NASDAQ: PFSA October 2025 INVESTOR PRESENTATION ”Pioneering real time biochemistry that drives AI - led, personalized healthcare technologies”

NASDAQ: PFSA DISCLAIMER AND SAFE HARBOR STATEMENT 2 Disclaimer This presentation (“Presentation”) is being issued by Profusa, Inc. (the “Company” or “Profusa”) for information purposes onl y. The content of this Presentation has not been approved by any securities regulatory authority. Reliance on this Presentation for the purpose of engaging in any investment activity may expose an individ ual to a significant risk of losing all of the property or other assets invested. This Presentation is not an admission document, prospectus or an advertisement and is being provided for information purposes on ly and does not constitute or form part of, and should not be construed as, an offer or invitation to sell or any solicitation of any offer to purchase or subscribe for any securities of the Compan y i n the United States or any other jurisdiction. Neither this Presentation, nor any part of it nor anything contained or referred to in it, nor the fact of its distribution, should form the basis of or be relied on in connection with or act as an inducement in relation to a decision to purchase or subscribe for or enter into any contract or make any other commitment whatsoever in relation to any securities of the Company . N o representation or warranty, express or implied, is given by or on behalf of the Company, its directors, officers and advisors or any other person as to the accuracy, sufficiency or completeness of t he information or opinions contained in this Presentation and no liability whatsoever is accepted by the Company, its directors, officers or advisors or any other person for any loss howsoever arising , d irectly or indirectly, from any use of such information or opinions or otherwise arising in connection therewith. Forward - Looking Statements Certain statements contained in this Presentation constitute “forward - looking information” or “forward - looking statements” (coll ectively, “forward - looking statements”) within the meaning of applicable Canadian and United States securities laws relating to, without limitation, expectations, intentions, plans and beliefs, incl udi ng information as to the future events, results of operations and the Company’s future performance (both operational and financial) and business prospects. In certain cases, forward - looking statements can be identified by the use of words such as “expects”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes”, “plans”, “seeks”, “projects” or variations of such words and phrases, or state that cer tai n actions, events or results “may” or “will” be taken, occur or be achieved. Such forward - looking statements reflect the Company’s beliefs, estimates and opinions regarding its future growth, results of operati ons, results of litigation, future performance (both operational and financial), and business prospects and opportunities at the time such statements are made, and the Company undertakes no obligation to up dat e forward - looking statements if these beliefs, estimates and opinions or circumstances should change. Forward - looking statements are necessarily based upon a number of estimates and assumptions made by the Company that are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Forward - looking statements are not guarantees of fu ture performance. In particular, this Presentation contains forward - looking statements pertaining, but not limited, to: total addressable market for the Company’s products; future sales; timelines for cli nical development, manufacturing and supply; market opportunities; expectations respecting future competitive conditions; and the Company’s objectives, strategies and competitive strengths. By their nature, forward - looking statements involve numerous current assumptions, known and unknown risks, uncertainties and oth er factors which may cause the actual results, performance or achievements of the Company to differ materially from those anticipated by the Company and described in the forward - looking stat ements. Factors, risks and uncertainties that could cause results to differ materially from those anticipated and described herein are more fully described in the Registration Statement on Form S - 4 (File No. 333 - 269417) and the Company’s other filings with the SEC. You should not place undue reliance on these forward - looking statements, which are made only as of the date hereof or as of the dates indic ated in the forward - looking statements. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ ma terially from those described in its forward - looking statements there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance t hat forward - looking statements will materialize or prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward - looking statemen ts contained in this Presentation are expressly qualified by this cautionary statement. Except as may be required by law, the Company expressly disclaims any intention or obligation to revise or update any forward - looking statements or information whether as a result of new information, future events or otherwise. Trademarks This presentation includes trademarks of Profusa, which are protected under applicable intellectual property laws and are the pr operty of Profusa or its subsidiaries. This presentation also includes other trademarks, trade names and service marks that are the property of their respective owners. Solely for convenience, in some case s, the trademarks, trade names and service marks referred to in this proxy statement/prospectus are listed without the applicable ®, м and SM symbols, but they will assert, to the fullest extent under ap plicable law, their rights to these trademarks, trade names and service marks.

NASDAQ: PFSA 3 KEY INVESTMENT HIGHLIGHTS • Platform technology yields multiple commercial revenue opportunities in the US and Europe • >$10.5B+ global TAM in tissue and pulse oximetry oxygen monitoring by 2030 (1) • 500M+ people globally with diabetes in 2024, growing 45% by 2050 (2) • Commercial stage Oxygen Platform with large addressable markets • Projected revenue $0.5 - 2 million in 2026, growing to $200 – 250M by 2030 • Lumee tissue oxygen monitoring launch: expected 1Q2026E (Europe) and 1H2027E (US) • Sales from research only use: expected 1Q2026 • Pipeline opportunities • Lumee continuous glucose monitoring (CGM) clinical data • Robust data discovery platform • Capital Investment - $150M+ • $22M PIPE - $12M drawn • $100M Equity Line of Credit - $5M drawn • Bitcoin treasury strategy • Strong Family Office and Venture Capital support • National Institutes of Health (NIH). Defense Advanced Research Projects Agency (DARPA) • 67 global patents issued and 18 pending (1) https://www.grandviewresearch.com/industry - analyis/pulse - oximeter - market; https://growthmarketreports.com/report/wearable - ti ssue - oxygenation - sensors - market; https://www.reanin.com/reports/global - medical - oxygen - sensors - market (2) https://diabetesatlas.org/resources/idf - diabetes - atlas - 2025/

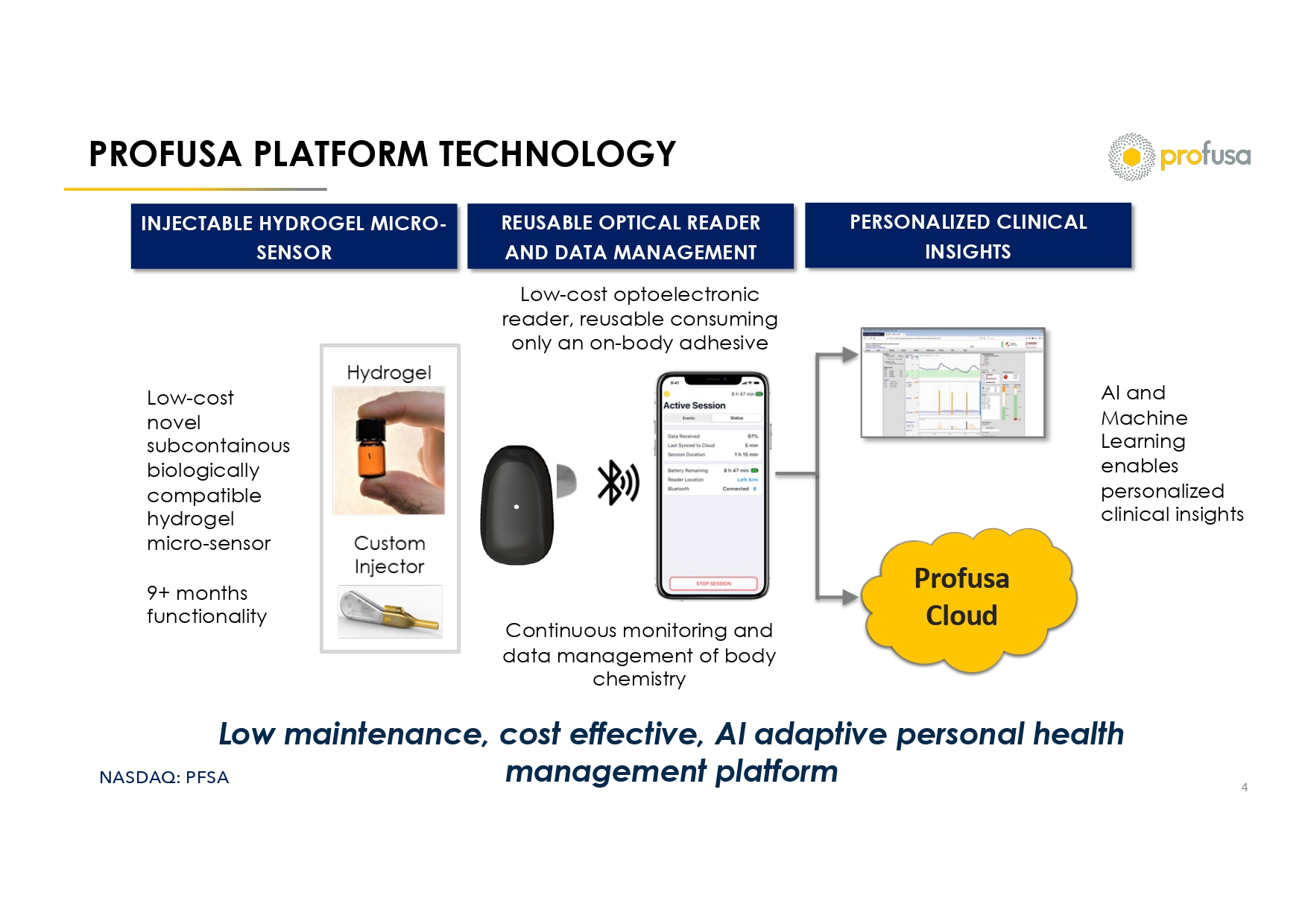

NASDAQ: PFSA PROFUSA PLATFORM TECHNOLOGY 4 Profusa Cloud Low maintenance, cost effective, AI adaptive personal health management platform Low - cost novel subcontainous biologically compatible hydrogel micro - sensor 9+ months functionality INJECTABLE HYDROGEL MICRO - SENSOR REUSABLE OPTICAL READER AND DATA MANAGEMENT Continuous monitoring and data management of body chemistry PERSONALIZED CLINICAL INSIGHTS Low - cost optoelectronic reader, reusable consuming only an on - body adhesive AI and Machine Learning enables personalized clinical insights

