1 GALAXY A Detailed Overview of Galaxy’s Financials December 2025

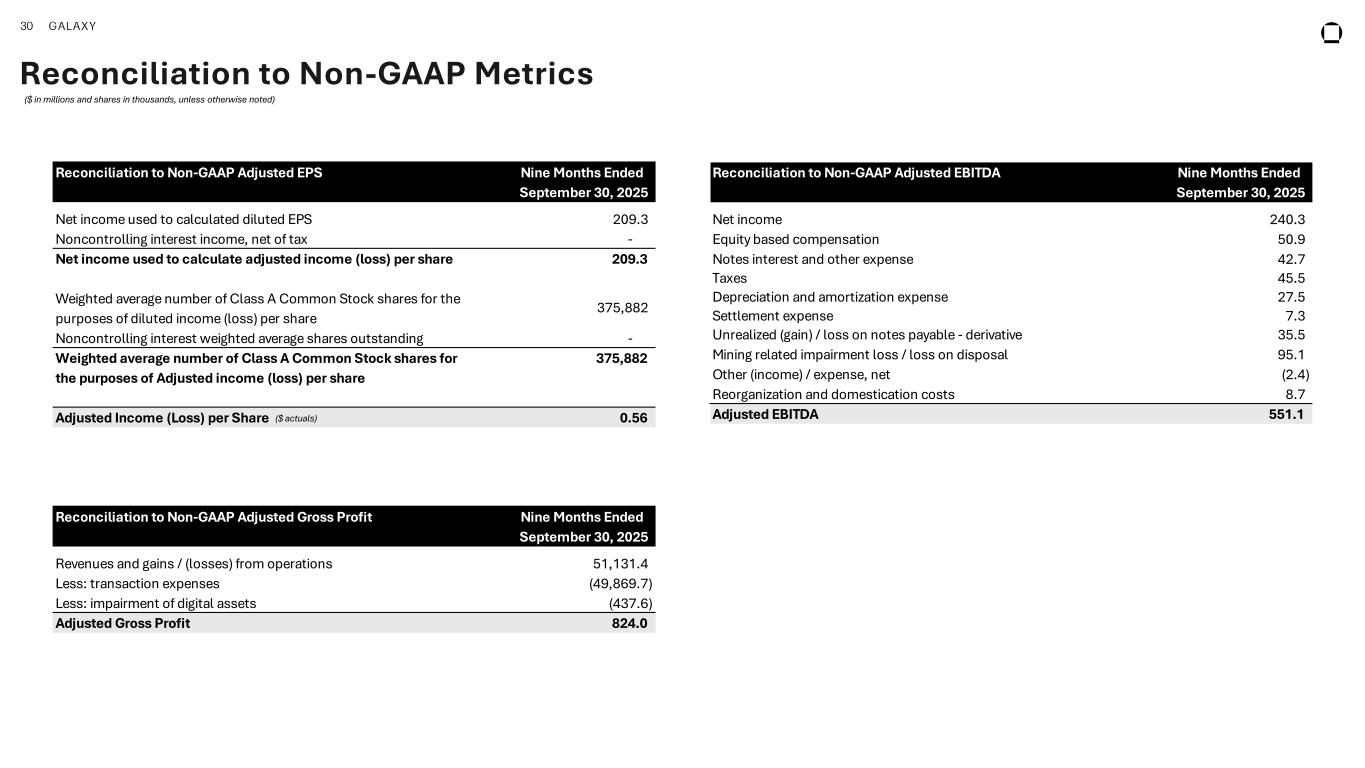

2 GALAXY D is cl ai m er This presentation, and the information contained herein, has been provided to you by Galaxy Digital Inc. and its affiliates (“Galaxy Digital” or “Galaxy”) solely for informational purposes. This document may not be reproduced or redistributed in whole or in part, in any format, without the express written approval of Galaxy Digital. Neither the information, nor any opinion contained in this document, constitutes an offer to buy or sell, or a solicitation of an offer to buy or sell, any advisory services, securities, futures, options or other financial instruments or to participate in any advisory services or trading strategy. Nothing contained in this document constitutes investment, legal or tax advice. You should make your own investigations and evaluations of the information herein. Any decisions based on information contained in this document are the sole responsibility of the reader. Certain statements in this document reflect Galaxy Digital’s views, estimates, opinions or predictions (which may be based on proprietary models and assumptions, including, in particular, Galaxy Digital’s views on the current and future market for certain digital assets), and there is no guarantee that these views, estimates, opinions or predictions are currently accurate or that they will be ultimately realized. To the extent these assumptions or models are not correct or circumstances change, the actual performance may vary substantially from, and be less than, the estimates included herein. None of Galaxy Digital nor any of its affiliates, shareholders, partners, members, directors, officers, management, employees or representatives makes any representation or warranty, express or implied, as to the accuracy or completeness of any of the information or any other information (whether communicated in written or oral form) transmitted or made available to you. Each of the aforementioned parties expressly disclaims any and all liability relating to or resulting from the use of this information. Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Galaxy Digital and Galaxy Digital, does not assume responsibility for the accuracy of such information. Affiliates of Galaxy Digital may have owned or may own investments in some of the digital assets, companies and protocols discussed in this document and the inclusion herein is not an endorsement of such asset or company. Except where otherwise indicated, the information in this document is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof. The Toronto Stock Exchange has not approved or disapproved of the information contained herein. No securities commission or similar regulatory authority in Canada has reviewed the information contained herein or has in any way passed on the merits of the securities of Galaxy Digital or upon the merits of the disclosure record of Galaxy Digital. The information contained herein is not, and under no circumstances is to be construed as, a prospectus, an advertisement or public offering of securities in Canada, nor is there any attempt to induce or cause any person or company to purchase any securities. CAUTION ABOUT FORWARD-LOOKING STATEMENTS This presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and "forward-looking information" under Canadian securities laws (collectively, "forward-looking statements"). Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Statements that are not historical facts, including statements about Galaxy’s business plans and goals, including with respect to the lease with CoreWeave, and the parties, perspectives and expectations related thereto are forward-looking statements. In addition, any statements that refer to estimates, projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on us taking into account information currently available to us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including, but not limited to, those risks contained in filings we make with the Securities and Exchange Commission (the “SEC”) from time to time, including in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025, filed with the SEC on November 10, 2025 and available on Galaxy’s profile at www.sec.gov. Factors that could cause actual results to differ materially from those described in such forward-looking statements include, but are not limited to, financing and construction terms and conditions, a decline in the digital asset market, or general economic conditions; the possibility that our addressable market is smaller than we have anticipated and/or that we may not gain share of the stated addressable market; the failure or delay in the adoption of digital assets and the blockchain ecosystem; a delay or failure in developing infrastructure for our business or our businesses achieving our mandates; delays or other challenges in the mining and AI/HPC infrastructure business related to hosting, power or construction; any challenges faced with respect to exploits, considerations with respect to liquidity and capital planning; and changes in applicable law or regulation and adverse regulatory developments. Should one or more of these risks or uncertainties materialize, they could cause our actual results to differ materially from the forward-looking statements. Except as required by law, we assume no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements. ©Copyright Galaxy Digital 2025 All rights reserved. ®Registered Service Mark of Galaxy Digital Holdings LP Galaxy manages a number of funds, including the Galaxy Crypto Index Fund, Galaxy Ethereum Fund, the Galaxy Bitcoin Funds, the Galaxy Liquid Crypto Fund, the Galaxy Venture Fund I, the Galaxy Interactive Family of Funds and the Galaxy Vision Hill Family of Funds (each a “Fund” and together “Galaxy Funds”) which invests in digital assets. The Information is not an offer to buy or sell, nor is it a solicitation of an offer to buy or sell, interests in the Fund or any advisory services or any other security or to participate in any advisory services or trading strategy. If any offer and sale of securities is made, it will be pursuant to the confidential offering memorandum of the Fund (the “Offering Memorandum”). Any decision to make an investment in the Fund should be made after reviewing such Offering Memorandum, conducting such investigations as the investor deems necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment. The performance of the Fund will vary from the performance of the relevant Index that it tracks. None of the Information has been filed with the SEC, any securities administrator under any state securities laws or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of the offering of any securities by the Fund or Galaxy, or the adequacy of the information contained herein. Any representation to the contrary is a criminal offense in the United States. Investing in the Funds and digital assets involves a substantial degree of risk. There can be no assurance that the investment objectives of the Fund will be achieved. Any investment in the Fund may result in a loss of the entire amount invested. Investment losses may occur, and investors could lose some or all of their investment. Neither historical returns nor economic, market or other performance is an indication of future results. In addition to our results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation and the accompanying tables contain Adjusted Gross Profit, adjusted EBITDA, Adjusted EPS, and EBITDA margin, which are non-GAAP financial measures. Adjusted gross profit, Adjusted EBITDA, Adjusted EPS, and EBITDA margin are unaudited, presented as supplemental disclosure and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Please see slide 30 for a reconciliation of Adjusted Gross Profit to revenues and gains / (losses) from operations (including for our individual segments) during the nine months ended September 30, 2025, of Adjusted EBITDA to net income (loss) (including for our individual segments) and Adjusted Income (loss) Per Share, during the nine months ended September 30, 2025. It is important to note that the particular items we exclude from, or include in, Adjusted Gross Profit, Adjusted EBITDA, Adjusted EPS, and EBITDA margin may differ from the items excluded from, or included in, similar non-GAAP financial measures used by other companies in the same industry. We also periodically review our non-GAAP financial measures and may revise these measures to reflect changes in our business or otherwise. We believe adjusted gross profit is a helpful non-GAAP financial measure to our management and investors because it eliminates the impact of the directly attributable transaction expenses. As such, it provides useful information about our financial performance, enhances the overall understanding of our past performance and future prospects, allows for greater transparency with respect to important metrics used by our management for financial, risk management and operational decision-making and provides an additional tool for investors to use to understand and compare our operating results across accounting periods. Adjusted EBITDA is a non-GAAP financial measure that is used by management, in addition to GAAP financial measures, to understand and compare our operating results across accounting periods, for risk management and operational decision-making. This non-GAAP measure provides investors with additional information in evaluating the Company’s operating performance. Adjusted EBITDA represents Net income / (loss) excluding (i) equity based compensation, (ii) interest expense on structural debt, (iii) taxes, (iv) depreciation and amortization expense, (v) gains and losses on the embedded derivative on our exchangeable notes which ceased to exist upon consolidation as a result of the Reorganization Transactions, (vi) mining-related impairment loss / loss on disposal of mining equipment, (vii) settlement expense, (viii) other (income) / expense, net and (ix) and reorganization and reorganization merger costs. The above items are excluded from our Adjusted EBITDA because these items are non-cash in nature, or because the amount and timing of these items are unpredictable, are not driven by core results of operations, and render comparisons with prior periods and competitors less meaningful. EBITDA Margin is defined as EBITDA, divided by revenue minus pass through expenses for the same period. This non-GAAP financial measure is commonly used as an analytical indicator of performance by investors within the industries in which we operate. EBITDA margin is not a measure of financial performance under GAAP. Items excluded from EBITDA Margin are significant components in understanding and assessing financial performance. EBITDA Margin should not be considered in isolation or as an alternative to or a substitute for financial statement data presented in Galaxy’s Digital’s consolidated financial statements as indicators of financial performance or liquidity (which, in the case of EBITDA margin, is net income margin).

3 GALAXY Today’s Agenda 1. Company Overview 2. Consolidated Financials 3. Digital Assets 4. Treasury & Corporate 5. Data Centers

4 GALAXY Today’s Presenters Jonathan Goldowsky Head of Investor Relations Robert Rico Chief Accounting Officer Tony Paquette Chief Financial Officer Dritan Muneka Head of SEC Reporting and Accounting Policy Brian Wright Co-Head of Data Centers Tessa Wilson Investor Relations Noël Hodnett Investor Relations

