Investor Presentation Q3 2025 SPEAKERS: McKeel Hagerty | Chief Executive Officer and Chairman Patrick McClymont | Chief Financial Officer

HAGERTY Q3 2025 | 2 FORWARD LOOKING STATEMENTS / NON-GAAP FINANCIAL MEASURES This presentation contains statements that constitute “forward-looking statements” within the meaning of the federal securities laws. All statements we provide, other than statements of historical fact, are forward-looking statements, including those regarding our future operating results and financial position, our business strategy and plans, products, services, and technology implementations, market conditions, growth and trends, expansion plans and opportunities, and our objectives for future operations. The words “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “ongoing,” “contemplate,” and similar expressions, and the negatives of these expressions, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations about future events, which may not materialize. Actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements. These factors include, among other things, our ability to: (i) compete effectively and to attract, retain, and engage insurance policyholders and paid Hagerty Drivers Club (“HDC”) members; (ii) Hagerty’s reliance on key strategic relationships, including distribution partners and underwriting carrier partners, and our ability to enter into, implement, and realize the anticipated benefits of the proposed Fronting Arrangement with Markel; (iii) the performance and availability of reinsurance and fronting capacity, and the timing and terms of renewals; (iv) execution risks associated with technology initiatives, including implementation and migration to the Duck Creek policy administration platform, and risks of disruptions, interruptions, outages, cybersecurity events, or other issues with Hagerty’s technology systems or third‑party service providers; (v) macroeconomic and industry conditions, including inflation, interest rate movements, capital market volatility, consumer sentiment, and the cyclicality of collector and enthusiast vehicle prices and transaction volumes; (vi) risks associated with Hagerty’s Marketplace and Broad Arrow Capital businesses, including inventory and credit risk, financing availability and cost, and the potential for write‑downs; (vii) catastrophe, weather and other losses, including increases in the frequency or severity of claims; (viii) Hagerty’s ability to obtain and implement rate changes and other regulatory approvals on a timely basis; and (ix) the impact of evolving laws and regulations applicable to Hagerty’s business in the United States and internationally. You should not rely on forward-looking statements as predictions of future events. We operate in a very competitive and rapidly changing environment and new risks emerge from time to time. The forward-looking statements in this presentation represent our views as of the date hereof. This presentation should be read in conjunction with the information included in our filings with the SEC and press releases. Understanding the information contained in these filings is important in order to fully understand our reported financial results and our business outlook for future periods. In addition, this presentation contains certain “non-GAAP financial measures”. The non-GAAP measures are presented for supplemental informational purposes only. These financial measures are not recognized measures under GAAP and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Reconciliations to the most directly comparable financial measure calculated and presented in accordance with GAAP are provided in the appendix to this presentation. ON THE COVER: Taking the long way home in a 1996 Porsche Carrera. PHOTOGRAPHER: ALEX CRICK

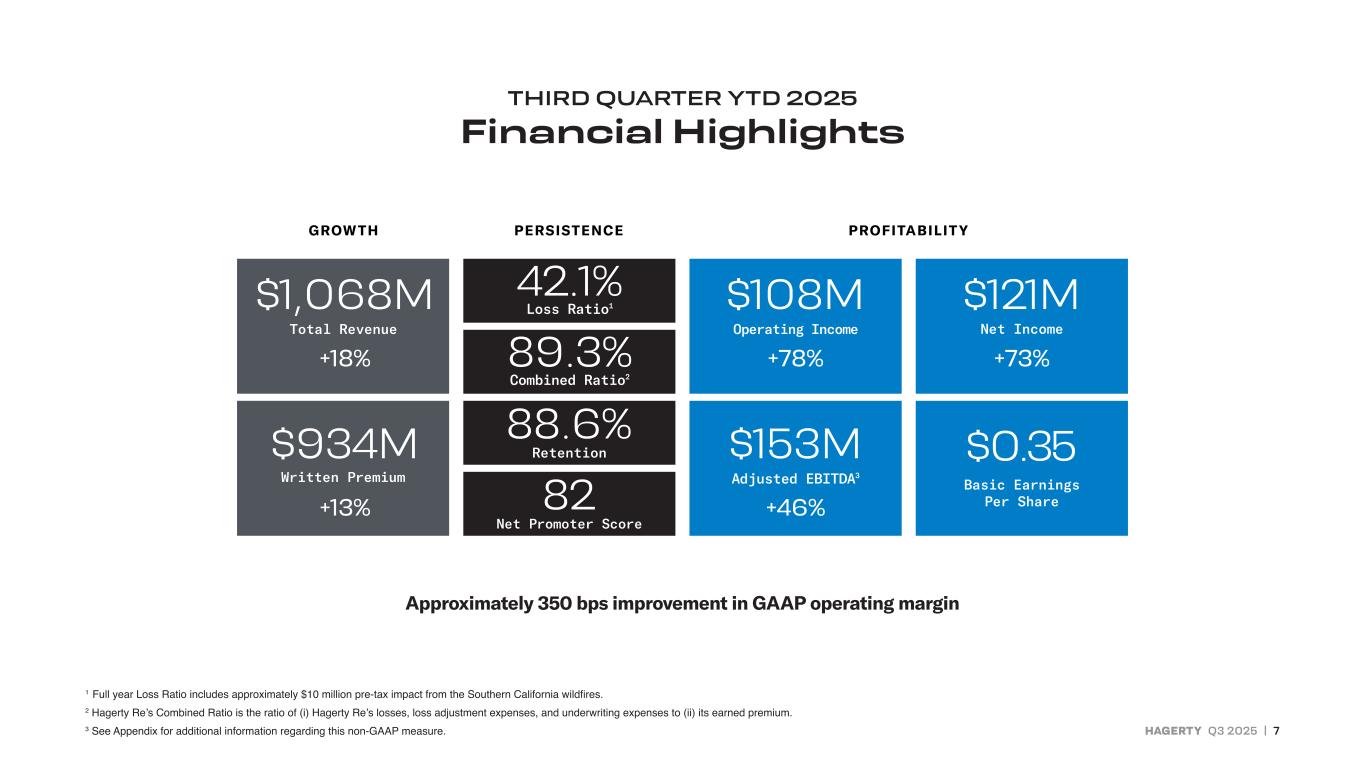

HAGERTY Q3 2025 | 3 THIRD QUARTER YTD 2025 Highlights TOTAL REVENUE GROWTH OF 18% TO $1,068 MILLION 1. Commission and Fee growth of 14% 2. Written Premium growth of 13% » Added 258,000 new members during the first nine months of 2025 3. Membership, Marketplace and other revenue growth of 54% » Marketplace growth of 135%, primarily due to higher level of inventory sales and the launch of additional auctions in Europe SIGNIFICANTLY IMPROVED PROFITABILITY 1. Operating Income of $108 million compared to $60 million (+78%) » Improved operating margin by approximately 350 bps 2. Net Income1 of $121 million compared to $70 million (+73%) 3. Adjusted EBITDA2 of $153 million compared to $105 million (+46%) SIGNED NEW PARTNERSHIP WITH LIBERTY MUTUAL TO OFFER ENHANCED COLLECTIBLE CAR INSURANCE TO LIBERTY MUTUAL AND SAFECO CUSTOMERS ANNOUNCED NON-BINDING LOI FOR A NEW FRONTING ARRANGEMENT WITH MARKEL WHERE HAGERTY WOULD CONTROL 100% OF THE PREMIUM, BEGINNING IN 2026 1. We anticipate better profitability and operational control without disruption to policyholders 1 Year-to-date net income includes a $6 million net benefit as a result of the release of a portion of our valuation allowance of $38 million partially offset by a $32 million loss related to the change in value of the TRA liability. Net income in the prior year includes a $9 million loss as a result of a change in the fair value and settlement of our warrant liabilities. 2 See Appendix for additional information regarding this non-GAAP financial measure. The 2008 Koenigsegg CCX, a piece of art that looks fast even when standing still. PHOTOGRAPHER: ANDREW LINK

2025 Priorities Investing to double Hagerty’s policies in force to 3.0 million by 2030 FASTER, SMARTER, BETTER INTEGRATED: » Insurance growth with State Farm rollout and launch of Enthusiast+ » Integrated membership with authentic delivery of products and services » Marketplace global expansion in live and digital auctions to help members buy and sell the cars they love » Operational excellence by delivering great experiences more efficiently as we drive margins higher » Technology integration and speed as we transition to cloud native, scalable architecture » Cultural excellence by engaging best in class teams to service all stakeholders HAGERTY Q3 2025 | 4 → A ‘65 and a ‘70 Ford Mustang, making memories on the open road. PHOTOGRAPHER: JAMES LIPMAN

