Earnings Release Feb 2026 4Q 20 25

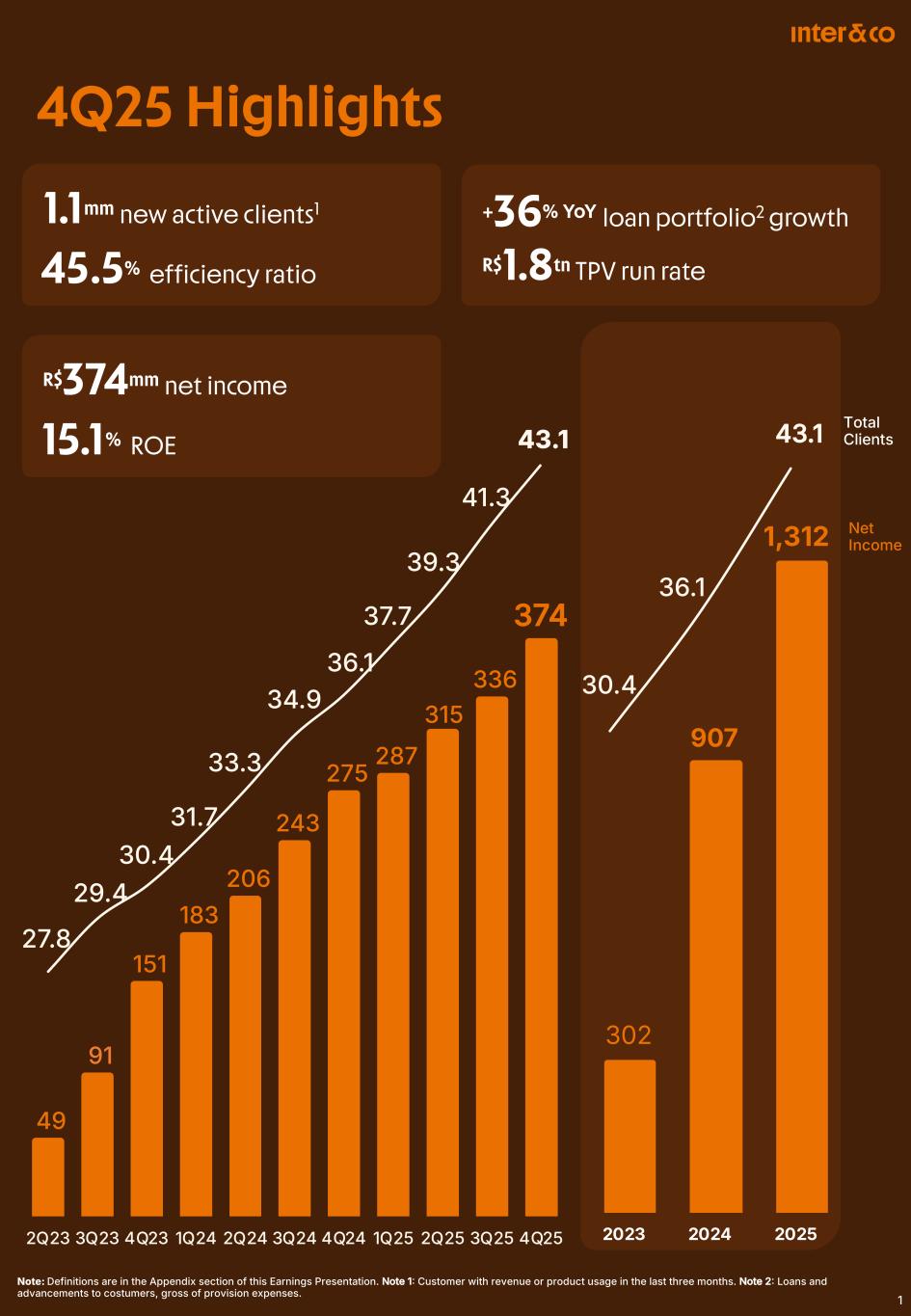

4Q25 Highlights Net Income 1 Total Clients 1.1mm new active clients1 45.5% efficiency ratio +36% YoY loan portfolio2 growth R$1.8tn TPV run rate Note: Definitions are in the Appendix section of this Earnings Presentation. Note 1 Customer with revenue or product usage in the last three months. Note 2 Loans and advancements to costumers, gross of provision expenses. R$374mm net income 15.1% ROE 49 91 151 183 206 243 275 287 315 336 374 - 5 0 1 0 1 50 2 0 2 50 3 0 3 50 4 0 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 302 907 1,312 2023 2024 2025 30.4 36.1 43.1 27.8 29.4 30.4 31.7 33.3 34.9 36.1 37.7 39.3 41.3 43.1

From Global CEO João Vitor Menin CEO Letter 2 I am excited to share that we’ve achieved another standout year of growth while continuing to build Inter for the future. Across 2025, we delivered exceptional results, launched innovative solutions that simplify and enhance the lives of our clients . These accomplishments reflect our relentless focus on innovation, disciplined execution, and our commitment to long-term sustainable growth. Our credit portfolio reached a remarkable growth of 36% YoY, three times faster than the Brazilian market. This achievement was driven by multiple product categories, including payroll loans, real estate financing, and credit cards. Our Private Payroll Loan, launched in March, already serves 500,000 clients, a fully digital and scalable product. Its rapid success reflects our commitment to innovation and our ability to deliver sustainable, client-centric solutions. 2025 another transformative for Inter. We expanded our platform with notable achievements, including Forum, a social media space for investment and product offering, now with 18 million users engaging daily; My Piggy Bank, helping 1.5 million users achieve financial goals, reinforcing our customer-centric DNA; My Credit Journey: a financial education tool launched in December, accessed by 3 million users. Through these innovations, we continue to push boundaries, improve user experiences, and strengthen our brand. Every interaction with clients builds trust and further establishes Inter as a leader in financial services. Our global expansion also reached significant milestones. As we secured our U.S. Bank license, we look forward to lower operational costs, better funding efficiency, and the ability to deliver products across geographies. Our disciplined execution has translated into solid results, including Q4 net income of R$374 million and a 15% annualized ROE. We’ve maintained stability in credit metrics despite economic volatility, supported by robust underwriting practices and collection. João Vitor Menin Inter&Co Global CEO None of this would be possible without our experienced and aligned team. In 2025, we strengthened our leadership with new talent and introduced the new DAC framework Direction, Alignment, and Commitment) to guide strong governance and collaboration. I am immensely proud of the team’s innovation, dedication, and execution. As we step into 2026, I am excited about the opportunities ahead. With 43 million clients, ongoing advancements in AI, and a continued focus on growth and scalability, we are positioned to deliver another year of exceptional progress. Thank you for your trust and support. Together, we are shaping the future of digital financial services.

Portfolio & Funding NIM & Fees Strategic Update Growth & Innovation Activation & Engagement Net Income & ROE Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 3 • Loan portfolio growth of 36% YoY, 3x the Brazilian market • Funding reached R$73 billion, + 32% YoY, a 65% of CDI cost of funding • Net revenue increased by 30% YoY, driven by robust credit growth • NIM continued to show consistent growth expanding 83 bps YoY • Added 4.4 million net new active clients in the year • Received U.S. Branch approval, which will bring efficiency to global products • Activation rate of 58%, with over 22 million logins per day • Run-rate TPV of R$1.8 trillion, with Pix market share of over 8.5% • Record R$1.3 billion net income in 2025 (+45% YoY) and R$374 million in 4Q25 • ROE reached 15% mark in 4Q25 Note: Definitions are in the Appendix section of this Earnings Release.

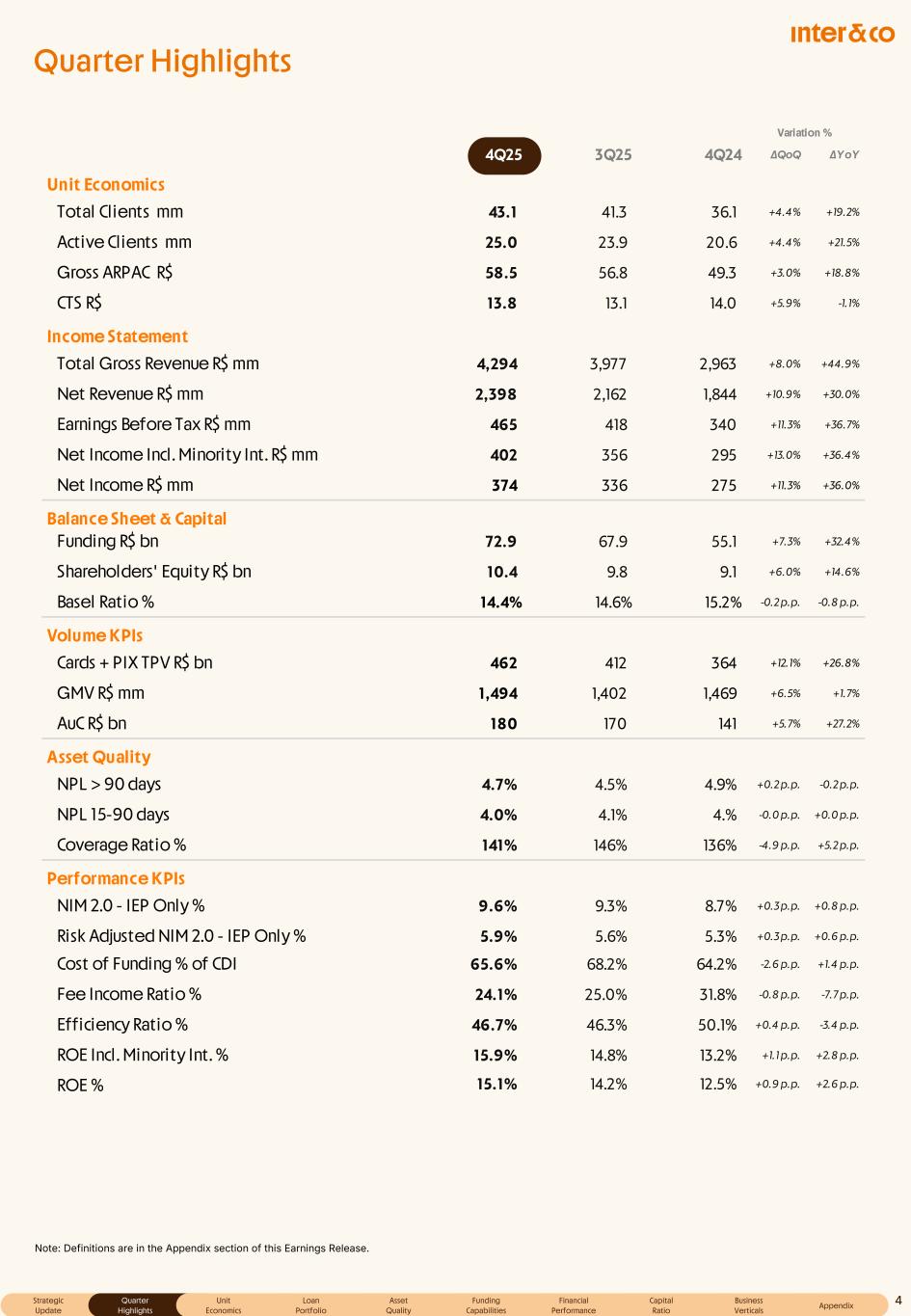

4Q25 3Q25 4Q24 ∆QoQ ∆YoY Unit Economics Total Clients mm 43.1 41.3 36.1 +4.4% +19.2% Active Clients mm 25.0 23.9 20.6 +4.4% +21.5% Gross ARPAC R$ 58.5 56.8 49.3 +3.0% +18.8% CTS R$ 13.8 13.1 14.0 +5.9% -1.1% Income Statement Total Gross Revenue R$ mm 4,294 3,977 2,963 +8.0% +44.9% Net Revenue R$ mm 2,398 2,162 1,844 +10.9% +30.0% Earnings Before Tax R$ mm 465 418 340 +11.3% +36.7% Net Income Incl. Minority Int. R$ mm 402 356 295 +13.0% +36.4% Net Income R$ mm 374 336 275 +11.3% +36.0% Balance Sheet & Capital Variation % Funding R$ bn 72.9 67.9 55.1 +7.3% +32.4% Shareholders' Equity R$ bn 10.4 9.8 9.1 +6.0% +14.6% Basel Ratio % 14.4% 14.6% 15.2% -0.2 p.p. -0.8 p.p. Volume KPIs Cards + PIX TPV R$ bn 462 412 364 +12.1% +26.8% GMV R$ mm 1,494 1,402 1,469 +6.5% +1.7% AuC R$ bn 180 170 141 +5.7% +27.2% Asset Quality NPL > 90 days 4.7% 4.5% 4.9% +0.2 p.p. -0.2 p.p. NPL 15-90 days 4.0% 4.1% 4.% -0.0 p.p. +0.0 p.p. Coverage Ratio % 141% 146% 136% -4.9 p.p. +5.2 p.p. Performance KPIs NIM 2.0 - IEP Only % 9.6% 9.3% 8.7% +0.3 p.p. +0.8 p.p. Risk Adjusted NIM 2.0 - IEP Only % 5.9% 5.6% 5.3% +0.3 p.p. +0.6 p.p. Cost of Funding % of CDI 65.6% 68.2% 64.2% -2.6 p.p. +1.4 p.p. Fee Income Ratio % 24.1% 25.0% 31.8% -0.8 p.p. -7.7 p.p. Efficiency Ratio % 46.7% 46.3% 50.1% +0.4 p.p. -3.4 p.p. ROE Incl. Minority Int. % 15.9% 14.8% 13.2% +1.1 p.p. +2.8 p.p. ROE % 15.1% 14.2% 12.5% +0.9 p.p. +2.6 p.p. Note: Definitions are in the Appendix section of this Earnings Release. Quarter Highlights Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 4

