1 GALAXY As of September 30, 2025 Q3 · 25 Investor.galaxy.com .2

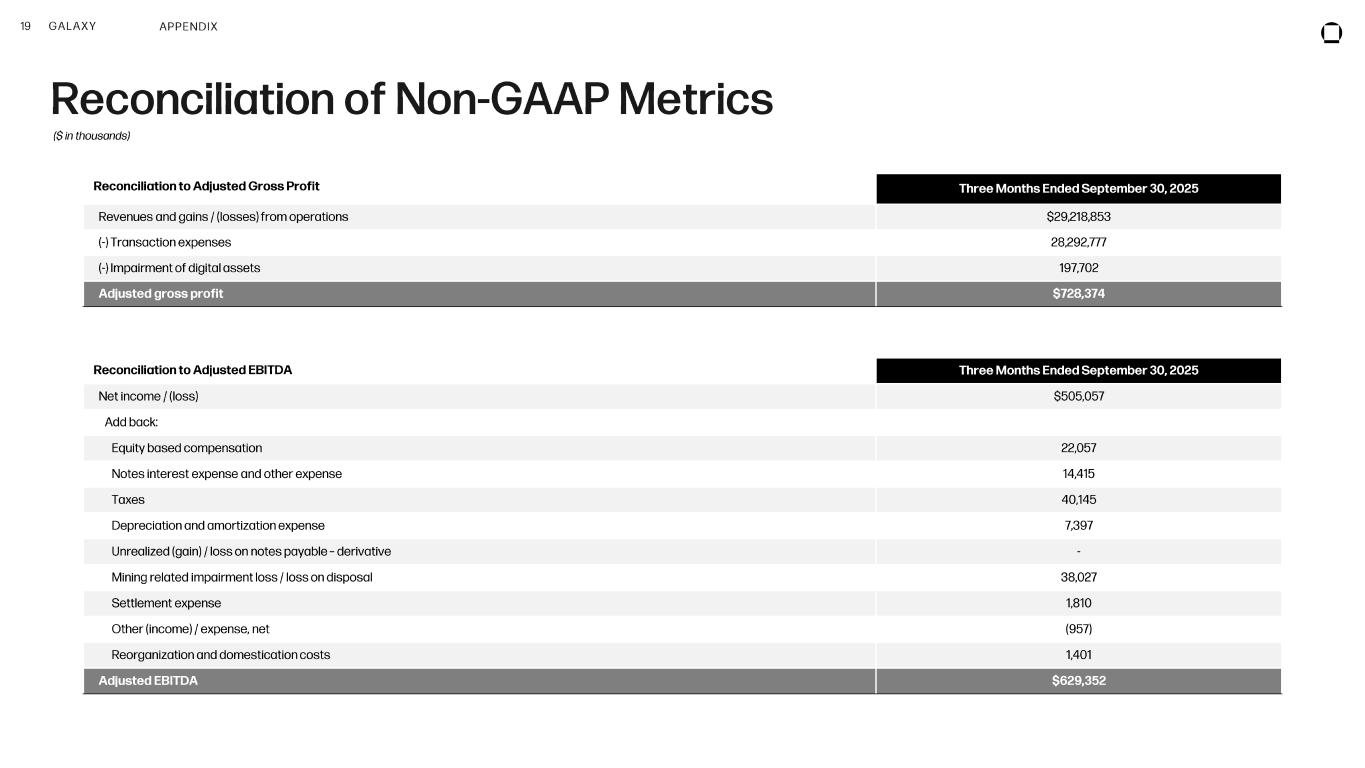

2 GALAXY D is cl ai m er This document, and the information contained herein, has been provided to you by Galaxy Digital Inc . and its affiliates (“Galaxy Digital” or “Galaxy”) solely for informational purposes . This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital . Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy . Nothing contained in this document constitutes investment, legal or tax advice . You should make your own investigations and evaluations of the information herein . Any decisions based on information contained in this document are the sole responsibility of the reader . Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including , in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized . To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein . None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information . Certain information contained herein (including financial information) has been obtained from published and non-published sources . Such information has not been independently verified by Galaxy Digital and Galaxy Digital, does not assume responsibility for the accuracy of such information . Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets, companies and protocols discussed in this document and the inclusion herein is not an endorsement of such asset or company . Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof . The Toronto Stock Exchange has not approved or disapproved of the information contained herein . No securities commission or similar regulatory authority in Canada has reviewed the information contained herein or has in any way passed on the merits of the securities of Galaxy Digital or upon the merits of the disclosure record of Galaxy Digital . The information contained herein is not, and under no circumstances is to be construed as, a prospectus, an advertisement or public offering of securities in Canada, nor is there any attempt to induce or cause any person or company to purchase any securities . CAUTION ABOUT FORWARD -LOOKING STATEMENTS Certain statements in these materials constitute forward -looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (“PLSRA”), Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and “forward -looking information” under Canadian securities laws (collectively, “forward -looking statements”) . In some cases, you can identify these statements by forward -looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology . These forward -looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of Galaxy Digital’s future financial performance or results, our anticipated growth strategies, anticipated trends in our business or future events and circumstances . These statements are only predictions based on Galaxy Digital’s current expectations, estimates, forecasts and projections about future events and trends that may affect the business, results of operations, financial condition and prospects . And as a result, these statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of Galaxy Digital and which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements . For a further discussion of these risks, uncertainties and assumptions, please see the section titled “Risk Factors” in Part II, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended June 30 , 2025 filed with the Securities Exchange Commission on August 5, 2025 , and available on Galaxy’s profile at www.sec .gov . Forward -looking statements are provided as a general guide only, and should not be relied on as an indication or guarantee of future performance . They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties . Given these uncertainties, recipients are cautioned to not place undue reliance on any forward -looking statement . Forward -looking statements speak only as of the date they are made . Subject to any continuing obligations under applicable law Galaxy Digital disclaims any obligation or undertaking to disseminate any updates or revisions to any forward -looking statements in these materials to reflect any change in expectations in relation to such forward -looking statements or any change in events, conditions or circumstances on which any such statement is based . ©Copyright Galaxy Digital 2025 All rights reserved . ®Registered Service Mark of Galaxy Digital Holdings LP Galaxy manages a number of funds, including the Galaxy Crypto Index Fund, Galaxy Ethereum Fund, the Galaxy Bitcoin Funds, the Galaxy Liquid Crypto Fund, the Galaxy Venture Fund I, the Galaxy Interactive Family of Funds and the Galaxy Vision Hill Family of Funds (each a “Fund” and together “Galaxy Funds”) which invests in digital assets . The Information is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, interests in the Fund or any advisory services or any other security or to participate in any advisory services or trading strategy . If any offer and sale of securities is made, it will be pursuant to the confidential offering memorandum of the Fund (the “Offering Memorandum”) . Any decision to make an investment in the Fund should be made after reviewing such Offering Memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment . The performance of the Fund will vary from the performance of the relevant Index that it tracks . None of the Information has been filed with the SEC, any securities administrator under any state securities laws or any other governmental or self -regulatory authority . No governmental authority has opined on the merits of the offering of any securities by the Fund or Galaxy, or the adequacy of the information contained herein . Any representation to the contrary is a criminal offense in the United States . Investing in the Funds and digital assets involves a substantial degree of risk . There can be no assurance that the investment objectives of the Fund will be achieved . Any investment in the Fund may result in a loss of the entire amount invested . Investment losses may occur, and investors could lose some or all of their investment . Neither historical returns nor economic, market or other performance is an indication of future results . In addition to our results determined in accordance with GAAP, this presentation and the accompanying tables contain adjusted gross profit, adjusted EBITDA and EBITDA margin, which are non-GAAP financial measures . Adjusted gross profit, adjusted EBITDA and EBITDA margin are unaudited, presented as supplemental disclosure and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP . Please see slide 19 for a reconciliation of adjusted gross profit to revenues and gains / (losses) from operations during the three months ended September 30 , 2025 , and of adjusted EBITDA to net income (loss ) during the three months ended September 30 , 2025 . It is important to note that the particular items we exclude from, or include in, adjusted gross profit, adjusted EBITDA and EBITDA margin may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry . We also periodically review our non-GAAP financial measures and may revise these measures to reflect changes in our business or otherwise . We believe adjusted gross profit is a helpful non-GAAP financial measure to our management and investors because it eliminates the impact of the directly attributable transaction expenses . As such, it provides useful information about our financial performance, enhances the overall understanding of our past performance and future prospects , allows for greater transparency with respect to important metrics used by our management for financial, risk management and operational decision -making and provides an additional tool for investors to use to understand and compare our operating results across accounting periods . Adjusted EBITDA is a non-GAAP financial measure that is used by management, in addition to GAAP financial measures, to understand and compare our operating results across accounting periods, for risk management and operational decision -making . This non-GAAP measure provides investors with additional information in evaluating the Company’s operating performance . Adjusted EBITDA represents Net income / (loss) excluding (i) equity based compensation, (ii) interest expense on structural debt, (iii) taxes, (iv) depreciation and amortization expense, (v) gains and losses on the embedded derivative on our exchangeable notes which ceased to exist upon consolidation as a result of the Reorganization Transactions, (vi) mining-related impairment loss / loss on disposal of mining equipment, (vii) settlement expense, (viii) other (income) / expense, net and (ix) and reorganization and reorganization merger costs . The above items are excluded from our Adjusted EBITDA because these items are non-cash in nature, or because the amount and timing of these items are unpredictable, are not driven by core results of operations, and render comparisons with prior periods and competitors less meaningful . EBITDA Margin is defined as EBITDA, divided by revenue minus pass through expenses for the same period . This non-GAAP financial measure is commonly used as an analytical indicator of performance by investors within the industries in which we operate . EBITDA margin is not a measure of financial performance under GAAP . Items excluded from EBITDA Margin are significant components in understanding and assessing financial performance . EBITDA Margin should not be considered in isolation or as an alternative to or a substitute for financial statement data presented in Galaxy’s Digital’s consolidated financial statements as indicators of financial performance or liquidity (which, in the case of EBITDA margin, is net income margin) .