HAGERTY Q3 2025 | 5 Investing in Growth and Efficiency Began the process of identifying challenges and risks of legacy IT infrastructure in 2023 Current technology stack: » Impacts operational efficiency, resulting in a high cost to serve » Prevents scalability that is needed to efficiently double our policy count to 3.0 million by 2030 New insurance IT platform should improve the member experience, enhance security, and lower marginal operating costs » Offer more self-serve functionality » Allow for more modern rating architecture with greater segmentation » Free up tech resources to develop differentiators for Hagerty NEAR-TERM REDUNDANT SYSTEMS RESULT IN HIGHER THAN NORMAL OPERATING AND SOFTWARE EXPENSES Launched Enthusiast+ in July of 2025 on Duck Creek platform An icon that continues to inspire, the 1973 BMW 3.0 CSL. PHOTOGRAPHER: DAVE BURNETT

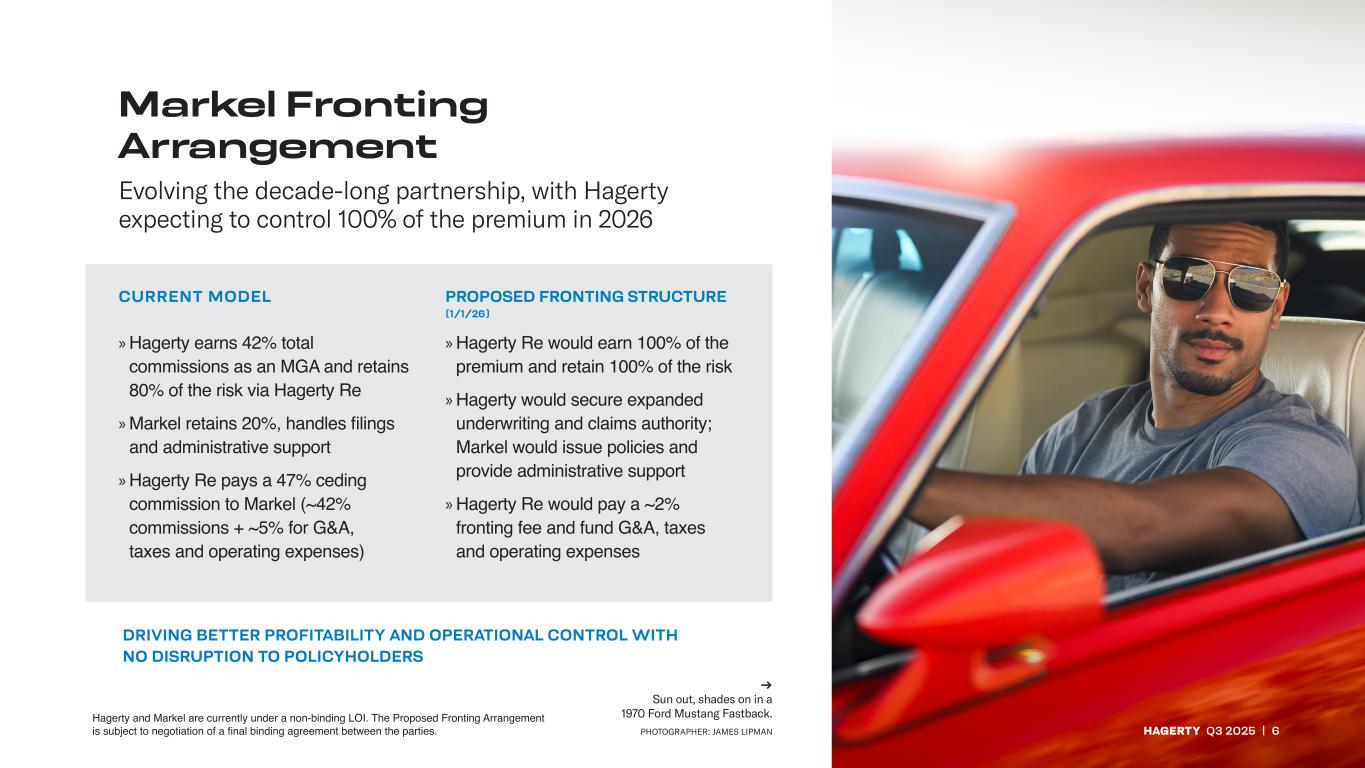

Markel Fronting Arrangement Evolving the decade-long partnership, with Hagerty expecting to control 100% of the premium in 2026 CURRENT MODEL PROPOSED FRONTING STRUCTURE (1/1/26) HAGERTY Q3 2025 | 6 → Sun out, shades on in a 1970 Ford Mustang Fastback. PHOTOGRAPHER: JAMES LIPMAN DRIVING BETTER PROFITABILITY AND OPERATIONAL CONTROL WITH NO DISRUPTION TO POLICYHOLDERS Hagerty and Markel are currently under a non-binding LOI. The Proposed Fronting Arrangement is subject to negotiation of a final binding agreement between the parties. »Hagerty earns 42% total commissions as an MGA and retains 80% of the risk via Hagerty Re »Markel retains 20%, handles filings and administrative support »Hagerty Re pays a 47% ceding commission to Markel (~42% commissions + ~5% for G&A, taxes and operating expenses) »Hagerty Re would earn 100% of the premium and retain 100% of the risk »Hagerty would secure expanded underwriting and claims authority; Markel would issue policies and provide administrative support »Hagerty Re would pay a ~2% fronting fee and fund G&A, taxes and operating expenses

HAGERTY Q3 2025 | 7 Approximately 350 bps improvement in GAAP operating margin $1,068M +18% +78% +73% +13% +46% $934M 88.6% $108M $153M $121M $0.35 THIRD QUARTER YTD 2025 Financial Highlights 1 Full year Loss Ratio includes approximately $10 million pre-tax impact from the Southern California wildfires. 2 Hagerty Re’s Combined Ratio is the ratio of (i) Hagerty Re’s losses, loss adjustment expenses, and underwriting expenses to (ii) its earned premium. 3 See Appendix for additional information regarding this non-GAAP measure. 82 42.1% Loss Ratio1 89.3% Combined Ratio2 Adjusted EBITDA3

