Earnings Conference Call Third Quarter 2025 November 7, 2025

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “could,” “may,” “expects,” “anticipates,” “will,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “predicts,” and variations on such words, and similar expressions that reflect our current views with respect to future events and operational, economic, and financial performance, are intended to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between Constellation and Calpine Corporation, the expected closing of the proposed transaction and the timing thereof. This includes statements regarding the financing of the proposed transaction and the pro forma combined company and its operations, strategies and plans, enhancements to investment-grade credit profile, synergies, opportunities and anticipated future performance and capital structure, and expected accretion to earnings per share and free cash flow. Information adjusted for the proposed transaction should not be considered a forecast of future results. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those projected. The factors that could cause actual results to differ materially from the forward-looking statements made by Constellation Energy Corporation and Constellation Energy Generation, LLC, (the Registrants) include those factors discussed herein, as well as the items discussed in (1) the Registrants’ combined 2024 Annual Report on Form 10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part II, ITEM 8. Financial Statements and Supplementary Data: Note 18, Commitments and Contingencies; (2) the Registrants’ Third Quarter 2025 Quarterly Report on Form 10-Q (to be filed on November 7, 2025) in (a) Part II, ITEM 1A. Risk Factors, (b) Part I, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) Part I, ITEM 1. Financial Statements: Note 14, Commitments and Contingencies; and (3) other factors discussed in filings with the SEC by the Registrants. Investors are cautioned not to place undue reliance on these forward-looking statements, whether written or oral, which apply only as of the date of this presentation. Neither Registrant undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. Cautionary Statements Regarding Forward-Looking Information 2

The Registrants report their financial results in accordance with accounting principles generally accepted in the United States (GAAP). Constellation supplements the reporting of financial information determined in accordance with GAAP with certain non-GAAP financial measures, including: • Adjusted Operating Earnings (and/or its per share equivalent) exclude certain costs, expenses, gains and losses and other specified items, including mark-to-market adjustments from economic hedging activities, interest rate swaps, and fair value adjustments related to gas imbalances and equity investments, decommissioning related activity, asset impairments, certain amounts associated with plant retirements and divestitures, pension and other post-employment benefits (OPEB) non-service credits, and other items as set forth in the Appendix • Free cash flows before growth (FCFbG) is cash flows from operations less capital expenditures under GAAP for maintenance and nuclear fuel, equity investments, and adjusted for changes in collateral and non-recurring costs-to-achieve (CTA) • Adjusted gross margin is defined as adjusted operating revenues less adjusted purchased power and fuel expense, excluding revenue related to decommissioning, gross receipts tax, variable interest entities, and net of direct cost of sales for certain end-user businesses – Adjusted operating revenues excludes the mark-to-market impact of economic hedging activities due to the volatility and unpredictability of the future changes in commodity prices – Adjusted purchased power and fuel excludes the mark-to-market impact of economic hedging activities and fair value adjustments related to gas imbalances due to the volatility and unpredictability of the future changes in commodity prices • Adjusted operating and maintenance (O&M) excludes direct cost of sales for certain end-user businesses, Asset Retirement Obligation (ARO) accretion expense from unregulated units and decommissioning costs that do not affect profit and loss, the impact from operating and maintenance expense related to variable interest entities at Constellation, and other items as set forth in the reconciliation in the Appendix Due to the forward-looking nature of our Adjusted Operating Earnings guidance, Projected Adjusted Gross Margin, and Projected Free Cash Flow Before Growth, we are unable to reconcile these non-GAAP financial measures to the comparable GAAP measures given the inherent uncertainty required in projecting gains and losses associated with the various fair value adjustments required by GAAP. These adjustments include future changes in fair value impacting the derivative instruments utilized in our current business operations, as well as the debt and equity securities held within our nuclear decommissioning trusts, which may have a material impact on our future GAAP results. Non-GAAP Financial Measures 3

