Please wait

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23818

NC SLF INC.

(Exact name of registrant as specified in charter)

375 Park Avenue, 9th Floor

New York, NY 10152

(Address of Principal Executive Offices)

John D. McCally, Esq.

General Counsel

Churchill Asset Management LLC

8500 Andrew Carnegie Blvd

Charlotte, NC 28262

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 478-9200

Date of fiscal year end: December 31, 2025

Date of reporting period: June 30, 2025

Item 1. Reports to Shareholders.

The semi-annual report to shareholders for the six months ended June 30, 2025 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

NC SLF Inc.

Semi-Annual Report

June 30, 2025

TABLE OF CONTENTS

NC SLF INC.

Letter to Shareholders and Management’s Discussion of Company Performance (Unaudited)

August 11, 2025

Dear Shareholders:

Company Overview

We are pleased to submit to you the report of NC SLF Inc. (“we”, “us”, “our” or the “Company”) for the six months ended June 30, 2025. The net asset value (“NAV”) of our shares at that date was $9.63 per share. The total return for the six months ended June 30, 2025, as reflected in the Company’s consolidated financial highlights, was 3.72%. Please refer to “Note 9. Consolidated Financial Highlights” to the consolidated financial statements for further details. Investment Objective

Our investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts, which we define as companies with approximately $10 million to $200 million of annual earnings before interest, taxes, depreciation, and amortization. We expect to make investments through both primary originations and open-market secondary purchases. We focus on making loans that we directly originate to U.S. middle market companies that operate in non-cyclical industries and demonstrate strong, consistent financial performance, market leadership, and are led by experienced management teams. Our portfolio is expected to comprise primarily first lien senior secured debt and unitranche loans.

Portfolio Review

As of June 30, 2025, we had investments in 94 portfolio companies across 37 industries. Based on fair value as of June 30, 2025, 100.0% of our portfolio was invested in debt bearing a floating interest rate. As of June 30, 2025, our weighted average total yield of investments in debt securities at fair value was 9.74%. The weighted average yield was computed using the effective interest rates as of June 30, 2025, including accretion of original issue discount, but excluding investments on non-accrual status, if any.

For the six months ended June 30, 2025, net investment income was approximately $27.2 million, or $0.50 per weighted average common share.

For the six months ended June 30, 2025, we recorded a net increase in net assets resulting from operations of approximately $19.3 million, or $0.35 per weighted average common share (inclusive of realized and unrealized gains and losses).

For the six months ended June 30, 2025, we made additional investments of approximately $150.4 million, and received approximately $51.3 million from repayments of our investments.

Capital Markets Overview

The second quarter of 2025 began with the market absorbing the news and related uncertainty regarding the U.S. global trade policy, which ultimately led to a temporary pause in transaction activity early in the quarter. After the initial, temporary pause, new LBOs for high quality assets in resilient, non-tariff exposed sectors continued to move forward, and the quarter ended with a steady, stable rebound in market sentiment and investment opportunities. By June, investment activity had returned to a more normalized level, similar to what we experienced in the first quarter of this year.

During the second quarter, the Churchill platform closed or committed $3.4 billion across 106 transactions, bringing our platform volume over the last twelve months (LTM) ended June 30, 2025, to $13.5 billion across 191 transactions.

As we enter the second half of the year, we continue to see positive momentum. While geopolitical uncertainty is likely to persist for the time being, Churchill remains relatively insulated due to our portfolio consisting of U.S-based middle market businesses. We are closely monitoring the impacts to our portfolio companies, and we will continue to seek

investments in defensive businesses with low levels of cyclicality, strong levels of free cash flow generation, and multiple channels to source products or materials.

Sincerely,

Kenneth Kencel

President and Chief Executive Officer

This letter is intended to assist shareholders in understanding the Company’s performance during the six months ended June 30, 2025. The views and opinions in this letter were current as of August 11, 2025. Statements other than those of historical facts included herein may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors. See “Forward-Looking Statements” below for more information. The Company undertakes no duty to update any forward-looking statement made herein. Information contained on our website is not incorporated by reference into this shareholder letter and you should not consider information contained on our website to be part of this shareholder letter or any other report we file with the Securities and Exchange Commission (the “SEC”).

_____________________________________________________________________________________________

Important Information

This report is transmitted to the shareholders of the Company and is furnished pursuant to certain regulatory requirements. This report and the information and views herein do not constitute investment advice, or a recommendation or an offer to enter into any transaction with the Company or any of its affiliates. This report is provided for informational purposes only, does not constitute an offer to sell securities of the Company and is not a prospectus.

An investment in the Company is not appropriate for all investors. Shares of closed-end investment companies, such as the Company, frequently trade at a discount from their NAV, which may increase investors’ risk of loss. Past performance is not indicative of, or a guarantee of, future performance. The performance and certain other portfolio information quoted herein represents information as of June 30, 2025. Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Company. Investment return and principal value of an investment will fluctuate, and shares, when sold, may be worth more or less than their original cost. The Company’s performance is subject to change since the end of the period noted in this Annual Report and may be lower or higher than the performance data shown herein.

About NC SLF Inc.

NC SLF Inc. is a registered closed-end management investment company. Its investment objective is to generate current income and capital appreciation primarily by investing in or originating first lien and unitranche leveraged loans made to private equity-owned U.S. middle-market companies that require capital for growth, acquisitions, recapitalizations, refinancings and leveraged buyouts.

Forward-Looking Statements

This report contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on our current expectations and estimates, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation:

•our future operating results;

•our business prospects and the prospects of our portfolio companies;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•changes in the markets in which we invest and changes in financial and lending markets generally;the impact of a protracted decline in the liquidity of credit markets on our business;

•the impact of increased competition;

•an economic downturn or recession and its impact on the ability of our portfolio companies to operate and the investment opportunities available to us;

•the impact of interest rate volatility on our business, our financial condition and our portfolio companies;

•the impact of supply chain constraints and labor difficulties on our portfolio companies and the global economy;

•the level of inflation and its impact on our portfolio companies and on the industries in which we invest;

•the uncertainty associated with the imposition of tariffs and trade barriers and changes in trade policies and its impact on our portfolio companies and the global economy;

•the impact of geopolitical conditions, including the conflict between Ukraine and Russia and the conflicts in the Middle East, and their impact on financial market volatility, global economic markets, and various sectors, industries and markets for commodities globally, such as oil and natural gas;

•our contractual arrangements and relationships with third parties;

•the valuation of our investments in portfolio companies, particularly those having no liquid trading market;

•actual and potential conflicts of interest with Churchill Asset Management LLC, our investment adviser (“Churchill” or the “Investment Adviser”) and/or its affiliates;

•the ability of our portfolio companies to achieve their objectives;

•the use of borrowed money to finance a portion of our investments;

•the adequacy of our financing sources and working capital;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•the ability of the Investment Adviser to locate suitable investments for us and to monitor and administer our investments;

•the ability of the Investment Adviser or its affiliates to attract and retain highly talented professionals;

•our ability to qualify and maintain our qualification as a regulated investment company (a “RIC”); and

•the impact of future legislation and regulation on our business and our portfolio companies.

Although we believe that the assumptions on which these forward-looking statements are based on are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a forward-looking statement in this report should not be regarded as a representation by us that our plans and objectives will be achieved. These forward-looking statements apply only as of the date of this report. Moreover, we assume no duty and do not undertake to update the forward-looking statements except as otherwise provided by law.

Strategy and Performance Overview (Unaudited)

