.2

1 Envudeucitinib ONWARD1 and ONWARD2 Phase 3 Topline Readout Analyst and Investor Webcast – January 6, 2026

2 Forward - Looking Statements This presentation contains forward looking statements within the meaning of federal securities laws, including the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 . Such statements are based upon current plans, estimates and expectations of management of Alumis Inc . (“ Alumis ”) in light of historical results and trends, current conditions and potential future developments, and are subject to various risks and uncertainties that could cause actual results to differ materially from such statements . The inclusion of forward - looking statements should not be regarded as a representation that such plans, estimates and expectations will be achieved . Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “may,” “will,” “should,” “plan,” “could,” “continue,” “target,” “contemplate,” “estimate,” “forecast,” “guidance,” “predict,” “possible,” “potential,” “pursue,” “likely,” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward - looking statements . All statements, other than statements of historical facts, including express or implied statements regarding the timing of Alumis ’ topline data in its Phase 2 b LUMUS trial, the timing of Alumis ’ evaluation of its lonigutamab program and the timing of other anticipated milestones with respect to its development programs, any expectations regarding the safety, efficacy or tolerability of envudeucitinib and statements regarding our expectations of the size of market opportunity, the potential for envudeucitinib to be a best - in - disease oral in psoriasis, future plans and prospects including our cash runway and development of our development pipeline and any assumptions underlying the foregoing, our competitive ability and position, our clinical pipeline, and any assumptions underlying any of the foregoing, are forward - looking statements . Risks and uncertainties include, among other things, the risk that Alumis may be adversely affected by economic, business and/or competitive factors ; the risk that the anticipated benefits and synergies of the recent merger with ACELYRIN, Inc . may not be fully realized or may take longer to realize than expected, including the risk that the combined company may not be able to be successfully integrated and achieve the growth prospects expected from the transaction ; the impact of legislative, regulatory, economic, competitive and technological changes ; the implementation of our business model and strategic plans for our product candidates and pipeline, and challenges inherent in developing, commercializing, manufacturing, launching, marketing and selling potential existing and new products and product candidates ; the scope, progress, results and costs of developing our product candidates and any future product candidates, including conducting preclinical studies and clinical trials, and otherwise related to the research and development of our pipeline ; the timing and costs involved in obtaining and maintaining regulatory approval for current or future product candidates, and any related restrictions, limitations and/or warnings in the label of any product, if and once approved ; the market for, adoption (including rate and degree of market acceptance) and pricing and reimbursement of our product candidates, if approved, and their respective abilities to compete with therapies and procedures that are rapidly growing and evolving ; uncertainties in contractual relationships, including collaborations, partnerships, licensing or other arrangements and the performance of third party suppliers and manufacturers ; our ability to establish and maintain intellectual property protection for products or avoid or defend claims of infringement ; and (xxi) potential delays in initiating, enrolling or completing preclinical studies and clinical trials . While the list of factors presented here are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties . For additional information about other factors that could cause actual results to differ materially from those described in the forward - looking statements, please refer to our periodic reports and other filings with the Securities and Exchange Commission (the “SEC”), including the risk factors identified in our most recent Quarterly Report on Form 10 - Q . The risks and uncertainties described above and in the SEC filings cited above are not exclusive and further information concerning us and our businesses, including factors that potentially could materially affect our business, financial conditions or operating results, may emerge from time to time . Readers are urged to consider these factors carefully in evaluating these forward - looking statements, and not to place undue reliance on any forward - looking statements, which speak only as of the date hereof . Readers should also carefully review the risk factors described in other documents we file from time to time with the SEC . The forward - looking statements included in this presentation are made only as of the date hereof . Alumis assumes no obligation and does not intend to update these forward - looking statements, even if new information becomes available in the future, except as required by law . Certain of the data in this presentation are not based on head - to - head or comparator trials . Differences exist between trial designs and caution should be exercised when comparing data across trials . This presentation contains trademarks, service marks, trade names and copyrights of Alumis and other companies which are the property of their respective owners . This presentation discusses product candidates that are under clinical study and which have not yet been approved for marketing by the U . S . Food and Drug Administration . No representation is made as to the safety or effectiveness of these product candidates for the uses for which they are being studied . This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry . These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . We have not independently verified the data generated by independent parties and cannot guarantee their accuracy or completeness . In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk . Additional Information and Where to Find It Copies of documents filed with the SEC by Alumis are available free of charge under the SEC Filings heading of the Investor Relations section of Alumis ’ website at https : //investors . alumis . com/ .

3 Agenda Speaker Topic John Schroer, CFO Welcome Martin Babler, CEO Opening Remarks Jörn Drappa , MD, PhD, CMO ONWARD Phase 3 Data Review Martin Babler, CEO Psoriasis Opportunity All Q&A

4 Overview

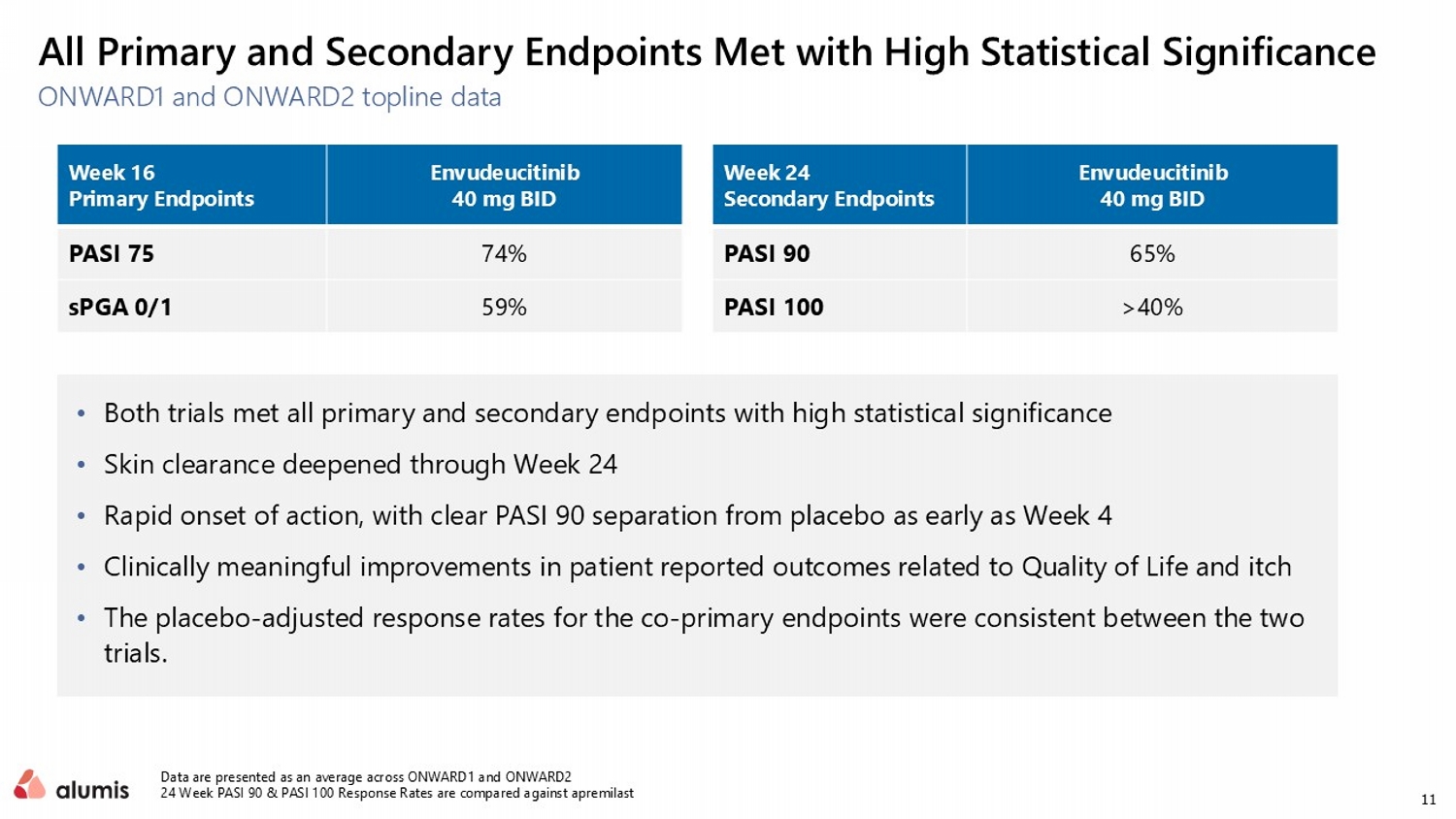

5 • Leading skin clearance for oral plaque psoriasis therapies • We believe envudeucitinib profile is highly compelling to physicians and patients • The placebo - adjusted response rates for the co - primary endpoints were consistent between the two trials • Phase 3 efficacy exceeded Phase 2 program results ONWARD1 and ONWARD2 Met All Primary and Secondary Endpoints Rapid onset of action, with clear separation from placebo for PASI 90 as early as Week 4 Highly statistically significant Phase 3 efficacy with deep skin clearance through Week 24 Clinically meaningful improvements in patient reported outcomes related to q uality of life and itch Generally well - tolerated with a safety profile consistent with the Phase 2 program

