Please wait

00018665812025FYFALSE33.3333.3333.33P1YP1YP1YP1YP1Yhttp://fasb.org/us-gaap/2025#SellingGeneralAndAdministrativeExpensehttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseRightOfUseAssetshttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseRightOfUseAssetshttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseRightOfUseAssetshttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseRightOfUseAssetshttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityCurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityNoncurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityNoncurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityNoncurrenthttp://www.dutchbros.com/20251231#OperatingAndFinanceLeaseLiabilityNoncurrent33.3333.3333.33iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesbros:storebros:statexbrli:purebros:renewalbros:taxReceivableAgreementbros:segmentbros:locationbros:site00018665812025-01-012025-12-3100018665812025-06-300001866581us-gaap:CommonClassAMember2026-02-060001866581us-gaap:CommonClassBMember2026-02-060001866581us-gaap:CommonClassCMember2026-02-0600018665812025-12-3100018665812024-12-310001866581us-gaap:CommonClassAMember2025-12-310001866581us-gaap:CommonClassAMember2024-12-310001866581us-gaap:CommonClassBMember2025-12-310001866581us-gaap:CommonClassBMember2024-12-310001866581us-gaap:CommonClassCMember2025-12-310001866581us-gaap:CommonClassCMember2024-12-310001866581bros:CompanyOperatedShopsMember2025-01-012025-12-310001866581bros:CompanyOperatedShopsMember2024-01-012024-12-310001866581bros:CompanyOperatedShopsMember2023-01-012023-12-310001866581bros:FranchisingAndOtherMember2025-01-012025-12-310001866581bros:FranchisingAndOtherMember2024-01-012024-12-310001866581bros:FranchisingAndOtherMember2023-01-012023-12-3100018665812024-01-012024-12-3100018665812023-01-012023-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:AdditionalPaidInCapitalMember2024-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001866581us-gaap:RetainedEarningsMember2024-12-310001866581us-gaap:NoncontrollingInterestMember2024-12-310001866581us-gaap:RetainedEarningsMember2025-01-012025-12-310001866581us-gaap:NoncontrollingInterestMember2025-01-012025-12-310001866581us-gaap:AdditionalPaidInCapitalMember2025-01-012025-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-01-012025-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-01-012025-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-01-012025-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2025-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2025-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2025-12-310001866581us-gaap:AdditionalPaidInCapitalMember2025-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-12-310001866581us-gaap:RetainedEarningsMember2025-12-310001866581us-gaap:NoncontrollingInterestMember2025-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2023-12-310001866581us-gaap:AdditionalPaidInCapitalMember2023-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001866581us-gaap:RetainedEarningsMember2023-12-310001866581us-gaap:NoncontrollingInterestMember2023-12-3100018665812023-12-310001866581us-gaap:RetainedEarningsMember2024-01-012024-12-310001866581us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001866581us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-01-012024-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2024-01-012024-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2024-01-012024-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2024-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2022-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2022-12-310001866581us-gaap:AdditionalPaidInCapitalMember2022-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001866581us-gaap:RetainedEarningsMember2022-12-310001866581us-gaap:NoncontrollingInterestMember2022-12-3100018665812022-12-310001866581us-gaap:RetainedEarningsMember2023-01-012023-12-310001866581us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001866581us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001866581us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001866581us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-12-310001866581us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-01-012023-12-310001866581us-gaap:CommonClassCMemberus-gaap:CommonStockMember2023-01-012023-12-310001866581bros:CommonClassDMemberus-gaap:CommonStockMember2023-01-012023-12-310001866581us-gaap:EntityOperatedUnitsMember2025-12-310001866581us-gaap:FranchisedUnitsMember2025-12-310001866581bros:DutchBrosIncMember2025-12-310001866581bros:ContinuingLLCEquityOwnersMember2025-12-310001866581bros:ContinuingLLCMembersMember2025-12-310001866581bros:DutchBrosIncMember2025-02-0700018665812025-02-072025-02-0700018665812025-02-070001866581us-gaap:CommonClassBMember2025-02-072025-02-070001866581us-gaap:CommonClassCMember2025-02-072025-02-070001866581us-gaap:CommonClassAMember2025-01-012025-12-310001866581bros:CommonClassDMember2025-01-012025-12-310001866581bros:ClassACommonUnitsMember2025-01-012025-12-310001866581bros:DutchBrosIncMemberus-gaap:CommonClassAMember2025-12-310001866581us-gaap:CommonClassAMember2024-01-012024-12-310001866581bros:CommonClassDMember2024-01-012024-12-310001866581bros:DutchBrosIncMemberus-gaap:CommonClassAMember2024-12-310001866581us-gaap:CommonClassBMember2024-05-310001866581us-gaap:SoftwareDevelopmentMember2025-12-310001866581srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2025-12-310001866581srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2025-12-310001866581srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2025-12-310001866581srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2025-12-310001866581srt:MinimumMemberus-gaap:BuildingMember2025-12-310001866581srt:MaximumMemberus-gaap:BuildingMember2025-12-310001866581srt:MinimumMemberus-gaap:RealEstateMember2025-12-310001866581srt:MaximumMemberus-gaap:RealEstateMember2025-12-310001866581bros:RealEstateLeaseFiveYearRenewalOptionMembersrt:MinimumMemberus-gaap:RealEstateMember2025-01-012025-12-310001866581bros:RealEstateLeaseFiveYearRenewalOptionMembersrt:MaximumMemberus-gaap:RealEstateMember2025-01-012025-12-310001866581bros:RealEstateLeaseFiveYearRenewalOptionMemberus-gaap:RealEstateMember2025-01-012025-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2025-01-012025-12-310001866581us-gaap:PerformanceSharesMember2025-01-012025-12-310001866581srt:MinimumMemberus-gaap:PerformanceSharesMember2025-01-012025-12-310001866581srt:MaximumMemberus-gaap:PerformanceSharesMember2025-01-012025-12-310001866581us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2025-01-012025-12-310001866581us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2025-01-012025-12-310001866581us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2025-01-012025-12-310001866581bros:CompanyOperatedShopsMember2025-01-012025-12-310001866581bros:CompanyOperatedShopsMember2024-01-012024-12-310001866581bros:CompanyOperatedShopsMember2023-01-012023-12-310001866581bros:FranchiseFeesMember2025-01-012025-12-310001866581bros:FranchiseFeesMember2024-01-012024-12-310001866581bros:FranchiseFeesMember2023-01-012023-12-310001866581us-gaap:ProductAndServiceOtherMember2025-01-012025-12-310001866581us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001866581us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001866581bros:GiftCardAndLoyaltyProgramsMember2025-12-310001866581bros:GiftCardAndLoyaltyProgramsMember2024-12-310001866581bros:InitialUnearnedFranchiseFeesMember2025-12-310001866581bros:InitialUnearnedFranchiseFeesMember2024-12-310001866581bros:GiftCardRewardRedemptionsMember2025-01-012025-12-310001866581bros:GiftCardRewardRedemptionsMember2024-01-012024-12-310001866581bros:GiftCardRewardRedemptionsMember2023-01-012023-12-3100018665812026-01-012025-12-3100018665812027-01-012025-12-3100018665812028-01-012025-12-3100018665812029-01-012025-12-3100018665812030-01-012025-12-3100018665812031-01-012025-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-292025-03-310001866581bros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2025-05-130001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2024-01-012024-12-310001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581us-gaap:EmployeeRelocationMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:TerminationBenefitsMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:EmployeeRelatedCostsMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:DuplicateRentMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:ConsultingMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2025-01-012025-12-310001866581us-gaap:OtherRestructuringMemberbros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2024-12-310001866581bros:OrganizationRealignmentAndRestructuringMember2025-12-310001866581us-gaap:CostOfSalesMember2025-01-012025-12-310001866581us-gaap:CostOfSalesMember2024-01-012024-12-310001866581us-gaap:CostOfSalesMember2023-01-012023-12-310001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2025-01-012025-12-310001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310001866581us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001866581us-gaap:SoftwareDevelopmentMember2024-12-310001866581us-gaap:FurnitureAndFixturesMember2025-12-310001866581us-gaap:FurnitureAndFixturesMember2024-12-310001866581us-gaap:LeaseholdImprovementsMember2025-12-310001866581us-gaap:LeaseholdImprovementsMember2024-12-310001866581us-gaap:BuildingMember2025-12-310001866581us-gaap:BuildingMember2024-12-310001866581us-gaap:LandMember2025-12-310001866581us-gaap:LandMember2024-12-310001866581us-gaap:ConstructionInProgressMember2025-12-310001866581us-gaap:ConstructionInProgressMember2024-12-310001866581us-gaap:FranchiseRightsMember2025-12-310001866581us-gaap:FranchiseRightsMember2024-12-310001866581bros:ReacquiredFranchiseRightsMember2025-12-310001866581bros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:SecuredDebtMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:LetterOfCreditMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:BridgeLoanMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-290001866581us-gaap:SecuredDebtMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581bros:The20252022CreditFacilitiesMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581bros:The2022CreditFacilityMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2025-05-292025-05-290001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-12-310001866581us-gaap:LetterOfCreditMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-12-310001866581bros:The2025CreditFacilityMemberus-gaap:SecuredDebtMember2025-12-310001866581bros:The2025CreditFacilityMemberus-gaap:SecuredDebtMember2024-12-310001866581us-gaap:RevolvingCreditFacilityMemberbros:The2025CreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001866581us-gaap:UnsecuredDebtMember2025-12-310001866581us-gaap:UnsecuredDebtMember2024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2025-01-012025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001866581us-gaap:DesignatedAsHedgingInstrumentMember2025-12-310001866581us-gaap:DesignatedAsHedgingInstrumentMember2024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-01-012025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2025-01-012025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2024-01-012024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2023-01-012023-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2025-01-012025-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2024-01-012024-12-310001866581us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberbros:IncomeTaxExpenseBenefitMember2023-01-012023-12-310001866581stpr:TN2024-01-012024-12-310001866581stpr:OR2025-01-012025-12-310001866581stpr:OR2024-01-012024-12-310001866581stpr:OR2023-01-012023-12-310001866581stpr:TX2025-01-012025-12-310001866581stpr:TX2024-01-012024-12-310001866581stpr:TX2023-01-012023-12-310001866581us-gaap:DomesticCountryMember2025-12-310001866581us-gaap:StateAndLocalJurisdictionMember2025-12-310001866581bros:RSUsPSUsMember2025-01-012025-12-310001866581bros:RSUsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberbros:VestingSchedule2Member2025-01-012025-12-310001866581bros:RSUsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberbros:VestingSchedule2Member2025-01-012025-12-310001866581bros:RSUsPSUsMemberbros:VestingSchedule3Member2025-01-012025-12-310001866581bros:RSUsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberbros:VestingSchedule1Member2025-01-012025-12-310001866581bros:RSUsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberbros:VestingSchedule1Member2025-01-012025-12-310001866581bros:RSUsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberbros:VestingSchedule1Member2025-01-012025-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2024-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2025-12-310001866581us-gaap:PerformanceSharesMember2024-12-310001866581us-gaap:PerformanceSharesMember2025-12-310001866581us-gaap:RestrictedStockMember2025-01-012025-12-310001866581us-gaap:RestrictedStockMember2024-01-012024-12-310001866581us-gaap:RestrictedStockMember2023-01-012023-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001866581us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001866581us-gaap:CommonClassAMemberbros:PublicStockOfferingSharesFromContinuingMembersMember2025-12-310001866581bros:ClassACommonUnitsHeldByDutchBrosIncAndNonControllingInterestHoldersMember2025-12-310001866581bros:ContinuingLLCMembersMemberus-gaap:CommonClassAMember2025-12-310001866581us-gaap:RelatedPartyMember2024-01-012024-12-310001866581us-gaap:PerformanceSharesMember2024-01-012024-12-310001866581us-gaap:PerformanceSharesMember2023-01-012023-12-310001866581us-gaap:PropertyLeaseGuaranteeMember2025-12-310001866581us-gaap:PropertyLeaseGuaranteeMember2024-12-310001866581us-gaap:RelatedPartyMember2025-01-012025-12-310001866581us-gaap:RelatedPartyMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:CompanyOperatedShopsMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:FranchisingAndOtherMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:BeverageFoodPackagingMemberbros:CompanyOperatedShopsMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:LaborCostsMemberbros:CompanyOperatedShopsMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:OccupancyOtherCostsMemberbros:CompanyOperatedShopsMember2023-01-012023-12-310001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2025-01-012025-12-310001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2024-01-012024-12-310001866581us-gaap:OperatingSegmentsMemberbros:PreOpeningCostsMemberbros:CompanyOperatedShopsMember2023-01-012023-12-310001866581bros:ClutchCoffeeMemberus-gaap:SubsequentEventMember2026-01-232026-01-2300018665812025-10-012025-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 10-K

