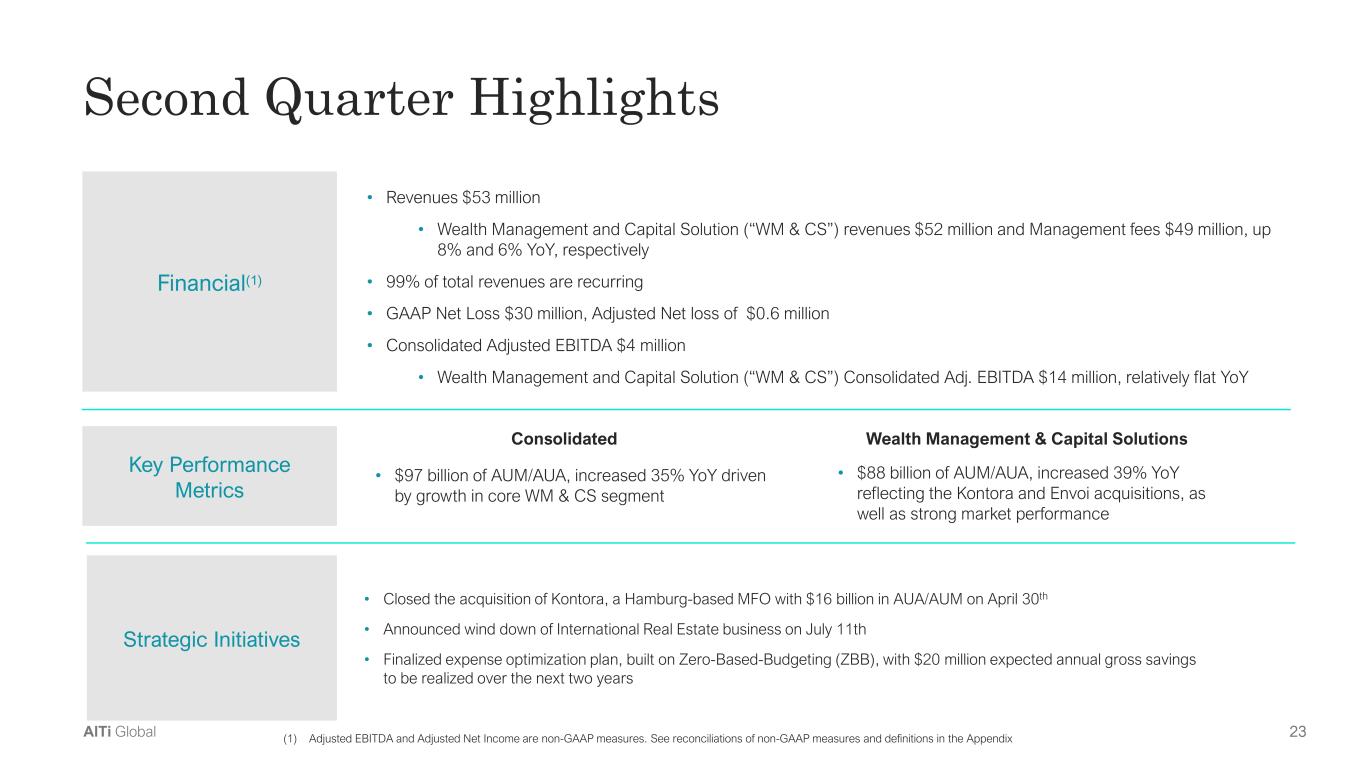

23AlTi Global Financial(1) Key Performance Metrics • Revenues $53 million • Wealth Management and Capital Solution (“WM & CS”) revenues $52 million and Management fees $49 million, up 8% and 6% YoY, respectively • 99% of total revenues are recurring • GAAP Net Loss $30 million, Adjusted Net loss of $0.6 million • Consolidated Adjusted EBITDA $4 million • Wealth Management and Capital Solution (“WM & CS”) Consolidated Adj. EBITDA $14 million, relatively flat YoY Second Quarter Highlights • $97 billion of AUM/AUA, increased 35% YoY driven by growth in core WM & CS segment Consolidated Wealth Management & Capital Solutions (1) Adjusted EBITDA and Adjusted Net Income are non-GAAP measures. See reconciliations of non-GAAP measures and definitions in the Appendix • $88 billion of AUM/AUA, increased 39% YoY reflecting the Kontora and Envoi acquisitions, as well as strong market performance Strategic Initiatives • Closed the acquisition of Kontora, a Hamburg-based MFO with $16 billion in AUA/AUM on April 30th • Announced wind down of International Real Estate business on July 11th • Finalized expense optimization plan, built on Zero-Based-Budgeting (ZBB), with $20 million expected annual gross savings to be realized over the next two years

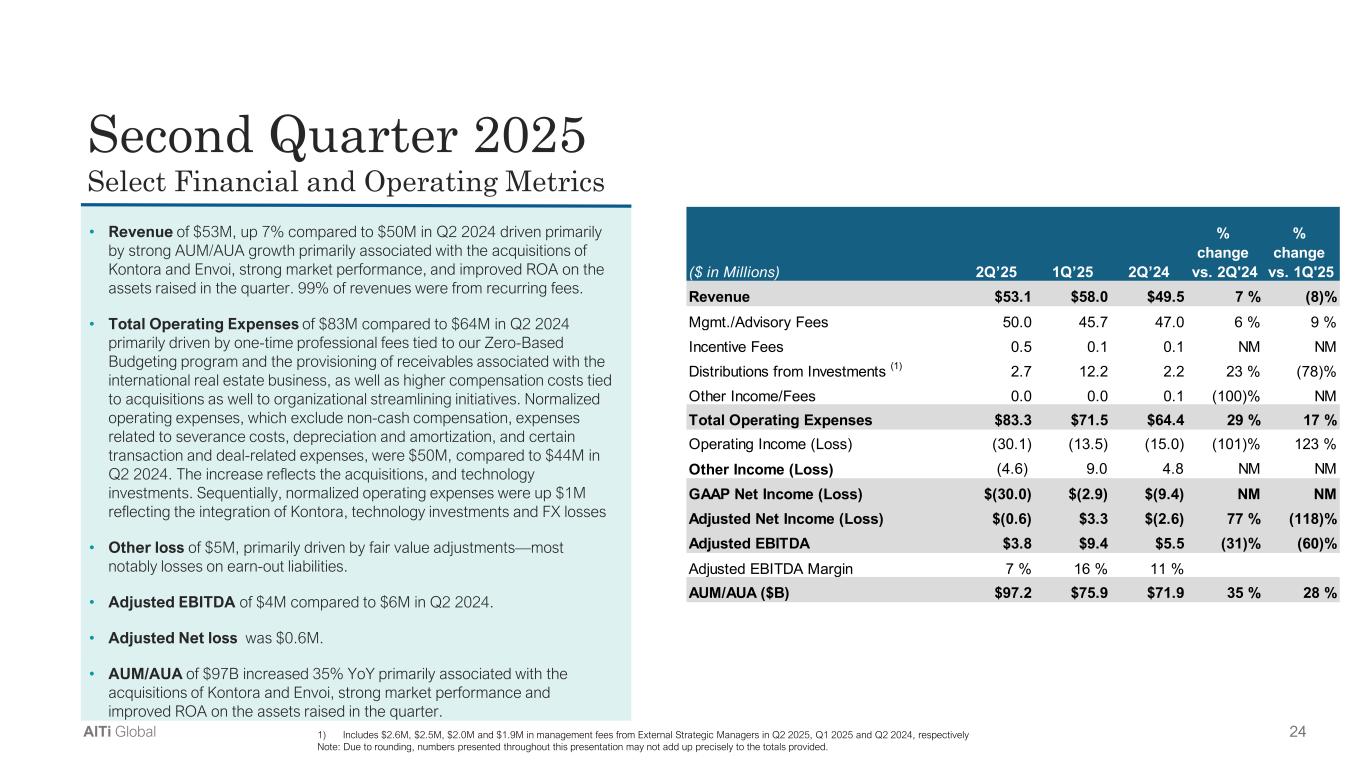

24AlTi Global Second Quarter 2025 Select Financial and Operating Metrics • Revenue of $53M, up 7% compared to $50M in Q2 2024 driven primarily by strong AUM/AUA growth primarily associated with the acquisitions of Kontora and Envoi, strong market performance, and improved ROA on the assets raised in the quarter. 99% of revenues were from recurring fees. • Total Operating Expenses of $83M compared to $64M in Q2 2024 primarily driven by one-time professional fees tied to our Zero-Based Budgeting program and the provisioning of receivables associated with the international real estate business, as well as higher compensation costs tied to acquisitions as well to organizational streamlining initiatives. Normalized operating expenses, which exclude non-cash compensation, expenses related to severance costs, depreciation and amortization, and certain transaction and deal-related expenses, were $50M, compared to $44M in Q2 2024. The increase reflects the acquisitions, and technology investments. Sequentially, normalized operating expenses were up $1M reflecting the integration of Kontora, technology investments and FX losses • Other loss of $5M, primarily driven by fair value adjustments—most notably losses on earn-out liabilities. • Adjusted EBITDA of $4M compared to $6M in Q2 2024. • Adjusted Net loss was $0.6M. • AUM/AUA of $97B increased 35% YoY primarily associated with the acquisitions of Kontora and Envoi, strong market performance and improved ROA on the assets raised in the quarter. 1) Includes $2.6M, $2.5M, $2.0M and $1.9M in management fees from External Strategic Managers in Q2 2025, Q1 2025 and Q2 2024, respectively Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Millions) 2Q’25 1Q’25 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Revenue $53.1 $58.0 $49.5 7 % (8)% Mgmt./Advisory Fees 50.0 45.7 47.0 6 % 9 % Incentive Fees 0.5 0.1 0.1 NM NM Distributions from Investments (1) 2.7 12.2 2.2 23 % (78)% Other Income/Fees 0.0 0.0 0.1 (100)% NM Total Operating Expenses $83.3 $71.5 $64.4 29 % 17 % Operating Income (Loss) (30.1) (13.5) (15.0) (101)% 123 % Other Income (Loss) (4.6) 9.0 4.8 NM NM GAAP Net Income (Loss) $(30.0) $(2.9) $(9.4) NM NM Adjusted Net Income (Loss) $(0.6) $3.3 $(2.6) 77 % (118)% Adjusted EBITDA $3.8 $9.4 $5.5 (31)% (60)% Adjusted EBITDA Margin 7 % 16 % 11 % AUM/AUA ($B) $97.2 $75.9 $71.9 35 % 28 %

