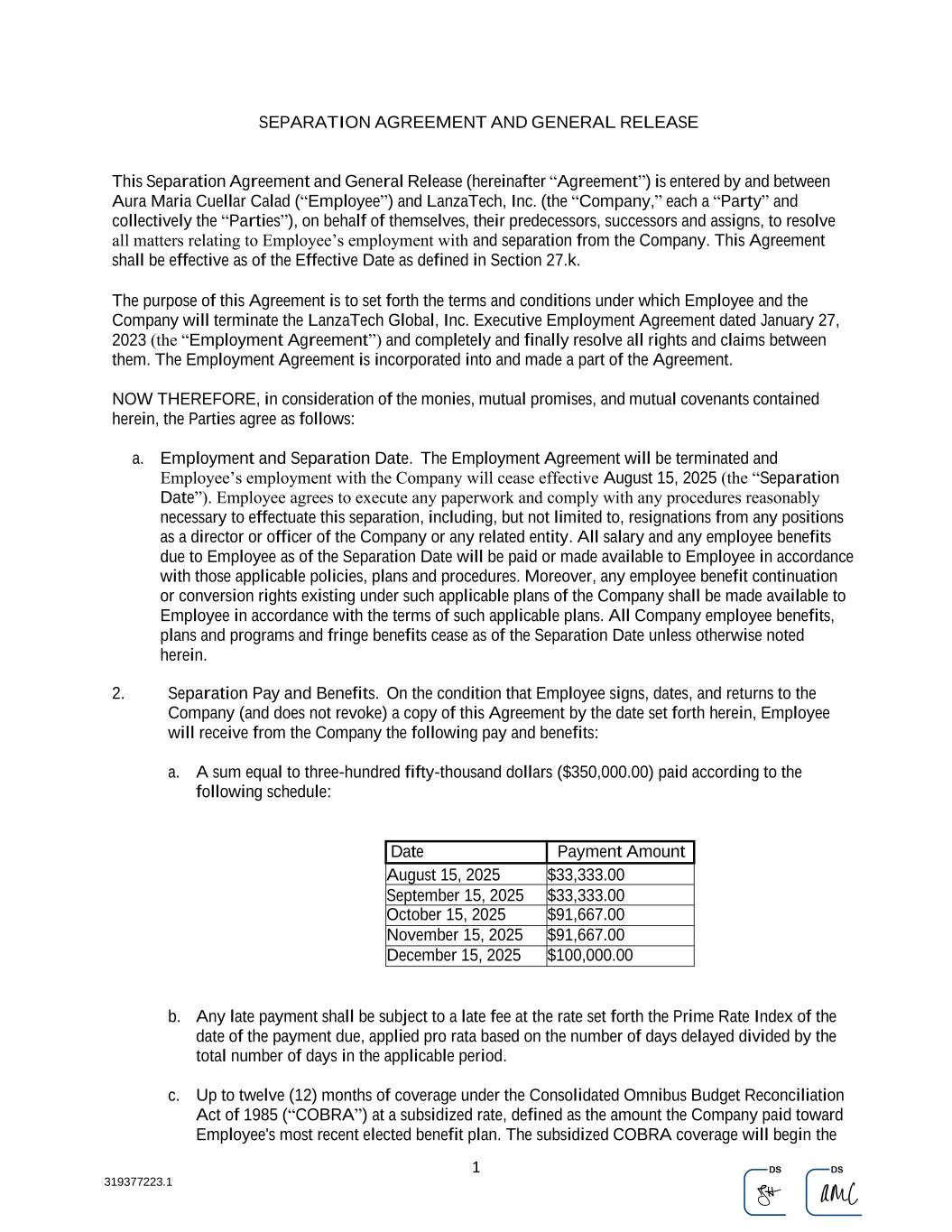

1 319377223.1 SEPARATION AGREEMENT AND GENERAL RELEASE This Separation Agreement and General Release (hereinafter “Agreement”) is entered by and between Aura Maria Cuellar Calad (“Employee”) and LanzaTech, Inc. (the “Company,” each a “Party” and collectively the “Parties”), on behalf of themselves, their predecessors, successors and assigns, to resolve all matters relating to Employee’s employment with and separation from the Company. This Agreement shall be effective as of the Effective Date as defined in Section 27.k. The purpose of this Agreement is to set forth the terms and conditions under which Employee and the Company will terminate the LanzaTech Global, Inc. Executive Employment Agreement dated January 27, 2023 (the “Employment Agreement”) and completely and finally resolve all rights and claims between them. The Employment Agreement is incorporated into and made a part of the Agreement. NOW THEREFORE, in consideration of the monies, mutual promises, and mutual covenants contained herein, the Parties agree as follows: a. Employment and Separation Date. The Employment Agreement will be terminated and Employee’s employment with the Company will cease effective August 15, 2025 (the “Separation Date”). Employee agrees to execute any paperwork and comply with any procedures reasonably necessary to effectuate this separation, including, but not limited to, resignations from any positions as a director or officer of the Company or any related entity. All salary and any employee benefits due to Employee as of the Separation Date will be paid or made available to Employee in accordance with those applicable policies, plans and procedures. Moreover, any employee benefit continuation or conversion rights existing under such applicable plans of the Company shall be made available to Employee in accordance with the terms of such applicable plans. All Company employee benefits, plans and programs and fringe benefits cease as of the Separation Date unless otherwise noted herein. 2. Separation Pay and Benefits. On the condition that Employee signs, dates, and returns to the Company (and does not revoke) a copy of this Agreement by the date set forth herein, Employee will receive from the Company the following pay and benefits: a. A sum equal to three-hundred fifty-thousand dollars ($350,000.00) paid according to the following schedule: Date Payment Amount August 15, 2025 $33,333.00 September 15, 2025 $33,333.00 October 15, 2025 $91,667.00 November 15, 2025 $91,667.00 December 15, 2025 $100,000.00 b. Any late payment shall be subject to a late fee at the rate set forth the Prime Rate Index of the date of the payment due, applied pro rata based on the number of days delayed divided by the total number of days in the applicable period. c. Up to twelve (12) months of coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”) at a subsidized rate, defined as the amount the Company paid toward Employee's most recent elected benefit plan. The subsidized COBRA coverage will begin the Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

2 319377223.1 first (1st) day of the month following the Separation Date and continuing through August 31, 2026. Employee will receive COBRA information following the Separation Date. To continue Employee’s coverage, Employee must file the required election form and timely pay the required premiums. If Employee elects to continue COBRA coverage beyond the twelve (12) months of subsidized coverage contemplated in this Agreement, Employee will be responsible for payment of full COBRA premiums. This benefit is only available if Employee is not receiving primary benefits through another employer or spouse. d. An annual bonus payment (if any) for 2025 equal to the annual bonus Employee would have received in accordance with Section 3(b) (Annual Bonus) and Section 7(b)(ii) (Compensation and Benefits upon Termination) of the Employment Agreement. The annual bonus will be based on the actual performance of the Company and/or the Employee, as applicable, multiplied by a fraction, the numerator of which is the number of days the Employee was employed during 2025, including the termination date, and the denominator of which is 365. e. The opportunity to work with LanzaTech as an independent contractor pursuant to the terms of the Consulting Agreement provided to Employee. All legally required taxes, deductions and any monies owed to the Company shall be deducted from the payments identified above. Employee will begin receiving the payments specified above on the Company’s first payroll cycle following the Effective Date this Agreement, provided all conditions contained in this Agreement have been met. The compensation and benefits described in Sections 1 and 2 are being offered in consideration of the promises and releases contained in the Agreement and are not normally provided to employees upon termination or resignation of employment. The foregoing constitutes full and fair consideration for all agreements, promises, and representations contained in this Agreement (including specifically the release of claims contained in Section 4). 