NASDAQ: PFSA 5 ARTIFICAL INTELLIGENCE (AI) DRIVEN DIGITAL HEALTHCARE • Machine learning to create algorithms for enhanced monitoring • Accounting for variations of the tissue composition for continuous accuracy while still using the single injectable sensor • Multiple calculations around other physical variables and fluctuations with regard to creating accurate oxygen and glucose measurements • Providing real - time comparison across data sets LUMEE PRODUCT PORTFOLIO DATA DISCOVERY PLATFORM • Building using best - in - class Nvidia technology backbone • Potential of large volume of real - time data for clinical insight • Profusa’s critical body of data enable future AI - driven healthcare • Planned physician portal to link real - time biochemistry with EMR and published clinical literature • Machine discernment between privacy - protected data and useable data across any given network

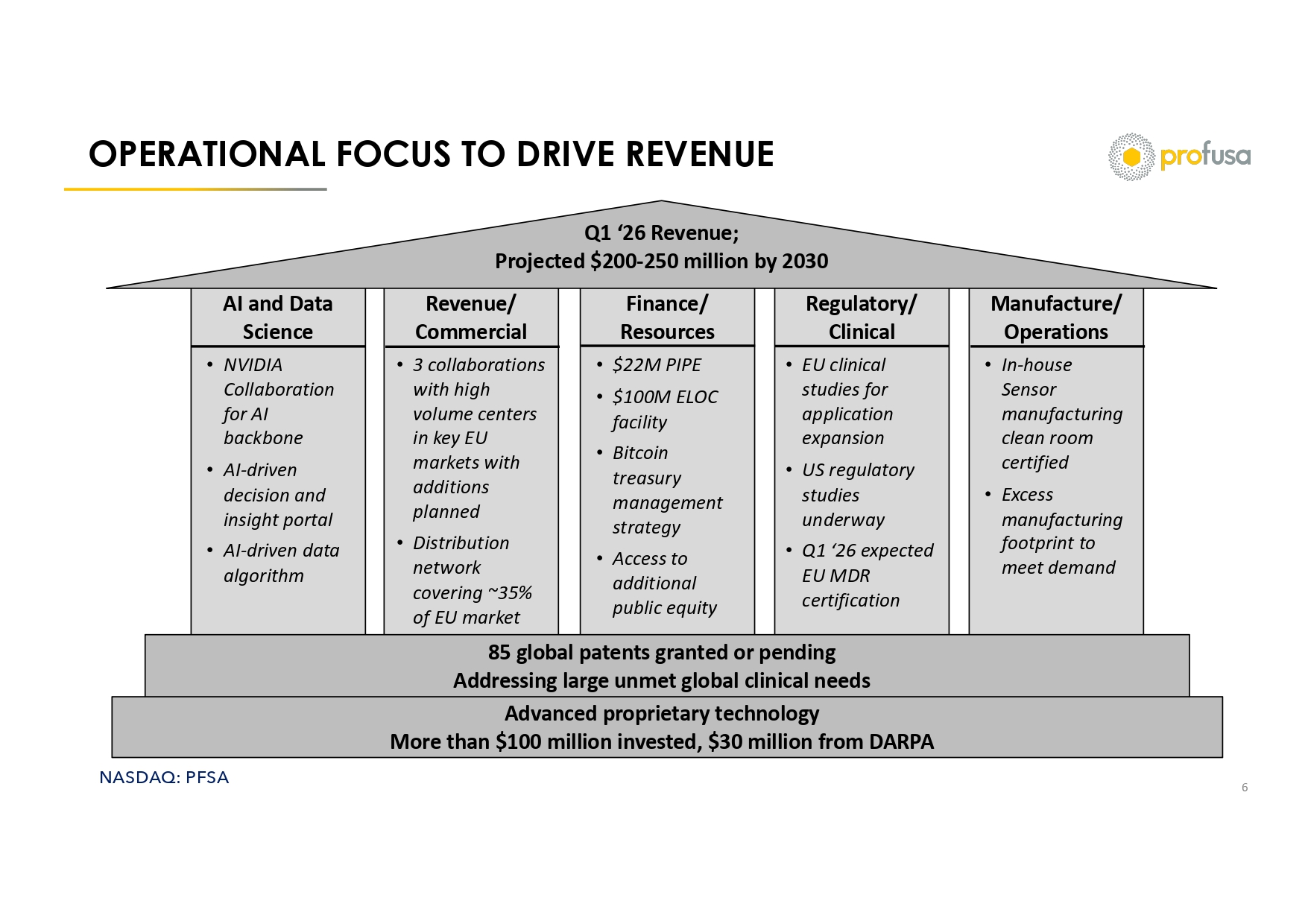

NASDAQ: PFSA Revenue/ Commercial AI and Data Science Finance/ Resources Regulatory/ Clinical Manufacture/ Operations OPERATIONAL FOCUS TO DRIVE REVENUE 6 Q1 ‘26 Revenue; Projected $200 - 250 million by 2030 • 3 collaborations with high volume centers in key EU markets with additions planned • Distribution network covering ~35% of EU market • NVIDIA Collaboration for AI backbone • AI - driven decision and insight portal • AI - driven data algorithm • $22M PIPE • $100M ELOC facility • Bitcoin treasury management strategy • Access to additional public equity • EU clinical studies for application expansion • US regulatory studies underway • Q1 ‘26 expected EU MDR certification • In - house Sensor manufacturing clean room certified • Excess manufacturing footprint to meet demand 85 global patents granted or pending Addressing large unmet global clinical needs Advanced proprietary technology More than $100 million invested, $30 million from DARPA

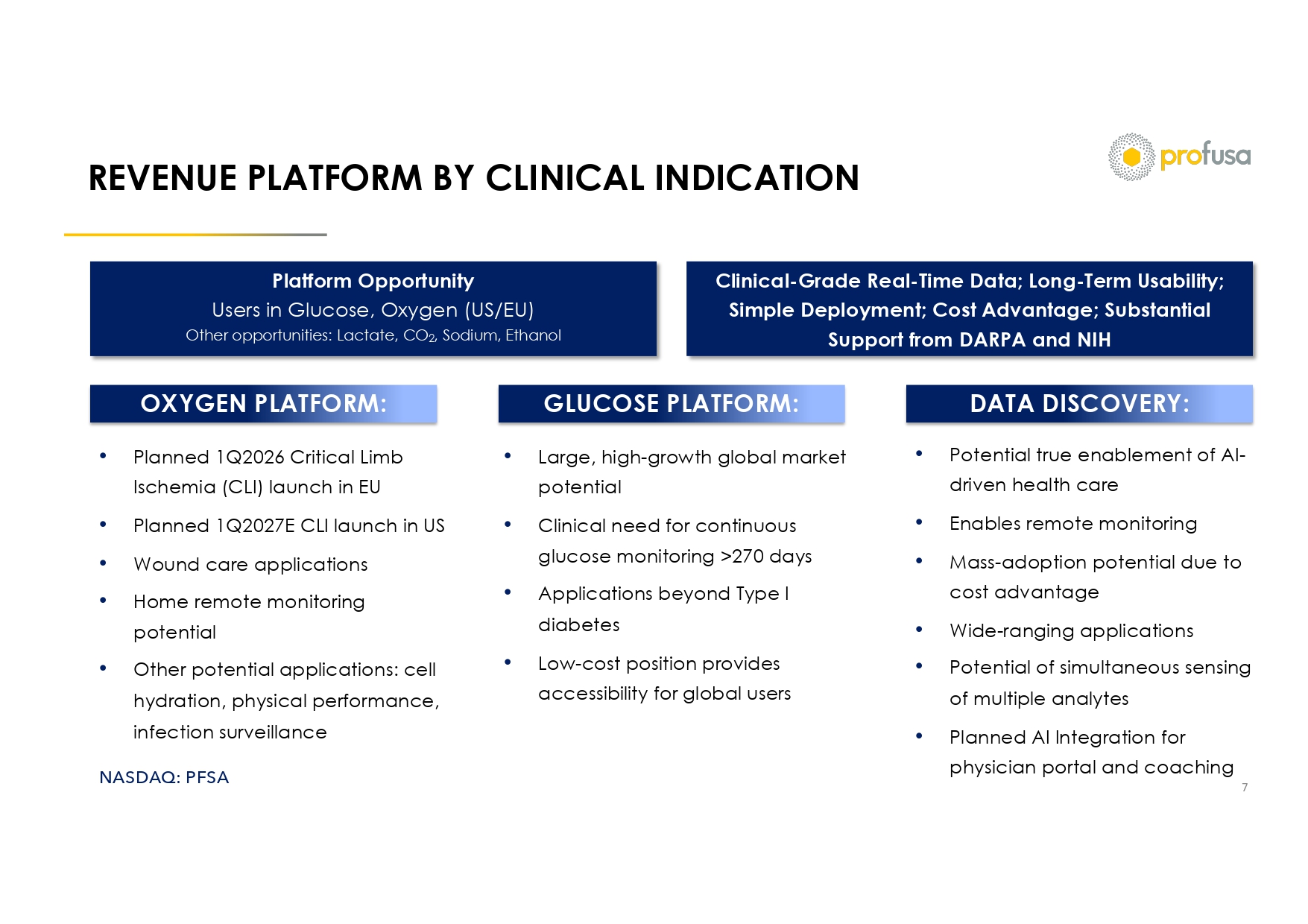

NASDAQ: PFSA REVENUE PLATFORM BY CLINICAL INDICATION 7 OXYGEN PLATFORM: GLUCOSE PLATFORM: DATA DISCOVERY: • Planned 1Q2026 Critical Limb Ischemia (CLI) launch in EU • Planned 1Q2027E CLI launch in US • Wound care applications • Home remote monitoring potential • Other potential applications: cell hydration, physical performance, infection surveillance • Large, high - growth global market potential • Clinical need for continuous glucose monitoring >270 days • Applications beyond Type I diabetes • Low - cost position provides accessibility for global users • Potential true enablement of AI - driven health care • Enables remote monitoring • Mass - adoption potential due to cost advantage • Wide - ranging applications • Potential of simultaneous sensing of multiple analytes • Planned AI Integration for physician portal and coaching Platform Opportunity Users in Glucose, Oxygen (US/EU) Other opportunities: Lactate, CO 2 , Sodium, Ethanol Clinical - Grade Real - Time Data; Long - Term Usability; Simple Deployment; Cost Advantage; Substantial Support from DARPA and NIH