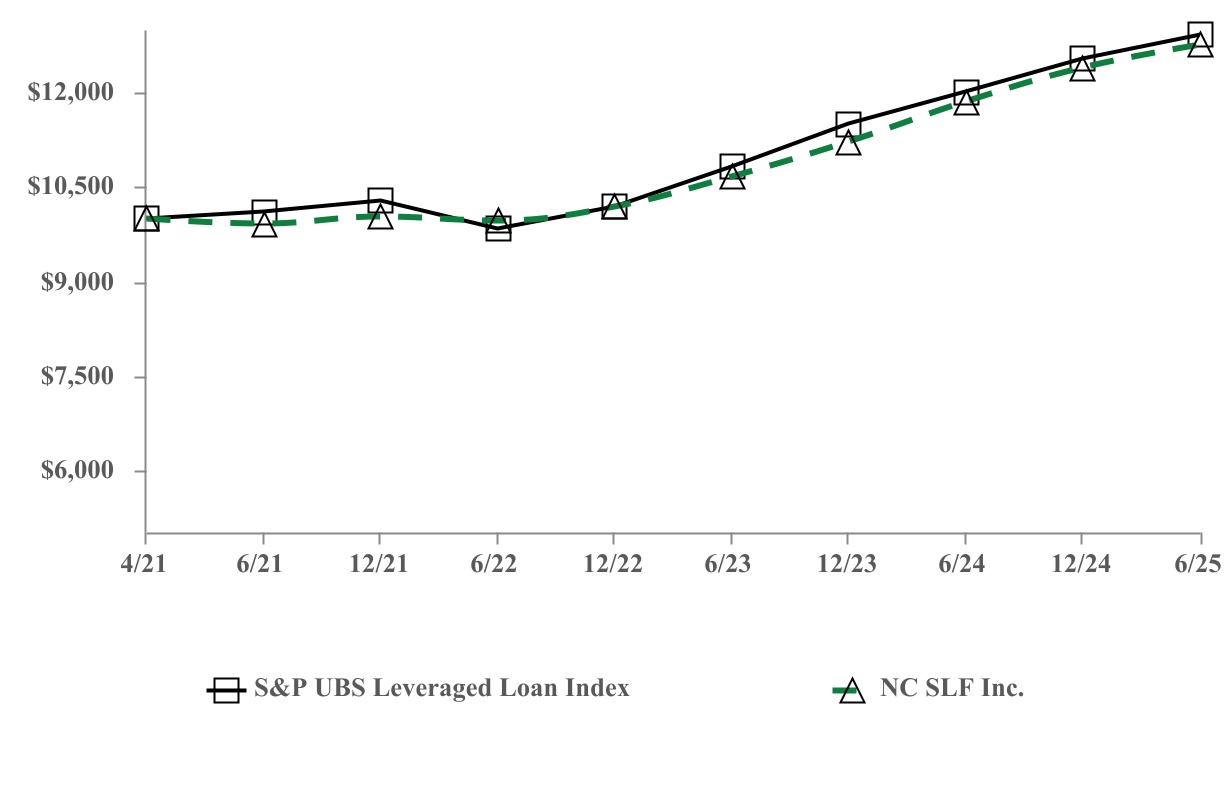

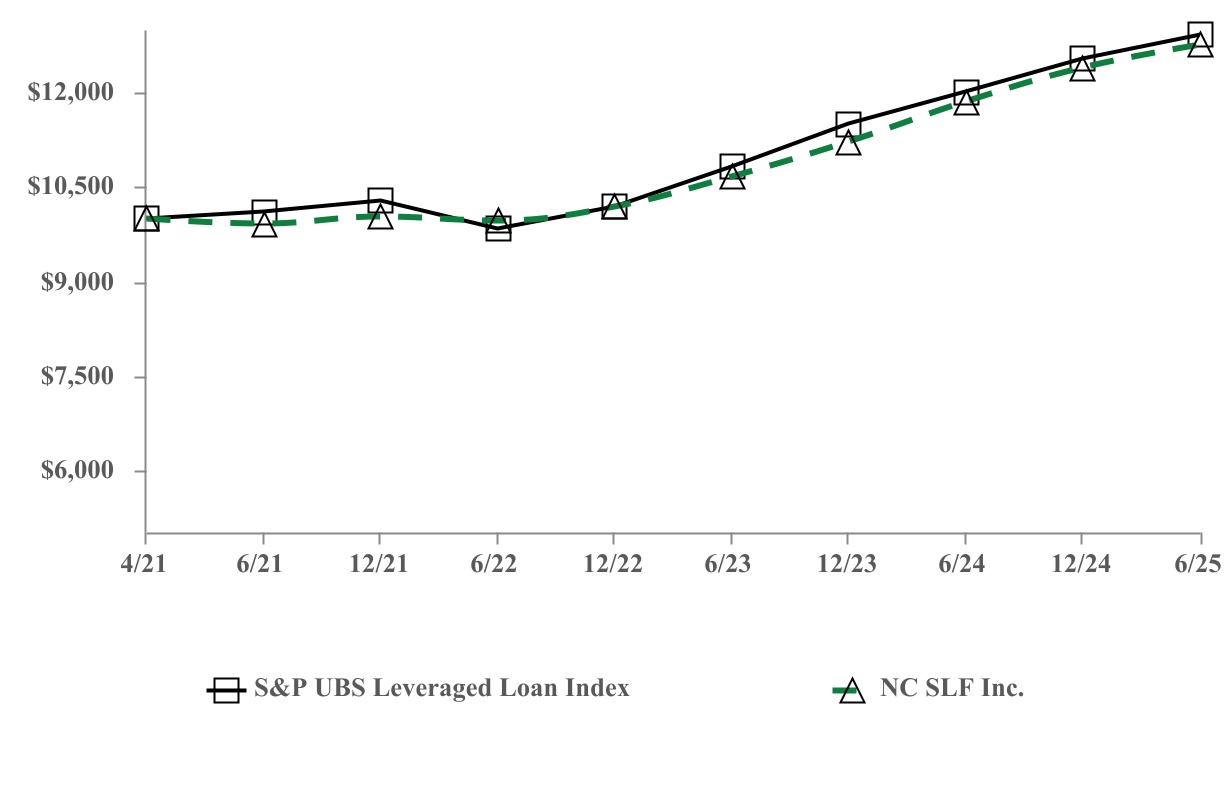

This graph compares the return on our common stock from April 16, 2021 (the inception date) to June 30, 2025 with that of S&P UBS Leveraged Loan Index. Prior to its registration as a closed-end fund under the 1940 Act on August 12, 2022, the Company operated as a business development company (“BDC”) from June 2, 2021 until August 12, 2022, whereupon it withdrew its election to be regulated as a BDC pursuant to Section 54(c) of the 1940 Act. The graph assumes that, on April 16, 2021 a person invested $10,000 in each of our common stock and the S&P UBS Leveraged Loan Index.

The graph measures total shareholder return, which takes into account changes in NAV and distributions. Distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Company’s distribution reinvestment plan (as applicable). Returns do not reflect the deduction of taxes that a shareholder would pay on Company distributions. Past performance is not indicative, or a guarantee, of future performance. Future results may vary and may be higher or lower than the data shown below.

COMPARISON OF INCEPTION TO DATE CUMULATIVE TOTAL RETURN*

NC SLF Inc. and the S&P UBS Leveraged Loan Index

*$10,000 invested on April 16, 2021 (the inception date) in stock or index, including reinvestment of dividends through June 30, 2025. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 5 to the consolidated financial statements for additional information).

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | 1 Year | | 2 Year | | Since Inception

(April 16, 2021) |

NC SLF (1) | | 7.68 | % | | 9.83 | % | | 6.57 | % |

S&P UBS Leveraged Loan Index | | 7.50 | % | | 9.67 | % | | 6.94 | % |

(1) Return is calculated as the change in NAV per share during the period, plus distributions per share, if any, divided by the beginning NAV per share. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at the quarter end NAV per share preceding the distribution. Returns for NC SLF Inc. reflect the impact of waived management fees for the period from July 1, 2021 through October 4, 2022 (Refer to Note 5 to the consolidated financial statements for additional information). Returns longer than one year are annualized. Portfolio Composition

As of June 30, 2025, our investments consisted of the following (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Amortized Cost | | Fair Value | | % of Fair Value |

| First-Lien Term Loans | $ | 805,603 | | | $ | 801,094 | | | 99.87 | % |

| Equity Investments | $ | 1,059 | | | $ | 1,059 | | | 0.13 | % |

| Total | $ | 806,662 | | | $ | 802,153 | | | 100.00 | % |

| Largest portfolio company investment | $ | 19,161 | | | $ | 19,443 | | | 2.42 | % |

| Average portfolio company investment | $ | 8,582 | | | $ | 8,534 | | | 1.06 | % |

The industry composition of our portfolio as a percentage of fair value as of June 30, 2025 was as follows:

| | | | | |

| Industry | |

| Aerospace & Defense | 2.42 | % |

| Air Freight & Logistics | 2.32 | % |

| Auto Components | 1.89 | % |

| Beverages | 0.52 | % |

| Building Products | 2.75 | % |

| Chemicals | 1.96 | % |

| Commercial Services & Supplies | 5.18 | % |

| Construction & Engineering | 4.91 | % |

| Construction Materials | 2.67 | % |

| Containers & Packaging | 3.25 | % |

| Distributors | 3.18 | % |

| Diversified Consumer Services | 1.49 | % |

| Diversified Financial Services | 6.10 | % |

| Diversified Telecommunication Services | 1.03 | % |

| Electrical Equipment | 1.50 | % |

| Electronic Equipment, Instruments & Components | 1.25 | % |

| Energy Equipment & Services | 2.17 | % |

| Food Products | 6.88 | % |

| Gas Utilities | 1.89 | % |

| Health Care Equipment & Supplies | 6.58 | % |

| Health Care Providers & Services | 9.00 | % |

| Hotels, Restaurants & Leisure | 0.17 | % |

| Household Durables | 0.71 | % |

| Household Products | 1.10 | % |

| Industrial Conglomerates | 2.30 | % |

| Insurance | 2.47 | % |

| Internet and Direct Marketing Retail | 1.23 | % |

| IT Services | 2.22 | % |

| Leisure Products | 0.90 | % |

| Machinery | 0.89 | % |

| Personal Products | 0.95 | % |

| Pharmaceuticals | 2.14 | % |

| Professional Services | 6.91 | % |

| Road & Rail | 0.63 | % |

| Software | 4.49 | % |

| Transportation Infrastructure | 2.60 | % |

| Wireless Telecommunication Services | 1.35 | % |

| Total | 100.00 | % |

The weighted average yield of our portfolio as of June 30, 2025 was as follows:

| | | | | |

Weighted average yield on debt and income producing investments, at cost (1) | 9.69 | % |

Weighted average yield on debt and income producing investments, at fair value (1) | 9.74 | % |

| Percentage of debt investments bearing a floating rate | 100.00 | % |

| Percentage of debt investments bearing a fixed rate | — | % |

_____________

(1) There were no investments on non-accrual status as of June 30, 2025.

The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders, but rather relates to our investment portfolio and is calculated before deduction of all of our fees and expenses. The weighted average yield was computed using the effective interest rates as of the reporting date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that the weighted average yield will remain at its current level.

