UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

––––––––––––––––––––––––––––––

______________________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

Filed by the Registrant |

|

☒ |

|

Filed by a Party other than the Registrant |

|

☐ |

Check the appropriate box:

|

☐ |

|

Preliminary Proxy Statement |

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

|

Definitive Proxy Statement |

|

☐ |

|

Definitive Additional Materials |

|

☐ |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

|

No fee required |

|

☐ |

|

Fee paid previously with preliminary materials |

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 11, 2025

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of NextNav Inc. (“NextNav” or the “Company”) to be held on Thursday, May 22, 2025, at 12:00 p.m. (Eastern Time) (the “Annual Meeting”). The Annual Meeting will be conducted as a virtual meeting this year, via live webcast online at www.virtualshareholdermeeting.com/NN2025.

If you attend the Annual Meeting, you will be able to vote and submit questions during the Annual Meeting by using the control number we provide to you in the Notice of Internet Availability of Proxy Materials (the “Notice”), which describes the availability of these proxy materials over the Internet. We will begin sending the Notice to our stockholders on or about April 11, 2025, which will contain instructions on how to access our 2025 Proxy Statement (the “Proxy Statement”) and Annual Report on Form 10-K for the year ended December 31, 2024, as well as instructions on how to vote. Internet distribution of our proxy materials expedites receipt by stockholders, lowers the cost of the Annual Meeting, and conserves natural resources. Stockholders who receive the Notice will not receive a printed copy of the proxy materials in the mail; however, if you would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice.

Please refer to the Proxy Statement for detailed information on each of the proposals and the Annual Meeting. Your vote is important, and we strongly urge all stockholders to vote their shares. For the election of directors, your shares will not be voted unless you provide voting instructions via the Internet or by returning a proxy card or voting instruction card. We encourage you to vote promptly, even if you plan to virtually attend the Annual Meeting.

Best regards,

|

Mariam Sorond |

|

President and Chief Executive Officer and Chair of the Board of Directors |

NextNav Inc.

11911 Freedom Drive, Suite 200

Reston, Virginia 20190

__________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 22, 2025

__________________________

To our Stockholders:

NOTICE IS HEREBY GIVEN that NextNav’s Annual Meeting will be held solely by means of live webcast online at www.virtualshareholdermeeting.com/NN2025 on Thursday, May 22, 2025, at 12:00 p.m. (Eastern Time), to consider and vote on the following matters described in the accompanying Proxy Statement:

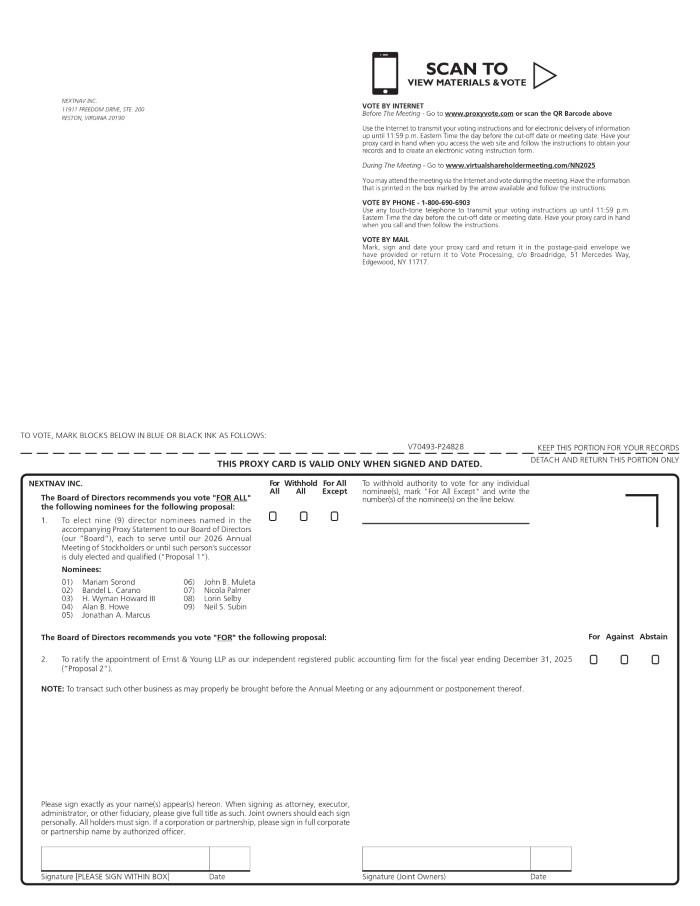

| 1. | To elect nine (9) director nominees named in the accompanying Proxy Statement to our Board of Directors (our “Board”), each to serve until our 2026 Annual Meeting of Stockholders or until such person’s successor is duly elected and qualified (“Proposal 1”). | |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (“Proposal 2”). | |

| 3. | To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof. |

Our Board has fixed March 25, 2025, as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. Only stockholders of record at the close of business on the Record Date will be entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose relevant to the Annual Meeting during ordinary business hours during the ten (10) days prior to the date of the Annual Meeting at 11911 Freedom Drive, Suite 200, Reston, Virginia 20190.

Our Board unanimously recommends that you vote “FOR ALL” for Proposal 1 and “FOR” Proposal 2.

By hosting the Annual Meeting online, we are able to effectively communicate with our stockholders, enable increased attendance and participation from locations around the world, reduce financial and environmental costs and increase overall efficiency and safety for both us and our stockholders. The Annual Meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. Whether or not you expect to attend, you are respectfully requested by our Board to promptly either sign, date and return the proxy card (if you requested a paper copy) or vote by telephone or via the Internet by following the instructions provided on the Notice.

|

|

|

By Order of the Board of Directors, | |

|

|

|

|

/s/ James Black |

|

|

|

|

Senior Vice President, General Counsel and Secretary |

|

Reston, Virginia |

|

|

|

|

April 11, 2025 |

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be Held on May 22, 2025:

Copies of our Proxy Materials, consisting of the Notice of Internet Availability of Proxy Materials, the

Proxy Statement and accompanying Form of Proxy Card, and our 2024 Annual Report on Form 10-K, are

available at www.proxyvote.com.

________________________________

YOUR VOTE IS IMPORTANT

If your shares are held in a brokerage account or by another nominee record holder and you do not receive a Notice, please be sure to mark your voting choices on the voting instruction card that accompanies this Proxy Statement. If you fail to specify your voting instructions for certain of the proposals, your shares will not be voted on such proposals due to rules applicable to broker voting, and we may incur additional costs to solicit votes.

