The Nation’s Fastest Growing Charter Airline August 2025 | OTCQB: JETMF, Cboe CA: JET, Cboe CA: JET.B TM

Disclaimer This presentation was prepared by Global Crossing Airlines Group Inc. (the “Company” or “GlobalX”) as a general presentation aimed solely at providing information about the Company, its operations and financial results. You should not rely upon it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed transaction (the "Possible Transaction") or otherwise. This presentation is incomplete without reference to, and should be viewed solely in conjunction with the Company’s reports and filings with applicable Canadian securities regulators and the U.S. Securities and Exchange Commission. You and your directors, officers, employees, agents and affiliates (collectively, the "Recipient") must hold this document, and any oral information provided in connection with this document in strict confidence and may not communicate, reproduce, distribute or disclose it to any other person, or refer to it publicly, in whole or in part at any time except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately. All figures are in US dollars unless otherwise noted. The information contained in the presentation is provided for purposes of convenience only; it neither constitutes a basis for making any investment decision nor does it substitute an independent collection and analysis of information. Moreover, it does not constitute a recommendation, an offer to sell and/or a solicitation or invitation of an offer to buy or subscribe for any securities of the Company or any of its subsidiaries or affiliates, nor shall there be any offer or sale of securities in any state or jurisdiction in which such offer or sale would be unlawful, nor a substitute for independent judgment or independent collection and analysis of information on the part of any investor. It is expected that if any securities are ultimately offered and sold by the Company, investors in such securities will conduct their own independent investigation of the Company and the terms of any such securities, as well as the data, assumptions, estimates, appraisals, methodologies and projections contained or referred to in this presentation. Some of the securities described herein have not been registered under the Securities Act of 1933 (the “Securities Act”) and may not be offered or sold in the United States or to U.S. Persons (other than distributors) unless the securities are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available. Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved any securities discussed herein or determined if the information is truthful or complete. Any representation to the contrary is a criminal offense. The information and details contained in this presentation are partially provided and presented in a condensed form solely for convenience purposes. You should not assume that any information in this presentation is accurate as of any date other than the date hereof or otherwise specified herein. This presentation contains certain “forward looking statements” and “forward-looking information”, as defined under applicable United States and Canadian securities laws, concerning anticipated developments and events that may occur in the future. Forward-looking statements contained in this presentation include, but are not limited to, statements with respect to growth and profitability, forecasted size and growth rates of the charter market, the Company’s aircraft fleet size, the destinations that the Company intends to service, future demand for block hours, increases in flight activity, expected future revenues and hours flown, estimated future cost savings, positive operating income, the expected conversion, delivery and entry into service timelines for A320 and A321F aircraft and future contract terms. In certain cases, forward-looking statements can be identified by the use of words such as "plans", "expects" "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance. Forward-looking statements contained in this presentation are based on certain factors and assumptions regarding, among other things, GlobalX’s receipt of financing to continue airline operations; the accuracy, reliability and success of GlobalX’s business model; GlobalX’s ability to accurately forecast demand; GlobalX will be able to successfully conclude definitive agreements for transactions subject to LOI; the timely receipt of governmental approvals; the success of airline operations of GlobalX; GlobalX’s ability to successfully enter new geographic markets; the legislative and regulatory environments of the jurisdictions where GlobalX will carry on business or have operations; GlobalX’s ability to have sufficient aircraft to provide its services; the impact of competition and the competitive response to GlobalX’s business strategy; the future price of fuel, and the availability of aircraft. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include risks related to, the ability to obtain financing at acceptable terms, the impact of general economic conditions, risks related to supply chain and labor disruptions, failure to retain or obtain sufficient aircraft, domestic and international airline industry conditions, failure to conclude definitive agreements for transactions subject to LOI, the effects of increased competition from our market competitors and new market entrants, passenger demand being less than anticipated, the impact of any resurgence of COVID-19, future relations with shareholders, volatility of fuel prices, increases in operating costs, terrorism, pandemics, natural disasters, currency fluctuations, interest rates, risks specific to the airline industry, risks associated with doing business in foreign countries, the ability of management to implement GlobalX’s operational strategy, the ability to attract qualified management and staff, labor disputes, regulatory risks, including risks relating to the acquisition of the necessary licenses and permits; risks related to significant disruption in, or breach in security of GlobalX’s information technology systems and resultant interruptions in service and any related impact on its reputation; and the additional risks identified in the "Risk Factors" section of the Company's reports and filings with applicable Canadian securities regulators and the U.S. Securities and Exchange Commission. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in the forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements are made as of the date of this presentation. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update any forward-looking statements. If GlobalX does update one or more forward-looking statements, no inference should be made that it will make additional updates with respect to those or other forward-looking statements. This presentation also contains future-oriented financial information and financial outlook information (collectively, “FOFI”) about future revenue and sales which are subject to the same assumptions, risk factors, limitations and qualifications as set forth in the above paragraphs. FOFI contained in this presentation was made as of the date of this presentation and was provided for the purpose of providing further information about GlobalX’s anticipated future business operations. GlobalX disclaims any intention or obligation to update or revise any FOFI contained in this presentation, whether as a result of new information, future events or otherwise, unless required pursuant to applicable law. FOFI contained in this presentation should not be used for purposes other than for which it is disclosed herein. FOFI contained in this presentation is provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that such outlook or information should not be used for purposes other than for which it is disclosed in this presentation.

GlobalX is The Nation’s Fastest Growing Charter Airline™ – setting the industry standard for on-time performance and reliability. Since our inception, we have consistently proven the strength of our charter platform, the resilience of our business model, the ability to grow demand in the narrowbody passenger market, while attracting and retaining top talent. Our strong foundation is expected to enable our further ability to scale operations, revenue, and shareholder value. *Refer to “Non-GAAP Financial Measures” Slide for additional information Company Overview 3

GlobalX Milestones OTCQB: JETMF, Cboe CA: JET, Cboe CA: JET.B 4 Company Overview

Market Size/Data Fastest growing charter carrier in the nation, with long-term upside potential within a growing $10B Market *Source: IBISWorld **Source: www.gmiinsights.com Industry Overview 5

Our Place in the Industry Ticket Risk Loss incurred by vacant seats 1 passenger as profitable as 150 Fuel Costs Exposed to variable fuel prices Costs pass through to the passenger Crew Costs Exposed to ticket risk Costs pass through to the passenger Billing No compensation for delays Passenger pays by block hour Aircraft Requirements New high-cost aircraft (~300 hrs / month) Used moderate-cost aircraft (~150 hrs / month) Arranges for flights before finding passengers Scheduled Carrier (i.e. Delta) Fly after the passengers have been arranged Aircraft Crew Maintenance Insurance ACMI Operator (GlobalX) V/S Company Overview 6

ACMI (Aircraft, Crew, Maintenance, and Insurance) Business vs All - In Charter Business ACMI Business Charter Business GlobalX Provides Outsourced Cargo and Passenger Aircraft, Crew, Maintenance and Insurance. Customer assume Fuel, Demand and Price Risk and are typically responsible for Landing, Airport and other Operational Fees. GlobalX Provides Outsourced Passenger and Cargo aircraft. Customer Pays a fixed fee that covers Fuel, Insurance, Landing and other Operational Expenses. Lower Revenue as customer pays for fuel, insurance and other expenses separately Lower Costs reflecting the absence of these aforementioned operational expenses The customer assumes all fuel and variable risk Revenue Cost Risk Exposure Higher Revenue reflecting the pass through of fuel, insurance and other expenses Higher Costs offset the increased revenue to cover the aforementioned operational expenses The carrier assumes no fuel and variable risk Revenue Cost Risk Exposure Company Overview 7 A customer books a one-way flight from JFK to SFO six weeks from now, during a period of volatility across commodity prices and a labor shortage. EXAMPLE