This information is intended to enhance an investor’s overall understanding of period over period financial results and provide an indication of Constellation’s operating performance by excluding items that are considered by management to be not directly related to the ongoing operations of the business. In addition, this information is among the primary indicators management uses as a basis for evaluating performance, allocating resources, setting incentive compensation targets and planning and forecasting of future periods. These non-GAAP financial measures are not a presentation defined under GAAP and may not be comparable to other companies’ presentations of similarly titled financial measures. Constellation has provided these non-GAAP financial measures as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These non-GAAP measures should not be deemed more useful than, a substitute for, or an alternative to the most comparable GAAP measures provided in the materials presented. Non-GAAP financial measures are identified by the phrase “non-GAAP” or an asterisk (*). Reconciliations of these non-GAAP measures to the most comparable GAAP measures are provided in the appendices and attachments to this presentation. Non-GAAP Financial Measures Continued 4

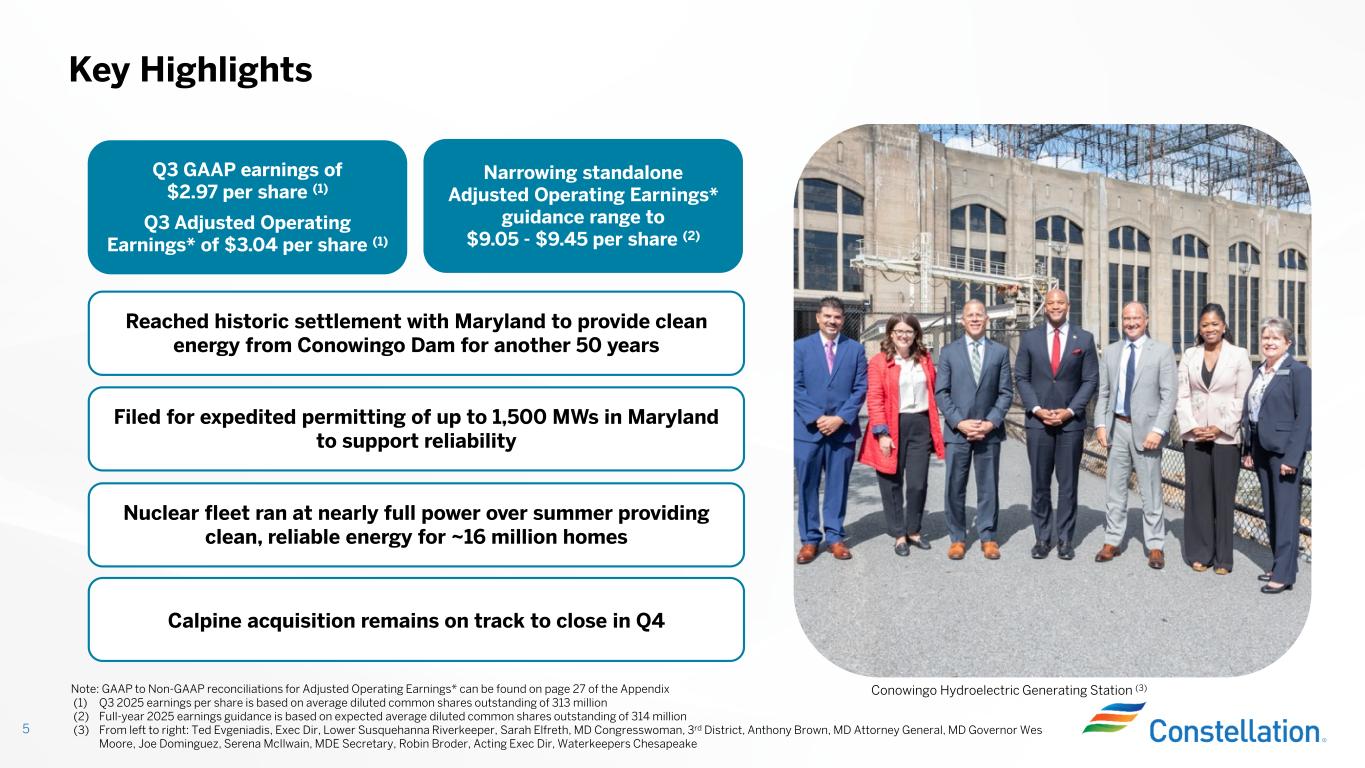

Key Highlights 5 Nuclear fleet ran at nearly full power over summer providing clean, reliable energy for ~16 million homes Conowingo Hydroelectric Generating Station (3) Calpine acquisition remains on track to close in Q4 Reached historic settlement with Maryland to provide clean energy from Conowingo Dam for another 50 years Filed for expedited permitting of up to 1,500 MWs in Maryland to support reliability (1) Q3 2025 earnings per share is based on average diluted common shares outstanding of 313 million (2) Full-year 2025 earnings guidance is based on expected average diluted common shares outstanding of 314 million (3) From left to right: Ted Evgeniadis, Exec Dir, Lower Susquehanna Riverkeeper, Sarah Elfreth, MD Congresswoman, 3rd District, Anthony Brown, MD Attorney General, MD Governor Wes Moore, Joe Dominguez, Serena McIlwain, MDE Secretary, Robin Broder, Acting Exec Dir, Waterkeepers Chesapeake Note: GAAP to Non-GAAP reconciliations for Adjusted Operating Earnings* can be found on page 27 of the Appendix Q3 GAAP earnings of $2.97 per share (1) Q3 Adjusted Operating Earnings* of $3.04 per share (1) Narrowing standalone Adjusted Operating Earnings* guidance range to $9.05 - $9.45 per share (2)

