Third Quarter 2025 FINANCIAL RESULTS November 5, 2025

Forward-Looking Statements. Certain statements contained in this Presentation, other than historical facts, may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Lineage operates, and beliefs of, and assumptions made by, the Company and involve uncertainties that could significantly affect Lineage’s financial results. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “can,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “measures,” “poised,” “focus,” “seek,” “objective,” “goal,” “vision,” “drive,” “opportunity,” “target,” “strategy,” “expect,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “tomorrow,” “long-term,” “should,” “could,” “would,” “might,” “help,” “aimed”, or other similar words. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Presentation. Such statements include, but are not limited to statements about Lineage’s plans, strategies, initiatives, and prospects and statements about its future results of operations, capital expenditures and liquidity. Such statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those projected or anticipated, including, without limitation: general business and economic conditions; continued volatility and uncertainty in the credit markets and broader financial markets, including potential fluctuations in the Consumer Price Index and changes in foreign currency exchange rates; the impact of tariffs and global trade disruptions on us and our customers; other risks inherent in the real estate business, including customer defaults, potential liability related to environmental matters, illiquidity of real estate investments and potential damages from natural disasters; the availability of suitable acquisitions and our ability to acquire properties or businesses on favorable terms; our success in implementing our business strategy and our ability to identify, underwrite, finance, consummate, integrate and manage diversifying acquisitions or investments; our ability to meet budgeted or stabilized returns on our development and expansion projects within expected time frames, or at all; our ability to manage our expanded operations, including expansion into new markets or business lines; our failure to realize the intended benefits from, or disruptions to our plans and operations or unknown or contingent liabilities related to, our recent and future acquisitions and greenfield developments; our failure to successfully integrate and operate acquired or developed properties or businesses; our ability to renew significant customer contracts; the impact of supply chain disruptions, including the impact on labor availability, raw material availability, manufacturing and food production, and transportation; difficulties managing an international business and acquiring or operating properties in foreign jurisdictions and unfamiliar metropolitan areas; changes in political conditions, geopolitical turmoil, political instability, civil disturbances, restrictive governmental actions or nationalization in the countries in which we operate; the degree and nature of our competition; our failure to generate sufficient cash flows to service our outstanding indebtedness; our ability to access debt and equity capital markets; continued volatility in interest rates; increased power, labor, or construction costs; changes in consumer demand or preferences for products we store in our warehouses; decreased storage rates or increased vacancy rates; labor shortages or our inability to attract and retain talent; changes in, or the failure or inability to comply with, government regulation; a failure of our information technology systems, systems conversions and integrations, cybersecurity attacks or a breach of our information security systems, networks, or processes; our failure to maintain our status as a real estate investment trust (“REIT”) for U.S. federal income tax purposes; changes in local, state, federal, and international laws and regulations, including related to taxation, tariffs, real estate and zoning laws, and increases in real property tax rates; the impact of any financial, accounting, legal, tax or regulatory issues or litigation that may affect us; and any other risks discussed in the Company’s filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2024. Should one of more of the risks or uncertainties described above occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Forward-looking statements in this Presentation speak only as of the date of this Presentation, and undue reliance should not be placed on such statements. We undertake no obligation to, nor do we intend to, update, or otherwise revise, any such statements that may become untrue because of subsequent events. There can be no assurance that the forward-looking statements can or will be attained or maintained. The forward-looking statements included in this Presentation have been included for purposes of illustration only, and no assurance can be given that the actual results will correspond with the results contemplated in the forward-looking statements. Market Data. We use market data throughout this Presentation that has generally been obtained from external, independent, and publicly available information and industry publications. None of Lineage, its affiliates, advisers, or representatives have verified such independent sources. Accordingly, neither the Company nor any of its affiliates, advisers or representatives make any representations as to the accuracy or completeness of that data or to update such data after the date of this presentation. Such data involves risk and uncertainties and are subject to change based on various factors. Capacity and market share data provided by the Global Cold Chain Alliance, or GCCA, reflects capacity of companies that report to GCCA. North American GCCA data includes GCCA’s estimate of capacity owned and operated by U.S. customers themselves based on data from U.S. Department of Agriculture surveys. Global GCCA data also reflects GCCA’s estimate of capacity of companies that do not report to GCCA. Non-GAAP Measures. This Presentation includes certain financial information that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Such non-GAAP financial measures should not be considered alternatives to net income as a performance measure or cash flows from operations as reported on Lineage’s statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. You should be aware that Lineage’s presentation of these and other non-GAAP financial measures in this Presentation may not be comparable to similarly-titled measures used by other companies. We caution investors not to place undue reliance on such non‐GAAP measures, but instead to consider them with the most directly comparable GAAP measures. Non‐GAAP financial measures have limitations as analytical tools and should not be considered in isolation. These non‐GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. Lineage believes that in addition to using GAAP results, non-GAAP financial measures can provide meaningful insight in evaluating the Lineage's financial performance and the effectiveness of its business strategies. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in the Appendix to this Presentation. Safe Harbor Statement 2

• Q3 Summary • US Supply and Demand • Segment Results • Capital Structure • Q4 and Full-Year Guidance Update • Summary and Q&A Agenda 3

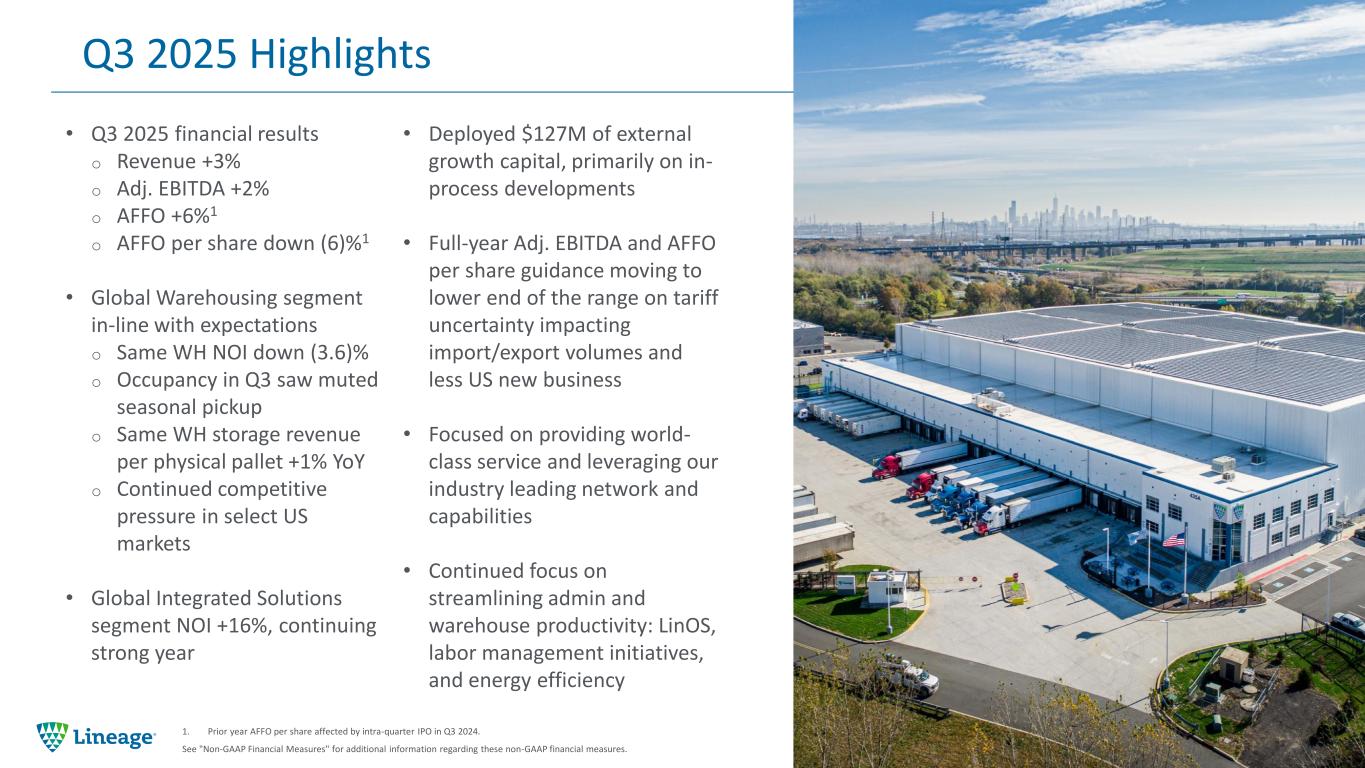

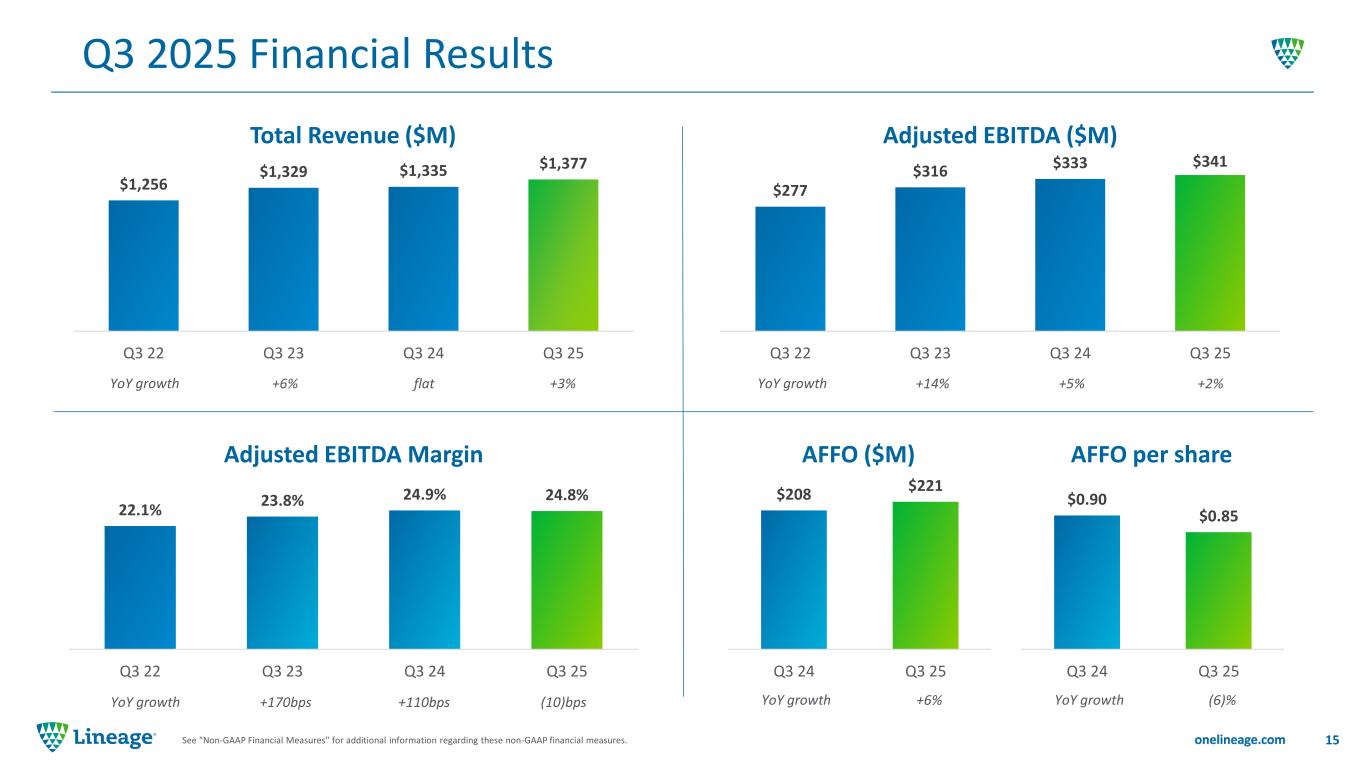

Q3 2025 Highlights 4 1. Prior year AFFO per share affected by intra-quarter IPO in Q3 2024. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. • Q3 2025 financial results o Revenue +3% o Adj. EBITDA +2% o AFFO +6%1 o AFFO per share down (6)%1 • Global Warehousing segment in-line with expectations o Same WH NOI down (3.6)% o Occupancy in Q3 saw muted seasonal pickup o Same WH storage revenue per physical pallet +1% YoY o Continued competitive pressure in select US markets • Global Integrated Solutions segment NOI +16%, continuing strong year • Deployed $127M of external growth capital, primarily on in- process developments • Full-year Adj. EBITDA and AFFO per share guidance moving to lower end of the range on tariff uncertainty impacting import/export volumes and less US new business • Focused on providing world- class service and leveraging our industry leading network and capabilities • Continued focus on streamlining admin and warehouse productivity: LinOS, labor management initiatives, and energy efficiency

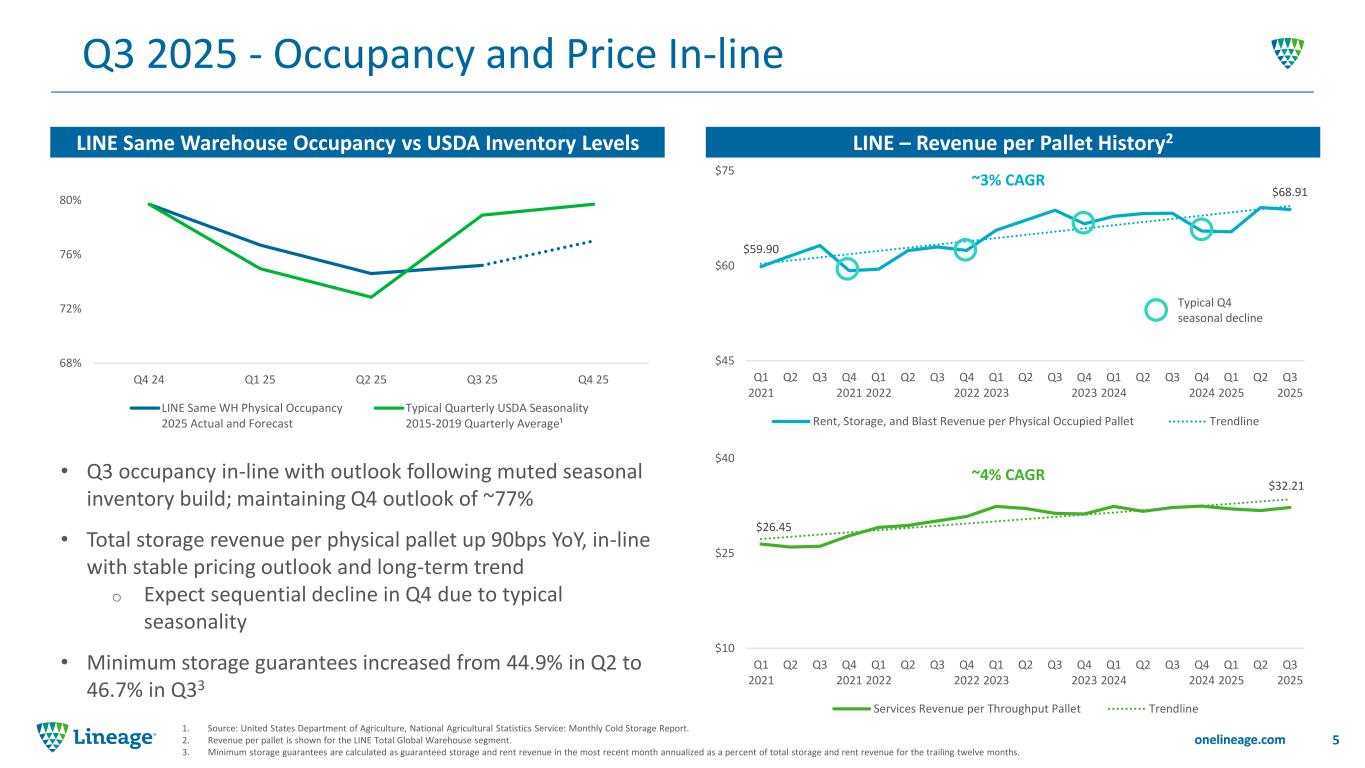

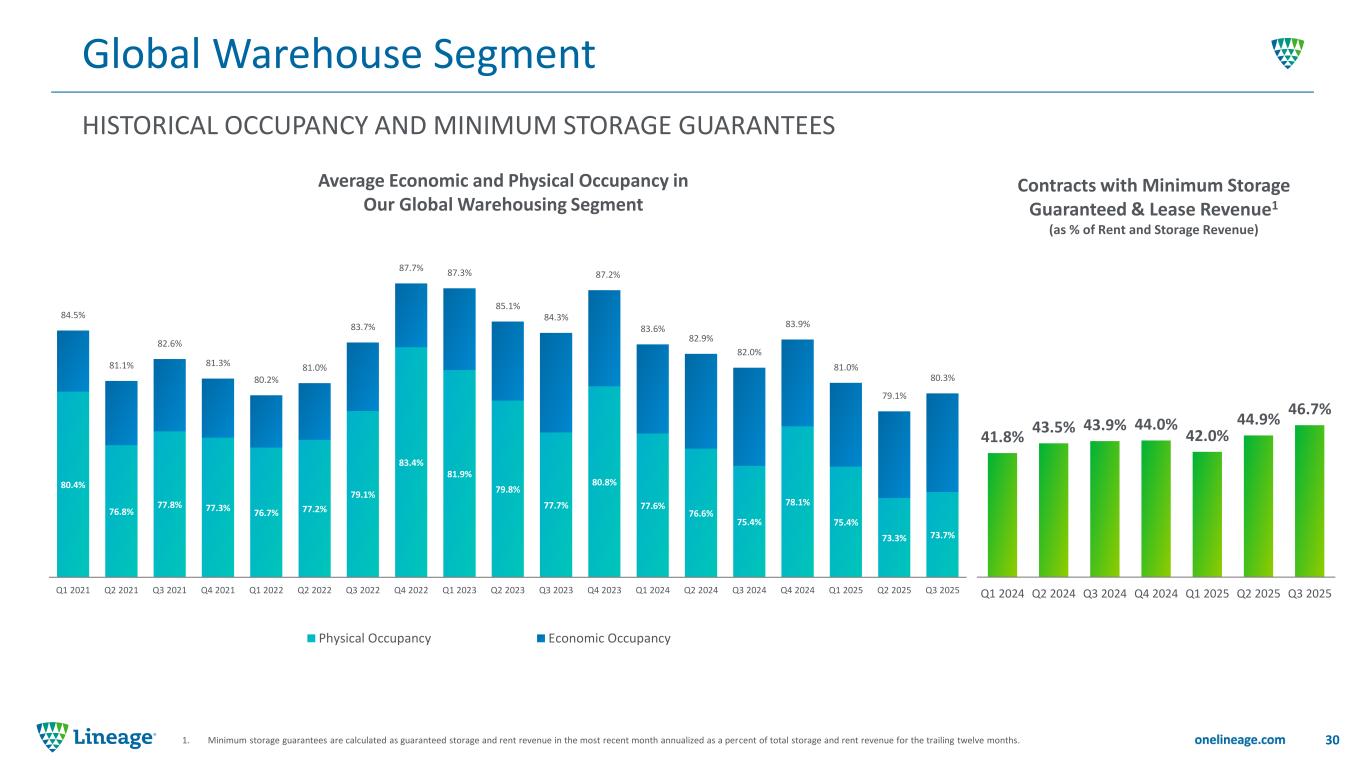

5 1. Source: United States Department of Agriculture, National Agricultural Statistics Service: Monthly Cold Storage Report. 2. Revenue per pallet is shown for the LINE Total Global Warehouse segment. 3. Minimum storage guarantees are calculated as guaranteed storage and rent revenue in the most recent month annualized as a percent of total storage and rent revenue for the trailing twelve months. Q3 2025 - Occupancy and Price In-line LINE Same Warehouse Occupancy vs USDA Inventory Levels LINE – Revenue per Pallet History2 • Q3 occupancy in-line with outlook following muted seasonal inventory build; maintaining Q4 outlook of ~77% • Total storage revenue per physical pallet up 90bps YoY, in-line with stable pricing outlook and long-term trend o Expect sequential decline in Q4 due to typical seasonality • Minimum storage guarantees increased from 44.9% in Q2 to 46.7% in Q33 $59.90 $68.91 $45 $60 $75 Q1 2021 Q2 Q3 Q4 2021 Q1 2022 Q2 Q3 Q4 2022 Q1 2023 Q2 Q3 Q4 2023 Q1 2024 Q2 Q3 Q4 2024 Q1 2025 Q2 Q3 2025 Rent, Storage, and Blast Revenue per Physical Occupied Pallet Trendline ~3% CAGR $26.45 $32.21 $10 $25 $40 Q1 2021 Q2 Q3 Q4 2021 Q1 2022 Q2 Q3 Q4 2022 Q1 2023 Q2 Q3 Q4 2023 Q1 2024 Q2 Q3 Q4 2024 Q1 2025 Q2 Q3 2025 Services Revenue per Throughput Pallet Trendline ~4% CAGR 68% 72% 76% 80% Q4 24 Q1 25 Q2 25 Q3 25 Q4 25 LINE Same WH Physical Occupancy 2025 Actual and Forecast Typical Quarterly USDA Seasonality 2015-2019 Quarterly Average¹ Typical Q4 seasonal decline

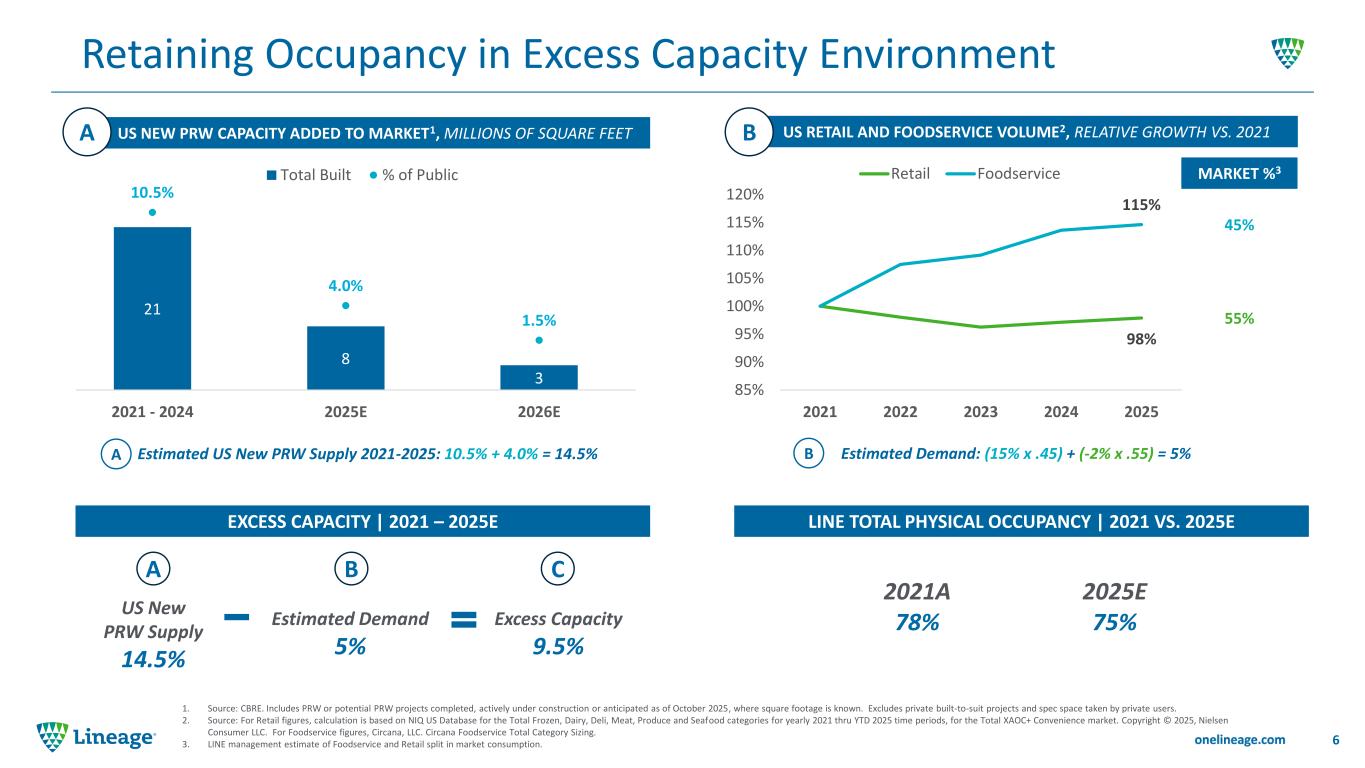

Estimated US New PRW Supply 2021-2025: 10.5% + 4.0% = 14.5% Retaining Occupancy in Excess Capacity Environment 6 1. Source: CBRE. Includes PRW or potential PRW projects completed, actively under construction or anticipated as of October 2025, where square footage is known. Excludes private built-to-suit projects and spec space taken by private users. 2. Source: For Retail figures, calculation is based on NIQ US Database for the Total Frozen, Dairy, Deli, Meat, Produce and Seafood categories for yearly 2021 thru YTD 2025 time periods, for the Total XAOC+ Convenience market. Copyright © 2025, Nielsen Consumer LLC. For Foodservice figures, Circana, LLC. Circana Foodservice Total Category Sizing. 3. LINE management estimate of Foodservice and Retail split in market consumption. 21 8 3 10.5% 4.0% 1.5% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 0 5 10 15 20 25 2021 - 2024 2025E 2026E Total Built % of Public US NEW PRW CAPACITY ADDED TO MARKET1, MILLIONS OF SQUARE FEET 98% 115% 85% 90% 95% 100% 105% 110% 115% 120% 2021 2022 2023 2024 2025 Retail Foodservice US RETAIL AND FOODSERVICE VOLUME2, RELATIVE GROWTH VS. 2021 EXCESS CAPACITY | 2021 – 2025E LINE TOTAL PHYSICAL OCCUPANCY | 2021 VS. 2025E MARKET %3 45% 55% Estimated Demand: (15% x .45) + (-2% x .55) = 5%A B A B A US New PRW Supply 14.5% B Estimated Demand 5% C Excess Capacity 9.5% 2021A 78% 2025E 75%

