Please wait

000186658112/312025Q3FALSEP3MP1YP1YP1YP1Yhttp://fasb.org/us-gaap/2025#SellingGeneralAndAdministrativeExpense354xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesbros:storebros:statexbrli:purebros:taxReceivableAgreementbros:segment00018665812025-01-012025-09-300001866581us-gaap:CommonClassAMember2025-10-310001866581us-gaap:CommonClassBMember2025-10-310001866581us-gaap:CommonClassCMember2025-10-3100018665812025-09-3000018665812024-12-310001866581us-gaap:CommonClassAMember2025-09-300001866581us-gaap:CommonClassAMember2024-12-310001866581us-gaap:CommonClassBMember2025-09-300001866581us-gaap:CommonClassBMember2024-12-310001866581us-gaap:CommonClassCMember2025-09-300001866581us-gaap:CommonClassCMember2024-12-310001866581bros:CompanyOperatedShopsMember2025-07-012025-09-300001866581bros:CompanyOperatedShopsMember2024-07-012024-09-300001866581bros:CompanyOperatedShopsMember2025-01-012025-09-300001866581bros:CompanyOperatedShopsMember2024-01-012024-09-300001866581bros:FranchisingAndOtherMember2025-07-012025-09-300001866581bros:FranchisingAndOtherMember2024-07-012024-09-300001866581bros:FranchisingAndOtherMember2025-01-012025-09-300001866581bros:FranchisingAndOtherMember2024-01-012024-09-3000018665812025-07-012025-09-3000018665812024-07-012024-09-3000018665812024-01-012024-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-06-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-06-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-06-300001866581us-gaap:AdditionalPaidInCapitalMember2025-06-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300001866581us-gaap:RetainedEarningsMember2025-06-300001866581us-gaap:NoncontrollingInterestMember2025-06-3000018665812025-06-300001866581us-gaap:RetainedEarningsMember2025-07-012025-09-300001866581us-gaap:NoncontrollingInterestMember2025-07-012025-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-012025-09-300001866581us-gaap:AdditionalPaidInCapitalMember2025-07-012025-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-07-012025-09-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-07-012025-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-09-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-09-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-09-300001866581us-gaap:AdditionalPaidInCapitalMember2025-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001866581us-gaap:RetainedEarningsMember2025-09-300001866581us-gaap:NoncontrollingInterestMember2025-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:AdditionalPaidInCapitalMember2024-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001866581us-gaap:RetainedEarningsMember2024-12-310001866581us-gaap:NoncontrollingInterestMember2024-12-310001866581us-gaap:RetainedEarningsMember2025-01-012025-09-300001866581us-gaap:NoncontrollingInterestMember2025-01-012025-09-300001866581us-gaap:AdditionalPaidInCapitalMember2025-01-012025-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-01-012025-09-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-01-012025-09-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-01-012025-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-06-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-06-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-06-300001866581us-gaap:AdditionalPaidInCapitalMember2024-06-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001866581us-gaap:RetainedEarningsMember2024-06-300001866581us-gaap:NoncontrollingInterestMember2024-06-3000018665812024-06-300001866581us-gaap:RetainedEarningsMember2024-07-012024-09-300001866581us-gaap:NoncontrollingInterestMember2024-07-012024-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001866581us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-07-012024-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-09-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-09-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-09-300001866581us-gaap:AdditionalPaidInCapitalMember2024-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001866581us-gaap:RetainedEarningsMember2024-09-300001866581us-gaap:NoncontrollingInterestMember2024-09-3000018665812024-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:AdditionalPaidInCapitalMember2023-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001866581us-gaap:RetainedEarningsMember2023-12-310001866581us-gaap:NoncontrollingInterestMember2023-12-3100018665812023-12-310001866581us-gaap:RetainedEarningsMember2024-01-012024-09-300001866581us-gaap:NoncontrollingInterestMember2024-01-012024-09-300001866581us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-09-300001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-01-012024-09-300001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-01-012024-09-300001866581bros:CommonClassDMemberus-gaap:CommonStockMember2024-01-012024-09-300001866581bros:CommonClassDMemberus-gaap:CommonStockMember2024-09-300001866581us-gaap:EntityOperatedUnitsMember2025-09-300001866581us-gaap:FranchisedUnitsMember2025-09-300001866581bros:DutchBrosIncMember2025-09-300001866581bros:ContinuingLLCEquityOwnersMember2025-09-300001866581bros:ContinuingLLCMembersMember2025-09-300001866581bros:DutchBrosIncMember2025-02-0700018665812025-02-072025-02-0700018665812025-02-070001866581us-gaap:CommonClassBMember2025-02-072025-02-070001866581us-gaap:CommonClassCMember2025-02-072025-02-070001866581bros:CompanyOperatedShopsMember2025-07-012025-09-300001866581bros:CompanyOperatedShopsMember2024-07-012024-09-300001866581bros:CompanyOperatedShopsMember2025-01-012025-09-300001866581bros:CompanyOperatedShopsMember2024-01-012024-09-300001866581bros:FranchiseFeesMember2025-07-012025-09-300001866581bros:FranchiseFeesMember2024-07-012024-09-300001866581bros:FranchiseFeesMember2025-01-012025-09-300001866581bros:FranchiseFeesMember2024-01-012024-09-300001866581us-gaap:ProductAndServiceOtherMember2025-07-012025-09-300001866581us-gaap:ProductAndServiceOtherMember2024-07-012024-09-300001866581us-gaap:ProductAndServiceOtherMember2025-01-012025-09-300001866581us-gaap:ProductAndServiceOtherMember2024-01-012024-09-300001866581bros:GiftCardAndLoyaltyProgramsMember2025-09-300001866581bros:GiftCardAndLoyaltyProgramsMember2024-12-310001866581bros:OtherDeferredRevenueNetMember2025-09-300001866581bros:OtherDeferredRevenueNetMember2024-12-310001866581bros:GiftCardRewardRedemptionsMember2025-07-012025-09-300001866581bros:GiftCardRewardRedemptionsMember2024-07-012024-09-300001866581bros:GiftCardRewardRedemptionsMember2025-01-012025-09-300001866581bros:GiftCardRewardRedemptionsMember2024-01-012024-09-3000018665812025-10-012025-09-3000018665812026-01-012025-09-3000018665812027-01-012025-09-3000018665812028-01-012025-09-3000018665812029-01-012025-09-3000018665812030-01-012025-09-300001866581bros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581bros:OrganizationRealignmentAndRestructuringMember2025-05-130001866581bros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581bros:OrganizationRealignmentAndRestructuringMember2025-07-012025-09-300001866581bros:OrganizationRealignmentAndRestructuringMember2024-07-012024-09-300001866581bros:OrganizationRealignmentAndRestructuringMember2024-01-012024-09-300001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-09-300001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581bros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2025-09-300001866581us-gaap:SoftwareDevelopmentMember2025-09-300001866581us-gaap:SoftwareDevelopmentMember2024-12-310001866581srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2025-09-300001866581srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2025-09-300001866581us-gaap:FurnitureAndFixturesMember2025-09-300001866581us-gaap:FurnitureAndFixturesMember2024-12-310001866581srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2025-09-300001866581srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2025-09-300001866581us-gaap:LeaseholdImprovementsMember2025-09-300001866581us-gaap:LeaseholdImprovementsMember2024-12-310001866581srt:MinimumMemberus-gaap:BuildingMember2025-09-300001866581srt:MaximumMemberus-gaap:BuildingMember2025-09-300001866581us-gaap:BuildingMember2025-09-300001866581us-gaap:BuildingMember2024-12-310001866581us-gaap:LandMember2025-09-300001866581us-gaap:LandMember2024-12-310001866581us-gaap:ConstructionInProgressMember2025-09-300001866581us-gaap:ConstructionInProgressMember2024-12-310001866581us-gaap:CostOfSalesMember2025-07-012025-09-300001866581us-gaap:CostOfSalesMember2024-07-012024-09-300001866581us-gaap:CostOfSalesMember2025-01-012025-09-300001866581us-gaap:CostOfSalesMember2024-01-012024-09-300001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2025-07-012025-09-300001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-07-012024-09-300001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2025-01-012025-09-300001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-09-300001866581us-gaap:FranchiseRightsMember2025-09-300001866581us-gaap:FranchiseRightsMember2024-12-310001866581bros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:SecuredDebtMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:LetterOfCreditMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:BridgeLoanMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:SecuredDebtMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581bros:The20252022CreditFacilitiesMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581bros:The2022CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-09-300001866581us-gaap:LetterOfCreditMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-09-300001866581bros:The2025CreditFacilityMemberus-gaap:SecuredDebtMember2025-09-300001866581bros:The2025CreditFacilityMemberus-gaap:SecuredDebtMember2024-12-310001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001866581us-gaap:UnsecuredDebtMember2025-09-300001866581us-gaap:UnsecuredDebtMember2024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2025-01-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001866581us-gaap:DesignatedAsHedgingInstrumentMember2025-09-300001866581us-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-07-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-07-012024-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-01-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2025-07-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2024-07-012024-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2025-01-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2024-01-012024-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2025-07-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2024-07-012024-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2025-01-012025-09-300001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2024-01-012024-09-3000018665812024-01-012024-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2024-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-09-300001866581us-gaap:RestrictedStockUnitsRSUMember2025-09-300001866581us-gaap:PerformanceSharesMember2024-12-310001866581us-gaap:PerformanceSharesMember2025-01-012025-09-300001866581us-gaap:PerformanceSharesMember2025-09-300001866581us-gaap:RestrictedStockMember2025-01-012025-09-300001866581us-gaap:RestrictedStockMember2024-01-012024-09-300001866581us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001866581us-gaap:CommonClassAMemberbros:PublicStockOfferingSharesFromContinuingMembersMember2025-09-300001866581bros:ClassACommonUnitsHeldByDutchBrosIncAndNonControllingInterestHoldersMember2025-09-300001866581us-gaap:RelatedPartyMember2024-07-012024-09-300001866581us-gaap:RelatedPartyMember2024-01-012024-09-300001866581us-gaap:RestrictedStockMember2025-07-012025-09-300001866581us-gaap:RestrictedStockMember2024-07-012024-09-300001866581us-gaap:RestrictedStockUnitsRSUMember2025-07-012025-09-300001866581us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001866581us-gaap:PerformanceSharesMember2025-07-012025-09-300001866581us-gaap:PerformanceSharesMember2024-07-012024-09-300001866581us-gaap:PerformanceSharesMember2024-01-012024-09-300001866581us-gaap:PropertyLeaseGuaranteeMember2025-09-300001866581us-gaap:PropertyLeaseGuaranteeMember2024-12-310001866581us-gaap:RelatedPartyMember2025-07-012025-09-300001866581us-gaap:RelatedPartyMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2025-07-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2024-07-012024-09-300001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-09-300001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-09-300001866581bros:ChristineBaroneMember2025-07-012025-09-300001866581bros:ChristineBaroneMember2025-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-Q

