expenses accrued for the quarter (including the management fee and any interest expense or fees on any credit facilities or outstanding debt and dividends paid on any issued and outstanding preferred shares, but excluding the Incentive Fee and any distribution and/or stockholder servicing fees).

Pre-Incentive Fee Net Investment Income Returns include, in the case of investments with a deferred interest feature (such as OID (as defined below), debt instruments with PIK interest and zero coupon securities), accrued income that GSCR has not yet received in cash. Pre-Incentive Fee Net Investment Income Returns do not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

Pre-Incentive Fee Net Investment Income Returns, expressed as a rate of return on the value of GSCR’s net assets at the end of the immediately preceding quarter, is compared to a “hurdle rate” of return of 1.25% per quarter (5.0% annualized).

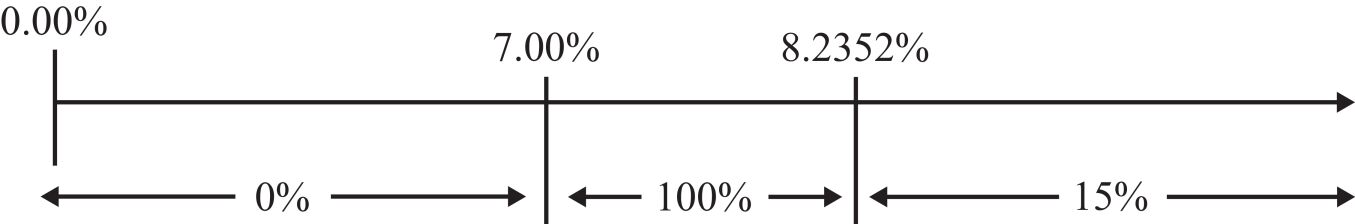

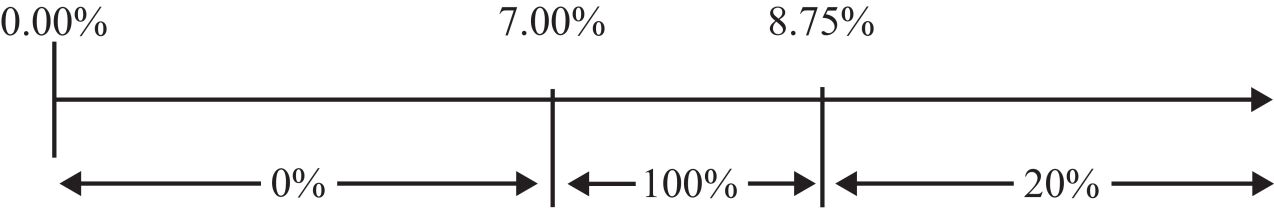

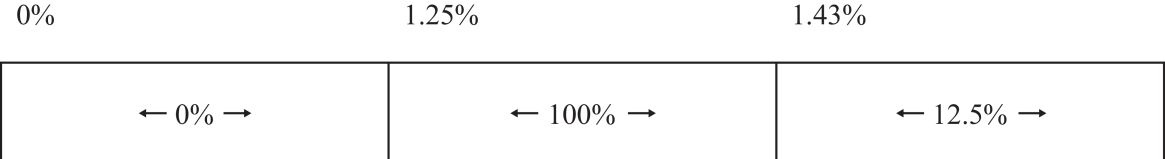

GSCR will pay GSAM an incentive fee quarterly in arrears with respect to GSCR’s Pre-Incentive Fee Net Investment Income Returns in each calendar quarter as follows:

| • | No incentive fee based on Pre-Incentive Fee Net Investment Income Returns in any calendar quarter in which GSCR’s Pre-Incentive Fee Net Investment Income Returns do not exceed the hurdle rate of 1.25% per quarter (5.0% annualized); |

| • | 100% of the dollar amount of GSCR’s Pre-Incentive Fee Net Investment Income Returns with respect to that portion of such Pre-Incentive Fee Net Investment Income Returns, if any, that exceeds the hurdle rate but is less than a rate of return of 1.43% (5.72% annualized). GSCR refer to this portion of GSCR’s Pre-Incentive Fee Net Investment Income Returns (which exceeds the hurdle rate but is less than 1.43%) as the “catch-up.” The “catch-up” is meant to provide GSAM with approximately 12.5% of GSCR’s Pre-Incentive Fee Net Investment Income Returns as if a hurdle rate did not apply if this net investment income exceeds 1.43% in any calendar quarter; and |

| • | 12.5% of the dollar amount of GSCR’s Pre-Incentive Fee Net Investment Income Returns, if any, that exceed a rate of return of 1.43% (5.72% annualized). This reflects that once the hurdle rate is reached and the catch-up is achieved, 12.5% of all Pre-Incentive Fee Net Investment Income Returns thereafter are allocated to GSAM. |

The following is a graphical representation of the calculation of the incentive fee based on income.

Pre-Incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets per quarter)

These calculations are pro-rated for any period of less than three months and adjusted for any share issuances or repurchases during the relevant quarter. You should be aware that a rise in the general level of interest rates can be expected to lead to higher interest rates applicable to GSCR’s debt investments. Accordingly, an increase in interest rates would make it easier for GSCR to meet or exceed the incentive fee hurdle rate and may result in a substantial increase of the amount of incentive fees payable to GSAM with respect to Pre-Incentive Fee Net Investment Income Returns. Because of the structure of the incentive fee, it is possible that GSCR may pay an incentive fee in a calendar quarter in which GSCR incur an overall loss taking into account capital account losses. For example, if GSCR receives Pre-Incentive Fee Net Investment Income Returns in excess of the quarterly hurdle rate, GSCR will pay the applicable incentive fee even if GSCR has incurred a loss in that calendar quarter due to realized and unrealized capital losses.

136