UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

Or

For the transition period from ___________ to ___________

Commission file number:

| (Exact name of registrant as specified in charter) |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

|

| |

| (Address of principal executive offices) | (Zip Code) |

| ( |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $0.0001 per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standard provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of

its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

The aggregate market value of the voting and non-voting

common equity held by non-affiliates of the registrant, as of December 29, 2024, the last business day of the registrant’s most

recently completed second fiscal quarter, was approximately $

As of November 30, 2025, the registrant had shares of its common stock, $0.0001 par value per share, outstanding.

| Audit Firm Id | Auditor Name: | Auditor Location: | ||

TABLE OF CONTENTS

i

Unless we state otherwise or the context otherwise requires, the terms the “Company” “Zapata,” “Zapata Quantum,” “we,” “us,” “our” and the “Company” refer to Zapata Quantum, Inc., a Delaware corporation. Solely for convenience, the trademarks and trade names in this report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

Unless otherwise noted, the description of our business and the discussion of related risk factors reflects Zapata Quantum’s operations and strategic direction as of 2025. The Company underwent significant changes after December 31, 2024, including a restructuring, rebranding, and renewed focus on quantum computing application development.

Cautionary Note Regarding Forward-Looking Statements

This Report contains forward-looking statements, including statements regarding our expectations for prospective future growth, operating results and financial condition, potential future trends and developments within our industry and the U.S. and global economies generally, plans and expectations for our future business plan and capital raising efforts, expectations and plans with respect to our products and services including the potential market for, timing, features, and demand for such products and services, and liquidity and sources of capital. Forward-looking statements are prefaced by words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “should,” “would,” “intend,” “seem,” “potential,” “appear,” “continue,” “future,” believe,” “estimate,” “forecast,” “project,” and similar words. We have based these forward-looking statements largely on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. We caution you, therefore, against relying on any of these forward-looking statements.

Our actual results may differ materially from those contemplated by the forward-looking statements for a variety of reasons, including, without limitation, the possibility that estimates, projections and assumptions on which the forward-looking statements are based prove to be incorrect, our ability to raise the necessary capital to re-establish material operations and generate revenue and the terms and timing of any related transactions, central bank interest rates and future interest rate changes, the risks arising from the impact of inflation, tariffs, the deterioration of the labor market of the United States, a recession which may result on the Company’s business, prospective customers, and on the national and global economy, our ability to attract homeowners to our products and services, the potential for regulatory changes impacting quantum computing, artificial intelligence, data privacy and other areas that impact the Company’s business, and the ability of us and third parties on which we depend to comply with applicable regulatory requirements, the risk that software and technology infrastructure on which we depend fail to perform as designed or intended, and the risks and uncertainties disclosed under Item 1A – Risk Factors contained in this Report. Any forward-looking statement made by us in this presentation speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

ii

Frequently Used Terms

In this document:

“AI” means artificial intelligence”

“Business Combination Agreement” means the Business Combination Agreement, dated as of September 6, 2023, by and among the Company, Merger Sub and Legacy Zapata, as may be amended from time to time.

“Code” means the Internal Revenue Code of 1986.

“Common Stock” means the common stock of the Company, par value $0.0001 per share.

“DGCL” means the General Corporation Law of the State of Delaware.

“Exchange Act” means the U.S. Securities Exchange Act of 1934.

“IP” means intellectual property.

“Legacy Zapata” means Zapata Computing, Inc., a Delaware corporation.

“Merger” means the merger of Merger Sub with and into Legacy Zapata with Legacy Zapata that occurred on March 28, 2024 with Legacy Zapata surviving the Merger as a wholly owned subsidiary of the Company as contemplated by the Business Combination Agreement.

“Merger Sub” means Tigre Merger Sub, Inc., a Delaware corporation and wholly owned direct subsidiary of the Company prior to the closing of the Merger.

“Nasdaq” means the Nasdaq Stock Market.

“Preferred Stock” means the preferred stock of the Company, par value $0.0001 per share.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933.

“Senior Secured Notes” means the senior secured promissory notes issued by Zapata and its subsidiary, the obligations of which are secured by the assets thereof.

iii

PART I

Item 1. Business

Overview

Zapata Quantum is a leading pure-play hardware-agnostic quantum software company. Following a strategic realignment in 2025, the Company will deliver solutions to efficiently deploy and accelerate the development of quantum and hybrid quantum-classical computing applications. Founded in 2017 by researchers from a Harvard University Quantum Computing Lab, Zapata has built one of the industry’s most robust intellectual property portfolios in quantum and hybrid quantum-classical computing and algorithmic methods, with over 60 patents granted and pending developed over eight years.

Zapata’s software platform for quantum computing applications is based on our patented technology and supports a wide range of use cases in cryptography, pharmaceuticals, manufacturing, materials discovery and defense. The Company is the only organization to have participated across all technical areas of the Defense Advanced Research Projects Agency’s (“DARPA”)’s Quantum Benchmarking program and has worked with Fortune 500 enterprises and government agencies to unlock the potential of quantum computing.

On March 28, 2024, we consummated the business combination contemplated by the Business Combination Agreement, dated September 6, 2023, by and among the Company, Merger Sub and Legacy Zapata. Pursuant to the Business Combination Agreement, the Merger took place pursuant to which Merger Sub merged with and into Legacy Zapata resulting in Legacy Zapata becoming a wholly owned subsidiary of the Company.

In late 2024 the Company voluntarily elected to temporarily suspend its operations due to its limited capital resources and inability to access adequate liquidity to continue to fund its operations and meet its outstanding debt obligations. In June 2025, the Company commenced debt restructuring and capital raising transactions and the reinstatement of operations by (1) entering into exchange agreements with unsecured creditors pursuant to which such creditors agreed to exchange outstanding obligations payable to them for common stock and certain rights related thereto, and (2) the Company sold convertible notes and warrants for gross proceeds of $3 million. The Company has since been continuing efforts to negotiate and restructure outstanding obligations and raise capital. In the furtherance of recommencing operations, the Company has also entered into advisory agreements with third parties and agreed to compensate such parties in the form of equity and/or cash compensation. See Note 20, Subsequent Events, in the notes to the consolidated financial statements contained in this Annual Report.

Following a period of broader AI exploration, the Company undertook, in 2024 and 2025, a strategic realignment to refocus on its core quantum mission: developing the software and tooling layer that enables enterprises, governments, and researchers to harness quantum computing for economically meaningful outcomes.

Zapata’s hardware-agnostic approach and proprietary technology address the “software bottleneck” that limits quantum adoption. The Company’s products - Orquestra, Bench-Q, Quantum Graph, and Quantum Pilot - provide the infrastructure and workflow tools that connect problem discovery, algorithm design, and hardware execution. These tools are supported by professional services, partnerships, and licensing programs that collectively form the Company’s business model.