5 GALAXY Company Overview

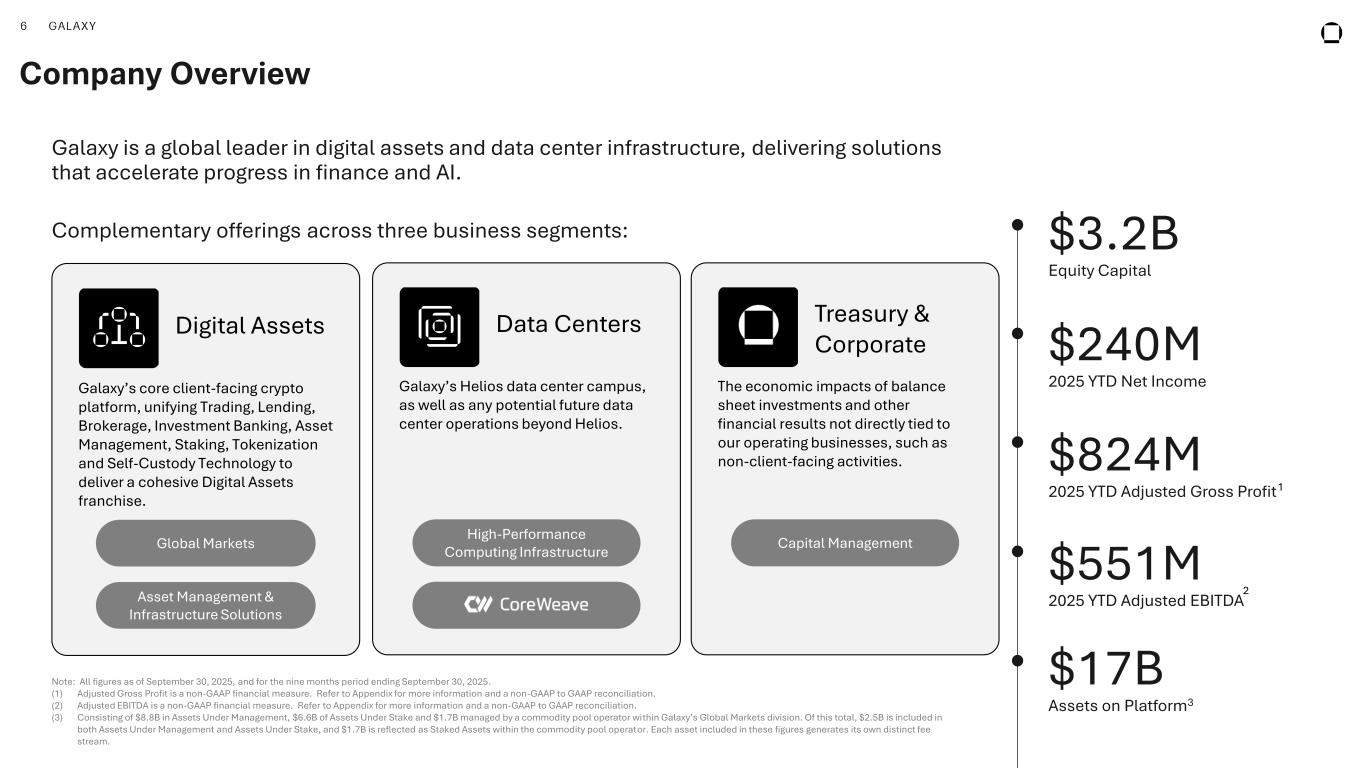

6 GALAXY Company Overview Equity Capital $3.2B Note: All figures as of September 30, 2025, and for the nine months period ending September 30, 2025. (1) Adjusted Gross Profit is a non-GAAP financial measure. Refer to Appendix for more information and a non-GAAP to GAAP reconciliation. (2) Adjusted EBITDA is a non-GAAP financial measure. Refer to Appendix for more information and a non-GAAP to GAAP reconciliation. (3) Consisting of $8.8B in Assets Under Management, $6.6B of Assets Under Stake and $1.7B managed by a commodity pool operator within Galaxy’s Global Markets division. Of this total, $2.5B is included in both Assets Under Management and Assets Under Stake, and $1.7B is reflected as Staked Assets within the commodity pool operator. Each asset included in these figures generates its own distinct fee stream. Galaxy is a global leader in digital assets and data center infrastructure, delivering solutions that accelerate progress in finance and AI. 2025 YTD Net Income $240M 2025 YTD Adjusted Gross Profit $824M 2025 YTD Adjusted EBITDA $551M Complementary offerings across three business segments: Digital Assets Galaxy’s core client-facing crypto platform, unifying Trading, Lending, Brokerage, Investment Banking, Asset Management, Staking, Tokenization and Self-Custody Technology to deliver a cohesive Digital Assets franchise. Global Markets Asset Management & Infrastructure Solutions Data Centers Galaxy’s Helios data center campus, as well as any potential future data center operations beyond Helios. High-Performance Computing Infrastructure Assets on Platform3 $17B 2 1 Treasury & Corporate The economic impacts of balance sheet investments and other financial results not directly tied to our operating businesses, such as non-client-facing activities. Capital Management

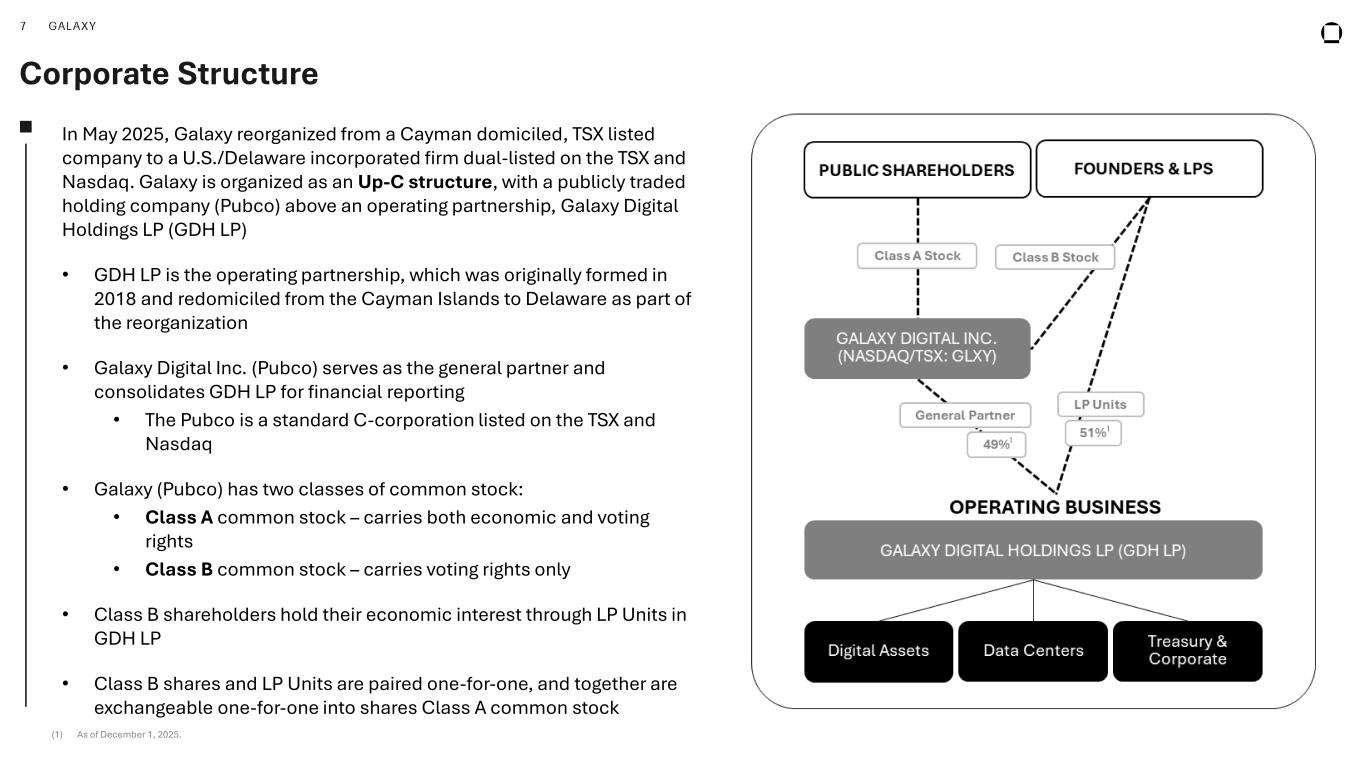

7 GALAXY In May 2025, Galaxy reorganized from a Cayman domiciled, TSX listed company to a U.S./Delaware incorporated firm dual-listed on the TSX and Nasdaq. Galaxy is organized as an Up-C structure, with a publicly traded holding company (Pubco) above an operating partnership, Galaxy Digital Holdings LP (GDH LP) • GDH LP is the operating partnership, which was originally formed in 2018 and redomiciled from the Cayman Islands to Delaware as part of the reorganization • Galaxy Digital Inc. (Pubco) serves as the general partner and consolidates GDH LP for financial reporting • The Pubco is a standard C-corporation listed on the TSX and Nasdaq • Galaxy (Pubco) has two classes of common stock: • Class A common stock – carries both economic and voting rights • Class B common stock – carries voting rights only • Class B shareholders hold their economic interest through LP Units in GDH LP • Class B shares and LP Units are paired one-for-one, and together are exchangeable one-for-one into shares Class A common stock (1) As of December 1, 2025. OPERATING BUSINESS Digital Assets Data Centers Treasury & Corporate GALAXY DIGITAL HOLDINGS LP (GDH LP) PUBLIC SHAREHOLDERS FOUNDERS & LPS 49% 51% GALAXY DIGITAL INC. (NASDAQ/TSX: GLXY) LP Units Class B StockClass A Stock General Partner 1 1 Corporate Structure

8 GALAXY Consolidated Financials

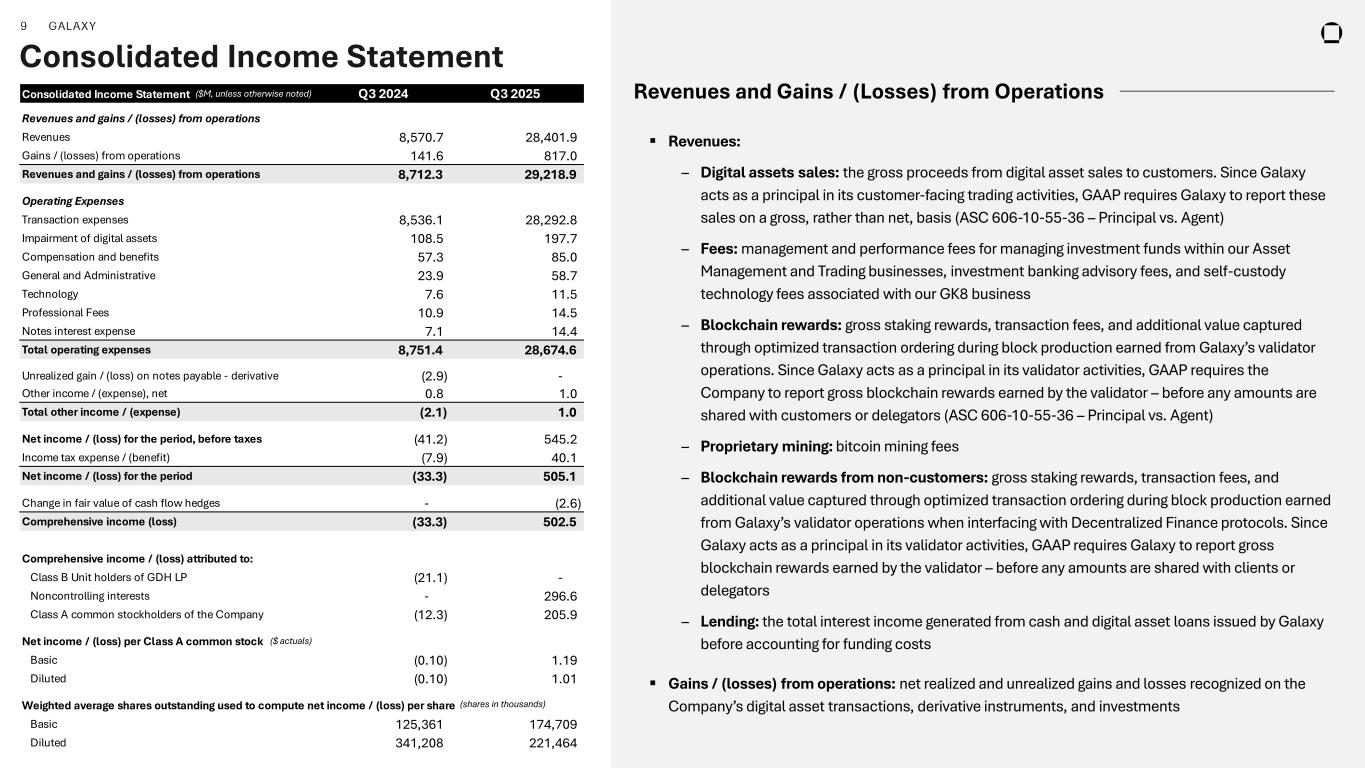

9 GALAXY Consolidated Income Statement ▪ Revenues: – Digital assets sales: the gross proceeds from digital asset sales to customers. Since Galaxy acts as a principal in its customer-facing trading activities, GAAP requires Galaxy to report these sales on a gross, rather than net, basis (ASC 606-10-55-36 – Principal vs. Agent) – Fees: management and performance fees for managing investment funds within our Asset Management and Trading businesses, investment banking advisory fees, and self-custody technology fees associated with our GK8 business – Blockchain rewards: gross staking rewards, transaction fees, and additional value captured through optimized transaction ordering during block production earned from Galaxy’s validator operations. Since Galaxy acts as a principal in its validator activities, GAAP requires the Company to report gross blockchain rewards earned by the validator – before any amounts are shared with customers or delegators (ASC 606-10-55-36 – Principal vs. Agent) – Proprietary mining: bitcoin mining fees – Blockchain rewards from non-customers: gross staking rewards, transaction fees, and additional value captured through optimized transaction ordering during block production earned from Galaxy’s validator operations when interfacing with Decentralized Finance protocols. Since Galaxy acts as a principal in its validator activities, GAAP requires Galaxy to report gross blockchain rewards earned by the validator – before any amounts are shared with clients or delegators – Lending: the total interest income generated from cash and digital asset loans issued by Galaxy before accounting for funding costs ▪ Gains / (losses) from operations: net realized and unrealized gains and losses recognized on the Company’s digital asset transactions, derivative instruments, and investments Consolidated Income Statement Q3 2024 Q3 2025 Revenues and gains / (losses) from operations Revenues 8,570.7 28,401.9 Gains / (losses) from operations 141.6 817.0 Revenues and gains / (losses) from operations 8,712.3 29,218.9 Operating Expenses Transaction expenses 8,536.1 28,292.8 Impairment of digital assets 108.5 197.7 Compensation and benefits 57.3 85.0 General and Administrative 23.9 58.7 Technology 7.6 11.5 Professional Fees 10.9 14.5 Notes interest expense 7.1 14.4 Total operating expenses 8,751.4 28,674.6 Unrealized gain / (loss) on notes payable - derivative (2.9) - Other income / (expense), net 0.8 1.0 Total other income / (expense) (2.1) 1.0 Net income / (loss) for the period, before taxes (41.2) 545.2 Income tax expense / (benefit) (7.9) 40.1 Net income / (loss) for the period (33.3) 505.1 Change in fair value of cash flow hedges - (2.6) Comprehensive income (loss) (33.3) 502.5 Comprehensive income / (loss) attributed to: Class B Unit holders of GDH LP (21.1) - Noncontrolling interests - 296.6 Class A common stockholders of the Company (12.3) 205.9 Net income / (loss) per Class A common stock Basic (0.10) 1.19 Diluted (0.10) 1.01 Weighted average shares outstanding used to compute net income / (loss) per share Basic 125,361 174,709 Diluted 341,208 221,464 Revenues and Gains / (Losses) from Operations ($M, unless otherwise noted) (shares in thousands) ($ actuals)

