Third quarter 2025 results November 4, 2025 © GXO Logistics, Inc.

© GXO Logistics, Inc. Disclaimer 2 Non-GAAP Financial Measures: As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables included in the attached appendix. GXO’s non-GAAP financial measures in this presentation include: adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), adjusted EBITDA margin, adjusted earnings before interest, taxes and amortization (“adjusted EBITA”), adjusted EBITA margin, adjusted EBITA, net of income taxes paid, adjusted net income attributable to GXO, adjusted earnings per share (basic and diluted) (“adjusted EPS”), free cash flow, free cash flow conversion, organic revenue, organic revenue growth, net leverage ratio, net debt, operating return on invested capital (“ROIC”) and net capital expenditures (“net capex”). We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, GXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures used by other companies. GXO’s non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITA, adjusted net income attributable to GXO and adjusted EPS include adjustments for transaction and integration costs, regulatory matters and litigation expenses as well as restructuring costs and other adjustments as set forth in the financial tables included in the attached appendix. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition, divestiture or spin-off and may include transaction costs, consulting fees, retention awards, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities), and certain costs related to integrating and separating IT systems. Regulatory matters and litigation expenses relate to the settlement of regulatory and legal matters. Restructuring costs primarily relate to severance costs associated with business optimization initiatives. We believe that free cash flow and free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We calculate free cash flow as cash flows from operations less net capex; we calculate net capex as capital expenditures plus proceeds from sale of property and equipment. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA, expressed as a percentage. We believe that adjusted EBITDA, adjusted EBITDA margin, adjusted EBITA, adjusted EBITA margin, and adjusted EBITA, net of income taxes paid improve comparability from period to period by removing the impact of our capital structure (interest expense), asset base (depreciation and amortization), tax impacts and other adjustments as set forth in the financial tables included in the attached appendix, which management has determined are not reflective of core operating activities and thereby assist investors with assessing trends in our underlying businesses. We believe that adjusted net income attributable to GXO and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains as set forth in the financial tables included in the attached appendix, which management has determined are not reflective of our core operating activities, including amortization of intangible assets acquired. We believe that organic revenue and organic revenue growth are important measures because they exclude the impact of foreign currency exchange rate fluctuations and revenue from acquired businesses. We believe that net leverage ratio and net debt are important measures of our overall liquidity position and are calculated by adding bank overdrafts and removing cash and cash equivalents (excluding restricted cash) from our total debt and net debt as a ratio of our trailing twelve months adjusted EBITDA. We calculate ROIC as our trailing twelve months adjusted EBITA, net of income taxes paid, divided by the average invested capital. We believe ROIC provides investors with an important perspective on how effectively GXO deploys capital and use this metric internally as a high-level target to assess overall performance throughout the business cycle. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating GXO’s ongoing performance. With respect to our financial targets for full-year 2025 organic revenue growth, adjusted EBITDA, adjusted diluted EPS, and free cash flow conversion to full year 2025 adjusted EBITDA, a reconciliation of these non-GAAP measures to the corresponding GAAP measures is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from these non-GAAP target measures. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statements of income and cash flows prepared in accordance with GAAP, that would be required to produce such a reconciliation. Forward-Looking Statements: This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements, including our full year 2025 financial targets of organic revenue growth, adjusted EBITDA, adjusted diluted EPS and adjusted EBITDA to free cash flow conversion; the expected incremental revenue in 2025 and 2026; our long-term target for operating return on invested capital; and our expected full year 2025 adjusted EBITDA. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by the company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors the company believes are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include, but are not limited to, the risks discussed in our filings with the SEC and the following: economic conditions generally; supply chain challenges, including labor shortages; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our respective customers’ demands; our ability to successfully integrate and realize anticipated benefits, synergies, cost savings and profit improvement opportunities with respect to acquired companies, including the acquisition of Wincanton; acquisitions may be unsuccessful or result in other risks or developments that adversely affect our financial condition and results; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our indebtedness; our ability to raise debt and equity capital; litigation; labor matters, including our ability to manage its subcontractors, and risks associated with labor disputes at our customers’ facilities and efforts by labor organizations to organize its employees; risks associated with def ined benefit plans for our current and former employees; our ability to attract or retain necessary talent; the increased costs associated with labor; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; fluctuations in customer confidence and spending; issues related to our intellectual property rights; governmental regulation, including environmental laws, trade compliance laws, as well as changes in international trade policies and tax regimes; governmental or political actions, including the United Kingdom’s exit from the European Union; natural disasters, terrorist attacks or similar incidents; damage to our reputation; a material disruption of our operations; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; failure in properly handling the inventory of our customers; the impact of potential cyber-attacks and information technology or data security breaches; and the inability to implement technology initiatives or business systems successfully; our ability to achieve Environmental, Social and Governance goals; and a determination by the IRS that the distribution or certain related spin-off transactions should be treated as taxable transactions. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Such forward-looking statements should therefore be construed in the light of such factors. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

© GXO Logistics, Inc. Patrick Kelleher Chief Executive Officer Baris Oran Chief Financial Officer Kristine Kubacki Chief Strategy Officer Presenters 3

© GXO Logistics, Inc.© GX Logistics, Inc. GXO is building the supply chain of the future. We design and operate the most technologically advanced logistics solutions in the world. 4

© GXO Logistics, Inc.© GX Logistics, Inc. Our value creation framework Outsized growth driven by secular tailwinds Global scale Leadership in technology and automation Customer-centric culture Effective capital allocation Compelling financial profile and long-term growth algorithm 5 1 2 3 4 5 6

© GXO Logistics, Inc. 3Q 2025 executive summary Record quarterly revenue of $3.4 billion, up 8% year over year Signed new business wins of $280 million, up 24% year over year(1) Wincanton integration well underway; on track to deliver $60 million in cost synergies Announced organizational changes to accelerate growth Reaffirmed full-year guidance 6 (1) Based on closing September 30, 2025, FX rates of 1.34 GBP/USD and 1.17 EUR/USD. 6