The Company’s business plans and operations described herein, and our ability to execute and continue with such efforts, will depend on our ability to raise capital needed to repay vendors and creditors, rehire various personnel and fund our working capital and growth needs. Further, our capital raising efforts and business and operation generally are subject to numerous risks and uncertainties, as described under “Item 1A – Risk Factors.”

Introduction to Quantum Computing

Quantum computing exploits the principles of quantum mechanics - superposition, entanglement, and interference - to process information in fundamentally new ways. Whereas classical computers operate on bits that are either 0 or 1, quantum computers use quantum bits, or “qubits” that can exist in multiple states simultaneously. This enables exponential scaling of computational possibilities and the potential to solve certain classes of problems - such as molecular simulation, combinatorial optimization, and cryptographic analysis - that are intractable on classical machines.

The field of quantum computing is advancing rapidly, supported by significant broad-based investment. Global governments have announced multibillion-dollar quantum initiatives, venture and public-market investment have accelerated considerably, and major cloud computing providers now offer access to quantum processors. A 2024 Boston Consulting Group analysis estimates that quantum technologies will create $450 billion to $850 billion of economic value globally, sustaining a $90 billion to $170 billion market for hardware and software providers by 2040.

| 1 |

Phases of Quantum Computing Technology Development

The first phase of quantum computing has been the arrival of Noisy Intermediate-Scale Quantum (NISQ) devices, characterized by limited qubit counts and the absence of full error correction. Despite these constraints, NISQ computing can still deliver tangible value especially in areas such as materials, chemical simulations and optimization.

Zapata has contributed significantly to the advancement of NISQ approaches including pioneering the Variational Quantum Eigensolver (VQE), a foundational hybrid quantum-classical algorithm that combines quantum state preparation with classical optimization to estimate molecular and materials properties, with applications to other domains as well.

VQE demonstrated one of the first practical uses of quantum hardware and helped establish the hybrid quantum-classical paradigm that continues to define much of the industry’s progress. Building on this foundation, Zapata develops software and tools that extend hybrid approaches to broader classes of scientific and industrial problems, creating an adaptable framework that evolves with each generation of hardware.

Rapid progress is now being made toward the second phase of quantum computing, known as Fault-Tolerant Quantum Computing (FTQC), where error-corrected qubits enable deep, large-scale algorithms with transformative performance. As these systems come online, the race is underway to display what is known as “quantum advantage” or “quantum supremacy” in an increasing number of key problem areas.

The number of announcements by leading FTQC hardware providers has accelerated considerably in recent months - including improvement in qubit coherence times, falling error rates, the demonstration of prototype logical qubits, and the announcement of quantum advantage for some problems. As these breakthroughs accumulate, the focus of progress is shifting toward the application and software layer - where practical utility will first emerge. This is the domain where Zapata Quantum operates.

Unlocking the full potential of FTQC will depend not only on better hardware, but also a mature software stack which will enhance the development of algorithms, compilers, and workflows that translate real-world problems into quantum form. Zapata has proven itself as a leader in this space, with pioneering work across a variety of domains - including chemistry, materials science, optimization, cryptography and machine learning.

By advancing the software infrastructure and application frameworks that will define the next generation of quantum computing, Zapata plays a critical role in enabling the industry’s evolution toward large-scale, fault-tolerant quantum advantage.

Market Opportunity

The quantum computing market is entering what many observers describe as its “readiness phase,” evidenced by Microsoft’s declaration of 2025 as the year of quantum readiness. In 2024, McKinsey & Co. estimated annual global spend on quantum computing technologies of approximately $2 billion, growing at 35% per year, including about $400 million directed to software and services.

While hardware improvements draw attention, the limiting factor to adoption is the absence of a robust, reusable software infrastructure. Enterprises seeking to explore quantum advantage face steep learning curves, fragmented hardware ecosystems, and scarce talent. Zapata addresses these pain points by providing a coherent, hardware-agnostic software stack and associated technical services.

The potential impact of quantum computing technology spans nearly every high-value computational domain:

| • | Cryptography and cybersecurity - post-quantum encryption, secure communication, and threat assessment; |

| • | Optimization - financial portfolio construction, logistics, manufacturing scheduling, and energy-grid control; |

| • | Discovery and simulation - drug design, materials discovery, and climate modeling; |

| • | Defense and aerospace - signal processing, sensor fusion, and strategic decision optimization. |

We believe the software layer will capture a high share of the value created by these solutions to our planet’s most intractable problems. Zapata’s strategy is to occupy this enabling layer - bridging scientific discovery and commercial deployment.

Products

Zapata’s products are organized around what it refers to as the Generalized Quantum Stack - a three-layer model that defines the end-to-end process of quantum application development and execution. This framework, validated through Zapata’s multi-year leadership across all technical areas of DARPA’s Quantum Benchmarking program, provides the blueprint for accelerating progress from use case identification to implementation on physical hardware.

| 2 |

Zapata Generalized Quantum Stack

Layer 1: WHY - Use-Case and Utility Benchmark Evaluation

Defines the purpose of quantum computing by assessing quantum-amenable problems and related utility benchmarks across domains such as chemistry, optimization, cryptography, and materials science. This layer involves curating high-utility, domain-driven benchmarks that connect abstract industry challenges to well-defined computational instances. Zapata’s work here includes building repositories of potential applications and developing workflows for systematic problem formulation, addressing a critical gap in how enterprises and researchers determine where quantum advantage will emerge.

Layer 2: WHAT - Algorithm Development and Benchmarking

Focuses on the design of quantum applications and algorithms. Zapata’s tools enable modular algorithm composition, evaluation, and benchmarking to translate domain problems into executable quantum circuits. This layer bridges academic innovation with industrial relevance by combining Zapata’s curated algorithm library and benchmarking datasets with methods for performance comparison across algorithms and hardware types.

Layer 3: HOW - Resource Estimation and Execution

Represents the implementation phase, encompassing resource estimation, compilation, and hybrid execution across quantum and classical backends. Zapata’s platform, Orquestra, provides an environment for orchestrating these workflows, allowing developers to simulate, optimize, and run algorithms on real quantum hardware or high-performance classical infrastructure. This layer ensures forward compatibility as the industry transitions from NISQ systems to FTQC architectures.

Together, these layers define the roadmap for scalable quantum application development. Zapata is the only hardware-agnostic quantum software company to have demonstrated leadership across all three layers of this stack - uniquely positioned to lead the acceleration of the field from theoretical research to practical implementation.

Specific Zapata products within these layers include:

Orquestra

Orquestra is Zapata’s software platform for developing, orchestrating, and executing quantum and hybrid classical/quantum applications. It provides a unified environment for constructing computational workflows that combine classical and quantum resources. Orquestra manages the end-to-end lifecycle: from problem definition through algorithm selection, circuit compilation, resource estimation, execution, and results analysis. The platform has been used in commercial and research settings including with BP, BASF, BBVA, and DARPA.