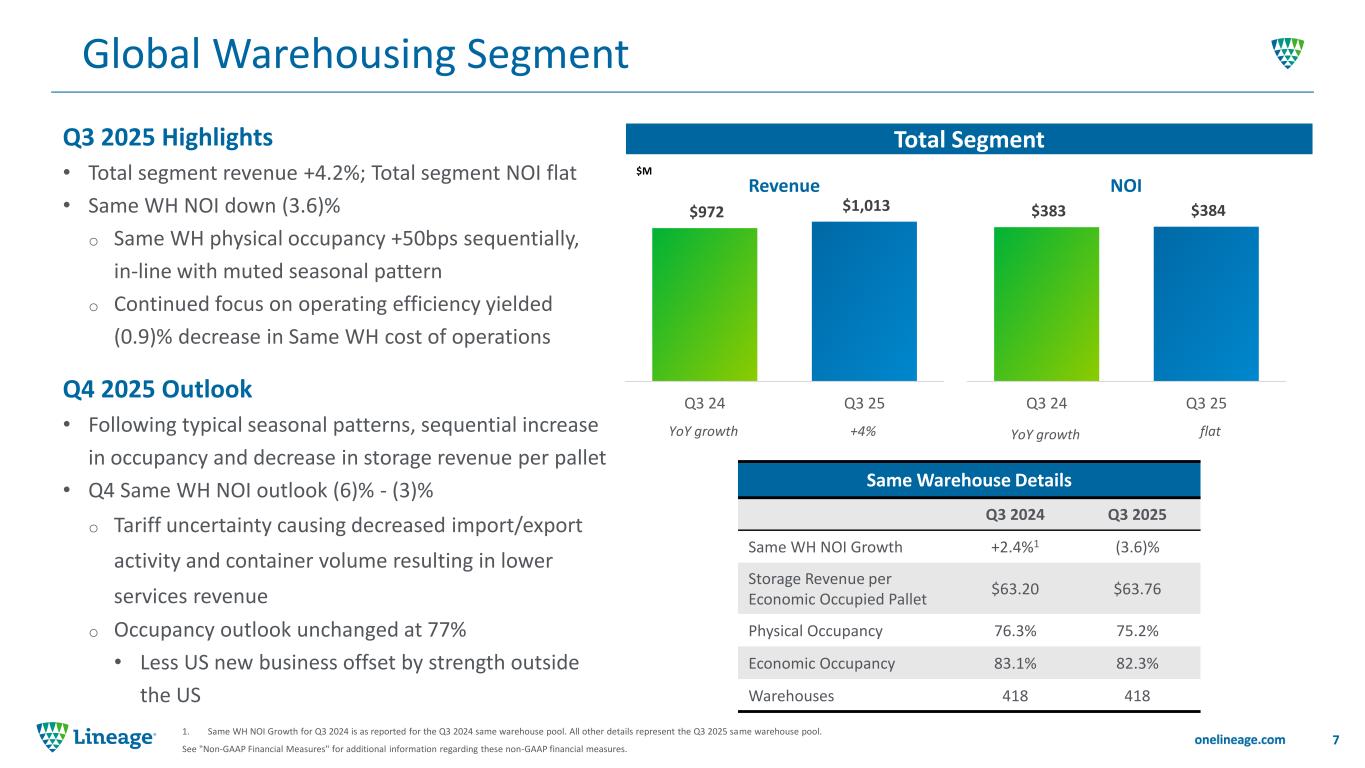

$972 $1,013 Q3 24 Q3 25 Revenue Global Warehousing Segment 7 1. Same WH NOI Growth for Q3 2024 is as reported for the Q3 2024 same warehouse pool. All other details represent the Q3 2025 same warehouse pool. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Q3 2025 Highlights • Total segment revenue +4.2%; Total segment NOI flat • Same WH NOI down (3.6)% o Same WH physical occupancy +50bps sequentially, in-line with muted seasonal pattern o Continued focus on operating efficiency yielded (0.9)% decrease in Same WH cost of operations Q4 2025 Outlook • Following typical seasonal patterns, sequential increase in occupancy and decrease in storage revenue per pallet • Q4 Same WH NOI outlook (6)% - (3)% o Tariff uncertainty causing decreased import/export activity and container volume resulting in lower services revenue o Occupancy outlook unchanged at 77% • Less US new business offset by strength outside the US $M 39.1% margin 39.5% margin 35.6% margin Total Segment $383 $384 Q3 24 Q3 25 NOI Same Warehouse Details Q3 2024 Q3 2025 Same WH NOI Growth +2.4%1 (3.6)% Storage Revenue per Economic Occupied Pallet $63.20 $63.76 Physical Occupancy 76.3% 75.2% Economic Occupancy 83.1% 82.3% Warehouses 418 418 +4%YoY growth flatYoY growth

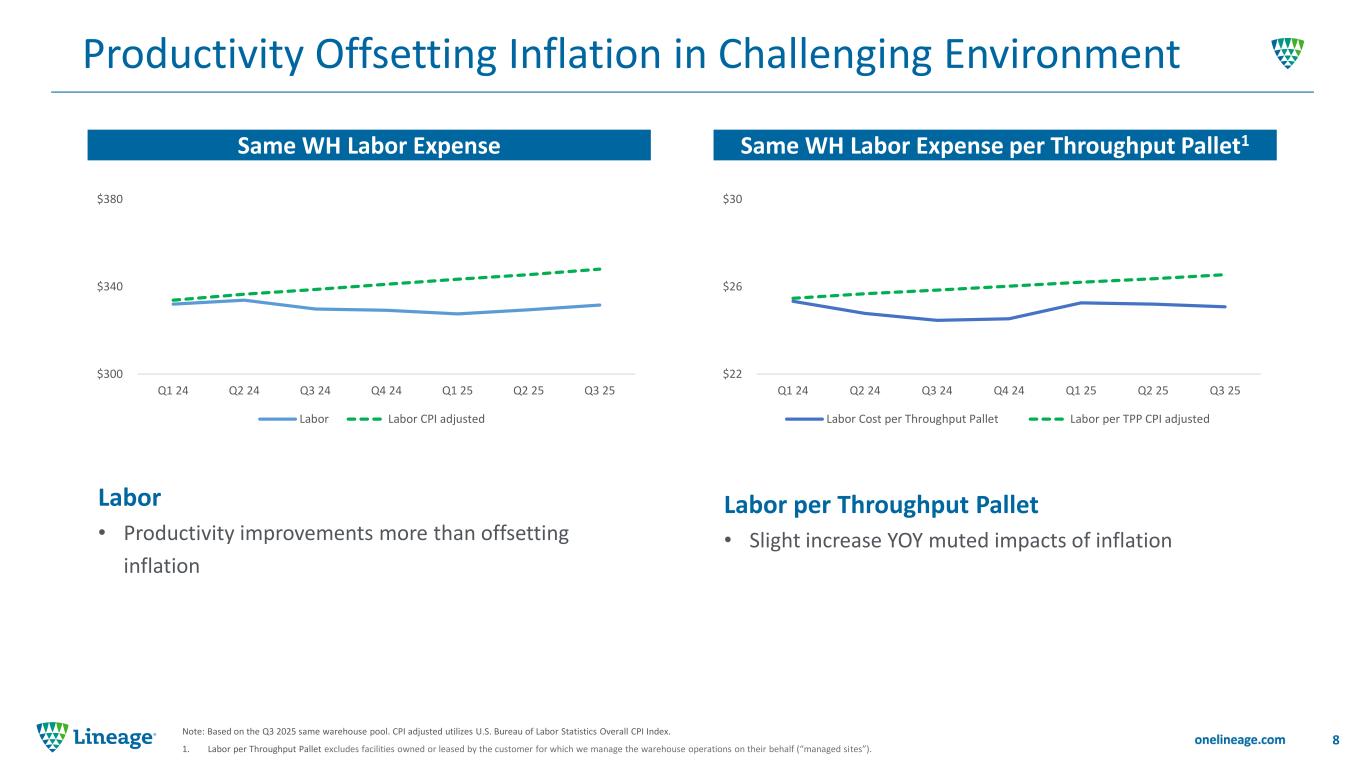

Productivity Offsetting Inflation in Challenging Environment 8 Note: Based on the Q3 2025 same warehouse pool. CPI adjusted utilizes U.S. Bureau of Labor Statistics Overall CPI Index. 1. Labor per Throughput Pallet excludes facilities owned or leased by the customer for which we manage the warehouse operations on their behalf (“managed sites”). Labor per Throughput Pallet • Slight increase YOY muted impacts of inflation $300 $340 $380 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Labor Labor CPI adjusted $22 $26 $30 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 Labor Cost per Throughput Pallet Labor per TPP CPI adjusted Same WH Labor Expense Labor • Productivity improvements more than offsetting inflation Same WH Labor Expense per Throughput Pallet1

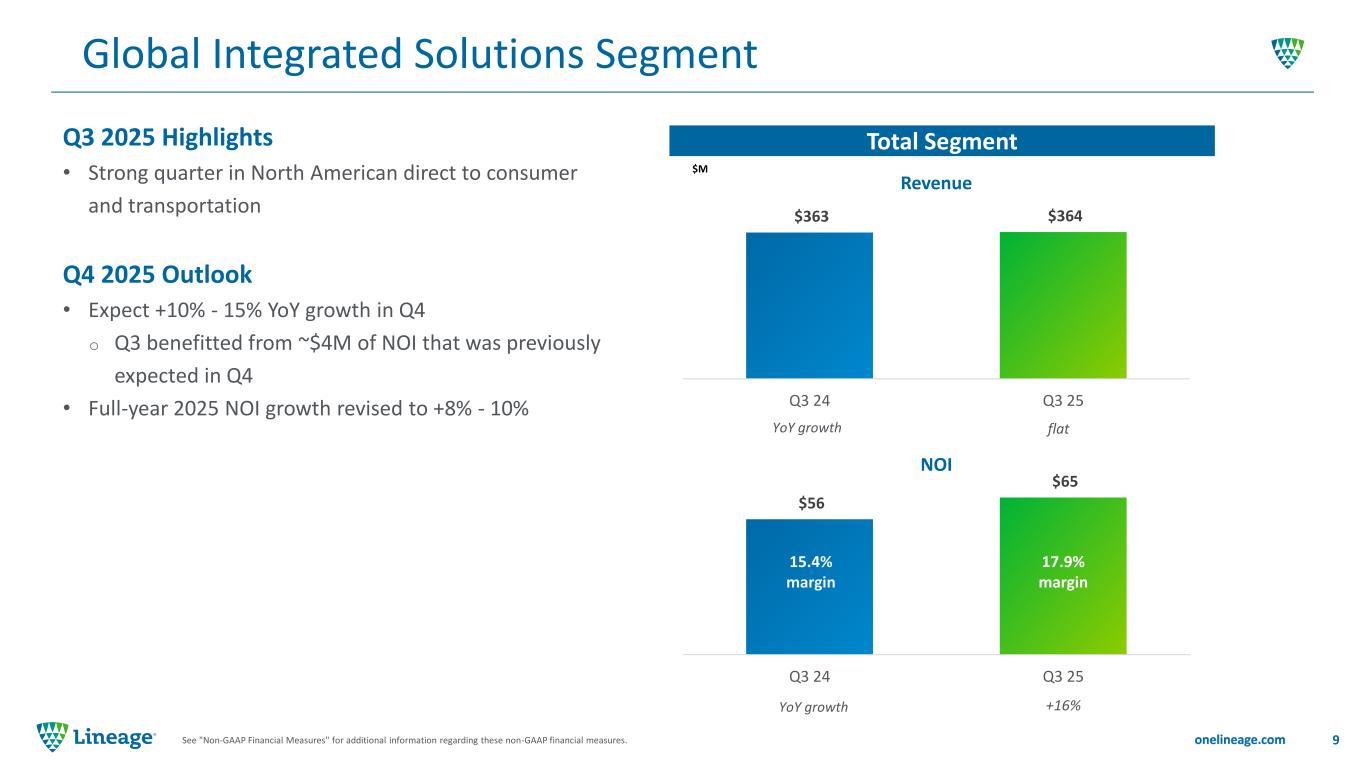

$363 $364 Q3 24 Q3 25 Revenue Global Integrated Solutions Segment 9See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. $M Total Segment $56 $65 Q3 24 Q3 25 NOI 15.4% margin 17.9% margin flatYoY growth +16%YoY growth Q3 2025 Highlights • Strong quarter in North American direct to consumer and transportation Q4 2025 Outlook • Expect +10% - 15% YoY growth in Q4 o Q3 benefitted from ~$4M of NOI that was previously expected in Q4 • Full-year 2025 NOI growth revised to +8% - 10%

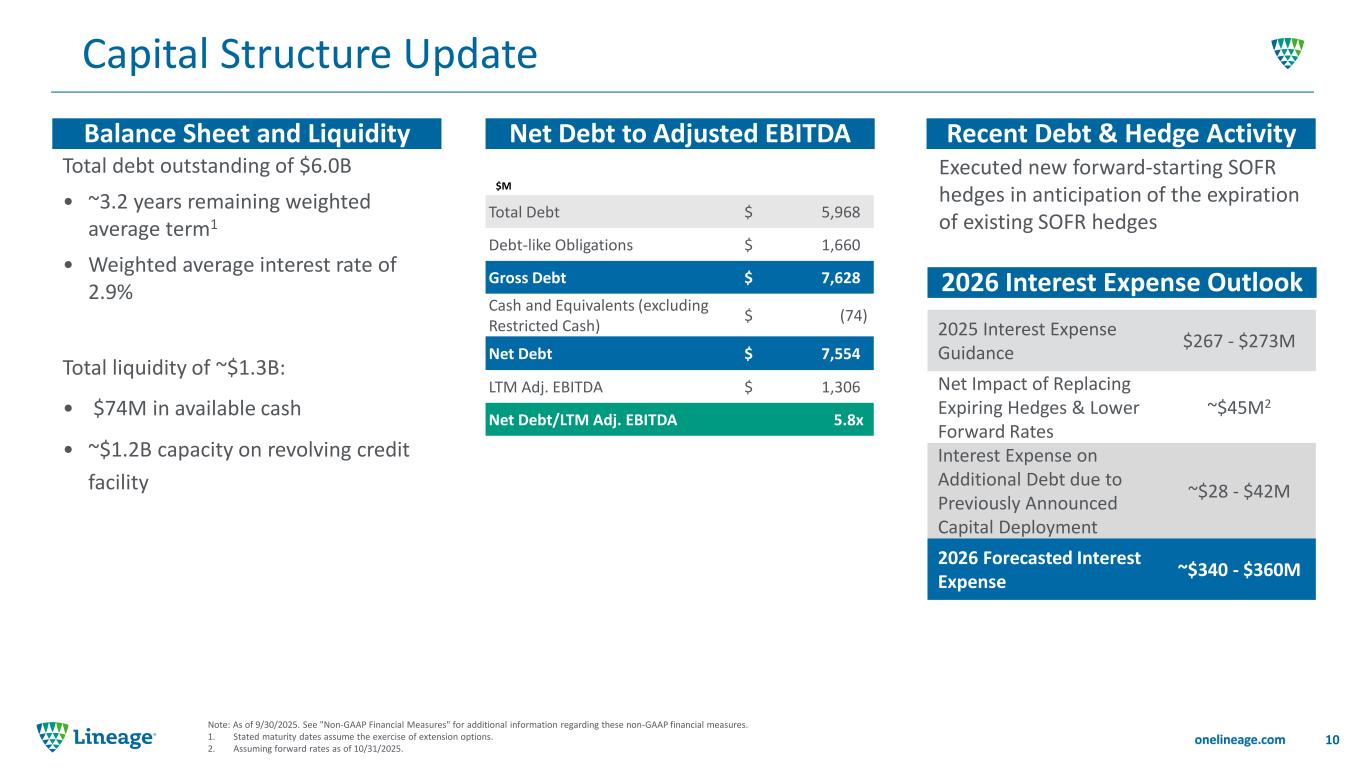

10 Capital Structure Update Note: As of 9/30/2025. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 1. Stated maturity dates assume the exercise of extension options. 2. Assuming forward rates as of 10/31/2025. Total debt outstanding of $6.0B • ~3.2 years remaining weighted average term1 • Weighted average interest rate of 2.9% Total liquidity of ~$1.3B: • $74M in available cash • ~$1.2B capacity on revolving credit facility Total Debt $ 5,968 Debt-like Obligations $ 1,660 Gross Debt $ 7,628 Cash and Equivalents (excluding Restricted Cash) $ (74) Net Debt $ 7,554 LTM Adj. EBITDA $ 1,306 Net Debt/LTM Adj. EBITDA 5.8x $M Net Debt to Adjusted EBITDABalance Sheet and Liquidity Recent Debt & Hedge Activity Executed new forward-starting SOFR hedges in anticipation of the expiration of existing SOFR hedges 2025 Interest Expense Guidance $267 - $273M Net Impact of Replacing Expiring Hedges & Lower Forward Rates ~$45M2 Interest Expense on Additional Debt due to Previously Announced Capital Deployment ~$28 - $42M 2026 Forecasted Interest Expense ~$340 - $360M 2026 Interest Expense Outlook

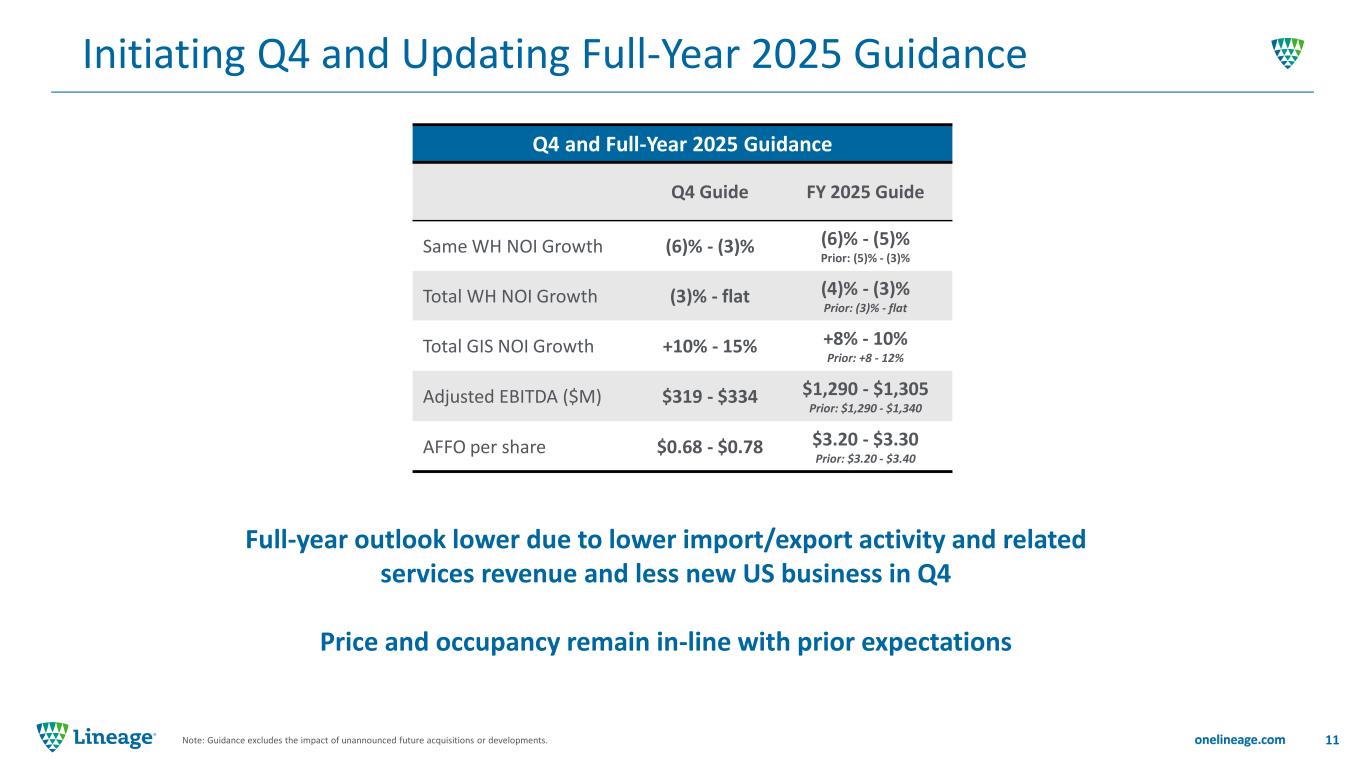

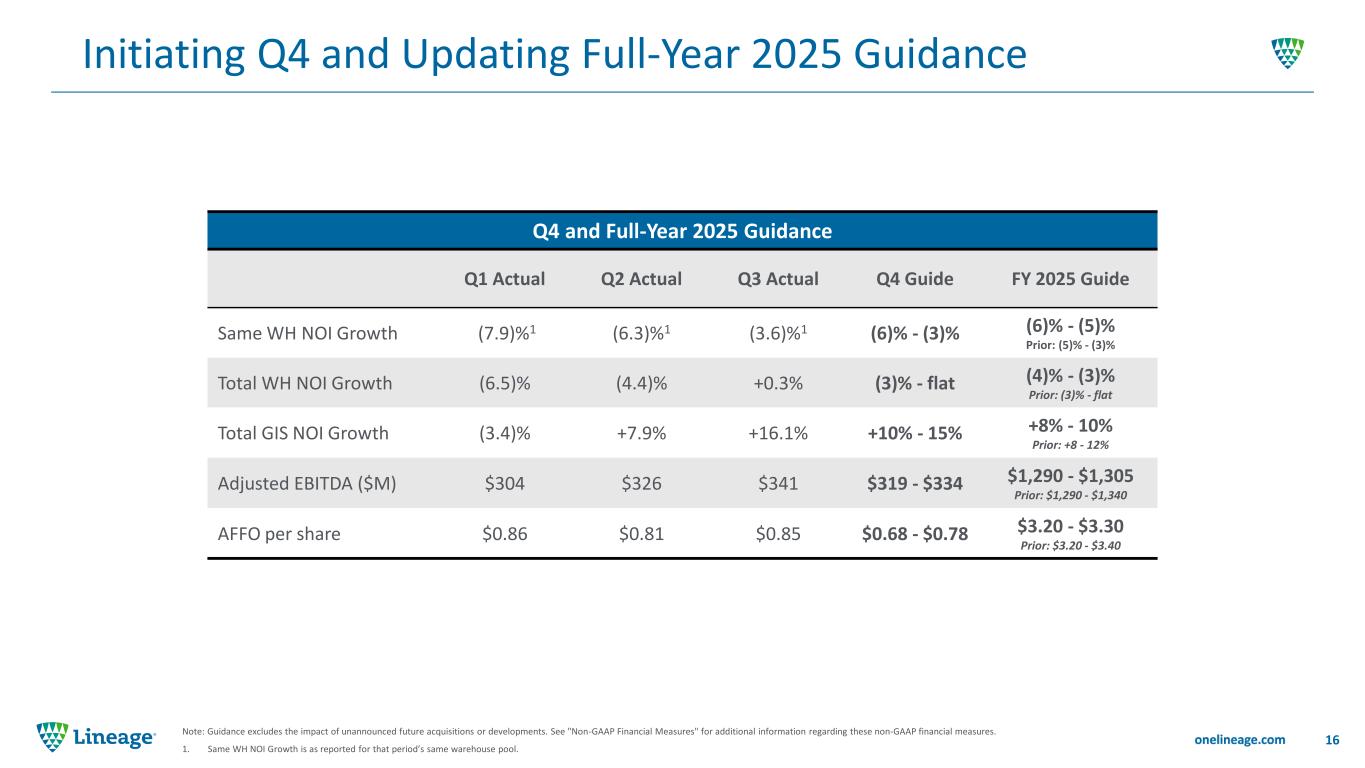

11Note: Guidance excludes the impact of unannounced future acquisitions or developments. Initiating Q4 and Updating Full-Year 2025 Guidance Full-year outlook lower due to lower import/export activity and related services revenue and less new US business in Q4 Price and occupancy remain in-line with prior expectations Q4 and Full-Year 2025 Guidance Q4 Guide FY 2025 Guide Same WH NOI Growth (6)% - (3)% (6)% - (5)% Prior: (5)% - (3)% Total WH NOI Growth (3)% - flat (4)% - (3)% Prior: (3)% - flat Total GIS NOI Growth +10% - 15% +8% - 10% Prior: +8 - 12% Adjusted EBITDA ($M) $319 - $334 $1,290 - $1,305 Prior: $1,290 - $1,340 AFFO per share $0.68 - $0.78 $3.20 - $3.30 Prior: $3.20 - $3.40

