Earnings Presentation | 3Q25 1 3Q 20 25 Earnings Presentation November 2025 “Building the future through profitable growth”

Earnings Presentation | 3Q25 2 Agenda 1. CEO Overview 2. Business Update João Vitor Menin | Global CEO Alexandre Riccio | Brazil CEO 3. Financial Performance Santiago Stel | SVP CFO

Earnings Presentation | 3Q25 3 This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the amount of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial numbers that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not fact or historical information may be forward-looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate” , “project” , “predict” , “plan” , “believe” , “can” , “expectation” , “anticipate” , “ intend” , “aimed”, “potential” , “may” , “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements. These forward-looking statements are based on Inter's expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20F. The numbers for our key metrics Unit Economics), which include active users, as average revenue per active client ARPAC, cost to serve CTS, are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and make adjustments to improve accuracy, including adjustments that may result in recalculating our historical metrics. About Non-IFRS Financial Measures To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, Cost to Serve, Cost of Funding, Efficiency Ratio, Underwriting, NPL 90 days, NPL 15 to 90 days, NPL and Stage 3 Formation, Cost of Risk, Coverage Ratio, Funding, All-in Cost of Funding, Gross Merchandise Volume GMV, Premium, Net Inflows, Global Services Deposits and Investments, Fee Income Ratio, Client Acquisition Cost, Cards+PIX TPV, Gross ARPAC, Net ARPAC, Marginal NIM 1.0, Marginal NIM 2.0, Net Interest Margin IEP Non- int. CC Receivables 1.0, Net Interest Margin IEP 2.0, Cost-to-Serve, Risk-Adjusted Net Interest Margin IEP Non-int. CC Receivables 1.0, Risk Adjusted Net Interest Margin IEP 2.0, Risk Adjusted Efficiency Ratio. A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies. Disclaimer

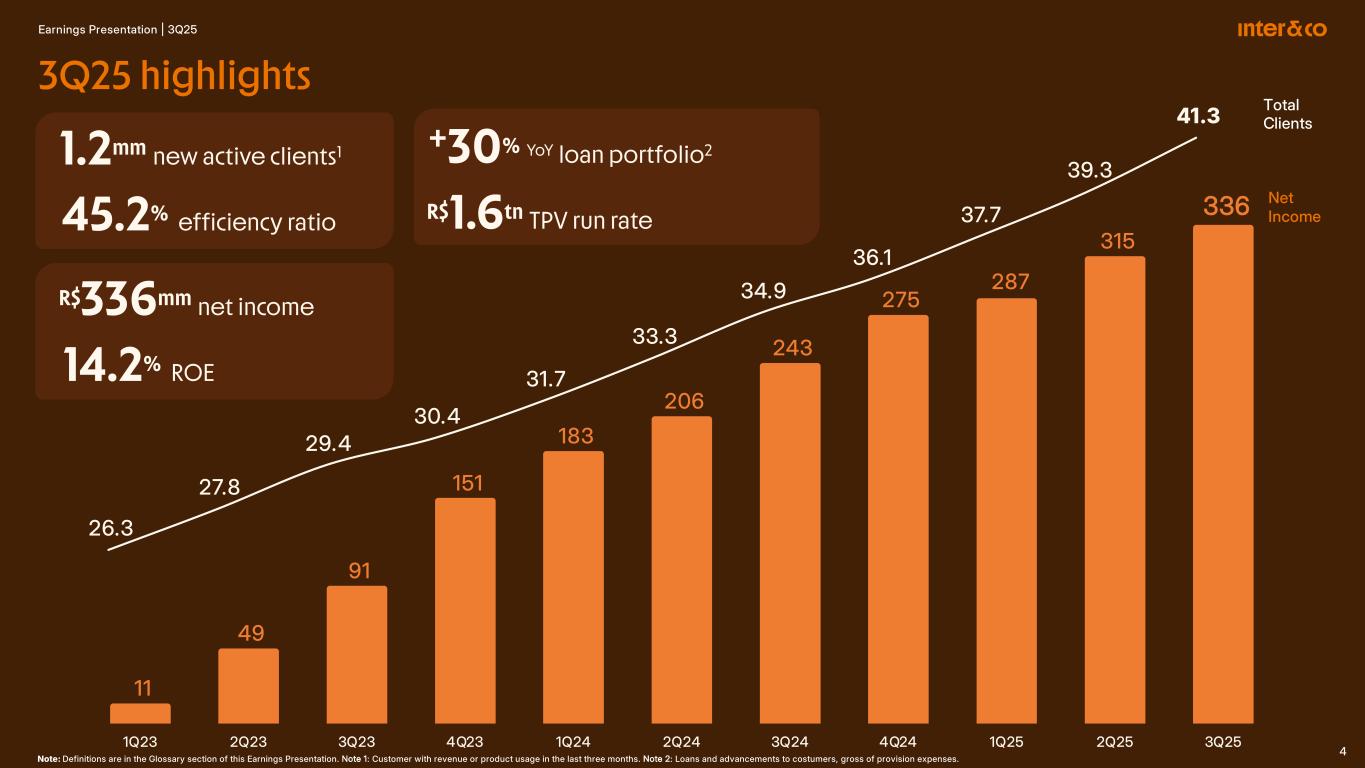

Earnings Presentation | 3Q25 4 26.3 27.8 29.4 30.4 31.7 33.3 34.9 36.1 37.7 39.3 41.3 11 49 91 151 183 206 243 275 287 315 336 - 5 0 1 0 1 50 2 0 2 50 3 0 3 50 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1: Customer with revenue or product usage in the last three months. Note 2: Loans and advancements to costumers, gross of provision expenses. Net Income R$336mm net income 14.2% ROE +30% YoY loan portfolio2 R$1.6tn TPV run rate 3Q25 highlights Total Clients 1.2mm new active clients1 45.2% efficiency ratio

Earnings Presentation | 3Q25 5 CEO Overview João Vitor Menin | Global CEO

Earnings Presentation | 3Q25 6 10 year-anniversary of our digital account Celebrating the journey, designing the future 2025

Earnings Presentation | 3Q25 7 To create a world where interactions between people generate more value Our mission statement

Earnings Presentation | 3Q25 8 The cultural pillars behind our strong performance Customer Centricity The customer at the center of all decisions Lead with Innovation Anticipate the future Operational Excellence Flawless execution Winning Mentality Extraordinary results as one team

Earnings Presentation | 3Q25 9 Innovation Building the future though profitable growth Expansion Team AI & Gen AI Hyper-personalization New features New products Single App New countries Team development Market experts New culture pillars

Earnings Presentation | 3Q25 101 Business Update Alexandre Riccio | Brazil CEO

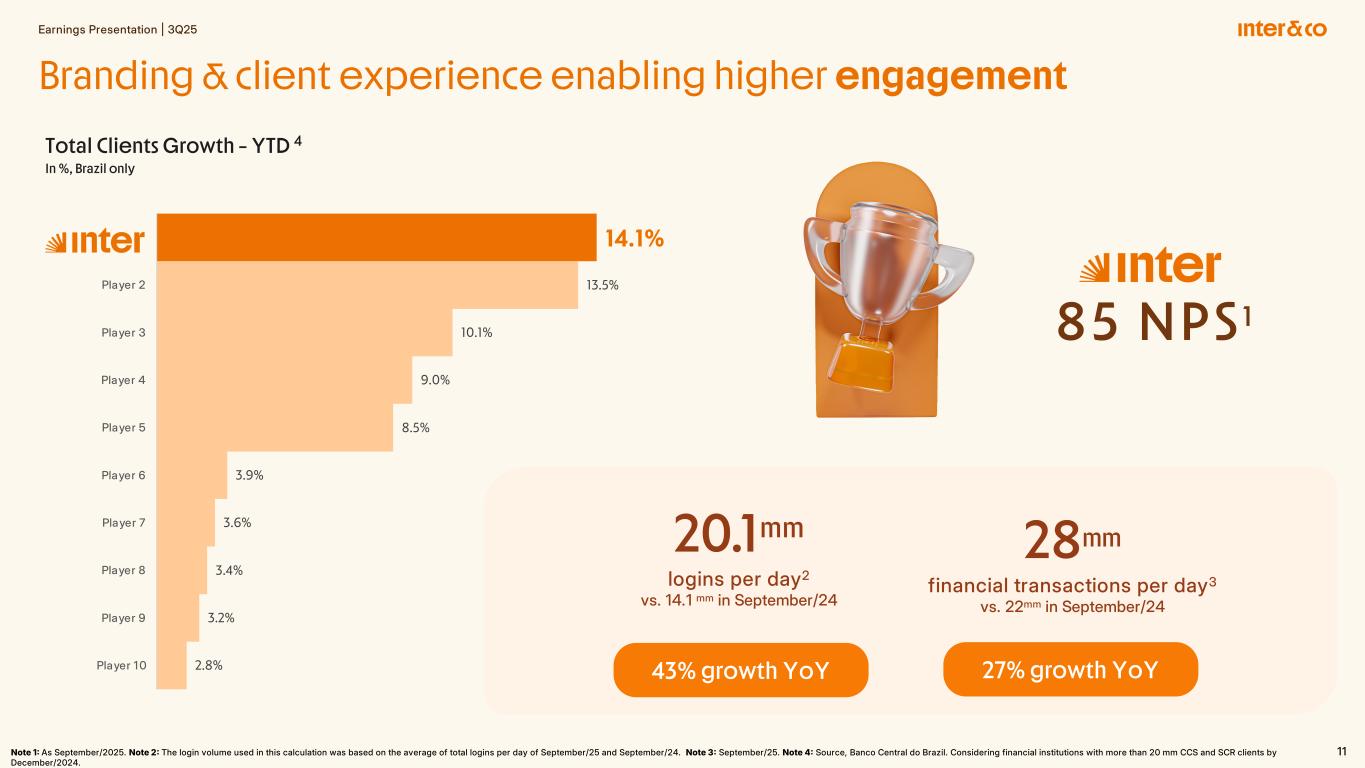

Earnings Presentation | 3Q25 11Note 1 As September/2025. Note 2 The login volume used in this calculation was based on the average of total logins per day of September/25 and September/24. Note 3 September/25. Note 4 Source, Banco Central do Brazil. Considering financial institutions with more than 20 mm CCS and SCR clients by December/2024. Branding & client experience enabling higher engagement Total Clients Growth – YTD 4 In %, Brazil only 20.1mm logins per day2 vs. 14.1 mm in September/24 28mm financial transactions per day3 vs. 22mm in September/24 85 NPS 1 14.1% 13.5% 10.1% 9.0% 8.5% 3.9% 3.6% 3.4% 3.2% 2.8% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Inter Player 2 Player 3 Player 4 Player 5 Player 6 Player 7 Player 8 Player 9 Player 1 0 43% growth YoY 27% growth YoY

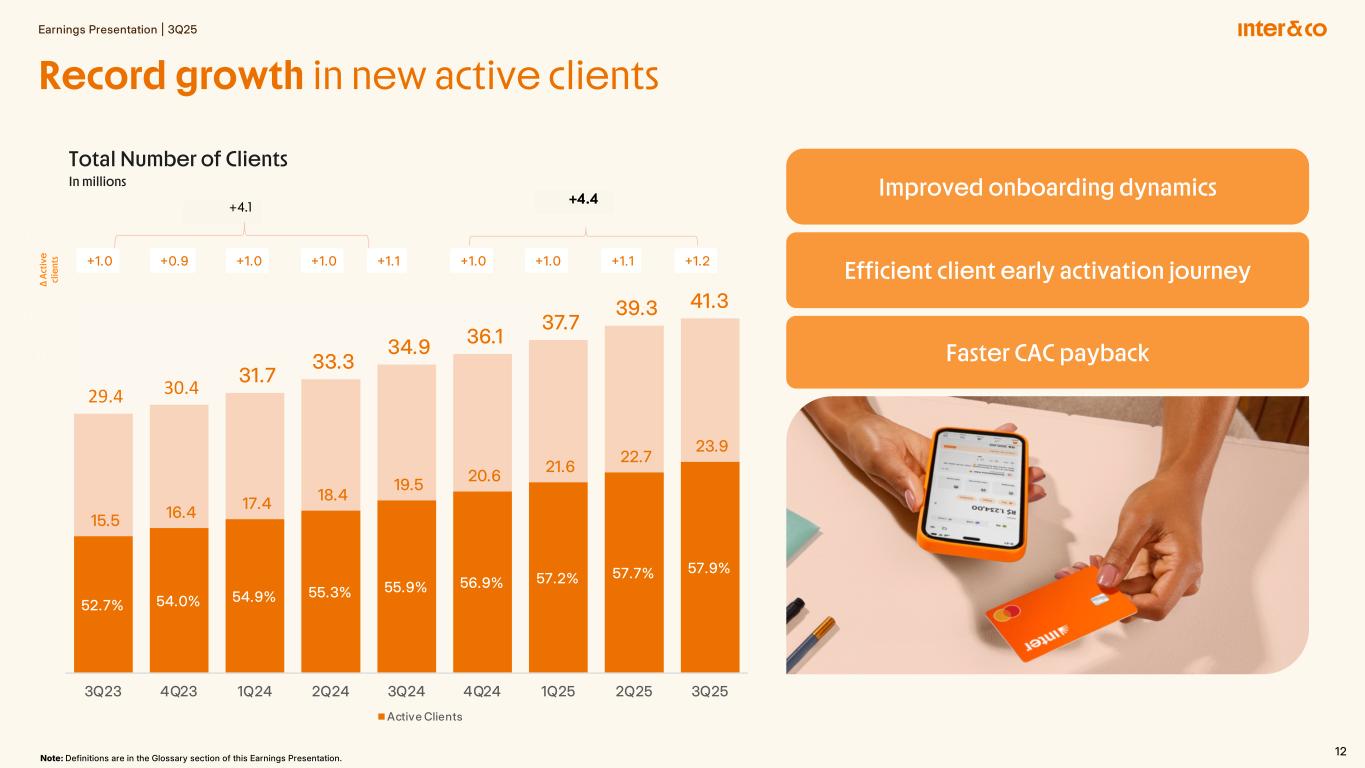

Earnings Presentation | 3Q25 12 1.0 0.9 1.0 1.0 1.1 1.0 1.0 1.1 1.2 0 0.5 1 1.5 52.7% 54.0% 54.9% 55.3% 55.9% 56.9% 57.2% 57.7% 57.9% 15.5 16.4 17.4 18.4 19.5 20.6 21.6 22.7 23.9 29.4 30.4 31.7 33.3 34.9 36.1 37.7 39.3 41.3 - 5 .0 1 0. 1 5.0 2 0. 2 5.0 3 0. 3 5.0 4 0. 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Active Clients Δ A ct iv e cl ie nt s Total Number of Clients In millions Note: Definitions are in the Glossary section of this Earnings Presentation. +4.1 +4.4 Record growth in new active clients Improved onboarding dynamics Efficient client early activation journey Faster CAC payback