Bench-Q

Bench-Q was developed under the U.S. Defense Advanced Research Projects Agency’s Quantum Benchmarking program, where Zapata uniquely participated across all technical areas (TA-1, TA-1.5 and TA-2). Bench-Q provides a standardized framework and software toolkit for evaluating quantum algorithms and hardware performance against utility-driven benchmarks. It defines metrics and workflows that allow researchers to trace the progression from abstract problem instances to executable circuits. The methods and data models produced in Bench-Q are core to Zapata’s commercial products.

Quantum Graph

Quantum Graph (QG) is a structured knowledge base that catalogs quantum use cases, algorithms, and application instances in a graph-based format. It provides a searchable, modular representation of how problems, algorithms, and hardware resources connect, forming a foundation for composable quantum application development. QG is currently in development.

Quantum Pilot

Quantum Pilot (QP) builds upon Quantum Graph by introducing an AI-assisted development environment that helps users compose, test, and refine hybrid quantum-classical workflows. By leveraging machine-learning models to suggest algorithmic building blocks and resource optimizations, Quantum Pilot aims to accelerate the design of viable quantum applications by orders of magnitude relative to manual methods. QP is currently in development.

Services

In-line with our historical activities prior to the cessation of operations in June 2024, we intend to complement our software offerings with high-value technical services to help customers unlock value using Zapata’s software products. Zapata’s service engagements will be performed by teams of quantum scientists, engineers, and domain experts. We expect that certain projects may evolve into longer-term subscriptions to our products, recurring research programs, or joint development agreements that involve co-created or licensed intellectual property.

| 3 |

These services will be strategically important both in the current noisy intermediate-scale quantum (NISQ) era and as fault-tolerant quantum computers (FTQC) become commercially available. By embedding its software and expertise in customer workflows today, Zapata intends to position itself as a long-term partner through the industry’s transition from research to scalable deployment.

Customer Value Proposition

Zapata’s quantum application development gives enterprises the confidence to invest in quantum computing with clarity and measurable results. It empowers customers to identify where quantum will create real value, validate that potential through data-driven modeling and benchmarking, and prove performance on real hardware before making costly commitments. By uniting discovery, design, and execution in one hardware-agnostic workflow, Zapata delivers readiness by reducing uncertainty, accelerating time-to-insight, and future-proofing quantum adoption. The result is faster innovation, smarter resource allocation, and tangible evidence of competitive advantage, turning quantum ambition into validated business outcomes.

Customers and Go-To-Market Strategy

The Company has previously executed multi-year contracts and collaborative engagements with leading organizations such as BP, BASF, BBVA, Mitsubishi Chemical, BMW, and Andretti Global, spanning industries including energy, chemicals, financial services, and advanced manufacturing.

In the public sector, Zapata has served as a prime contractor and collaborator under the Defense Advanced Research Projects Agency (DARPA) Quantum Benchmarking (QB) program. It was the only provider chosen to contribute to all technical areas - TA1 (use-case identification and benchmark definition), TA1.5 (algorithm design and implementation), and TA2 (hardware resource estimation and execution) - covering the full spectrum from problem formulation through algorithm development to hardware realization.

Through this work, Zapata developed the foundational methodologies and tooling that now underpin its commercial platforms, including Bench-Q, Orquestra, Quantum Graph and Quantum Pilot, in collaboration with leading universities, government research agencies, and hardware partners.

The Company’s go-to-market strategy combines direct enterprise sales, channel partnerships, and ecosystem collaborations. It also partners with strategy consultancies that serve enterprise clients exploring quantum readiness. This partnership-driven approach amplifies reach while keeping the Company focused on its core software and IP development.

Business Model

Our business model is to provide subscription-based offerings that combine Zapata Quantum software—specifically the Orquestra platform and any modules such as Bench-Q, Quantum Pilot or Quantum Graph which are delivered on top of it—as well as related services to develop and efficiently deploy custom quantum or hybrid quantum-classical computing applications designed to resolve our enterprise customers’ specific problems.

Our primary revenue model is based on subscription payments for our offerings which are utilized to develop and efficiently deploy quantum or hybrid quantum-classical computing applications. Based on our prior operating experience, these engagements typically span use case discovery to prototyping, benchmarking, and ultimately production as quantum hardware advances. We will also, consistent with our historical activity, selectively pursue government contracts related to the advancement of quantum computing applications as a complementary revenue source.

Competition

The quantum computing industry remains early and fragmented. Competition arises from (a) hardware manufacturers developing vertically integrated stacks (e.g., IBM, IonQ, Rigetti), (b) software-focused startups (e.g., Classiq, QC Ware, Horizon Quantum), and (c) internal R&D groups within large enterprises.

Management believes that Zapata’s differentiation derives from several advantages:

| • | Hardware agnosticism - Compatibility with all leading quantum hardware architectures |

| • | Comprehensive stack coverage - Participation across every technical area of DARPA’s Quantum Benchmarking Program, providing unique insight into end-to-end application development |

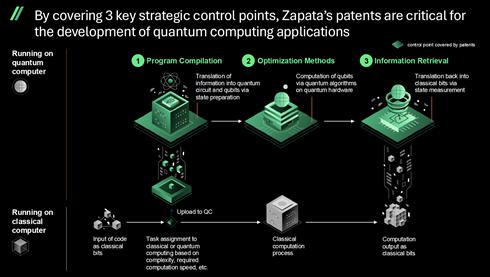

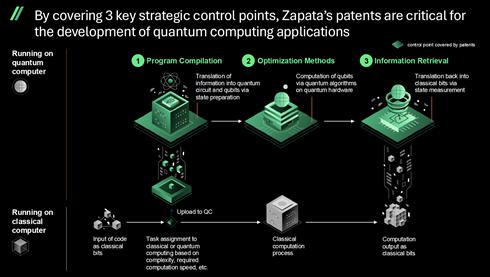

| • | Proprietary IP portfolio - More than 60 issued or pending patents across jurisdictions covering the critical control points of quantum computing - program compilation, optimization methods, and information retrieval - validated by third-party analysis as essential to the emerging quantum software ecosystem |

| • | Scientific leadership - A team of world-class researchers with deep roots in academic quantum computing, collectively holding dozens of publications and thousands of citations |

| • | AI integration - The use of generative-AI and agent-based methods to augment and automate the creation of quantum algorithms, enabling order-of-magnitude gains in efficiency |

These factors position Zapata as the leading pure-play publicly traded quantum software company.

| 4 |

Human Capital

As of October 31, 2025, Zapata had six employees, two of whom are full-time including its Chief Executive Officer. The Company intends to expand its headcount considerably upon raising future financing including the re-hiring of certain employees who were with the Company prior to its restructuring.