______________________________

(Mark One)

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period ended September 30, 2025

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-40798

______________________________

DUTCH BROS INC.

(Exact name of Registrant as specified in its charter)

______________________________

| | | | | | | | | | | | | | |

Delaware | | 87-1041305 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1930 W. Rio Salado Pkwy | | |

| Tempe, | Arizona |

| 85281 |

(Address of Principal Executive Offices) | | (Zip Code) |

(877) 899-2767

(Registrant's telephone number, including area code)

______________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on which Registered |

Class A Common Stock, par value $0.00001 per share | BROS | The New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Accelerated filer | o |

Non-accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of October 31, 2025, the registrant’s outstanding shares of common stock were as follows:

| | | | | |

| Class A common stock | 127,031,344 | |

| Class B common stock | 35,210,946 | |

| Class C common stock | 2,279,846 | |

| |

DUTCH BROS INC.

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

As used in this Quarterly Report on Form 10-Q (this Form 10-Q), the terms identified below have the meanings specified below unless otherwise noted or the context requires otherwise. References in this Form 10-Q to “Dutch Bros,” the “Company,” “we,” “us” and “our” refer to Dutch Bros Inc. and its consolidated subsidiaries unless the context indicates otherwise.

| | | | | | | | |

Term | | Definition |

| 2022 Credit Facility | | Has the meaning set forth in NOTE 9 — Debt to the condensed consolidated financial statements, included elsewhere in this Form 10-Q |

2025 Credit Facility | | Has the meaning set forth in NOTE 9 — Debt to the condensed consolidated financial statements, included elsewhere in this Form 10-Q |

| AOCI | | Accumulated Other Comprehensive Income |

| ASU | | Accounting Standards Update |

| AUV | | Average Unit Volume |

| | |

| BPS or bps | | Basis points, which is used to express differences in rates. One basis point is the equivalent of 1/100 of one percent |

| CEO | | Chief Executive Officer |

| CODM | | Chief Operating Decision Maker |

| Co-Founder | | Travis Boersma, our Executive Chairman and Co-Founder, and affiliated entities over which he maintains voting control |

| | |

| Continuing Members | | The Co-Founder and the Sponsor |

| Dutch Bros OpCo | | Dutch Mafia, LLC, a Delaware limited liability company and direct subsidiary of Dutch Bros Inc. |

| Dutch Bros Inc. | | A Delaware corporation, the Class A common stock of which is publicly traded on the New York Stock Exchange under the symbol “BROS” |

| | |

EBITDAR | | Earnings before interest, taxes, depreciation, amortization, and rent costs |

| FASB | | Financial Accounting Standards Board |

| GAAP | | U.S. Generally Accepted Accounting Principles |

| IPO | | Initial Public Offering |

| | |

| N/A | | Not applicable |

| N/M | | Not meaningful |

| OpCo LLC Agreement | | The Fifth Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo |

| OpCo Units | | Class A common units, Class B voting units and Class C voting units of Dutch Bros OpCo, each as further defined in the OpCo LLC Agreement, collectively |

| | |

| | |

| | |

| PSU | | Performance-Based Stock Units |

| | |

| | |

| RSA | | Restricted Stock Awards |

| RSU | | Restricted Stock Units |

| Same Shop Sales | | The estimated percentage change in year-over-year sales, for the comparable shop base, which we define as shops open for 15 complete months or longer as of the first day of the reporting period |

| SEC | | Securities and Exchange Commission |

| SOFR | | Secured Overnight Financing Rate |

| Sponsor | | TSG Consumer Partners, L.P. and certain of its affiliates |

Tax Receivable Agreements (TRAs) | | The Tax Receivable Agreement (Exchanges) that Dutch Bros Inc. entered into with the Continuing Members and the Tax Receivable Agreement (Reorganization) that Dutch Bros Inc. entered into with TSG7 A AIV VI Holdings-A, L.P. and DG Coinvestor Blocker Aggregator, L.P. or their assignees or successors, in connection with the IPO |

| | |

| | |

| | |

Dutch Bros, our Windmill logo ( ), Dutch Bros Blue Rebel, and our other registered and common law trade names, trademarks and service marks are the property of Dutch Bros Inc. All other trademarks, trade names, and service marks appearing in this Form 10-Q are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Form 10-Q may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

