Day One Biopharmaceuticals Targeted therapies for people of all ages January 2026 44th Annual J.P. Morgan Healthcare Conference .2

Forward looking statements This presentation and the accompanying oral commentary contain forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “would,” “continue,” “ongoing” or the negative of these terms or other comparable terminology. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including information concerning our future financial performance, including the sufficiency of our cash, cash equivalents and short-term investments to fund our operations, business plans and objectives, timing and success of our commercialization and marketing efforts, timing and success of our planned nonclinical and clinical development activities, the success of our acquisition of Mersana Therapeutics and its Emi-Le program, the results of any of our strategic collaborations, including the potential achievement of milestones and provision of royalty payments thereunder, efficacy and safety profiles of our products and product candidates, the ability of OJEMDA™ (tovorafenib) to treat pediatric low-grade glioma (pLGG) or related indications, the potential therapeutic benefits and economic value of our products and product candidates, potential growth opportunities, competitive position, industry environment and potential market opportunities, our ability to protect intellectual property and the impact of global business or macroeconomic conditions, including as a result of inflation, changing interest rates, government shutdowns, cybersecurity incidents, significant political, trade or regulatory developments, including tariffs, shifting priorities within the U.S. Food and Drug Administration and reduced funding of federal healthcare programs, and global regional conflicts, on our business and operations. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These factors, together with those that are described under the heading “Risk Factors” contained in our most recent Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) and other documents we file from time to time with the SEC, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this presentation, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

Inspired by the urgent needs of children, Day One creatively and intentionally develops new medicines for people of all ages with life-threatening diseases

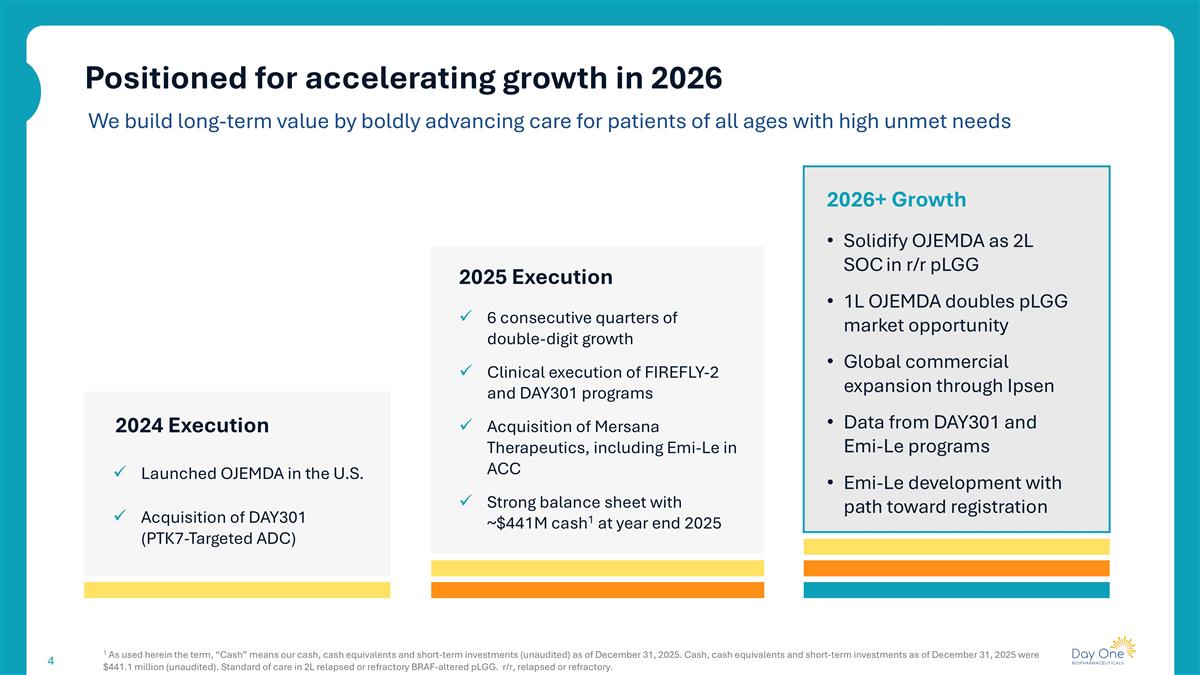

Positioned for accelerating growth in 2026 1 As used herein the term, “Cash” means our cash, cash equivalents and short-term investments (unaudited) as of December 31, 2025. Cash, cash equivalents and short-term investments as of December 31, 2025 were $441.1 million (unaudited). Standard of care in 2L relapsed or refractory BRAF-altered pLGG. r/r, relapsed or refractory. 2024 Execution Launched OJEMDA in the U.S. 2025 Execution 6 consecutive quarters of double-digit growth Clinical execution of FIREFLY-2 and DAY301 programs Acquisition of Mersana Therapeutics, including Emi-Le in ACC Strong balance sheet with ~$441M cash1 at year end 2025 2026+ Growth Solidify OJEMDA as 2L SOC in r/r pLGG 1L OJEMDA doubles pLGG market opportunity Global commercial expansion through Ipsen Data from DAY301 and Emi-Le programs Emi-Le development with path toward registration We build long-term value by boldly advancing care for patients of all ages with high unmet needs Acquisition of DAY301 (PTK7-Targeted ADC)