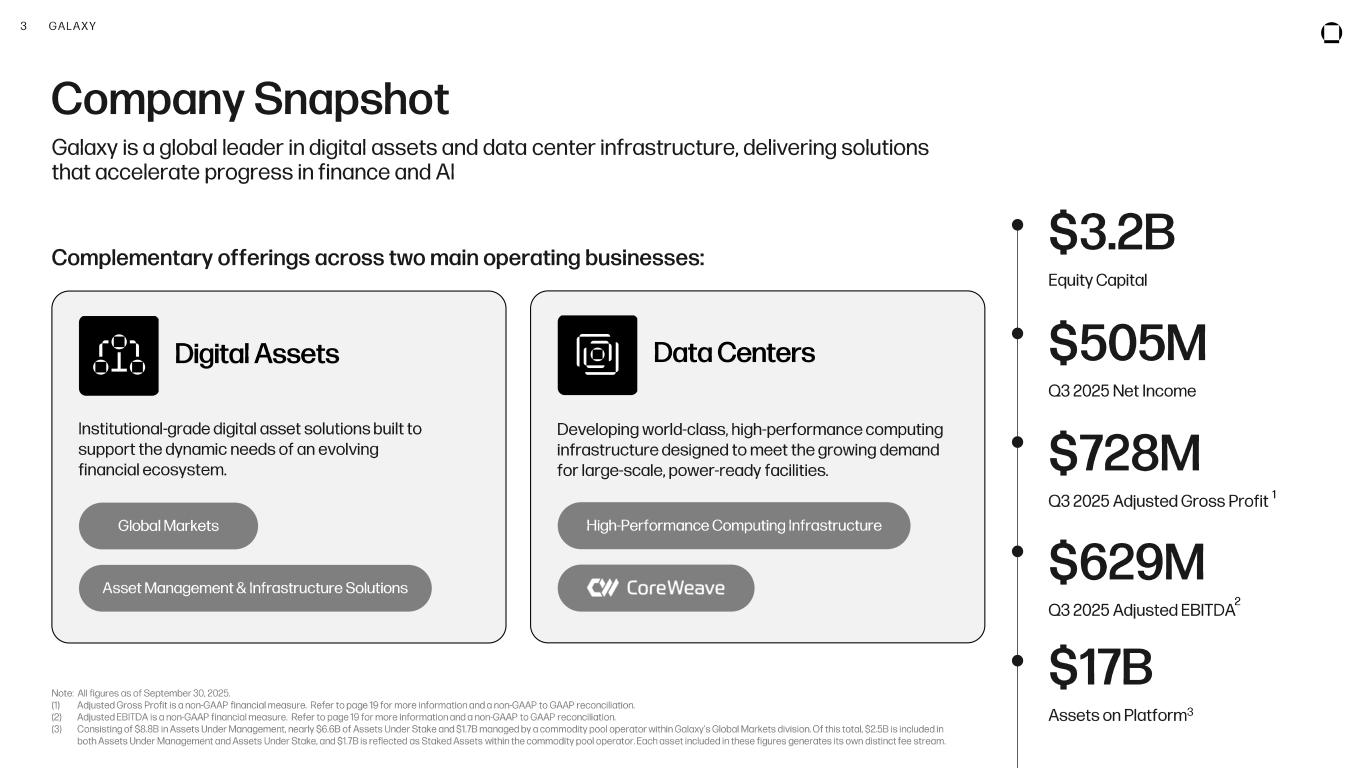

3 GALAXY Equity Capital $3.2B Note: All figures as of September 30, 2025. (1) Adjusted Gross Profit is a non -GAAP financial measure. Refer to page 19 for more information and a non -GAAP to GAAP reconciliat ion. (2) Adjusted EBITDA is a non -GAAP financial measure. Refer to page 19 for more information and a non -GAAP to GAAP reconciliation. (3) Consisting of $8.8B in Assets Under Management, nearly $6.6B of Assets Under Stake and $1.7B managed by a commodity pool oper ator within Galaxy’s Global Markets division. Of this total, $2.5B is included in both Assets Under Management and Assets Under Stake, and $1.7B is reflected as Staked Assets within the commodity pool operat or. Each asset included in these figures generates its own distinct fee stream. Galaxy is a global leader in digital assets and data center infrastructure, delivering solutions that accelerate progress in finance and AI Company Snapshot Q3 2025 Net Income $505M Q3 2025 Adjusted Gross Profit $728M Q3 2025 Adjusted EBITDA $629M Complementary offerings across two main operating businesses: Digital Assets Institutional-grade digital asset solutions built to support the dynamic needs of an evolving financial ecosystem. Global Markets Asset Management & Infrastructure Solutions Data Centers Developing world -class, high -performance computing infrastructure designed to meet the growing demand for large -scale, power -ready facilities. High-Performance Computing Infrastructure Assets on Platform 3 $17B 2 1

4 GALAXY Galaxy Leadership Team Erin Brown Chief Operating Officer Andrew Taubman Deputy Chief Operations Officer Jason Urban Global Head of Trading Chris Ferraro President & CIO Mike Novogratz Founder & CEO Tony Paquette Chief Financial Officer Michael Ashe Head of Strategy & Corporate Development Sebastian Benkert Chief Marketing Officer Rob Cornish Chief Technology Officer Francesca Don Angelo Deputy General Counsel & Corporate Secretary Steve Kurz Global Head of Asset Management Tom Harrop Chief Risk Officer Leinee Hornbeck Chief People Officer A deep bench of experts in capital markets, asset management, digital assets, investing, and technology. Matt Friedrich Chief Legal Officer