), Dutch Bros Blue Rebel, and our other registered and common law trade names, trademarks and service marks are the property of Dutch Bros Inc. All other trademarks, trade names, and service marks appearing in this Form 10-Q are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Form 10-Q may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.  Dutch Bros Inc.| Form 10-Q | 1

Dutch Bros Inc.| Form 10-Q | 1

Forward-Looking Statements

Certain statements in this Form 10-Q, including those in the section titled “Management’s Discussion and Analysis,” that are not historical facts, including those regarding the impact of inflation, increased minimum wages, interest rate risk, and general macroeconomic conditions on our results of operations, supply chain, or liquidity, the potential impact of actions we have taken to mitigate the impact of unforeseen circumstances, taxes and tax rates, our expectations regarding the number of new shops we may open, anticipated future revenues and earnings, consumer demand, and our expectations to generate positive cash flow in the foreseeable future are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. We use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “predict,” “project,” “should,” “target,” and similar terms and phrases, including references to assumptions, to identify forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These forward-looking statements are based on information available to us as of the date of this Form 10-Q, and we assume no obligation to update these forward-looking statements. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those described in the statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Form 10-Q.

You should read the following unaudited condensed consolidated financial statements and the related notes in this Form 10-Q together with our analysis and discussion of our financial condition and results of operations and other financial information included elsewhere in this Form 10-Q. You should also read our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 13, 2025 (2024 Form 10-K).

While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect actual results. You should evaluate all forward-looking statements made in this report in the context of the factors that could cause outcomes to differ materially from expectations. These factors include, but are not limited to, those listed under the “Risk Factors” section of this Form 10-Q, and in our 2024 Form 10-K, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

Website Disclosure

We use our website as a distribution channel of material company information. Financial and other important information regarding our company is routinely posted on and accessible through our website at https://investors.dutchbros.com. In addition, you may automatically receive email alerts and other information about our company when you subscribe your email address by visiting the “Investor Email Alerts” section of our investor relations page at https://investors.dutchbros.com/resources. The information on our website is not incorporated herein or otherwise a part of this Form 10-Q.

Dutch Bros Inc.| Form 10-Q | 2

Dutch Bros Inc.| Form 10-Q | 2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

DUTCH BROS INC.

Condensed Consolidated Balance Sheets

| | | | | | | | | | | | | | |

| | |

(in thousands, except per share amounts; unaudited) | | September 30,

2025 | | December 31,

2024 |

Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 267,195 | | | $ | 293,354 | |

| Accounts receivable, net | | 14,303 | | | 10,598 | |

| Inventories, net | | 45,295 | | | 36,488 | |

| Prepaid expenses and other current assets | | 14,345 | | | 17,501 | |

| Total current assets | | 341,138 | | | 357,941 | |

| Property and equipment, net | | 789,333 | | | 683,971 | |

| Finance lease right-of-use assets, net | | 393,406 | | | 374,623 | |

| Operating lease right-of-use assets, net | | 415,021 | | | 315,256 | |

| Intangibles, net | | 1,762 | | | 2,947 | |

| Goodwill | | 21,629 | | | 21,629 | |

| Deferred income tax assets, net | | 949,663 | | | 742,126 | |

| Other long-term assets | | 10,045 | | | 2,592 | |

| Total assets | | $ | 2,921,997 | | | $ | 2,501,085 | |

Liabilities and Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 38,242 | | | $ | 32,225 | |

Accrued compensation and benefits | | 49,256 | | | 49,778 | |

Other accrued liabilities | | 39,946 | | | 26,516 | |

| Other current liabilities | | 14,421 | | | 7,067 | |

| Deferred revenue | | 45,606 | | | 42,868 | |

| | | | |

| Current portion of tax receivable agreements liability | | 514 | | | 71 | |

| Current portion of finance lease liabilities | | 15,364 | | | 13,256 | |

| Current portion of operating lease liabilities | | 17,228 | | | 13,979 | |

| Current portion of long-term debt | | 3,879 | | | 17,311 | |

| Total current liabilities | | 224,456 | | | 203,071 | |

| Deferred revenue, net of current portion | | 7,104 | | | 8,015 | |

| Finance lease liabilities, net of current portion | | 390,707 | | | 369,297 | |

| Operating lease liabilities, net of current portion | | 413,402 | | | 309,311 | |

| | | | |

| Long-term debt, net of current portion | | 195,997 | | | 219,755 | |

Tax receivable agreements liability, net of current portion | | 825,302 | | | 627,763 | |

| Other long-term liabilities | | — | | | 8 | |

| Total liabilities | | 2,056,968 | | | 1,737,220 | |

Commitments and contingencies (Note 15) | | | | |

Dutch Bros Inc.| Form 10-Q | 3

Dutch Bros Inc.| Form 10-Q | 3

DUTCH BROS INC.

Condensed Consolidated Balance Sheets (continued)

| | | | | | | | | | | | | | |

| | |

(in thousands, except per share amounts; unaudited) | | September 30,

2025 | | December 31,

2024 |

Preferred stock, $0.00001 par value per share - 20,000 shares authorized; zero shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively | | — | | | — | |

Class A common stock, $0.00001 par value per share - 400,000 shares authorized; 127,031 and 115,432 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively | | 1 | | | 1 | |

Class B common stock, $0.00001 par value per share - 144,000 shares authorized; 35,211 and 35,227 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively | | — | | | — | |

Class C common stock, $0.00001 par value per share - 105,000 shares authorized; 2,280 and 3,545 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively | | — | | | — | |

| | | | |

Additional paid-in capital | | 578,256 | | | 517,074 | |

| Accumulated other comprehensive income | | 162 | | | 628 | |

Retained earnings | | 78,138 | | | 19,666 | |

| Total stockholders' equity attributable to Dutch Bros Inc. | | 656,557 | | | 537,369 | |

| Non-controlling interests | | 208,472 | | | 226,496 | |

| Total equity | | 865,029 | | | 763,865 | |

| Total liabilities and equity | | $ | 2,921,997 | | | $ | 2,501,085 | |

See accompanying notes to condensed consolidated financial statements.

Dutch Bros Inc.| Form 10-Q | 4

Dutch Bros Inc.| Form 10-Q | 4

DUTCH BROS INC.

