NOVEMBER 2025 Third Quarter 2025 Financial Results & Corporate Progress

Forward Looking Statements This presentation and the accompanying oral commentary contain forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “would,” “continue,” “ongoing” or the negative of these terms or other comparable terminology. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including information concerning our future financial performance, including the sufficiency of our cash, cash equivalents and short-term investments to fund our operations, business plans and objectives, timing and success of our commercialization and marketing efforts, timing and success of our planned nonclinical and clinical development activities, the results of any of our strategic collaborations, including the potential achievement of milestones and provision of royalty payments thereunder, efficacy and safety profiles of our products and product candidates, the ability of OJEMDA™ (tovorafenib) to treat pediatric low-grade glioma (pLGG) or related indications, the potential therapeutic benefits and economic value of our products and product candidates, potential growth opportunities, competitive position, industry environment and potential market opportunities, our ability to protect intellectual property and the impact of global business or macroeconomic conditions, including as a result of inflation, changing interest rates, government shutdowns, cybersecurity incidents, significant political, trade or regulatory developments, including tariffs, shifting priorities within the U.S. Food and Drug Administration and reduced funding of federal healthcare programs, and global regional conflicts, on our business and operations. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These factors, together with those that are described under the heading “Risk Factors” contained in our most recent Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) and other documents we file from time to time with the SEC, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this presentation, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

Agenda & Day One Participants Opening Remarks Jeremy Bender (Chief Executive Officer) OJEMDATM Launch Performance Lauren Merendino (Chief Commercial Officer) Financial Performance Charles York (Chief Operating & Chief Financial Officer) Q&A Session All, joined by: Mike Vasconcelles (Head of R&D)