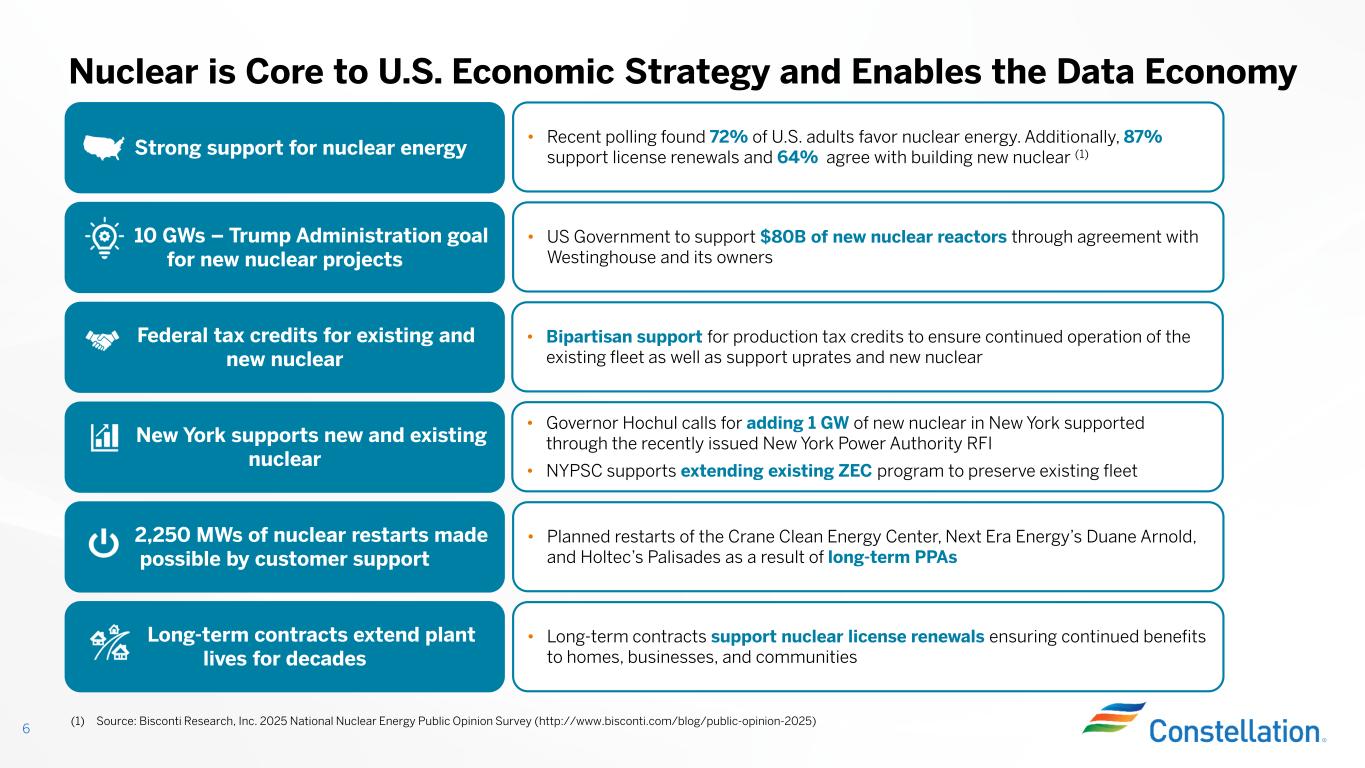

• Long-term contracts support nuclear license renewals ensuring continued benefits to homes, businesses, and communities Nuclear is Core to U.S. Economic Strategy and Enables the Data Economy 6 Strong support for nuclear energy • Recent polling found 72% of U.S. adults favor nuclear energy. Additionally, 87% support license renewals and 64% agree with building new nuclear (1) • US Government to support $80B of new nuclear reactors through agreement with Westinghouse and its owners • Bipartisan support for production tax credits to ensure continued operation of the existing fleet as well as support uprates and new nuclear 10 GWs – Trump Administration goal for new nuclear projects Federal tax credits for existing and new nuclear New York supports new and existing nuclear • Governor Hochul calls for adding 1 GW of new nuclear in New York supported through the recently issued New York Power Authority RFI • NYPSC supports extending existing ZEC program to preserve existing fleet • Planned restarts of the Crane Clean Energy Center, Next Era Energy’s Duane Arnold, and Holtec’s Palisades as a result of long-term PPAs 2,250 MWs of nuclear restarts made possible by customer support Long-term contracts extend plant lives for decades (1) Source: Bisconti Research, Inc. 2025 National Nuclear Energy Public Opinion Survey (http://www.bisconti.com/blog/public-opinion-2025)