12 Positioned to Win Global Integrated Solutions Customer Experience Optimizing Supply Chain Costs Customer Success Largest Global Footprint Procurement Leverage Consolidating Facilities Network Effects Warehouse Productivity LinOS Technology Lean Automation Earning the right to grow with our valued customers

13 Summary • Industry remains mission-critical for our customers and underlying consumer demand is growing • Challenges of excess supply and macro headwinds are short-term • While the industry remains competitive, we are seeing green shoots of optimism o Supply: New supply outlook coming down from recent levels o Demand: Fresh and frozen food consumption growing o Global Trade: Stabilization expected as agreements are reached • Continue to improve the areas under our control • As the industry leader, Lineage is best positioned to capitalize on industry inflection

Supplemental Financial and Operating Data 14

Q3 2025 Financial Results 15See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Total Revenue ($M) Adjusted EBITDA ($M) Adjusted EBITDA Margin AFFO per share $277 $316 $333 $341 Q3 22 Q3 23 Q3 24 Q3 25 22.1% 23.8% 24.9% 24.8% Q3 22 Q3 23 Q3 24 Q3 25 $1,256 $1,329 $1,335 $1,377 Q3 22 Q3 23 Q3 24 Q3 25 +3%flatYoY growth +6% +2%+5%YoY growth +14% (10)bps+110bpsYoY growth +170bps (6)%YoY growth $0.90 $0.85 Q3 24 Q3 25 AFFO ($M) +6%YoY growth $208 $221 Q3 24 Q3 25

16 Note: Guidance excludes the impact of unannounced future acquisitions or developments. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 1. Same WH NOI Growth is as reported for that period’s same warehouse pool. Initiating Q4 and Updating Full-Year 2025 Guidance Q4 and Full-Year 2025 Guidance Q1 Actual Q2 Actual Q3 Actual Q4 Guide FY 2025 Guide Same WH NOI Growth (7.9)%1 (6.3)%1 (3.6)%1 (6)% - (3)% (6)% - (5)% Prior: (5)% - (3)% Total WH NOI Growth (6.5)% (4.4)% +0.3% (3)% - flat (4)% - (3)% Prior: (3)% - flat Total GIS NOI Growth (3.4)% +7.9% +16.1% +10% - 15% +8% - 10% Prior: +8 - 12% Adjusted EBITDA ($M) $304 $326 $341 $319 - $334 $1,290 - $1,305 Prior: $1,290 - $1,340 AFFO per share $0.86 $0.81 $0.85 $0.68 - $0.78 $3.20 - $3.30 Prior: $3.20 - $3.40

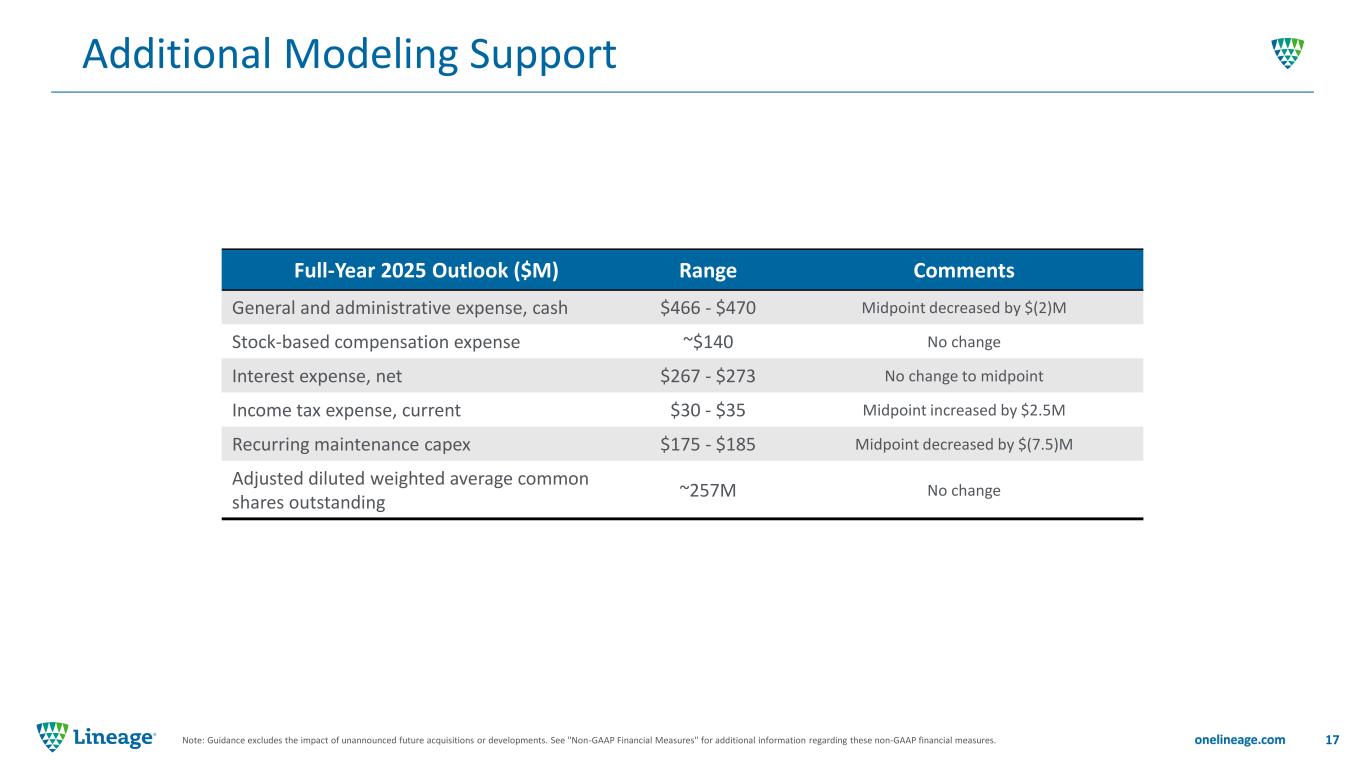

17 Additional Modeling Support Note: Guidance excludes the impact of unannounced future acquisitions or developments. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Full-Year 2025 Outlook ($M) Range Comments General and administrative expense, cash $466 - $470 Midpoint decreased by $(2)M Stock-based compensation expense ~$140 No change Interest expense, net $267 - $273 No change to midpoint Income tax expense, current $30 - $35 Midpoint increased by $2.5M Recurring maintenance capex $175 - $185 Midpoint decreased by $(7.5)M Adjusted diluted weighted average common shares outstanding ~257M No change

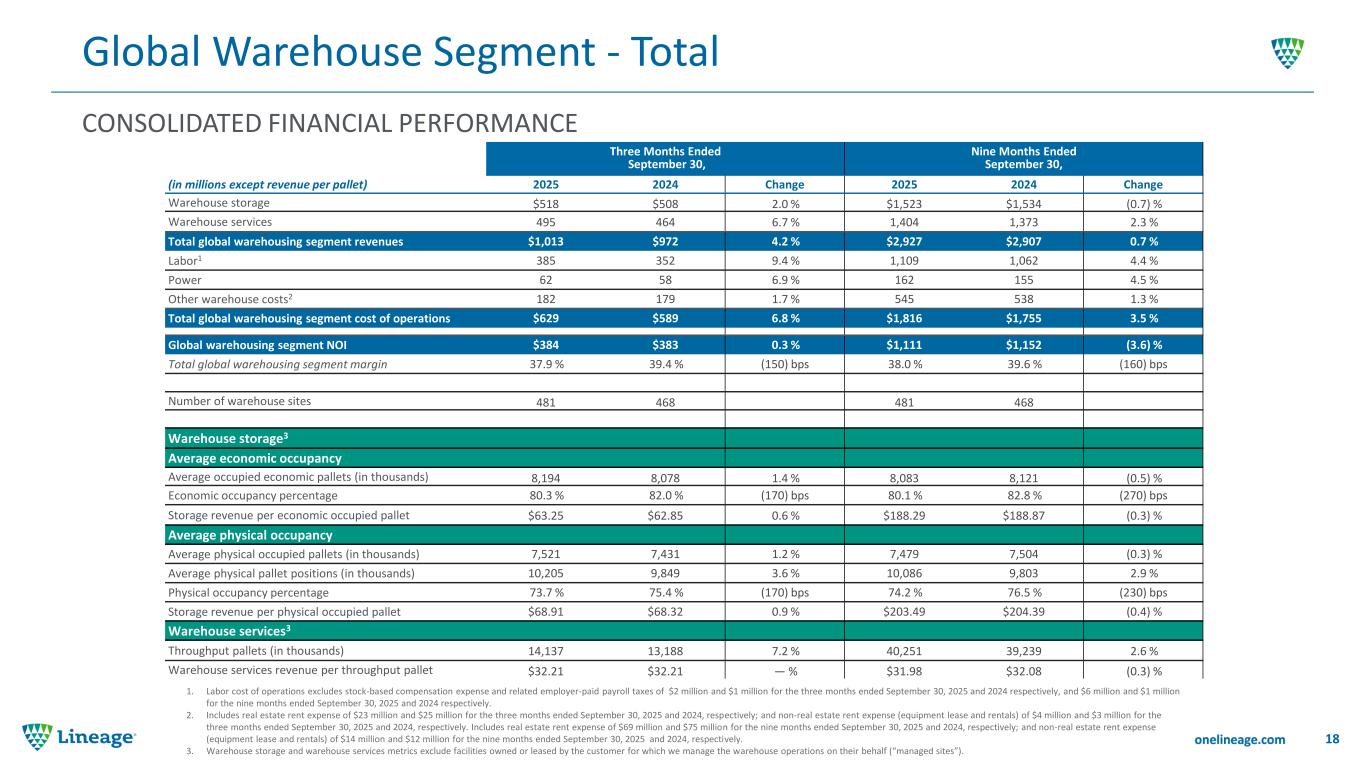

CONSOLIDATED FINANCIAL PERFORMANCE Global Warehouse Segment - Total 18 1. Labor cost of operations excludes stock-based compensation expense and related employer-paid payroll taxes of $2 million and $1 million for the three months ended September 30, 2025 and 2024 respectively, and $6 million and $1 million for the nine months ended September 30, 2025 and 2024 respectively. 2. Includes real estate rent expense of $23 million and $25 million for the three months ended September 30, 2025 and 2024, respectively; and non-real estate rent expense (equipment lease and rentals) of $4 million and $3 million for the three months ended September 30, 2025 and 2024, respectively. Includes real estate rent expense of $69 million and $75 million for the nine months ended September 30, 2025 and 2024, respectively; and non-real estate rent expense (equipment lease and rentals) of $14 million and $12 million for the nine months ended September 30, 2025 and 2024, respectively. 3. Warehouse storage and warehouse services metrics exclude facilities owned or leased by the customer for which we manage the warehouse operations on their behalf (“managed sites”). Three Months Ended September 30, Nine Months Ended September 30, (in millions except revenue per pallet) 2025 2024 Change 2025 2024 Change Warehouse storage $518 $508 2.0 % $1,523 $1,534 (0.7) % Warehouse services 495 464 6.7 % 1,404 1,373 2.3 % Total global warehousing segment revenues $1,013 $972 4.2 % $2,927 $2,907 0.7 % Labor1 385 352 9.4 % 1,109 1,062 4.4 % Power 62 58 6.9 % 162 155 4.5 % Other warehouse costs2 182 179 1.7 % 545 538 1.3 % Total global warehousing segment cost of operations $629 $589 6.8 % $1,816 $1,755 3.5 % Global warehousing segment NOI $384 $383 0.3 % $1,111 $1,152 (3.6) % Total global warehousing segment margin 37.9 % 39.4 % (150) bps 38.0 % 39.6 % (160) bps Number of warehouse sites 481 468 481 468 Warehouse storage3 Average economic occupancy Average occupied economic pallets (in thousands) 8,194 8,078 1.4 % 8,083 8,121 (0.5) % Economic occupancy percentage 80.3 % 82.0 % (170) bps 80.1 % 82.8 % (270) bps Storage revenue per economic occupied pallet $63.25 $62.85 0.6 % $188.29 $188.87 (0.3) % Average physical occupancy Average physical occupied pallets (in thousands) 7,521 7,431 1.2 % 7,479 7,504 (0.3) % Average physical pallet positions (in thousands) 10,205 9,849 3.6 % 10,086 9,803 2.9 % Physical occupancy percentage 73.7 % 75.4 % (170) bps 74.2 % 76.5 % (230) bps Storage revenue per physical occupied pallet $68.91 $68.32 0.9 % $203.49 $204.39 (0.4) % Warehouse services3 Throughput pallets (in thousands) 14,137 13,188 7.2 % 40,251 39,239 2.6 % Warehouse services revenue per throughput pallet $32.21 $32.21 — % $31.98 $32.08 (0.3) %

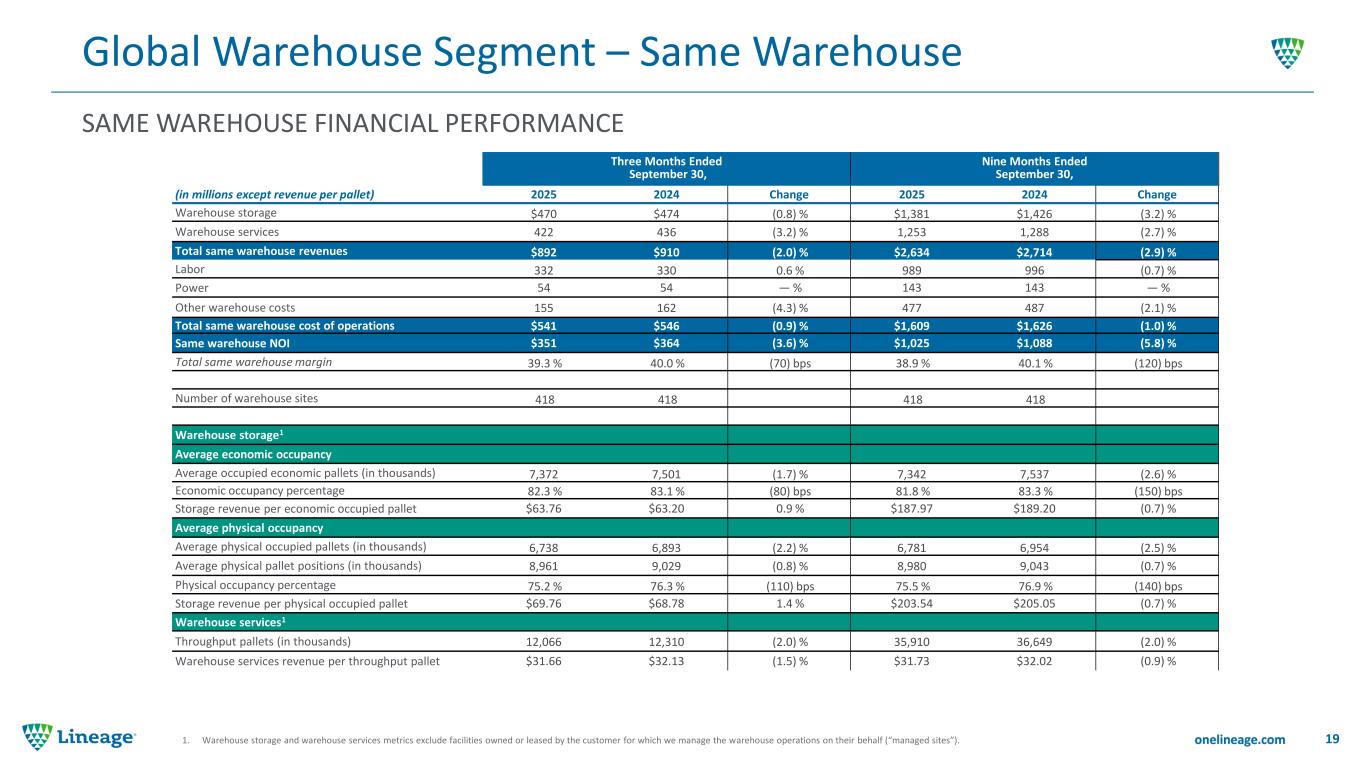

SAME WAREHOUSE FINANCIAL PERFORMANCE Global Warehouse Segment – Same Warehouse 191. Warehouse storage and warehouse services metrics exclude facilities owned or leased by the customer for which we manage the warehouse operations on their behalf (“managed sites”). Three Months Ended September 30, Nine Months Ended September 30, (in millions except revenue per pallet) 2025 2024 Change 2025 2024 Change Warehouse storage $470 $474 (0.8) % $1,381 $1,426 (3.2) % Warehouse services 422 436 (3.2) % 1,253 1,288 (2.7) % Total same warehouse revenues $892 $910 (2.0) % $2,634 $2,714 (2.9) % Labor 332 330 0.6 % 989 996 (0.7) % Power 54 54 — % 143 143 — % Other warehouse costs 155 162 (4.3) % 477 487 (2.1) % Total same warehouse cost of operations $541 $546 (0.9) % $1,609 $1,626 (1.0) % Same warehouse NOI $351 $364 (3.6) % $1,025 $1,088 (5.8) % Total same warehouse margin 39.3 % 40.0 % (70) bps 38.9 % 40.1 % (120) bps Number of warehouse sites 418 418 418 418 Warehouse storage1 Average economic occupancy Average occupied economic pallets (in thousands) 7,372 7,501 (1.7) % 7,342 7,537 (2.6) % Economic occupancy percentage 82.3 % 83.1 % (80) bps 81.8 % 83.3 % (150) bps Storage revenue per economic occupied pallet $63.76 $63.20 0.9 % $187.97 $189.20 (0.7) % Average physical occupancy Average physical occupied pallets (in thousands) 6,738 6,893 (2.2) % 6,781 6,954 (2.5) % Average physical pallet positions (in thousands) 8,961 9,029 (0.8) % 8,980 9,043 (0.7) % Physical occupancy percentage 75.2 % 76.3 % (110) bps 75.5 % 76.9 % (140) bps Storage revenue per physical occupied pallet $69.76 $68.78 1.4 % $203.54 $205.05 (0.7) % Warehouse services1 Throughput pallets (in thousands) 12,066 12,310 (2.0) % 35,910 36,649 (2.0) % Warehouse services revenue per throughput pallet $31.66 $32.13 (1.5) % $31.73 $32.02 (0.9) %