______________________________

(Mark One)

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2025

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-40798

______________________________

DUTCH BROS INC.

(Exact name of registrant as specified in its charter)

______________________________

| | | | | | | | | | | | | | |

Delaware | | 87-1041305 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| 1930 W. Rio Salado Pkwy | | |

| Tempe, | Arizona |

| 85281 |

(Address of principal executive offices) | | (Zip Code) |

(877) 899-2767

(Registrant's telephone number, including area code)

______________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Exchange on which Registered |

Class A Common Stock, par value $0.00001 per share | BROS | The New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, as of June 30, 2025, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $8.5 billion, computed using the closing price on that day of $68.37.

As of February 6, 2026, the registrant’s outstanding shares of common stock were as follows:

| | | | | |

| Class A common stock | 127,054,187 | |

| Class B common stock | 35,210,946 | |

| Class C common stock | 2,279,846 | |

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement relating to the 2026 Annual Meeting of Stockholders of Dutch Bros Inc., which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2025, are incorporated by reference in Items 10, 11, 12, 13, and 14 of Part III of this report.

DUTCH BROS INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

Glossary | |

| |

| | |

| PART I | | |

| | |

| | |

| | |

| ITEM 1. | | |

| ITEM 1A. | | |

| ITEM 1B. | | |

ITEM 1C. | | |

| ITEM 2. | | |

| ITEM 3. | | |

| ITEM 4. | | |

| | |

| PART II | | |

| | |

| | |

| | |

| ITEM 5. | | |

| ITEM 6. | | |

| ITEM 7. | | |

| ITEM 7A. | | |

| ITEM 8. | | |

| ITEM 9. | | |

| ITEM 9A. | | |

| ITEM 9B. | | |

| ITEM 9C. | | |

| | |

| PART III | | |

| | |

| | |

| | |

| ITEM 10. | | |

| ITEM 11. | | |

| ITEM 12. | | |

| ITEM 13. | | |

| ITEM 14. | | |

| | |

| PART IV | | |

| | |

| | |

| | |

| ITEM 15. | | |

| ITEM 16. | | |

| | |

| SIGNATURES | | |

| | |

| | |

| | |

As used in this Annual Report on Form 10-K (this Form 10-K), the terms identified below have the meanings specified below unless otherwise noted or the context requires otherwise. References in this Form 10-K to “Dutch Bros,” the “Company,” “we,” “us” and “our” refer to Dutch Bros Inc. and its consolidated subsidiaries unless the context indicates otherwise.

| | | | | | | | |

| TERM | | DEFINITION |

2022 Credit Facility | | Has the meaning set forth in NOTE 9 — Debt to the consolidated financial statements, included elsewhere in this Form 10-K |

2025 Credit Facility | | Has the meaning set forth in NOTE 9 — Debt to the consolidated financial statements, included elsewhere in this Form 10-K |