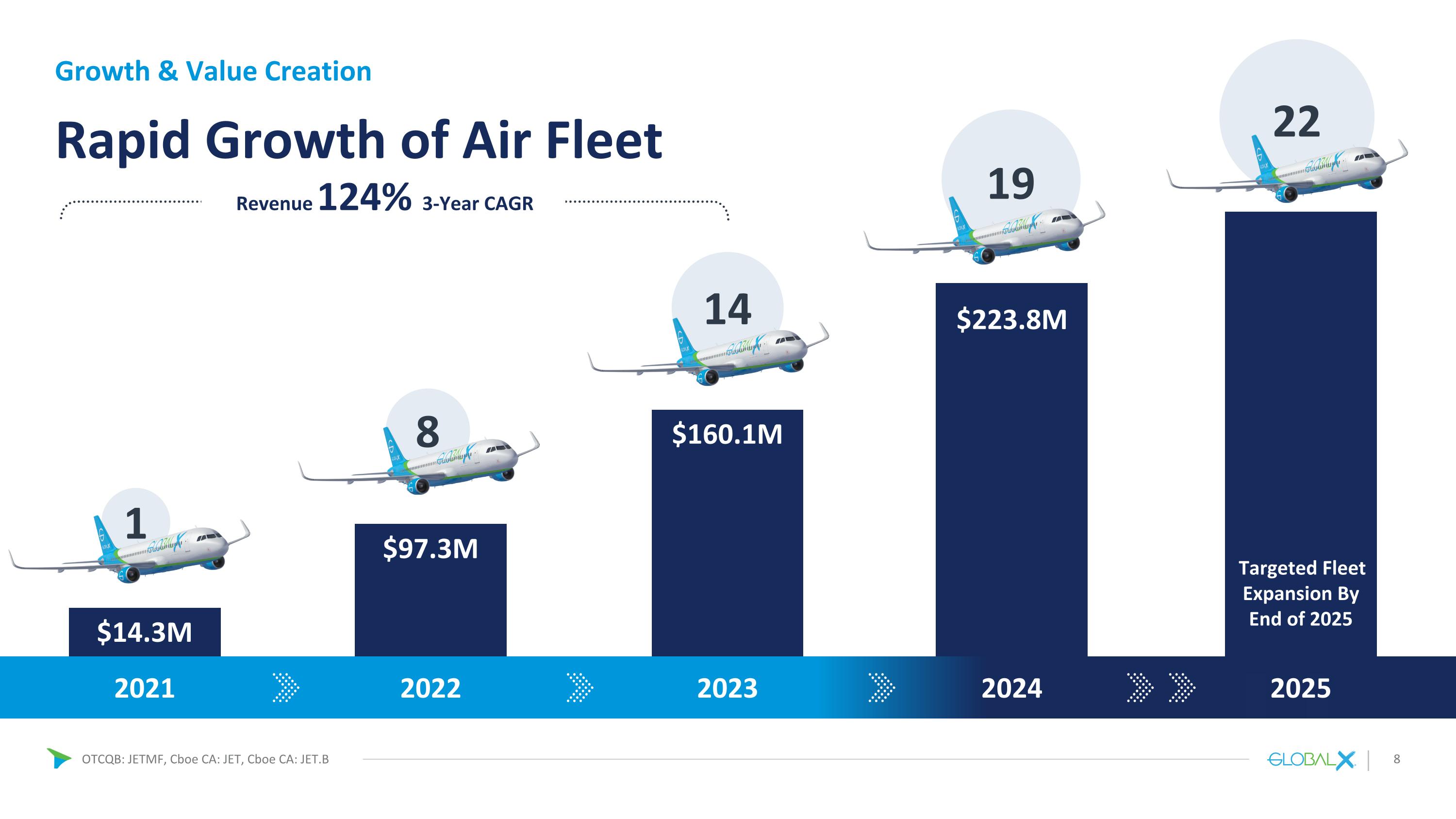

22 Rapid Growth of Air Fleet 2021 2022 2023 2024 14 19 1 8 2025 $14.3M $97.3M $160.1M Revenue 124% 3-Year CAGR Growth & Value Creation 8 $223.8M Targeted Fleet Expansion By End of 2025

Geographically dispersed operating bases, driven by anchor client contracts, allow us to operate a more cost effective, flexible, and reactive operation. The optimal distance for winning charter business is to quote aircraft repositioning within 3.0 hours from the starting and ending airport of each client. Having the majority of the U.S. airports within 3.0 hours of one of our operating bases creates a competitive advantage unmatched by our competitive set. With fewer reposition hours we win more business than our competitors and increase market share. Our aircraft have longer range capability (4.5 hours vs 3.0 hours), however our basing strategy maximizes reaction time. Current base locations include: Miami, FL, Alexandria, LA, and Harlingen, TX Fleet presence in multiple Southern United States bases allows: Sales efforts and pricing to be competitive for clients across the US Enhanced reaction time for immediate need contracts/IROP support for other carriers and clients Reduced time and cost in responding to internal reflow/IROP support for internal needs Reduced costs associated with crew movement, driven by local crew bases Reduced ferry cost for maintenance events Strategic Bases: Enhancing Efficiency & Market Reach Our Operations 9