3. Employee Acknowledgements. Employee acknowledges that the Company has paid all sums owed to Employee, including, but not limited to, all wages and/or salary, business expenses, allowances, vacation pay and other benefits and perks as a result of his/her employment with the Company and/or the separation of that employment or that such amounts are contemplated in this Agreement and will be paid as stated herein. Except as otherwise provided herein, Employee further acknowledges that in the absence of this Agreement, Employee would not be entitled to, among other things, the payments and benefits specified in Sections 2 above. Employee further acknowledges that she has no rights under any transition, severance, bonus or incentive plan, program, or arrangement except as specified herein, and she hereby waives any rights thereto. 4. Release by Employee and Company. Release of Claims by Employee: In exchange for the promises and agreements contained herein and the payment and benefits described in Section 2 above, Employee hereby irrevocably and unconditionally releases, holds harmless and discharges the Company and its affiliates, predecessors, successors, assigns, parents, subsidiaries, employee benefit plans and all other related business entities, and each of their respective past, present and future employees, owners, officers, directors, agents, insurers, fiduciaries, partners, attorneys and/or representatives (collectively, “Employer”) from any and all charges, complaints, claims, grievances, liabilities, obligations, promises, agreements, controversies, damages, disability benefits, medical and hospital expenses, actions, causes of action, suits, rights, demands, costs, losses, debits and expenses of any nature whatsoever, whether known or unknown, suspected or unsuspected, vested or contingent, and whether concealed or hidden, which Employee has against the Employer up to the date of this Agreement by reason of any and all acts, omissions, events, transactions, circumstances or facts existing or occurring up to the date hereof, including, but not limited to, claims related to Employee’s offer of employment, pay (including, but not limited to, payment Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

3 319377223.1 pursuant to any practice, policy, handbook, or manual of the Employer), commissions, hours, bonuses, pension, disability, physical or mental affliction, wrongful discharge, breach of contract (whether express or implied), breach of the implied covenant of good faith and fair dealings, benefits including vacation days and payment for unused vacation, terms and conditions of employment, attorney fees or costs, potential per quo claims by Employee’s spouse, any claim for fraud, negligent or intentional representation, defamation and claims of retaliation or discrimination on account of age, race, color, sex, sexual orientation, marital status, disability, national origin, citizenship and religion, including any and all claims arising under the Age Discrimination in Employment Act, 29 U.S.C. 621, et seq.; Title VII of the Civil Rights Act of 1964, 42 U.S.C. §§ 2000 et seq.; the Civil Rights Act of 1866, 42 U.S.C. § 1981; the Civil Rights Act of 1991, Pub. L. No. 102-166; the National Labor Relations Act, 29 U.S.C. §§ 151, et seq.; the Rehabilitation Act of 1973, 29 U.S.C. §§ 701, et seq.; the Equal Pay Act, 29 U.S.C. §§ 206(d), et seq.; Federal Executive Order 11246; the Family and Medical Leave Act, 29 U.S.C. §§ 2601 et seq.; the Americans with Disabilities Act, 42 U.S.C. §§ 12101, et seq.; the Employee Retirement Income Security Act, 29 U.S.C. §§ 1001, et seq.; the Fair Labor Standards Act, 29 U.S.C. §§ 201, et seq.; the Sarbanes-Oxley Act; the Dodd-Frank Wall Street Reform and Consumer Protection Act; the Illinois Wage Payment and Collection Act, 820 ILCS 115, et seq., or any similar state wage and hour law; the Illinois Human Rights Act or any other state anti- discrimination law; the Right to Privacy in the Workplace Act, the Illinois Worker Adjustment and Retraining Notification Act, the Illinois One Day Rest in Seven Act, the Illinois Union Employee Health and Benefits Protection Act, the Illinois Employment Contract Act, the Illinois Labor Dispute Act, the Victims' Economic Security and Safety Act, the Illinois Whistleblower Act, the Illinois Equal Pay Act, the Illinois Biometric Information Privacy Act, the Federal Worker Adjustment and Retraining Act; the Fair Credit