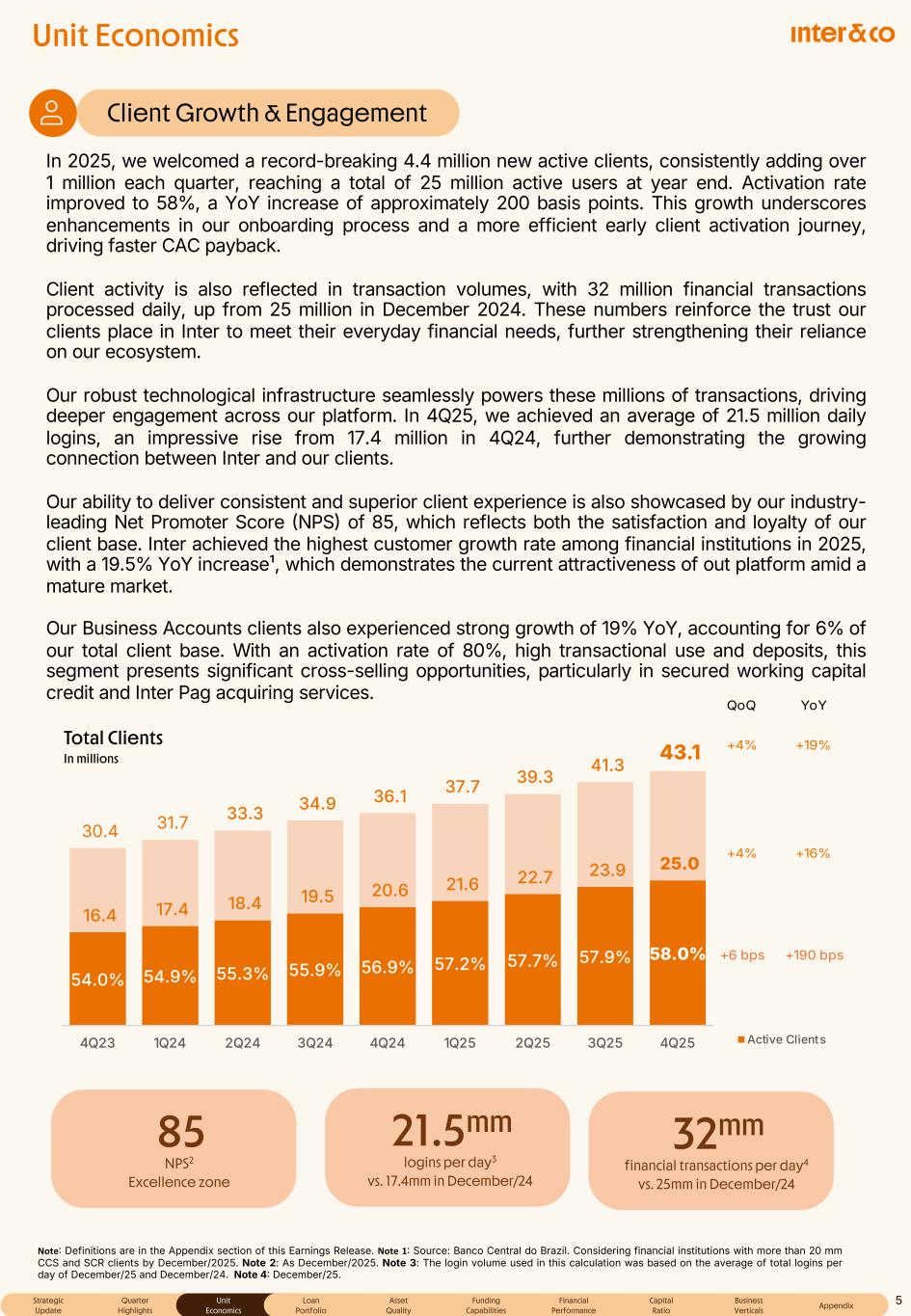

Note Definitions are in the Appendix section of this Earnings Release. Note 1 Source: Banco Central do Brazil. Considering financial institutions with more than 20 mm CCS and SCR clients by December/2025. Note 2: As December/2025. Note 3: The login volume used in this calculation was based on the average of total logins per day of December/25 and December/24. Note 4 December/25. Unit Economics Client Growth & Engagement 54.0% 54.9% 55.3% 55.9% 56.9% 57.2% 57.7% 57.9% 58.0% 16.4 17.4 18.4 19.5 20.6 21.6 22.7 23.9 25.0 30.4 31.7 33.3 34.9 36.1 37.7 39.3 41.3 43.1 1 .0 6 .0 1 1.0 1 6.0 2 1.0 2 6.0 3 1.0 3 6.0 4 1.0 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Active Clients QoQ YoY +4% +19% +4% +16% +6 bps +190 bps Total Clients In millions Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 5 In 2025, we welcomed a record-breaking 4.4 million new active clients, consistently adding over 1 million each quarter, reaching a total of 25 million active users at year end. Activation rate improved to 58%, a YoY increase of approximately 200 basis points. This growth underscores enhancements in our onboarding process and a more efficient early client activation journey, driving faster CAC payback. Client activity is also reflected in transaction volumes, with 32 million financial transactions processed daily, up from 25 million in December 2024. These numbers reinforce the trust our clients place in Inter to meet their everyday financial needs, further strengthening their reliance on our ecosystem. Our robust technological infrastructure seamlessly powers these millions of transactions, driving deeper engagement across our platform. In 4Q25, we achieved an average of 21.5 million daily logins, an impressive rise from 17.4 million in 4Q24, further demonstrating the growing connection between Inter and our clients. Our ability to deliver consistent and superior client experience is also showcased by our industry- leading Net Promoter Score NPS of 85, which reflects both the satisfaction and loyalty of our client base. Inter achieved the highest customer growth rate among financial institutions in 2025, with a 19.5% YoY increase¹, which demonstrates the current attractiveness of out platform amid a mature market. Our Business Accounts clients also experienced strong growth of 19% YoY, accounting for 6% of our total client base. With an activation rate of 80%, high transactional use and deposits, this segment presents significant cross-selling opportunities, particularly in secured working capital credit and Inter Pag acquiring services. 21.5mm logins per day3 vs. 17.4mm in December/24 32mm financial transactions per day4 vs. 25mm in December/24 85 NPS2 Excellence zone

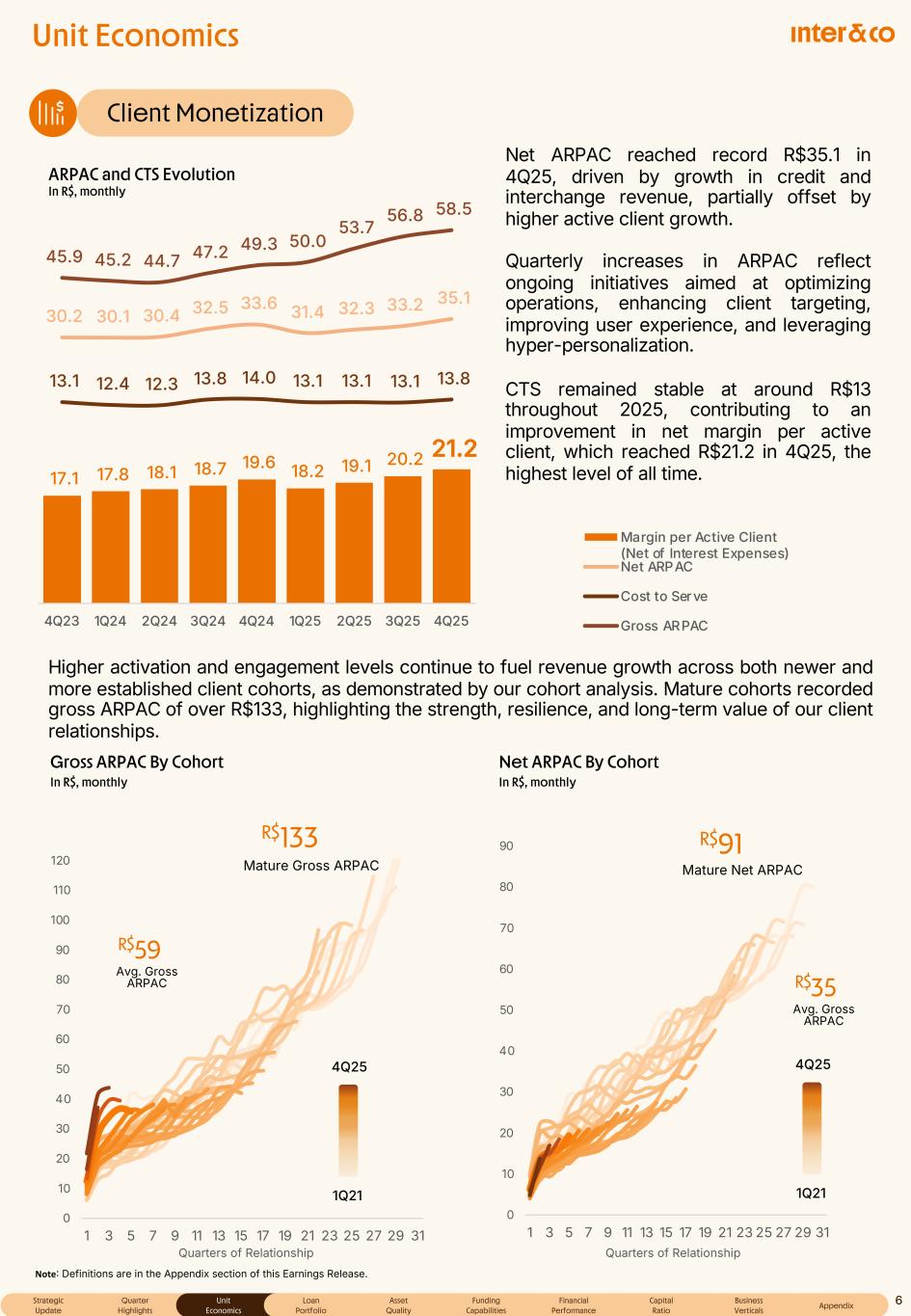

0 10 20 30 40 50 60 70 80 90 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 0 10 20 30 40 50 60 70 80 90 100 110 120 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 17.1 17.8 18.1 18.7 19.6 18.2 19.1 20.2 21.2 30.2 30.1 30.4 32.5 33.6 31.4 32.3 33.2 35.1 13.1 12.4 12.3 13.8 14.0 13.1 13.1 13.1 13.8 45.9 45.2 44.7 47.2 49.3 50.0 53.7 56.8 58.5 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Margin per Active Client (Net of Interest Expenses) Net ARPAC Cost to Serve Gross ARPAC Unit Economics Client Monetization Net ARPAC By Cohort In R$, monthly ARPAC and CTS Evolution In R$, monthly Note Definitions are in the Appendix section of this Earnings Release. Gross ARPAC By Cohort In R$, monthly Quarters of Relationship Quarters of Relationship Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 6 Higher activation and engagement levels continue to fuel revenue growth across both newer and more established client cohorts, as demonstrated by our cohort analysis. Mature cohorts recorded gross ARPAC of over R$133, highlighting the strength, resilience, and long-term value of our client relationships. R$59 Avg. Gross ARPAC R$133 Mature Gross ARPAC R$91 Mature Net ARPAC Net ARPAC reached record R$35.1 in 4Q25, driven by growth in credit and interchange revenue, partially offset by higher active client growth. Quarterly increases in ARPAC reflect ongoing initiatives aimed at optimizing operations, enhancing client targeting, improving user experience, and leveraging hyper-personalization. CTS remained stable at around R$13 throughout 2025, contributing to an improvement in net margin per active client, which reached R$21.2 in 4Q25, the highest level of all time. 4Q25 1Q21 4Q25 1Q21 R$35 Avg. Gross ARPAC