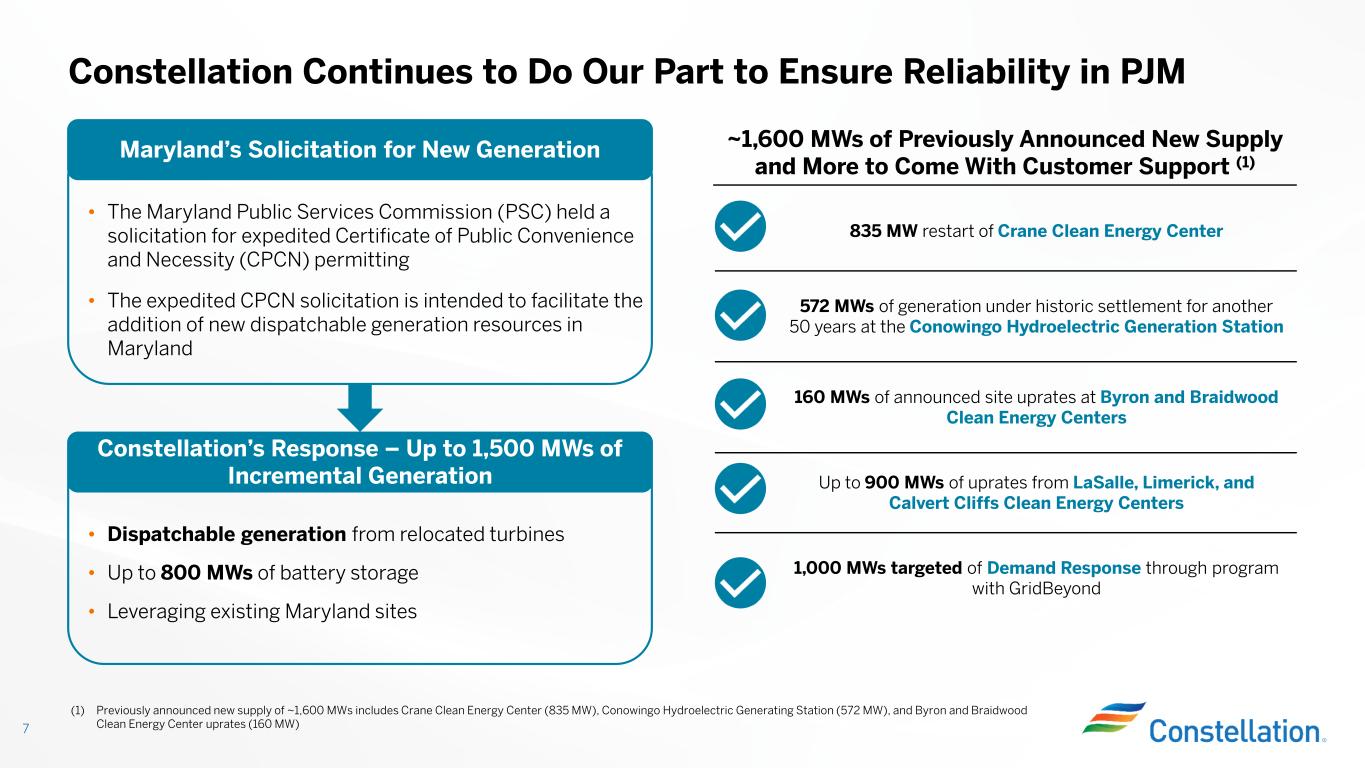

7 Constellation Continues to Do Our Part to Ensure Reliability in PJM • The Maryland Public Services Commission (PSC) held a solicitation for expedited Certificate of Public Convenience and Necessity (CPCN) permitting • The expedited CPCN solicitation is intended to facilitate the addition of new dispatchable generation resources in Maryland Maryland’s Solicitation for New Generation • Dispatchable generation from relocated turbines • Up to 800 MWs of battery storage • Leveraging existing Maryland sites Constellation’s Response – Up to 1,500 MWs of Incremental Generation ~1,600 MWs of Previously Announced New Supply and More to Come With Customer Support (1) 835 MW restart of Crane Clean Energy Center 572 MWs of generation under historic settlement for another 50 years at the Conowingo Hydroelectric Generation Station 160 MWs of announced site uprates at Byron and Braidwood Clean Energy Centers Up to 900 MWs of uprates from LaSalle, Limerick, and Calvert Cliffs Clean Energy Centers 1,000 MWs targeted of Demand Response through program with GridBeyond (1) Previously announced new supply of ~1,600 MWs includes Crane Clean Energy Center (835 MW), Conowingo Hydroelectric Generating Station (572 MW), and Byron and Braidwood Clean Energy Center uprates (160 MW)