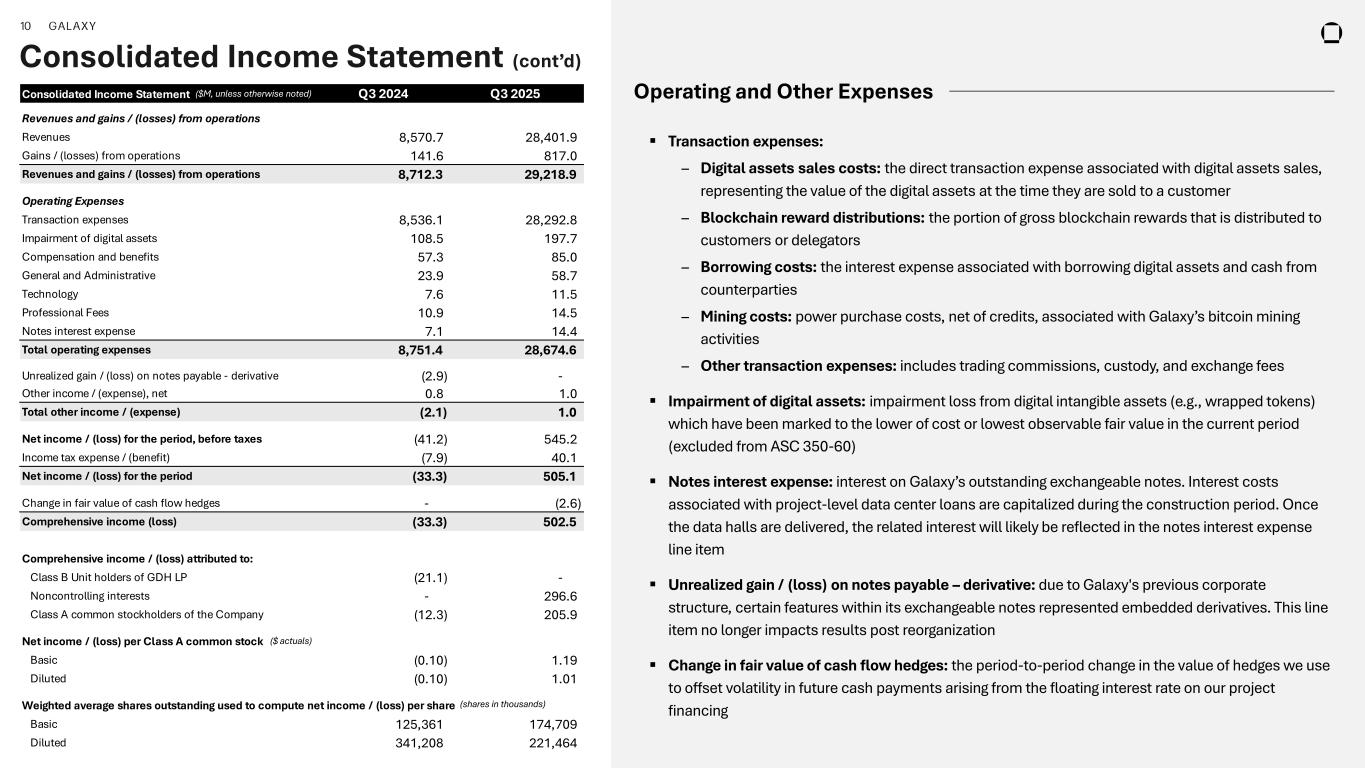

10 GALAXY Consolidated Income Statement (cont’d) ▪ Transaction expenses: – Digital assets sales costs: the direct transaction expense associated with digital assets sales, representing the value of the digital assets at the time they are sold to a customer – Blockchain reward distributions: the portion of gross blockchain rewards that is distributed to customers or delegators – Borrowing costs: the interest expense associated with borrowing digital assets and cash from counterparties – Mining costs: power purchase costs, net of credits, associated with Galaxy’s bitcoin mining activities – Other transaction expenses: includes trading commissions, custody, and exchange fees ▪ Impairment of digital assets: impairment loss from digital intangible assets (e.g., wrapped tokens) which have been marked to the lower of cost or lowest observable fair value in the current period (excluded from ASC 350-60) ▪ Notes interest expense: interest on Galaxy’s outstanding exchangeable notes. Interest costs associated with project-level data center loans are capitalized during the construction period. Once the data halls are delivered, the related interest will likely be reflected in the notes interest expense line item ▪ Unrealized gain / (loss) on notes payable – derivative: due to Galaxy's previous corporate structure, certain features within its exchangeable notes represented embedded derivatives. This line item no longer impacts results post reorganization ▪ Change in fair value of cash flow hedges: the period-to-period change in the value of hedges we use to offset volatility in future cash payments arising from the floating interest rate on our project financing Operating and Other ExpensesConsolidated Income Statement Q3 2024 Q3 2025 Revenues and gains / (losses) from operations Revenues 8,570.7 28,401.9 Gains / (losses) from operations 141.6 817.0 Revenues and gains / (losses) from operations 8,712.3 29,218.9 Operating Expenses Transaction expenses 8,536.1 28,292.8 Impairment of digital assets 108.5 197.7 Compensation and benefits 57.3 85.0 General and Administrative 23.9 58.7 Technology 7.6 11.5 Professional Fees 10.9 14.5 Notes interest expense 7.1 14.4 Total operating expenses 8,751.4 28,674.6 Unrealized gain / (loss) on notes payable - derivative (2.9) - Other income / (expense), net 0.8 1.0 Total other income / (expense) (2.1) 1.0 Net income / (loss) for the period, before taxes (41.2) 545.2 Income tax expense / (benefit) (7.9) 40.1 Net income / (loss) for the period (33.3) 505.1 Change in fair value of cash flow hedges - (2.6) Comprehensive income (loss) (33.3) 502.5 Comprehensive income / (loss) attributed to: Class B Unit holders of GDH LP (21.1) - Noncontrolling interests - 296.6 Class A common stockholders of the Company (12.3) 205.9 Net income / (loss) per Class A common stock Basic (0.10) 1.19 Diluted (0.10) 1.01 Weighted average shares outstanding used to compute net income / (loss) per share Basic 125,361 174,709 Diluted 341,208 221,464 ($M, unless otherwise noted) ($ actuals) (shares in thousands)

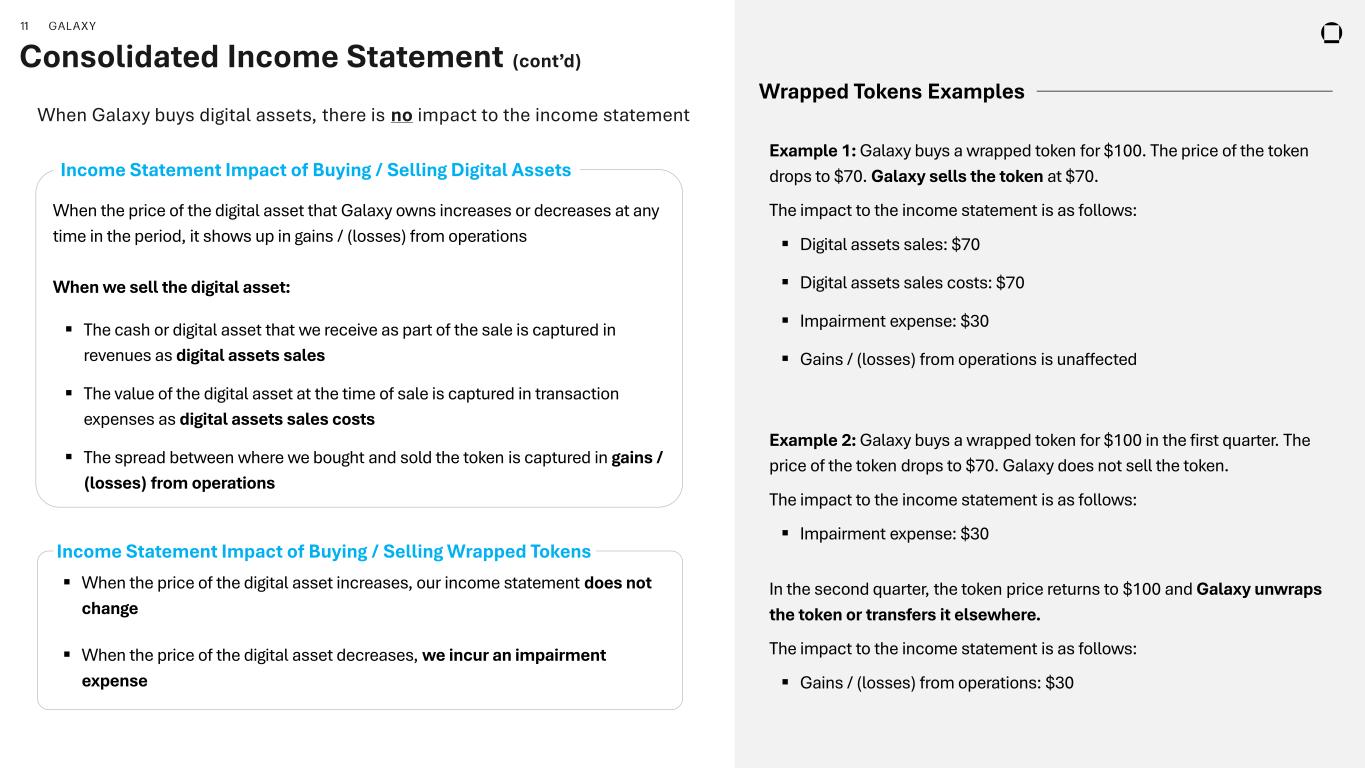

11 GALAXY Consolidated Income Statement (cont’d) Example 1: Galaxy buys a wrapped token for $100. The price of the token drops to $70. Galaxy sells the token at $70. The impact to the income statement is as follows: ▪ Digital assets sales: $70 ▪ Digital assets sales costs: $70 ▪ Impairment expense: $30 ▪ Gains / (losses) from operations is unaffected Example 2: Galaxy buys a wrapped token for $100 in the first quarter. The price of the token drops to $70. Galaxy does not sell the token. The impact to the income statement is as follows: ▪ Impairment expense: $30 In the second quarter, the token price returns to $100 and Galaxy unwraps the token or transfers it elsewhere. The impact to the income statement is as follows: ▪ Gains / (losses) from operations: $30 Wrapped Tokens Examples When the price of the digital asset that Galaxy owns increases or decreases at any time in the period, it shows up in gains / (losses) from operations When we sell the digital asset: ▪ The cash or digital asset that we receive as part of the sale is captured in revenues as digital assets sales ▪ The value of the digital asset at the time of sale is captured in transaction expenses as digital assets sales costs ▪ The spread between where we bought and sold the token is captured in gains / (losses) from operations Income Statement Impact of Buying / Selling Digital Assets ▪ When the price of the digital asset increases, our income statement does not change ▪ When the price of the digital asset decreases, we incur an impairment expense Income Statement Impact of Buying / Selling Wrapped Tokens When Galaxy buys digital assets, there is no impact to the income statement

