Please wait

|

Prospectus Supplement No. 6

(to prospectus dated February 1, 2022) |

|

Filed pursuant to Rule 424(b)(3)

Registration No. 333-262179 |

Bowlero Corp.

216,956,397 Shares of Class A Common Stock

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated February 1, 2022 (the “Prospectus”), related to the offer

and sale, from time to time, by the selling securityholders identified in the Prospectus, or their permitted transferees, of up to 216,956,397

shares of Class A common stock, par value $0.0001 (the “Class A Common Stock”) with the information contained in our Annual

Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on September 15, 2022 (the “Annual Report”).

Accordingly, we have attached the Annual Report to this prospectus supplement.

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our Class A Common Stock is listed on the NYSE under

the symbol “BOWL.” On September 14, 2022, the closing sale price per share of our Class A Common Stock was $12.99.

Investing in our securities involves risks. See

“Risk Factors” beginning on page 6 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus or this prospectus supplement.

Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September

15, 2022.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

___________________________________

FORM

10-K

___________________________________

|

|

|

|

|

|

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended July

3, 2022

OR

|

|

|

|

|

|

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

file number 001-40142

___________________________________

BOWLERO

CORP.

(Exact

name of registrant as specified in its charter)

___________________________________

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

|

98-1632024 |

| (State

or other jurisdiction of incorporation or organization) |

|

|

(I.R.S.

Employer Identification No.) |

|

|

|

| 7313

Bell Creek Road |

|

|

|

|

Mechanicsville,

Virginia |

|

|

23111 |

| (Address

of Principal Executive Offices) |

|

|

(Zip

Code) |

(804)

417-2000

Registrant's

telephone number, including area code

Securities

registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Class

A common stock,

par value $0.0001 per share |

BOWL |

The

New York Stock Exchange |

Securities

registered pursuant to section 12(g) of the Act: None

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

☐ No

☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

No

☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2)

has been subject to such filing requirements for the past 90 days. Yes

☒

No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such files). Yes

☒

No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☐ |

|

|

Emerging

growth company |

☒ |

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

No ☒

The aggregate

market value of Class A common stock held by non-affiliates of the registrant on the last business day of the registrant’s most

recently completed second fiscal quarter, was approximately $325,356,000,

based on the closing price of $9.15 for shares of the registrant’s Class A common stock as reported by the New York Stock Exchange.

The

registrant had outstanding 110,122,265

shares of Class A common stock, 55,911,203

shares of Class B common stock, and 200,000 shares of Series A preferred stock as of September 6, 2022.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions of our

definitive Proxy Statement for the 2022 Annual Meeting of Stockholders, expected to be filed within 120 days of our fiscal year end, are

incorporated by reference into Part III.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Auditor

Name: |

KPMG

LLP |

|

Auditor

Location: |

Richmond,

Virginia |

|

Auditor

Firm ID: |

185 |

Table

of Contents

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995 that involve risk, assumptions and uncertainties, such as statements of our plans,

objectives, expectations, intentions and forecasts.. These forward-looking statements are generally identified by the use of forward-looking

terminology, including the terms “anticipate,” “believe,” “confident,” “continue,” “could,”

“estimate,” “expect,” “intend,” “likely,” “may,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and, in each case, their negative or other various or comparable terminology. Our actual results and the timing of

selected events could differ materially from those discussed in these forward-looking statements as a result of several factors, including

those set forth under the section of this Annual Report on Form 10-K titled Part I, Item 1A “Risk Factors” and elsewhere in

this Annual Report on Form 10-K. These statements involve known and unknown risks, uncertainties and other important factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Important factors that could cause our results to vary from expectations include,

but are not limited to: the impact of COVID-19 pandemic and any future outbreaks of contagious diseases on our business; our ability to

design and execute our business strategy; changes in consumer preferences and buying patterns; our ability to compete in our markets;

the occurrence of unfavorable publicity; risks associated with long-term non-cancellable leases for our centers; our ability to retain

key managers; risks associated with our substantial indebtedness and limitations on future sources of liquidity; our ability to carry

out our expansion plans; our continued ability to produce content, build infrastructure and market Professional Bowlers Association (“PBA”)

events; our ability to successfully defend litigation brought against us; our ability to adequately obtain, maintain, protect and enforce

our intellectual property and proprietary rights and claims of intellectual property and proprietary right infringement, misappropriation

or other violation by competitors and third parties; failure to hire and retain qualified employees and personnel; the cost and availability

of commodities and other products we need to operate our business; cybersecurity breaches, cyber-attacks and other interruptions to our

and our third-party service providers’ technological and physical infrastructures; catastrophic events, including war, terrorism

and other conflicts; public health issues or natural catastrophes and accidents; changes in the regulatory atmosphere and related private

sector initiatives; fluctuations in our operating results; economic conditions, including the impact of increasing interest rates, inflation

and recession; and other risks, uncertainties and factors set forth in this Annual Report on Form 10-K, including those set forth under

Part I, Item 1A “Risk Factors.” These forward-looking statements reflect our views with respect to future events as of the

date of this Annual Report on Form 10-K and are based on assumptions and subject to risks and uncertainties. Given these uncertainties,

you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and

assumptions only as of the date of this Annual Report on Form 10-K and, except as required by law, we undertake no obligation to update

or review publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of

this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. You should read

this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from

what we expect. Our forward-looking statements do not reflect the potential impact of any future acquisitions, merger, dispositions, joint

ventures or investments we may undertake. We qualify all of our forward-looking statements by these cautionary statements.

RISK

FACTOR SUMMARY

Our

business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely

affect our business, financial condition, results of operations, cash flows and prospects. Risks that we deem material are described below.

These risks include, but are not limited to, the following:

•the

impact of COVID-19 pandemic on our business, including any additional future government-mandated and voluntary shutdowns and operating

restrictions on our business and the level of customer demand;

•lack

of demand for our services;

•changes

in economic and business conditions;

•inability

to sustain further growth in our business;

•failure

to meet customer expectations;

•changing

patterns in consumer spending and preferences;

•competition

that we face;

•inability

to maintain our brand identity and our reputation;

•inability

to obtain, maintain and defend intellectual property rights;

•inability

to manage changes in commodity prices and other product costs;

•risks

associated with our non-cancelable, long-term operating leases that account for a significant portion of our operating expenses;

•cybersecurity

breaches and data leaks, and our dependence on information technology systems;

•the

impact of seasonality, recession, weather, inflation, acts of violence or terrorism and other factors outside our control

These

are not the only risks and uncertainties the Company faces, and you should carefully review and consider the full discussion of the Company’s

risk factors in the section titled Part I, Item 1A “Risk Factors,” together with the other information in this Annual Report

on Form 10-K. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business,

financial condition, results of operations and cash flows.

Part

I

Item

1. Business

Overview

We

are the world’s largest operator of bowling entertainment centers. Since the acquisition of the original Bowlmor Lanes location

in 1997 in Greenwich Village, New York City, our journey has continued to revolutionize bowling entertainment. We operate traditional

bowling centers and more upscale entertainment concepts with lounge seating, arcades, enhanced food and beverage offerings, and more robust

customer service for individuals and group events, as well as hosting and overseeing professional and non-professional bowling tournaments

and related broadcasting. Our bowling business is our only reporting segment. All amounts are in thousands, except share, per share or

as otherwise specifically noted.