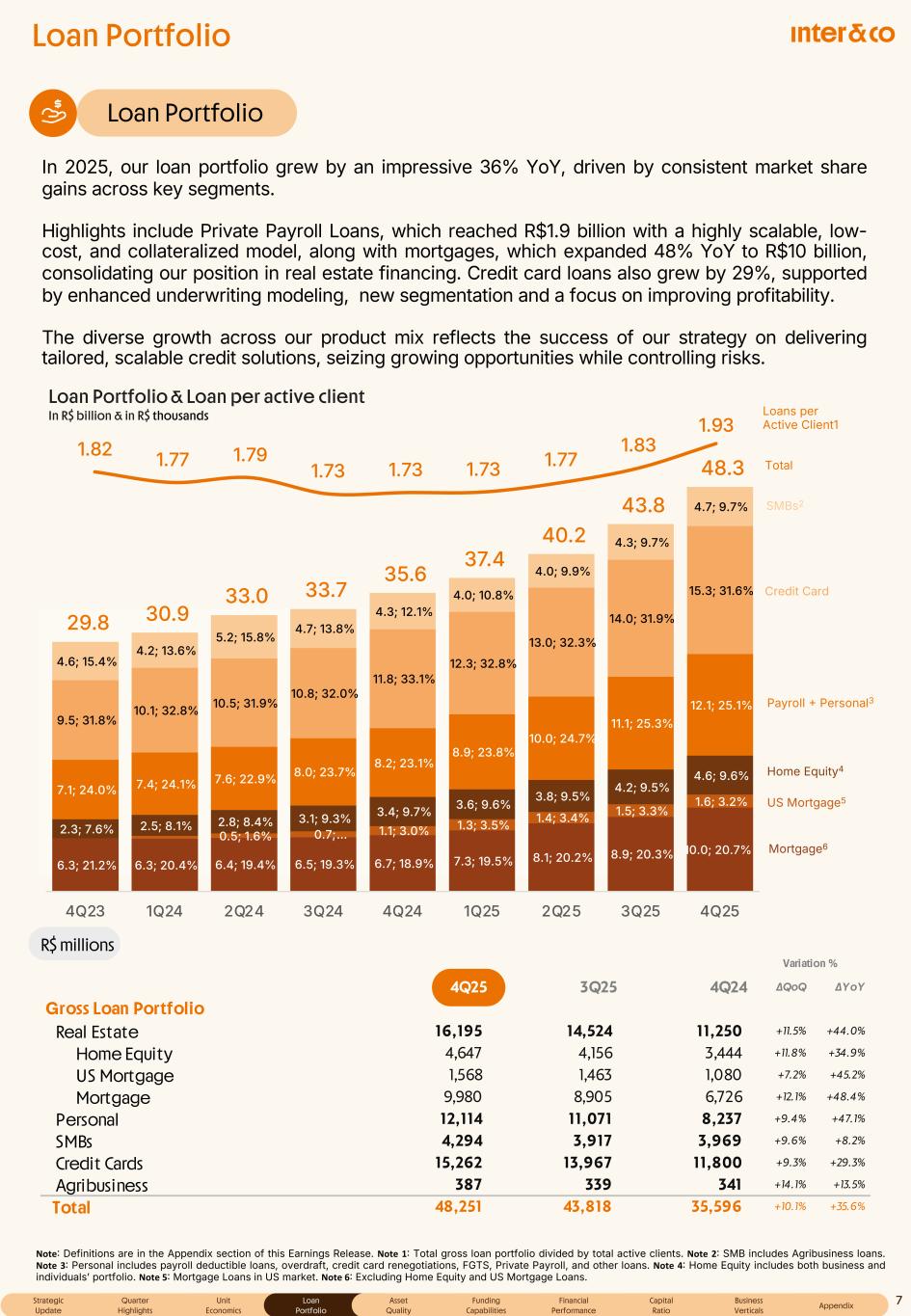

Loan Portfolio Loan Portfolio Payroll Personal3 SMBs2 Credit Card Total R$ millions Note Definitions are in the Appendix section of this Earnings Release. Note 1 Total gross loan portfolio divided by total active clients. Note 2 SMB includes Agribusiness loans. Note 3 Personal includes payroll deductible loans, overdraft, credit card renegotiations, FGTS, Private Payroll, and other loans. Note 4 Home Equity includes both business and individuals’ portfolio. Note 5 Mortgage Loans in US market. Note 6 Excluding Home Equity and US Mortgage Loans. 4Q25 3Q25 4Q24 ∆QoQ ∆YoY Gross Loan Portfolio Real Estate 16,195 14,524 11,250 +11.5% +44.0% Home Equity 4,647 4,156 3,444 +11.8% +34.9% US Mortgage 1,568 1,463 1,080 +7.2% +45.2% Mortgage 9,980 8,905 6,726 +12.1% +48.4% Personal 12,114 11,071 8,237 +9.4% +47.1% SMBs 4,294 3,917 3,969 +9.6% +8.2% Credit Cards 15,262 13,967 11,800 +9.3% +29.3% Agribusiness 387 339 341 +14.1% +13.5% Total 48,251 43,818 35,596 +10.1% +35.6% Variation % Loans per Active Client1 Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 7 In 2025, our loan portfolio grew by an impressive 36% YoY, driven by consistent market share gains across key segments. Highlights include Private Payroll Loans, which reached R$1.9 billion with a highly scalable, low- cost, and collateralized model, along with mortgages, which expanded 48% YoY to R$10 billion, consolidating our position in real estate financing. Credit card loans also grew by 29%, supported by enhanced underwriting modeling, new segmentation and a focus on improving profitability. The diverse growth across our product mix reflects the success of our strategy on delivering tailored, scalable credit solutions, seizing growing opportunities while controlling risks. 6.3; 21.2% 6.3; 20.4% 6.4; 19.4% 6.5; 19.3% 6.7; 18.9% 7.3; 19.5% 8.1; 20.2% 8.9; 20.3% 10.0; 20.7% 0.5; 1.6% 0.7; … 1.1; 3.0% 1.3; 3.5% 1.4; 3.4% 1.5; 3.3% 1.6; 3.2% 2.3; 7.6% 2.5; 8.1% 2.8; 8.4% 3.1; 9.3% 3.4; 9.7% 3.6; 9.6% 3.8; 9.5% 4.2; 9.5% 4.6; 9.6% 7.1; 24.0% 7.4; 24.1% 7.6; 22.9% 8.0; 23.7% 8.2; 23.1% 8.9; 23.8% 10.0; 24.7% 11.1; 25.3% 12.1; 25.1% 9.5; 31.8% 10.1; 32.8% 10.5; 31.9% 10.8; 32.0% 11.8; 33.1% 12.3; 32.8% 13.0; 32.3% 14.0; 31.9% 15.3; 31.6% 4.6; 15.4% 4.2; 13.6% 5.2; 15.8% 4.7; 13.8% 4.3; 12.1% 4.0; 10.8% 4.0; 9.9% 4.3; 9.7% 4.7; 9.7% 29.8 30.9 33.0 33.7 35.6 37.4 40.2 43.8 48.3 - 5 .0 1 0. 0 1 5. 0 2 0 .0 2 5. 0 3 0 .0 3 5. 0 4 0 .0 4 5. 0 5 0 .0 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Mortgage6 Home Equity4 US Mortgage5 1.82 1.77 1.79 1.73 1.73 1.73 1.77 1.83 1.93 1 .7 1 .7 1 .8 1 .8 1 .9 1 .9 2 .0 Loan Portfolio & Loan per active client In R$ billion & in R$ thousands

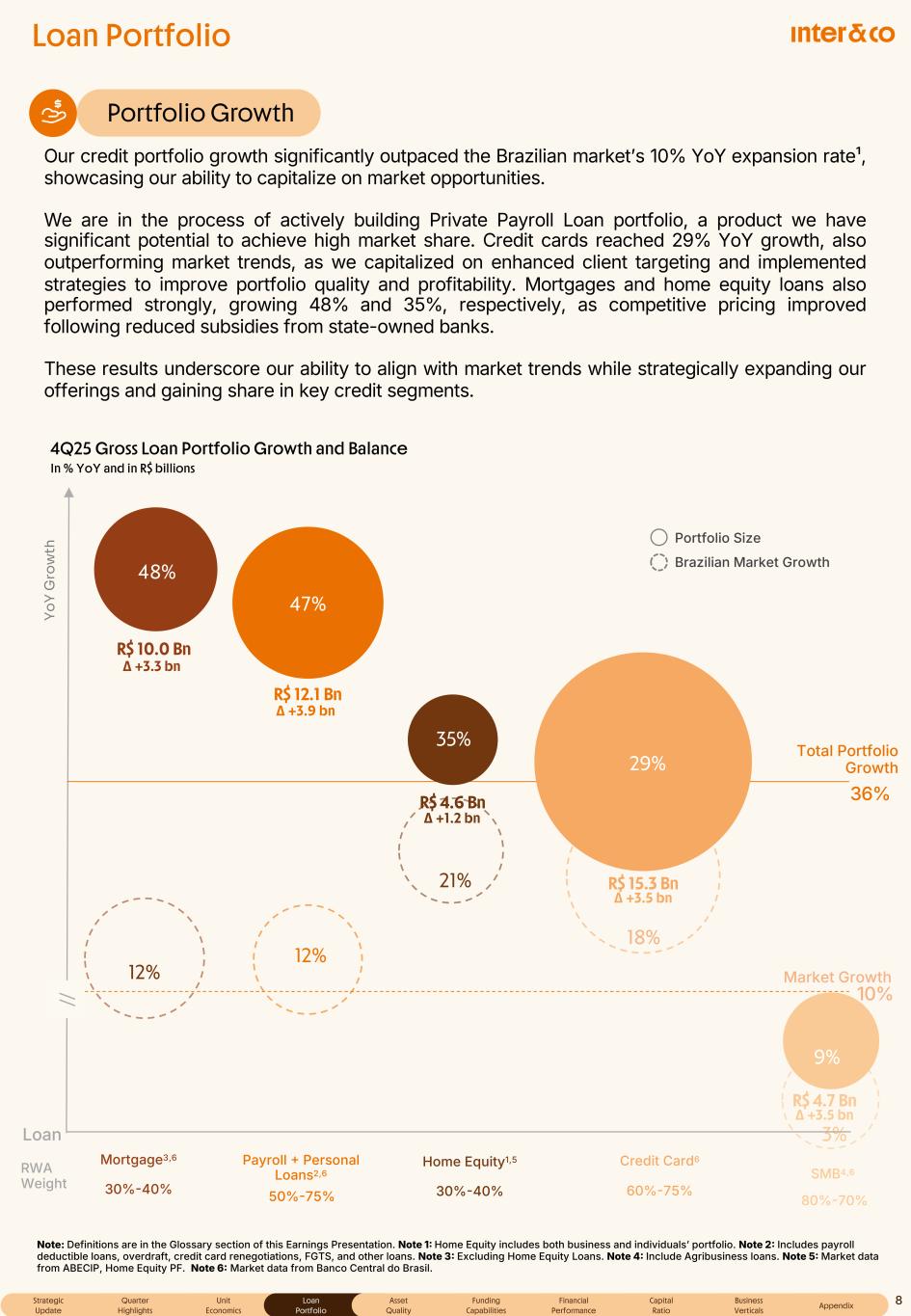

Loan Portfolio Portfolio Growth Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Home Equity includes both business and individuals’ portfolio. Note 2 Includes payroll deductible loans, overdraft, credit card renegotiations, FGTS, and other loans. Note 3 Excluding Home Equity Loans. Note 4 Include Agribusiness loans. Note 5 Market data from ABECIP, Home Equity PF. Note 6 Market data from Banco Central do Brasil. 4Q25 Gross Loan Portfolio Growth and Balance In % YoY and in R$ billions Portfolio Size Brazilian Market Growth Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update R$ 4.7 Bn Δ +3.5 bn 9% Payroll Personal Loans2,6 50%75% Credit Card6 60%75% Home Equity1,5 30%40% RWA Weight Loan Mortgage3,6 30%40% SMB4,6 80%70% Yo Y G ro w th Total Portfolio Growth 36% 21% 18% 3% Market Growth 10% 8 Our credit portfolio growth significantly outpaced the Brazilian market’s 10% YoY expansion rate¹, showcasing our ability to capitalize on market opportunities. We are in the process of actively building Private Payroll Loan portfolio, a product we have significant potential to achieve high market share. Credit cards reached 29% YoY growth, also outperforming market trends, as we capitalized on enhanced client targeting and implemented strategies to improve portfolio quality and profitability. Mortgages and home equity loans also performed strongly, growing 48% and 35%, respectively, as competitive pricing improved following reduced subsidies from state-owned banks. These results underscore our ability to align with market trends while strategically expanding our offerings and gaining share in key credit segments. // R$ 15.3 Bn Δ +3.5 bn 29% R$ 4.6 Bn Δ +1.2 bn 35% 12% 47% R$ 12.1 Bn Δ +3.9 bn R$ 10.0 Bn Δ +3.3 bn 48% 12%

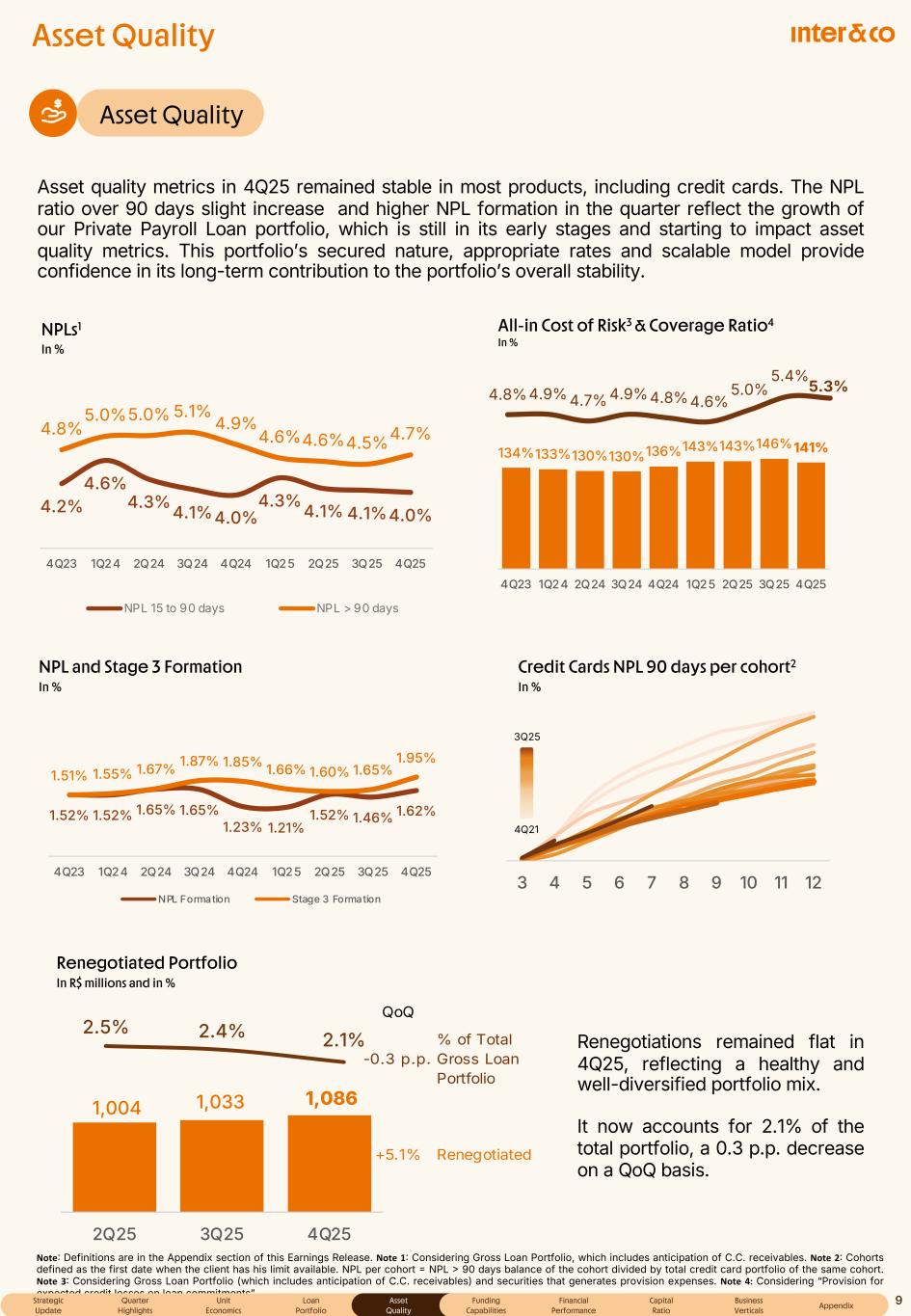

Asset Quality Asset Quality 1.52% 1.52% 1.65% 1.65% 1.23% 1.21% 1.52% 1.46% 1.62% 1.51% 1.55% 1.67% 1.87% 1.85% 1.66% 1.60% 1.65% 1.95% 0 .0 0% 1. 0 % 2 .0 0% 3 .0 0% 4 .0 0% 5 .0 0% 6 .0 0% 7 .0 0% 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 NPL Formation Stage 3 Formation NPLs1 In % Note Definitions are in the Appendix section of this Earnings Release. Note 1 Considering Gross Loan Portfolio, which includes anticipation of C.C. receivables. Note 2 Cohorts defined as the first date when the client has his limit available. NPL per cohort NPL 90 days balance of the cohort divided by total credit card portfolio of the same cohort. Note 3 Considering Gross Loan Portfolio (which includes anticipation of C.C. receivables) and securities that generates provision expenses. Note 4: Considering “Provision for expected credit losses on loan commitments” Credit Cards NPL 90 days per cohort2 In % NPL and Stage 3 Formation In % Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 9 Asset quality metrics in 4Q25 remained stable in most products, including credit cards. The NPL ratio over 90 days slight increase and higher NPL formation in the quarter reflect the growth of our Private Payroll Loan portfolio, which is still in its early stages and starting to impact asset quality metrics. This portfolio’s secured nature, appropriate rates and scalable model provide confidence in its long-term contribution to the portfolio’s overall stability. 3 4 5 6 7 8 9 10 11 12 134%133%130%130%136%143%143%146%141% 0 .0 % 2 0. 0% 4 0. 0% 6 0. 0% 8 0. 0% 10 0 .0 % 12 0 .0 % 14 0 .0 % 16 0 .0 % 18 0 .0 % 2 0 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 4.8%4.9% 4.7% 4.9%4.8%4.6% 5.0% 5.4%5.3% 2 .0 % 2 .5 % 3 .0 % 3 .5 % 4 .0 % 4 .5 % 5 .0 % 5 .5 % 6 .0 % 6 .5 % 7 .0 % All-in Cost of Risk3 & Coverage Ratio4 In % 4.2% 4.6% 4.3%4.1%4.0% 4.3%4.1% 4.1%4.0% 4.8% 5.0%5.0% 5.1% 4.9% 4.6%4.6%4.5%4.7% 3 .0 % 3 .5 % 4 .0 % 4 .5 % 5 .0 % 5 .5 % 6 .0 % 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 NPL 15 to 90 days NPL > 90 days Renegotiations remained flat in 4Q25, reflecting a healthy and well-diversified portfolio mix. It now accounts for 2.1% of the total portfolio, a 0.3 p.p. decrease on a QoQ basis. Renegotiated Portfolio In R$ millions and in % QoQ -0.3 p.p. % of Total Gross Loan Portfolio +5.1% Renegotiated 2.5% 2.4% 2.1% 1,004 1,033 1,086 - 2 0 4 0 6 0 8 0 1 ,0 0 1 ,20 0 1 ,40 0 2Q25 3Q25 4Q25 3Q25 4Q21