5 GALAXY Our Opportunity

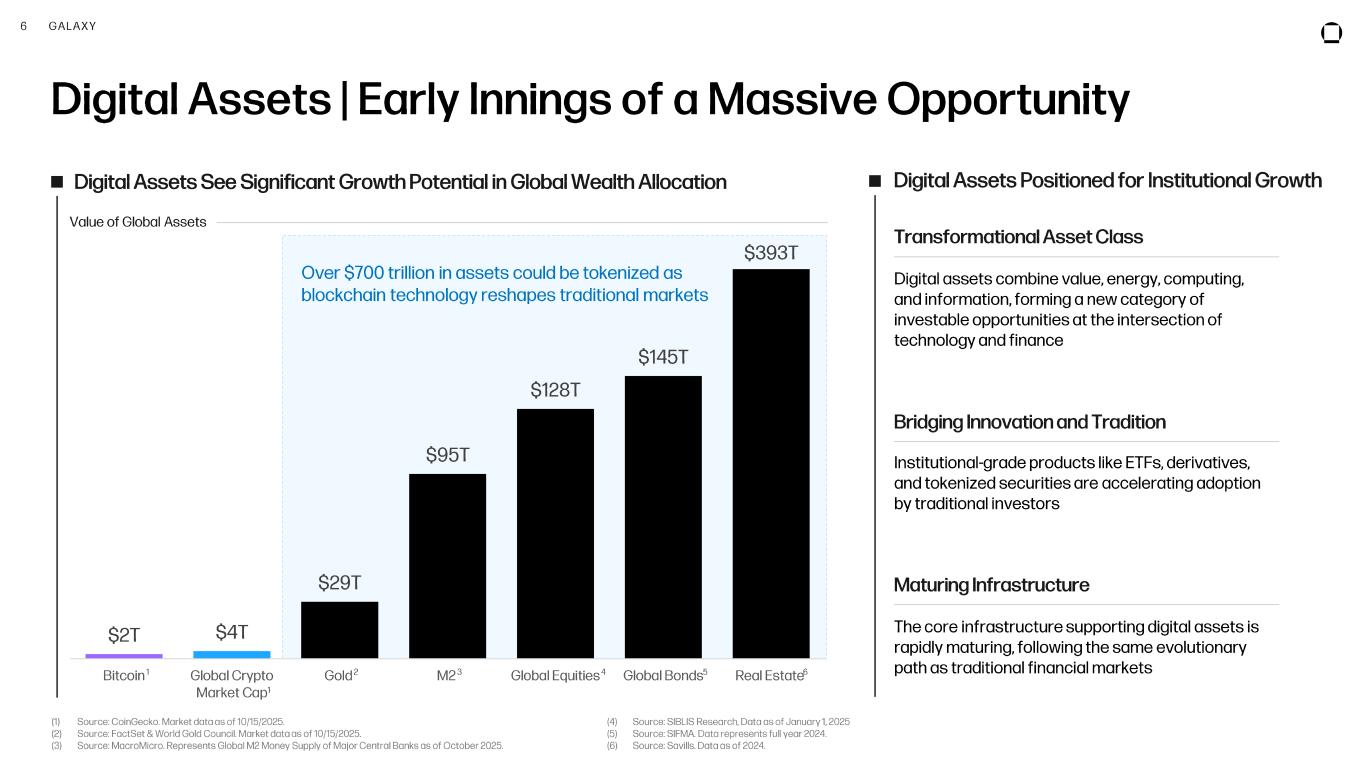

6 GALAXY (1) Source: CoinGecko . Market data as of 10/15/2025. (2) Source: FactSet & World Gold Council. Market data as of 10/15/2025. (3) Source: MacroMicro . Represents Global M2 Money Supply of Major Central Banks as of October 2025. (4) Source: SIBLIS Research, Data as of January 1, 2025 (5) Source: SIFMA. Data represents full year 2024. (6) Source: Savills. Data as of 2024. Digital Assets | Early Innings of a Massive Opportunity Digital Assets See Significant Growth Potential in Global Wealth Allocation Digital Assets Positioned for Institutional Growth Value of Global Assets $2T $4T $29T $95T $128T $145T $393T Bitcoin Global Crypto Market Cap Gold M2 Global Equities Global Bonds Real Estate543 621 1 Over $700 trillion in assets could be tokenized as blockchain technology reshapes traditional markets Transformational Asset Class Digital assets combine value, energy, computing, and information, forming a new category of investable opportunities at the intersection of technology and finance Bridging Innovation and Tradition Institutional-grade products like ETFs, derivatives, and tokenized securities are accelerating adoption by traditional investors Maturing Infrastructure The core infrastructure supporting digital assets is rapidly maturing, following the same evolutionary path as traditional financial markets

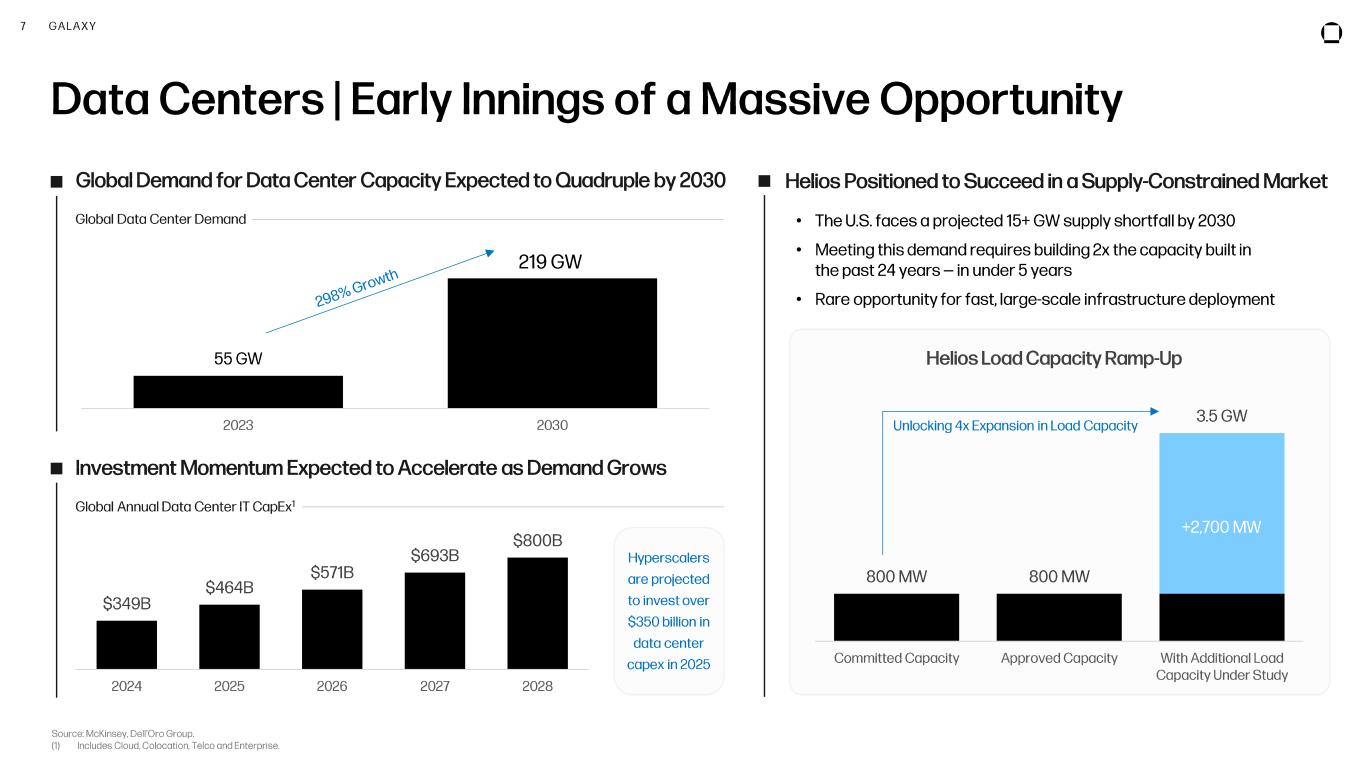

7 GALAXY Source: McKinsey, Dell’Oro Group. (1) Includes Cloud, Colocation, Telco and Enterprise. Data Centers | Early Innings of a Massive Opportunity 55 GW 219 GW 2023 2030 Investment Momentum Expected to Accelerate as Demand Grows 800 MW 800 MW 3.5 GW Committed Capacity Approved Capacity With Additional Load Capacity Under Study Helios Positioned to Succeed in a Supply -Constrained Market $349B $464B $571B $693B $800B 2024 2025 2026 2027 2028 Global Annual Data Center IT CapEx 1 Global Data Center Demand • The U.S. faces a projected 15+ GW supply shortfall by 2030 • Meeting this demand requires building 2x the capacity built in the past 24 years — in under 5 years • Rare opportunity for fast, large -scale infrastructure deployment Helios Load Capacity Ramp -Up +2,700 MW Global Demand for Data Center Capacity Expected to Quadruple by 2030 Unlocking 4x Expansion in Load Capacity Hyperscalers are projected to invest over $350 billion in data center capex in 2025