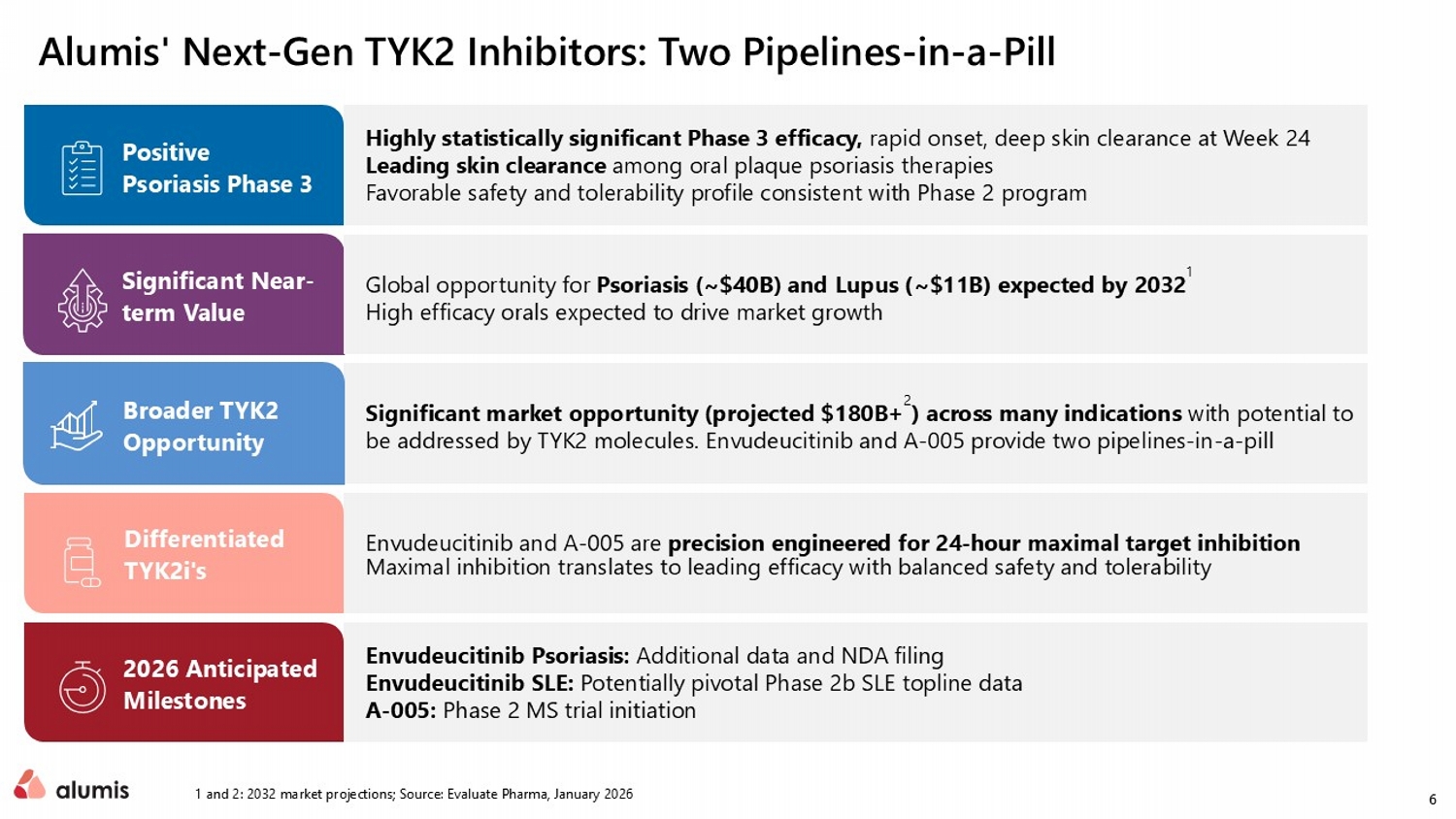

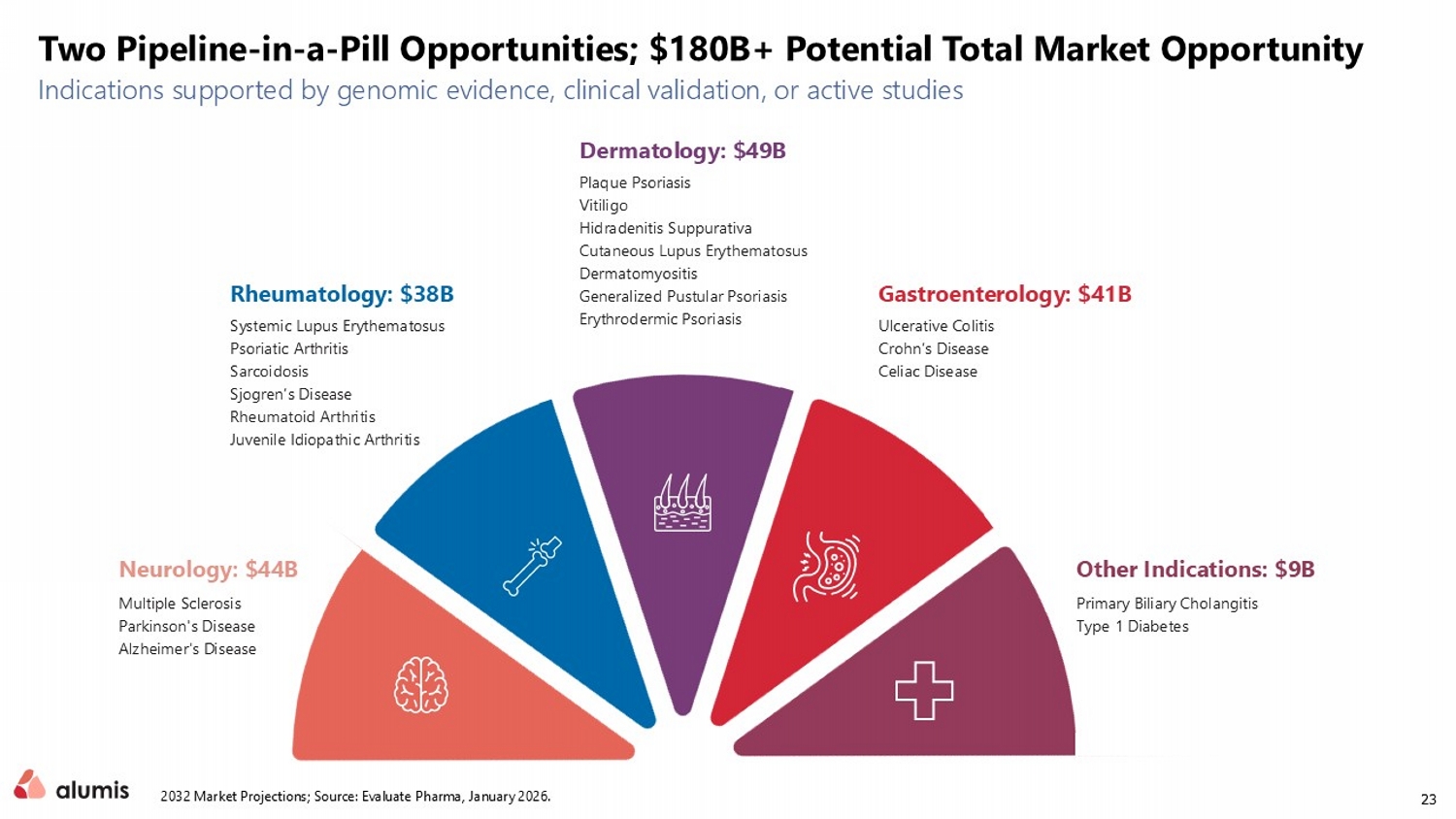

6 Alumis ' Next - Gen TYK2 Inhibitors: Two Pipelines - in - a - Pill 1 and 2: 2032 market projections; Source: Evaluate Pharma, January 2026 Significant market opportunity (projected $ 180B+ 2 ) across many indications with potential to be addressed by TYK2 molecules. Envudeucitinib and A - 005 provide two pipelines - in - a - pill Highly statistically significant Phase 3 efficacy, rapid onset, deep skin clearance at Week 24 Leading skin clearance among oral plaque psoriasis therapies F avorable safety and tolerability profile consistent with Phase 2 program Envudeucitinib Psoriasis: Additional data and NDA filing Envudeucitinib SLE: Potentially pivotal Phase 2b SLE topline data A - 005: Phase 2 MS trial initiation Positive Psoriasis Phase 3 Global opportunity for Psoriasis (~$40B) and Lupus (~$11B ) expected by 2032 1 High efficacy orals expected to drive market growth Significant Near - term Value Broader TYK2 Opportunity 2026 Anticipated Milestones Envudeucitinib and A - 005 are precision engineered for 24 - hour maximal target inhibition Maximal inhibition translates to leading efficacy with balanced safety and tolerability Differentiated TYK2i's