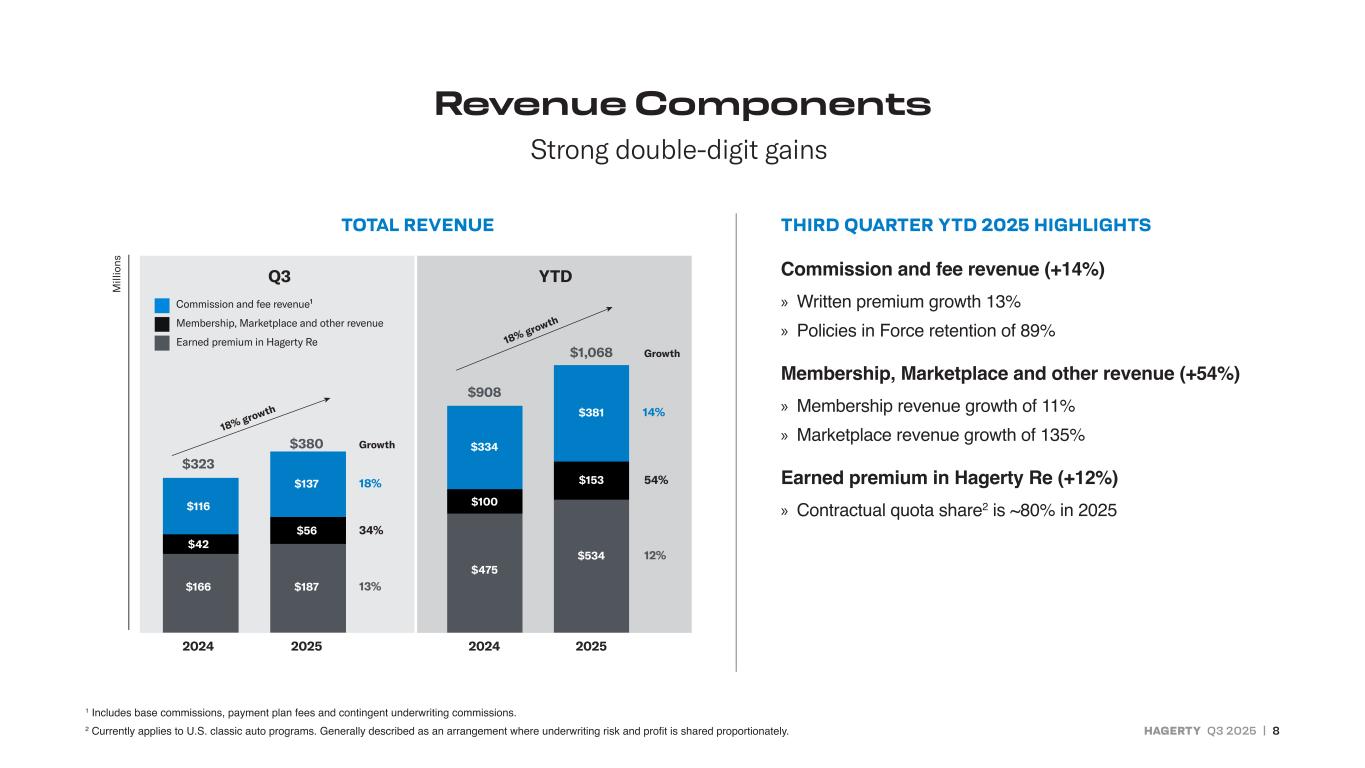

HAGERTY Q3 2025 | 8 THIRD QUARTER YTD 2025 HIGHLIGHTS Commission and fee revenue (+14%) » Written premium growth 13% » Policies in Force retention of 89% Membership, Marketplace and other revenue (+54%) » Membership revenue growth of 11% » Marketplace revenue growth of 135% Earned premium in Hagerty Re (+12%) » Contractual quota share2 is ~80% in 2025 Revenue Components 1 Includes base commissions, payment plan fees and contingent underwriting commissions. 2 Currently applies to U.S. classic auto programs. Generally described as an arrangement where underwriting risk and profit is shared proportionately. Q3 YTD $323 $380 $42 $187 $116 $56 $166 $137 $908 $1,068 $475 $100 $334 $381 $153 $534 18% 14% 34% 54% 13% 12% Growth Growth 2024 2025 2024 2025 18% growth 18% growth $323 $380 $42 $187 $116 $56 $166 $137 $908 $1,068 $475 $100 $334 $381 $153 $534 18% 14% 34% 54% 13% 12% Growth Growth 2024 2025 2024 2025 18% growth 18% growth Strong double-digit gains TOTAL REVENUE Commission and fee revenue1 Membership, Marketplace and other revenue Earned premium in Hagerty Re

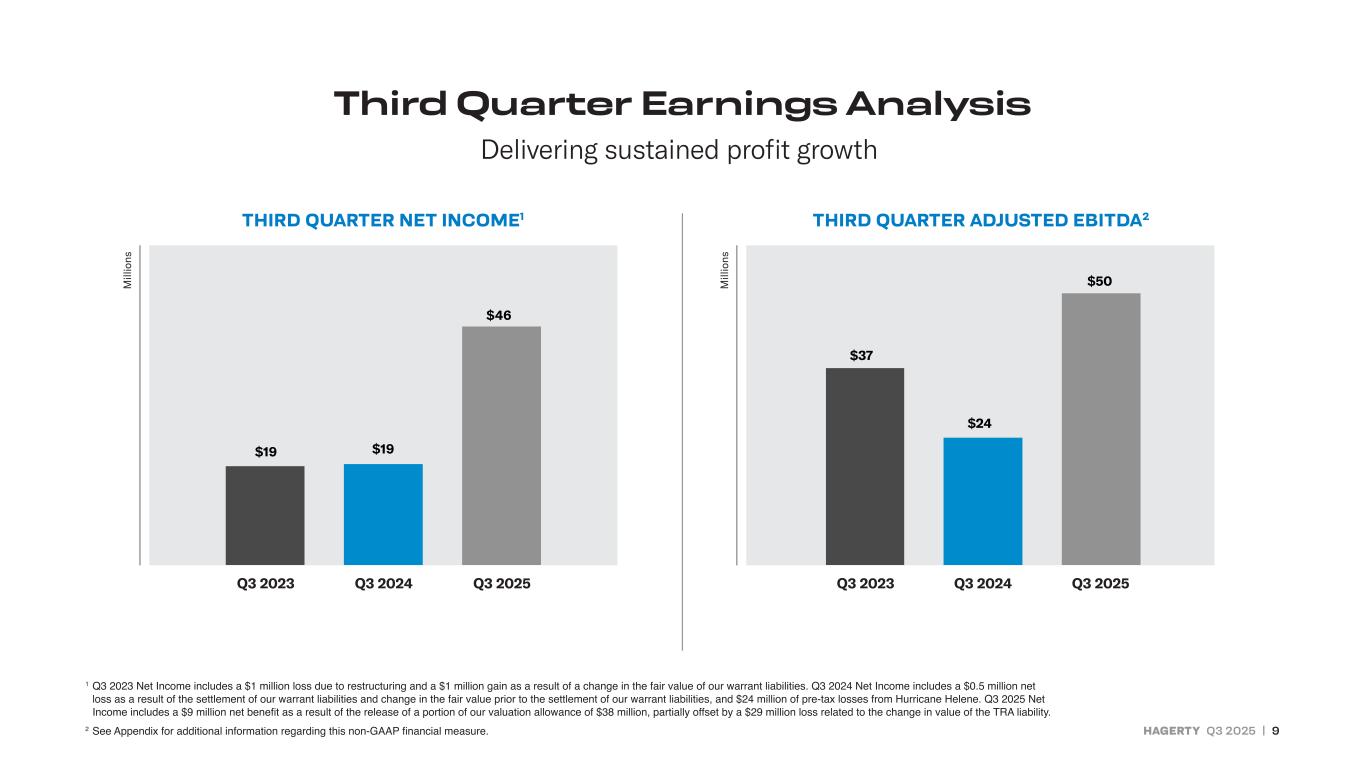

HAGERTY Q3 2025 | 9 Q3 2023 Q3 2023Q3 2024 Q3 2024Q3 2025 Q3 2025 Delivering sustained profit growth Third Quarter Earnings Analysis THIRD QUARTER NET INCOME1 THIRD QUARTER ADJUSTED EBITDA2 1 Q3 2023 Net Income includes a $1 million loss due to restructuring and a $1 million gain as a result of a change in the fair value of our warrant liabilities. Q3 2024 Net Income includes a $0.5 million net loss as a result of the settlement of our warrant liabilities and change in the fair value prior to the settlement of our warrant liabilities, and $24 million of pre-tax losses from Hurricane Helene. Q3 2025 Net Income includes a $9 million net benefit as a result of the release of a portion of our valuation allowance of $38 million, partially offset by a $29 million loss related to the change in value of the TRA liability. 2 See Appendix for additional information regarding this non-GAAP financial measure. $19 $19 $37 $46 $24 $50 $19 $19 $37 $46 $24 $50

