Exhibit (c)(22)

AvidXchange Board Discussion Materials

TPG / Corpay Bid Proposal Summary

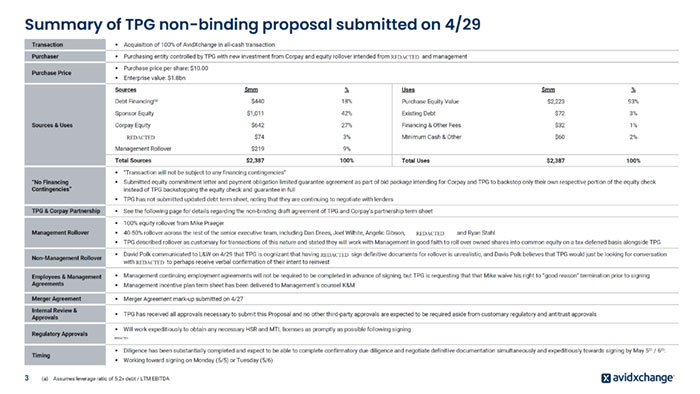

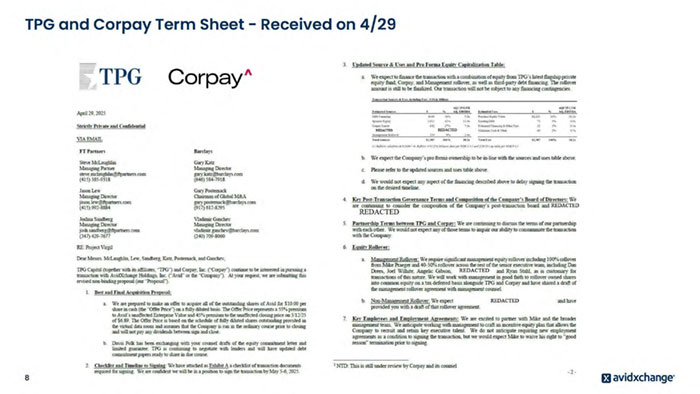

Summary of TPG non-binding proposal submitted on 4/29 Transaction ? Acquisition of 100% of AvidXchange in all-cash transaction Purchaser ? Purchasing entity controlled by TPG with new investment from Corpay and equity rollover intended from and management Purchase Price ? Purchase price per share: $10.00 ? Enterprise value: $1.8bn Sources & Uses Sources $mm % Uses $mm % Debt Financing(a) $440 18% Purchase Equity Value $2,223 93% Sponsor Equity $1,011 42% Existing Debt $72 3% Corpay Equity $642 27% Financing & Other Fees $32 1% $74 3% Minimum Cash & Other $60 2% Management Rollover $219 9% Total Sources $2,387 100% Total Uses $2,387 100% “No Financing Contingencies” ? “Transaction will not be subject to any financing contingencies” ? Submitted equity commitment letter and payment obligation limited guarantee agreement as part of bid package intending for Corpay and TPG to backstop only their own respective portion of the equity check instead of TPG backstopping the equity check and guarantee in full ? TPG has not submitted updated debt term sheet, noting that they are continuing to negotiate with lenders TPG & Corpay Partnership ? See the following page for details regarding the non-binding draft agreement of TPG and Corpay’s partnership term sheet Management Rollover ? 100% equity rollover from Mike Praeger ? 40-50% rollover across the rest of the senior executive team, including Dan Drees, Joel Wilhite, Angelic Gibson, and Ryan Stahl ? TPG described rollover as customary for transactions of this nature and stated they will work with Management in good faith to roll over owned shares into common equity on a tax-deferred basis alongside TPG Non-Management Rollover ? David Polk communicated to L&W on 4/29 that TPG is cognizant that having sign definitive documents for rollover is unrealistic, and Davis Polk believes that TPG would just be looking for conversation with to perhaps receive verbal confirmation of their intent to reinvest Employees & Management Agreements ? Management continuing employment agreements will not be required to be completed in advance of signing, but TPG is requesting that that Mike waive his right to “good reason” termination prior to signing ? Management incentive plan term sheet has been delivered to Management’s counsel K&M Merger Agreement ? Merger Agreement mark-up submitted on 4/27 Internal Review & Approvals ? TPG has received all approvals necessary to submit this Proposal and no other third-party approvals are expected to be required aside from customary regulatory and antitrust approvals Regulatory Approvals ? Will work expeditiously to obtain any necessary HSR and MTL licenses as promptly as possible following signing Timing ? Diligence has been substantially completed and expect to be able to complete confirmatory due diligence and negotiate definitive documentation simultaneously and expeditiously towards signing by May 5th / 6th: ? Working toward signing on Monday (5/5) or Tuesday (5/6) (a) Assumes leverage ratio 3 of 5.2x debt / LTM EBITDA REDACTED REDACTED REDACTED REDACTED REDACTED REDACTED