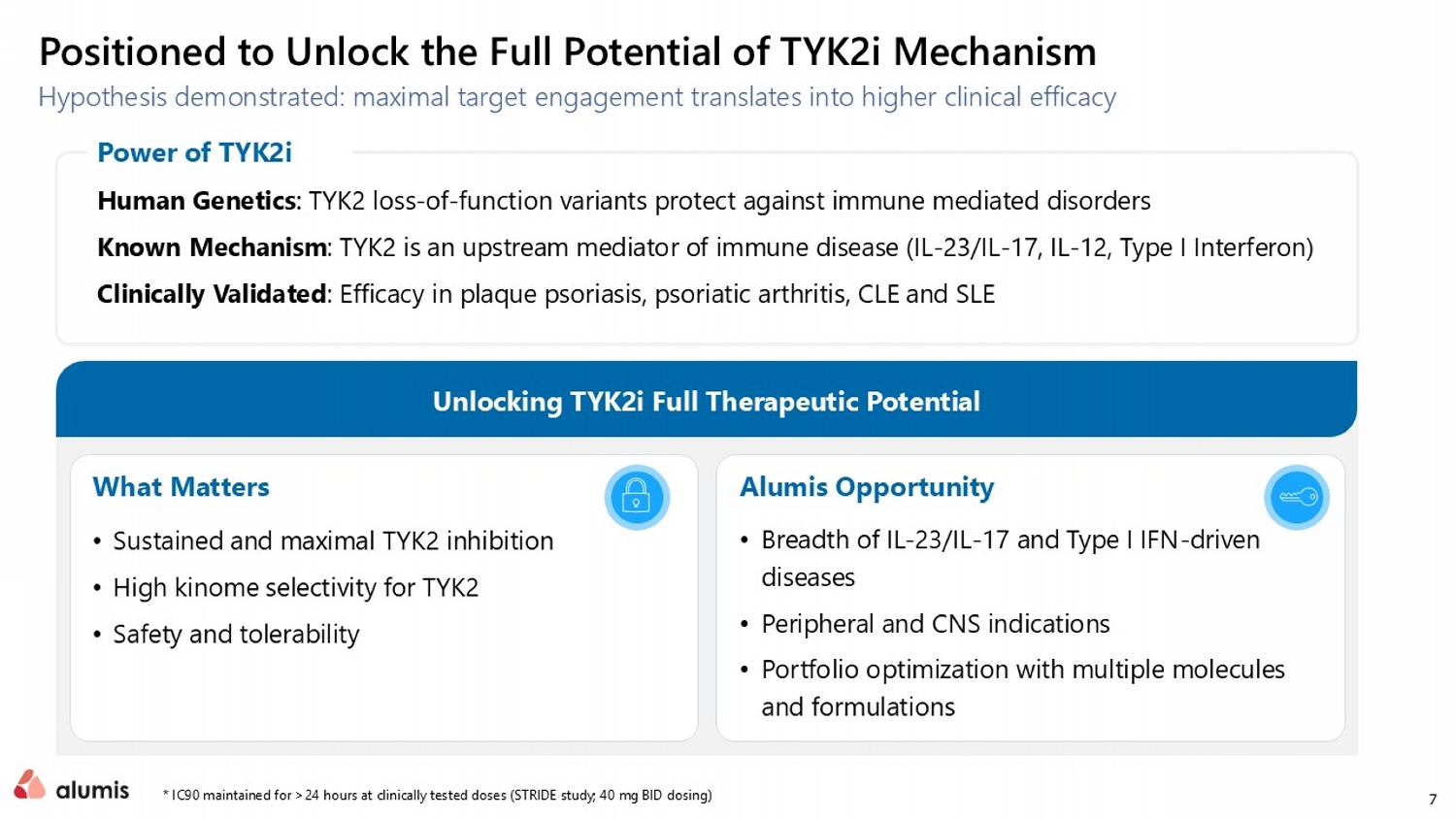

7 Hypothesis demonstrated: maximal target engagement translates into higher clinical efficacy * IC90 maintained for >24 hours at clinically tested doses (STRIDE study; 40 mg BID dosing) Positioned to Unlock the Full Potential of TYK2i Mechanism Human Genetics : TYK2 loss - of - function variants protect against immune mediated disorders Known Mechanism : TYK2 is an upstream mediator of immune disease (IL - 23/IL - 17, IL - 12, Type I Interferon ) Clinically Validated : Efficacy in plaque psoriasis, psoriatic arthritis, CLE and SLE Power of TYK2i • Breadth of IL - 23/IL - 17 and Type I IFN - driven diseases • Peripheral and CNS indications • Portfolio optimization with multiple molecules and formulations Alumis Opportunity • Sustained and maximal TYK2 inhibition • High kinome selectivity for TYK2 • Safety and tolerability What Matters Unlocking TYK2i Full Therapeutic Potential

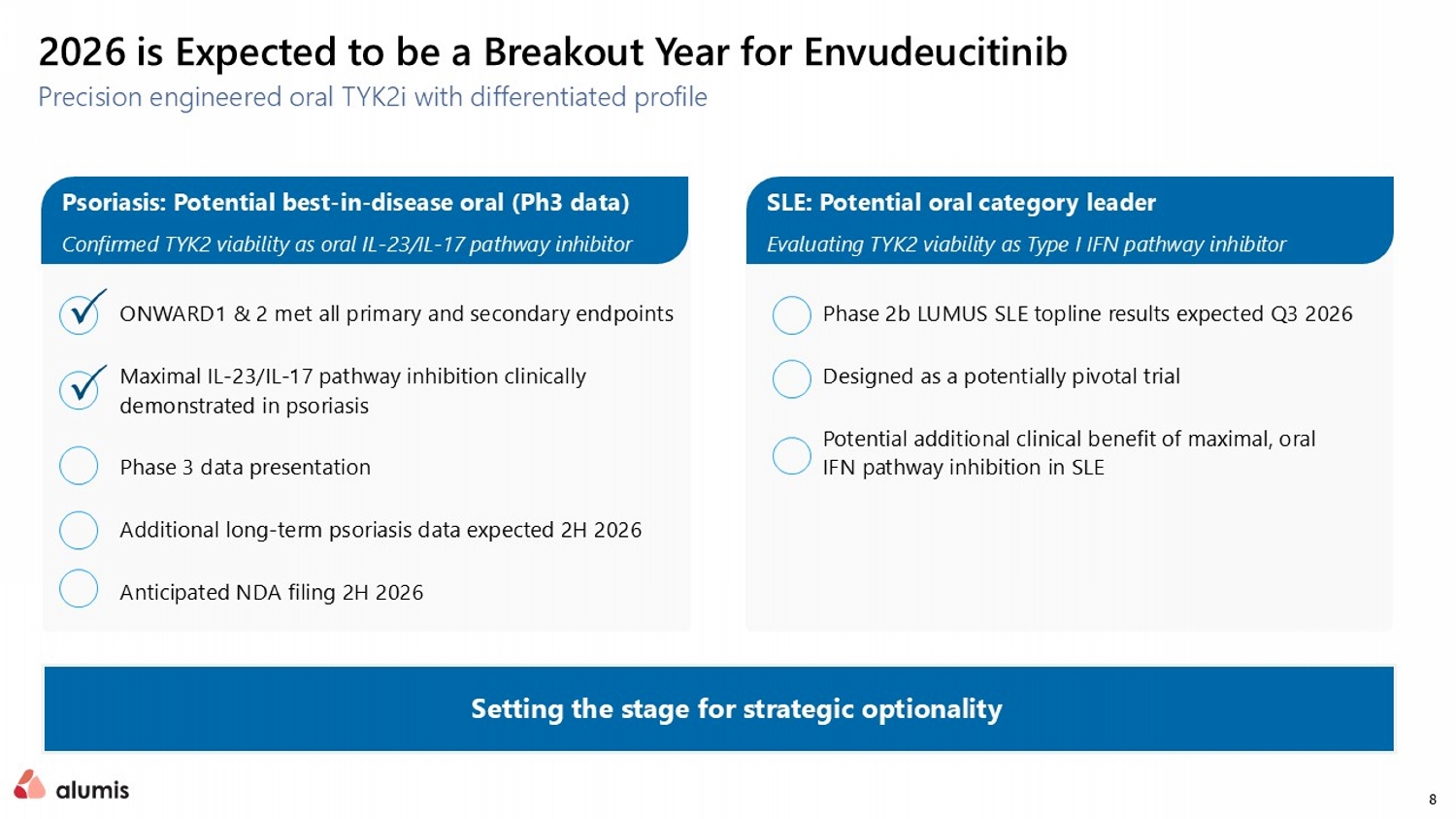

8 ONWARD1 & 2 met all primary and secondary endpoints Maximal IL - 23/IL - 17 pathway inhibition clinically demonstrated in psoriasis Phase 3 data presentation Additional long - term psoriasis data expected 2H 2026 Anticipated NDA filing 2H 2026 Phase 2b LUMUS SLE topline results expected Q3 2026 Designed as a potentially pivotal trial Potential additional clinical benefit of maximal, oral IFN pathway inhibition in SLE 2026 is Expected to be a Breakout Year for Envudeucitinib Precision engineered oral TYK2i with differentiated profile Setting the stage for strategic optionality Psoriasis: Potential best - in - disease oral (Ph3 data) Confirmed TYK2 viability as oral IL - 23/IL - 17 pathway inhibitor SLE: Potential oral category leader Evaluating TYK2 viability as Type I IFN pathway inhibitor