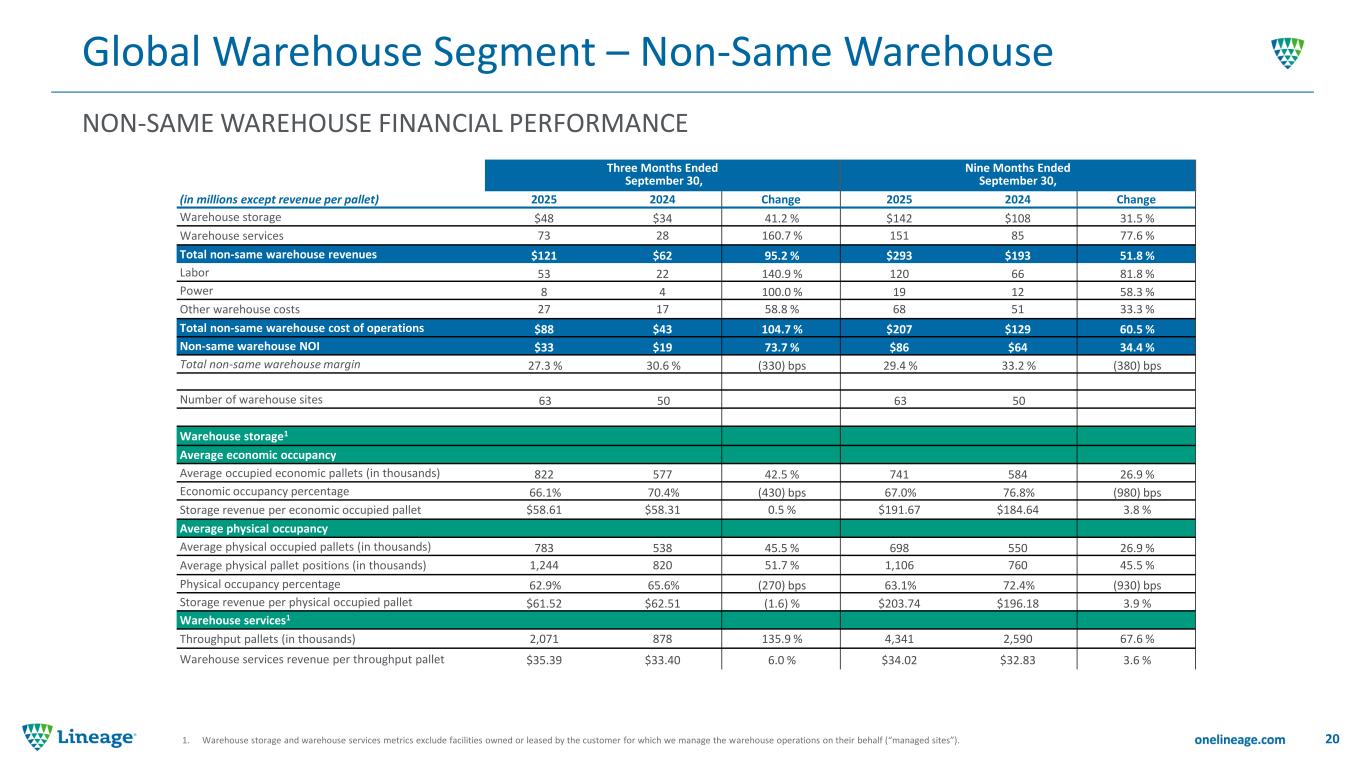

NON-SAME WAREHOUSE FINANCIAL PERFORMANCE Global Warehouse Segment – Non-Same Warehouse 201. Warehouse storage and warehouse services metrics exclude facilities owned or leased by the customer for which we manage the warehouse operations on their behalf (“managed sites”). Three Months Ended September 30, Nine Months Ended September 30, (in millions except revenue per pallet) 2025 2024 Change 2025 2024 Change Warehouse storage $48 $34 41.2 % $142 $108 31.5 % Warehouse services 73 28 160.7 % 151 85 77.6 % Total non-same warehouse revenues $121 $62 95.2 % $293 $193 51.8 % Labor 53 22 140.9 % 120 66 81.8 % Power 8 4 100.0 % 19 12 58.3 % Other warehouse costs 27 17 58.8 % 68 51 33.3 % Total non-same warehouse cost of operations $88 $43 104.7 % $207 $129 60.5 % Non-same warehouse NOI $33 $19 73.7 % $86 $64 34.4 % Total non-same warehouse margin 27.3 % 30.6 % (330) bps 29.4 % 33.2 % (380) bps Number of warehouse sites 63 50 63 50 Warehouse storage1 Average economic occupancy Average occupied economic pallets (in thousands) 822 577 42.5 % 741 584 26.9 % Economic occupancy percentage 66.1% 70.4% (430) bps 67.0% 76.8% (980) bps Storage revenue per economic occupied pallet $58.61 $58.31 0.5 % $191.67 $184.64 3.8 % Average physical occupancy Average physical occupied pallets (in thousands) 783 538 45.5 % 698 550 26.9 % Average physical pallet positions (in thousands) 1,244 820 51.7 % 1,106 760 45.5 % Physical occupancy percentage 62.9% 65.6% (270) bps 63.1% 72.4% (930) bps Storage revenue per physical occupied pallet $61.52 $62.51 (1.6) % $203.74 $196.18 3.9 % Warehouse services1 Throughput pallets (in thousands) 2,071 878 135.9 % 4,341 2,590 67.6 % Warehouse services revenue per throughput pallet $35.39 $33.40 6.0 % $34.02 $32.83 3.6 %

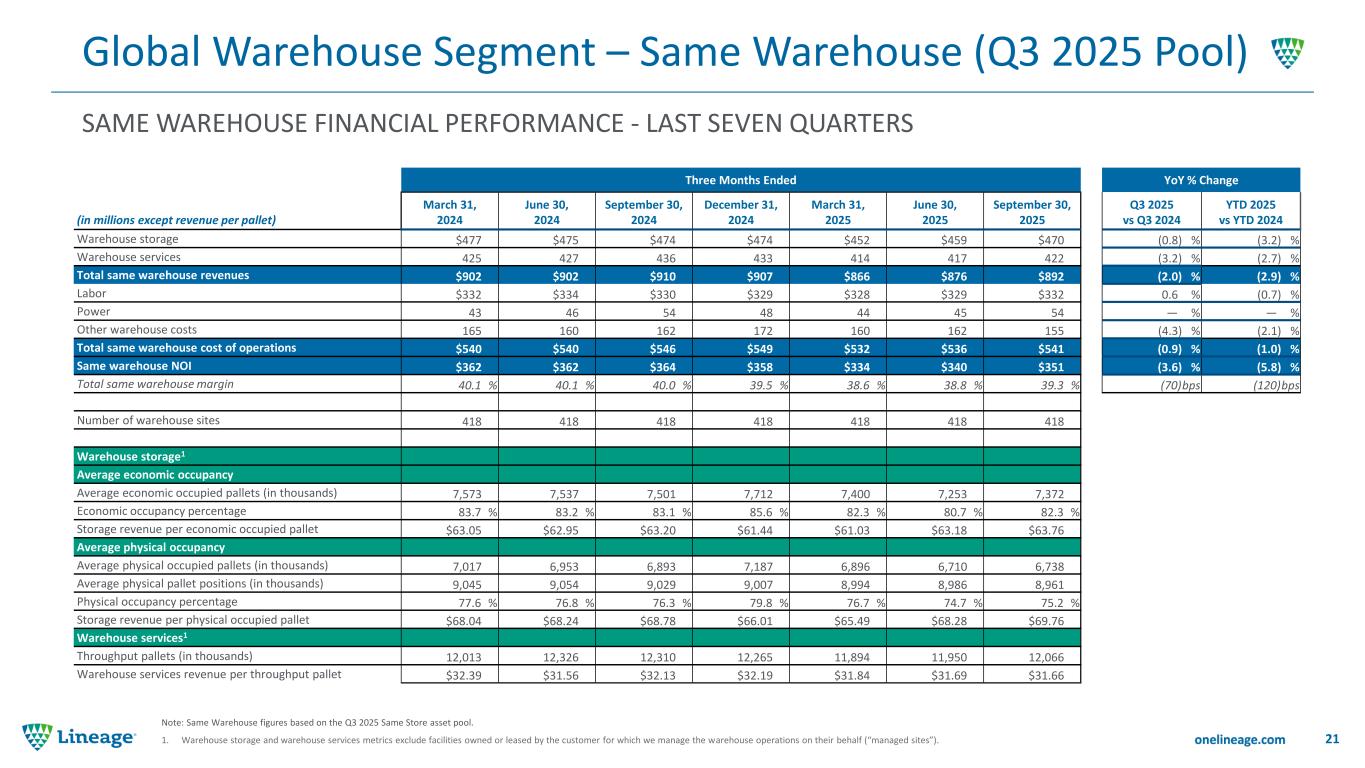

SAME WAREHOUSE FINANCIAL PERFORMANCE - LAST SEVEN QUARTERS Global Warehouse Segment – Same Warehouse (Q3 2025 Pool) 21 Note: Same Warehouse figures based on the Q3 2025 Same Store asset pool. 1. Warehouse storage and warehouse services metrics exclude facilities owned or leased by the customer for which we manage the warehouse operations on their behalf (“managed sites”). Three Months Ended YoY % Change (in millions except revenue per pallet) March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 Q3 2025 vs Q3 2024 YTD 2025 vs YTD 2024 Warehouse storage $477 $475 $474 $474 $452 $459 $470 (0.8) % (3.2) % Warehouse services 425 427 436 433 414 417 422 (3.2) % (2.7) % Total same warehouse revenues $902 $902 $910 $907 $866 $876 $892 (2.0) % (2.9) % Labor $332 $334 $330 $329 $328 $329 $332 0.6 % (0.7) % Power 43 46 54 48 44 45 54 — % — % Other warehouse costs 165 160 162 172 160 162 155 (4.3) % (2.1) % Total same warehouse cost of operations $540 $540 $546 $549 $532 $536 $541 (0.9) % (1.0) % Same warehouse NOI $362 $362 $364 $358 $334 $340 $351 (3.6) % (5.8) % Total same warehouse margin 40.1 % 40.1 % 40.0 % 39.5 % 38.6 % 38.8 % 39.3 % (70)bps (120)bps Number of warehouse sites 418 418 418 418 418 418 418 Warehouse storage1 Average economic occupancy Average economic occupied pallets (in thousands) 7,573 7,537 7,501 7,712 7,400 7,253 7,372 Economic occupancy percentage 83.7 % 83.2 % 83.1 % 85.6 % 82.3 % 80.7 % 82.3 % Storage revenue per economic occupied pallet $63.05 $62.95 $63.20 $61.44 $61.03 $63.18 $63.76 Average physical occupancy Average physical occupied pallets (in thousands) 7,017 6,953 6,893 7,187 6,896 6,710 6,738 Average physical pallet positions (in thousands) 9,045 9,054 9,029 9,007 8,994 8,986 8,961 Physical occupancy percentage 77.6 % 76.8 % 76.3 % 79.8 % 76.7 % 74.7 % 75.2 % Storage revenue per physical occupied pallet $68.04 $68.24 $68.78 $66.01 $65.49 $68.28 $69.76 Warehouse services1 Throughput pallets (in thousands) 12,013 12,326 12,310 12,265 11,894 11,950 12,066 Warehouse services revenue per throughput pallet $32.39 $31.56 $32.13 $32.19 $31.84 $31.69 $31.66

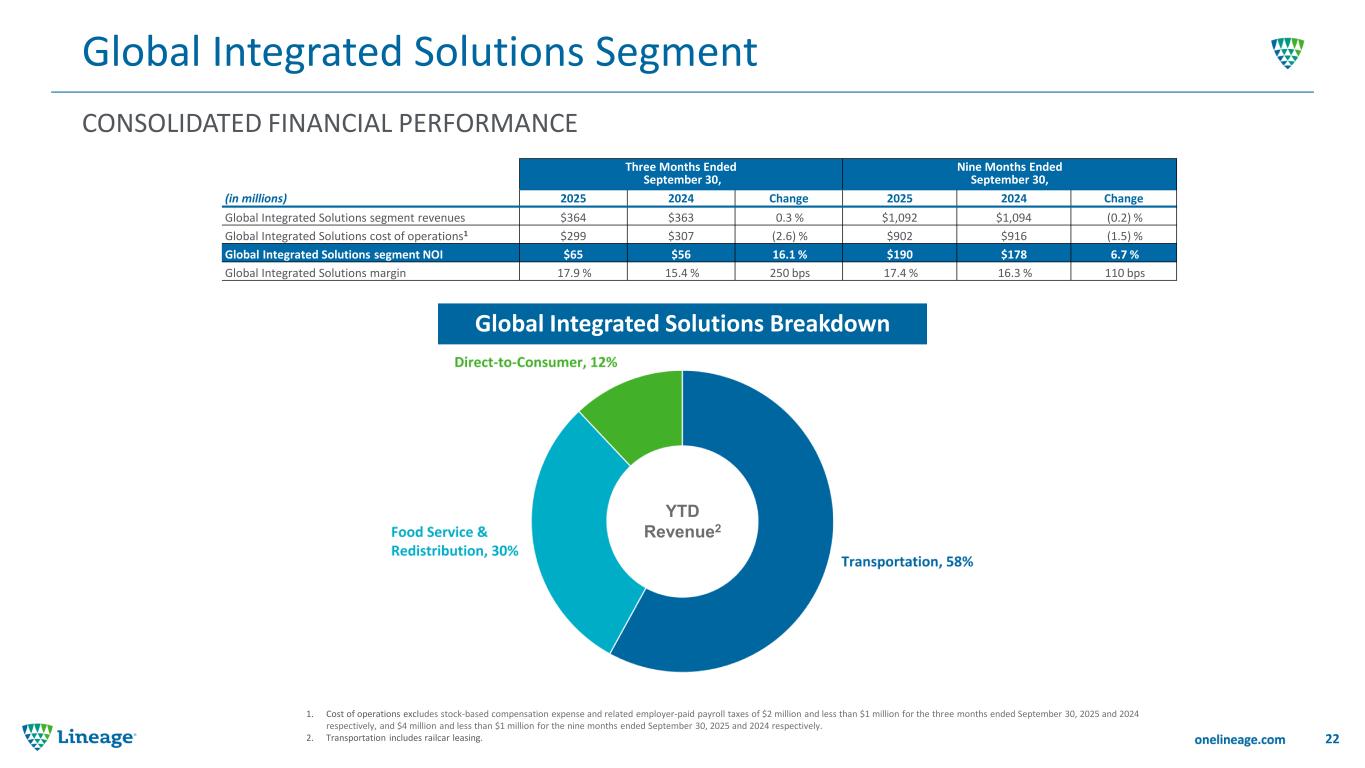

Global Integrated Solutions Segment 22 1. Cost of operations excludes stock-based compensation expense and related employer-paid payroll taxes of $2 million and less than $1 million for the three months ended September 30, 2025 and 2024 respectively, and $4 million and less than $1 million for the nine months ended September 30, 2025 and 2024 respectively. 2. Transportation includes railcar leasing. Three Months Ended September 30, Nine Months Ended September 30, (in millions) 2025 2024 Change 2025 2024 Change Global Integrated Solutions segment revenues $364 $363 0.3 % $1,092 $1,094 (0.2) % Global Integrated Solutions cost of operations1 $299 $307 (2.6) % $902 $916 (1.5) % Global Integrated Solutions segment NOI $65 $56 16.1 % $190 $178 6.7 % Global Integrated Solutions margin 17.9 % 15.4 % 250 bps 17.4 % 16.3 % 110 bps CONSOLIDATED FINANCIAL PERFORMANCE Global Integrated Solutions Breakdown YTD Revenue2

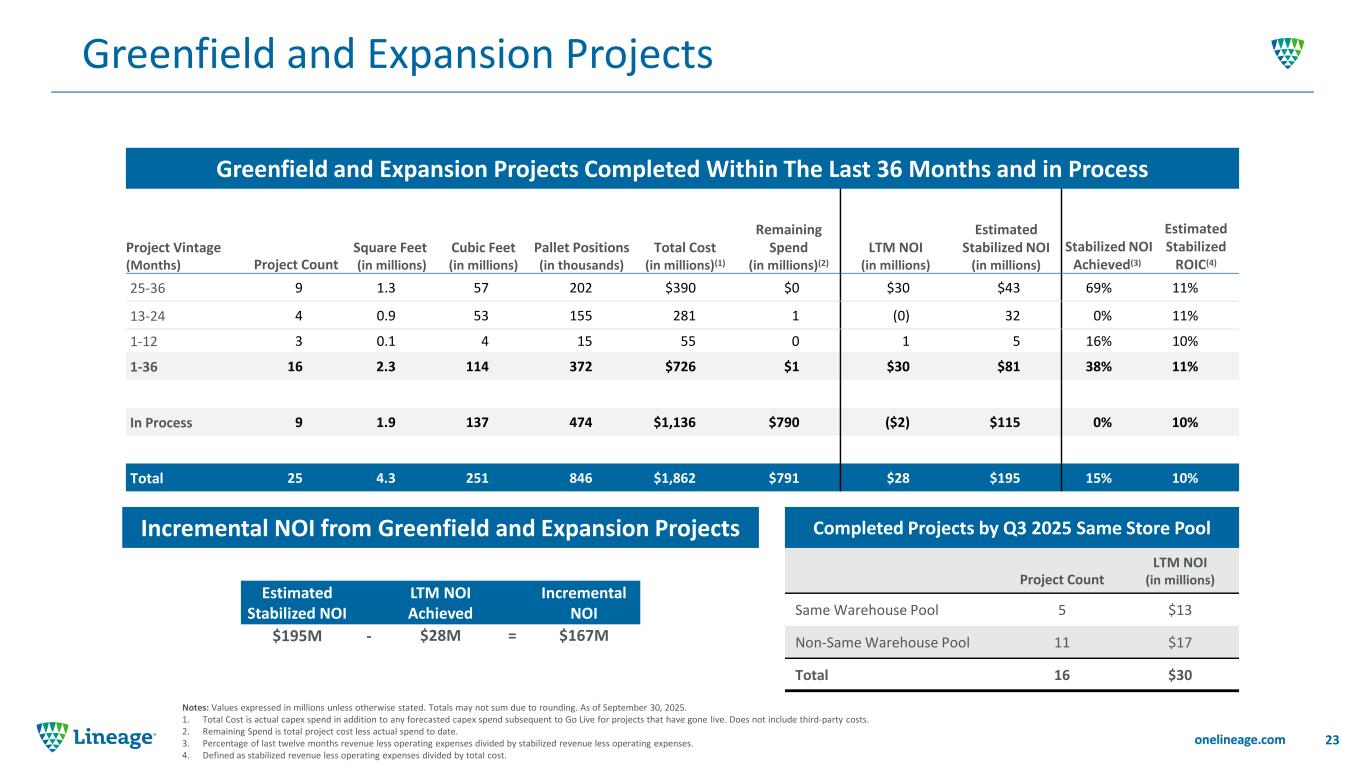

Greenfield and Expansion Projects 23 Notes: Values expressed in millions unless otherwise stated. Totals may not sum due to rounding. As of September 30, 2025. 1. Total Cost is actual capex spend in addition to any forecasted capex spend subsequent to Go Live for projects that have gone live. Does not include third-party costs. 2. Remaining Spend is total project cost less actual spend to date. 3. Percentage of last twelve months revenue less operating expenses divided by stabilized revenue less operating expenses. 4. Defined as stabilized revenue less operating expenses divided by total cost. Greenfield and Expansion Projects Completed Within The Last 36 Months and in Process Project Vintage (Months) Project Count Square Feet (in millions) Cubic Feet (in millions) Pallet Positions (in thousands) Total Cost (in millions)(1) Remaining Spend (in millions)(2) LTM NOI (in millions) Estimated Stabilized NOI (in millions) Stabilized NOI Achieved(3) Estimated Stabilized ROIC(4) 25-36 9 1.3 57 202 $390 $0 $30 $43 69% 11% 13-24 4 0.9 53 155 281 1 (0) 32 0% 11% 1-12 3 0.1 4 15 55 0 1 5 16% 10% 1-36 16 2.3 114 372 $726 $1 $30 $81 38% 11% In Process 9 1.9 137 474 $1,136 $790 ($2) $115 0% 10% Total 25 4.3 251 846 $1,862 $791 $28 $195 15% 10% Incremental NOI from Greenfield and Expansion Projects Estimated Stabilized NOI LTM NOI Achieved Incremental NOI $195M - $28M = $167M Completed Projects by Q3 2025 Same Store Pool Project Count LTM NOI (in millions) Same Warehouse Pool 5 $13 Non-Same Warehouse Pool 11 $17 Total 16 $30

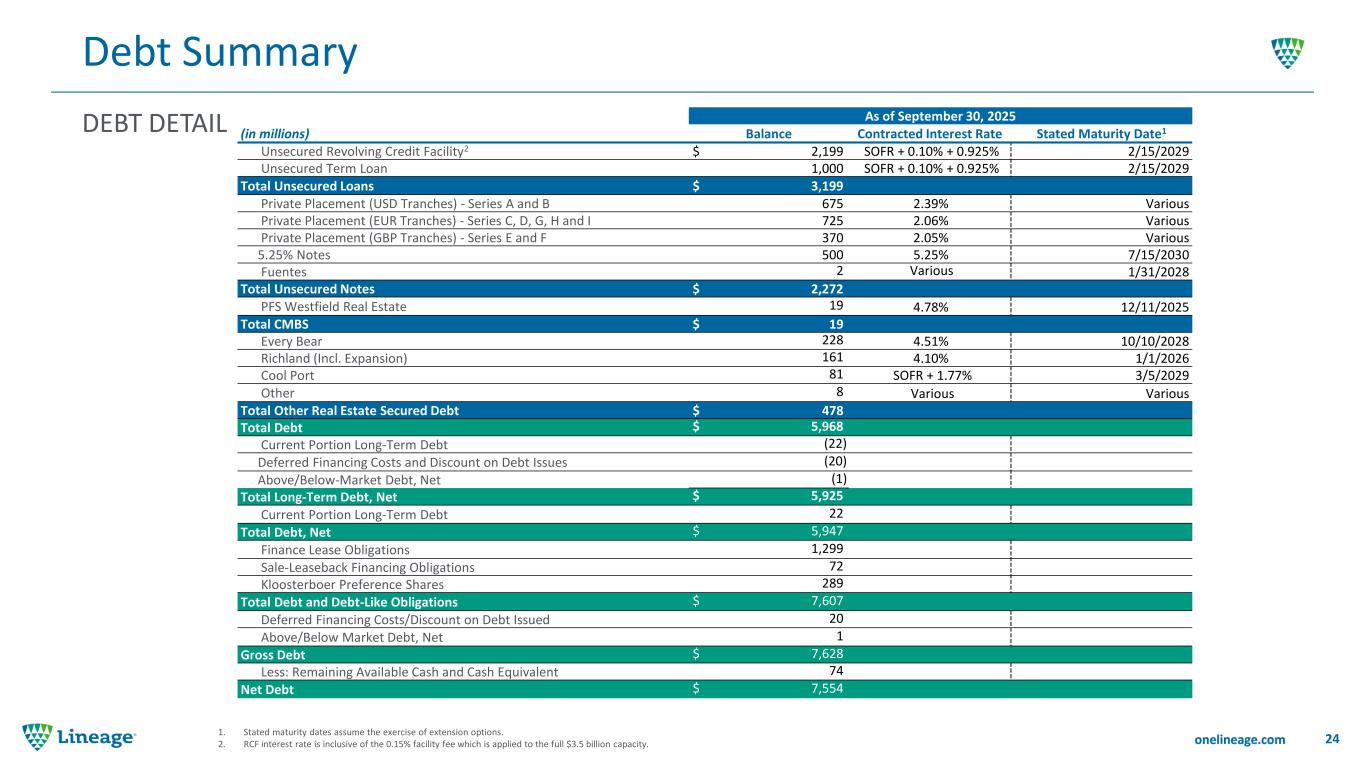

DEBT DETAIL Debt Summary 24 1. Stated maturity dates assume the exercise of extension options. 2. RCF interest rate is inclusive of the 0.15% facility fee which is applied to the full $3.5 billion capacity. As of September 30, 2025 (in millions) Balance Contracted Interest Rate Stated Maturity Date1 Unsecured Revolving Credit Facility2 $ 2,199 SOFR + 0.10% + 0.925% 2/15/2029 Unsecured Term Loan 1,000 SOFR + 0.10% + 0.925% 2/15/2029 Total Unsecured Loans $ 3,199 Private Placement (USD Tranches) - Series A and B 675 2.39% Various Private Placement (EUR Tranches) - Series C, D, G, H and I 725 2.06% Various Private Placement (GBP Tranches) - Series E and F 370 2.05% Various 5.25% Notes 500 5.25% 7/15/2030 Fuentes 2 Various 1/31/2028 Total Unsecured Notes $ 2,272 PFS Westfield Real Estate 19 4.78% 12/11/2025 Total CMBS $ 19 Every Bear 228 4.51% 10/10/2028 Richland (Incl. Expansion) 161 4.10% 1/1/2026 Cool Port 81 SOFR + 1.77% 3/5/2029 Other 8 Various Various Total Other Real Estate Secured Debt $ 478 Total Debt $ 5,968 Current Portion Long-Term Debt (22) Deferred Financing Costs and Discount on Debt Issues (20) Above/Below-Market Debt, Net (1) Total Long-Term Debt, Net $ 5,925 Current Portion Long-Term Debt 22 Total Debt, Net $ 5,947 Finance Lease Obligations 1,299 Sale-Leaseback Financing Obligations 72 Kloosterboer Preference Shares 289 Total Debt and Debt-Like Obligations $ 7,607 Deferred Financing Costs/Discount on Debt Issued 20 Above/Below Market Debt, Net 1 Gross Debt $ 7,628 Less: Remaining Available Cash and Cash Equivalent 74 Net Debt $ 7,554

