Exhibit (c)(23)

P.Virgil – Process Overview May 5th, 2025

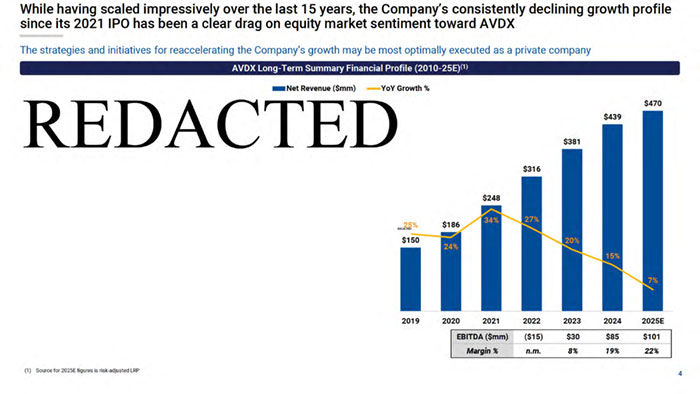

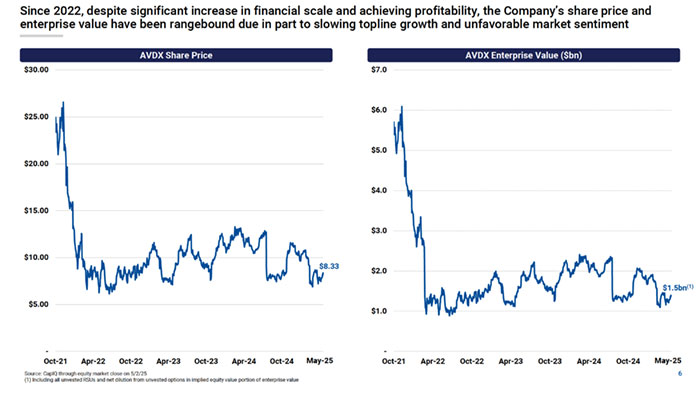

2 Historical context for 2025 transaction process Long-term historical profile ? From 2010 through 2024, AvidXchange grew annual revenue from $10mm to $439mm, a compounded annual growth rate of 31%, and turned profitable, generating positive full-year EBITDA beginning in 2023 ? From 2010 through 2020, the Company raised hundreds of millions of dollars in financing from blue-chip investors (e.g., Bain Capital, Capital Group, CPPIB, Sequoia, Mastercard, Temasek, TPG, etc.) across multiple funding rounds Backdrop of AVDX in public equity markets ? The Company’s IPO was priced at $25.00 in October 2021, and AVDX traded up to all-time high closing price of $26.57 in November 2021 before falling to an all-time closing low of $6.14 in June 2022 ? The stock price gradually recovered some over the next two years and closed at $12.72 on 7/30/24, the day before the Company reported Q2’24 results ? Since going public, the Company’s growth rate has declined every year, down to 7% projected revenue growth for 2025E(1), which has had a negative impact on AVDX’s valuation in the public equity markets ? In addition to business performance trends, certain capital market dynamics and broader macroeconomic uncertainties (e.g., tariffs) have negatively impacted the Company’s stock price ? After Q2’24 results were released on 7/31/24, AVDX fell and traded between ~$7.50-$8.50 through November 2024, which in part spurred heightened, unsolicited inbound acquisition interest in the Company (1) Source for 2025E figures is risk-adjusted LRP