Opening Remarks Jeremy Bender Chief Executive Officer

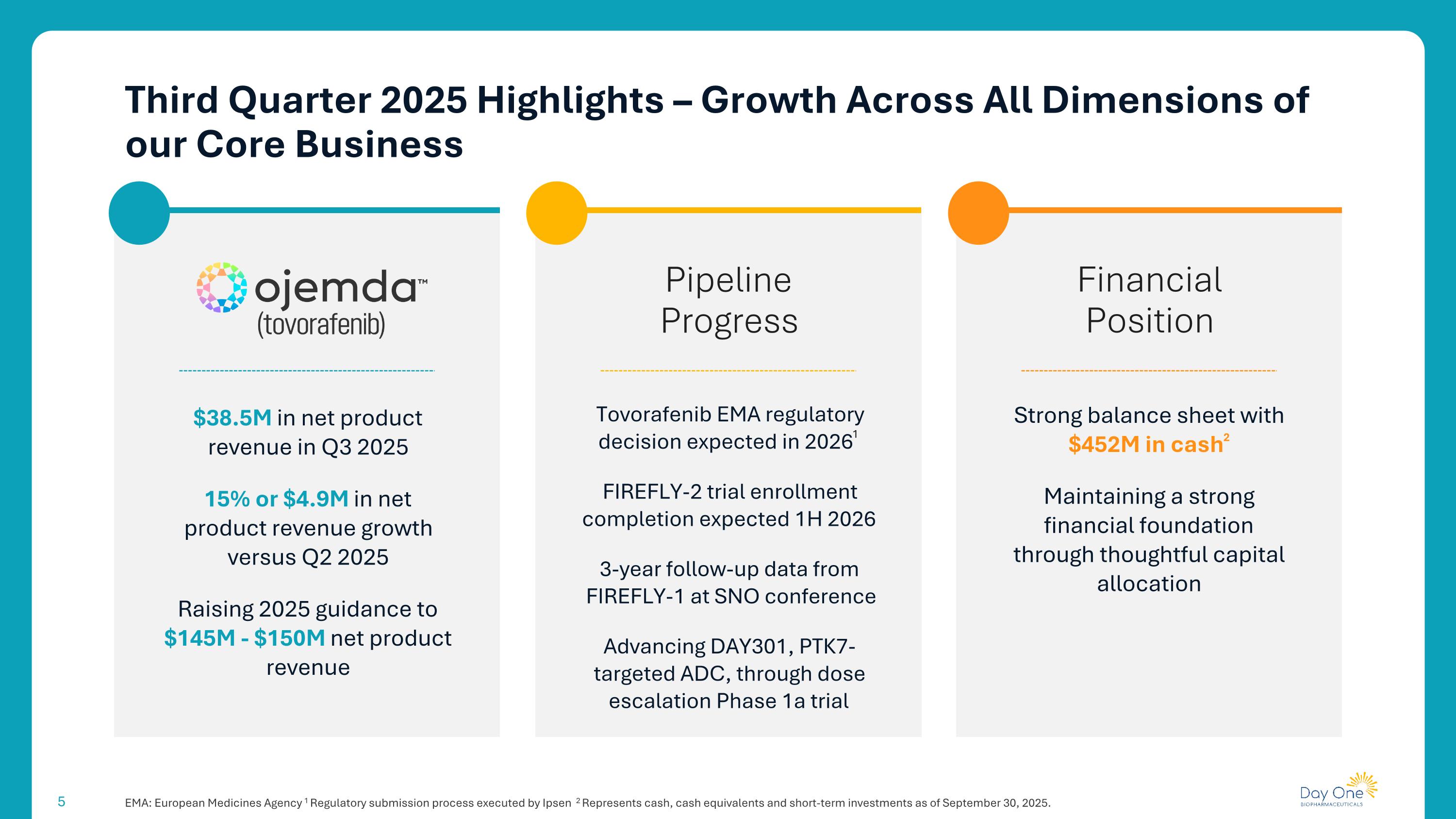

Third Quarter 2025 Highlights – Growth Across All Dimensions of our Core Business EMA: European Medicines Agency 1 Regulatory submission process executed by Ipsen 2 Represents cash, cash equivalents and short-term investments as of September 30, 2025. Financial Position Pipeline Progress $38.5M in net product revenue in Q3 2025 15% or $4.9M in net product revenue growth versus Q2 2025 Raising 2025 guidance to $145M - $150M net product revenue Tovorafenib EMA regulatory decision expected in 20261 FIREFLY-2 trial enrollment completion expected 1H 2026 3-year follow-up data from FIREFLY-1 at SNO conference Advancing DAY301, PTK7-targeted ADC, through dose escalation Phase 1a trial Strong balance sheet with $452M in cash2 Maintaining a strong financial foundation through thoughtful capital allocation