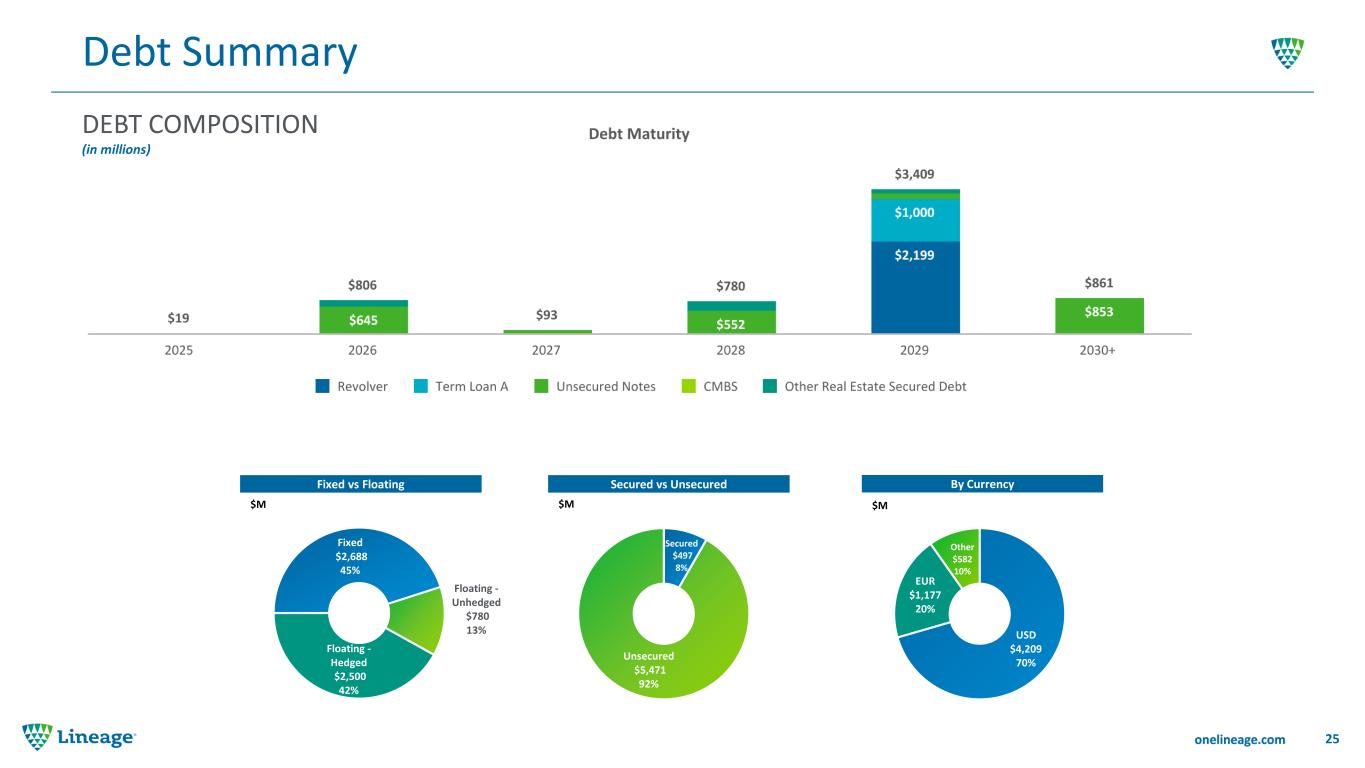

DEBT COMPOSITION (in millions) Debt Summary 25 USD $4,209 70% EUR $1,177 20% Other $582 10% Secured $497 8% Unsecured $5,471 92% Fixed $2,688 45% Floating - Unhedged $780 13% Floating - Hedged $2,500 42% Fixed vs Floating Secured vs Unsecured By Currency $M $M $M

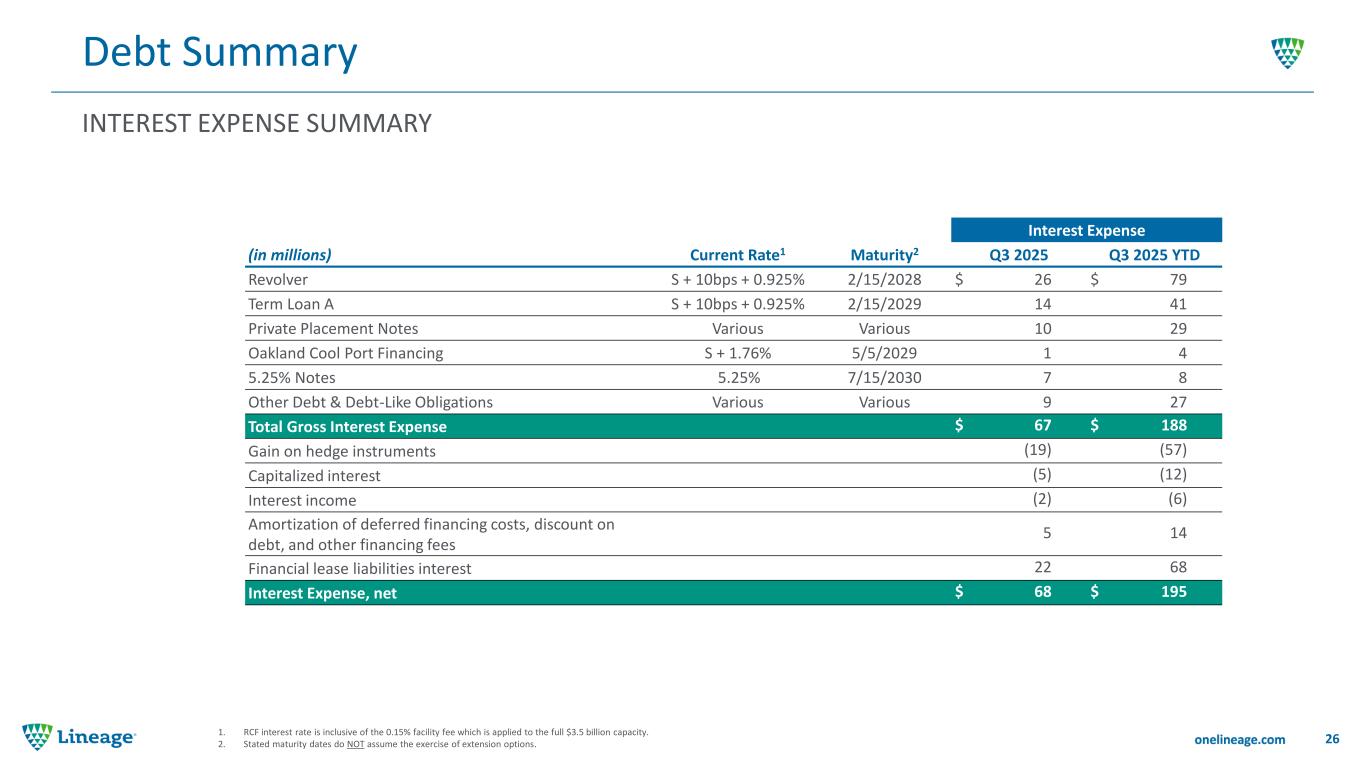

INTEREST EXPENSE SUMMARY Debt Summary 26 1. RCF interest rate is inclusive of the 0.15% facility fee which is applied to the full $3.5 billion capacity. 2. Stated maturity dates do NOT assume the exercise of extension options. Interest Expense (in millions) Current Rate1 Maturity2 Q3 2025 Q3 2025 YTD Revolver S + 10bps + 0.925% 2/15/2028 $ 26 $ 79 Term Loan A S + 10bps + 0.925% 2/15/2029 14 41 Private Placement Notes Various Various 10 29 Oakland Cool Port Financing S + 1.76% 5/5/2029 1 4 5.25% Notes 5.25% 7/15/2030 7 8 Other Debt & Debt-Like Obligations Various Various 9 27 Total Gross Interest Expense $ 67 $ 188 Gain on hedge instruments (19) (57) Capitalized interest (5) (12) Interest income (2) (6) Amortization of deferred financing costs, discount on debt, and other financing fees 5 14 Financial lease liabilities interest 22 68 Interest Expense, net $ 68 $ 195

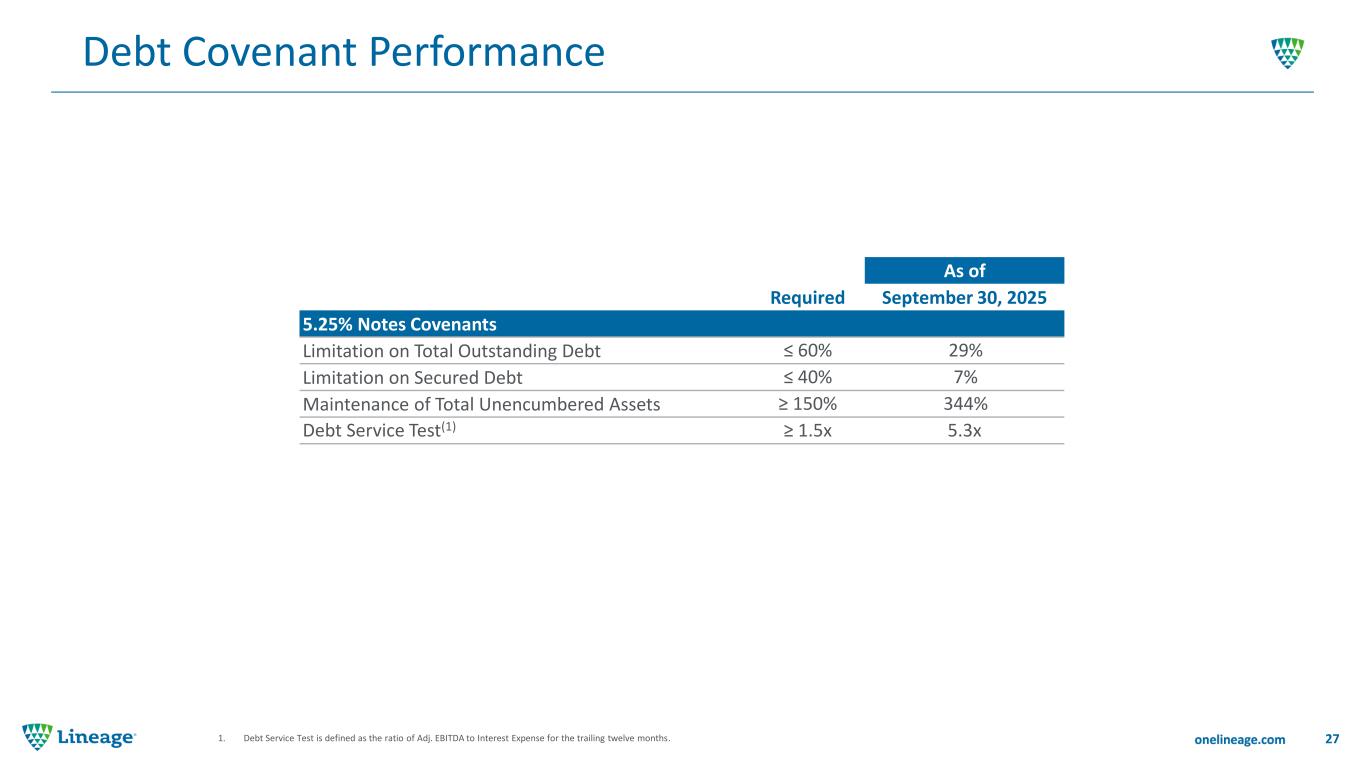

Debt Covenant Performance 271. Debt Service Test is defined as the ratio of Adj. EBITDA to Interest Expense for the trailing twelve months. As of Required September 30, 2025 5.25% Notes Covenants Limitation on Total Outstanding Debt ≤ 60% 29% Limitation on Secured Debt ≤ 40% 7% Maintenance of Total Unencumbered Assets ≥ 150% 344% Debt Service Test(1) ≥ 1.5x 5.3x

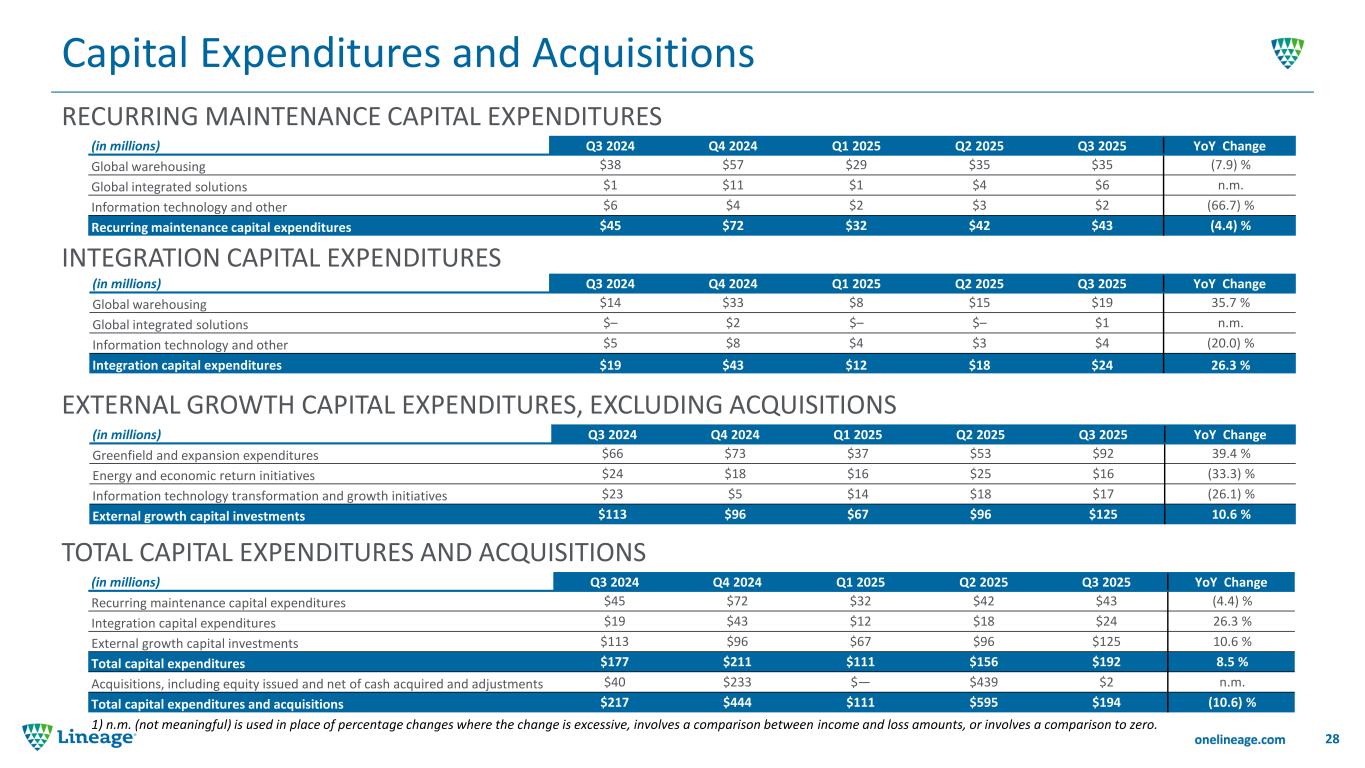

RECURRING MAINTENANCE CAPITAL EXPENDITURES Capital Expenditures and Acquisitions 28 (in millions) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 YoY Change Global warehousing $38 $57 $29 $35 $35 (7.9) % Global integrated solutions $1 $11 $1 $4 $6 n.m. Information technology and other $6 $4 $2 $3 $2 (66.7) % Recurring maintenance capital expenditures $45 $72 $32 $42 $43 (4.4) % INTEGRATION CAPITAL EXPENDITURES (in millions) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 YoY Change Global warehousing $14 $33 $8 $15 $19 35.7 % Global integrated solutions $– $2 $– $– $1 n.m. Information technology and other $5 $8 $4 $3 $4 (20.0) % Integration capital expenditures $19 $43 $12 $18 $24 26.3 % EXTERNAL GROWTH CAPITAL EXPENDITURES, EXCLUDING ACQUISITIONS (in millions) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 YoY Change Greenfield and expansion expenditures $66 $73 $37 $53 $92 39.4 % Energy and economic return initiatives $24 $18 $16 $25 $16 (33.3) % Information technology transformation and growth initiatives $23 $5 $14 $18 $17 (26.1) % External growth capital investments $113 $96 $67 $96 $125 10.6 % TOTAL CAPITAL EXPENDITURES AND ACQUISITIONS (in millions) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 YoY Change Recurring maintenance capital expenditures $45 $72 $32 $42 $43 (4.4) % Integration capital expenditures $19 $43 $12 $18 $24 26.3 % External growth capital investments $113 $96 $67 $96 $125 10.6 % Total capital expenditures $177 $211 $111 $156 $192 8.5 % Acquisitions, including equity issued and net of cash acquired and adjustments $40 $233 $— $439 $2 n.m. Total capital expenditures and acquisitions $217 $444 $111 $595 $194 (10.6) % 1) n.m. (not meaningful) is used in place of percentage changes where the change is excessive, involves a comparison between income and loss amounts, or involves a comparison to zero.

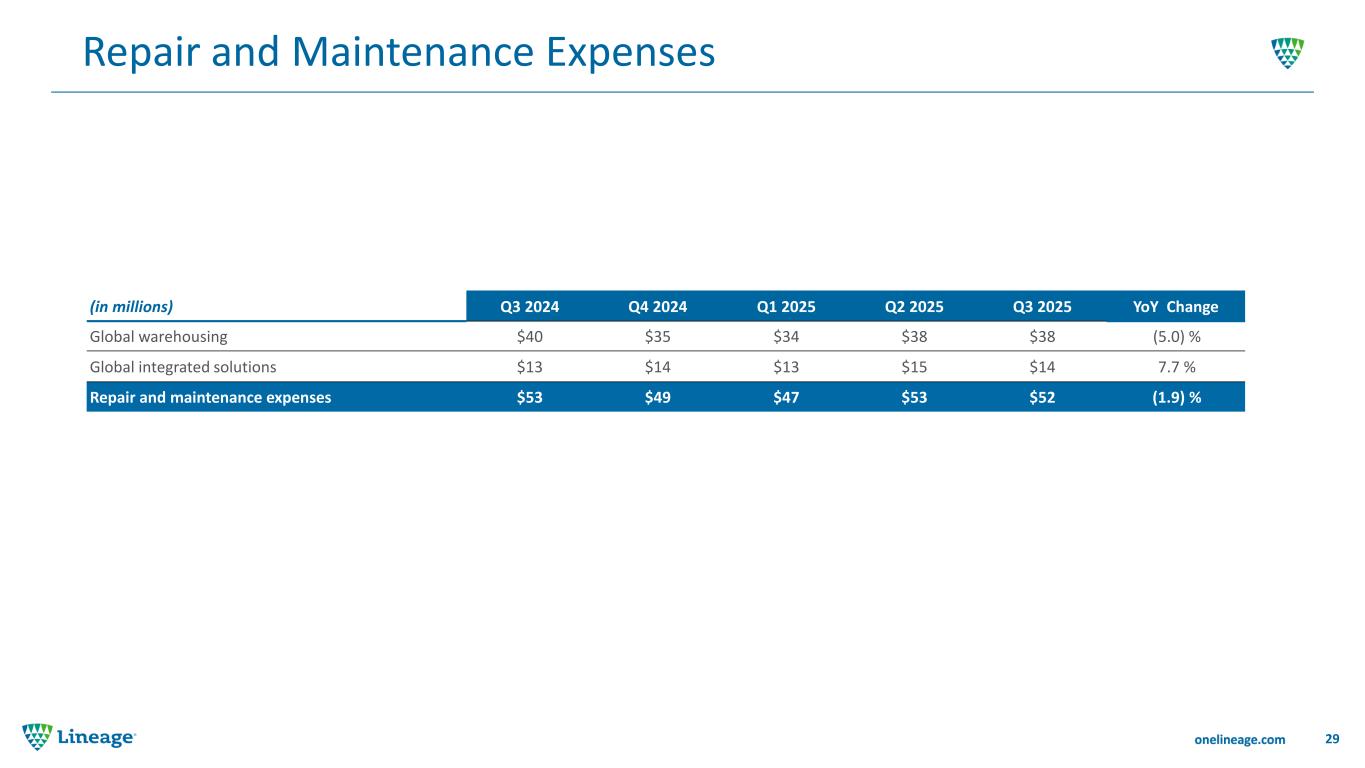

Repair and Maintenance Expenses 29 (in millions) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 YoY Change Global warehousing $40 $35 $34 $38 $38 (5.0) % Global integrated solutions $13 $14 $13 $15 $14 7.7 % Repair and maintenance expenses $53 $49 $47 $53 $52 (1.9) %

HISTORICAL OCCUPANCY AND MINIMUM STORAGE GUARANTEES Global Warehouse Segment 301. Minimum storage guarantees are calculated as guaranteed storage and rent revenue in the most recent month annualized as a percent of total storage and rent revenue for the trailing twelve months. 80.4% 76.8% 77.8% 77.3% 76.7% 77.2% 79.1% 83.4% 81.9% 79.8% 77.7% 80.8% 77.6% 76.6% 75.4% 78.1% 75.4% 73.3% 73.7% 84.5% 81.1% 82.6% 81.3% 80.2% 81.0% 83.7% 87.7% 87.3% 85.1% 84.3% 87.2% 83.6% 82.9% 82.0% 83.9% 81.0% 79.1% 80.3% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Physical Occupancy Economic Occupancy Average Economic and Physical Occupancy in Our Global Warehousing Segment 41.8% 43.5% 43.9% 44.0% 42.0% 44.9% 46.7% Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 20. 0% 25. 0% 30. 0% 35. 0% 40. 0% 45. 0% 50. 0% Contracts with Minimum Storage Guaranteed & Lease Revenue1 (as % of Rent and Storage Revenue)

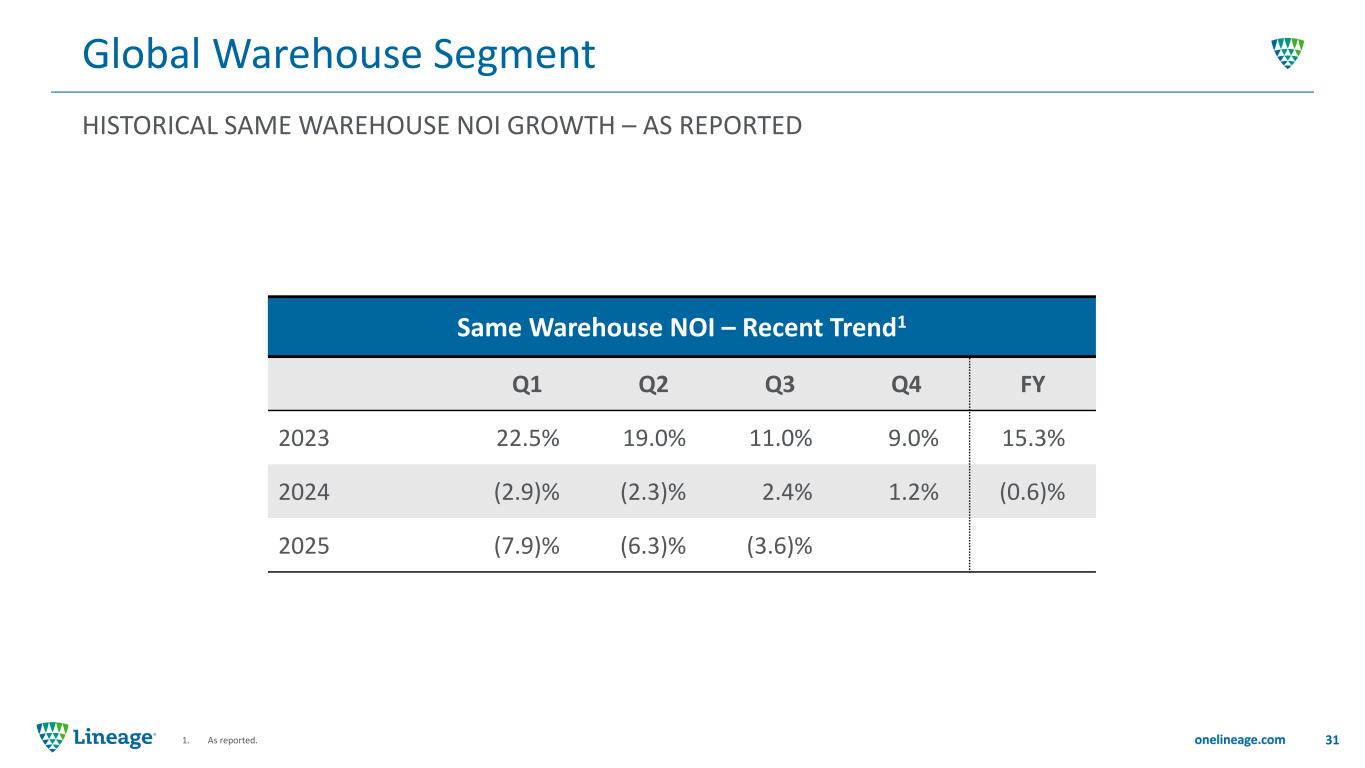

HISTORICAL SAME WAREHOUSE NOI GROWTH – AS REPORTED Global Warehouse Segment 311. As reported. Same Warehouse NOI – Recent Trend1 Q1 Q2 Q3 Q4 FY 2023 22.5% 19.0% 11.0% 9.0% 15.3% 2024 (2.9)% (2.3)% 2.4% 1.2% (0.6)% 2025 (7.9)% (6.3)% (3.6)%