________________________________

TABLE OF CONTENTS

| i |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement carefully before voting.

|

2025 Annual Meeting of Stockholders | ||||

|

DATE & TIME |

|

RECORD DATE |

|

NUMBER OF SHARES OUTSTANDING AS OF THE RECORD DATE |

|

12:00 p.m. (ET) on |

|

March 25, 2025 |

|

132,143,691 |

|

Thursday, May 22, 2025 |

|

|

|

|

|

VIRTUAL MEETING LOCATION |

|

MAILING DATE |

|

VOTING |

|

www.virtualshareholdermeeting.com/NN2025 |

|

This Proxy Statement will be first mailed or made available to stockholders on or about April 11, 2025. |

|

Stockholders as of the Record Date are entitled to vote. Each share of common stock is entitled one vote for each director nominee and one vote for the other proposal to be voted on. |

Voting Matters and Vote Recommendation

|

Proposals to be Considered at the 2025 Annual Meeting |

|

Board Vote Recommendation |

|

Election of Directors |

|

FOR ALL |

|

Ratification of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2025 |

|

FOR |

How to Cast Your Vote

|

INTERNET (www.proxyvote.com) until 11:59 PM (ET) on Wednesday, May 21, 2025 |

|

MAIL by completing, signing and returning your proxy card or voting instruction card so that it is received before the polls close on Thursday, May 22, 2025 |

|

TELEPHONE (1-800-690-6903) until 11:59 PM (ET) on Wednesday, May 21, 2025 |

|

VIRTUALLY “IN PERSON” by participating in and voting online at the 2025 Annual Meeting. See “How Do I Attend the Annual Meeting?” on page 6 for more information. Please note that if you do not receive a control number with your Notice or voting instructions, you will need to obtain a legal proxy to participate in and vote your shares at the Annual Meeting |

Snapshot of 2025 Director Nominees

|

|

||

Our Director Nominees exhibit an effective mix of skills, experiences and perspectives, including: Our Director Nominees exhibit an effective mix of skills, experiences and perspectives, including: | ||

|

|

|

|

|

|

|

|

|

|

|

|

We ask that our stockholders ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the year ending December 31, 2025. Below is summary information about EY’s fees for services provided in fiscal years 2024 and 2023.

|

Fee Category: |

|

2024 |

|

2023 | ||

|

Audit Fees(1) |

|

$ |

511,000 |

|

$ |

534,000 |

|

Audit-Related Fees |

|

$ |

— |

|

$ |

— |

|

Tax Fees(2) |

|

$ |

152,070 |

|

$ |

127,330 |

|

All Other Fees(3) |

|

$ |

2,000 |

|

$ |

2,000 |

|

Total Fees |

|

$ |

665,070 |

|

$ |

663,330 |

| (1) | Audit Fees: Consists of fees for the audit and other procedures in connection with the Annual Report on Form 10-K for the years ended December 31, 2024 and December 31, 2023, and fees related to consents provided in connection with registration statements. | |

| (2) | Tax Fees: Consists of fees for general tax consulting, tax compliance and other tax advice. Tax fees encompass a variety of permissible tax services, primarily including tax advice related to federal, state and international income tax compliance. | |

| (3) | All Other Fees: Consists of subscription fees for online publications and search engine services. | |

The Audit Committee of our Board of Directors (the “Audit Committee”) approved a resolution appointing EY as our independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ended December 31, 2024, which was ratified by a vote of our stockholders during our 2024 Annual Meeting of Stockholders on May 16, 2024. For information on audit fees, see “Proposal 2: Ratification of Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2025 — Fees Paid to Independent Registered Public Accounting Firm” below.

NextNav Inc.

11911 Freedom Drive, Suite 200

Reston, Virginia 20190

___________________________________

___________________________________

2025 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 22, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON THURSDAY, MAY 22, 2025.

We are making this Proxy Statement and the accompanying form of proxy card, and our Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report”) available electronically via the Internet at www.virtualshareholdermeeting.com/NN2025 and our website, www.nextnav.com. If you wish to receive a paper or e-mail copy of these documents, please request one by following the instructions contained in the Notice of Internet Availability of Proxy Materials (the “Notice”). There is no charge for requesting a copy.

The Notice will be first mailed or made available to our stockholders on or about April 11, 2025, in connection with the solicitation of proxies on behalf of our Board for use at our 2025 Annual Meeting of Stockholders, to be held on Thursday, May 22, 2025, at 12:00 p.m. (Eastern Time), virtually at www.virtualshareholdermeeting.com/NN2025, and at any adjournment or postponement thereof (the “Annual Meeting”). Whether or not you plan to attend the Annual Meeting, please follow the instructions on the Notice so that your shares may be voted at the Annual Meeting. You may vote your shares by mail, by telephone or through the Internet by following the instructions set forth on the Notice. If you attend the Annual Meeting, you may revoke your previously-submitted proxy and you will be permitted to vote virtually during the Annual Meeting.

The following questions and answers present important information pertaining to the Annual Meeting:

Q: What is in this Proxy Statement?

A: This Proxy Statement describes the proposals on which we would like you, as a stockholder, to vote at the Annual Meeting. It gives you information on the proposals, as well as other information about us, including the compensation of our directors and certain of our executive officers and corporate governance matters, so that you can make an informed decision on whether or how to vote your stock.

Q: What is the purpose of this Proxy Statement?

A: Our Board is soliciting your proxy to vote at the Annual Meeting, which will be held online at www.virtualshareholdermeeting.com/NN2025 on Thursday, May 22, 2025, at 12:00 p.m. (Eastern Time). You will receive proxy materials if you own common stock at the close of business on March 25, 2025 (the “Record Date”), which entitles you to vote at the Annual Meeting. This Proxy Statement contains important information about the matters to be voted on at the Annual Meeting and about us. As many of our stockholders may be unable to attend the Annual Meeting, proxies are solicited to give each stockholder an opportunity to vote on all matters that will properly come before the Annual Meeting. References in this Proxy Statement to the Annual Meeting include any adjournments or postponements of the Annual Meeting.

Q: What is the purpose of the Annual Meeting?

A: We are holding the Annual Meeting for the following purposes, which are described in more detail below in this Proxy Statement:

1. To elect nine (9) directors to our Board, each to serve until our 2026 Annual Meeting of Stockholders or until such person’s successor is duly elected and qualified (“Proposal 1”).

2. To ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for the year ending December 31, 2025 (“Proposal 2”).

We will also consider any other business that may properly come before the Annual Meeting and any adjournment or postponement thereof. See “Will any other business be presented for action by stockholders at the Annual Meeting?” below.

Q: Will any other business be presented for action by stockholders at the Annual Meeting?

A: Management knows of no business that will be presented at the Annual Meeting other than Proposal 1 and Proposal 2. If any other matter properly comes before the Annual Meeting, the persons named as proxies in the proxy card intend to vote your shares (which confer discretionary authority to vote on such matters) in accordance with their judgment on the matter. Your proxy holders will have the authority to appoint a substitute to act as proxy.

Q: Who is entitled to vote at the Annual Meeting?

A: Only stockholders of record as of the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting. During the ten days before the Annual Meeting, you may inspect a list of stockholders eligible to vote. If you would like to inspect the list, please contact our Secretary at (408) 400-7843 to make arrangements to inspect the list.

Q: How many shares of common stock can vote?

A: There were 132,143,691 shares of our common stock outstanding as of the close of business on the Record Date. Each stockholder entitled to vote at the Annual Meeting may cast one vote for each share of common stock owned by him, her or it that has voting power upon each matter considered at the Annual Meeting. Our stockholders do not have the right to cumulate their votes in the election of directors.

Q: How do I vote my shares?

A: The answer depends on whether you own your shares of our common stock directly (that is, you hold shares that show your name as the registered stockholder) or if your shares are held in a brokerage account or by another nominee holder.

If you own shares of our common stock directly (i.e., you are a “registered stockholder”), your proxy is being solicited directly by us, and you can vote at the Annual Meeting or by proxy whether or not you attend the Annual Meeting virtually.

• If you wish to vote over the Internet, go to www.proxyvote.com and log in using your unique control number that was included in the Notice. Internet voting is available 24 hours a day.