AI | | Artificial intelligence |

AOCI | | Accumulated Other Comprehensive Income |

ASU | | Accounting Standards Update |

| AUV | | Average Unit Volume; determined based on the net sales for any trailing twelve-month period for systemwide and company-operated shops that have been open a minimum of 15 months. |

| Blocker Companies | | TSG7 A AIV VI Holdings, LLC and DG Coinvestor Blocker, LLC |

| BPS or bps | | Basis points which is used to express differences in rates. One basis point is the equivalent of 1/100 of one percent. |

CODM | | Chief Operating Decision Maker |

| Co-Founder | | Travis Boersma and affiliated entities over which he maintains voting control. |

| Continuing Members | | The Co-Founder and the Sponsor and any of their assignees or successors pursuant to the terms of the Exchange Tax Receivable Agreement or OpCo LLC Agreement |

| | |

| Dutch Bros OpCo | | Dutch Mafia, LLC, a Delaware limited liability company and direct subsidiary of Dutch Bros Inc. |

| Dutch Bros Inc. | | A Delaware corporation, the Class A common stock of which is publicly traded on the New York Stock Exchange under the symbol “BROS”. |

| EBITDAR | | Earnings before interest, taxes, depreciation, amortization, and rent costs |

ESG | | Environmental, social, and corporate governance |

Exchange Tax Receivable Agreement | | The Exchange Tax Receivable Agreement among the Company and the Continuing Members entered into in connection with reorganization transactions prior to the IPO. |

FASB | | Financial Accounting Standards Board |

| GAAP | | U.S. Generally Accepted Accounting Principles |

| IPO | | Initial Public Offering |

| MOB | | A group of master broistas who travel to help open new locations and markets. They train new broistas on operations and infuse them with the culture of Dutch Bros. |

| N/M | | A not meaningful percentage. |

OpCo LLC Agreement | | The Fifth Amended and Restated Limited Liability Company Agreement of Dutch Bros OpCo. |

| OpCo Units | | Class A common units, Class B voting units and Class C voting units of Dutch Bros OpCo, each as further defined in the OpCo LLC Agreement, collectively. |

| Pre-IPO Blocker Holders | | TSG7 A AIV VI Holdings-A, L.P. and DG Coinvestor Blocker Aggregator, L.P. or their assignees or successors pursuant to the terms of that certain Reorganization Tax Receivable Agreement. |

PSU | | Performance-Based Stock Units |

| QSR | | Quick Service Restaurant |

Dutch Bros Inc.| Form 10-K | 1

Dutch Bros Inc.| Form 10-K | 1

| | | | | | | | |

| TERM | | DEFINITION |

Reorganization Tax Receivable Agreement | | The Reorganization Tax Receivable Agreement among the Company and the Pre-IPO Blocker Holders entered into in connection with the reorganization transactions prior to the IPO. |

| | |

| RSA | | Restricted Stock Awards |

| RSU | | Restricted Stock Units |

| | |

Same Shop Sales | | The estimated percentage change in year-over-year sales, for the comparable shop base, which we define as shops open for 15 complete months or longer as of the first day of the reporting period. |

| SEC | | Securities and Exchange Commission |

SOFR | | Secured Overnight Financing Rate |

| Sponsor | | TSG Consumer Partners, L.P. and certain of its affiliates. |

| Tax Receivable Agreements and TRAs | | The Reorganization Tax Receivable Agreement, and the Exchange Tax Receivable Agreement entered into in connection with reorganization transactions prior to the IPO. |

TSR | | Relative Total Shareholder Return |

| Western United States | | The collection of states including Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Utah and Washington. |

Dutch Bros, our Windmill logo ( ), Dutch Bros Rebel, and our other registered and common law trade names, trademarks and service marks are the property of Dutch Bros Inc. All other trademarks, trade names and service marks appearing in this Form 10-K are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Form 10-K may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

), Dutch Bros Rebel, and our other registered and common law trade names, trademarks and service marks are the property of Dutch Bros Inc. All other trademarks, trade names and service marks appearing in this Form 10-K are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Form 10-K may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.  Dutch Bros Inc.| Form 10-K | 2

Dutch Bros Inc.| Form 10-K | 2

Forward-Looking Statements

Certain statements in this Form 10-K, including statements regarding our expectations regarding our growth and the number of new shops we may open, the impact of new and ongoing initiatives, including Dutch Rewards, order ahead, hot food and consumer packaged goods, consumer demand, the impact of inflation, increased minimum wages, and general macroeconomic conditions on our results of operations, supply chain or liquidity, the potential impact of actions we have taken to mitigate the impact of unforeseen circumstances, taxes and tax rates, and new and evolving legislative and regulatory requirements, are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. We use words such as “anticipate,” “believe,” “could,” “should,” “estimate,” “expect,” “intend,” “may,” “predict,” “project,” “target,” and similar terms and phrases, including references to assumptions, to identify forward-looking statements. These forward-looking statements are based on information available to us as of the date any such statements are made, and we assume no obligation to update these forward-looking statements. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those described in the statements. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Form 10-K.

While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect actual results. You should evaluate all forward-looking statements made in this report in the context of the factors that could cause outcomes to differ materially from expectations. These factors include, but are not limited to, those listed under “Item 1A. Risk Factors” of this report, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

You should read the consolidated financial statements and the related notes in this Form 10-K together with our analysis and discussion of our consolidated financial condition and results of operations and other financial information included elsewhere in this Form 10-K.

Website Disclosure

We use our website as a distribution channel of material company information. Financial and other important information regarding our company is routinely posted on and accessible through our website at https://investors.dutchbros.com. In addition, you may automatically receive email alerts and other information about our company when you subscribe your email address by visiting the “Investor Email Alerts” section of our investor relations page at https://investors.dutchbros.com/resources. The information on our website is not incorporated herein or otherwise a part of this Form 10-K.

Dutch Bros Inc.| Form 10-K | 3

Dutch Bros Inc.| Form 10-K | 3

PART I

ITEM 1. BUSINESS

Dutch Bros Inc. is a Delaware corporation, and its Class A common stock trades on the New York Stock Exchange under the symbol “BROS”.

Our Company

Dutch Bros is a high growth operator and franchisor of drive-thru shops that focus on serving high- QUALITY, hand-crafted beverages with unparalleled SPEED and superior SERVICE. Founded in 1992 by brothers Dane and Travis Boersma, Dutch Bros began with a double-head espresso machine and a pushcart in Grants Pass, Oregon. Today, we believe that Dutch Bros is one of the fastest-growing brands in the quick service beverage industry in the United States.