Competitive

Strengths

We

believe our key competitive strengths include our highly loyal customers, strong branding, diverse product offerings, excellent and well-diversified

geographic locations, proven business model and experienced management team, all of which contribute to our solid track record of sustainable

growth and generating positive earnings.

Loyal

Customers: With

the over 26-million customers (pre-pandemic) we serve each year, we are well-positioned in highly attractive markets across North America

to capitalize on the very large addressable markets for bowling and out-of-home entertainment. With our strong market position, we are

able to leverage our competitive strengths to grow our business by, among other things, differentiating our bowling, dining and amusement

video game entertainment offerings for our retail, league and group event customers. Retail consists of our walk-in customers and is by

far our largest and most diverse audience. Leagues are a large and stable source of recurring revenue and group events, such as birthday

parties and corporate events, are a consistent revenue stream with significant growth potential.

Strong

Branding: Our

centers operate under different brand names and our strong branding plays an integral role in the success of our business. The Bowlero

branded centers offer a more upscale entertainment concept with lounge seating, enhanced food and beverage offerings, and a more robust

customer service for individual and group events. The AMF centers are traditional bowling centers in an updated format.

Diverse

Product Offerings: We

attribute our success to our many competitive strengths and our ongoing efforts to grow and revitalize all aspects of the bowling industry.

We are well positioned in the marketplace with our well-located centers, combined with our strong branding and highly loyal customer base.

We have made significant investments over the years in upgrading and converting our centers and training our staff to provide our guests

with world-class customer experiences. Our gaming operations pioneer in-center gaming, apps and new technology to bring gaming into our

centers and beyond our bowling centers. Our food and beverage offerings are a key element to the overall experience at our centers for

which we are well positioned for the price, quality and value. Our iconic branding extends to media, as we own, operate and produce all

of the content for the Professional Bowlers Association (PBA Tour). As the leader in bowling entertainment, the PBA is a strategic part

of our operations, as the PBA has thousands of members and millions of fans across the globe. The PBA is the major sanctioning body for

the sport of professional ten-pin bowling in the United States, a membership organization for professional bowlers, and oversees professional

bowling tournaments and related broadcasting.

Proven

Business Model: Bowlero

has a lengthy history since our founding in 1997. For the five-year period from March 29, 2015 to March 29, 2020, which was the last five-year

fiscal period which was not affected by the impact of the COVID-19 pandemic, our revenue increased from $544,200 to $657,100. However,

when including COVID-19 pandemic-impacted periods, for the five-year period beginning July 1, 2018 and ended July 3, 2022, our revenue

increased from $619,100 to $911,705. We remain focused on creating long-term shareholder value by driving organic growth through conversions

and upgrading of centers to more upscale entertainment concepts offering a broader range of offerings, as well as through the opening

of new centers. Additionally, we have implemented several initiatives, including self-service kiosks, robotic process automation, online

reservations and event sales, as well as other technologies to optimize our resources so as to operate with a leaner staffing model, further

improving margins and operating cash flows.

A

key part of our growth strategy is center acquisitions, as we continually evaluate potential acquisitions that strategically fit within

our overall growth strategy. We also have an established blueprint for in-market acquisitions, including entering markets through direct

purchases or through leasing arrangements. To that end, we entered into an agreement on May 27, 2021 to acquire Bowl America Incorporated

(NYSE American: BWL-A) which operated 17 bowling centers in Florida, Virginia and Maryland. We completed this acquisition on August 16,

2021, as well as a number of other acquisitions in various markets throughout the year as detailed in Note 3 - Business

Combinations and Acquisitions

to our consolidated financial statements included in this Annual Report in Form 10-K.

Proven

Management Team: Our

executive management team is well proven and highly experienced with a long track record of driving positive results for increased shareholder

value and world-class experiences for our guests. Our founder continues to drive the entrepreneurial culture which underpins our ongoing

success. Our management team is committed to constantly improving our world-class company. We also have a team of skilled, loyal and committed

managers and other associates at each of our centers. We have developed and maintain as a key initiative the training of our center managers

and associates to attract and retain talent, create high-performance center leadership teams and maintain a culture to build upon our

inspiring purpose, vision and values.

Our

Industry

We

operate in the leisure industry, which includes entertainment, restaurants and amusements. The leisure industry is comprised of a large

number of venues ranging from small to large, heavily themed destinations. We are the world’s largest owner and operator of bowling

centers and we are approximately six times larger than the next largest operator of U.S. based bowling centers. The out-of-home entertainment

market includes concepts that are broad family entertainment centers, such as amusement parks, movie theaters, sporting events, sports

activity centers and arcades. The addressable market in the United States is estimated to be $4,000,000 (pre-COVID-19 pandemic) for bowling

and over $100,000,000 for the out-of-home entertainment. We believe we are well-positioned with our competitive advantages to grow our

revenues and profitability, especially in light of the secular shift in consumer spending from products to experiential spending.

COVID-19

We

believe our bowling centers provide ideal venues for entertainment, even with the COVID-19 pandemic and its variants, when considering

social distancing and other such measures. Our centers are large open buildings with the

structural

separation of lanes and ventilation systems, which became apparent with the strong rebound in our business as we were allowed to return

to operation after the COVID-19 mandated closures.

E-commerce

or online shopping continues to increase and negatively impact consumer traffic at traditional “brick and mortar” retail sites

located in regional malls, lifestyle centers, big box shopping centers and entertainment centers. Vacancies have also increased due to

the COVID-19 pandemic. A decline in development or closures of businesses in these settings or a decline in visitors to retail areas near

our centers could negatively affect our sales. However, those vacancies can also create opportunities for us to construct new centers

on favorable terms. The impacts of the COVID-19 pandemic on our business are discussed in further detail throughout this Business section,

“Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations” of this report.

Foreign

Operations

We

currently operate five centers in Mexico and two in Canada. Our Mexican and Canadian centers, combined, represented approximately $8,800

and $1,200 in revenues for the fiscal years 2022 and 2021, respectively, and have combined net assets of $23,000 and $24,400 as of July 3,

2022 and June 27, 2021, respectively. Our foreign operations are subject to various risks of conducting businesses in foreign countries,

including changes in foreign currencies, laws, regulations, and economic and political stability. See “Risk

Factors”

for more information regarding the risks.

Competition

The

out-of-home entertainment industries are highly competitive, with a number of major national and regional chains operating in each of

these spaces. In this regard, we compete for customers on the basis of (a) our name recognition; (b) the price, quality, variety and perceived

value of our food and entertainment offerings; (c) the quality of our customer service; and (d) the convenience and attractiveness of

our facilities. Although there are other concepts that presently utilize the combined family dining and entertainment format, these competitors

primarily operate on a regional or market-by-market basis. To a lesser extent, we also compete directly and/or indirectly with other dining

and entertainment formats, including full-service and quick-service restaurants appealing to families with young children, the quick service

pizza segment, movie theaters, themed amusement attractions and other entertainment facilities.