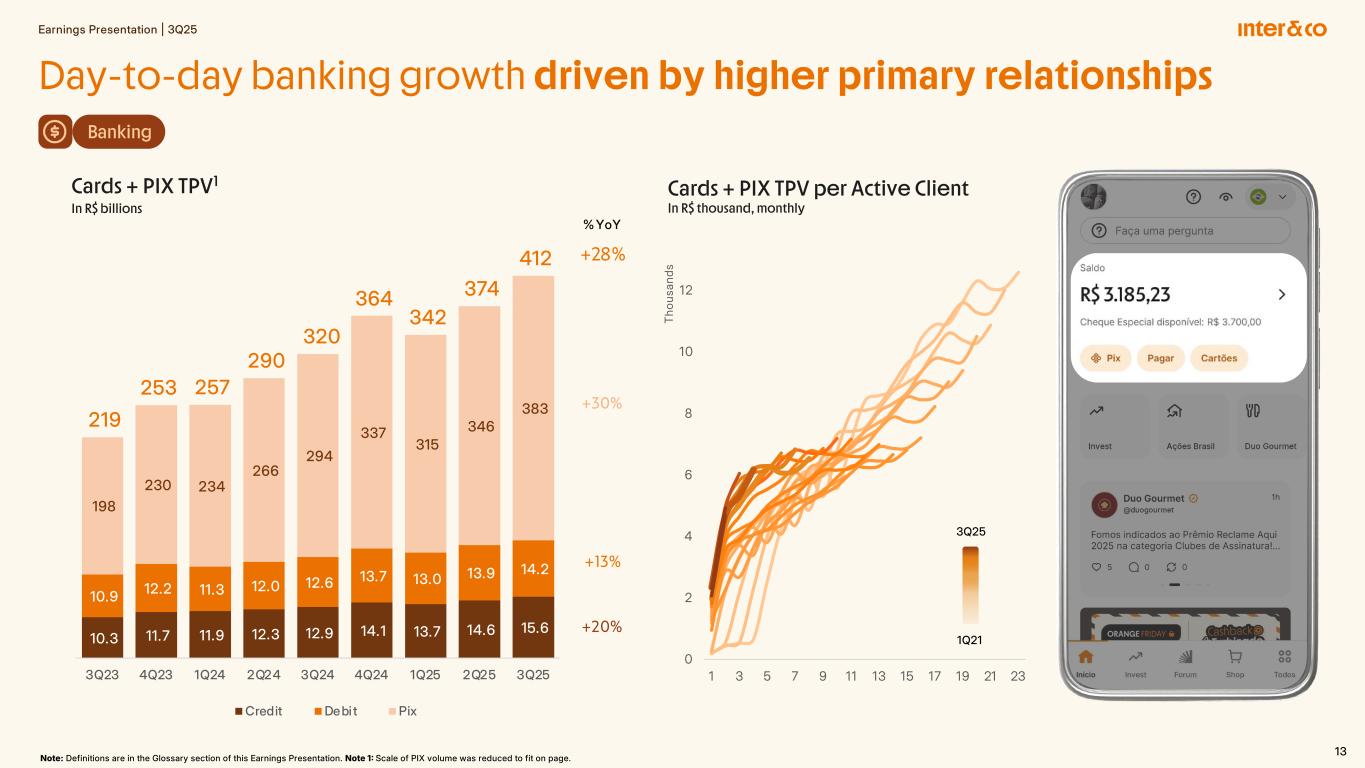

Earnings Presentation | 3Q25 13 0 2 4 6 8 10 12 1 3 5 7 9 11 13 15 17 19 21 23 Th ou sa nd s Cards + PIX TPV per Active Client In R$ thousand, monthly Cards + PIX TPV1 In R$ billions Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Scale of PIX volume was reduced to fit on page. % YoY +28% +13% +20% 10.3 11.7 11.9 12.3 12.9 14.1 13.7 14.6 15.6 10.9 12.2 11.3 12.0 12.6 13.7 13.0 13.9 14.2 198 230 234 266 294 337 315 346 383 219 253 257 290 320 364 342 374 412 - 1 0. 0 2 0 .0 3 0 .0 4 0 .0 5 0 .0 6 0 .0 7 0 .0 8 0 .0 9 0 .0 1 0 .0 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Credit De bi t Pix +30% Day-to-day banking growth driven by higher primary relationships Banking 3Q25 1Q21

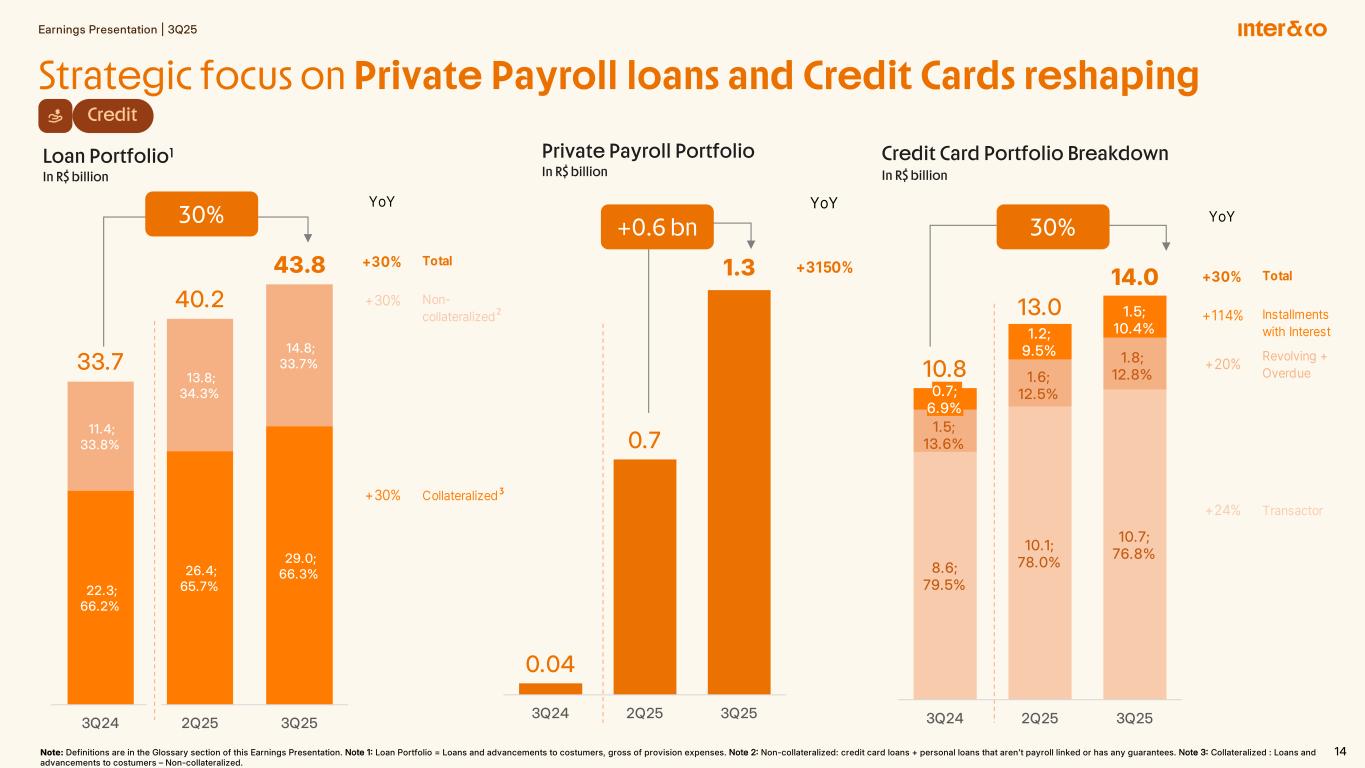

Earnings Presentation | 3Q25 14 Strategic focus on Private Payroll loans and Credit Cards reshaping Private Payroll Portfolio In R$ billion Credit Card Portfolio Breakdown In R$ billion 30% YoY +3150% YoY +30% Total +114% Installments with Interest +20% Revolving + Overdue +24% Transactor Credit 0.04 0.7 1.3 0 .0 0 .20 0 .40 0 .60 0 .80 1 .0 1 .20 3Q24 2Q25 3Q25 8.6; 79.5% 10.1; 78.0% 10.7; 76.8% 1.5; 13.6% 1.6; 12.5% 1.8; 12.8% 0.7; 6.9% 1.2; 9.5% 1.5; 10.4% 10.8 13.0 14.0 ( 1.0 ) 1 .0 3 .0 5 .0 7 .0 9 .0 1 1.0 1 3.0 1 5.0 3Q24 2Q25 3Q25 +0.6 bn 22.3; 66.2% 26.4; 65.7% 29.0; 66.3% 11.4; 33.8% 13.8; 34.3% 14.8; 33.7% 33.7 40.2 43.8 - 5 .0 1 0. 0 1 5. 0 2 0 .0 2 5. 0 3 0 .0 3 5. 0 4 0 .0 4 5. 0 5 0 .0 3Q24 2Q25 3Q25 Loan Portfolio1 In R$ billion 30% YoY +30% Total +30% Non- collateralized +30% Collateralized Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Loan Portfolio = Loans and advancements to costumers, gross of provision expenses. Note 2 Non-collateralized: credit card loans + personal loans that aren’t payroll linked or has any guarantees. Note 3 Collateralized : Loans and advancements to costumers – Non-collateralized. 2 3