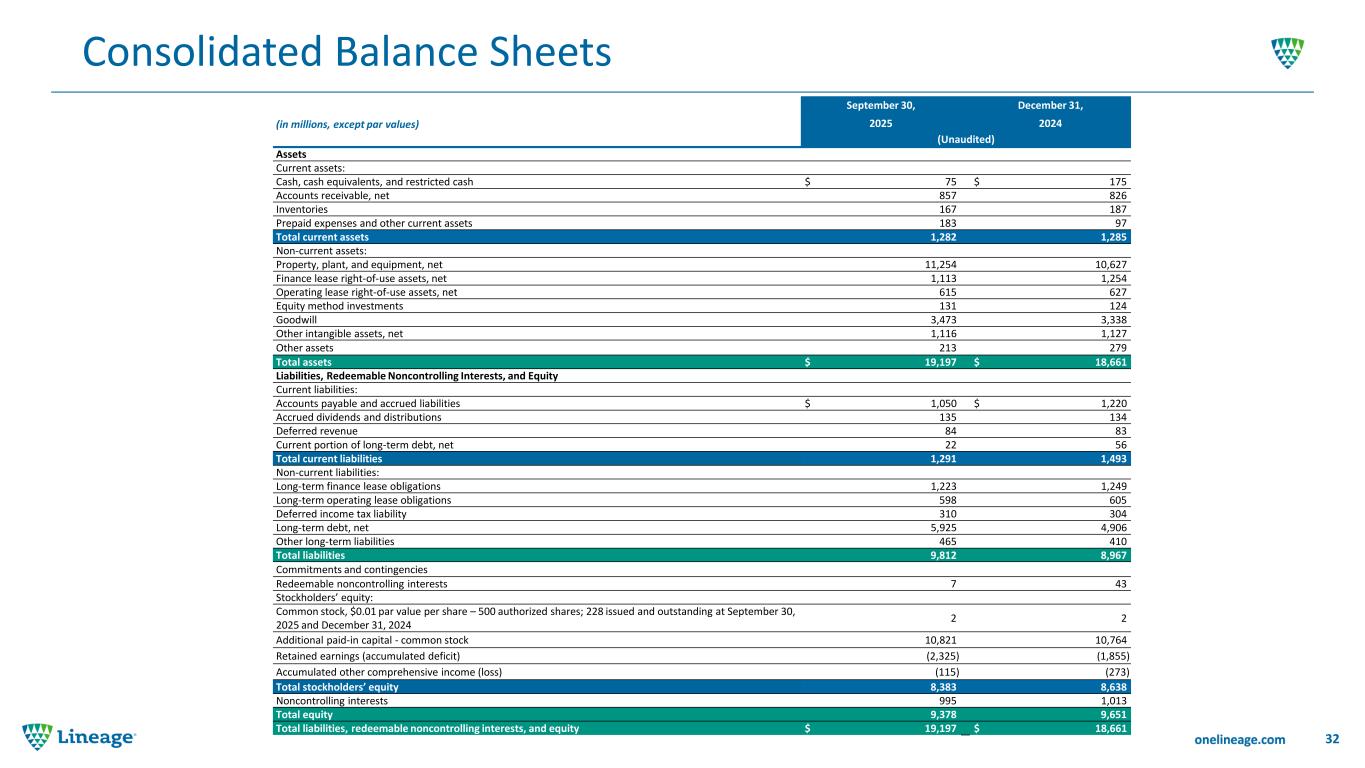

Consolidated Balance Sheets 32 September 30, December 31, (in millions, except par values) 2025 2024 (Unaudited) Assets Current assets: Cash, cash equivalents, and restricted cash $ 75 $ 175 Accounts receivable, net 857 826 Inventories 167 187 Prepaid expenses and other current assets 183 97 Total current assets 1,282 1,285 Non-current assets: Property, plant, and equipment, net 11,254 10,627 Finance lease right-of-use assets, net 1,113 1,254 Operating lease right-of-use assets, net 615 627 Equity method investments 131 124 Goodwill 3,473 3,338 Other intangible assets, net 1,116 1,127 Other assets 213 279 Total assets $ 19,197 $ 18,661 Liabilities, Redeemable Noncontrolling Interests, and Equity Current liabilities: Accounts payable and accrued liabilities $ 1,050 $ 1,220 Accrued dividends and distributions 135 134 Deferred revenue 84 83 Current portion of long-term debt, net 22 56 Total current liabilities 1,291 1,493 Non-current liabilities: Long-term finance lease obligations 1,223 1,249 Long-term operating lease obligations 598 605 Deferred income tax liability 310 304 Long-term debt, net 5,925 4,906 Other long-term liabilities 465 410 Total liabilities 9,812 8,967 Commitments and contingencies Redeemable noncontrolling interests 7 43 Stockholders’ equity: Common stock, $0.01 par value per share – 500 authorized shares; 228 issued and outstanding at September 30, 2025 and December 31, 2024 2 2 Additional paid-in capital - common stock 10,821 10,764 Retained earnings (accumulated deficit) (2,325) (1,855) Accumulated other comprehensive income (loss) (115) (273) Total stockholders’ equity 8,383 8,638 Noncontrolling interests 995 1,013 Total equity 9,378 9,651 Total liabilities, redeemable noncontrolling interests, and equity $ 19,197 $ 18,661

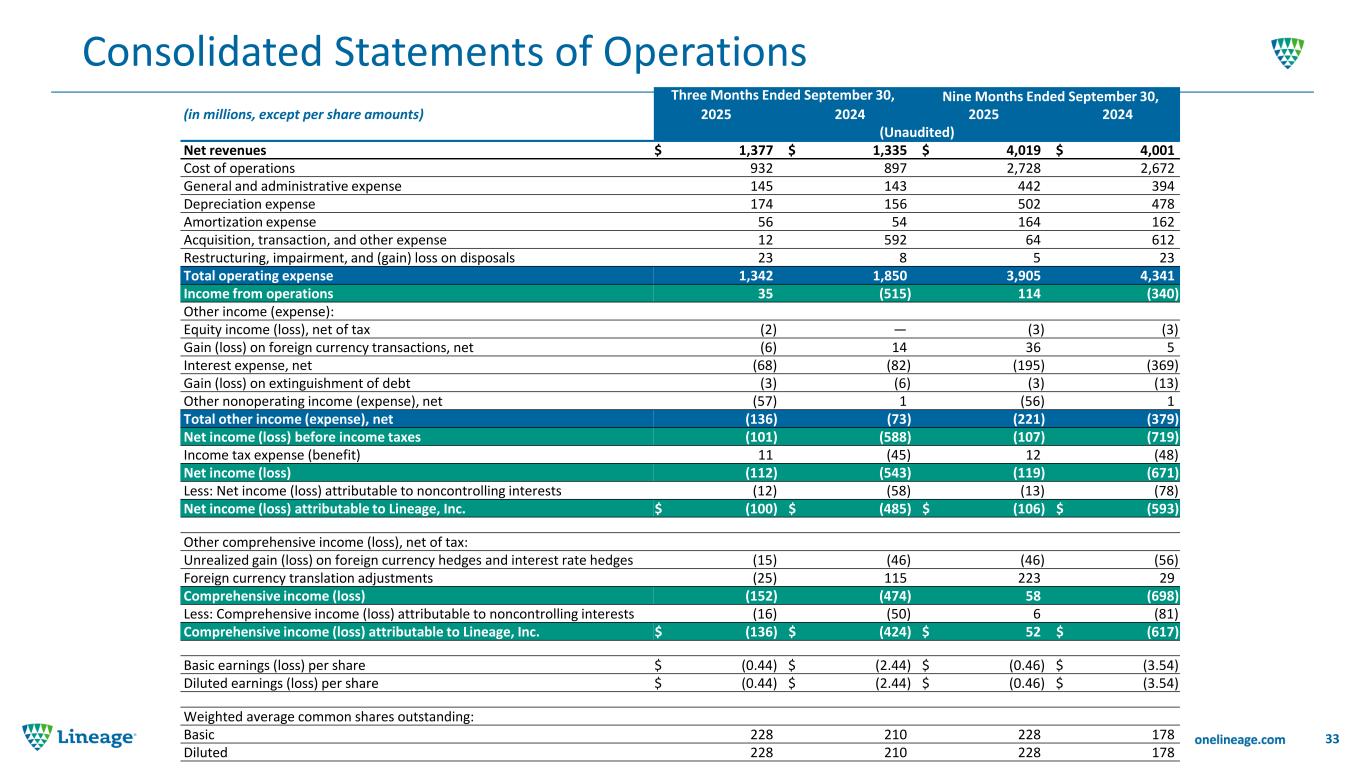

Consolidated Statements of Operations 33 Three Months Ended September 30, Nine Months Ended September 30, (in millions, except per share amounts) 2025 2024 2025 2024 (Unaudited) Net revenues $ 1,377 $ 1,335 $ 4,019 $ 4,001 Cost of operations 932 897 2,728 2,672 General and administrative expense 145 143 442 394 Depreciation expense 174 156 502 478 Amortization expense 56 54 164 162 Acquisition, transaction, and other expense 12 592 64 612 Restructuring, impairment, and (gain) loss on disposals 23 8 5 23 Total operating expense 1,342 1,850 3,905 4,341 Income from operations 35 (515) 114 (340) Other income (expense): Equity income (loss), net of tax (2) — (3) (3) Gain (loss) on foreign currency transactions, net (6) 14 36 5 Interest expense, net (68) (82) (195) (369) Gain (loss) on extinguishment of debt (3) (6) (3) (13) Other nonoperating income (expense), net (57) 1 (56) 1 Total other income (expense), net (136) (73) (221) (379) Net income (loss) before income taxes (101) (588) (107) (719) Income tax expense (benefit) 11 (45) 12 (48) Net income (loss) (112) (543) (119) (671) Less: Net income (loss) attributable to noncontrolling interests (12) (58) (13) (78) Net income (loss) attributable to Lineage, Inc. $ (100) $ (485) $ (106) $ (593) Other comprehensive income (loss), net of tax: Unrealized gain (loss) on foreign currency hedges and interest rate hedges (15) (46) (46) (56) Foreign currency translation adjustments (25) 115 223 29 Comprehensive income (loss) (152) (474) 58 (698) Less: Comprehensive income (loss) attributable to noncontrolling interests (16) (50) 6 (81) Comprehensive income (loss) attributable to Lineage, Inc. $ (136) $ (424) $ 52 $ (617) Basic earnings (loss) per share $ (0.44) $ (2.44) $ (0.46) $ (3.54) Diluted earnings (loss) per share $ (0.44) $ (2.44) $ (0.46) $ (3.54) Weighted average common shares outstanding: Basic 228 210 228 178 Diluted 228 210 228 178

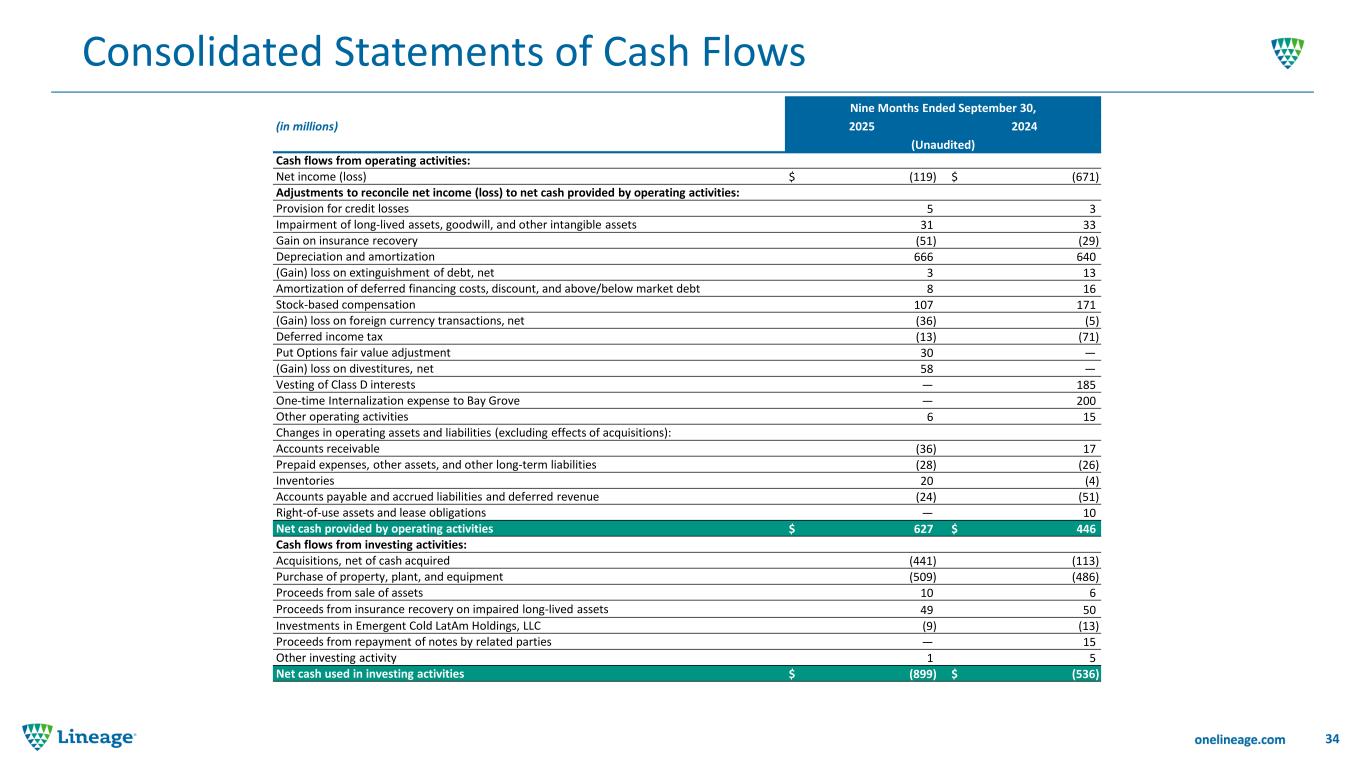

Consolidated Statements of Cash Flows 34 Nine Months Ended September 30, (in millions) 2025 2024 (Unaudited) Cash flows from operating activities: Net income (loss) $ (119) $ (671) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Provision for credit losses 5 3 Impairment of long-lived assets, goodwill, and other intangible assets 31 33 Gain on insurance recovery (51) (29) Depreciation and amortization 666 640 (Gain) loss on extinguishment of debt, net 3 13 Amortization of deferred financing costs, discount, and above/below market debt 8 16 Stock-based compensation 107 171 (Gain) loss on foreign currency transactions, net (36) (5) Deferred income tax (13) (71) Put Options fair value adjustment 30 — (Gain) loss on divestitures, net 58 — Vesting of Class D interests — 185 One-time Internalization expense to Bay Grove — 200 Other operating activities 6 15 Changes in operating assets and liabilities (excluding effects of acquisitions): Accounts receivable (36) 17 Prepaid expenses, other assets, and other long-term liabilities (28) (26) Inventories 20 (4) Accounts payable and accrued liabilities and deferred revenue (24) (51) Right-of-use assets and lease obligations — 10 Net cash provided by operating activities $ 627 $ 446 Cash flows from investing activities: Acquisitions, net of cash acquired (441) (113) Purchase of property, plant, and equipment (509) (486) Proceeds from sale of assets 10 6 Proceeds from insurance recovery on impaired long-lived assets 49 50 Investments in Emergent Cold LatAm Holdings, LLC (9) (13) Proceeds from repayment of notes by related parties — 15 Other investing activity 1 5 Net cash used in investing activities $ (899) $ (536)

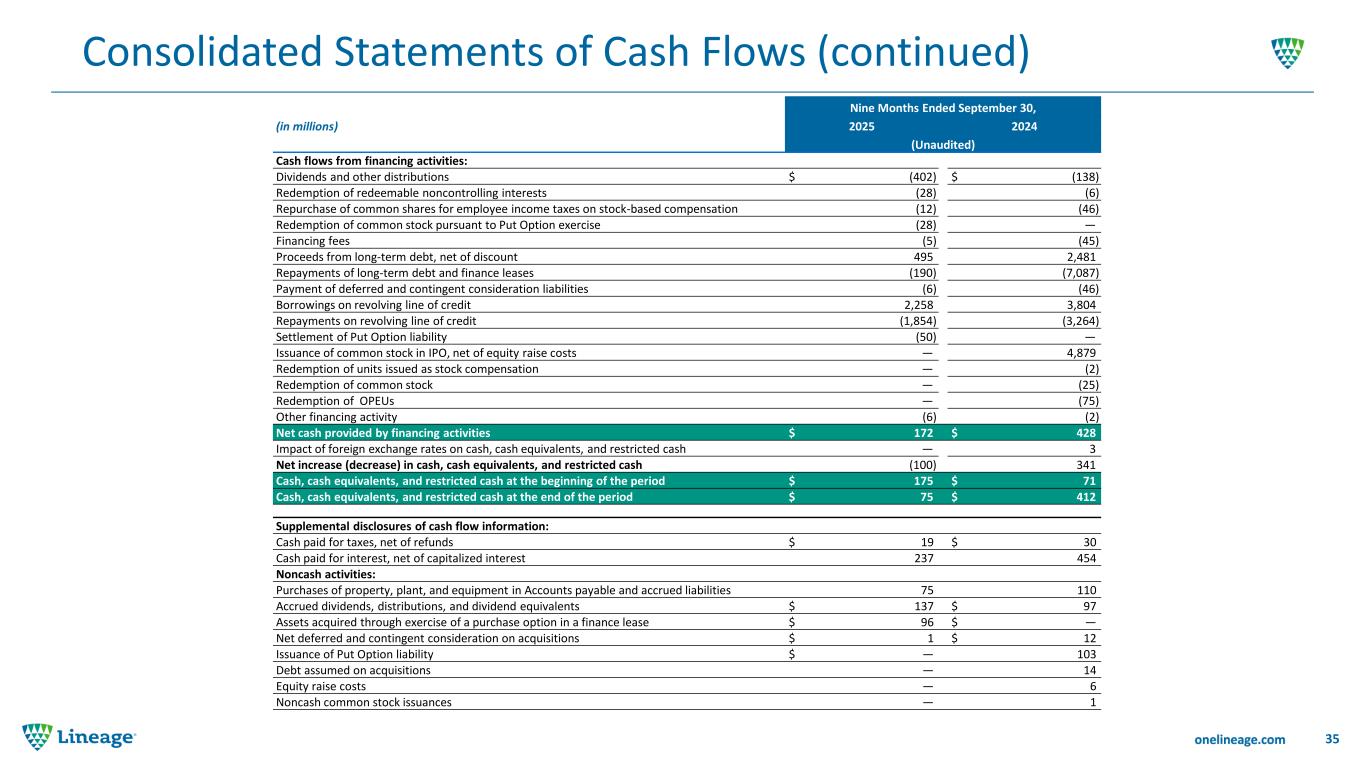

Consolidated Statements of Cash Flows (continued) 35 Nine Months Ended September 30, (in millions) 2025 2024 (Unaudited) Cash flows from financing activities: Dividends and other distributions $ (402) $ (138) Redemption of redeemable noncontrolling interests (28) (6) Repurchase of common shares for employee income taxes on stock-based compensation (12) (46) Redemption of common stock pursuant to Put Option exercise (28) — Financing fees (5) (45) Proceeds from long-term debt, net of discount 495 2,481 Repayments of long-term debt and finance leases (190) (7,087) Payment of deferred and contingent consideration liabilities (6) (46) Borrowings on revolving line of credit 2,258 3,804 Repayments on revolving line of credit (1,854) (3,264) Settlement of Put Option liability (50) — Issuance of common stock in IPO, net of equity raise costs — 4,879 Redemption of units issued as stock compensation — (2) Redemption of common stock — (25) Redemption of OPEUs — (75) Other financing activity (6) (2) Net cash provided by financing activities $ 172 $ 428 Impact of foreign exchange rates on cash, cash equivalents, and restricted cash — 3 Net increase (decrease) in cash, cash equivalents, and restricted cash (100) 341 Cash, cash equivalents, and restricted cash at the beginning of the period $ 175 $ 71 Cash, cash equivalents, and restricted cash at the end of the period $ 75 $ 412 Supplemental disclosures of cash flow information: Cash paid for taxes, net of refunds $ 19 $ 30 Cash paid for interest, net of capitalized interest 237 454 Noncash activities: Purchases of property, plant, and equipment in Accounts payable and accrued liabilities 75 110 Accrued dividends, distributions, and dividend equivalents $ 137 $ 97 Assets acquired through exercise of a purchase option in a finance lease $ 96 $ — Net deferred and contingent consideration on acquisitions $ 1 $ 12 Issuance of Put Option liability $ — 103 Debt assumed on acquisitions — 14 Equity raise costs — 6 Noncash common stock issuances — 1