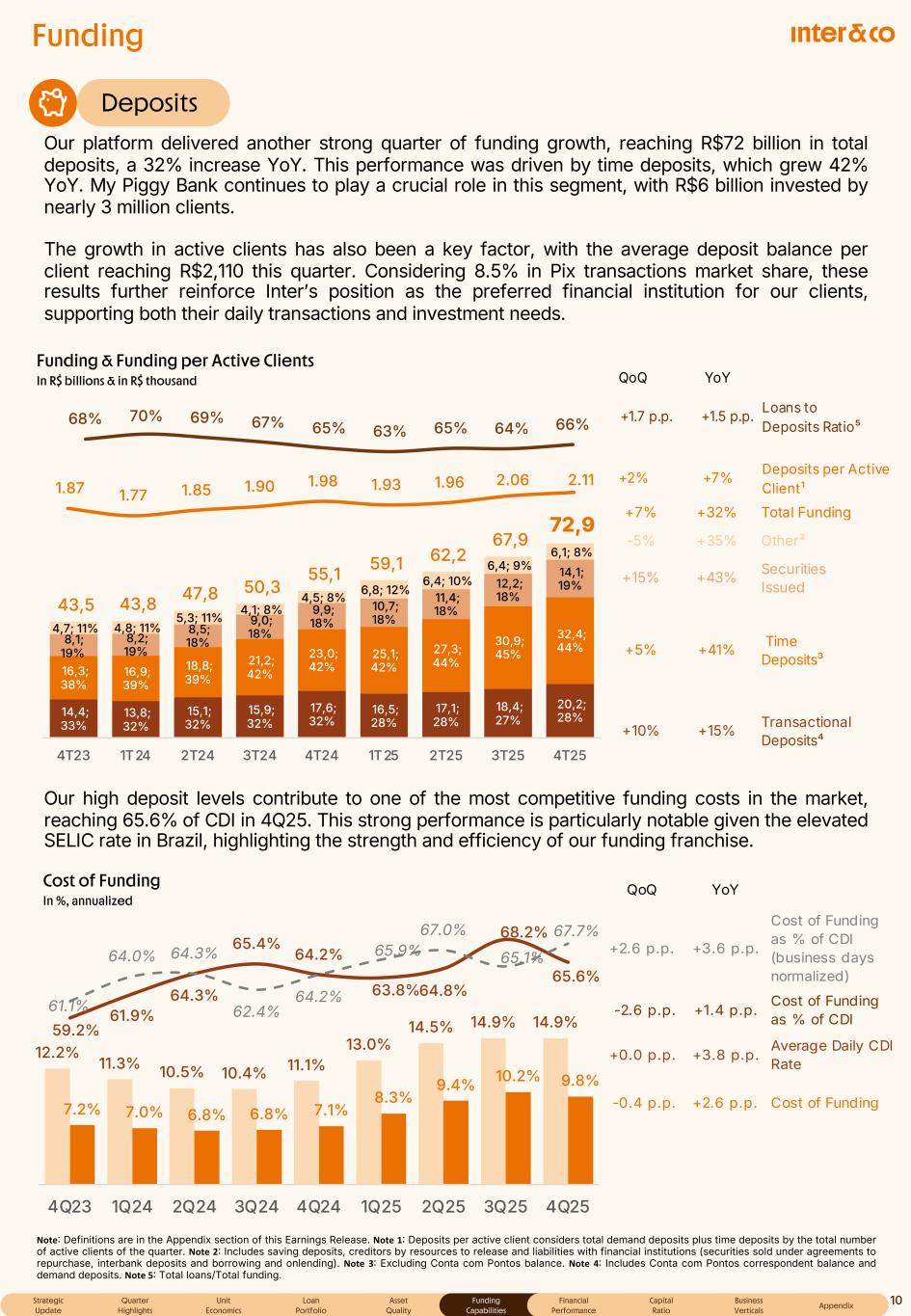

Funding Note Definitions are in the Appendix section of this Earnings Release. Note 1 Deposits per active client considers total demand deposits plus time deposits by the total number of active clients of the quarter. Note 2 Includes saving deposits, creditors by resources to release and liabilities with financial institutions (securities sold under agreements to repurchase, interbank deposits and borrowing and onlending). Note 3 Excluding Conta com Pontos balance. Note 4 Includes Conta com Pontos correspondent balance and demand deposits. Note 5 Total loans/Total funding. Cost of Funding In %, annualized Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 10 Our high deposit levels contribute to one of the most competitive funding costs in the market, reaching 65.6% of CDI in 4Q25. This strong performance is particularly notable given the elevated SELIC rate in Brazil, highlighting the strength and efficiency of our funding franchise. 12.2% 11.3% 10.5% 10.4% 11.1% 13.0% 14.5% 14.9% 14.9% 7.2% 7.0% 6.8% 6.8% 7.1% 8.3% 9.4% 10.2% 9.8% 59.2% 61.9% 64.3% 65.4% 64.2% 63.8%64.8% 68.2% 65.6% 61.1% 64.0% 64.3% 62.4% 64.2% 65.9% 67.0% 65.1% 67.7% 2.0% 7.0% 12.0% 17.0% 22.0 % 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 QoQ YoY +2.6 p.p. +3.6 p.p. Cost of Funding as % of CDI (business days normalized) -2.6 p.p. +1.4 p.p. Cost of Funding as % of CDI +0.0 p.p. +3.8 p.p. Average Daily CDI Rate -0.4 p.p. +2.6 p.p. Cost of Funding 14,4; 33% 13,8; 32% 15,1; 32% 15,9; 32% 17,6; 32% 16,5; 28% 17,1; 28% 18,4; 27% 20,2; 28% 16,3; 38% 16,9; 39% 18,8; 39% 21,2; 42% 23,0; 42% 25,1; 42% 27,3; 44% 30,9; 45% 32,4; 44% 8,1; 19% 8,2; 19% 8,5; 18% 9,0; 18% 9,9; 18% 10,7; 18% 11,4; 18% 12,2; 18% 14,1; 19% 4,7; 11% 4,8; 11% 5,3; 11% 4,1; 8% 4,5; 8% 6,8; 12% 6,4; 10% 6,4; 9% 6,1; 8% 43,5 43,8 47,8 50,3 55,1 59,1 62,2 67,9 72,9 4T23 1T24 2T24 3T24 4T24 1T25 2T25 3T25 4T25 Deposits Funding & Funding per Active Clients In R$ billions & in R$ thousand Our platform delivered another strong quarter of funding growth, reaching R$72 billion in total deposits, a 32% increase YoY. This performance was driven by time deposits, which grew 42% YoY. My Piggy Bank continues to play a crucial role in this segment, with R$6 billion invested by nearly 3 million clients. The growth in active clients has also been a key factor, with the average deposit balance per client reaching R$2,110 this quarter. Considering 8.5% in Pix transactions market share, these results further reinforce Inter’s position as the preferred financial institution for our clients, supporting both their daily transactions and investment needs. 1.87 1.77 1.85 1.90 1.98 1.93 1.96 2.06 2.11 1 .70 1 .80 1 .90 2 .0 2 .10 2 .20 68% 70% 69% 67% 65% 63% 65% 64% 66% 6 0% 6 5% 7 0% 7 5% 8 0% QoQ YoY +1.7 p.p. +1.5 p.p. Loans to Deposits Ratio⁵ +2% +7% Deposits per Active Client¹ +7% +32% Total Funding -5% +35% Other² +15% +43% Securities Issued +5% +41% Time Deposits³ +10% +15% Transactional Deposits⁴

Financial Performance Revenue R$ millions Note Definitions are in the Appendix section of this Earnings Release. 4Q25 3Q25 4Q24 ∆QoQ ∆YoY Total Revenues Interest income incl. loan hedge results Income from securities, derivatives and FX excl. loan hedge results Revenues from services and commissions 663 628 653 +5.5% +1.5% Other revenues 92 72 111 +27.0% -17.5% Total gross revenue 4,294 3,977 2,963 +8.0% +44.9% Interest expenses (1,720) (1,654) (941) +4.0% +82.8% Expenses from services and commissions (52) (47) (39) +10.2% +33.0% Cashback expenses (72) (75) (102) -4.5% -29.6% Inter Loop (52) (39) (37) +33.9% +40.4% Total net revenue 2,398 2,162 1,844 +10.9% +30.0% Variation % 2,486 2,376 1,611 +4.6% +54.3% 1,053 900 588 +17.0% +79.0% QoQ YoY +8% +45% Total Gross Revenue +11% +30% Total Net Revenue +7% -1% Net Fee Revenue +12% +45% Net Interest Income 897 68% 992 71% 1,042 70% 1,164 69% 1,258 68% 1,363 74% 1,470 73% 1,623 75% 1,819 76% 416 32% 409 29% 437 30% 512 31% 586 32% 475 26% 534 27% 539 25% 579 24% 1,313 1,401 1,479 1,676 1,844 1,838 2,003 2,162 2,398 2,197 2,291 2,404 2,684 2,963 3,162 3,567 3,977 4,294 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update R$ 4.2bn Gross Revenue R$2.4bn Net Revenue 11 Our diversified revenue mix continues to strengthen our results. In 4Q25, we generated gross revenues of R$4.2 billion and net revenues of R$2.4 billion, growing 45% and 30% YoY, respectively. Net interest income growth was driven by the evolution of our credit mix, with strong Private Payroll loan growth, and improved Credit Card interest earning portfolio performance. Net fee revenue was impacted by multiple factors in 2025. These included regulatory changes introduced by Resolution 4966, which affected fee recognition, as well as one-off effects from capital gains. Additionally, we observed slower growth pace in Inter Shop GMV and Inter Pag MDR due to the competitive environment in retail. Revenue In R$ millions 3,297 69% 4,457 70% 6,274 75% 1,456 31% 1,943 30% 2,127 25% 4,753 6,400 8,401 8,079 10,342 14,999 - 2 ,0 00 4 ,0 00 6 ,0 00 8 ,0 00 10 ,0 00 12 ,0 00 14 ,0 00 16 ,0 00 2023 2024 2025 YoY +45% +31% +9% +41%

12.2% 11.3% 10.5% 10.4% 11.1% 13.0% 14.5% 14.9% 14.9% 4.4% 5.8% 4.3% 3.2% 6.0% 8.4% 3.8% 2.5% 2.4% 1.0 % 3. 0% 5. 0% 7. 0% 9. 0% 11.0 % 13. 0% 15. 0% 6.81% 7.09% 7.10% 7.50% 7.55% 7.65% 7.87% 8.08% 8.33% 7.87% 8.22% 8.24% 8.68% 8.74% 8.84% 9.07% 9.28% 9.57% 3.89% 4.15% 4.23% 4.46% 4.58% 4.77% 4.82% 4.89% 5.16% 4.50% 4.81% 4.91% 5.16% 5.30% 5.51% 5.56% 5.62% 5.92% 3. 0% 4. 0% 5. 0% 6. 0% 7. 0% 8. 0% 9. 0% 10. 0% 11.0 % 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Financial Performance NIM Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 9.6% NIM 2.0 5.9% NIM 2.0 Risk-Adjusted Note Definitions are in the Appendix section of this Earnings Release. Note 1 All-in NIM 2.0 and Risk-Adjusted All-in NIM 2.0 do not include transactor credit card portfolio. 12 Our NIMs sustained their upward trajectory throughout 2025, driven by improvements in credit origination mix, refined client targeting and pricing, and optimized capital allocation across credit and securities. We achieved record levels in both NIM and risk-adjusted NIM, consistently reflecting the strength of our growth strategy. This consistent performance was achieved even with IPCA and CDI fluctuations, showcasing the resilience and effectiveness of our capital allocation approach. NIM 2.0 NIM 1.0 NIM 2.0 Risk-Adjusted NIM 1.0 Risk-Adjusted Average CDI of the Quarter Annualized IPCA of the Quarter NIM1 In %