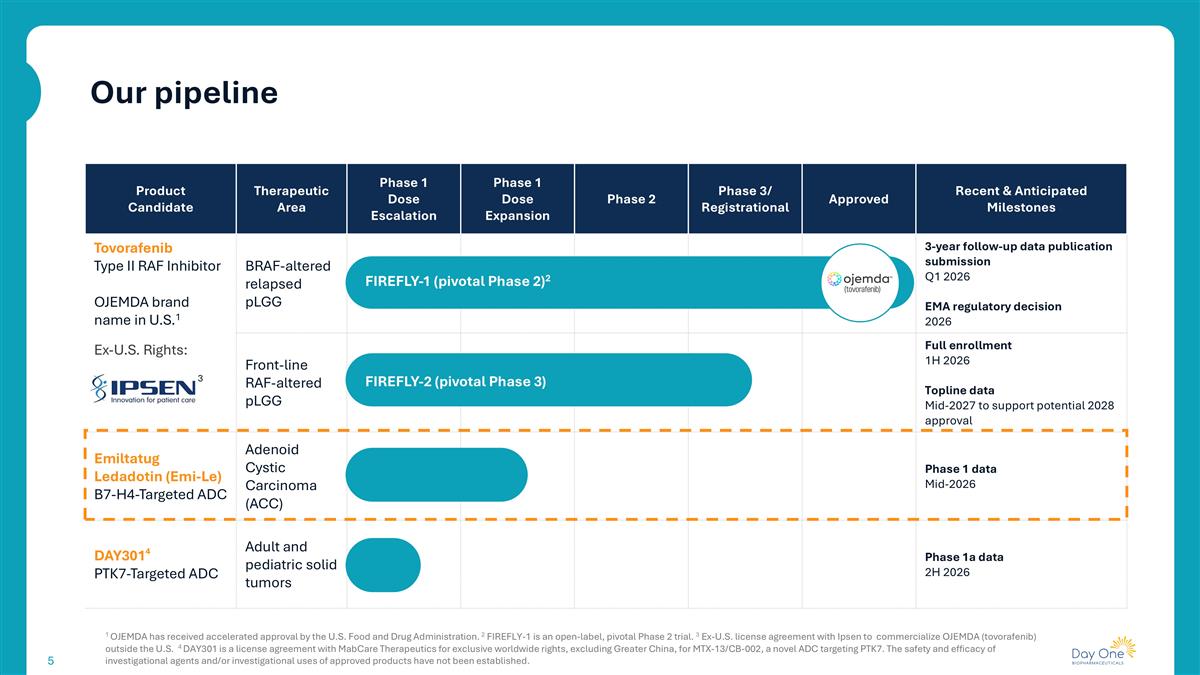

Product Candidate Therapeutic Area Phase 1 Dose Escalation Phase 1 Dose Expansion Phase 2 Phase 3/ Registrational Approved Recent & Anticipated Milestones Tovorafenib Type II RAF Inhibitor OJEMDA brand name in U.S.1 Ex-U.S. Rights: 3 BRAF-altered relapsed pLGG 3-year follow-up data publication submission Q1 2026 EMA regulatory decision 2026 Front-line RAF-altered pLGG Full enrollment 1H 2026 Topline data Mid-2027 to support potential 2028 approval Emiltatug Ledadotin (Emi-Le) B7-H4-Targeted ADC Adenoid Cystic Carcinoma (ACC) Phase 1 data Mid-2026 DAY3014 PTK7-Targeted ADC Adult and pediatric solid tumors Phase 1a data 2H 2026 FIREFLY-1 (pivotal Phase 2)2 FIREFLY-2 (pivotal Phase 3) 1 OJEMDA has received accelerated approval by the U.S. Food and Drug Administration. 2 FIREFLY-1 is an open-label, pivotal Phase 2 trial. 3 Ex-U.S. license agreement with Ipsen to commercialize OJEMDA (tovorafenib) outside the U.S. 4 DAY301 is a license agreement with MabCare Therapeutics for exclusive worldwide rights, excluding Greater China, for MTX-13/CB-002, a novel ADC targeting PTK7. The safety and efficacy of investigational agents and/or investigational uses of approved products have not been established. Our pipeline