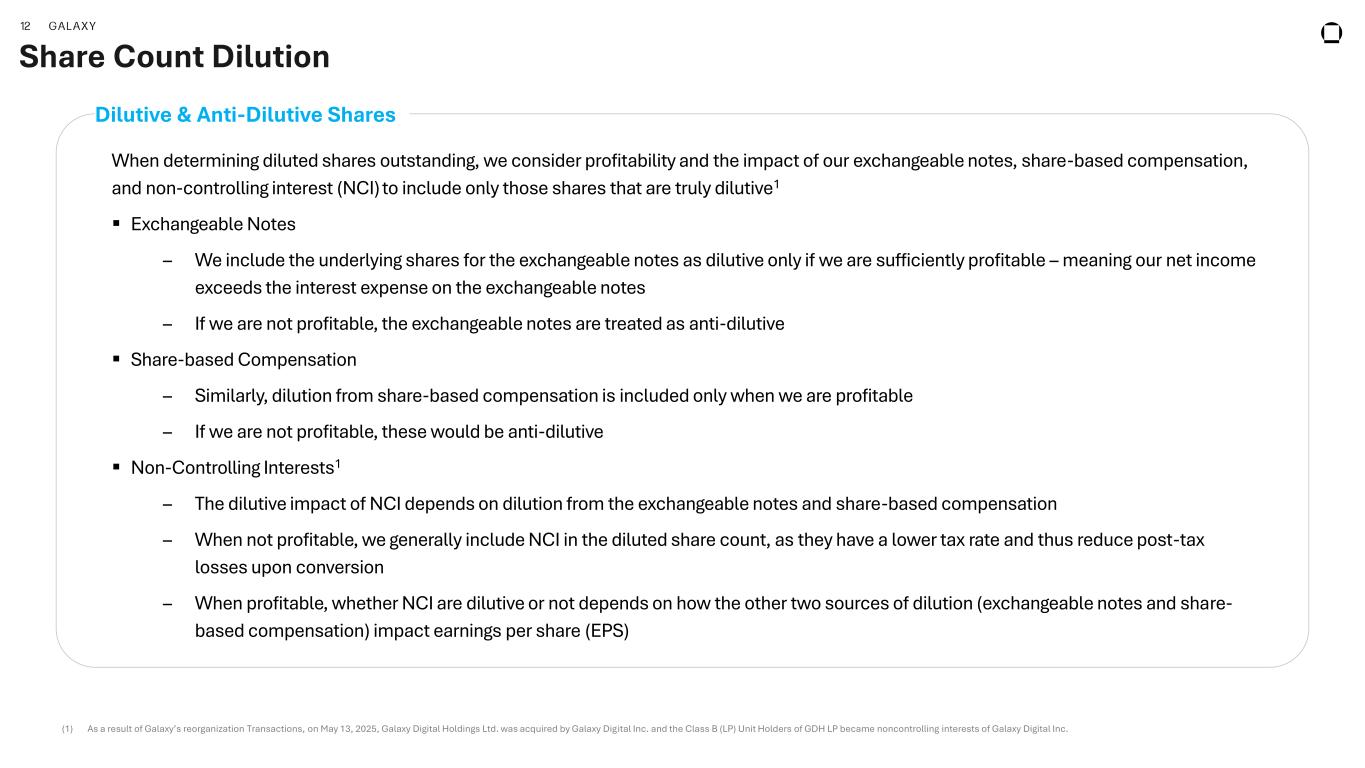

12 GALAXY Share Count Dilution Dilutive & Anti-Dilutive Shares When determining diluted shares outstanding, we consider profitability and the impact of our exchangeable notes, share-based compensation, and non-controlling interest (NCI) to include only those shares that are truly dilutive1 ▪ Exchangeable Notes – We include the underlying shares for the exchangeable notes as dilutive only if we are sufficiently profitable – meaning our net income exceeds the interest expense on the exchangeable notes – If we are not profitable, the exchangeable notes are treated as anti-dilutive ▪ Share-based Compensation – Similarly, dilution from share-based compensation is included only when we are profitable – If we are not profitable, these would be anti-dilutive ▪ Non-Controlling Interests1 – The dilutive impact of NCI depends on dilution from the exchangeable notes and share-based compensation – When not profitable, we generally include NCI in the diluted share count, as they have a lower tax rate and thus reduce post-tax losses upon conversion – When profitable, whether NCI are dilutive or not depends on how the other two sources of dilution (exchangeable notes and share- based compensation) impact earnings per share (EPS) (1) As a result of Galaxy’s reorganization Transactions, on May 13, 2025, Galaxy Digital Holdings Ltd. was acquired by Galaxy Digital Inc. and the Class B (LP) Unit Holders of GDH LP became noncontrolling interests of Galaxy Digital Inc.

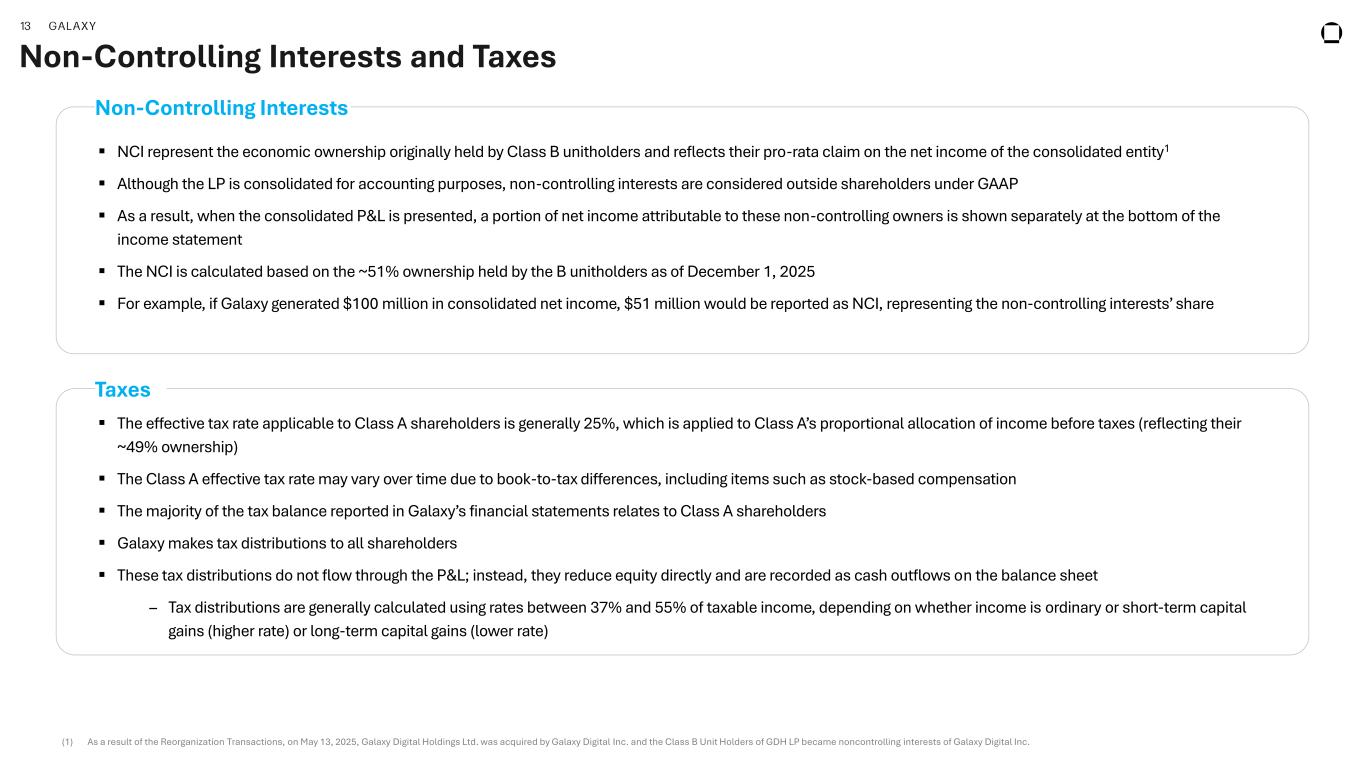

13 GALAXY Non-Controlling Interests and Taxes Non-Controlling Interests ▪ NCI represent the economic ownership originally held by Class B unitholders and reflects their pro-rata claim on the net income of the consolidated entity1 ▪ Although the LP is consolidated for accounting purposes, non-controlling interests are considered outside shareholders under GAAP ▪ As a result, when the consolidated P&L is presented, a portion of net income attributable to these non-controlling owners is shown separately at the bottom of the income statement ▪ The NCI is calculated based on the ~51% ownership held by the B unitholders as of December 1, 2025 ▪ For example, if Galaxy generated $100 million in consolidated net income, $51 million would be reported as NCI, representing the non-controlling interests’ share Taxes ▪ The effective tax rate applicable to Class A shareholders is generally 25%, which is applied to Class A’s proportional allocation of income before taxes (reflecting their ~49% ownership) ▪ The Class A effective tax rate may vary over time due to book-to-tax differences, including items such as stock-based compensation ▪ The majority of the tax balance reported in Galaxy’s financial statements relates to Class A shareholders ▪ Galaxy makes tax distributions to all shareholders ▪ These tax distributions do not flow through the P&L; instead, they reduce equity directly and are recorded as cash outflows on the balance sheet – Tax distributions are generally calculated using rates between 37% and 55% of taxable income, depending on whether income is ordinary or short-term capital gains (higher rate) or long-term capital gains (lower rate) (1) As a result of the Reorganization Transactions, on May 13, 2025, Galaxy Digital Holdings Ltd. was acquired by Galaxy Digital Inc. and the Class B Unit Holders of GDH LP became noncontrolling interests of Galaxy Digital Inc.

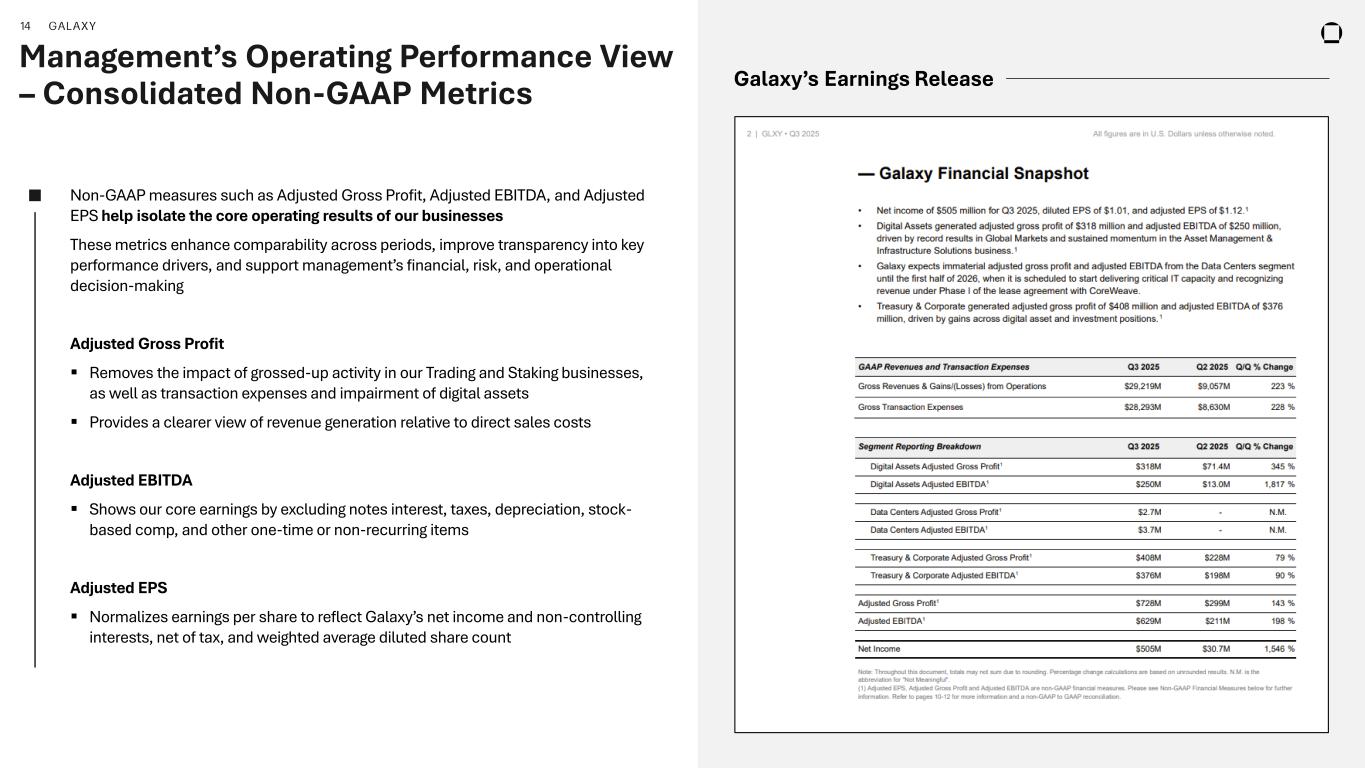

14 GALAXY Management’s Operating Performance View – Consolidated Non-GAAP Metrics Non-GAAP measures such as Adjusted Gross Profit, Adjusted EBITDA, and Adjusted EPS help isolate the core operating results of our businesses These metrics enhance comparability across periods, improve transparency into key performance drivers, and support management’s financial, risk, and operational decision-making Adjusted Gross Profit ▪ Removes the impact of grossed-up activity in our Trading and Staking businesses, as well as transaction expenses and impairment of digital assets ▪ Provides a clearer view of revenue generation relative to direct sales costs Adjusted EBITDA ▪ Shows our core earnings by excluding notes interest, taxes, depreciation, stock- based comp, and other one-time or non-recurring items Adjusted EPS ▪ Normalizes earnings per share to reflect Galaxy’s net income and non-controlling interests, net of tax, and weighted average diluted share count Galaxy’s Earnings Release