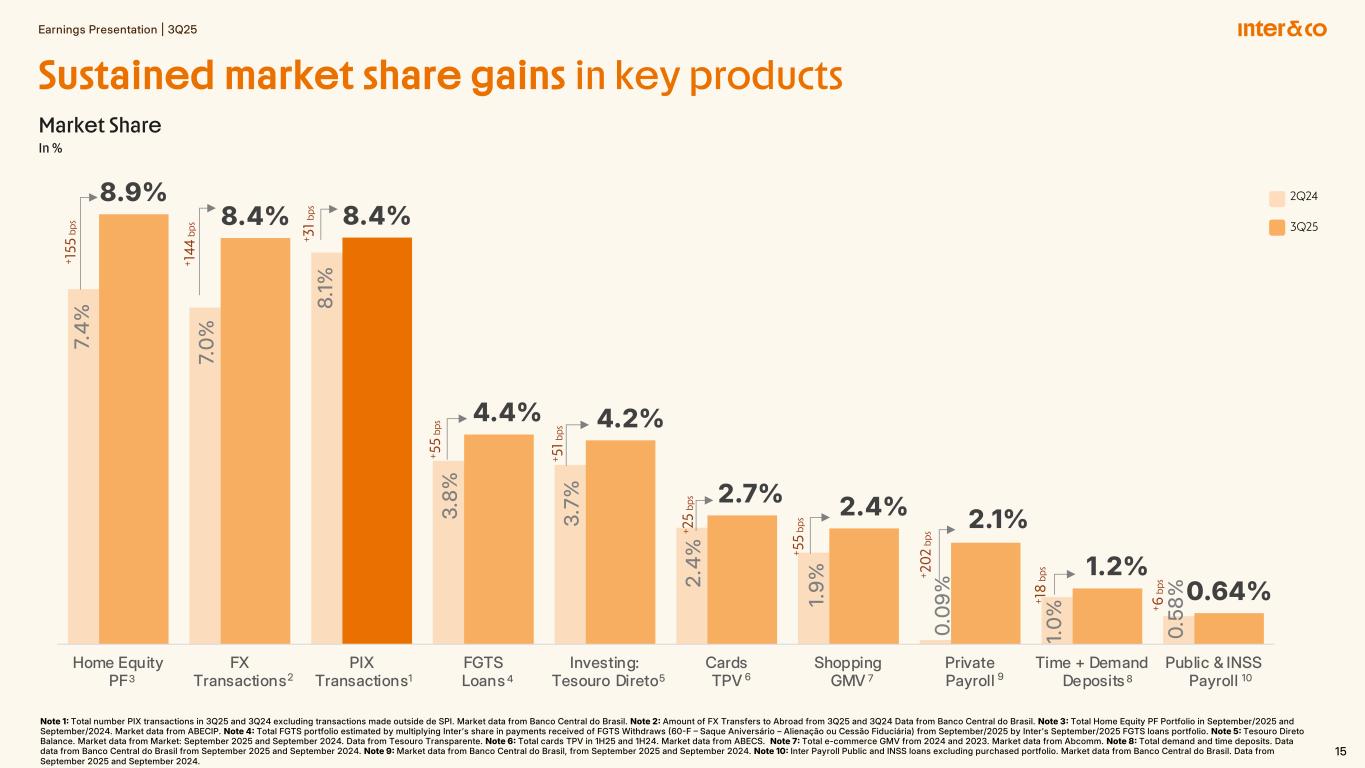

Earnings Presentation | 3Q25 15 7. 4% 7. 0% 8. 1% 3. 8% 3. 7% 2. 4% 1.9 % 0. 09 % 1.0 % 0. 58 % 8.9% 8.4% 8.4% 4.4% 4.2% 2.7% 2.4% 2.1% 1.2% 0.64% 0. 0% 1.0 % 2. 0% 3. 0% 4. 0% 5. 0% 6. 0% 7. 0% 8. 0% 9. 0% 10. 0% Home Equity PF FX Transactions PIX Transactions FGTS Loans Investing: Tesouro Direto Cards TPV Shopping GMV Private Payroll Time + Demand Deposits Public & INSS Payroll 2Q24 Market Share In % Sustained market share gains in key products Note 1 Total number PIX transactions in 3Q25 and 3Q24 excluding transactions made outside de SPI. Market data from Banco Central do Brasil. Note 2 Amount of FX Transfers to Abroad from 3Q25 and 3Q24 Data from Banco Central do Brasil. Note 3 Total Home Equity PF Portfolio in September/2025 and September/2024. Market data from ABECIP. Note 4 Total FGTS portfolio estimated by multiplying Inter’s share in payments received of FGTS Withdraws 60F Saque Aniversário – Alienação ou Cessão Fiduciária) from September/2025 by Inter’s September/2025 FGTS loans portfolio. Note 5 Tesouro Direto Balance. Market data from Market: September 2025 and September 2024. Data from Tesouro Transparente. Note 6 Total cards TPV in 1H25 and 1H24. Market data from ABECS. Note 7 Total e-commerce GMV from 2024 and 2023. Market data from Abcomm. Note 8 Total demand and time deposits. Data data from Banco Central do Brasil from September 2025 and September 2024. Note 9 Market data from Banco Central do Brasil, from September 2025 and September 2024. Note 10 Inter Payroll Public and INSS loans excluding purchased portfolio. Market data from Banco Central do Brasil. Data from September 2025 and September 2024. + 18 bp s + 15 5 b p s + 55 bp s + 55 bp s + 6 b p s+ 20 2 b p s + 51 bp s + 25 bp s 123 4 5 6 7 9 8 10 3Q25 + 31 bp s + 14 4 b p s

Earnings Presentation | 3Q25 16 7 verticals building the future through continuous innovation Growth in all verticals Compounding profitability Insurance

Earnings Presentation | 3Q25 17 Financial Performance Santiago Stel | SVP CFO 1

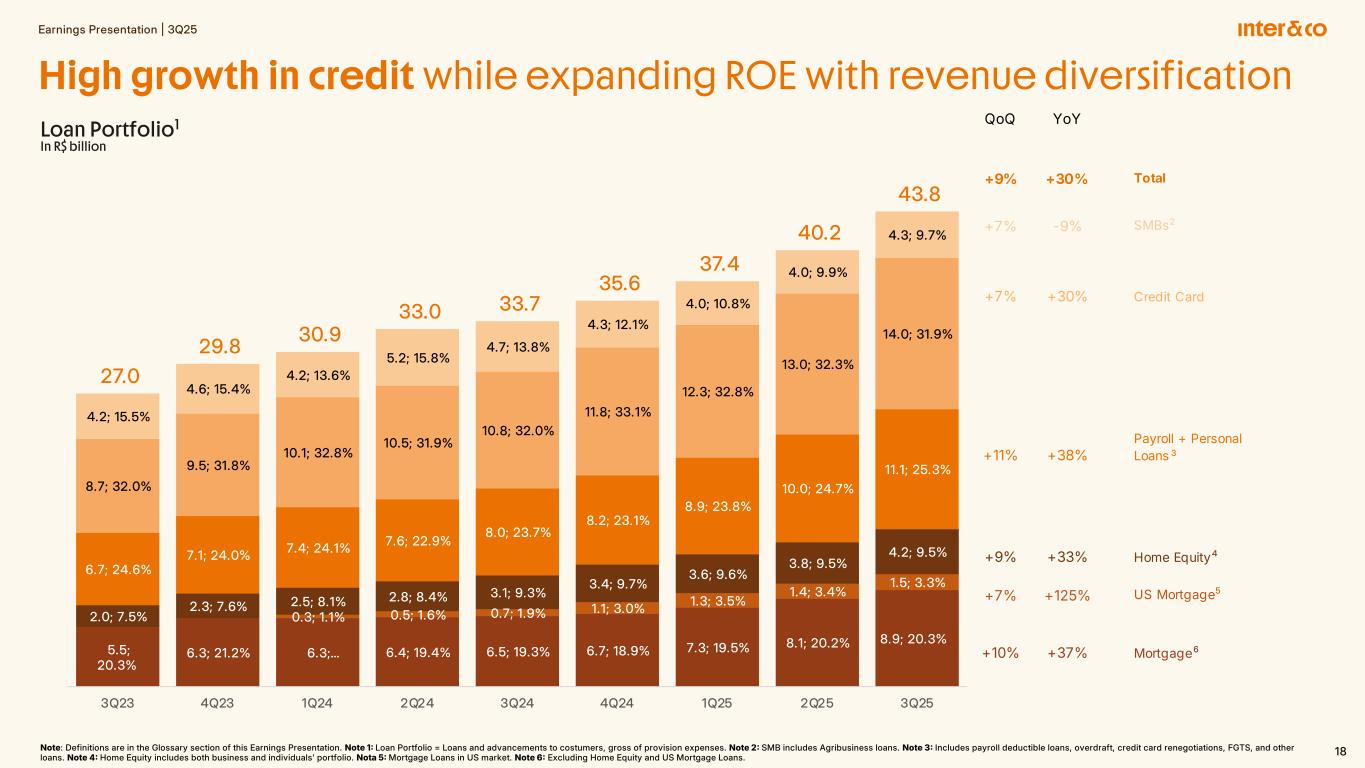

Earnings Presentation | 3Q25 18Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Loan Portfolio = Loans and advancements to costumers, gross of provision expenses. Note 2 SMB includes Agribusiness loans. Note 3 Includes payroll deductible loans, overdraft, credit card renegotiations, FGTS, and other loans. Note 4 Home Equity includes both business and individuals’ portfolio. Nota 5 Mortgage Loans in US market. Note 6 Excluding Home Equity and US Mortgage Loans. Loan Portfolio1 In R$ billion 5.5; 20.3% 6.3; 21.2% 6.3; … 6.4; 19.4% 6.5; 19.3% 6.7; 18.9% 7.3; 19.5% 8.1; 20.2% 8.9; 20.3% 0.3; 1.1% 0.5; 1.6% 0.7; 1.9% 1.1; 3.0% 1.3; 3.5% 1.4; 3.4% 1.5; 3.3% 2.0; 7.5% 2.3; 7.6% 2.5; 8.1% 2.8; 8.4% 3.1; 9.3% 3.4; 9.7% 3.6; 9.6% 3.8; 9.5% 4.2; 9.5% 6.7; 24.6% 7.1; 24.0% 7.4; 24.1% 7.6; 22.9% 8.0; 23.7% 8.2; 23.1% 8.9; 23.8% 10.0; 24.7% 11.1; 25.3% 8.7; 32.0% 9.5; 31.8% 10.1; 32.8% 10.5; 31.9% 10.8; 32.0% 11.8; 33.1% 12.3; 32.8% 13.0; 32.3% 14.0; 31.9% 4.2; 15.5% 4.6; 15.4% 4.2; 13.6% 5.2; 15.8% 4.7; 13.8% 4.3; 12.1% 4.0; 10.8% 4.0; 9.9% 4.3; 9.7% 27.0 29.8 30.9 33.0 33.7 35.6 37.4 40.2 43.8 - 5 .0 1 0. 0 1 5. 0 2 0 .0 2 5. 0 3 0 .0 3 5. 0 4 0 .0 4 5. 0 5 0 .0 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 QoQ YoY +9% +30% Total +7% -9% SMBs +7% +30% Credit Card +11% +38% Payroll + Personal Loans +9% +33% Home Equity +7% +125% US Mortgage +10% +37% Mortgage High growth in credit while expanding ROE with revenue diversification 2 3 4 6 5

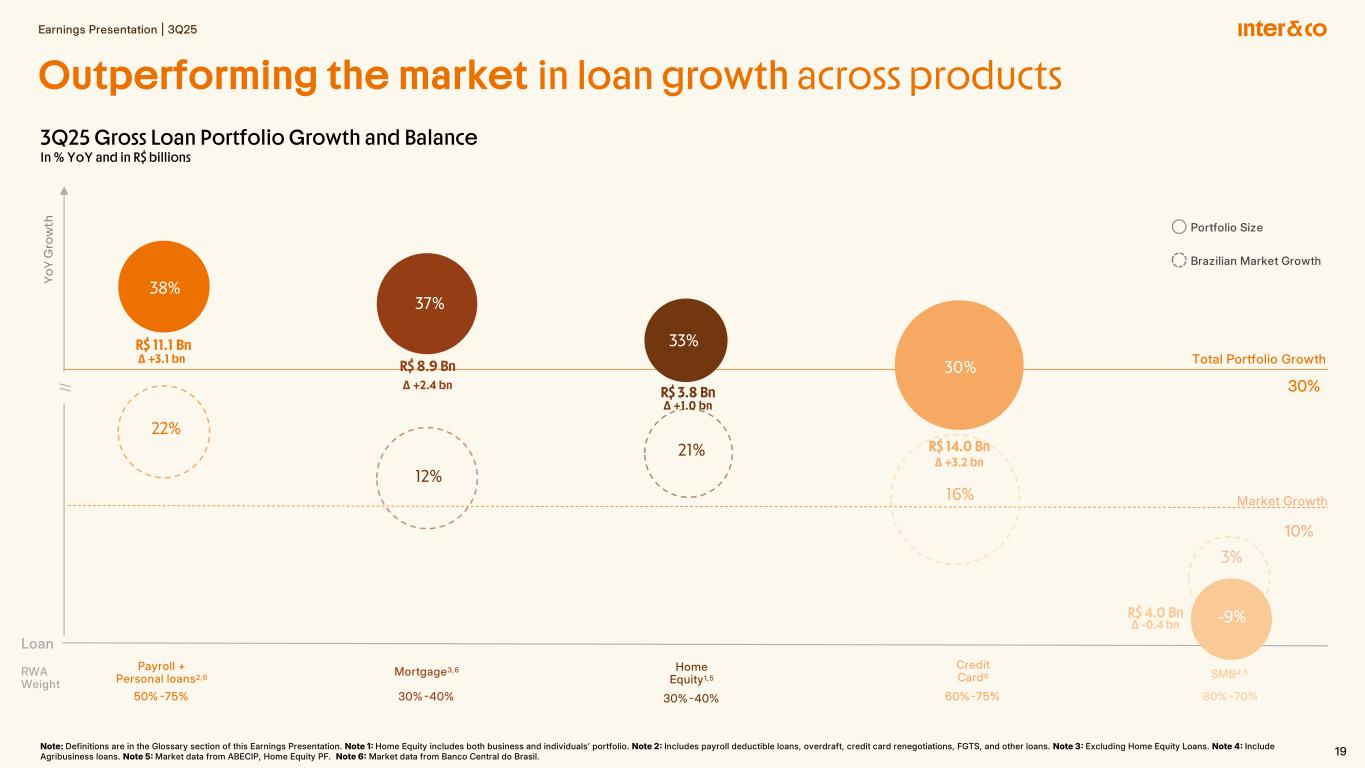

Earnings Presentation | 3Q25 19 3Q25 Gross Loan Portfolio Growth and Balance In % YoY and in R$ billions RWA Weight Loan Yo Y G ro w th // Total Portfolio Growth 30% Market Growth 10% Payroll + Personal loans2,6 50%75% Credit Card6 60%75% Home Equity1,5 30%40% Mortgage3,6 30%40% SMB4,6 80%70% Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Home Equity includes both business and individuals’ portfolio. Note 2 Includes payroll deductible loans, overdraft, credit card renegotiations, FGTS, and other loans. Note 3 Excluding Home Equity Loans. Note 4 Include Agribusiness loans. Note 5 Market data from ABECIP, Home Equity PF. Note 6 Market data from Banco Central do Brasil. 22% R$ 11.1 Bn Δ +3.1 bn 38% 12% R$ 8.9 Bn Δ +2.4 bn 37% 21% R$ 3.8 Bn Δ +1.0 bn 33% 16% R$ 14.0 Bn Δ +3.2 bn 30% 3% R$ 4.0 Bn Δ -0.4 bn -9% Outperforming the market in loan growth across products Portfolio Size Brazilian Market Growth