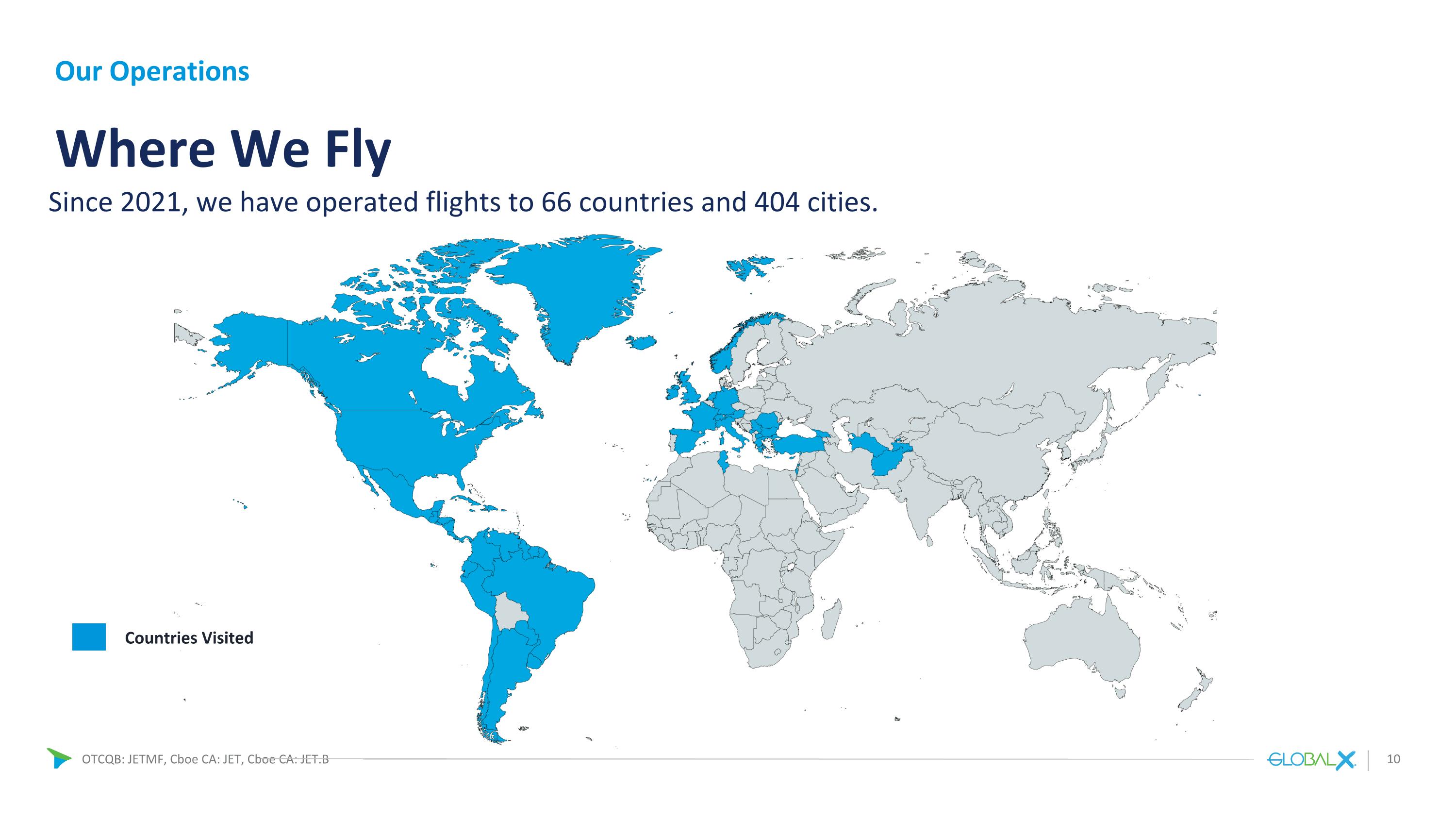

Where We Fly Since 2021, we have operated flights to 66 countries and 404 cities. Countries Visited Our Operations 10

Financials 11

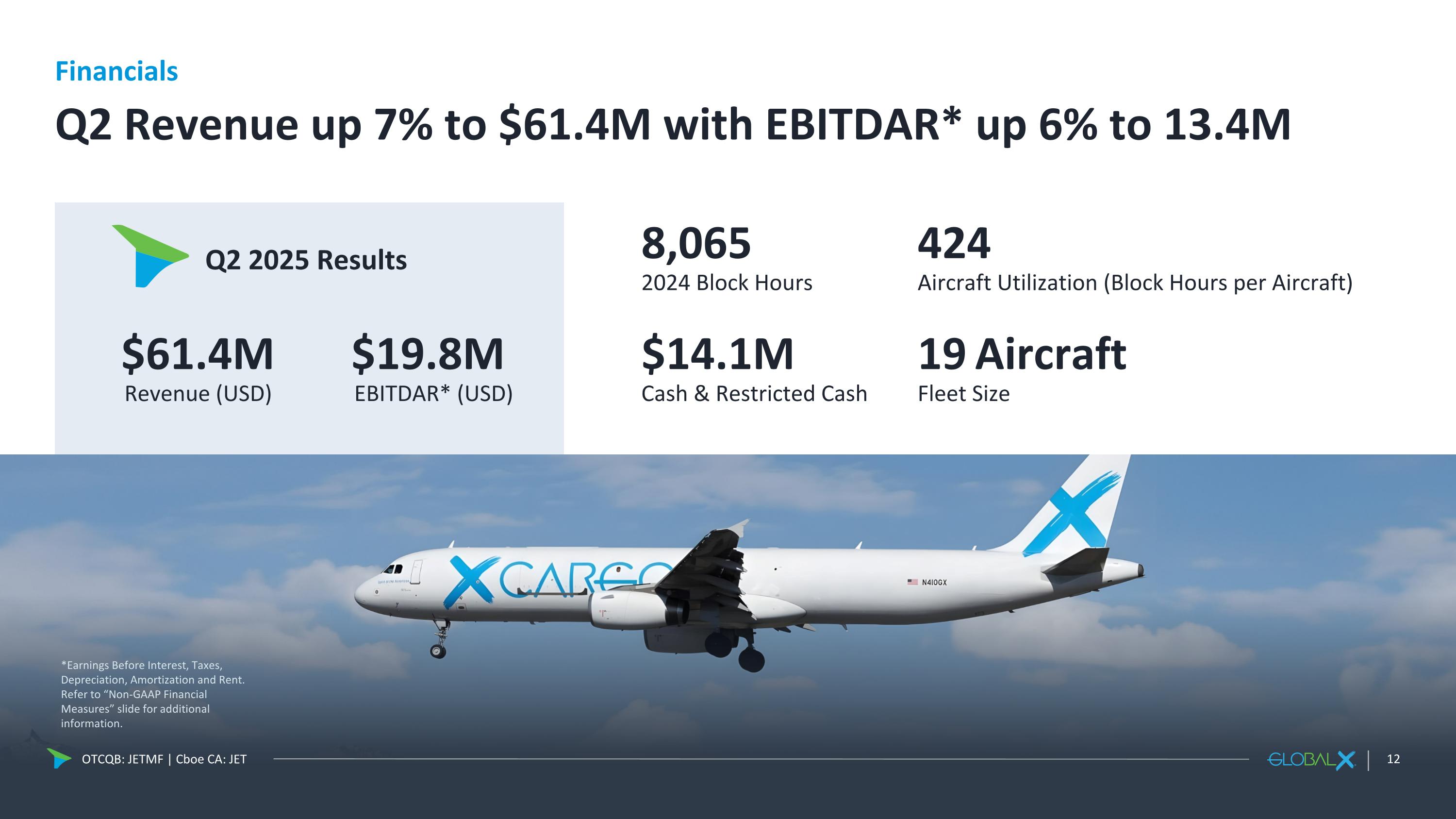

Q2 2025 Results Q2 Revenue up 7% to $61.4M with EBITDAR* up 6% to 13.4M $61.4M Revenue (USD) $19.8M EBITDAR* (USD) 19 Aircraft Fleet Size $14.1M Cash & Restricted Cash 424 Aircraft Utilization (Block Hours per Aircraft) 8,065 2024 Block Hours *Earnings Before Interest, Taxes, Depreciation, Amortization and Rent. Refer to “Non-GAAP Financial Measures” slide for additional information. Financials OTCQB: JETMF | Cboe CA: JET