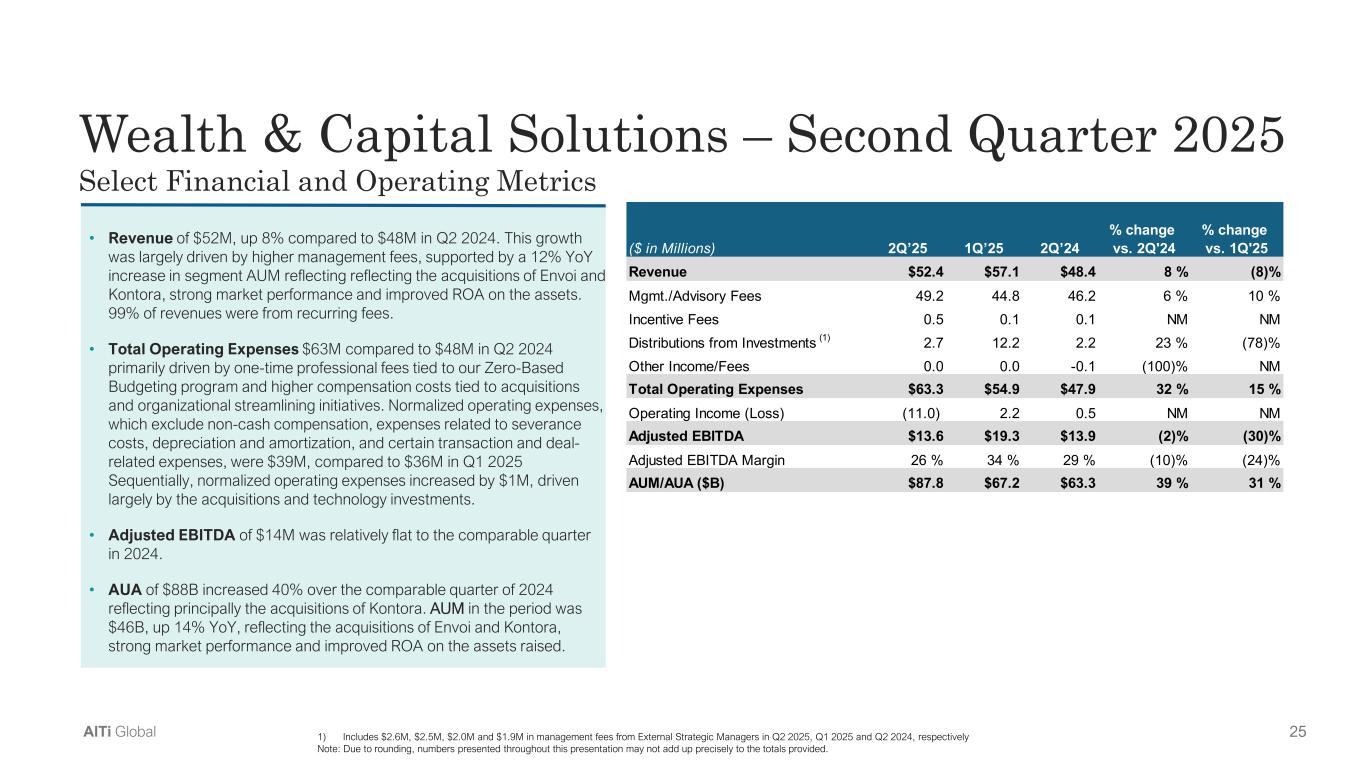

25AlTi Global • Revenue of $52M, up 8% compared to $48M in Q2 2024. This growth was largely driven by higher management fees, supported by a 12% YoY increase in segment AUM reflecting reflecting the acquisitions of Envoi and Kontora, strong market performance and improved ROA on the assets. 99% of revenues were from recurring fees. • Total Operating Expenses $63M compared to $48M in Q2 2024 primarily driven by one-time professional fees tied to our Zero-Based Budgeting program and higher compensation costs tied to acquisitions and organizational streamlining initiatives. Normalized operating expenses, which exclude non-cash compensation, expenses related to severance costs, depreciation and amortization, and certain transaction and deal- related expenses, were $39M, compared to $36M in Q1 2025 Sequentially, normalized operating expenses increased by $1M, driven largely by the acquisitions and technology investments. • Adjusted EBITDA of $14M was relatively flat to the comparable quarter in 2024. • AUA of $88B increased 40% over the comparable quarter of 2024 reflecting principally the acquisitions of Kontora. AUM in the period was $46B, up 14% YoY, reflecting the acquisitions of Envoi and Kontora, strong market performance and improved ROA on the assets raised. Wealth & Capital Solutions – Second Quarter 2025 Select Financial and Operating Metrics 1) Includes $2.6M, $2.5M, $2.0M and $1.9M in management fees from External Strategic Managers in Q2 2025, Q1 2025 and Q2 2024, respectively Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Millions) 2Q’25 1Q’25 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Revenue $52.4 $57.1 $48.4 8 % (8)% Mgmt./Advisory Fees 49.2 44.8 46.2 6 % 10 % Incentive Fees 0.5 0.1 0.1 NM NM Distributions from Investments (1) 2.7 12.2 2.2 23 % (78)% Other Income/Fees 0.0 0.0 -0.1 (100)% NM Total Operating Expenses $63.3 $54.9 $47.9 32 % 15 % Operating Income (Loss) (11.0) 2.2 0.5 NM NM Adjusted EBITDA $13.6 $19.3 $13.9 (2)% (30)% Adjusted EBITDA Margin 26 % 34 % 29 % (10)% (24)% AUM/AUA ($B) $87.8 $67.2 $63.3 39 % 31 %

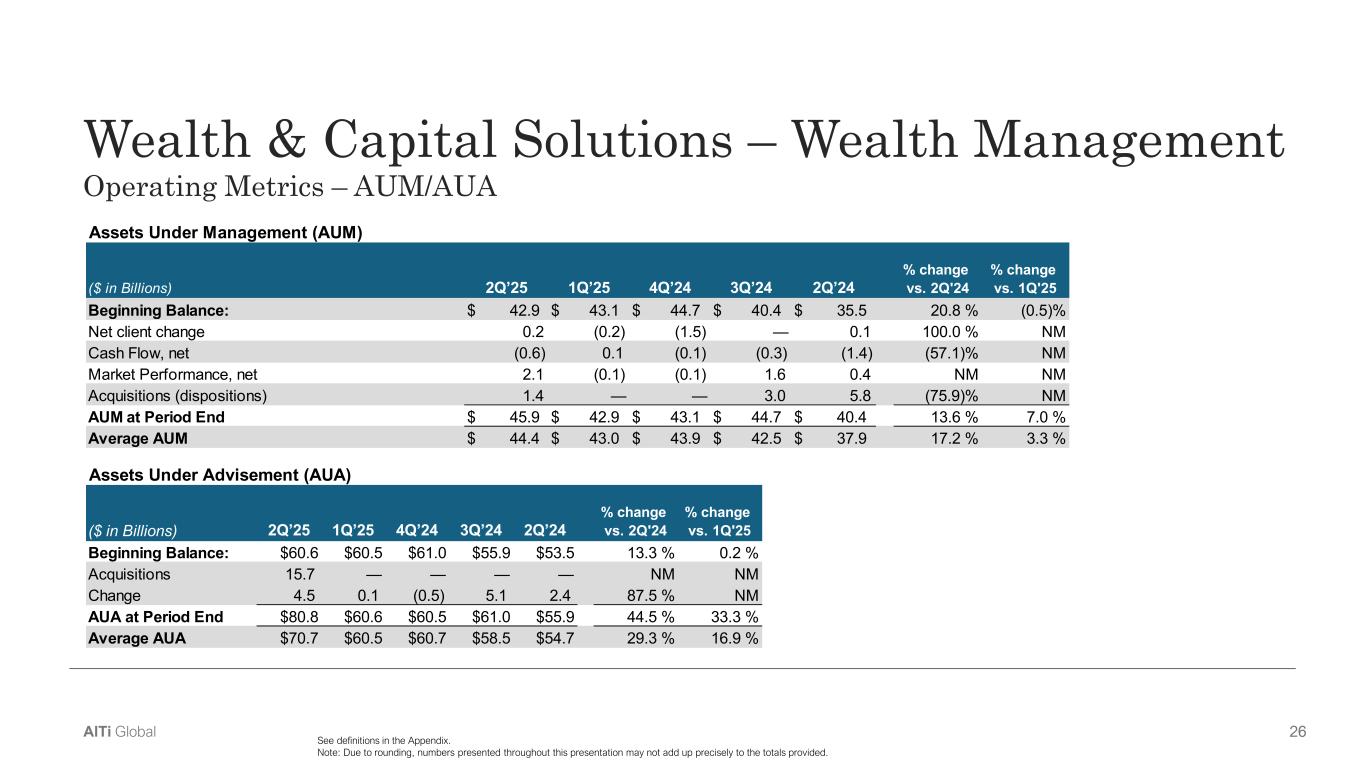

26AlTi Global Wealth & Capital Solutions – Wealth Management Operating Metrics – AUM/AUA See definitions in the Appendix. Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Billions) 2Q’25 1Q’25 4Q’24 3Q’24 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Beginning Balance: $ 42.9 $ 43.1 $ 44.7 $ 40.4 $ 35.5 20.8 % (0.5)% Net client change 0.2 (0.2) (1.5) — 0.1 100.0 % NM Cash Flow, net (0.6) 0.1 (0.1) (0.3) (1.4) (57.1)% NM Market Performance, net 2.1 (0.1) (0.1) 1.6 0.4 NM NM Acquisitions (dispositions) 1.4 — — 3.0 5.8 (75.9)% NM AUM at Period End $ 45.9 $ 42.9 $ 43.1 $ 44.7 $ 40.4 13.6 % 7.0 % Average AUM $ 44.4 $ 43.0 $ 43.9 $ 42.5 $ 37.9 17.2 % 3.3 % Assets Under Management (AUM) ($ in Billions) 2Q’25 1Q’25 4Q’24 3Q’24 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Beginning Balance: $60.6 $60.5 $61.0 $55.9 $53.5 13.3 % 0.2 % Acquisitions 15.7 — — — — NM NM Change 4.5 0.1 (0.5) 5.1 2.4 87.5 % NM AUA at Period End $80.8 $60.6 $60.5 $61.0 $55.9 44.5 % 33.3 % Average AUA $70.7 $60.5 $60.7 $58.5 $54.7 29.3 % 16.9 % Assets Under Advisement (AUA)