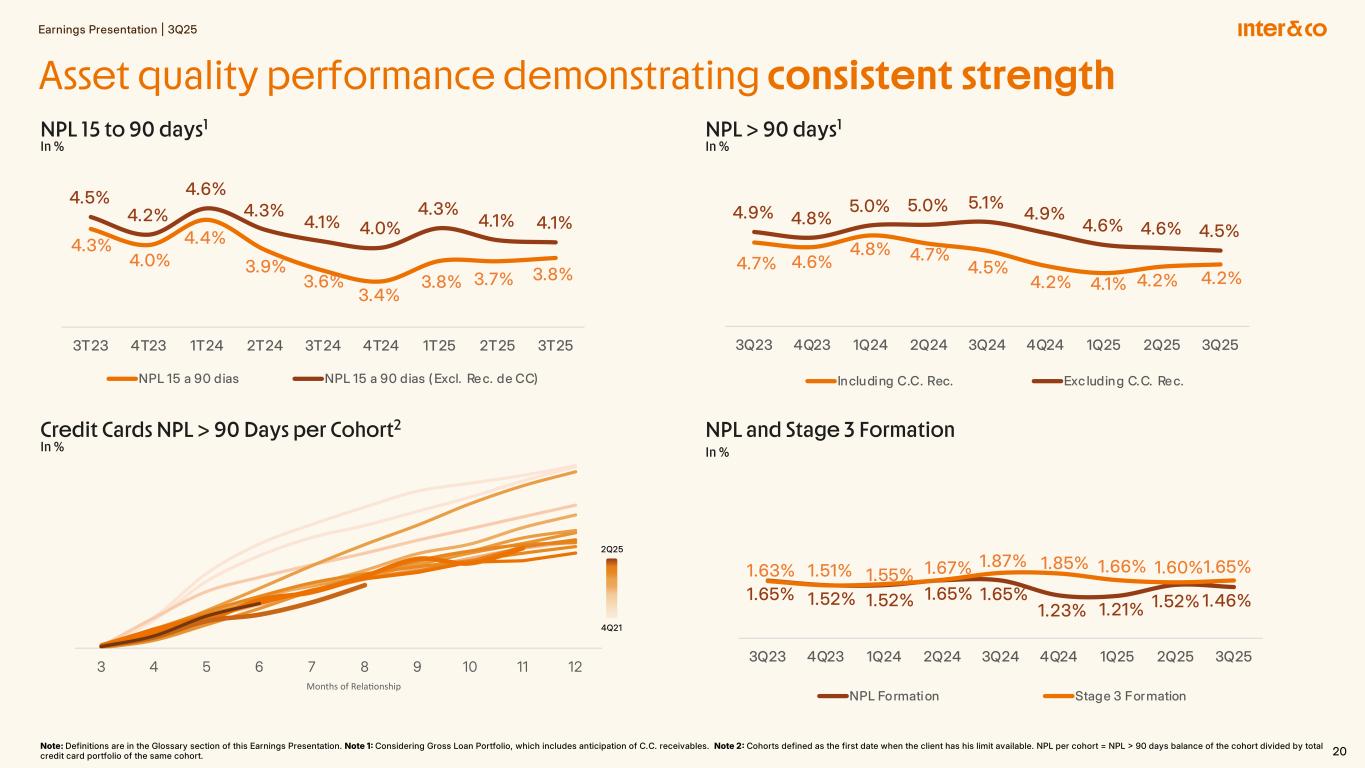

Earnings Presentation | 3Q25 20 NPL > 90 days1 In % Credit Cards NPL > 90 Days per Cohort2 In % NPL 15 to 90 days1 In % NPL and Stage 3 Formation In % Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Considering Gross Loan Portfolio, which includes anticipation of C.C. receivables. Note 2 Cohorts defined as the first date when the client has his limit available. NPL per cohort = NPL 90 days balance of the cohort divided by total credit card portfolio of the same cohort. 4.7% 4.6% 4.8% 4.7% 4.5% 4.2% 4.1% 4.2% 4.2% 4.9% 4.8% 5.0% 5.0% 5.1% 4.9% 4.6% 4.6% 4.5% 3 .0 % 3 .5 % 4 .0 % 4 .5 % 5 .0 % 5 .5 % 6 .0 % 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Including C.C. Rec. Exc luding C.C. Re c. 1.65% 1.52% 1.52% 1.65% 1.65% 1.23% 1.21% 1.52% 1.46% 1.63% 1.51% 1.55% 1.67% 1.87% 1.85% 1.66% 1.60%1.65% 0 .0 % 0 .5 % 1. 0% 1. 5% 2 .0 % 2 .5 % 3 .0 % 3 .5 % 4 .0 % 4 .5 % 5 .0 % 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 NPL Formation Stage 3 Formation 4.3% 4.0% 4.4% 3.9% 3.6% 3.4% 3.8% 3.7% 3.8% 4.5% 4.2% 4.6% 4.3% 4.1% 4.0% 4.3% 4.1% 4.1% 2 .7% 3 .2% 3 .7% 4 .2 % 4 .7% 3T23 4T23 1T24 2T24 3T24 4T24 1T25 2T25 3T25 NPL 15 a 90 dias NPL 15 a 90 dias ( Excl. Re c. de CC) 3 4 5 6 7 8 9 10 11 12 2Q25 4Q21 Months of Rela-onship Asset quality performance demonstrating consistent strength

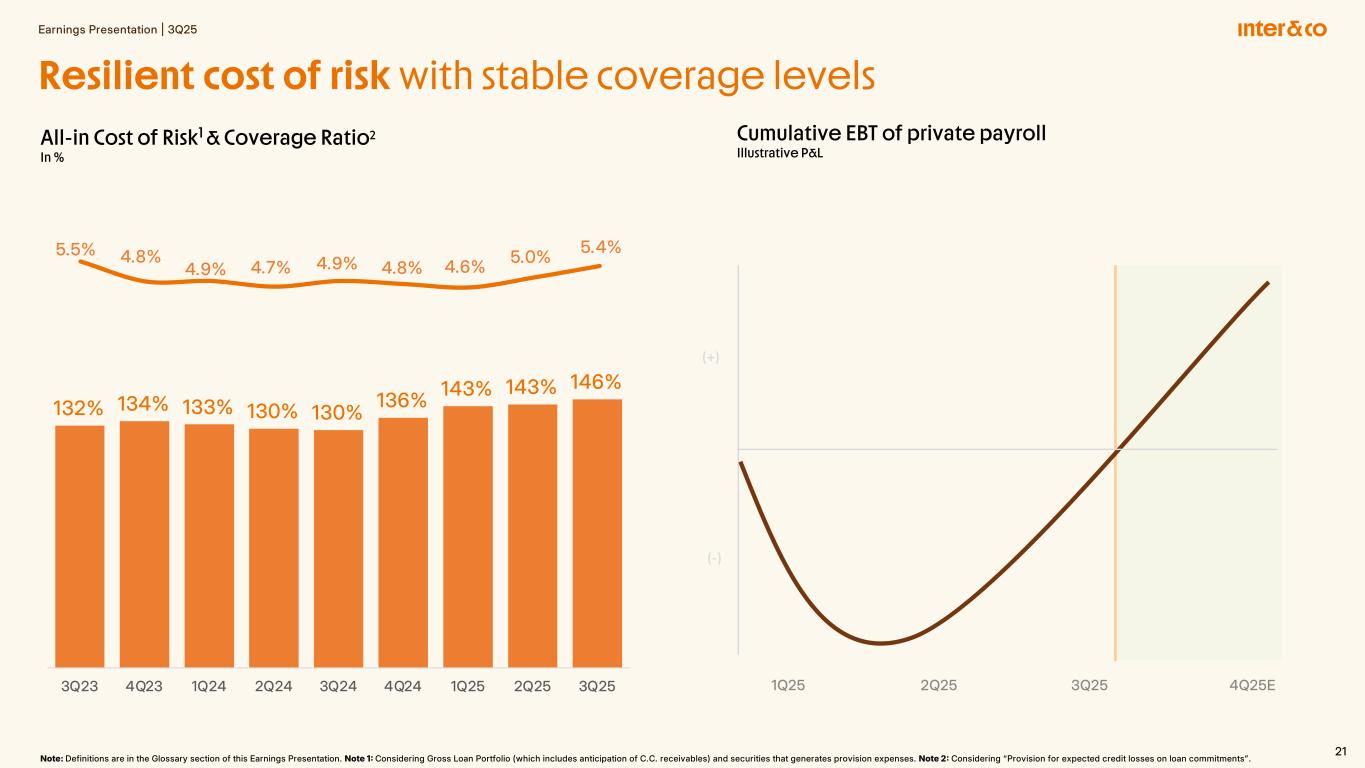

Earnings Presentation | 3Q25 21 5.5% 4.8% 4.9% 4.7% 4.9% 4.8% 4.6% 5.0% 5.4% 0 .0 % 1. 0% 2 .0 % 3 .0 % 4 .0 % 5 .0 % 6 .0 % 7 .0 % 8 .0 % 9 .0 % 10 .0 % All-in Cost of Risk1 & Coverage Ratio2 In % Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Considering Gross Loan Portfolio (which includes anticipation of C.C. receivables) and securities that generates provision expenses. Note 2 Considering “Provision for expected credit losses on loan commitments”. 132% 134% 133% 130% 130% 136% 143% 143% 146% 0 .0 % 2 0. 0% 4 0. 0% 6 0. 0% 8 0. 0% 10 0 .0 % 12 0 .0 % 14 0 .0 % 16 0 .0 % 18 0 .0 % 2 0 .0 % 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Resilient cost of risk with stable coverage levels Cumulative EBT of private payroll Illustrative P&L 3Q25 (-) 1Q25 (+) 2Q25 4Q25E

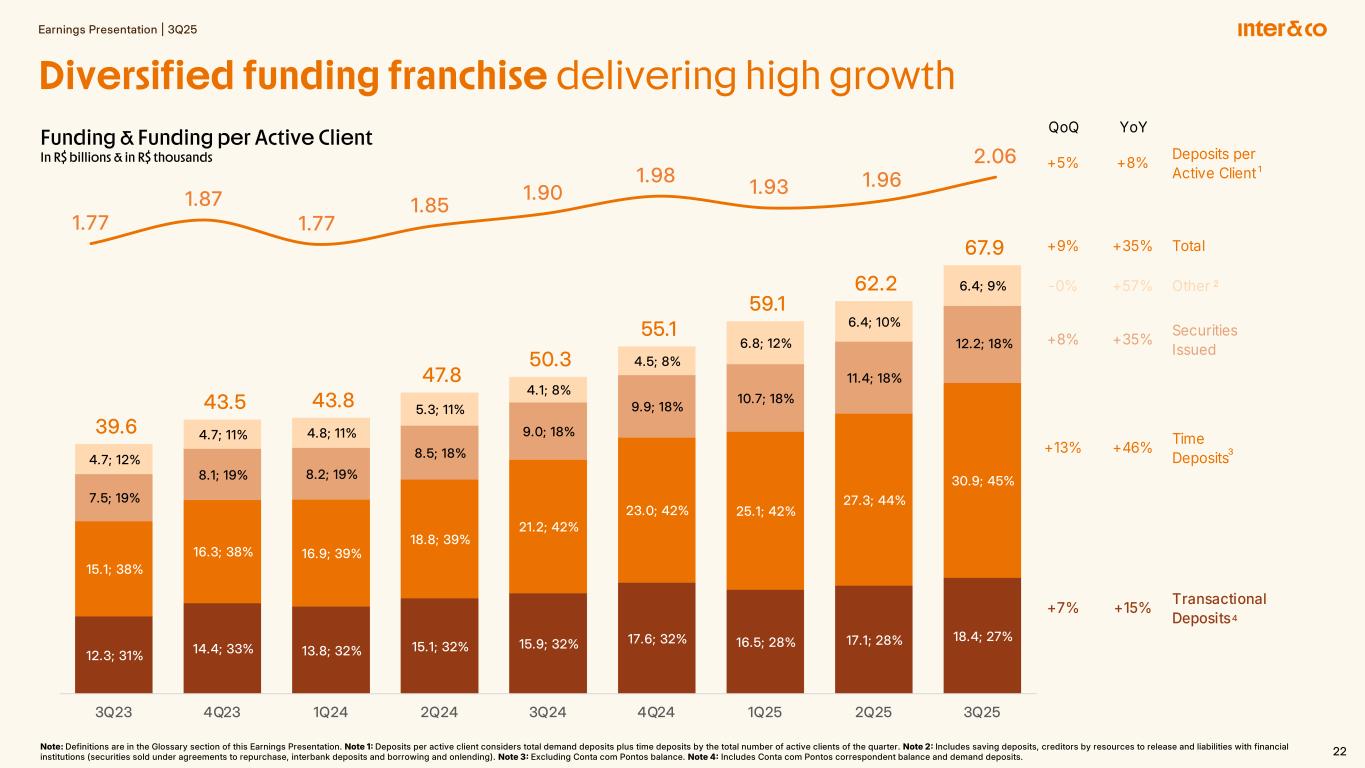

Earnings Presentation | 3Q25 22 QoQ YoY +5% +8% Deposits per Active Client +9% +35% Total -0% +57% Other +8% +35% Securities Issued +13% +46% Time Deposits +7% +15% Transactional Deposits 12.3; 31% 14.4; 33% 13.8; 32% 15.1; 32% 15.9; 32% 17.6; 32% 16.5; 28% 17.1; 28% 18.4; 27% 15.1; 38% 16.3; 38% 16.9; 39% 18.8; 39% 21.2; 42% 23.0; 42% 25.1; 42% 27.3; 44% 30.9; 45% 7.5; 19% 8.1; 19% 8.2; 19% 8.5; 18% 9.0; 18% 9.9; 18% 10.7; 18% 11.4; 18% 12.2; 18% 4.7; 12% 4.7; 11% 4.8; 11% 5.3; 11% 4.1; 8% 4.5; 8% 6.8; 12% 6.4; 10% 6.4; 9% 39.6 43.5 43.8 47.8 50.3 55.1 59.1 62.2 67.9 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 1.77 1.87 1.77 1.85 1.90 1.98 1.93 1.96 2.06 1 .65 1 .70 1 .75 1 .80 1 .85 1 .90 1 .95 2 .0 2 .05 2 .10 Funding & Funding per Active Client In R$ billions & in R$ thousands Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Deposits per active client considers total demand deposits plus time deposits by the total number of active clients of the quarter. Note 2 Includes saving deposits, creditors by resources to release and liabilities with financial institutions (securities sold under agreements to repurchase, interbank deposits and borrowing and onlending). Note 3 Excluding Conta com Pontos balance. Note 4 Includes Conta com Pontos correspondent balance and demand deposits. 2 3 4 1 Diversified funding franchise delivering high growth