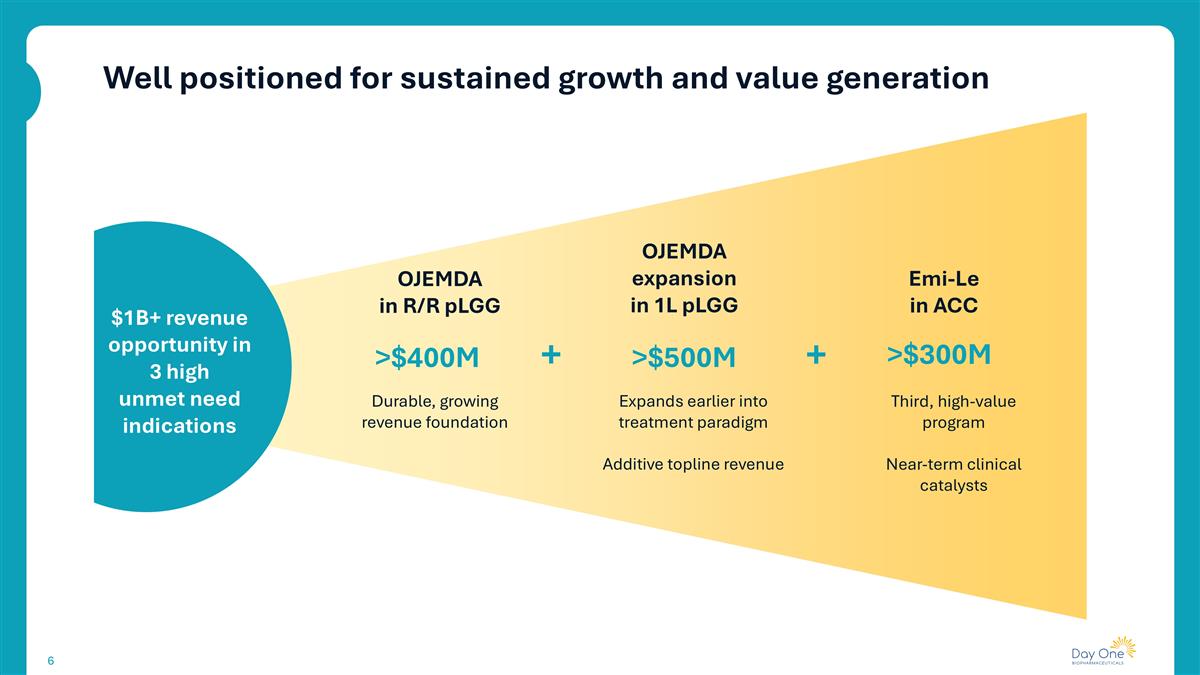

Well positioned for sustained growth and value generation $1B+ revenue opportunity in 3 high unmet need indications OJEMDA in R/R pLGG OJEMDA expansion in 1L pLGG Emi-Le in ACC Durable, growing revenue foundation Expands earlier into treatment paradigm Additive topline revenue Third, high-value program Near-term clinical catalysts >$400M >$500M >$300M + +

Relapsed or refractory BRAF-altered pLGG OJEMDA Nora Living with pLGG

OJEMDA is redefining the treatment paradigm in relapsed or refractory pLGG Clinical data reinforce OJEMDA’s role in the r/r pLGG treatment paradigm Three-year follow-up data (Society for Neuro-Oncology 2025) reinforce durability of OJEMDA and align with how physicians manage pLGG Growing long-term data and physician experience are driving OJEMDA toward standard of care in the evolving treatment paradigm for children with r/r pLGG