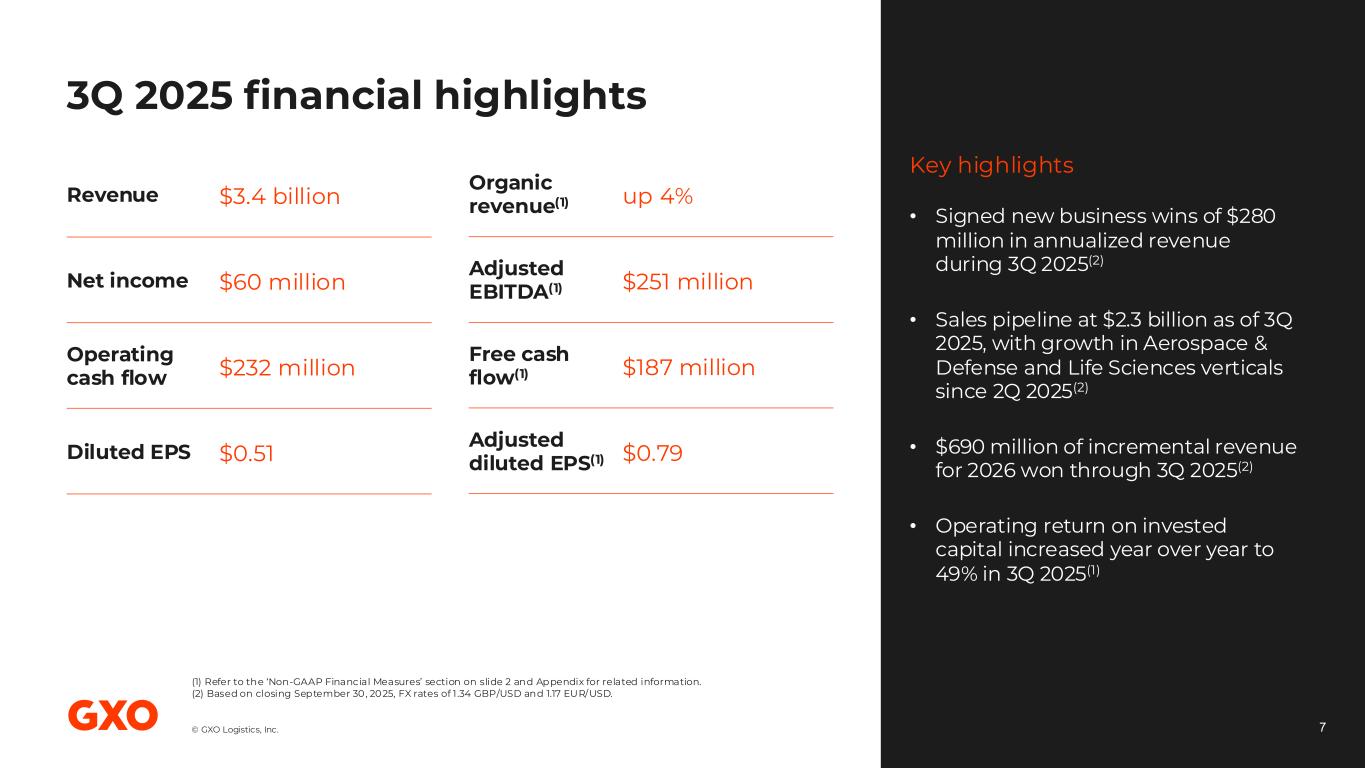

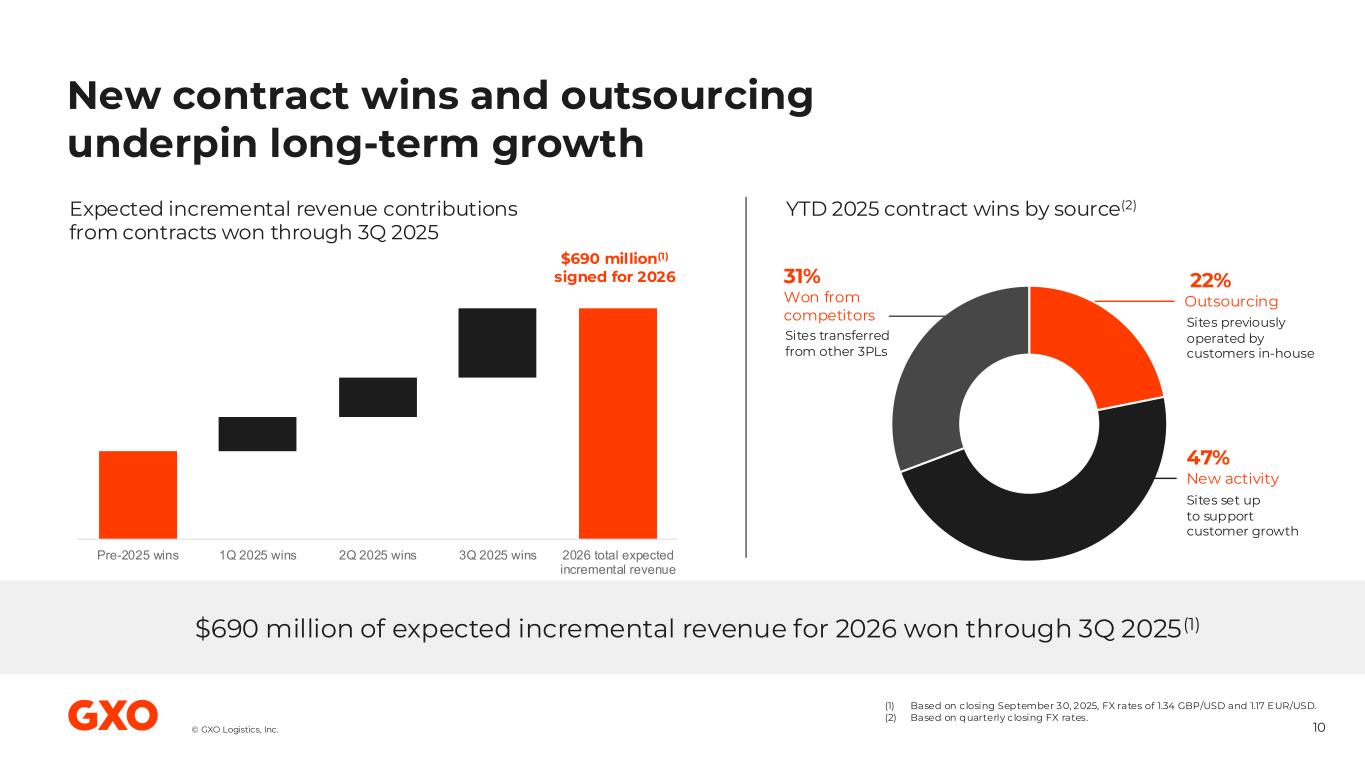

© GXO Logistics, Inc. 3Q 2025 financial highlights 7 (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. (2) Based on closing September 30, 2025, FX rates of 1.34 GBP/USD and 1.17 EUR/USD. Key highlights • Signed new business wins of $280 million in annualized revenue during 3Q 2025(2) • Sales pipeline at $2.3 billion as of 3Q 2025, with growth in Aerospace & Defense and Life Sciences verticals since 2Q 2025(2) • $690 million of incremental revenue for 2026 won through 3Q 2025(2) • Operating return on invested capital increased year over year to 49% in 3Q 2025(1) Revenue $3.4 billion Net income $60 million Operating cash flow $232 million Diluted EPS $0.51 Organic revenue(1) up 4% Adjusted EBITDA(1) $251 million Free cash flow(1) $187 million Adjusted diluted EPS(1) $0.79