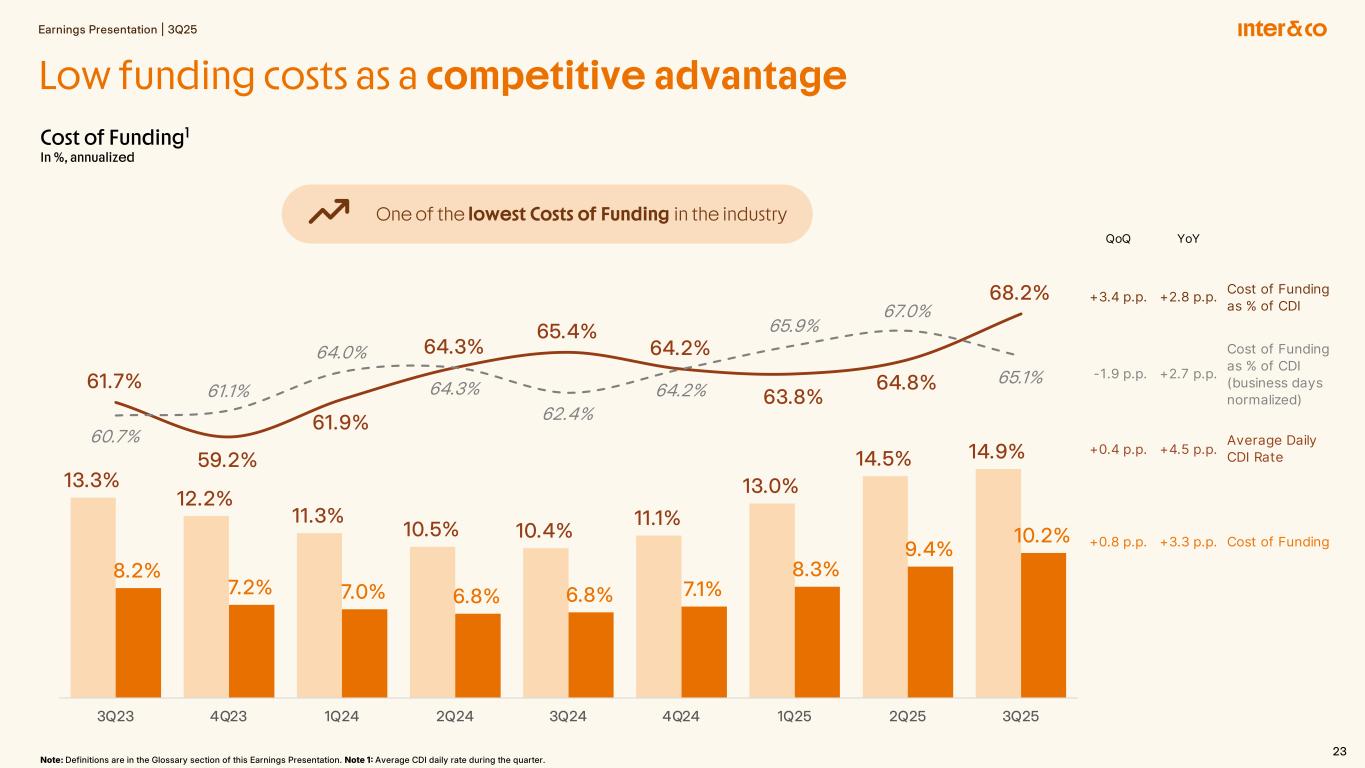

Earnings Presentation | 3Q25 23 Cost of Funding1 In %, annualized Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Average CDI daily rate during the quarter. One of the lowest Costs of Funding in the industry Low funding costs as a competitive advantage 13.3% 12.2% 11.3% 10.5% 10.4% 11.1% 13.0% 14.5% 14.9% 8.2% 7.2% 7.0% 6.8% 6.8% 7.1% 8.3% 9.4% 10.2% 61.7% 59.2% 61.9% 64.3% 65.4% 64.2% 63.8% 64.8% 68.2% 60.7% 61.1% 64.0% 64.3% 62.4% 64.2% 65.9% 67.0% 65.1% 2.0% 7.0% 12.0% 17.0% 22.0 % 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 QoQ YoY +3.4 p.p. +2.8 p.p. Cost of Funding as % of CDI -1.9 p.p. +2.7 p.p. Cost of Funding as % of CDI (business days normalized) +0.4 p.p. +4.5 p.p. Average Daily CDI Rate +0.8 p.p. +3.3 p.p. Cost of Funding

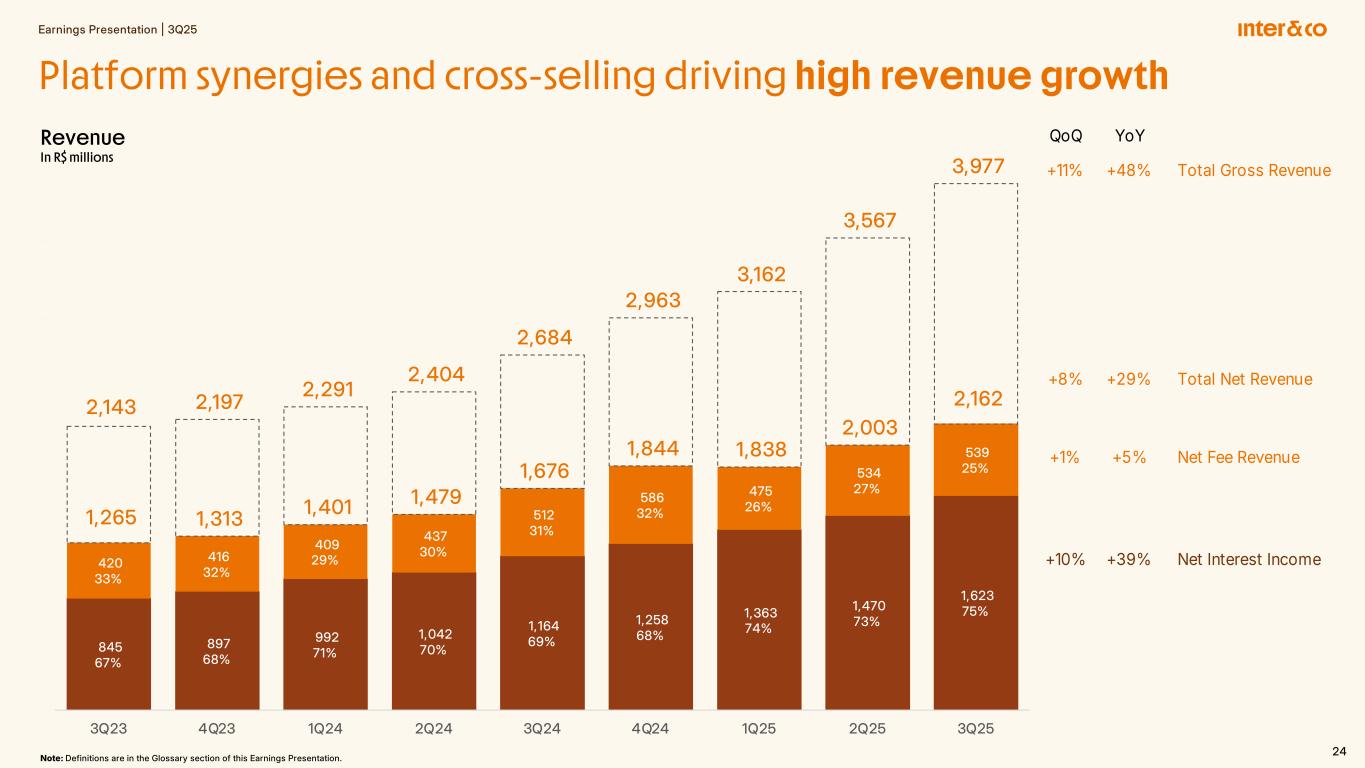

Earnings Presentation | 3Q25 24 845 67% 897 68% 992 71% 1,042 70% 1,164 69% 1,258 68% 1,363 74% 1,470 73% 1,623 75% 420 33% 416 32% 409 29% 437 30% 512 31% 586 32% 475 26% 534 27% 539 25% 1,265 1,313 1,401 1,479 1,676 1,844 1,838 2,003 2,162 2,143 2,197 2,291 2,404 2,684 2,963 3,162 3,567 3,977 - 5 00 1, 00 0 1, 50 0 2 ,0 00 2 ,50 0 3 ,0 00 3 ,50 0 4 ,0 00 4 ,5 00 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 QoQ YoY +11% +48% Total Gross Revenue +8% +29% Total Net Revenue +1% +5% Net Fee Revenue +10% +39% Net Interest Income Revenue In R$ millions Platform synergies and cross-selling driving high revenue growth Note: Definitions are in the Glossary section of this Earnings Presentation.

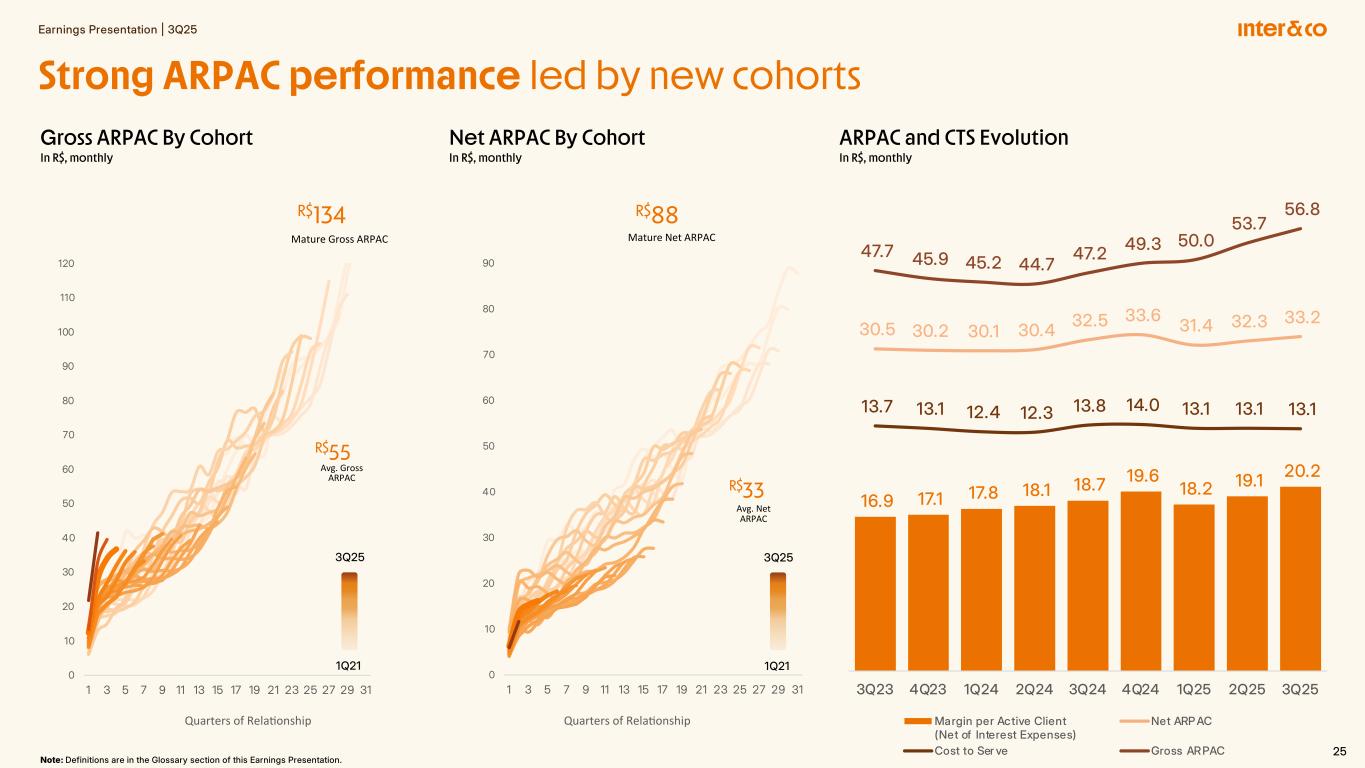

Earnings Presentation | 3Q25 25 0 10 20 30 40 50 60 70 80 90 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 ARPAC and CTS Evolution In R$, monthly 16.9 17.1 17.8 18.1 18.7 19.6 18.2 19.1 20.2 30.5 30.2 30.1 30.4 32.5 33.6 31.4 32.3 33.2 13.7 13.1 12.4 12.3 13.8 14.0 13.1 13.1 13.1 47.7 45.9 45.2 44.7 47.2 49.3 50.0 53.7 56.8 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Margin per Active Client (Net of Interest Expenses) Net ARP AC Cost to Ser ve Gross ARPAC Note: Definitions are in the Glossary section of this Earnings Presentation. Strong ARPAC performance led by new cohorts Quarters of Rela-onshipQuarters of Rela-onship R$88 Mature Net ARPAC R$33 Avg. Net ARPAC R$134 Mature Gross ARPAC Gross ARPAC By Cohort In R$, monthly Net ARPAC By Cohort In R$, monthly R$55 Avg. Gross ARPAC 0 10 20 30 40 50 60 70 80 90 100 110 120 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 3Q25 1Q21 3Q25 1Q21

Earnings Presentation | 3Q25 26 13.3% 12.2% 11.3% 10.5% 10.4% 11.1% 13.0% 14.5% 14.9% 2.5% 4.4% 5.8% 4.3% 3.2% 6.0% 8.4% 3.8% 2.5% 1.0 % 3. 0% 5. 0% 7. 0% 9. 0% 11.0 % 13. 0% 15. 0% NIM 2.0 NIM1, 2 In % Consistent NIM growth across quarters NIM 1.0 NIM 2.0 Risk-Adjusted NIM 1.0 Risk-Adjusted Average CDI of the Quarter Annualized IPCA of the Quarter Asset ÷ Equity9.0x8.9x8.4x7.9x7.7x7.3x7.9x7.5x 9.4x 7.07% 6.81% 7.09% 7.10% 7.50% 7.55% 7.65% 7.87% 8.08%8.15% 7.87% 8.22% 8.24% 8.68% 8.74% 8.84% 9.07% 9.28% 3.66% 3.89% 4.15% .23% 4.46% 4.58% 4.77% 4.82% 4.89% 4.22% 4.50% 4.81% 4.91% 5.16% 5.30% 5.51% 5.56% 5.62% 3. 00 % 4. 00 % 5. 00 % 6. 00 % 7. 00 % 8. 00 % 9. 0 % 10. 00 % 11.0 0% 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Net interest income and income from securities, derivatives and foreign exchange * 4 / average of the last two periods of cash and cash equivalents, amounts due from financial institutions net of provisions for expected credit losses (excluding interbank deposits), deposits at Central Bank of Brazil, securities net of provisions for expected credit losses, derivative financial assets and loans and advances to customers, net of provisions for expected credit losses. Note 2 All-in NIM 2.0 and Risk-Adjusted All-in NIM 2.0 do not include transactor credit card portfolio.