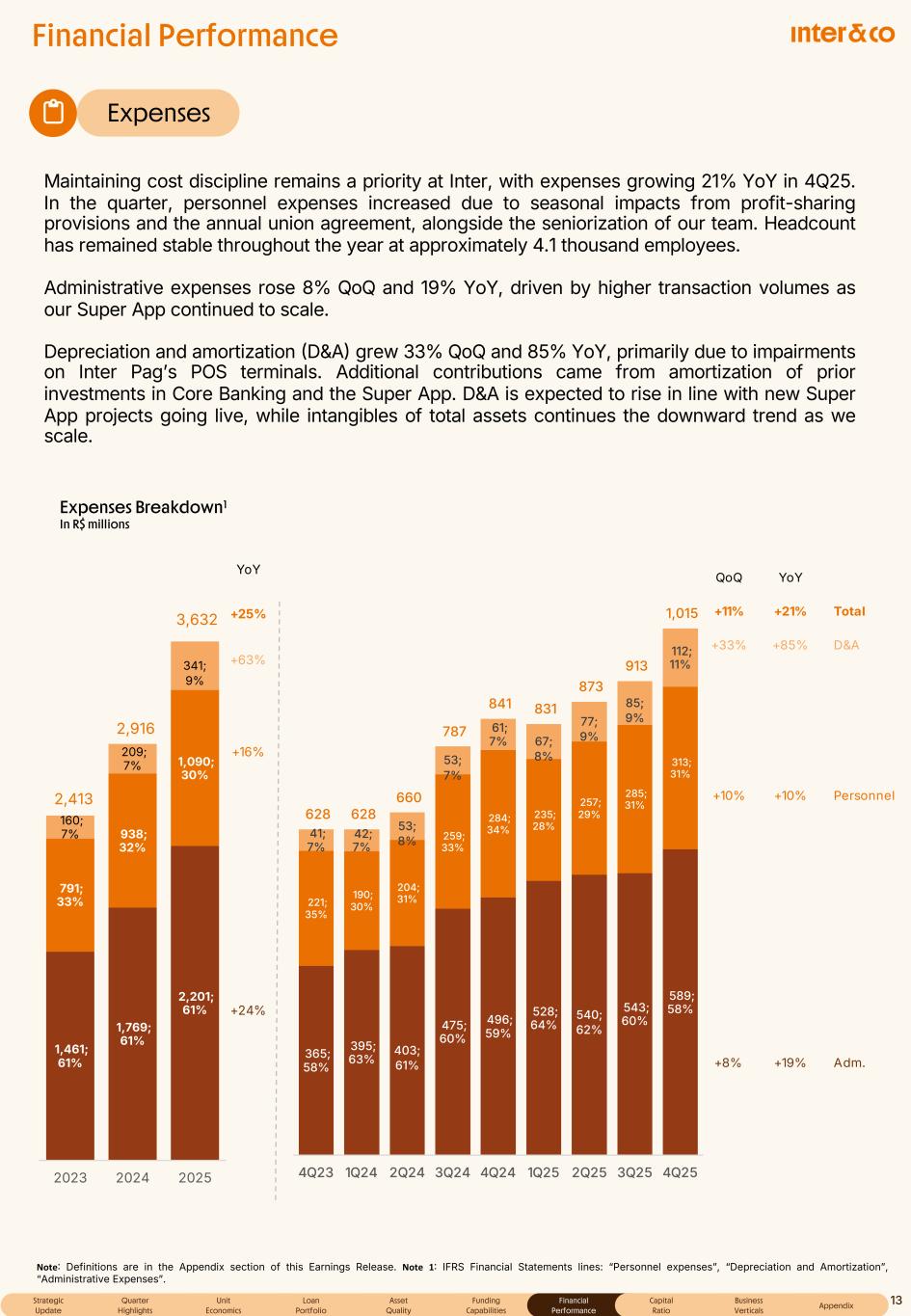

Financial Performance Expenses Note Definitions are in the Appendix section of this Earnings Release. Note 1 IFRS Financial Statements lines: “Personnel expenses”, “Depreciation and Amortization”, “Administrative Expenses”. Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 13 Maintaining cost discipline remains a priority at Inter, with expenses growing 21% YoY in 4Q25. In the quarter, personnel expenses increased due to seasonal impacts from profit-sharing provisions and the annual union agreement, alongside the seniorization of our team. Headcount has remained stable throughout the year at approximately 4.1 thousand employees. Administrative expenses rose 8% QoQ and 19% YoY, driven by higher transaction volumes as our Super App continued to scale. Depreciation and amortization D&A grew 33% QoQ and 85% YoY, primarily due to impairments on Inter Pag’s POS terminals. Additional contributions came from amortization of prior investments in Core Banking and the Super App. D&A is expected to rise in line with new Super App projects going live, while intangibles of total assets continues the downward trend as we scale. QoQ YoY +11% +21% Total +33% +85% D&A +10% +10% Personnel +8% +19% Adm. Expenses Breakdown1 In R$ millions 365; 58% 395; 63% 403; 61% 475; 60% 496; 59% 528; 64% 540; 62% 543; 60% 589; 58% 221; 35% 190; 30% 204; 31% 259; 33% 284; 34% 235; 28% 257; 29% 285; 31% 313; 31% 41; 7% 42; 7% 53; 8% 53; 7% 61; 7% 67; 8% 77; 9% 85; 9% 112; 11% 628 628 660 787 841 831 873 913 1,015 - 2 0 0 4 0 0 6 0 0 8 0 0 1 ,0 0 1 ,2 0 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 1,461; 61% 1,769; 61% 2,201; 61% 791; 33% 938; 32% 1,090; 30% 160; 7% 209; 7% 341; 9% 2,413 2,916 3,632 2023 2024 2025 YoY +25% +63% +16% +24%

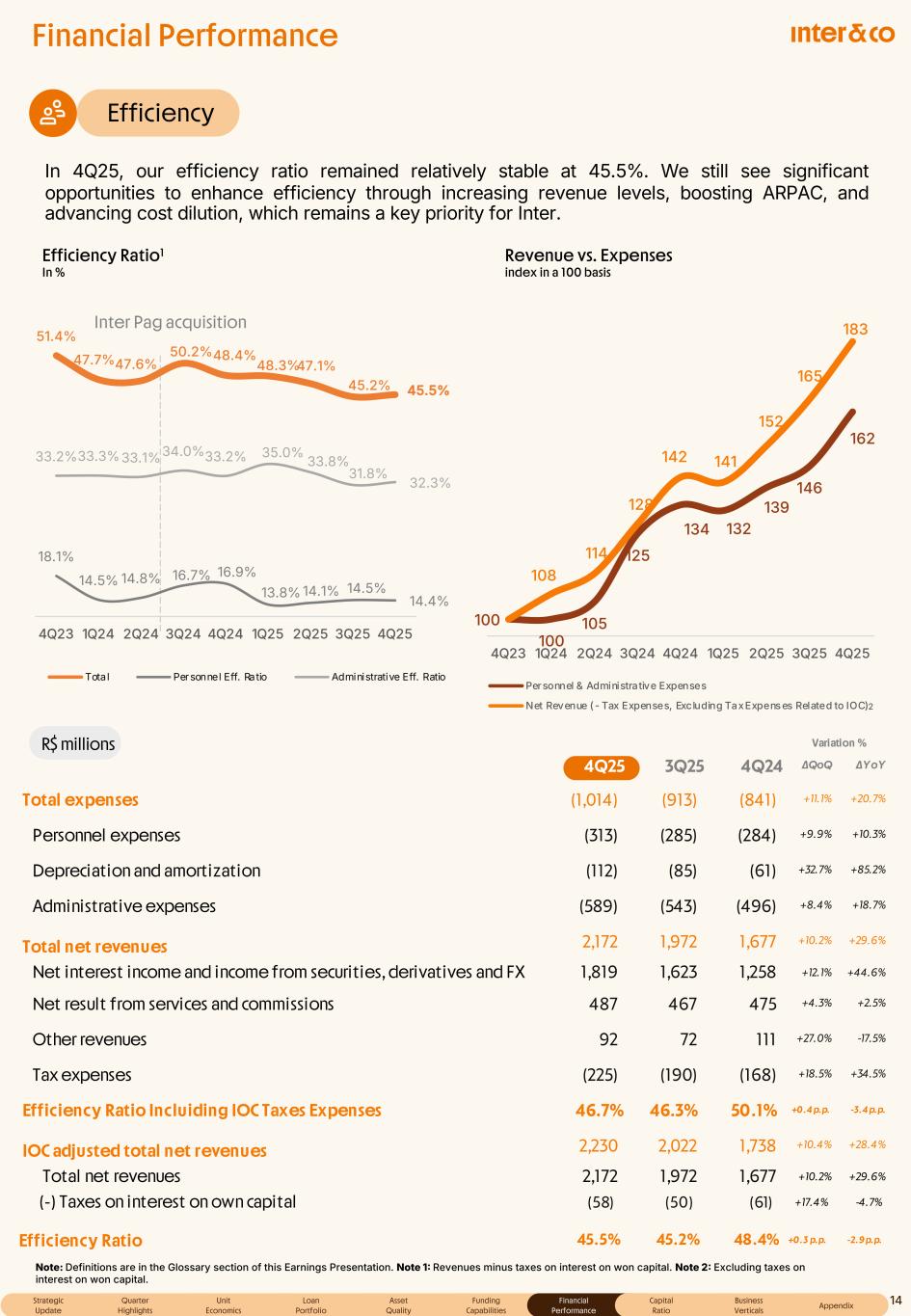

Financial Performance Efficiency Efficiency Ratio1 In % Note: Definitions are in the Glossary section of this Earnings Presentation. Note 1 Revenues minus taxes on interest on won capital. Note 2 Excluding taxes on interest on won capital. R$ millions 4Q25 3Q25 4Q24 ∆QoQ ∆YoY Total expenses (1,014) (913) (841) +11.1% +20.7% Personnel expenses (313) (285) (284) +9.9% +10.3% Depreciation and amortization (112) (85) (61) +32.7% +85.2% Administrative expenses (589) (543) (496) +8.4% +18.7% Total net revenues 2,172 1,972 1,677 +10.2% +29.6% Net interest income and income from securities, derivatives and FX 1,819 1,623 1,258 +12.1% +44.6% Net result from services and commissions 487 467 475 +4.3% +2.5% Other revenues 92 72 111 +27.0% -17.5% Tax expenses (225) (190) (168) +18.5% +34.5% Efficiency Ratio Incluiding IOC Taxes Expenses 46.7% 46.3% 50.1% +0.4 p.p. -3.4 p.p. IOC adjusted total net revenues 2,230 2,022 1,738 +10.4% +28.4% Total net revenues 2,172 1,972 1,677 +10.2% +29.6% Variation % Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update Revenue vs. Expenses index in a 100 basis 14 In 4Q25, our efficiency ratio remained relatively stable at 45.5%. We still see significant opportunities to enhance efficiency through increasing revenue levels, boosting ARPAC, and advancing cost dilution, which remains a key priority for Inter. Inter Pag acquisition (-) Taxes on interest on own capital (58) (50) (61) +17.4% -4.7% Efficiency Ratio 45.5% 45.2% 48.4% +0.3 p.p. -2.9 p.p. 2 100 100 105 125 134 132 139 146 162 108 114 128 142 141 152 165 183 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Personnel & Administrative Expenses Net Revenue ( - Tax Expenses, Excluding Tax Expenses Related to IOC) 51.4% 47.7%47.6% 50.2%48.4% 48.3%47.1% 45.2% 45.5% 18.1% 14.5% 14.8% 16.7% 16.9% 13.8% 14.1% 14.5% 14.4% 33.2%33.3%33.1%34.0%33.2% 35.0% 33.8% 31.8% 32.3% 12 .0 % 17 .0 % 2 2. 0% 2 7.0 % 3 2.0 % 3 7.0 % 4 2. 0% 4 7.0 % 5 2. 0% 5 7.0 % 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Total Personnel Eff. Ratio Administrative Eff. Ratio

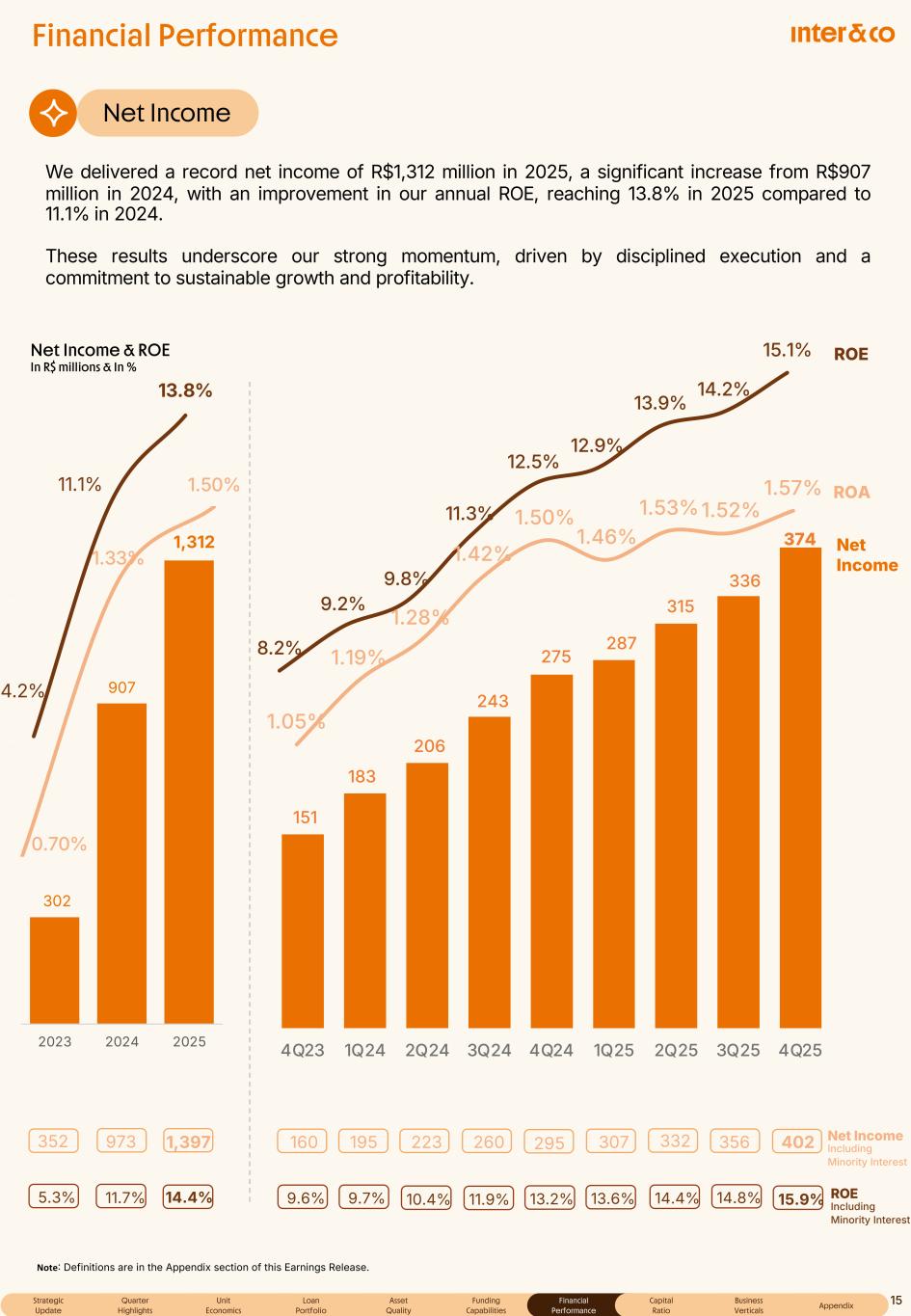

151 183 206 243 275 287 315 336 374 - 5 0 1 0 1 50 2 0 2 50 3 0 3 50 4 0 4 50 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Financial Performance Net Income Note Definitions are in the Appendix section of this Earnings Release. Net Income & ROE In R$ millions & In % Net Income Including Minority Interest ROE Including Minority Interest Net Income Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 15 We delivered a record net income of R$1,312 million in 2025, a significant increase from R$907 million in 2024, with an improvement in our annual ROE, reaching 13.8% in 2025 compared to 11.1% in 2024. These results underscore our strong momentum, driven by disciplined execution and a commitment to sustainable growth and profitability. ROA 302 907 1,312 - 20 0 40 0 60 0 80 0 1,00 0 1,20 0 1,40 0 2023 2024 2025 160 195 223 260 295 307 332 356 402 9.6% 9.7% 10.4% 11.9% 13.2% 13.6% 14.4% 14.8% 15.9% 8.2% 9.2% 9.8% 11.3% 12.5% 12.9% 13.9% 14.2% 15.1% 1.05% 1.19% 1.28% 1.42% 1.50% 1.46% 1.53%1.52% 1.57% 352 973 1,397 5.3% 11.7% 14.4% 4.2% 11.1% 13.8% 0.70% 1.33% 1.50% ROE