NASDAQ: PFSA MISSION DRIVEN EXECUTIVE MANAGEMENT 8 Ben Hwang Ph.D., Chairman, CEO From his early exposure as an undergraduate research fellow at the lab of Leroy Hood at Caltech, where the automated DNA sequencer was developed, to bringing cutting edge life sciences tools to the market at Life Technologies Corp. (acquired by Thermo Fisher Scientific, Inc.), Ben has seen first - hand the transformative impact that science and technology have to change our world. Bill McMillan Co - founder, CSO & Head of Research Bill was the initial driving force behind Profusa , he built the company road map, enlisted top talent & secured seed funding. A co - inventor of Profusa’s biologically integrated sensor & optical reader, Bill is a biotech pioneer whose career has spanned more than three decades in the development of next - generation diagnostic, medical device technologies and products, the last 20 years as an entrepreneur. Fred Knechtel Chief Financial Officer Fred led finance and operations activities from start - ups to multi - billion dollar publicly traded companies. As CFO, he guided organizations operating in the life sciences, automotive, consumer products and aerospace industries through profitable growth, capital restructure, mergers/acquisitions/sales and IPOs. Companies include Northrop Grumman, Stanley Black and Decker, DuPont, Remy International, Sims Metal Management and GENEWIZ ( Azenta ) Sean Givens Head of Government Business Sean comes to Profusa with 20 years of experience in government accounting and contracting, as well as extensive operations experience in consumer electronics, medical devices and drug development. Most recently Sean was a co - founder and COO of MIODx , a company focused on immune repertoire, Kerstin Rebrin , M.D., Ph.D., VP of Medical Affairs & Clinical Development Kerstin is responsible for developing & executing Profusa’s Medical & Clinical strategies. Dr. Rebrin is a seasoned physician - scientist with clinical & research experience in the field of diabetes & other metabolic diseases. She is known for her pioneering artificial pancreas research with introducing continuous glucose sensing & therapy algorithms based on glucose monitoring for various routes of insulin delivery. Aide Sordet GM OF EUROPE Aude brings extensive international experience in commercial strategy, marketing, and business leadership across Europe and Asia in senior roles at Bayer, M8 Pharmaceuticals and GC Aesthetics. Aude has successfully led cross - functional teams, driven market growth, and forged strategic partnerships to expand regional presence. Aude combines medical insight with strategic vision to advance innovative healthcare solutions and strengthen Profusa’s European operations.