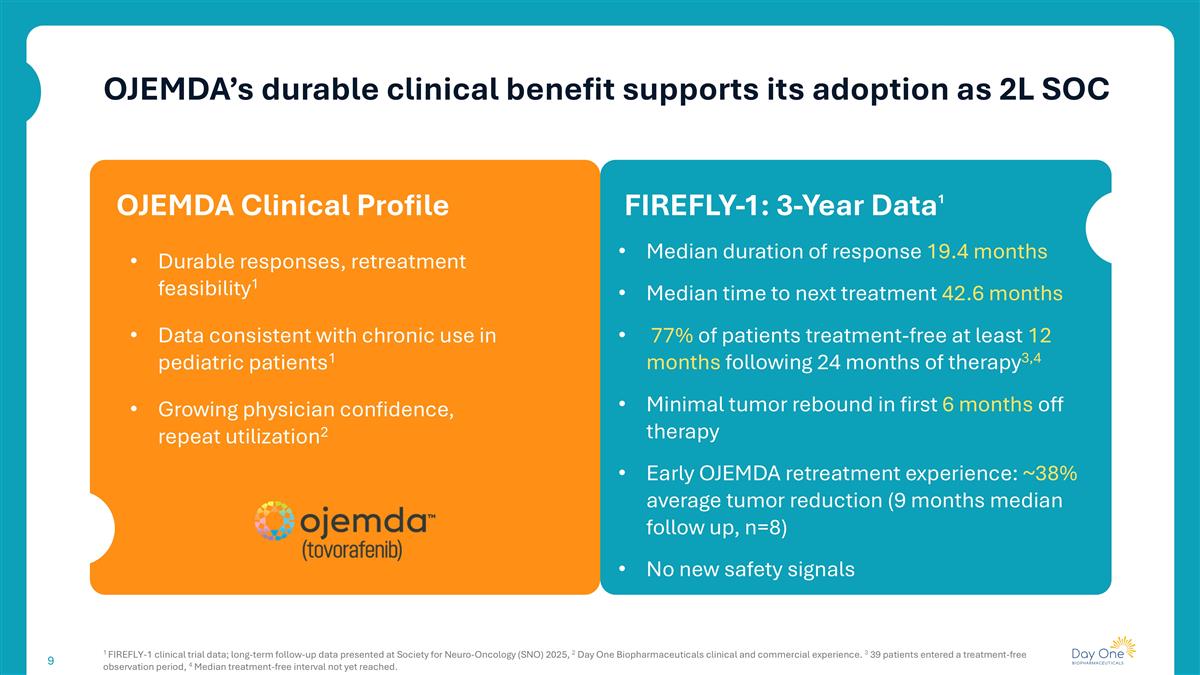

OJEMDA’s durable clinical benefit supports its adoption as 2L SOC 1 FIREFLY-1 clinical trial data; long-term follow-up data presented at Society for Neuro-Oncology (SNO) 2025, 2 Day One Biopharmaceuticals clinical and commercial experience. 3 39 patients entered a treatment-free observation period, 4 Median treatment-free interval not yet reached. FIREFLY-1: 3-Year Data1 Durable responses, retreatment feasibility1 Data consistent with chronic use in pediatric patients1 Growing physician confidence, repeat utilization2 OJEMDA Clinical Profile Median duration of response 19.4 months Median time to next treatment 42.6 months 77% of patients treatment-free at least 12 months following 24 months of therapy3,4 Minimal tumor rebound in first 6 months off therapy Early OJEMDA retreatment experience: ~38% average tumor reduction (9 months median follow up, n=8) No new safety signals

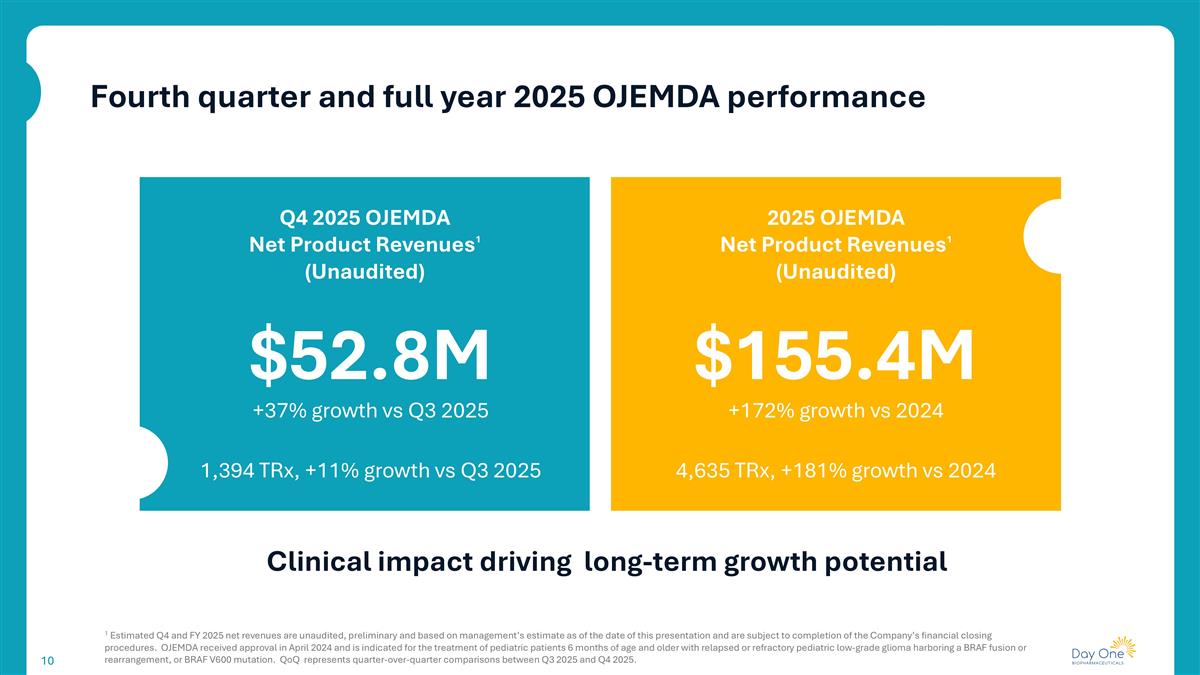

$52.8M Q4 2025 OJEMDA Net Product Revenues1 (Unaudited) 1 Estimated Q4 and FY 2025 net revenues are unaudited, preliminary and based on management’s estimate as of the date of this presentation and are subject to completion of the Company’s financial closing procedures. OJEMDA received approval in April 2024 and is indicated for the treatment of pediatric patients 6 months of age and older with relapsed or refractory pediatric low-grade glioma harboring a BRAF fusion or rearrangement, or BRAF V600 mutation. QoQ represents quarter-over-quarter comparisons between Q3 2025 and Q4 2025. Fourth quarter and full year 2025 OJEMDA performance Clinical impact driving long-term growth potential 2025 OJEMDA Net Product Revenues1 (Unaudited) $155.4M +37% growth vs Q3 2025 +172% growth vs 2024 1,394 TRx, +11% growth vs Q3 2025 4,635 TRx, +181% growth vs 2024