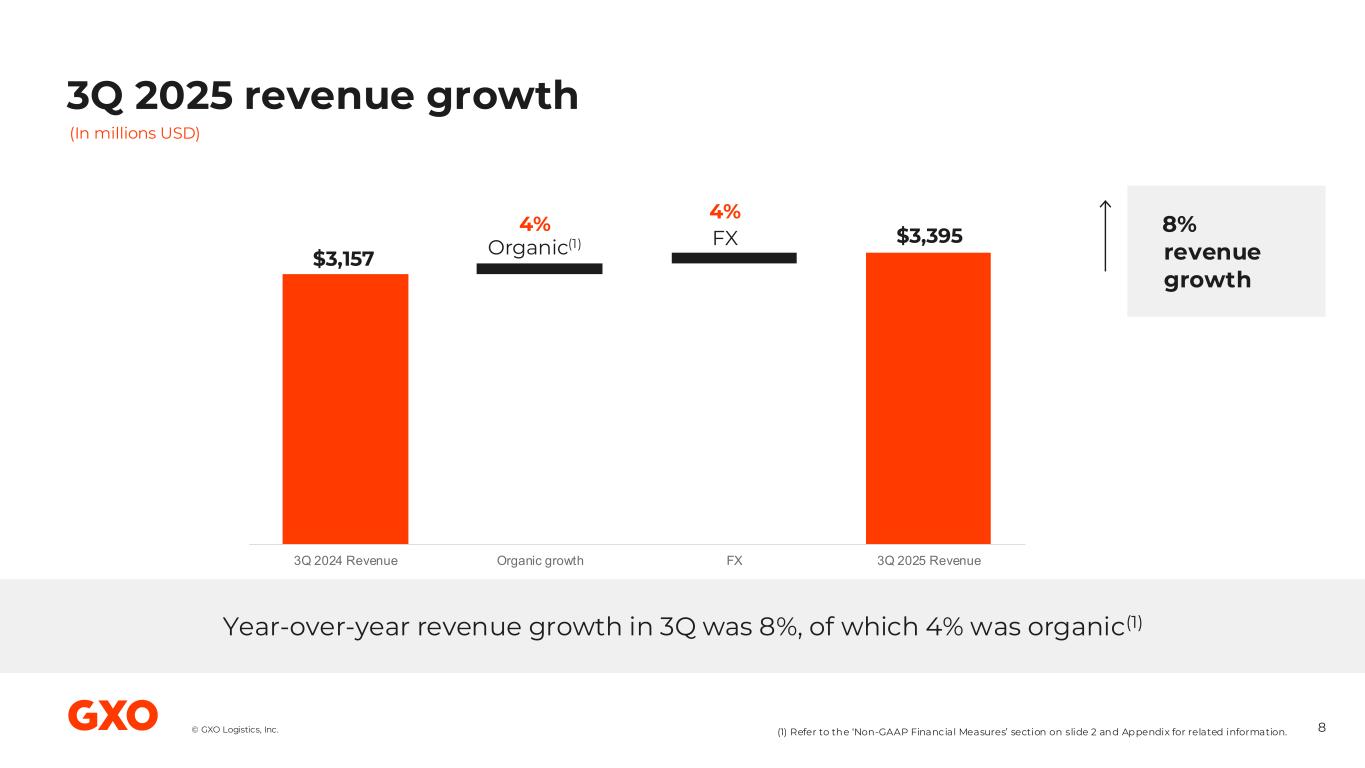

© GXO Logistics, Inc. 3Q 2024 Revenue Organic growth FX 3Q 2025 Revenue Year-over-year revenue growth in 3Q was 8%, of which 4% was organic(1) (1) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. 3Q 2025 revenue growth 8 4% Organic(1) 4% FX $3,157 $3,395 (In millions USD) 8% revenue growth

© GXO Logistics, Inc. Recent wins and expansions 9

© GXO Logistics, Inc. Pre-2025 wins 1Q 2025 wins 2Q 2025 wins 3Q 2025 wins 2026 total expected incremental revenue New contract wins and outsourcing underpin long-term growth 10 Expected incremental revenue contributions from contracts won through 3Q 2025 YTD 2025 contract wins by source(2) Sites set up to support customer growth Sites previously operated by customers in-house 47% New activity 22% Outsourcing $690 million(1) signed for 2026 (1) Based on closing September 30, 2025, FX rates of 1.34 GBP/USD and 1.17 EUR/USD. (2) Based on quarterly closing FX rates. $690 million of expected incremental revenue for 2026 won through 3Q 2025(1) Sites transferred from other 3PLs 31% Won from competitors

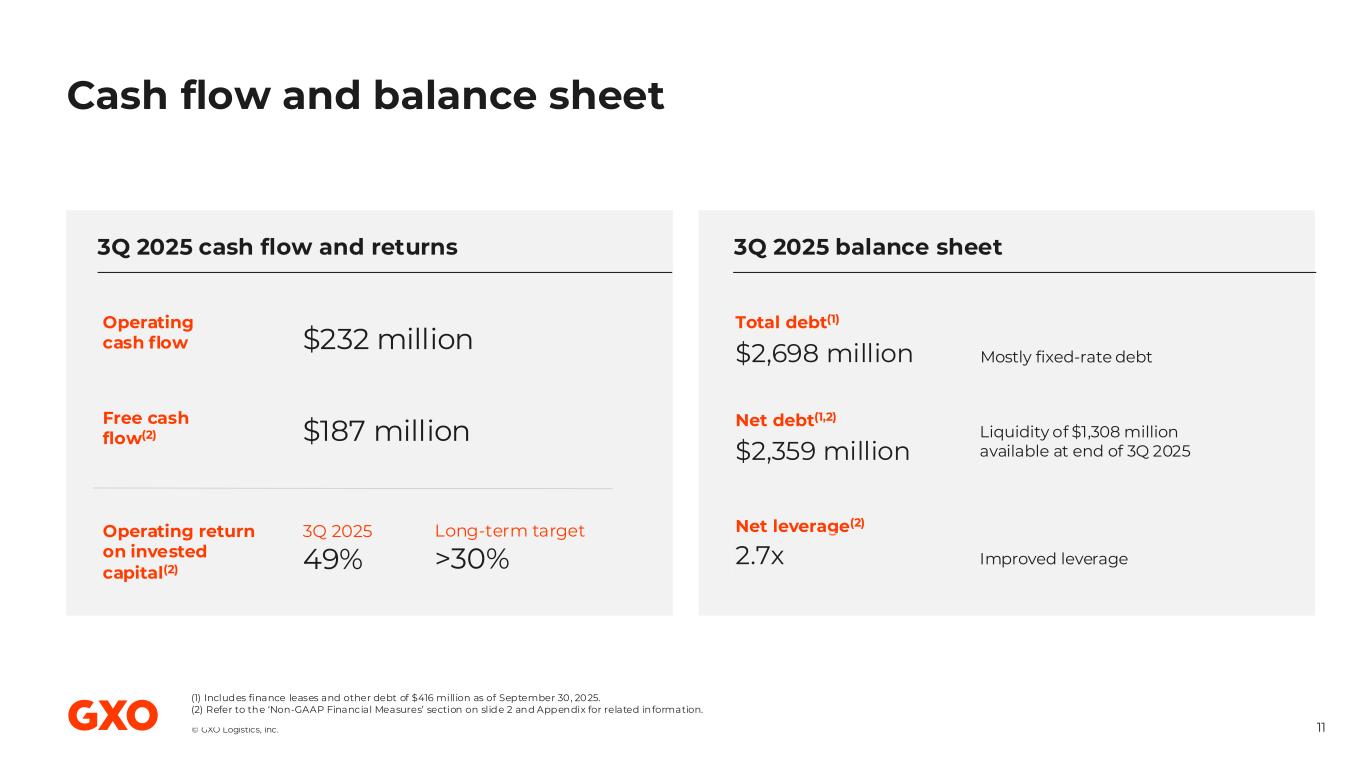

© GXO Logistics, Inc. Cash flow and balance sheet 11 (1) Includes finance leases and other debt of $416 million as of September 30, 2025. (2) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2 and Appendix for related information. 3Q 2025 balance sheet Total debt(1) $2,698 million Mostly fixed-rate debt Improved leverage Net debt(1,2) $2,359 million Net leverage(2) 2.7x Liquidity of $1,308 million available at end of 3Q 2025 Free cash flow(2) 3Q 2025 cash flow and returns Operating return on invested capital(2) $232 million $187 million Operating cash flow 3Q 2025 49% Long-term target >30%

