Nextdoor Investor Update Q3 2025 © 2025 Nextdoor. All rights reserved. Any copying or use of this confidential information is strictly prohibited without the express written permission of Nextdoor. Confidential, attorney-client privileged.

John T. Williams 2 Head of Investor Relations

Certain statements in this Investor Update may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “project,” “target,” “plan,” or “potentially” or the negatives of these terms or variations of them or similar terminology. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the fourth quarter of 2025 and 2026, trends and expectations regarding our business and operating results, including the implementation and potential impact of our new Nextdoor initiative, our expectations on Verified Neighbor growth, our business strategy and plans, and our objectives and future operations, including our expansion into new markets. Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this Investor Update, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: our ability to scale our business and monetization efforts; our ability to expand business operations abroad; our limited operating history; risks associated with managing our growth; our ability to achieve and maintain profitability in the future; the effects of the highly competitive market in which we operate; the impact of macroeconomic conditions on our business, including the impact of significant political, trade and regulatory developments; our ability to attract new and retain existing customers and users, or renew and expand our relationships with them; our ability to anticipate and satisfy customer preferences; market acceptance of our platform; our ability to successfully develop and timely introduce new products and services; risks associated with the use of AI and ML-driven features in our platform; our ability to achieve our objectives of strategic and operational initiatives; cybersecurity risks to our various systems and software; the impact of privacy and data security laws and other applicable laws and regulations; and other general market, political, economic, and business conditions. Additional risks and uncertainties that could affect our financial results and business are more fully described in our Quarterly Report on Form 10-Q for the period ended September 30, 2025, filed on November 5, 2025, and our other SEC filings, which are available on the Investor Relations page of our website at investors.nextdoor.com and on the SEC’s website at www.sec.gov. All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements.We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Investor Update or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on the forward-looking statements in this Investor Update. This Investor Update includes certain non-GAAP financial measures (including on a forward-looking basis). These non-GAAP measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to their nearest GAAP equivalent or any other performance measures derived in accordance with GAAP. A reconciliation of the non-GAAP financial measures used in this Investor Update to their nearest GAAP equivalent is included in the Appendix to this Investor Update. Nextdoor believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Nextdoor. Nextdoor’s management uses forward-looking non-GAAP measures to evaluate Nextdoor’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in Nextdoor’s financial measures. In addition, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Nextdoor’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. 3 Disclaimer

Nirav Tolia 4 CEO

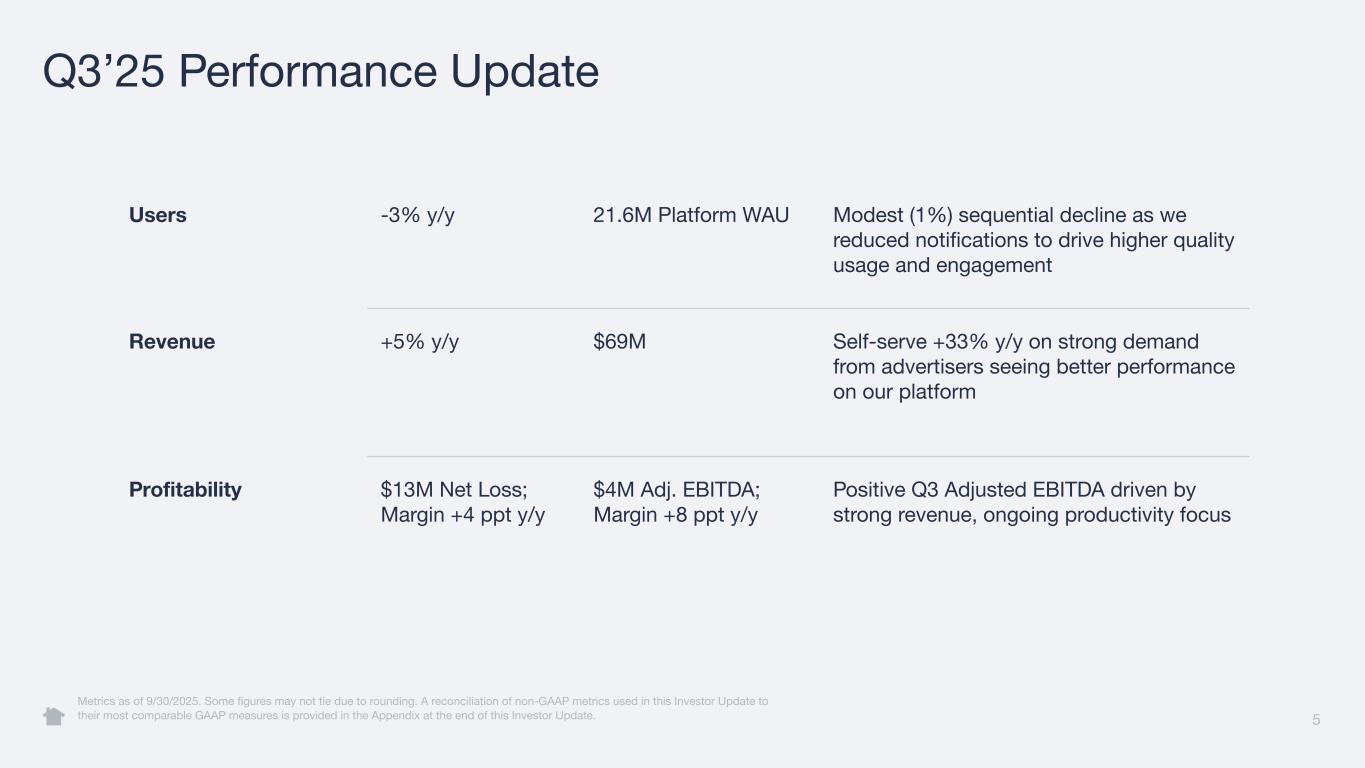

5 Q3’25 Performance Update Users -3% y/y 21.6M Platform WAU Modest (1%) sequential decline as we reduced notifications to drive higher quality usage and engagement Revenue +5% y/y $69M Self-serve +33% y/y on strong demand from advertisers seeing better performance on our platform Profitability $13M Net Loss; Margin +4 ppt y/y $4M Adj. EBITDA; Margin +8 ppt y/y Positive Q3 Adjusted EBITDA driven by strong revenue, ongoing productivity focus Metrics as of 9/30/2025. Some figures may not tie due to rounding. A reconciliation of non-GAAP metrics used in this Investor Update to their most comparable GAAP measures is provided in the Appendix at the end of this Investor Update.