Condensed Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

(in thousands, except per share amounts; unaudited) | | 2025 | | 2024 | | 2025 | | 2024 | | |

| Revenues | | | | | | | | | | |

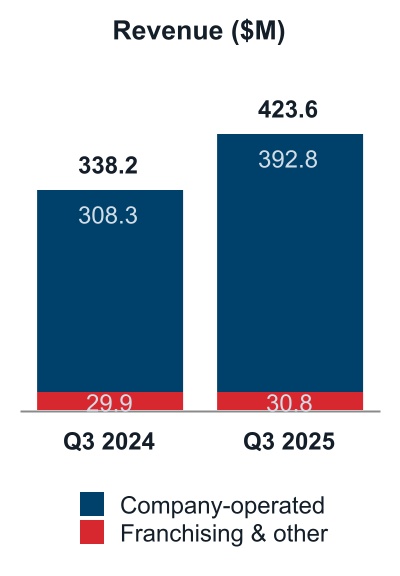

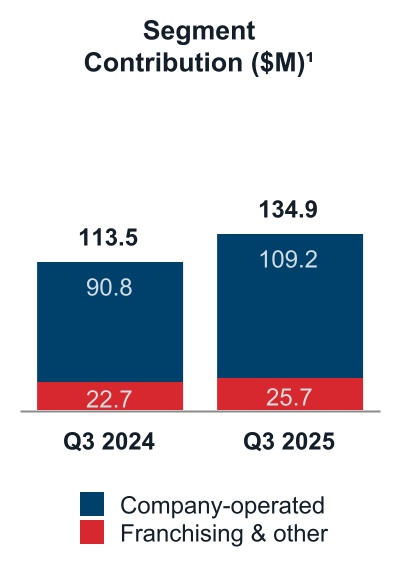

| Company-operated shops | | $ | 392,833 | | | $ | 308,295 | | | $ | 1,099,754 | | | $ | 851,648 | | | |

| Franchising and other | | 30,751 | | | 29,917 | | | 94,795 | | | 86,581 | | | |

| Total revenues | | 423,584 | | | 338,212 | | | 1,194,549 | | | 938,229 | | | |

| | | | | | | | | | |

Costs and Expenses | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cost of sales | | 316,805 | | | 248,161 | | | 877,733 | | | 686,048 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Selling, general and administrative | | 65,289 | | | 57,536 | | | 189,595 | | | 161,866 | | | |

| Total costs and expenses | | 382,094 | | | 305,697 | | | 1,067,328 | | | 847,914 | | | |

| | | | | | | | | | |

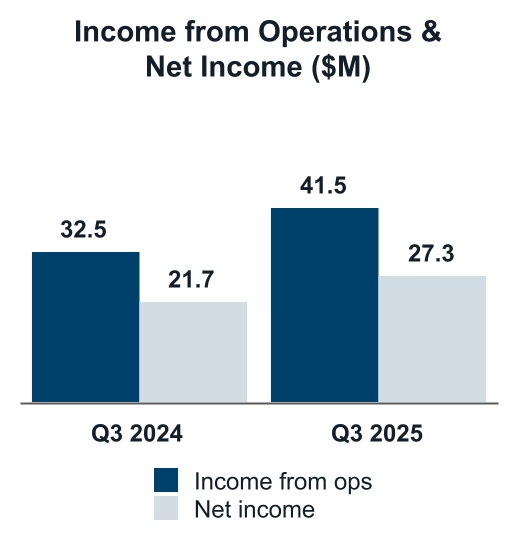

| Income from operations | | 41,490 | | | 32,515 | | | 127,221 | | | 90,315 | | | |

| | | | | | | | | | |

| Other expense | | | | | | | | | | |

| Interest expense, net | | (6,695) | | | (6,869) | | | (20,886) | | | (20,259) | | | |

| Other income (expense), net | | 149 | | | 764 | | | (1,852) | | | 7,357 | | | |

| Total other expense | | (6,546) | | | (6,105) | | | (22,738) | | | (12,902) | | | |

| | | | | | | | | | |

| Income before income taxes | | 34,944 | | | 26,410 | | | 104,483 | | | 77,413 | | | |

| Income tax expense | | 7,661 | | | 4,698 | | | 16,363 | | | 17,330 | | | |

| Net income | | $ | 27,283 | | | $ | 21,712 | | | $ | 88,120 | | | $ | 60,083 | | | |

| | | | | | | | | | |

Less: Net income attributable to non-controlling interests | | 9,788 | | | 9,068 | | | 29,648 | | | 28,437 | | | |

Net income attributable to Dutch Bros Inc. | | $ | 17,495 | | | $ | 12,644 | | | $ | 58,472 | | | $ | 31,646 | | | |

Net income per share of Class A and Class D common stock: | | | | | | | | | | |

| Basic | | $ | 0.14 | | | $ | 0.11 | | | $ | 0.47 | | | $ | 0.32 | | | |

| Diluted | | $ | 0.14 | | | $ | 0.11 | | | $ | 0.47 | | | $ | 0.32 | | | |

Weighted-average shares of Class A and Class D common stock outstanding: | | | | | | | | | | |

| Basic | | 126,986 | | | 113,819 | | | 124,751 | | | 99,756 | | | |

| Diluted | | 127,379 | | | 114,252 | | | 125,204 | | | 100,070 | | | |

See accompanying notes to condensed consolidated financial statements.

Dutch Bros Inc.| Form 10-Q | 5

Dutch Bros Inc.| Form 10-Q | 5

DUTCH BROS INC.

Condensed Consolidated Statements of Comprehensive Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

(in thousands; unaudited) | | 2025 | | 2024 | | 2025 | | 2024 | | |

| Net income | | $ | 27,283 | | | $ | 21,712 | | | $ | 88,120 | | | $ | 60,083 | | | |

| Other comprehensive loss: | | | | | | | | | | |

Unrealized loss on derivative securities, effective portion, net of income tax benefit of $(40), $(247), $(187) and $(183), respectively | | (187) | | | (1,324) | | | (777) | | | (537) | | | |

| Comprehensive income | | 27,096 | | | 20,388 | | | 87,343 | | | 59,546 | | | |

| | | | | | | | | | |

| Less: comprehensive income attributable to non-controlling interests | | 9,723 | | | 8,506 | | | 29,337 | | | 28,134 | | | |

| Comprehensive income attributable to Dutch Bros Inc. | | $ | 17,373 | | | $ | 11,882 | | | $ | 58,006 | | | $ | 31,412 | | | |

See accompanying notes to condensed consolidated financial statements.

Dutch Bros Inc.| Form 10-Q | 6

Dutch Bros Inc.| Form 10-Q | 6

DUTCH BROS INC.

Condensed Consolidated Statements of Stockholders’ Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2025 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Dutch Bros Inc. Stockholders’ Equity | | | | |

| | | | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | | | | | | | | | | | |

| (in thousands; unaudited) | | | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | | | | Additional Paid-in-Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Non-Controlling Interests | | Total Equity |

| Balance, June 30, 2025 | | | | 126,932 | | | $ | 1 | | | 35,211 | | | $ | — | | | 2,347 | | | $ | — | | | | | | | $ | 575,240 | | | $ | 284 | | | $ | 60,643 | | | $ | 197,761 | | | $ | 833,929 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | — | | | 17,495 | | | 9,788 | | | 27,283 | |

Unrealized loss on derivative securities, effective portion, net of income tax benefit of $40 | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | (122) | | | — | | | (65) | | | (187) | |

| Equity-based compensation expense | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 3,326 | | | — | | | — | | | 1,322 | | | 4,648 | |

| Issuance of Class A common stock pursuant to vesting of equity awards | | | | 32 | | | — | | | — | | | — | | | — | | | — | | | | | | | (728) | | | — | | | — | | | (289) | | | (1,017) | |

| Issuance of Class A common stock for conversion of Dutch Bros OpCo Class A common units, and for surrender and cancellation of Class C common stock, pursuant to exchange transactions | | | | 67 | | | — | | | — | | | — | | | (67) | | | — | | | | | | | — | | | — | | | — | | | — | | | — | |

| Effect of equity transactions of Dutch Bros OpCo Class A common units | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 45 | | | — | | | — | | | (45) | | | — | |

| Impacts of Tax Receivable Agreements | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 373 | | | — | | | — | | | — | | | 373 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, September 30, 2025 | | | | 127,031 | | | $ | 1 | | | 35,211 | | | $ | — | | | 2,280 | | | $ | — | | | | | | | $ | 578,256 | | | $ | 162 | | | $ | 78,138 | | | $ | 208,472 | | | $ | 865,029 | |

Dutch Bros Inc.| Form 10-Q | 7

Dutch Bros Inc.| Form 10-Q | 7

DUTCH BROS INC.