OJEMDA Launch Performance Lauren Merendino Chief Commercial Officer

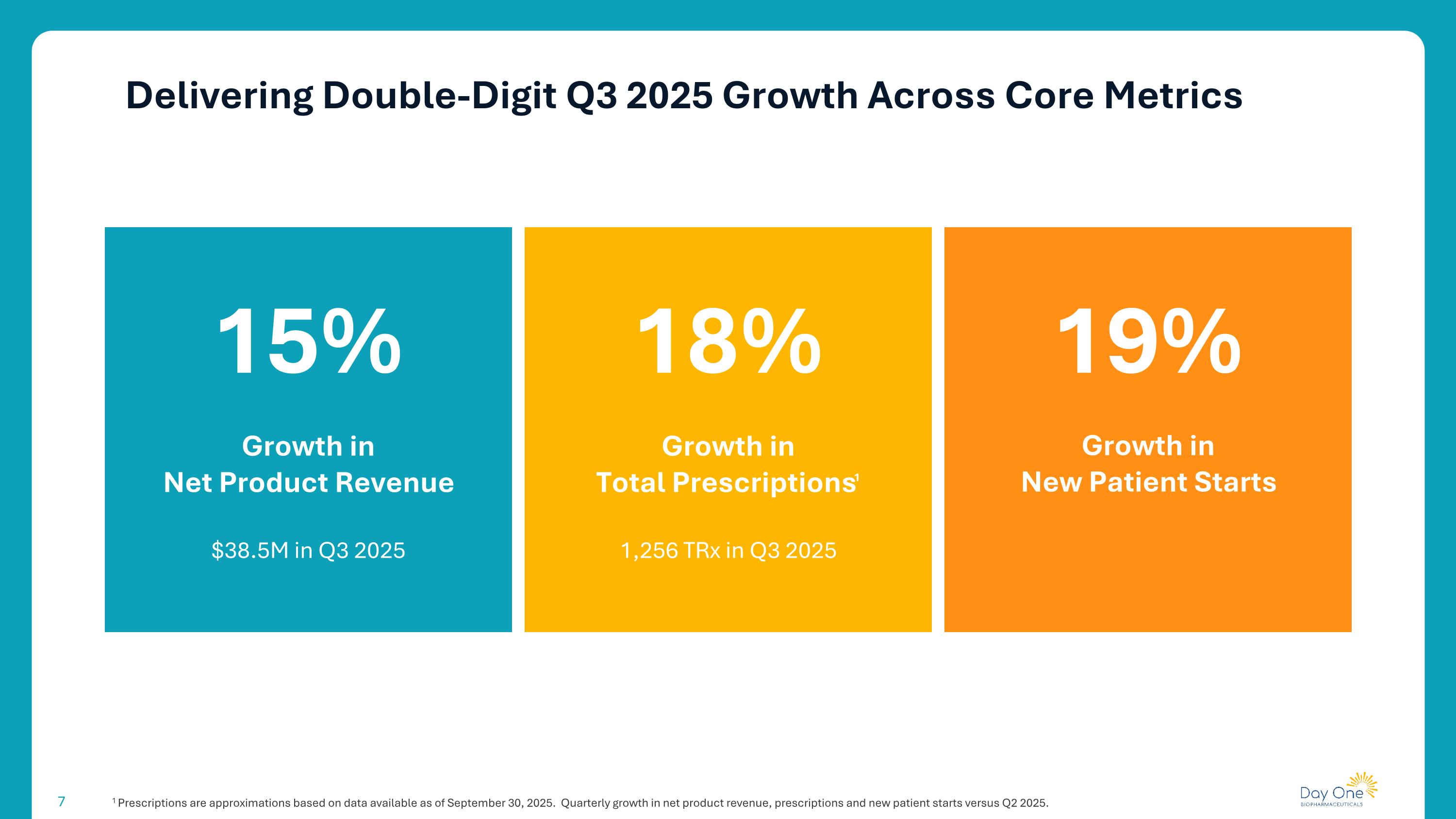

Delivering Double-Digit Q3 2025 Growth Across Core Metrics 1 Prescriptions are approximations based on data available as of September 30, 2025. Quarterly growth in net product revenue, prescriptions and new patient starts versus Q2 2025. 15% Growth in Net Product Revenue 18% $38.5M in Q3 2025 19% Growth in New Patient Starts Growth in Total Prescriptions1 1,256 TRx in Q3 2025