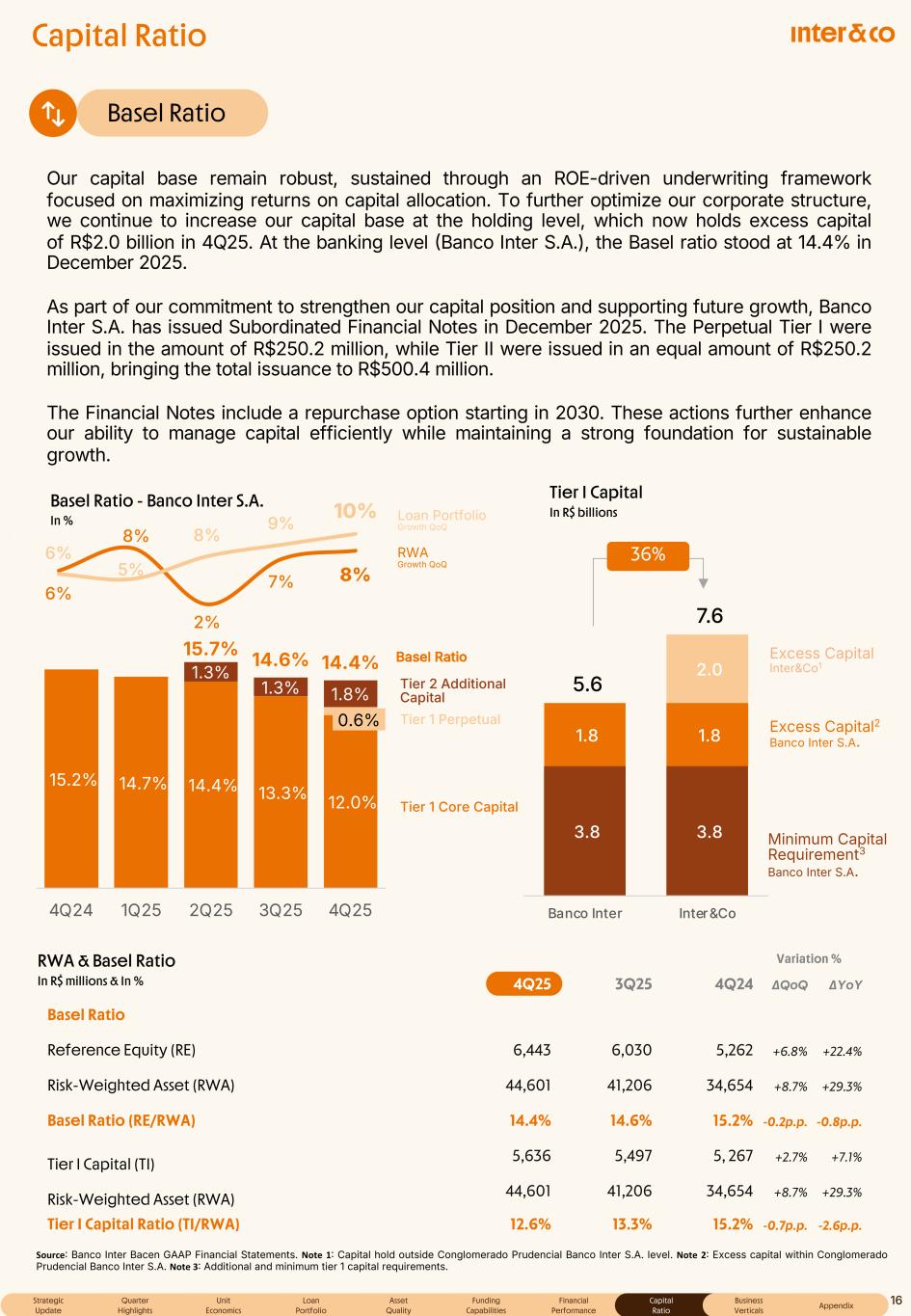

15.2% 14.7% 14.4% 13.3% 12.0% 0.6% 1.3% 1.3% 1.8% 15.7% 14.6% 14.4% 0 .0 % 2 .0 % 4 .0 % 6 .0 % 8 .0 % 10 .0 % 12 .0 % 14 .0 % 16 .0 % 18 .0 % 4Q24 1Q25 2Q25 3Q25 4Q25 Capital Ratio Basel Ratio Our capital base remain robust, sustained through an ROE-driven underwriting framework focused on maximizing returns on capital allocation. To further optimize our corporate structure, we continue to increase our capital base at the holding level, which now holds excess capital of R$2.0 billion in 4Q25. At the banking level Banco Inter S.A.), the Basel ratio stood at 14.4% in December 2025. As part of our commitment to strengthen our capital position and supporting future growth, Banco Inter S.A. has issued Subordinated Financial Notes in December 2025. The Perpetual Tier I were issued in the amount of R$250.2 million, while Tier II were issued in an equal amount of R$250.2 million, bringing the total issuance to R$500.4 million. The Financial Notes include a repurchase option starting in 2030. These actions further enhance our ability to manage capital efficiently while maintaining a strong foundation for sustainable growth. Loan Portfolio Growth QoQ RWA Growth QoQ RWA & Basel Ratio In R$ millions & In % Minimum Capital Requirement3 Banco Inter S.A. Excess Capital2 Banco Inter S.A. Source Banco Inter Bacen GAAP Financial Statements. Note 1 Capital hold outside Conglomerado Prudencial Banco Inter S.A. level. Note 2 Excess capital within Conglomerado Prudencial Banco Inter S.A. Note 3 Additional and minimum tier 1 capital requirements. 6% 8% 2% 7% 8% 6% 5% 8% 9% 10% 0% 2% 4% 6% 8% 10% 12% 3.8 3.8 1.8 1.8 2.0 5.6 7.6 - 1 .0 2 .0 3 .0 4 .0 5 .0 6 .0 7 .0 8 .0 9 .0 Banco Inter Inter&Co Excess Capital Inter&Co1 Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 16 Tier 1 Core Capital Tier 2 Additional Capital Basel Ratio Tier I Capital In R$ billions 36% Variation % 4Q25 3Q25 4Q24 ∆QoQ ∆YoY Basel Ratio Reference Equity (RE) 6,443 6,030 5,262 +6.8% +22.4% Risk-Weighted Asset (RWA) 44,601 41,206 34,654 +8.7% +29.3% Basel Ratio (RE/RWA) 14.4% 14.6% 15.2% -0.2p.p. -0.8p.p. Tier I Capital (TI) 5,636 5,497 5, 267 +2.7% +7.1% Risk-Weighted Asset (RWA) 44,601 41,206 34,654 +8.7% +29.3% Tier I Capital Ratio (TI/RWA) 12.6% 13.3% 15.2% -0.7p.p. -2.6p.p. Tier 1 Perpetual Basel Ratio - Banco Inter S.A. In %

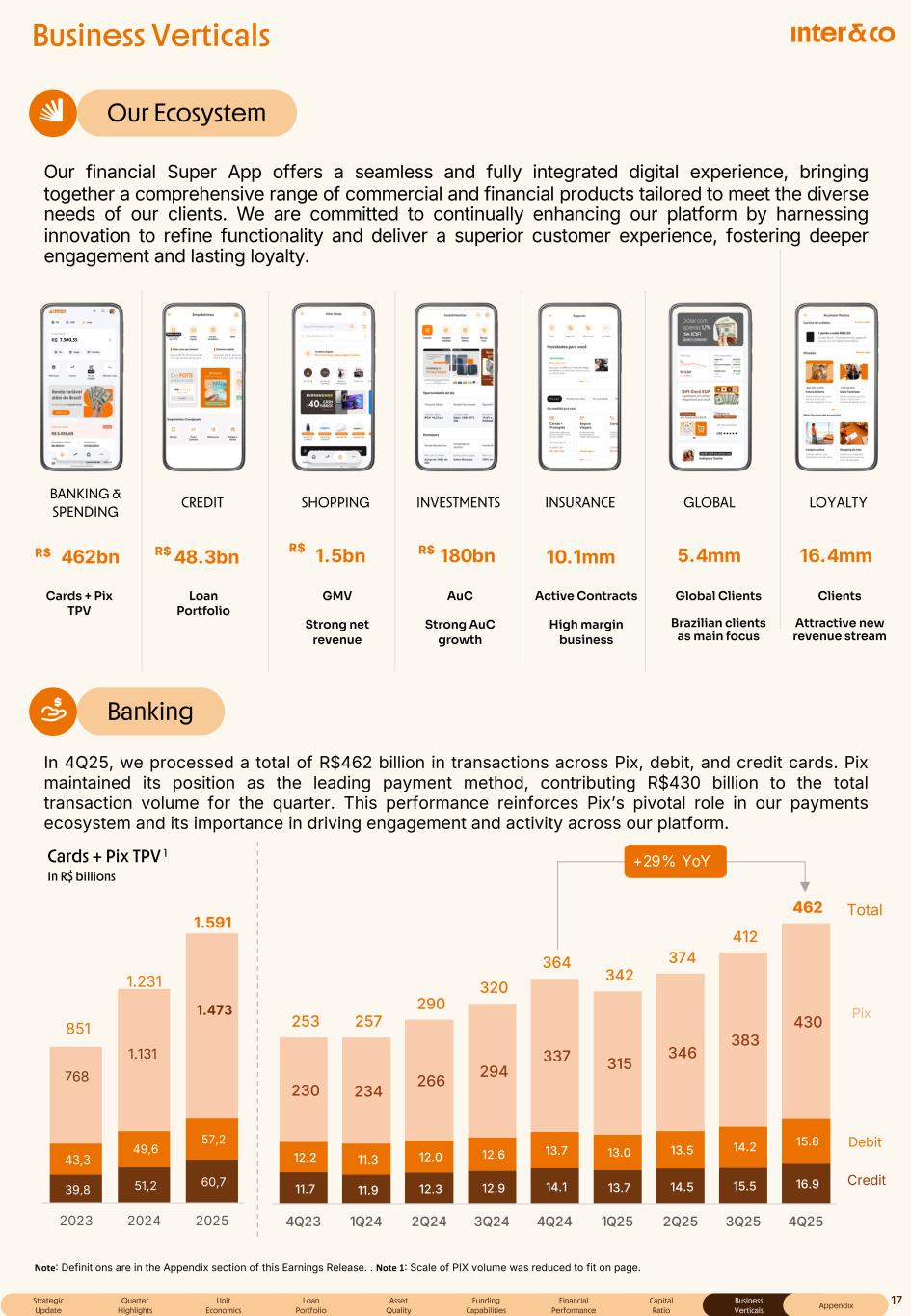

11.7 11.9 12.3 12.9 14.1 13.7 14.5 15.5 16.9 12.2 11.3 12.0 12.6 13.7 13.0 13.5 14.2 15.8 230 234 266 294 337 315 346 383 430 253 257 290 320 364 342 374 412 462 - 2 0. 0 4 0. 0 6 0. 0 8 0. 0 10 0. 0 12 0. 0 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 4Q25 Business Verticals Our Ecosystem BANKING & SPENDING SHOPPING INVESTMENTS INSURANCE GLOBALCREDIT LOYALTY Cards + Pix TPV Loan Portfolio AuC Strong AuC growth Active Contracts High margin business Global Clients Brazilian clients as main focus Clients Attractive new revenue stream Banking Debit Credit Pix Total Cards + Pix TPV 1 In R$ billions 7.300,35 Our financial Super App offers a seamless and fully integrated digital experience, bringing together a comprehensive range of commercial and financial products tailored to meet the diverse needs of our clients. We are committed to continually enhancing our platform by harnessing innovation to refine functionality and deliver a superior customer experience, fostering deeper engagement and lasting loyalty. Note Definitions are in the Appendix section of this Earnings Release. . Note 1 Scale of PIX volume was reduced to fit on page. +29% YoY 10.1mm 5.4mm 16.4mm462bnR$ 48.3bnR$ 1.5bnR$ 180bnR$ Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 17 In 4Q25, we processed a total of R$462 billion in transactions across Pix, debit, and credit cards. Pix maintained its position as the leading payment method, contributing R$430 billion to the total transaction volume for the quarter. This performance reinforces Pix’s pivotal role in our payments ecosystem and its importance in driving engagement and activity across our platform. GMV Strong net revenue 39,8 51,2 60,7 43,3 49,6 57,2 768 1.131 1.473 851 1.231 1.591 - 5 0 .0 1 0 .0 1 50 .0 2 0 0. 0 2 50 .0 3 0 0. 0 3 50 .0 4 0 0. 0 2023 2024 2025