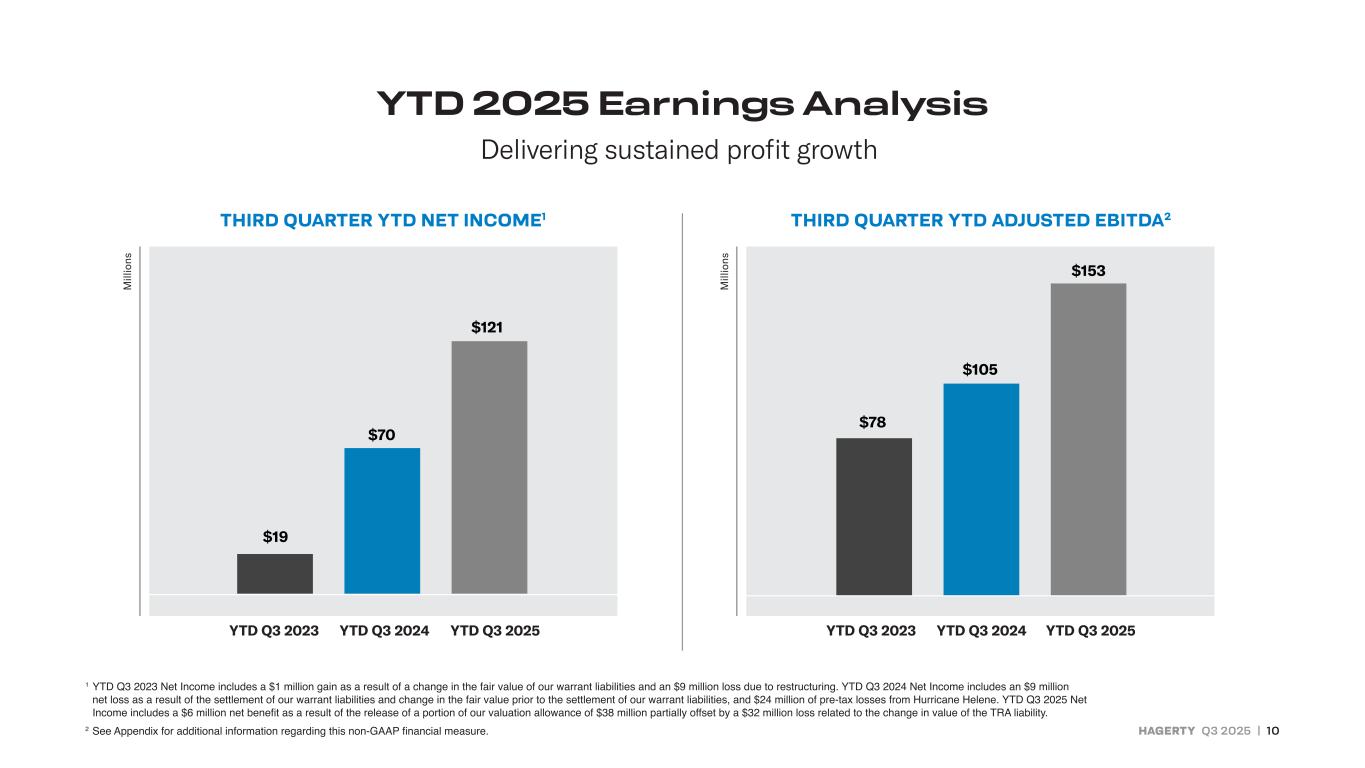

HAGERTY Q3 2025 | 10 YTD Q3 2023 YTD Q3 2023YTD Q3 2024 YTD Q3 2024YTD Q3 2025 YTD Q3 2025 Delivering sustained profit growth YTD 2025 Earnings Analysis THIRD QUARTER YTD NET INCOME1 THIRD QUARTER YTD ADJUSTED EBITDA2 1 YTD Q3 2023 Net Income includes a $1 million gain as a result of a change in the fair value of our warrant liabilities and an $9 million loss due to restructuring. YTD Q3 2024 Net Income includes an $9 million net loss as a result of the settlement of our warrant liabilities and change in the fair value prior to the settlement of our warrant liabilities, and $24 million of pre-tax losses from Hurricane Helene. YTD Q3 2025 Net Income includes a $6 million net benefit as a result of the release of a portion of our valuation allowance of $38 million partially offset by a $32 million loss related to the change in value of the TRA liability. 2 See Appendix for additional information regarding this non-GAAP financial measure. $153 $105 YTD Q3 2023 YTD Q3 2024 YTD Q3 2025 $78 YTD Q3 2023 YTD Q3 2024 YTD Q3 2025 $19 $70 $121

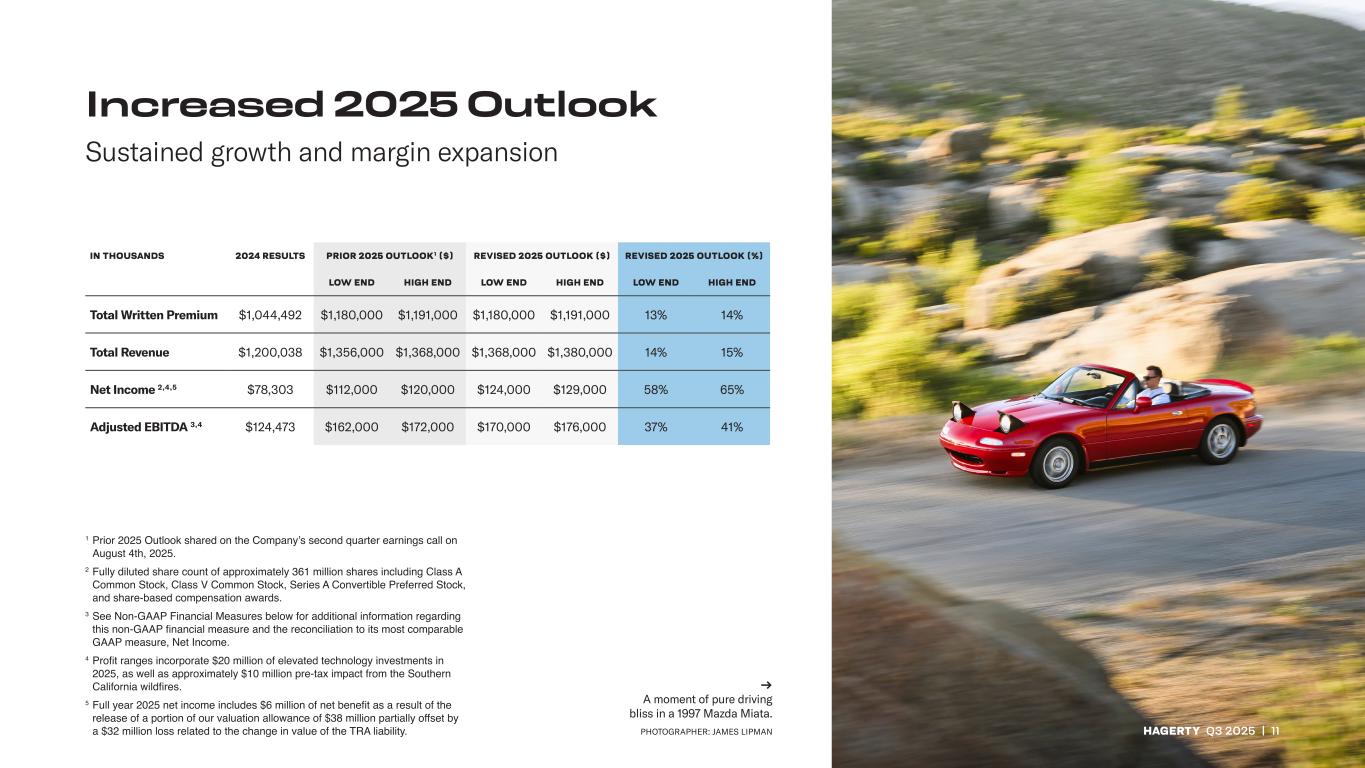

HAGERTY Q3 2025 | 11 IN THOUSANDS 2024 RESULTS PRIOR 2025 OUTLOOK1 ($) REVISED 2025 OUTLOOK ($) REVISED 2025 OUTLOOK (%) LOW END HIGH END LOW END HIGH END LOW END HIGH END Total Written Premium $1,044,492 $1,180,000 $1,191,000 $1,180,000 $1,191,000 13% 14% Total Revenue $1,200,038 $1,356,000 $1,368,000 $1,368,000 $1,380,000 14% 15% Net Income 2,4,5 $78,303 $112,000 $120,000 $124,000 $129,000 58% 65% Adjusted EBITDA 3,4 $124,473 $162,000 $172,000 $170,000 $176,000 37% 41% 1 Prior 2025 Outlook shared on the Company’s second quarter earnings call on August 4th, 2025. 2 Fully diluted share count of approximately 361 million shares including Class A Common Stock, Class V Common Stock, Series A Convertible Preferred Stock, and share-based compensation awards. 3 See Non-GAAP Financial Measures below for additional information regarding this non-GAAP financial measure and the reconciliation to its most comparable GAAP measure, Net Income. 4 Profit ranges incorporate $20 million of elevated technology investments in 2025, as well as approximately $10 million pre-tax impact from the Southern California wildfires. 5 Full year 2025 net income includes $6 million of net benefit as a result of the release of a portion of our valuation allowance of $38 million partially offset by a $32 million loss related to the change in value of the TRA liability. Sustained growth and margin expansion Increased 2025 Outlook → A moment of pure driving bliss in a 1997 Mazda Miata. PHOTOGRAPHER: JAMES LIPMAN