36 Appendix: Non-GAAP Reconciliations

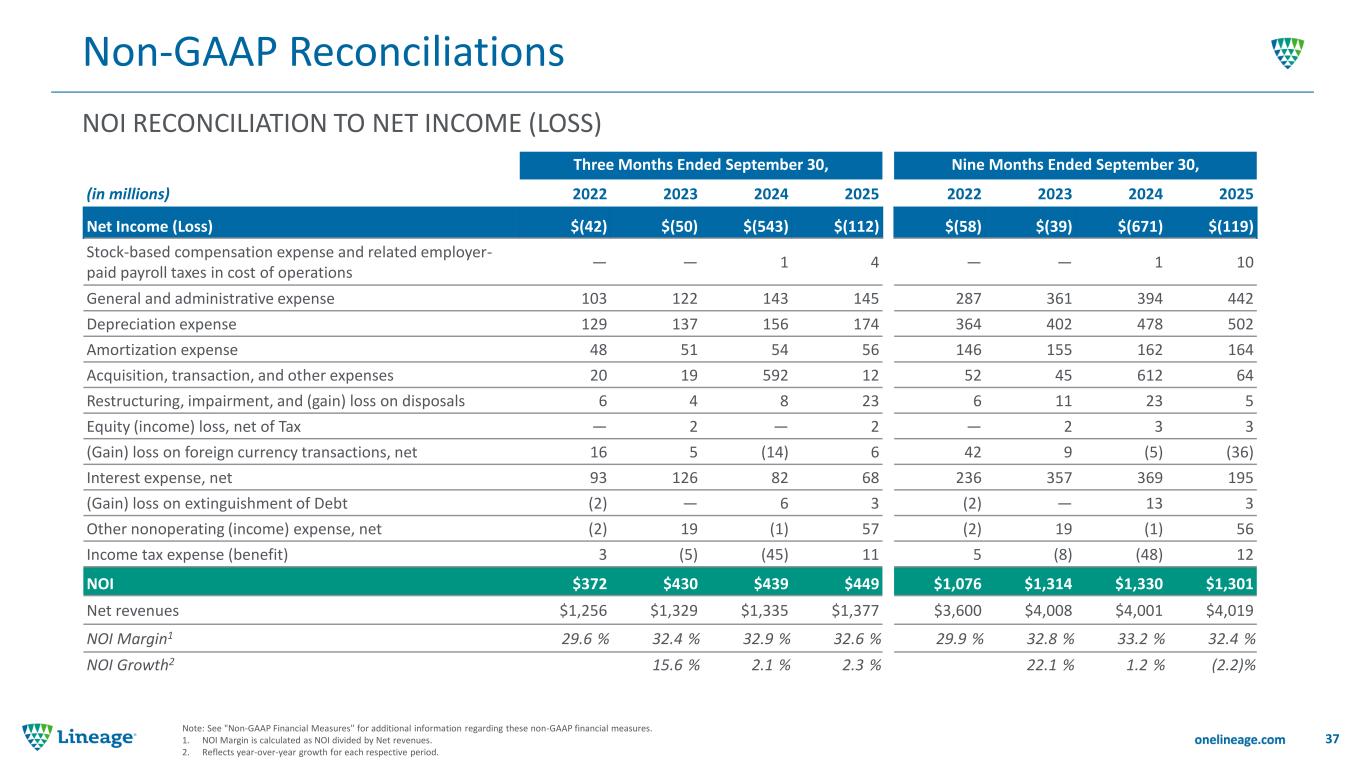

NOI RECONCILIATION TO NET INCOME (LOSS) Non-GAAP Reconciliations 37 Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 1. NOI Margin is calculated as NOI divided by Net revenues. 2. Reflects year-over-year growth for each respective period. Three Months Ended September 30, Nine Months Ended September 30, (in millions) 2022 2023 2024 2025 2022 2023 2024 2025 Net Income (Loss) $(42) $(50) $(543) $(112) $(58) $(39) $(671) $(119) Stock-based compensation expense and related employer- paid payroll taxes in cost of operations — — 1 4 — — 1 10 General and administrative expense 103 122 143 145 287 361 394 442 Depreciation expense 129 137 156 174 364 402 478 502 Amortization expense 48 51 54 56 146 155 162 164 Acquisition, transaction, and other expenses 20 19 592 12 52 45 612 64 Restructuring, impairment, and (gain) loss on disposals 6 4 8 23 6 11 23 5 Equity (income) loss, net of Tax — 2 — 2 — 2 3 3 (Gain) loss on foreign currency transactions, net 16 5 (14) 6 42 9 (5) (36) Interest expense, net 93 126 82 68 236 357 369 195 (Gain) loss on extinguishment of Debt (2) — 6 3 (2) — 13 3 Other nonoperating (income) expense, net (2) 19 (1) 57 (2) 19 (1) 56 Income tax expense (benefit) 3 (5) (45) 11 5 (8) (48) 12 NOI $372 $430 $439 $449 $1,076 $1,314 $1,330 $1,301 Net revenues $1,256 $1,329 $1,335 $1,377 $3,600 $4,008 $4,001 $4,019 NOI Margin1 29.6 % 32.4 % 32.9 % 32.6 % 29.9 % 32.8 % 33.2 % 32.4 % NOI Growth2 15.6 % 2.1 % 2.3 % 22.1 % 1.2 % (2.2)%

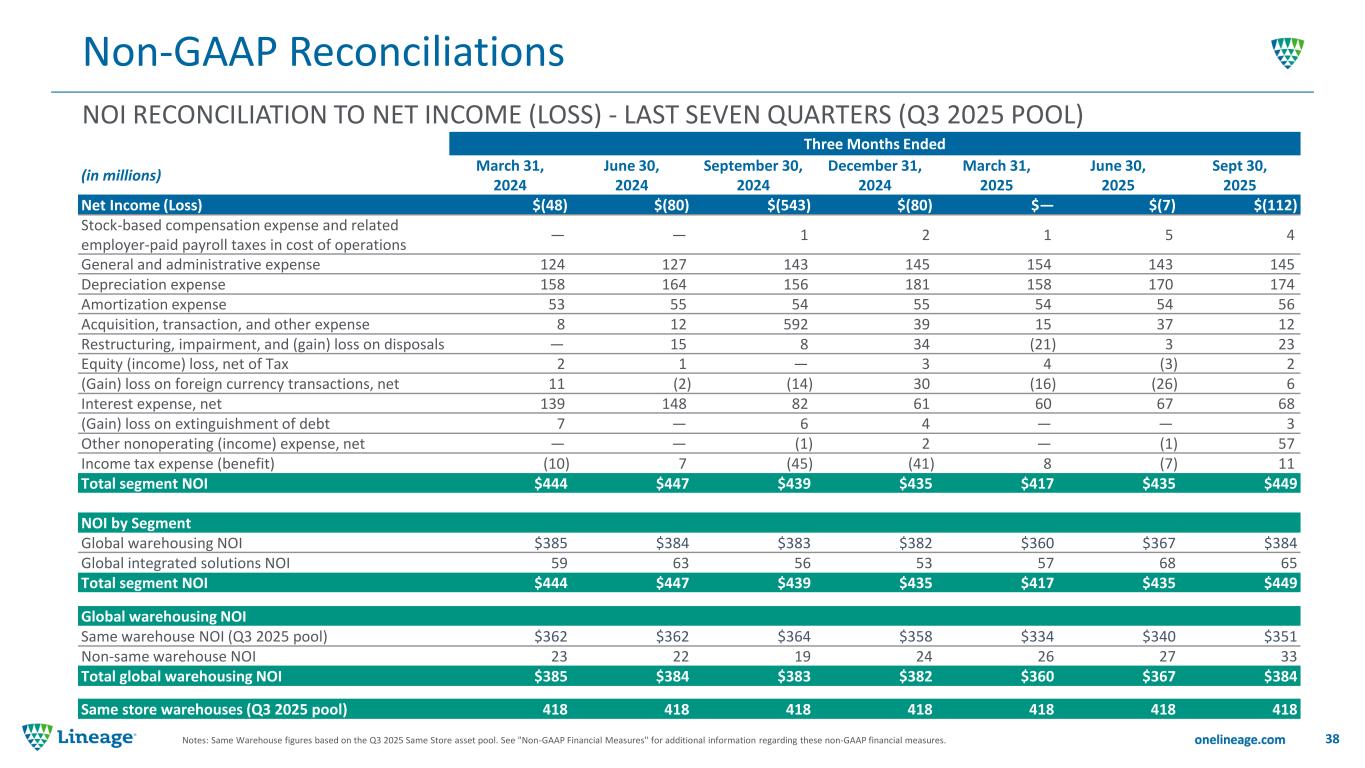

NOI RECONCILIATION TO NET INCOME (LOSS) - LAST SEVEN QUARTERS (Q3 2025 POOL) Non-GAAP Reconciliations 38Notes: Same Warehouse figures based on the Q3 2025 Same Store asset pool. See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended (in millions) March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 March 31, 2025 June 30, 2025 Sept 30, 2025 Net Income (Loss) $(48) $(80) $(543) $(80) $— $(7) $(112) Stock-based compensation expense and related employer-paid payroll taxes in cost of operations — — 1 2 1 5 4 General and administrative expense 124 127 143 145 154 143 145 Depreciation expense 158 164 156 181 158 170 174 Amortization expense 53 55 54 55 54 54 56 Acquisition, transaction, and other expense 8 12 592 39 15 37 12 Restructuring, impairment, and (gain) loss on disposals — 15 8 34 (21) 3 23 Equity (income) loss, net of Tax 2 1 — 3 4 (3) 2 (Gain) loss on foreign currency transactions, net 11 (2) (14) 30 (16) (26) 6 Interest expense, net 139 148 82 61 60 67 68 (Gain) loss on extinguishment of debt 7 — 6 4 — — 3 Other nonoperating (income) expense, net — — (1) 2 — (1) 57 Income tax expense (benefit) (10) 7 (45) (41) 8 (7) 11 Total segment NOI $444 $447 $439 $435 $417 $435 $449 NOI by Segment Global warehousing NOI $385 $384 $383 $382 $360 $367 $384 Global integrated solutions NOI 59 63 56 53 57 68 65 Total segment NOI $444 $447 $439 $435 $417 $435 $449 Global warehousing NOI Same warehouse NOI (Q3 2025 pool) $362 $362 $364 $358 $334 $340 $351 Non-same warehouse NOI 23 22 19 24 26 27 33 Total global warehousing NOI $385 $384 $383 $382 $360 $367 $384 Same store warehouses (Q3 2025 pool) 418 418 418 418 418 418 418

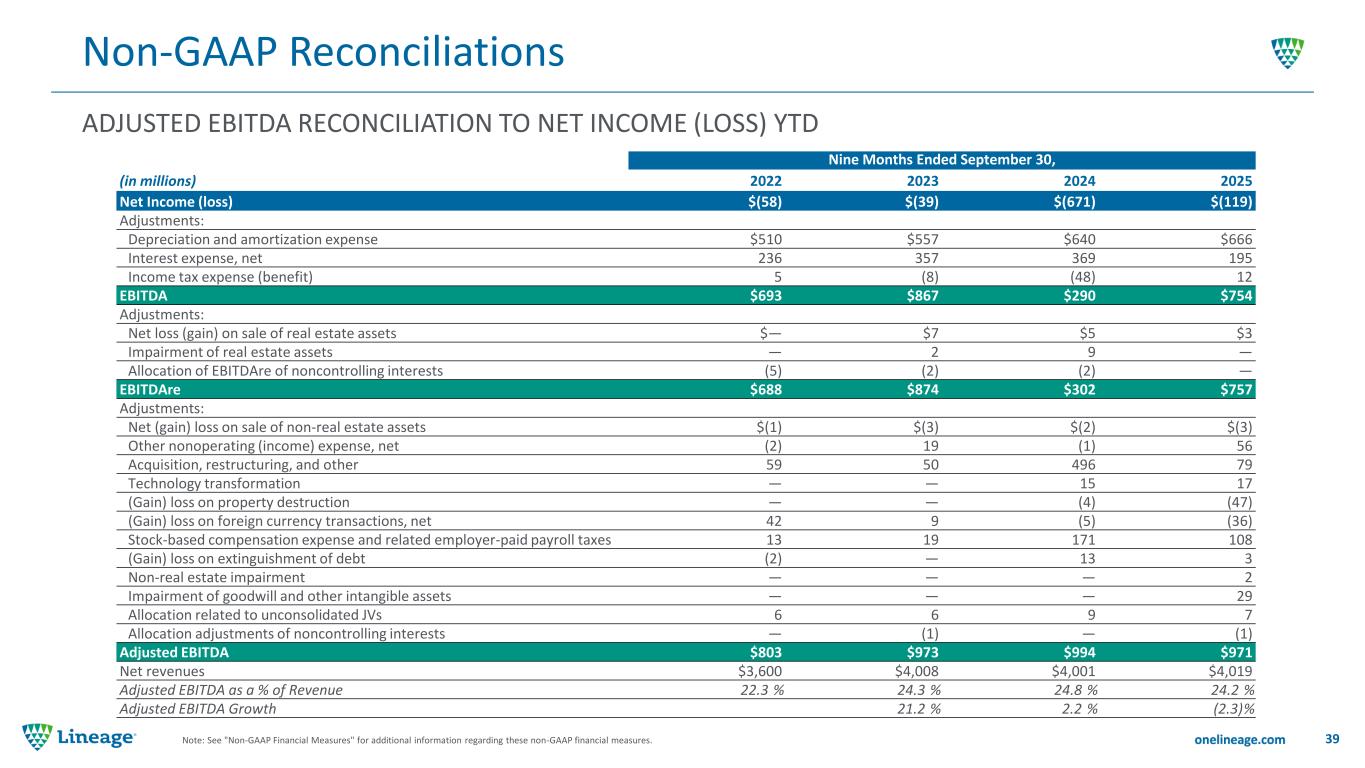

ADJUSTED EBITDA RECONCILIATION TO NET INCOME (LOSS) YTD Non-GAAP Reconciliations 39Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Nine Months Ended September 30, (in millions) 2022 2023 2024 2025 Net Income (loss) $(58) $(39) $(671) $(119) Adjustments: Depreciation and amortization expense $510 $557 $640 $666 Interest expense, net 236 357 369 195 Income tax expense (benefit) 5 (8) (48) 12 EBITDA $693 $867 $290 $754 Adjustments: Net loss (gain) on sale of real estate assets $— $7 $5 $3 Impairment of real estate assets — 2 9 — Allocation of EBITDAre of noncontrolling interests (5) (2) (2) — EBITDAre $688 $874 $302 $757 Adjustments: Net (gain) loss on sale of non-real estate assets $(1) $(3) $(2) $(3) Other nonoperating (income) expense, net (2) 19 (1) 56 Acquisition, restructuring, and other 59 50 496 79 Technology transformation — — 15 17 (Gain) loss on property destruction — — (4) (47) (Gain) loss on foreign currency transactions, net 42 9 (5) (36) Stock-based compensation expense and related employer-paid payroll taxes 13 19 171 108 (Gain) loss on extinguishment of debt (2) — 13 3 Non-real estate impairment — — — 2 Impairment of goodwill and other intangible assets — — — 29 Allocation related to unconsolidated JVs 6 6 9 7 Allocation adjustments of noncontrolling interests — (1) — (1) Adjusted EBITDA $803 $973 $994 $971 Net revenues $3,600 $4,008 $4,001 $4,019 Adjusted EBITDA as a % of Revenue 22.3 % 24.3 % 24.8 % 24.2 % Adjusted EBITDA Growth 21.2 % 2.2 % (2.3)%

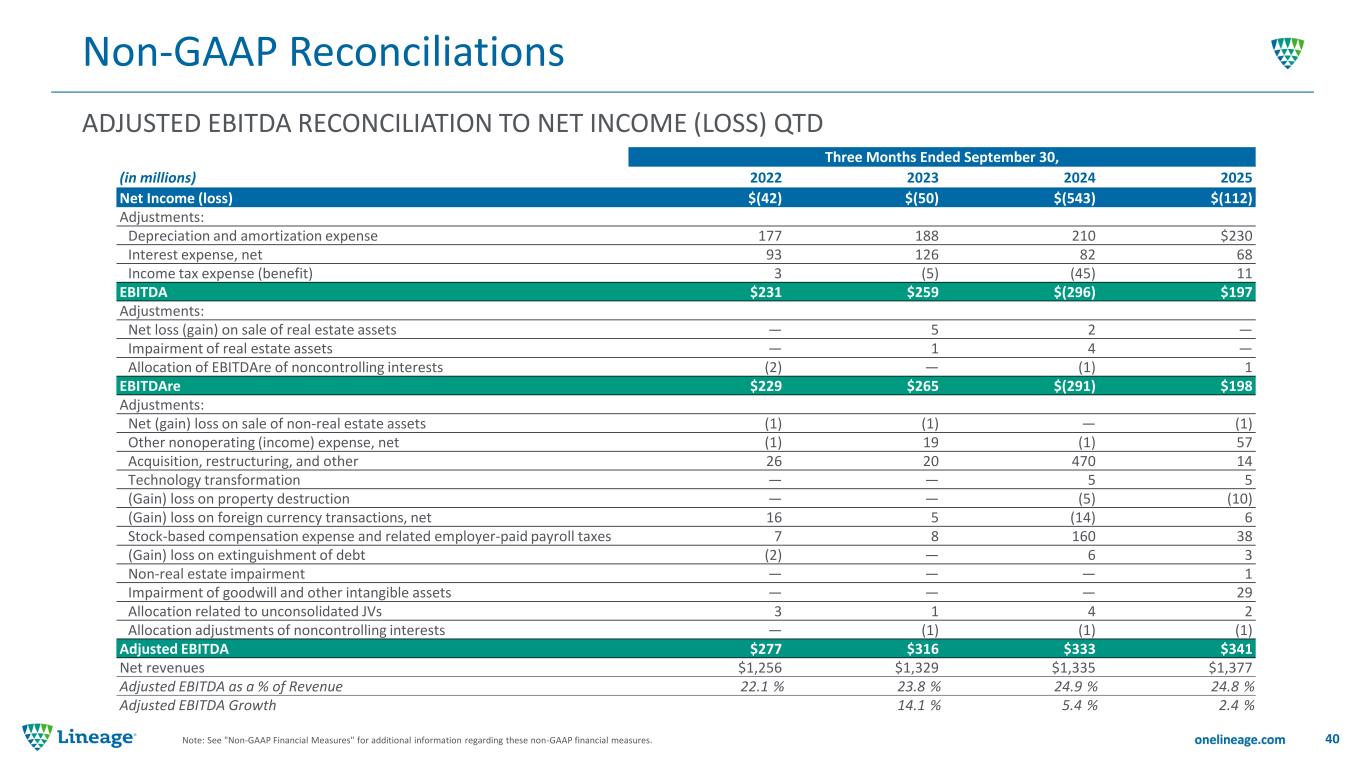

ADJUSTED EBITDA RECONCILIATION TO NET INCOME (LOSS) QTD Non-GAAP Reconciliations 40Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended September 30, (in millions) 2022 2023 2024 2025 Net Income (loss) $(42) $(50) $(543) $(112) Adjustments: Depreciation and amortization expense 177 188 210 $230 Interest expense, net 93 126 82 68 Income tax expense (benefit) 3 (5) (45) 11 EBITDA $231 $259 $(296) $197 Adjustments: Net loss (gain) on sale of real estate assets — 5 2 — Impairment of real estate assets — 1 4 — Allocation of EBITDAre of noncontrolling interests (2) — (1) 1 EBITDAre $229 $265 $(291) $198 Adjustments: Net (gain) loss on sale of non-real estate assets (1) (1) — (1) Other nonoperating (income) expense, net (1) 19 (1) 57 Acquisition, restructuring, and other 26 20 470 14 Technology transformation — — 5 5 (Gain) loss on property destruction — — (5) (10) (Gain) loss on foreign currency transactions, net 16 5 (14) 6 Stock-based compensation expense and related employer-paid payroll taxes 7 8 160 38 (Gain) loss on extinguishment of debt (2) — 6 3 Non-real estate impairment — — — 1 Impairment of goodwill and other intangible assets — — — 29 Allocation related to unconsolidated JVs 3 1 4 2 Allocation adjustments of noncontrolling interests — (1) (1) (1) Adjusted EBITDA $277 $316 $333 $341 Net revenues $1,256 $1,329 $1,335 $1,377 Adjusted EBITDA as a % of Revenue 22.1 % 23.8 % 24.9 % 24.8 % Adjusted EBITDA Growth 14.1 % 5.4 % 2.4 %

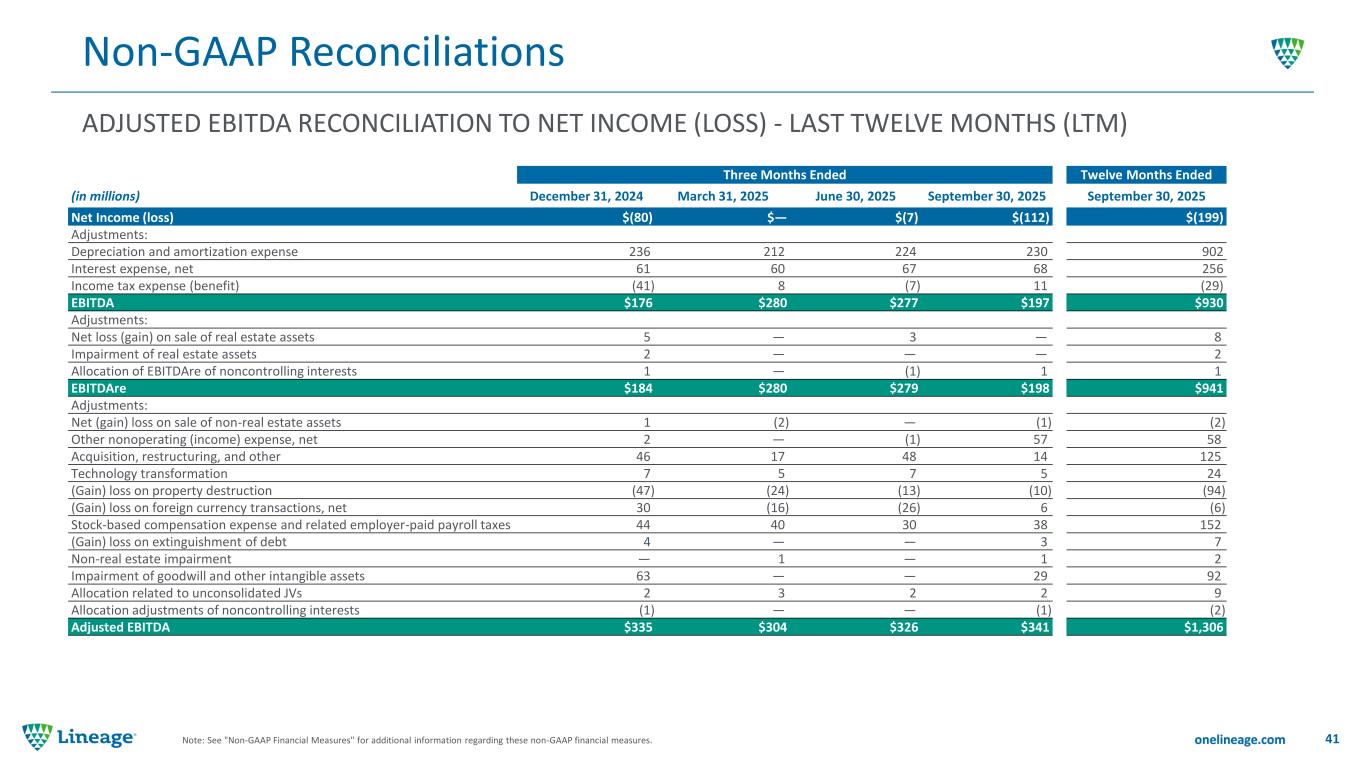

ADJUSTED EBITDA RECONCILIATION TO NET INCOME (LOSS) - LAST TWELVE MONTHS (LTM) Non-GAAP Reconciliations 41Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended Twelve Months Ended (in millions) December 31, 2024 March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 Net Income (loss) $(80) $— $(7) $(112) $(199) Adjustments: Depreciation and amortization expense 236 212 224 230 902 Interest expense, net 61 60 67 68 256 Income tax expense (benefit) (41) 8 (7) 11 (29) EBITDA $176 $280 $277 $197 $930 Adjustments: Net loss (gain) on sale of real estate assets 5 — 3 — 8 Impairment of real estate assets 2 — — — 2 Allocation of EBITDAre of noncontrolling interests 1 — (1) 1 1 EBITDAre $184 $280 $279 $198 $941 Adjustments: Net (gain) loss on sale of non-real estate assets 1 (2) — (1) (2) Other nonoperating (income) expense, net 2 — (1) 57 58 Acquisition, restructuring, and other 46 17 48 14 125 Technology transformation 7 5 7 5 24 (Gain) loss on property destruction (47) (24) (13) (10) (94) (Gain) loss on foreign currency transactions, net 30 (16) (26) 6 (6) Stock-based compensation expense and related employer-paid payroll taxes 44 40 30 38 152 (Gain) loss on extinguishment of debt 4 — — 3 7 Non-real estate impairment — 1 — 1 2 Impairment of goodwill and other intangible assets 63 — — 29 92 Allocation related to unconsolidated JVs 2 3 2 2 9 Allocation adjustments of noncontrolling interests (1) — — (1) (2) Adjusted EBITDA $335 $304 $326 $341 $1,306