• If you wish to vote by telephone, call 1-800-690-6903 (toll free in North America) and follow the instructions and refer to your unique control number that was included in the Notice.

• If you wish to vote by mail, please request a paper copy of the materials, which will include a proxy card. Please promptly complete, sign and return your proxy card by following the instructions included thereon to ensure that it is received prior to the closing of the polls at the Annual Meeting. Please keep in mind that if you sign your proxy card but do not indicate how you wish to vote, the proxies will vote your shares “FOR ALL” of the nine (9) director nominees and “FOR” the ratification of EY as our independent registered public accounting firm for the year ending December 31, 2025. Unsigned proxy cards will not be counted. If the proxy card is not dated, it will be deemed to be submitted seven (7) calendar days after the date on which it was mailed to you.

• If you wish to vote live over the Internet during the meeting, go to www.virtualshareholdermeeting.com/NN2025 and enter your unique control number that was included in the Notice. Once properly admitted to the Annual Meeting, you will be able to vote your shares by following the instructions that will be available on the Annual Meeting website.

Internet and telephone votes must be submitted no later than 11:59 PM on Wednesday, May 21, 2025. The chair of the Annual Meeting may waive the proxy cut-off without notice.

If you hold your shares of our common stock through a broker, bank or other nominee, a voting instruction card has been provided to you by your broker, bank or other nominee describing how to vote your shares. If you receive a voting instruction card, you can vote by completing and returning the voting instruction card. Please be sure to mark your voting choices on your voting instruction card before you return it. You may also be able to vote by telephone, via the Internet or at the Annual Meeting, depending upon your voting instructions. Please refer to the instructions provided with your voting instruction card for information about voting in these ways. See also “What is the effect if I fail to give voting instructions to my broker, bank or other nominee?” below.

If you wish to vote live over the Internet during the meeting, ballot buttons will be available at the Annual Meeting website. However, if you are the beneficial owner of shares held in street name through a bank, broker or other nominee and did not receive a control number with your voting instruction form or Notice, you may not vote your shares at the Annual Meeting unless you obtain a “legal proxy” from the bank, broker or other nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. See “How do I attend the Annual Meeting?” below for more details.

A: The Annual Meeting is being held as a virtual only meeting this year. If you are a stockholder of record as of the Record Date, you may attend, vote and ask questions virtually at the meeting by logging in at www.virtualshareholdermeeting.com/NN2025 using the control number included in the Notice, on your proxy card, or on the instructions that accompanied your proxy materials. The Annual Meeting will begin promptly at 12:00 p.m. (Eastern Time). Online check-in will begin at 11:45 a.m. (Eastern Time), and you should allow ample time for the online check-in procedures.

If you are a stockholder holding your shares in “street name” as of the Record Date and your voting instruction form or the Notice indicates that you may vote those shares through www.proxyvote.com, then you may access, participate in, and vote at the Annual Meeting with the control number indicated on that voting instruction form or the Notice. If you are a stockholder holding your shares in “street name” as of the Record Date and did not receive a control number, please contact your bank, broker or other nominee at least five (5) days before the Annual Meeting and obtain a legal proxy to be able to participate in or vote at the Annual Meeting.

By hosting the Annual Meeting online, we are able to communicate more effectively with our stockholders, enable increased attendance and participation from locations around the world, reduce costs and increase overall efficiency and safety for us and our stockholders. The virtual Annual Meeting has been designed to provide the same rights to participate as you would have at an in-person meeting. If you plan to attend the Annual Meeting virtually, you will need your unique control number we have provided to you with the Notice.

If you are a stockholder as of the Record Date and have logged in using your control number, you may type questions into the dialog box provided at any point during the meeting (until the floor is closed to questions).

If you are not a stockholder as of the Record Date or do not log in using your control number, you may still listen to the Annual Meeting, but will not be able to ask questions or vote at the Annual Meeting.

Q: Will I have the same participation rights in this virtual-only stockholder meeting as I would have at an in-person stockholder meeting?

A: Yes. On the day of the Annual Meeting, please go to www.virtualshareholdermeeting.com/NN2025 and log in using the control number that was included in the Notice. You will be able to vote online during the Annual Meeting, change a vote you have submitted previously, or ask questions online that will be reviewed and answered by the speakers. You will only be able to participate in this manner if you log in with your control number and follow the other steps described herein.

Q: Can I submit a question for the Annual Meeting?

A: Stockholders who attend the Annual Meeting and log in as a stockholder using their control number will have an opportunity to submit questions in writing during a portion of the Annual Meeting. Instructions for submitting a question during the Annual Meeting will be provided on the Annual Meeting website. We will endeavor to answer as many submitted questions as time permits; however, we reserve the right to exclude questions regarding topics that are not pertinent to meeting matters, are about personal concerns not shared by stockholders generally, or are inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Our Investor Relations team will respond to any questions that are appropriate and pertinent to the Annual Meeting but cannot be answered during the Annual Meeting due to time constraints after the Annual Meeting.

Q: What should I do if I need technical support during the Annual Meeting?

A: The Annual Meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plugins. Attendees should ensure they have a strong internet or Wi-Fi connection wherever they intend to participate in the Annual Meeting. Attendees should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

If you experience any technical difficulties with the virtual meeting platform on the meeting day, please call the phone number that will be provided on the Annual Meeting website. We will have technicians ready to assist you with any technical difficulties you may have beginning 10 minutes prior to the start of the Annual Meeting, and the technicians will be available through the conclusion of the Annual Meeting. Additional information regarding matters addressing technical and logistical issues, including technical support during the Annual Meeting, will be available on the Annual Meeting website.

Q: What is a proxy?

A: A proxy is a person you appoint to vote on your behalf. By using any of the methods discussed above, you will appoint the following individuals as your proxies, James Black, our Senior Vice President, General Counsel and Secretary, and Christian D. Gates, our Executive Vice President and Chief Financial Officer. They may act together or individually on your behalf and will have the authority to appoint a substitute to act as proxy. Whether or not you expect to attend the Annual Meeting, we request that you please use the means available to you to vote by proxy so as to ensure that your shares of common stock may be voted.

Q: What is the effect if I fail to give voting instructions to my broker, bank or other nominee?

A: If your shares of our common stock are held by a broker, bank or other nominee and your voting instruction card does not indicate that you may vote your shares directly, you must provide your broker or nominee with instructions on how to vote your shares for Proposal 1 in order for your shares to be counted. Brokers, banks or other nominees will have discretionary authority with respect to “routine” matters, such as Proposal 2.

A broker non-vote occurs when a beneficial owner of shares held in street name does not provide such voting instructions and, as a result, the broker, bank or other nominee that holds the shares is prohibited from voting those shares on certain “non-routine” matters (including the election of directors). In the event of a broker non-vote, such beneficial owners’ shares of common stock will be included in determining whether a quorum is present, but otherwise will not be counted. Similarly, abstentions will be included in determining whether a quorum is present but otherwise will not be counted. Thus, a broker non-vote or an abstention will make a quorum more readily obtainable, but a broker non-vote or an abstention will not otherwise affect the outcome of a vote on a proposal that requires a plurality of the votes cast. A broker non-vote or an abstention with respect to a proposal that requires the affirmative vote of a majority of outstanding shares or a majority of the shares present in person or by proxy and entitled to vote will, however, have the same effect as a vote against the proposal. See “What vote is required to approve each proposal?” below.