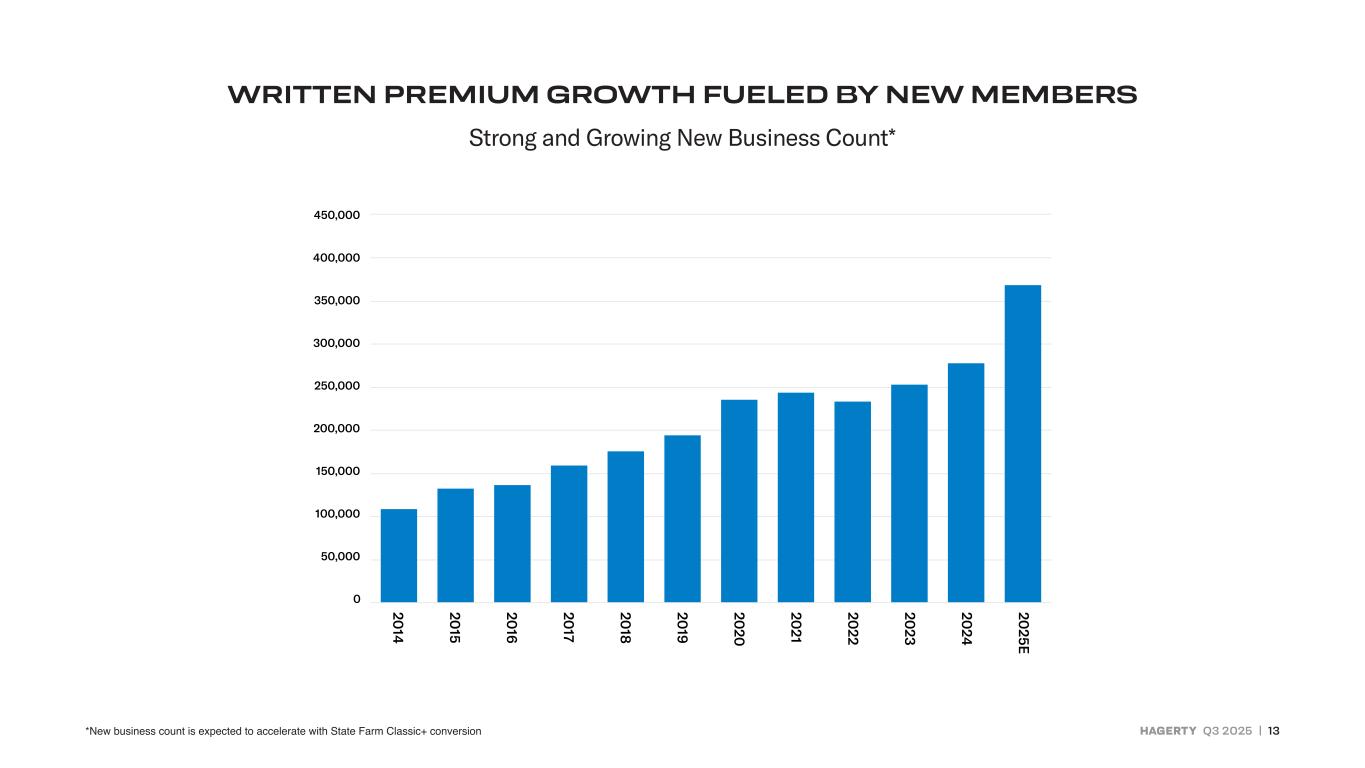

HAGERTY Q3 2025 | 13 WRITTEN PREMIUM GROWTH FUELED BY NEW MEMBERS Strong and Growing New Business Count* 450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 20 25E 20 24 20 23 20 22 20 21 20 20 20 19 20 18 20 17 20 16 20 15 20 14 *New business count is expected to accelerate with State Farm Classic+ conversion

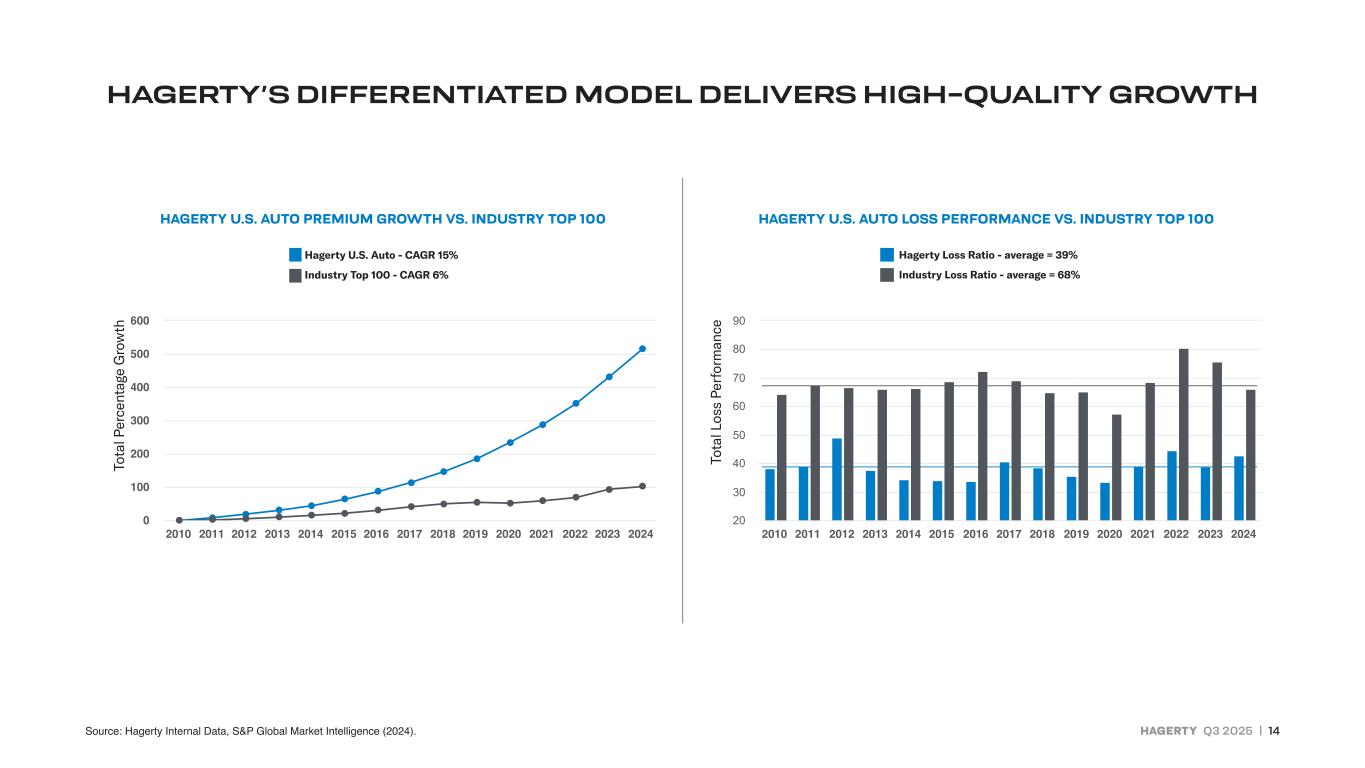

HAGERTY Q3 2025 | 14 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 0 100 200 300 400 500 600 HAGERTY’S DIFFERENTIATED MODEL DELIVERS HIGH-QUALITY GROWTH Hagerty U.S. Auto - CAGR 15% Industry Top 100 - CAGR 6% Hagerty Loss Ratio - average = 39% Industry Loss Ratio - average = 68% HAGERTY U.S. AUTO PREMIUM GROWTH VS. INDUSTRY TOP 100 HAGERTY U.S. AUTO LOSS PERFORMANCE VS. INDUSTRY TOP 100 Source: Hagerty Internal Data, S&P Global Market Intelligence (2024). To ta l P er ce nt ag e G ro w th To ta l L os s Pe rf or m an ce 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 20 30 40 50 60 70 80 90

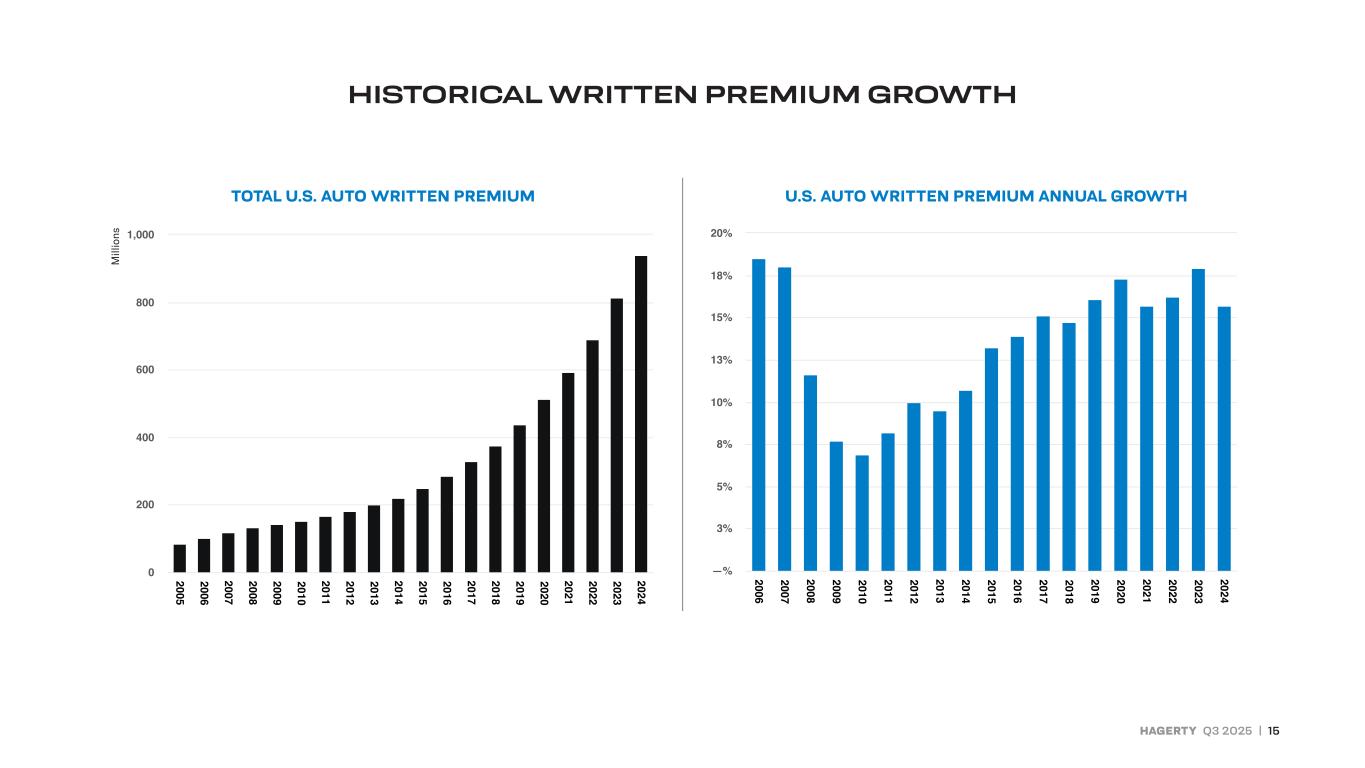

HAGERTY Q3 2025 | 15 HISTORICAL WRITTEN PREMIUM GROWTH 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 0 200 400 600 800 1,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 —% 3% 5% 8% 10% 13% 15% 18% 20% TOTAL U.S. AUTO WRITTEN PREMIUM U.S. AUTO WRITTEN PREMIUM ANNUAL GROWTH