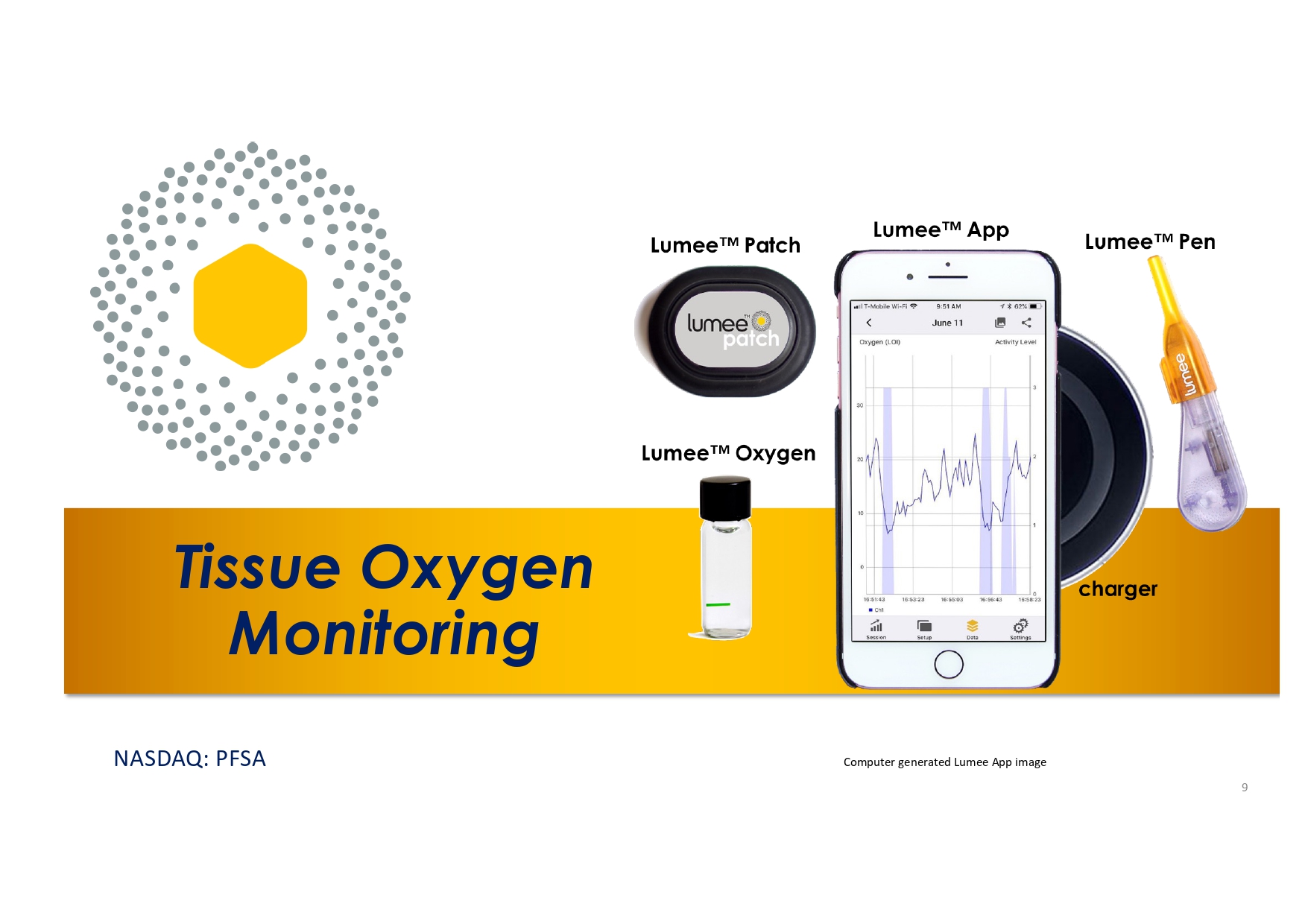

9 Tissue Oxygen Monitoring NASDAQ: PFSA Computer generated Lumee App image

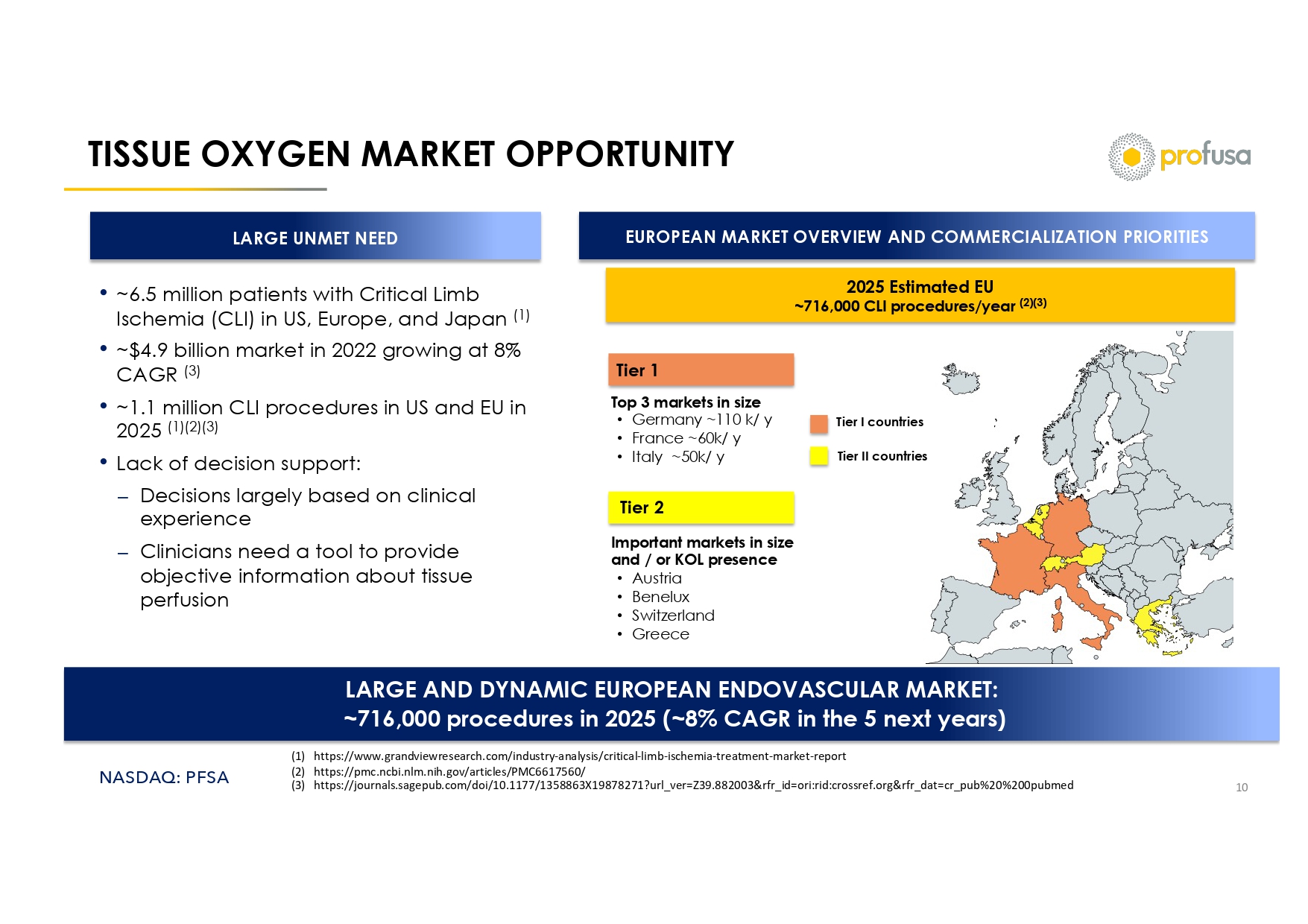

NASDAQ: PFSA TISSUE OXYGEN MARKET OPPORTUNITY 10 LARGE UNMET NEED • ~6.5 million patients with Critical Limb Ischemia (CLI) in US, Europe, and Japan (1) • ~$4.9 billion market in 2022 growing at 8% CAGR (3) • ~1.1 million CLI procedures in US and EU in 2025 (1)(2)(3) • Lack of decision support: ⎼ Decisions largely based on clinical experience ⎼ Clinicians need a tool to provide objective information about tissue perfusion EUROPEAN MARKET OVERVIEW AND COMMERCIALIZATION PRIORITIES 2025 Estimated EU ~716,000 CLI procedures/year (2)(3) Top 3 markets in size • Germany ~110 k/ y • France ~60k/ y • Italy ~50k/ y Important markets in size and / or KOL presence • Austria • Benelux • Switzerland • Greece Tier I countries Tier II countries LARGE AND DYNAMIC EUROPEAN ENDOVASCULAR MARKET: ~716,000 procedures in 2025 (~8% CAGR in the 5 next years) Tier 1 Tier 2 (1) https://www.grandviewresearch.com/industry - analysis/critical - limb - ischemia - treatment - market - report (2) https://pmc.ncbi.nlm.nih.gov/articles/PMC6617560/ (3) https://journals.sagepub.com/doi/10.1177/1358863X19878271?url_ver=Z39.882003&rfr_id=ori:rid:crossref.org&rfr_dat=cr_pub%20%2 00pubmed

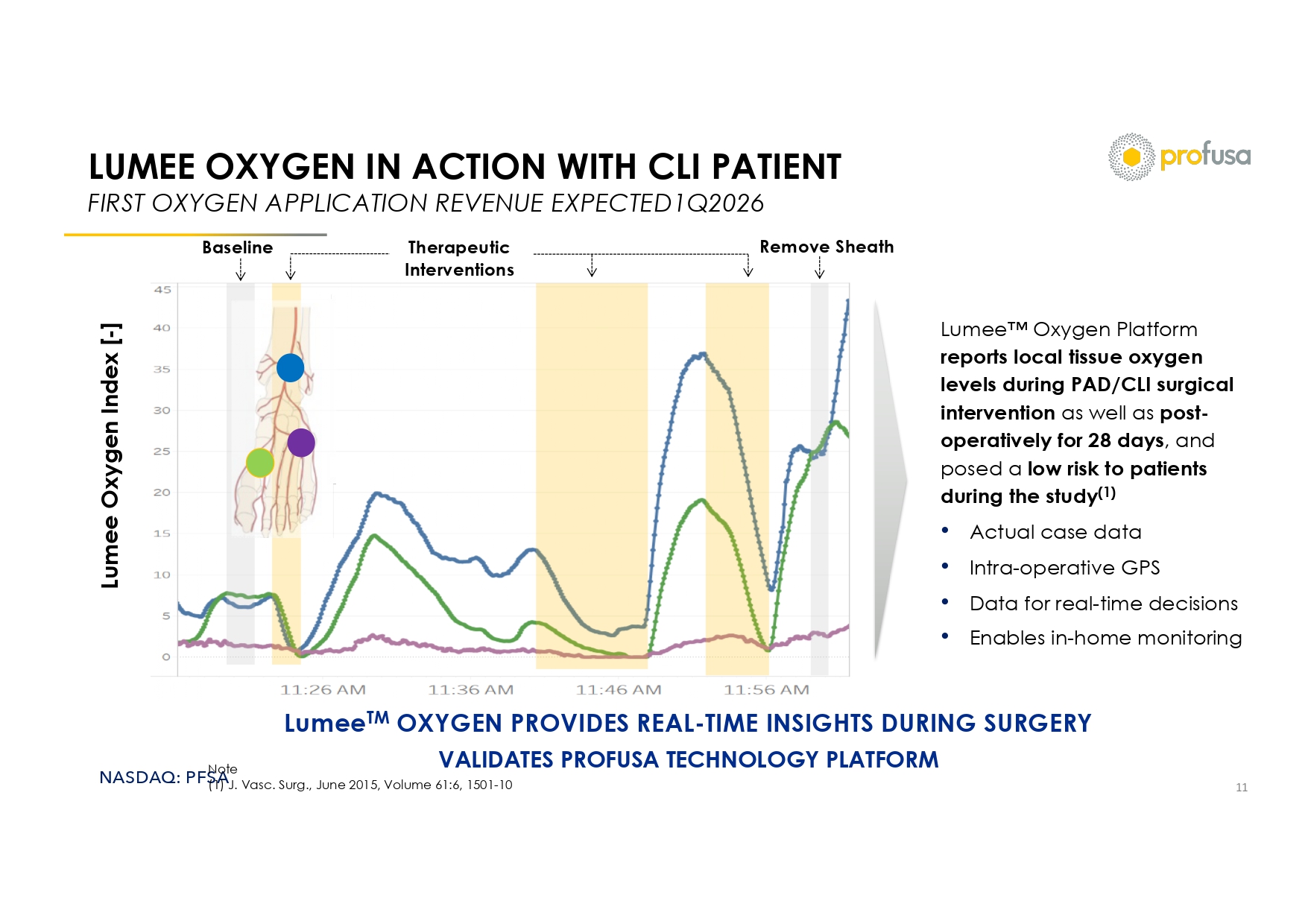

NASDAQ: PFSA LUMEE OXYGEN IN ACTION WITH CLI PATIENT FIRST OXYGEN APPLICATION REVENUE EXPECTED1Q2026 11 Therapeutic Interventions Lumee Oxygen Index [ - ] Remove Sheath Baseline Note (1) J. Vasc . Surg., June 2015, Volume 61:6, 1501 - 10 Lumee Oxygen Platform reports local tissue oxygen levels during PAD/CLI surgical intervention as well as post - operatively for 28 days , and posed a low risk to patients during the study (1) • Actual case data • Intra - operative GPS • Data for real - time decisions • Enables in - home monitoring Lumee TM OXYGEN PROVIDES REAL - TIME INSIGHTS DURING SURGERY VALIDATES PROFUSA TECHNOLOGY PLATFORM

