Stockholder Letter Q1 2025

HAGERTY Q1 2025 | 2 Spring is upon us, and with it comes the joyful sound of classic engines roaring to life after a long winter’s rest. As enthusiasts across the country begin planning their first drives of the season, it seems the perfect time to discuss Hagerty’s business model and how it is built to thrive whether the economic weather is sunny, rainy, or somewhere in between. First and most important, Hagerty is a U.S.- centric specialty insurer with approximately 95% of our revenue generated in the United States. We have a track record as a stable, predictable, high-growth company, that collects premiums up front and pays out claims at a later date, thereby producing the possibility of profits from the margin earned and investment income. It’s a good gig when you have built an excellent brand that enables you to grow written premium without compromising the quality of your underwriting. As Warren Buffett has said, insurance is one of the few businesses where “somebody hands you money, and you hand them a little piece of paper.” No wonder then, that he describes insurance as “the engine that has propelled Berkshire’s expansion since 1967.” Built for the Long Haul Insurance is also recession resistant. In Hagerty’s case, we begin each year with roughly 90% of our revenues locked in thanks to our industry-leading retention. This recurring revenue is a distinct advantage for us and allows us to grow through good times and bad, as does the fact that our primary product – insurance – isn’t optional. For classic car owners to legally operate their beloved vehicles, they need auto insurance. It’s as simple as that. And when they drive, they drive fewer miles than their “daily drivers.” They are also less likely to get in an accident or file a claim. Why? Because, as my mother Louise Hagerty used to say, “People take care of their toys.” Dear Hagerty Stockholders, Members and One Team Hagerty, Stockholder Letter THE POWER OF PARTNERSHIPS ON THE COVER: Three Lamborghini Countaches. From the top: The 1975 LP400 “Periscopio,” 1988 25th Anniversary, and 1988 5000QV. PHOTOGRAPHER: JAMES LIPMAN