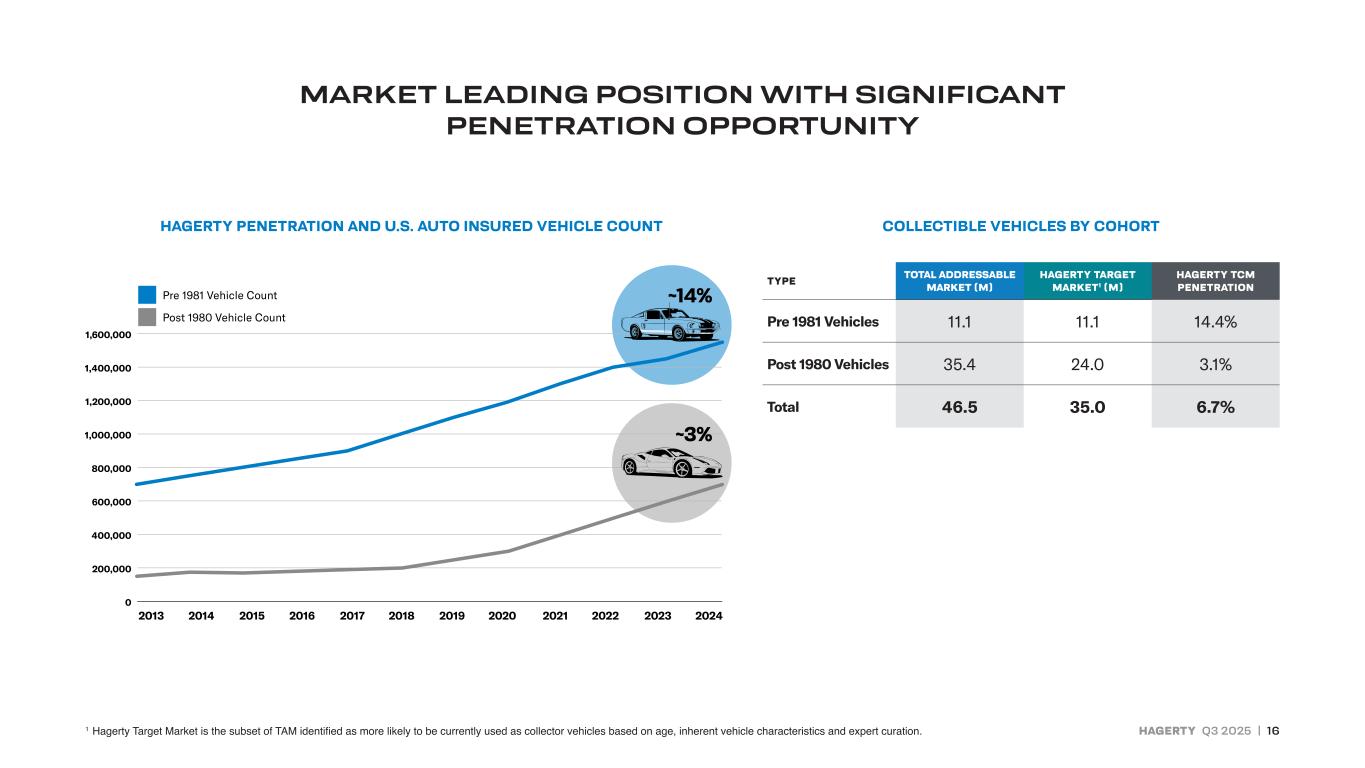

HAGERTY Q3 2025 | 16 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 1,400,000 1,600,000 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 ~14% ~3% Pre 1981 Vehicle Count Type Total Market (cars, mm) Collectible Vehicles by Cohort Hagerty Penetration Pre 1981 Vehicles 11.1 14.0% Post 1980 Vehicles 36.7 1.9% Total 47.8 4.7% Post 1980 Vehicle Count MARKET LEADING POSITION WITH SIGNIFICANT PENETRATION OPPORTUNITY TYPE TOTAL ADDRESSABLE MARKET (M) HAGERTY TARGET MARKET1 (M) HAGERTY TCM PENETRATION Pre 1981 Vehicles 11.1 11.1 14.4% Post 1980 Vehicles 35.4 24.0 3.1% Total 46.5 35.0 6.7% HAGERTY PENETRATION AND U.S. AUTO INSURED VEHICLE COUNT COLLECTIBLE VEHICLES BY COHORT 1 Hagerty Target Market is the subset of TAM identified as more likely to be currently used as collector vehicles based on age, inherent vehicle characteristics and expert curation.

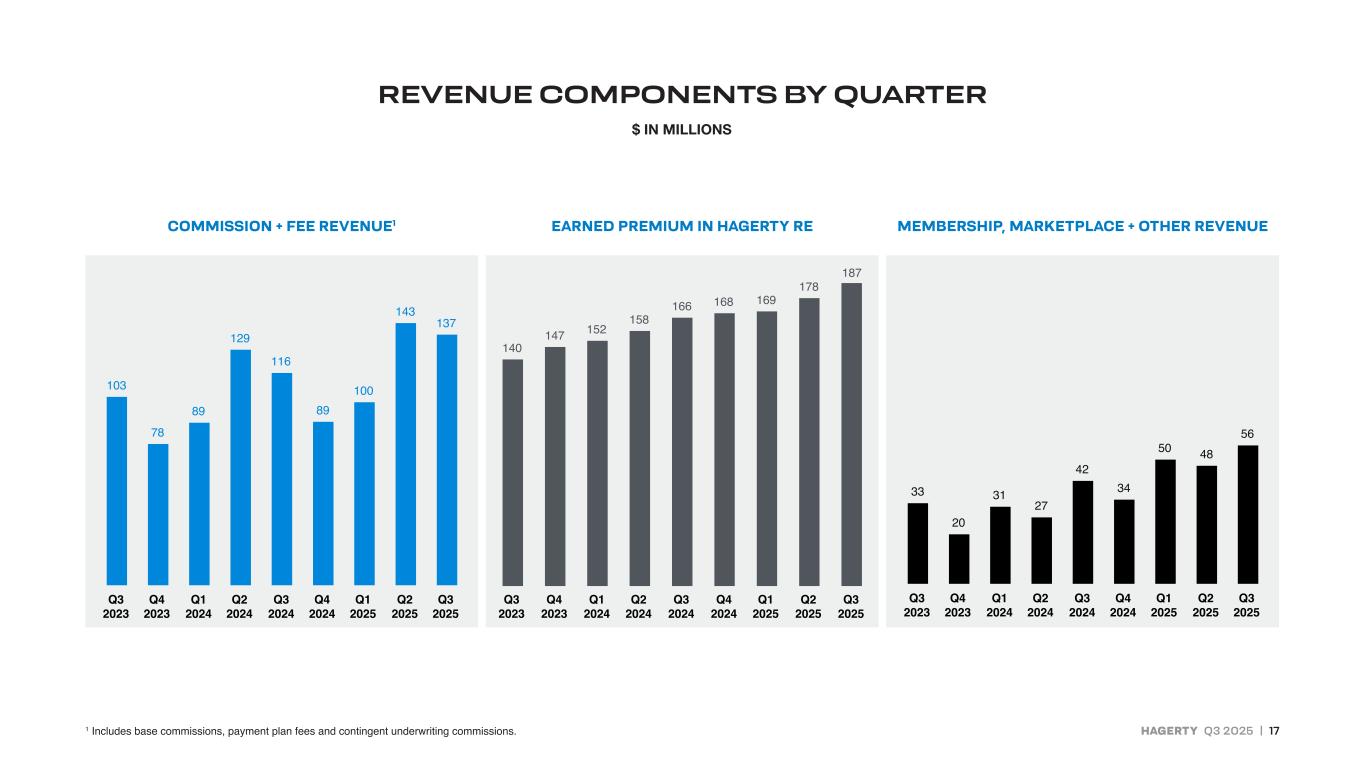

HAGERTY Q3 2025 | 17 REVENUE COMPONENTS BY QUARTER $ IN MILLIONS 140 147 152 158 166 168 169 178 187 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 103 78 89 129 116 89 100 143 137 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 33 20 31 27 42 34 50 48 56 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 COMMISSION + FEE REVENUE1 EARNED PREMIUM IN HAGERTY RE MEMBERSHIP, MARKETPLACE + OTHER REVENUE 1 Includes base commissions, payment plan fees and contingent underwriting commissions.