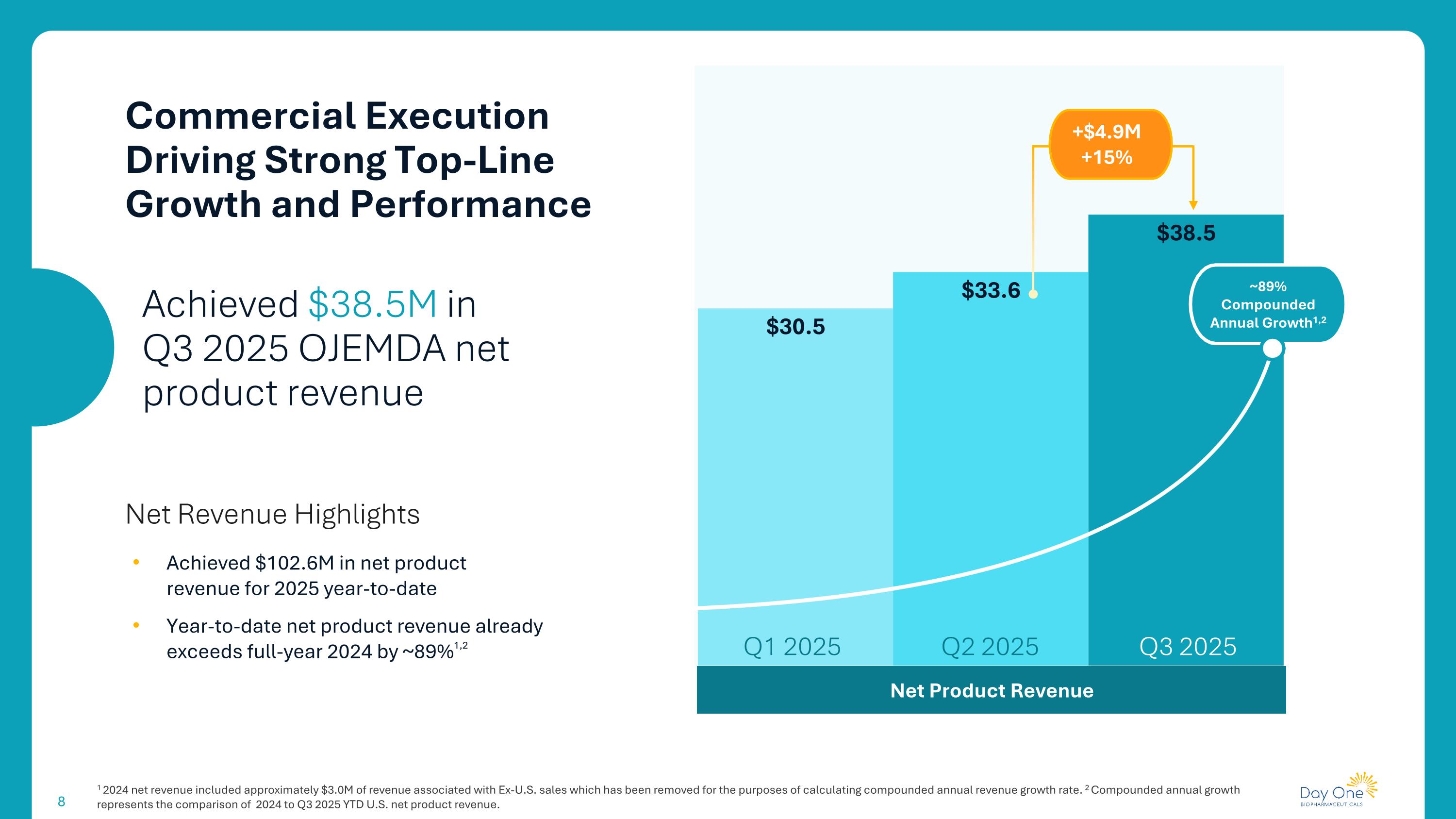

1 2024 net revenue included approximately $3.0M of revenue associated with Ex-U.S. sales which has been removed for the purposes of calculating compounded annual revenue growth rate. 2 Compounded annual growth represents the comparison of 2024 to Q3 2025 YTD U.S. net product revenue. Commercial Execution Driving Strong Top-Line Growth and Performance Net Product Revenue Q3 2025 Q1 2025 Q2 2025 +$4.9M +15% ~89% Compounded Annual Growth1,2 Achieved $38.5M in Q3 2025 OJEMDA net product revenue Net Revenue Highlights Achieved $102.6M in net product revenue for 2025 year-to-date Year-to-date net product revenue already exceeds full-year 2024 by ~89%1,2