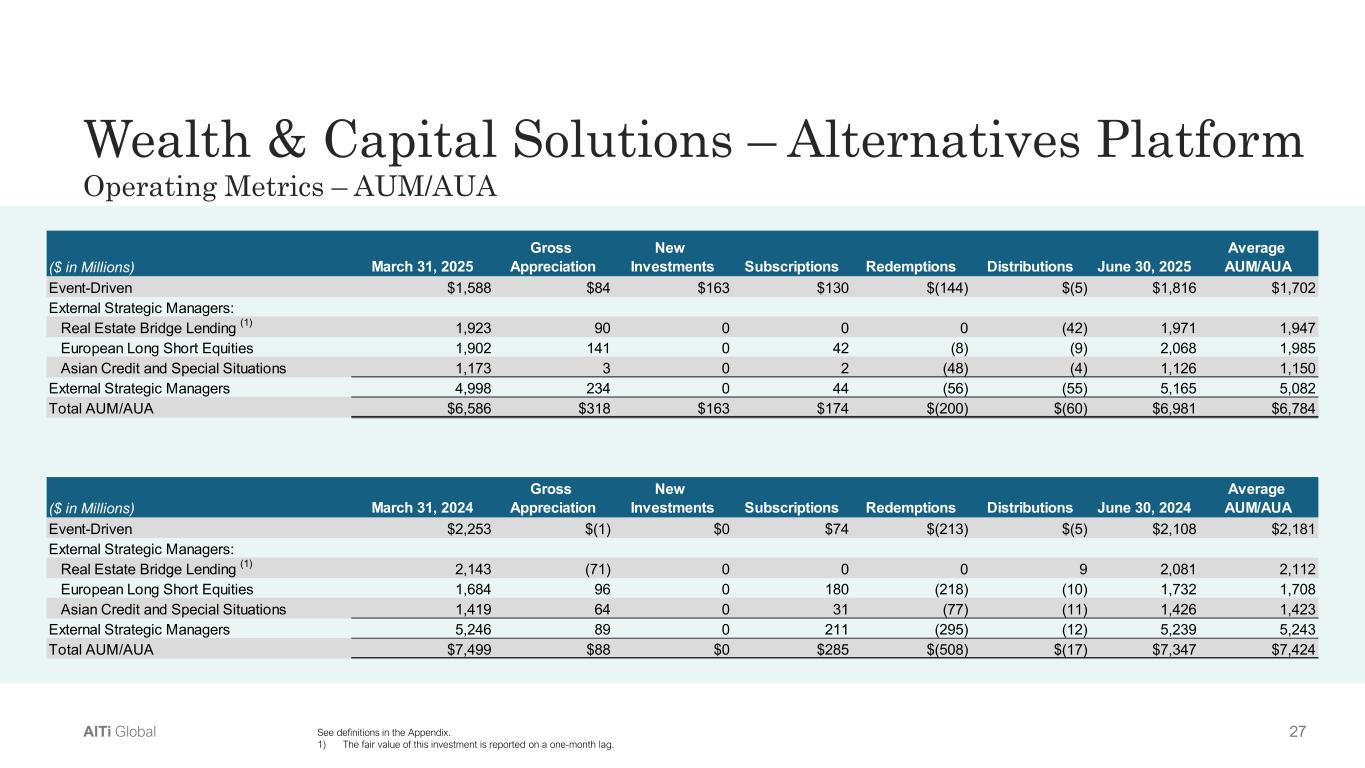

27AlTi Global Wealth & Capital Solutions – Alternatives Platform Operating Metrics – AUM/AUA See definitions in the Appendix. 1) The fair value of this investment is reported on a one-month lag. ($ in Millions) March 31, 2025 Gross Appreciation New Investments Subscriptions Redemptions Distributions June 30, 2025 Average AUM/AUA Event-Driven $1,588 $84 $163 $130 $(144) $(5) $1,816 $1,702 External Strategic Managers: Real Estate Bridge Lending (1) 1,923 90 0 0 0 (42) 1,971 1,947 European Long Short Equities 1,902 141 0 42 (8) (9) 2,068 1,985 Asian Credit and Special Situations 1,173 3 0 2 (48) (4) 1,126 1,150 External Strategic Managers 4,998 234 0 44 (56) (55) 5,165 5,082 Total AUM/AUA $6,586 $318 $163 $174 $(200) $(60) $6,981 $6,784 ($ in Millions) March 31, 2024 Gross Appreciation New Investments Subscriptions Redemptions Distributions June 30, 2024 Average AUM/AUA Event-Driven $2,253 $(1) $0 $74 $(213) $(5) $2,108 $2,181 External Strategic Managers: Real Estate Bridge Lending (1) 2,143 (71) 0 0 0 9 2,081 2,112 European Long Short Equities 1,684 96 0 180 (218) (10) 1,732 1,708 Asian Credit and Special Situations 1,419 64 0 31 (77) (11) 1,426 1,423 External Strategic Managers 5,246 89 0 211 (295) (12) 5,239 5,243 Total AUM/AUA $7,499 $88 $0 $285 $(508) $(17) $7,347 $7,424

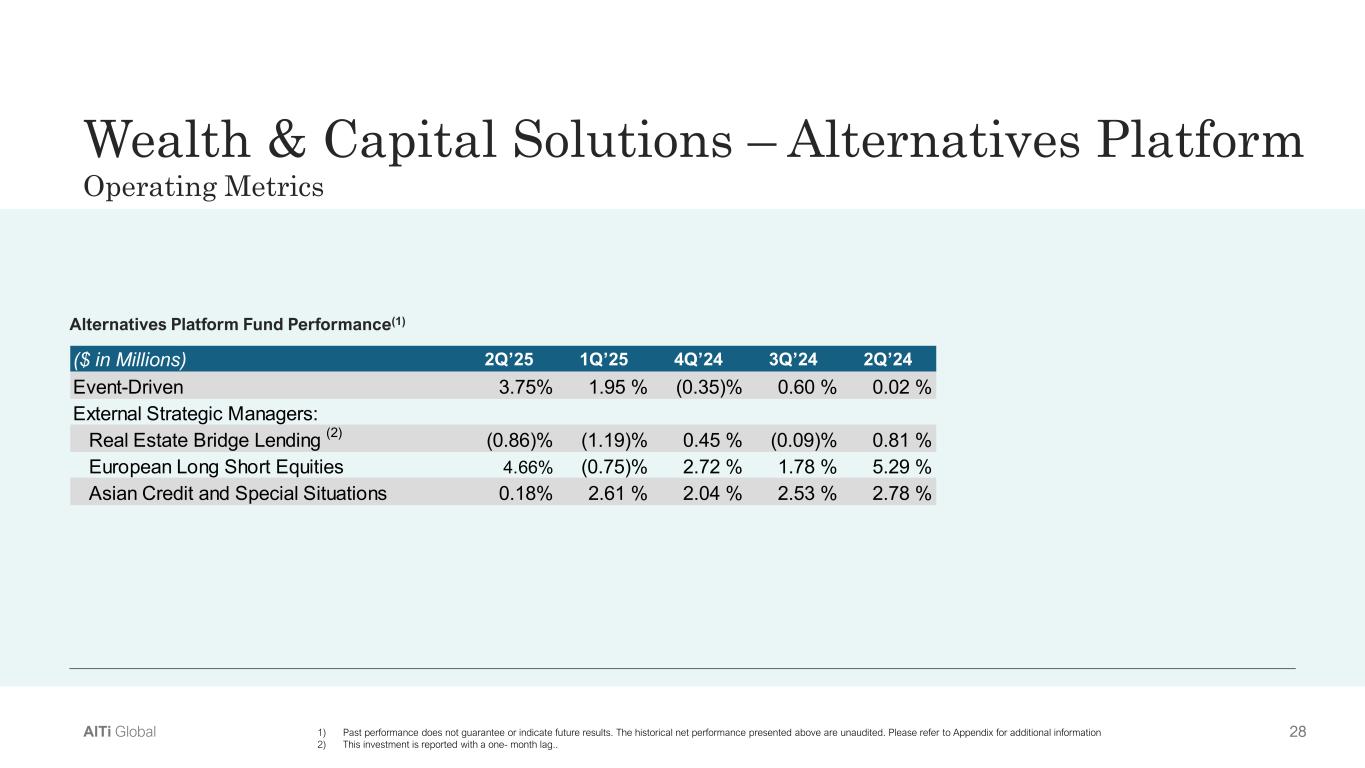

28AlTi Global Wealth & Capital Solutions – Alternatives Platform Operating Metrics Alternatives Platform Fund Performance(1) 1) Past performance does not guarantee or indicate future results. The historical net performance presented above are unaudited. Please refer to Appendix for additional information 2) This investment is reported with a one- month lag.. ($ in Millions) 2Q’25 1Q’25 4Q’24 3Q’24 2Q’24 Event-Driven 3.75% 1.95 % (0.35)% 0.60 % 0.02 % External Strategic Managers: Real Estate Bridge Lending (2) (0.86)% (1.19)% 0.45 % (0.09)% 0.81 % European Long Short Equities 4.66% (0.75)% 2.72 % 1.78 % 5.29 % Asian Credit and Special Situations 0.18% 2.61 % 2.04 % 2.53 % 2.78 %