We

believe that our principal competitive strengths consist of the quality, variety and unique nature of our entertainment offerings, our

established and well recognized brand, the quality and value of the food and service we provide, the location and attractiveness of our

centers and their cleanliness, and the whole family fun we offer our guests.

Intellectual

Property

We

own various trademarks, used in connection with our business, which have been registered with the appropriate patent and trademark offices.

The duration of such trademarks is unlimited, subject to continued use and renewal. To further protect our brand, we have registered internet

domain names, including www.bowlero.com.

We believe that we hold the necessary rights for protection of the trademarks considered essential to conduct our business. We believe

our trade name and our ownership of trademarks are an important competitive advantage, and we actively seek to protect our interests in

such property.

Seasonality

Our

operating results fluctuate seasonally. We typically generate our highest sales volumes during the third quarter of each fiscal year due

to the timing of leagues, holidays and changing weather conditions. School operating schedules, holidays and weather conditions may also

affect our sales volumes in some operating regions differently than others. Because of the seasonality of our business, results for any

quarter are not necessarily indicative of the results that may be achieved for our full fiscal year.

Government

Regulation

We

are subject to various federal, state and local laws and regulations affecting the development and operation of our centers. For a discussion

of government regulation risks to our business, see “Risk

Factors.”

Human

Capital Resources

Environmental,

Social, Governance (“ESG”) Oversight

We

are committed to advancing a purpose-led vision and fostering a culture that encourages our employees to enhance our business and the

communities in which we operate. We endeavor to integrate ESG practices that create

sustainable

economic value to our employees, stockholders, communities, and other stakeholders. Our dedicated environmental and community stewardship

is an integral component of our delivering excellence, driving strategic innovation, and growing long-term stockholder value. We believe

that our impact on the environment, how we manage our relationships with employees, suppliers, guests and the communities where we operate,

and the accountability of our leadership to our stockholders are all critically important to our business. We have undertaken a number

of initiatives to further these goals.

From

an environmental perspective, we have implemented and plan to continue to implement policies and practices with the goal of supporting

the continued reduction of energy consumption (thereby reducing greenhouse gas emissions), water, and waste production across the portfolio.

Initiatives we have taken include the installation of solar panels on the roofs of our bowling centers, electric vehicle charging stations

in the parking lots of our bowling centers and LED lighting. Additionally, we are continuing to research solar and alternative energy

options to further reduce our consumption and carbon footprint. We are committed to maintaining sustainable operations and believe that

our long-term sustainability goals will provide positive financial and environmental outcomes for shareholders, associates and the communities

in which we invest.

Oversight

of Human Capital Management

As

of July 3, 2022, we employed approximately 9,390 employees, including approximately 8,938 in the operation of our centers and approximately

452 at the corporate level. We had 2,965 full-time employees and 6,422 part-time employees, of whom 55 were based in Canada and 127 in

Mexico. We had 71 employees who are members of a union. We believe that our employee relations are satisfactory, and we have not experienced

any work stoppages at any of our centers. Each center typically employs a center General Manager, two operation managers, a facilities

manager who oversees the maintenance of the facility and bowling equipment, and approximately 20 to 30 associates to handle food and beverage

preparation, customer service and maintenance. Our staffing requirements are seasonal, and the number of people we employ at our stores

will fluctuate throughout the year.

Our

reputation for exceptional quality relies on having exceptional people who support our guest-focused mission in our bowling centers, so

we ensure that our team is rewarded, engaged and developed to build fulfilling careers. We provide competitive associate wages that are

appropriate to employee positions, skill levels, experience, knowledge and geographic location. In the United States, we offer our associates

a wide array of health, and welfare benefits, which we believe are competitive relative to others in our industry. We benchmark our benefits

plan annually to ensure our associate value proposition remains competitive and attractive to new talent. In our operations in Canada

and Mexico, we offer benefits that may vary from those offered to our U.S. associates due to customary local practices and statutory requirements.

In all locations, we provide time off benefits, company-paid holidays, recognition programs and career development opportunities.

Workforce

Diversity,

equality, inclusion and belonging are fundamental principles in our culture. We strive to create a workplace where all our associates

can thrive and to employ a workforce that represents the communities where we operate and the customers we serve. We are committed to

fostering, cultivating, celebrating and preserving a culture of diversity, equality, inclusion and belonging among our associates, customers

and suppliers. We embrace our associates’ differences in age, color, disability, ethnicity, family or marital status, gender identity

or expression, language, national origin, physical and mental ability, political affiliation, race, religion, sexual orientation, socio-economic

status, caste, veteran status, and other characteristics that make our associates unique. Bowlero’s diversity initiatives include,

but are not limited to, our practices and policies on recruitment and selection; compensation and benefits; professional development and

training; promotions; transfers; social and recreational programs; terminations; and the ongoing development of a work environment that

encourages and enforces respectful communication, teamwork, work/life balance and engaging in community efforts that promote a greater

understanding and respect for the principles of diversity.

Our

workforce diversity is summarized in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Female