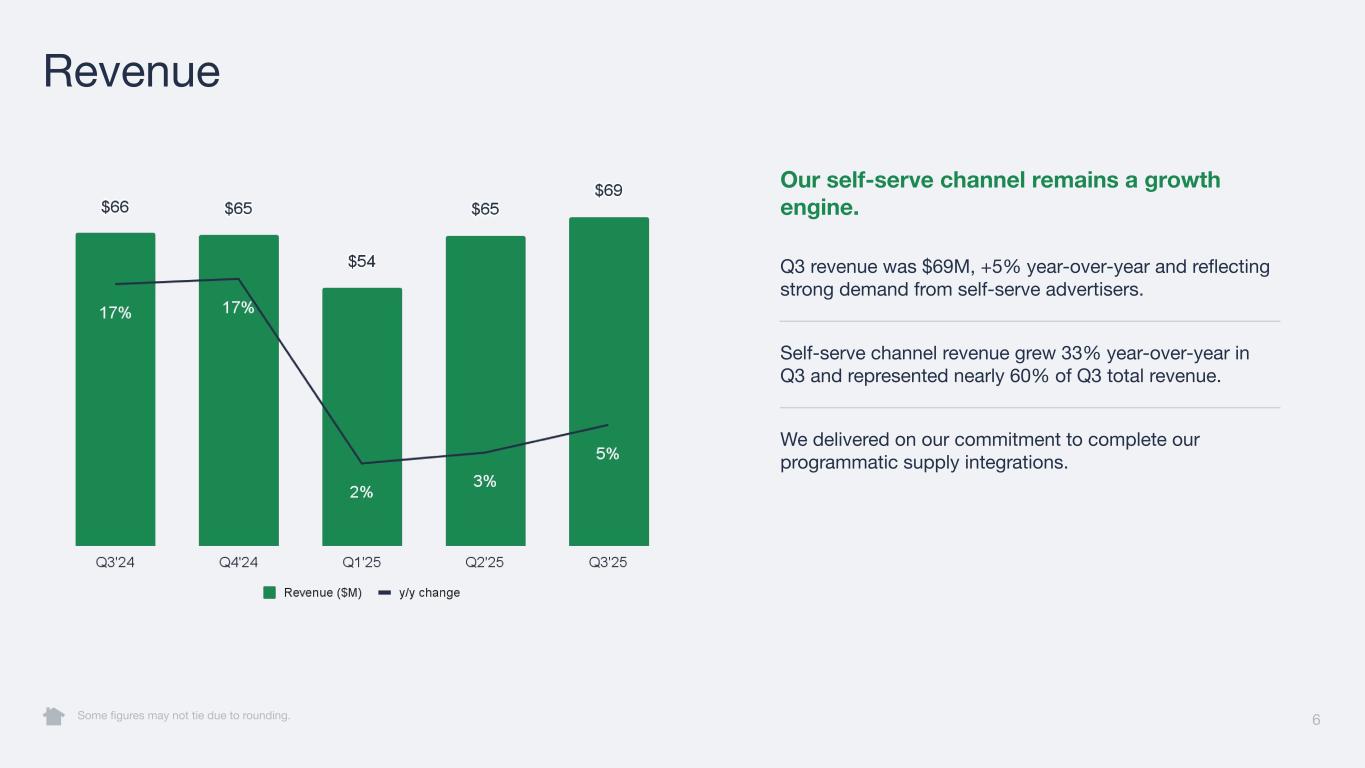

Our self-serve channel remains a growth engine. Q3 revenue was $69M, +5% year-over-year and reflecting strong demand from self-serve advertisers. Self-serve channel revenue grew 33% year-over-year in Q3 and represented nearly 60% of Q3 total revenue. We delivered on our commitment to complete our programmatic supply integrations. 6 Revenue Some figures may not tie due to rounding.