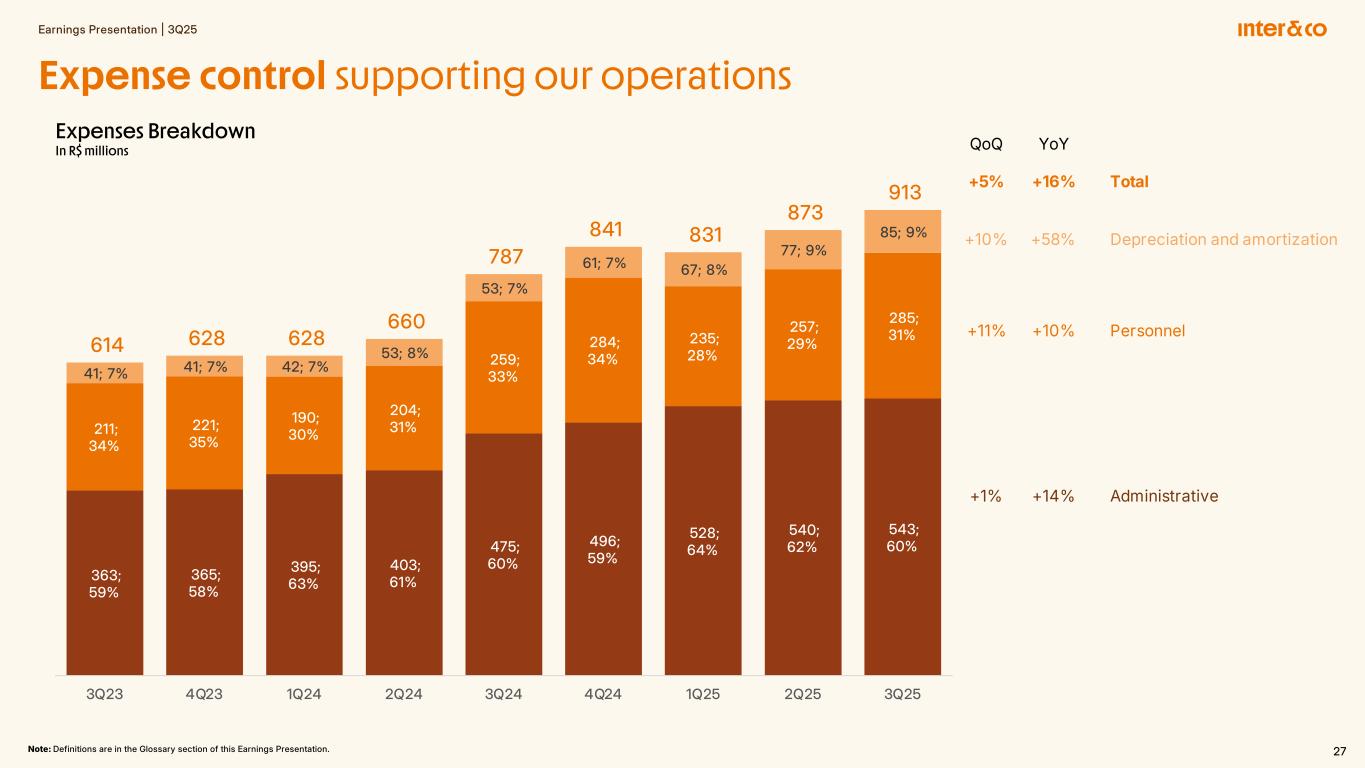

Earnings Presentation | 3Q25 27Note: Definitions are in the Glossary section of this Earnings Presentation. Expenses Breakdown In R$ millions 363; 59% 365; 58% 395; 63% 403; 61% 475; 60% 496; 59% 528; 64% 540; 62% 543; 60% 211; 34% 221; 35% 190; 30% 204; 31% 259; 33% 284; 34% 235; 28% 257; 29% 285; 31% 41; 7% 41; 7% 42; 7% 53; 8% 53; 7% 61; 7% 67; 8% 77; 9% 85; 9% 614 628 628 660 787 841 831 873 913 - 1 0 2 0 0 3 0 0 4 0 0 5 0 0 6 0 0 7 0 0 8 0 0 9 0 0 1 ,0 0 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 QoQ YoY +5% +16% Total +10% +58% Depreciation and amortization +11% +10% Personnel +1% +14% Administrative Expense control supporting our operations

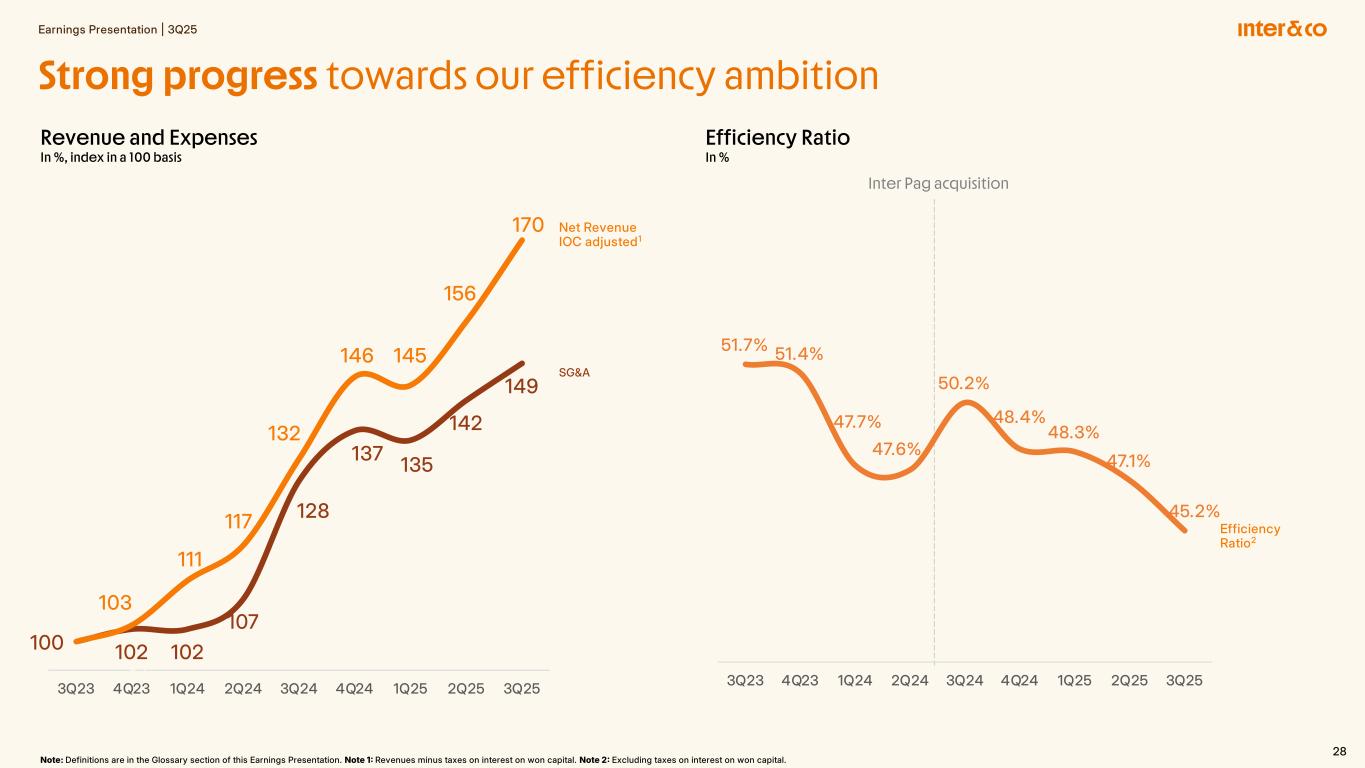

Earnings Presentation | 3Q25 28 SG&A 100 102 102 107 128 137 135 142 149 103 111 117 132 146 145 156 170 95 125 155 185 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Revenues minus taxes on interest on won capital. Note 2 Excluding taxes on interest on won capital. Efficiency Ratio In % Revenue and Expenses In %, index in a 100 basis Strong progress towards our efficiency ambition Inter Pag acquisition Efficiency Ratio2 Net Revenue IOC adjusted1 51.7% 51.4% 47.7% 47.6% 50.2% 48.4% 48.3% 47.1% 45.2% 4 0. 0% 4 2. 0% 4 4. 0% 4 6. 0% 4 8. 0% 5 0. 0% 5 2. 0% 5 4. 0% 5 6. 0% 5 8. 0% 6 0. 0% 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25

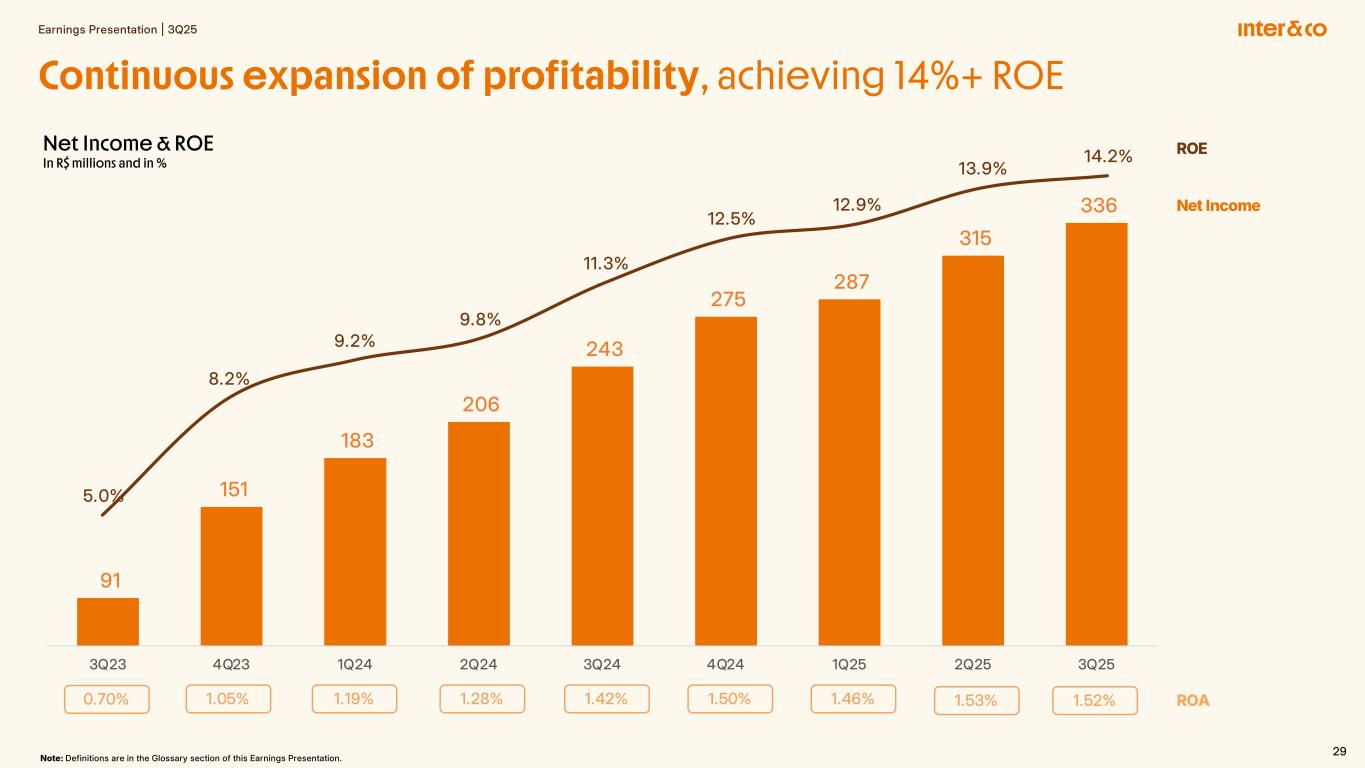

Earnings Presentation | 3Q25 29 91 151 183 206 243 275 287 315 336 6 0 1 10 1 60 2 10 2 60 3 10 3 60 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Net Income & ROE In R$ millions and in % Net Income ROE Note: Definitions are in the Glossary section of this Earnings Presentation. ROA Continuous expansion of profitability, achieving 14%+ ROE 5.0% 8.2% 9.2% 9.8% 11.3% 12.5% 12.9% 13.9% 14.2% 0.70% 1.05% 1.19% 1.28% 1.42% 1.50% 1.46% 1.53% 1.52%