8 GALAXY Digital Assets Serving the digital asset ecosystem end -to-end. Global Markets Asset Management & Infrastructure Solutions

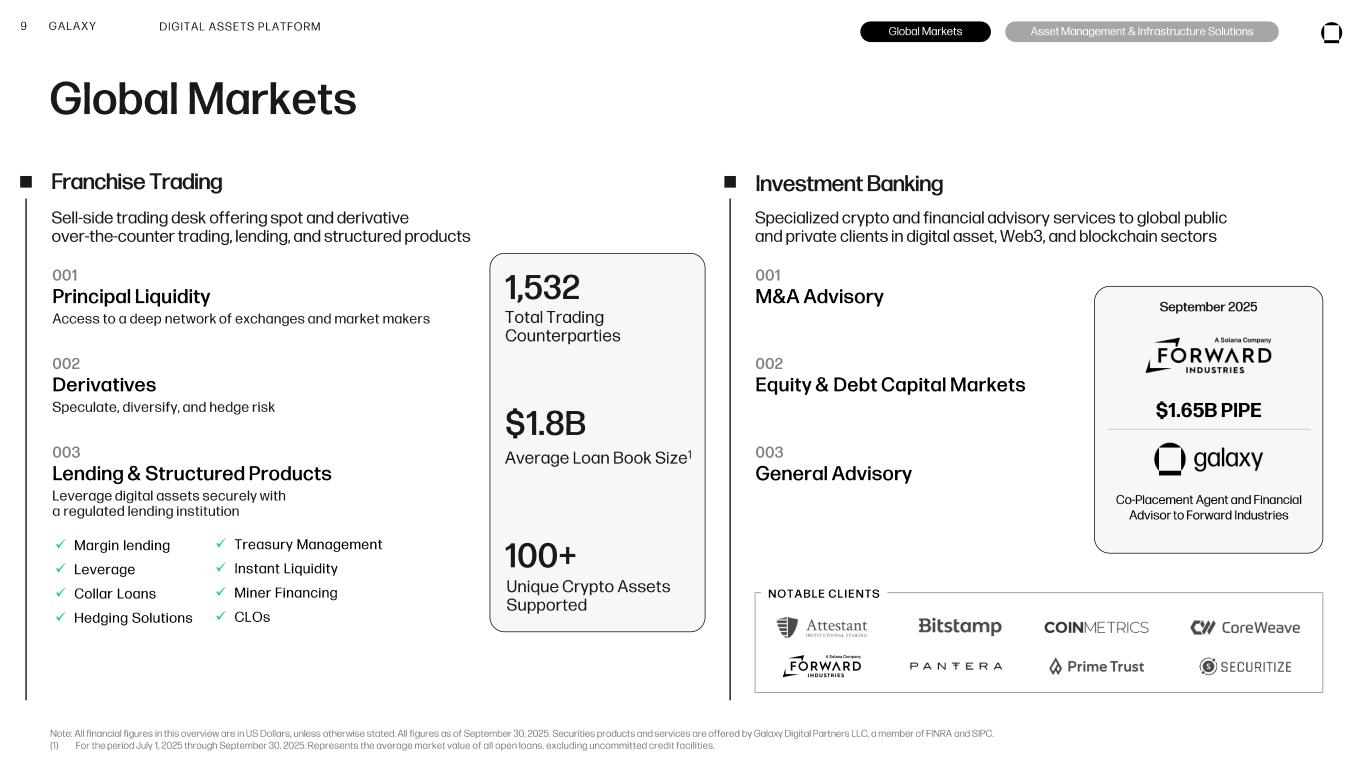

9 GALAXY Global Markets Investment Banking Franchise Trading Sell -side trading desk offering spot and derivative over -the-counter trading, lending, and structured products 001 Principal Liquidity Access to a deep network of exchanges and market makers Specialized crypto and financial advisory services to global public and private clients in digital asset, Web3, and blockchain sectors DIGITAL ASSETS PLATFORM Global Markets Asset Management & Infrastructure Solutions 002 Derivatives Speculate, diversify, and hedge risk ✓ Margin lending ✓ Leverage ✓ Collar Loans ✓ Hedging Solutions ✓ Treasury Management ✓ Instant Liquidity ✓ Miner Financing ✓ CLOs 003 Lending & Structured Products Leverage digital assets securely with a regulated lending institution Total Trading Counterparties 1,532 Average Loan Book Size 1 $1.8B Unique Crypto Assets Supported 100+ 001 M&A Advisory 002 Equity & Debt Capital Markets 003 General Advisory NOTABLE CLIENTS Note: All financial figures in this overview are in US Dollars, unless otherwise stated. All figures as of September 30, 2025 . Securities products and services are offered by Galaxy Digital Partners LLC, a member of FINRA and SIPC. (1) For the period July 1, 2025 through September 30, 2025. Represents the average market value of all open loans, excluding uncommitted credit facilities. September 2025 $1.65B PIPE Co -Placement Agent and Financial Advisor to Forward Industries