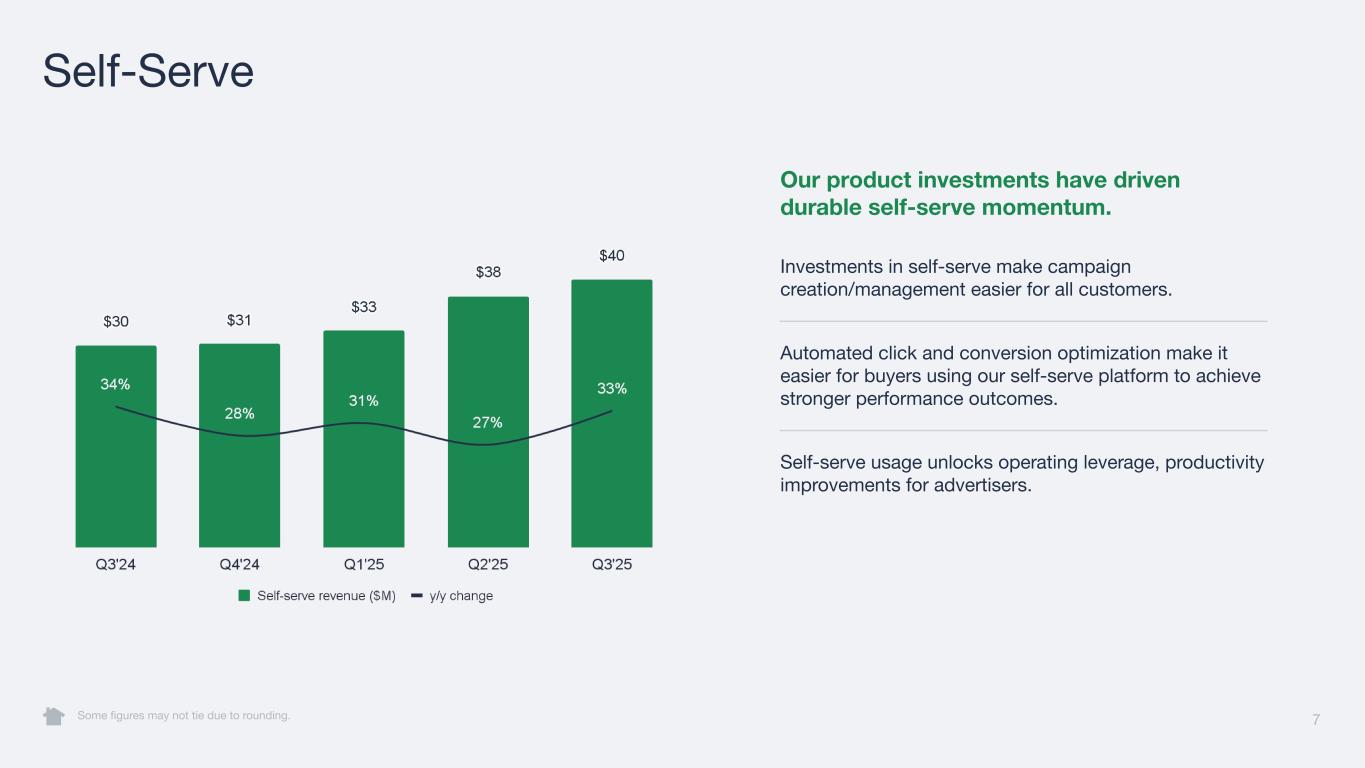

7 Self-Serve Some figures may not tie due to rounding. Our product investments have driven durable self-serve momentum. Investments in self-serve make campaign creation/management easier for all customers. Automated click and conversion optimization make it easier for buyers using our self-serve platform to achieve stronger performance outcomes. Self-serve usage unlocks operating leverage, productivity improvements for advertisers.

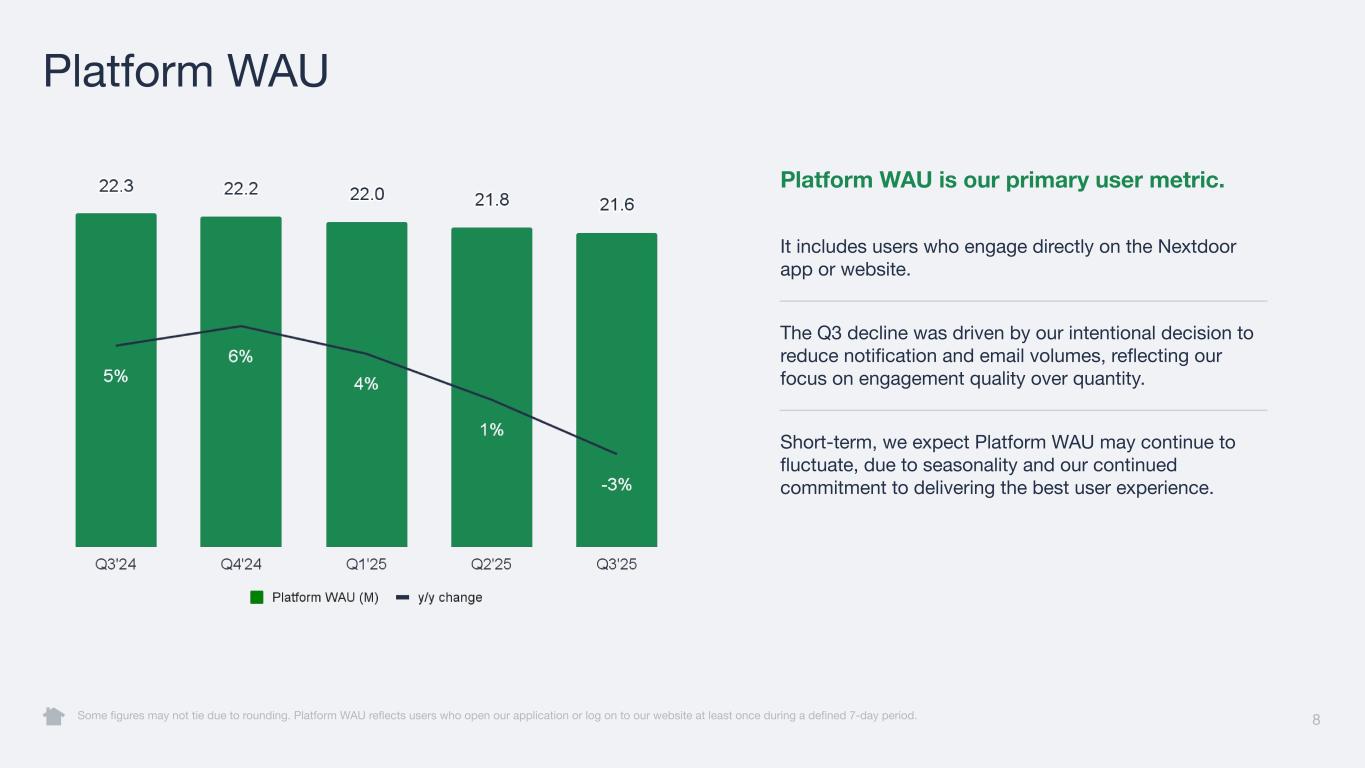

8 Platform WAU Some figures may not tie due to rounding. Platform WAU reflects users who open our application or log on to our website at least once during a defined 7-day period. Platform WAU is our primary user metric. It includes users who engage directly on the Nextdoor app or website. The Q3 decline was driven by our intentional decision to reduce notification and email volumes, reflecting our focus on engagement quality over quantity. Short-term, we expect Platform WAU may continue to fluctuate, due to seasonality and our continued commitment to delivering the best user experience.