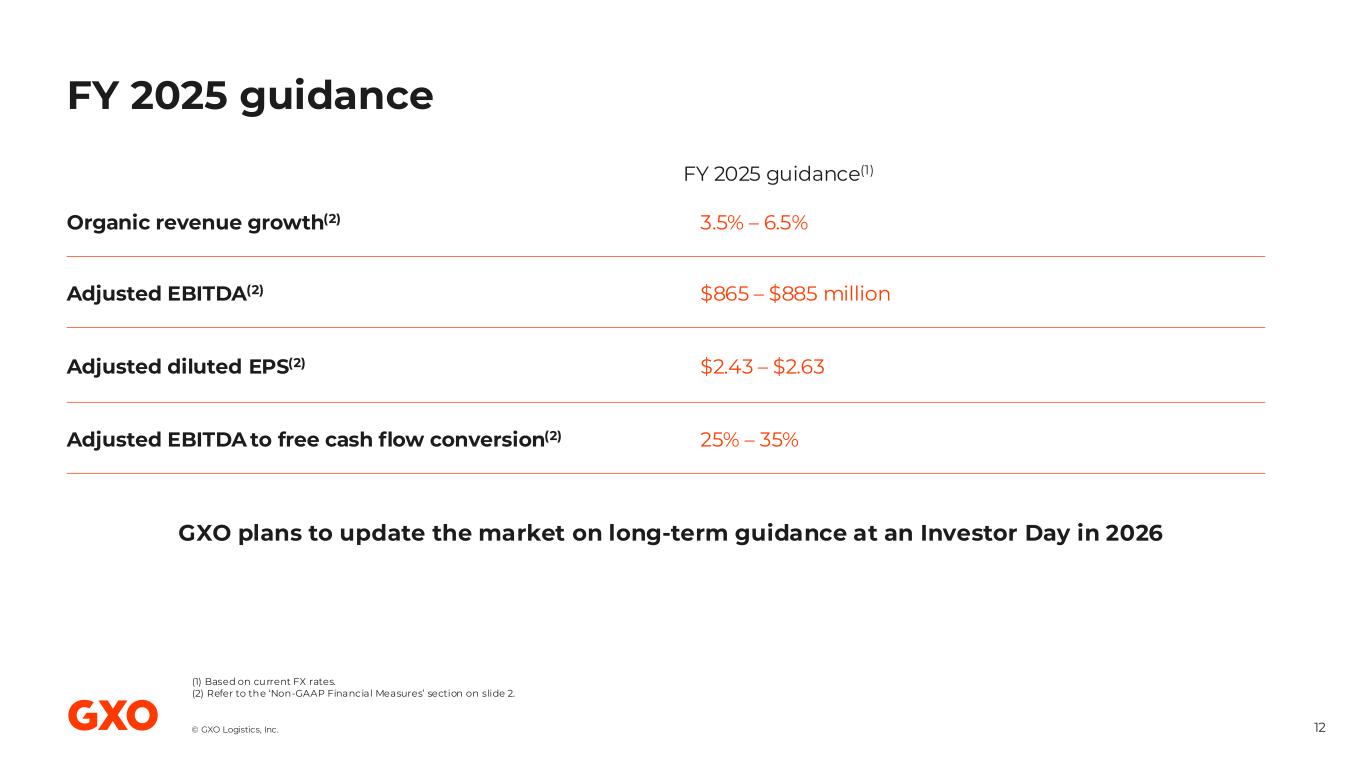

© GXO Logistics, Inc. FY 2025 guidance 12 Organic revenue growth(2) 3.5% – 6.5% Adjusted EBITDA(2) $865 – $885 million Adjusted diluted EPS(2) $2.43 – $2.63 Adjusted EBITDA to free cash flow conversion(2) 25% – 35% (1) Based on current FX rates. (2) Refer to the ‘Non-GAAP Financial Measures’ section on slide 2. FY 2025 guidance(1) GXO plans to update the market on long-term guidance at an Investor Day in 2026

© GXO Logistics, Inc. The GXO investment case 13 Maximizing shareholder returns Compelling financial profile • Structural organic growth • Resilient margins • Strong free cash flows • High returns The GXO Difference • Tech and automation leadership • Global scale • Trusted expertise Effective capital allocation framework • Innovation and organic growth • Investment grade balance sheet • Strategic M&A • Return capital to shareholders + Powerful secular drivers • Automation • E-commerce • Outsourcing • Supply chain complexity