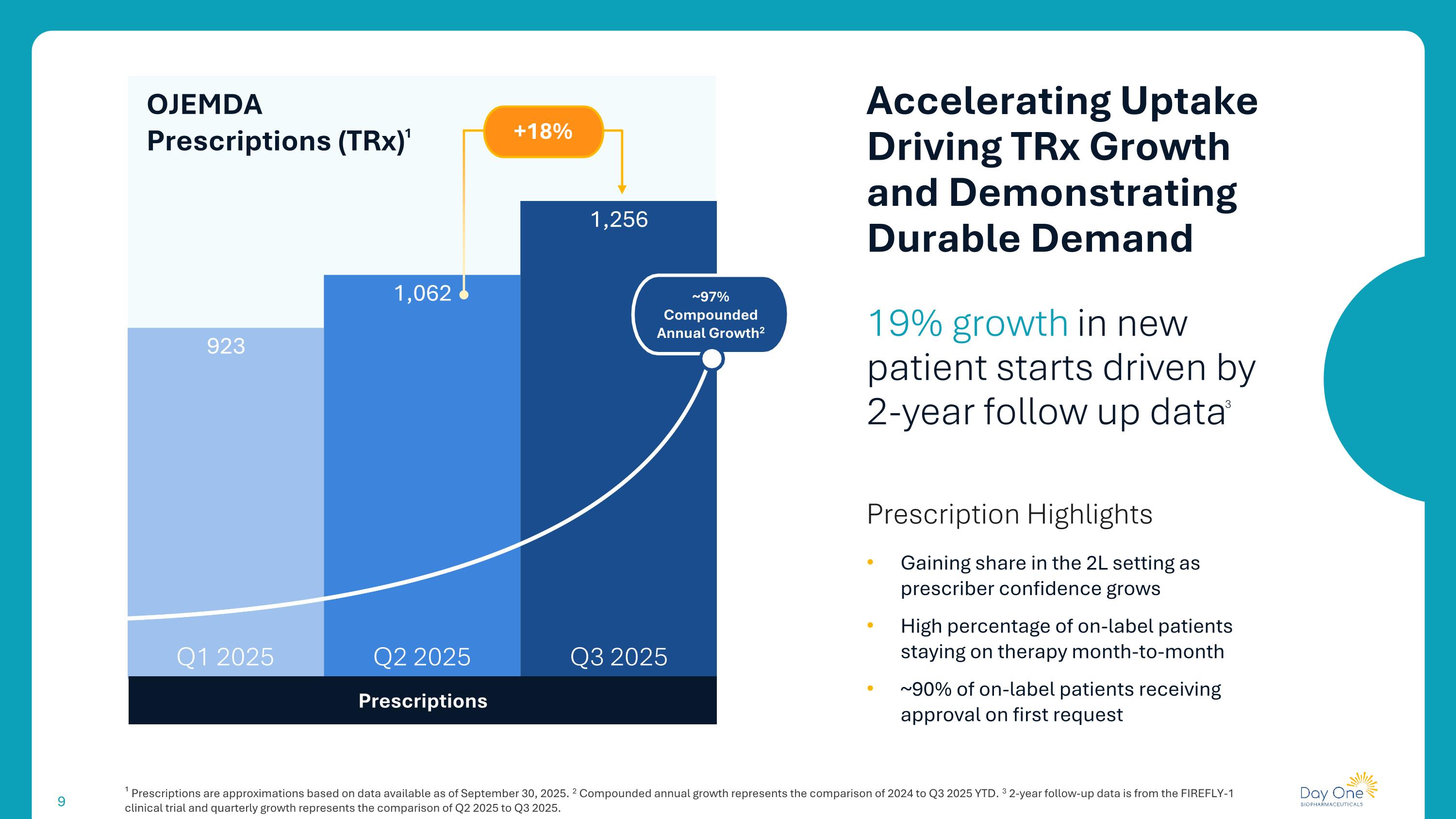

19% growth in new patient starts driven by 2-year follow up data3 Prescription Highlights Gaining share in the 2L setting as prescriber confidence grows High percentage of on-label patients staying on therapy month-to-month ~90% of on-label patients receiving approval on first request Accelerating Uptake Driving TRx Growth and Demonstrating Durable Demand Prescriptions OJEMDA Prescriptions (TRx)1 Q3 2025 Q1 2025 Q2 2025 ¹ Prescriptions are approximations based on data available as of September 30, 2025. 2 Compounded annual growth represents the comparison of 2024 to Q3 2025 YTD. 3 2-year follow-up data is from the FIREFLY-1 clinical trial and quarterly growth represents the comparison of Q2 2025 to Q3 2025. ~97% Compounded Annual Growth2 +18%