TPG and Corpay partnership non-binding term sheet submitted on 4/29 TPG & Corpay Holding Company Structure ? TPG and Corpay will form and capitalize a holding company (the “Company”) with cash, and the Company will use the proceeds of such capitalization and debt financing proceeds to acquire AvidXchange 4 REDACTED REDACTED REDACTED

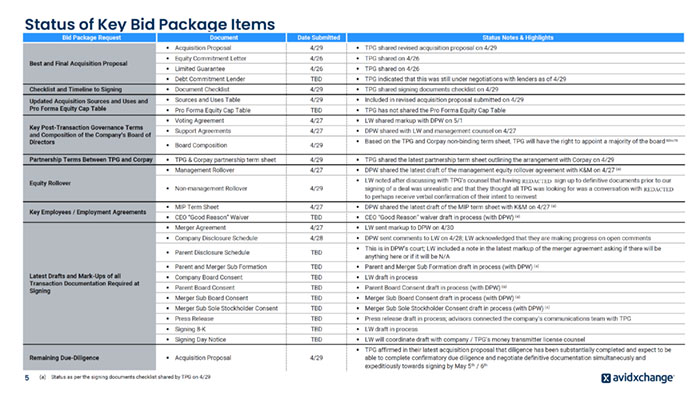

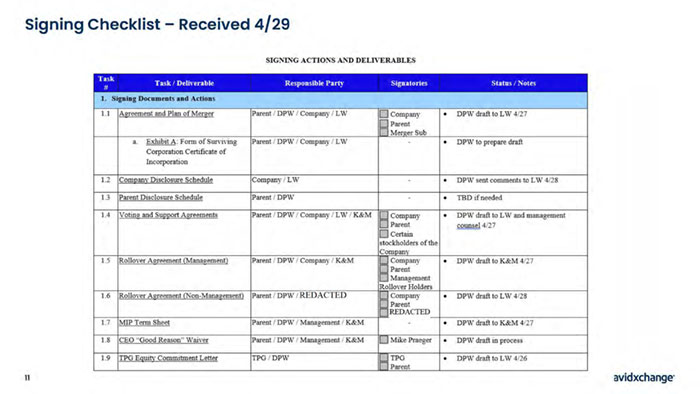

Status of Key Bid Package Items Bid Package Request Document Date Submitted Status Notes & Highlights Best and Final Acquisition Proposal ? Acquisition Proposal 4/29 ? TPG shared revised acquisition proposal on 4/29 ? Equity Commitment Letter 4/26 ? TPG shared on 4/26 ? Limited Guarantee 4/26 ? TPG shared on 4/26 ? Debt Commitment Lender TBD ? TPG indicated that this was still under negotiations with lenders as of 4/29 Checklist and Timeline to Signing ? Document Checklist 4/29 ? TPG shared signing documents checklist on 4/29 Updated Acquisition Sources and Uses and Pro Forma Equity Cap Table ? Sources and Uses Table 4/29 ? Included in revised acquisition proposal submitted on 4/29 ? Pro Forma Equity Cap Table TBD ? TPG has not shared the Pro Forma Equity Cap Table Key Post-Transaction Governance Terms and Composition of the Company’s Board of Directors ? Voting Agreement 4/27 ? LW shared markup with DPW on 5/1 ? Support Agreements 4/27 ? DPW shared with LW and management counsel on 4/27 ? Board Composition 4/29 ? Based on the TPG and Corpay non-binding term sheet, TPG will have the right to appoint a majority of the board Partnership Terms Between TPG and Corpay ? TPG & Corpay partnership term sheet 4/29 ? TPG shared the latest partnership term sheet outlining the arrangement with Corpay on 4/29 Equity Rollover ? Management Rollover 4/27 ? DPW shared the latest draft of the management equity rollover agreement with K&M on 4/27 (a) ? Non-management Rollover 4/29 ? LW noted after discussing with TPG’s counsel that having sign up to definitive