Reporting Act; the Immigration Reform Control Act; the Occupational Safety and Health Act; the Uniformed Services Employment and Reemployment Rights Act; the Genetic Information Nondiscrimination Act; and/or any other federal, state, or local statute, ordinance, regulation, order or common law, contract, implied contract, public policy, or tort or in any way resulting from Employee’s employment with the Employer or the separation of her employment from the Employer; any claims under local statutes and ordinances that may be legally waived and released, all including any amendments and their respective implementing regulations, and any other state or local law (statutory, regulatory, or otherwise) that may be legally waived and released; however, the identification of specific statutes is for purposes of example only, and the omission of any specific statute or law shall not limit the scope of this general release in any manner. The Release of Claims by Employee immediately above excludes: Employee’s rights to defense and indemnification pursuant to applicable directors and officers insurance coverage and pursuant to the Company’s Articles of Incorporation and bylaws with respect to any and all claims made against Employee based on her prior employment with the Company and/or performance of duties as a member of the Board of Directors or as an officer of the Company or its affiliates; any claims arising after Employee signs this Agreement; claims for breach of this Agreement; and claims that cannot be waived, such as for unemployment or worker’s compensation. Employee, nonetheless, gives up all rights to recover money or other individual relief from the Employer in connection with any administrative charge, whether filed by Employee or another person, agency or other entity; or any class, collective or other representative action. However, neither the general release nor anything else in this Agreement limits Employee’s rights to file a charge with any administrative agency or to participate in an agency investigation or other administrative proceeding. However, Employee gives up all rights to any money or other personal benefit from any administrative charge, investigation, or proceeding. Release of Claims by Company. In exchange for the promises and agreements of Employee contained herein, the Company, its affiliates, predecessors, successors, assigns, parents, subsidiaries, employee benefit plans and all other related business entities (the “Employer”), hereby Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

4 319377223.1 irrevocably and unconditionally releases, holds harmless and discharges Employee and Employee’s spouse from any and all complaints, claims, grievances, liabilities, obligations, promises, agreements, controversies, damages, actions, causes of action, suits, rights, demands, costs, losses, debits and expenses of any nature whatsoever, whether known or unknown, suspected or unsuspected, vested or contingent, and whether concealed or hidden, which the Employer has against the Employee up to the date of this Agreement by reason of any and all acts, omissions, events, transactions, circumstances or facts existing or occurring up to the date hereof, including, but not limited to, claims related to Employee’s employment, prior service as an officer or as a member of Employer’s Board of Directors, including, but not limited to any claims against Employee for breach of the Employment Agreement or other contracts between the Employer Employee, any breach of Employer’s Articles of Incorporation or bylaws, and any and all claims against Employee arising under local, state or federal laws, regulations, ordinances and state or federal common law claims, inclusive of claims for damages, punitive damages, penalties, injunctive relief and attorney’s fees. The Release of Claims by Company immediately above excludes: Claims for breach of this Agreement and claims that cannot legally be waived.. 5. All Claims Waived. Employee and Employer understand that each is releasing claims Employee and Employer may not know about (including, for example, monetary damages or reinstatement). Releasing such claims is Employee’s and Employer’s knowing and voluntary intent, even though Employee and Employer recognize that someday Employee or Employer might regret having signed this Agreement. Nevertheless, Employee and Employer are assuming that risk and agree that this Agreement shall remain effective in all respects in any such case. Employee and the Employer expressly waives all rights Employee or Employer might have under any law that is intended to protect Employee or Employer from waiving unknown claims, including those listed in Section 4 above. 