9 Envudeucitinib ONWARD1 and ONWARD2 Phase 3 Topline Data

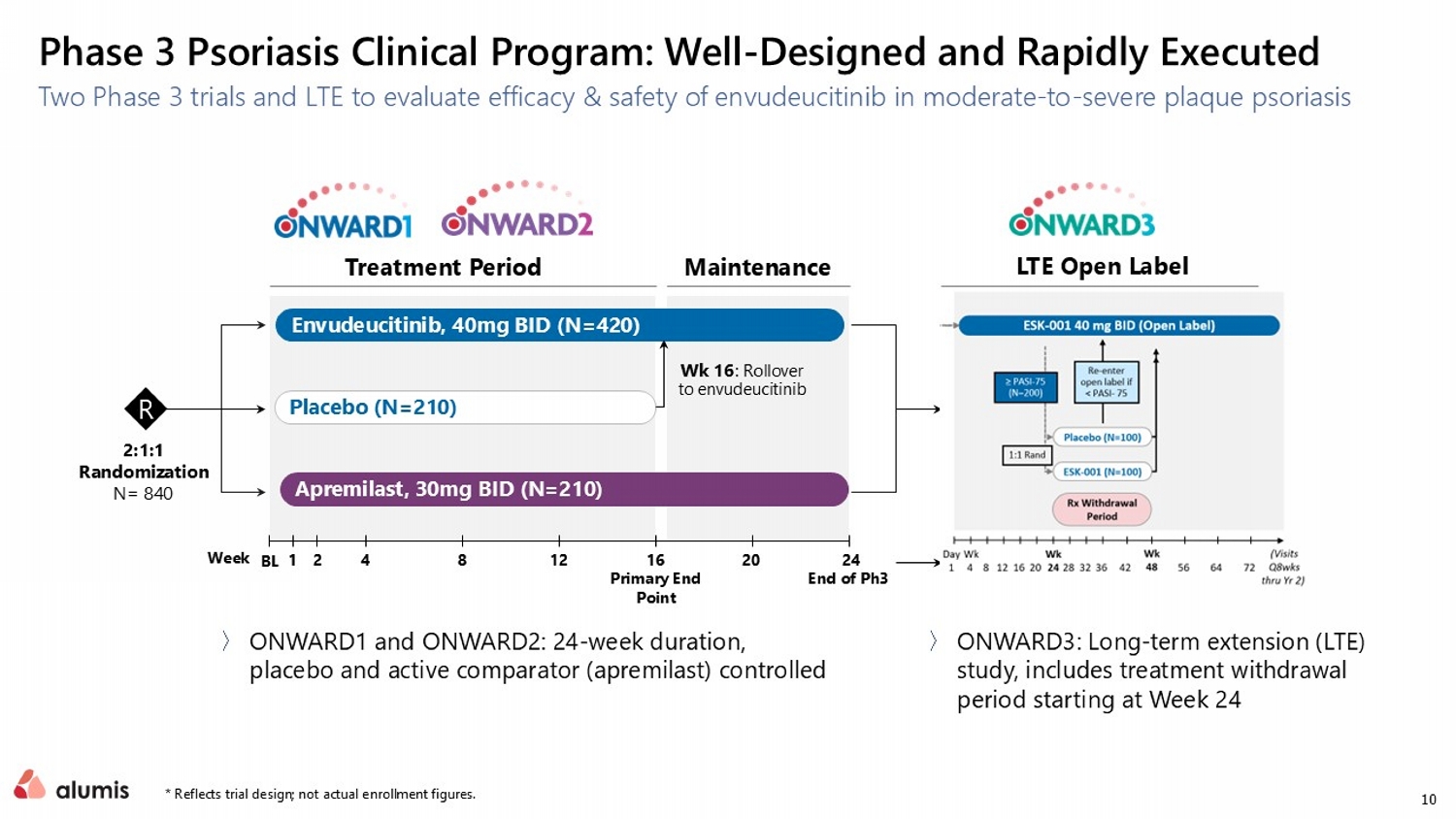

10 Phase 3 Psoriasis Clinical Program: Well - Designed and Rapidly Executed Two Phase 3 trials and LTE to evaluate efficacy & safety of envudeucitinib in moderate - to - severe plaque psoriasis Envudeucitinib , 40mg BID (N=420) Treatment Period Maintenance Placebo (N= 210 ) Wk 16 : Rollover to envudeucitinib Apremilast, 30mg BID (N=210) Envudeucitinib LTE Open Label 2:1:1 Randomization N= 840 16 Primary End Point 24 End of Ph3 20 2 4 8 12 1 BL 〉 ONWARD1 and ONWARD2: 24 - week duration, placebo and active comparator (apremilast) controlled 〉 ONWARD3: Long - term extension (LTE) study, includes treatment withdrawal period starting at Week 24 R Week * Reflects trial design; not actual enrollment figures.

11 • Both trials met all primary and secondary endpoints with high statistical significance • Skin clearance deepened through Week 24 • Rapid onset of action, with clear PASI 90 separation from placebo as early as Week 4 • Clinically meaningful improvements in patient reported outcomes related to Quality of Life and itch • The placebo - adjusted response rates for the co - primary endpoints were consistent between the two trials. ONWARD1 and ONWARD2 topline data Data are presented as an average across ONWARD1 and ONWARD2 24 Week PASI 90 & PASI 100 Response Rates are compared against apremilast All Primary and Secondary Endpoints Met with High Statistical Significance Envudeucitinib 40 mg BID Week 16 Primary Endpoints 74% PASI 75 59% sPGA 0/1 Envudeucitinib 40 mg BID Week 24 Secondary Endpoints 65% PASI 90 >40% PASI 100

12 ONWARD1 and ONWARD2 topline data Envudeucitinib Delivered a Favorable Safety Profile • Generally well tolerated through Week 24 in both ONWARD1 and ONWARD2 and consistent with Alumis ’ Phase 2 program, including the Phase 2 open - label extension • No new safety signal observed in Phase 3 • Treatment - emergent adverse event (TEAE) frequency and severity similar across trials • Majority of TEAEs being mild to moderate, transient, and responding to standard therapy • Most common TEAEs were headaches, nasopharyngitis, upper respiratory tract infections and acne Envudeucitinib Topline Safety Summary

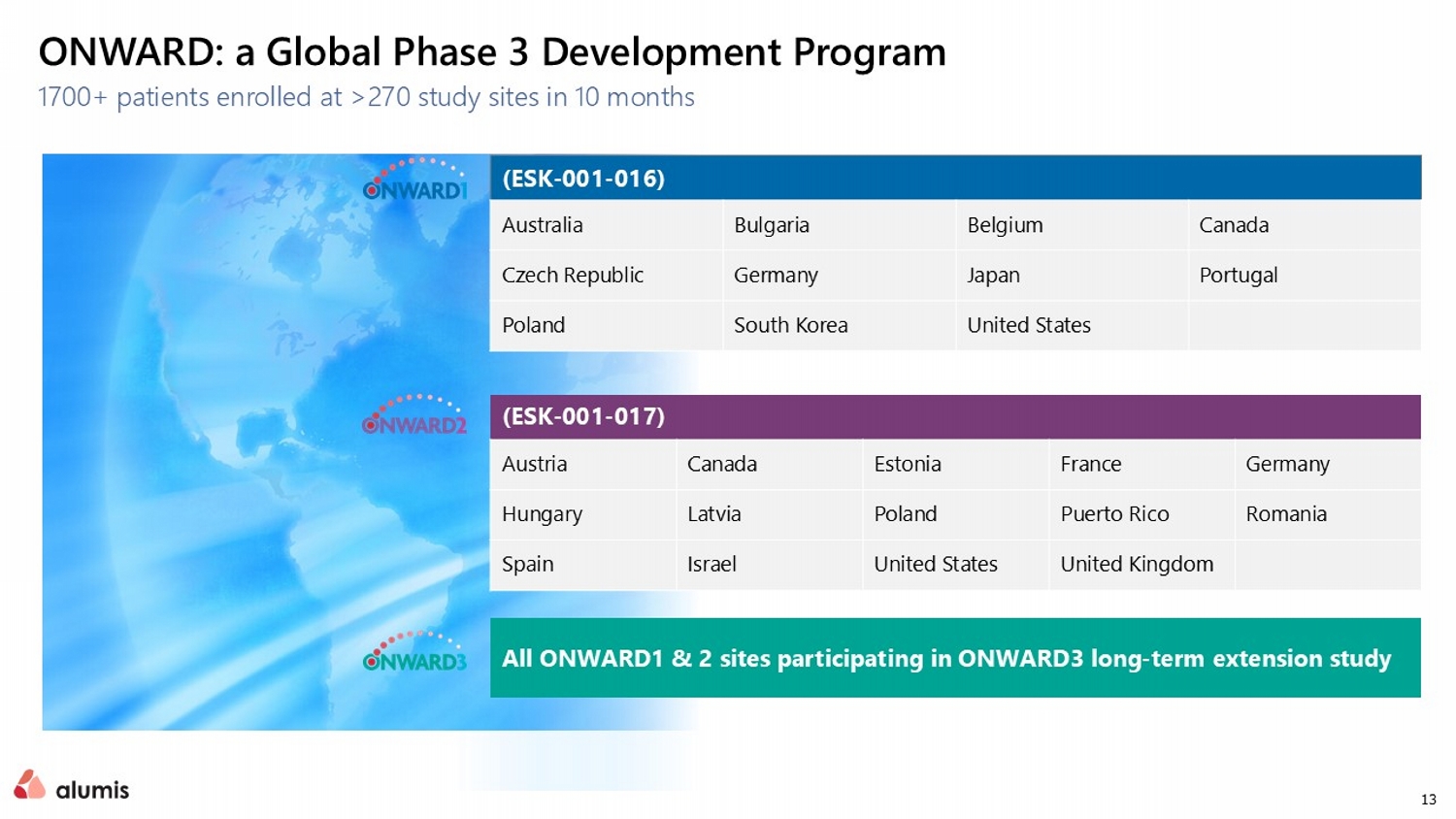

13 1700+ patients enrolled at >270 study sites in 10 months ONWARD: a Global Phase 3 Development Program All ONWARD1 & 2 sites participating in ONWARD3 long - term extension study (ESK - 001 - 016) Canada Belgium Bulgaria Australia Portugal Japan Germany Czech Republic United States South Korea Poland (ESK - 001 - 017) Germany France Estonia Canada Austria Romania Puerto Rico Poland Latvia Hungary United Kingdom United States Israel Spain