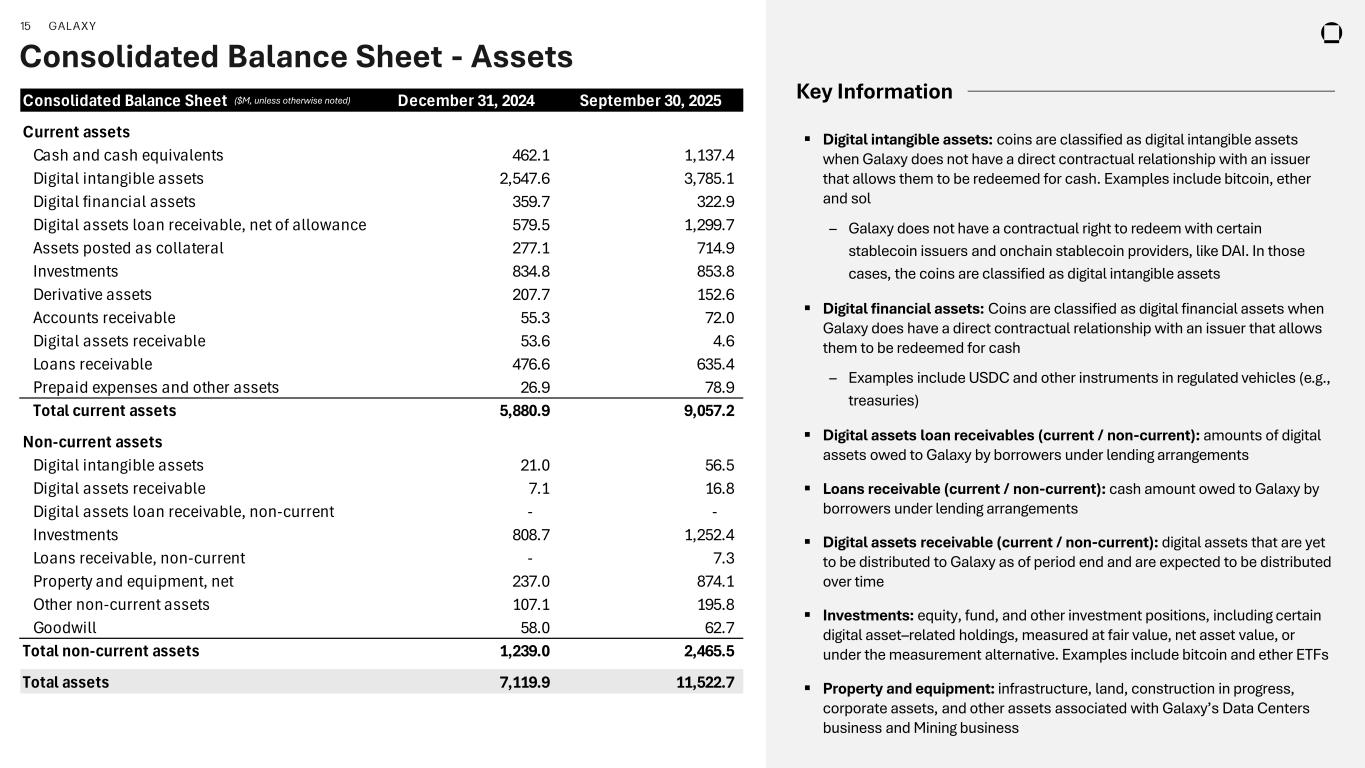

15 GALAXY Consolidated Balance Sheet December 31, 2024 September 30, 2025 Current assets Cash and cash equivalents 462.1 1,137.4 Digital intangible assets 2,547.6 3,785.1 Digital financial assets 359.7 322.9 Digital assets loan receivable, net of allowance 579.5 1,299.7 Assets posted as collateral 277.1 714.9 Investments 834.8 853.8 Derivative assets 207.7 152.6 Accounts receivable 55.3 72.0 Digital assets receivable 53.6 4.6 Loans receivable 476.6 635.4 Prepaid expenses and other assets 26.9 78.9 Total current assets 5,880.9 9,057.2 Non-current assets Digital intangible assets 21.0 56.5 Digital assets receivable 7.1 16.8 Digital assets loan receivable, non-current - - Investments 808.7 1,252.4 Loans receivable, non-current - 7.3 Property and equipment, net 237.0 874.1 Other non-current assets 107.1 195.8 Goodwill 58.0 62.7 Total non-current assets 1,239.0 2,465.5 Total assets 7,119.9 11,522.7 Consolidated Balance Sheet - Assets ▪ Digital intangible assets: coins are classified as digital intangible assets when Galaxy does not have a direct contractual relationship with an issuer that allows them to be redeemed for cash. Examples include bitcoin, ether and sol – Galaxy does not have a contractual right to redeem with certain stablecoin issuers and onchain stablecoin providers, like DAI. In those cases, the coins are classified as digital intangible assets ▪ Digital financial assets: Coins are classified as digital financial assets when Galaxy does have a direct contractual relationship with an issuer that allows them to be redeemed for cash – Examples include USDC and other instruments in regulated vehicles (e.g., treasuries) ▪ Digital assets loan receivables (current / non-current): amounts of digital assets owed to Galaxy by borrowers under lending arrangements ▪ Loans receivable (current / non-current): cash amount owed to Galaxy by borrowers under lending arrangements ▪ Digital assets receivable (current / non-current): digital assets that are yet to be distributed to Galaxy as of period end and are expected to be distributed over time ▪ Investments: equity, fund, and other investment positions, including certain digital asset–related holdings, measured at fair value, net asset value, or under the measurement alternative. Examples include bitcoin and ether ETFs ▪ Property and equipment: infrastructure, land, construction in progress, corporate assets, and other assets associated with Galaxy’s Data Centers business and Mining business Key Information($M, unless otherwise noted)

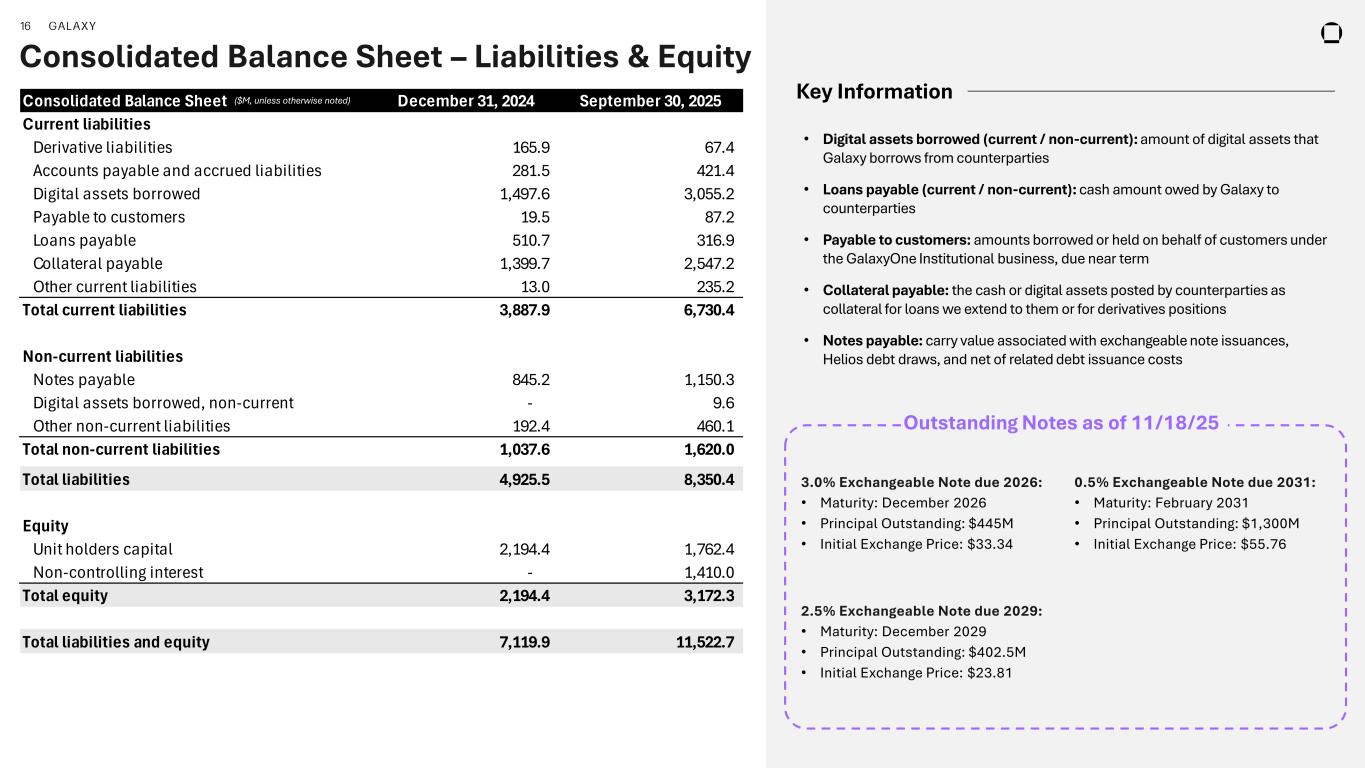

16 GALAXY Consolidated Balance Sheet December 31, 2024 September 30, 2025 Current liabilities Derivative liabilities 165.9 67.4 Accounts payable and accrued liabilities 281.5 421.4 Digital assets borrowed 1,497.6 3,055.2 Payable to customers 19.5 87.2 Loans payable 510.7 316.9 Collateral payable 1,399.7 2,547.2 Other current liabilities 13.0 235.2 Total current liabilities 3,887.9 6,730.4 Non-current liabilities Notes payable 845.2 1,150.3 Digital assets borrowed, non-current - 9.6 Other non-current liabilities 192.4 460.1 Total non-current liabilities 1,037.6 1,620.0 Total liabilities 4,925.5 8,350.4 Equity Unit holders capital 2,194.4 1,762.4 Non-controlling interest - 1,410.0 Total equity 2,194.4 3,172.3 Total liabilities and equity 7,119.9 11,522.7 Consolidated Balance Sheet – Liabilities & Equity • Digital assets borrowed (current / non-current): amount of digital assets that Galaxy borrows from counterparties • Loans payable (current / non-current): cash amount owed by Galaxy to counterparties • Payable to customers: amounts borrowed or held on behalf of customers under the GalaxyOne Institutional business, due near term • Collateral payable: the cash or digital assets posted by counterparties as collateral for loans we extend to them or for derivatives positions • Notes payable: carry value associated with exchangeable note issuances, Helios debt draws, and net of related debt issuance costs Key Information 3.0% Exchangeable Note due 2026: • Maturity: December 2026 • Principal Outstanding: $445M • Initial Exchange Price: $33.34 2.5% Exchangeable Note due 2029: • Maturity: December 2029 • Principal Outstanding: $402.5M • Initial Exchange Price: $23.81 0.5% Exchangeable Note due 2031: • Maturity: February 2031 • Principal Outstanding: $1,300M • Initial Exchange Price: $55.76 Outstanding Notes as of 11/18/25 ($M, unless otherwise noted)

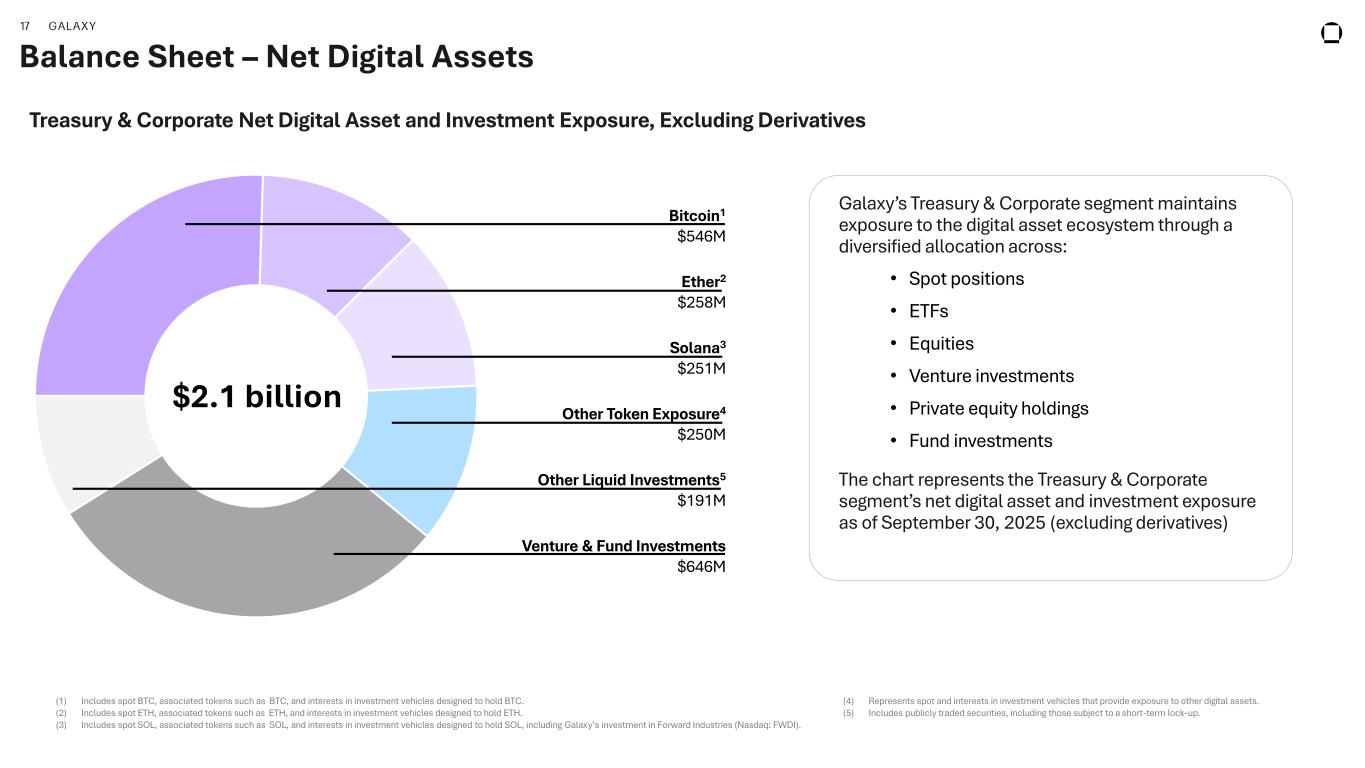

17 GALAXY Balance Sheet – Net Digital Assets Bitcoin1 $546M Ether2 $258M Solana3 $251M Venture & Fund Investments $646M Other Token Exposure4 $250M Other Liquid Investments5 $191M (1) Includes spot BTC, associated tokens such as BTC, and interests in investment vehicles designed to hold BTC. (2) Includes spot ETH, associated tokens such as ETH, and interests in investment vehicles designed to hold ETH. (3) Includes spot SOL, associated tokens such as SOL, and interests in investment vehicles designed to hold SOL, including Galaxy’s investment in Forward Industries (Nasdaq: FWDI). (4) Represents spot and interests in investment vehicles that provide exposure to other digital assets. (5) Includes publicly traded securities, including those subject to a short-term lock-up. Treasury & Corporate Net Digital Asset and Investment Exposure, Excluding Derivatives Galaxy’s Treasury & Corporate segment maintains exposure to the digital asset ecosystem through a diversified allocation across: • Spot positions • ETFs • Equities • Venture investments • Private equity holdings • Fund investments The chart represents the Treasury & Corporate segment’s net digital asset and investment exposure as of September 30, 2025 (excluding derivatives) $2.1 billion