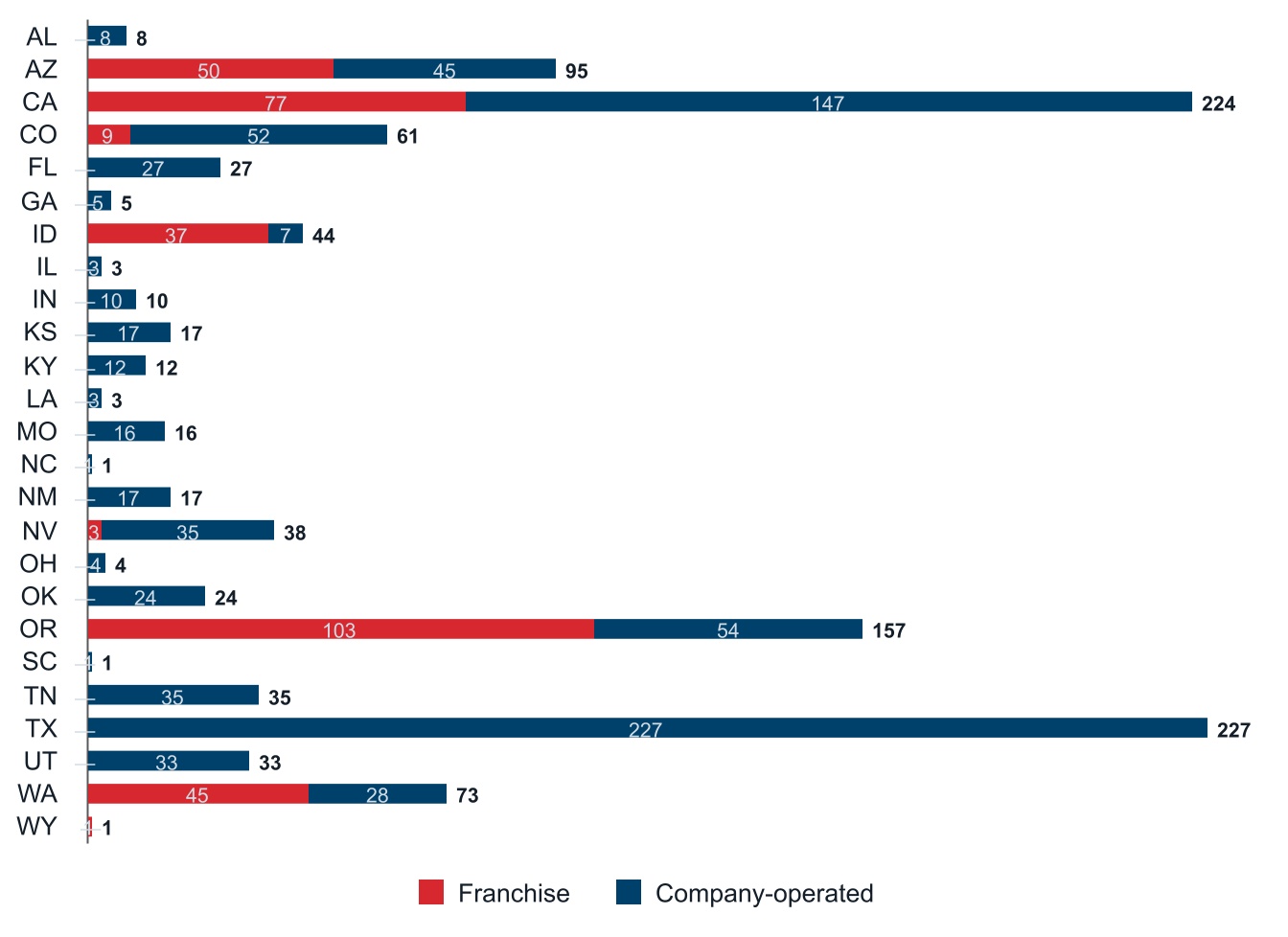

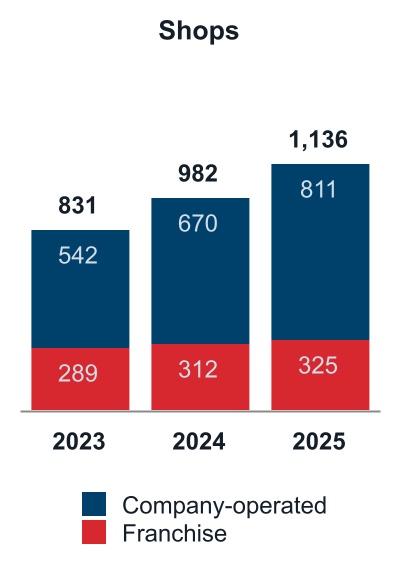

As of December 31, 2025, we had 1,136 shops, of which 811 were company-operated and 325 were franchise, across 25 states as shown in the graphic below. For additional information regarding company-operated and franchise shops by state, refer to Part I, Item 2 Properties of this Form 10-K.

Dutch Bros Inc.| Form 10-K | 4

Dutch Bros Inc.| Form 10-K | 4

The Dutch Bros Experience

| | | | | | | | |

| | Dutch Bros is more than just the products we serve: we are dedicated to making differences in the lives of our employees, customers, and the communities in which we operate. Our people are the key to our success and our broistas are the face of Dutch Bros, delivering on our core values of SPEED, QUALITY, and SERVICE. |

•SPEED: Our drive-thru and walk-up windows enable us to rapidly serve our customers. In 2024, we launched order ahead functionality to elevate throughput and enhance convenience.

•QUALITY: We take pride in the training and skills of our broistas, which enable them to provide consistent, high-quality hand-crafted beverages to our customers.

•SERVICE: We embrace a customer-first attitude and use every interaction to connect with our customers and seek to deliver an experience that exceeds our customers’ expectations.

The combination of hand-crafted and high-quality beverages, our unique drive-thru experience, and our community-driven people-first culture has allowed us to successfully open new shops and continue to share the “Dutch Luv”. To achieve these experiences and create meaningful differentiation in our industry, we and our franchise partners are committed to attracting and retaining broistas who deliver an experience that exceeds our customers’ expectations. We empower our broistas to take the extra step to make each customer interaction remarkable.

Our Menu

We sell a wide range of customizable hot, iced, and blended beverages, as well as certain food offerings.

•Coffee: coffee-based beverages make up ~50%1 of our menu mix. In our shops, we utilize premium La Marzocco machines to handcraft espresso shots for both our hot and cold custom classic and signature coffee beverages. We also sell our proprietary coffee-based “Freeze” blended beverages and cold brew. We import and roast our own coffee beans. Our Private Reserve coffee is a 100% Arabica three-bean blend, roasted by Dutch Bros in our Grants Pass, Oregon or Melissa, Texas facilities.

•Energy: ~25%1 of our menu mix is based upon our proprietary Dutch Bros Rebel® energy drink, which is highly customizable with flavors and modifiers and can be served blended or over ice. Our energy platform helps us appeal to a diverse customer base.

•Refreshments and Other: the remaining ~25%1 of our menu mix is a wide variety of teas, lemonades, smoothies, and sodas offering caffeine-lite and caffeine-free beverages that can be enjoyed across all dayparts and by customers of all ages. We also offer a select variety of food options.

_________________

1 Based on percentage of total sales in 2025.

Dutch Bros Inc.| Form 10-K | 5

Dutch Bros Inc.| Form 10-K | 5

| | | | | | | | |

| | Customization is at the core of what we do, and we encourage our customers to make their drinks “their own” through the addition of flavors and other modifiers including protein milk, boba, soft top and a variety of other mix-ins and toppings. We believe this customization process helps create a competitive moat and drives a broad demographic appeal. Because of our robust pantry and “made-to-order” process, we also have the ability to tailor many of our drinks to specific dietary needs, including sugar-free, dairy-free, caffeine-free, and fat-free, which positions us favorably as customer trends evolve. |

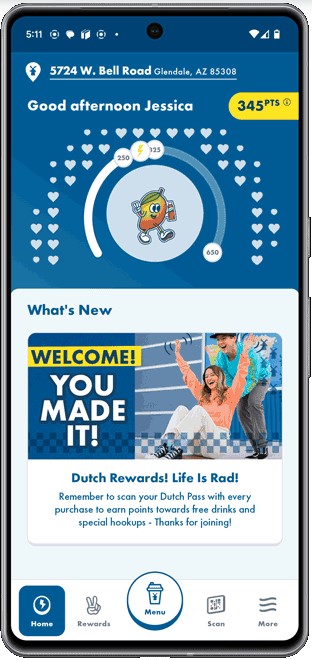

Our Dutch Rewards Loyalty Program

Dutch Rewards is our app-based digital loyalty program. In 2025, approximately 72% of all transactions were attributable to Dutch Rewards members, up from approximately 68% in 2024.

| | | | | | | | |

| Dutch Rewards uses a spend-based model, where customers collect points that can be redeemed for rewards. These rewards can be utilized to receive free drinks or shared with others. Points and rewards generally expire after six months. | | |

| |

We offer members the ability to preload funds on their account and pay through our app, a function we call Dutch Pass. In addition to being convenient for customers, Dutch Pass enables us to increase our speed of service by reducing the payment collection time. Our Dutch Pass functionality also allows users to purchase and share gift cards, providing more customers the opportunity to share in the Dutch Bros experience. | |

| |

We utilize Dutch Rewards to communicate and interact directly with our customers and drive transactions. We see an opportunity to continue enhancing the sophistication of our segmentation and targeting efforts, using consumer insights to drive behaviors that we expect will create lasting value. We intend to continue investing in consumer insights and moving toward more segmented marketing to offer targeted messaging, offers, and rewards that enhance the Dutch Bros experience at an attractive return on investment. | |

Order Ahead

In 2024, we launched order ahead functionality within our Dutch Rewards app. Customers can either choose to park and pick-up at our walk-up window or pick-up their order in our drive thru. To date, many customers have chosen to utilize the pick-up feature, which we believe has considerable capacity. Whether customers choose our drive thru or walk-up window, their drink is personally delivered with a friendly interaction from a broista, which we believe helps maintain and strengthen service and connection as competitive differentiators.