We encourage you to provide voting instructions to the organization that holds your shares if you are not able to vote your shares directly.

Q: What if I want to change my vote or revoke my proxy?

A: A registered stockholder may change his, her or its vote or revoke his, her or its proxy at any time before the Annual Meeting in the following ways: (i) by going to www.proxyvote.com and logging in using your unique control number that was included in the Notice; (ii) by attending and voting at the Annual Meeting; or (iii) by submitting a later dated proxy card. We will count your vote in accordance with the last instructions we receive from you prior to the closing of the polls, whether your instructions are received by mail, telephone, Internet or at the Annual Meeting. If you hold your shares through a broker, bank or other nominee and wish to change your vote, you must follow the procedures required by your broker, bank or other nominee. Please note that attendance at the Annual Meeting alone will not cause your previously granted proxy or voting instructions to be revoked unless you specifically so request or vote at the Annual Meeting.

Q: What is a quorum?

A: The holders of a majority of the 132,143,691 shares of common stock outstanding and entitled to vote as of the Record Date, either present by remote communication or represented by proxy, constitutes a quorum. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Broker non-votes and abstentions will be counted as present for the purpose of establishing a quorum. If a quorum is not present by attendance at the Annual Meeting or represented by proxy, the Annual Meeting will be adjourned until a quorum is obtained. If an adjournment is for more than thirty (30) days or a new record date is fixed for the adjourned meeting, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the meeting.

Q: What vote is required to approve each proposal?

A: 1. Proposal 1 — Election of directors: Votes may be cast: FOR ALL nominees, WITHHOLD ALL nominees or FOR ALL EXCEPT those nominees noted by you on the appropriate portion of your proxy or voting instruction card. A plurality of the votes cast by the holders of the shares of our common stock present by remote communication or represented by proxy at the Annual Meeting and entitled to vote generally on the election of directors is required for the election of the director nominees to our Board as directors. This means that the nine (9) director nominees with the most votes will be elected.

You may choose to vote or withhold your vote for one or more of such nominees. Withholding a vote from a director nominee will not be voted with respect to the director nominee indicated and will have no effect on the outcome of this proposal, although it will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect on the outcome of this proposal.

2. Proposal 2 — Ratification of the appointment of EY as our independent registered public accounting firm for 2025: Votes may be cast: FOR, AGAINST or ABSTAIN. The affirmative vote of the holders of the majority of shares of common stock present by remote communication or represented by proxy at the Annual Meeting and entitled to vote is required to approve this proposal. Abstentions with respect to this proposal will have the effect of votes “AGAINST” this proposal. There will be no broker non-votes with respect to this proposal.

Q: How does the Board recommend that I vote on each of the proposals?

A: Our Board unanimously recommends that stockholders vote “FOR ALL” for Proposal 1 and “FOR” Proposal 2.

Q: How many shares of our common stock do the directors and officers of the Company beneficially own, and how do they plan to vote their shares?

A: Directors and executive officers, who, as of the Record Date, had beneficial ownership of approximately 7.7% of our outstanding shares of common stock, are expected to vote, or direct the voting of their shares, “FOR ALL” for Proposal 1 and “FOR” Proposal 2.

Q: Who will count the votes, and is my vote confidential?

A: We will appoint an inspector of elections for the meeting to determine whether or not a quorum is present and to tabulate votes cast by proxy or virtually at the Annual Meeting. Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation.

Q: How will proxies be solicited and who will pay the cost of the proxy solicitation?

A: The solicitation of proxies will be primarily by mail, but our directors, officers and other employees may also solicit proxies personally or by telephone but will receive no special compensation for doing so. We will bear all costs of the solicitation, including the printing, handling and mailing of the Annual Meeting materials. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials to our stockholders, if any.

Q: Where can I find the voting results?

A: Final voting results will be reported in a Current Report on Form 8-K, which we will file with the Securities and Exchange Commission (the “SEC”) on EDGAR at https://www.sec.gov within four business days of the Annual Meeting.

Q: Who is the independent registered public accounting firm, and will it be represented at the Annual Meeting?

A: EY served as our independent registered public accounting firm for the fiscal year ended December 31, 2024 and audited our consolidated financial statements for such fiscal year. We expect that one or more representatives of EY will be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire, and will be available to answer appropriate questions at the end of the Annual Meeting. EY has been appointed by the Audit Committee to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

Q: Why are we being asked to ratify the appointment of Ernst & Young LLP?

A: Although stockholder approval of the Audit Committee’s appointment of EY as our independent registered public accounting firm is not binding or required, we believe that it is best practice and advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the Annual Meeting, the Audit Committee may reconsider its selection of EY, but will not be required to take any action.

Our Board currently consists of seven (7) members. In addition, H. Wyman Howard III and Lorin Selby have been appointed by the Board effective May 1, 2025.

Our Bylaws provide that each director shall hold office until the next annual meeting of stockholders and until their respective successor shall have been duly elected and qualified, subject, however, to prior death, resignation, retirement, disqualification or removal from office. Consequently, each current director, in addition to Messrs. Howard and Selby, have been renominated for election at the upcoming Annual Meeting.

Set forth below for each nominee for election at the Annual Meeting is a list of current Board Committee memberships and a description of their business experience, qualifications, education and skills that led our Board to conclude that such individual should serve as a member of our Board.

|

Director/Nominee |

Age |

Position(s) | ||

|

Mariam Sorond |

52 |

President and Chief Executive Officer and Chair of the Board of Directors | ||

|

Bandel L. Carano |

63 |

Director | ||

| H. Wyman Howard III | 56 | Director, effective May 1, 2025 | ||

|

Alan B. Howe |

63 |

Director | ||

|

Jonathan A. Marcus |

64 |

Director | ||

|

John B. Muleta |

60 |

Director | ||

|

Nicola Palmer |

57 |

Director | ||

|

Lorin Selby |

61 |

Director, effective May 1, 2025 | ||

|

Neil S. Subin |

60 |

Director |

Mariam Sorond has served as a director and as our President and Chief Executive Officer since November 2023. Prior to her appointment as our President and Chief Executive Officer, Ms. Sorond served as Chief Technology Officer of the Service Provider and Edge Business Unit at VMware since March 28, 2022 where she helped to define technical strategy internally and externally as well as lead engagements with service provider partners to influence and promote vision, product and solution alignment and adoption towards the digital transformation. From September 2019 to December 2021, Ms. Sorond served as Chief Research and Development Officer at CableLabs, where she focused on technical thought leadership, vision and strategy for the future of converged connectivity of broadband cable and mobile networks within the cable industry. Prior to CableLabs, from April 2012 to September 2019, Ms. Sorond served as Chief Wireless Architect of DISH and as the wireless expert for the company’s entry into the wireless market. Earlier in her career, Ms. Sorond worked for vendors such as Lucent Technologies (now Nokia), and several operators including ICO Global Communications, Nextel, and PrimeCo, where she began as a radio frequency engineer. Ms. Sorond has served as a member of the National Telecommunications and Information Administration’s Commerce Spectrum Management Advisory Committee since 2014 and joined as a member of the Federal Communications Commission’s Technical Advisory Committee in 2022. Ms. Sorond has been awarded several patents, with others pending and is an author and frequent speaker and panelist at industry forums.