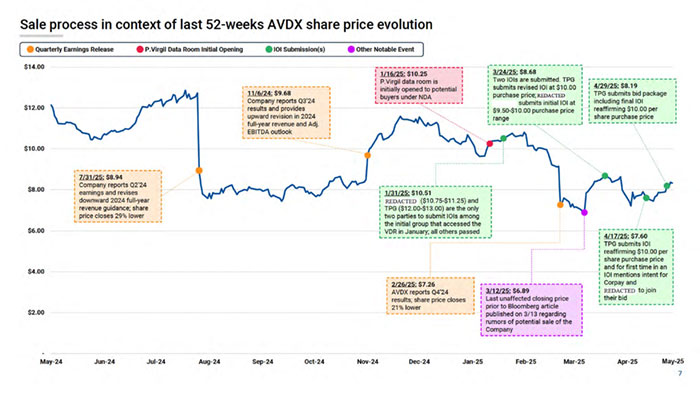

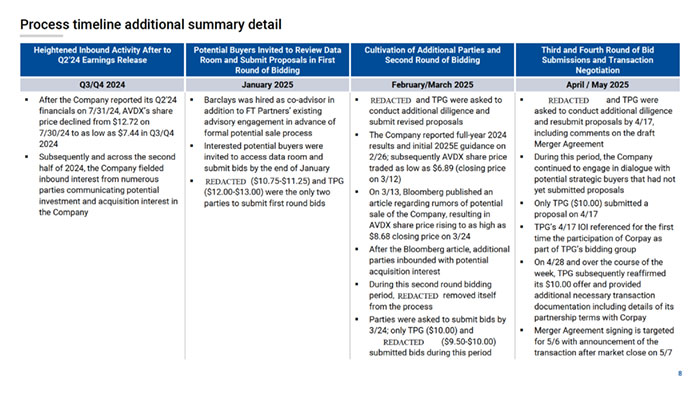

3 Overview of 2025 transaction process Genesis, construction, and management of thorough transaction process ? Across the second half of 2024, the Company fielded unsolicited inbound interest from numerous credible parties communicating potential investment and acquisition interest in the Company ? Given the number of credible acquirers expressing interest, the Company opted to pursue a formal market check / transaction process ? Barclays was hired as co-advisor to the Company in January 2025 (with FT Partners, the “Advisors”) prior to the start of formal sale process ? Ultimately, 18 parties inbounded or otherwise engaged in dialogue considering the Company as a potential acquisition target ? The Advisors also conducted thorough analyses (e.g., accretion / dilution, financing capacity, etc.) before inviting strategics to progress further in the process to sign NDAs and receive confidential information Process key events ? In the first round of bidding at the end of January 2025, only ($10.75-$11.25) and TPG ($12.00-$13.00) submitted bids ? During a second round of bidding in March 2025, removed itself from the process while TPG submitted a revised lower bid ($10.00), and new process entrant ($9.50-$10.00) also submitted a bid ? TPG were asked to conduct submit a further best-and-final bid by 4/17, and only TPG submitted a bid, reaffirming its $10.00 offer price while removed itself from the process ? In this 4/17 bid, TPG for the first time formally indicated in writing its intent to have Corpay join its bid as a minority investor ? TPG indicated that its $10.00 valuation was potentially predicated in large part on Corpay participating meaningfully as part of TPG’s bidding group ? TPG was asked to submit a final bid package by 4/28 including additional transaction documentation, which it did, again reaffirming its $10.00 purchase price and intent to formally sign the Merger Agreement by 5/5 and announce the deal on 5/6 REDACTED REDACTED REDACTED REDACTED REDACTED

REDACTED

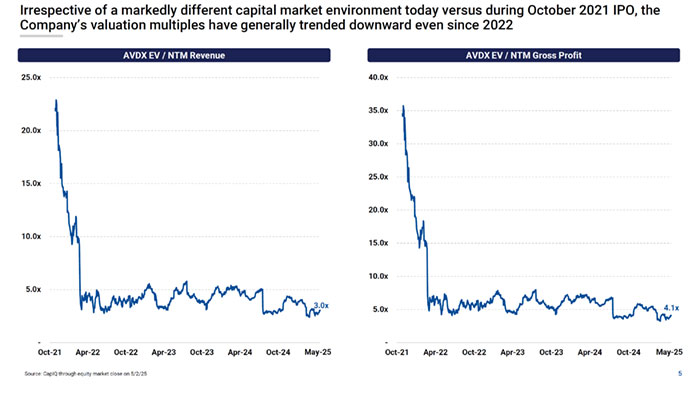

5 Irrespective of a markedly different capital market environment today versus during October 2021 IPO, the Company’s valuation multiples have generally trended downward even since 2022 - 5.0x 10.0x 15.0x 20.0x 25.0x Oct-21 Apr-22 Oct-22 Apr-23 Oct-23 Apr-24 Oct-24 - 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x 35.0x 40.0x Oct-21 Apr-22 Oct-22 Apr-23 Oct-23 Apr-24 Oct-24 AVDX EV / NTM Revenue AVDX EV / NTM Gross Profit May-25 May-25 3.0x 4.1x Source: CapIQ through equity market close on 5/2/25