Condensed Consolidated Statements of Stockholders’ Equity (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2025 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Dutch Bros Inc. Stockholders’ Equity | | | | |

| | | | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | | | | | | | | | | | |

| (in thousands; unaudited) | | | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | | | | Additional Paid-in-Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Non-Controlling Interests | | Total Equity |

| Balance, December 31, 2024 | | | | 115,432 | | | $ | 1 | | | 35,227 | | | $ | — | | | 3,545 | | | $ | — | | | | | | | $ | 517,074 | | | $ | 628 | | | $ | 19,666 | | | $ | 226,496 | | | $ | 763,865 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | — | | | 58,472 | | | 29,648 | | | 88,120 | |

Unrealized loss on derivative securities, effective portion, net of income tax benefit of $187 | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | (108) | | | (466) | | | — | | | (311) | | | (885) | |

| Equity-based compensation expense | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 9,567 | | | — | | | — | | | 3,946 | | | 13,513 | |

| Issuance of Class A common stock pursuant to vesting of equity awards, net of stock withheld for tax withholding obligations | | | | 335 | | | — | | | — | | | — | | | — | | | — | | | | | | | (8,499) | | | — | | | — | | | (3,536) | | | (12,035) | |

Issuance of Class A common stock for conversion of Dutch Bros OpCo Class A common units, and for surrender and cancellation of Class C common stock, pursuant to exchange transactions | | | | 11,264 | | | — | | | — | | | — | | | (1,264) | | | — | | | | | | | — | | | — | | | — | | | — | | | — | |

| Effect of equity transactions of Dutch Bros OpCo Class A common units | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 40,904 | | | — | | | — | | | (40,904) | | | — | |

| Impacts of Tax Receivable Agreements | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 19,318 | | | — | | | — | | | — | | | 19,318 | |

| Reverse Split transaction pursuant to OpCo Recapitalization | | | | — | | | — | | | (16) | | | — | | | (1) | | | — | | | | | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions paid to non-controlling interest holders | | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | (6,867) | | | (6,867) | |

| Balance, September 30, 2025 | | | | 127,031 | | | $ | 1 | | | 35,211 | | | $ | — | | | 2,280 | | | $ | — | | | | | | | $ | 578,256 | | | $ | 162 | | | $ | 78,138 | | | $ | 208,472 | | | $ | 865,029 | |

Dutch Bros Inc.| Form 10-Q | 8

Dutch Bros Inc.| Form 10-Q | 8

DUTCH BROS INC.

Condensed Consolidated Statements of Stockholders’ Equity (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dutch Bros Inc. Stockholders’ Equity | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | | | | | | | | | | | |

| (in thousands; unaudited) | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | | | | | Additional Paid-in-Capital | | Accumulated Other Comprehensive Income | | Retained Earnings (Accumulated Deficit) | | Non-Controlling Interests | | Total Equity |

| Balance, June 30, 2024 | | 113,817 | | | $ | 1 | | | 35,227 | | | $ | — | | | 5,142 | | | $ | — | | | | | | | $ | 504,657 | | | $ | 1,072 | | | $ | 3,410 | | | $ | 220,672 | | | $ | 729,812 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | — | | | 12,644 | | | 9,068 | | | 21,712 | |

Unrealized loss on derivative securities, effective portion, net of income tax benefit of $247 | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | (762) | | | — | | | (562) | | | (1,324) | |

Equity-based compensation expense | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 1,902 | | | — | | | — | | | 1,059 | | | 2,961 | |

| Issuance of Class A common stock pursuant to vesting of equity awards, net of stock withheld for tax withholding obligations | | 6 | | | — | | | — | | | — | | | — | | | — | | | | | | | (36) | | | — | | | — | | | (21) | | | (57) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Effect of equity transactions of Dutch Bros OpCo Class A common units | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 8 | | | — | | | — | | | (8) | | | — | |

| Tax impacts of other equity-related transactions | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | 254 | | | — | | | — | | | — | | | 254 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions paid to non-controlling interest holders | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | (687) | | | (687) | |

| Balance, September 30, 2024 | | 113,823 | | | $ | 1 | | | 35,227 | | | $ | — | | | 5,142 | | | $ | — | | | | | | | $ | 506,785 | | | $ | 310 | | | $ | 16,054 | | | $ | 229,521 | | | $ | 752,671 | |

Dutch Bros Inc.| Form 10-Q | 9

Dutch Bros Inc.| Form 10-Q | 9

DUTCH BROS INC.

Condensed Consolidated Statements of Stockholders’ Equity (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Dutch Bros Inc. Stockholders’ Equity | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Class D Common Stock | | | | | | | | | | |

| (in thousands; unaudited) | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Additional Paid-in-Capital | | Accumulated Other Comprehensive Income | | Retained Earnings (Accumulated Deficit) | | Non-Controlling Interests | | Total Equity |

| Balance, December 31, 2023 | | 69,958 | | | $ | 1 | | | 60,629 | | | $ | 1 | | | 35,864 | | | $ | — | | | 10,669 | | | $ | — | | | $ | 379,391 | | | $ | 544 | | | $ | (15,592) | | | $ | 311,576 | | | $ | 675,921 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 31,646 | | | 28,437 | | | 60,083 | |

Unrealized loss on derivative securities, effective portion, net of income tax benefit of $183 | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (328) | | | (234) | | | — | | | (303) | | | (865) | |

Equity-based compensation expense | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,866 | | | — | | | — | | | 3,354 | | | 8,220 | |

Issuance of Class A common stock pursuant to vesting of equity awards, net of stock withheld for tax withholding obligations | | 71 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,831 | | | — | | | — | | | (2,763) | | | (932) | |

| Issuance of Class A common stock in exchange for surrender and cancellation of Class D common stock, and conversion of Dutch Bros OpCo Class A common units for surrender and cancellation of Class B and C common stock, pursuant to exchange transactions | | 43,794 | | | — | | | (2,402) | | | — | | | (30,722) | | | — | | | (10,669) | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Effect of exchange transactions of Dutch Bros OpCo Class A common units | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 110,093 | | | — | | | — | | | (110,093) | | | — | |

| Tax impacts of other equity-related transactions | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 254 | | | — | | | — | | | — | | | 254 | |

Impacts of Tax Receivable Agreements | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 10,678 | | | — | | | — | | | — | | | 10,678 | |

| Class B common stock decoupled from Dutch Bros OpCo Class A common units, surrendered and cancelled | | — | | | — | | | (23,000) | | | (1) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1) | |

Distributions paid to non-controlling interest holders | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (687) | | | (687) | |

| Balance, September 30, 2024 | | 113,823 | | | $ | 1 | | | 35,227 | | | $ | — | | | 5,142 | | | $ | — | | | — | | | $ | — | | | $ | 506,785 | | | $ | 310 | | | $ | 16,054 | | | $ | 229,521 | | | $ | 752,671 | |

See accompanying notes to condensed consolidated financial statements.

Dutch Bros Inc.| Form 10-Q | 10

Dutch Bros Inc.| Form 10-Q | 10

DUTCH BROS INC.

Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

(in thousands; unaudited) | | 2025 | | 2024 | | |

| Cash flows from operating activities: | | | | | | |

| Net income | | $ | 88,120 | | | $ | 60,083 | | | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | | 83,389 | | | 67,484 | | | |

| Non-cash interest expense | | 635 | | | 834 | | | |

| | | | | | |

(Gain) loss on disposal of assets | | 115 | | | (1,373) | | | |

| Loss on extinguishment of debt | | 809 | | | — | | | |

| Equity-based compensation | | 13,513 | | | 8,220 | | | |

| Deferred income taxes | | 14,649 | | | 15,335 | | | |

Remeasurement gain on TRAs | | — | | | (5,687) | | | |

| Non-cash operating lease cost | | 14,959 | | | 11,334 | | | |

Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable, net | | (3,705) | | | (1,238) | | | |

| Inventories, net | | (8,807) | | | 8,572 | | | |

| Prepaid expenses and other current assets | | 2,800 | | | 2,894 | | | |

| Other long-term assets | | (9,541) | | | (729) | | | |

| Accounts payable | | 1,131 | | | 3,236 | | | |

Accrued compensation and benefits | | (522) | | | 7,701 | | | |

Other accrued liabilities | | 11,771 | | | 9,804 | | | |

| Other current liabilities | | 7,354 | | | (461) | | | |

| Deferred revenue | | 1,827 | | | 5,080 | | | |

| | | | | | |

| Other long-term liabilities | | (8) | | | — | | | |

| Operating lease liabilities | | (2,583) | | | (6,894) | | | |

| Net cash provided by operating activities | | 215,906 | | | 184,195 | | | |

| Cash flows from investing activities: | | | | | | |

| Purchases of property and equipment | | (169,967) | | | (178,969) | | | |

| Proceeds from disposal of fixed assets | | 31 | | | 9,606 | | | |

| | | | | | |

| Net cash used in investing activities | | (169,936) | | | (169,363) | | | |

| Cash flows from financing activities: | | | | | | |

| | | | | | |

| | | | | | |

| Payments on finance lease liabilities | | (11,266) | | | (7,726) | | | |

| | | | | | |

| Proceeds from long-term debt | | 250,000 | | | 150,000 | | | |

| Payments on long-term debt | | (285,716) | | | (7,898) | | | |

| Payments of debt issuance costs | | (1,547) | | | — | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Tax withholding payments upon vesting of equity awards | | (12,035) | | | (932) | | | |

Distributions to non-controlling interest holders | | (6,867) | | | (687) | | | |

| Payments under tax receivable agreements | | (4,698) | | | — | | | |

| Net cash provided by (used in) financing activities | | (72,129) | | | 132,757 | | | |

| Net increase (decrease) in cash and cash equivalents | | (26,159) | | | 147,589 | | | |

| Cash and cash equivalents, beginning of period | | 293,354 | | | 133,545 | | | |

| Cash and cash equivalents, end of period | | $ | 267,195 | | | $ | 281,134 | | | |

Dutch Bros Inc.| Form 10-Q | 11

Dutch Bros Inc.| Form 10-Q | 11

DUTCH BROS INC.

Condensed Consolidated Statements of Cash Flows (continued)

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

(in thousands; unaudited) | | 2025 | | 2024 | | |

| Supplemental disclosure of cash flow information | | | | | | |

Interest paid | | $ | 29,196 | | | $ | 29,125 | | | |

Income taxes paid | | 900 | | | 1,824 | | | |

| Supplemental disclosure of noncash investing and financing activities | | | | | | |

| | | | | | |

| Additions of property and equipment accrued as of end of period | | 19,180 | | | 13,155 | | | |

| | | | | | |

| | | | | | |

See accompanying notes to condensed consolidated financial statements.

Dutch Bros Inc.| Form 10-Q | 12

Dutch Bros Inc.| Form 10-Q | 12

DUTCH BROS INC.

Index for Notes to Condensed Consolidated Financial Statements

| | | | | | | | |

| Note | | Page |

| NOTE 1 — Organization and Background | | |

| NOTE 2 — Basis of Presentation and Summary of Significant Accounting Policies | | |

| NOTE 3 — Revenue Recognition | | |

| NOTE 4 — Organization Realignment and Restructurings | | |

| | |

| NOTE 5 — Inventories | | |

| NOTE 6 — Property and Equipment | | |

| NOTE 7 — Intangible Assets | | |

| NOTE 8 — Leases | | |

| NOTE 9 — Debt | | |

| | |

| NOTE 10 — Derivative Financial Instruments | | |

| | |

| NOTE 11 — Income Taxes | | |

| NOTE 12 — Equity-Based Compensation | | |

| | |

| NOTE 13 — Non-Controlling Interests | | |

| NOTE 14 — Income Per Share | | |

| NOTE 15 — Commitments and Contingencies | | |

| NOTE 16 — Related Party Transactions | | |

| NOTE 17 — Segment Reporting | | |

| | |

Dutch Bros Inc.| Form 10-Q | 13

Dutch Bros Inc.| Form 10-Q | 13

DUTCH BROS INC.

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1 — Organization and Background

Business

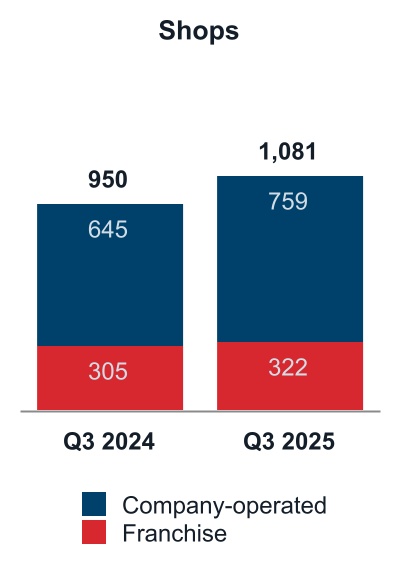

Dutch Bros Inc., a Delaware corporation, together with its subsidiaries (the Company, we, us, or our, collectively) is in the business of operating and franchising drive-thru coffee shops as well as the wholesale and distribution of coffee, coffee-related products, and accessories. As of September 30, 2025, there were 1,081 shops in operation in 24 U.S. states, of which 759 were company-operated and 322 were franchised.

Organization

Dutch Bros Inc. is the sole managing member of Dutch Bros OpCo and operates and controls all of the business and affairs of Dutch Bros OpCo. As a result, Dutch Bros Inc. consolidates the financial results of Dutch Bros OpCo and reports a non-controlling interest representing the economic interest in Dutch Bros OpCo held by the other members of Dutch Bros OpCo. The Company’s fiscal year end is December 31. As of September 30, 2025, Dutch Bros Inc. held 100.0% of the voting interest and 71.6% of the economic interest of Dutch Bros OpCo. The Continuing Members held no voting interest and the remaining 28.4% of the economic interest of Dutch Bros OpCo.

Dutch Bros OpCo Recapitalization

From time to time, Dutch Bros Inc. receives cash distributions from Dutch Bros OpCo pursuant to the OpCo LLC Agreement. Dutch Bros Inc. may then loan any cash in excess of its liabilities back to Dutch Bros OpCo for operations, under the open-ended balance Subordinated Intercompany Note, between Dutch Bros OpCo and Dutch Bros Inc., dated February 28, 2022 (the Intercompany Note).

On February 7, 2025, Dutch Bros Inc. entered into a subscription agreement with Dutch Bros OpCo, pursuant to which Dutch Bros OpCo issued 51,942 newly authorized Dutch Bros OpCo Class A common units to Dutch Bros Inc. in exchange for satisfaction of the outstanding balance of the Intercompany Note, which at that time was approximately $3.5 million.