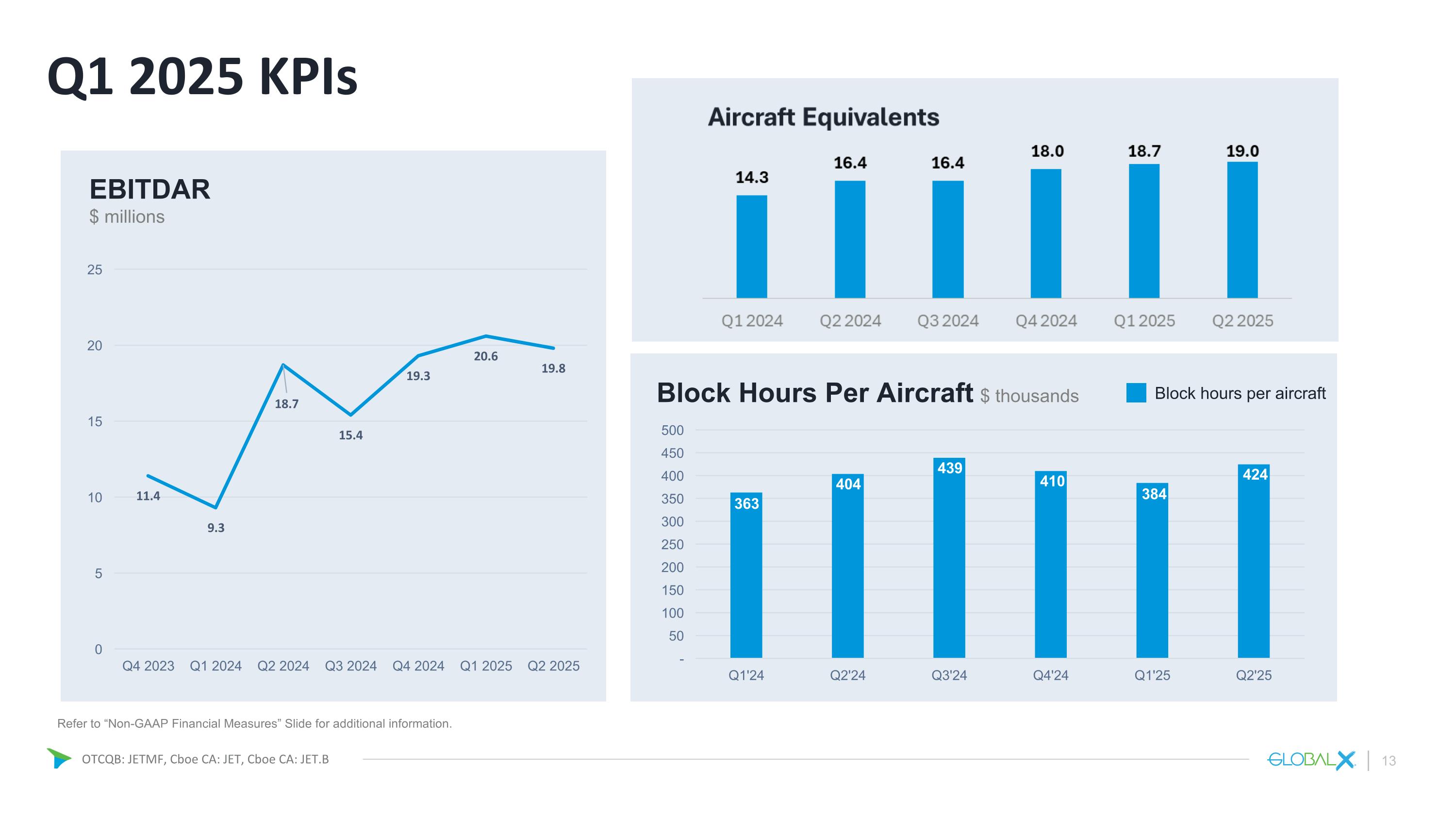

Q1 2025 KPIs 13 Refer to “Non-GAAP Financial Measures” Slide for additional information. EBITDAR $ millions Block Hours Per Aircraft $ thousands Block hours per aircraft 363 404 439 410 384 424