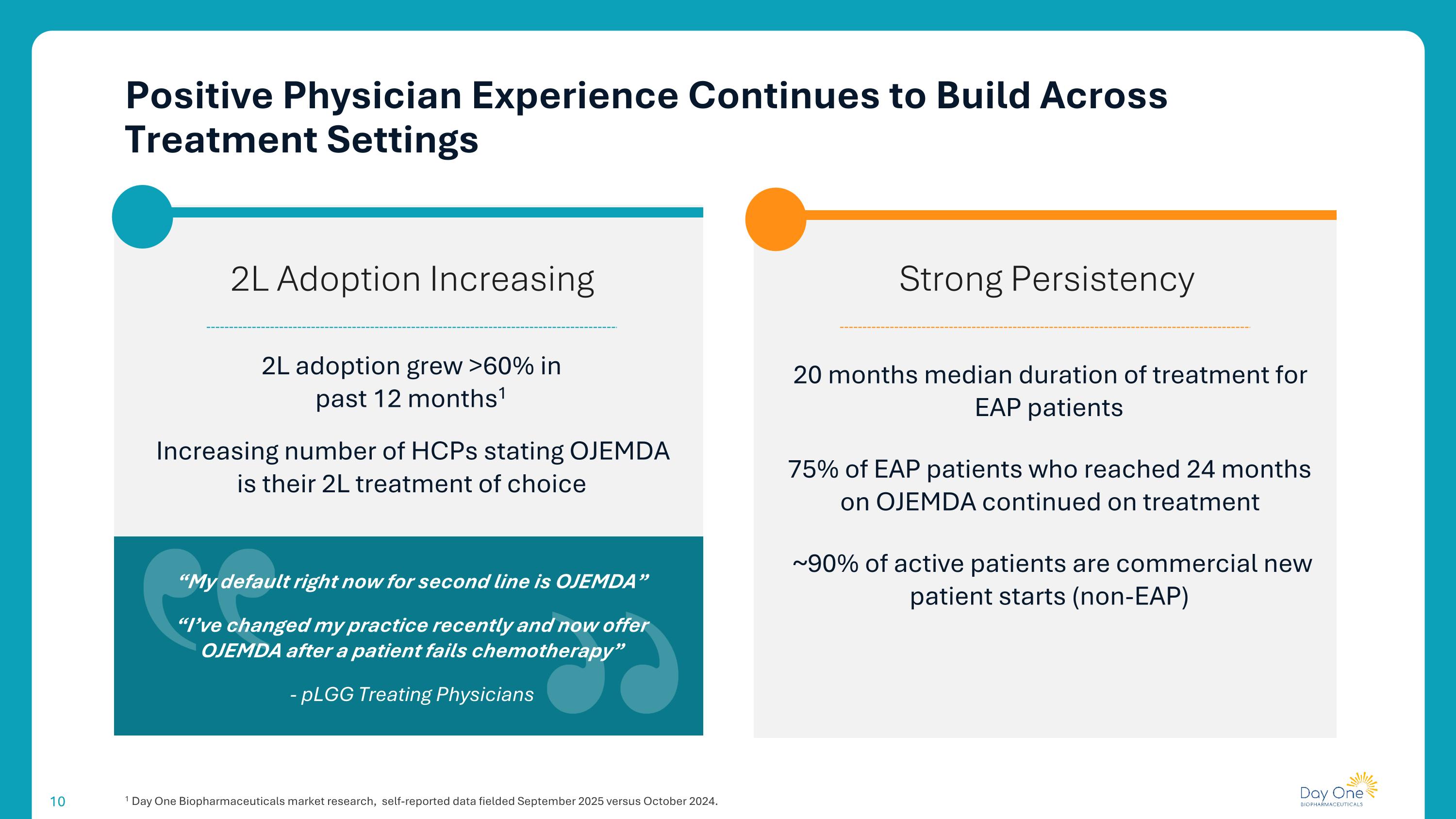

Positive Physician Experience Continues to Build Across Treatment Settings 1 Day One Biopharmaceuticals market research, self-reported data fielded September 2025 versus October 2024. Strong Persistency 2L Adoption Increasing 20 months median duration of treatment for EAP patients 75% of EAP patients who reached 24 months on OJEMDA continued on treatment ~90% of active patients are commercial new patient starts (non-EAP) 2L adoption grew >60% in past 12 months1 Increasing number of HCPs stating OJEMDA is their 2L treatment of choice “My default right now for second line is OJEMDA” “I’ve changed my practice recently and now offer OJEMDA after a patient fails chemotherapy” - pLGG Treating Physicians