Our order ahead system interacts with our existing point-of-sale and kitchen display system, easing integration with our operations. We believe our shops are well situated for order ahead, with multiple beverage production bars and escape lanes and pick-up windows at many of our shops. We have the ability to throttle production at peak times to help ensure smooth operations.

Dutch Bros Inc.| Form 10-K | 6

Dutch Bros Inc.| Form 10-K | 6

Order ahead provides enhanced convenience to our customers, allowing for orders to be placed in advance of customers arriving at a shop and offering an alternative to waiting in line. Compared to our peers in the beverage industry, we have an opportunity to drive transactions in the morning daypart. Order ahead may present an opportunity to appeal to a broader range of customers who may be time-constrained in the morning and have not previously considered Dutch Bros as part of their morning routine.

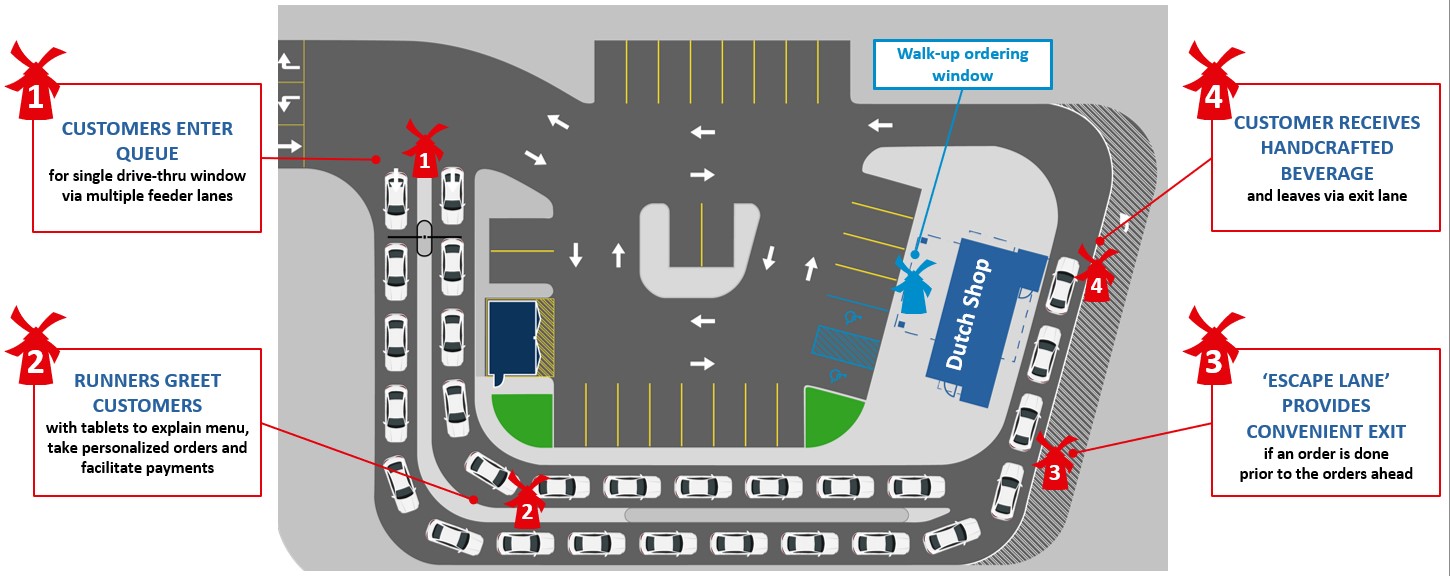

Our Shops

Speed is core to what we do at Dutch Bros. We primarily utilize a drive-thru model: approximately 85% of our business is conducted through the drive-thru with the remaining 15% conducted at our walk-up windows. The vast majority of our shops do not have lobbies with customer seating areas. We believe our business model places a premium on customer convenience without sacrificing the personal experience. Our shops and our real estate strategy are designed from the ground up to support this drive-thru centric business.

Although our shops typically have a smaller overall footprint than competitors drive-thru formats, essentially all of our square footage is used to support the production of beverages. We typically target lots that are at least 25,000 square feet to handle substantial car volume. Except for a handful of legacy “coffee houses,” which do have lobby areas, our shops are designed to enable customers to drive-thru or walk-up and enjoy their beverage off premises. Most of our shops feature either a single or double drive-thru window with multiple feeder lanes for traffic flow and a walk-up window.

| | | | | | | | | | | | | | |

| Legacy Configuration | | Current Configuration | | Endcap Configuration |

| | | | |

Size: ~500 square feet | | Size: ~800-1,000 square feet | | Size: ~1,000-1,200 square feet |

| | | | |

Geographies: Legacy West Coast | | Geographies: Widespread | | Geographies: Select Locations |

| | | | |

Characteristics: May have drive-thru lanes on both sides of the building; walk-up window optional; no lobby; storage outbuilding may be needed. | | Characteristics: Multiple drive-thru lanes served by one window; ample car stacking and circulation, escape lane likely; walk-up window standard; no lobby. | | Characteristics: Attached to the end of a strip center or purpose built with co-tenants; may have lobby with walk-up window, but no seating. |

When our shops are busy, a “runner” broista leaves the shop and greets our customers before they reach the drive-thru window. The runner explains the menu and helps customers personalize their orders. Using tablets, our runners take orders, sending them to broistas inside the shop, who utilize our flexible systems to hand-craft custom beverages.

Dutch Bros Inc.| Form 10-K | 7

Dutch Bros Inc.| Form 10-K | 7

Many of our shops also have walk-up ordering windows and “escape lanes” that enable customers to exit the line after a runner delivers their drink before reaching the window, helping increase throughput and reducing congestion. For illustration of our shop model, see the graphic below.

Our Long-Term Franchise Partners

We believe we have a high-quality and strong franchise base, made up of long-term franchise partners. Many of these franchise partners began their Dutch Bros journeys working in the shops as broistas.

Throughout our history, we have used a variety of development models, including both franchise and company-operated led growth. We currently utilize a mixed model, where we continue to encourage our franchisees to develop within their existing operating areas (where we believe there is significant room for continued growth) while developing new regions with company-operated shops.

Since 2017, our focus has been a company-operated strategy with all operators recruited from within our organization. While we maintain great relationships with our existing franchise partners and they continue to open new shops as they look to infill their high-demand markets, we anticipate that the majority of new shops we open each year going forward will continue to be company-operated shops.

