How do I vote?

The voting process is different depending on whether you are a record (registered) or non-record shareholder:

+ | You are a non-record shareholder if your B+L Common Shares are held on your behalf by a bank, trust company, securities broker, trustee or other intermediary. This means the B+L Common Shares are registered in your intermediary’s name, and you are the beneficial owner. Most shareholders are non-record shareholders. |

+ | You are a record shareholder if your name appears in our share register. |

Non-record shareholders

If you are a non-record shareholder, you should receive voting instructions from your broker or other intermediary holding your shares. You should carefully follow the instructions provided by the broker or intermediary in order to instruct them how to vote your B+L Common Shares. The availability of voting by telephone or internet, and the deadline for providing your broker or nominee with your voting instructions, will depend on the voting process of your broker or intermediary.

Your intermediary must receive your voting instructions in sufficient time for your intermediary to act on them prior to the deadline for the deposit of proxies of 10:00 a.m. (Eastern Daylight Time) on Tuesday, May 20, 2025, or, in the case of any adjournment of the Meeting, not less than 48 hours (excluding Saturdays, Sundays and applicable Canadian holidays) prior to the rescheduled Meeting.

If you wish to vote your B+L Common Shares online during the Meeting, you may do so by following the instructions provided during the webcast of the Meeting. Even if you plan to attend the virtual Meeting, we recommend that you vote before the Meeting by following the instructions provided by your broker or intermediary, so that your vote will be counted if you later decide not to, or are unable to, attend the Meeting.

Record shareholders

If you are a record shareholder, there are several ways for you to vote your B+L Common Shares or submit your proxy:

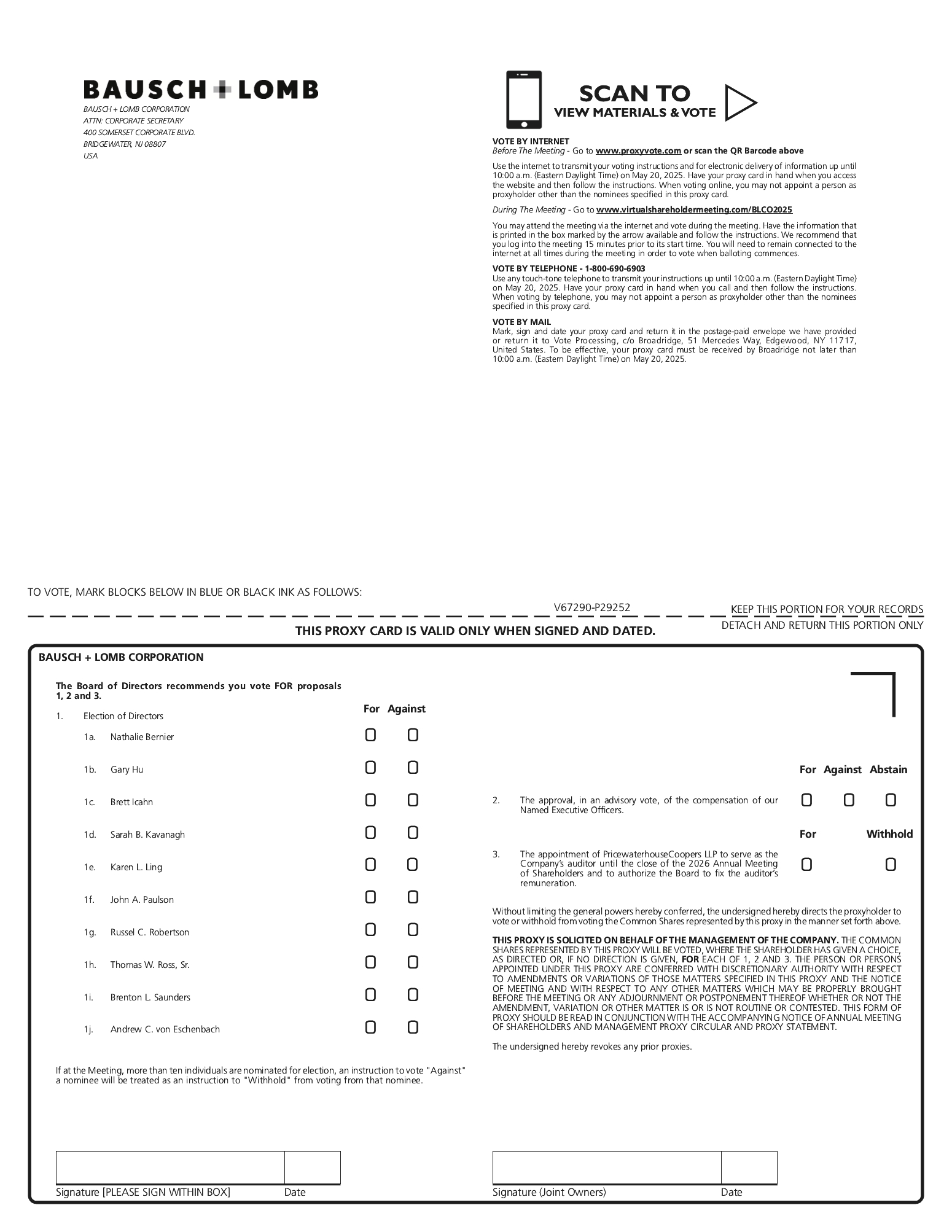

Via the internet: Go to www.proxyvote.com and follow the instructions on the website. You will be prompted to provide the 16-digit control number printed on your proxy card. The internet voting service will be available until 10:00 a.m. (Eastern Daylight Time) on Tuesday, May 20, 2025.

By telephone: You may vote via telephone by calling toll free 1-800-690-6903. You will be prompted to provide the 16-digit control number printed on your proxy card). The telephone voting service will be available until 10:00 a.m. (Eastern Daylight Time) on Tuesday, May 20, 2025.

By mail: Complete, sign and date each proxy card you received, and return it in the prepaid envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717, United States. Broadridge must receive your proxy card by 10:00 a.m. (Eastern Daylight Time) on Tuesday, May 20, 2025 in order for your vote to be counted if sent in by mail. If the Meeting is adjourned or postponed, Broadridge must receive your proxy card at least 48 hours, excluding Saturdays, Sundays and applicable Canadian holidays, before the rescheduled Meeting.

During the Meeting: You may vote your B+L Common Shares online during the Meeting by following the instructions provided during the webcast of the Meeting. Even if you plan to attend the virtual Meeting, we recommend that you submit your proxy card or vote by telephone or internet by the above deadlines so that your vote will be counted if you later decide not to, or are unable to, attend the Meeting.

We provide internet proxy voting to allow you to vote your B+L Common Shares via the internet, with procedures designed to help ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

The Board, or the Chair of the Meeting may, at their discretion, accept late proxies or waive the time limit for deposit of proxies, but is under no obligation to accept or reject any late proxy. If you receive more than one set of proxy materials, your B+L Common Shares are registered in more than one name or are registered in different accounts. Please follow the voting instructions on each Notice and/or proxy card to ensure that all of your B+L Common Shares are voted.

How do I appoint a proxyholder?

Your proxyholder is the person you appoint to cast your votes on your behalf at the Meeting. You can choose anyone you want to be your proxyholder; it does not have to be either of the persons we have designated on your proxy card or voting instruction form, nor does it have to be a shareholder. Please ensure that the person you have appointed will be attending the virtual Meeting and has your Control Number and other information required in order to vote your B+L Common Shares. Since the Meeting will take place virtually, the process for appointing another person as your proxyholder other than the persons we have designated, is different than it would be for an in-person meeting.

If you wish to appoint such a person as your proxyholder and you are a record shareholder, you must follow the instructions on your proxy card. Non-record shareholders wishing to appoint such a person as their proxyholder must contact their intermediary for instructions.

The Board recommends that you vote

The Board recommends that you vote