Asset Quality

In addition to various risk management and monitoring tools, we use the Investment Adviser’s investment rating system to characterize and monitor the credit profile and expected level of returns on each investment in our portfolio. Each investment team utilizes a systematic, consistent approach to credit evaluation, with a particular focus on an acceptable level of debt repayment and deleveraging under a “base case” set of projections (the “Base Case”), which generally reflects a more conservative estimate than the set of projections provided by a prospective portfolio company (the “Management Case”). The following is a description of the conditions associated with each investment rating:

1.Performing - Superior: Borrower is performing significantly above Management Case.

2.Performing - High: Borrower is performing at or near the Management Case (i.e., in a range slightly below to slightly above).

3.Performing - Low Risk: Borrower is operating well ahead of the Base Case to slightly below the Management Case.

4.Performing - Stable Risk: Borrower is operating at or near the Base Case (i.e., in a range slightly below to slightly above). This is the initial rating assigned to all new borrowers.

5.Performing - Management Notice: Borrower is operating below the Base Case. Adverse trends in business conditions and/or industry outlook are viewed as temporary. There is no immediate risk of payment default and only a low to moderate risk of covenant default.

6.Watch List - Low Maintenance: Borrower is operating below the Base Case, with declining margin of protection. Adverse trends in business conditions and/or industry outlook are viewed as probably lasting for more than a year. Payment default is still considered unlikely, but there is a moderate to high risk of covenant default.

7.Watch List - Medium Maintenance: Borrower is operating well below the Base Case, but has adequate liquidity. Adverse trends are more pronounced than in Internal Risk Rating 6 above. There is a high risk of covenant default, or it may have already occurred. Payments are current, although subject to greater uncertainty, and there is a moderate to high risk of payment default.

8.Watch List - High Maintenance: Borrower is operating well below the Base Case. Liquidity may be strained. Covenant default is imminent or may have occurred. Payments are current, but there is a high risk of payment default. Negotiations to restructure or refinance debt on normal terms may have begun. Further significant deterioration appears unlikely and no loss of principal is currently anticipated.

9.Watch List - Possible Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Liquidity is strained. Payment default may have occurred or is very likely in the short term unless creditors grant some relief. Loss of principal is possible.

10.Watch List - Probable Loss: At the current level of operations and financial condition, the borrower does not have the ability to service and ultimately repay or refinance all outstanding debt on current terms. Payment default is very likely or may have already occurred. Liquidity is extremely limited. The prospects for improvement in the borrower’s situation are sufficiently negative that loss of some or all principal is probable.

The Investment Adviser regularly monitors and, when appropriate, changes the investment rating assigned to each investment in our portfolio. Each investment team will review the investment ratings in connection with monthly or quarterly portfolio reviews.

The following table shows the investment ratings of the investments in our portfolio as of June 30, 2025 (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | % of Portfolio | | Number of Portfolio Companies |

| 1 | | $ | — | | | — | % | | — | |

| 2 | | — | | | — | % | | — | |

| 3 | | 28,408 | | | 3.54 | % | | 2 | |

| 4 | | 682,091 | | | 85.03 | % | | 81 |

| 5 | | 57,528 | | | 7.17 | % | | 8 | |

| 6 | | 34,126 | | | 4.26 | % | | 3 | |

| 7 | | | | — | % | | — | |

| 8 | | — | | | — | % | | — | |

| 9 | | — | | | — | % | | — | |

| 10 | | — | | | — | % | | — | |

| Total | | $ | 802,153 | | | 100.00 | % | | 94 |

As of June 30, 2025, the weighted average Internal Risk Rating of our investment portfolio was 4.1.

Availability of Quarterly Portfolio Schedule

The Company files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Company’s filings on Form N-PORT are available on the SEC’s website at www.sec.gov.

TOP TEN HOLDINGS

AS OF JUNE 30, 2025

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment | | Maturity | | Fair Value | | % Total Fair Value | | % of Net Assets |

| PAG Holding Corp. (Precision Aviation Group) | | 12/21/2029 | | $ | 19,443 | | | 2.42 | % | | 3.52 | % |

| Motion & Control Enterprises LLC | | 6/1/2028 | | 19,249 | | | 2.40 | % | | 3.49 | % |

| Nellson Nutraceutical, LLC | | 4/17/2031 | | 18,921 | | | 2.36 | % | | 3.43 | % |

| Heartland Paving Partners, LLC | | 8/9/2030 | | 18,845 | | | 2.35 | % | | 3.41 | % |

| Kenco PPC Buyer LLC | | 11/15/2029 | | 18,649 | | | 2.32 | % | | 3.38 | % |

| ISG Enterprises, LLC (Industrial Service Group) | | 12/7/2028 | | 18,436 | | | 2.30 | % | | 3.34 | % |

| Diligent Corporation (fka Diamond Merger Sub II, Corp.) | | 8/2/2030 | | 17,053 | | | 2.13 | % | | 3.09 | % |

| Olympus US Bidco LLC (Phaidon International) | | 8/22/2029 | | 16,800 | | | 2.09 | % | | 3.04 | % |

| FirstCall Mechanical Group, LLC | | 6/27/2030 | | 16,519 | | | 2.06 | % | | 2.99 | % |

| Redwood Services Group, LLC (Evergreen Services Group) | | 6/15/2029 | | 16,281 | | | 2.03 | % | | 2.95 | % |

| | | | | | 22.46 | % | | 32.64 | % |

NC SLF INC.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES (UNAUDITED)

(dollars in thousands, except share and per share data)

| | | | | |

| June 30, 2025 |

| |

| Assets | |

| Non-controlled/non-affiliated company investments, at fair value (amortized cost of $806,662) | $ | 802,153 | |

| Cash and cash equivalents | 14,613 | |

| Interest receivable | 4,630 | |

| Receivable for investments sold | 245 | |

| |

| Prepaid expenses | 107 | |

| Total assets | $ | 821,748 | |

| |

| Liabilities | |

| Secured borrowings (net of $3,385 deferred financing cost) | $ | 248,115 | |

| Payable for investments purchased | 3,044 | |

| Interest payable | 3,169 | |

| |

Management fees payable (See Note 5) | 903 | |

| Distributions payable | 13,757 | |

Directors' fees payable (See Note 5) | 15 | |

| Accounts payable and accrued expenses | 883 | |

| Total liabilities | 269,886 | |

| |

Commitments and contingencies (See Note 7) | |

| |

| |

| Common stock, par value $0.01 per share, 500,000,000 shares authorized, 57,322,385 shares issued and outstanding as of June 30, 2025 | 573 | |

| Paid-in-capital in excess of par value | 565,591 | |

| Total distributable earnings (loss) | (14,302) | |

| Total net assets | $ | 551,862 | |

| |

Net asset value per share (See Note 9) | $ | 9.63 | |

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

(dollars in thousands, except share and per share data)

| | | | | |

| Six Months Ended June 30, 2025 |

| Investment income: | |

| Non-controlled/non-affiliated company investments: | |

| Interest income | $ | 37,608 | |

| Other income | 188 | |

| Total investment income | 37,796 | |

| |

| Expenses: | |

| Interest and debt financing expenses | 7,851 | |

| |

| 1,751 | |

| Professional fees | 343 | |

| 29 | |

Administration fees (See Note 5) | 412 | |

| Other general and administrative expenses | 208 | |

| Total expenses | 10,594 | |

| |

| |

| Net investment income (loss) | 27,202 |

| |

| Realized and unrealized gain (loss) on investments: | |

| Net realized gain (loss) on non-controlled/non-affiliated company investments | (6,787) | |

| Net change in unrealized appreciation (depreciation) on non-controlled/non-affiliated company investments | (1,111) | |

| Total net realized and unrealized gain (loss) on investments | (7,898) | |

| |

| Net increase (decrease) in net assets resulting from operations | $ | 19,304 | |

| |

| Per share data: | |

| Net investment income (loss) per share | $ | 0.50 | |

| Net increase (decrease) in net assets resulting from operations per share | $ | 0.35 | |

| Weighted average common shares outstanding | 54,560,031 | |

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENTS OF CHANGES IN NET ASSETS

(dollars in thousands, except share and per share data)

| | | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Year Ended December 31, | | | | | |

| 2025 | | 2024 | | | | | |

| (UNAUDITED) | | | | | | | |

| Increase (decrease) in net assets resulting from operations: | | | | | | | | |

| Net investment income (loss) | $ | 27,202 | | | $ | 49,257 | | | | | | |

| Net realized gain (loss) on investments | (6,787) | | | (4,596) | | | | | | |

| Net change in unrealized appreciation (depreciation) on investments | (1,111) | | | 6,746 | | | | | | |

| Net increase (decrease) in net assets resulting from operations | 19,304 | | | 51,407 | | | | | | |

| Shareholder distributions: | | | | | | | | |

Distributions declared from distributable earnings | (26,830) | | | (48,761) | | | | | | |

| Net increase (decrease) in net assets resulting from shareholder distributions | (26,830) | | | (48,761) | | | | | | |

| Capital share transactions: | | | | | | | | |

| Issuance of common shares | 25,000 | | | 105,000 | | | | | | |

| Reinvestment of shareholder distributions | 25,889 | | | 45,645 | | | | | | |

| Net increase (decrease) in net assets resulting from capital share transactions | 50,889 | | | 150,645 | | | | | | |

| Total increase (decrease) in net assets | 43,363 | | | 153,291 | | | | | | |

| Net assets, beginning of period | 508,499 | | | 355,208 | | | | | | |

| Net assets, end of period | $ | 551,862 | | | $ | 508,499 | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

NC SLF INC.