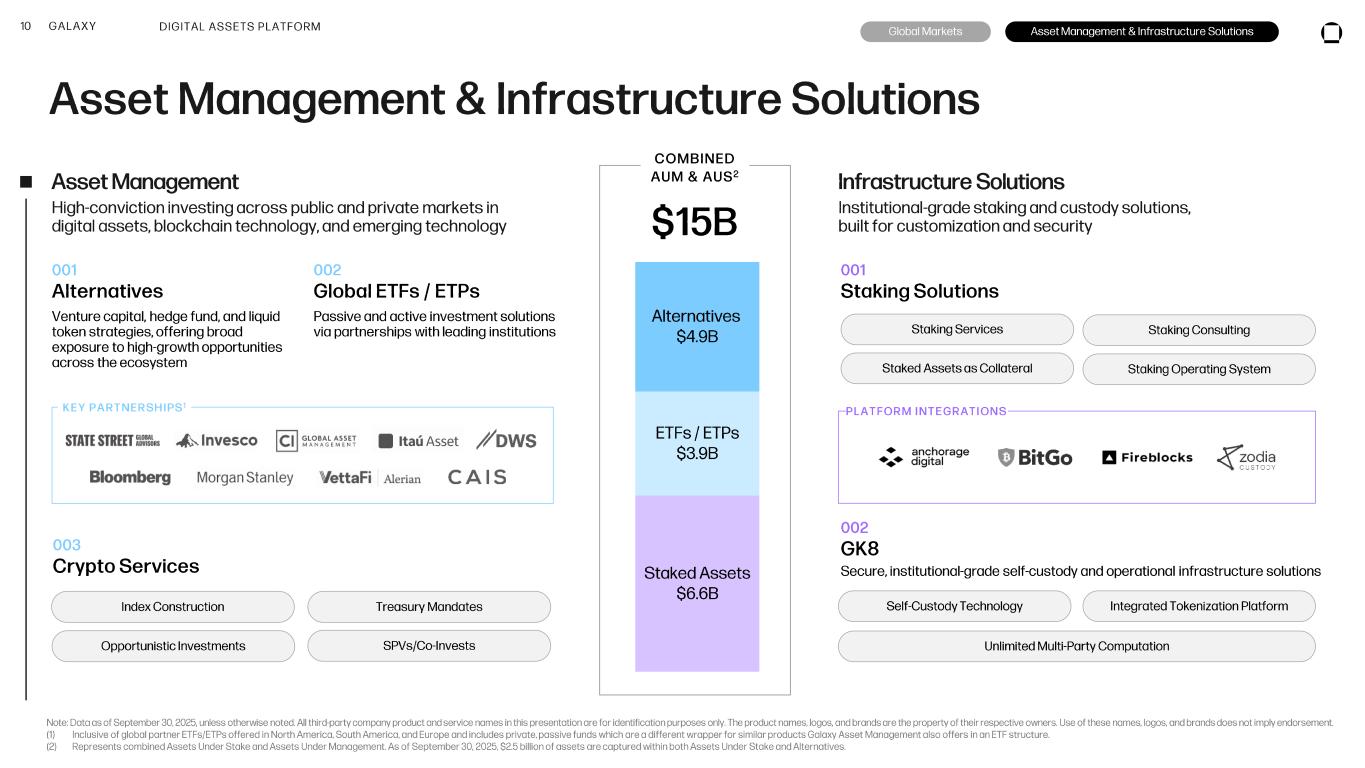

10 GALAXY Asset Management & Infrastructure Solutions Infrastructure Solutions Asset Management DIGITAL ASSETS PLATFORM High-conviction investing across public and private markets in digital assets, blockchain technology, and emerging technology Institutional-grade staking and custody solutions, built for customization and security Staked Assets $6.6B ETFs / ETPs $3.9B Alternatives $4.9B $15B Global Markets Asset Management & Infrastructure Solutions Self -Custody Technology Integrated Tokenization Platform Unlimited Multi-Party Computation Staking Operating System Staking Consulting Staked Assets as Collateral Staking Services 001 Alternatives Venture capital, hedge fund, and liquid token strategies, offering broad exposure to high -growth opportunities across the ecosystem 002 Global ETFs / ETPs Passive and active investment solutions via partnerships with leading institutions 003 Crypto Services Index Construction SPVs/Co -Invests Treasury Mandates Opportunistic Investments 001 Staking Solutions 002 GK8 Secure, institutional -grade self -custody and operational infrastructure solutions KEY PARTNERSHIPS 1 PLATFORM INTEGRATIONS COMBINED AUM & AUS 2 Note: Data as of September 30, 2025, unless otherwise noted. All third-party company product and service names in this presentation are for identification purposes only. The product names, logos, and brands are the property of their respective owners. Use of these names, logos, and brands does not imply endorsement. (1) Inclusive of global partner ETFs/ETPs offered in North America, South America, and Europe and includes private, passive funds which are a different wrapper for similar products Galaxy Asset Management also offers in an ETF structure. (2) Represents combined Assets Under Stake and Assets Under Management. As of September 30, 2025, $2.5 billion of assets are captured within both Assets Under Stake and Alternatives.

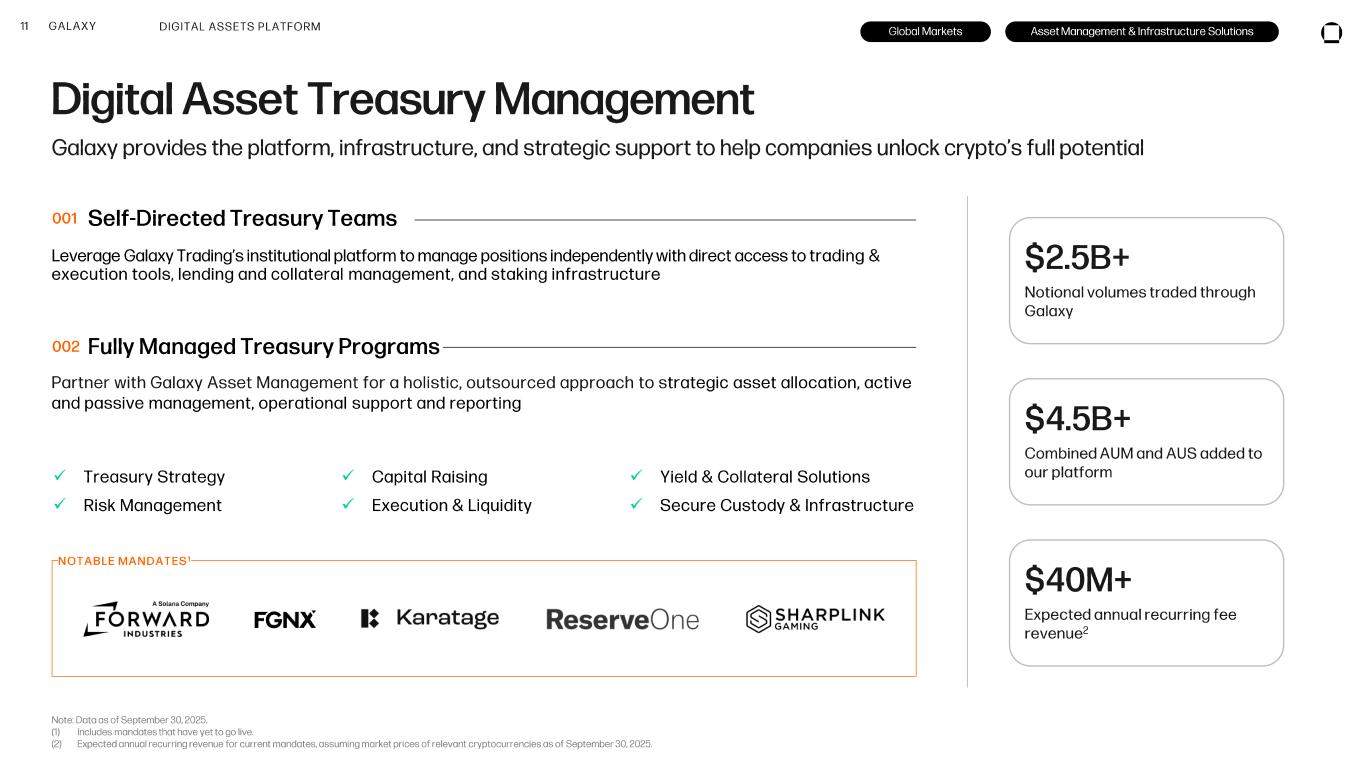

11 GALAXY Digital Asset Treasury Management Self -Directed Treasury Teams Leverage Galaxy Trading’s institutional platform to manage positions independently with direct access to trading & execution tools, lending and collateral management, and staking infrastructure Fully Managed Treasury Programs Partner with Galaxy Asset Management for a holistic, outsourced approach to s trategic asset allocation, active and passive management, operational support and reporting Galaxy provides the platform, infrastructure, and strategic support to help companies unlock crypto’s full potential ✓ Treasury Strategy ✓ Risk Management ✓ Capital Raising ✓ Execution & Liquidity ✓ Yield & Collateral Solutions ✓ Secure Custody & Infrastructure NOTABLE MANDATES 1 Global Markets Asset Management & Infrastructure SolutionsDIGITAL ASSETS PLATFORM 001 002 Note: Data as of September 30, 2025. (1) Includes mandates that have yet to go live. (2) Expected annual recurring revenue for current mandates, assuming market prices of relevant cryptocurrencies as of September 30, 2025. $2.5B+ Notional volumes traded through Galaxy $4.5B+ Combined AUM and AUS added to our platform $ 40M + Expected annual recurring fee revenue 2