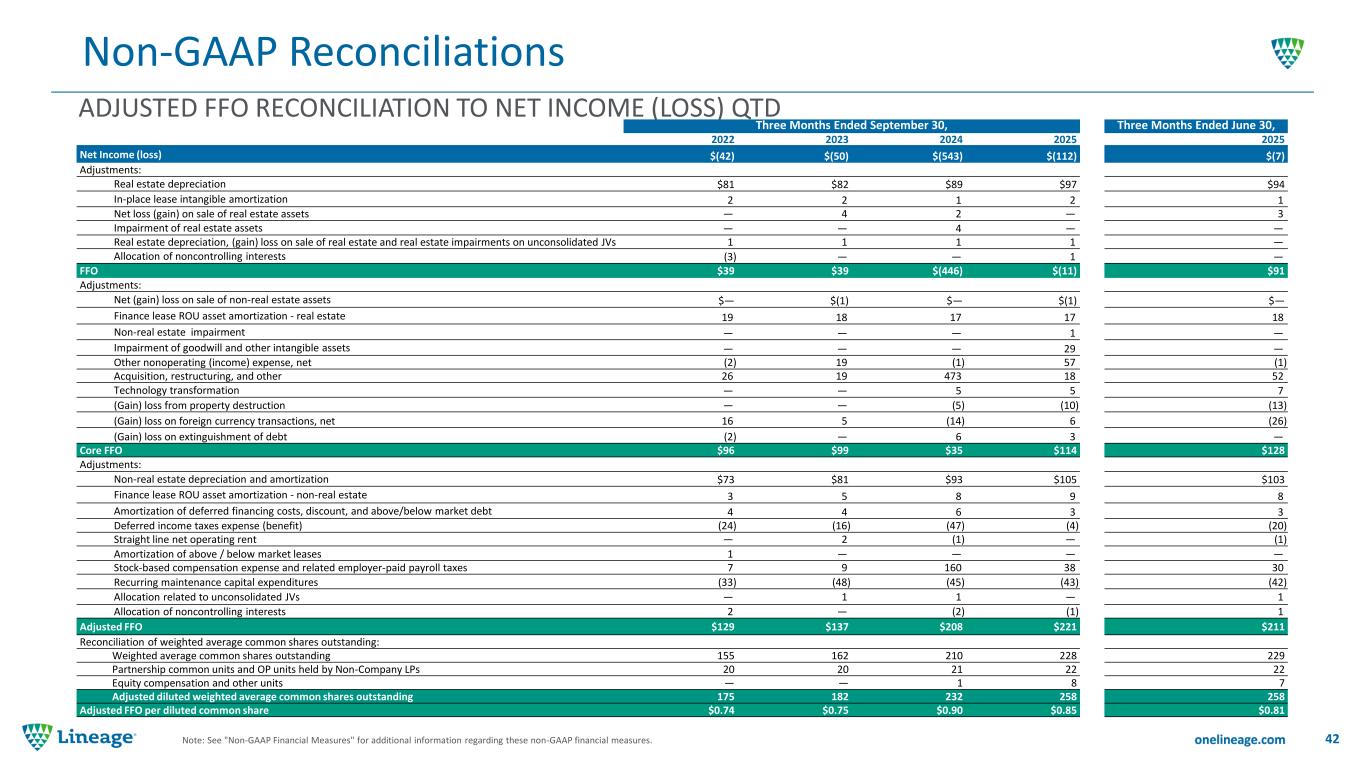

ADJUSTED FFO RECONCILIATION TO NET INCOME (LOSS) QTD Non-GAAP Reconciliations 42Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Three Months Ended September 30, Three Months Ended June 30, 2022 2023 2024 2025 2025 Net Income (loss) $(42) $(50) $(543) $(112) $(7) Adjustments: Real estate depreciation $81 $82 $89 $97 $94 In-place lease intangible amortization 2 2 1 2 1 Net loss (gain) on sale of real estate assets — 4 2 — 3 Impairment of real estate assets — — 4 — — Real estate depreciation, (gain) loss on sale of real estate and real estate impairments on unconsolidated JVs 1 1 1 1 — Allocation of noncontrolling interests (3) — — 1 — FFO $39 $39 $(446) $(11) $91 Adjustments: Net (gain) loss on sale of non-real estate assets $— $(1) $— $(1) $— Finance lease ROU asset amortization - real estate 19 18 17 17 18 Non-real estate impairment — — — 1 — Impairment of goodwill and other intangible assets — — — 29 — Other nonoperating (income) expense, net (2) 19 (1) 57 (1) Acquisition, restructuring, and other 26 19 473 18 52 Technology transformation — — 5 5 7 (Gain) loss from property destruction — — (5) (10) (13) (Gain) loss on foreign currency transactions, net 16 5 (14) 6 (26) (Gain) loss on extinguishment of debt (2) — 6 3 — Core FFO $96 $99 $35 $114 $128 Adjustments: Non-real estate depreciation and amortization $73 $81 $93 $105 $103 Finance lease ROU asset amortization - non-real estate 3 5 8 9 8 Amortization of deferred financing costs, discount, and above/below market debt 4 4 6 3 3 Deferred income taxes expense (benefit) (24) (16) (47) (4) (20) Straight line net operating rent — 2 (1) — (1) Amortization of above / below market leases 1 — — — — Stock-based compensation expense and related employer-paid payroll taxes 7 9 160 38 30 Recurring maintenance capital expenditures (33) (48) (45) (43) (42) Allocation related to unconsolidated JVs — 1 1 — 1 Allocation of noncontrolling interests 2 — (2) (1) 1 Adjusted FFO $129 $137 $208 $221 $211 Reconciliation of weighted average common shares outstanding: Weighted average common shares outstanding 155 162 210 228 229 Partnership common units and OP units held by Non-Company LPs 20 20 21 22 22 Equity compensation and other units — — 1 8 7 Adjusted diluted weighted average common shares outstanding 175 182 232 258 258 Adjusted FFO per diluted common share $0.74 $0.75 $0.90 $0.85 $0.81

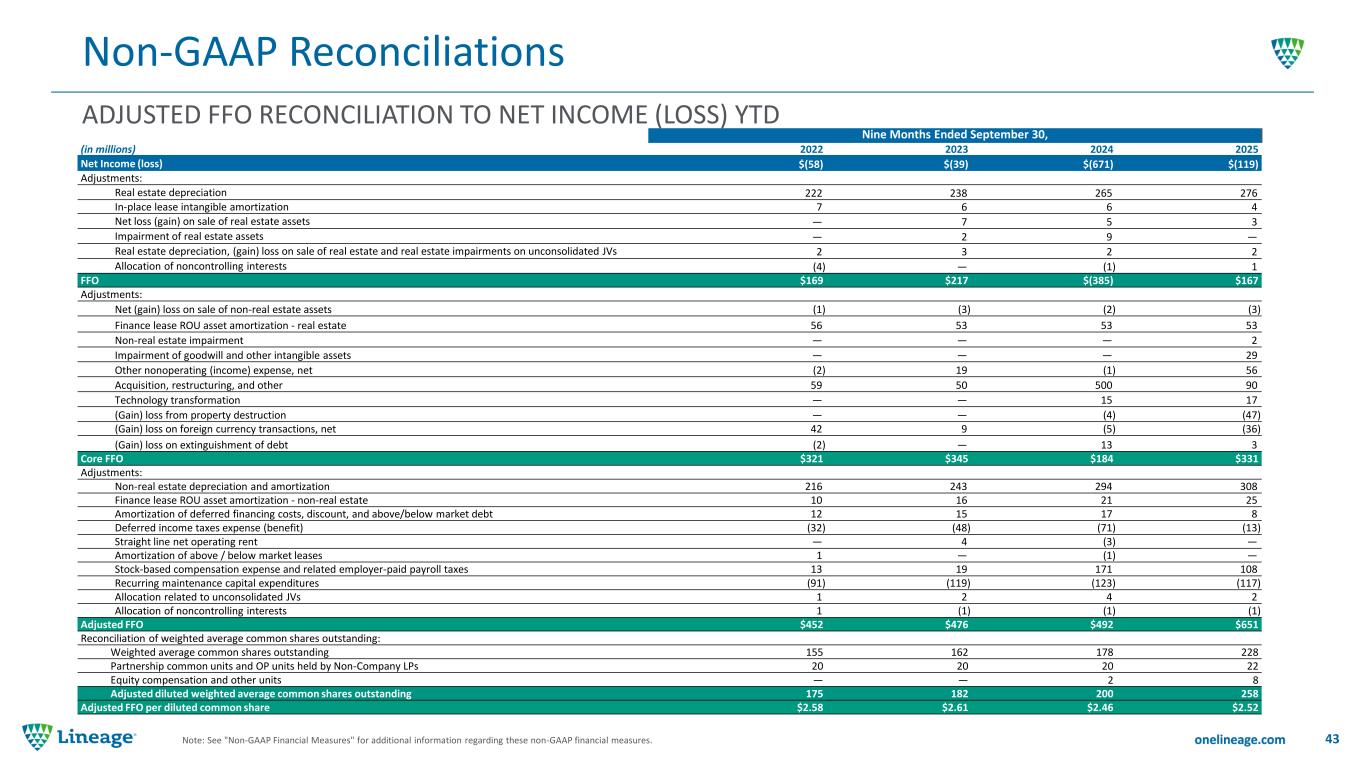

ADJUSTED FFO RECONCILIATION TO NET INCOME (LOSS) YTD Non-GAAP Reconciliations 43Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. Nine Months Ended September 30, (in millions) 2022 2023 2024 2025 Net Income (loss) $(58) $(39) $(671) $(119) Adjustments: Real estate depreciation 222 238 265 276 In-place lease intangible amortization 7 6 6 4 Net loss (gain) on sale of real estate assets — 7 5 3 Impairment of real estate assets — 2 9 — Real estate depreciation, (gain) loss on sale of real estate and real estate impairments on unconsolidated JVs 2 3 2 2 Allocation of noncontrolling interests (4) — (1) 1 FFO $169 $217 $(385) $167 Adjustments: Net (gain) loss on sale of non-real estate assets (1) (3) (2) (3) Finance lease ROU asset amortization - real estate 56 53 53 53 Non-real estate impairment — — — 2 Impairment of goodwill and other intangible assets — — — 29 Other nonoperating (income) expense, net (2) 19 (1) 56 Acquisition, restructuring, and other 59 50 500 90 Technology transformation — — 15 17 (Gain) loss from property destruction — — (4) (47) (Gain) loss on foreign currency transactions, net 42 9 (5) (36) (Gain) loss on extinguishment of debt (2) — 13 3 Core FFO $321 $345 $184 $331 Adjustments: Non-real estate depreciation and amortization 216 243 294 308 Finance lease ROU asset amortization - non-real estate 10 16 21 25 Amortization of deferred financing costs, discount, and above/below market debt 12 15 17 8 Deferred income taxes expense (benefit) (32) (48) (71) (13) Straight line net operating rent — 4 (3) — Amortization of above / below market leases 1 — (1) — Stock-based compensation expense and related employer-paid payroll taxes 13 19 171 108 Recurring maintenance capital expenditures (91) (119) (123) (117) Allocation related to unconsolidated JVs 1 2 4 2 Allocation of noncontrolling interests 1 (1) (1) (1) Adjusted FFO $452 $476 $492 $651 Reconciliation of weighted average common shares outstanding: Weighted average common shares outstanding 155 162 178 228 Partnership common units and OP units held by Non-Company LPs 20 20 20 22 Equity compensation and other units — — 2 8 Adjusted diluted weighted average common shares outstanding 175 182 200 258 Adjusted FFO per diluted common share $2.58 $2.61 $2.46 $2.52

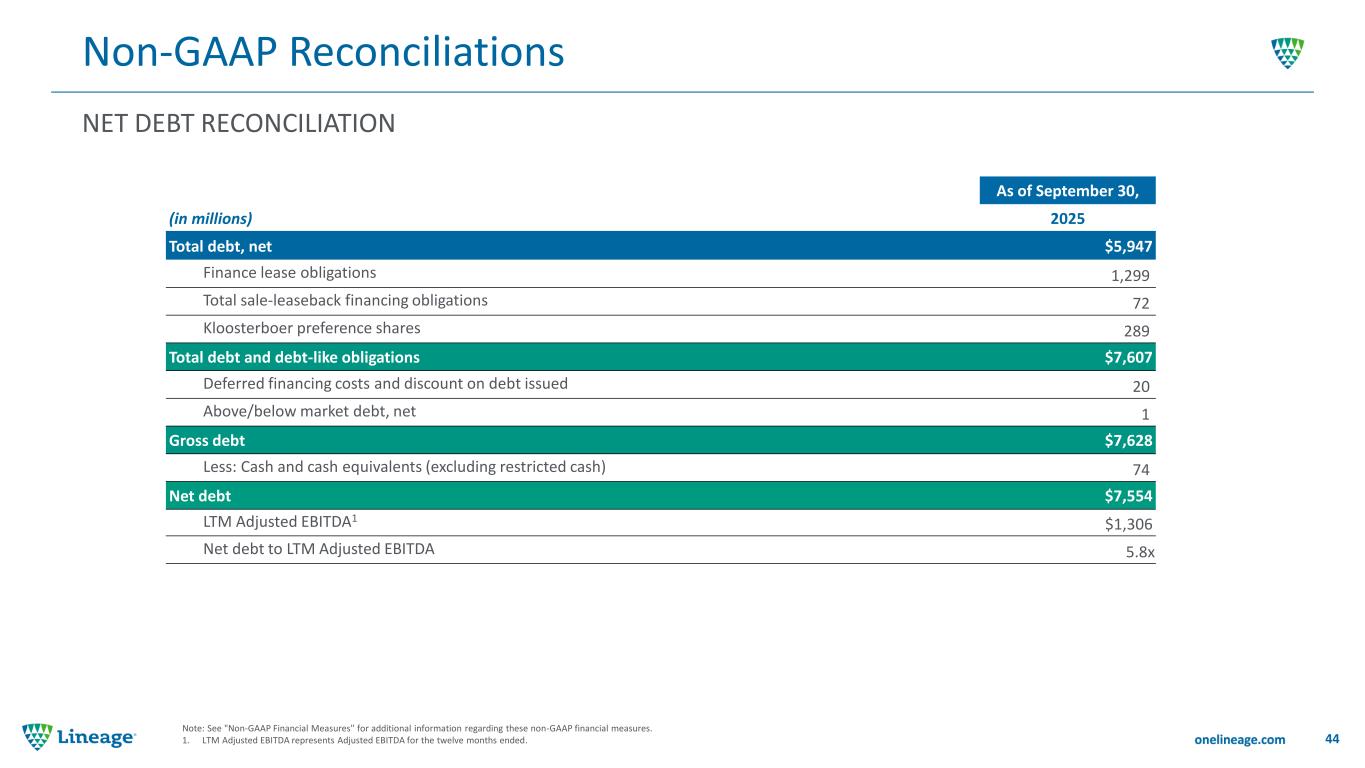

NET DEBT RECONCILIATION Non-GAAP Reconciliations 44 Note: See "Non-GAAP Financial Measures" for additional information regarding these non-GAAP financial measures. 1. LTM Adjusted EBITDA represents Adjusted EBITDA for the twelve months ended. As of September 30, (in millions) 2025 Total debt, net $5,947 Finance lease obligations 1,299 Total sale-leaseback financing obligations 72 Kloosterboer preference shares 289 Total debt and debt-like obligations $7,607 Deferred financing costs and discount on debt issued 20 Above/below market debt, net 1 Gross debt $7,628 Less: Cash and cash equivalents (excluding restricted cash) 74 Net debt $7,554 LTM Adjusted EBITDA1 $1,306 Net debt to LTM Adjusted EBITDA 5.8x

We use the following non-GAAP financial measures as supplemental performance measures of our business: segment NOI, FFO, Core FFO, Adjusted FFO, EBITDA, EBITDAre, Adjusted EBITDA, Adjusted EBITDA margin, and net debt. We also use same warehouse and non-same warehouse metrics. We calculate total segment NOI (or “NOI”) as our total revenues less our cost of operations (excluding any depreciation and amortization, general and administrative expense, stock-based compensation expense and related employer-paid payroll taxes from grants under our equity incentive plans, restructuring and impairment expense, gain and loss on sale of assets, and acquisition, transaction, and other expense). We use segment NOI to evaluate our segments for purposes of making operating decisions and assessing performance in accordance with ASC 280, Segment Reporting. We believe segment NOI is helpful to investors as a supplemental performance measure to net income because it assists both investors and management in understanding the core operations of our business. There is no industry definition of segment NOI and, as a result, other REITs may calculate segment NOI or other similarly-captioned metrics in a manner different than we do. We calculate EBITDA for Real Estate, or “EBITDAre”, in accordance with the standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, or “NAREIT”, defined as earnings before interest income or expense, taxes, depreciation and amortization, net loss or gain on sale of real estate, net of withholding taxes, impairment write-downs on real estate property, and adjustments to reflect our share of EBITDAre for partially owned entities. EBITDAre is a measure commonly used in our industry, and we present EBITDAre to enhance investor understanding of our operating performance. We believe that EBITDAre provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and useful life of related assets among otherwise comparable companies. We also calculate our Adjusted EBITDA as EBITDAre further adjusted for the effects of gain or loss on the sale of non-real estate assets, gain or loss on the destruction of property (net of insurance proceeds), other nonoperating income or expense, acquisition, restructuring, and other expense, foreign currency exchange gain or loss, stock-based compensation expense and related employer-paid payroll taxes from grants under our equity incentive plans, loss or gain on debt extinguishment and modification, non-real estate impairments, technology transformation, and reduction in EBITDAre from partially owned entities. We believe that the presentation of Adjusted EBITDA provides a measurement of our operations that is meaningful to investors because it excludes the effects of certain items that are otherwise included in EBITDAre but which we do not believe are indicative of our core business operations. EBITDAre and Adjusted EBITDA are not measurements of financial performance under GAAP, and our EBITDAre and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. You should not consider our EBITDAre and Adjusted EBITDA as alternatives to net income or cash flows from operating activities determined in accordance with GAAP. Our calculations of EBITDAre and Adjusted EBITDA have limitations as analytical tools, including the following: • these measures do not reflect our historical or future cash requirements for maintenance capital expenditures or growth and expansion capital expenditures; • these measures do not reflect changes in, or cash requirements for, our working capital needs; • these measures do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness; • these measures do not reflect our tax expense or the cash requirements to pay our taxes; and • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and these measures do not reflect any cash requirements for such replacements. We use EBITDA, EBITDAre, and Adjusted EBITDA as measures of our operating performance and not as measures of liquidity. We also calculate Adjusted EBITDA margin, which represents Adjusted EBITDA as a percentage of Net revenues and which provides an additional way to compare the above-described measure of our operations across periods. (continued on following slide) Non-GAAP Financial Measures 45

(continued) We calculate funds from operations, or FFO, in accordance with the standards established by the Board of Governors of the NAREIT. NAREIT defines FFO as net income or loss determined in accordance with GAAP, excluding extraordinary items as defined under GAAP and gains or losses from sales of previously depreciated operating real estate assets, plus specified non-cash items, such as real estate asset depreciation and amortization, in-place lease intangible amortization, real estate asset impairment, and our share of reconciling items for partially owned entities. We believe that FFO is helpful to investors as a supplemental performance measure because it excludes the effect of depreciation, amortization, and gains or losses from sales of real estate, all of which are based on historical costs, which implicitly assumes that the value of real estate diminishes predictably over time. Since real estate values instead have historically risen or fallen with market conditions, FFO can facilitate comparisons of operating performance between periods and among other equity REITs. We calculate core funds from operations, or Core FFO, as FFO adjusted for the effects of gain or loss on the sale of non-real estate assets, gain or loss on the destruction of property (net of insurance proceeds), finance lease ROU asset amortization real estate, non-real estate impairments, acquisition, restructuring and other, other nonoperating income or expense, loss on debt extinguishment and modifications and the effects of gain or loss on foreign currency exchange. We also adjust for the impact attributable to non-real estate impairments on unconsolidated joint ventures and natural disaster. We believe that Core FFO is helpful to investors as a supplemental performance measure because it excludes the effects of certain items which can create significant earnings volatility, but which do not directly relate to our core business operations. We believe Core FFO can facilitate comparisons of operating performance between periods, while also providing a more meaningful predictor of future earnings potential. However, because FFO and Core FFO add back real estate depreciation and amortization and do not capture the level of recurring maintenance capital expenditures necessary to maintain the operating performance of our properties, both of which have material economic impacts on our results from operations, we believe the utility of FFO and Core FFO as a measure of our performance may be limited. We calculate adjusted funds from operations, or Adjusted FFO, as Core FFO adjusted for the effects of amortization of deferred financing costs, amortization of debt discount/premium amortization of above or below market leases, straight-line net operating rent, provision or benefit from deferred income taxes, stock-based compensation expense and related employer-paid payroll taxes from grants under our equity incentive plans, non-real estate depreciation and amortization, non-real estate finance lease ROU asset amortization, and recurring maintenance capital expenditures. We also adjust for Adjusted FFO attributable to our share of reconciling items of partially owned entities. We believe that Adjusted FFO is helpful to investors as a meaningful supplemental comparative performance measure of our ability to make incremental capital investments in our business and to assess our ability to fund distribution requirements from our operating activities. FFO, Core FFO, Adjusted FFO, and Adjusted FFO per diluted share are used by management, investors, and industry analysts as supplemental measures of operating performance of equity REITs. FFO, Core FFO Adjusted FFO and Adjusted FFO per diluted share should be evaluated along with GAAP net income and net income per diluted share (the most directly comparable GAAP measures) in evaluating our operating performance. FFO, Core FFO, and Adjusted FFO do not represent net income or cash flows from operating activities in accordance with GAAP and are not indicative of our results of operations or cash flows from operating activities as disclosed in our condensed consolidated financial statements included elsewhere in this Presentation. FFO, Core FFO, and Adjusted FFO should be considered as supplements, but not alternatives, to our net income or cash flows from operating activities as indicators of our operating performance. Moreover, other REITs may not calculate FFO in accordance with the NAREIT definition or may interpret the NAREIT definition differently than we do. Accordingly, our FFO may not be comparable to FFO as calculated by other REITs. In addition, there is no industry definition of Core FFO or Adjusted FFO and, as a result, other REITs may also calculate Core FFO or Adjusted FFO, or other similarly-captioned metrics, in a manner different than we do. We calculate net debt as our gross debt (defined as total debt, net plus finance lease obligations, failed sale-leaseback financing obligations, deferred financing costs, above/below market debt, net and the Kloosterboer preference shares), less cash and cash equivalents (excluding restricted cash). Adjusted net debt to LTM Adjusted EBITDA is calculated using adjusted net debt as of period end divided by Adjusted EBITDA for the twelve months then ended. We use this ratio to evaluate our capital structure and financial leverage. This ratio is also commonly used in our industry, and we believe it provides investors, lenders and rating agencies a meaningful supplemental measure of our ability to repay and service our debt obligations. Other REITs may also calculate this ratio or other similarly-captioned metrics in a manner different than we do. We are not able to provide forward-looking guidance for certain financial data that would make a reconciliation from the most comparable GAAP measure to non-GAAP financial measure for forward-looking Adjusted EBITDA and Adjusted FFO per share possible without unreasonable effort. This is due to unpredictable nature of relevant reconciling items from factors such as acquisitions, divestitures, impairments, natural disaster events, restructurings, debt issuances that have not yet occurred, or other events that are out of our control and cannot be forecasted. The impact of such adjustments could be significant. Non-GAAP Financial Measures 46

C O N TA C T Thank you 47 Investor Relations ir@onelineage.com