|

|

Male |

|

Not

Declared |

|

Total |

| American

Indian/Alaskan Native |

0.4 |

% |

|

0.3 |

% |

|

— |

% |

|

0.7 |

% |

| Asian

|

1.3 |

% |

|

1.8 |

% |

|

— |

% |

|

3.1 |

% |

| Black

or African-American |

9.4 |

% |

|

11.2 |

% |

|

0.1 |

% |

|

20.7 |

% |

| Hispanic

or Latino |

10.1 |

% |

|

10.5 |

% |

|

0.2 |

% |

|

20.8 |

% |

| Native

Hawaiian/Pacific Island |

0.2 |

% |

|

0.2 |

% |

|

— |

% |

|

0.4 |

% |

| Not

Declared |

1.1 |

% |

|

1.2 |

% |

|

0.5 |

% |

|

2.8 |

% |

| Two

or more Races |

2.2 |

% |

|

2.2 |

% |

|

0.1 |

% |

|

4.5 |

% |

| Unknown

|

0.1 |

% |

|

— |

% |

|

— |

% |

|

0.1 |

% |

| White

|

20.4 |

% |

|

25.9 |

% |

|

0.6 |

% |

|

46.9 |

% |

| Total |

45.2 |

% |

|

53.3 |

% |

|

1.5 |

% |

|

100.0 |

% |

Business

Combination

On

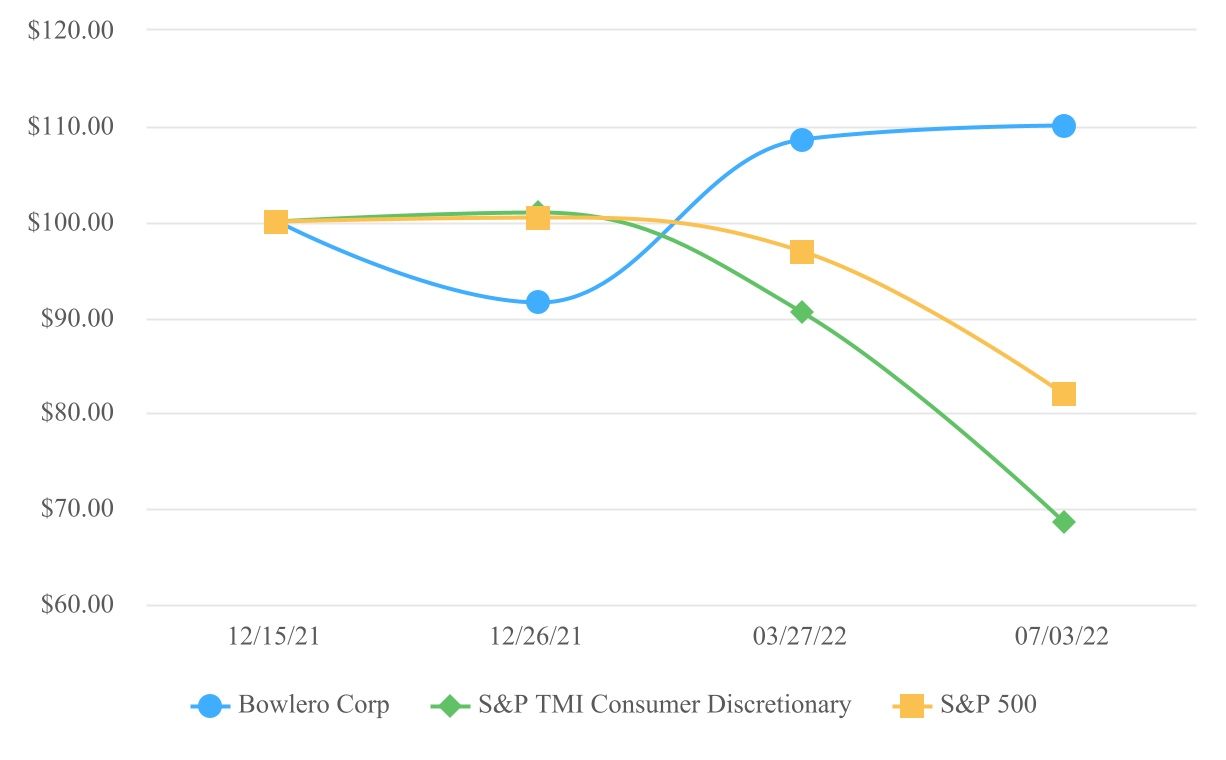

December 15, 2021, Isos Acquisition Corporation, a Cayman Islands exempted company, (“Isos”) consummated its previously announced

acquisition of Bowlero Corp., a Delaware corporation (“Old Bowlero”), pursuant to the business combination agreement, dated

as of July 1, 2021, as amended (the “Business Combination Agreement”), between Old Bowlero and Isos. In connection with the

consummation of the transactions contemplated by the Business Combination Agreement, Isos was redomiciled as a Delaware corporation and

Old Bowlero was merged with and into Isos, with Isos surviving the merger (the “Business Combination”). In addition, in connection

with the consummation of the Business Combination, “Isos Acquisition Corporation” was renamed “Bowlero Corp.”

Item

1A. Risk Factors

In

addition to the other information contained in this Annual Report on Form 10-K, including the matters addressed under the heading “Forward-Looking

Statements,” you should carefully consider the following risk factors in this Annual Report on Form 10-K before investing in our

securities. The risk factors described below disclose both material and are not intended to be exhaustive and are not the only risks facing

us. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business,

financial condition, results of operations and cash flows in future periods or are not identified because they are generally common to

businesses.

Risks

Related to Our Business and Industry

The

COVID-19 pandemic has disrupted and is expected to continue to disrupt our business to some extent, which has had a material adverse impact

on our business, results of operations and financial condition and could continue for an extended period of time. Future outbreaks of

contagious diseases or other adverse public health developments in the United States or worldwide could have similar impacts on our business.

The

outbreak of COVID-19 has had a material adverse effect on our business, results of operations, liquidity and financial condition and the

same could continue for an extended period of time. Beginning in 2020, the COVID-19 pandemic significantly impacted the economy in general,

as well as our business directly, and continues to negatively affect our business. These effects include, but are not limited to:

•the

government-mandated and voluntary shutdowns, and operating restrictions on our business;

•the

level of customer demand following re-opening;

•the

ability to maintain a functioning workforce;

•the

ability to maintain adequate supplies and resources;

•our

ability to access funding sources in the future;

•the

economic impact of COVID-19 and related disruptions on the communities we serve; and

•management’s

ability to estimate future performance of our business and impact on our business.

Prior

to the closure of our centers due to COVID-19, the Company consistently grew revenues; however, the closure of our centers due to COVID-19

prohibited the Company from generating sales and cash flows. Consequently, the Company incurred significant losses and consumed cash,

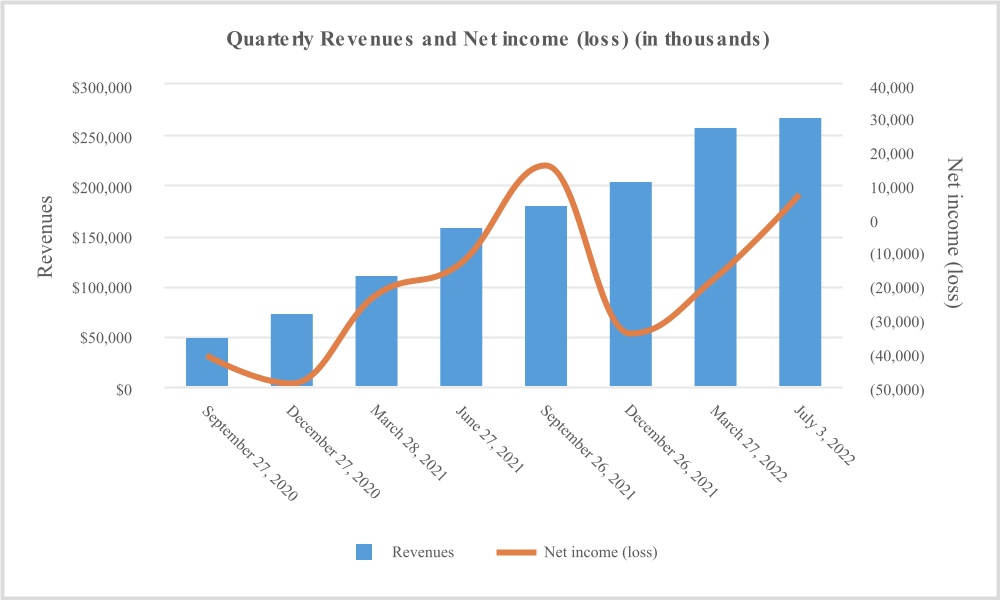

and in order to increase liquidity, the Company incurred additional debt. Net losses in fiscal years 2022 and 2021 were $29,934 and $126,461,

respectively, which were driven by costs associated with the Business Combination in 2022 and the closure of our centers in 2021. In 2021,

Net proceeds from financing activities from long-term debt and revolver directly utilized to support our liquidity were $34,805.