Earnings Presentation | 3Q25 303 Closing Remarks João Vitor Menin | Global CEO

Earnings Presentation | 3Q25 31 Celebrating the journey, designing the future 10 year-anniversary of our digital account in Brazil Inter by design 2025

Earnings Presentation | 3Q25 323 Appendix

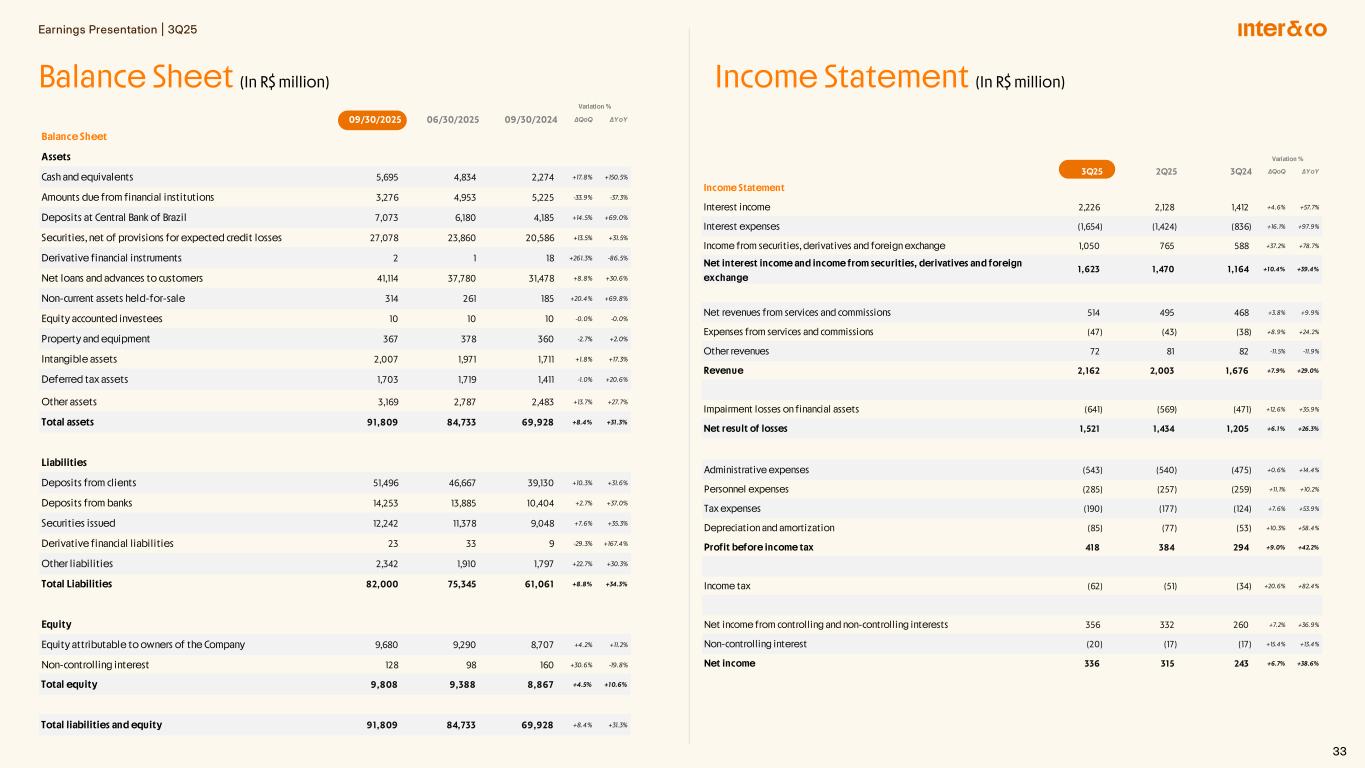

Earnings Presentation | 3Q25 33 Balance Sheet (In R$ million) Income Statement (In R$ million) 09/30/2025 06/30/2025 09/30/2024 ∆QoQ ∆YoY Balance Sheet Assets Cash and equivalents 5,695 4,834 2,274 +17.8% +150.5% Amounts due from financial institutions 3,276 4,953 5,225 -33.9% -37.3% Deposits at Central Bank of Brazil 7,073 6,180 4,185 +14.5% +69.0% Securities, net of provisions for expected credit losses 27,078 23,860 20,586 +13.5% +31.5% Derivative financial instruments 2 1 18 +261.3% -86.5% Net loans and advances to customers 41,114 37,780 31,478 +8.8% +30.6% Non-current assets held-for-sale 314 261 185 +20.4% +69.8% Equity accounted investees 10 10 10 -0.0% -0.0% Property and equipment 367 378 360 -2.7% +2.0% Intangible assets 2,007 1,971 1,711 +1.8% +17.3% Deferred tax assets 1,703 1,719 1,411 -1.0% +20.6% Variation % Other assets 3,169 2,787 2,483 +13.7% +27.7% Total assets 91,809 84,733 69,928 +8.4% +31.3% Liabilities Deposits from clients 51,496 46,667 39,130 +10.3% +31.6% Deposits from banks 14,253 13,885 10,404 +2.7% +37.0% Securities issued 12,242 11,378 9,048 +7.6% +35.3% Derivative financial liabilities 23 33 9 -29.3% +167.4% Other liabilities 2,342 1,910 1,797 +22.7% +30.3% Total Liabilities 82,000 75,345 61,061 +8.8% +34.3% Equity Equity attributable to owners of the Company 9,680 9,290 8,707 +4.2% +11.2% Non-controlling interest 128 98 160 +30.6% -19.8% Total equity 9,808 9,388 8,867 +4.5% +10.6% Total liabilities and equity 91,809 84,733 69,928 +8.4% +31.3% 3Q25 2Q25 3Q24 ∆QoQ ∆YoY Income Statement Interest income 2,226 2,128 1,412 +4.6% +57.7% Interest expenses (1,654) (1,424) (836) +16.1% +97.9% Income from securities, derivatives and foreign exchange 1,050 765 588 +37.2% +78.7% Net interest income and income from securities, derivatives and foreign exchange 1,623 1,470 1,164 +10.4% +39.4% Net revenues from services and commissions 514 495 468 +3.8% +9.9% Expenses from services and commissions (47) (43) (38) +8.9% +24.2% Other revenues 72 81 82 -11.5% -11.9% Revenue 2,162 2,003 1,676 +7.9% +29.0% Impairment losses on financial assets (641) (569) (471) +12.6% +35.9% Net result of losses 1,521 1,434 1,205 +6.1% +26.3% Variation % Administrative expenses (543) (540) (475) +0.6% +14.4% Personnel expenses (285) (257) (259) +11.1% +10.2% Tax expenses (190) (177) (124) +7.6% +53.9% Depreciation and amortization (85) (77) (53) +10.3% +58.4% Profit before income tax 418 384 294 +9.0% +42.2% Income tax (62) (51) (34) +20.6% +82.4% Net income from controlling and non-controlling interests 356 332 260 +7.2% +36.9% Non-controlling interest (20) (17) (17) +15.4% +13.4% Net income 336 315 243 +6.7% +38.6%

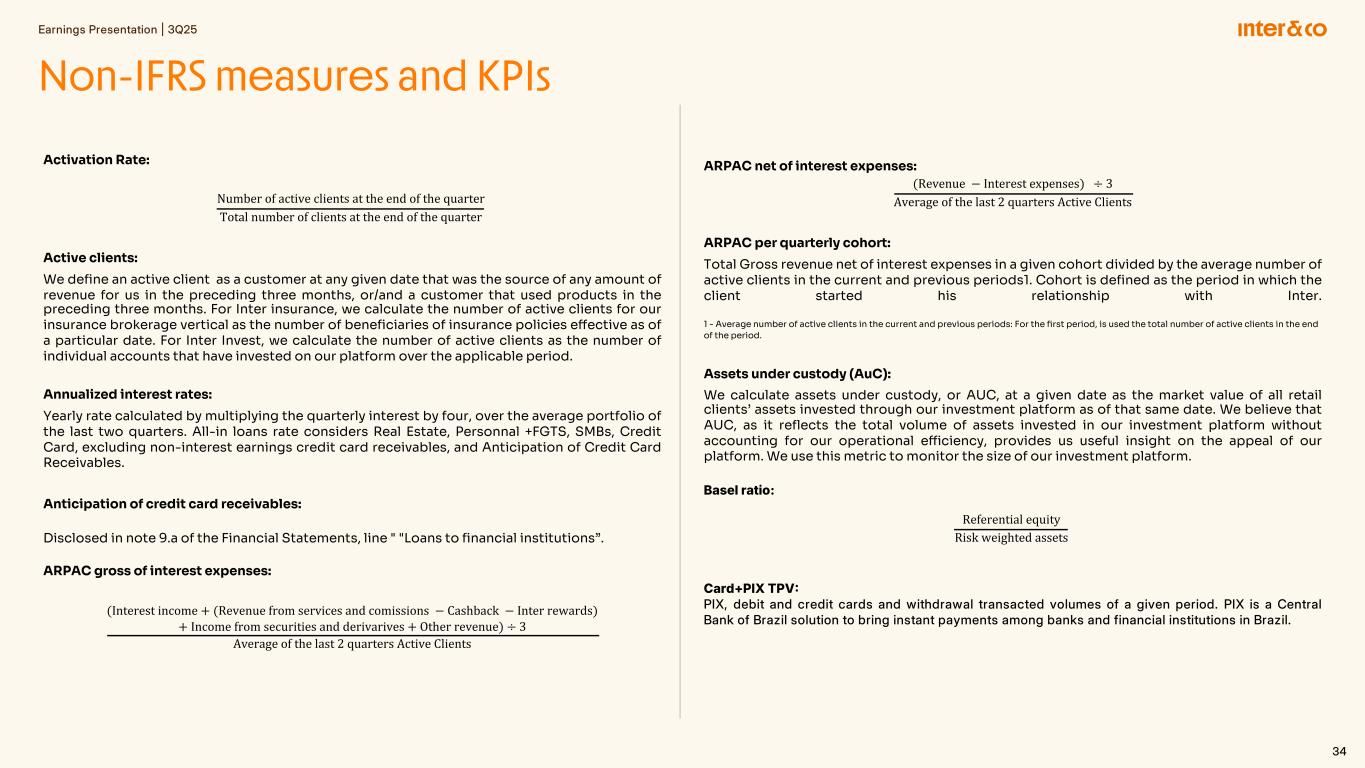

Earnings Presentation | 3Q25 34 Activation Rate: Number of active clients at the end of the quarter Total number of clients at the end of the quarter Active clients: We define an active client as a customer at any given date that was the source of any amount of revenue for us in the preceding three months, or/and a customer that used products in the preceding three months. For Inter insurance, we calculate the number of active clients for our insurance brokerage vertical as the number of beneficiaries of insurance policies effective as of a particular date. For Inter Invest, we calculate the number of active clients as the number of individual accounts that have invested on our platform over the applicable period. Annualized interest rates: Yearly rate calculated by multiplying the quarterly interest by four, over the average portfolio of the last two quarters. All-in loans rate considers Real Estate, Personnal +FGTS, SMBs, Credit Card, excluding non-interest earnings credit card receivables, and Anticipation of Credit Card Receivables. Anticipation of credit card receivables: Disclosed in note 9.a of the Financial Statements, line " "Loans to financial institutions”. ARPAC gross of interest expenses: (Interest income + (Revenue from services and comissions − Cashback − Inter rewards) + Income from securities and derivarives + Other revenue) ÷ 3 Average of the last 2 quarters Active Clients ARPAC net of interest expenses: (Revenue − Interest expenses) ÷ 3 Average of the last 2 quarters Active Clients ARPAC per quarterly cohort: Total Gross revenue net of interest expenses in a given cohort divided by the average number of active clients in the current and previous periods1. Cohort is defined as the period in which the client started his relationship with Inter. 1 - Average number of active clients in the current and previous periods: For the first period, is used the total number of active clients in the end of the period. Assets under custody (AuC): We calculate assets under custody, or AUC, at a given date as the market value of all retail clients’ assets invested through our investment platform as of that same date. We believe that AUC, as it reflects the total volume of assets invested in our investment platform without accounting for our operational efficiency, provides us useful insight on the appeal of our platform. We use this metric to monitor the size of our investment platform. Basel ratio: Referential equity Risk weighted assets Card+PIX TPV PIX, debit and credit cards and withdrawal transacted volumes of a given period. PIX is a Central Bank of Brazil solution to bring instant payments among banks and financial institutions in Brazil. Non-IFRS measures and KPIs