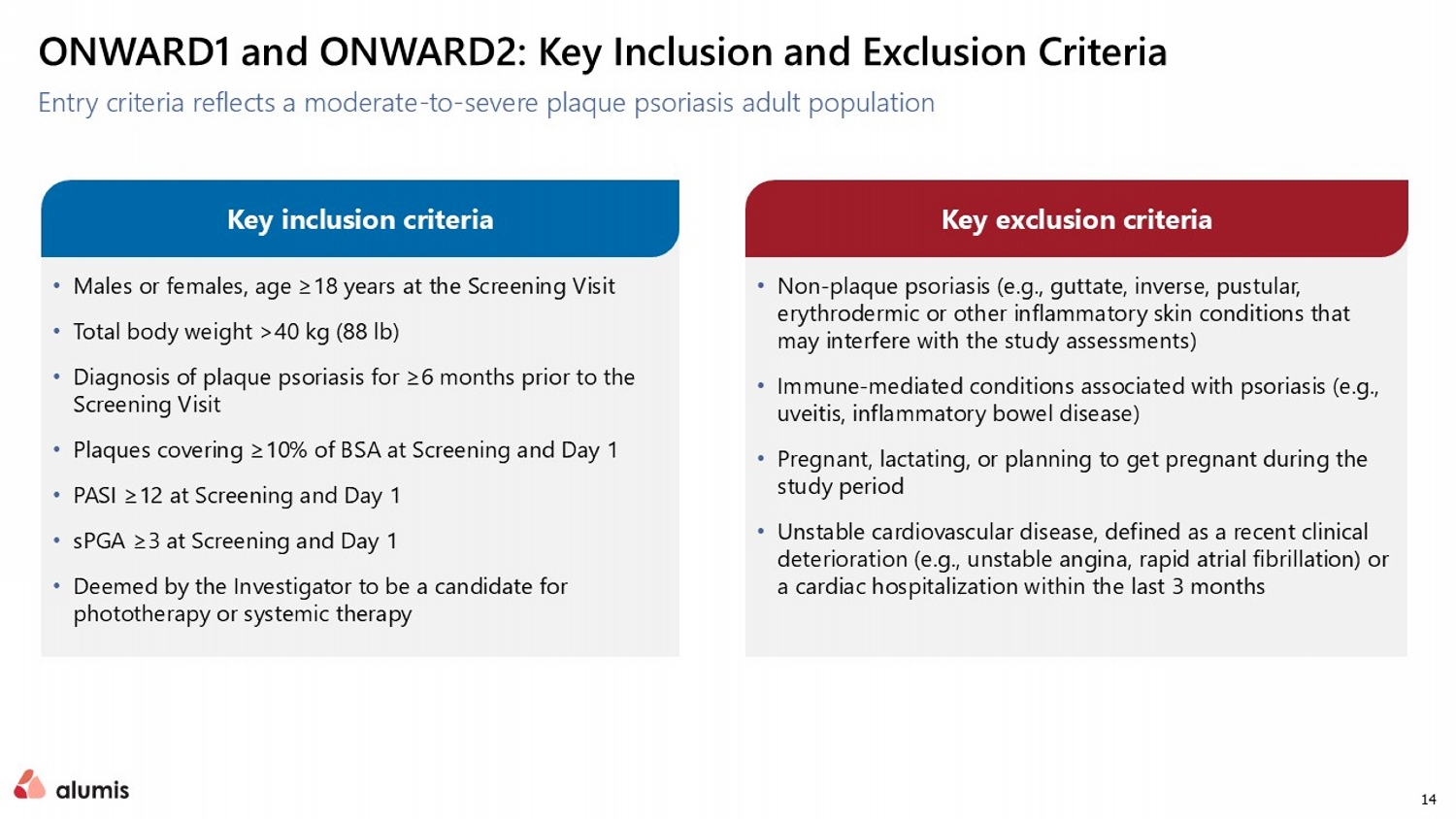

14 ONWARD1 and ONWARD2: Key Inclusion and Exclusion Criteria • Males or females, age ≥18 years at the Screening Visit • Total body weight >40 kg (88 lb ) • Diagnosis of plaque psoriasis for ≥6 months prior to the Screening Visit • Plaques covering ≥10% of BSA at Screening and Day 1 • PASI ≥12 at Screening and Day 1 • sPGA ≥3 at Screening and Day 1 • Deemed by the Investigator to be a candidate for phototherapy or systemic therapy • Non - plaque psoriasis (e.g., guttate, inverse, pustular, erythrodermic or other inflammatory skin conditions that may interfere with the study assessments) • Immune - mediated conditions associated with psoriasis (e.g., uveitis, inflammatory bowel disease) • Pregnant, lactating, or planning to get pregnant during the study period • Unstable cardiovascular disease, defined as a recent clinical deterioration (e.g., unstable angina, rapid atrial fibrillation) or a cardiac hospitalization within the last 3 months Key inclusion criteria Entry criteria reflects a moderate - to - severe plaque psoriasis adult population Key exclusion criteria

15 Balanced patients and disease characteristics across groups Data based on average from both studies Demographics and Baseline Characteristics for ONWARD1 and ONWARD2 • 64 - 67% Male • 79 - 89% White • 33 - 38% United States, • 6.1% (56 patients) enrolled from Japan in ESK - 001 - 016 study only • Duration of Psoriasis Diagnosis ~19 years • Over 40% prior systemic use • Approximately 25% prior biologic use • Mean PASI ~20; approximately 40% of patients having a PASI score >20 • sPGA of 3 in 70 - 73% of patients; sPGA of 4 in 27 - 30% of patients • Mean BSA of 26% Demographics similar between both trials Baseline disease characteristics similar between both trials

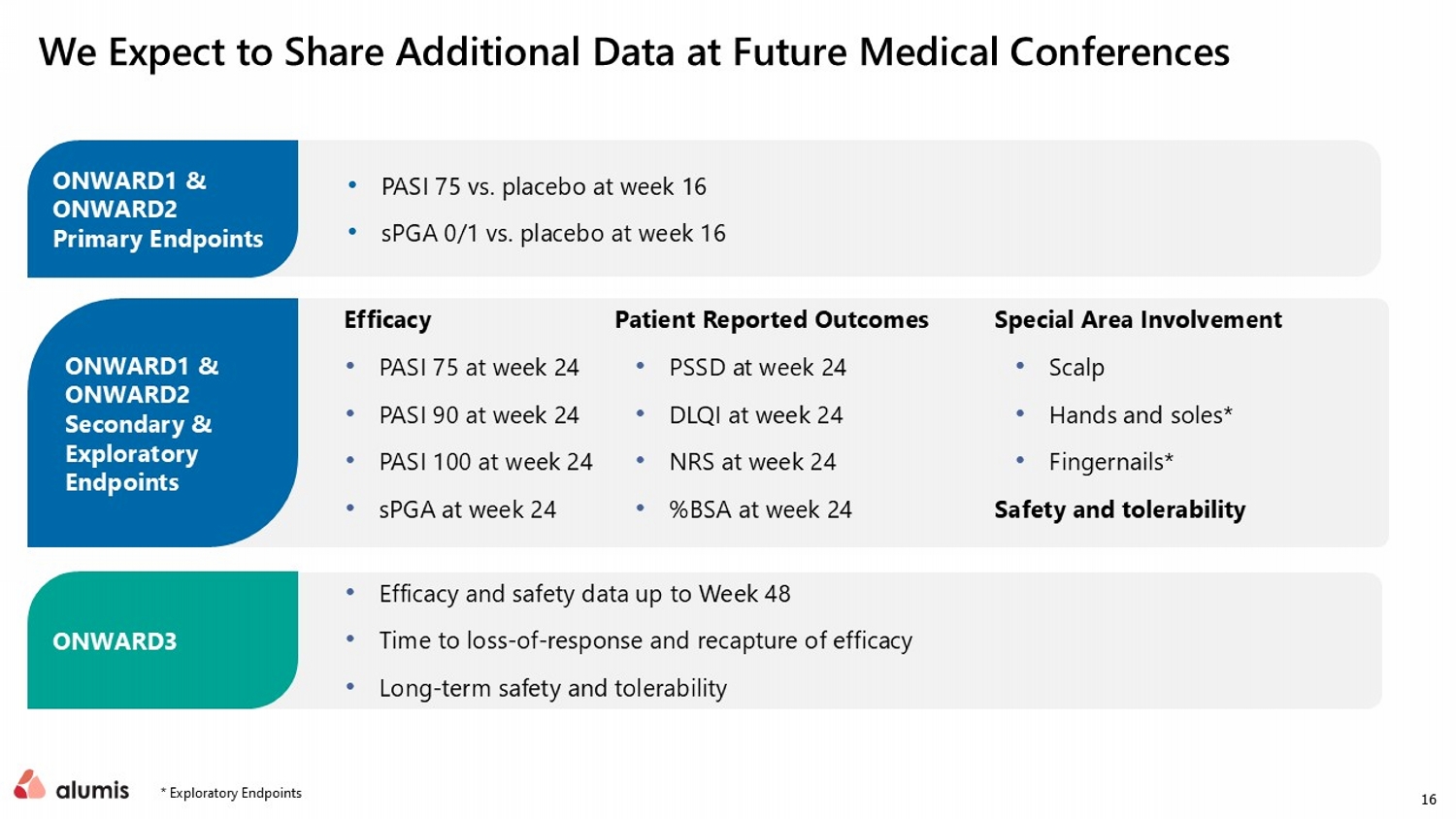

16 We Expect to Share Additional Data at Future Medical Conferences Efficacy • PASI 75 at week 24 • PASI 90 at week 24 • PASI 100 at week 24 • sPGA at week 24 Patient Reported Outcomes • PSSD at week 24 • DLQI at week 24 • NRS at week 24 • %BSA at week 24 Special Area Involvement • Scalp • Hands and soles* • Fingernails* Safety and tolerability • PASI 75 vs. placebo at week 16 • sPGA 0/1 vs. placebo at week 16 • Efficacy and safety data up to Week 48 • Time to loss - of - response and recapture of efficacy • Long - term safety and tolerability ONWARD1 & ONWARD2 Primary Endpoints ONWARD1 & ONWARD2 Secondary & Exploratory Endpoints ONWARD3 * Exploratory Endpoints