Our Growth Strategies

We are a high-growth company with considerable whitespace and opportunities. We will continue expanding our business to positively impact our communities through the following growth strategies:

| | | | | | | | |

| | Grow Our People: Scale Our Culture |

| |

| •Recruit, develop, and retain great people |

| |

| •Provide robust internal training and career advancement programs, which help develop a high-quality talent pool of candidates seeking larger roles within the Company |

| |

| •Target 100% internal promotion for regional operators from a list of approximately 475 qualified candidates with an average tenure of more than 7.5 years |

| |

| •Invest in our leadership team to support operations and drive strategy |

Dutch Bros Inc.| Form 10-K | 8

Dutch Bros Inc.| Form 10-K | 8

| | | | | | | | |

| | Grow Our Shop Base: Execute On Our Large Whitespace |

| |

| •Open new shops with superior financial returns |

| |

| •Target a “mid-teens” annual new shop growth rate |

| |

| •Invest in our shop development teams so they can utilize new data sources, analytic techniques, and tighter underwriting standards |

| |

| •Utilize a refined real estate strategy that balances infill penetration and pacing to support new shop productivity as we grow in new markets |

|

| | | | | | | | |

|

| Grow Transactions: Develop Sales Layers |

| |

| •Innovation - assume an innovation leadership position within the beverage industry, keeping the brand fresh and encouraging trial and frequency |

| |

| •Paid Media - build brand awareness in new and existing markets through enhanced messaging and elevated spending |

| |

| •Dutch Rewards - increase sophistication of our segmentation and offers to drive more effective communication and higher frequency |

| |

| •Order Ahead - offer greater convenience, widen our addressable customer set, and seek to drive frequency, especially in the morning daypart where customers may have greater time constraints |

| |

| •Food - expand food offering in 2026 to better address customer needs in the critical morning daypart. We aim to capture beverage occasions with potential customers who desire breakfast with their morning beverage and choose options other than Dutch Bros currently |

| |

| •Throughput - make strategic labor deployment decisions to drive a consistent and elevated customer experience |

| | | | | | | | |

| | Grow Margins: Deliver Long-term Margin Expansion |

| |

| •Continue targeting company-operated contribution margins of ~30%, supporting quick capital paybacks and funding future shop growth |

| |

| •Seek opportunities to continue to reinforce our shop-level P&L through operational improvements, which will enable us to continue investing to maintain our competitive advantages |

| |

| •Continue targeting and achieving Adjusted SG&A leverage through strong revenue growth and smart investments |

Operations

Coffee Procurement and Roasting

We pride ourselves on the quality of our coffee. To ensure we are able to consistently deliver high-quality coffee across all shops in our system, we are actively involved in the sourcing, roasting, packaging, and distribution of coffee beans.

Dutch Bros Inc.| Form 10-K | 9

Dutch Bros Inc.| Form 10-K | 9

| | | | | | | | |

| | We partner with third-party importers and exporters to purchase and import our green coffee beans. Through this relationship, we source high-quality coffee beans from across Central and South America. Since 2021, we have partnered with Enveritas, an independent nonprofit organization that provides sustainability verifications for coffee. Annually, we have our green coffee purchases and our farmer support impact investments assessed against Enveritas’ responsible sourcing standards. In their evaluation, Enveritas maps our sourcing footprint and evaluates and monitors environmental, economic, and social conditions within the sourcing areas where we purchase our coffee, including child labor and forced labor. Within Dutch Bros, we sponsor a Coffee Origins Impact Program focused on continuous improvement and targeted investments in environmental, economic, and social conditions within our supply chain. We are also proud members of World Coffee Research, an organization dedicated to ensuring the future of coffee with a strategic aim to preserve origin diversity in the face of climate change and accelerate innovation for coffee agriculture and climate resistant varietal productivity. |

| | |

| | We currently roast all our coffee in our roasting facilities in Grants Pass, Oregon and Melissa, Texas. We roast our coffee bean varietals to specific profiles designed to highlight each of the coffee beans’ unique flavors and aromas. After the coffee beans are roasted, we blend them to create our signature Private Reserve espresso blend. |

| |

| We package and ship our Private Reserve, Decaf and White Coffee espresso blends to several distributors across the country that supply all our company-operated and franchised shops. |

We designed our supply chain to be flexible in response to changes in the market. On average, we typically have approximately three months of green coffee bean inventory stored at our two ports of entry in the United States or at our roasting facilities. In the event of a supply disruption in any one of our production origins, we have identified alternate coffee beans with substantially similar flavor profiles that can be sourced and incorporated to produce our blend.

In 2024, we opened a new roasting facility in Melissa, Texas. This facility increases the resilience of our supply chain and we expect this to reduce transportation costs as we expand company-operated shops eastward within the United States.

Sourcing and Supply Chain

In addition to coffee purchases, we also source dairy, syrups, packaging, Dutch Bros Rebel energy drink, and other items. We strive to have multiple sources for our key commodities, including dairy, to provide stability. As we grow eastward, we are continuing to adjust our supplier and distribution network to find partners more centrally located to our expanding shop base while continuing to evaluate our current market partnerships to ensure that they can grow and scale in accordance with our future plans. Strategically, our Supply Chain team is recalibrating its innovation-to-implementation pipeline, aiming to add more process capabilities while remaining nimble for increased product innovation at scale.

Dutch Bros Inc.| Form 10-K | 10

Dutch Bros Inc.| Form 10-K | 10

| | | | | | | | |

We also manufacture our own proprietary Dutch Bros Rebel energy drink via a co-bottling and co-packaging relationship. Neither our Dutch Bros Rebel energy drink, nor our syrups, contain high-fructose corn syrup, as we use pure cane sugar as a sweetener for our non-sugar free offerings. In 2023, we began rolling out tap systems and distributing our Dutch Bros Rebel energy drink via a “bag in a box” system for use in shop beverage taps, with the goal of helping us reduce our dependence on aluminum cans. In 2025, all new company-operated shops had tap machines installed, and we continue to test and explore additional solutions for retrofits and installations. As we scale, we remain committed to reducing our footprint related to beverage dispensing and continue to look for opportunities to mitigate our impact on the environment. | | |

Quality, Health, and Safety

We and our franchise partners strive to maintain a safe, healthy environment at each shop through the careful training and supervision of personnel and by following rigorous quality standards. Both company operated and franchise shops receive quality assurance inspections on a regular cadence. As part of our people-first culture, the health and safety of our customers and employees are our highest priority.

Our commitment to beverage and food safety is strengthened through the direct relationships among our supply chain, culinary research and development, food safety, and operations teams. We collaborate with our supply chain partners on material decisions regarding ingredients and process changes to ensure our final customer-facing product meets our standards of approval. We examine new and existing suppliers’ food safety and quality records through compliance assessments, and we reserve the right to conduct spot-checks, onsite audits, and verify insurance coverage. We believe that our established requirement for franchise partners to purchase supplies and equipment from approved vendors further enhances safety and quality within our system.

Furthermore, as part of our broista onboarding process, new hires are taken through our “broista manifesto” which includes food safety training. Before working a shift on their own, broistas must pass our “flow check” test, which ensures they can make every drink to our high standards. We have recently strengthened and improved our food safety training to include programs and practices that address the expected wider rollout of our food program.

Our supply chain risk model stretches beyond food safety and quality assurance practices. Products are evaluated for risk on the basis of other numerous factors, including price volatility, supply continuity, and sustainability.

People

Our people are the heart of our mission and the foundation of our success. We strive to build meaningful relationships with our employees, who are key members of the communities we love and serve. We attract individuals who love growth, thrive in unique and fun environments, and radiate positivity. With a love for life, a natural ability to connect with others in any circumstance, and a genuine smile, our team members embody everything that makes Dutch Bros special. As of December 31, 2025, we and our franchise partners have approximately 32,000 employees, of which approximately 23,000 employees are in our company-operated shops and headquarters.

Sharing the Dutch Luv

We are committed to sharing the Dutch Luv at our headquarters, at the window, and in our communities, cultivating an inclusive environment of love, acceptance, and kindness. Our commitment strives to ensure all customers, crews, and communities are welcomed, honored, and loved.

Dutch Bros Inc.| Form 10-K | 11

Dutch Bros Inc.| Form 10-K | 11

•Building Community Through Employee Resource Groups: Expanded and enriched Employee Resource Groups foster connection, belonging, and shared purpose among employees and allies. These groups create spaces where individuals can celebrate their identities, support one another, and collaborate on initiatives that make a meaningful impact, strengthening the sense of community across the organization.

•Continuous improvement of our library of training, events, and resources to headquarters employees and shop management.