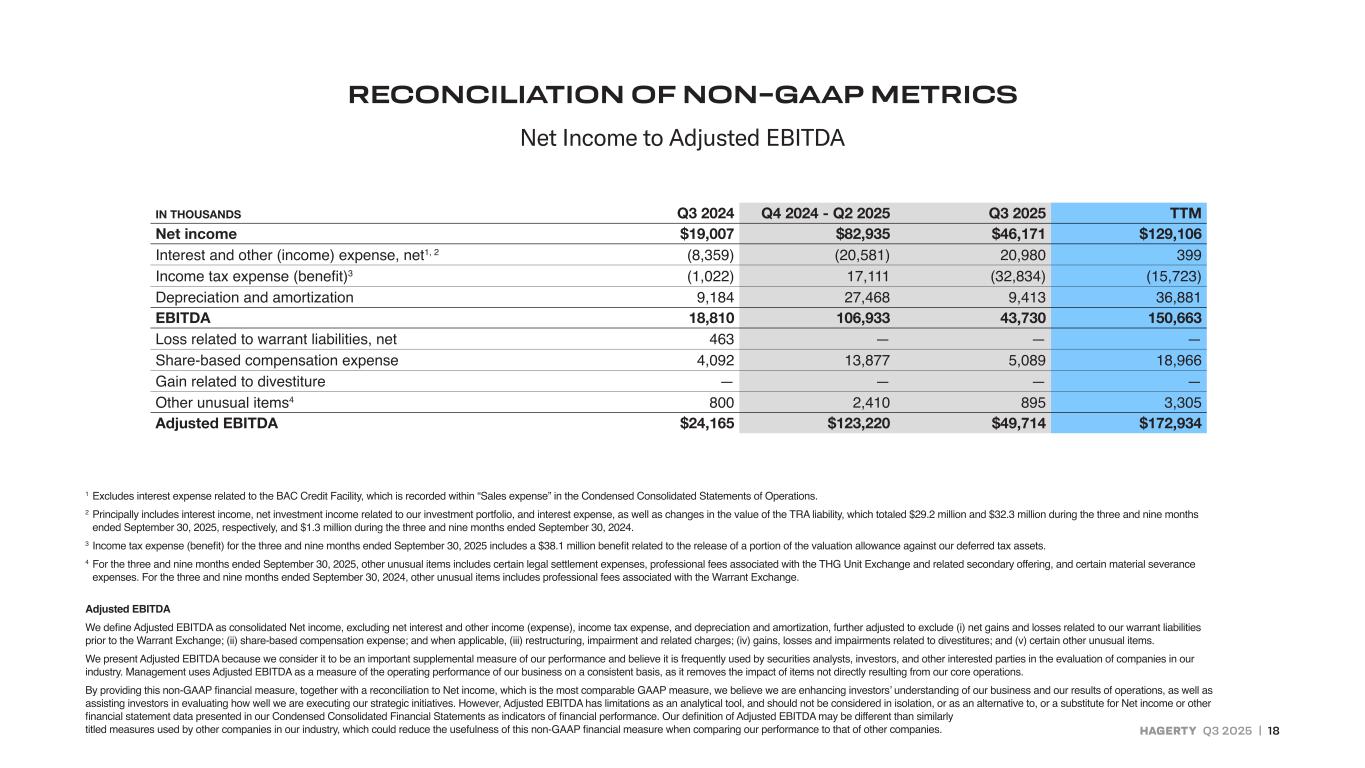

HAGERTY Q3 2025 | 18 IN THOUSANDS Q3 2024 Q4 2024 - Q2 2025 Q3 2025 TTM Net income $19,007 $82,935 $46,171 $129,106 Interest and other (income) expense, net1, 2 (8,359) (20,581) 20,980 399 Income tax expense (benefit)3 (1,022) 17,111 (32,834) (15,723) Depreciation and amortization 9,184 27,468 9,413 36,881 EBITDA 18,810 106,933 43,730 150,663 Loss related to warrant liabilities, net 463 — — — Share-based compensation expense 4,092 13,877 5,089 18,966 Gain related to divestiture — — — — Other unusual items4 800 2,410 895 3,305 Adjusted EBITDA $24,165 $123,220 $49,714 $172,934 RECONCILIATION OF NON-GAAP METRICS Net Income to Adjusted EBITDA 1 Excludes interest expense related to the BAC Credit Facility, which is recorded within “Sales expense” in the Condensed Consolidated Statements of Operations. 2 Principally includes interest income, net investment income related to our investment portfolio, and interest expense, as well as changes in the value of the TRA liability, which totaled $29.2 million and $32.3 million during the three and nine months ended September 30, 2025, respectively, and $1.3 million during the three and nine months ended September 30, 2024. 3 Income tax expense (benefit) for the three and nine months ended September 30, 2025 includes a $38.1 million benefit related to the release of a portion of the valuation allowance against our deferred tax assets. 4 For the three and nine months ended September 30, 2025, other unusual items includes certain legal settlement expenses, professional fees associated with the THG Unit Exchange and related secondary offering, and certain material severance expenses. For the three and nine months ended September 30, 2024, other unusual items includes professional fees associated with the Warrant Exchange. Adjusted EBITDA We define Adjusted EBITDA as consolidated Net income, excluding net interest and other income (expense), income tax expense, and depreciation and amortization, further adjusted to exclude (i) net gains and losses related to our warrant liabilities prior to the Warrant Exchange; (ii) share-based compensation expense; and when applicable, (iii) restructuring, impairment and related charges; (iv) gains, losses and impairments related to divestitures; and (v) certain other unusual items. We present Adjusted EBITDA because we consider it to be an important supplemental measure of our performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. Management uses Adjusted EBITDA as a measure of the operating performance of our business on a consistent basis, as it removes the impact of items not directly resulting from our core operations. By providing this non-GAAP financial measure, together with a reconciliation to Net income, which is the most comparable GAAP measure, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. However, Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for Net income or other financial statement data presented in our Condensed Consolidated Financial Statements as indicators of financial performance. Our definition of Adjusted EBITDA may be different than similarly titled measures used by other companies in our industry, which could reduce the usefulness of this non-GAAP financial measure when comparing our performance to that of other companies.