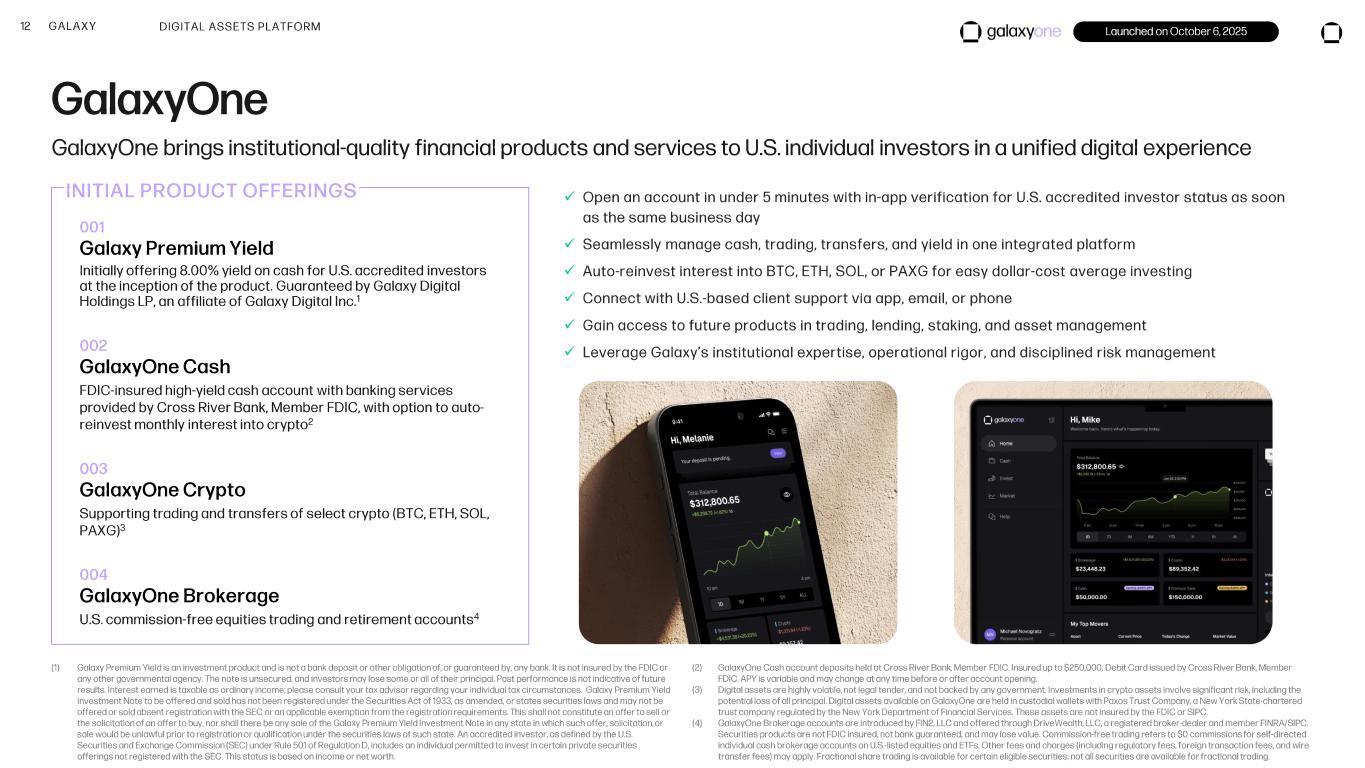

12 GALAXY GalaxyOne GalaxyOne brings institutional -quality financial products and services to U.S. individual investors in a unified digital experie nce Launched on October 6, 2025 001 Galaxy Premium Yield Initially offering 8.00% yield on cash for U.S. accredited investors at the inception of the product. Guaranteed by Galaxy Digital Holdings LP, an affiliate of Galaxy Digital Inc. 1 002 GalaxyOne Cash FDIC -insured high -yield cash account with banking services provided by Cross River Bank , Member FDIC, with option to auto - reinvest monthly interest into crypto 2 003 GalaxyOne Crypto Supporting trading and transfers of select crypto (BTC, ETH, SOL, PAXG) 3 004 GalaxyOne Brokerage U.S. commission -free equities trading and retirement accounts 4 INITIAL PRODUCT OFFERINGS ✓ Open an account in under 5 minutes with in -app verification for U.S. accredited investor status as soon as the same business day ✓ Seamlessly manage cash, trading, transfers, and yield in one integrated platform ✓ Auto -reinvest interest into BTC, ETH, SOL, or PAXG for easy dollar -cost average investing ✓ Connect with U.S. -based client support via app, email, or phone ✓ Gain access to future products in trading, lending, staking, and asset management ✓ Leverage Galaxy’s institutional expertise, operational rigor, and disciplined risk management DIGITAL ASSETS PLATFORM (1) Galaxy Premium Yield is an investment product and is not a bank deposit or other obligation of, or guaranteed by, any bank. I t is not insured by the FDIC or any other governmental agency. The note is unsecured, and investors may lose some or all of their principal. Past performance is not indicative of future results. Interest earned is taxable as ordinary income; please consult your tax advisor regarding your individual tax circums tances. Galaxy Premium Yield Investment Note to be offered and sold has not been registered under the Securities Act of 1933, as amended, or states securi ties laws and may not be offered or sold absent registration with the SEC or an applicable exemption from the registration requirements. This shall no t constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Galaxy Premium Yield Investment Note in any state in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state. An accredited investor , as defined by the U.S. Securities and Exchange Commission (SEC) under Rule 501 of Regulation D, includes an individual permitted to invest in certai n private securities offerings not registered with the SEC. This status is based on income or net worth. (2) GalaxyOne Cash account deposits held at Cross River Bank , Member FDIC. Insured up to $250,000. Debit Card issued by Cross River Bank , Member FDIC. APY is variable and may change at any time before or after account opening. (3) Digital assets are highly volatile, not legal tender, and not backed by any government. Investments in crypto assets involve sig nificant risk, including the potential loss of all principal. Digital assets available on GalaxyOne are held in custodial wallets with Paxos Trust Company , a New York State -chartered trust company regulated by the New York Department of Financial Services. These assets are not insured by the FDIC or SIPC. (4) GalaxyOne Brokerage accounts are introduced by FIN2, LLC and offered through DriveWealth , LLC, a registered broker -dealer and member FINRA/SIPC. Securities products are not FDIC insured, not bank guaranteed, and may lose value. Commission -free trading refers to $0 commissi ons for self -directed individual cash brokerage accounts on U.S. -listed equities and ETFs. Other fees and charges (including regulatory fees, foreign transaction fees, and wire transfer fees) may apply. Fractional share trading is available for certain eligible securities; not all securities are avail able for fractional trading.