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(dollars in thousands, except share and per share data) | | | | | | | |

| Six Months Ended June 30, 2025 |

| Cash flows from operating activities: | | | |

| Net increase (decrease) in net assets resulting from operations | $ | 19,304 | | | |

| | | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities | | | |

| Purchase of investments | (150,427) | | | |

| Proceeds from principal repayments of investments and sales of investments | 51,299 | | | |

| Amortization of premium/accretion of discount, net | (922) | | | |

| Net realized (gain) loss on investments | 6,787 | | | |

| Net change in unrealized (appreciation) depreciation on investments | 1,111 | | | |

| Amortization of deferred financing costs | 469 | | | |

| Changes in operating assets and liabilities: | | | |

| Interest receivable | (234) | | | |

| Receivable for investments sold | (66) | | | |

| Prepaid expenses | (61) | | | |

| | | |

| | | |

| Payable for investments purchased | 3,044 | | | |

| Interest payable | 422 | | | |

| Management fees payable | 75 | | | |

| | | |

| Accounts payable and accrued expenses | 352 | | | |

| Net cash provided by (used in) operating activities | (68,847) | | | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of common shares | 25,000 | | | |

| Shareholder distributions | (219) | | | |

| Proceeds from secured borrowings | 90,000 | | | |

| Repayments of secured borrowings | (49,500) | | | |

| Payments of deferred financing costs | (1,509) | | | |

| Net cash provided by (used in) financing activities | 63,772 | | | |

| | | |

| Net increase (decrease) in cash and cash equivalents | (5,075) | | | |

| Cash and cash equivalents, beginning of period | 19,688 | | | |

| Cash and cash equivalents, end of period | $ | 14,613 | | | |

| | | |

| Supplemental disclosure of cash flow Information: | | | |

| Cash paid during the period for interest | $ | 7,804 | | | |

| Taxes, including excise tax, paid during the period | $ | 44 | | | |

| Supplemental disclosure of non-cash flow information: | | | |

| Reinvestment of shareholder distributions | $ | 25,889 | | | |

| Distributions payable | $ | 13,757 | | | |

The accompanying notes are an integral part of these consolidated financial statements.

The following table provides a reconciliation of cash and cash equivalents reported on the consolidated statement of assets and liabilities that sum to the total of comparable amounts on the consolidated statement of cash flows (dollars in thousands):

| | | | | | | |

| June 30, 2025 | | |

| Cash | $ | 1,931 | | | |

| Cash Equivalents | 12,682 | | | |

| Total Cash and Cash Equivalents Shown on the Consolidated Statement of Cash Flows | $ | 14,613 | | | |

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| | | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | | | |

| Debt Investments | | | | | | | | | | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | | | | | | | | | | |

| PAG Holding Corp. (Precision Aviation Group) | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 12/21/2029 | | $ | 14,592 | | | $ | 14,360 | | | $ | 14,602 | | | 2.64 | % |

| PAG Holding Corp. (Precision Aviation Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.04 | % | | 12/21/2029 | | 4,837 | | | 4,801 | | 4,841 | | 0.88 | % |

| Total Aerospace & Defense | | | | | | | | | | | | | | 19,161 | | 19,443 | | 3.52 | % |

| | | | | | | | | | | | | | | | | | |

| Air Freight & Logistics | | | | | | | | | | | | | | | | | | |

| Kenco PPC Buyer LLC | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.00 | % | | 11/15/2029 | | 16,236 | | | 16,040 | | 16,085 | | 2.91 | % |

| Kenco PPC Buyer LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 8.98 | % | | 11/15/2029 | | 2,594 | | | 2,564 | | 2,569 | | 0.47 | % |

| Kenco PPC Buyer LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 11/15/2029 | | 488 | | | (4) | | (5) | | — | % |

| Total Air Freight & Logistics | | | | | | | | | | | | | | 18,600 | | 18,649 | | 3.38 | % |

| | | | | | | | | | | | | | | | | | |

| Auto Components | | | | | | | | | | | | | | | | | | |

| Randys Holdings, Inc. (Randy's Worldwide Automotive) | | (4) (7) | | First Lien Debt | | S + 5.00% | | 9.29 | % | | 11/1/2029 | | 12,797 | | | 12,638 | | 12,583 | | 2.28 | % |

| Randys Holdings, Inc. (Randy's Worldwide Automotive) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.29 | % | | 11/1/2029 | | 4,359 | | | 2,683 | | 2,611 | | 0.47 | % |

| Total Auto Components | | | | | | | | | | | | | | 15,321 | | 15,194 | | 2.75 | % |

| | | | | | | | | | | | | | | | | | |

| Beverages | | | | | | | | | | | | | | | | | | |

| Refresh Buyer, LLC (Sunny Sky Products) | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 12/23/2028 | | 3,374 | | | 3,350 | | 3,314 | | 0.60 | % |

| Refresh Buyer, LLC (Sunny Sky Products) | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 12/23/2028 | | 854 | | | 854 | | 839 | | 0.15 | % |

| Total Beverages | | | | | | | | | | | | | | 4,204 | | 4,153 | | 0.75 | % |

| | | | | | | | | | | | | | | | | | |

| Building Products | | | | | | | | | | | | | | | | | | |

| Clean Solutions Buyer, Inc. | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.83 | % | | 9/9/2030 | | 4,240 | | | 4,203 | | 4,202 | | 0.76 | % |

| Cobalt Service Partners, LLC | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 10/13/2031 | | 12,467 | | | 3,397 | | 3,336 | | 0.60 | % |

| Cobalt Service Partners, LLC | | (4) (7) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 10/13/2031 | | 7,214 | | | 7,149 | | 7,146 | | 1.29 | % |

| Vertex Service Partners, LLC | | (4) (10) | | First Lien Debt | | S + 6.00% | | 10.30 | % | | 11/8/2030 | | 2,241 | | | 2,214 | | | 2,263 | | | 0.41 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Vertex Service Partners, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.30 | % | | 11/8/2030 | | $ | 4,407 | | | $ | 845 | | | $ | 779 | | | 0.14 | % |

| Vertex Service Partners, LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.30 | % | | 11/8/2030 | | 4,319 | | | 4,313 | | 4,363 | | 0.79 | % |

| Total Building Products | | | | | | | | | | | | | | 22,121 | | 22,089 | | 3.99 | % |

| | | | | | | | | | | | | | | | | | |

| Chemicals | | | | | | | | | | | | | | | | | | |

| Chroma Color Corporation | | (4) | | First Lien Debt | | S + 4.25% | | 8.53 | % | | 4/23/2029 | | 3,006 | | | 2,965 | | | 2,962 | | | 0.54 | % |

| Chroma Color Corporation | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.25% | | 8.55 | % | | 4/23/2029 | | 664 | | | 659 | | 654 | | 0.12 | % |

| Olympic Buyer, Inc. (Ascensus) | | (4) (7) | | First Lien Debt | | S + 4.25% | | 8.68 | % | | 6/30/2028 | | 13,927 | | | 13,787 | | 12,099 | | 2.19 | % |

| Total Chemicals | | | | | | | | | | | | | | 17,411 | | 15,715 | | 2.85 | % |

| | | | | | | | | | | | | | | | | | |

| Commercial Services & Supplies | | | | | | | | | | | | | | | | | | |

| FirstCall Mechanical Group, LLC | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 6/27/2030 | | 6,501 | | | 6,446 | | 6,443 | | 1.17 | % |

| FirstCall Mechanical Group, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 6/27/2030 | | 13,082 | | | 10,181 | | 10,076 | | 1.83 | % |

| Integrated Power Services Holdings, Inc. | | (4) | | First Lien Debt | | S + 4.50% | | 8.94 | % | | 11/22/2028 | | 4,915 | | | 4,898 | | 4,915 | | 0.89 | % |

| Olympus US Bidco LLC (Phaidon International) | | (4) (8) | | First Lien Debt | | S + 5.50% | | 9.93 | % | | 8/22/2029 | | 17,237 | | | 17,132 | | 16,800 | | 3.03 | % |

| Safety Infrastructure Services Intermediate LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.31 | % | | 7/21/2028 | | 1,727 | | | 306 | | 276 | | 0.05 | % |

| Safety Infrastructure Services Intermediate LLC | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.30 | % | | 7/21/2028 | | 3,077 | | | 3,053 | | 3,016 | | 0.55 | % |

| Total Commercial Services & Supplies | | | | | | | | | | | | | | 42,016 | | 41,526 | | 7.52 | % |

| | | | | | | | | | | | | | | | | | |

| Construction & Engineering | | | | | | | | | | | | | | | | | | |

| CLS Management Services, LLC (Contract Land Staff) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.30 | % | | 3/27/2030 | | 3,251 | | | 3,224 | | 3,224 | | 0.58 | % |

| CLS Management Services, LLC (Contract Land Staff) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.30 | % | | 3/27/2030 | | 1,307 | | | 1,305 | | 1,296 | | 0.23 | % |

| CLS Management Services, LLC (Contract Land Staff) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.30 | % | | 3/27/2030 | | 2,176 | | | (5) | | (18) | | — | % |

| ERA Industries, LLC (BTX Precision) | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.08 | % | | 7/25/2030 | | 679 | | | 671 | | 673 | | 0.12 | % |