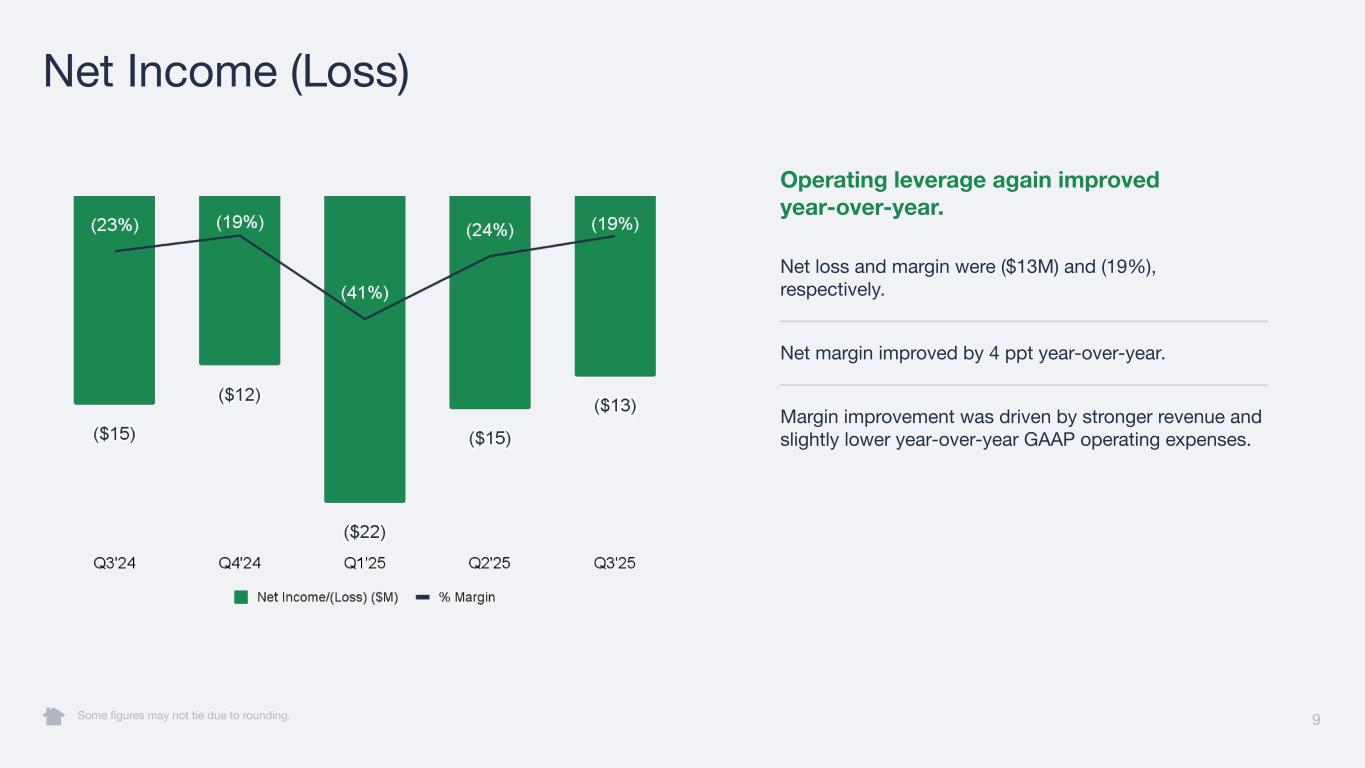

9 Net Income (Loss) Some figures may not tie due to rounding. Operating leverage again improved year-over-year. Net loss and margin were ($13M) and (19%), respectively. Net margin improved by 4 ppt year-over-year. Margin improvement was driven by stronger revenue and slightly lower year-over-year GAAP operating expenses.