In accordance with the OpCo LLC Agreement, all outstanding Dutch Bros OpCo Class A common units were then recapitalized through a reverse unit split (the Reverse Split) in order to maintain a one-to-one ratio between the number of Dutch Bros OpCo Class A common units owned by Dutch Bros Inc. and the number of outstanding shares of Class A common stock. Consequently, 15,734 outstanding shares of Class B common stock, and 1,220 outstanding shares of Class C common stock, that were paired with Dutch Bros OpCo Class A common units eliminated as a result of the Reverse Split, were cancelled.

NOTE 2 — Basis of Presentation and Summary of Significant Accounting Policies

Financial Statements Presentation

Our condensed consolidated financial statements as of September 30, 2025 and for the three and nine months ended September 30, 2025 and 2024 have been prepared in accordance with GAAP and pursuant to the rules and regulations of the SEC, consistent in all material respects with those applied in the 2024 Form 10-K and as updated by this Form 10-Q.

We have made estimates and judgments affecting the amounts reported in its condensed consolidated financial statements and the accompanying notes. Although management bases its estimates on historical experience and assumptions that are believed to be reasonable under the circumstances, actual results could differ from those estimates. This report should be read in conjunction with the consolidated financial statements in the 2024 Form 10-K that includes additional information on accounting estimates, policies, and the methods and assumptions used in its estimates.

Dutch Bros Inc.| Form 10-Q | 14

Dutch Bros Inc.| Form 10-Q | 14

In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly our consolidated financial statements for the periods presented. Operating results for the three and nine months ended September 30, 2025 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2025.

Significant Accounting Policies Updates

There have been no material updates to our significant accounting policies during the nine months ended September 30, 2025 from those previously reported in the 2024 Form 10-K.

Recently Issued Accounting Standards

In September 2025, the FASB issued ASU 2025-06, Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40): Targeted Improvements to the Accounting for Internal-Use Software. The intent of this ASU is to address businesses’ shift from using prescriptive and sequential software development methods to using incremental and iterative development methods. The amendments in this ASU remove all references to prescriptive and sequential software development stages, and also provides criteria for when an entity is required to start capitalizing software costs. ASU 2025-06 is effective for all entities' annual reporting periods beginning after December 15, 2027, and interim periods within those annual reporting periods using a prospective transition, modified transition or retrospective transition approach. Early adoption is permitted as of the beginning of an annual reporting period. We will assess potential impacts of this standard on our disclosures in future periods.

In November 2024, the FASB issued ASU No. 2024-03, Income Statement - Reporting Comprehensive Income - Expense Disaggregation Disclosures (Subtopic 220-40). The intent of this ASU is to improve public entity financial footnote disclosures around types of expenses in commonly presented expense categories (i.e., cost of sales; selling, general, and administrative expense; and research and development expense). The amendments in this ASU do not change or remove current expense disclosure requirements, but rather 1) impact where this information appears in the notes to the consolidated financial statements and 2) add additional disclosure requirements for certain expense line items appearing on the face of our consolidated statements of operations. ASU 2024-03, as amended, is effective for annual reporting periods beginning after December 15, 2026 and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. We are currently assessing potential impacts of this standard on our business processes and future disclosures.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The amendments in this update are intended to enhance the transparency and decision usefulness of income tax disclosures, primarily through improvements to the rate reconciliation and income taxes paid information, specifically requiring (1) consistent categories and greater disaggregation of information in the rate reconciliation, and (2) income taxes paid disaggregation by jurisdiction. These amendments are effective for public business entities' annual periods beginning after December 15, 2024 and interim periods within fiscal years beginning after December 15, 2025, and should be applied on a prospective basis. Early adoption is permitted for annual financial statements that have not yet been issued. We expect to provide additional detail and disclosures under the new guidance in our Form 10-K to be filed for the year ending December 31, 2025.

Dutch Bros Inc.| Form 10-Q | 15

Dutch Bros Inc.| Form 10-Q | 15

NOTE 3 — Revenue Recognition

Revenue

The following table disaggregates revenue by major component:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 | | 2025 | | 2024 | | |

| Company-operated shops | | $ | 392,833 | | | $ | 308,295 | | | $ | 1,099,754 | | | $ | 851,648 | | | |

| Franchising | | 29,122 | | | 28,694 | | | 89,787 | | | 82,545 | | | |

| Other | | 1,629 | | | 1,223 | | | 5,008 | | | 4,036 | | | |

| Total revenues | | $ | 423,584 | | | $ | 338,212 | | | $ | 1,194,549 | | | $ | 938,229 | | | |

Deferred Revenue

Components of our deferred revenue liability are as follows:

| | | | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2025 | | December 31, 2024 | | |

Gift card and loyalty programs | | $ | 50,226 | | | $ | 48,265 | | | |

Other deferred revenue, net 1 | | 2,484 | | | 2,618 | | | |

| | | | | | |

| Total deferred revenue | | $ | 52,710 | | | $ | 50,883 | | | |

| | | | | | |

| | | | | | |

_______________

1 Other deferred revenue, net, are primarily unearned franchise fees.

Deferred revenue activity was as follows:

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 |

| Beginning balance | | $ | 50,883 | | | $ | 37,025 | |

Revenue deferred 1 | | 405,087 | | | 312,963 | |

Revenue recognized 2 | | (403,126) | | | (308,012) | |

| | | | |

| | | | |

Other deferred revenue, net | | (134) | | | 129 | |

| Ending balance | | 52,710 | | | 42,105 | |

| Less: current portion | | (45,606) | | | (35,738) | |

| Deferred revenue, net of current portion | | $ | 7,104 | | | $ | 6,367 | |

_______________

1 Revenue deferred includes gift card activations, loyalty app cash loads and loyalty points and rewards earned.

2 Revenue recognized includes redemptions of gift cards, loyalty app and loyalty rewards, and breakage.

Revenue recognized during the three and nine months ended September 30, 2025 and 2024, respectively, that was included in the respective deferred revenue liability balances at the beginning of the period are shown below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 | | 2025 | | 2024 | | |

Gift card redemptions 1 | | $ | 756 | | | $ | 637 | | | $ | 7,163 | | | $ | 5,737 | | | |

| Earned franchise fees | | 110 | | | 112 | | | 337 | | | 336 | | | |

_____________________

1 Amounts exclude cash loads and transactions related to our loyalty rewards program.

Dutch Bros Inc.| Form 10-Q | 16

Dutch Bros Inc.| Form 10-Q | 16

Future recognition of initial unearned franchise fees as of September 30, 2025 is as follows:

| | | | | | | | |

| (in thousands) | | |

| Remainder of 2025 | | $ | 111 | |

| 2026 | | 418 | |

| 2027 | | 373 | |

| 2028 | | 324 | |

| 2029 | | 279 | |

| | |

| Thereafter | | 979 | |

| Total | | $ | 2,484 | |

NOTE 4 — Organization Realignment and Restructurings

On January 29, 2024, our Board of Directors approved an organizational realignment and restructuring plan to expand support operations at our Phoenix, Arizona office. As part of this large-scale initiative, we relocated certain support center staff from our Grants Pass, Oregon headquarters to the Phoenix office. As of March 31, 2025, this initiative was substantially complete, including the build-out and move into our new Phoenix office location. We incurred total aggregate charges of approximately $19.1 million related to this initiative, consisting of (i) approximately $16.6 million in employee-related costs, including relocation, retention and transition costs, termination benefits, and duplicate transition wages and benefits; and (ii) approximately $2.5 million in other costs, including the donation of a building, consulting fees, and duplicate rent. Substantially all of the charges have resulted in current or expected future cash expenditures.