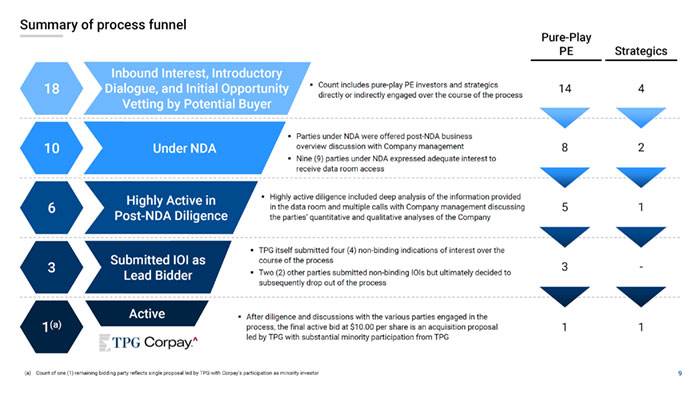

9 Summary of process funnel 18 Inbound Interest, Introductory Dialogue, and Initial Opportunity Vetting by Potential Buyer 6 10 Under NDA 1(a) Active 3 Highly Active in Post-NDA Diligence Submitted IOI as Lead Bidder (a) Count of one (1) remaining bidding party reflects single proposal led by TPG with Corpay’s participation as minority investor 14 4 8 2 5 1 3 - 1 1 Pure-Play PE Strategics ? Count includes pure-play PE investors and strategics directly or indirectly engaged over the course of the process ? Parties under NDA were offered post-NDA business overview discussion with Company management ? Nine (9) parties under NDA expressed adequate interest to receive data room access ? Highly active diligence included deep analysis of the information provided in the data room and multiple calls with Company management discussing the parties’ quantitative and qualitative analyses of the Company ? TPG itself submitted four (4) non-binding indications of interest over the course of the process ? Two (2) other parties submitted non-binding IOIs but ultimately decided to subsequently drop out of the process ? After diligence and discussions with the various parties engaged in the process, the final active bid at $10.00 per share is an acquisition proposal led by TPG with substantial minority participation from TPG

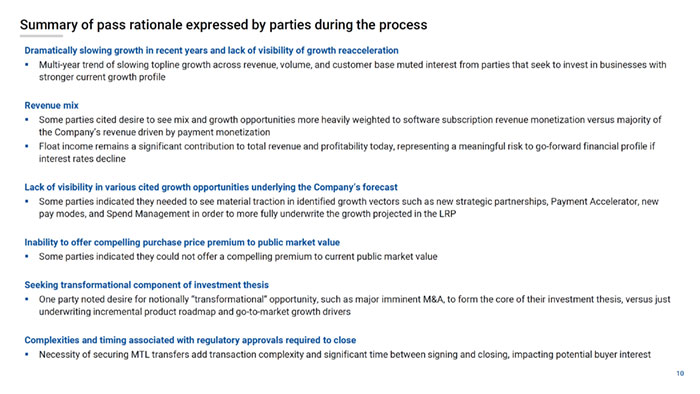

10 Summary of pass rationale expressed by parties during the process Dramatically slowing growth in recent years and lack of visibility of growth reacceleration ? Multi-year trend of slowing topline growth across revenue, volume, and customer base muted interest from parties that seek to invest in businesses with stronger current growth profile Revenue mix ? Some parties cited desire to see mix and growth opportunities more heavily weighted to software subscription revenue monetization versus majority of the Company’s revenue driven by payment monetization ? Float income remains a significant contribution to total revenue and profitability today, representing a meaningful risk to go-forward financial profile if interest rates decline Lack of visibility in various cited growth opportunities underlying the Company’s forecast ? Some parties indicated they needed to see material traction in identified growth vectors such as new strategic partnerships, Payment Accelerator, new pay modes, and Spend Management in order to more fully underwrite the growth projected in the LRP Inability to offer compelling purchase price premium to public market value ? Some parties indicated they could not offer a compelling premium to current public market value Seeking transformational component of investment thesis ? One party noted desire for notionally “transformational” opportunity, such as major imminent M&A, to form the core of their investment thesis, versus just underwriting incremental product roadmap and go-to-market growth drivers Complexities and timing associated with regulatory approvals required to close ? Necessity of securing MTL transfers add transaction complexity and significant time between signing and closing, impacting potential buyer interest