6. Employee Affirmation Regarding Benefits. Employee understands and acknowledges that Employee shall not be entitled to any benefits from Company other than those expressly set forth in Sections 2 above and any vested stock awards and other vested benefits earned under employee benefit plans through the Separation Date. 7. Reimbursements. Employee will be reimbursed for outstanding business expenses in accordance with the Company’s standard procedures. Employee will have thirty (30) days from the Separation Date to submit all outstanding business expenses, if any, with appropriate documentation for reimbursement by the Company. Failure to submit documented expenses for reimbursement within this time period will be considered a representation by Employee that Employee has been reimbursed for all business expenses. 8. No Existing or Pending Claims. Employee and Employer agree not to seek or accept any monetary award or settlement from any source or proceeding (including, but not limited to, any proceeding brought by any other person or by any government agency) with respect to any claim or other claim released by this Agreement, and Employee and Employer also represents that, as of the date Employee and Employer execute this Agreement, Employee and Employer have not commenced any proceedings or filed any claim, charge, or complaint of any kind with any federal, state, or local court, administrative agency, or arbitral forum based on any claims or matters waived in this Agreement. 9. Covenant Not to Sue. Employee and the Company hereby represent that they have not filed and will not file any local, state or federal lawsuits, complaints, charges, and/or claims based on or arising out of Employee’s employment with the Company to date, or the termination thereof, or any other matters with respect to Employee’s employment at the Company at any time before the date Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

5 319377223.1 of this Agreement. Employee and the Company acknowledge and agree that the covenant not to file any suit, claim or complaint is an essential and material part of this Agreement and that without its inclusion, this Agreement would not have been reached by the Parties. 10. No Admission of Liability. It is understood that this Agreement does not constitute an admission by Employer or Employee of any violation of any federal, state or municipal statutory or common law. Neither this Agreement nor anything in this Agreement shall be construed to be or shall be admissible in any proceeding as evidence of wrongdoing by the Employer or Employee. Further, the Employer and Employee specifically deny any wrongdoing and disclaim any liability to or wrongful acts against Employee or Employer. 11. Separation Confidentiality. Employee agrees not to disclose the terms of this Agreement to anyone other than her spouse, her attorneys and her financial advisors, except when required by law or valid subpoena. Aside from the noted exceptions, Employee further agrees to advise her spouse, her attorneys and her financial advisors as to the terms of this section, to instruct her spouse, her attorneys and her financial advisors not to disclose the terms and existence of this Agreement to anyone else and to be responsible for any violation by any person to whom he/she has disclosed any portion of the Agreement. Nothing in this paragraph limits Employee from exercising rights under Section 7 of the National Labor Relations Act or similar state law to engage in protected, concerted activity with other employees. The Parties acknowledge that nothing in this Agreement restricts Employee’s right to: (a) report any good faith allegation of unlawful employment practices to any appropriate federal, state, or local government agency that enforces anti-discrimination laws; (b) report any good faith allegation of criminal conduct to any appropriate federal, state, or local official; (c) participate in a proceeding with any appropriate federal, state, or local government agency that enforces anti-discrimination laws; (d) make any truthful statements or disclosures required by law, regulation, or legal process; (e) request or receive confidential legal or financial advice; (f) discuss or disclose information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful. 12. Return of Property. At a time agreed by the Company and the Employee on or before the Separation Date, Employee will account for and return to the Company all property belonging to the Company that is in Employee’s possession with the exception of any property identified in the Consulting Agreement, which shall be returned as set forth therein. This property includes (but is not limited to) laptop and personal computers (and related equipment and software), keys, identification cards and/or badges, credit cards, cell phones, electronically stored and physical correspondence, files, reports, plans, records, surveys, diagrams, and client/customer documentation. 