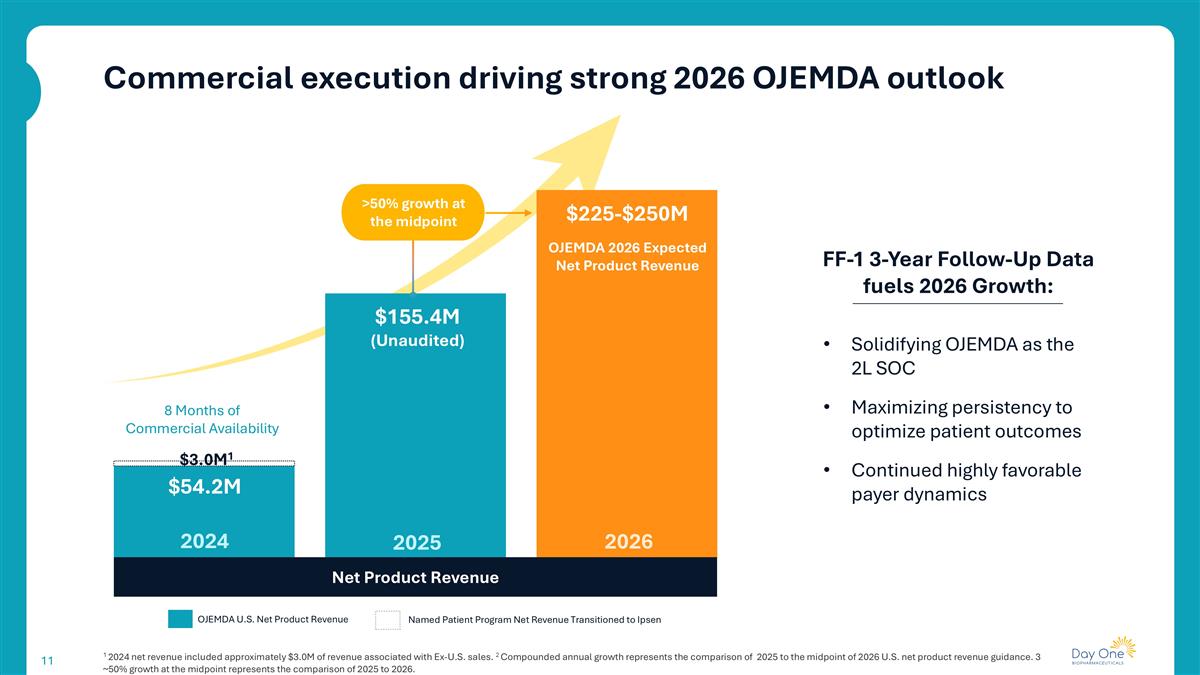

Commercial execution driving strong 2026 OJEMDA outlook 1 2024 net revenue included approximately $3.0M of revenue associated with Ex-U.S. sales. 2 Compounded annual growth represents the comparison of 2025 to the midpoint of 2026 U.S. net product revenue guidance. 3 ~50% growth at the midpoint represents the comparison of 2025 to 2026. FF-1 3-Year Follow-Up Data fuels 2026 Growth: Net Product Revenue 2026 2024 2025 8 Months of Commercial Availability Named Patient Program Net Revenue Transitioned to Ipsen OJEMDA U.S. Net Product Revenue OJEMDA 2026 Expected Net Product Revenue $155.4M (Unaudited) $54.2M $225-$250M >50% growth at the midpoint Solidifying OJEMDA as the 2L SOC Maximizing persistency to optimize patient outcomes Continued highly favorable payer dynamics $3.0M1

~1,100 unique r/r pLGG treatment decisions annually2,3 1 Treatment eligible population is calculated from epidemiology and progression curves; further validated by claims. 2 Based on internal analysis of available U.S. claims data over a rolling 12-month period. Incidence verified by independent third party, 3 r/r pLGG patients with a treatment claim over a 12-month period. Meaningful Runway for OJEMDA Increased Utilization Current penetration reflects only a portion of the addressable r/r market, indicating substantial headroom for OJEMDA share growth OJEMDA has meaningful runway for increased utilization in the 2L+ pLGG market

Pivotal phase 3 trial of tovorafenib in front-line pLGG FIREFLY-2 Bradon Living with pLGG since age 11