Ms. Sorond’s experience leading transformational change across mobile, wireless, fixed and satellite networks for more than 30 years and her leadership positions within start-ups and Fortune 500 enterprises qualify her to serve on our Board.

Board Committees: None

Bandel L. Carano has served as a director since October 2021. Prior to this, Mr. Carano served as a director of former NextNav from September 2014 to October 2021. Mr. Carano joined Oak Investment Partners, a multi-stage venture capital firm, in 1985 and has been a General Partner of Oak Investment Partners since 1987. Mr. Carano has been a Managing Partner of Oak Investments Partners since 2010. From 1983 to 1985, Mr. Carano was a member of Morgan Stanley’s Venture Capital Group, where he was responsible for advising Morgan Stanley on high-tech new business development and sponsoring venture investments. As a venture capitalist, Mr. Carano has been involved with numerous technology companies in the telecommunications, wireless, rich media and semiconductor industries including 2Wire, Inc., Avici Systems, Qtera Corporation, Sentient Networks, Inc. and Wellfleet Communications, among others.

Mr. Carano currently serves on the boards of directors of company nLight, Inc. (Nasdaq: LASR), a public company and Centric Software, a private company. Mr. Carano has previously served on the board of several public companies, including Airspan Networks Holdings, Inc. (NYSE: MIMO), NeoPhotonics Corp. (Nasdaq: NPTN), Kratos Defense & Security Solutions, Inc. (Nasdaq: KTOS), Tele Atlas BV (acquired by TomTom (OTCMKTS: TMOAY) in 2007), Synopsys, Inc. (Nasdaq: SNPS), FiberTower Corporation (acquired by AT&T (NYSE: T) in 2018), Virata, Inc. (acquired by Globespan Inc. in 2001) and Polycom, Inc. (acquired by Plantronics, Inc. (NYSE: PLT) in 2018). Mr. Carano serves on the Investment Advisory Board of the Stanford Engineering Venture Fund. Mr. Carano holds both a Master of Science and a Bachelor of Science in Electrical Engineering from Stanford University.

Mr. Carano’s years of venture capital investing, his experience as a director of various public companies and his insights in building these businesses make him a valuable asset to our Board.

Board Committees: Compensation and Human Capital Committee (Member); Nominating and Corporate Governance Committee (Member)

H. Wyman Howard III has been appointed by the Board to serve as a director, effective on May 1, 2025. Admiral Howard retired from the U.S. Navy in September 2022 as Rear Admiral (Upper Half) after over 32 years of service for the SEAL Teams and Joint Special Operations. He has had multiple tours in command of Special Operations Joint Task Forces and was among the first to deploy into Afghanistan following the attacks on September 11, 2001. The combat contributions of the teams Admiral Howard commanded, and with whom he served, were recognized with five Presidential Unit Citations, a Navy Unit Commendation medal, and four Joint Meritorious Unit Awards. Admiral Howard’s joint, interagency, and intelligence experience include service as the second Director of Operations for the National Geospatial-Intelligence Agency in 2016 and as the Commander, Naval Special Warfare Command from 2020 to 2022, which are equivalent leadership roles of a Chief Operating Officer and Chief Executive Officer, respectively. Admiral Howard is acknowledged for his leadership in designing new irregular deterrence capabilities and options that increase the leverage of the United States to deter the nation’s adversaries. Admiral Howard also serves on the board of Bridger Aerospace Group Holdings, Inc. (NASDAQ: BAER), an aerial firefighting and aerospace services company, and Invitation Homes Inc. (NYSE: INVH), a single-family home leasing and management company. Admiral Howard was recommended to our Board by John Muleta, a NextNav director.

Admiral Howard graduated from the United States Naval Academy and holds a Master of Business Administration from the TRIUM consortium of the London School of Economics, HEC Paris School of Management, and New York University’s Stern School of Business. Admiral Howard holds a Master of Science in National Security and Resource Strategy with a focus on commercial, civil, and military space sectors from the Eisenhower School and a Professional Certificate in Artificial Intelligence and Business Strategy from the Massachusetts Institute of Technology’s Computer Science and Artificial Intelligence Laboratory.

Admiral Howard is well qualified to serve as a director on our Board due to his distinctive leadership, at the strategic, operational and tactical levels, where he was at the helm in command for outcomes that advanced the security of the United States and its allies.

Board Committees: Not Applicable

Alan B. Howe has served as a director since October 2021. Prior to this, Mr. Howe served as a director of Spartacus Acquisition Corporation (Nasdaq: TMTS), an entity party to the Business Combination (as defined below), from October 2020 until the closing of the Business Combination in October 2021. He has served as co-founder and Managing Partner of Broadband Initiatives, LLC, a telecommunications consulting firm, since 2001. Mr. Howe also served as Vice President of Strategic and Wireless Business Development for Covad Communications, Inc. (formerly Nasdaq: COVD), a national broadband telecommunications company, from May 2005 to October 2008, and as Chief Financial Officer and Vice President of Corporate Development for Teletrac, Inc., a mobile data and location solutions provider, from April 1995 to April 2011. Previously, Mr. Howe held various executive management positions for Sprint Corporation (NYSE: S) and Manufacturers Hanover Trust Company.

Mr. Howe has over 30 years of extensive hands-on operational expertise combined with corporate finance, business development and corporate governance experience. Mr. Howe has a broad business background and has been exposed to a wide variety of complex business situations within large corporations, financial institutions, start-ups, small-caps and turnarounds. Mr. Howe is currently a member of the board of directors and serves on the audit committees of Babcock and Wilcox (NYSE: BW) and as a member of the board of directors of the San Diego Rescue Mission.

Previously, Mr. Howe served on the boards of over twenty public companies, including Sonim Technologies Inc. (Nasdaq: SONM), Resonant, Inc. (formerly Nasdaq: RESN), Data I/O Corporation (Nasdaq: DAIO), Determine, Inc. (OTCMKTS: DTRM), Urban Communications, Inc. (formerly TSX-V: UBN), MagicJack, Vocaltec Communications Inc. (formerly Nasdaq: Call), WidePoint Corporation (NYSE American: WYY), CafePress Inc. (formerly Nasdaq: PRSS), and Orion Energy Systems, Inc. (Nasdaq: OESX). Mr. Howe holds a Bachelor of Science in Business Administration and Marketing from the University of Illinois, School of Commerce and a Master of Business Administration in Finance from the Indiana University, Kelley Graduate School of Business.

Mr. Howe is well qualified to serve as a director on our Board due to his extensive financial capital markets and M&A experience, as well as his experience serving on the boards of directors of other public companies.

Board Committees: Audit Committee (Member); Nominating and Corporate Governance Committee (Member)

Jonathan A. Marcus has served as a director since May 2024. Mr. Marcus serves as the Chairman of Alimco Financial Corp., a position he has held since May 2023. Prior thereto, Mr. Marcus was the Chief Executive Officer of Alimco Financial Corp. since March 2019. Prior to March 2019, Mr. Marcus was a managing member and co-founder of Broadbill Partners, L.P., a fund focused on special situations and distressed securities. Prior to Broadbill’s inception in 2011, Mr. Marcus was the Chief Investment Officer of Cypress Management, L.P., the predecessor fund to Broadbill, which he founded in 1995 to specialize in investing in distressed securities. Mr. Marcus’s career also includes extensive investment banking and financial advisory work at Prudential-Bache Securities and Credit Suisse First Boston, with a substantial focus advising financially troubled companies or their creditors. Since January 2018, Mr. Marcus has served as Special Advisor to Milfam LLC. Mr. Marcus currently serves on the boards of directors of Alimco Financial Corp and Anacomp, Inc. and previously served on the board of director of Kaspien Holdings Inc.