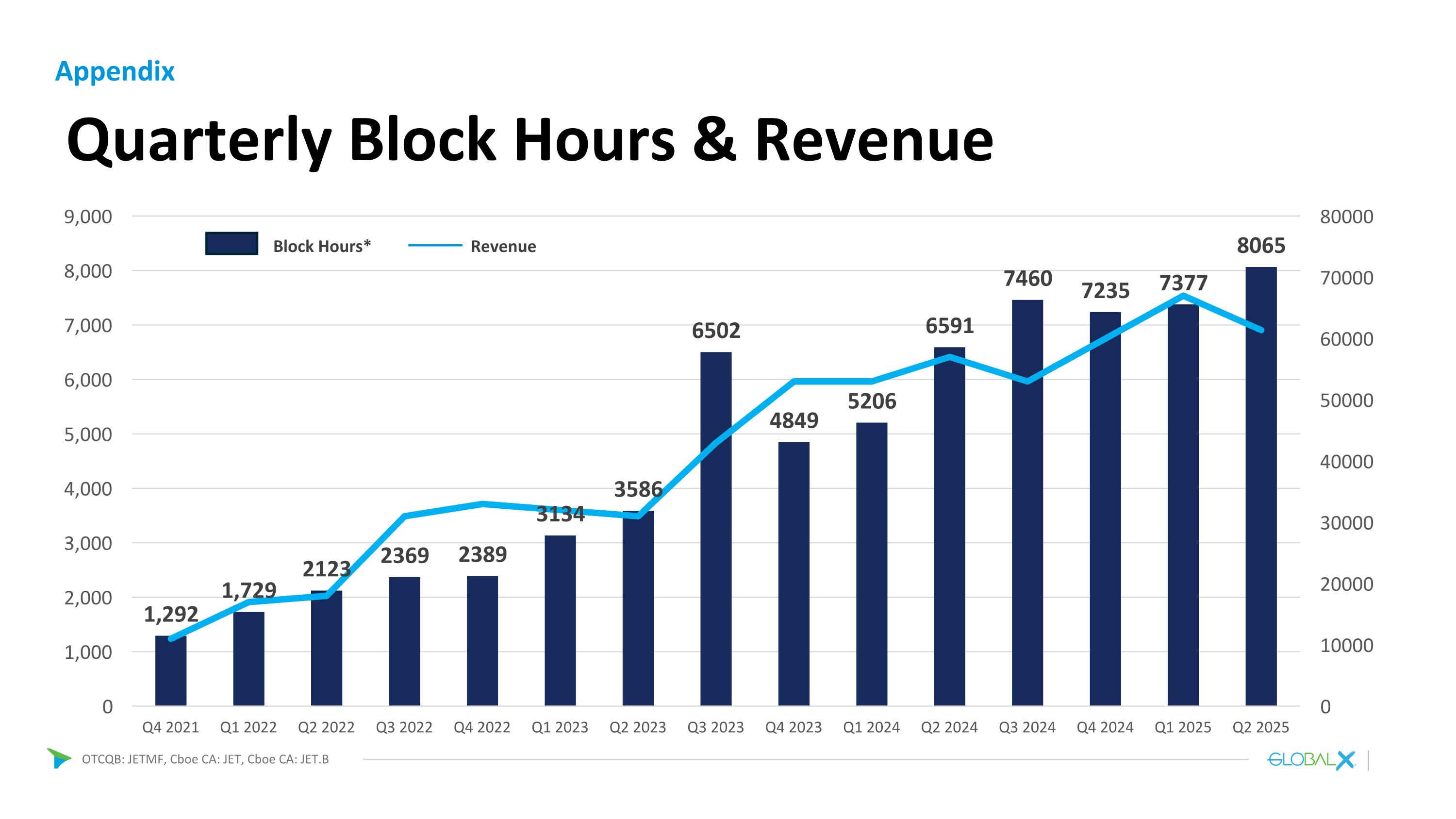

Quarterly Block Hours & Revenue Appendix Block Hours* Revenue

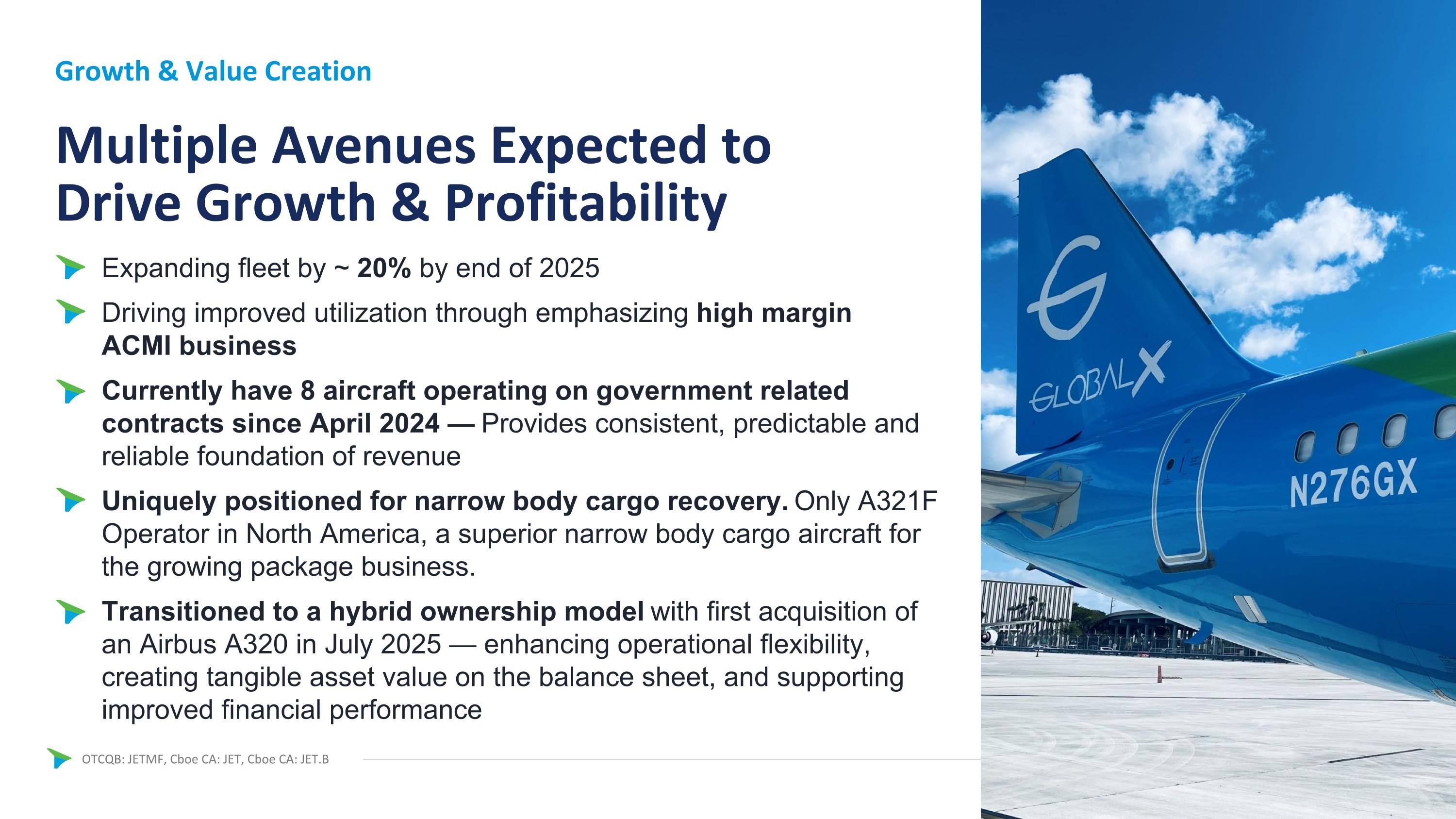

Expanding fleet by ~ 20% by end of 2025 Driving improved utilization through emphasizing high margin ACMI business Currently have 8 aircraft operating on government related contracts since April 2024 — Provides consistent, predictable and reliable foundation of revenue Uniquely positioned for narrow body cargo recovery. Only A321F Operator in North America, a superior narrow body cargo aircraft for the growing package business. Transitioned to a hybrid ownership model with first acquisition of an Airbus A320 in July 2025 — enhancing operational flexibility, creating tangible asset value on the balance sheet, and supporting improved financial performance Multiple Avenues Expected to Drive Growth & Profitability Growth & Value Creation

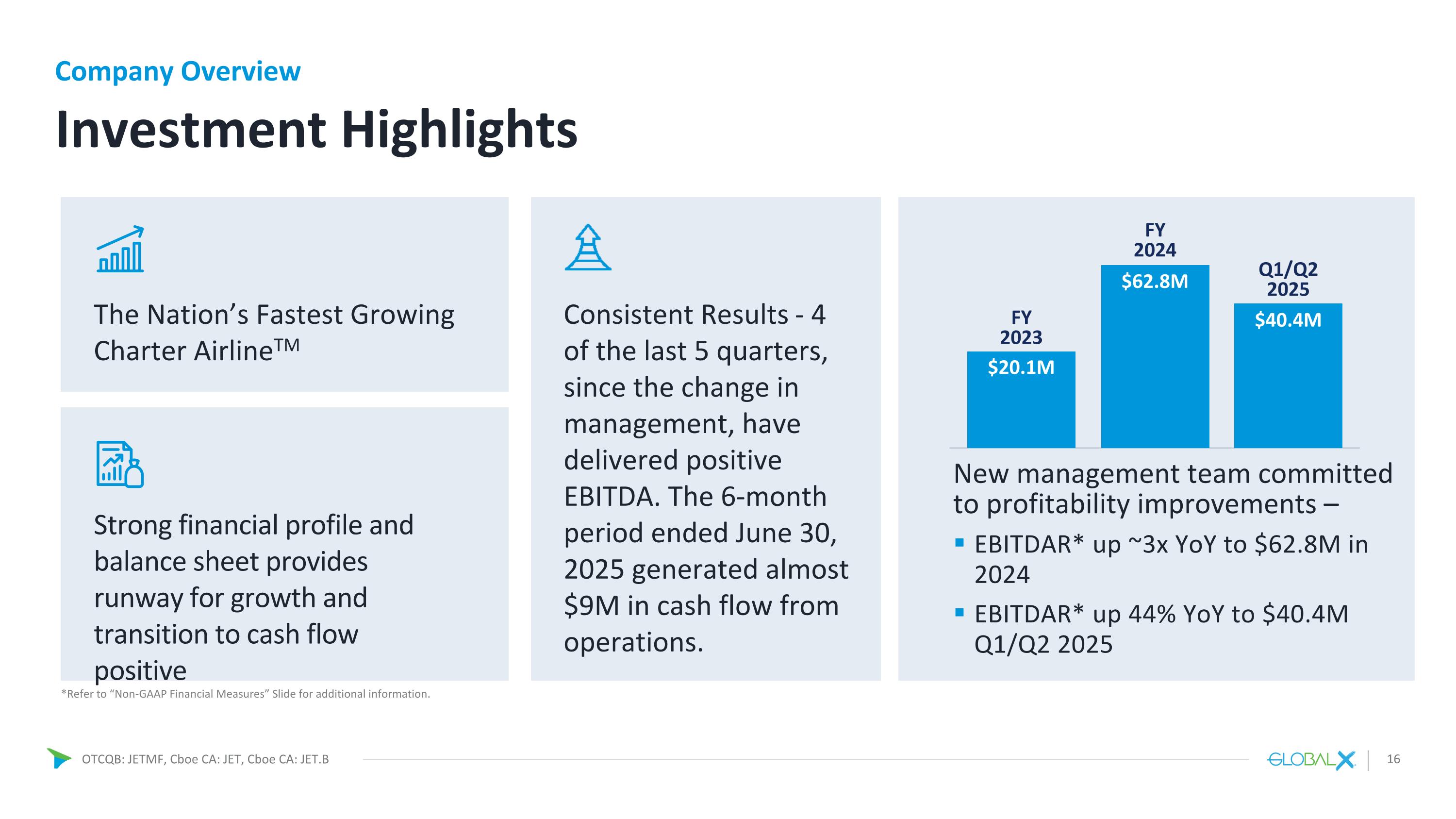

Investment Highlights The Nation’s Fastest Growing Charter AirlineTM Strong financial profile and balance sheet provides runway for growth and transition to cash flow positive Consistent Results - 4 of the last 5 quarters, since the change in management, have delivered positive EBITDA. The 6-month period ended June 30, 2025 generated almost $9M in cash flow from operations. New management team committed to profitability improvements – EBITDAR* up ~3x YoY to $62.8M in 2024 EBITDAR* up 44% YoY to $40.4M Q1/Q2 2025 Company Overview 16 *Refer to “Non-GAAP Financial Measures” Slide for additional information. $20.1M FY 2023 FY 2024 $62.8M $40.4M Q1/Q2 2025