documents prior to our signing of a deal was unrealistic and that they thought all TPG was looking for was a conversation with to perhaps receive verbal confirmation of their intent to reinvest Key Employees / Employment Agreements ? MIP Term Sheet 4/27 ? DPW shared the latest draft of the MIP term sheet with K&M on 4/27 (a) ? CEO “Good Reason” Waiver TBD ? CEO “Good Reason” waiver draft in process (with DPW) (a) Latest Drafts and Mark-Ups of all Transaction Documentation Required at Signing ? Merger Agreement 4/27 ? LW sent markup to DPW on 4/30 ? Company Disclosure Schedule 4/28 ? DPW sent comments to LW on 4/28; LW acknowledged that they are making progress on open comments ? Parent Disclosure Schedule TBD ? This is in DPW’s court; LW included a note in the latest markup of the merger agreement asking if there will be anything here or if it will be N/A ? Parent and Merger Sub Formation TBD ? Parent and Merger Sub Formation draft in process (with DPW) (a) ? Company Board Consent TBD ? LW draft in process ? Parent Board Consent TBD ? Parent Board Consent draft in process (with DPW) (a) ? Merger Sub Board Consent TBD ? Merger Sub Board Consent draft in process (with DPW) (a) ? Merger Sub Sole Stockholder Consent TBD ? Merger Sub Sole Stockholder Consent draft in process (with DPW) (a) ? Press Release TBD ? Press release draft in process; advisors connected the company’s communications team with TPG ? Signing 8-K TBD ? LW draft in process ? Signing Day Notice TBD ? LW will coordinate draft with company / TPG’s money transmitter license counsel Remaining Due-Diligence ? Acquisition Proposal 4/29 ? TPG affirmed in their latest acquisition proposal that diligence has been substantially completed and expect to be able to complete confirmatory due diligence and negotiate definitive documentation simultaneously and expeditiously towards signing by May 5th / 6th (a) Status as per the signing documents checklist 5 shared by TPG on 4/29 REDACTED REDACTED REDACTE