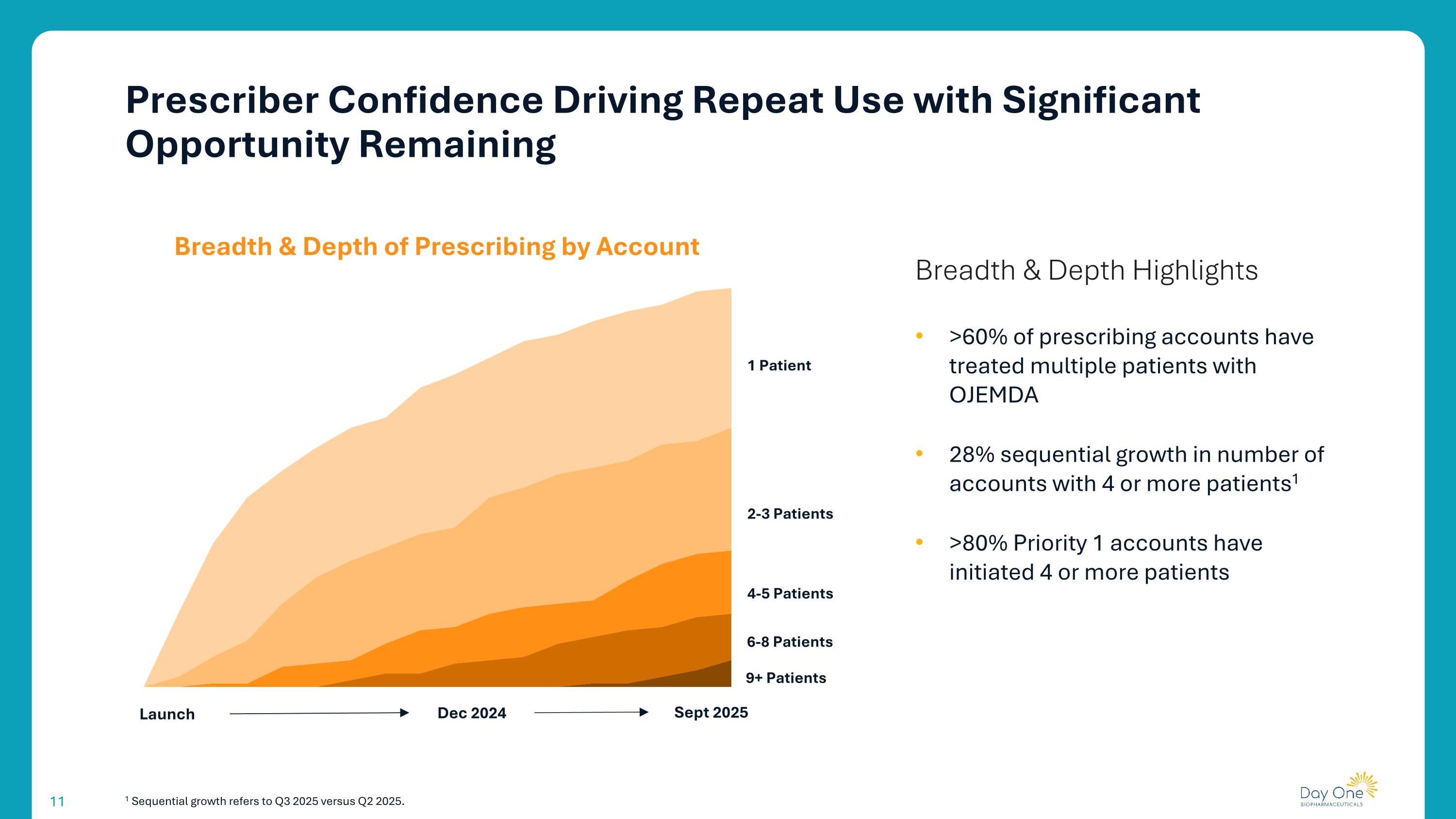

1 Sequential growth refers to Q3 2025 versus Q2 2025. >60% of prescribing accounts have treated multiple patients with OJEMDA 28% sequential growth in number of accounts with 4 or more patients1 >80% Priority 1 accounts have initiated 4 or more patients Launch Dec 2024 Sept 2025 1 Patient 2-3 Patients 4-5 Patients 6-8 Patients 9+ Patients Breadth & Depth of Prescribing by Account Breadth & Depth Highlights Prescriber Confidence Driving Repeat Use with Significant Opportunity Remaining

Focused Execution and Meaningful Progress Driving Continued Adoption and Treatment Durability through 2025 On label patients only. Raising 2025 guidance to $145 - $150 million net product revenue OPTIMIZE PERSISTENCE Support physicians and patients to optimize their experience on OJEMDA including effective AE management and reimbursement support Increase depth of prescribing by expanding physicians' belief in which patients will benefit from OJEMDA and using it in 2L* Continue to expand prescriber base by converting non-users into first-time adopters of OJEMDA DRIVE NEW PATIENT STARTS

We Continue to Strengthen the OJEMDA Story Through Enhancing the Target Product Profile and Data Generation FIREFLY-1 3-Year Data Highlighting clinical stability following treatment with OJEMDA and opportunity for retreatment Potential to further expand physician confidence and adoption while reinforcing target product profile Presentation at SNO conference and publication efforts underway Establishing OJEMDA as the Standard of Care in 2L r/r BRAF-altered pLGG

Financial Performance Charles York Chief Operating Officer & Chief Financial Officer