Appendix

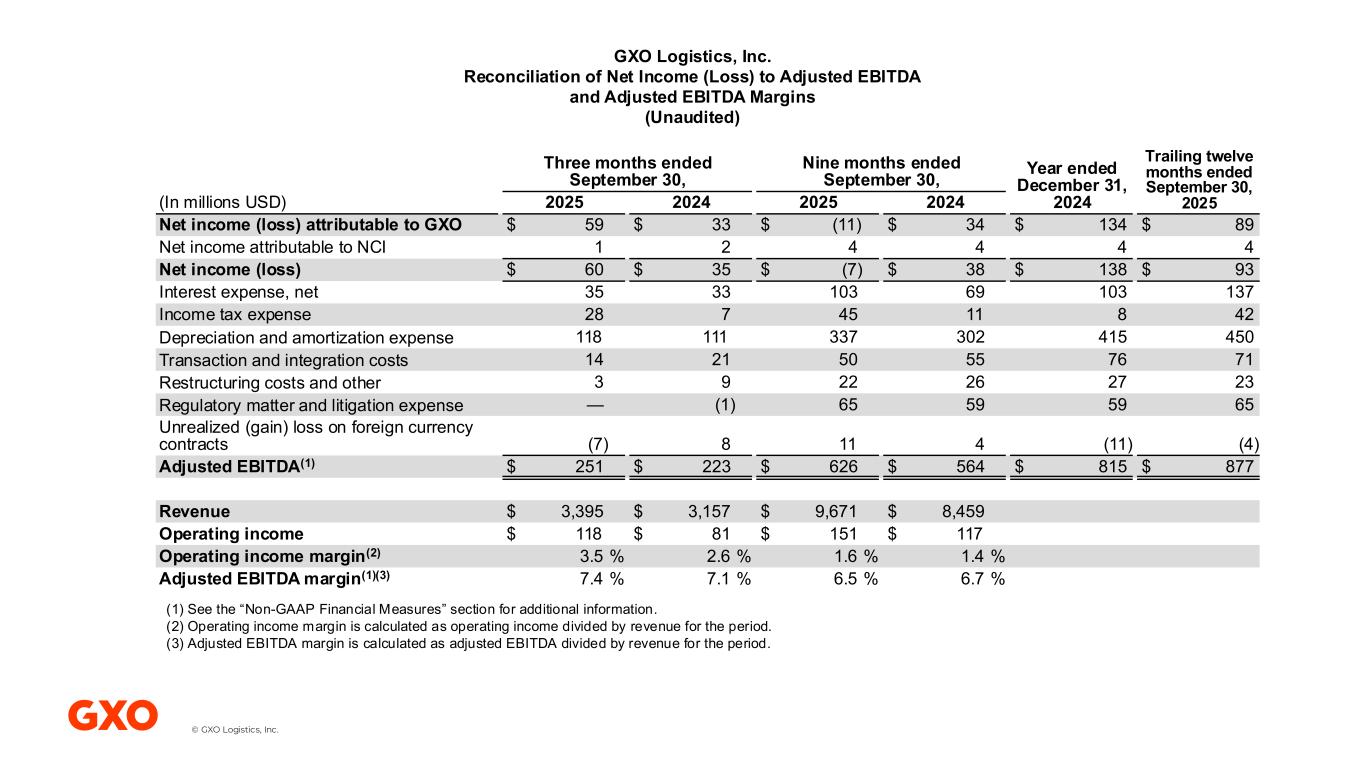

© GXO Logistics, Inc. Three months ended September 30, Nine months ended September 30, Year ended December 31, 2024 Trailing twelve months ended September 30, 2025(In millions USD) 2025 2024 2025 2024 Net income (loss) attributable to GXO $ 59 $ 33 $ (11) $ 34 $ 134 $ 89 Net income attributable to NCI 1 2 4 4 4 4 Net income (loss) $ 60 $ 35 $ (7) $ 38 $ 138 $ 93 Interest expense, net 35 33 103 69 103 137 Income tax expense 28 7 45 11 8 42 Depreciation and amortization expense 118 111 337 302 415 450 Transaction and integration costs 14 21 50 55 76 71 Restructuring costs and other 3 9 22 26 27 23 Regulatory matter and litigation expense — (1) 65 59 59 65 Unrealized (gain) loss on foreign currency contracts (7) 8 11 4 (11) (4) Adjusted EBITDA(1) $ 251 $ 223 $ 626 $ 564 $ 815 $ 877 Revenue $ 3,395 $ 3,157 $ 9,671 $ 8,459 Operating income $ 118 $ 81 $ 151 $ 117 Operating income margin(2) 3.5 % 2.6 % 1.6 % 1.4 % Adjusted EBITDA margin(1)(3) 7.4 % 7.1 % 6.5 % 6.7 % GXO Logistics, Inc. Reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA Margins (Unaudited) (1) See the “Non-GAAP Financial Measures” section for additional information. (2) Operating income margin is calculated as operating income divided by revenue for the period. (3) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue for the period.

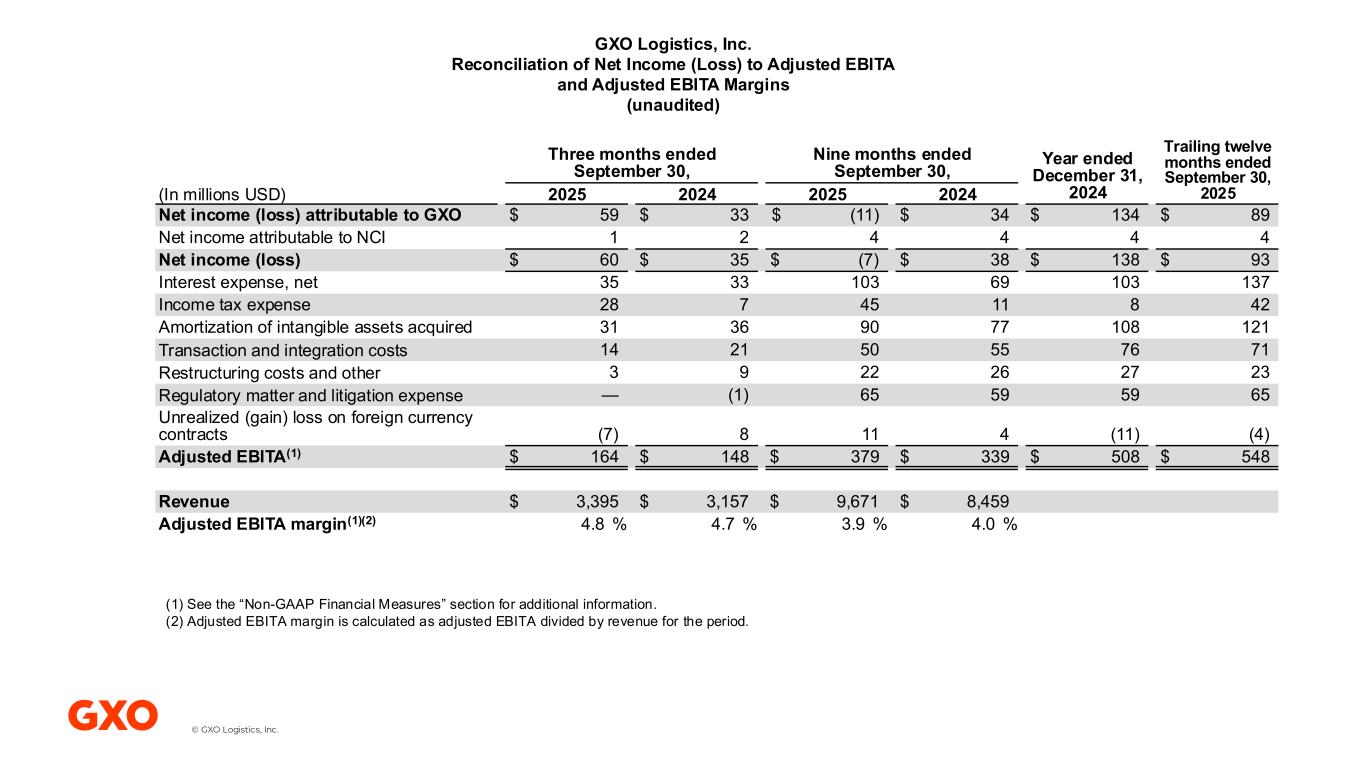

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of Net Income (Loss) to Adjusted EBITA and Adjusted EBITA Margins (unaudited) Three months ended September 30, Nine months ended September 30, Year ended December 31, 2024 Trailing twelve months ended September 30, 2025(In millions USD) 2025 2024 2025 2024 Net income (loss) attributable to GXO $ 59 $ 33 $ (11) $ 34 $ 134 $ 89 Net income attributable to NCI 1 2 4 4 4 4 Net income (loss) $ 60 $ 35 $ (7) $ 38 $ 138 $ 93 Interest expense, net 35 33 103 69 103 137 Income tax expense 28 7 45 11 8 42 Amortization of intangible assets acquired 31 36 90 77 108 121 Transaction and integration costs 14 21 50 55 76 71 Restructuring costs and other 3 9 22 26 27 23 Regulatory matter and litigation expense — (1) 65 59 59 65 Unrealized (gain) loss on foreign currency contracts (7) 8 11 4 (11) (4) Adjusted EBITA(1) $ 164 $ 148 $ 379 $ 339 $ 508 $ 548 Revenue $ 3,395 $ 3,157 $ 9,671 $ 8,459 Adjusted EBITA margin(1)(2) 4.8 % 4.7 % 3.9 % 4.0 % (1) See the “Non-GAAP Financial Measures” section for additional information. (2) Adjusted EBITA margin is calculated as adjusted EBITA divided by revenue for the period.