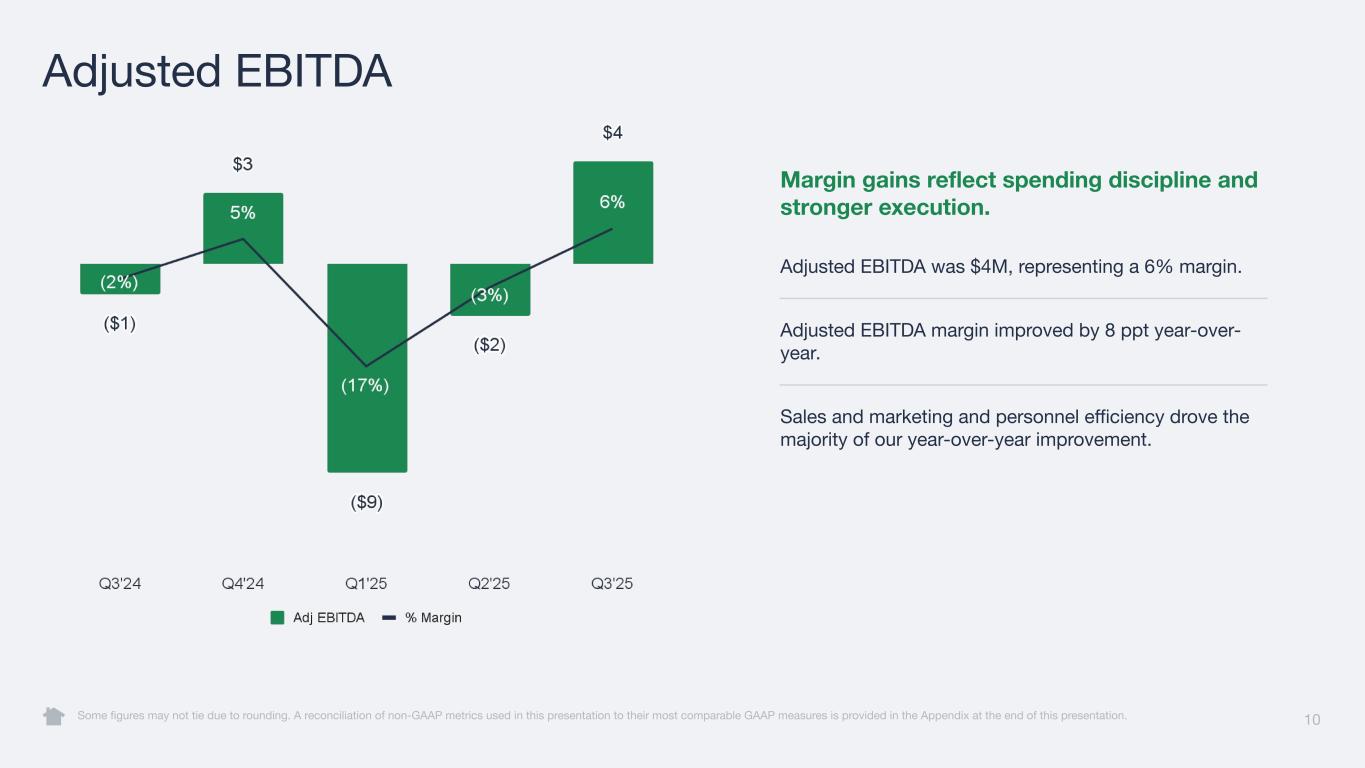

10 Adjusted EBITDA Some figures may not tie due to rounding. A reconciliation of non-GAAP metrics used in this presentation to their most comparable GAAP measures is provided in the Appendix at the end of this presentation. Margin gains reflect spending discipline and stronger execution. Adjusted EBITDA was $4M, representing a 6% margin. Adjusted EBITDA margin improved by 8 ppt year-over- year. Sales and marketing and personnel efficiency drove the majority of our year-over-year improvement.

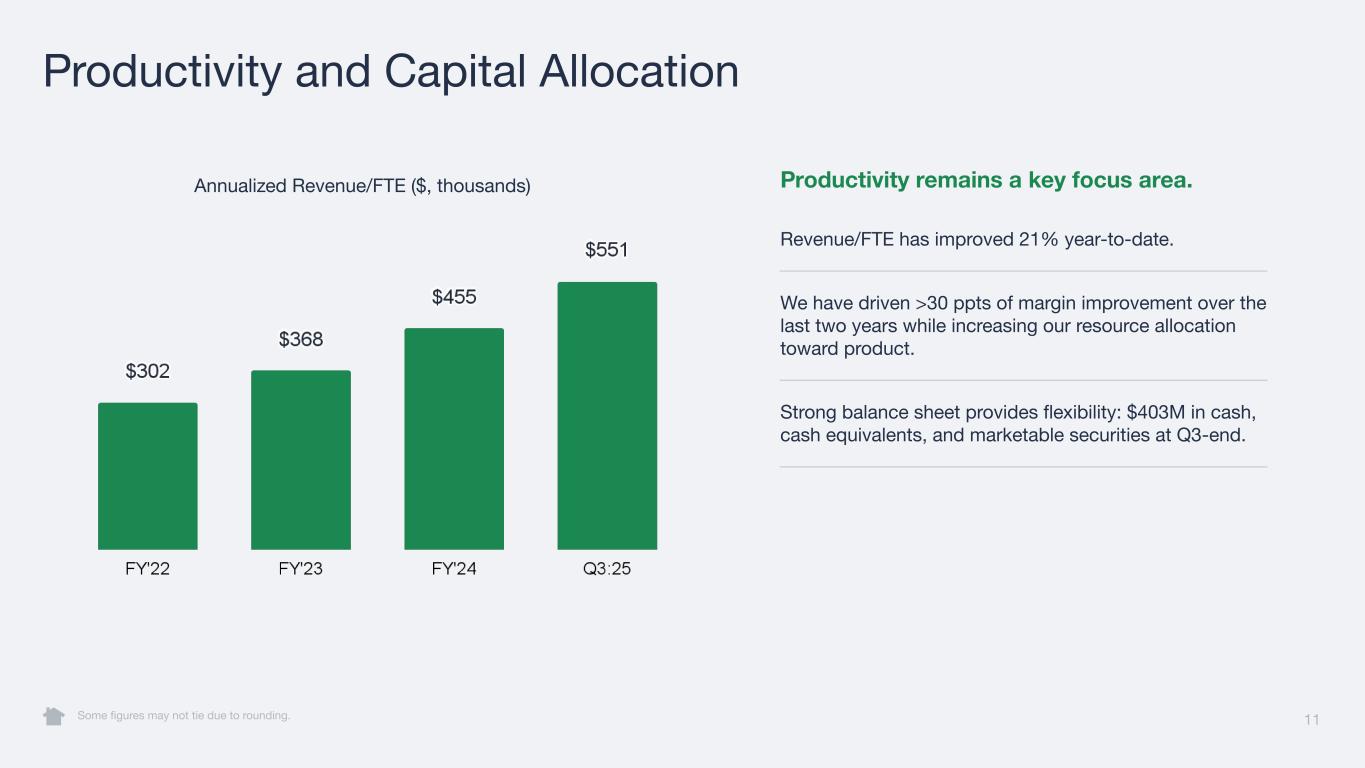

11 Productivity and Capital Allocation Some figures may not tie due to rounding. Annualized Revenue/FTE ($, thousands) Productivity remains a key focus area. Revenue/FTE has improved 21% year-to-date. We have driven >30 ppts of margin improvement over the last two years while increasing our resource allocation toward product. Strong balance sheet provides flexibility: $403M in cash, cash equivalents, and marketable securities at Q3-end.