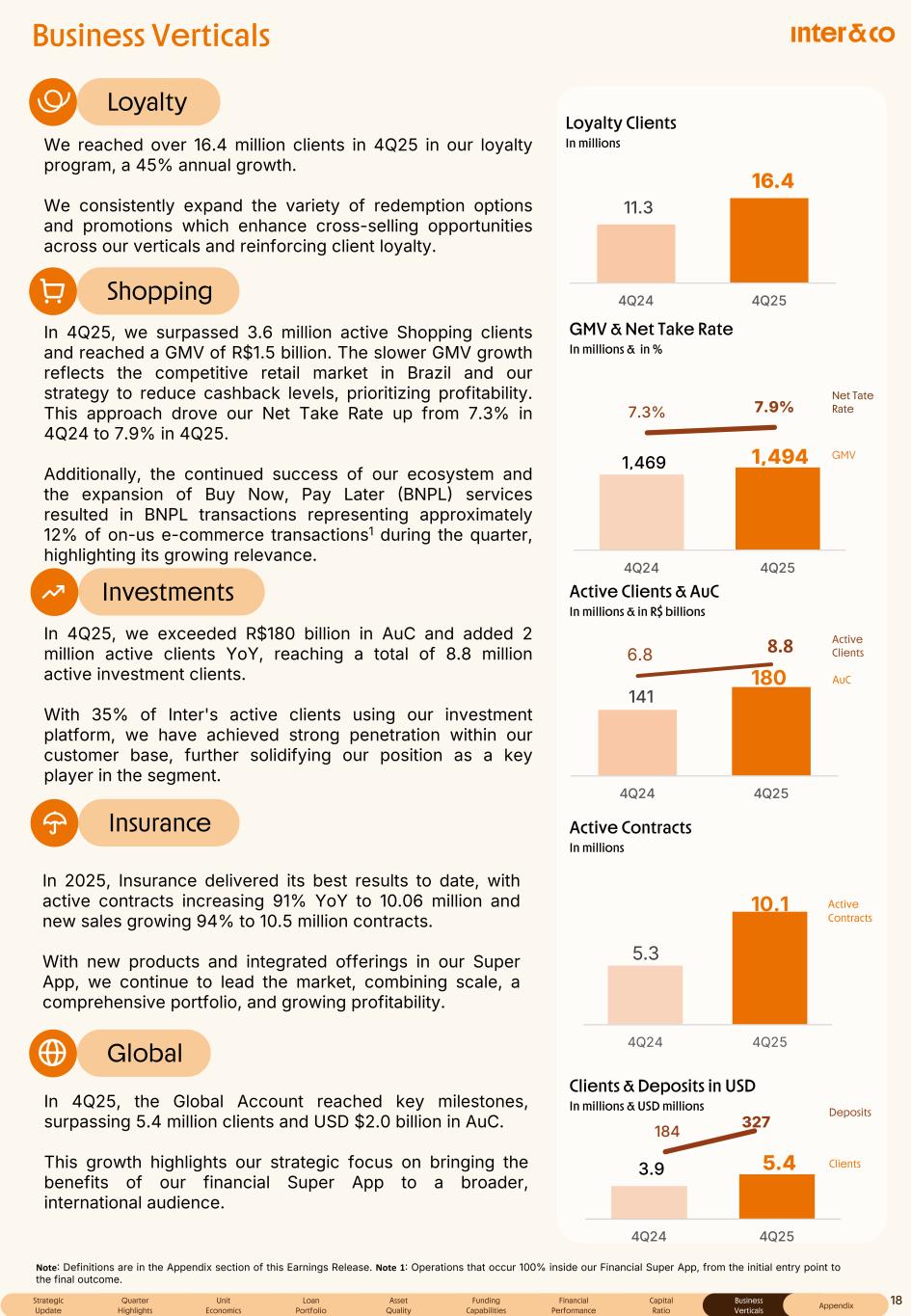

Business Verticals Loyalty Shopping Investments Insurance Global GMV & Net Take Rate In millions & in % Active Clients & AuC In millions & in R$ billions Loyalty Clients In millions Note Definitions are in the Appendix section of this Earnings Release. Note 1 Operations that occur 100% inside our Financial Super App, from the initial entry point to the final outcome. Active Clients AuC 141 180 6.8 8.8 3 0 .0 5 0 .0 7 0. 0 9 0 .0 1 10 .0 1 30 .0 1 50 .0 1 70 .0 1 90 .0 2 10 .0 2 3 0. 4Q24 4Q25 11.3 16.4 0 .0 2 .0 4 .0 6 .0 8 .0 10 .0 12 .0 14 .0 16 .0 18 .0 2 0. 0 4Q24 4Q25 Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update Deposits Clients 18 Clients & Deposits in USD In millions & USD millions In 2025, Insurance delivered its best results to date, with active contracts increasing 91% YoY to 10.06 million and new sales growing 94% to 10.5 million contracts. With new products and integrated offerings in our Super App, we continue to lead the market, combining scale, a comprehensive portfolio, and growing profitability. In 4Q25, the Global Account reached key milestones, surpassing 5.4 million clients and USD $2.0 billion in AuC. This growth highlights our strategic focus on bringing the benefits of our financial Super App to a broader, international audience. In 4Q25, we surpassed 3.6 million active Shopping clients and reached a GMV of R$1.5 billion. The slower GMV growth reflects the competitive retail market in Brazil and our strategy to reduce cashback levels, prioritizing profitability. This approach drove our Net Take Rate up from 7.3% in 4Q24 to 7.9% in 4Q25. Additionally, the continued success of our ecosystem and the expansion of Buy Now, Pay Later BNPL services resulted in BNPL transactions representing approximately 12% of on-us e-commerce transactions1 during the quarter, highlighting its growing relevance. In 4Q25, we exceeded R$180 billion in AuC and added 2 million active clients YoY, reaching a total of 8.8 million active investment clients. With 35% of Inter's active clients using our investment platform, we have achieved strong penetration within our customer base, further solidifying our position as a key player in the segment. We reached over 16.4 million clients in 4Q25 in our loyalty program, a 45% annual growth. We consistently expand the variety of redemption options and promotions which enhance cross-selling opportunities across our verticals and reinforcing client loyalty. Active Contracts Net Tate Rate GMV 5.3 10.1 4Q24 4Q25 1,469 1,494 4Q24 4Q25 7.3% 7.9% Active Contracts In millions 184 327 - 5 0. 1 0 .0 1 50 .0 2 0 .0 2 50 .0 3 0 .0 3 50 .0 3.9 5.4 0 .8 1 .3 1 .8 2 .3 2 .8 3 .3 3 .8 4 .3 4 .8 4Q24 4Q25

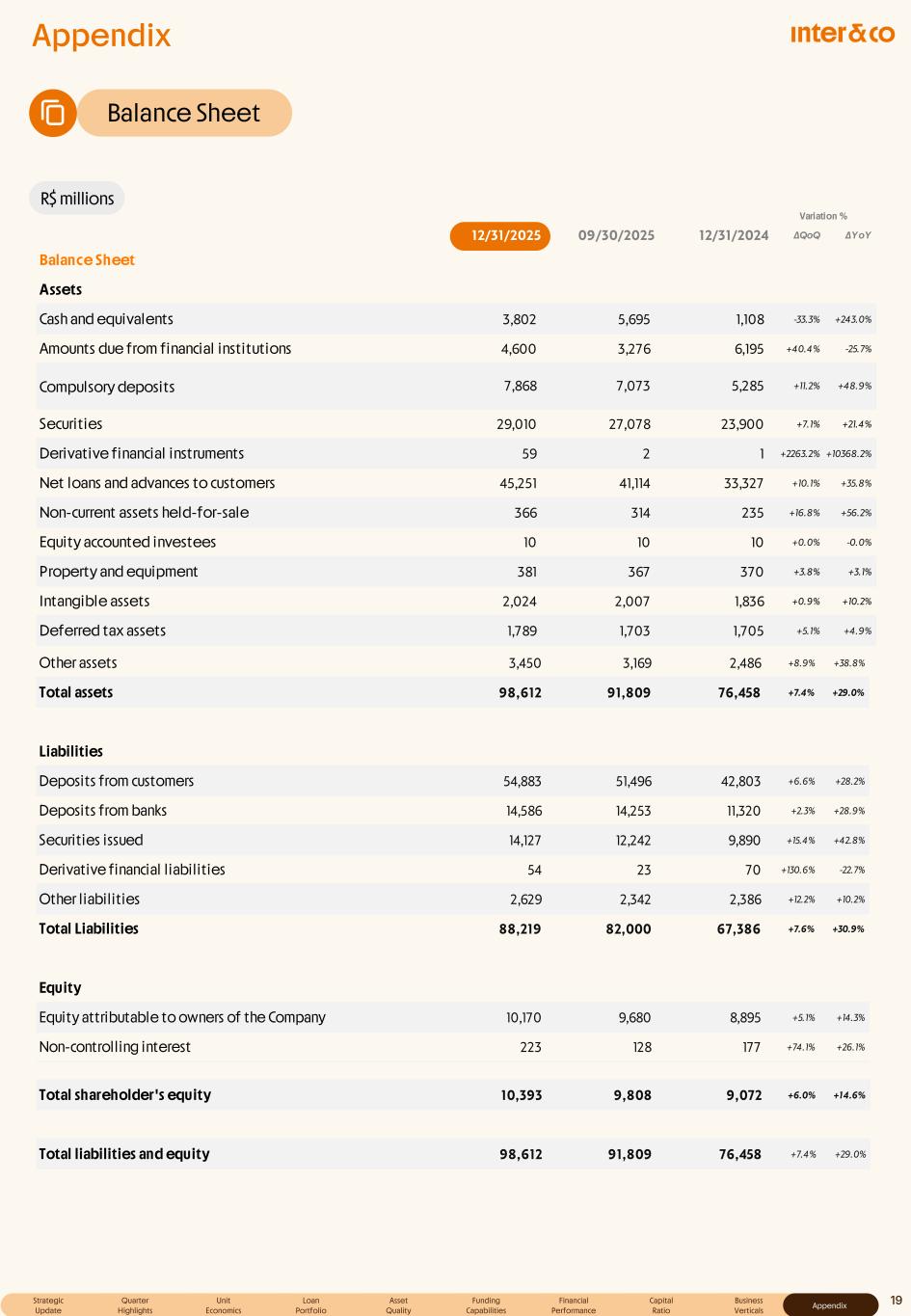

Appendix Balance Sheet R$ millions 12/31/2025 09/30/2025 12/31/2024 ∆QoQ ∆YoY Balance Sheet Assets Cash and equivalents 3,802 5,695 1,108 -33.3% +243.0% Amounts due from financial institutions 4,600 3,276 6,195 +40.4% -25.7% Compulsory deposits 7,868 7,073 5,285 +11.2% +48.9% Securities 29,010 27,078 23,900 +7.1% +21.4% Derivative financial instruments 59 2 1 +2263.2% +10368.2% Net loans and advances to customers 45,251 41,114 33,327 +10.1% +35.8% Non-current assets held-for-sale 366 314 235 +16.8% +56.2% Equity accounted investees 10 10 10 +0.0% -0.0% Property and equipment 381 367 370 +3.8% +3.1% Intangible assets 2,024 2,007 1,836 +0.9% +10.2% Deferred tax assets 1,789 1,703 1,705 +5.1% +4.9% Variation % Other assets 3,450 3,169 2,486 +8.9% +38.8% Total assets 98,612 91,809 76,458 +7.4% +29.0% Liabilities Deposits from customers 54,883 51,496 42,803 +6.6% +28.2% Deposits from banks 14,586 14,253 11,320 +2.3% +28.9% Securities issued 14,127 12,242 9,890 +15.4% +42.8% Derivative financial liabilities 54 23 70 +130.6% -22.7% Other liabilities 2,629 2,342 2,386 +12.2% +10.2% Total Liabilities 88,219 82,000 67,386 +7.6% +30.9% Equity Equity attributable to owners of the Company 10,170 9,680 8,895 +5.1% +14.3% Non-controlling interest 223 128 177 +74.1% +26.1% Total shareholder's equity 10,393 9,808 9,072 +6.0% +14.6% Total liabilities and equity 98,612 91,809 76,458 +7.4% +29.0% 19Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