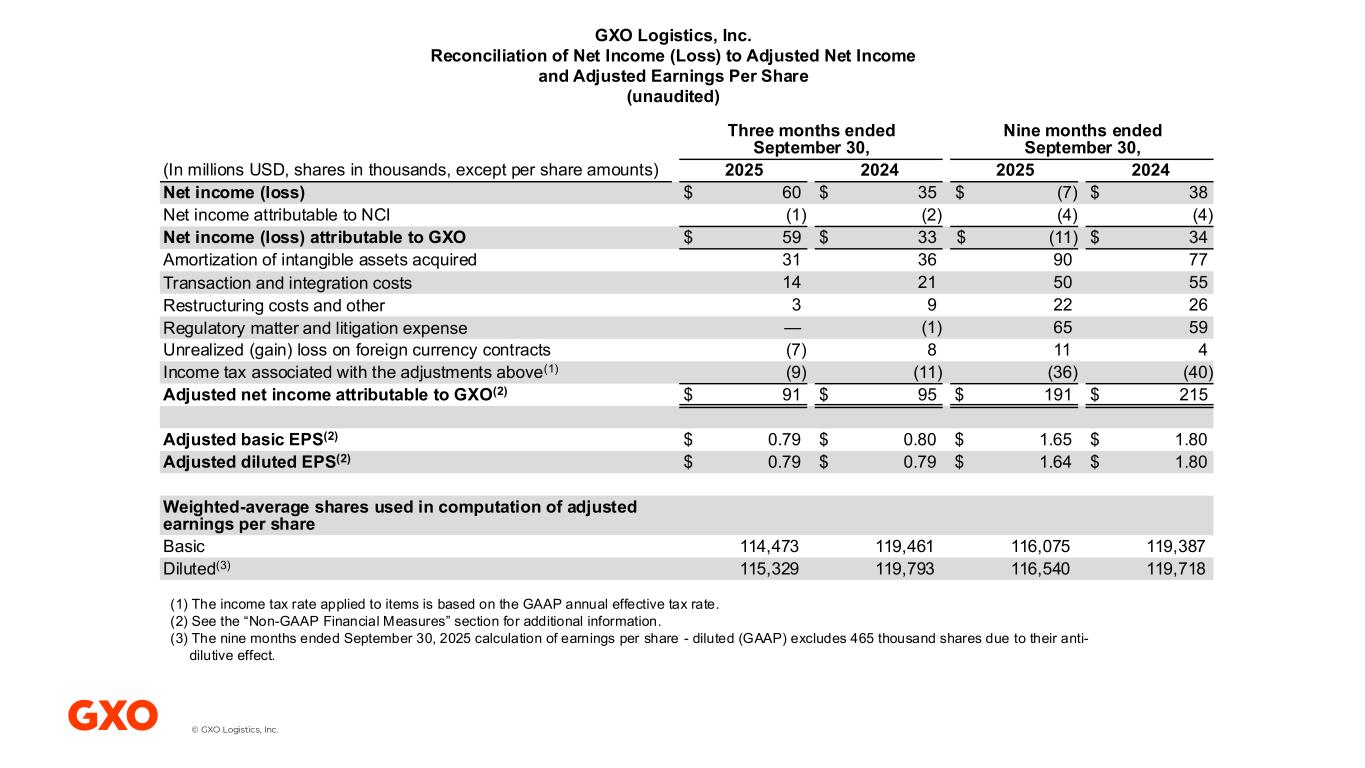

© GXO Logistics, Inc. GXO Logistics, Inc. Reconciliation of Net Income (Loss) to Adjusted Net Income and Adjusted Earnings Per Share (unaudited) Three months ended September 30, Nine months ended September 30, (In millions USD, shares in thousands, except per share amounts) 2025 2024 2025 2024 Net income (loss) $ 60 $ 35 $ (7) $ 38 Net income attributable to NCI (1) (2) (4) (4) Net income (loss) attributable to GXO $ 59 $ 33 $ (11) $ 34 Amortization of intangible assets acquired 31 36 90 77 Transaction and integration costs 14 21 50 55 Restructuring costs and other 3 9 22 26 Regulatory matter and litigation expense — (1) 65 59 Unrealized (gain) loss on foreign currency contracts (7) 8 11 4 Income tax associated with the adjustments above(1) (9) (11) (36) (40) Adjusted net income attributable to GXO(2) $ 91 $ 95 $ 191 $ 215 Adjusted basic EPS(2) $ 0.79 $ 0.80 $ 1.65 $ 1.80 Adjusted diluted EPS(2) $ 0.79 $ 0.79 $ 1.64 $ 1.80 Weighted-average shares used in computation of adjusted earnings per share Basic 114,473 119,461 116,075 119,387 Diluted(3) 115,329 119,793 116,540 119,718 (1) The income tax rate applied to items is based on the GAAP annual effective tax rate. (2) See the “Non-GAAP Financial Measures” section for additional information. (3) The nine months ended September 30, 2025 calculation of earnings per share - diluted (GAAP) excludes 465 thousand shares due to their anti- dilutive effect.