If

we are unable to successfully design and execute our business strategy plan, including growing comparable center sales, our revenues and

profitability may be adversely affected.

Our

ability to increase revenues and profitability is dependent on executing effective business strategies. If we are delayed or unsuccessful

in executing our strategies or if our strategies do not yield desired results, our business, financial condition and results of operations

may suffer. Our ability to meet our business strategy plan is dependent upon, among other things, our ability to:

•increase

gross sales and operating profits at existing centers with bowling, food, beverage, game and entertainment options desired by our guests;

•evolve

our marketing and branding strategies to continue to appeal to our guests;

•innovate

and implement new initiatives to provide a unique guest experience;

•identify

adequate sources of capital to fund and finance strategic initiatives;

•grow

and expand operations;

•identify

new opportunities to improve customer reach;

•maintain

a talented workforce responsive to customer needs and operational demands; and

•identify,

implement and maintain cost-reducing strategies to scale operations.

Changes

in consumer preferences and buying patterns could negatively affect our results of operations.

Visiting

our centers is a discretionary purchase for consumers; therefore, our business is susceptible to economic slowdowns and recessions. We

are dependent in particular upon discretionary spending by consumers living in the communities in which our centers are located. A significant

weakening in the local economies of these geographic areas, or any of the areas in which our centers are located, may cause consumers

to curtail discretionary spending, which in turn could reduce our centers’ sales and have an adverse effect on our business and

our results of operations. Our centers are sometimes located near high density retail areas such as regional malls, lifestyle centers,

big box shopping centers and entertainment centers. We depend on a high volume of visitors at these locations to attract guests to our

centers. As demographic and economic patterns change, current centers may or may not continue to be attractive or profitable.

E-commerce

or online shopping continues to increase and negatively impact consumer traffic at traditional “brick and mortar” retail sites

located in regional malls, lifestyle centers, big box shopping centers and entertainment centers, and a decline in development or closures

of businesses in these settings or a decline in visitors to retail areas near our centers could negatively affect our sales.

Additionally,

consumers continually change their dietary preferences. As a result, we are challenged to evolve our food and beverage menu offerings

to appeal to these changing customer preferences, while maintaining our brand character and retaining popular menu items. New information

or changes in dietary, nutritional, allergen or health guidelines or environmental or sustainability concerns, whether issued by governmental

agencies, academic studies, advocacy organizations or similar groups, may cause some groups of consumers to select foods other than those

that are offered by our centers. It is also unclear currently if the COVID-19 pandemic may have a lasting impact on consumer demand. If

we fail to anticipate changing trends or other consumer preferences, our business, financial condition and results of operations would

be adversely affected.

Advances

in technologies or certain changes in consumer behavior driven by such technologies could have a negative effect on our business. Technology

and consumer offerings continue to develop, and we expect new or enhanced technologies and consumer offerings will be available in the

future. As part of our marketing efforts, we use a variety of digital platforms including search engines, mobile, online videos and social

media platforms such as Facebook®, Twitter® and Instagram® to attract and retain guests. We also test new technology platforms

to improve our level of digital engagement with our guests and employees to help strengthen our marketing and related consumer analytics

capabilities. These initiatives may not prove to be successful and may result in expenses incurred without the benefit of higher revenues

or increased engagement.

We

may not be able to compete favorably in the highly competitive out-of-home and home-based entertainment markets, which could have a material

adverse effect on our business, results of operations or financial condition.

The

out-of-home entertainment market is highly competitive. We compete for customers’ discretionary entertainment dollars with providers

of out-of-home entertainment, including localized attraction facilities such as other bowling centers, movie theaters, sporting events,

sports activity centers, arcades and entertainment centers, nightclubs, and restaurants as well as theme parks. Some of the entities operating

these businesses are larger and have significantly greater financial resources, a greater number of locations, have been in business longer,

have greater name recognition and are better established in the markets where our centers are located or are planned to be located. As

a result, they may be able to invest greater resources than we can in attracting customers and succeed in attracting customers who would

otherwise come to our centers. We also face competition from local, regional, and national establishments that offer similar entertainment

experiences to ours that are highly competitive with respect to price, quality of service, location, ambience and type and quality of

food. In addition, we also face competition from increasingly sophisticated home-based forms of entertainment, such as internet and video

gaming and home movie streaming and delivery. Our failure to compete favorably in the competitive out-of-home and home-based entertainment

markets could have a material adverse effect on our business, results of operations and financial condition.

Unfavorable

publicity or a failure to respond effectively to adverse publicity, could harm our business.

Our

brand and our reputation are among our most important assets. Our ability to attract and retain customers depends, in part, upon the external

perception of Bowlero, the quality of our facilities and our integrity. Multi-location businesses, such as ours, can be adversely affected

by unfavorable publicity resulting from food safety concerns, flu or other virus outbreaks and other public health concerns stemming from

one or a limited number of our centers. Additionally, we rely on our network of suppliers to properly handle, store, and transport our

ingredients for delivery to our centers.

Failure

by our suppliers, or their suppliers, could cause our ingredients to be contaminated, which could be difficult to detect and put the safety

of our food in jeopardy.

Negative

publicity may also result from crime incidents, data privacy breaches, scandals involving our employees or operational problems at our

centers. Regardless of whether the allegations or complaints are valid, unfavorable publicity related to one or more of our centers could

affect public perception of the entire brand. Even incidents at similar businesses could result in negative publicity that could indirectly

harm our brand. If one or more of our centers were the subject of unfavorable publicity and we are unable to quickly and effectively respond

to such reports, our overall brand could be adversely affected, which could have a material adverse effect on our business, results of

operations and financial condition.

There

has been a significant increase in the use of social media and similar platforms, including weblogs (blogs), social media websites and

other forms of Internet-based communications that allow individuals access to a broad audience of consumers and other interested persons.

Consumers value readily available information concerning goods and services that they have or plan to purchase and may act on such information

without further investigation or authentication. Many social media platforms immediately publish the content their subscribers and participants

post, often without filters or checks on accuracy of the content posted. The opportunity exists for dissemination of information, including

inaccurate information, to spread quickly. Inaccurate or adverse information concerning Bowlero may be posted on such platforms at any

time. The harm may be immediate without affording us an opportunity for redress or correction. Such platforms also may be used for dissemination

of trade secret information, compromising valuable company assets. In summary, the dissemination of information via social media and similar

platforms may harm our business, prospects, financial condition, and results of operations, regardless of the information’s accuracy.

The inappropriate use of social media vehicles by our guests or employees could increase our costs, lead to litigation or result in negative

publicity that could damage our reputation.

Further,

if we are not effective in addressing social and environmental responsibility matters or achieving relevant sustainability goals, consumer

trust in our brand may suffer. Consumer demand for our products and our brand value could diminish significantly if any such incidents

or other matters erode consumer confidence in us or our products, which could likely result in lower revenues.

We

are subject to risks associated with leasing space subject to long-term, non-cancelable leases.