Total Rewards

At our company, we are committed to fostering a dynamic and supportive workplace that nurtures the growth and satisfaction of our employees. To remain competitive in today’s ever-evolving business landscape, we routinely evaluate and adjust our salary and wage offerings, ensuring alignment with current labor market conditions.

As part of our strategic growth initiatives, we continuously enhance our total rewards program, which is designed to attract and retain exceptional talent. Our comprehensive suite of benefits reflects this commitment and includes several key offerings for our broistas, shop management, and headquarters employees, such as:

•Competitive Compensation: We uphold a company-wide minimum wage of at least $10.00 per hour, ensuring fair pay across all markets.

•Parental Leave: Employees in management roles and those at our headquarters benefit from more than eight weeks of company-paid parental leave after completing one year of service.

•Wellness Initiatives: Our wellness program empowers employees to prioritize their health and well-being, while our employee assistance program offers free access to support resources for all team members.

•Tuition Assistance: We provide financial support for professional development through tuition assistance, available after one full year of service, enabling our employees to enhance their skills and advance in their careers.

•Flexible Working Arrangements: Flexible working arrangements are a feature of our headquarters, which fosters a positive work-life balance through a hybrid work environment.

•Community Engagement: We encourage social responsibility by offering up to 16 hours of paid volunteer time for all employees, allowing them to contribute positively to their communities.

•Growth Opportunities: Our culture emphasizes teamwork and collaboration, with numerous opportunities for leadership development and career advancement.

Training and Development

We are committed to inspiring and facilitating personal and professional growth for our people as they fulfill their dreams and contribute to their communities. As part of this commitment, we provide resources to train and develop our people.

Broista Training

•3 days of “Manifesto” Training: cultural immersion, history, and fundamental knowledge

•7 shifts of on-the-job positional training

•Review of Manifesto, field guide, and employee handbook, and have proficiency tests twice per year

Dutch Bros Inc.| Form 10-K | 12

Dutch Bros Inc.| Form 10-K | 12

Compelling Future Pathways

We exclusively source regional operators, who we view as the linchpins of our field organization and lead between 3-7 shops at scale, from within our organization. For our continued growth, it is critical that we consistently train and develop new leaders. Our leadership development program, branded “LEAD” outlines shop growth opportunities at all levels of the organization and furthers our philosophy of hiring and developing leaders from within. This program provides ample opportunities for our shop broistas to create their own compelling future pathway, which can be a mix of Path A and B, to reach their potential goals.

| | | | | | | | | | | | | | | | | | | | |

| Broista |

| | | ê | | | |

| Shift Lead |

| | í | | î | | |

| Path A: Shop Level Operations | | | | Path B: Shop Opening Team | |

| | | | | | |

| | | | | | |

| Shop Lead | | | | | |

| | | | | Master of Broistas (MOB) | |

| Manager | | | | | |

| | | | | Lead MOB | |

| Regional Manager | | | | | |

| | | | | | |

| | î | | í | | |

| Regional Operator |

This leadership program develops a pipeline of home-grown talent, which we believe will be sufficient for our new shop growth over the next several years.

Philanthropy

Since our inception, we have been dedicated to giving back to the communities in which we serve, and we consider our brand to be a powerful platform for social impact. Our philanthropic efforts support local and national causes as well as the farmers, families and communities where our coffee beans grow. A culture of philanthropy and giving back to build better communities permeates the entire Dutch Bros organization, energizing our broistas and customers alike.

In partnership with the Dutch Bros Foundation (the Foundation) and our franchise partners, we host company-wide giveback days each year. The Foundation is a not-for-profit organization founded by Dutch Bros that supports our philanthropic efforts, making impactful contributions to causes across the country.

Dutch Bros Inc.| Form 10-K | 13

Dutch Bros Inc.| Form 10-K | 13

| | | | | | | | | | | | | | |

| | | | |

| | | | |

“Dutch Luv” | | “Drink One for Dane” | | “Buck for Kids” |

In February, we hosted a giveback day in support of local organizations working to fight food insecurity in our communities. | | In May, in honor of our co-founder Dane Boersma, we hosted a fundraising event to support the Muscular Dystrophy Association to find a cause and cure for ALS, or Lou Gehrig’s disease. | | In September, we hosted a giveback day in support of local nonprofit organizations helping create brighter futures for local kids. |

| | | | |

2025 Donations |

More than $1.0 million | | $1.0 million | | More than $1.2 million |

Additionally, our operators and franchise partners are empowered to host local, shop-specific giveback days throughout the year that help support and build relationships within the communities they serve. In 2025, our local giveback days resulted in over $1.5 million donated to approximately 180 local organizations.

Competition

The beverage industry is highly competitive and fragmented, and our shops compete on a variety of factors, including convenience, taste, price, quality, service, labor, and location. We believe our primary competitors include national and regional coffee chains, local specialty coffee shops, regional drive-thru beverage chains, and drive-thru quick service restaurants. Our competitors operate company-operated, franchised, and mixed business models. In addition, we also compete with convenience stores.

Intellectual Property

We own many registered trademarks and service marks in the United States, the most important of which might be our trademarked Windmill logo. Other important trademarks include our “Dutch Bros,” “Dutch Bros Coffee,” “Dutch Bros Rebel,” and “Dutch Bros. Blue Rebel” word marks and our recognizable Dutch Bros sign logo. We believe the Dutch Bros name and the many distinctive marks associated with it are of significant value and are very important to our business. Accordingly, as a general policy, we pursue registration and monitor the use of our marks in the United States and challenge unauthorized use.

We license the use of our marks to franchise partners, third-party vendors and others through franchise agreements, vendor agreements, and licensing agreements. These agreements typically restrict third parties’ activities with respect to use of the marks, impose brand standards requirements, and require licensees to inform us of any potential infringement of the marks.

We register some of our copyrighted material and otherwise rely on common law protection of our copyrighted works. Such copyrighted materials are not material to our business.

Dutch Bros Inc.| Form 10-K | 14

Dutch Bros Inc.| Form 10-K | 14

Government Regulation and Environmental Matters

We are subject to extensive federal, state, local, and foreign laws and regulations, as well as other statutory and regulatory requirements, including those related to, among others, nutritional content labeling and disclosure requirements, food safety regulations, local licensure, building, and zoning regulations, employment regulations, laws and regulations related to our licensed operations, and environmental reporting requirements. New laws and regulations or new interpretations of existing laws and regulations may also impact our business. The costs of compliance with these laws and regulations are high, are likely to increase in the future, and any failure on our part to comply with these laws may subject us to significant liabilities and other penalties. See "Risk Related to Regulation and Litigation" in Item 1A, Risk Factors for more information.

We are not aware of any federal, state, or local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, that have materially affected, or are reasonably expected to materially affect, our results of operations, competitive position, or capital expenditures.

Seasonality

Our business is subject to seasonal fluctuations that impact our revenue and shop gross profit margins. We typically experience higher nominal system sales in the summer months, which impacts revenue and shop gross profit margins in our second and third quarters of our fiscal year.