Mr. Marcus is well qualified to serve as a director on our Board due to his extensive financial capital markets and financial advisory experiences, as well as his experience serving on the boards of directors of other companies.

Board Committees: Audit Committee (Chair)

John B. Muleta has served as a director since January 2024. Since October 2010, Mr. Muleta has served as the Chief Executive Officer of ATELUM LLC, a technology transfer firm specializing in mobile and Internet services. Since August 2014, Mr. Muleta has served as the Managing Member of SNR Wireless Management LLC. In December 2005, Mr. Muleta founded M2Z Networks, Inc., a wireless broadband internet provider, and served as its Chief Executive Officer and director until October 2010. From March 2005 to April 2006, Mr. Muleta was a partner and the co-chair of the Communications Group at Venable LLP, a law firm. From February 2003 until March 2005, Mr. Muleta served as the Chief of the Federal Communications Commission’s Wireless Telecommunications Bureau. From January 2000 to January 2001, Mr. Muleta served as Executive Vice President of Navisite, Inc. with responsibility for International Markets and Business Development. From January 1998 to January 2000, Mr. Muleta concurrently served as president of PSINet Ventures Inc., president of PSINet’s Global Facilities Division and president of PSINet’s India, Middle East and Africa Division.

Mr. Muleta is well qualified to serve as a director on our Board due to his unparalleled expertise and experience in dealing with wireless policy matters, particularly spectrum allocation matters and driving innovations in public safety communications. Moreover, Mr. Muleta’s long experience in helping emerging companies in the wireless and internet sectors achieve scale is of particular relevance to the Company.

Board Committees: Compensation and Human Capital Committee (Member); Nominating and Corporate Governance Committee (Chair)

Nicola Palmer has served as a director since June 2024. Ms. Palmer served as Chief Technology Ambassador of Verizon Communications, Inc., a global provider of technology, communications, information and entertainment products and services, having served in that role from 2022 until her retirement in 2023. Previously she served as Chief Product Development Officer from 2019 to 2022, as Chief Network Engineering Officer and Head of Wireless Networks from 2017 to 2018 and as Chief Technology Officer for Verizon Wireless from 2013 to 2017, after having served in technology roles of increasing responsibility for Verizon since 2000. Ms. Palmer currently serves on the board of directors of Nvent Electric PLC (NYSE: NVT). Ms. Palmer was recommended to our Board by our Chief Executive Officer, Mariam Sorond.

Ms. Palmer is well qualified to serve as a director on our Board due to her extensive expertise in building, evolving and innovating technology products, platforms and services, as well as her significant experience in digital business transformation, evaluating acquisitions and investments to drive innovation, and cybersecurity, including governance, assessment, control evaluation, security engineering, incident response and on-going business continuity planning.

Board Committees: Audit Committee (Member); Compensation and Human Capital Committee (Chair)

Lorin Selby has been appointed by the Board to serve as a director, effective on May 1, 2025. Admiral Selby retired as a Rear Admiral from the U.S. Navy in 2023 after nearly 37 years of service. Admiral Selby served in several high-profile positions throughout his Navy career, making significant impacts as a Navy leader. His last assignment was as the Chief of Naval Research from May 2020, to June 2023. In that role, he led a distributed team of 3,800 personnel and developed leading-edge technologies for the Navy and Marine Corps, overseeing a $4 billion budget. A stand-out achievement in this role was the establishment of the Navy’s Hedge Strategy, which calls for the addition of thousands of small, attritable, unmanned systems and sensors, to augment existing battle force ships. He also initiated the Integrated Battle Problem experimentation series, allowing companies and government laboratories to demonstrate their ideas and products to the Navy and Marine Corps in operationally relevant environments. Previously, he served as the Chief Engineer of the United States Navy and Deputy Commander for Ship Design, Integration, and Naval Engineering at the Naval Sea Systems Command from June 2016 until May 2020. Admiral Selby was brought in to drive innovation, optimize performance, and generate new ways of doing business. He also served as the Commander of the Naval Surface Warfare Centers, becoming the first submarine officer assigned to lead a surface warfare R&D hub for these same reasons. His command at sea was the nuclear fast-attack submarine USS GREENEVILLE (SSN 772). Admiral Selby also held highly visible roles like the Deputy Director of the Navy Office of Legislative Affairs to the U.S. House of Representatives.

Following his retirement, Admiral Selby has taken on various consulting roles, advising small and mid-sized technology companies. He currently serves as President and CEO of Selby Partners Consulting LLC and is a founding partner in a maritime-focused growth equity fund, Mare Liberum Capital Partners. Admiral Selby was recommended to our Board by John Muleta, a NextNav director.

Admiral Selby holds a B.S. in Nuclear Engineering from the University of Virginia, an M.S. in Nuclear Engineering, and a Nuclear Engineer Degree from the Massachusetts Institute of Technology. He has also completed extensive executive business coursework, and his achievements have been recognized through numerous personal and unit awards.

Admiral Selby is well qualified to serve as a director on our Board due to his extensive leadership experience, deep expertise in technology and innovation, and proven ability to drive technological advancements.

Board Committees: Not Applicable

Neil S. Subin has served as a director since August 2022. Mr. Subin serves as Chief Investment Officer for MILFAM, a single-family office exclusively managing the assets of the Miller family, a position he has held since January 2018. Previously, Mr. Subin was the Chairman of Broadbill Investment Partners, LLC, a private investment management firm focused on distressed and special situations investments. Prior to Broadbill, he was the founder and Managing Director of Trendex Capital Management Corp., a private investment advisor focusing primarily on financially distressed companies. Mr. Subin has held numerous other board seats, including on the boards of directors of Centrus Energy Corp. (NYSE: LEU), Alimco Financial Corp., Penn Treaty American Corp., PHAZR Inc., FiberTower Corp., Phosphate Holdings, Inc., Institutional Financial Markets, Inc. and DynTek Inc.

Mr. Subin is well qualified to serve as a director on our Board due to his financial competency as well as his expertise in crafting corporate strategy and executing on corporate action, especially within the telecommunications industry.

Board Committees: Audit Committee (Member)

No Family Relationships

There are no family relationships between any of our executive officers, directors or director nominees.

Our Board of Directors believes that good corporate governance is important to ensure that we are managed for the long-term benefit of our stockholders. Complete copies of our Corporate Governance Guidelines, committee charters and Code of Conduct and Ethics described below are available on the Investors page of our website at www.nextnav.com. Alternatively, you can request a copy of any of these documents by writing to: Investor Relations, NextNav Inc., 11911 Freedom Drive, Suite 200, Reston, Virginia 20190. Note that the inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of NextNav and our stockholders. These guidelines provide a framework for the conduct of our Board’s business, and provide, among other things, that:

• the principal responsibility of the directors is to oversee management of the Company;

• a majority of the members of our Board shall be independent directors;

• the independent directors meet regularly in executive session;

• directors have access to senior management and, as necessary and appropriate, independent advisors; and

• at least annually, our Board and its committees conduct a self-evaluation to determine whether they are functioning effectively.