| ERA Industries, LLC (BTX Precision) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.28 | % | | 7/25/2030 | | 363 | | | 359 | | 360 | | 0.07 | % |

| ERA Industries, LLC (BTX Precision) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 7/25/2030 | | 513 | | | (2) | | (5) | | — | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| ERA Industries, LLC (BTX Precision) | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.06 | % | | 7/25/2030 | | $ | 389 | | | $ | 388 | | | $ | 385 | | | 0.07 | % |

| Heartland Paving Partners, LLC | | (4) (10) | | First Lien Debt | | S + 4.75% | | 8.97 | % | | 8/9/2030 | | 8,380 | | | 8,307 | | 8,305 | | 1.50 | % |

| Heartland Paving Partners, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 8.94 | % | | 8/9/2030 | | 5,629 | | | 5,005 | | | 4,967 | | | 0.90 | % |

| Heartland Paving Partners, LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 8.89 | % | | 8/9/2030 | | 5,623 | | | 5,611 | | 5,573 | | 1.01 | % |

| ICE USA Infrastructure, Inc. | | (4) (10) | | First Lien Debt | | S + 5.75% | | 10.05 | % | | 3/15/2030 | | 793 | | | 786 | | 772 | | 0.14 | % |

| ICE USA Infrastructure, Inc. | | (4) (10) | | First Lien Debt | | S + 5.75% | | 10.05 | % | | 3/15/2030 | | 2,846 | | | 2,823 | | 2,770 | | 0.50 | % |

| MEI Buyer LLC | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 6/29/2029 | | 5,443 | | | 5,363 | | 5,443 | | 0.99 | % |

| MEI Buyer LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.31 | % | | 6/29/2029 | | 870 | | | 868 | | 870 | | 0.16 | % |

| WSB Engineering Holdings Inc. | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.83 | % | | 8/31/2029 | | 3,101 | | | 3,067 | | 3,070 | | 0.56 | % |

| WSB Engineering Holdings Inc. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.83 | % | | 8/31/2029 | | 14,508 | | | (54) | | (144) | | (0.03) | % |

| WSB Engineering Holdings Inc. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.78 | % | | 8/31/2029 | | 2,079 | | | 1,817 | | 1,806 | | 0.33 | % |

| Total Construction & Engineering | | | | | | | | | | | | | | 39,533 | | 39,347 | | 7.13 | % |

| | | | | | | | | | | | | | | | | | |

| Construction Materials | | | | | | | | | | | | | | | | | | |

| Java Buyer, Inc. (Sciens Building Solutions, LLC) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.28 | % | | 12/15/2027 | | 5,211 | | | 5,189 | | 5,189 | | 0.94 | % |

| Java Buyer, Inc. (Sciens Building Solutions, LLC) | | (4) (7) | | First Lien Debt | | S + 5.00% | | 9.28 | % | | 12/15/2027 | | 9,866 | | | 9,774 | | 9,824 | | 1.78 | % |

| SCIC Buyer, Inc. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.30 | % | | 3/28/2031 | | 1,352 | | | (3) | | (8) | | — | % |

| SCIC Buyer, Inc. | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.30 | % | | 3/28/2031 | | 6,432 | | | 6,369 | | 6,395 | | 1.16 | % |

| Total Construction Materials | | | | | | | | | | | | | | 21,329 | | 21,400 | | 3.88 | % |

| | | | | | | | | | | | | | | | | | |

| Containers & Packaging | | | | | | | | | | | | | | | | | | |

| Impact Parent Corporation (Impact Environmental Group) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 2,755 | | | 393 | | 364 | | 0.07 | % |

| Impact Parent Corporation (Impact Environmental Group) | | (4) | | First Lien Debt | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 3,578 | | | 3,527 | | | 3,527 | | | 0.64 | % |

| Impact Parent Corporation (Impact Environmental Group) | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 733 | | | 723 | | 723 | | 0.13 | % |

| Impact Parent Corporation (Impact Environmental Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 1,672 | | | 1,666 | | 1,648 | | 0.30 | % |

| Impact Parent Corporation (Impact Environmental Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 1,512 | | | 1,510 | | 1,491 | | 0.27 | % |

| Impact Parent Corporation (Impact Environmental Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.65 | % | | 3/23/2029 | | 3,263 | | | 3,252 | | 3,217 | | 0.58 | % |

| New Spartech Holdings LLC | | (4) | | First Lien Debt | | S + 7.00% | | 11.31 | % | | 3/31/2030 | | 961 | | | 942 | | 961 | | 0.17 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| New Spartech Holdings LLC | | (4) (7) | | First Lien Debt | | S + 5.25% | | 9.56 | % | | 9/30/2030 | | $ | 1,571 | | | $ | 1,571 | | | $ | 1,571 | | | 0.28 | % |

| Online Labels Group, LLC | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.55 | % | | 12/19/2029 | | 1,583 | | | 1,571 | | 1,583 | | 0.29 | % |

| Online Labels Group, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.55 | % | | 12/19/2029 | | 195 | | | — | | — | | — | % |

| Online Labels Group, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.55 | % | | 12/19/2029 | | 195 | | | 97 | | 97 | | 0.02 | % |

| Pelican Products, Inc. | | (7) (9) | | First Lien Debt | | S + 4.25% | | 8.81 | % | | 12/29/2028 | | 7,720 | | | 7,679 | | | 6,789 | | | 1.23 | % |

| Performance Packaging Buyer, LLC | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.63 | % | | 4/15/2031 | | 3,053 | | | 3,023 | | 3,024 | | 0.55 | % |

| Total Containers & Packaging | | | | | | | | | | | | | | 25,954 | | 24,995 | | 4.53 | % |

| | | | | | | | | | | | | | | | | | |

| Distributors | | | | | | | | | | | | | | | | | | |

| Motion & Control Enterprises LLC | | (4) (10) | | First Lien Debt | | S + 6.00% | | 10.32 | % | | 6/1/2028 | | 3,971 | | | 3,939 | | | 3,936 | | | 0.71 | % |

| Motion & Control Enterprises LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.32 | % | | 6/1/2028 | | 10,932 | | | 10,929 | | 10,834 | | 1.96 | % |

| Motion & Control Enterprises LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.32 | % | | 6/1/2028 | | 3,971 | | | 3,971 | | 3,936 | | 0.71 | % |

| Motion & Control Enterprises LLC | | (4) (10) | | First Lien Debt | | S + 6.00% | | 10.32 | % | | 6/1/2028 | | 548 | | | 544 | | 543 | | 0.10 | % |

| Rhino Intermediate Holding Company, LLC (Rhino Tool House) | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.69 | % | | 4/4/2029 | | 5,280 | | | 5,212 | | 5,204 | | 0.94 | % |

| Rhino Intermediate Holding Company, LLC (Rhino Tool House) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.70 | % | | 4/4/2029 | | 1,058 | | | 1,055 | | 1,043 | | 0.19 | % |

| Total Distributors | | | | | | | | | | | | | | 25,650 | | 25,496 | | 4.61 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Consumer Services | | | | | | | | | | | | | | | | | | |

| Excel Fitness Holdings, Inc. | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.55 | % | | 4/27/2029 | | 11,760 | | | 11,673 | | 11,760 | | 2.13 | % |

| Excel Fitness Holdings, Inc. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.80 | % | | 4/27/2029 | | 1,031 | | | 199 | | 205 | | 0.04 | % |

| Total Diversified Consumer Services | | | | | | | | | | | | | | 11,872 | | 11,965 | | 2.17 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Financial Services | | | | | | | | | | | | | | | | | | |

| Ascend Partner Services LLC | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.75 | % | | 8/11/2031 | | 7,211 | | | 7,149 | | | 7,231 | | | 1.31 | % |

| Ascend Partner Services LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.74 | % | | 8/11/2031 | | 12,453 | | | 8,819 | | 8,905 | | 1.61 | % |

| Cohen Advisory, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.78 | % | | 12/31/2031 | | 2,100 | | | 85 | | 79 | | 0.01 | % |

| Cohen Advisory, LLC | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.78 | % | | 12/31/2031 | | 3,762 | | | 3,728 | | | 3,734 | | | 0.68 | % |

| KRIV Acquisition, Inc. (Riveron) | | (4) (10) | | First Lien Debt | | S + 5.75% | | 10.05 | % | | 7/6/2029 | | 9,677 | | | 9,477 | | | 9,632 | | | 1.75 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| KRIV Acquisition, Inc. (Riveron) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.05 | % | | 7/6/2029 | | $ | 1,452 | | | $ | 1,439 | | | $ | 1,445 | | | 0.26 | % |

| Sagebrush Buyer, LLC (Province) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 7/1/2030 | | 2,034 | | | 2,017 | | | 2,016 | | | 0.37 | % |

| Smith & Howard Advisory LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.29 | % | | 11/26/2030 | | 1,023 | | | 481 | | | 474 | | | 0.09 | % |

| Smith & Howard Advisory LLC | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.29 | % | | 11/26/2030 | | 1,266 | | | 1,255 | | 1,254 | | 0.23 | % |

| Vensure Employer Services, Inc. | | (4) (7) (10) | | First Lien Debt | | S + 4.75% | | 9.08 | % | | 9/27/2031 | | 14,200 | | | 14,091 | | 14,178 | | 2.57 | % |

| Vensure Employer Services, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.08 | % | | 9/27/2031 | | 1,431 | | | (6) | | (2) | | — | % |