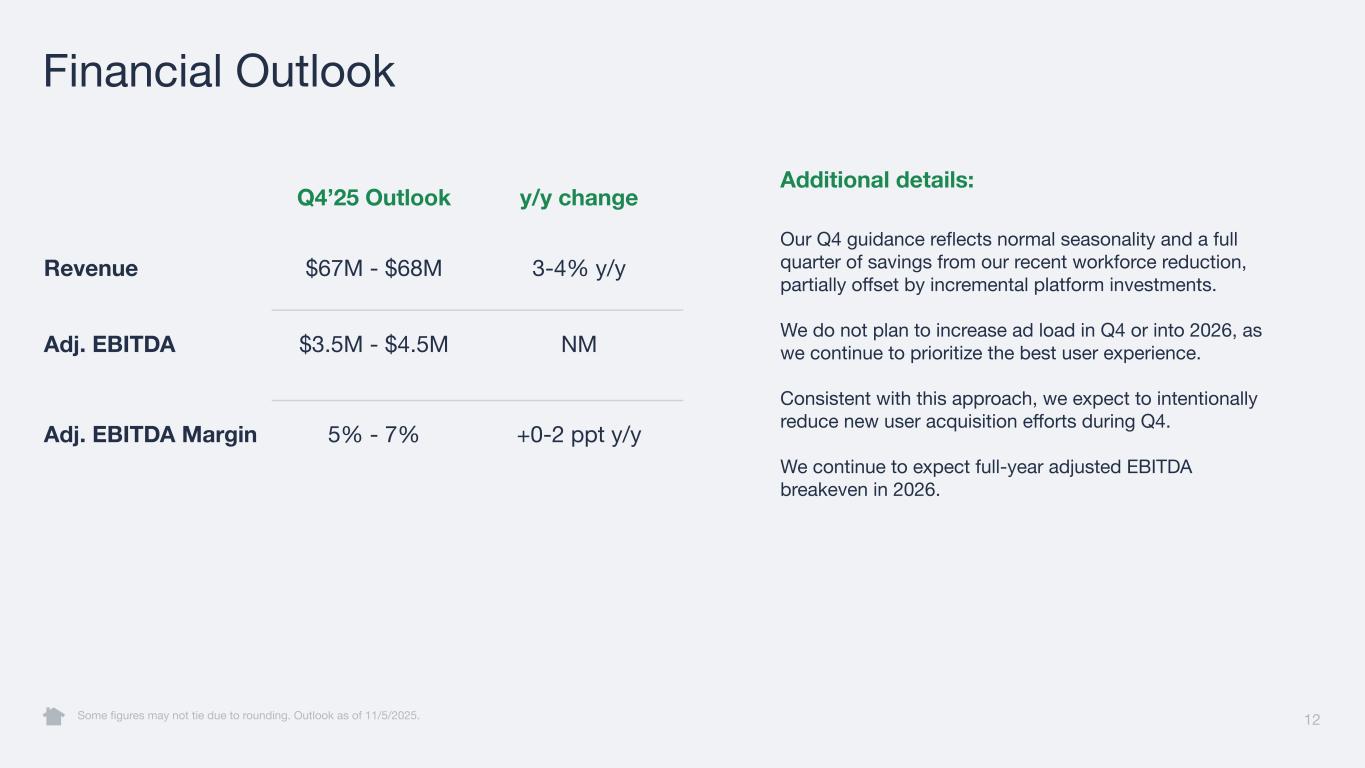

12 Financial Outlook Some figures may not tie due to rounding. Outlook as of 11/5/2025. Q4’25 Outlook y/y change Revenue $67M - $68M 3-4% y/y Adj. EBITDA $3.5M - $4.5M NM Adj. EBITDA Margin 5% - 7% +0-2 ppt y/y Additional details: Our Q4 guidance reflects normal seasonality and a full quarter of savings from our recent workforce reduction, partially offset by incremental platform investments. We do not plan to increase ad load in Q4 or into 2026, as we continue to prioritize the best user experience. Consistent with this approach, we expect to intentionally reduce new user acquisition efforts during Q4. We continue to expect full-year adjusted EBITDA breakeven in 2026.

Q3 Product Update 13

Nirav Tolia 14 CEO

Appendix 15

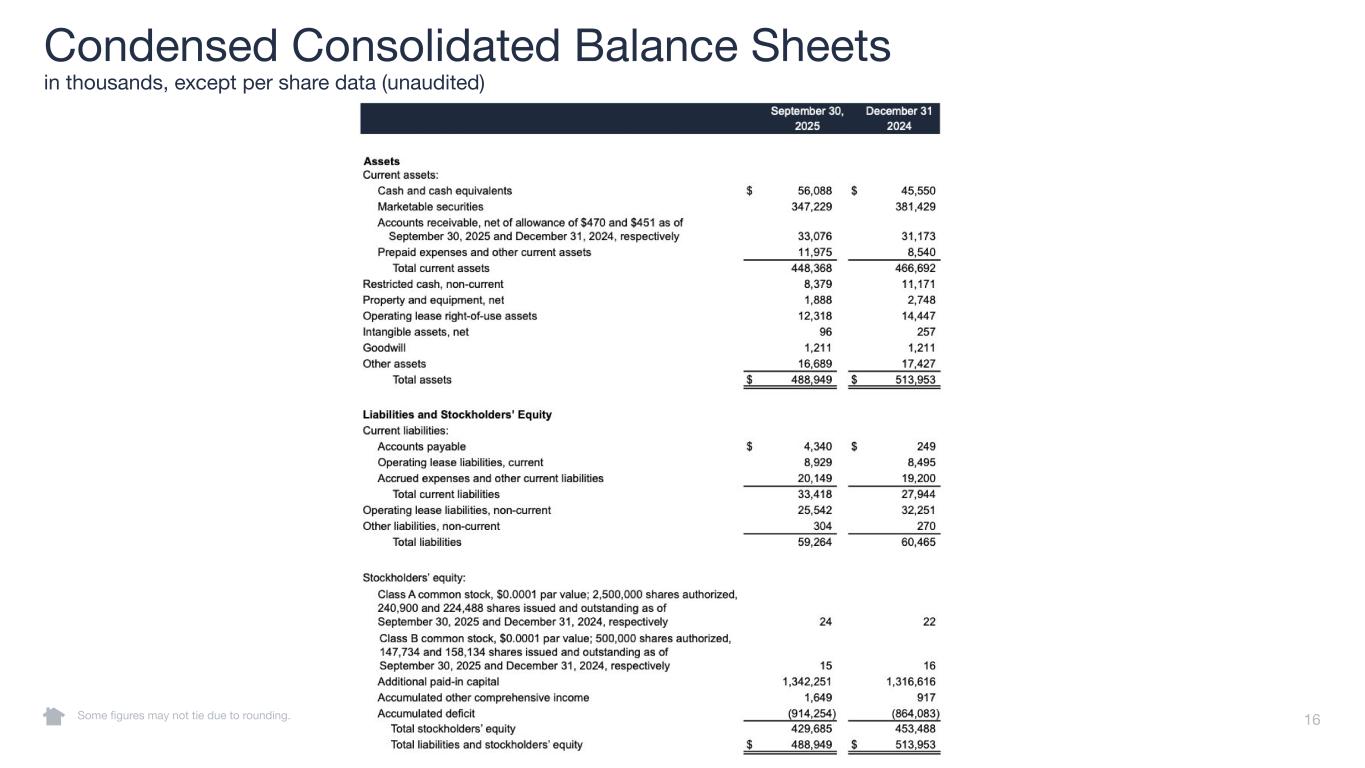

16 Condensed Consolidated Balance Sheets in thousands, except per share data (unaudited) Some figures may not tie due to rounding.