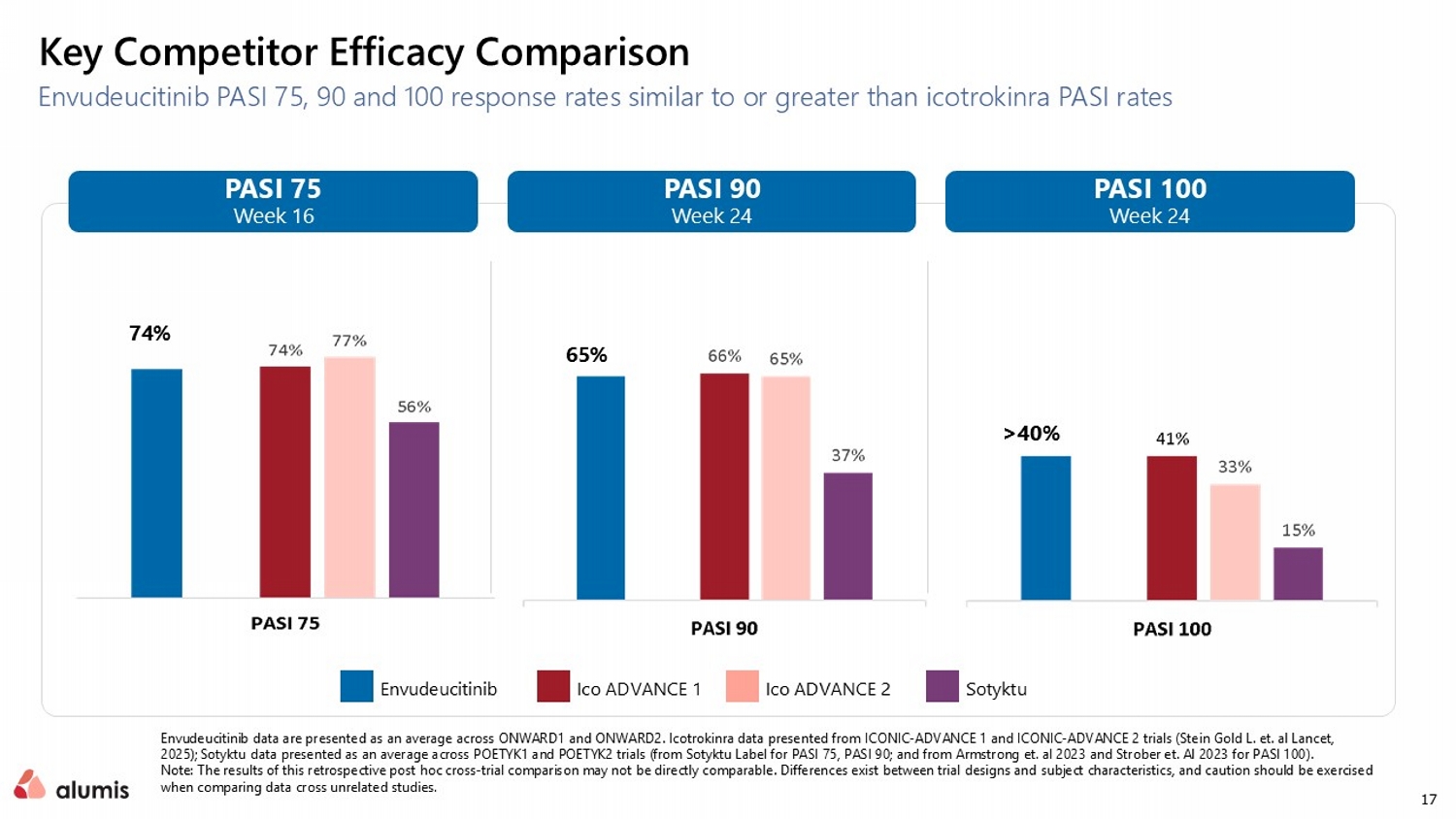

17 Key Competitor Efficacy Comparison Envudeucitinib PASI 75, 90 and 100 response rates similar to or greater than icotrokinra PASI rates PASI 100 Week 24 PASI 90 Week 24 PASI 75 Week 16 >40% 74% 65% Ico ADVANCE 1 Ico ADVANCE 2 Sotyktu Envudeucitinib Envudeucitinib data are presented as an average across ONWARD1 and ONWARD2. Icotrokinra data presented from ICONIC - ADVANCE 1 and ICONIC - ADVANCE 2 trials (Stein Gold L. et. al Lancet, 2025); Sotyktu data presented as an average across POETYK1 and POETYK2 trials (from Sotyktu Label for PASI 75, PASI 90; and from Armstrong et. al 2023 and Strober et. Al 2023 for PASI 100). Note: The results of this retrospective post hoc cross - trial comparison may not be directly comparable. Differences exist betwee n trial designs and subject characteristics, and caution should be exercised when comparing data cross unrelated studies.

18 Envudeucitinib Substantial Market Potential in Psoriasis

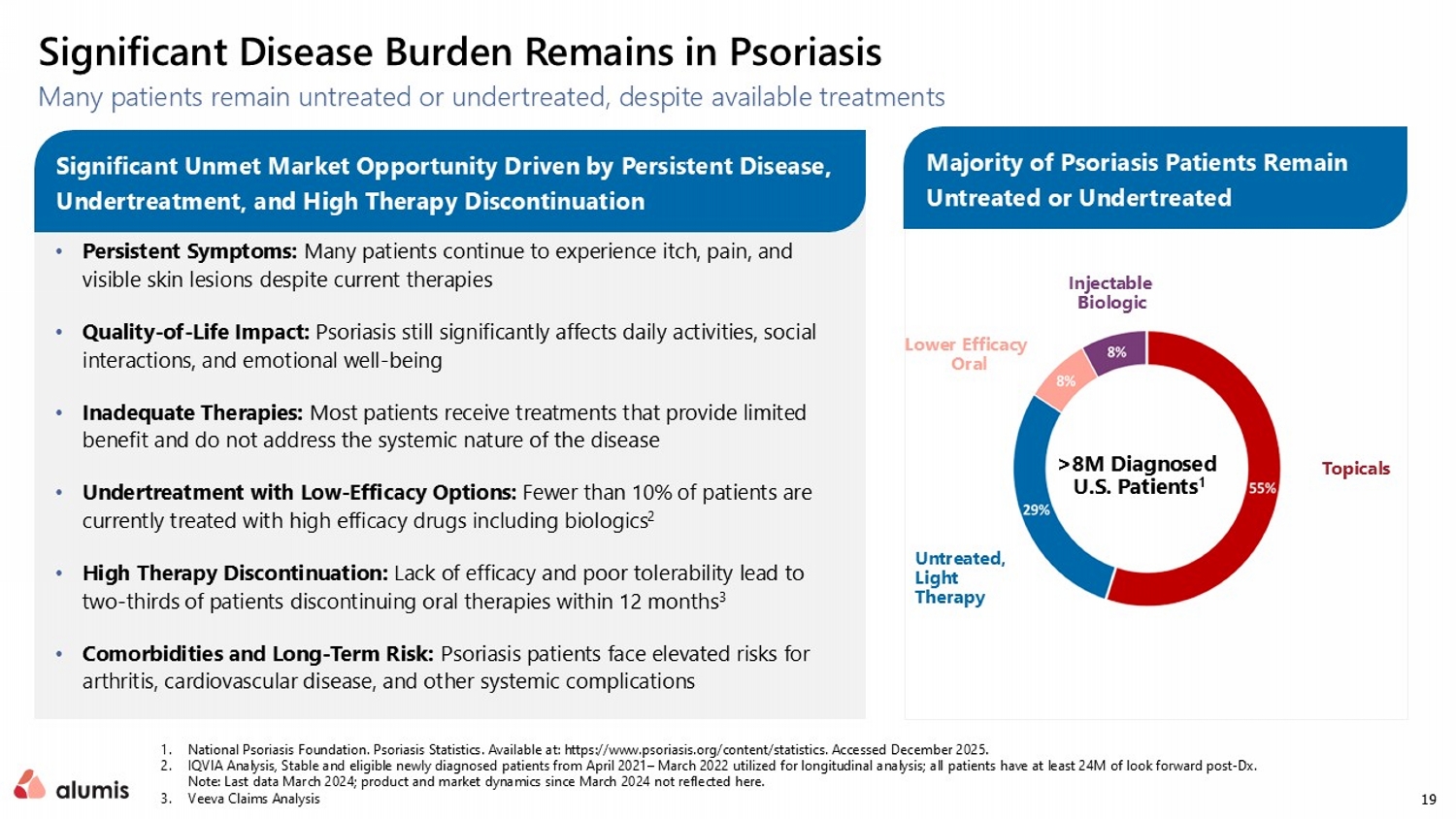

19 Many patients remain untreated or undertreated, despite available treatments 1. National Psoriasis Foundation. Psoriasis Statistics. Available at: https:// www.psoriasis.org /content/statistics. Accessed December 2025. 2. IQVIA Analysis, Stable and eligible newly diagnosed patients from April 2021 – March 2022 utilized for longitudinal analysis; all patients have at least 24M of look forward post - Dx. Note: Last data March 2024; product and market dynamics since March 2024 not reflected here. 3. Veeva Claims Analysis Significant Disease Burden Remains in Psoriasis • Persistent Symptoms: Many patients continue to experience itch, pain, and visible skin lesions despite current therapies • Quality - of - Life Impact: Psoriasis still significantly affects daily activities, social interactions, and emotional well - being • Inadequate Therapies: Most patients receive treatments that provide limited benefit and do not address the systemic nature of the disease • Undertreatment with Low - Efficacy Options: Fewer than 10% of patients are currently treated with high efficacy drugs including biologics 2 • High Therapy Discontinuation: Lack of efficacy and poor tolerability lead to two - thirds of patients discontinuing oral therapies within 12 months 3 • Comorbidities and Long - Term Risk: Psoriasis patients face elevated risks for arthritis, cardiovascular disease, and other systemic complications Untreated, Light Therapy Topicals Lower Efficacy Oral Injectable Biologic >8M Diagnosed U.S. Patients 1 Significant Unmet Market Opportunity Driven by Persistent Disease, Undertreatment, and High Therapy Discontinuation Majority of Psoriasis Patients Remain Untreated or Undertreated