Payments

under our non-cancelable, long-term operating leases account for a significant portion of our operating expenses and we expect many of

the new centers we open in the future will also be leased. We often cannot cancel these leases without substantial economic penalty. If

an existing or future center is not profitable, and we decide to close it, we may nonetheless be committed to perform our obligations

under the applicable lease, including, among other things, paying the rent for the remainder of the lease term. We depend on cash flow

from operations to pay our lease obligations. If our business does not generate adequate cash flow from operating activities and sufficient

funds are not otherwise available to us from borrowings under our existing credit facility, we may not be able to service our operating

lease obligations, grow our business, respond to competitive challenges or fund other liquidity and capital needs, all of which could

have a material adverse effect on us.

In

addition, as each of our leases expires, we may choose not to renew, or may not be able to renew, such existing leases if the renewal

rent is too high and/or the capital investment required to maintain the centers at the leased locations is not justified by the return

required on the investment. If we are not able to renew the leases at rents that allow such centers to remain profitable as their terms

expire, the number of such centers may decrease, resulting in lower revenue from operations, or we may relocate a center, which could

subject us to construction and other costs and risks, and in either case, could have a material adverse effect on our business, results

of operations and financial condition.

Our

financial performance and the ability to implement successfully our strategic direction could be adversely affected if we fail to retain,

or effectively respond, to a loss of key management.

Our

future success is substantially supported by the contributions and abilities of senior management, including key executives and other

leadership personnel. Changes in senior management could expose us to significant changes in strategic direction and initiatives. A failure

to maintain appropriate organizational capacity and capability to support leadership excellence or a loss of key skill sets could jeopardize

our ability to meet our business performance expectations and growth targets. Although we have employment agreements with many members

of senior management, we cannot prevent members of senior management from terminating their employment with us. Losing the services of

members of senior management could materially harm our business until a suitable replacement is found, and such replacement may not have

equal experience and capabilities.

We

face risks related to our substantial indebtedness and limitations on future sources of liquidity.

Our

substantial indebtedness as of July 3, 2022 and our forecasted current debt service of $53,200 in minimum debt payments and estimated

interest payments in fiscal year 2023 could have important consequences to us, including:

•making

it more difficult for us to satisfy our obligations with respect to our debt, and any failure to comply with the obligations under our

debt instruments, including restrictive covenants, could result in an event of default under the agreements governing our indebtedness

increasing our vulnerability to general economic and industry conditions, including as a result of disruption caused by the global COVID-19

pandemic;

•requiring

a substantial portion of our cash flow from operations to be dedicated to the payment of obligations with respect to our debt, thereby

reducing our ability to use our cash flow to fund our operations, lease payments, capital expenditures, selling and marketing efforts,

product development, future business opportunities and other purposes;

•exposing

us to the risk of continued increased interest rates as some of our borrowings are at variable rates;

•limiting

our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements,

strategic acquisitions and general corporate or other purposes; and

•limiting

our ability to plan for, or adjust to, changing market conditions and placing us at a competitive disadvantage compared to our competitors

who may be less highly leveraged.

Covenants

in our debt agreements restrict our business and could limit our ability to implement our business plan.

Our

credit facility contains covenants that may restrict our ability to implement our business plan, finance future operations, respond to

changing business and economic conditions, secure additional financing, and engage in opportunistic transactions, such as strategic acquisitions.

In addition, if we fail to satisfy the covenants contained in the credit facility, our ability to borrow under the revolving credit loans

portion of the credit facility may be restricted. The credit facility includes covenants restricting, among other things, our ability

to do the following under certain circumstances:

•incur

or guarantee additional indebtedness or issue certain disqualified or preferred stock;

•pay

dividends or make other distributions on, or redeem or purchase any equity interests or make other restricted payments;

•make

certain acquisitions or investments;

•create

or incur liens;

•transfer

or sell assets;

•incur

restrictions on the payment of dividends or other distributions from our restricted subsidiaries;

•alter

the business that we conduct;

•enter

into transactions with affiliates; and

•consummate

a merger or consolidation or sell, assign, transfer, lease or otherwise dispose of all or substantially all our assets.

In

addition, failure to meet a leverage-based test that is applicable when our revolving credit facility, along with certain letters of credit,

is at least 35% drawn, is a default under the agreement governing our credit facilities. The leverage-based test is calculated on the

basis of our Adjusted EBITDA, as defined in the agreement governing our credit facilities.

Events

beyond our control, including the impact of COVID-19, may affect our ability to comply with our covenants, even after the cessation of

the second amendment suspension period. Additionally, our master lease agreements include cross-default provisions with the agreement

governing our credit facilities. If we default under the credit facility because of a covenant breach or otherwise, all outstanding amounts

thereunder could become immediately due and payable. We cannot assure you that we will be able to comply with our covenants under the

credit facility or that any covenant violations will be waived in the future. Any violation that is not waived could result in an event

of default, permitting our lenders to declare outstanding indebtedness and interest thereon due and payable, and permitting the lenders

under the revolving credit loans provided under the credit facility to suspend commitments to make any advance, or require any

outstanding

letters of credit to be collateralized by an interest bearing cash account, any or all of which could have a material adverse effect on

our business, financial condition and results of operations. In addition, if we fail to comply with our financial or other covenants under

the credit facility, we may need additional financing to service or extinguish our indebtedness. We may not be able to obtain financing

or refinancing on commercially reasonable terms, or at all. We cannot assure you that we would have sufficient funds to repay outstanding

amounts under the credit facility and any acceleration of amounts due would have a material adverse effect on our liquidity and financial

condition.

The

success of our longer-term growth strategy depends in part on our ability to open and operate new centers profitably.

Our

ability to timely and efficiently open new centers on a new-construction or acquisition basis and to operate these centers profitably

is dependent on numerous factors including quality locations, acceptable lease or purchase agreements, zoning, use and other regulations,

our liquidity, staffing needs and training, permitting, customer acceptance, impact on existing centers and financial performance targets.

The timing of new location openings may result in significant fluctuations in our quarterly performance. We typically incur significant

costs prior to opening for pre-opening and construction and increased labor and operating costs for a newly opened center.

Our

failure to maintain or renew key agreements could adversely affect our ability to distribute our media content and/or other of our goods

and services, which could adversely affect our operating results.

A

portion of our profits is derived from our media content, which is distributed by cable, satellite and broadcast television networks and

digital platforms around the globe. As detailed below, we have depended on and will continue to depend on, third parties for many aspects

of the operation and distribution of PBA events. Any failure to maintain (such as due to a breach or alleged breach by either party) or

renew arrangements with distributors and platforms, the failure of distributors or platforms to continue to provide services to us or

the failure to enter into new distribution opportunities on terms favorable to us could adversely affect our financial outlook, liquidity,

business and operating results. We have relationships with Fox Sports, CBS Sports and Flo Bowling, which carry PBA events through their

cable networks and streaming channels.

Many

of our other goods and services, such as our merchandise and arcade games are manufactured and sold by other parties under licenses of

our intellectual property or distribution agreements. Our inability for any reason to enter into, maintain and/or renew or replace, as

the case may be, these agreements on terms favorable to us could adversely affect our financial outlook, liquidity, business and/or operating

results.