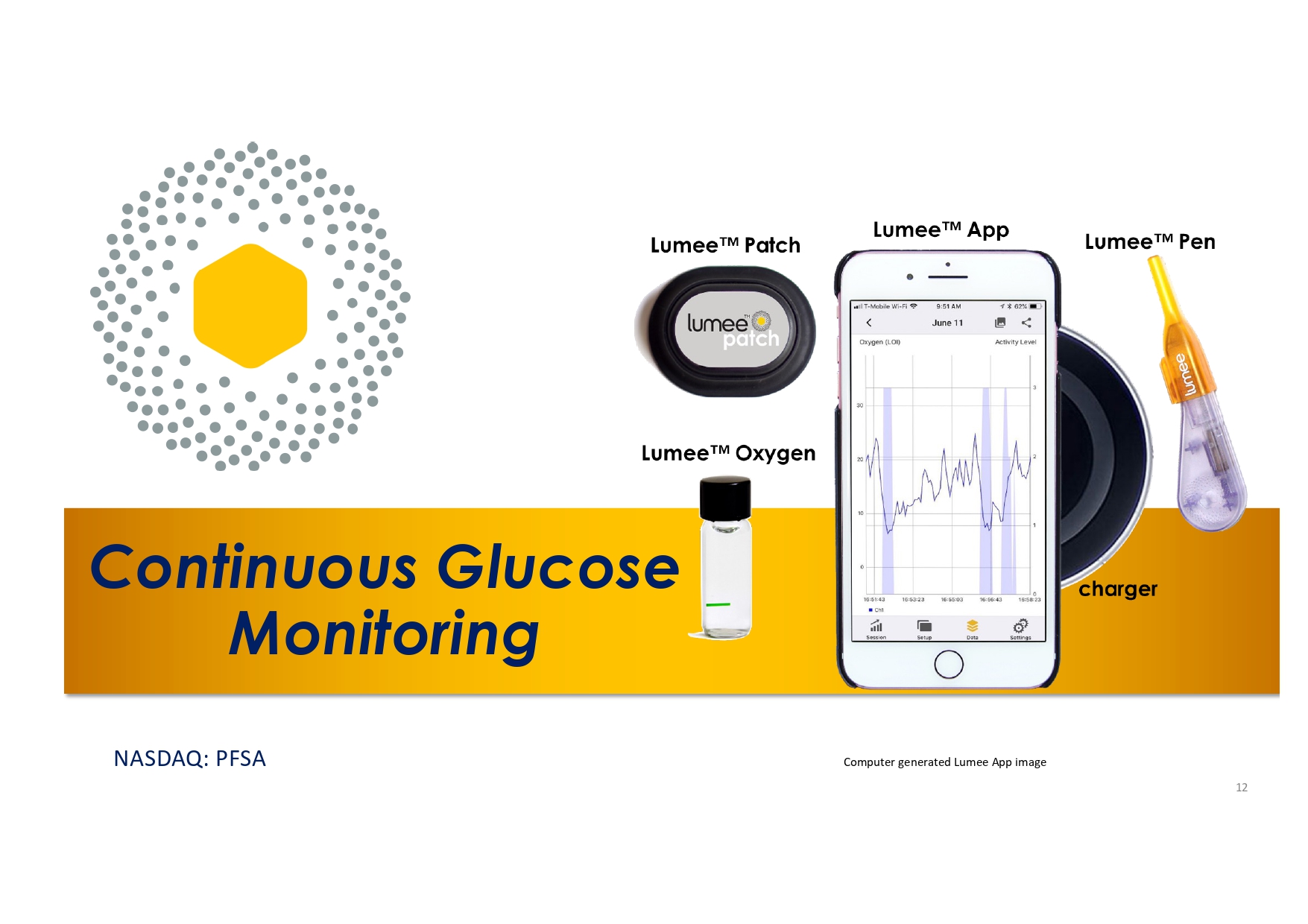

12 Continuous Glucose Monitoring NASDAQ: PFSA Computer generated Lumee App image

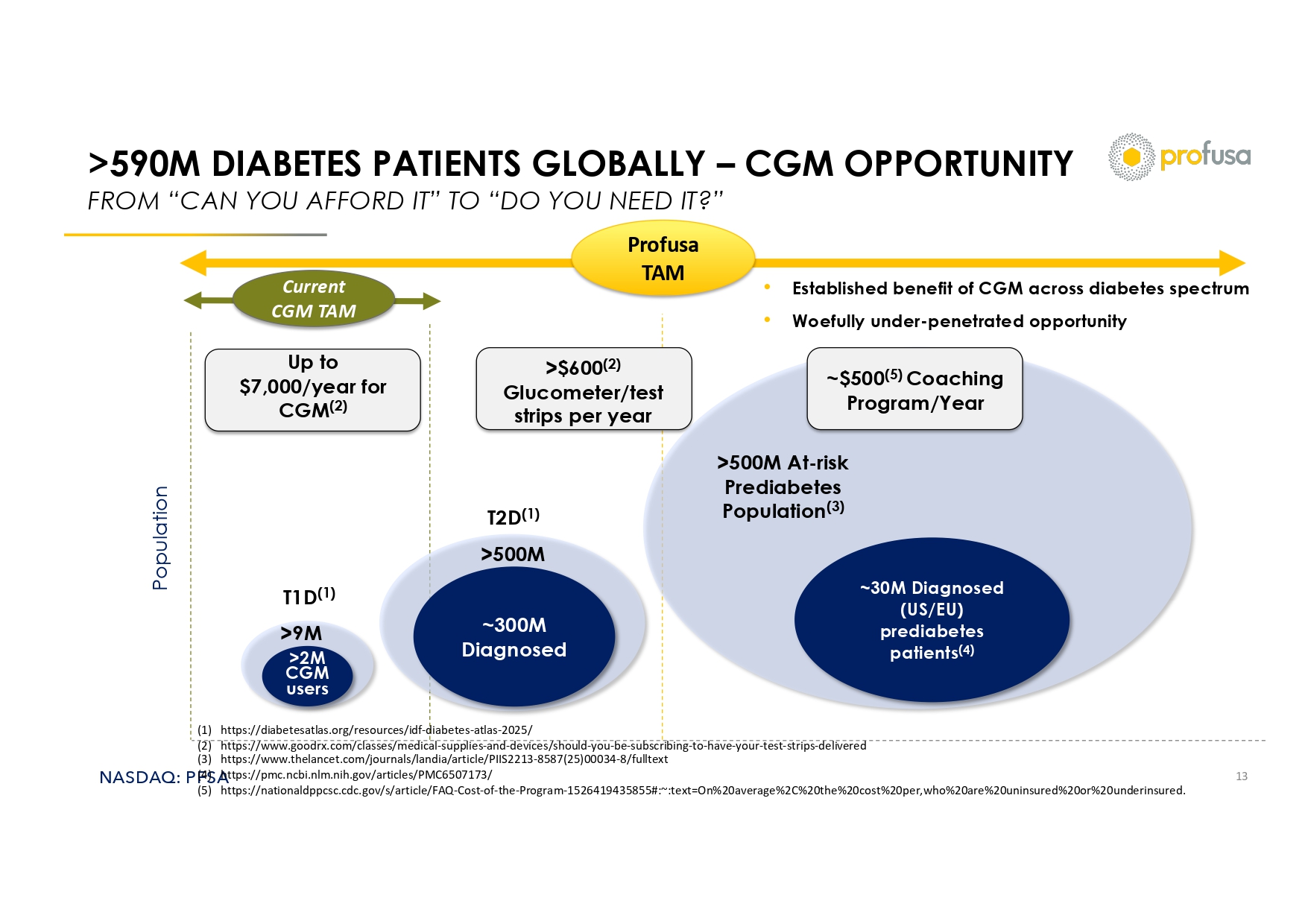

NASDAQ: PFSA >590M DIABETES PATIENTS GLOBALLY – CGM OPPORTUNITY FROM “CAN YOU AFFORD IT” TO “DO YOU NEED IT?” 13 Current CGM TAM Profusa TAM • Established benefit of CGM across diabetes spectrum • Woefully under - penetrated opportunity >2M CGM users ~300M Diagnosed ~30M Diagnosed (US/EU) prediabetes patients (4) Population T1D (1) T2D (1) >500M At - risk Prediabetes Population (3) >9M >500M Up to $7,000/year for CGM (2) >$600 (2) Glucometer/test strips per year ~$500 (5) Coaching Program/Year (1) https://diabetesatlas.org/resources/idf - diabetes - atlas - 2025/ (2) https://www.goodrx.com/classes/medical - supplies - and - devices/should - you - be - subscribing - to - have - your - test - strips - delivered (3) https://www.thelancet.com/journals/landia/article/PIIS2213 - 8587(25)00034 - 8/fulltext (4) https://pmc.ncbi.nlm.nih.gov/articles/PMC6507173/ (5) https://nationaldppcsc.cdc.gov/s/article/FAQ - Cost - of - the - Program - 1526419435855#:~:text=On%20average%2C%20the%20cost%20per,wh o%20are%20uninsured%20or%20underinsured.