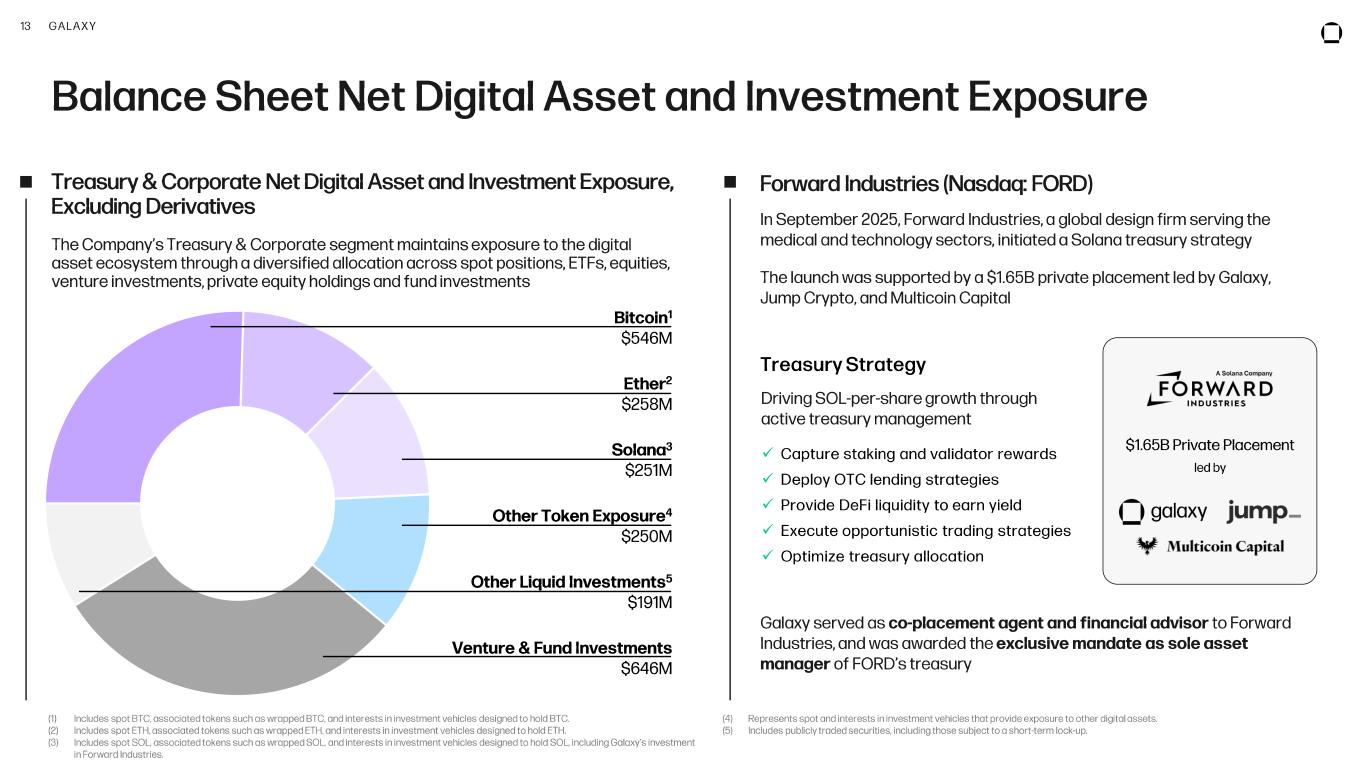

13 GALAXY Balance Sheet Net Digital Asset and Investment Exposure Forward Industries (Nasdaq: FORD) Treasury & Corporate Net Digital Asset and Investment Exposure, Excluding Derivatives The Company’s Treasury & Corporate segment maintains exposure to the digital asset ecosystem through a diversified allocation across spot positions, ETFs, equities, venture investments, private equity holdings and fund investments In September 2025, Forward Industries, a global design firm serving the medical and technology sectors, initiated a Solana treasury strategy The launch was supported by a $1.65B private placement led by Galaxy, Jump Crypto, and Multicoin Capital (1) Includes spot BTC, associated tokens such as wrapped BTC, and interests in investment vehicles designed to hold BTC. (2) Includes spot ETH, associated tokens such as wrapped ETH, and interests in investment vehicles designed to hold ETH. (3) Includes spot SOL, associated tokens such as wrapped SOL, and interests in investment vehicles designed to hold SOL, includin g Galaxy’s investment in Forward Industries. (4) Represents spot and interests in investment vehicles that provide exposure to other digital assets. (5) Includes publicly traded securities, including those subject to a short -term lock-up. Treasury Strategy Driving SOL -per-share growth through active treasury management ✓ Capture staking and validator rewards ✓ Deploy OTC lending strategies ✓ Provide DeFi liquidity to earn yield ✓ Execute opportunistic trading strategies ✓ Optimize treasury allocation $1.65B Private Placement led by Galaxy served as co -placement agent and financial advisor to Forward Industries, and was awarded the exclusive mandate as sole asset manager of FORD’s treasury Bitcoin 1 $546M Ether 2 $258M Solana 3 $251M Venture & Fund Investments $646M Other Token Exposure 4 $250M Other Liquid Investments 5 $191M

14 GALAXY Data Centers Developing infrastructure for an AI -enabled future. Data Centers High-Performance Computing Infrastructure

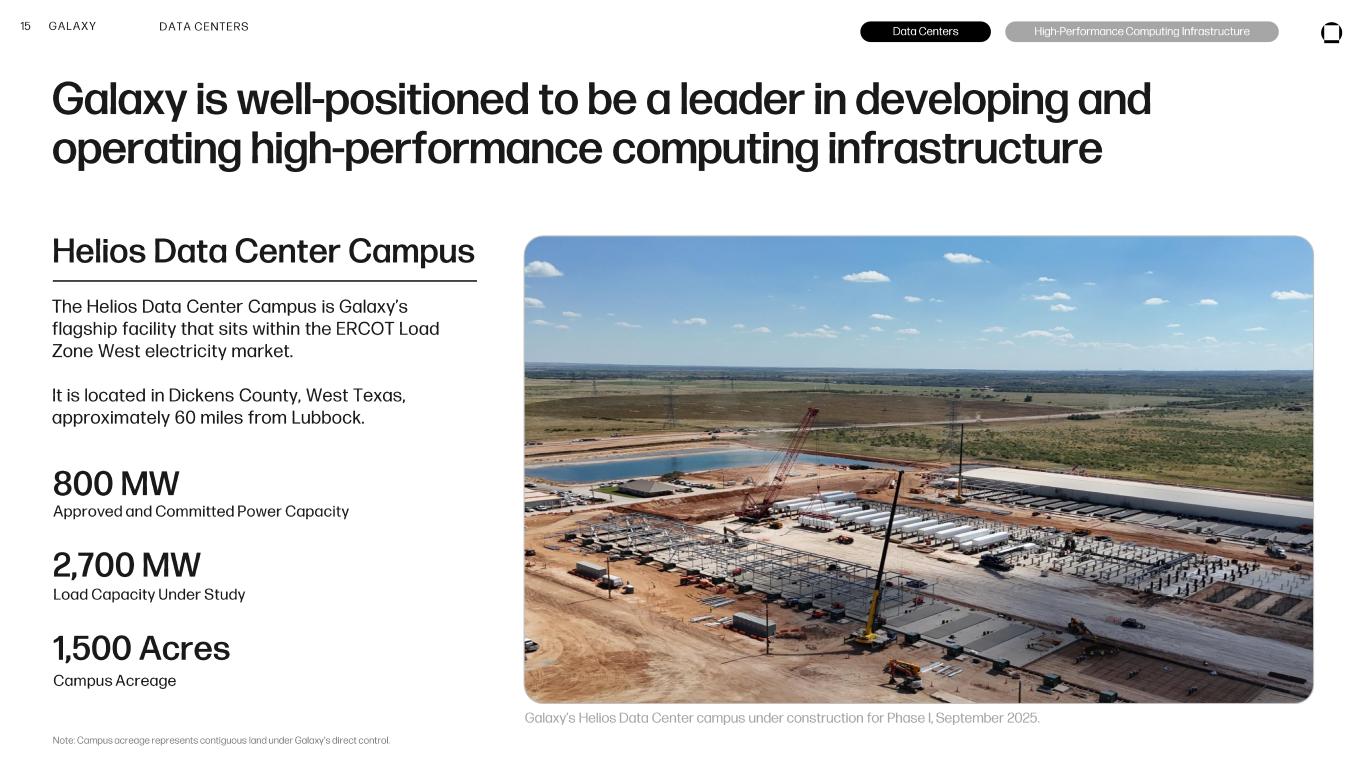

15 GALAXY DATA CENTERS Galaxy is well -positioned to be a leader in developing and operating high -performance computing infrastructure Data Centers High-Performance Computing Infrastructure Note: Campus acreage represents contiguous land under Galaxy’s direct control. Load Capacity Under Study 2,700 MW The Helios Data Center Campus is Galaxy’s flagship facility that sits within the ERCOT Load Zone West electricity market. It is located in Dickens County, West Texas, approximately 60 miles from Lubbock. Helios Data Center Campus 800 MW Approved and Committed Power Capacity 1,500 Acres Campus Acreage Galaxy’s Helios Data Center campus under construction for Phase I, September 2025.