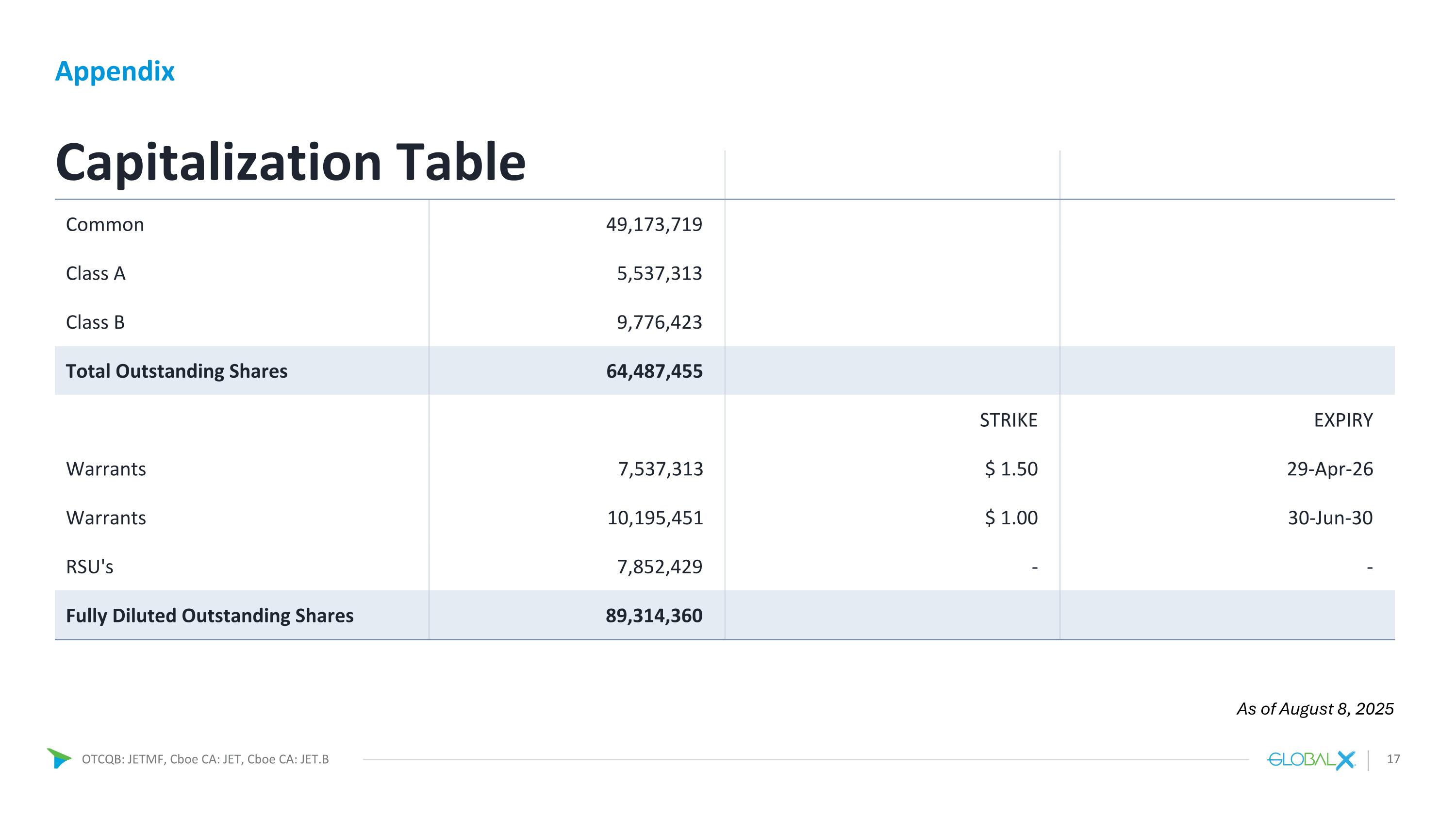

Capitalization Table Common 49,173,719 Class A 5,537,313 Class B 9,776,423 Total Outstanding Shares 64,487,455 STRIKE EXPIRY Warrants 7,537,313 $ 1.50 29-Apr-26 Warrants 10,195,451 $ 1.00 30-Jun-30 RSU's 7,852,429 - - Fully Diluted Outstanding Shares 89,314,360 Appendix 17 As of August 8, 2025

Thank you! Corporate Office Global Crossing Airlines Group 4200 NW 36th Street, Building 5A Miami International Airport Miami, FL (786) 751-85500 Investor Relations Contact Sean Mansouri, CFA | Aaron D’Souza jet@elevate-ir.com (720) 330-2829 18

19 19 Appendix

Chris Jamroz Executive Chairman Our Leadership Team Company Overview 20 OTCQB: JETMF, Cboe CA: JET, Cboe CA: JET.B The architect and operator behind some of the most successful transformations in logistics. With eight prior successful exits and nearly $10 billion in shareholder value created for financial sponsors and ownership groups, Chris Jamroz is a renowned value-unlocking specialist and Founder of LyonIX Holdings and its subsidiary funds, a private equity investments firm with holdings in Transportation & Logistics, multi-family residential and industrial real estate, and cyber security. Through its proprietary model of ultra-precise operations management, LyonIX has consistently delivered superior results and outsized returns across all modes of the supply chain, globally. Chris is Executive Chairman of the Board of Global Crossing Airlines Group Inc. (JET: NEO; JET.B: NEO; JETMF: OTCQB), a full-service passenger and cargo airline headquartered in Miami, FL. In 2021, he led the transformative pre-certification investment that enabled the formal launch of the airline's operations. Executive Chairman of the Board and CEO of Roadrunner Transportation Systems (PINK: RRTS), the transportation industry's "greatest comeback story." Roadrunner is a national asset-light Less-Than-Truckload (LTL’) carrier focused on direct metro-to-metro expedite-like trucking services across North America. Chris led the sale of the business from Elliott Management to Prospero Staff, a LyonIX Holdings’ fund in 2024. Previously, Executive Chairman and CEO of Ascent Global Logistics, a prominent 3PL and the leading North American platform for expedited freight, freight forwarding and brokerage services. In his capacity as CEO, Chris led USA Jet, a U.S.-based air cargo carrier operating under both FAR Part 135 and 121 Ops Specs focused on ad-hoc charter services. Mr. Jamroz sold the business to HIG Capital in December 2023. Mr. Jamroz serves as non-Executive Director, and formerly Chairman, of the Board of CMS Info Systems Limited (CMSINFO.NSE), one of the largest secure logistics and the 5th largest ATM services companies in the world. Under Chris’ tenure, the company executed an exit for Blackstone through a sale to Bearing Private Equity Asia. Then, in 2021, Chris led the company through its IPO on the Mumbai Stock Exchange. In 2024, Chris facilitated a sell-down of the remaining stake and full exit for EQT. Previously, Chris was CEO and Executive Chairman of STG Logistics, North America’s specialty 3PL and intermodal services critical to the global supply chain. The business was sold via continuation fund structure in 2022 to a consortium of private equity firms led by Oaktree Infrastructure Fund. Prior to STG, Chris served as acting CEO and Executive Chairman of Emergent Cold, an international specialty logistics provider focused on the global cold chain. Chris led a successful sale of the business to Lineage Logistics backed by Bay Grove Capital in 2020. Mr. Jamroz was President and COO of Garda Cash Logistics, leading Garda to become the #1 currency supply chain, secure logistics and cash business services provider in North America. While at the helm, Chris secured the largest outsourcing contract in vault operation industry’s history valued at over $2 billion. In his capacity, he also oversaw the operations of Ameriflight, America’s largest Part 135 Cargo airline, with a fleet of over 230 owned fixed wing aircraft. Chris took the business private with Apax Partners in 2013 and later sold the business to Rhone Group in 2016. Prior to Garda, Chris was a top executive at one of the leading global investment banks, as the Head of JPMorgan in Canada.