To date, Zapata has not experienced any work stoppages and maintains good working relationships with its employees. None of our employees are subject to a collective bargaining agreement or are represented by labor unions at this time.

Culture

Zapata’s culture is built around its people and network: a global cohort of accomplished scientists, engineers and business professionals. Zapata has, since its founding, demonstrated a commitment to hiring people from diverse backgrounds and locations.

One of Zapata’s core strengths is innovation, not only in its offerings, but also with the mindset of its people. Over the course of Zapata’s eight years in business, employees have, and continue to, organically collaborate in open forums with varying degrees of organization. Examples include, but are not limited to:

| • | Weekly science meetings where employees present their work; |

| • | Working groups where cross-functional group of employees converge to discuss how to move the platform forward; and |

| • | A book club, which rotates books and members and serves as a forum to have non-work-related discussions. |

Core Values

The company adheres to five core values:

| • | Integrity: The practice of being honest and showing a consistent and uncompromising adherence to strong moral, ethical, and scientific principles and values. |

| • | Revolutionary Mindset: An attitude towards changing established paradigms and looking for innovative solutions to problems. |

| • | Transparency: Operating in a way that makes it easy for others to see what actions are performed. This manifests itself in a culture of providing feedback and communicating clearly, recognizing our own mistakes, disagreeing in a constructive way. |

| • | Inclusiveness: The quality of including many different types of people and treating them all fairly and equally. We strive to be empathic and to appreciate the unique perspective of other people and teams at Zapata Quantum, their own needs and struggles, and to build processes that intentionally include a broad range of perspectives. |

| • | Thoughtfulness: Making ourselves aware of the needs and feelings of others and acting accordingly. Bringing new depth to solutions takes time and attention. We make decisions with a rounded view, considering the needs of all stakeholders and the impact it will have, with as much data as possible. |

Intellectual Property

Zapata Quantum’s platform is grounded in a broad and growing portfolio of intellectual property that secures its position as a leader in quantum software. The Company’s intellectual property (IP) strategy focuses on protecting core technologies that enable the efficient development, benchmarking, and deployment of quantum and hybrid applications across multiple hardware platforms.

As of October 31, 2025, Zapata Quantum held or had pending more than 60 patents worldwide, spanning the United States, Europe, Canada, Australia, and Israel. These patents and applications cover critical methods and systems that define the key control points in quantum software - including program compilation, optimization methods, and information retrieval between classical and quantum computing systems.

| 5 |

Representative Patents

| • | U.S. Patent No. 11,599,344 - Computer Architecture for Compiling Hybrid AI / Quantum Programs (QIR) - foundational compiler framework enabling concurrent classical-quantum execution through a Quantum Intermediate Representation (QIR). |

| • | U.S. Patent No. 11,615,329 - Hybrid Quantum-Classical Computer for Bayesian Inference - improves probabilistic inference by reducing measurement overhead and enhancing efficiency as hardware scales. |

| • | U.S. Patent No. 11,605,015 - Hybrid Quantum-Classical Computer System for Implementing and Optimizing Quantum Boltzmann Machines - supports hybrid learning models for generative AI and materials discovery. |

| • | U.S. Patent No. 11,663,513 - Quantum Computer with Exact Compression of Quantum States - reduces qubit requirements through mathematically exact state compression. |

| • | U.S. Patent No. 11,169,801 - Hybrid Quantum-Classical Computer for Variational Coupled Cluster Methods - pioneering VQE-based algorithm for molecular and materials simulation. |

| • | U.S. Patent No. 11,681,774 - Classically-Boosted Quantum Optimization System - enhances convergence speed of quantum optimization algorithms using classical heuristics |

The Company’s early and sustained investment in these domains established Zapata as one of the first companies to secure foundational intellectual property for hybrid quantum-classical computing. The Company believes its intellectual property represents a durable competitive advantage that will be increasingly difficult for competitors to replicate. Zapata continues to evaluate opportunities to assert, license, and expand its IP rights globally to maximize shareholder value and maintain leadership in quantum software innovation.

Research and Development

Research and development (“R&D”) are central to Zapata Quantum’s mission of advancing practical quantum computing. The Company’s R&D program focuses on the creation of scalable algorithmic frameworks, benchmarking methodologies, and AI-assisted development tools that enhance the performance and usability of its software platforms. These initiatives support both near-term hybrid computing and the transition to future fault-tolerant quantum systems.

Zapata’s R&D activities are carried out through close collaboration with government agencies, research consortia, leading universities, and quantum hardware providers. The Company has partnered with multiple academic and national research institutions worldwide, engaging in joint projects that span algorithm design, benchmarking, and system integration. These collaborations help validate Zapata’s technologies in real-world settings and ensure alignment with global scientific and industrial standards.

The Company is also supported by a Scientific Advisory Board composed of prominent researchers and technical leaders from across the globe who are recognized authorities in quantum information science, applied mathematics, and computational physics. This board provides guidance on long-term research directions, peer review of core technologies, and input on emerging scientific and policy trends affecting the quantum ecosystem.

Through these efforts, Zapata seeks to accelerate the development of useful quantum applications while deepening its intellectual-property base. The Company’s integrated research program - combining internal innovation, academic collaboration, and global scientific advisory oversight - positions it to contribute meaningfully to the advancement and commercialization of quantum computing technologies.

| 6 |

Legal Proceedings

From time to time, Zapata Quantum may be involved in legal proceedings and claims that arise in the ordinary course of business, including matters relating to intellectual-property protection, contracts, employment, or regulatory compliance. As of the filing of this report, the Company is not a party to any material pending legal proceeding that, if adversely determined, would have a material adverse effect on its financial position or results of operations.

Government Regulation

We may receive, store, and otherwise process personal information and other data from and about our customers, employees, and from other stakeholders like our vendors. There are numerous federal, state, provincial, local, and international laws and regulations regarding privacy, data protection, information security, and the storing, sharing, use, processing, transfer, disclosure, retention, and protection of personal information and other content, the scope of which is rapidly changing, subject to differing interpretations and may be inconsistent among regions, countries and states, or conflict with other legal requirements. We strive to comply with applicable laws, regulations, policies, and other legal obligations relating to privacy, data protection, and information security.

In addition, to the extent we operate in foreign markets, we will be subject to additional laws and regulations relating to those operations and the applicable jurisdictions, in addition to U.S. laws and regulations applicable to the conduct of business in foreign jurisdictions.

For a discussion of certain of the government regulations we currently or may in the future face in conducting our business and the risks and uncertainties relating thereto, see Item 1A – Risk Factors contained in this Report.