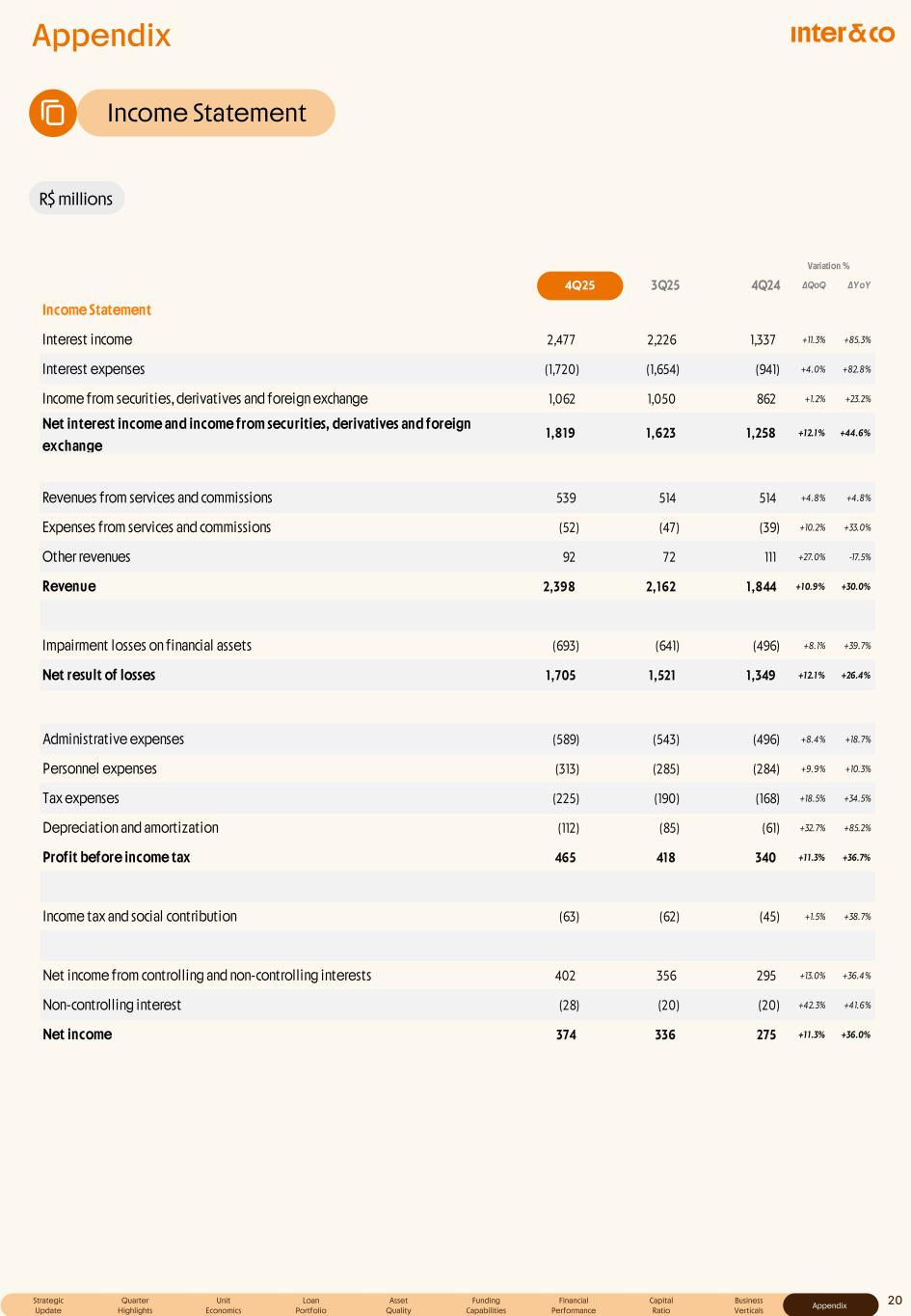

Appendix Income Statement R$ millions 20Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update 4Q25 3Q25 4Q24 ∆QoQ ∆YoY Income Statement Interest income 2,477 2,226 1,337 +11.3% +85.3% Interest expenses (1,720) (1,654) (941) +4.0% +82.8% Income from securities, derivatives and foreign exchange 1,062 1,050 862 +1.2% +23.2% Net interest income and income from securities, derivatives and foreign exchange 1,819 1,623 1,258 +12.1% +44.6% Revenues from services and commissions 539 514 514 +4.8% +4.8% Expenses from services and commissions (52) (47) (39) +10.2% +33.0% Other revenues 92 72 111 +27.0% -17.5% Revenue 2,398 2,162 1,844 +10.9% +30.0% Impairment losses on financial assets (693) (641) (496) +8.1% +39.7% Net result of losses 1,705 1,521 1,349 +12.1% +26.4% Variation % Administrative expenses (589) (543) (496) +8.4% +18.7% Personnel expenses (313) (285) (284) +9.9% +10.3% Tax expenses (225) (190) (168) +18.5% +34.5% Depreciation and amortization (112) (85) (61) +32.7% +85.2% Profit before income tax 465 418 340 +11.3% +36.7% Income tax and social contribution (63) (62) (45) +1.5% +38.7% Net income from controlling and non-controlling interests 402 356 295 +13.0% +36.4% Non-controlling interest (28) (20) (20) +42.3% +41.6% Net income 374 336 275 +11.3% +36.0% 4Q25

Appendix Non-IFRS measures and KPIs Activation Rate: Number of active clients at the end of the quarter Total number of clients at the end of the quarter Active clients: We define an active client as a customer at any given date that was the source of any amount of revenue for us in the preceding three months, or/and a customer that used products in the preceding three months. For Inter insurance, we calculate the number of active clients for our insurance brokerage vertical as the number of beneficiaries of insurance policies effective as of a particular date. For Inter Invest, we calculate the number of active clients as the number of individual accounts that have invested on our platform over the applicable period. Annualized interest rates: Yearly rate calculated by multiplying the quarterly interest by four, over the average portfolio of the last two quarters. All-in loans rate considers Real Estate, Personnal +FGTS, SMBs, Credit Card, excluding non- interest earnings credit card receivables, and Anticipation of Credit Card Receivables. Anticipation of credit card receivables: Disclosed in note 9.a of the Financial Statements, line " "Loans to financial institutions”. ARPAC gross of interest expenses: (Interest income + (Revenue from services and comissions − Cashback − Inter rewards) + Income from securities and derivarives + Other revenue) ÷ 3 Average of the last 2 quarters Active Clients ARPAC net of interest expenses: (Revenue − Interest expenses) ÷ 3 Average of the last 2 quarters Active Clients ARPAC per quarterly cohort: Total Gross revenue net of interest expenses in a given cohort divided by the average number of active clients in the current and previous periods1. Cohort is defined as the period in which the client started his relationship with Inter. 1 - Average number of active clients in the current and previous periods: For the first period, is used the total number of active clients in the end of the period. 21Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

Appendix Non-IFRS measures and KPIs Assets under custody (AuC): We calculate assets under custody, or AUC, at a given date as the market value of all retail clients’ assets invested through our investment platform as of that same date. We believe that AUC, as it reflects the total volume of assets invested in our investment platform without accounting for our operational efficiency, provides us useful insight on the appeal of our platform. We use this metric to monitor the size of our investment platform. Basel ratio: Referential equity Risk weighted assets Card+PIX TPV PIX, debit and credit cards and withdrawal transacted volumes of a given period. PIX is a Central Bank of Brazil solution to bring instant payments among banks and financial institutions in Brazil. Card+PIX TPV per active client: Card+PIX TPV for a given period divided by the number of active clients as of the last day of the period. Cost of funding: Interest expenses × 4 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of funding normalized by business days: Interest expenses × 4 ÷ business days in the quarter x 63 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of risk: Impairment losses on Linancial assets × 4 Average of last 2 quarters of: Loans and advances to customers + Commercial promissory notes + Cer$ficates of agricultural receivables + Cer$ficates of real estate receivables + Debenture (Fair value through other comprehensive income) + Rural product bill + Debentures Amortized cost + Investment fund quotas + CertiLicates of real estate receivables + Debentures + Bank deposit certiLicates + CertiLicates of agricultural receivables + Agribusiness credit bills + Commercial promissory notes + Real estate credit bills (Fair value through proLit or loss) Cost-to-serve CTS Personnel Expense + Administrative Expenses + Depreciation and Amortization ÷ 3 Average of the last 2 quarters Active Clients Coverage ratio: Provision for expected credit loss + Provision for expected credit losses on loan commitments Overdue higher than 90 days 22Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

Appendix Non-IFRS measures and KPIs Earning portfolio IEP Earnings Portfolio includes “Amounts due from financial institutions” + “Loans and advances to customers” + “Securities” + “Derivatives” from the IFRS Balance Sheet Efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expenses + Taxes on interest on own capital Fee income ratio: Net result from services and commissions + Other revenue Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Funding: Demand Deposits + Time Deposits + Securities Issued + Savings Deposits + Creditors by Resources to Release + Securities sold under agreements to repurchase Interbank deposits Borrowing and onlending Global Clients: Includes Brazilian Global Account clients, US clients and international investors. Gross loan portfolio: Loans and Advance to Customers + Loans to financial institutions Gross merchandise volume GMV Gross merchandise value, or GMV, for a given period as the total value of all sales made or initiated through our Inter Shop & Commerce Plus platform managed by Inter Shop & Commerce Plus. Gross take rate: Inter Shop gross revenue GMV Loan portfolio: "Loans and Advance to Customers", gross of provision for expected losses Margin per active client gross of interest expenses: ARPAC gross of interest expenses – Cost to Serve Margin per active client net of interest expenses: ARPAC net of interest expenses – Cost to Serve Net fee income: Net result from services and commissions Other Revenue Revenue foreign exchange 23Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

Appendix Non-IFRS measures and KPIs Net interest income: Interest Income + Interest Expenses + Income from securities + Income from derivatives Net revenue: Net interest income Net fee income Net take rate: Inter Shop net revenue GMV Net revenue IOC adjusted: Net interest income Net fee income Taxes on interest on own Capital NIM 1.0 IEP Credit Card Transactional Portfolio: Net interest income and income from securities, derivatives and foreign Exchange x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securities, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for expected credit losses – Interbank deposits + Credit card transactor portfolio) NIM 2.0 IEP Only: Net interest income and income from securities, derivatives and foreign Exchange x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securi$es, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for expected credit losses – Interbank deposits) NPL 15 to 90 days Including Credit Card Receivables: Overdue 15 to 90 days Loans and Advance to Costumers + Loans to Linancial institutions NPL 90 days Including Credit Card Receivables: Overdue higher than 90 days Loans and Advance to Costumers + Loans to Linancial institutions NPL 15 to 90 days Excluding Credit Card Receivables: Overdue 15 to 90 days Loans and Advance to Costumers NPL 90 days Including Credit Card Receivables: Overdue higher than 90 days Loans and Advance to Costumers NPL formation: Overdue balance higher than 90 days in the current quarter – Overdue balance higher than 90 days inthe previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter 24Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

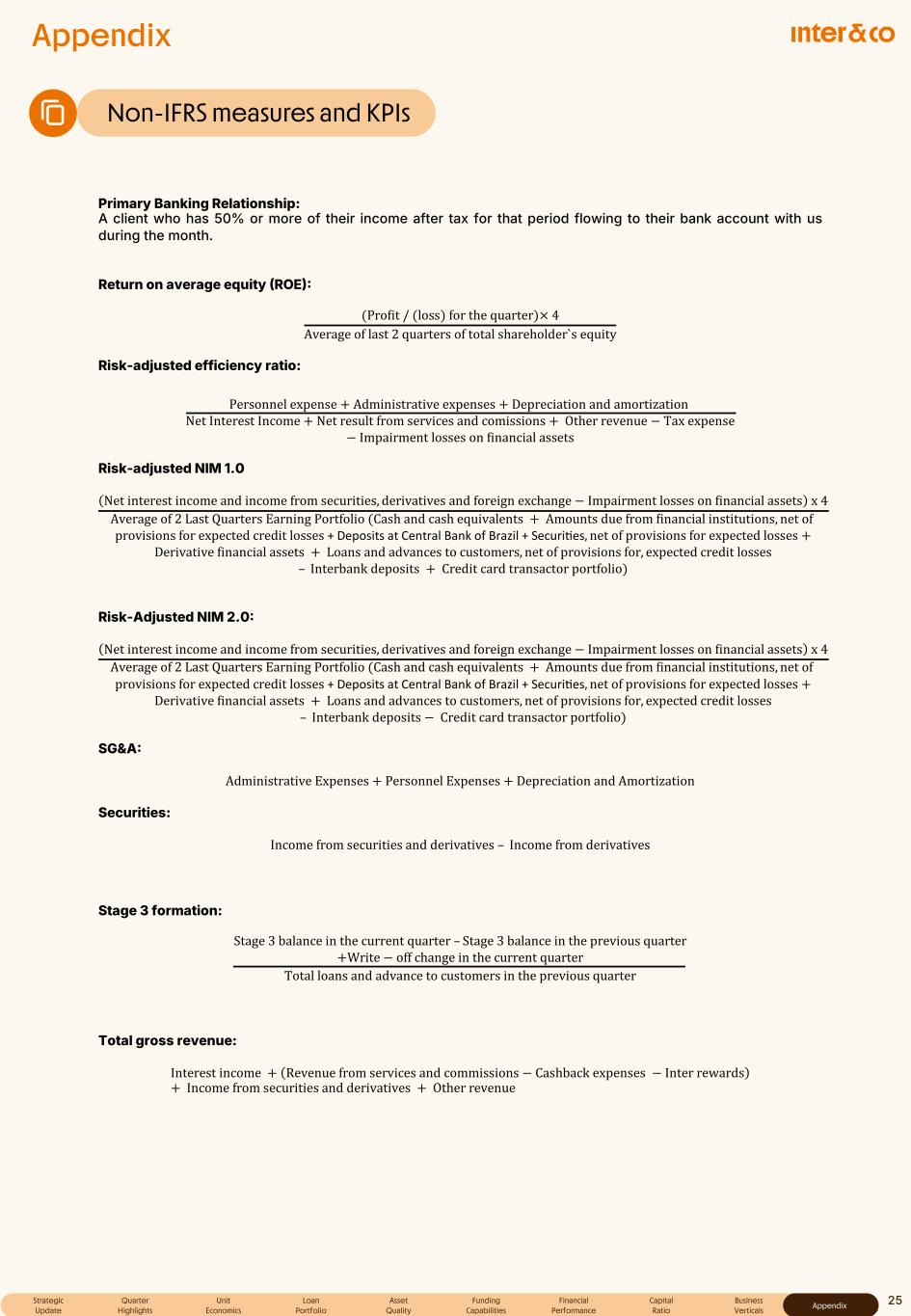

Appendix Non-IFRS measures and KPIs Primary Banking Relationship: A client who has 50% or more of their income after tax for that period flowing to their bank account with us during the month. Return on average equity ROE (ProLit / (loss) for the quarter)× 4 Average of last 2 quarters of total shareholder`s equity Risk-adjusted efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense − Impairment losses on Linancial assets Risk-adjusted NIM 1.0 Net interest income and income from securities, derivatives and foreign exchange − Impairment losses on Linancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securi$es, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for, expected credit losses – Interbank deposits + Credit card transactor portfolio) Risk-Adjusted NIM 2.0 Net interest income and income from securities, derivatives and foreign exchange − Impairment losses on Linancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Cash and cash equivalents + Amounts due from Linancial institutions, net of provisions for expected credit losses + Deposits at Central Bank of Brazil + Securi$es, net of provisions for expected losses + Derivative Linancial assets + Loans and advances to customers, net of provisions for, expected credit losses – Interbank deposits − Credit card transactor portfolio) SG&A Administrative Expenses + Personnel Expenses + Depreciation and Amortization Securities: Income from securities and derivatives – Income from derivatives Stage 3 formation: Stage 3 balance in the current quarter – Stage 3 balance in the previous quarter +Write − off change in the current quarter Total loans and advance to customers in the previous quarter Total gross revenue: Interest income + Revenue from services and commissions − Cashback expenses − Inter rewards + Income from securities and derivatives + Other revenue 25Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update

Appendix Disclaimer This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward-looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the amount of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial numbers that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward-looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements. These forward-looking statements are based on Inter's expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20F. The numbers for our key metrics Unit Economics), which include active users, as average revenue per active client ARPAC, cost-to-serve CTS, are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, but there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and make adjustments to improve accuracy, including adjustments that may result in recalculating our historical metrics. About Non-IFRS Financial Measures To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, cost-to-serve, Cost of Funding, Efficiency Ratio, Underwriting, NPL 90 days, NPL 15 to 90 days, NPL and Stage 3 Formation, Cost of Risk, Coverage Ratio, Funding, All-in Cost of Funding, Gross Merchandise Volume GMV, Premiuns, Net Inflows, Global Services Deposits and Investments, Fee Income Ratio, Client Acquisition Cost, Cards+Pix TPV, Gross ARPAC, Net ARPAC, Marginal NIM 1.0, Marginal NIM 2.0, Net Interest Margin IEP Non-int. CC Receivables 1.0, Net Interest Margin IEP 2.0, Cost-to-Serve. A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies. 26Quarter Highlights Appendix Unit Economics Loan Portfolio Asset Quality Funding Capabilities Financial Performance Capital Ratio Business Verticals Strategic Update