We

produce content, build infrastructure and market PBA events. If, for any number of reasons, we are unable to continue to develop and monetize

this content successfully, it could have an adverse effect on our operating results.

Need

to Attract, Retain and Replace Fans.

We believe

that the PBA has a passionate fan base. However, the markets for entertainment video are intensely competitive and include many subscription,

transactional and ad-supported models and vast amounts of pirated materials, all of which capture segments of the entertainment video

market. These markets have and are expected to continue to be subject to rapid changes, and new technologies and evolving business models

are developing at a fast pace. We expect this competition to continue to grow and the markets to continue to transform. Many players that

have entered this space have vastly greater financial and marketing resources than we, as well as longer operating histories, large customer

bases and strong brand recognition. These competitors may aggressively price their offerings and devote more technology and marketing

resources. Certain of these competitors have begun to bundle digital networks. Other competitors for viewers of media content include

broadcast, cable and satellite television, many of which have so-called “TV everywhere,” stand-alone streaming and/or “on

demand” content, online movie and television content providers (both legal and illegal (pirated)), and ad-supported services such

as YouTube. In non-pandemic times, viewers also commit viewing dollars to theatrical films, live events or other leisure activities. Our

ability to attract and retain fans for PBA will depend in part on our ability to provide consistent high-quality content and a high level

of service that is perceived as a good value for the consumer’s entertainment dollars in the face of this intense competition. Our

failure to do so could adversely affect our business and operating results.

The

adoption or modification of laws and regulations relating to our business could limit or otherwise adversely affect the manner in which

we conduct our business.

The

growth and development of the market for online commerce has led to more stringent consumer protection laws, including privacy laws such

as the European Union General Data Protection Regulation (“GDPR”) and the California Consumer Privacy Act (“CCPA”),

imposing additional burdens on us. We may be required to comply with new regulations or legislation or new interpretations of existing

regulations or legislation. This compliance could cause us to incur

significant

additional expense or alter our business model or could result in substantial fines, civil liability and/or harm to reputation for noncompliance.

In addition, the delivery of PBA content in international markets exposes us to multiple regulatory frameworks and societal norms, the

complexity of which may result in unintentional noncompliance which could adversely affect our business and operating results.

Our

failure to continue to build and maintain our brand of entertainment could adversely affect our operating results.

We

must continue to build and maintain our strong brand identity to attract and retain fans who have a number of entertainment choices. The

creation, marketing and distribution of live events, programming and films that our fans value and enjoy are at the core of our business.

The production of compelling live, televised, streamed and film content is critical to our ability to generate revenues across our media

platforms and product outlets. Our ability to produce compelling content depends on our ability to attract professional bowlers to our

tournaments. Professional bowlers are independent agents and make their own decisions on whether or not to participate in a tournament.

In addition, we are dependent on advertising, sponsorship and marketing revenue from third parties in order to be able to host tournaments.

If such third parties decide to sponsor or advertise at other types of sporting events, our costs for hosting tournaments will increase,

and we may host fewer tournaments, resulting in a decrease in the amount of content that we can produce. We are also dependent on the

U.S. Bowling Congress who own rights to certain tournaments, such as the US Open and the USBC Masters. PBA partners with the U.S. Bowling

Congress to deliver televised events for tournaments owned by the U.S. Bowling Congress. Our current agreements with the U.S. Bowling

Congress provide for the delivery of televised content for such tournaments until 2023, and we may be unable to secure such rights after

2023 at attractive terms or at all. Also important are effective consumer communications, such as marketing, customer service and public

relations. The role of social media by fans and by us is an important factor in our brand perception. If our efforts to create compelling

services and goods and/or otherwise promote and maintain our brand, services and merchandise are not successful, our ability to attract

and retain fans may be adversely affected. Such a result would likely lead to a decline in our television ratings, attendance at our live

events post-pandemic, and/or otherwise impact our sales of goods and services, which would adversely affect our operating results.

Our

failure to compete effectively in a rapidly evolving media landscape could adversely affect our operating results.

The

manner in which audio/media content is distributed and viewed is constantly changing, and consumers have increasing options to access

entertainment video. Changes in technology require our resources including personnel, capital and operating expenses. Conversely, technology

changes have also decreased the cost of video production and distribution for certain programmers (such as through social media), which

lowers the barriers to entry and increases the competition for viewership and revenues. While we attempt to distribute our programming

across all platforms, our failure to continue to do so effectively (including, for example, our emphasizing a distribution platform that

may in time lessen in importance or become obsolete or our loss of, or other inability to procure, carriage on an important platform)

could adversely affect our operating results. If other providers of video programming address the changes in consumer viewing habits in

a manner that is better able to meet content distributor and consumer needs and expectations, our business could be adversely affected.

The number of subscribers and ratings of television networks and advertising revenues in general have been reported as being impacted

by viewers moving to alternative media content providers, a process known as “cord cutting” and “cord shaving.”

Many well-funded digital companies have been competing with the traditional television business model and, while it has been widely reported

that they are paying significant amounts for media content, it is not clear that these digital distributors will replace the importance

(in terms of money paid for content, viewer penetration and other factors) of television distribution to media content owners. Our media

partners’ businesses are affected by their sale of advertising and subscriptions for their services. If they are unable to sell

advertising and/or subscriptions either with regard to PBA programming specifically (such as, by way of example and without limitation,

due to a decline in the popularity of our programming and/or brand) or all of their programming generally, it could adversely affect our

operating results.

Changes

in the regulatory atmosphere and related private sector initiatives could adversely affect our businesses.

Production

of video programming by independent producers is generally not directly regulated by the federal or state governments in the United States.

PBA events are on broadcast television on the Fox and CBS Networks, and we are responsible, directly or indirectly, for compliance with

certain additional FCC regulations and statutory requirements applicable to programming distributed over television broadcast stations.

Any failure to remain in compliance with these requirements could expose us to substantial costs and adverse publicity which could impact

our operating results. Changes in FCC regulations, and the ongoing reallocation of satellite spectrum for “5G” next generation

wireless broadband use, could impact the availability of satellite transmission spectrum for video programming distribution, which could

increase the transmission costs of certain of our programming and/or affect transmission quality and reliability. The markets for programming

in the United States and internationally may be substantially affected by government regulations applicable

to,

as well as social and political influences on, television stations and networks. We voluntarily designate the suitability of each of our

television and PBA programs using standard industry ratings. Domestic and foreign governmental and private-sector initiatives relating

to the production and distribution of video programming are announced from time to time. Compliance by our licensees of these initiatives

and/or their noncompliance of governmental policies could restrict our program distribution and adversely affect our levels of viewership,

result in adverse publicity and/or otherwise impact our operating results.

Risks

Related to Information Technology and Cybersecurity

Information

technology system failures or interruptions may impact our ability to effectively operate our business.

We

rely heavily on various information technology systems, including point-of-sale, kiosk and amusement operations systems in our centers,

data centers that process transactions, communication systems and various other software applications used throughout our operations.