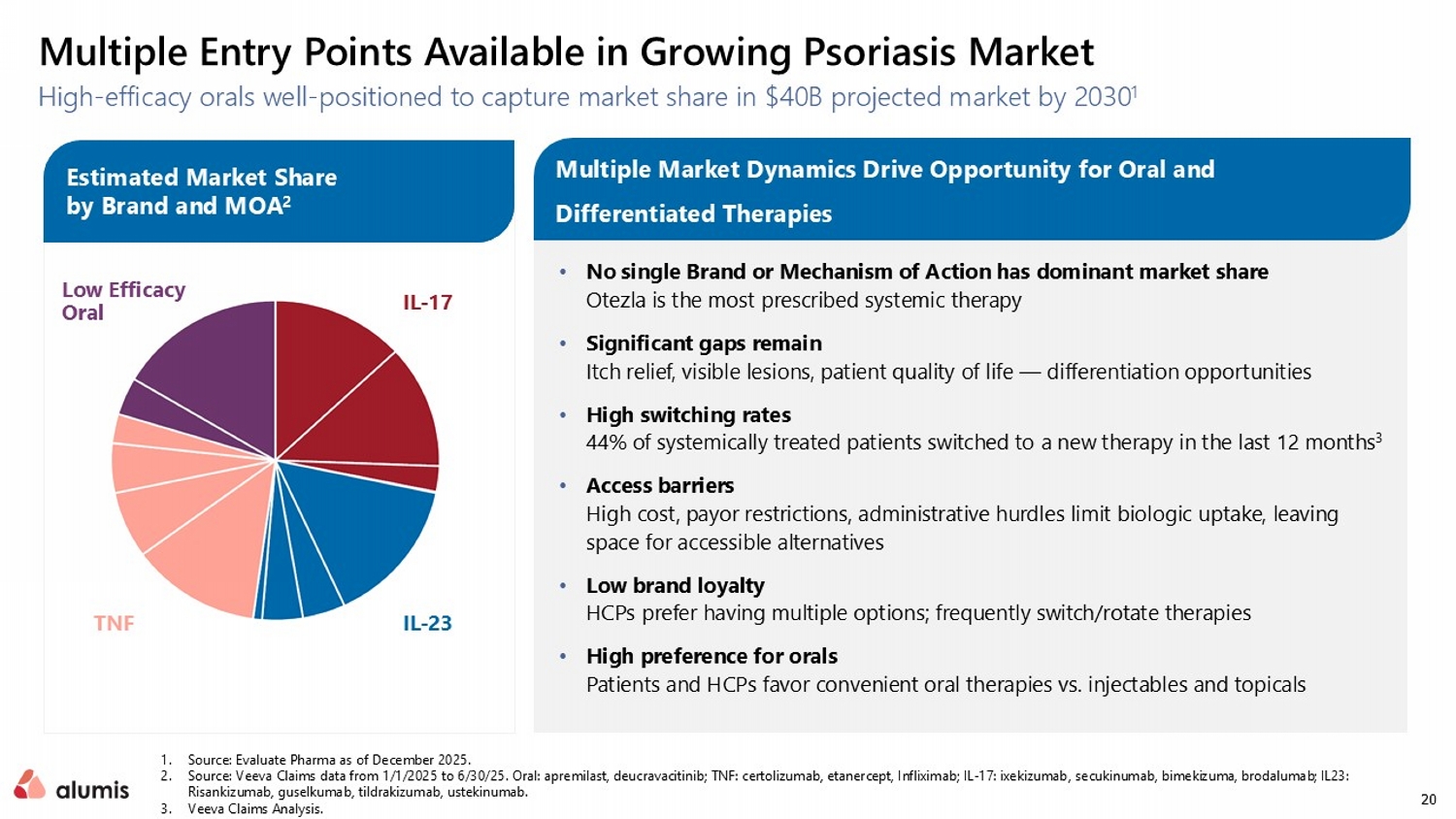

20 High - efficacy orals well - positioned to capture market share in $40B projected market by 2030 1 1. Source: Evaluate Pharma as of December 2025. 2. Source: Veeva Claims data from 1/1/2025 to 6/30/25. Oral: apremilast, deucravacitinib ; TNF: certolizumab, etanercept, Infliximab; IL - 17: ixekizumab , secukinumab , bimekizuma , brodalumab ; IL23: Risankizumab, guselkumab , tildrakizumab, ustekinumab. 3. Veeva Claims Analysis. Multiple Entry Points Available in Growing Psoriasis Market • No single Brand or Mechanism of Action has dominant market share Otezla is the most prescribed systemic therapy • Significant gaps remain Itch relief, visible lesions, patient quality of life — differentiation opportunities • High switching rates 44% of systemically treated patients switched to a new therapy in the last 12 months 3 • Access barriers High cost, payor restrictions, administrative hurdles limit biologic uptake, leaving space for accessible alternatives • Low brand loyalty HCPs prefer having multiple options; frequently switch/rotate therapies • High preference for orals Patients and HCPs favor convenient oral therapies vs. injectables and topicals Multiple Market Dynamics Drive Opportunity for Oral and Differentiated Therapies Estimated Market Share by Brand and MOA 2 IL - 17 IL - 23 TNF Low Efficacy Oral Estimated Market Share by Brand and MOA 2

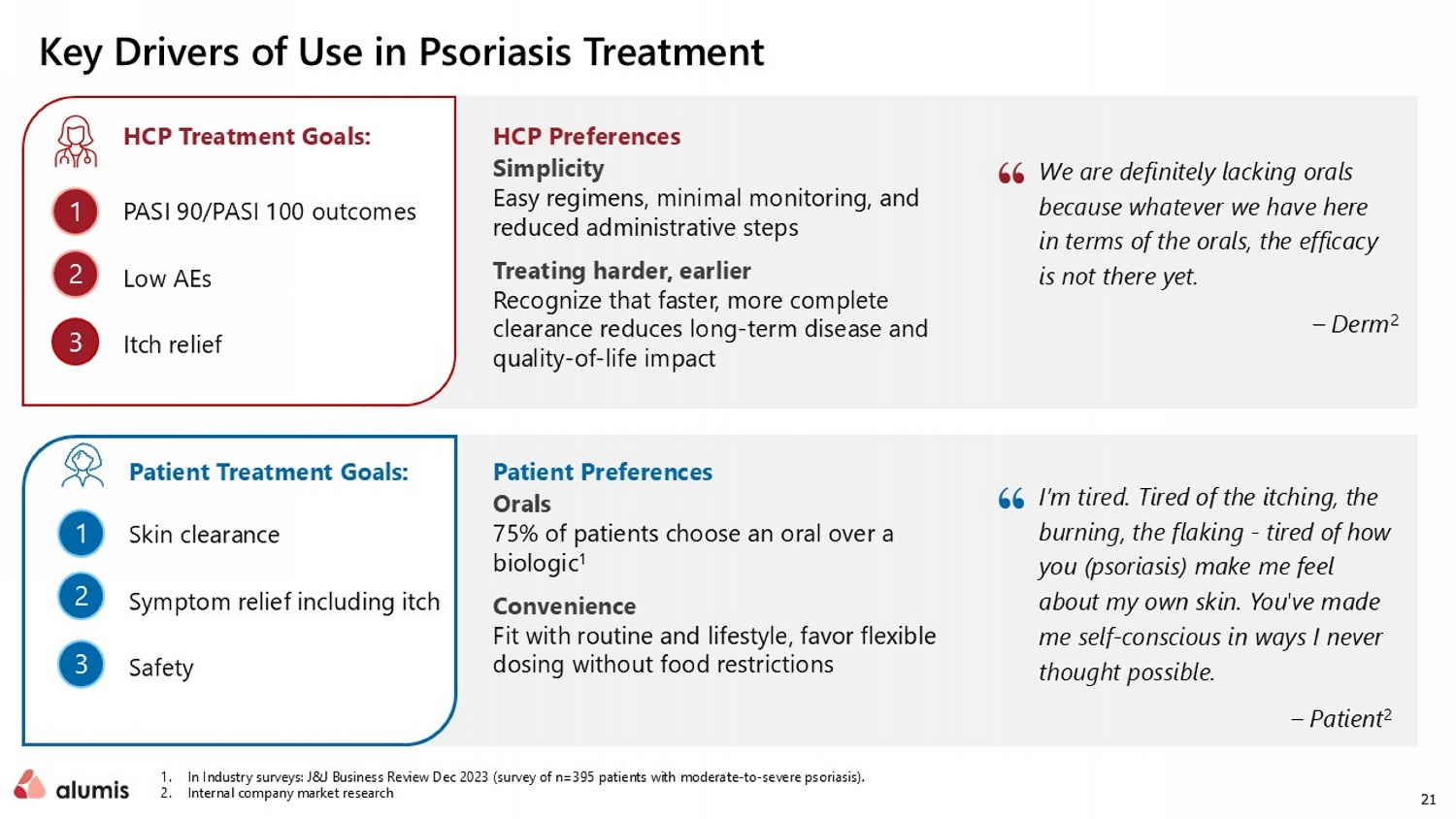

21 Key Drivers of Use in Psoriasis Treatment 1. In Industry surveys: J&J Business Review Dec 2023 (survey of n=395 patients with moderate - to - severe psoriasis). 2. Internal company market research I’m tired. Tired of the itching, the burning, the flaking - tired of how you (psoriasis) make me feel about my own skin. You've made me self - conscious in ways I never thought possible. – Patient 2 We are definitely lacking orals because whatever we have here in terms of the orals, the efficacy is not there yet. – Derm 2 HCP Treatment Goals: HCP Preferences Simplicity Easy regimens, minimal monitoring, and reduced administrative steps Treating harder, earlier R ecognize that faster, more complete clearance reduces long - term disease and quality - of - life impact 1 2 3 PASI 90/PASI 100 outcomes Low AEs Itch relief Patient Treatment Goals: Patient Preferences Orals 75% of patients choose an oral over a biologic 1 Convenience Fit with routine and lifestyle, favor flexible dosing without food restrictions 1 2 3 Skin clearance Symptom relief including itch Safety