18 GALAXY Digital Assets

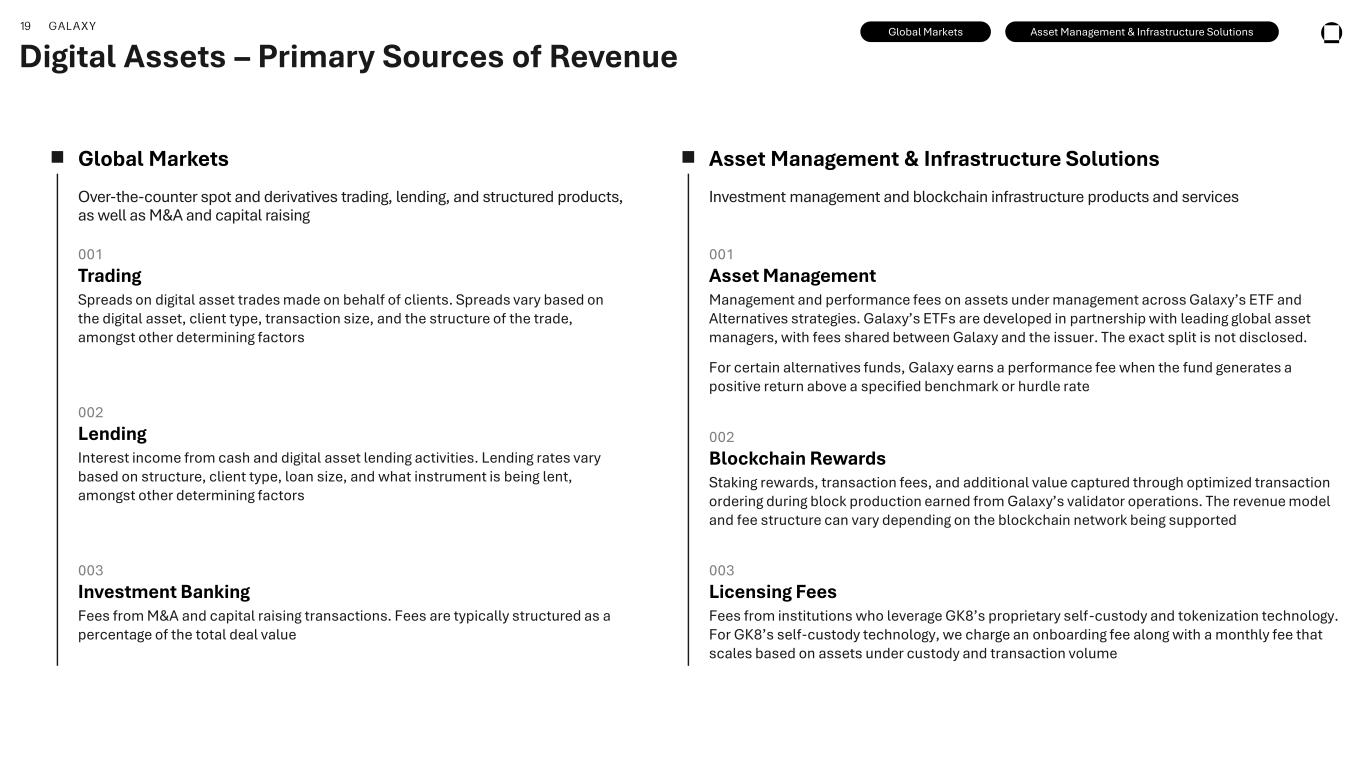

19 GALAXY Digital Assets – Primary Sources of Revenue Over-the-counter spot and derivatives trading, lending, and structured products, as well as M&A and capital raising Investment management and blockchain infrastructure products and services 001 Trading Spreads on digital asset trades made on behalf of clients. Spreads vary based on the digital asset, client type, transaction size, and the structure of the trade, amongst other determining factors 003 Investment Banking Fees from M&A and capital raising transactions. Fees are typically structured as a percentage of the total deal value 002 Lending Interest income from cash and digital asset lending activities. Lending rates vary based on structure, client type, loan size, and what instrument is being lent, amongst other determining factors 001 Asset Management Management and performance fees on assets under management across Galaxy’s ETF and Alternatives strategies. Galaxy’s ETFs are developed in partnership with leading global asset managers, with fees shared between Galaxy and the issuer. The exact split is not disclosed. For certain alternatives funds, Galaxy earns a performance fee when the fund generates a positive return above a specified benchmark or hurdle rate 003 Licensing Fees Fees from institutions who leverage GK8’s proprietary self-custody and tokenization technology. For GK8’s self-custody technology, we charge an onboarding fee along with a monthly fee that scales based on assets under custody and transaction volume 002 Blockchain Rewards Staking rewards, transaction fees, and additional value captured through optimized transaction ordering during block production earned from Galaxy’s validator operations. The revenue model and fee structure can vary depending on the blockchain network being supported Global Markets Asset Management & Infrastructure Solutions Global Markets Asset Management & Infrastructure Solutions

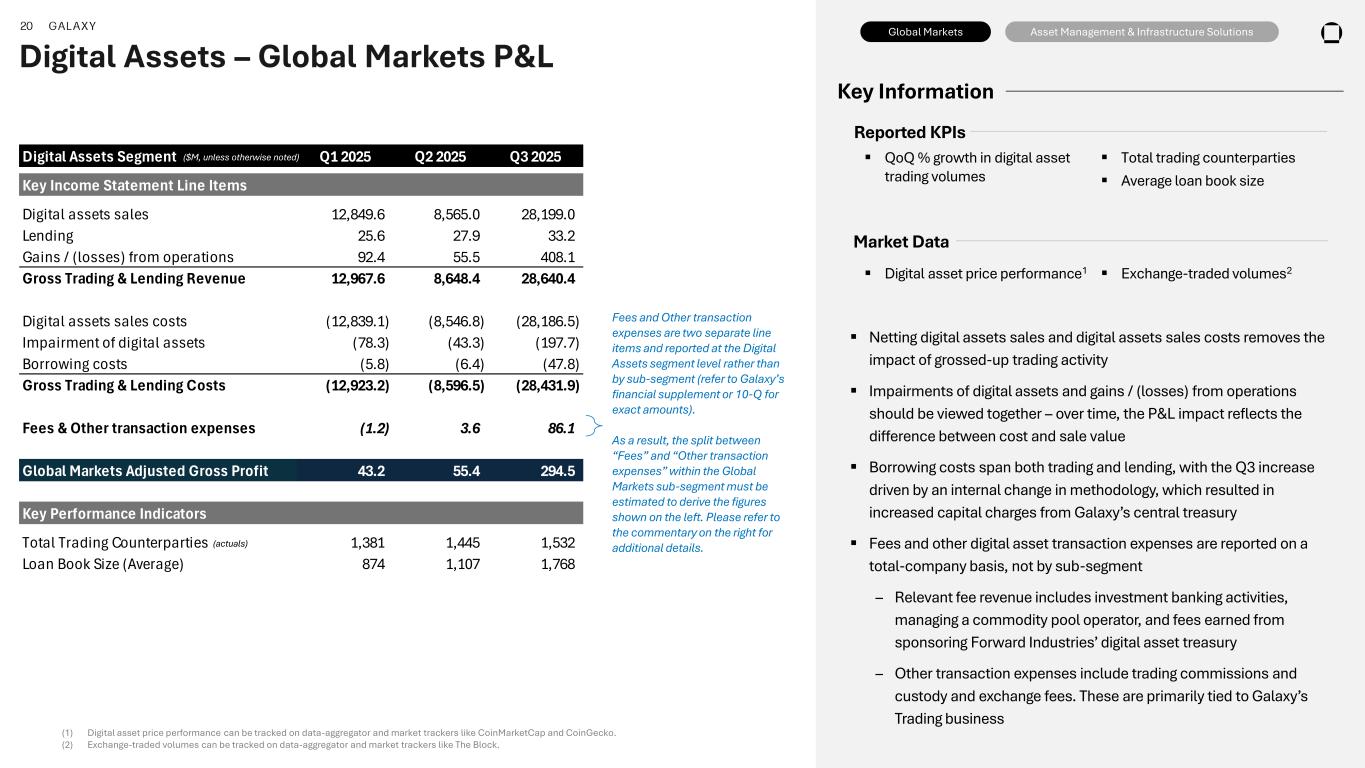

20 GALAXY Digital Assets Segment Q1 2025 Q2 2025 Q3 2025 Key Income Statement Line Items Digital assets sales 12,849.6 8,565.0 28,199.0 Lending 25.6 27.9 33.2 Gains / (losses) from operations 92.4 55.5 408.1 Gross Trading & Lending Revenue 12,967.6 8,648.4 28,640.4 Digital assets sales costs (12,839.1) (8,546.8) (28,186.5) Impairment of digital assets (78.3) (43.3) (197.7) Borrowing costs (5.8) (6.4) (47.8) Gross Trading & Lending Costs (12,923.2) (8,596.5) (28,431.9) Fees & Other transaction expenses (1.2) 3.6 86.1 Global Markets Adjusted Gross Profit 43.2 55.4 294.5 Key Performance Indicators Total Trading Counterparties 1,381 1,445 1,532 Loan Book Size (Average) 874 1,107 1,768 Global Markets Asset Management & Infrastructure Solutions Digital Assets – Global Markets P&L ▪ QoQ % growth in digital asset trading volumes ▪ Total trading counterparties ▪ Average loan book size Reported KPIs ▪ Digital asset price performance1 ▪ Exchange-traded volumes2 Market Data ▪ Netting digital assets sales and digital assets sales costs removes the impact of grossed-up trading activity ▪ Impairments of digital assets and gains / (losses) from operations should be viewed together – over time, the P&L impact reflects the difference between cost and sale value ▪ Borrowing costs span both trading and lending, with the Q3 increase driven by an internal change in methodology, which resulted in increased capital charges from Galaxy’s central treasury ▪ Fees and other digital asset transaction expenses are reported on a total-company basis, not by sub-segment – Relevant fee revenue includes investment banking activities, managing a commodity pool operator, and fees earned from sponsoring Forward Industries’ digital asset treasury – Other transaction expenses include trading commissions and custody and exchange fees. These are primarily tied to Galaxy’s Trading business (1) Digital asset price performance can be tracked on data-aggregator and market trackers like CoinMarketCap and CoinGecko. (2) Exchange-traded volumes can be tracked on data-aggregator and market trackers like The Block. Fees and Other transaction expenses are two separate line items and reported at the Digital Assets segment level rather than by sub-segment (refer to Galaxy’s financial supplement or 10-Q for exact amounts). As a result, the split between “Fees” and “Other transaction expenses” within the Global Markets sub-segment must be estimated to derive the figures shown on the left. Please refer to the commentary on the right for additional details. Key Information ($M, unless otherwise noted) (actuals)