| Total Diversified Financial Services | | | | | | | | | | | | | | 48,535 | | 48,946 | | 8.88 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Telecommunication Services | | | | | | | | | | | | | | | | | | |

| Sapphire Telecom, Inc. | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.30 | % | | 6/27/2029 | | 8,246 | | | 8,179 | | 8,247 | | 1.49 | % |

| Total Diversified Telecommunication Services | | | | | | | | | | | | | | 8,179 | | 8,247 | | 1.49 | % |

| | | | | | | | | | | | | | | | | | |

| Electrical Equipment | | | | | | | | | | | | | | | | | | |

| Matador US Buyer, LLC (Insulation Technology Group) | | (4) (8) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 6/25/2030 | | 9,682 | | | 9,599 | | | 9,589 | | | 1.74 | % |

| Matador US Buyer, LLC (Insulation Technology Group) | | (4) (6) (8) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 6/25/2030 | | 2,561 | | | 2,439 | | 2,414 | | 0.44 | % |

| Total Electrical Equipment | | | | | | | | | | | | | | 12,038 | | 12,003 | | 2.18 | % |

| | | | | | | | | | | | | | | | | | |

| Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | | | | | |

| INS Intermediate II, LLC (Ergotech DBA Industrial Networking Solutions) | | (4) (10) | | First Lien Debt | | S + 5.50% | | 9.98 | % | | 1/19/2029 | | 8,403 | | | 8,304 | | 8,325 | | 1.51 | % |

| INS Intermediate II, LLC (Ergotech DBA Industrial Networking Solutions) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.98 | % | | 1/19/2029 | | 1,708 | | | 1,687 | | | 1,692 | | | 0.31 | % |

| Total Electronic Equipment, Instruments & Components | | | | | | | | | | | | | | 9,991 | | 10,017 | | 1.82 | % |

| | | | | | | | | | | | | | | | | | |

| Energy Equipment & Services | | | | | | | | | | | | | | | | | | |

| Ovation Holdings, Inc | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.30 | % | | 2/4/2030 | | 3,427 | | | 2,824 | | | 2,851 | | | 0.52 | % |

| Ovation Holdings, Inc | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.28 | % | | 2/4/2030 | | 411 | | | 407 | | 410 | | 0.07 | % |

| Ovation Holdings, Inc | | (4) | | First Lien Debt | | S + 5.00% | | 9.28 | % | | 2/4/2030 | | 6,924 | | | 6,826 | | | 6,918 | | | 1.25 | % |

| Ovation Holdings, Inc | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.28 | % | | 2/4/2030 | | 1,639 | | | 1,625 | | | 1,637 | | | 0.30 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| SI Solutions, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.06 | % | | 8/15/2030 | | $ | 2,438 | | | $ | 482 | | | $ | 478 | | | 0.09 | % |

| SI Solutions, LLC | | (4) (10) | | First Lien Debt | | S + 4.75% | | 8.88 | % | | 8/15/2030 | | 5,142 | | | 5,098 | | 5,122 | | 0.93 | % |

| Total Energy Equipment & Services | | | | | | | | | | | | | | 17,262 | | 17,416 | | 3.16 | % |

| | | | | | | | | | | | | | | | | | |

| Food Products | | | | | | | | | | | | | | | | | | |

| AmerCareRoyal, LLC | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 9/10/2030 | | 14,113 | | | 13,991 | | 13,704 | | 2.48 | % |

| AmerCareRoyal, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 9/10/2030 | | 3,257 | | | — | | (94) | | (0.02) | % |

| AmerCareRoyal, LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 9/10/2030 | | 2,248 | | | 2,238 | | 2,182 | | 0.40 | % |

| Commercial Bakeries Corp. | | (4) (8) (10) | | First Lien Debt | | S + 5.50% | | 9.80 | % | | 9/25/2029 | | 7,301 | | | 7,194 | | 7,158 | | 1.30 | % |

| Commercial Bakeries Corp. | | (4) (8) (10) | | First Lien Debt | | S + 5.50% | | 9.80 | % | | 9/25/2029 | | 1,842 | | | 1,829 | | 1,806 | | 0.33 | % |

| Commercial Bakeries Corp. | | (4) (8) (10) | | First Lien Debt | | S + 5.50% | | 9.82 | % | | 9/25/2029 | | 877 | | | 871 | | 860 | | 0.16 | % |

| FoodScience, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.67 | % | | 11/14/2031 | | 2,750 | | | 800 | | 758 | | 0.14 | % |

| FoodScience, LLC | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.72 | % | | 11/14/2031 | | 2,567 | | | 2,544 | | 2,522 | | 0.46 | % |

| Nellson Nutraceutical, LLC | | (4) (7) (10) | | First Lien Debt | | S + 5.75% | | 10.05 | % | | 4/17/2031 | | 11,493 | | | 11,381 | | | 11,386 | | | 2.06 | % |

| Nellson Nutraceutical, LLC | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.05 | % | | 4/17/2031 | | 595 | | | (1) | | | (6) | | | — | % |

| Nellson Nutraceutical, LLC | | (4) (7) (10) | | First Lien Debt | | S + 5.75% | | 10.05 | % | | 4/17/2031 | | 7,612 | | | 7,538 | | | 7,541 | | | 1.37 | % |

| Sugar PPC Buyer LLC (Sugar Foods) | | (4) (7) (10) | | First Lien Debt | | S + 5.25% | | 9.50 | % | | 10/2/2030 | | 5,796 | | | 5,690 | | | 5,796 | | | 1.05 | % |

| Sugar PPC Buyer LLC (Sugar Foods) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.55 | % | | 10/2/2030 | | 1,610 | | | 1,596 | | 1,610 | | 0.29 | % |

| Total Food Products | | | | | | | | | | | | | | 55,671 | | 55,223 | | 10.02 | % |

| | | | | | | | | | | | | | | | | | |

| Gas Utilities | | | | | | | | | | | | | | | | | | |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.46 | % | | 9/15/2028 | | 7,193 | | | 7,108 | | | 7,116 | | | 1.29 | % |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.47 | % | | 9/15/2028 | | 1,402 | | | (6) | | (15) | | — | % |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.45 | % | | 9/15/2028 | | 2,374 | | | 2,342 | | 2,349 | | 0.43 | % |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.42 | % | | 9/15/2028 | | 2,844 | | | 2,389 | | 2,369 | | 0.43 | % |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.47 | % | | 9/15/2028 | | 2,289 | | | 2,277 | | | 2,265 | | | 0.41 | % |

| DH United Holdings, LLC (D&H United Fueling Solutions) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.41 | % | | 9/15/2028 | | 1,076 | | | 1,073 | | 1,065 | | 0.19 | % |

| Total Gas Utilities | | | | | | | | | | | | | | 15,183 | | | 15,149 | | | 2.75 | % |

| | | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Health Care Equipment & Supplies | | | | | | | | | | | | | | | | | | |

| ACP Maverick Holdings, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 3/18/2031 | | $ | 3,582 | | | $ | (17) | | | $ | (34) | | | (0.01) | % |

| ACP Maverick Holdings, Inc. | | (4) (7) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 3/18/2031 | | 16,077 | | | 15,922 | | 15,923 | | 2.89 | % |

| Bridges Consumer Healthcare Intermediate LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.49 | % | | 12/22/2031 | | 2,099 | | | (10) | | (45) | | (0.01) | % |

| Bridges Consumer Healthcare Intermediate LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.49 | % | | 12/22/2031 | | 1,199 | | | 953 | | 933 | | 0.17 | % |

| Bridges Consumer Healthcare Intermediate LLC | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.49 | % | | 12/22/2031 | | 2,518 | | | 2,495 | | 2,464 | | 0.45 | % |

| HMN Acquirer Corp. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.80 | % | | 11/5/2031 | | 1,056 | | | (2) | | (16) | | — | % |

| HMN Acquirer Corp. | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.80 | % | | 11/5/2031 | | 2,858 | | | 2,832 | | 2,813 | | 0.51 | % |

| Impact Advisors, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 3/19/2032 | | 7,010 | | | (34) | | (68) | | (0.01) | % |

| Impact Advisors, LLC | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 3/19/2032 | | 12,587 | | | 12,464 | | 12,464 | | 2.25 | % |

| Tidi Legacy Products, Inc. | | (4) (7) (10) | | First Lien Debt | | S + 4.50% | | 8.83 | % | | 12/19/2029 | | 7,383 | | | 7,326 | | 7,457 | | 1.35 | % |

| Tidi Legacy Products, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.83 | % | | 12/19/2029 | | 1,972 | | | — | | | 20 | | | — | % |

| YI, LLC (Young Innovations) | | (4) (7) (10) | | First Lien Debt | | S + 5.75% | | 10.06 | % | | 12/3/2029 | | 11,105 | | | 11,021 | | 10,869 | | 1.97 | % |

| Total Health Care Equipment & Supplies | | | | | | | | | | | | | | 52,950 | | 52,780 | | 9.56 | % |

| | | | | | | | | | | | | | | | | | |

| Health Care Providers & Services | | | | | | | | | | | | | | | | | | |

| AB Centers Acquisition Corporation (Action Behavior Centers) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.32 | % | | 7/2/2031 | | 6,788 | | | 6,729 | | 6,924 | | 1.25 | % |

| AB Centers Acquisition Corporation (Action Behavior Centers) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 7/2/2031 | | 1,664 | | | 1,657 | | | 1,697 | | | 0.31 | % |