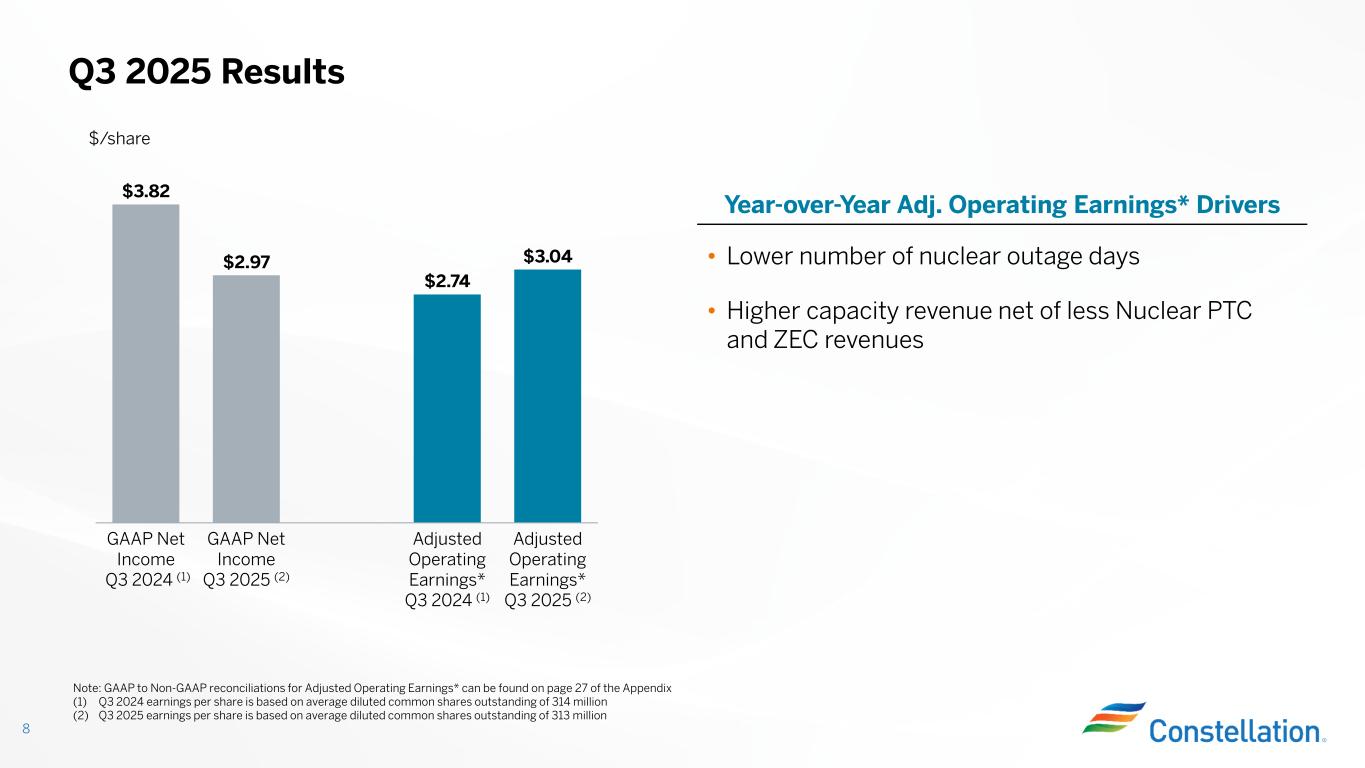

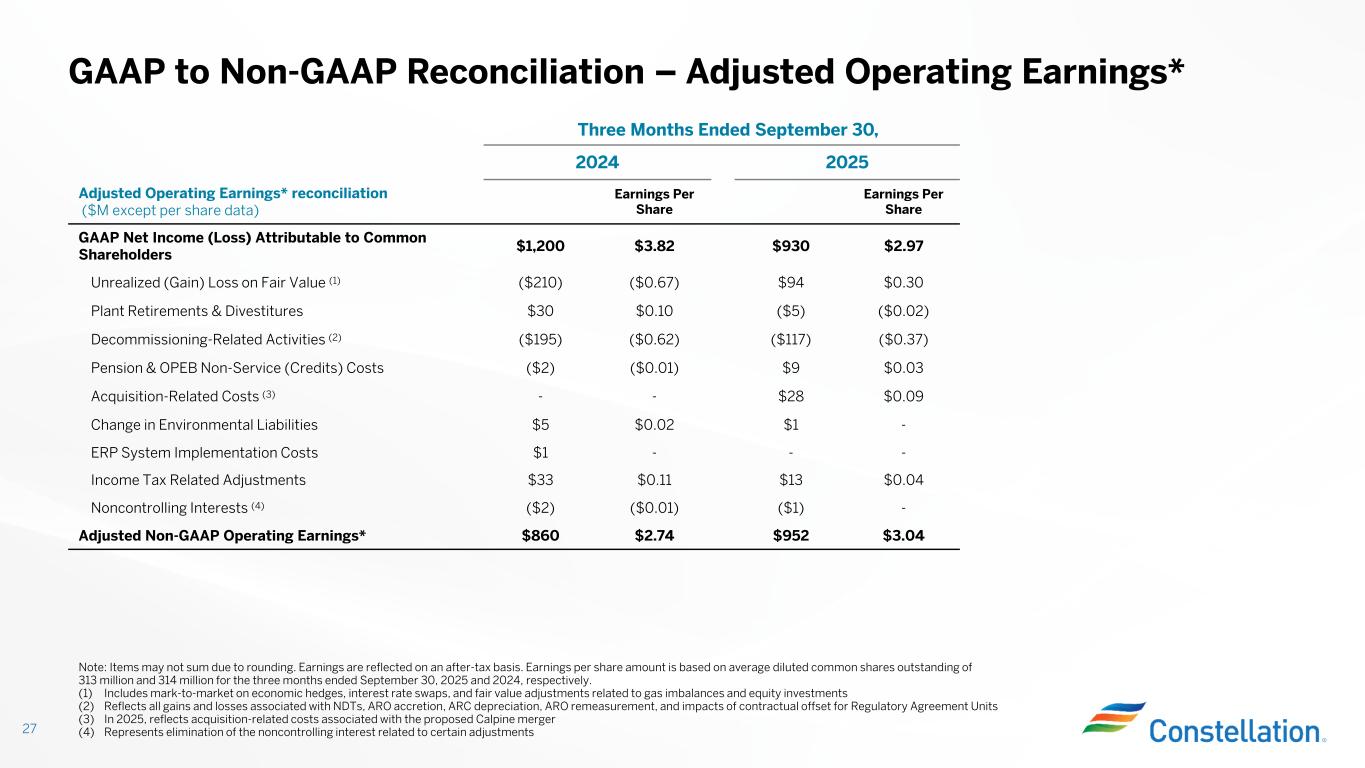

(1) Q3 2024 earnings per share is based on average diluted common shares outstanding of 314 million (2) Q3 2025 earnings per share is based on average diluted common shares outstanding of 313 million