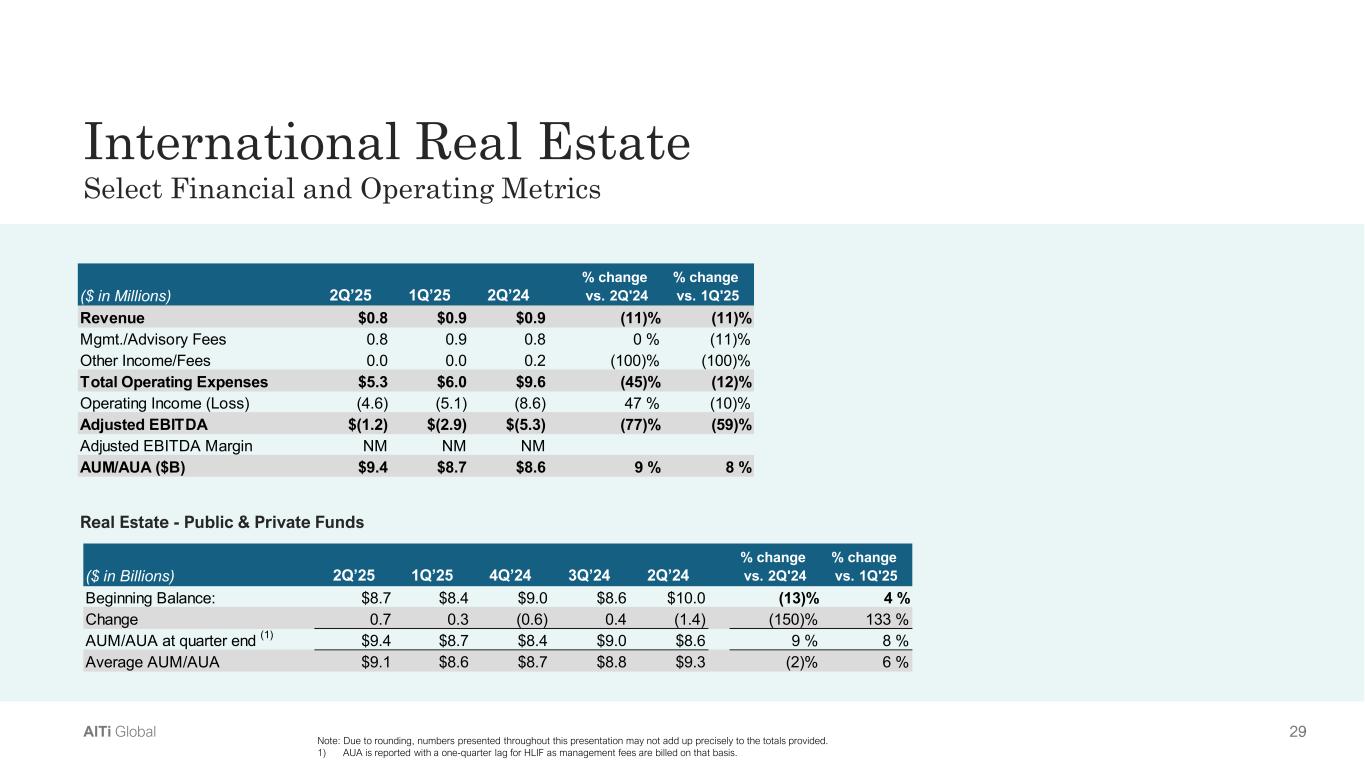

29AlTi Global International Real Estate Select Financial and Operating Metrics Real Estate - Public & Private Funds Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. 1) AUA is reported with a one-quarter lag for HLIF as management fees are billed on that basis. ($ in Billions) 2Q’25 1Q’25 4Q’24 3Q’24 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Beginning Balance: $8.7 $8.4 $9.0 $8.6 $10.0 (13)% 4 % Change 0.7 0.3 (0.6) 0.4 (1.4) (150)% 133 % AUM/AUA at quarter end (1) $9.4 $8.7 $8.4 $9.0 $8.6 9 % 8 % Average AUM/AUA $9.1 $8.6 $8.7 $8.8 $9.3 (2)% 6 % ($ in Millions) 2Q’25 1Q’25 2Q’24 % change vs. 2Q'24 % change vs. 1Q'25 Revenue $0.8 $0.9 $0.9 (11)% (11)% Mgmt./Advisory Fees 0.8 0.9 0.8 0 % (11)% Other Income/Fees 0.0 0.0 0.2 (100)% (100)% Total Operating Expenses $5.3 $6.0 $9.6 (45)% (12)% Operating Income (Loss) (4.6) (5.1) (8.6) 47 % (10)% Adjusted EBITDA $(1.2) $(2.9) $(5.3) (77)% (59)% Adjusted EBITDA Margin NM NM NM AUM/AUA ($B) $9.4 $8.7 $8.6 9 % 8 %

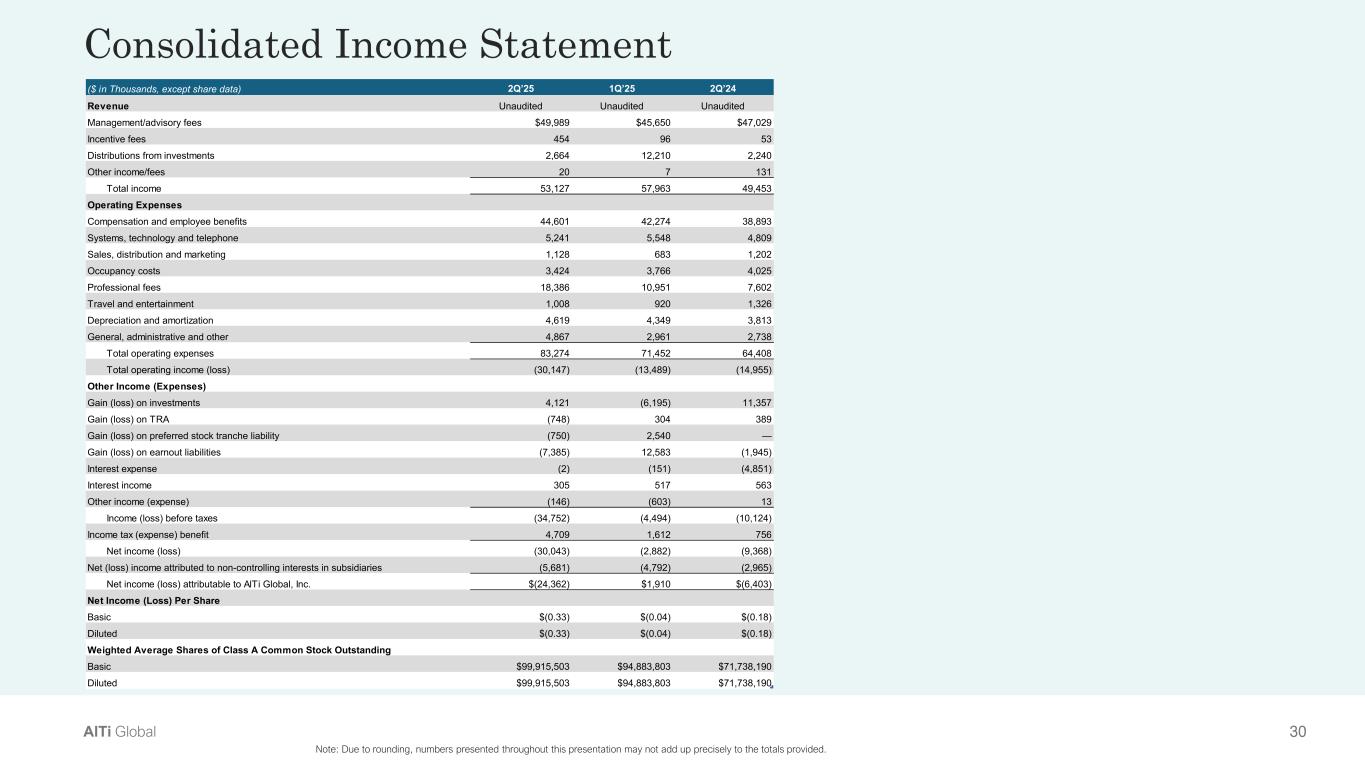

30AlTi Global Consolidated Income Statement Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Thousands, except share data) 2Q’25 1Q’25 2Q’24 Revenue Unaudited Unaudited Unaudited Management/advisory fees $49,989 $45,650 $47,029 Incentive fees 454 96 53 Distributions from investments 2,664 12,210 2,240 Other income/fees 20 7 131 Total income 53,127 57,963 49,453 Operating Expenses Compensation and employee benefits 44,601 42,274 38,893 Systems, technology and telephone 5,241 5,548 4,809 Sales, distribution and marketing 1,128 683 1,202 Occupancy costs 3,424 3,766 4,025 Professional fees 18,386 10,951 7,602 Travel and entertainment 1,008 920 1,326 Depreciation and amortization 4,619 4,349 3,813 General, administrative and other 4,867 2,961 2,738 Total operating expenses 83,274 71,452 64,408 Total operating income (loss) (30,147) (13,489) (14,955) Other Income (Expenses) Gain (loss) on investments 4,121 (6,195) 11,357 Gain (loss) on TRA (748) 304 389 Gain (loss) on preferred stock tranche liability (750) 2,540 — Gain (loss) on earnout liabilities (7,385) 12,583 (1,945) Interest expense (2) (151) (4,851) Interest income 305 517 563 Other income (expense) (146) (603) 13 Income (loss) before taxes (34,752) (4,494) (10,124) Income tax (expense) benefit 4,709 1,612 756 Net income (loss) (30,043) (2,882) (9,368) Net (loss) income attributed to non-controlling interests in subsidiaries (5,681) (4,792) (2,965) Net income (loss) attributable to AlTi Global, Inc. $(24,362) $1,910 $(6,403) Net Income (Loss) Per Share Basic $(0.33) $(0.04) $(0.18) Diluted $(0.33) $(0.04) $(0.18) Weighted Average Shares of Class A Common Stock Outstanding Basic $99,915,503 $94,883,803 $71,738,190 Diluted $99,915,503 $94,883,803 $71,738,190