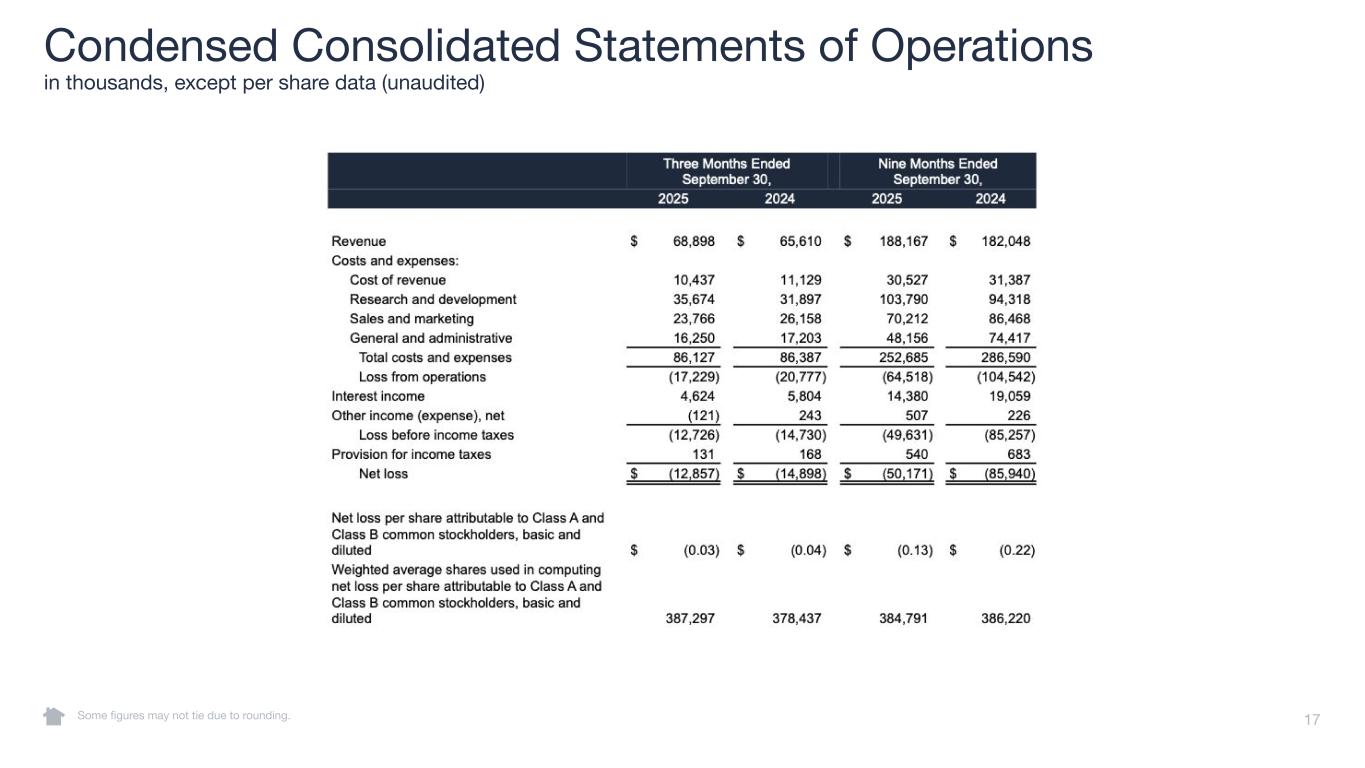

17 Condensed Consolidated Statements of Operations in thousands, except per share data (unaudited) Some figures may not tie due to rounding.