On May 13, 2025, our Board of Directors approved the plan for an additional restructuring program, primarily related to the relocation and streamlining of our remaining back-office operations from our former Grants Pass, Oregon headquarters to our newly-designated Phoenix office corporate headquarters. Affected employees were either offered an opportunity to relocate and continue employment in the Phoenix office or were offered a severance package; these communications were largely completed by May 20, 2025. For this program, we expect to incur total aggregate charges of approximately $8.5 million, consisting of (i) employee-related costs, including relocation, retention and transition costs, termination benefits, and duplicate transition wages and benefits; and (ii) other costs, including consulting fees. Substantially all of the estimated charges are expected to result in current and future cash expenditures. We expect that by December 31, 2025, substantially all of our headquarters employees will be located in our Phoenix office.

During the three and nine months ended September 30, 2025 and 2024, we recorded restructuring charges for employee-related and other costs in selling, general and administrative expenses on the condensed consolidated statements of operations as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 | | 2025 | | 2024 |

Relocation and travel costs | | $ | 1,122 | | | $ | 2,217 | | | $ | 1,903 | | | $ | 9,710 | |

Termination benefits | | 1,362 | | | 1,781 | | | 3,324 | | | 3,577 | |

Total employee-related costs | | 2,484 | | | 3,998 | | | 5,227 | | | 13,287 | |

| | | | | | | | |

Duplicate rent | | — | | | 193 | | | 244 | | | 223 | |

Consulting | | 166 | | | — | | | 170 | | | — | |

| Total other costs | | 166 | | | 193 | | | 414 | | | 223 | |

| Total restructuring costs incurred | | $ | 2,650 | | | $ | 4,191 | | | $ | 5,641 | | | $ | 13,510 | |

Dutch Bros Inc.| Form 10-Q | 17

Dutch Bros Inc.| Form 10-Q | 17

As of September 30, 2025 and December 31, 2024, the accruals for corporate restructuring costs are included in accounts payable, accrued compensation and benefits, and accrued expenses on the condensed consolidated balance sheets. The following table summarizes the activity for the restructuring liabilities during the nine months ended September 30, 2025:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Liability, December 31, 2024 | | Charges | | Cash Payments | | | | Liability, September 30, 2025 |

Relocation and travel costs | | $ | 698 | | | $ | 1,903 | | | $ | (2,545) | | | | | $ | 56 | |

Termination benefits | | 2,028 | | | 3,324 | | | (3,447) | | | | | 1,905 | |

| Total employee-related costs | | 2,726 | | | 5,227 | | | (5,992) | | | | | 1,961 | |

Duplicate rent | | — | | | 244 | | | (244) | | | | | — | |

Consulting | | 55 | | | 170 | | | (191) | | | | | 34 | |

| | | | | | | | | | |

Total other costs | | 55 | | | 414 | | | (435) | | | | | 34 | |

| Totals | | $ | 2,781 | | | $ | 5,641 | | | $ | (6,427) | | | | | $ | 1,995 | |

NOTE 5 — Inventories

Inventories, net consist of the following: | | | | | | | | | | | | | | |

| | |

| (in thousands) | | September 30, 2025 | | December 31, 2024 |

| Raw materials | | $ | 21,835 | | | $ | 14,594 | |

| Finished goods | | 23,460 | | | 21,894 | |

| Total inventories | | $ | 45,295 | | | $ | 36,488 | |

NOTE 6 — Property and Equipment

Property and equipment, net consists of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

(dollars in thousands) | | Useful Life (Years) | | September 30, 2025 | | December 31, 2024 |

| Software | | 3 | | $ | 13,676 | | | $ | 10,666 | |

| | | | | | | | |

| Equipment and fixtures | | 3 | — | 7 | | 254,859 | | | 229,307 | |

| Leasehold improvements | | 5 | — | 15 | | 63,864 | | | 54,535 | |

| Buildings | | 10 | — | 39 | | 574,221 | | | 487,060 | |

| Land | | N/A | | 7,022 | | | 7,022 | |

| | | | | | |

Construction-in-progress 1 | | N/A | | 113,571 | | | 71,951 | |

| Property and equipment, gross | | | | | | 1,027,213 | | | 860,541 | |

| Less: accumulated depreciation | | | | | | (237,880) | | | (176,570) | |

| Property and equipment, net | | | | | | $ | 789,333 | | | $ | 683,971 | |

_______________

1 Construction-in-progress primarily consists of construction and equipment costs for new and existing shops.

Dutch Bros Inc.| Form 10-Q | 18

Dutch Bros Inc.| Form 10-Q | 18

Depreciation expense included in our condensed consolidated statements of operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 | | 2025 | | 2024 | | |

| Cost of sales | | $ | 20,901 | | | $ | 16,556 | | | $ | 59,808 | | | $ | 45,579 | | | |

Selling, general, and administrative | | 914 | | | 373 | | | 2,102 | | | 841 | | | |

| Total depreciation expense | | $ | 21,815 | | | $ | 16,929 | | | $ | 61,910 | | | $ | 46,420 | | | |

NOTE 7 — Intangible Assets

The details of the intangible assets are as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

(dollars in thousands) | | | | Weighted-average amortization period (in years) | | September 30, 2025 | | December 31, 2024 |

| Reacquired franchise rights | | | | 3.0 | | $ | 27,049 | | | $ | 27,049 | |

| Less: accumulated amortization | | | | | | (25,287) | | | (24,102) | |

| Intangibles, net | | | | | | $ | 1,762 | | | $ | 2,947 | |

Amortization expense included in our condensed consolidated statements of operations was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | 2025 | | 2024 | | 2025 | | 2024 | | |

| Cost of sales | | $ | 272 | | | $ | 508 | | | $ | 1,185 | | | $ | 1,960 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Dutch Bros Inc.| Form 10-Q | 19

Dutch Bros Inc.| Form 10-Q | 19

NOTE 8 — Leases

The components of lease costs, excluding short-term lease costs and sublease income (both immaterial for the periods presented), were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Statements of Operations Classification | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands) | | | 2025 | | 2024 | | 2025 | | 2024 | | |

Finance lease costs | | | | | | | | | | | | |

| Amortization of right-of-use assets | | Cost of sales | | $ | 6,969 | | | $ | 6,429 | | | $ | 20,254 | | | $ | 19,059 | | | |

| Amortization of right-of-use assets | | Selling, general, and administrative | | 10 | | | 15 | | | 40 | | | 45 | | | |

| Interest on lease liabilities | | Interest expense | | 5,896 | | | 5,541 | | | 17,234 | | | 16,499 | | | |

Total finance lease costs | | | | 12,876 | | | 11,985 | | | 37,529 | | | 35,603 | | | |

| | | | | | | | | | | | |

Operating lease costs | | | | | | | | | | | | |

Lease expenses | | Cost of sales | | 10,851 | | | 7,656 | | | 29,170 | | | 20,568 | | | |

Lease expenses | | Selling, general, and administrative | | 709 | | | 680 | | | 2,108 | | | 959 | | | |

Total operating lease costs | | | | 11,560 | | | 8,336 | | | 31,278 | | | 21,527 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Variable lease costs | | Cost of sales | | 2,552 | | | 1,747 | | | 6,977 | | | 4,871 | | | |