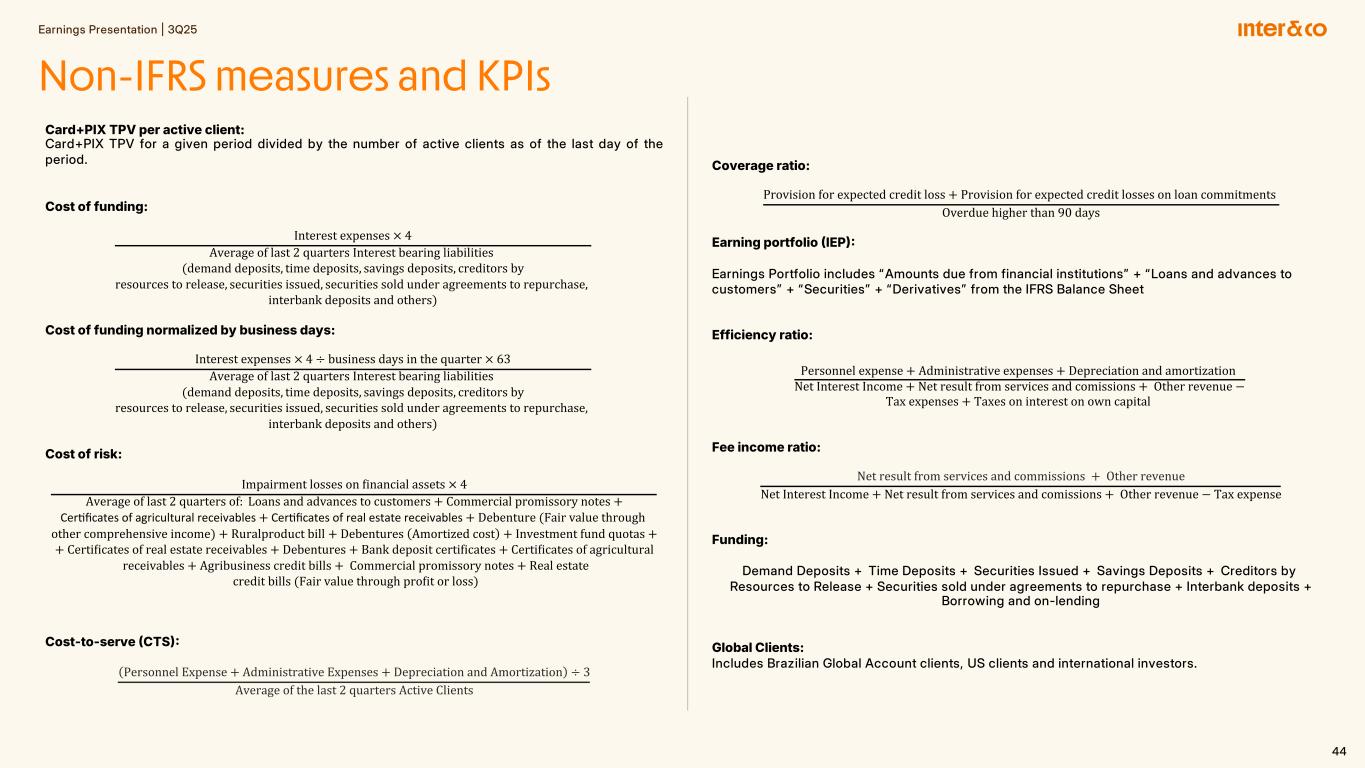

Earnings Presentation | 3Q25 35 Card+PIX TPV per active client: Card+PIX TPV for a given period divided by the number of active clients as of the last day of the period. Cost of funding: Interest expenses × 4 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of funding normalized by business days: Interest expenses × 4 ÷ business days in the quarter × 63 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of risk: Impairment losses on Linancial assets × 4 Average of last 2 quarters of: Loans and advances to customers + Commercial promissory notes + Cer-ficates of agricultural receivables+ Cer-ficates of real estate receivables+ Debenture (Fair value through other comprehensive income) + Ruralproduct bill + Debentures Amortized cost + Investment fund quotas + + CertiLicates of real estate receivables + Debentures + Bank deposit certiLicates + CertiLicates of agricultural receivables + Agribusiness credit bills + Commercial promissory notes + Real estate credit bills (Fair value through proLit or loss) Cost-to-serve CTS Personnel Expense + Administrative Expenses + Depreciation and Amortization ÷ 3 Average of the last 2 quarters Active Clients Coverage ratio: Provision for expected credit loss + Provision for expected credit losses on loan commitments Overdue higher than 90 days Earning portfolio IEP Earnings Portfolio includes “Amounts due from financial institutions” + “Loans and advances to customers” + “Securities” + “Derivatives” from the IFRS Balance Sheet Efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expenses + Taxes on interest on own capital Fee income ratio: Net result from services and commissions + Other revenue Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Funding: Demand Deposits + Time Deposits + Securities Issued + Savings Deposits + Creditors by Resources to Release + Securities sold under agreements to repurchase + Interbank deposits + Borrowing and on-lending Global Clients: Includes Brazilian Global Account clients, US clients and international investors. Non-IFRS measures and KPIs 44

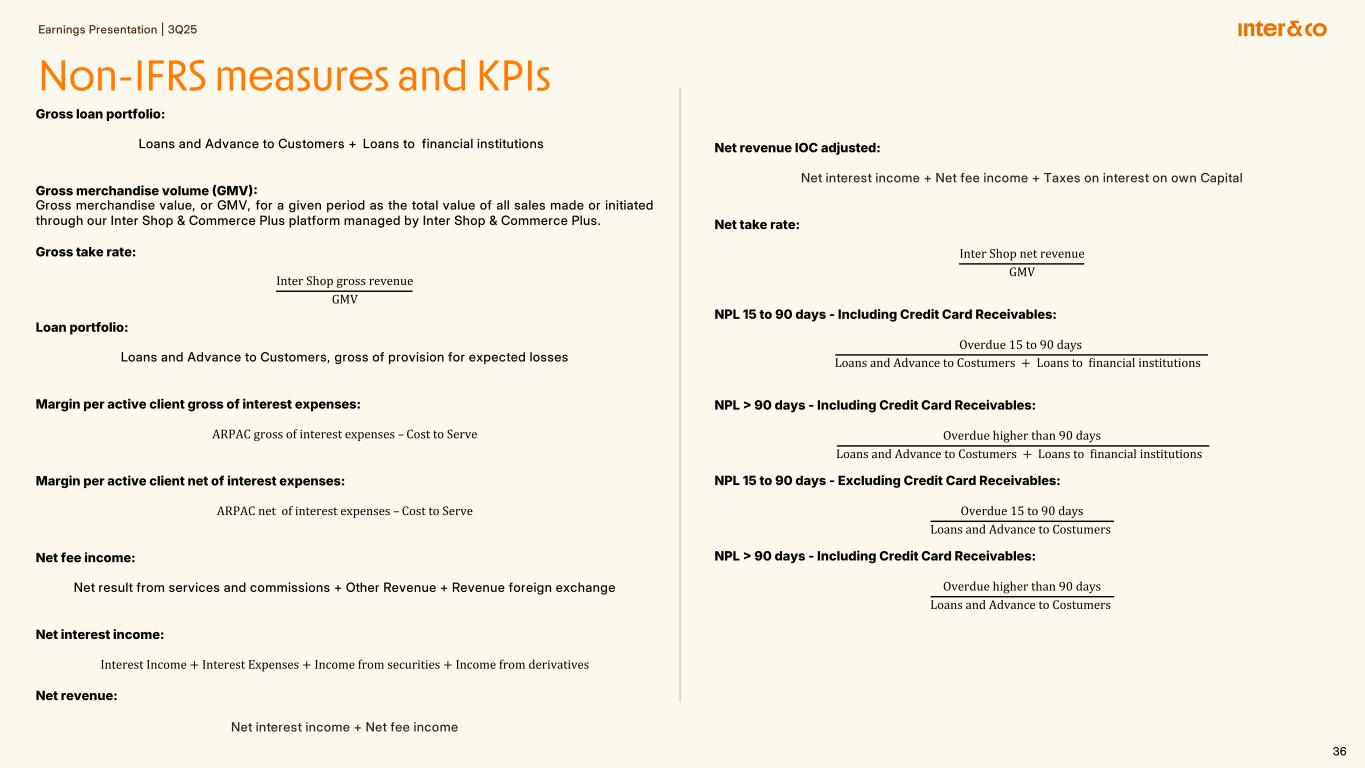

Earnings Presentation | 3Q25 36 Gross loan portfolio: Loans and Advance to Customers + Loans to financial institutions Gross merchandise volume GMV Gross merchandise value, or GMV, for a given period as the total value of all sales made or initiated through our Inter Shop & Commerce Plus platform managed by Inter Shop & Commerce Plus. Gross take rate: Inter Shop gross revenue GMV Loan portfolio: Loans and Advance to Customers, gross of provision for expected losses Margin per active client gross of interest expenses: ARPAC gross of interest expenses – Cost to Serve Margin per active client net of interest expenses: ARPAC net of interest expenses – Cost to Serve Net fee income: Net result from services and commissions + Other Revenue + Revenue foreign exchange Net interest income: Interest Income + Interest Expenses + Income from securities + Income from derivatives Net revenue: Net interest income + Net fee income Net revenue IOC adjusted: Net interest income + Net fee income + Taxes on interest on own Capital Net take rate: Inter Shop net revenue GMV NPL 15 to 90 days - Including Credit Card Receivables: Overdue 15 to 90 days Loans and Advance to Costumers + Loans to Linancial institutions NPL 90 days - Including Credit Card Receivables: Overdue higher than 90 days Loans and Advance to Costumers + Loans to Linancial institutions NPL 15 to 90 days - Excluding Credit Card Receivables: Overdue 15 to 90 days Loans and Advance to Costumers NPL 90 days - Including Credit Card Receivables: Overdue higher than 90 days Loans and Advance to Costumers Non-IFRS measures and KPIs

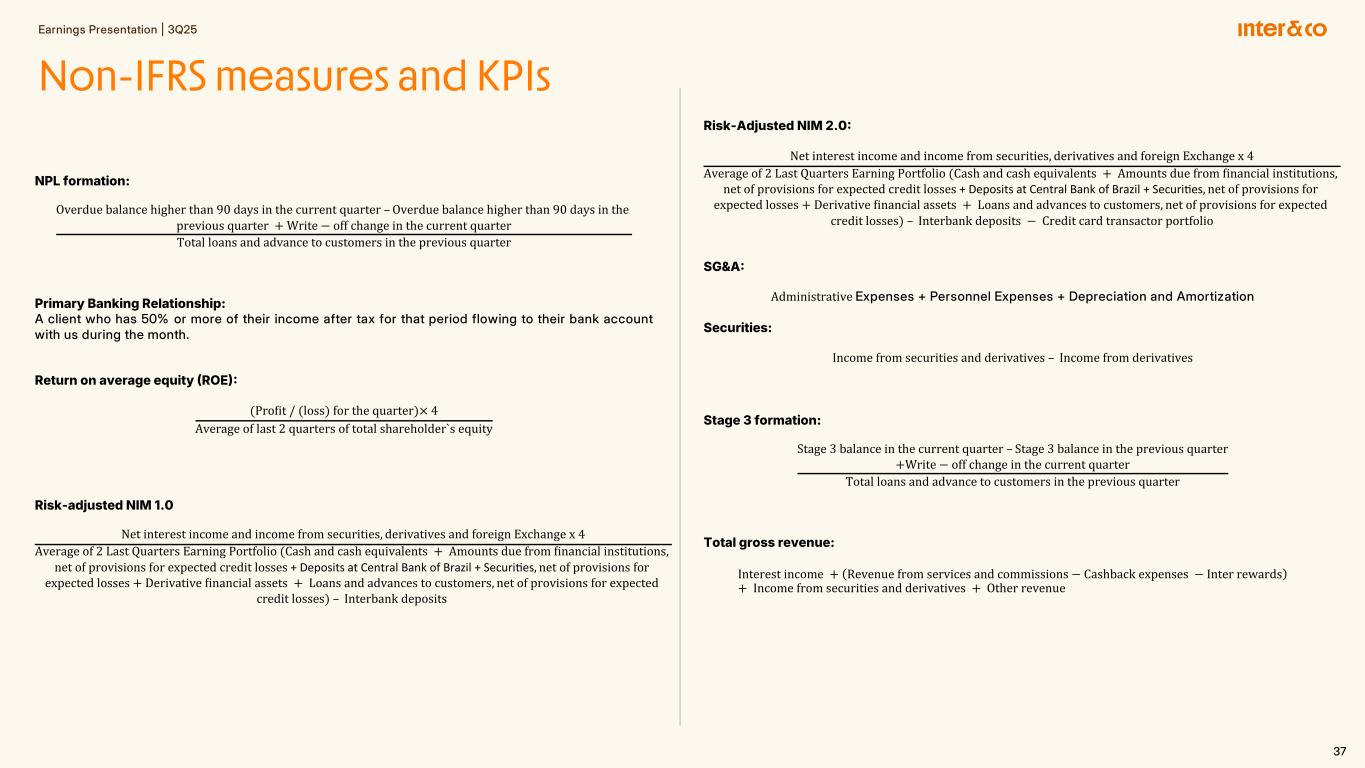

Earnings Presentation | 3Q25 37 Risk-Adjusted NIM 2.0 Net interest income and income from securities, derivatives and foreign Exchange x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securi-es, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for expected credit losses) – Interbank deposits − Credit card transactor portfolio SG&A Administrative Expenses + Personnel Expenses + Depreciation and Amortization Securities: Income from securities and derivatives – Income from derivatives Stage 3 formation: Stage 3 balance in the current quarter – Stage 3 balance in the previous quarter +Write − off change in the current quarter Total loans and advance to customers in the previous quarter Total gross revenue: Interest income + Revenue from services and commissions − Cashback expenses − Inter rewards + Income from securities and derivatives + Other revenue NPL formation: Overdue balance higher than 90 days in the current quarter – Overdue balance higher than 90 days in the previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter Primary Banking Relationship: A client who has 50% or more of their income after tax for that period flowing to their bank account with us during the month. Return on average equity ROE (ProLit / (loss) for the quarter)× 4 Average of last 2 quarters of total shareholder`s equity Risk-adjusted NIM 1.0 Net interest income and income from securities, derivatives and foreign Exchange x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securi-es, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for expected credit losses) – Interbank deposits Non-IFRS measures and KPIs

Earnings Presentation | 3Q25 38 E A R N I N G S P R E S E N T A T I O N | 4 Q 2 4