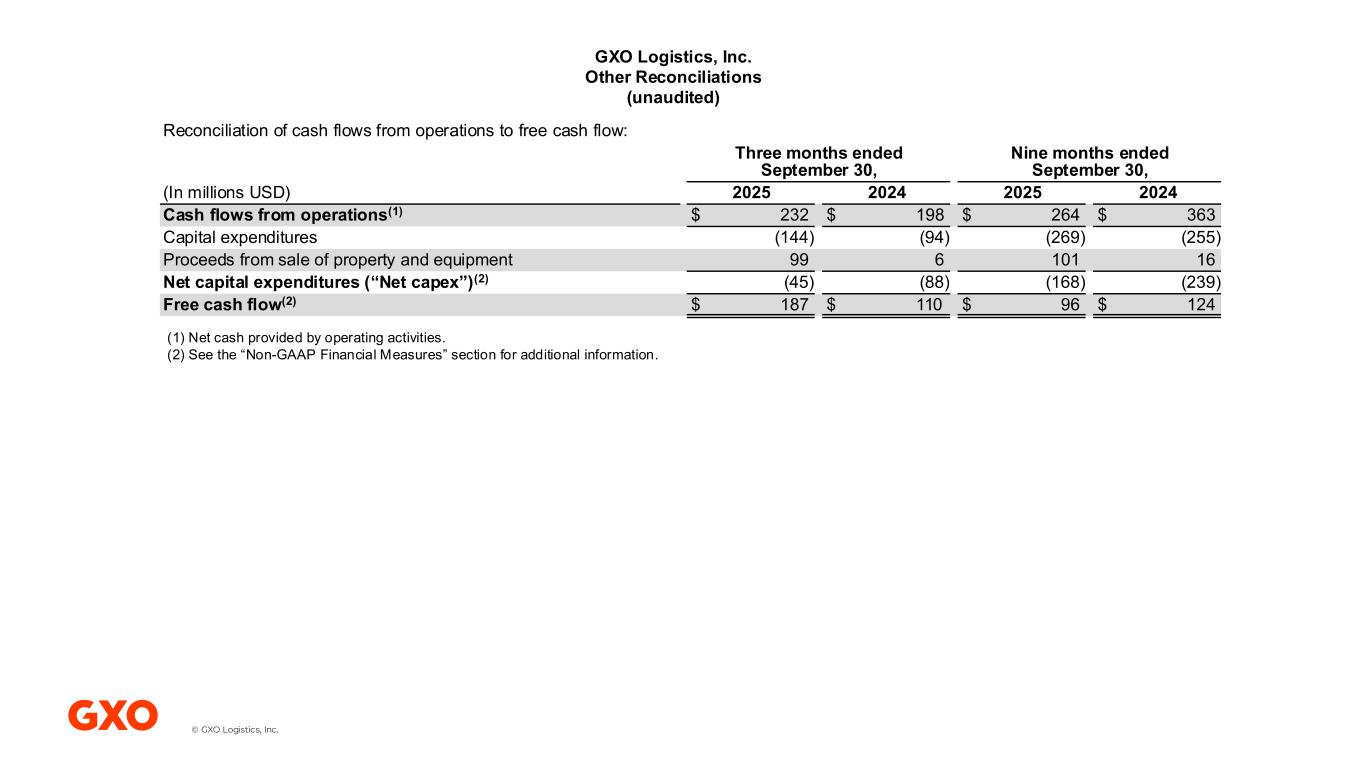

© GXO Logistics, Inc. GXO Logistics, Inc. Other Reconciliations (unaudited) Reconciliation of cash flows from operations to free cash flow: Three months ended September 30, Nine months ended September 30, (In millions USD) 2025 2024 2025 2024 Cash flows from operations(1) $ 232 $ 198 $ 264 $ 363 Capital expenditures (144) (94) (269) (255) Proceeds from sale of property and equipment 99 6 101 16 Net capital expenditures (“Net capex”)(2) (45) (88) (168) (239) Free cash flow(2) $ 187 $ 110 $ 96 $ 124 (1) Net cash provided by operating activities. (2) See the “Non-GAAP Financial Measures” section for additional information.

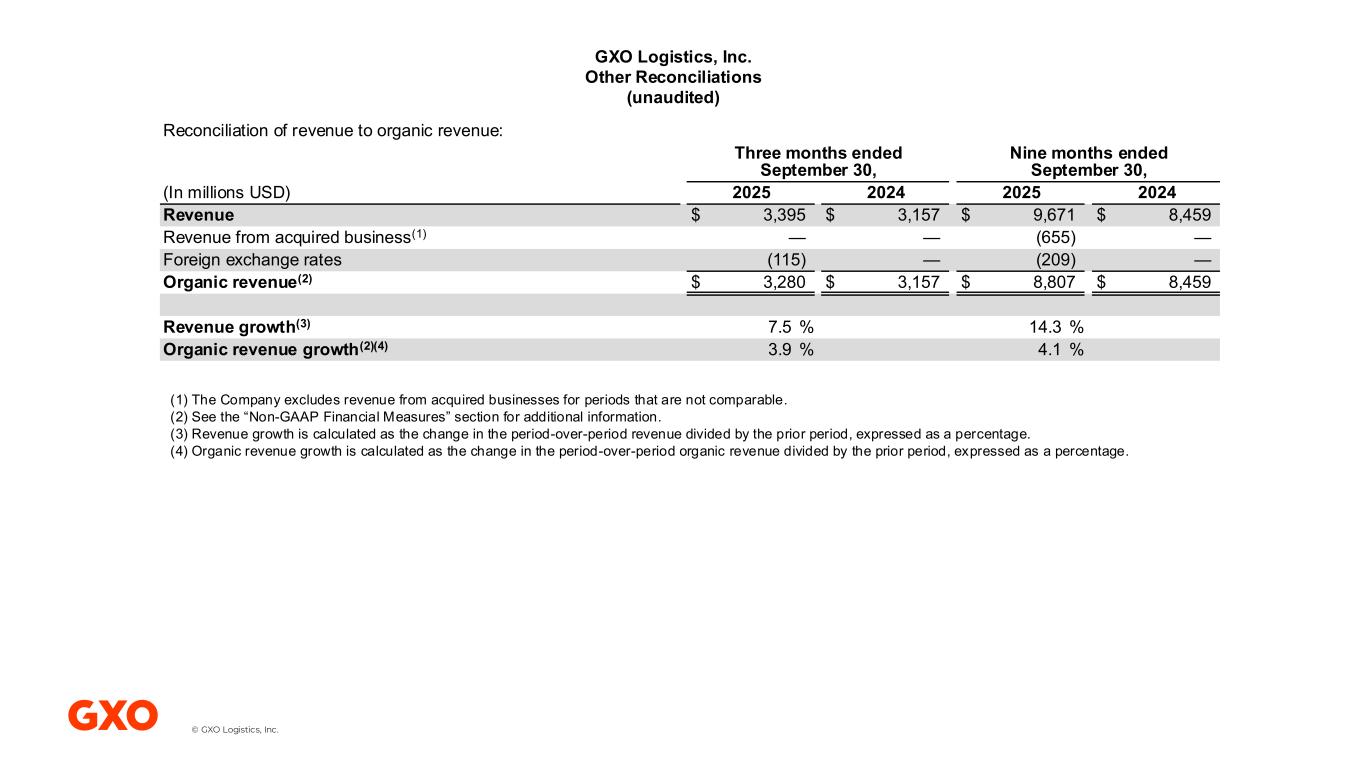

© GXO Logistics, Inc. GXO Logistics, Inc. Other Reconciliations (unaudited) Reconciliation of revenue to organic revenue: Three months ended September 30, Nine months ended September 30, (In millions USD) 2025 2024 2025 2024 Revenue $ 3,395 $ 3,157 $ 9,671 $ 8,459 Revenue from acquired business(1) — — (655) — Foreign exchange rates (115) — (209) — Organic revenue(2) $ 3,280 $ 3,157 $ 8,807 $ 8,459 Revenue growth(3) 7.5 % 14.3 % Organic revenue growth(2)(4) 3.9 % 4.1 % (1) The Company excludes revenue from acquired businesses for periods that are not comparable. (2) See the “Non-GAAP Financial Measures” section for additional information. (3) Revenue growth is calculated as the change in the period-over-period revenue divided by the prior period, expressed as a percentage. (4) Organic revenue growth is calculated as the change in the period-over-period organic revenue divided by the prior period, expressed as a percentage.