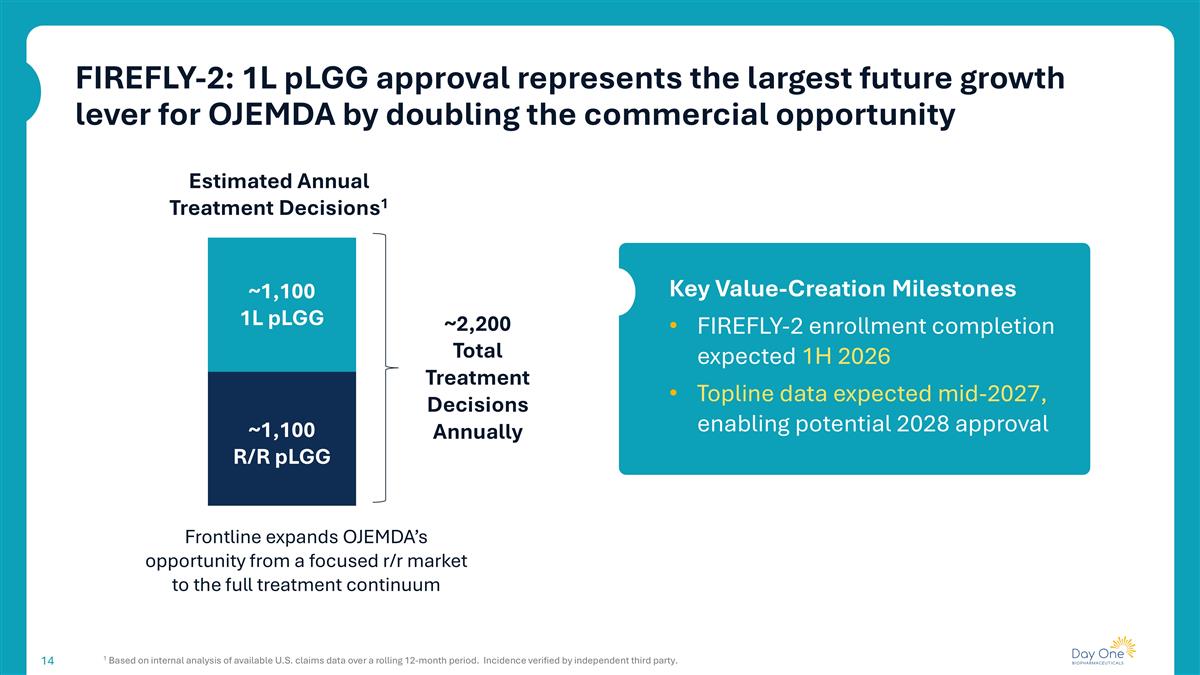

FIREFLY-2: 1L pLGG approval represents the largest future growth lever for OJEMDA by doubling the commercial opportunity 1 Based on internal analysis of available U.S. claims data over a rolling 12-month period. Incidence verified by independent third party. Key Value-Creation Milestones FIREFLY-2 enrollment completion expected 1H 2026 Topline data expected mid-2027, enabling potential 2028 approval ~1,100 R/R pLGG ~1,100 1L pLGG Estimated Annual Treatment Decisions1 Frontline expands OJEMDA’s opportunity from a focused r/r market to the full treatment continuum ~2,200 Total Treatment Decisions Annually

B7-H4-targeted antibody-drug conjugate (ADC) Emi-Le

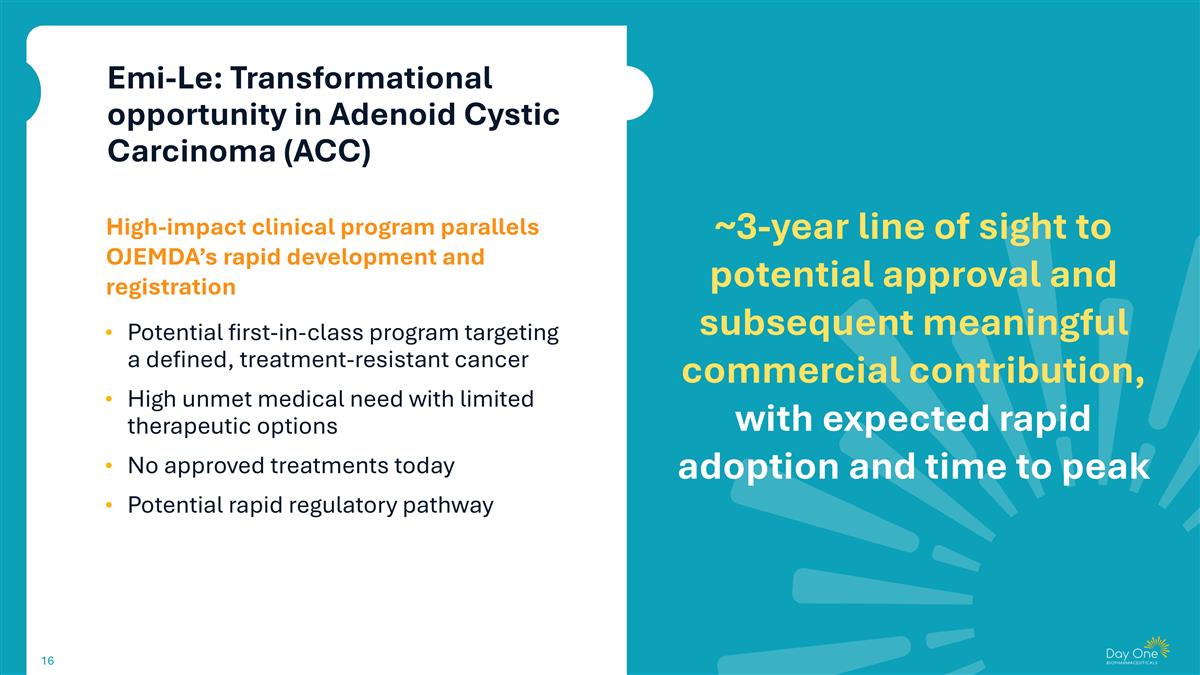

High-impact clinical program parallels OJEMDA’s rapid development and registration Potential first-in-class program targeting a defined, treatment-resistant cancer High unmet medical need with limited therapeutic options No approved treatments today Potential rapid regulatory pathway Emi-Le: Transformational opportunity in Adenoid Cystic Carcinoma (ACC) ~3-year line of sight to potential approval and subsequent meaningful commercial contribution, with expected rapid adoption and time to peak