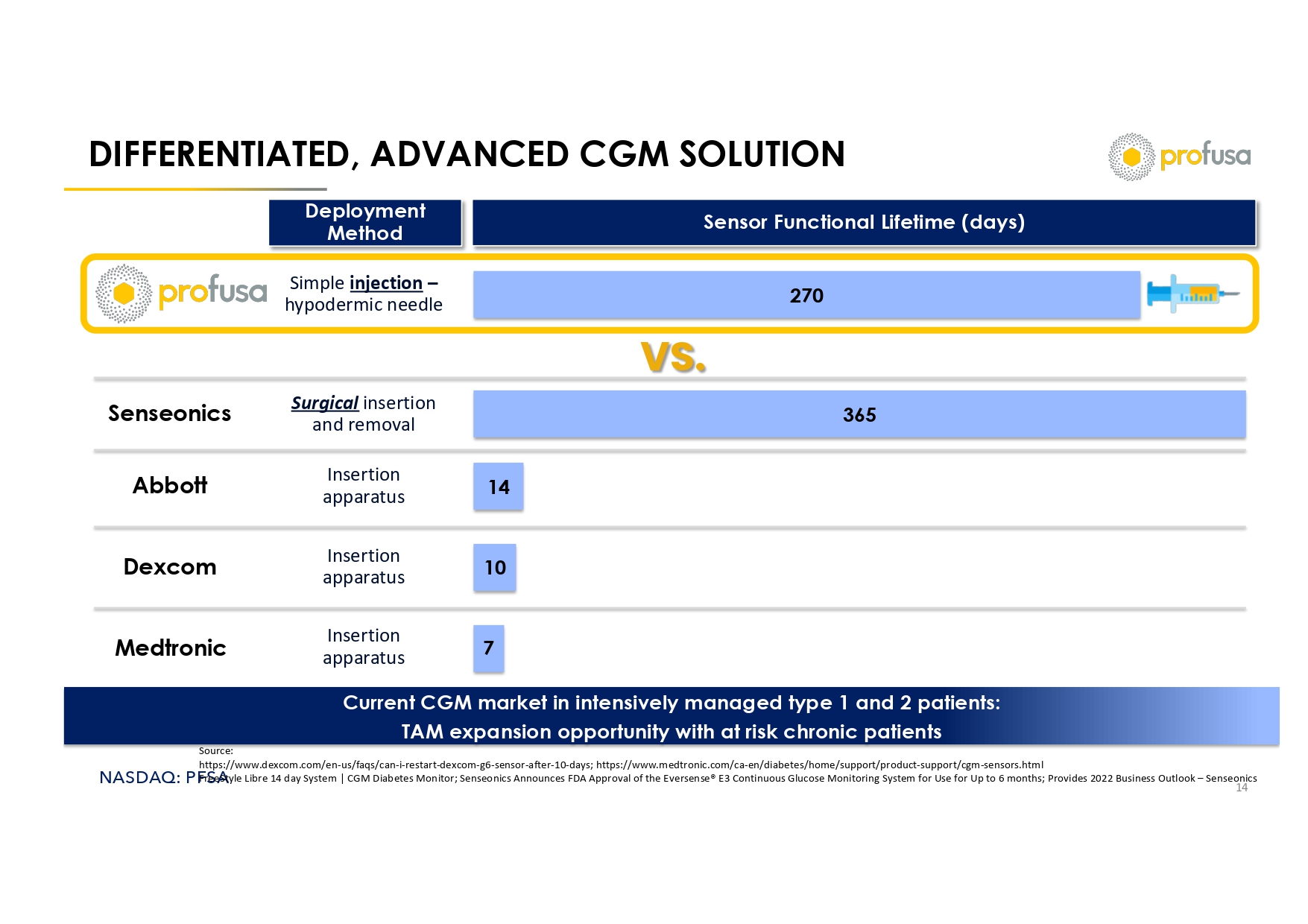

NASDAQ: PFSA DIFFERENTIATED, ADVANCED CGM SOLUTION 14 Insertion apparatus Insertion apparatus Surgical insertion and removal Simple injection – hypodermic needle Sensor Functional Lifetime (days) Deployment Method Dexcom Medtronic Abbott Senseonics Source: https://www.dexcom.com/en - us/faqs/can - i - restart - dexcom - g6 - sensor - after - 10 - days; https://www.medtronic.com/ca - en/diabetes/home/su pport/product - support/cgm - sensors.html FreeStyle Libre 14 day System | CGM Diabetes Monitor; Senseonics Announces FDA Approval of the Eversense ® E3 Continuous Glucose Monitoring System for Use for Up to 6 months; Provides 2022 Business Outlook – Senseonics 270 365 14 10 7 Insertion apparatus Current CGM market in intensively managed type 1 and 2 patients: TAM expansion opportunity with at risk chronic patients VS.

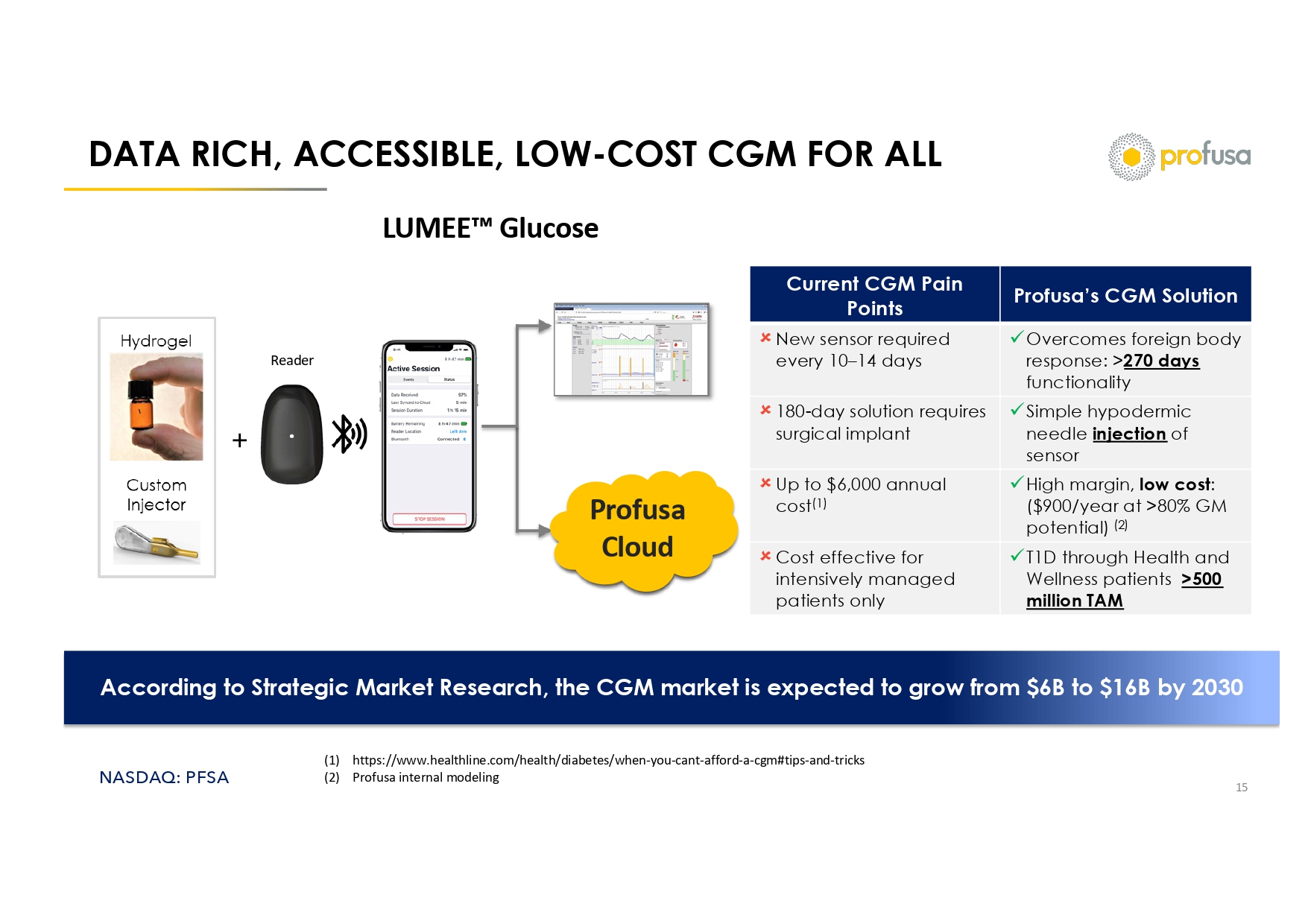

NASDAQ: PFSA DATA RICH, ACCESSIBLE, LOW - COST CGM FOR ALL 15 Profusa Cloud Reader Profusa’s CGM Solution Current CGM Pain Points x Overcomes foreign body response: > 270 days functionality New sensor required every 10 – 14 days x Simple hypodermic needle injection of sensor 180 - day solution requires surgical implant x High margin, low cost : ($900/year at >80% GM potential) (2) Up to $6,000 annual cost (1) x T1D through Health and Wellness patients >500 million TAM Cost effective for intensively managed patients only According to Strategic Market Research, the CGM market is expected to grow from $6B to $16B by 2030 LUMEE Glucose (1) https://www.healthline.com/health/diabetes/when - you - cant - afford - a - cgm#tips - and - tricks (2) Profusa internal modeling

NASDAQ: PFSA 16 LUMEE GLUCOSE CLINICAL TRIAL Demonstrated Safety and Functionality • Clinical trial evaluated the safety and functionality of the glucose platform, sensor, reader and AI platform ⎼ 4 Clinical sites ⎼ Two European clinical sites ⎼ Two Asian clinical sites • 54 Subjects enrolled • 108 Sensors injected; 398 study visits completed • 745 Glucose traces collected; >18,000 paired reference points • Top line results: MARD (1) 10 - 12%; functionality >270 days: safety profile met (1) Current development data processing and algorithm