13. Non-Disclosure. Employee acknowledges and agrees that, in performance of Employee’s duties for the Company, Employee received certain non-public information (“Confidential Information”) that may have included (but is not limited to) any or all of the following: any proprietary or non- public information that relates to the actual or anticipated business or research and development of Company, technical data, trade secrets or know-how, including, but not limited to, research, product plans or other information regarding the Company’s products or services and their markets, customer lists and customers, software, developments, inventions, processes, formulas, technology, designs, drawing, engineering, hardware configuration information, marketing, finances or other business information. Employee agrees to continue to be bound by the duty of confidentiality set out in the “Employee Proprietary Information and Inventions Agreement” signed by the Employee, a copy of which is included with this agreement, and not to share the Confidential Information following the Separation Date or at any time thereafter. All Confidential Information shall remain the property of the Company. 14. Cooperation Clause. Employee agrees that, as requested by the Company or its counsel, Employee Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

6 319377223.1 will provide reasonable cooperation to the Company and its counsel in conducting any internal investigation, responding to or participating in any investigation or inquiry by any governmental, regulatory, or law enforcement agency, or defending the Company against any current or future regulatory action, administrative charge, or lawsuit. For example, upon request by the Company or its counsel, Employee will promptly and fully respond to all inquiries, will promptly provide all information or documents relevant to the subject matter of the inquiry, and will testify in connection with any regulatory administrative action, or any lawsuit, including at deposition, a hearing, arbitration, or trial. Such cooperation further includes, but is not limited to, declarations and assignments for filing patent applications in the United States and foreign countries. However, the Employee’s cooperation will at all times be subordinate to Employee’s personal commitments and professional obligations, and to the extent that the Company’s requests for assistance require Employee to spend more than a de minimis amount of time, Employee’s cooperation shall also be subject to the Company’s payment for Employee’s time at an agreeable rate of compensation. 15. Non-Disparagement. For the two year period following the Effective Date of this Agreement, Employee agrees that Employee will not at any time make, publish, or communicate to any person or entity or in any public forum any defamatory, maliciously false, or disparaging remarks, comments, or statements concerning the Company or its businesses, or any of its employees, officers, or directors and its/their existing and prospective customers, suppliers, investors, and other associated third parties, now or in the future. For purposes of this provision, “disparaging” shall mean any communication that is reckless or maliciously untrue. This Section does not in any way restrict or impede Employee from exercising any protected rights to the extent that such rights cannot be waived by agreement. For the two-year period following the Effective Date of this Agreement, Employer agrees that it will not at any time make, publish, or communicate to any person or entity or in any public forum any defamatory, maliciously false, or disparaging remarks, comments, or statements concerning Employee. For purposes of this provision, “disparaging” shall mean any communication that is reckless or maliciously untrue. This Section does not in any way restrict or impede Employer from exercising any protected rights to the extent that such rights cannot be waived by agreement. 16. Non-Solicitation. In consideration of the benefits provided under this Agreement, for twelve (12) months immediately following Employee’s Separation Date, Employee agrees that Employee will not directly or indirectly: (i) solicit or induce any employee of the Company, or any of the Company’s affiliates or subsidiaries, to leave employment therewith; or (ii) offer employment to any employee employed by the Company, or any of its affiliates or subsidiaries. The Company has advised Employee, and hereby advises Employee, that, subject to any durational or other limitations imposed by law in a particular jurisdiction, the Company will enforce this section to the fullest extent legally permissible. 