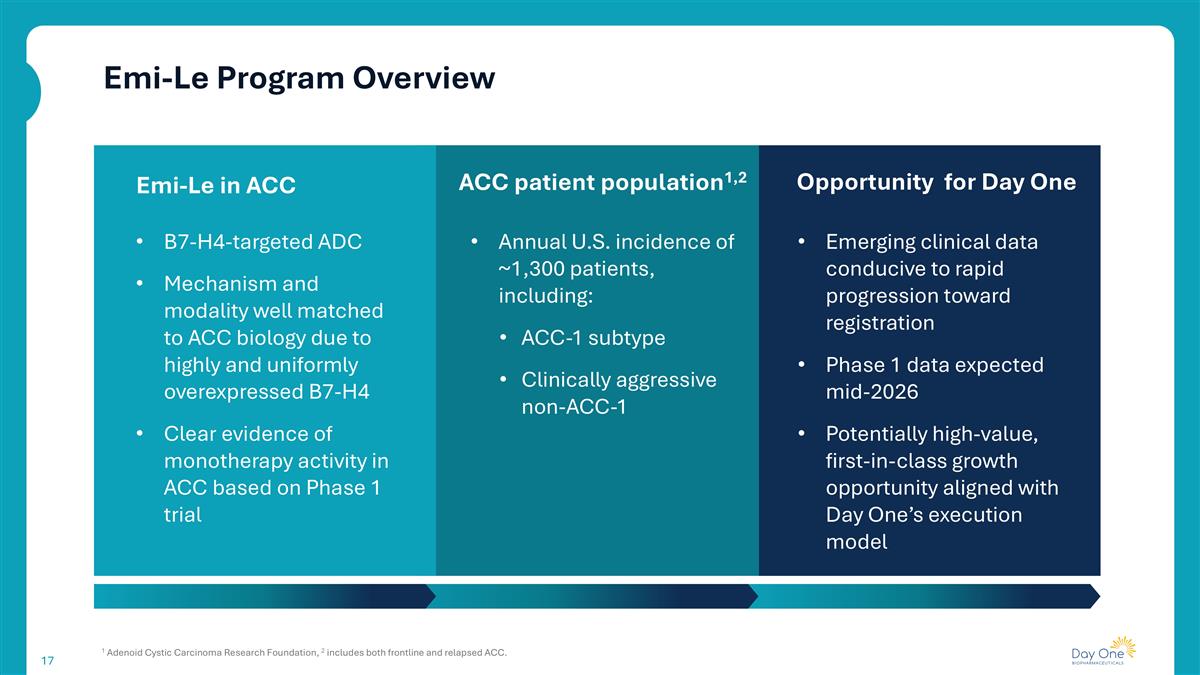

Emi-Le Program Overview 1 Adenoid Cystic Carcinoma Research Foundation, 2 includes both frontline and relapsed ACC. ACC patient population1,2 B7-H4-targeted ADC Mechanism and modality well matched to ACC biology due to highly and uniformly overexpressed B7-H4 Clear evidence of monotherapy activity in ACC based on Phase 1 trial Emi-Le in ACC Opportunity for Day One Annual U.S. incidence of ~1,300 patients, including: ACC-1 subtype Clinically aggressive non-ACC-1 Emerging clinical data conducive to rapid progression toward registration Phase 1 data expected mid-2026 Potentially high-value, first-in-class growth opportunity aligned with Day One’s execution model