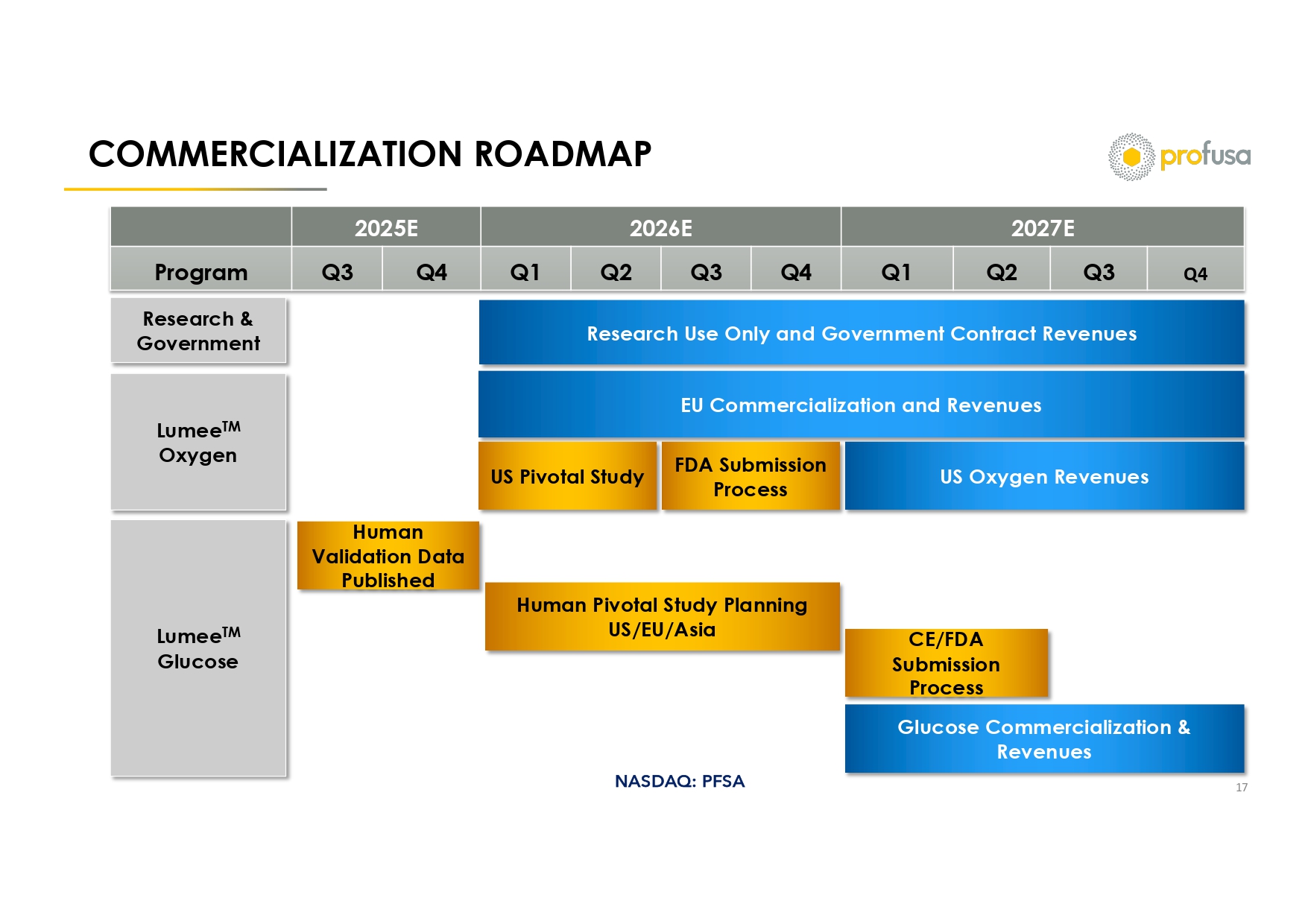

NASDAQ: PFSA COMMERCIALIZATION ROADMAP 17 2027E 2026E 2025E Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Program Research Use Only and Government Contract Revenues Research & Government Lumee TM Oxygen Lumee TM Glucose EU Commercialization and Revenues US Oxygen Revenues FDA Submission Process US Pivotal Study Human Validation Data Published Human Pivotal Study Planning US/EU/Asia CE/FDA Submission Process Glucose Commercialization & Revenues

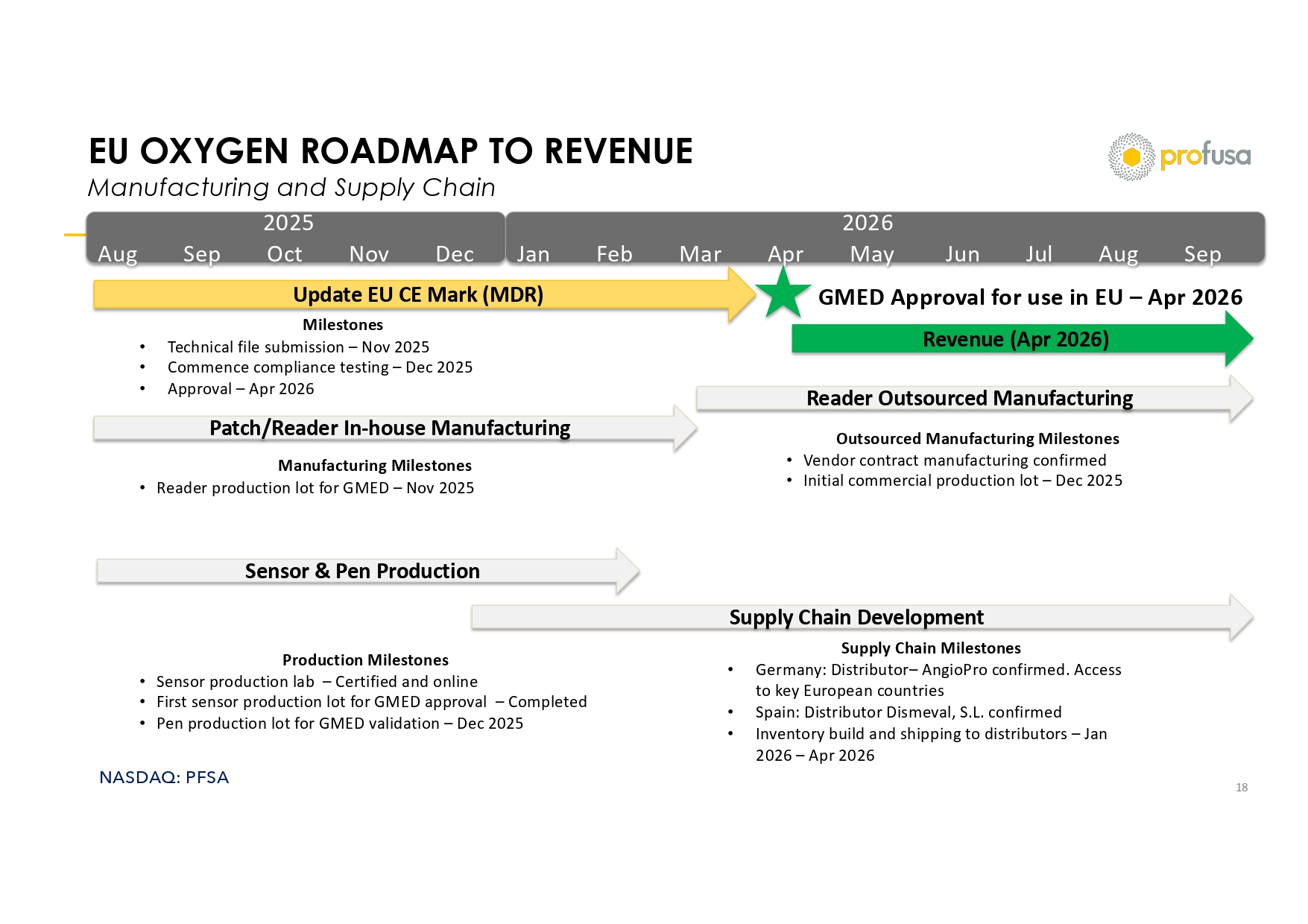

NASDAQ: PFSA EU OXYGEN ROADMAP TO REVENUE Manufacturing and Supply Chain 18 2025 Aug Sep Oct Nov Dec 2026 Jan Feb Mar Apr May Jun Jul Aug Sep Update EU CE Mark (MDR) Milestones • Technical file submission – Nov 2025 • Commence compliance testing – Dec 2025 • Approval – Apr 2026 Sensor & Pen Production Production Milestones • Sensor production lab – Certified and online • First sensor production lot for GMED approval – Completed • Pen production lot for GMED validation – Dec 2025 Patch/Reader In - house Manufacturing Reader Outsourced Manufacturing Manufacturing Milestones • Reader production lot for GMED – Nov 2025 Revenue (Apr 2026) GMED Approval for use in EU – Apr 2026 Supply Chain Development Supply Chain Milestones • Germany: Distributor – AngioPro confirmed. Access to key European countries • Spain: Distributor Dismeval , S.L. confirmed • Inventory build and shipping to distributors – Jan 2026 – Apr 2026 Outsourced Manufacturing Milestones • Vendor contract manufacturing confirmed • Initial commercial production lot – Dec 2025

NASDAQ: PFSA OXYGEN PLATFORM REVENUE OPERATING MODEL 19 Distribution partners and Profusa commercial team will market directly to Centers • High Volume Hospital Centers: perform 1,000 to1,500 procedures/year • Ambulatory Centers & Doctors’ Offices: perform 200 – 1,000 procedures/year Equipment required for center to perform procedure • Each center will require 3 kits to perform the annual procedures • Each kit contains (1) tablet (iPad) with software preloaded, (4) patches/sensors and a small supply of adhesives • Each procedure will require (4) sensors and (4) pens Revenue (1) • Projected to be 600 EUR per procedure • Startup kits projected to be 10,000 EUR per kit (1) Based on Internal projections