17. Continuing Obligations. The Employee shall at all times, both before and after termination of employment, provide reasonable cooperation to the Company in executing and delivering documents including, but not limited to, declarations and assignments for filing patent applications in the United States and foreign countries. 18. Remedies. In the event Employee or Employer breach their respective obligations pursuant to the provisions of Sections 9, 11, 12, 13, 14, 15, 16, or 17 of this Agreement, such breach may result in irreparable harm and that the non-breaching party shall be entitled to seek and obtain an injunction (without being required to provide damages or furnish any bond or other security) to restrain a violation of such provisions. 19. Entire Agreement. Except as set forth herein, this Agreement sets forth the entire agreement between the Parties and supersedes any written or oral understanding, promise, or agreement directly or indirectly related to it. Employee and the Company acknowledge that each is legally Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

7 319377223.1 competent and is duly authorized to execute this Agreement and accept full responsibility for this Agreement. This Agreement shall be final and binding upon the Parties, their predecessors, affiliates, successors, and assigns, as to all past or present disputes referred to herein which may have existed, or now exists, between them. The Parties agree that in the event that any claim, suit or action shall be commenced by Employee (including her heirs, executors, spouse, or administrators) or by the Employer relating to Employee’s prior employment with the Company and/or the separation thereof, this Agreement shall constitute a complete defense to any such claims, suits or actions so instituted. Any changes in this Agreement may only be made in a writing that is signed by both Parties. 20. Severability. If any part of this Agreement is found to be unenforceable, the remainder of this Agreement shall remain in full force and effect; except that if any material portion of the release provided by Employee in Section 4 is declared invalid in whole or in part, then the whole Agreement shall be null and void and all consideration shall be returned. 21. Dispute Resolution. Except as prohibited by applicable law, should any dispute between Employee and the Company arise at any time out of any aspect of the employment relationship, including, but not limited to, the hiring, performance, or termination of employment, the interpretation of this Agreement, and further including disputes relating to a claim against any employee, officer, agent or alleged agent, director, affiliate, subsidiary or sister company relationship, Employee and Company agree to have the dispute resolved by final and binding Arbitration consistent with the relevant controlling law. Employee and Company agree that the arbitration shall be held in the Cook County, Illinois, and shall be conducted by a single arbitrator appointed by the American Arbitration Association (the “AAA”), and be subject to the AAAs Employment Rules and Procedures and the fee schedule in effect at the time the claim is filed with the AAA. All previously unasserted claims arising under federal, state, or local statutory or common law, and all disputes relating to the validity of this contract, as well this arbitration provision, shall be decided by final and binding arbitration. Any award of the arbitrator(s) shall be final and binding and may be entered as a judgment in any court of competent jurisdiction. In the event a court having jurisdiction finds any portion of this agreement unenforceable, that portion shall not be effective and the remainder of the agreement shall remain in effect. Claims for injunctions, specific performance, or similar actions to enforce the provisions of Sections 11, 12, 13, 14, 15 or 16 of this Agreement are permitted exceptions to this Section 21. 22. Governing Law. This Agreement shall be interpreted, construed, and enforced under the laws of the State of Illinois without regard to its conflict of laws provisions. The language of all parts of this Agreement shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against either of the parties. 23. Attorneys’ Fees. The prevailing party shall be entitled to recover from the losing party its reasonable attorneys’ fees and costs incurred in any action or proceeding brought to enforce any right arising out of this Agreement. 24. Employee's and Company Acknowledgment. Employee and the Company further represent that each is executing this Agreement knowingly, voluntarily, in good faith, with a genuine intent to waive the rights identified herein, and that neither been subjected to any duress, coercion, or fraud. 25. Counterparts. This Agreement may be executed in one (1) or more counterparts, each of which shall be deemed an original and all of which together shall constitute one (1) instrument. 26. This Agreement is intended to comply with Section 409A of Internal Revenue Code of 1986, as amended and all guidance issued thereunder by the U.S. Internal Revenue Service (“Section 409A”); with respect to any nonqualified deferred compensation subject to Section 409A. Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