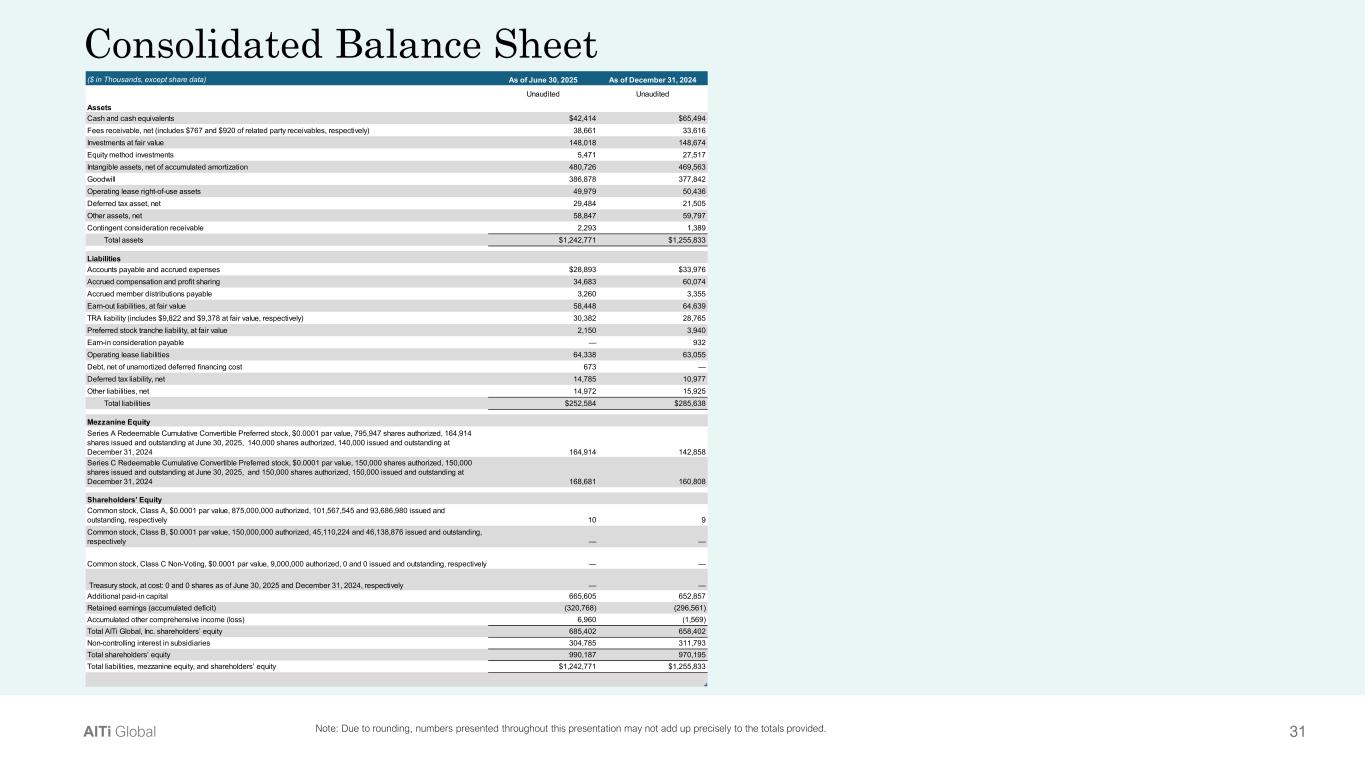

31AlTi Global Consolidated Balance Sheet Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Thousands, except share data) As of June 30, 2025 As of December 31, 2024 Unaudited Unaudited Assets Cash and cash equivalents $42,414 $65,494 Fees receivable, net (includes $767 and $920 of related party receivables, respectively) 38,661 33,616 Investments at fair value 148,018 148,674 Equity method investments 5,471 27,517 Intangible assets, net of accumulated amortization 480,726 469,563 Goodwill 386,878 377,842 Operating lease right-of-use assets 49,979 50,436 Deferred tax asset, net 29,484 21,505 Other assets, net 58,847 59,797 Contingent consideration receivable 2,293 1,389 Total assets $1,242,771 $1,255,833 Liabilities Accounts payable and accrued expenses $28,893 $33,976 Accrued compensation and profit sharing 34,683 60,074 Accrued member distributions payable 3,260 3,355 Earn-out liabilities, at fair value 58,448 64,639 TRA liability (includes $9,822 and $9,378 at fair value, respectively) 30,382 28,765 Preferred stock tranche liability, at fair value 2,150 3,940 Earn-in consideration payable — 932 Operating lease liabilities 64,338 63,055 Debt, net of unamortized deferred financing cost 673 — Deferred tax liability, net 14,785 10,977 Other liabilities, net 14,972 15,925 Total liabilities $252,584 $285,638 Mezzanine Equity Series A Redeemable Cumulative Convertible Preferred stock, $0.0001 par value, 795,947 shares authorized, 164,914 shares issued and outstanding at June 30, 2025, 140,000 shares authorized, 140,000 issued and outstanding at December 31, 2024 164,914 142,858 Series C Redeemable Cumulative Convertible Preferred stock, $0.0001 par value, 150,000 shares authorized, 150,000 shares issued and outstanding at June 30, 2025, and 150,000 shares authorized, 150,000 issued and outstanding at December 31, 2024 168,681 160,808 Shareholders’ Equity Common stock, Class A, $0.0001 par value, 875,000,000 authorized, 101,567,545 and 93,686,980 issued and outstanding, respectively 10 9 Common stock, Class B, $0.0001 par value, 150,000,000 authorized, 45,110,224 and 46,138,876 issued and outstanding, respectively — — Common stock, Class C Non-Voting, $0.0001 par value, 9,000,000 authorized, 0 and 0 issued and outstanding, respectively — — Treasury stock, at cost: 0 and 0 shares as of June 30, 2025 and December 31, 2024, respectively — — Additional paid-in capital 665,605 652,857 Retained earnings (accumulated deficit) (320,768) (296,561) Accumulated other comprehensive income (loss) 6,960 (1,569) Total AlTi Global, Inc. shareholders’ equity 685,402 658,402 Non-controlling interest in subsidiaries 304,785 311,793 Total shareholders’ equity 990,187 970,195 Total liabilities, mezzanine equity, and shareholders’ equity $1,242,771 $1,255,833