PTK7-targeted antibody-drug conjugate (ADC) DAY301

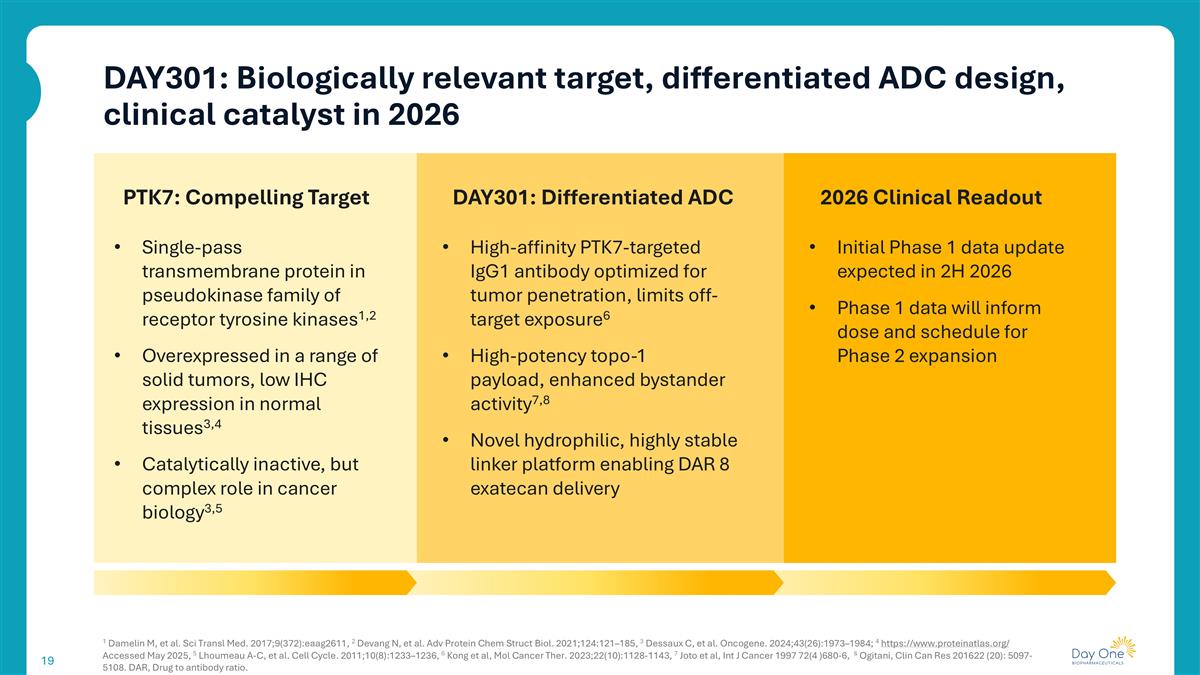

DAY301: Biologically relevant target, differentiated ADC design, clinical catalyst in 2026 1 Damelin M, et al. Sci Transl Med. 2017;9(372):eaag2611, 2 Devang N, et al. Adv Protein Chem Struct Biol. 2021;124:121–185, 3 Dessaux C, et al. Oncogene. 2024;43(26):1973–1984; 4 https://www.proteinatlas.org/ Accessed May 2025, 5 Lhoumeau A-C, et al. Cell Cycle. 2011;10(8):1233–1236, 6 Kong et al, Mol Cancer Ther. 2023;22(10):1128-1143, 7 Joto et al, Int J Cancer 1997 72(4 )680-6, 8 Ogitani, Clin Can Res 201622 (20): 5097-5108. DAR, Drug to antibody ratio. PTK7: Compelling Target Single-pass transmembrane protein in pseudokinase family of receptor tyrosine kinases1,2 Overexpressed in a range of solid tumors, low IHC expression in normal tissues3,4 Catalytically inactive, but complex role in cancer biology3,5 DAY301: Differentiated ADC 2026 Clinical Readout High-affinity PTK7-targeted IgG1 antibody optimized for tumor penetration, limits off-target exposure6 High-potency topo-1 payload, enhanced bystander activity7,8 Novel hydrophilic, highly stable linker platform enabling DAR 8 exatecan delivery Initial Phase 1 data update expected in 2H 2026 Phase 1 data will inform dose and schedule for Phase 2 expansion

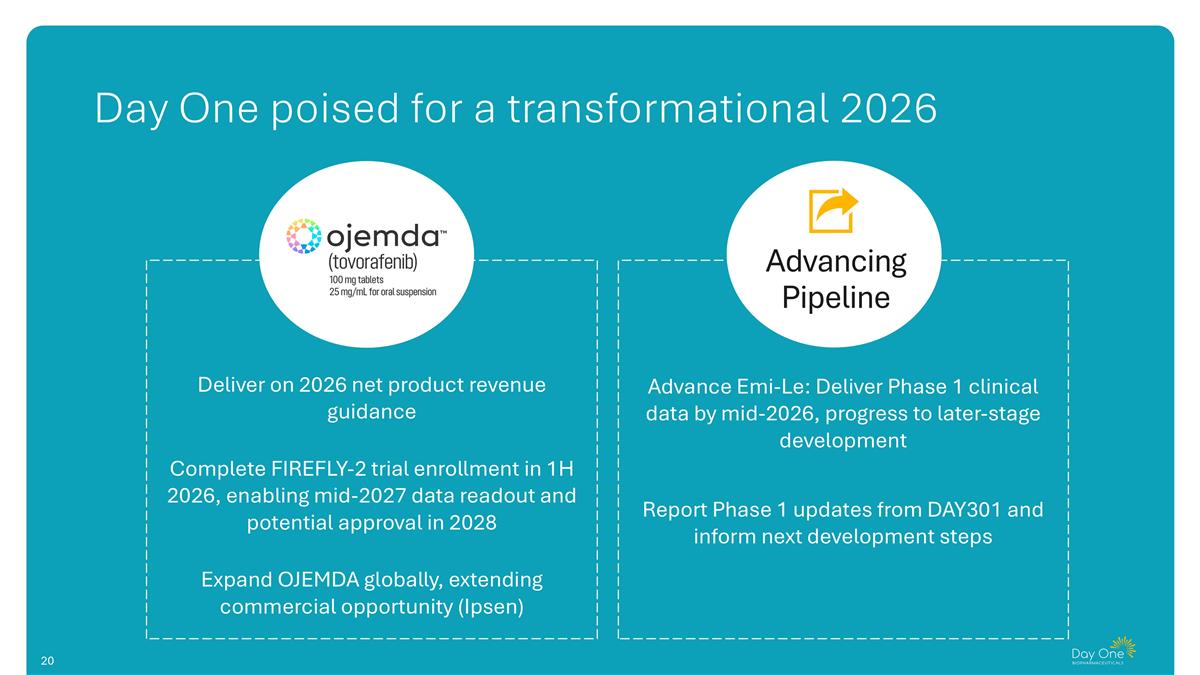

Day One poised for a transformational 2026 Advancing Pipeline Deliver on 2026 net product revenue guidance Complete FIREFLY-2 trial enrollment in 1H 2026, enabling mid-2027 data readout and potential approval in 2028 Expand OJEMDA globally, extending commercial opportunity (Ipsen) Advance Emi-Le: Deliver Phase 1 clinical data by mid-2026, progress to later-stage development Report Phase 1 updates from DAY301 and inform next development steps

Q&A