Board and Committees

Director Independence

Our Board has determined that: (i) all of our directors and nominees for director, except Mariam Sorond, are independent within the meaning of Section 5605(a)(2) of the Nasdaq Stock Market LLC (“Nasdaq”) listing rules (the “Nasdaq Stock Market Rules”); (ii) Messrs. Marcus, Howe and Subin and Ms. Palmer each meet the additional test for independence for audit committee members imposed by Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 5605(c)(2)(A) of the Nasdaq Stock Market Rules; and (iii) Ms. Palmer and Messrs. Carano and Muleta each meet the additional test for independence for compensation committee members imposed by Section 5605(d)(2) of the Nasdaq Stock Market Rules, and are non-employee directors for purposes of Rule 16b-3. In making such determination, our Board considered the relationships that each such non-employee director has with us and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director and any previous consulting arrangements we had with any of our directors.

Our Board is currently composed of seven (7) directors. In addition, H. Wyman Howard III and Lorin Selby have been appointed by the Board to serve as directors, effective on May 1, 2025. At the Annual Meeting, our stockholders are being asked to elect these nine (9) nominees to a one-year term. Once elected, all directors, with the exception of Ms. Sorond, will be independent.

Board and Committee Meetings; Annual Meeting Attendance

For the year ended December 31, 2024, our Board held 6 meetings, our Audit Committee held 4 meetings, our Compensation and Human Capital Committee (the “Compensation Committee”) held 2 meetings, and our Nominating and Corporate Governance Committee (the “Nominating Committee”) held 5 meetings.

During 2024, each of our directors attended at least 75% of (i) the number of Board meetings held during the period for which he or she has been a director and (ii) the total number of committee meetings held during the period for which he or she has served on each such committee. Directors are strongly encouraged, but not required, to attend our annual meetings. Mariam Sorond, Bandel L. Carano, Alan B. Howe, Jonathan A. Marcus, John B. Muleta and Gary M. Parsons attended our 2024 Annual Meeting of Stockholders.

Board Leadership Structure and Role in Risk Oversight

We seek to maintain an appropriate balance between management and our Board. Our Board does not have a policy regarding the separation of the offices of Chair of our Board and Chief Executive Officer. Our Board believes that it is important to retain the flexibility to combine or separate the responsibilities of the offices of Chair of our Board and Chief Executive Officer, as from time to time it may be in our best interests.

Currently, our leadership structure combines the offices of Chief Executive Officer and Chair of our Board, with Ms. Sorond serving as our Chief Executive Officer and as Chair of our Board. Our Corporate Governance Guidelines provide that the independent directors on our Board may choose to elect a director to serve as the “Lead Independent Director” of the Board when the offices of the Chief Executive Officer and the Chair of the Board are not separate. Alan B. Howe has served as Lead Independent Director since May 2024, following our 2024 Annual Meeting of Stockholders. The Board has elected John B. Muleta to this position effective May 2025.

Our Board has determined that, in certain circumstances, selecting our Chief Executive Officer to serve as Chair of the Board may be the most effective leadership model for the Company at a given time. Having one individual serve in both roles can provide for clear leadership, accountability, and alignment on corporate strategy.

When the offices of the Chief Executive Officer and the Chair of our Board are not separate, our Board believes that appointing a Lead Independent Director strengthens our Board governance, as our Lead Independent Director can serve as the principal liaison between the Chair and the independent directors. Our Lead Independent Director is responsible for:

• presiding at all meetings of the Board where the Chair is not present;

• presiding at all meetings and executive sessions of the independent directors;

• calling meetings of the independent directors, as needed;

• meeting regularly with the Chief Executive Officer;

• developing the agendas for meetings of the independent directors;

• approving Board meeting agendas and schedules;

• reviewing information sent to the Board; and

• meeting with stockholders, as appropriate.

Our Board is responsible for overseeing the establishment and maintenance of our risk management processes. While it does not have a standing risk management committee, our Board administers this oversight directly and through its committees, each of which addresses risks within its respective area of responsibility as outlined in its charter.

Our Board may delegate primary oversight of specific risks to one or more committees. When a committee is responsible for evaluating and managing a particular risk, its chair must promptly report any material risk exposures to our Board, ensuring effective coordination of risk oversight, particularly in managing interrelated risks. Our Board or the appropriate committee regularly engages with management to discuss major risk exposures, assess their potential impact, and review mitigation strategies.

Management is responsible for the day-to-day implementation of risk management processes and regularly reports on potential material risks to our Board. These reports, provided by the Chief Executive Officer, Chief Financial Officer, General Counsel, and other senior executives, ensure that our Board remains informed. Additionally, our full Board, with input from its committees, considers and evaluates material risks as part of its broader oversight responsibilities.

Board Committees

As noted above, our Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating Committee. Charters for each of the committees are available under the Governance tab of the Investors page of our website at www.nextnav.com. Each committee reviews its respective charter on an annual basis. In compliance with the Nasdaq Stock Market Rules and the federal securities laws, as applicable, all of the members of our committees are independent under the applicable independence standards for such committee.

Committee membership immediately prior to the Annual Meeting is as follows:

| Audit Committee |

Compensation Committee |

Nominating Committee | ||||

| Mariam Sorond, Chair | ||||||

| Bandel L. Carano |  |

| ||||

| Alan B. Howe |  |

| ||||

| Jonathan A. Marcus |  |

|||||

| John B. Muleta |  |

| ||||

| Nicola Palmer |  |

|

||||

| Neil S. Subin |  |

|||||

|

|

Audit Committee

The primary purpose of our Audit Committee is to assist our Board in the oversight of the integrity of our accounting and financial reporting process, the audits of our financial statements and internal control over financial reporting, as applicable, our compliance with legal and regulatory requirements, and our programs for identifying, evaluating and controlling significant risks. The functions of our Audit Committee include, among other things:

• appointing, approving the compensation of, and evaluating the work and independence of our independent registered public accounting firm;

• pre-approving audit, audit-related and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm;

• overseeing our risk assessment, risk management and risk mitigation policies and programs, including matters relating to privacy and cybersecurity and climate and the environment;

• reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures;

• recommending, based upon its review and discussions with management and the independent registered public accounting firm, whether our audited financial statements shall be included in our Annual Report on Form 10-K;

• reviewing and discussing with the independent registered public accounting firm the critical accounting policies and practices used by us, the auditor’s responsibilities under U.S. GAAP and the responsibilities of management in the audit process;

• reviewing the adequacy of our internal control over financial reporting;

• establishing procedures for receiving, retaining and treating complaints regarding accounting, internal accounting controls, auditing, and federal securities laws matters, and for the confidential, anonymous submission by employees and independent contractors of concerns regarding questionable accounting or auditing matters;

• monitoring our compliance with legal and regulatory requirements;

• preparing the Audit Committee report required by the rules of the SEC to be included in our annual proxy statement;

• reviewing, and, if appropriate, approving or ratifying, all related party transactions for potential conflict of interest situations; and

• reviewing and discussing with management and our independent registered public accounting firm any financial information and earnings guidance provided to analysts and rating agencies.