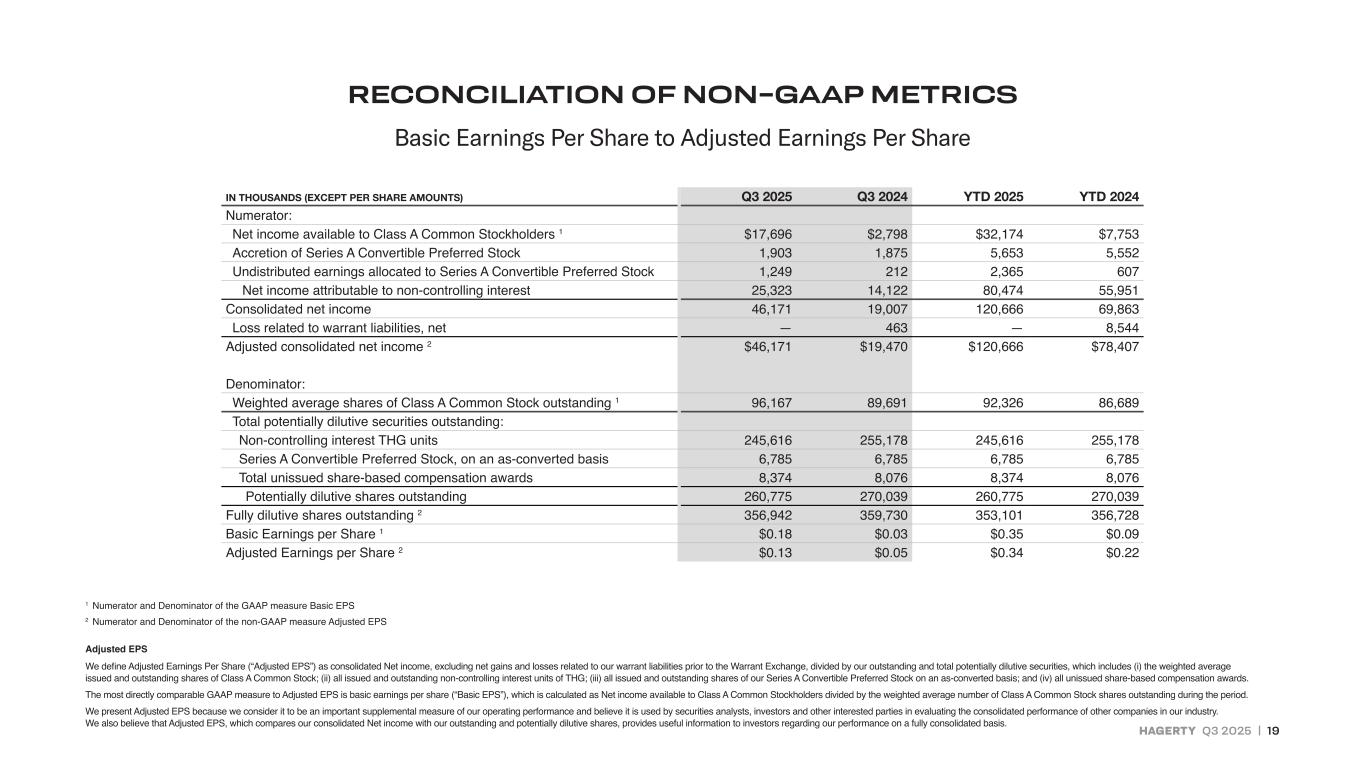

HAGERTY Q3 2025 | 19 IN THOUSANDS (EXCEPT PER SHARE AMOUNTS) Q3 2025 Q3 2024 YTD 2025 YTD 2024 Numerator: Net income available to Class A Common Stockholders 1 $17,696 $2,798 $32,174 $7,753 Accretion of Series A Convertible Preferred Stock 1,903 1,875 5,653 5,552 Undistributed earnings allocated to Series A Convertible Preferred Stock 1,249 212 2,365 607 Net income attributable to non-controlling interest 25,323 14,122 80,474 55,951 Consolidated net income 46,171 19,007 120,666 69,863 Loss related to warrant liabilities, net — 463 — 8,544 Adjusted consolidated net income 2 $46,171 $19,470 $120,666 $78,407 Denominator: Weighted average shares of Class A Common Stock outstanding 1 96,167 89,691 92,326 86,689 Total potentially dilutive securities outstanding: Non-controlling interest THG units 245,616 255,178 245,616 255,178 Series A Convertible Preferred Stock, on an as-converted basis 6,785 6,785 6,785 6,785 Total unissued share-based compensation awards 8,374 8,076 8,374 8,076 Potentially dilutive shares outstanding 260,775 270,039 260,775 270,039 Fully dilutive shares outstanding 2 356,942 359,730 353,101 356,728 Basic Earnings per Share 1 $0.18 $0.03 $0.35 $0.09 Adjusted Earnings per Share 2 $0.13 $0.05 $0.34 $0.22 Basic Earnings Per Share to Adjusted Earnings Per Share RECONCILIATION OF NON-GAAP METRICS 1 Numerator and Denominator of the GAAP measure Basic EPS 2 Numerator and Denominator of the non-GAAP measure Adjusted EPS Adjusted EPS We define Adjusted Earnings Per Share (“Adjusted EPS”) as consolidated Net income, excluding net gains and losses related to our warrant liabilities prior to the Warrant Exchange, divided by our outstanding and total potentially dilutive securities, which includes (i) the weighted average issued and outstanding shares of Class A Common Stock; (ii) all issued and outstanding non-controlling interest units of THG; (iii) all issued and outstanding shares of our Series A Convertible Preferred Stock on an as-converted basis; and (iv) all unissued share-based compensation awards. The most directly comparable GAAP measure to Adjusted EPS is basic earnings per share (“Basic EPS”), which is calculated as Net income available to Class A Common Stockholders divided by the weighted average number of Class A Common Stock shares outstanding during the period. We present Adjusted EPS because we consider it to be an important supplemental measure of our operating performance and believe it is used by securities analysts, investors and other interested parties in evaluating the consolidated performance of other companies in our industry. We also believe that Adjusted EPS, which compares our consolidated Net income with our outstanding and potentially dilutive shares, provides useful information to investors regarding our performance on a fully consolidated basis.

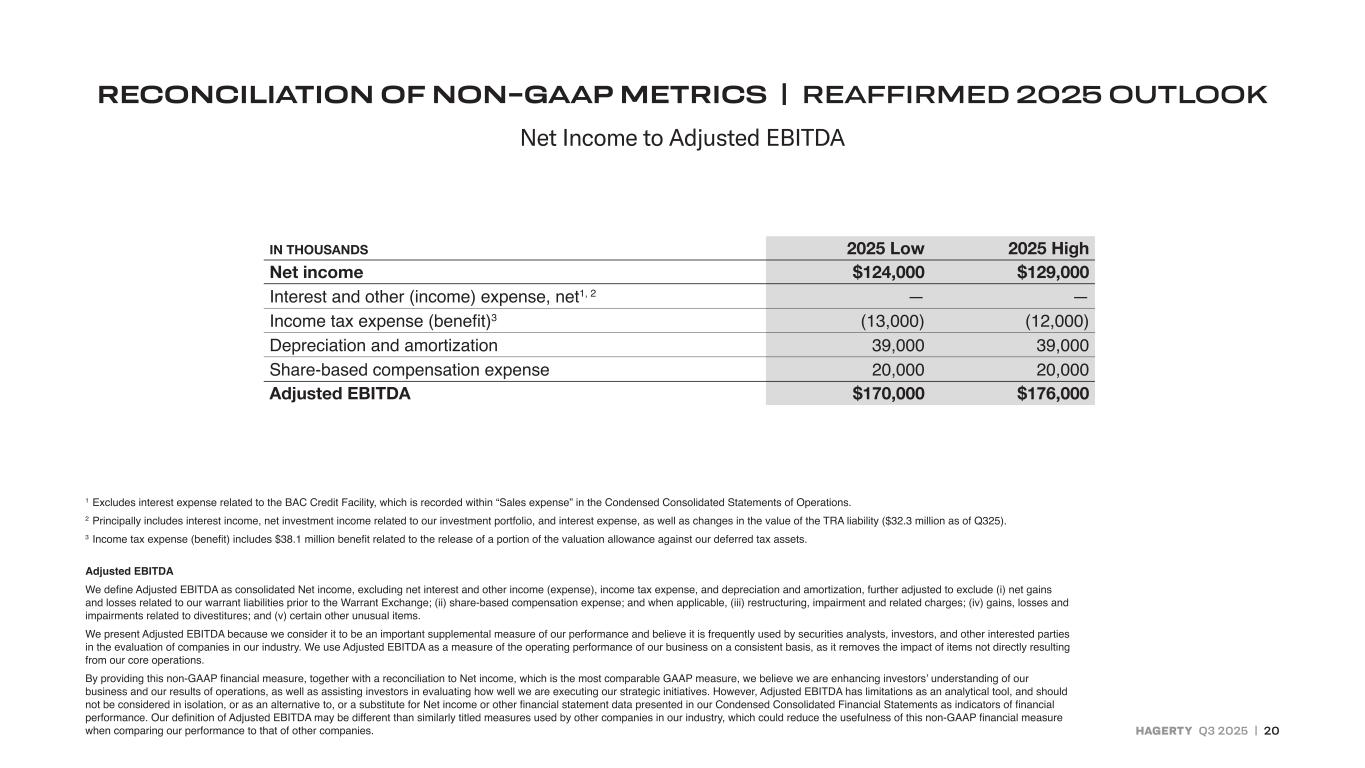

HAGERTY Q3 2025 | 20 IN THOUSANDS 2025 Low 2025 High Net income $124,000 $129,000 Interest and other (income) expense, net1, 2 — — Income tax expense (benefit)3 (13,000) (12,000) Depreciation and amortization 39,000 39,000 Share-based compensation expense 20,000 20,000 Adjusted EBITDA $170,000 $176,000 Net Income to Adjusted EBITDA RECONCILIATION OF NON-GAAP METRICS | REAFFIRMED 2025 OUTLOOK 1 Excludes interest expense related to the BAC Credit Facility, which is recorded within “Sales expense” in the Condensed Consolidated Statements of Operations. 2 Principally includes interest income, net investment income related to our investment portfolio, and interest expense, as well as changes in the value of the TRA liability ($32.3 million as of Q325). 3 Income tax expense (benefit) includes $38.1 million benefit related to the release of a portion of the valuation allowance against our deferred tax assets. Adjusted EBITDA We define Adjusted EBITDA as consolidated Net income, excluding net interest and other income (expense), income tax expense, and depreciation and amortization, further adjusted to exclude (i) net gains and losses related to our warrant liabilities prior to the Warrant Exchange; (ii) share-based compensation expense; and when applicable, (iii) restructuring, impairment and related charges; (iv) gains, losses and impairments related to divestitures; and (v) certain other unusual items. We present Adjusted EBITDA because we consider it to be an important supplemental measure of our performance and believe it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in our industry. We use Adjusted EBITDA as a measure of the operating performance of our business on a consistent basis, as it removes the impact of items not directly resulting from our core operations. By providing this non-GAAP financial measure, together with a reconciliation to Net income, which is the most comparable GAAP measure, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. However, Adjusted EBITDA has limitations as an analytical tool, and should not be considered in isolation, or as an alternative to, or a substitute for Net income or other financial statement data presented in our Condensed Consolidated Financial Statements as indicators of financial performance. Our definition of Adjusted EBITDA may be different than similarly titled measures used by other companies in our industry, which could reduce the usefulness of this non-GAAP financial measure when comparing our performance to that of other companies.