Mr. Goepel is a seasoned finance and operations executive with over 25 years of experience, specializing in leadership roles across a variety of industries, including LCC (Low-Cost Carrier), ACMI (Aircraft, Crew, Maintenance, and Insurance), and narrowbody charter airline operations. His career includes significant expertise in mergers and acquisitions, turnarounds, debt and equity raises and scaling up startups. Career Highlights: GlobalX Mr. Goepel is a founding shareholder and the original CFO of GlobalX, where he played a pivotal role in the company's launch, growth, and evolution. Under his leadership, GlobalX raised $60 million in debt and equity and negotiated the acquisition of 25 Airbus aircraft. He grew the company from 1 to 700 employees and helped achieve $200 million in annual revenue within the first four years. As President, starting in Q1 2024, Mr. Goepel executed a strategic transformation, leading the company to profitable positive EBITDA, EBITDAR, and Net Income quarters in Q2, Q4 2024 and Q1, Q2 2025. Flair Airlines Mr. Goepel served as the Chief Financial Officer of Flair Airlines in Canada, where he led a major turnaround. The company went from the brink of bankruptcy to launching the first ULCC (Ultra-Low-Cost Carrier) airline in Canada. His efforts helped the company grow from a negative EBITDA of $25 million to a positive EBITDA of $30 million annually while modernizing the Boeing fleet and tripling the organization's size. ZeiTECS As CFO of ZeiTECS, a Shell Oil Ventures company, he played a critical role in growing the company from the ground up. His efforts led to the acquisition of ZeiTECS by Schlumberger, resulting in a 4x return on investment. Kellogg Brown & Root (KBR) At KBR, he served as the Controller and Business Unit Finance Leader for the KBR Services division, overseeing 12,000 employees and managing $300 million to $3 billion in global projects. Mr. Goepel led the financial integration of three major acquisitions and played a key role in the company's growth. Burger King As the Director of Global Finance at Burger King, he worked closely with private equity owners (Bain, TPG, and Goldman Sachs) to drive a financial turnaround. His work in capital spending, financial reporting, and investor relations led to a successful $600 million IPO and over $1.7 billion in new debt funding, offering a 5x return for investors. Halliburton Mr. Goepel's early career includes roles at Halliburton, where he was involved in strategic marketing for the Eurasia division and investor relations. His work in these areas helped lead Halliburton through crises, including the 2002 Iraq War contract issues and an asbestos class action lawsuit, helping recover the company's stock price three times over. Education & Credentials: Certified Management Accountant MBA, Texas A&M University BA in Political Science, University of British Columbia Mr. Goepel's extensive experience in corporate finance, leadership, and strategic growth has consistently led to successful turnarounds and significant value creation for the companies he's been involved with. Ryan Goepel President & CFO Our Leadership Team Company Overview 21 OTCQB: JETMF, Cboe CA: JET, Cboe CA: JET.B

Over 30 years of global leadership experience with a focus on people, talent, and succession strategies across consumer goods, education, technology, and airlines Chief People Officer for JetBlue Airlines Chief Human Resources Officer for Spirit Airlines Advisory Board Member for Primate Technologies Laurie Villa Over 20 years in Senior Finance Roles with the majority in the aviation sector Proven track record integrating systems and processes that deliver financial results. SVP Finance Transformation – Teladoc VP and Assistant Corporate Controller – Atlas Air Wendy Shapiro Over 20 years of travel industry experience Extensive experience across cruises, gaming, and managing charter programs Has developed air charter programs for the world’s leading travel brands Head of Gaming – Royal Caribbean Group Director, Global Business Development – Carnival Corporation Mark Salvador Over 20 years of commercial and charter airline experience SVP - Elite Airways VP, Inflight - Elite Airways Director, Customer Service – Elite Airways Director, Commercial Sales - Marriott International David Dow Ken Zedan Over 30 years of pilot experience, including 23 years of Part 121 and 2 years of Part 150 operations Has more than 14,000 flight hours and logged over 9,000 hours as Pilot in Command (PIC). Certified and rated on the A320, A330, B737, and CRJ700 aircraft Our Leadership Team (Cont’d) 22 Company Overview Over 20 years of Technical Operations leadership, including 119 Director of Maintenance experience Vice President, Technical Operations - Silver Airways Technical Services - Amerijet Various senior leadership positions within the American Airlines, US Airways, and America West organizations Scott McGovern Chief People Officer SVP, Corporate Controller SVP, Marketing and Admin SVP, Flight Operations VP, Technical Operations VP, Sales