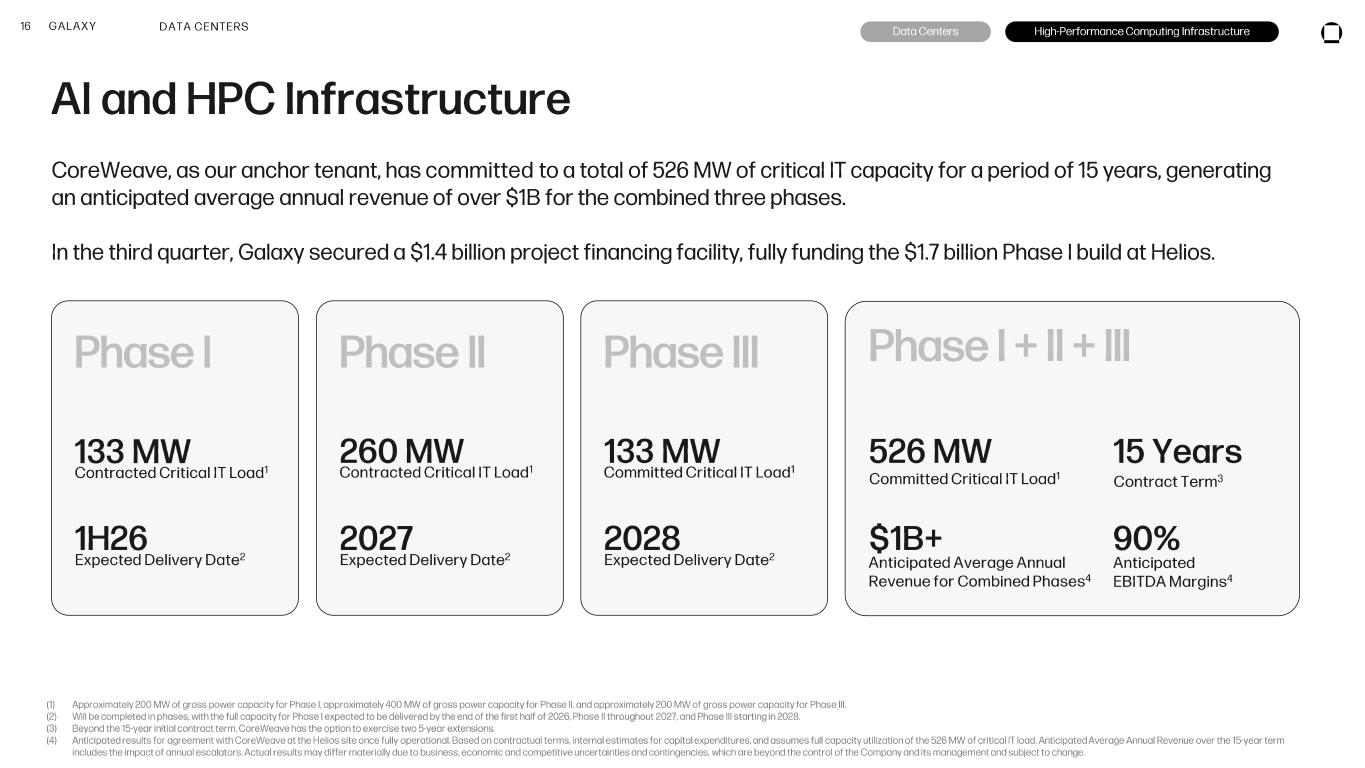

16 GALAXY DATA CENTERS Data Centers High-Performance Computing Infrastructure CoreWeave, as our anchor tenant, has committed to a total of 526 MW of critical IT capacity for a period of 15 years, generating an anticipated average annual revenue of over $1B for the combined three phases. In the third quarter, Galaxy secured a $1.4 billion project financing facility, fully funding the $1.7 billion Phase I build at Helios. AI and HPC Infrastructure Phase I Contracted Critical IT Load 1 133 MW Expected Delivery Date 2 1H26 Phase II Contracted Critical IT Load 1 260 MW Expected Delivery Date 2 2027 Phase I + II + III Anticipated Average Annual Revenue for Combined Phases 4 $1B+ Anticipated EBITDA Margins 4 90% (1) Approximately 200 MW of gross power capacity for Phase I, approximately 400 MW of gross power capacity for Phase II, and appr oximately 200 MW of gross power capacity for Phase III. (2) Will be completed in phases, with the full capacity for Phase I expected to be delivered by the end of the first half of 2026 , Phase II throughout 2027, and Phase III starting in 2028. (3) Beyond the 15-year initial contract term, CoreWeave has the option to exercise two 5 -year extensions. (4) Anticipated results for agreement with CoreWeave at the Helios site once fully operational. Based on contractual terms, internal estimates for ca pital expenditures, and assumes full capacity utilization of the 526 MW of critical IT load. Anticipated Average Annual Revenue over the 15-year term includes the impact of annual escalators. Actual results may differ materially due to business, economic and competitive unce rtainties and contingencies, which are beyond the control of the Company and its management and subject to change. 526 MW Committed Critical IT Load 1 15 Years Contract Term 3 Phase III Committed Critical IT Load 1 133 MW Expected Delivery Date 2 2028

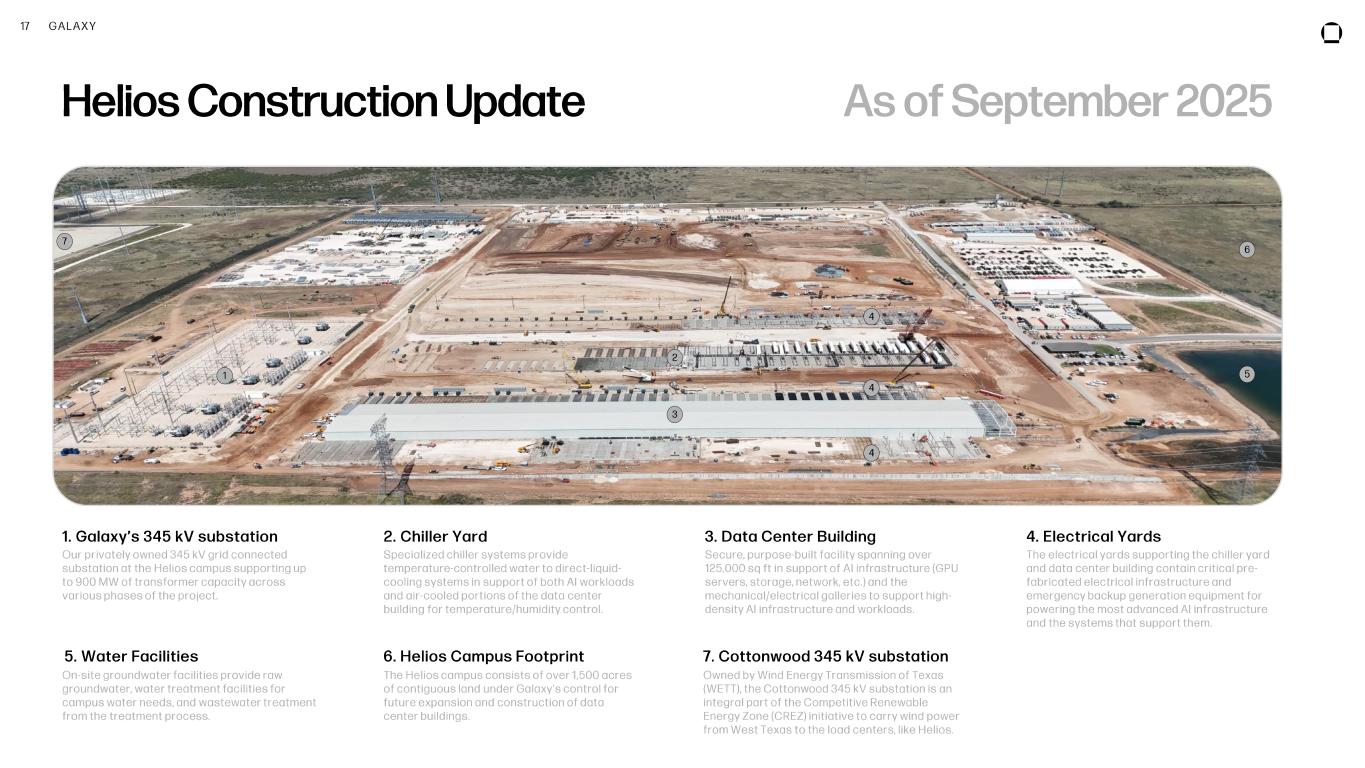

17 GALAXY Helios Construction Update As of September 2025 1 2 4 5 3 7 6 1. Galaxy’s 345 kV substation Our privately owned 345 kV grid connected substation at the Helios campus supporting up to 900 MW of transformer capacity across various phases of the project. 2. Chiller Yard Specialized chiller systems provide temperature -controlled water to direct -liquid - cooling systems in support of both AI workloads and air -cooled portions of the data center building for temperature/humidity control. 4. Electrical Yards The electrical yards supporting the chiller yard and data center building contain critical pre - fabricated electrical infrastructure and emergency backup generation equipment for powering the most advanced AI infrastructure and the systems that support them. 5. Water Facilities On -site groundwater facilities provide raw groundwater, water treatment facilities for campus water needs, and wastewater treatment from the treatment process. 3. Data Center Building Secure, purpose -built facility spanning over 125,000 sq ft in support of AI infrastructure (GPU servers, storage, network , etc.) and the mechanical/electrical galleries to support high - density AI infrastructure and workloads. 7. Cottonwood 345 kV substation Owned by Wind Energy Transmission of Texas (WETT), the Cottonwood 345 kV substation is an integral part of the Competitive Renewable Energy Zone (CREZ) initiative to carry wind power from West Texas to the load centers, like Helios. 4 4 6. Helios Campus Footprint The Helios campus consists of over 1,500 acres of contiguous land under Galaxy’s control for future expansion and construction of data center buildings.

18 GALAXY Appendix

19 GALAXY APPENDIX Reconciliation of Non -GAAP Metrics Reconciliation to Adjusted Gross Profit Three Months Ended September 30, 2025 Revenues and gains / (losses) from operations $29,218,853 (-) Transaction expenses 28,292,777 (-) Impairment of digital assets 197,702 Adjusted gross profit $728,374 Reconciliation to Adjusted EBITDA Three Months Ended September 30, 2025 Net income / (loss) $505,057 Add back: Equity based compensation 22,057 Notes interest expense and other expense 14,415 Taxes 40,145 Depreciation and amortization expense 7,397 Unrealized (gain) / loss on notes payable – derivative - Mining related impairment loss / loss on disposal 38,027 Settlement expense 1,810 Other (income) / expense, net (957) Reorganization and domestication costs 1,401 Adjusted EBITDA $629,352 ($ in thousands)