Item 1A. Risk Factors

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties that you should consider before investing in our common stock. Some of the principal risk factors that make an investment in the Company speculative or risky are summarized as follows:

Risks Related to our Financial Condition and Status as an Early Stage Company

| • | We will need additional capital to continue as a going concern. |

| • | We have a history of operating losses, which are expected to continue in the future. |

| • | We are an early stage company with a limited operating history in a nascent industry. |

| • | We may not be able to scale our business quickly enough to meet demand. |

| • | Our assets are pledged to the holders of the Secured Notes and we face risks related to the potential failure to repay obligations or any other default events. |

| • | We have identified material weaknesses in our internal control over financial reporting, and may fail to maintain an effective system of disclosure controls and internal control over financial reporting. |

| • | Our ability to use existing or future net operating loss carryforwards and other tax attributes may be limited. |

Risks Related to our Business and Industry

| • | Our business plan could suffer if we are not able to establish and grow contractual relationships with third parties or enter into certain important strategic partnerships. |

| • | Our business plan could suffer if we are not able to enter into important strategic partnerships. |

| • | We are highly dependent on our key employees. |

| • | The failure to attract and retain additional qualified personnel or to maintain our company culture could harm our business and prevent us from executing our business strategy. |

| • | Our business is dependent on growing and retaining qualified personnel. |

| • | Our estimate of market opportunities may prove to be inaccurate. |

| • | Our quantum computing application development solutions may not be widely accepted. |

| • | If the market for our quantum computing application development solutions fails to develop or grow as we expect, our business could be adversely affected. |

| • | Our business plan relies upon the adoption of our quantum computing application development solutions by enterprise customers. |

| • | We could fail to respond to rapid technological changes. |

| • | Would be negatively impacted by delays in development of our software platform. |

| • | Our success could be materially affected by problems with or defects in the Orquestra platform or our other software offerings. |

| • | The pursuit of inorganic growth opportunities could result in harm to our business. |

| 7 |

Risks Related to Competition

| • | Competitors may develop products and technologies that are superior to ours. |

| • | The quantum computing industry is highly competitive, and we may not be successful. |

| • | Our business plan depends on access to public clouds through major cloud providers |

| • | Our business plan depends on access to specialized hardware which we may struggle to access. |

Risks Related to Intellectual Property

| • | Our patent applications may not result in issued patents or our patent rights may be contested, circumvented, invalidated or limited in scope. |

| • | There is no guarantee that our IP will provide the desired competitive advantage. |

| • | We may face patent infringement and other intellectual property claims. |

| • | Our use of third-party open source software could negatively affect our sales efforts. |

| • | Use of open source software may result in be fewer technology barriers to entry. |

Risks Related to Government Regulation and Litigation

| • | We may fail to comply with United States and foreign laws related to privacy, data security, and data protection. |

| • | We are potentially subject to governmental export and import control laws. |

| • | We are subject to U.S. and foreign anti-corruption, anti-bribery, and similar laws. |

| • | We are exposed to risks associated with litigation and regulatory proceedings. |

Risks Outside Our Specific Business

| • | Our business relies on computer systems which are vulnerable to attack and/or failure. |

| • | Widespread damage to the global economy would likely adversely affect our business. |

| • | Risks Relating to Ownership of our Common Stock |

| • | Shares of Common Stock underlying outstanding securities will cause holders to experience substantial future dilution and downward price pressure. |

| • | The market price of our shares of Common Stock is subject to volatility. |

| • | There is currently a limited trading market for the Company’s Common Stock. |

| • | Common Stock is a “penny stock” and thereby is subject to additional restrictions. |

| • | As a former shell company, we face certain disadvantages relative to other companies. |

| • | We will incur significant increased costs as a result of being a public company. |

| • | Due to our size, we have a limited management team. |

| • | We do not currently intend to pay cash dividends on our Common Stock. |

| • | Certain provisions in our Certificate of Incorporation and Bylaws and Delaware law might may adversely affect us and/or certain investors. |

Investing in our Common Stock involves a high degree of risk. Investors should carefully consider the following Risk Factors before deciding whether to invest in the Company. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impair our business operations or our financial condition. If any of the events discussed in the Risk Factors below occur, our business, consolidated financial condition, results of operations or prospects could be materially and adversely affected. In such case, the value and marketability of our securities could decline.

Risks Related to Zapata’s Financial Condition and Status as an early-stage Company

We will need additional capital to continue as a going concern, implement our business plan or respond to business opportunities or unforeseen circumstances and such financing may not be available.

Through October 31, 2025, we have funded our operations primarily with proceeds from sales of preferred stock, promissory notes and warrants. Our continuation as a going concern is dependent upon our ability to effect or continue to identify future debt or equity financing and generate profitable operations from our operations. Management estimates needing to raise at least an additional $5 million to establish and continue operations over the next 12 months under our current business plan. There can be no assurance that such capital will be available in sufficient amounts or on terms acceptable to us. Further, the Company has not generated any revenue since September 2024, and does not expect to generate any revenue unless and until it can re-commence material operations which will be dependent on our ability to raise sufficient capital. These factors raise substantial doubt about our ability to continue as a going concern.

Our business plan also contemplates a substantial scaling of Zapata across all departments, including science, software engineering, and product design, in order to launch multiple products and/or offerings in a timely manner to obtain and preserve a competitive advantage. This scaling will require substantial capital at a time when we project we will be operating at a loss and in which we have limited capital and other resources with which to execute our business plan, and this process may take longer than we anticipate. Consequently, our expansion is limited in proportion to our growth in revenue and available capital, as well as by our limited personnel and infrastructure. The capital required to sustain our business during this period may be greater than anticipated. In addition, presently unforeseen opportunities or circumstances may require capital beyond what we currently project. The period during which we expect to operate at a loss may be extended by circumstances beyond our control.

| 8 |

We may obtain additional financing through public or private equity or debt financings (subject to the limitations under our outstanding agreements and debt instruments) that may result in dilution to stockholders, the issuance of securities with priority as to liquidation and/or dividend and other rights more favorable than the Common Stock, or the imposition of debt covenants and repayment obligations or other restrictions that may adversely affect our business. For example, as of October 31, 2025, we have outstanding an aggregate principal amount of $4 million in secured promissory notes (collectively, the “Secured Notes”). Included in the Secured Notes is a senior secured promissory note (in the aggregate principal amount of $1 million the “Senior Secured Note”). This Senior Secured Note, among other things, converts at the option of the holder at $8.50 per share of Common Stock and prohibits Legacy Zapata from issuing additional indebtedness and undertaking certain other actions, subject to limited exceptions, which may prevent or limit us from raising further capital or engaging in strategic transactions in the future. In addition, the other Secured Notes (the “2025 Notes”) have a total outstanding principal amount of $3 million, mature on June 12, 2026 (subject to acceleration upon the occurrence of certain customary events of default or a change of control), and bear 10% per annum interest. These 2025 Notes are convertible into shares of Common Stock at the option of the holder based on a conversion price of $0.04 per share, subject to certain adjustments. These 2025 Notes convert automatically upon the Company’s completion of a securities offering resulting in gross proceeds of at least $5 million. The Company also issued warrants to purchase a total of 37,500,000 shares of Common Stock to the investors of the 2025 Notes.