Some of these systems have been internally developed or we rely on third-party providers and platforms for some of these information technology

systems and support. Although we have operational safeguards in place, those technology systems and solutions could become vulnerable

to damage, disability, or failures due to theft, fire, power outages, telecommunications failure or other catastrophic events. Any failure

of these systems could significantly impact our operations and could make our content unavailable or degraded. These service disruptions

could be prolonged. We rely on third-party service providers for certain key elements of our operations including credit card processing,

telecommunications, utilities and delivery of video programming. Our reliance on systems operated by third parties also present the risk

faced by the third party’s business, including the operational, cybersecurity, and credit risks of those parties. If those systems

were to fail or otherwise be unavailable, and we were unable to timely recover, we could experience an interruption in our operations.

Our business interruption insurance may not cover us in the event these types of business interruptions occur.

Cybersecurity

breaches or other privacy or data security incidents that expose confidential customer, personal employee or other material, confidential

information that is stored in our information systems or by third parties on our behalf may impact our business.

Many

of our information technology systems (and those of our third-party business partners, whether cloud-based or hosted in proprietary servers),

including those used for point-of-sale, web and mobile platforms, mobile payment systems and administrative functions, contain personal,

financial or other information that is entrusted to us by our guests and associates. Many of our information technology systems also contain

proprietary and other confidential information related to our business, such as business plans and initiatives. A cyber incident (generally

any intentional or unintentional attack that results in unauthorized access resulting in disruption of systems, corruption of data, theft

or exposure of confidential information or intellectual property) that compromises the information of our customers or employees could

result in widespread negative publicity, damage to our reputation, a loss of customers, and disruption of our business.

The

regulatory environment surrounding information security and privacy is increasingly demanding, with the frequent imposition of new and

constantly changing requirements. Compliance with these requirements can be costly and time-consuming and the costs could adversely impact

our results of operations due to necessary system changes and the development of new administrative processes. The California Consumer

Privacy Act of 2018, provides a private right of action for data breaches and requires companies that process information about California

residents to make new disclosures to consumers about their data collection, use and sharing practices and allow consumers to opt out of

certain data sharing with third parties. Security breaches could also result in a violation of applicable privacy and other laws, and

subject us to private consumer, business partner or securities litigation and governmental investigations and proceedings, any of which

could result in our exposure to material civil or criminal liability. We are required to maintain the highest level of Payment Card Industry

Data Security Standard (“PCI”) compliance at our corporate office and centers. If we do not maintain the required level of

PCI compliance, we could be subject to costly fines or additional fees from the card brands that we accept or lose our ability to accept

those payment cards. Additionally, an increasing number of government and industry groups have established laws and standards for the

protection of personal and health information.

Our

existing cybersecurity policy includes cybersecurity techniques, tactics, and procedures, including continuous monitoring and detection

programs, network protections, annual employee training and awareness and incident response preparedness. In addition, we periodically

scan our environment for any vulnerabilities, perform penetration testing and engage third parties to assess effectiveness of our security

measures. We utilize a voluntary tool to help manage privacy risk by independently benchmarking our cybersecurity program to the NIST

Cybersecurity Framework, using an independent third party, and we share the results of our annual audit with our audit committee. Although

we employ security technologies and practices and have taken other steps to try to prevent a breach, there are no assurances that such

measures will prevent or detect cybersecurity breaches, and we may nevertheless not have the resources or technical

sophistication

to prevent rapidly evolving types of cyberattacks. We maintain a separate insurance policy covering cybersecurity risks and such insurance

coverage may, subject to policy terms and conditions, cover certain aspects of cyber risks, but this policy is subject to a retention

amount and may not be applicable to a particular incident or otherwise may be insufficient to cover all our losses beyond any retention.

Based on recent court rulings, there is uncertainty as to whether traditional commercial general liability policies will be construed

to cover the expenses related to cyberattacks and breaches if credit and debit card information is stolen.

We

have been and likely will continue to be, the target of cyber and other security threats. If in the future, we experience a security breach,

we could become subject to claims, lawsuits or other proceedings for purportedly fraudulent transactions arising out of the theft of credit

or debit card information, compromised security and information systems, failure of our employees to comply with applicable laws, the

unauthorized acquisition or use of such information by third parties, or other similar claims.

Our

reliance on computer systems and software could expose us to material financial and reputational harm if any of those computer systems

or software were subject to any material disruption or corruption.

Our

servers and those of third parties used in our business may be vulnerable to cybersecurity attacks, computer viruses (including worms,

malware, ransomware and other destructive or disruptive software or denial of service attacks), physical or electronic break-ins and similar

disruptions and could experience directed attacks intended to lead to interruptions and delays in our service and operations as well as

loss, misuse, theft or release of proprietary, confidential, sensitive or otherwise valuable company or subscriber data or information.

Such a cybersecurity attack, virus, break-in, disruption or attack could remain undetected for an extended period, could harm our business,

financial condition or results of operations, be expensive to remedy, expose us to litigation and/or damage our reputation. Our insurance

may not cover expenses related to such disruptions or unauthorized access fully or at all.

Because

the techniques used to obtain unauthorized access to, or disable, degrade or sabotage, these systems and servers change frequently and

often are not recognized until launched against a target, we and the third parties used in distribution of our content may be unable to

anticipate these techniques, implement adequate preventative measures or remediate any intrusion on a timely or effective basis. Moreover,

the development and maintenance of these preventative and detective measures is costly and requires ongoing monitoring and updating as

technologies change and efforts to overcome security measures become more sophisticated. Despite the efforts of us and/or third parties,

the possibility of these events occurring cannot be eliminated.

Risks

Related to the Location-Based Entertainment Industry

Our

success depends upon our ability to recruit and retain qualified center management and operating personnel while also controlling our

labor costs.

We

must continue to attract, retain, and motivate qualified management and operating personnel to maintain consistency in our service, hospitality,

quality, and atmosphere of our centers, and to also support future growth. Adequate staffing of qualified personnel is a critical factor

impacting our guests’ experience in our centers. Qualified management and operating personnel are typically in high demand. Current

unemployment subsidies and difficult pandemic-related operating demands are resulting in aggressive competition for talent, wage inflation

and pressure to improve benefits and workplace conditions to remain competitive. If we are unable to attract and retain a satisfactory

number of qualified management and operating personnel, labor shortages could delay the planned openings of new centers or adversely impact

our existing centers. Any such delays, material increases in employee turnover rates in existing centers or widespread employee dissatisfaction

could have a material adverse effect on our business and results of operations. Competition for qualified employees could require us to

pay higher wages, which could result in higher labor costs and could have a material adverse effect on our results of operations.

Our

revenues and operating results may fluctuate significantly due to various risks and unforeseen circumstances, including increases in costs,

seasonality, weather, acts of violence or terrorism and other factors outside our control.

Certain

regions in which our centers are located have been, and may in the future be, subject to natural disasters, such as earthquakes, floods,

and hurricanes. Depending upon its magnitude, a natural disaster could severely damage a cohort of our centers, which could adversely

affect our business, results of operations or financial condition. Our corporate headquarters and our data center are located in Richmond,