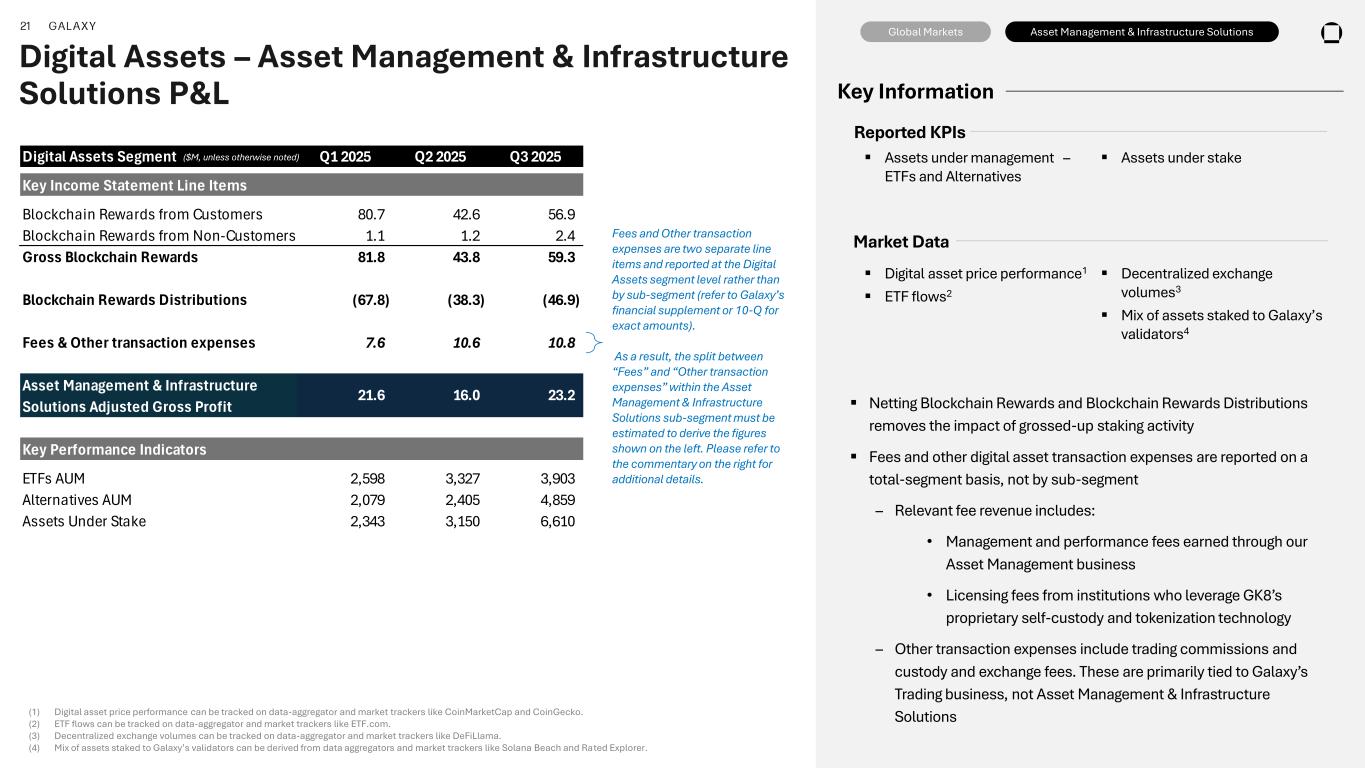

21 GALAXY Digital Assets Segment Q1 2025 Q2 2025 Q3 2025 Key Income Statement Line Items Blockchain Rewards from Customers 80.7 42.6 56.9 Blockchain Rewards from Non-Customers 1.1 1.2 2.4 Gross Blockchain Rewards 81.8 43.8 59.3 Blockchain Rewards Distributions (67.8) (38.3) (46.9) Fees & Other transaction expenses 7.6 10.6 10.8 Asset Management & Infrastructure Solutions Adjusted Gross Profit Key Performance Indicators ETFs AUM 2,598 3,327 3,903 Alternatives AUM 2,079 2,405 4,859 Assets Under Stake 2,343 3,150 6,610 21.6 16.0 23.2 Global Markets Asset Management & Infrastructure Solutions Digital Assets – Asset Management & Infrastructure Solutions P&L ▪ Assets under management – ETFs and Alternatives ▪ Assets under stake Reported KPIs ▪ Digital asset price performance1 ▪ ETF flows2 ▪ Decentralized exchange volumes3 ▪ Mix of assets staked to Galaxy’s validators4 Market Data ▪ Netting Blockchain Rewards and Blockchain Rewards Distributions removes the impact of grossed-up staking activity ▪ Fees and other digital asset transaction expenses are reported on a total-segment basis, not by sub-segment – Relevant fee revenue includes: • Management and performance fees earned through our Asset Management business • Licensing fees from institutions who leverage GK8’s proprietary self-custody and tokenization technology – Other transaction expenses include trading commissions and custody and exchange fees. These are primarily tied to Galaxy’s Trading business, not Asset Management & Infrastructure Solutions Fees and Other transaction expenses are two separate line items and reported at the Digital Assets segment level rather than by sub-segment (refer to Galaxy’s financial supplement or 10-Q for exact amounts). As a result, the split between “Fees” and “Other transaction expenses” within the Asset Management & Infrastructure Solutions sub-segment must be estimated to derive the figures shown on the left. Please refer to the commentary on the right for additional details. Key Information (1) Digital asset price performance can be tracked on data-aggregator and market trackers like CoinMarketCap and CoinGecko. (2) ETF flows can be tracked on data-aggregator and market trackers like ETF.com. (3) Decentralized exchange volumes can be tracked on data-aggregator and market trackers like DeFiLlama. (4) Mix of assets staked to Galaxy’s validators can be derived from data aggregators and market trackers like Solana Beach and Rated Explorer. ($M, unless otherwise noted)

22 GALAXY Treasury & Corporate

23 GALAXY 001 Principal Investments Realized and unrealized gains and losses on digital asset and investment holdings held in Treasury & Corporate, and associated trading activity 003 Residual Proprietary Mining Bitcoin rewards from proprietary bitcoin mining 001 Asset Management Fees Galaxy’s Asset Management business manages a portion of the firm’s balance sheet digital assets and investments. In these cases, the Treasury & Corporate segment is charged a management fee equivalent to that of a comparable external fund managed by Asset Management. This fee is recorded under digital assets fees and offset within the Treasury & Corporate fees line item 003 Corporate Costs Expenses or one-time costs not attributable to a specific segment 002 Blockchain Rewards & Blockchain Rewards Distributions Galaxy’s Infrastructure Solutions business stakes a portion of the firm’s balance sheet digital assets to its validators. Similar to our treatment of third-party assets staked on Galaxy validators, in order to show the Treasury & Corporate and Digital Assets segments as separate entities, we gross up the revenue and costs associated with these Treasury & Corporate tokens staked on Galaxy validators 002 Intercompany Transfer Pricing Interest income earned from cash and from Treasury & Corporate lending of cash and digital assets to the Digital Assets business to support trading and liquidity needs Performance Drivers Intercompany Elimination & Corporate Costs Treasury & Corporate Overview

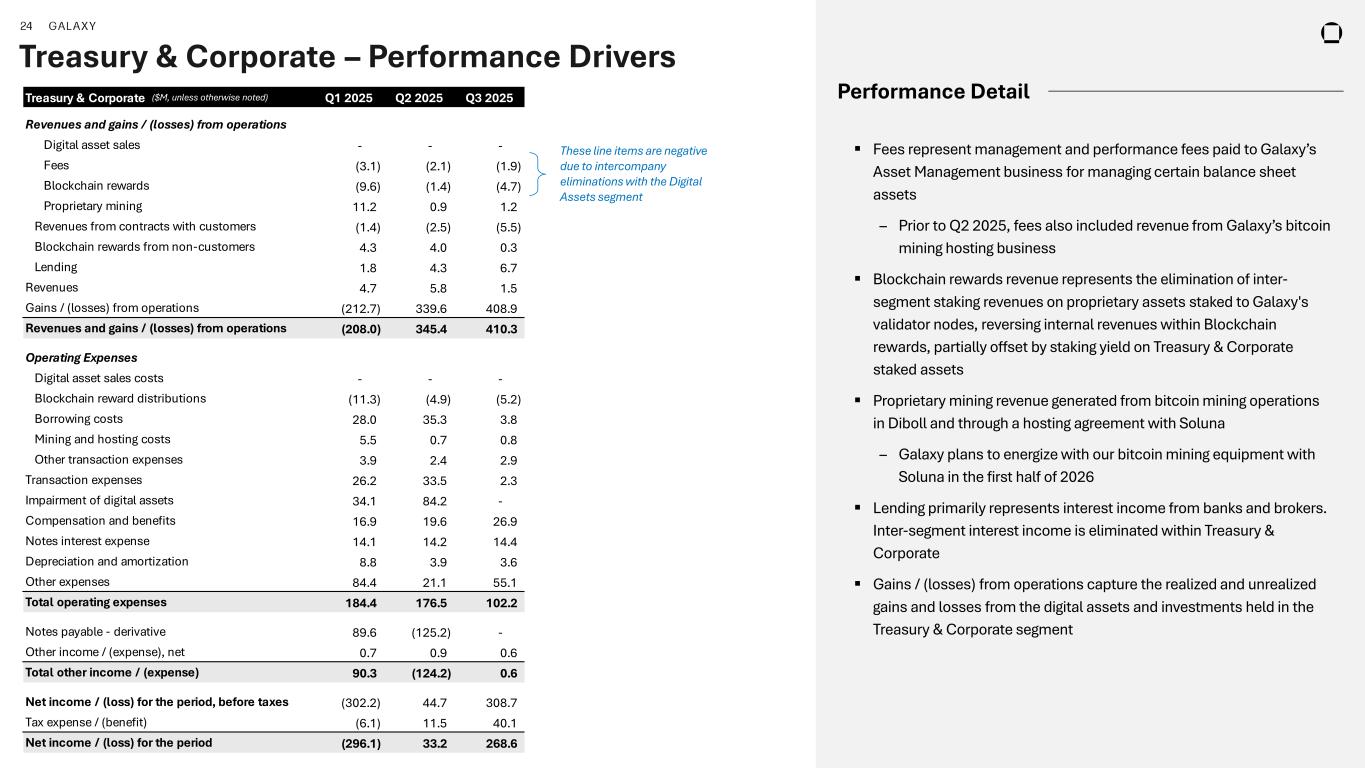

24 GALAXY Treasury & Corporate Q1 2025 Q2 2025 Q3 2025 Revenues and gains / (losses) from operations Digital asset sales - - - Fees (3.1) (2.1) (1.9) Blockchain rewards (9.6) (1.4) (4.7) Proprietary mining 11.2 0.9 1.2 Revenues from contracts with customers (1.4) (2.5) (5.5) Blockchain rewards from non-customers 4.3 4.0 0.3 Lending 1.8 4.3 6.7 Revenues 4.7 5.8 1.5 Gains / (losses) from operations (212.7) 339.6 408.9 Revenues and gains / (losses) from operations (208.0) 345.4 410.3 Operating Expenses Digital asset sales costs - - - Blockchain reward distributions (11.3) (4.9) (5.2) Borrowing costs 28.0 35.3 3.8 Mining and hosting costs 5.5 0.7 0.8 Other transaction expenses 3.9 2.4 2.9 Transaction expenses 26.2 33.5 2.3 Impairment of digital assets 34.1 84.2 - Compensation and benefits 16.9 19.6 26.9 Notes interest expense 14.1 14.2 14.4 Depreciation and amortization 8.8 3.9 3.6 Other expenses 84.4 21.1 55.1 Total operating expenses 184.4 176.5 102.2 Notes payable - derivative 89.6 (125.2) - Other income / (expense), net 0.7 0.9 0.6 Total other income / (expense) 90.3 (124.2) 0.6 Net income / (loss) for the period, before taxes (302.2) 44.7 308.7 Tax expense / (benefit) (6.1) 11.5 40.1 Net income / (loss) for the period (296.1) 33.2 268.6 Treasury & Corporate – Performance Drivers ▪ Fees represent management and performance fees paid to Galaxy’s Asset Management business for managing certain balance sheet assets – Prior to Q2 2025, fees also included revenue from Galaxy’s bitcoin mining hosting business ▪ Blockchain rewards revenue represents the elimination of inter- segment staking revenues on proprietary assets staked to Galaxy's validator nodes, reversing internal revenues within Blockchain rewards, partially offset by staking yield on Treasury & Corporate staked assets ▪ Proprietary mining revenue generated from bitcoin mining operations in Diboll and through a hosting agreement with Soluna – Galaxy plans to energize with our bitcoin mining equipment with Soluna in the first half of 2026 ▪ Lending primarily represents interest income from banks and brokers. Inter-segment interest income is eliminated within Treasury & Corporate ▪ Gains / (losses) from operations capture the realized and unrealized gains and losses from the digital assets and investments held in the Treasury & Corporate segment Performance Detail These line items are negative due to intercompany eliminations with the Digital Assets segment ($M, unless otherwise noted)

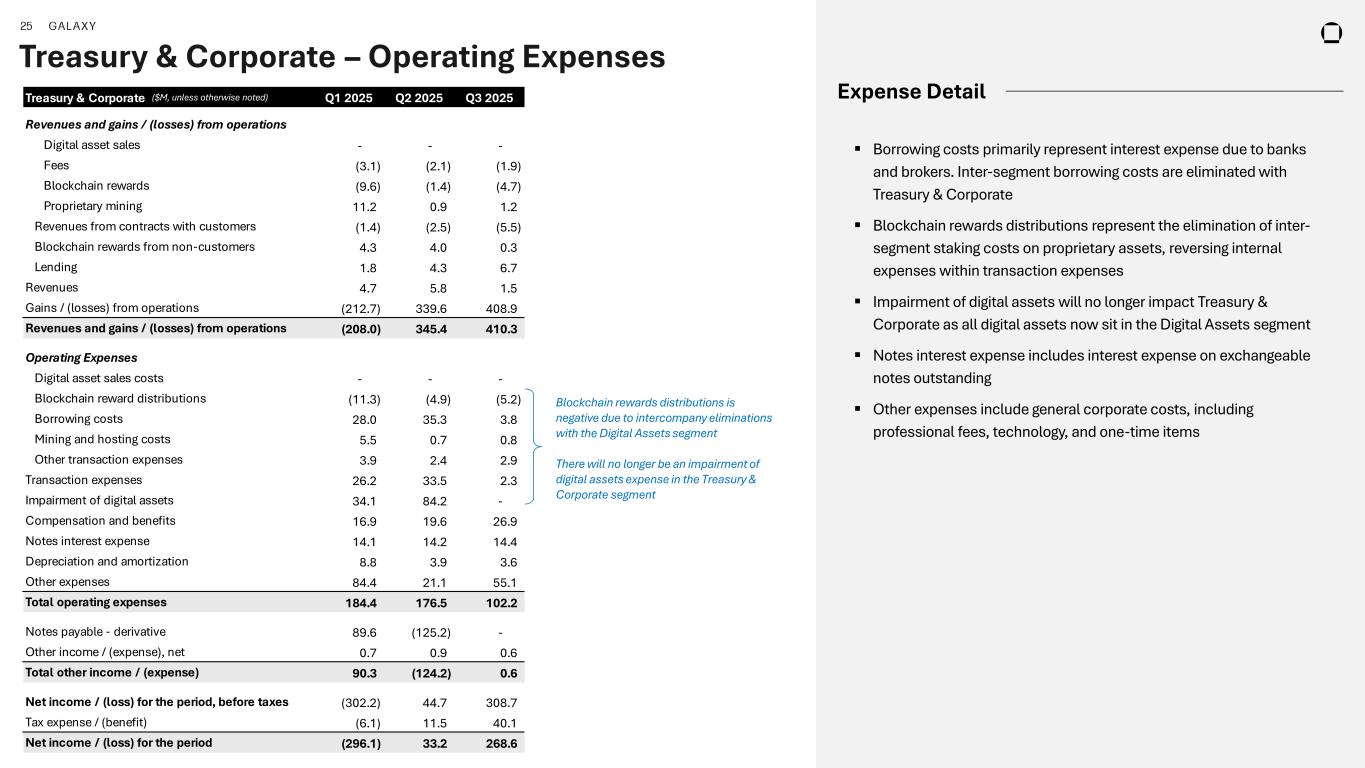

25 GALAXY Treasury & Corporate Q1 2025 Q2 2025 Q3 2025 Revenues and gains / (losses) from operations Digital asset sales - - - Fees (3.1) (2.1) (1.9) Blockchain rewards (9.6) (1.4) (4.7) Proprietary mining 11.2 0.9 1.2 Revenues from contracts with customers (1.4) (2.5) (5.5) Blockchain rewards from non-customers 4.3 4.0 0.3 Lending 1.8 4.3 6.7 Revenues 4.7 5.8 1.5 Gains / (losses) from operations (212.7) 339.6 408.9 Revenues and gains / (losses) from operations (208.0) 345.4 410.3 Operating Expenses Digital asset sales costs - - - Blockchain reward distributions (11.3) (4.9) (5.2) Borrowing costs 28.0 35.3 3.8 Mining and hosting costs 5.5 0.7 0.8 Other transaction expenses 3.9 2.4 2.9 Transaction expenses 26.2 33.5 2.3 Impairment of digital assets 34.1 84.2 - Compensation and benefits 16.9 19.6 26.9 Notes interest expense 14.1 14.2 14.4 Depreciation and amortization 8.8 3.9 3.6 Other expenses 84.4 21.1 55.1 Total operating expenses 184.4 176.5 102.2 Notes payable - derivative 89.6 (125.2) - Other income / (expense), net 0.7 0.9 0.6 Total other income / (expense) 90.3 (124.2) 0.6 Net income / (loss) for the period, before taxes (302.2) 44.7 308.7 Tax expense / (benefit) (6.1) 11.5 40.1 Net income / (loss) for the period (296.1) 33.2 268.6 Treasury & Corporate – Operating Expenses ▪ Borrowing costs primarily represent interest expense due to banks and brokers. Inter-segment borrowing costs are eliminated with Treasury & Corporate ▪ Blockchain rewards distributions represent the elimination of inter- segment staking costs on proprietary assets, reversing internal expenses within transaction expenses ▪ Impairment of digital assets will no longer impact Treasury & Corporate as all digital assets now sit in the Digital Assets segment ▪ Notes interest expense includes interest expense on exchangeable notes outstanding ▪ Other expenses include general corporate costs, including professional fees, technology, and one-time items Expense Detail Blockchain rewards distributions is negative due to intercompany eliminations with the Digital Assets segment There will no longer be an impairment of digital assets expense in the Treasury & Corporate segment ($M, unless otherwise noted)