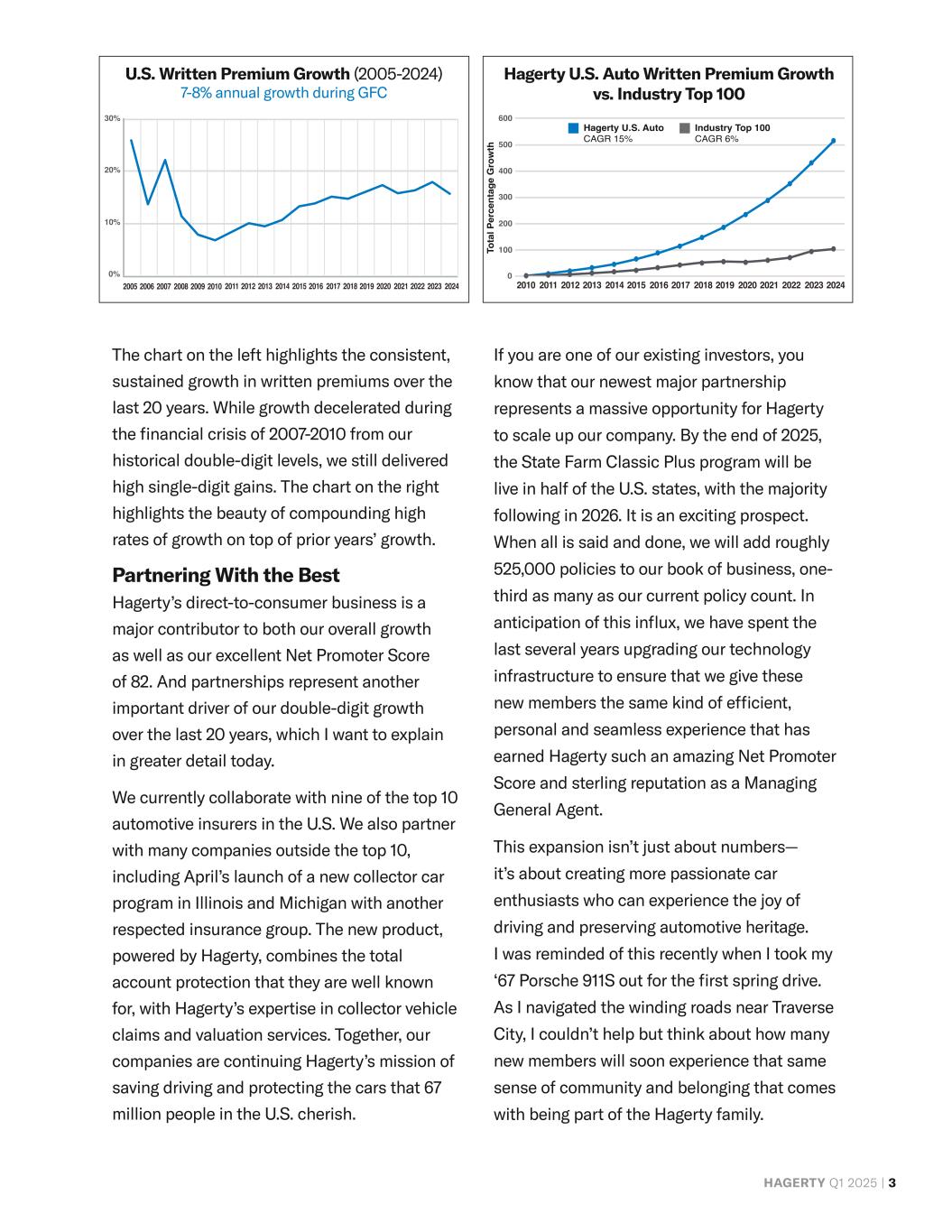

HAGERTY Q1 2025 | 3 The chart on the left highlights the consistent, sustained growth in written premiums over the last 20 years. While growth decelerated during the financial crisis of 2007-2010 from our historical double-digit levels, we still delivered high single-digit gains. The chart on the right highlights the beauty of compounding high rates of growth on top of prior years’ growth. Partnering With the Best Hagerty’s direct-to-consumer business is a major contributor to both our overall growth as well as our excellent Net Promoter Score of 82. And partnerships represent another important driver of our double-digit growth over the last 20 years, which I want to explain in greater detail today. We currently collaborate with nine of the top 10 automotive insurers in the U.S. We also partner with many companies outside the top 10, including April’s launch of a new collector car program in Illinois and Michigan with another respected insurance group. The new product, powered by Hagerty, combines the total account protection that they are well known for, with Hagerty’s expertise in collector vehicle claims and valuation services. Together, our companies are continuing Hagerty’s mission of saving driving and protecting the cars that 67 million people in the U.S. cherish. If you are one of our existing investors, you know that our newest major partnership represents a massive opportunity for Hagerty to scale up our company. By the end of 2025, the State Farm Classic Plus program will be live in half of the U.S. states, with the majority following in 2026. It is an exciting prospect. When all is said and done, we will add roughly 525,000 policies to our book of business, one- third as many as our current policy count. In anticipation of this influx, we have spent the last several years upgrading our technology infrastructure to ensure that we give these new members the same kind of efficient, personal and seamless experience that has earned Hagerty such an amazing Net Promoter Score and sterling reputation as a Managing General Agent. This expansion isn’t just about numbers— it’s about creating more passionate car enthusiasts who can experience the joy of driving and preserving automotive heritage. I was reminded of this recently when I took my ‘67 Porsche 911S out for the first spring drive. As I navigated the winding roads near Traverse City, I couldn’t help but think about how many new members will soon experience that same sense of community and belonging that comes with being part of the Hagerty family. 0 100 200 300 400 500 600 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 20242005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 0% 10% 20% 30% To ta l P er ce nt ag e G ro w th Hagerty U.S. Auto CAGR 15% Industry Top 100 CAGR 6% U.S. Written Premium Growth (2005-2024) 7-8% annual growth during GFC Hagerty U.S. Auto Written Premium Growth vs. Industry Top 100

HAGERTY Q1 2025 | 4 Why Hagerty? You have many options when it comes to your investments, just as our partners have plenty of choices about who they partner with. Why choose Hagerty? Because we have carefully curated our reputation as the insurance company for people who love their cars. We love them, too! We have built a reputation as the experts on classic car claims and valuation data. We boast decades of pricing data and loss ratio analysis for 40,000 different types of collector cars, trucks, vans and motorcycles from the pre-war era to modern classics. Data and expertise are vital to our success. You cannot, for instance, just plop any old windshield back into a ‘66 Jaguar. It’s not a $500 repair...more likely than not, it’s going to cost somewhere between $5,000 and $15,000. You have to have a specialty source for parts, and it takes a lot of time, energy and care to put that windshield in. Those are the kinds of claims that regular insurance companies struggle with, but that is what we do every day. And it is why companies ultimately partner with us: We make life easier for them and their customers. The Halo Effect Our incredible claims and member service experts also create a halo effect for our partners. When customers are treated well, they remember it in the context of both their primary insurance company for home and daily drivers, as well as Hagerty. Insurance company executives really, really like that because it helps them retain customers, and as we all know retention is critical to driving profitability. Our laser focus on customers, brand, members and team are the main reasons Hagerty has posted nine straight quarters of profitable growth. As we grow larger, we are becoming more and more efficient, which allows us to reinvest back into our business to lengthen our leadership position in the classic car and enthusiast markets and attract new members and partners to the Hagerty ecosystem. High rates of visible profit growth in a defensive industry sounds like a winning proposition for investors, and we are hard at work to ensure this continues in the years to come. As I have mentioned before, we believe Hagerty’s growth potential is vast. There are an estimated $1 trillion worth of collectible vehicles in the U.S. and we currently have 1.5 million policies in force today. Meaning the sky’s the limit. By 2030, we expect to double our policies in force to 3 million. We believe this expansion of our customer base will encourage discussions with other partners to both broaden and deepen our relationships with them. In addition, we hope that many of these new members will also join our Hagerty Drivers Club (HDC), creating a compounding economic benefit for us. Currently, HDC has 890,000 members who pay $70 (just $6 a month) a year to belong. We are glad you are on this road trip with us. And, as always, I want to take this opportunity to say thank you to One Team Hagerty for their incredible work. We wouldn’t exist without you and your talents. Until next time, keep on driving. McKeel Hagerty CEO and Chairman, Hagerty