There is no guarantee that future financing will be at financial terms equal to or more favorable than those described above or that our existing indebtedness will not limit or prevent us from raising capital in the future, and we may need to enter into future equity or, if available, debt financing at significantly less favorable terms. Our failure to raise capital as and when needed would have a negative impact on our financial condition and our ability to pursue our business strategy.

We may also seek additional financing even if in our view such additional financing is not required in order to take advantage of favorable market conditions or for strategic considerations. There can be no assurance that additional financing will be available on favorable terms, or at all. The inability to obtain such additional financing if needed may adversely affect our ability to operate at the levels necessary to execute our business plan or may force us into bankruptcy.

We have a history of operating losses, which are expected to continue for the foreseeable future.

We have incurred significant operating losses since our inception. We incurred net losses of $38.2 million and $29.8 million during the years ended December 31, 2024 and 2023, respectively, and we have a cumulative deficit since the formation of Legacy Zapata in November 2017 through December 31, 2024 of approximately $127.7 million. Since 2024, we have continued to incur net losses. We believe that we will continue to incur operating and net losses each quarter at least for the foreseeable future. The size of future losses will depend on several factors, including the degree to which we seek to establish and expand our scientific, product, software engineering, sales and other teams, and the revenue that we can generate from sales of our quantum computing application development solutions. Our operating expenses have increased as a result of becoming a public company and we expect that our expenses will continue to increase as we grow our business, including hiring and re-hiring personnel as we seek to re-establish material operations as part of our ongoing restructuring efforts in 2025.

We are an early stage company with a limited operating history, in a nascent industry, making it difficult to forecast future results.

We were founded in 2017 to develop and provide software with related services and proprietary IP to utilize quantum math on classical and future quantum hardware. In late 2024, due to financial difficulties we temporarily suspended our operations. In June 2025, following restructuring efforts and conversion of certain outstanding indebtedness into equity, we shifted our business focus from artificial intelligence (AI) to quantum computing software and solutions. Our ability to re-establish material operations and generate revenue will be dependent upon our ability to access sufficient capital for such purpose. The market focus for our quantum computing application development solutions and the use of quantum math and algorithms are nascent fields with uncertainty on future market uptake and in technological progress in the field.

There can be no assurance that we can or will meet the challenges commonly faced by early stage companies, including the need to scale operations and to achieve and manage rapid growth. A number of factors could cause our efforts to be adversely impacted, including any inability to raise the necessary capital needed to re-establish material operations and pursue our business objectives, increased competition, lesser-than-expected growth or contraction of our overall market, our inability to accurately forecast demand for our customer offerings, our inability to establish sales or other partnerships with service firms, an inability to develop repeatable solutions, an inability to grow our team, or our failure, for any reason, to capitalize on growth opportunities. We have encountered and will encounter risks and uncertainties frequently experienced by early stage companies in rapidly changing industries, such as the risks and uncertainties described herein. We cannot provide assurance that we can meet the challenges faced by all companies, including established companies, in rapidly changing or nascent industries. The failure to address these challenges successfully or promptly could have a material adverse effect on our future operating results and financial condition.

| 9 |

We may not be able to scale our business and quantum computing application development solutions quickly enough to meet customer and market demand and to remain competitive in the market for quantum computing application development solutions.

In order to establish and grow our business, we will need to re-establish and scale material operations in every area from our existing start-up capacity. These challenges will require that we:

| • | scale our product design team to design and continually re-design our quantum computing application development solutions in order to maintain a competitive position in the market, including increasing the number of employees following our previous reductions in force; |

| • | increase the size of our software engineering team to produce in a competitively timely manner stable quantum computing application development solutions based on the chosen design elements; |

| • | increase the size of our services team to provide ongoing services in connection with our quantum computing application development solutions; |

| • | expand our customer-support services; |

| • | expand our scientific research and development in order to generate IP required or helpful to our business, including IP to develop our quantum computing application development solutions, to provide freedom to operate for our quantum computing application development solutions, and to create barriers to competition, on an accelerated time frame in order to minimize the risk that third-parties might first create potentially blocking IP; |

| • | increase our sales and marketing teams and efforts; |

| • | develop and expand relationships with large service firms to leverage sales of our quantum computing application development solutions; |

| • | develop and expand our operational, financial and legal systems and teams to accommodate increases in customer and partner relationships and additional legal requirements we will face as a result of international data privacy regulations, securities compliance and reporting obligations; |

| • | establish, maintain and scale effective financial disclosure controls and procedures; |

| • | expand our executive and administrative teams in all areas including finance, accounting, operations, human resources, and legal, in order to effectively manage our growth; and |

| • | expand our access to computing hardware and specifically Graphics Processing Unit chips (“GPUS”), which have faced supply limitations. |

If we cannot successfully overcome these challenges and manage the organizational growth required to do so, then our business, including our ability to establish and maintain a competitive place in the market, financial condition, and profitability, may be materially adversely affected.

Our assets are pledged to the holders of the Secured Notes and failure to repay obligations to these noteholders when due, or any other default events, will have a material adverse effect on our business and could result in foreclosure on these assets.

In connection with the issuance of Secured Notes, the Company entered into Security Agreements and an Intercreditor Agreement with Acquiom Agency Services LLC as collateral agent on behalf of the noteholders (collectively, the “Security Agreement”). The Security Agreement creates a security interest in all of the property of Zapata and its subsidiaries, subject to certain exceptions specified in the Security Agreement (the “Collateral”). Pursuant to the Security Agreement, each of Zapata Computing, Inc. and Zapata Government Services, Inc. has agreed to guarantee the obligations of the Company under the Security Agreement and the Secured Notes.

Upon the occurrence of an Event of Default under the Security Agreement, the collateral agent will have certain rights under the Security Agreement, including the right to take control of the Collateral and, in certain circumstances, sell the Collateral to cover obligations owed to the holders of the Secured Notes pursuant to its terms. “Event of Default” under the Security Agreement means (i) any default of the terms, conditions or covenants of the Security Agreement (after giving effect to any applicable grace or cure period) and any event of default under the Secured Notes, which includes any failure to pay any principal or interest payment on the due date or any other payments required under the terms of the Secured Notes, a breach of any other covenant under the Secured Notes, and entering into any voluntary or involuntary bankruptcy or insolvency proceedings. Any such default would have a material adverse effect on Legacy Zapata’s and, by extension, our, business and our stockholders could lose their entire investment in us.

If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired.