26 GALAXY Data Centers

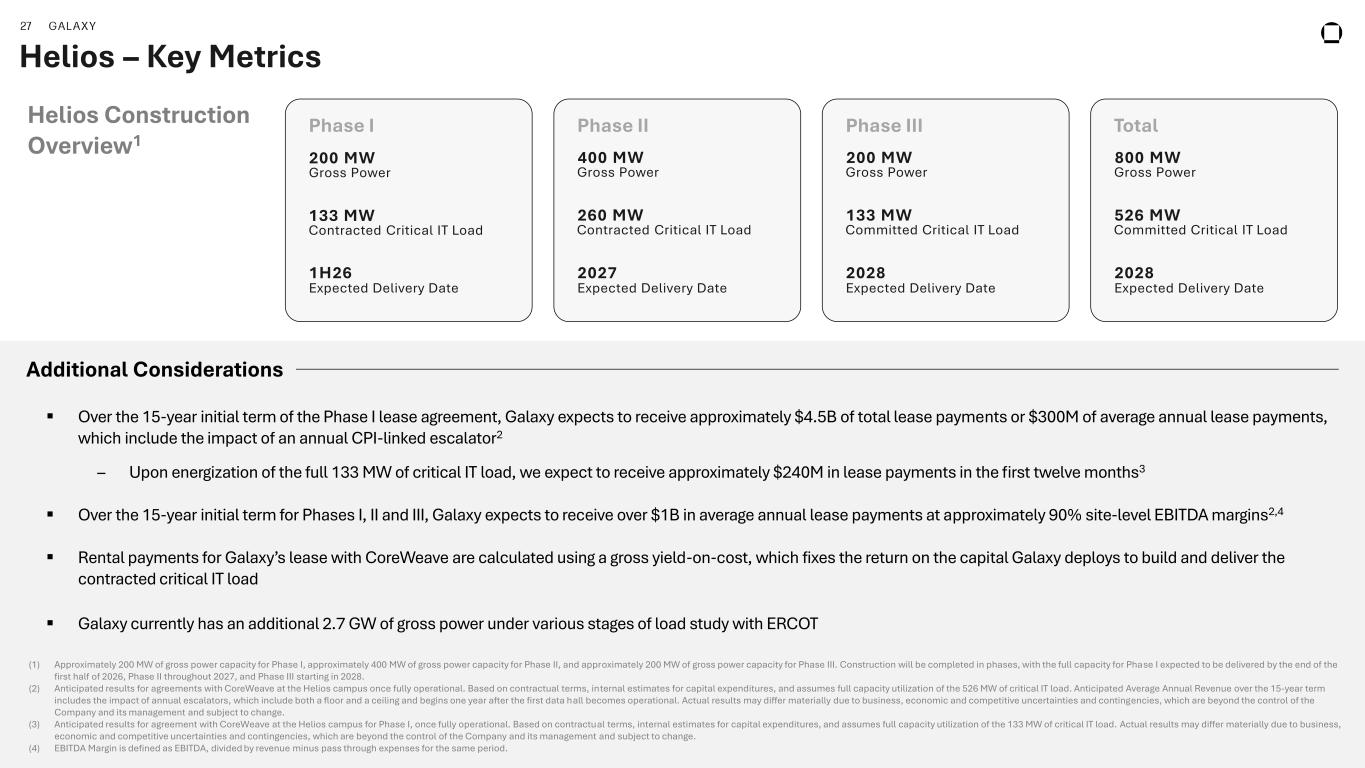

27 GALAXY Helios – Key Metrics ▪ Over the 15-year initial term of the Phase I lease agreement, Galaxy expects to receive approximately $4.5B of total lease payments or $300M of average annual lease payments, which include the impact of an annual CPI-linked escalator2 – Upon energization of the full 133 MW of critical IT load, we expect to receive approximately $240M in lease payments in the first twelve months3 ▪ Over the 15-year initial term for Phases I, II and III, Galaxy expects to receive over $1B in average annual lease payments at approximately 90% site-level EBITDA margins2,4 ▪ Rental payments for Galaxy’s lease with CoreWeave are calculated using a gross yield-on-cost, which fixes the return on the capital Galaxy deploys to build and deliver the contracted critical IT load ▪ Galaxy currently has an additional 2.7 GW of gross power under various stages of load study with ERCOT Additional Considerations (1) Approximately 200 MW of gross power capacity for Phase I, approximately 400 MW of gross power capacity for Phase II, and approximately 200 MW of gross power capacity for Phase III. Construction will be completed in phases, with the full capacity for Phase I expected to be delivered by the end of the first half of 2026, Phase II throughout 2027, and Phase III starting in 2028. (2) Anticipated results for agreements with CoreWeave at the Helios campus once fully operational. Based on contractual terms, internal estimates for capital expenditures, and assumes full capacity utilization of the 526 MW of critical IT load. Anticipated Average Annual Revenue over the 15-year term includes the impact of annual escalators, which include both a floor and a ceiling and begins one year after the first data hall becomes operational. Actual results may differ materially due to business, economic and competitive uncertainties and contingencies, which are beyond the control of the Company and its management and subject to change. (3) Anticipated results for agreement with CoreWeave at the Helios campus for Phase I, once fully operational. Based on contractual terms, internal estimates for capital expenditures, and assumes full capacity utilization of the 133 MW of critical IT load. Actual results may differ materially due to business, economic and competitive uncertainties and contingencies, which are beyond the control of the Company and its management and subject to change. (4) EBITDA Margin is defined as EBITDA, divided by revenue minus pass through expenses for the same period. Phase I Contracted Critical IT Load 133 MW Expected Delivery Date 1H26 Gross Power 200 MW Phase II Contracted Critical IT Load 260 MW Expected Delivery Date 2027 Gross Power 400 MW Phase III Committed Critical IT Load 133 MW Expected Delivery Date 2028 Gross Power 200 MW Total Committed Critical IT Load 526 MW Expected Delivery Date 2028 Gross Power 800 MW Helios Construction Overview1

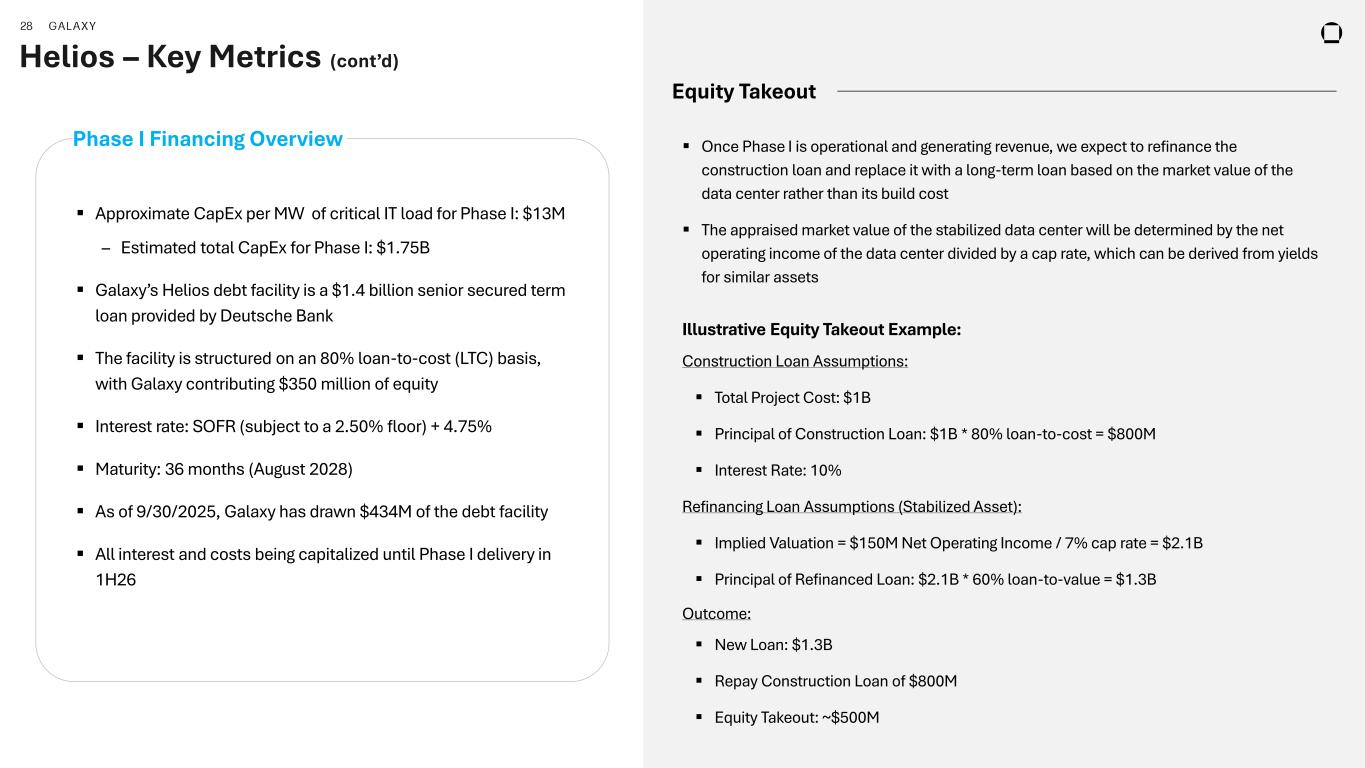

28 GALAXY Helios – Key Metrics (cont’d) ▪ Once Phase I is operational and generating revenue, we expect to refinance the construction loan and replace it with a long-term loan based on the market value of the data center rather than its build cost ▪ The appraised market value of the stabilized data center will be determined by the net operating income of the data center divided by a cap rate, which can be derived from yields for similar assets Illustrative Equity Takeout Example: Construction Loan Assumptions: ▪ Total Project Cost: $1B ▪ Principal of Construction Loan: $1B * 80% loan-to-cost = $800M ▪ Interest Rate: 10% Refinancing Loan Assumptions (Stabilized Asset): ▪ Implied Valuation = $150M Net Operating Income / 7% cap rate = $2.1B ▪ Principal of Refinanced Loan: $2.1B * 60% loan-to-value = $1.3B Outcome: ▪ New Loan: $1.3B ▪ Repay Construction Loan of $800M ▪ Equity Takeout: ~$500M Equity Takeout Phase I Financing Overview ▪ Approximate CapEx per MW of critical IT load for Phase I: $13M – Estimated total CapEx for Phase I: $1.75B ▪ Galaxy’s Helios debt facility is a $1.4 billion senior secured term loan provided by Deutsche Bank ▪ The facility is structured on an 80% loan-to-cost (LTC) basis, with Galaxy contributing $350 million of equity ▪ Interest rate: SOFR (subject to a 2.50% floor) + 4.75% ▪ Maturity: 36 months (August 2028) ▪ As of 9/30/2025, Galaxy has drawn $434M of the debt facility ▪ All interest and costs being capitalized until Phase I delivery in 1H26

29 GALAXY Appendix

30 GALAXY Reconciliation to Non-GAAP Metrics ($ in millions and shares in thousands, unless otherwise noted) Reconciliation to Non-GAAP Adjusted EPS Nine Months Ended September 30, 2025 Net income used to calculated diluted EPS 209.3 Noncontrolling interest income, net of tax - Net income used to calculate adjusted income (loss) per share 209.3 Weighted average number of Class A Common Stock shares for the purposes of diluted income (loss) per share Noncontrolling interest weighted average shares outstanding - Weighted average number of Class A Common Stock shares for 375,882 the purposes of Adjusted income (loss) per share Adjusted Income (Loss) per Share 0.56 Reconciliation to Non-GAAP Adjusted Gross Profit Nine Months Ended September 30, 2025 Revenues and gains / (losses) from operations 51,131.4 Less: transaction expenses (49,869.7) Less: impairment of digital assets (437.6) Adjusted Gross Profit 824.0 375,882 Reconciliation to Non-GAAP Adjusted EBITDA Nine Months Ended September 30, 2025 Net income 240.3 Equity based compensation 50.9 Notes interest and other expense 42.7 Taxes 45.5 Depreciation and amortization expense 27.5 Settlement expense 7.3 Unrealized (gain) / loss on notes payable - derivative 35.5 Mining related impairment loss / loss on disposal 95.1 Other (income) / expense, net (2.4) Reorganization and domestication costs 8.7 Adjusted EBITDA 551.1 ($ actuals)