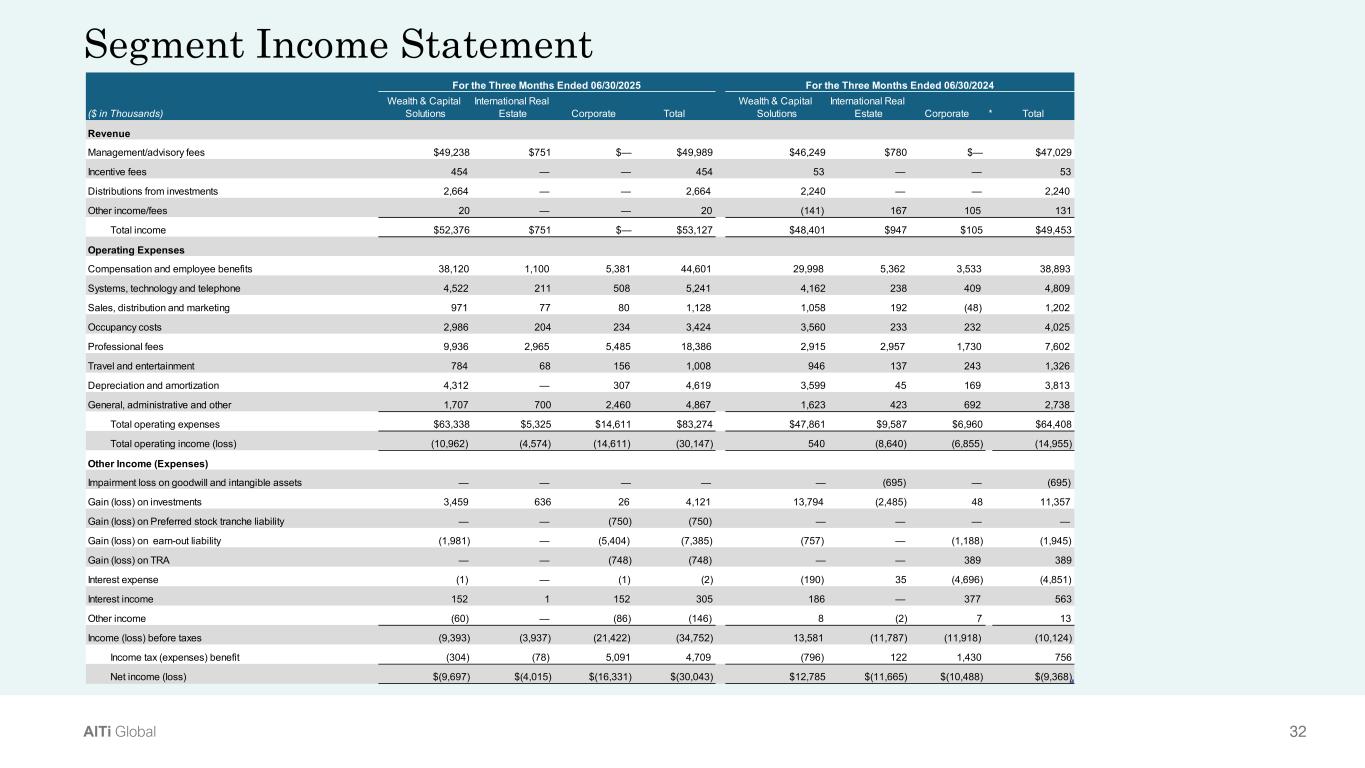

32AlTi Global Segment Income Statement ($ in Thousands) Wealth & Capital Solutions International Real Estate Corporate Total Wealth & Capital Solutions International Real Estate Corporate * Total Revenue Management/advisory fees $49,238 $751 $— $49,989 $46,249 $780 $— $47,029 Incentive fees 454 — — 454 53 — — 53 Distributions from investments 2,664 — — 2,664 2,240 — — 2,240 Other income/fees 20 — — 20 (141) 167 105 131 Total income $52,376 $751 $— $53,127 $48,401 $947 $105 $49,453 Operating Expenses Compensation and employee benefits 38,120 1,100 5,381 44,601 29,998 5,362 3,533 38,893 Systems, technology and telephone 4,522 211 508 5,241 4,162 238 409 4,809 Sales, distribution and marketing 971 77 80 1,128 1,058 192 (48) 1,202 Occupancy costs 2,986 204 234 3,424 3,560 233 232 4,025 Professional fees 9,936 2,965 5,485 18,386 2,915 2,957 1,730 7,602 Travel and entertainment 784 68 156 1,008 946 137 243 1,326 Depreciation and amortization 4,312 — 307 4,619 3,599 45 169 3,813 General, administrative and other 1,707 700 2,460 4,867 1,623 423 692 2,738 Total operating expenses $63,338 $5,325 $14,611 $83,274 $47,861 $9,587 $6,960 $64,408 Total operating income (loss) (10,962) (4,574) (14,611) (30,147) 540 (8,640) (6,855) (14,955) Other Income (Expenses) Impairment loss on goodwill and intangible assets — — — — — (695) — (695) Gain (loss) on investments 3,459 636 26 4,121 13,794 (2,485) 48 11,357 Gain (loss) on Preferred stock tranche liability — — (750) (750) — — — — Gain (loss) on earn-out liability (1,981) — (5,404) (7,385) (757) — (1,188) (1,945) Gain (loss) on TRA — — (748) (748) — — 389 389 Interest expense (1) — (1) (2) (190) 35 (4,696) (4,851) Interest income 152 1 152 305 186 — 377 563 Other income (60) — (86) (146) 8 (2) 7 13 Income (loss) before taxes (9,393) (3,937) (21,422) (34,752) 13,581 (11,787) (11,918) (10,124) Income tax (expenses) benefit (304) (78) 5,091 4,709 (796) 122 1,430 756 Net income (loss) $(9,697) $(4,015) $(16,331) $(30,043) $12,785 $(11,665) $(10,488) $(9,368) For the Three Months Ended 06/30/2025 For the Three Months Ended 06/30/2024

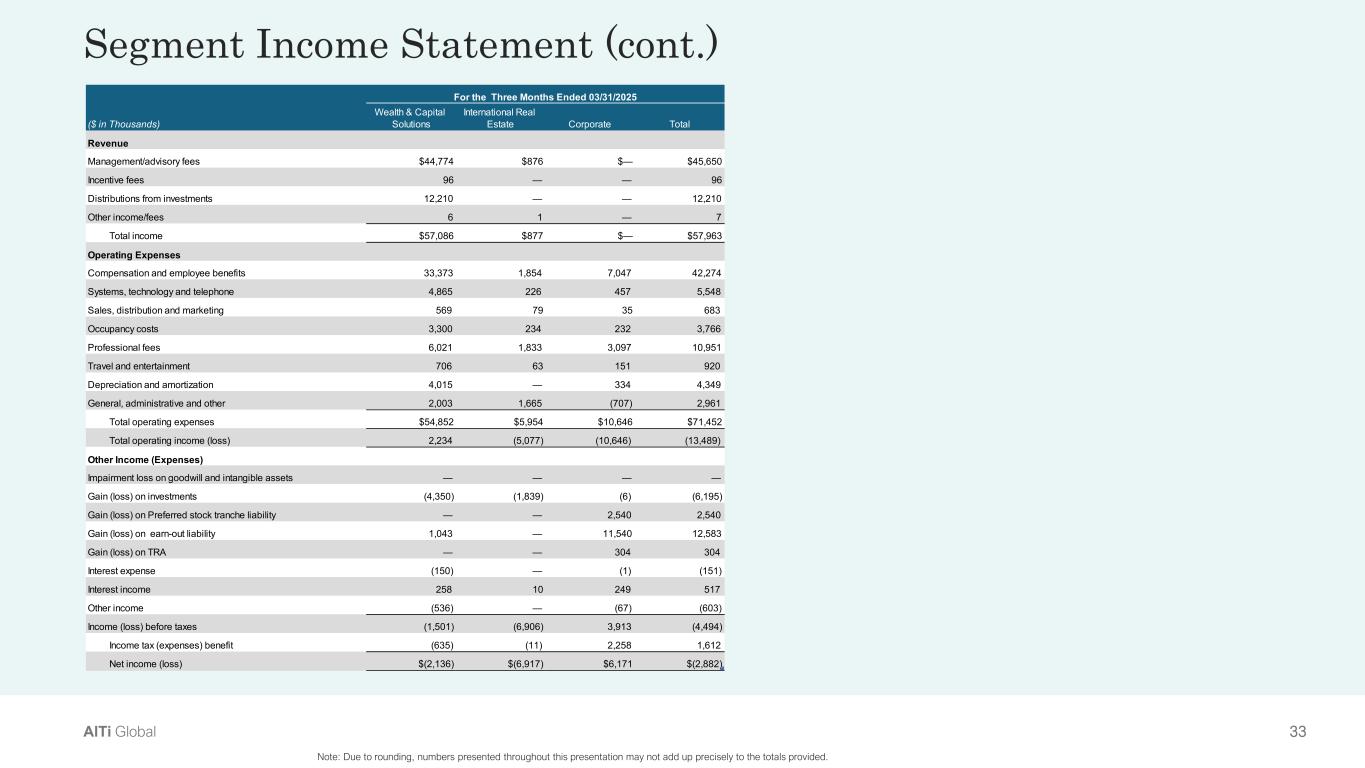

33AlTi Global Segment Income Statement (cont.) Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. ($ in Thousands) Wealth & Capital Solutions International Real Estate Corporate Total Revenue Management/advisory fees $44,774 $876 $— $45,650 Incentive fees 96 — — 96 Distributions from investments 12,210 — — 12,210 Other income/fees 6 1 — 7 Total income $57,086 $877 $— $57,963 Operating Expenses Compensation and employee benefits 33,373 1,854 7,047 42,274 Systems, technology and telephone 4,865 226 457 5,548 Sales, distribution and marketing 569 79 35 683 Occupancy costs 3,300 234 232 3,766 Professional fees 6,021 1,833 3,097 10,951 Travel and entertainment 706 63 151 920 Depreciation and amortization 4,015 — 334 4,349 General, administrative and other 2,003 1,665 (707) 2,961 Total operating expenses $54,852 $5,954 $10,646 $71,452 Total operating income (loss) 2,234 (5,077) (10,646) (13,489) Other Income (Expenses) Impairment loss on goodwill and intangible assets — — — — Gain (loss) on investments (4,350) (1,839) (6) (6,195) Gain (loss) on Preferred stock tranche liability — — 2,540 2,540 Gain (loss) on earn-out liability 1,043 — 11,540 12,583 Gain (loss) on TRA — — 304 304 Interest expense (150) — (1) (151) Interest income 258 10 249 517 Other income (536) — (67) (603) Income (loss) before taxes (1,501) (6,906) 3,913 (4,494) Income tax (expenses) benefit (635) (11) 2,258 1,612 Net income (loss) $(2,136) $(6,917) $6,171 $(2,882) For the Three Months Ended 03/31/2025