8 319377223.1 Notwithstanding any provision herein to the contrary, this Agreement shall be interpreted, operated and administered to maximize the exemptions from Section 409A and, to the extent this Agreement provides for deferred compensation subject to Section 409A, to comply with Section 409A and to avoid the imposition of tax, interest and/or penalties upon Employee under Section 409A. The Company does not however, assume any economic burdens associate with Section 409A. Each separate installment under this Agreement shall be treated as a separate payment for purposes of determining whether such payment is subject to or exempt from compliance with the requirements of Section 409A. Each such payment that is made within 2½ months following the end of the year that contains the date of Employee’s termination of employment is intended to be exempt from Section 409A as a short-term deferral within the meaning of the final regulations under Section 409A. Each such payment that is made later than 2½ months following the end of the year that contains the date of Employee’s termination of employment is intended to be exempt under the two-times exception of Treasury Reg. § 1.409A-1(b)(9)(iii), up to the limitation on the availability of that exception specified in the regulation. To the extent necessary to comply with Section 409A, in no event may Employee, directly or indirectly, designate the taxable year of payment. In particular, to the extent necessary to comply with Section 409A, if any payment to Employee under this Agreement that is conditioned upon Employee executing and not revoking a release of claims and if the designated payment period for such payment begins in one taxable year and ends in the next taxable year, the payment will be made in the later taxable year. 27. Employee Confirmations. Employee hereby agrees that this general release is given knowingly and voluntarily and acknowledges that: a. This Agreement is written in a manner understood by Employee; b. At or before the time Employee was given a copy of this Agreement, Employee was informed (and Employee is hereby informed) that Employee has at least twenty-one (21) days following the date Employee initially received this Agreement to consider it; c. The offer provided in this Agreement is open and valid until August 30, 2025, at which time it will expire unless executed and returned to the Company prior to such date; d. Employee has carefully read and fully understands all of the provisions of this Agreement including the rights Employee is waiving and the terms and consequences of Employee’s execution of this Agreement; e. Employee has not waived any rights arising after the date of this Agreement; f. Employee has received valuable consideration in exchange for the release in addition to amounts Employee is already entitled to receive; g. Employee knowingly, voluntarily and in good faith agrees to all of the terms set forth in this Agreement; h. Employee knowingly, voluntarily and in good faith intends to be legally bound by this Agreement and to waive the rights identified herein; i. Employee has been advised to consult with an attorney prior to executing this Agreement; and j. Prior to executing this Agreement, Employee was informed (and hereby is informed) in writing that after execution, Employee has seven (7) days to revoke their acceptance this Agreement. Thereafter, the Agreement will become effective, enforceable and irrevocable (the “Effective Date”). [Signature Page Follows] Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6

9 319377223.1 EMPLOYEE UNDERSTANDS THAT EMPLOYEE SHOULD CONSULT WITH AN ATTORNEY PRIOR TO SIGNING THIS AGREEMENT AND THAT EMPLOYEE IS GIVING UP ANY LEGAL CLAIMS EMPLOYEE HAS AGAINST THE EMPLOYER RELEASED ABOVE BY SIGNING THIS AGREEMENT. EMPLOYEE ACKNOWLEDGES (S)HE IS SIGNING THIS AGREEMENT KNOWINGLY, WILLINGLY, AND VOLUNTARILY IN EXCHANGE FOR THE BENEFITS DESCRIBED HEREIN. LanzaTech, Inc. Employee Signature: ________________________________ Signature: _________________________________ Name: ___________________________________ Name: _____________________________________ Title: ____________________________________ Date: ______________________________________ Date: ____________________________________ Docusign Envelope ID: 01C86D04-32A4-4807-A171-E076588876F6 Aura Cuellar Aug-18-2025 | 15:40 PDTCEO Jennifer Holmgren Aug-18-2025 | 21:20 PDT