| AB Centers Acquisition Corporation (Action Behavior Centers) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.32 | % | | 7/2/2031 | | 1,238 | | | 443 | | 470 | | 0.09 | % |

| Bluebird PM Buyer, Inc. | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.05 | % | | 2/3/2032 | | 502 | | | (1) | | | (4) | | | — | % |

| Bluebird PM Buyer, Inc. | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 2/3/2032 | | 3,672 | | | 3,638 | | 3,644 | | 0.66 | % |

| Dermatology Intermediate Holdings III, Inc. (Forefront Dermatology) | | (4) (7) (10) | | First Lien Debt | | S + 4.25% | | 8.53 | % | | 3/30/2029 | | 4,533 | | | 4,487 | | 4,314 | | 0.78 | % |

| Eyesouth Eye Care Holdco LLC | | (4) | | First Lien Debt | | S + 5.50% | | 9.93 | % | | 10/5/2029 | | 7,647 | | | 7,533 | | 7,518 | | 1.36 | % |

| Eyesouth Eye Care Holdco LLC | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.93 | % | | 10/5/2029 | | 2,507 | | | 2,507 | | 2,465 | | 0.45 | % |

| JKC Buyer, Inc. (J. Knipper and Company Inc) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.31 | % | | 2/13/2032 | | 2,644 | | | 2,621 | | 2,629 | | 0.48 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| JKC Buyer, Inc. (J. Knipper and Company Inc) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 2/13/2032 | | $ | 915 | | | $ | 911 | | | $ | 910 | | | 0.16 | % |

| OMERS Relief Acquisition, LLC (Gastro Health) | | (4) | | First Lien Debt | | S + 4.50% | | 8.94 | % | | 7/3/2028 | | 8,122 | | | 8,094 | | | 8,024 | | | 1.45 | % |

| Promptcare Infusion Buyer, Inc. | | (4) (7) | | First Lien Debt | | S + 6.00% | | 10.39 | % | | 9/1/2027 | | 9,073 | | | 9,049 | | | 8,890 | | | 1.61 | % |

| Promptcare Infusion Buyer, Inc. | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.38 | % | | 9/1/2027 | | 1,413 | | | 1,412 | | 1,385 | | 0.25 | % |

| Promptcare Infusion Buyer, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 6.00% | | 10.38 | % | | 9/1/2027 | | 1,245 | | | 619 | | | 594 | | | 0.11 | % |

| Sandlot Buyer, LLC (Prime Time Healthcare) | | (4) | | First Lien Debt | | S + 6.25% | | 10.68 | % | | 9/19/2028 | | 15,666 | | | 15,375 | | 15,502 | | 2.81 | % |

| VMG Holdings LLC (VMG Health) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 4/16/2030 | | 494 | | | 490 | | 490 | | 0.09 | % |

| VMG Holdings LLC (VMG Health) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 4/16/2030 | | 6,883 | | | 6,826 | | | 6,823 | | | 1.24 | % |

| Total Health Care Providers & Services | | | | | | | | | | | | | | 72,390 | | 72,275 | | 13.10 | % |

| | | | | | | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | | | | |

| Davidson Hotel Company LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 10/31/2031 | | 458 | | | 17 | | 16 | | — | % |

| Davidson Hotel Company LLC | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 10/31/2031 | | 1,374 | | | 1,362 | | 1,368 | | 0.25 | % |

| Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | 1,379 | | 1,384 | | 0.25 | % |

| | | | | | | | | | | | | | | | | | |

| Household Durables | | | | | | | | | | | | | | | | | | |

| AMS Parent, LLC (All My Sons) | | (4) (10) | | First Lien Debt | | S + 4.75% | | 9.19 | % | | 10/25/2028 | | 5,756 | | | 5,726 | | 5,735 | | 1.04 | % |

| Total Household Durables | | | | | | | | | | | | | | 5,726 | | 5,735 | | 1.04 | % |

| | | | | | | | | | | | | | | | | | |

| Household Products | | | | | | | | | | | | | | | | | | |

| DRS Holdings III, Inc. | | (4) (7) (10) | | First Lien Debt | | S + 5.25% | | 9.58 | % | | 11/1/2028 | | 1,302 | | | 1,296 | | 1,296 | | 0.23 | % |

| MPG Parent Holdings, LLC (Market Performance Group) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.30 | % | | 1/8/2030 | | 6,017 | | | 5,970 | | 6,048 | | 1.10 | % |

| MPG Parent Holdings, LLC (Market Performance Group) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 1/8/2030 | | 2,165 | | | (5) | | 11 | | — | % |

| MPG Parent Holdings, LLC (Market Performance Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.31 | % | | 1/8/2030 | | 1,477 | | | 1,477 | | | 1,485 | | | 0.27 | % |

| Total Household Products | | | | | | | | | | | | | | 8,738 | | 8,840 | | 1.60 | % |

| | | | | | | | | | | | | | | | | | |

| Industrial Conglomerates | | | | | | | | | | | | | | | | | | |

| ISG Enterprises, LLC (Industrial Service Group) | | (4) | | First Lien Debt | | S + 5.75% | | 10.03 | % | | 12/7/2028 | | 5,623 | | | 5,551 | | | 5,492 | | | 1.00 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| ISG Enterprises, LLC (Industrial Service Group) | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.03 | % | | 12/7/2028 | | $ | 2,928 | | | $ | 2,920 | | | $ | 2,860 | | | 0.52 | % |

| ISG Enterprises, LLC (Industrial Service Group) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.03 | % | | 12/7/2028 | | 10,846 | | | 10,332 | | | 10,084 | | | 1.83 | % |

| Total Industrial Conglomerates | | | | | | | | | | | | | | 18,803 | | 18,436 | | 3.35 | % |

| | | | | | | | | | | | | | | | | | |

| Insurance | | | | | | | | | | | | | | | | | | |

| Accession Risk Management Group, Inc. (f/k/a RSC Acquisition Inc) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 4.75% | | 9.06 | % | | 11/1/2029 | | 11,129 | | | 11,129 | | | 11,129 | | | 2.02 | % |

| Patriot Growth Insurance Services, LLC | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.45 | % | | 10/16/2028 | | 8,830 | | | 8,781 | | 8,676 | | 1.57 | % |

| Total Insurance | | | | | | | | | | | | | | 19,910 | | 19,805 | | 3.59 | % |

| | | | | | | | | | | | | | | | | | |

| Internet and Direct Marketing Retail | | | | | | | | | | | | | | | | | | |

| XpressMyself.com LLC (SmartSign) | | (4) | | First Lien Debt | | S + 5.50% | | 9.91 | % | | 9/7/2028 | | 7,197 | | | 7,158 | | | 7,197 | | | 1.30 | % |

| XpressMyself.com LLC (SmartSign) | | (4) | | First Lien Debt | | S + 5.75% | | 10.17 | % | | 9/7/2028 | | 2,639 | | | 2,605 | | 2,639 | | 0.48 | % |

| Total Internet and Direct Marketing Retail | | | | | | | | | | | | | | 9,763 | | 9,836 | | 1.78 | % |

| | | | | | | | | | | | | | | | | | |

| IT Services | | | | | | | | | | | | | | | | | | |

| 360 Holdco, Inc. (360 Training) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 8/2/2028 | | 1,489 | | | 1,478 | | 1,489 | | 0.27 | % |

| 360 Holdco, Inc. (360 Training) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 8/2/2028 | | 1,346 | | | — | | — | | — | % |

| Redwood Services Group, LLC (Evergreen Services Group) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.56 | % | | 6/15/2029 | | 4,767 | | | 1,593 | | 1,575 | | 0.29 | % |

| Redwood Services Group, LLC (Evergreen Services Group) | | (4) (7) (10) | | First Lien Debt | | S + 5.25% | | 9.55 | % | | 6/15/2029 | | 12,686 | | | 12,536 | | | 12,581 | | | 2.27 | % |

| Redwood Services Group, LLC (Evergreen Services Group) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.55 | % | | 6/15/2029 | | 2,143 | | | 2,129 | | | 2,125 | | | 0.39 | % |

| Total IT Services | | | | | | | | | | | | | | 17,736 | | 17,770 | | 3.22 | % |

| | | | | | | | | | | | | | | | | | |

| Leisure Products | | | | | | | | | | | | | | | | | | |

| TouchTunes Music Group, LLC (TouchTunes Interactive Network) | | (9) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 4/2/2029 | | 7,461 | | | 7,414 | | 7,224 | | 1.31 | % |

| Total Leisure Products | | | | | | | | | | | | | | 7,414 | | 7,224 | | 1.31 | % |

| | | | | | | | | | | | | | | | | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Machinery | | | | | | | | | | | | | | | | | | |

| Hyperion Materials & Technologies, Inc. | | (9) | | First Lien Debt | | S + 4.50% | | 9.02 | % | | 8/30/2028 | | $ | 4,185 | | | $ | 4,179 | | | $ | 4,047 | | | 0.73 | % |

| Jetson Buyer, Inc. (E-Technologies Group, Inc.) | | (4) (10) | | First Lien Debt | | S + 5.50% | | 9.80 | % | | 4/9/2030 | | 3,152 | | | 3,126 | | 3,066 | | 0.56 | % |

| Total Machinery | | | | | | | | | | | | | | 7,305 | | 7,113 | | 1.29 | % |

| | | | | | | | | | | | | | | | | | |

| Personal Products | | | | | | | | | | | | | | | | | | |

| Healthspan Buyer, LLC (Thorne HealthTech) | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.55 | % | | 10/16/2030 | | 5,066 | | | 5,026 | | | 4,991 | | | 0.90 | % |