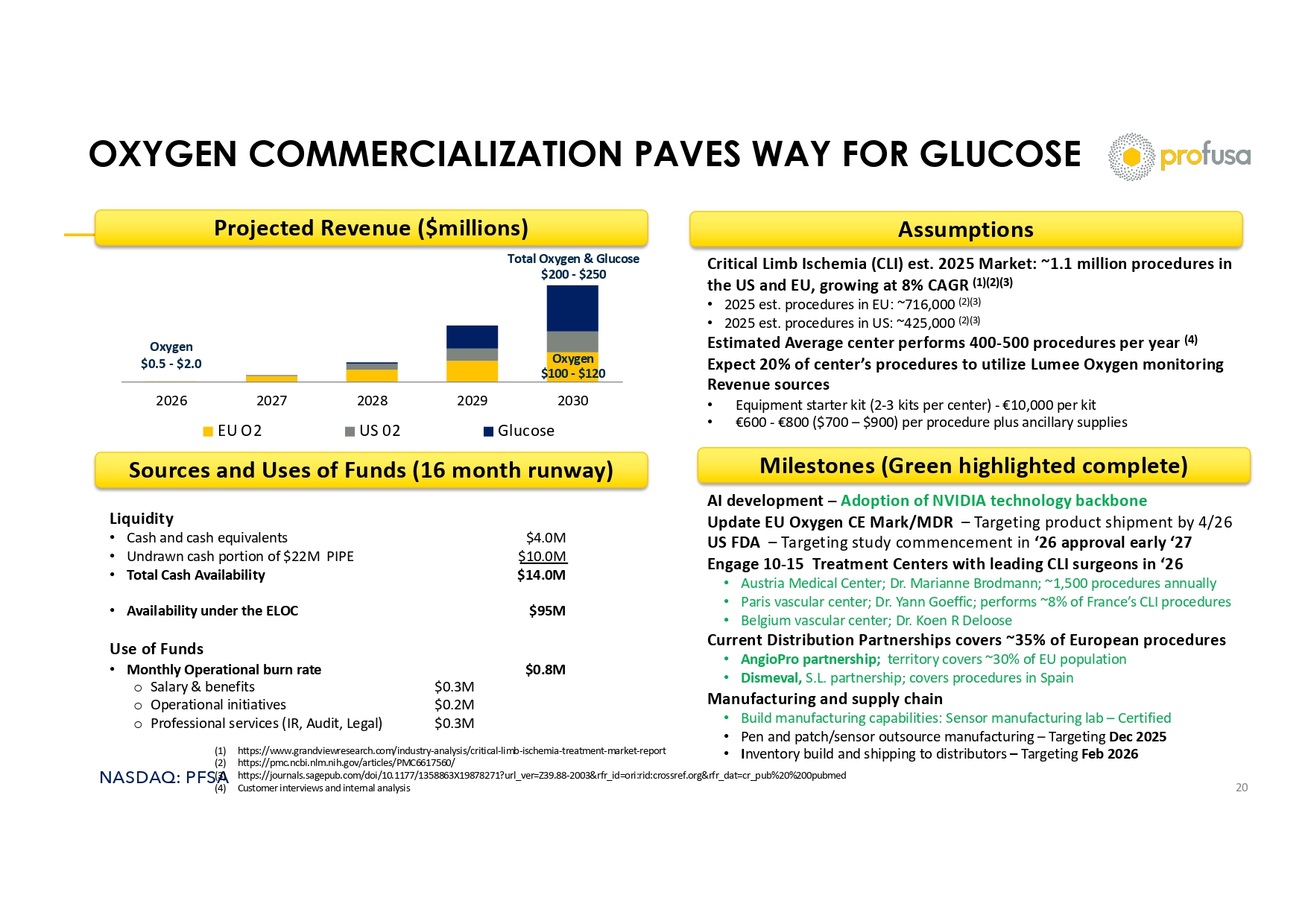

NASDAQ: PFSA OXYGEN COMMERCIALIZATION PAVES WAY FOR GLUCOSE 20 2026 2027 2028 2029 2030 EU O2 US 02 Glucose Projected Revenue ($millions) Assumptions Critical Limb Ischemia (CLI) est. 2025 Market: ~1.1 million procedures in the US and EU, growing at 8% CAGR (1)(2)(3) • 2025 est. procedures in EU: ~716,000 (2)(3) • 2025 est. procedures in US: ~425,000 (2)(3) Estimated Average center performs 400 - 500 procedures per year (4) Expect 20% of center’s procedures to utilize Lumee Oxygen monitoring Revenue sources • Equipment starter kit (2 - 3 kits per center) - €10,000 per kit • €600 - €800 ($700 – $900) per procedure plus ancillary supplies Milestones (Green highlighted complete) AI development – Adoption of NVIDIA technology backbone Update EU Oxygen CE Mark/MDR – Targeting product shipment by 4/26 US FDA – Targeting study commencement in ‘26 approval early ‘27 Engage 10 - 15 Treatment Centers with leading CLI surgeons in ‘26 • Austria Medical Center; Dr. Marianne Brodmann; ~1,500 procedures annually • Paris vascular center; Dr. Yann Goeffic ; performs ~8% of France’s CLI procedures • Belgium vascular center; Dr. Koen R Deloose Current Distribution Partnerships covers ~35% of European procedures • AngioPro partnership; territory covers ~30% of EU population • Dismeval , S.L. partnership; covers procedures in Spain Manufacturing and supply chain • Build manufacturing capabilities: Sensor manufacturing lab – Certified • Pen and patch/sensor outsource manufacturing – Targeting Dec 2025 • I nventory build and shipping to distributors – Targeting Feb 2026 Liquidity • Cash and cash equivalents $4.0M • Undrawn cash portion of $22M PIPE $10.0M • Total Cash Availability $14.0M • Availability under the ELOC $95M Use of Funds • Monthly Operational burn rate $0.8M o Salary & benefits $0.3M o Operational initiatives $0.2M o Professional services (IR, Audit, Legal) $0.3M Sources and Uses of Funds (16 month runway) Oxygen $100 - $120 Oxygen $0.5 - $2.0 Total Oxygen & Glucose $200 - $250 (1) https://www.grandviewresearch.com/industry - analysis/critical - limb - ischemia - treatment - market - report (2) https://pmc.ncbi.nlm.nih.gov/articles/PMC6617560/ (3) https://journals.sagepub.com/doi/10.1177/1358863X19878271?url_ver=Z39.88 - 2003&rfr_id=ori:rid:crossref.org&rfr_dat=cr_pub%20% 200pubmed (4) Customer interviews and internal analysis

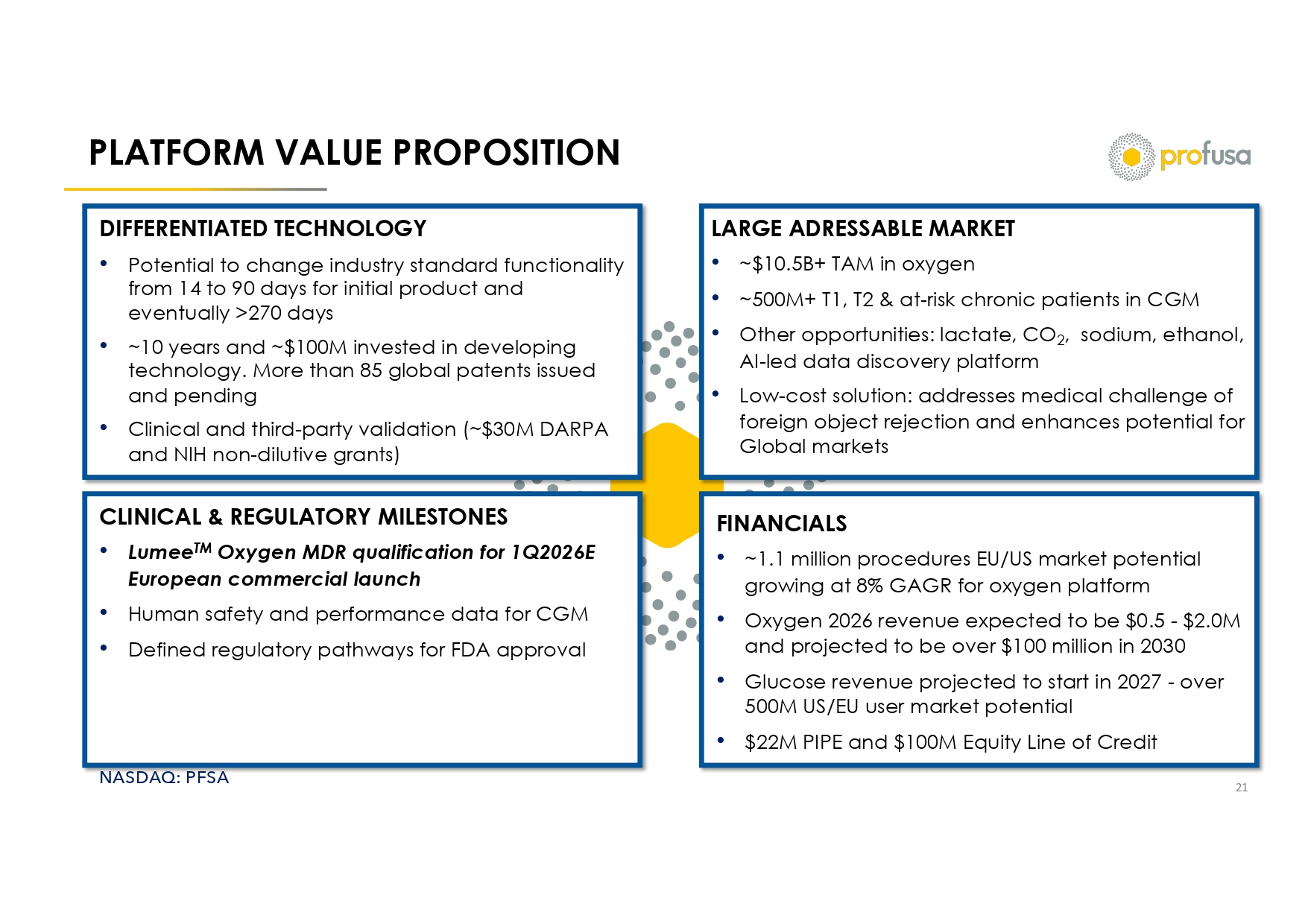

NASDAQ: PFSA PLATFORM VALUE PROPOSITION 21 DIFFERENTIATED TECHNOLOGY • Potential to change industry standard functionality from 14 to 90 days for initial product and eventually >270 days • ~10 years and ~$100M invested in developing technology. More than 85 global patents issued and pending • Clinical and third - party validation (~$30M DARPA and NIH non - dilutive grants) CLINICAL & REGULATORY MILESTONES • Lumee TM Oxygen MDR qualification for 1Q2026E European commercial launch • Human safety and performance data for CGM • Defined regulatory pathways for FDA approval LARGE ADRESSABLE MARKET • ~$10.5B+ TAM in oxygen • ~500M+ T1, T2 & at - risk chronic patients in CGM • Other opportunities: lactate, CO 2 , sodium, ethanol, AI - led data discovery platform • Low - cost solution: addresses medical challenge of foreign object rejection and enhances potential for Global markets FINANCIALS • ~1.1 million procedures EU/US market potential growing at 8% GAGR for oxygen platform • Oxygen 2026 revenue expected to be $0.5 - $2.0M and projected to be over $100 million in 2030 • Glucose revenue projected to start in 2027 - over 500M US/EU user market potential • $22M PIPE and $100M Equity Line of Credit

22 Investor & Media Relations: CORE IR email: info@coreir.com phone: 1 (212) 655 - 0924 NASDAQ: PFSA