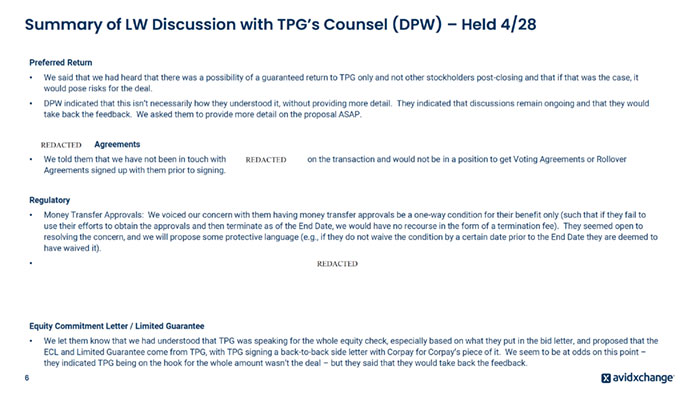

Summary of LW Discussion with TPG’s Counsel (DPW) – Held 4/28 Preferred Return • We said that we had heard that there was a possibility of a guaranteed return to TPG only and not other stockholders post-closing and that if that was the case, it would pose risks for the deal. • DPW indicated that this isn’t necessarily how they understood it, without providing more detail. They indicated that discussions remain ongoing and that they would take back the feedback. We asked them to provide more detail on the proposal ASAP. Agreements • We told them that we have not been in touch with on the transaction and would not be in a position to get Voting Agreements or Rollover Agreements signed up with them prior to signing. Regulatory • Money Transfer Approvals: We voiced our concern with them having money transfer approvals be a one-way condition for their benefit only (such that if they fail to use their efforts to obtain the approvals and then terminate as of the End Date, we would have no recourse in the form of a termination fee). They seemed open to resolving the concern, and we will propose some protective language (e.g., if they do not waive the condition by a certain date prior to the End Date they are deemed to have waived it). • Equity Commitment Letter / Limited Guarantee • We let them know that we had understood that TPG was speaking for the whole equity check, especially based on what they put in the bid letter, and proposed that the ECL and Limited Guarantee come from TPG, with TPG signing a back-to-back side letter with Corpay for Corpay’s piece of it. We seem to be at odds on this point – they indicated TPG being on the hook for the whole amount wasn’t the deal – but they said that they would take back the feedback. 6 REDACTED REDACTED REDACTED

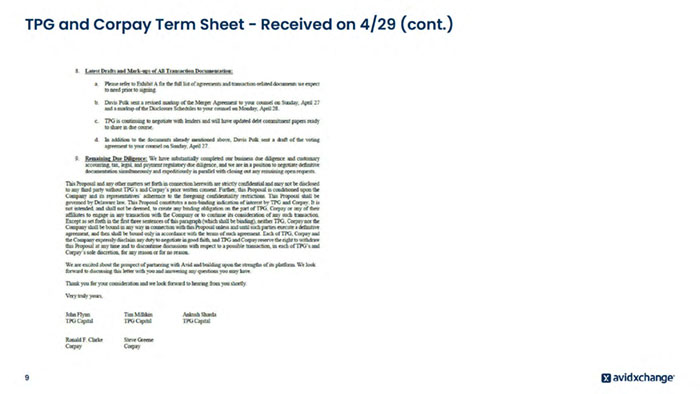

Appendix - TPG and Corpay Term Sheet

Appendix - TPG Signing Documents checklist

signing checklist received 4/29

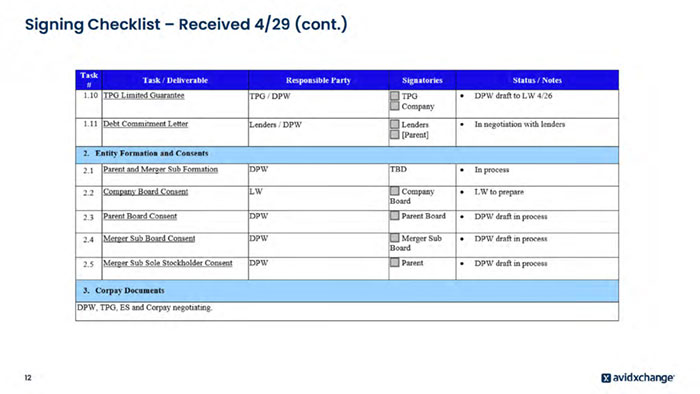

signing checklist received 4/29 (cont.)

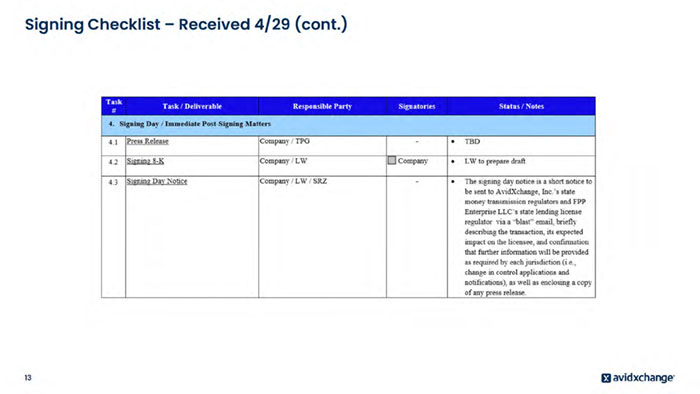

signing checklist received 4/29 (cont.)

Appendix - TPG and Corpay Partnership Term Sheet

Term sheet received 4-29

Term sheet received 4-29 (cont.)