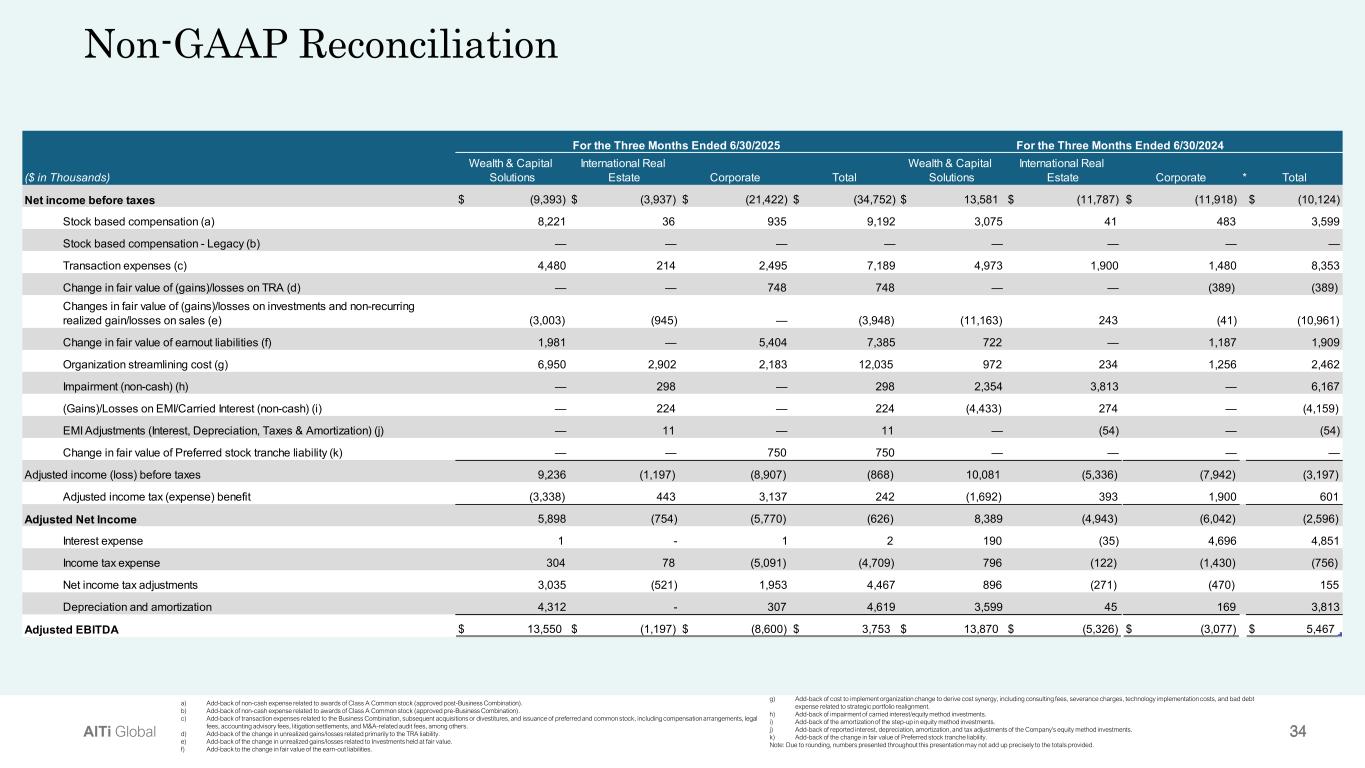

34AlTi Global g) Add-back of cost to implement organization change to derive cost synergy, including consulting fees, severance charges, technology implementation costs, and bad debt expense related to strategic portfolio realignment. h) Add-back of impairment of carried interest/equity method investments. i) Add-back of the amortization of the step-up in equity method investments. j) Add-back of reported interest, depreciation, amortization, and tax adjustments of the Company's equity method investments. k) Add-back of the change in fair value of Preferred stock tranche liability. Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. Non-GAAP Reconciliation a) Add-back of non-cash expense related to awards of Class A Common stock (approved post-Business Combination). b) Add-back of non-cash expense related to awards of Class A Common stock (approved pre-Business Combination). c) Add-back of transaction expenses related to the Business Combination, subsequent acquisitions or divestitures, and issuance of preferred and common stock, including compensation arrangements, legal fees, accounting advisory fees, litigation settlements, and M&A-related audit fees, among others. d) Add-back of the change in unrealized gains/losses related primarily to the TRA liability. e) Add-back of the change in unrealized gains/losses related to Investments held at fair value. f) Add-back to the change in fair value of the earn-out liabilities. ($ in Thousands) Wealth & Capital Solutions International Real Estate Corporate Total Wealth & Capital Solutions International Real Estate Corporate * Total Net income before taxes $ (9,393) $ (3,937) $ (21,422) $ (34,752) $ 13,581 $ (11,787) $ (11,918) $ (10,124) Stock based compensation (a) 8,221 36 935 9,192 3,075 41 483 3,599 Stock based compensation - Legacy (b) — — — — — — — — Transaction expenses (c) 4,480 214 2,495 7,189 4,973 1,900 1,480 8,353 Change in fair value of (gains)/losses on TRA (d) — — 748 748 — — (389) (389) Changes in fair value of (gains)/losses on investments and non-recurring realized gain/losses on sales (e) (3,003) (945) — (3,948) (11,163) 243 (41) (10,961) Change in fair value of earnout liabilities (f) 1,981 — 5,404 7,385 722 — 1,187 1,909 Organization streamlining cost (g) 6,950 2,902 2,183 12,035 972 234 1,256 2,462 Impairment (non-cash) (h) — 298 — 298 2,354 3,813 — 6,167 (Gains)/Losses on EMI/Carried Interest (non-cash) (i) — 224 — 224 (4,433) 274 — (4,159) EMI Adjustments (Interest, Depreciation, Taxes & Amortization) (j) — 11 — 11 — (54) — (54) Change in fair value of Preferred stock tranche liability (k) — — 750 750 — — — — Adjusted income (loss) before taxes 9,236 (1,197) (8,907) (868) 10,081 (5,336) (7,942) (3,197) Adjusted income tax (expense) benefit (3,338) 443 3,137 242 (1,692) 393 1,900 601 Adjusted Net Income 5,898 (754) (5,770) (626) 8,389 (4,943) (6,042) (2,596) Interest expense 1 - 1 2 190 (35) 4,696 4,851 Income tax expense 304 78 (5,091) (4,709) 796 (122) (1,430) (756) Net income tax adjustments 3,035 (521) 1,953 4,467 896 (271) (470) 155 Depreciation and amortization 4,312 - 307 4,619 3,599 45 169 3,813 Adjusted EBITDA $ 13,550 $ (1,197) $ (8,600) $ 3,753 $ 13,870 $ (5,326) $ (3,077) $ 5,467 For the Three Months Ended 6/30/2025 For the Three Months Ended 6/30/2024

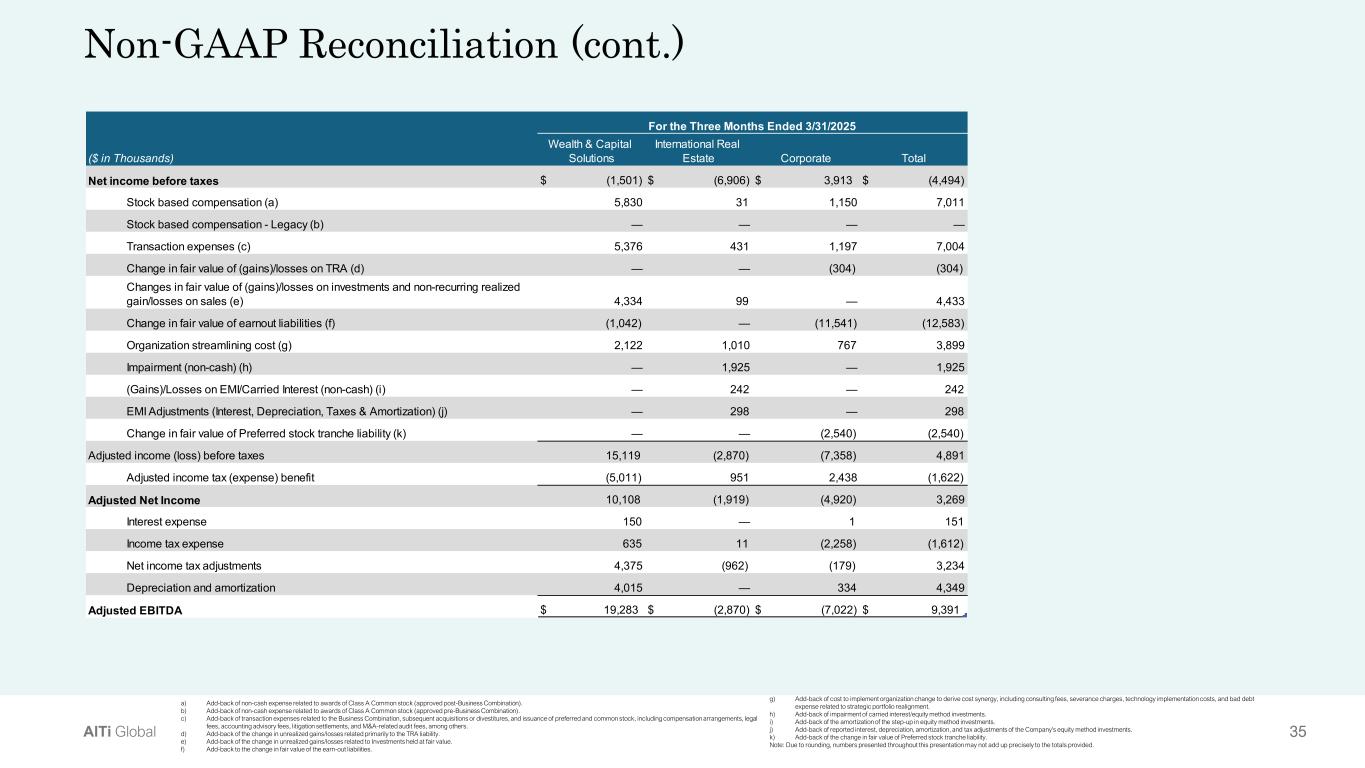

35AlTi Global Non-GAAP Reconciliation (cont.) g) Add-back of cost to implement organization change to derive cost synergy, including consulting fees, severance charges, technology implementation costs, and bad debt expense related to strategic portfolio realignment. h) Add-back of impairment of carried interest/equity method investments. i) Add-back of the amortization of the step-up in equity method investments. j) Add-back of reported interest, depreciation, amortization, and tax adjustments of the Company's equity method investments. k) Add-back of the change in fair value of Preferred stock tranche liability. Note: Due to rounding, numbers presented throughout this presentation may not add up precisely to the totals provided. a) Add-back of non-cash expense related to awards of Class A Common stock (approved post-Business Combination). b) Add-back of non-cash expense related to awards of Class A Common stock (approved pre-Business Combination). c) Add-back of transaction expenses related to the Business Combination, subsequent acquisitions or divestitures, and issuance of preferred and common stock, including compensation arrangements, legal fees, accounting advisory fees, litigation settlements, and M&A-related audit fees, among others. d) Add-back of the change in unrealized gains/losses related primarily to the TRA liability. e) Add-back of the change in unrealized gains/losses related to Investments held at fair value. f) Add-back to the change in fair value of the earn-out liabilities. ($ in Thousands) Wealth & Capital Solutions International Real Estate Corporate Total Net income before taxes $ (1,501) $ (6,906) $ 3,913 $ (4,494) Stock based compensation (a) 5,830 31 1,150 7,011 Stock based compensation - Legacy (b) — — — — Transaction expenses (c) 5,376 431 1,197 7,004 Change in fair value of (gains)/losses on TRA (d) — — (304) (304) Changes in fair value of (gains)/losses on investments and non-recurring realized gain/losses on sales (e) 4,334 99 — 4,433 Change in fair value of earnout liabilities (f) (1,042) — (11,541) (12,583) Organization streamlining cost (g) 2,122 1,010 767 3,899 Impairment (non-cash) (h) — 1,925 — 1,925 (Gains)/Losses on EMI/Carried Interest (non-cash) (i) — 242 — 242 EMI Adjustments (Interest, Depreciation, Taxes & Amortization) (j) — 298 — 298 Change in fair value of Preferred stock tranche liability (k) — — (2,540) (2,540) Adjusted income (loss) before taxes 15,119 (2,870) (7,358) 4,891 Adjusted income tax (expense) benefit (5,011) 951 2,438 (1,622) Adjusted Net Income 10,108 (1,919) (4,920) 3,269 Interest expense 150 — 1 151 Income tax expense 635 11 (2,258) (1,612) Net income tax adjustments 4,375 (962) (179) 3,234 Depreciation and amortization 4,015 — 334 4,349 Adjusted EBITDA $ 19,283 $ (2,870) $ (7,022) $ 9,391 For the Three Months Ended 3/31/2025