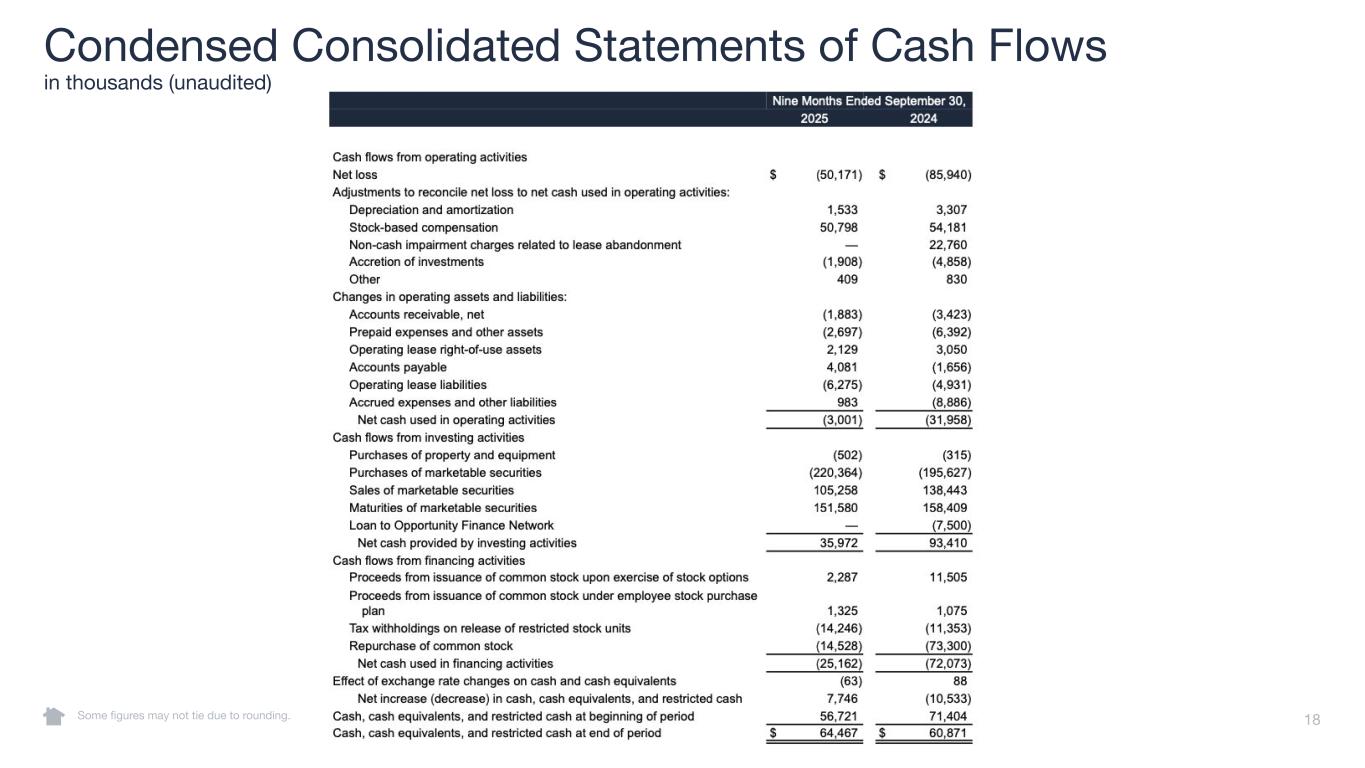

18 Condensed Consolidated Statements of Cash Flows in thousands (unaudited) Some figures may not tie due to rounding.

We have not reconciled our adjusted EBITDA and adjusted EBITDA margin outlook to GAAP net loss or GAAP net loss margin because certain items that impact GAAP net loss and GAAP net loss margin are uncertain or out of our control and cannot be reasonably predicted. In particular, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2025 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of adjusted EBITDA outlook to net loss and adjusted EBITDA margin to GAAP net loss margin is not available without unreasonable efforts. To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present non-GAAP adjusted EBITDA and adjusted EBITDA margin in this Investor Update. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP. We use these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization (non-cash expense), interest income, provision for income taxes, and, if applicable, restructuring charges and acquisition-related costs. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense (if any), or the cash requirements necessary to service interest or principal payments on debt (if any), which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. A reconciliation of these non-GAAP measures has been provided on the following page. 19 Non-GAAP Financial Measures

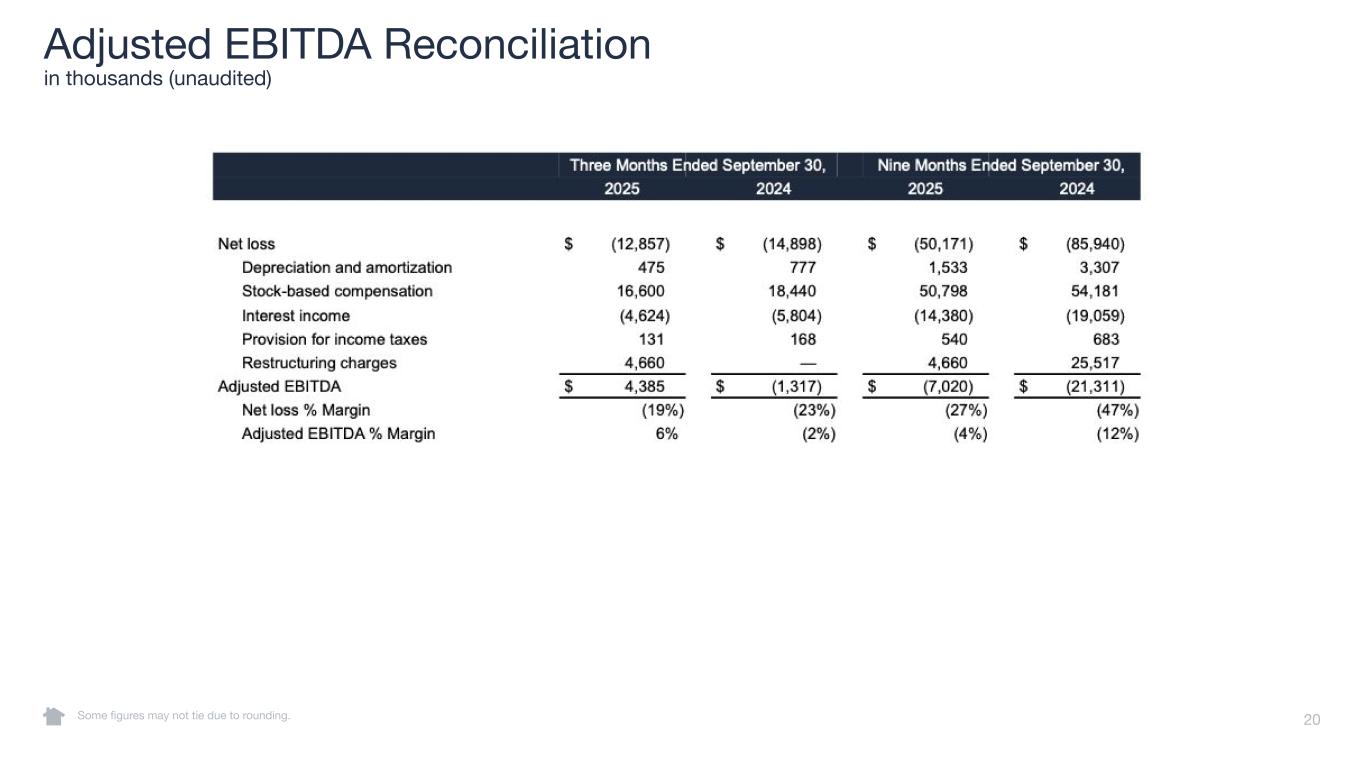

20 Adjusted EBITDA Reconciliation in thousands (unaudited) Some figures may not tie due to rounding.

21 investors.nextdoor.com · ir@nextdoor.com