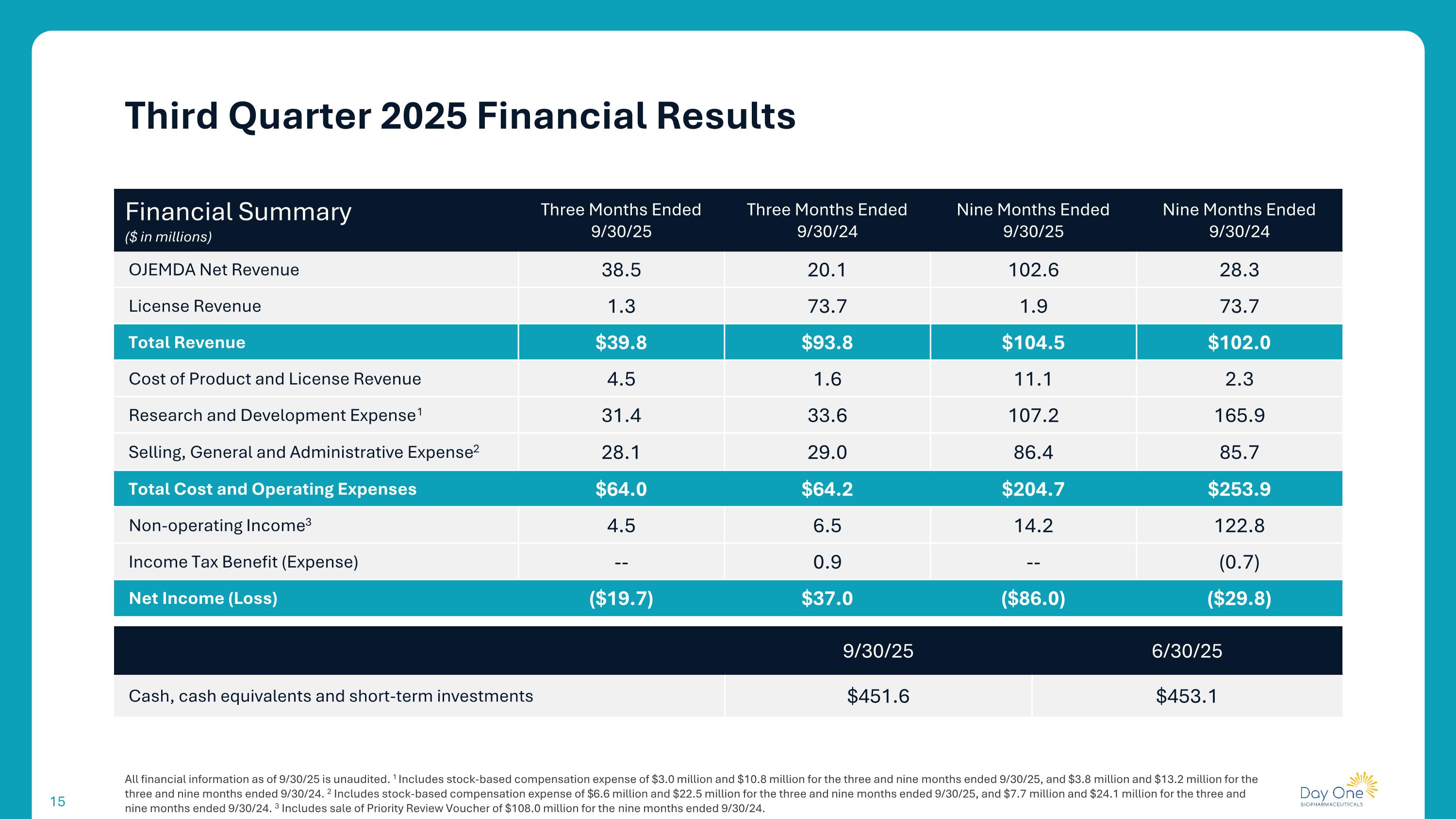

All financial information as of 9/30/25 is unaudited. 1 Includes stock-based compensation expense of $3.0 million and $10.8 million for the three and nine months ended 9/30/25, and $3.8 million and $13.2 million for the three and nine months ended 9/30/24. 2 Includes stock-based compensation expense of $6.6 million and $22.5 million for the three and nine months ended 9/30/25, and $7.7 million and $24.1 million for the three and nine months ended 9/30/24. 3 Includes sale of Priority Review Voucher of $108.0 million for the nine months ended 9/30/24. Third Quarter 2025 Financial Results Financial Summary ($ in millions) Three Months Ended 9/30/25 Three Months Ended 9/30/24 Nine Months Ended 9/30/25 Nine Months Ended 9/30/24 OJEMDA Net Revenue 38.5 20.1 102.6 28.3 License Revenue 1.3 73.7 1.9 73.7 Total Revenue $39.8 $93.8 $104.5 $102.0 Cost of Product and License Revenue 4.5 1.6 11.1 2.3 Research and Development Expense1 31.4 33.6 107.2 165.9 Selling, General and Administrative Expense2 28.1 29.0 86.4 85.7 Total Cost and Operating Expenses $64.0 $64.2 $204.7 $253.9 Non-operating Income3 4.5 6.5 14.2 122.8 Income Tax Benefit (Expense) -- 0.9 -- (0.7) Net Income (Loss) ($19.7) $37.0 ($86.0) ($29.8) 9/30/25 6/30/25 Cash, cash equivalents and short-term investments $451.6 $453.1

Thank You