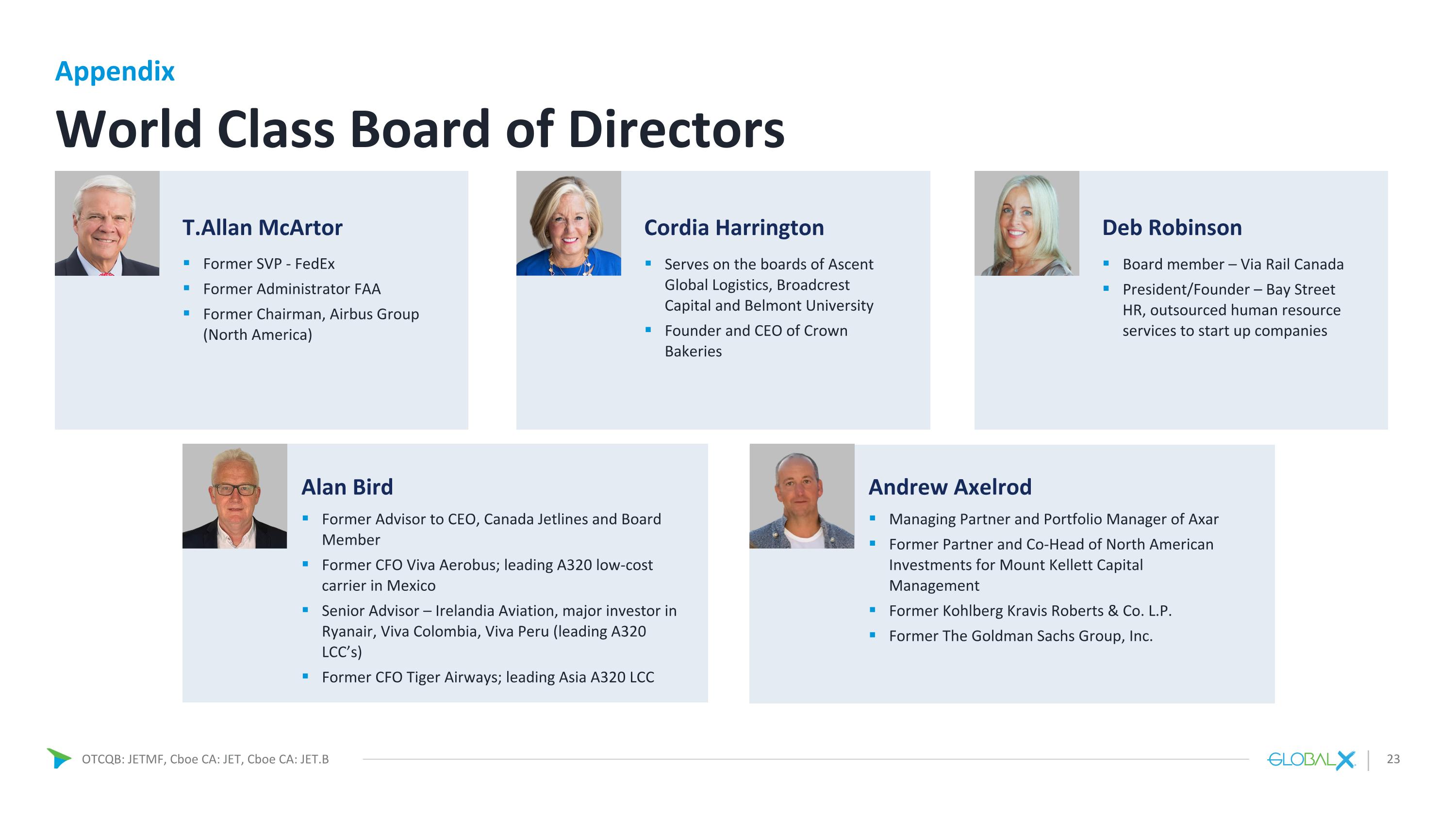

Former SVP - FedEx Former Administrator FAA Former Chairman, Airbus Group (North America) World Class Board of Directors Andrew Axelrod Alan Bird T.Allan McArtor Cordia Harrington Deb Robinson Board member – Via Rail Canada President/Founder – Bay Street HR, outsourced human resource services to start up companies Serves on the boards of Ascent Global Logistics, Broadcrest Capital and Belmont University Founder and CEO of Crown Bakeries Former Advisor to CEO, Canada Jetlines and Board Member Former CFO Viva Aerobus; leading A320 low-cost carrier in Mexico Senior Advisor – Irelandia Aviation, major investor in Ryanair, Viva Colombia, Viva Peru (leading A320 LCC’s) Former CFO Tiger Airways; leading Asia A320 LCC Managing Partner and Portfolio Manager of Axar Former Partner and Co-Head of North American Investments for Mount Kellett Capital Management Former Kohlberg Kravis Roberts & Co. L.P. Former The Goldman Sachs Group, Inc. Appendix 23

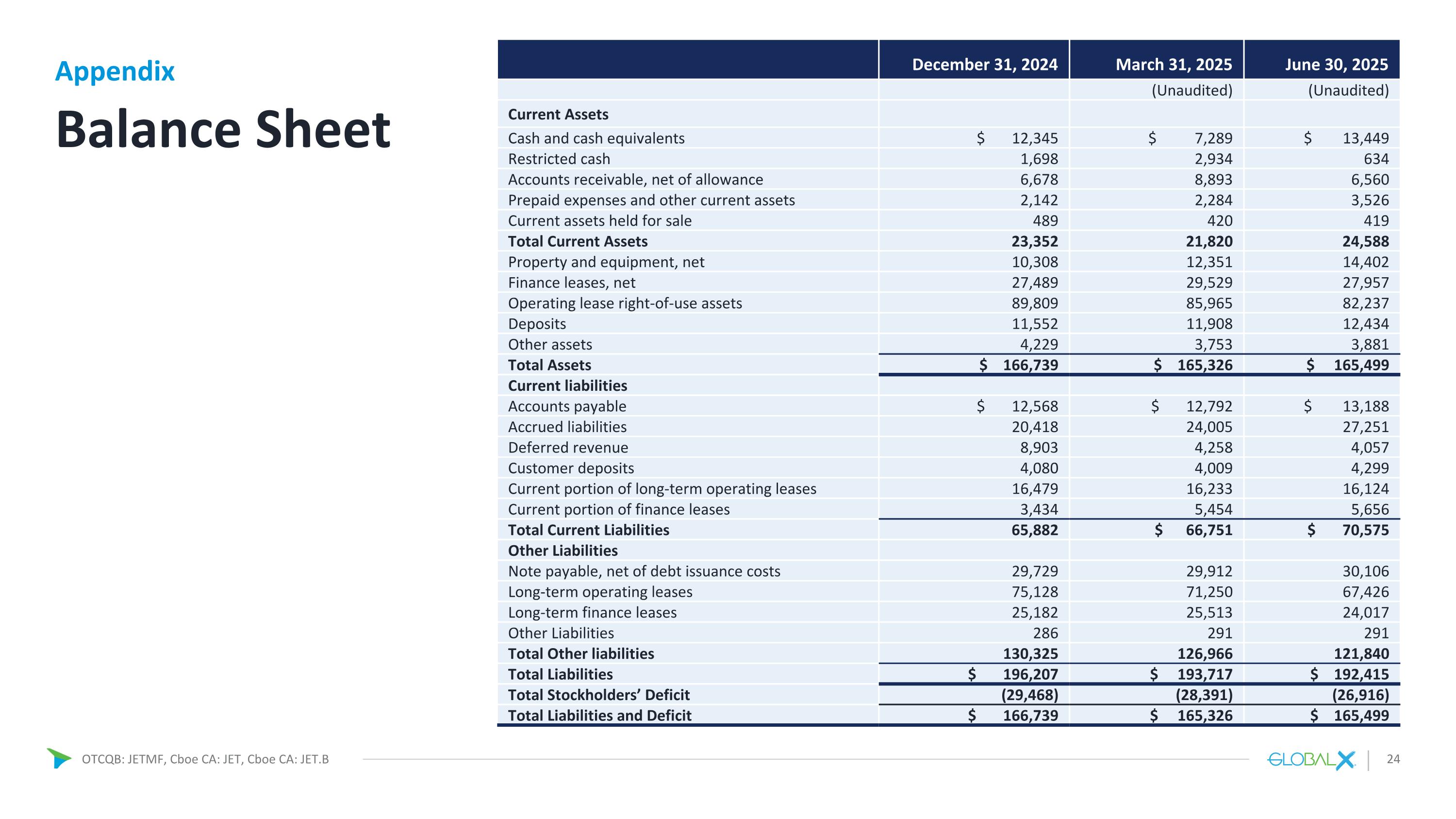

December 31, 2024 March 31, 2025 June 30, 2025 (Unaudited) (Unaudited) Current Assets Cash and cash equivalents $ 12,345 $ 7,289 $ 13,449 Restricted cash 1,698 2,934 634 Accounts receivable, net of allowance 6,678 8,893 6,560 Prepaid expenses and other current assets 2,142 2,284 3,526 Current assets held for sale 489 420 419 Total Current Assets 23,352 21,820 24,588 Property and equipment, net 10,308 12,351 14,402 Finance leases, net 27,489 29,529 27,957 Operating lease right-of-use assets 89,809 85,965 82,237 Deposits 11,552 11,908 12,434 Other assets 4,229 3,753 3,881 Total Assets $ 166,739 $ 165,326 $ 165,499 Current liabilities Accounts payable $ 12,568 $ 12,792 $ 13,188 Accrued liabilities 20,418 24,005 27,251 Deferred revenue 8,903 4,258 4,057 Customer deposits 4,080 4,009 4,299 Current portion of long-term operating leases 16,479 16,233 16,124 Current portion of finance leases 3,434 5,454 5,656 Total Current Liabilities 65,882 $ 66,751 $ 70,575 Other Liabilities Note payable, net of debt issuance costs 29,729 29,912 30,106 Long-term operating leases 75,128 71,250 67,426 Long-term finance leases 25,182 25,513 24,017 Other Liabilities 286 291 291 Total Other liabilities 130,325 126,966 121,840 Total Liabilities $ 196,207 $ 193,717 $ 192,415 Total Stockholders’ Deficit (29,468) (28,391) (26,916) Total Liabilities and Deficit $ 166,739 $ 165,326 $ 165,499 Balance Sheet Appendix