Information About our Executive Officers

The executive officers of Dutch Bros Inc. as of the filing of this Form 10-K, are as follows:

| | | | | |

| Travis Boersma, 55 | Co-founder and Executive Chairman of the Board |

Mr. Boersma is our Co-Founder and has served as our Executive Chairman since August 2021 and as the Executive Chairman of Dutch Bros OpCo since February 2021. Prior to serving as our Executive Chairman, he served as the Chief Executive Officer of Dutch Bros OpCo from February 2019 to February 2021. Mr. Boersma has led us as Co-Founder since 1992. Mr. Boersma attended Southern Oregon University.

| | | | | |

| Christine Barone, 52 | Chief Executive Officer and President |

Ms. Barone has served as our Chief Executive Officer and as a member of our Board since January 2024, and as our President since February 2023. Ms. Barone has worked in the food service and beverage industries for more than a decade, and most recently served as Chief Executive Officer at True Food Kitchen, a high growth restaurant and lifestyle brand, from August 2016 to February 2023. Prior to that, she served in various leadership roles at Starbucks Corporation (Nasdaq: SBUX). Earlier in her career, she held positions with Bain & Company and Raymond James. Since March 2020, Ms. Barone has served on the Board of Directors of Yelp Inc. Ms. Barone holds a B.A. in Applied Mathematics and an M.B.A. from Harvard University.

| | | | | |

| Joshua Guenser, 47 | Chief Financial Officer |

Mr. Guenser has served as our Chief Financial Officer since May 2024, after a transitional period as Incoming Chief Financial Officer from February 2024 to May 2024. Mr. Guenser served as Chief Financial Officer of MOD Super Fast Pizza Holdings, LLC, a US-based fast-casual pizza restaurant chain, from March 2020 to January 2024. Prior to that, he served in various roles at Starbucks Corporation (Nasdaq: SBUX), a global coffee chain, from October 2009 to March 2020, most recently as Senior Vice President, Finance - Americas from January 2019 to March 2020, and prior to that, as Vice President, Finance - US Retail from July 2018 to January 2019. Mr. Guenser holds a Master of Professional Accounting and a B.A. in Business Administration from the University of Washington.

Dutch Bros Inc.| Form 10-K | 15

Dutch Bros Inc.| Form 10-K | 15

| | | | | |

| Tana Davila, 43 | Chief Marketing Officer |

Ms. Davila has served as our Chief Marketing Officer since June 2023. Prior to joining Dutch Bros, she served as Chief Marketing Officer at CKE Restaurants, Inc., a quick service restaurant group, from September 2022 to June 2023. Prior to that, she served in various roles at PF Chang’s China Bistro Inc., a casual dining restaurant chain, including most recently as Chief Marketing Officer from September 2019 to August 2022, as Senior Vice President – Marketing from January 2019 to September 2019, and as Vice President – Marketing and Brand Development from November 2017 to January 2019. Ms. Davila has served on the board of directors of El Pollo Loco (NASDAQ:LOCO) since January 2026. Ms. Davila is a Fulbright Scholar and holds a B.A. in International Studies and German from Washington University in St. Louis, a J.D. from Seton Hall University, and an M.B.A. from Emory University.

| | | | | |

| Victoria Tullett, 58 | Chief Legal Officer |

Ms. Tullett has served as our Chief Legal Officer since September 2022 and has more than 20 years of experience helping diverse organizations manage operational risk and achieve record levels of growth, compliance, and profitability. Prior to joining Dutch Bros, she served Papa Murphy’s International, a franchise model take-and-bake pizza company, for more than 20 years in various roles, including most recently as Senior Vice President, General Counsel, and head of new store Development from May 2019 to August 2022, and from May 2014 to May 2019, as Chief Legal Officer while the company was publicly traded on the Nasdaq. Ms. Tullett holds a J.D. from Lewis & Clark, Northwestern School of Law.

Senior Leadership Team

Along with our executive officers, other members of our senior leadership team include:

| | | | | |

| Brian Cahoe | Chief Development Officer |

Mr. Cahoe has served as our Chief Development Officer since February 2025. Responsible for overseeing the Company’s new shop growth and development strategy, he brings nearly 25 years of experience in the quick service restaurant industry. Prior to joining Dutch Bros, he most recently served as Chief Development Officer for KFC U.S. at Yum! Brands (NYSE: YUM). He holds a B.S. in Industrial Engineering from the University of Louisville, and an M.B.A. from Bellarmine University.

| | | | | |

| Jess Elmquist | Chief People Officer |

Mr. Elmquist has served as our Chief People Officer since January 2024. He has nearly 30 years of experience leading people in founder-led and high growth companies. Before joining the Company, Mr. Elmquist served as Chief Human Resources Officer and Chief Evangelist for Phenom, a global HR technology company. Mr. Elmquist also served in various leadership roles at Life Time, most recently as Chief Learning Officer, and EVP of Human Capital. He holds a B.A. in Education from Bethel University and an M.A. in Organizational Psychology and Change Leadership from Columbia University

| | | | | |

| Venki Krishnababu | Chief Technology and Information Officer |

Mr. Krishnababu has served as our Chief Technology and Information Officer since December 2024. He has nearly 30 years of experience leading transformational, enterprise-shaping tech strategies in the health care and global retail sectors. Before joining the Company, Mr. Krishnababu served seven years at lululemon athletica inc. (NASDAQ: LULU), most recently as Chief Technology Officer. Earlier in his career, he served as Chief Technology Officer at Premera Blue Cross and in various tech leadership roles at Nordstrom, Inc. He holds a Bachelor of Engineering from PSG College of Technology.

Dutch Bros Inc.| Form 10-K | 16

Dutch Bros Inc.| Form 10-K | 16

| | | | | |

| Jennifer Somers | Chief Shops Officer |

Ms. Somers has served as our Chief Shops Officer since January 2026. Before joining the Company, Ms. Somers served as Chief Operations Officer of Cava Group, Inc. (NYSE: CAVA), a fast-casual Mediterranean restaurant chain, from November 2021 to September 2025. Prior to that, she served in various roles at Taco Bell, under Yum! Brands, Inc. (NYSE: YUM), an operator and franchisor of fast-casual and quick-service restaurant chains, from November 2015 to November 2021, most recently as Senior Vice President of US Restaurant Operations from November 2020 to November 2021. Ms. Somers holds an M.B.A. from The Wharton School, University of Pennsylvania, and a B.S. in Operations Research & Industrial Engineering from Cornell University.

Available Information

Our website address is dutchbros.com. Our Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, and all amendments to these filings, can be obtained free of charge from our website at https://investors.dutchbros.com/financials/sec-filings/default.aspx or by contacting our Investor Relations department at our office address listed above as soon as reasonably practical following our filing or furnishing of any of these reports with the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. We also routinely use the investor relations page on our website as a channel of distribution for important Company information, including press releases, analyst presentations, and financial and corporate governance information. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

Dutch Bros Inc.| Form 10-K | 17

Dutch Bros Inc.| Form 10-K | 17

ITEM 1A. RISK FACTORS

Summary of Risk Factors

Below is a summary of the principal factors that make an investment in our Class A common stock speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this Form 10-K and our other filings with the SEC before making investment decisions regarding our Class A common stock.

•Evolving consumer preferences and tastes or changes in consumer spending may adversely affect our business.

•Our financial condition and quarterly results of operations are subject to, and may be adversely affected by, a number of factors, many of which are also largely outside our control and as such our results may fluctuate significantly and may not fully reflect the underlying performance of our business.

•We may not be able to compete successfully with other shops, QSRs and convenience shops, including the growing number of coffee delivery options. Intense competition in the food service and restaurant industry could make it more difficult to expand our business and could also have a negative impact on our operating results if customers favor our competitors.

•Our failure to manage our growth effectively could harm our business and operating results.

•Our inability to identify, recruit, and retain qualified individuals for our shops could slow our growth and adversely impact our ability to operate.

•Our shops are geographically concentrated in the Western United States, and we could be negatively affected by conditions specific to that region.

•Interruption of our supply chain of coffee, flavored syrups or other ingredients, coffee machines and other restaurant equipment or packaging could affect our ability to produce or deliver our products and could negatively impact our business and profitability.

•Increases or sustained inflation in the cost of high-quality arabica coffee beans, dairy, or other commodities or decreases in the availability of high-quality arabica coffee beans, dairy, or other commodities could have an adverse impact on our business and financial results.

•Our success depends substantially on the value of our brand and failure to preserve its value could have a negative impact on our financial results.

•Food safety and quality concerns may negatively impact our brand, business, and profitability, our internal operational controls and standards may not always be met and our employees may not always act professionally, responsibly and in our and our customers’ best interests. Any possible instances or reports, whether true or not, of food and/or beverage-borne illness could reduce our sales.

•Changes in the availability of and the cost of labor could harm our business.