| Healthspan Buyer, LLC (Thorne HealthTech) | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.55 | % | | 10/16/2030 | | 2,691 | | | 2,679 | | 2,651 | | 0.48 | % |

| Total Personal Products | | | | | | | | | | | | | | 7,705 | | 7,642 | | 1.38 | % |

| | | | | | | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | | | | | | | |

| Lavie Group, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.25% | | 9.42 | % | | 10/10/2029 | | 321 | | | (1) | | (3) | | — | % |

| Lavie Group, Inc. | | (4) (7) (10) | | First Lien Debt | | S + 5.25% | | 9.42 | % | | 10/12/2029 | | 1,199 | | | 1,188 | | 1,188 | | 0.22 | % |

| Wellspring Pharmaceutical Corporation | | (4) | | First Lien Debt | | S + 5.00% | | 9.27 | % | | 8/22/2028 | | 3,222 | | | 3,184 | | 3,226 | | 0.58 | % |

| Wellspring Pharmaceutical Corporation | | (4) | | First Lien Debt | | S + 5.00% | | 9.27 | % | | 8/22/2028 | | 2,605 | | | 2,571 | | 2,609 | | 0.47 | % |

| Wellspring Pharmaceutical Corporation | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.27 | % | | 8/22/2028 | | 3,167 | | | 3,151 | | 3,171 | | 0.57 | % |

| Wellspring Pharmaceutical Corporation | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.27 | % | | 8/22/2028 | | 1,547 | | | 1,541 | | 1,549 | | 0.28 | % |

| Wellspring Pharmaceutical Corporation | | (4) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.27 | % | | 8/22/2028 | | 5,408 | | | 5,393 | | | 5,417 | | | 0.98 | % |

| Total Pharmaceuticals | | | | | | | | | | | | | | 17,027 | | 17,157 | | 3.10 | % |

| | | | | | | | | | | | | | | | | | |

| Professional Services | | | | | | | | | | | | | | | | | | |

| AG Group Holdings, Inc. (Addison Group) | | (4) | | First Lien Debt | | S + 4.25% | | 8.58 | % | | 12/29/2028 | | 5,491 | | | 5,489 | | | 5,140 | | | 0.93 | % |

| ALKU Intermediate Holdings, LLC | | (4) | | First Lien Debt | | S + 6.25% | | 10.47 | % | | 5/23/2029 | | 3,917 | | | 3,861 | | 3,901 | | 0.71 | % |

| All4 Buyer, LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.50% | | 8.78 | % | | 1/23/2032 | | 1,038 | | | (5) | | (10) | | — | % |

| All4 Buyer, LLC | | (4) (10) | | First Lien Debt | | S + 4.50% | | 8.78 | % | | 1/23/2032 | | 1,243 | | | 1,231 | | 1,231 | | 0.22 | % |

| Archer Acquisition, LLC (ARMstrong) | | (4) (10) | | First Lien Debt | | S + 5.00% | | 9.40 | % | | 10/8/2029 | | 5,444 | | | 5,382 | | 5,396 | | 0.98 | % |

| Archer Acquisition, LLC (ARMstrong) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.39 | % | | 10/8/2029 | | 529 | | | 188 | | 186 | | 0.03 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Cornerstone Advisors of Arizona, LLC | | (4) (7) (10) | | First Lien Debt | | S + 4.75% | | 9.05 | % | | 5/13/2032 | | $ | 8,700 | | | $ | 8,657 | | | $ | 8,660 | | | 1.57 | % |

| KENG Acquisition, Inc. (Enagage PEO) | | (4) (7) (10) | | First Lien Debt | | S + 5.00% | | 9.28 | % | | 8/1/2029 | | 4,598 | | | 4,545 | | 4,559 | | 0.83 | % |

| KENG Acquisition, Inc. (Enagage PEO) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.28 | % | | 8/1/2029 | | 4,469 | | | 2,772 | | 2,741 | | 0.50 | % |

| KENG Acquisition, Inc. (Enagage PEO) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.28 | % | | 8/1/2029 | | 2,851 | | | (6) | | (24) | | — | % |

| KENG Acquisition, Inc. (Engage PEO) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.28 | % | | 8/1/2029 | | 5,347 | | | (24) | | | (45) | | | (0.01) | % |

| LSCS Holdings, Inc. (Dohmen) | | (7) (9) (10) | | First Lien Debt | | S + 4.50% | | 8.80 | % | | 3/4/2032 | | 7,980 | | | 7,940 | | 7,845 | | 1.42 | % |

| Orion Group FM Holdings, LLC (Leo Facilities) | | (4) (10) | | First Lien Debt | | S + 5.50% | | 9.80 | % | | 7/3/2029 | | 7,635 | | | 7,549 | | 7,642 | | 1.38 | % |

| Orion Group FM Holdings, LLC (Leo Facilities) | | (4) (10) | | First Lien Debt | | S + 5.50% | | 9.80 | % | | 7/3/2029 | | 645 | | | 639 | | 646 | | 0.12 | % |

| Orion Group FM Holdings, LLC (Leo Facilities) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.77 | % | | 7/3/2029 | | 5,785 | | | 4,261 | | | 4,275 | | | 0.77 | % |

| Orion Group FM Holdings, LLC (Leo Facilities) | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.82 | % | | 7/3/2029 | | 5,488 | | | — | | | 5 | | | — | % |

| Secretariat Advisors LLC | | (4) (10) | | First Lien Debt | | S + 4.00% | | 8.30 | % | | 2/28/2032 | | 3,278 | | | 3,263 | | | 3,258 | | | 0.59 | % |

| Secretariat Advisors LLC | | (4) (6) | | First Lien Debt (Delayed Draw) | | S + 4.00% | | 8.30 | % | | 2/28/2032 | | 396 | | | — | | (2) | | — | % |

| Total Professional Services | | | | | | | | | | | | | | 55,742 | | 55,404 | | 10.04 | % |

| | | | | | | | | | | | | | | | | | |

| Road & Rail | | | | | | | | | | | | | | | | | | |

| EVDR Purchaser, Inc. (Alternative Logistics Technologies Buyer, LLC) | | (4) (7) (10) | | First Lien Debt | | S + 5.50% | | 9.83 | % | | 2/14/2031 | | 5,073 | | | 5,033 | | | 5,029 | | | 0.91 | % |

| EVDR Purchaser, Inc. (Alternative Logistics Technologies Buyer, LLC) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.83 | % | | 2/14/2031 | | 1,468 | | | — | | (13) | | — | % |

| Total Road & Rail | | | | | | | | | | | | | | 5,033 | | 5,016 | | 0.91 | % |

| | | | | | | | | | | | | | | | | | |

| Software | | | | | | | | | | | | | | | | | | |

| Businessolver.com, Inc. | | (4) (7) | | First Lien Debt | | S + 5.50% | | 9.90 | % | | 12/1/2027 | | 8,690 | | | 8,651 | | | 8,690 | | | 1.57 | % |

| Businessolver.com, Inc. | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.50% | | 9.90 | % | | 12/1/2027 | | 1,304 | | | 1,066 | | 1,069 | | 0.19 | % |

| Diligent Corporation (fka Diamond Merger Sub II, Corp.) | | (4) (6) (7) | | First Lien Debt (Delayed Draw) | | S + 5.00% | | 9.33 | % | | 8/2/2030 | | 2,515 | | | (10) | | (17) | | — | % |

| Diligent Corporation (fka Diamond Merger Sub II, Corp.) | | (4) (7) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 8/2/2030 | | 2,515 | | | 2,505 | | 2,498 | | 0.45 | % |

| Diligent Corporation (fka Diamond Merger Sub II, Corp.) | | (4) (7) (10) | | First Lien Debt | | S + 5.00% | | 9.33 | % | | 8/2/2030 | | 14,670 | | | 14,612 | | 14,572 | | 2.64 | % |

CONSOLIDATED SCHEDULE OF INVESTMENTS (UNAUDITED)

June 30, 2025

(dollar amounts in thousands, except shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company (1) (2) | | Footnotes | | Investment | | Spread Above Reference Rate (3) | | Interest Rate (3) | | Maturity Date | | Par Amount | | Amortized Cost | | Fair Value | | % of Net Assets (5) |

| Revalize Inc. (f/k/a AQ Holdco Inc.) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.20 | % | | 4/15/2027 | | $ | 4,910 | | | $ | 4,905 | | | $ | 4,673 | | | 0.85 | % |

| Revalize Inc. (f/k/a AQ Holdco Inc.) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.20 | % | | 4/15/2027 | | 1,261 | | | 1,257 | | 1,200 | | 0.22 | % |

| Revalize Inc. (f/k/a AQ Holdco Inc.) | | (4) (7) | | First Lien Debt (Delayed Draw) | | S + 5.75% | | 10.18 | % | | 4/15/2027 | | 280 | | | 279 | | | 266 | | | 0.05 | % |

| VALIDITY INC | | (4) (10) | | First Lien Debt | | S + 5.25% | | 9.58 | % | | 4/7/2032 | | 3,075 | | | 3,044 | | 3,044 | | 0.55 | % |

| Total Software | | | | | | | | | | | | | | 36,309 | | 35,995 | | 6.52 | % |

| | | | | | | | | | | | | | | | | | |

| Transportation Infrastructure | | | | | | | | | | | | | | | | | | |