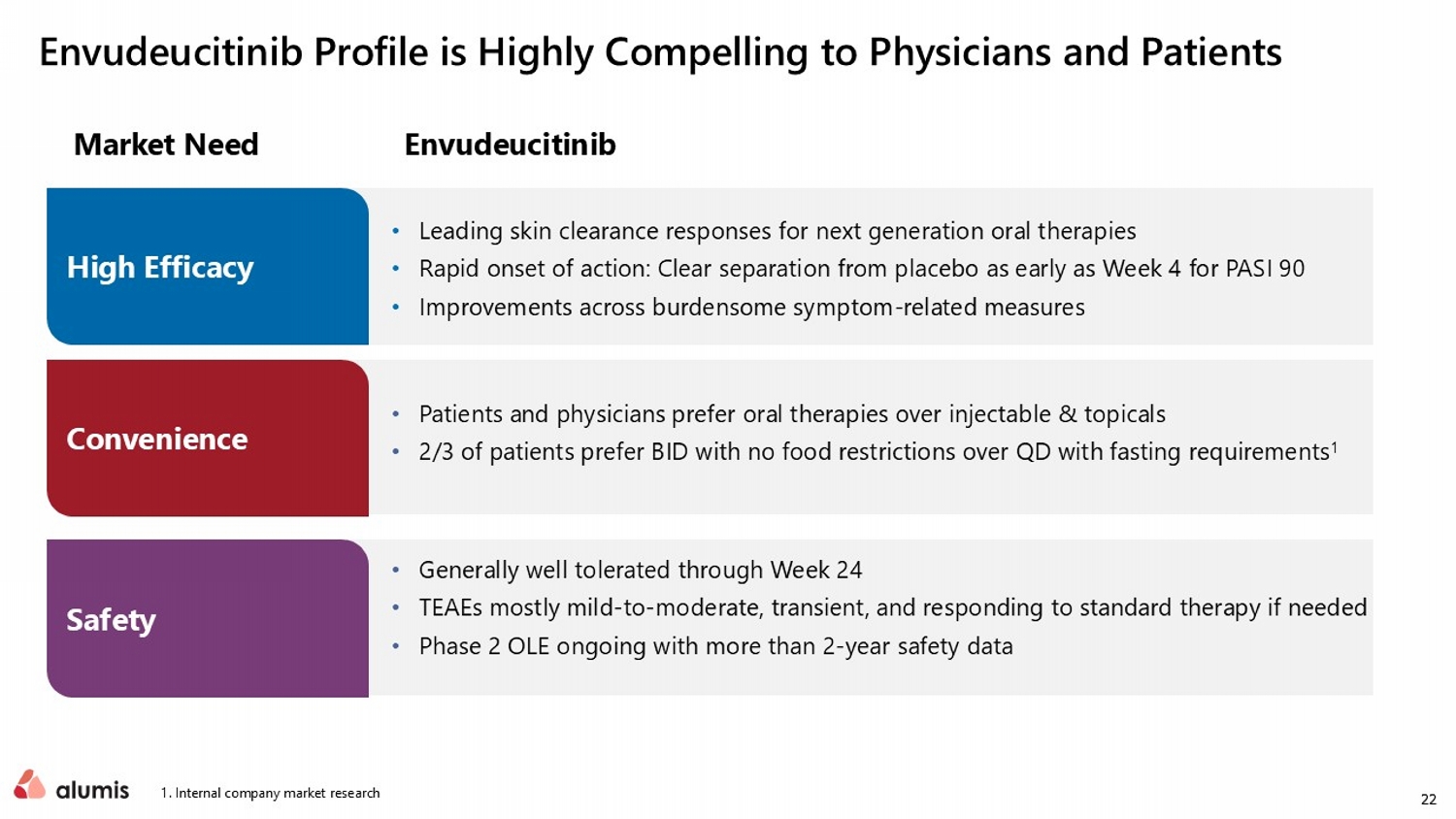

22 1. Internal company market research Envudeucitinib Profile is Highly Compelling to Physicians and Patients Market Need Envudeucitinib • Leading skin clearance responses for next generation oral therapies • Rapid onset of action: Clear separation from placebo as early as Week 4 for PASI 90 • Improvements across burdensome symptom - related measures • Patients and physicians prefer oral therapies over injectable & topicals • 2/3 of patients prefer BID with no food restrictions over QD with fasting requirements 1 • Generally well tolerated through Week 24 • TEAEs mostly mild - to - moderate, transient, and responding to standard therapy if needed • Phase 2 OLE ongoing with more than 2 - year safety data High Efficacy Convenience Safety

23 Neurology: $44B Rheumatology: $38B Gastroenterology: $41B Dermatology: $49B Other Indications: $9B Multiple Sclerosis Parkinson's Disease Alzheimer's Disease Systemic Lupus Erythematosus Psoriatic Arthritis Sarcoidosis Sjogren’s Disease Rheumatoid Arthritis Juvenile Idiopathic Arthritis Ulcerative Colitis Crohn’s Disease Celiac Disease Plaque Psoriasis Vitiligo Hidradenitis Suppurativa Cutaneous Lupus Erythematosus Dermatomyositis Generalized Pustular Psoriasis Erythrodermic Psoriasis Primary Biliary Cholangitis Type 1 Diabetes Indications supported by genomic evidence, clinical validation, or active studies Two Pipeline - in - a - Pill Opportunities; $180B+ Potential Total Market Opportunity 2032 Market Projections; Source: Evaluate Pharma , January 2026.

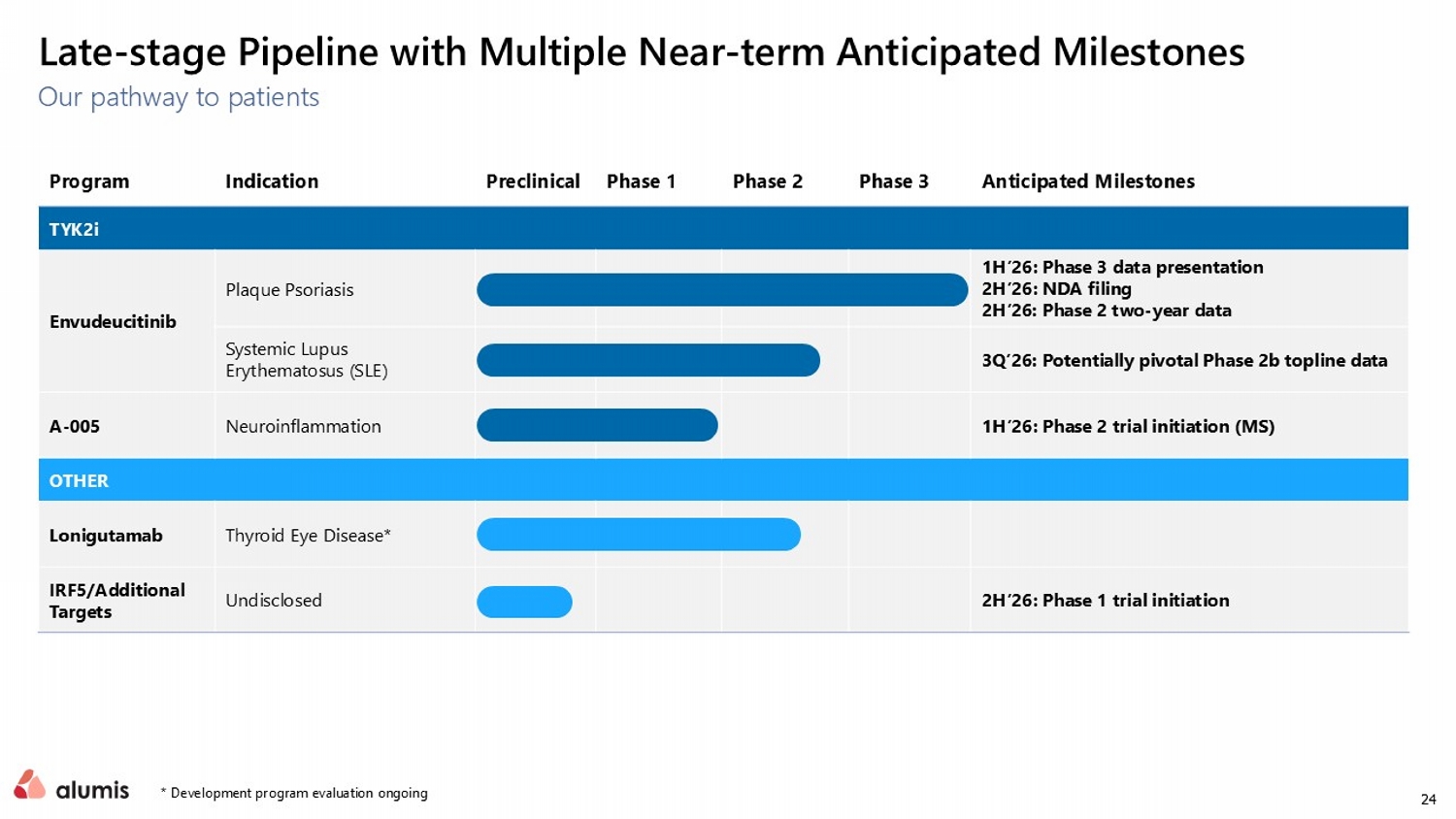

24 Late - stage Pipeline with Multiple Near - term Anticipated Milestones * Development program evaluation ongoing Our pathway to patients Anticipated Milestones Phase 3 Phase 2 Phase 1 Preclinical Indication Program TYK2i 1H’26: Phase 3 data presentation 2H’26: NDA filing 2H’26 : Phase 2 two - year data Plaque Psoriasis Envudeucitinib 3Q’26: Potentially pivotal Phase 2b topline data Systemic Lupus Erythematosus (SLE) 1H’26: Phase 2 trial initiation (MS) Neuroinflammation A - 005 OTHER Thyroid Eye Disease* Lonigutamab 2H’26: Phase 1 trial initiation Undisclosed IRF5/Additional Targets

25 Thank You!