The financial literacy requirements of the SEC require that each member of our Audit Committee be able to read and understand fundamental financial statements. In addition, at least one member of our Audit Committee must be qualified as an audit committee financial expert, as defined in Item 407(d)(5) of Regulation S-K, and have financial sophistication in accordance with the Nasdaq Stock Market Rules. Our Board has determined that each of Mr. Marcus and Mr. Howe qualifies as an audit committee financial expert. For the relevant experience which qualifies each of Mr. Marcus and Mr. Howe as an audit committee financial expert, please see his biographical information under the “Board of Directors” section of this Proxy Statement.

Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee. Our Audit Committee receives regular reports on risks facing the company at each meeting, including on cybersecurity. For information on audit fees, see “Proposal 2: Ratification of Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for 2025.”

Compensation Committee

The primary purpose of our Compensation Committee is to review the performance and development of our management in achieving corporate goals and objectives and to assure that our executive officers are compensated effectively in a manner consistent with our strategy, competitive practice and stockholder interests. In carrying out these responsibilities, our Compensation Committee reviews all components of executive officer compensation for consistency with its compensation philosophy, as in effect from time to time. The functions of our Compensation Committee include, among other things:

• reviewing, determining and implementing our compensation philosophy;

• annually reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer;

• evaluating the performance of our chief executive officer in light of such corporate goals and objectives and determining and approving the compensation of our Chief Executive Officer;

• reviewing and approving the compensation of our other executive officers;

• administering our equity and other incentive compensation plans and approving the adoption of any amendment to our incentive-compensation and equity-based plans;

• appointing, compensating and overseeing the work of any compensation consultant, external legal counsel or other advisor retained by the Compensation Committee;

• conducting the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, counsel or other advisor retained by the Compensation Committee;

• annually reviewing and reassessing the adequacy of the committee charter and the structure, processes and membership requirements of the Compensation Committee;

• overseeing and reporting to our Board its review of its policies and strategies for fostering a fair and effective human capital management system, as well as promoting a strong corporate governance culture; and

• reviewing and discussing with management the compensation discussion and analysis and recommending to our Board whether the compensation discussion and analysis and related executive compensation information be included in our proxy statement or annual report on Form 10-K.

From time to time, various members of management and other employees as well as outside advisors or consultants may be invited by our Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in our Compensation Committee meetings. With respect to our Chief Executive Officer’s compensation, our Compensation Committee evaluates our Chief Executive Officer’s performance against pre-established corporate goals and objectives and approves the compensation level of our Chief Executive Officer based on this evaluation. The Chief Executive Officer may not be present during voting or deliberations on her compensation.

Our Compensation Committee’s charter grants our Compensation Committee authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. The Committee did not engage an outside consultant for the fiscal year ending December 31, 2024.

Nominating Committee

The primary purpose of our Nominating Committee is to assist our Board in identifying nominees for election to our Board, consistent with the qualifications and criteria approved by our Board, and to promote the implementation of sound corporate governance principles and practices. The functions of our Nominating Committee include, among other things:

• developing and recommending to the Board for its approval general criteria and qualifications for director candidates;

• identifying, and recommending to the Board for selection, director nominees for election or re-election at our annual meeting of stockholders in each fiscal year and to fill vacancies and newly created directorships;

• developing and recommending to the Board a set of Corporate Governance Guidelines;

• monitoring, reviewing and evaluating any change of circumstances or actual or potential conflict of interest relating to any director that may affect the independence of the director;

• overseeing our corporate governance programs, policies and practices; and

• overseeing the evaluation of the Board, its committees and the Company’s management.

Our Nominating Committee recommends candidates based upon many factors, including the diversity of their business or professional experience, the diversity of their background and their array of talents and perspectives. Our Nominating Committee is responsible for developing and recommending to our Board for its approval general criteria and qualifications for director candidates.

Our Nominating Committee identifies candidates through a variety of means, including recommendations from members of our Board and suggestions from our management, including our Chief Executive Officer. In addition, our Nominating Committee considers candidates recommended by third parties, including stockholders. Our Nominating Committee gives the same consideration to candidates recommended by stockholders as those candidates recommended by members of our Board and management.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing composition of our Board. However, at a minimum, our corporate governance guidelines provide that each nominee exhibit high standards of integrity, demonstrated strong business judgment and professional achievement, and expertise that is useful to the Company and complementary to the background and experience of other Board members. Our Board as a whole should contain a range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to all of our operations and interests. Each nominee should exhibit confidence and a willingness to express ideas and engage in constructive discussion with other Board members, management and all relevant persons. Each nominee should be able to regularly attend and participate in meetings of our Board and its committees on which he or she serves, should have the interest and ability to understand the sometimes-conflicting interests of our various constituencies, which include stockholders, employees, governmental units and the general public, and to act in the best interests of all stockholders. Further, each nominee should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all of our stockholders and to fulfill the responsibilities of a director.

A stockholder wishing to nominate a person for election to our Board at any annual meeting at which our Board has determined that one or more directors will be elected must submit a written notice of his, her or its nomination of a candidate to the attention of our Secretary at our offices at NextNav Inc., 11911 Freedom Drive, Suite 200, Reston, Virginia 20190, providing:

• the name, age, business address and residence address of such nominee;

• the principal occupation or employment of such nominee;

• the class or series and number of shares of capital stock that are owned of record and beneficially by such nominee;

• such other information concerning such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved), or that is otherwise required to be disclosed pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder (including such person’s written consent to being named as a nominee and to serving as a director if elected);

• all information with respect to the stockholder that would be required to be set forth in a stockholder’s notice pursuant to our Bylaws if such person were a stockholder or beneficial owner, on whose behalf the nomination was made, submitting a notice providing for the nomination of a person or persons for election as a director or directors in accordance with our Bylaws; and

• such other information as we may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such proposed nominee.

Pursuant to our Bylaws, the submission must be received by our Secretary at our principal executive offices not later than the close of business on the 90th day nor earlier than the opening of business on the 120th day before the first anniversary of the date of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 60 days after the anniversary of the preceding year’s annual meeting, notice by the stockholder to be timely must be so received not earlier than the opening of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such annual meeting is first made. In no event will an adjournment or a postponement of an annual meeting for which notice has been given, or the public announcement thereof has been made, commence a new time period for the giving of a stockholder’s notice as described above.

Stockholder Communications with our Board

Stockholders who wish to communicate directly with our Board, or with a particular director, may send a letter addressed to our Secretary at NextNav Inc., 11911 Freedom Drive, Suite 200, Reston, Virginia 20190. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder Board Communication” or “Stockholder Director Communication.” All such letters must identify the author as a stockholder and clearly state whether the intended recipients are all members of our Board or just certain specified individual directors. Our Secretary will make copies of all such letters and circulate them to the director(s) addressed. If a stockholder wishes the communication to be confidential, such stockholder must clearly indicate on the envelope that the communication is “confidential.”

Our Secretary will handle routine inquiries and requests for information. If our Secretary determines the communication is made for a valid purpose and is relevant to us and our business, our Secretary will forward such communication to the director(s) specified on the envelope, or if none, to our Chair of our Board. Our Secretary will not forward any communication that is: an advertisement or other commercial solicitation or communication; obviously frivolous or obscene; unduly hostile, threatening, or illegal; or related to trivial matters. At each regular meeting of our Board, our Secretary will present a summary of all stockholder communications received since the previous meeting that were not forwarded and will make those communications available to the directors upon request.

Code of Conduct and Ethics