36AlTi Global Appendix

37AlTi Global Glossary Assets Under Management and Assets Under Advisement. Unless otherwise defined and subject to applicable regulations, assets under management (“AUM”) refers to assets on which a business provides continuous and regular billable supervisory or discretionary management services and non-discretionary arrangements constituting investment advice of an on-going nature. Assets under advisement (“AUA”) refers to assets that are managed or custodied, as well as non-discretionary assets that are not managed but are overseen in a consulting or similar capacity. For financial presentation purposes, total assets under management and assets under advisement (“AUM/AUA”) of AlTi is calculated as follows: (a) AUM/AUA includes billable and non-billable assets. Billable assets represent the portion of assets on which we charge fees, including under co-investment arrangements. Non- billable assets are exempt of fees and can include cash and cash equivalents, real estate, investment consulting assets and other types of assets designated as such; (b) for the purpose of calculating International Real Estate co-investment assets, we include the gross asset value of all assets managed or supervised by operating partner subsidiaries, affiliates and joint ventures in which we hold either a majority or minority stake; and (c) our AUM/AUA includes the assets under management of each of our External Strategic Managers. AlTi’s AUM/AUA should not be viewed as AUM reporting for regulatory and/or statutory purposes under the U.S. Investment Advisers Act of 1940, as amended. Adjusted EBITDA. We use Adjusted EBITDA as a non-US GAAP measure to track our performance and assess our ability to service our borrowings. This is a non-US GAAP financial measure supplement and should be considered in addition to and not in lieu of, the results of operations, prepared in accordance with US GAAP. Adjusted EBITDA is derived from and reconciled to, but not equivalent to, its most directly comparable GAAP measure of net income (loss). Adjusted EBITDA represents adjusted net income plus (a) interest expense, net, (b) income tax expense, (c) adjusted income tax expense less income tax expense, and (d) depreciation and amortization expense. Adjusted Net Income. We use Adjusted Net Income as a non-US GAAP measure to track our performance and assess our ability to service our borrowings. This is a non-US GAAP financial measure supplement and should be considered in addition to and not in lieu of, the results of operations, prepared in accordance with U.S. GAAP. Adjusted Net Income represents net income (loss) before taxes plus (a) equity-settled share-based payments, (b) transaction-related costs, including professional fees, (c) impairment of equity method investments, (d) change in fair value of investment or other financial instruments, (e) onetime bonuses recorded in the statement of operations, (f) compensation expense related to the earn-in of certain variable interest entities, and (g) adjusted income tax expense. Billable Assets. Represents the portion of our AUM/AUA on which we charge fees. External Strategic Managers. are those managers in which the we have made an external investment, and the strategies of these managers include Real Estate Bridge Lending, European Long/Short Equity and Asian Credit and Special Situations. MFO. Multi-family office Mgmt./Advisory Fees. Mgmt./Advisory fees represent fees recurring in nature, primarily management fees. Impact Investing. Investment practices seeking to generate various levels of financial performance together with the generation of positive measurable environmental and social impacts. Recurring revenues. Management/Advisory fees plus the management fee portion of distribution from investments. UHNW. Ultra High Net Worth individuals are people with a net worth of at least $30 million.

38AlTi Global Footnotes Past performance does not guarantee or indicate future results. The historical net performance presented are unaudited. A description of the strategies is provided below: Event-driven: The Event-driven strategy is based in New York. This strategy focuses on 0-to-30-day events within the merger process. The investment team employs deep research on each situation in the portfolio with a focus on complex, hostile, up-for-sale situations where our primary research work can drive uncorrelated alpha. The research and investment process is focused on hard catalyst events and is not dependent on deal flow. Real Estate Bridge Lending : The Real Estate Bridge Lending strategy is managed by an external manager based in Toronto and focuses on complex construction, term, and pre-development bridge loans throughout North America. The strategy’s diversified portfolio primarily consists of first lien mortgages with little to no structural leverage. The team places an emphasis on risk management via rigorous underwriting consisting of borrower analysis, vetting, and extensive monitoring across all major real estate asset classes. European Long Short Equities: The European Long Short Equities strategy is managed by an external manager based in London. The strategy trades the portfolio actively and absolute return-oriented with a focus on financials, cyclicals, and mining and minerals. The strategy is market agnostic and runs with a variable net exposure, equally comfortable net long or net short. Asia Credit and Special Situations: The Asia Credit and Special Situations strategy is managed by an external manager based in Hong Kong. The strategy includes performing, stressed, and distressed bonds and loans throughout the Asia Pacific region. The manager strives to capitalize on what it believes is an under-researched and inefficient market with limited competition and attractive levels of stressed and distressed activity.

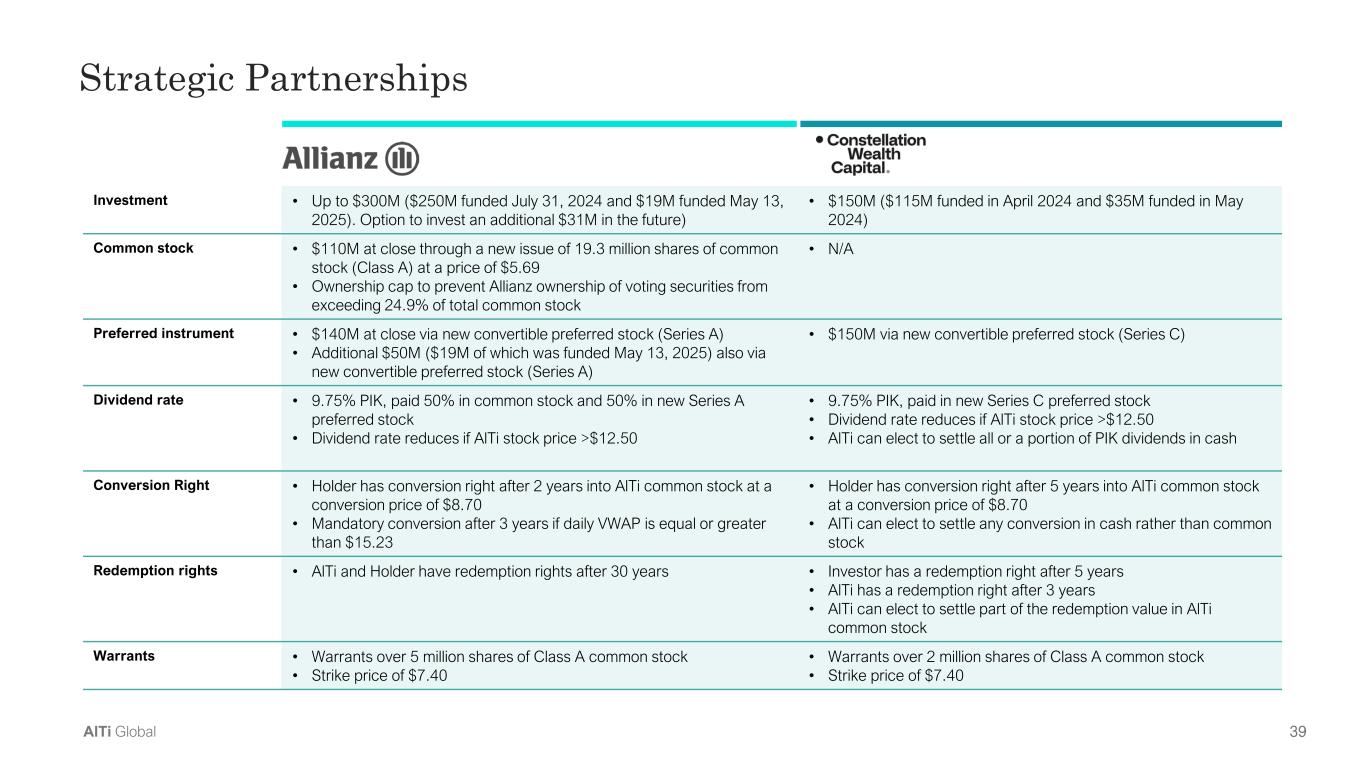

39AlTi Global Investment • Up to $300M ($250M funded July 31, 2024 and $19M funded May 13, 2025). Option to invest an additional $31M in the future) • $150M ($115M funded in April 2024 and $35M funded in May 2024) Common stock • $110M at close through a new issue of 19.3 million shares of common stock (Class A) at a price of $5.69 • Ownership cap to prevent Allianz ownership of voting securities from exceeding 24.9% of total common stock • N/A Preferred instrument • $140M at close via new convertible preferred stock (Series A) • Additional $50M ($19M of which was funded May 13, 2025) also via new convertible preferred stock (Series A) • $150M via new convertible preferred stock (Series C) Dividend rate • 9.75% PIK, paid 50% in common stock and 50% in new Series A preferred stock • Dividend rate reduces if AlTi stock price >$12.50 • 9.75% PIK, paid in new Series C preferred stock • Dividend rate reduces if AlTi stock price >$12.50 • AlTi can elect to settle all or a portion of PIK dividends in cash Conversion Right • Holder has conversion right after 2 years into AlTi common stock at a conversion price of $8.70 • Mandatory conversion after 3 years if daily VWAP is equal or greater than $15.23 • Holder has conversion right after 5 years into AlTi common stock at a conversion price of $8.70 • AlTi can elect to settle any conversion in cash rather than common stock Redemption rights • AlTi and Holder have redemption rights after 30 years • Investor has a redemption right after 5 years • AlTi has a redemption right after 3 years • AlTi can elect to settle part of the redemption value in AlTi common stock Warrants • Warrants over 5 million shares of Class A common stock • Strike price of $7.40 • Warrants over 2 million shares of Class A common stock • Strike price of $7.40 Strategic Partnerships

40AlTi Global Thank You