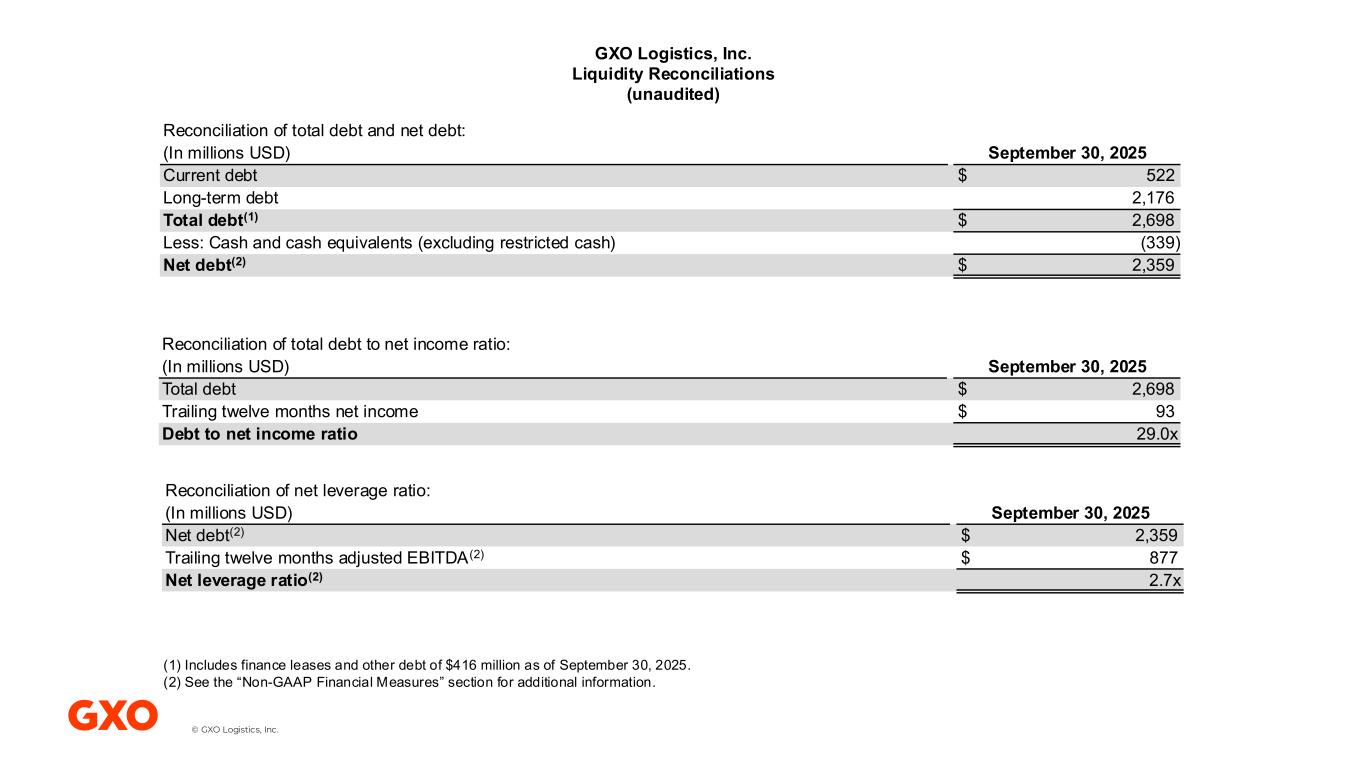

© GXO Logistics, Inc. GXO Logistics, Inc. Liquidity Reconciliations (unaudited) Reconciliation of total debt and net debt: (In millions USD) September 30, 2025 Current debt $ 522 Long-term debt 2,176 Total debt(1) $ 2,698 Less: Cash and cash equivalents (excluding restricted cash) (339) Net debt(2) $ 2,359 Reconciliation of total debt to net income ratio: (In millions USD) September 30, 2025 Total debt $ 2,698 Trailing twelve months net income $ 93 Debt to net income ratio 29.0x Reconciliation of net leverage ratio: (In millions USD) September 30, 2025 Net debt(2) $ 2,359 Trailing twelve months adjusted EBITDA(2) $ 877 Net leverage ratio(2) 2.7x (1) Includes finance leases and other debt of $416 million as of September 30, 2025. (2) See the “Non-GAAP Financial Measures” section for additional information.

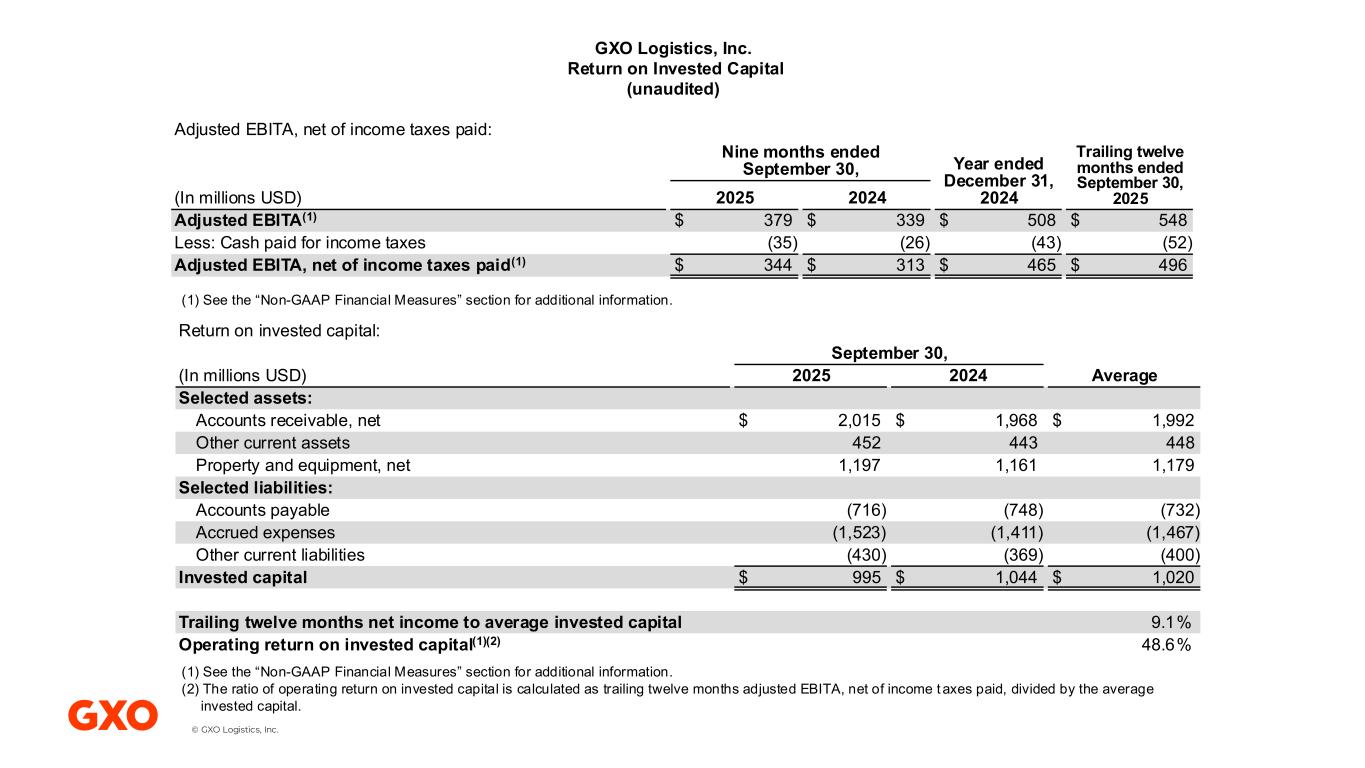

© GXO Logistics, Inc. Adjusted EBITA, net of income taxes paid: Nine months ended September 30, Year ended December 31, 2024 Trailing twelve months ended September 30, 2025(In millions USD) 2025 2024 Adjusted EBITA(1) $ 379 $ 339 $ 508 $ 548 Less: Cash paid for income taxes (35) (26) (43) (52) Adjusted EBITA, net of income taxes paid(1) $ 344 $ 313 $ 465 $ 496 Return on invested capital: September 30, (In millions USD) 2025 2024 Average Selected assets: Accounts receivable, net $ 2,015 $ 1,968 $ 1,992 Other current assets 452 443 448 Property and equipment, net 1,197 1,161 1,179 Selected liabilities: Accounts payable (716) (748) (732) Accrued expenses (1,523) (1,411) (1,467) Other current liabilities (430) (369) (400) Invested capital $ 995 $ 1,044 $ 1,020 Trailing twelve months net income to average invested capital 9.1% Operating return on invested capital(1)(2) 48.6% GXO Logistics, Inc. Return on Invested Capital (unaudited) (1) See the “Non-GAAP Financial Measures” section for additional information. (2) The ratio of operating return on invested capital is calculated as trailing twelve months adjusted EBITA, net of income t axes paid, divided by the average invested capital. (1) See the “Non-GAAP Financial Measures” section for additional information.