As a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, including regular attestations by management concerning its internal control over financial reporting. Management may not be able to effectively and timely implement controls and procedures that adequately respond to these increased regulatory compliance and reporting requirements. If we are not able to implement the additional requirements of Section 404 of the Sarbanes-Oxley Act (“Section 404”) in a timely manner or with adequate compliance, we may not be able to assess whether our internal control over financial reporting is effective and may fail to provide timely and accurate financial information to investors. This may subject us to adverse regulatory consequences and could harm investor confidence. We expect that the requirements of these rules and regulations will continue to increase our legal, accounting, and financial compliance costs, make some activities more difficult, time consuming, and costly, and place significant strain on our personnel, systems, and resources. We will need to hire additional accounting and financial personnel in order to achieve these goals.

| 10 |

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. The controls required are not currently in place; however, we are working to develop and refine our disclosure controls and other procedures that are designed to ensure that information required to be disclosed by us in the reports that we will file with the SEC is recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms and that information required to be disclosed in reports under the Exchange Act is accumulated and communicated to our principal executive and financial officers. We are also working to design and maintain our internal control over financial reporting.

Our current controls and any new controls that we develop may be inadequate because of changes in conditions in our business. In addition, changes in accounting principles or interpretations could also challenge our internal controls and require that we establish new business processes, systems, and controls to accommodate such changes. We have limited experience with implementing the systems and controls that will be necessary to operate as a public company, as well as adopting changes in accounting principles or interpretations mandated by the relevant regulatory bodies. Additionally, if these new systems, controls, or standards and the associated process changes do not give rise to the benefits that we expect or do not operate as intended, it could adversely affect our financial reporting systems and processes, the effectiveness of internal control over financial reporting, and/or our ability to produce timely and accurate financial reports. Moreover, our business may be harmed if we experience problems with any new systems and controls, resulting in delayed implementation or increased costs to correct any issues.

Further, in addition to the material weaknesses described in the Risk Factor which follows and elsewhere in this Report, weaknesses in our disclosure controls and internal control over financial reporting may be discovered in the future. Any failure to develop or maintain effective controls or any difficulties encountered in their implementation or improvement could harm our business or cause us to fail to meet our reporting obligations. That failure could result in a restatement of our financial statements for prior periods. Any failure to implement and maintain effective internal control over financial reporting could adversely affect the results of periodic management evaluations and annual independent registered public accounting firm attestation reports regarding the effectiveness of our internal control over financial reporting. Those reports will eventually be included in our periodic reports filed with the SEC. Ineffective disclosure controls or internal control over financial reporting could also cause investors to lose confidence in our reported financial and other information, which would likely have a negative effect on the trading price of our Common Stock.

Any failure to maintain effective disclosure controls and internal control over financial reporting could harm our business and could cause a decline in the trading price of our Common Stock.

We have identified material weaknesses in our internal control over financial reporting. If we are unable to remediate these weaknesses, identify additional material weaknesses in the future, or otherwise fail to maintain an effective system of internal control over financial reporting, this may result in misstatements in our financial statements, cause us to fail to meet periodic reporting obligations, or cause our access to capital markets to be impaired.

In connection with the preparation and audit of our financial statements as of and for the year ended December 31, 2024, material weaknesses have been identified in its internal control over financial reporting. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

The material weaknesses we identified include:

| • | The Company does not have sufficient segregation of duties within accounting functions, as its Chief Executive Officer is the sole officer as of the date of this Report. |

| • | The Company does not have sufficient or complete written documentation of our internal controls policies and procedures. |

| • | A substantial portion of the Company’s financial reporting is carried out by an outside accounting firm. |

| • | The Company’s human resources, processes and systems are not sufficient to enable the production of timely and accurate financial statements in accordance with US GAAP. |

These material weaknesses could result in a misstatement of account balances or disclosures that would result in a material misstatement to our combined annual or interim financial statements that would not be prevented or detected.

| 11 |

In an effort to remediate the material weaknesses, we have retained an accounting consulting firm to provide additional depth and breadth to our technical accounting and financial reporting capabilities. We intend to engage internal control consultants to assist us in performing a risk assessment to identify relevant risks and specify needed objectives. With their assistance, we intend to formalize and communicate our policies and procedures surrounding our financial close, financial reporting and other accounting processes, and to further develop and document necessary policies and procedures regarding our internal control over financial reporting, such that we are able to perform a Section 404 analysis of our internal control over financial reporting when and as required. We cannot assure that these measures will significantly improve or remediate the material weaknesses described above. We also cannot assure that we have identified all or that we will not have additional material weaknesses in the future. Accordingly, a material weakness may still exist when we report on the effectiveness of our internal control over financial reporting for purposes of our management’s required attestation. Further, while we remain an emerging growth company, we will not be required to include an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

We have incurred and expect to incur additional costs to remediate these control deficiencies, though there can be no assurance that our efforts will be successful or that we will avoid potential future material weaknesses. If we are unable to successfully remediate our existing or any future material weaknesses in our internal control over financial reporting, or if we identify any additional material weaknesses, the accuracy and timing of our financial reporting may be adversely affected, we may be unable to maintain compliance with securities law requirements regarding timely filing of periodic reports in addition to applicable stock exchange listing requirements, investors may lose confidence in our financial reporting, and our stock price may decline as a result. We also could become subject to investigations by the SEC or other regulatory authorities.

Our ability to use existing or future net operating loss carryforwards and other tax attributes may be limited.

We have incurred net operating losses (“NOLs”) for tax purposes for each year since our incorporation and we expect to continue to operate at a loss for the foreseeable future. As of December 31, 2024 we had a cumulative U.S. federal carryforward of approximately $68.8 million and a cumulative state NOL carryforward of approximately $39.7 million. If not utilized, the state NOLs will expire at various dates through 2044. The U.S. federal NOLs generated after 2017 can be carried forward indefinitely. Under the Code, the deductibility of the U.S. federal NOL carryforward as of December 31, 2024 and all future U.S. federal NOL carryforwards is limited to 80% of taxable income, limiting or delaying in part the use of NOL carryforwards if and when we cease operating at a loss. We may potentially use these U.S. federal and state NOLs to offset taxable income for U.S. federal and state income tax purposes. However, the use of these NOLs may be subject to numerous limitations under the Code and under state tax laws. Among such limitations, Section 382 of the Code may limit the use of these NOLs in any year for U.S. federal income tax purposes in the event of certain past or future changes in ownership of us or Legacy Zapata. An ownership change under Section 382 of the Code, referred to in this discussion as an ownership change, generally occurs if one or more stockholders or groups of stockholders who own at least 5% of a company’s stock increase their ownership by more than 50 percentage points over their lowest ownership percentage within a rolling three-year period. We have not conducted a Section 382 study to determine whether the use of our NOLs is impaired under Section 382 of the Code as a result of any prior ownership change. We may have previously undergone one or more ownership changes. An ownership change in respect of us also could be deemed to be an ownership change in respect of Legacy Zapata. The Merger, or future issuances or sales of our securities, including certain transactions involving our securities that are outside of our control, could result in ownership changes. Ownership changes that have occurred in the past or that may occur in the future could result in the imposition of an annual limit under Section 382 of the Code on the amount of pre ownership change NOLs and other tax attributes that we or Legacy Zapata could use to reduce our taxable income, potentially increasing or accelerating its liability for income taxes, and also potentially causing those tax attributes to expire unused.

States may impose similar limitations on the use of applicable NOLs. We have recorded a valuation allowance related to NOL carryforwards and other deferred tax assets due to the uncertainty of the ultimate realization of the future benefits of those assets.

Any limitation on using NOLs, whether under Section 382 of the Code or otherwise under U.S. federal or state tax laws, could, depending on the extent of such limitation and the NOLs previously used, result in Legacy Zapata or us retaining less cash after payment of U.S. federal and state income taxes in respect of any year in which we have taxable income, rather than losses, than we would be entitled to retain if such NOLs were available as an offset against such income for U.S. federal and state income tax reporting purposes, which could adversely impact our operating results.

| 12 |

Risks Related to our Business and Industry

Failure of quantum computing solutions in general and our quantum computing application development solutions in particular to satisfy customer demands or to achieve increased market acceptance would adversely affect our business, results of operations, financial condition, and growth prospects, and the current state of the quantum computing industry is still new and rapidly evolving, so there is no guarantee that it will succeed.

When we re-commence material operations, we expect to derive substantially all of our revenue from our quantum computing application development software and related services. Accordingly, the market acceptance of quantum computing in general - and our quantum computing solutions in particular - is critical to our continued success.

The market for quantum computing is still in its early stages and is rapidly evolving. Adoption depends on customer awareness of the potential benefits of quantum computing over classical methods, the continued progress of underlying hardware, and the availability of practical quantum algorithms and workflows. There is no assurance that quantum computing will achieve large scale commercial viability or that customers will adopt our products at the rate or in the manner we anticipate.

Demand for our solutions is affected by factors largely beyond our control, including the pace of hardware advancement, competitive product introductions, data-security and regulatory considerations, and general macroeconomic conditions. Further, the use of quantum technology is not widespread and is generally limited to certain specific types of organizations and activities, and our prospective customer base will therefore be limited. We expect the needs of our customers to continue to evolve and grow in complexity as the industry progresses toward fault-tolerant quantum computing. To remain competitive, we must continually enhance the functionality, performance, and usability of our software and services to meet these changing demands.

If the market fails to achieve broad acceptance of quantum computing or our application development solutions do not meet with sufficient customer demand, or if we fail to keep pace with rapid technological change, our business, operating results, and growth prospects could be materially and adversely affected.

While significant progress has been made in advancing quantum hardware, the commercial utility of quantum computing remains largely unproven. As the technology is applied to new domains such as chemistry, materials science, optimization, cryptography, and machine learning, it is possible that performance gains may be more limited than current forecasts suggest. Techniques we or others develop could quickly become obsolete as new methods or architectures emerge. Because many of our competitors are larger companies with greater resources, they may be able to incorporate new techniques or access next-generation hardware more rapidly than we can.

There can also be no assurance that our analysis of the eventual market need for quantum computing is correct. If our assessment proves inaccurate, the future value of our products and services, our competitive position, and our profitability could be materially lower than we currently anticipate.

Our business plan could suffer if we are not able to establish and grow contractual relationships with third parties or enter into certain important strategic partnerships, and if we are unable to ensure that our quantum computing application development solutions interoperate with computing hardware or software that are developed by others, we may become less competitive and our resulting operations may be harmed.

As a quantum computing application development company, our solutions must provide our customers with the ability to use products of third parties, such as quantum processors and classical computing resources, which we do not manufacture. The cost or availability of these dependencies could be adversely affected by a variety of factors, including the transition to a clean energy economy, local and regional environmental regulations, and geopolitical disruptions. Our quantum computing application development solutions must integrate with a variety of hardware and software platforms, and we need to continuously modify and enhance our quantum and classical software libraries to adapt to changes in hardware and software technologies. In particular, we have developed our quantum development frameworks to be able to easily integrate with key third-party applications, including the applications of software providers that compete with us as well as our partners. In general, we are and will be subject to standard terms and conditions of such providers and open source licenses, which govern the distribution, operation, and fees of such software systems, and which are subject to change by such providers from time to time. Our business will be harmed if any provider of such software systems:

| • | discontinues or limits our access to its software; |

| • | modifies its terms of service or other policies, including fees charged to, or other restrictions on us, or other platform and application developers; |

| • | changes or modifies its open source license; |

| • | changes how information is accessed by us or our customers; |

| • | establishes more favorable relationships with one or more of our competitors; or |

| • | develops or otherwise favors its own competitive offerings over AI software libraries. |

| 13 |

Third-party services and products are constantly evolving, and we may not be able to modify our quantum computing application development solutions to assure their compatibility with that of other third parties as they continue to develop or emerge in the future or we may not be able to make such modifications in a timely and cost-effective manner. In addition, some of our competitors may be able to disrupt the operations or compatibility of our quantum development frameworks with their products or services, or exert strong business influence on our ability to, and terms on which we, operate our quantum computing application development solutions. Should any of our competitors modify their products or standards in a manner that degrades the functionality of our quantum development frameworks or gives preferential treatment to our competitors or competitive products, whether to enhance their competitive position or for any other reason, the interoperability of our quantum computing application development solutions with these products could decrease and our business, results of operations, and financial condition would be harmed. If we are not permitted or able to integrate with these and other third-party applications in the future, our business, results of operations, and financial condition would be harmed.

Our business plan could suffer if we are not able to enter into important strategic partnerships.

As part of our growth plans, we expect to expand, sell to, with, and through partners, including developing repeatable solutions built with services firms, and developing partnerships with hardware providers, system integrators and consulting services firms. However, our relationships with these partners may not result in additional business. If we are unable to enter into beneficial and contractual strategic partnerships, or further its relationship with existing partners, or is unable to do so on favorable terms, then its growth could be limited or delayed.

If we cannot manage our growth effectively, we may not become profitable.

Businesses, including development stage companies such as ours which often grow rapidly, tend to have difficulty managing their growth. If we are able to successfully market our products and services, we will likely need to expand our management team and other key personnel by recruiting and employing experienced executives and key employees and/or consultants capable of providing the necessary support.

As described elsewhere in this Report, we are in the process of developing and/or pursuing business plans for relatively novel technology in an industry that remains in its infant stages, and which involves a unique business model and would take substantial time and resources to execute and develop into a revenue generating enterprise. We cannot assure you that our management will be able to manage our growth effectively or successfully. Our failure to meet these challenges could cause us to lose money, and your investment could be lost.

We are highly dependent on our key employees.