Q3 2025 Results 8 Year-over-Year Adj. Operating Earnings* Drivers $3.82 $2.97 $2.74 $3.04 GAAP Net Income Q3 2024 (1) GAAP Net Income Q3 2025 (2) Adjusted Operating Earnings* Q3 2024 (1) Adjusted Operating Earnings* Q3 2025 (2) • Lower number of nuclear outage days • Higher capacity revenue net of less Nuclear PTC and ZEC revenues Note: GAAP to Non-GAAP reconciliations for Adjusted Operating Earnings* can be found on page 27 of the Appendix $/share

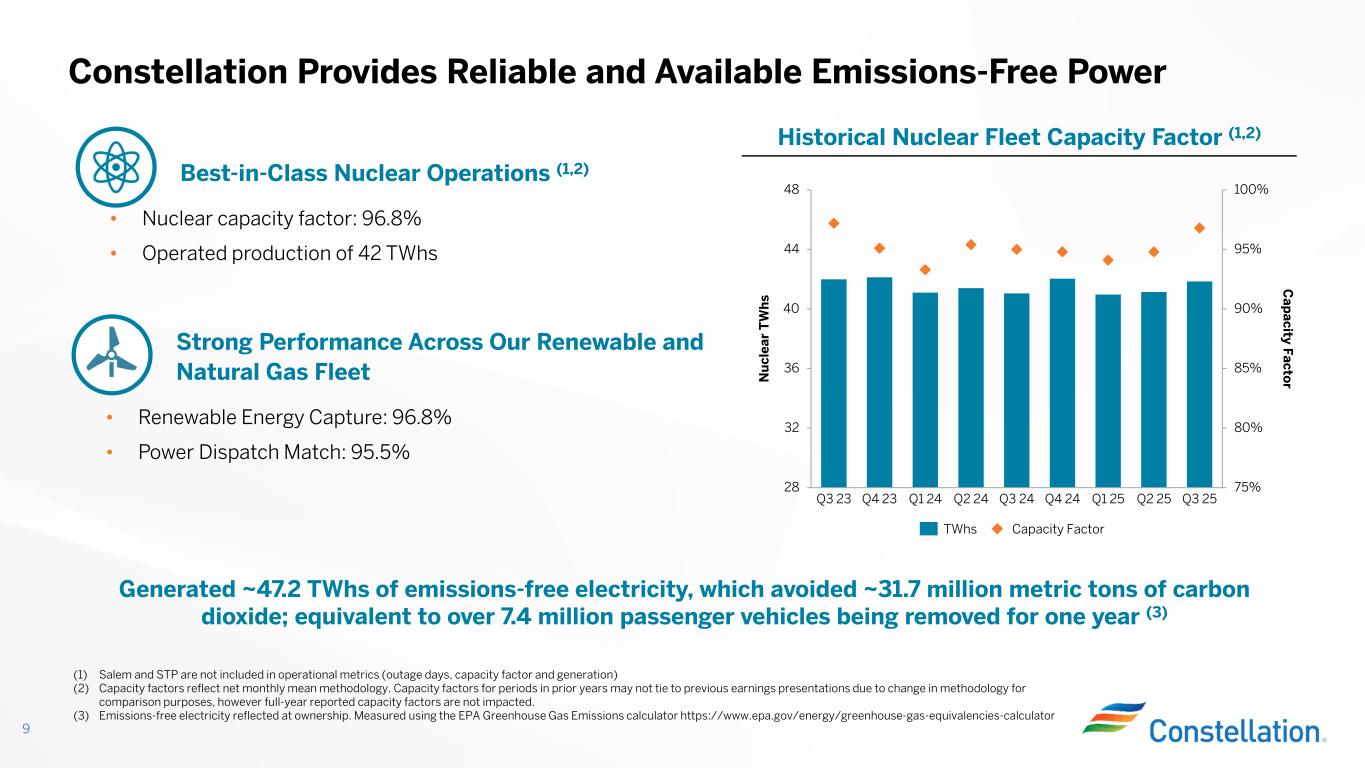

Best-in-Class Nuclear Operations (1,2) • Nuclear capacity factor: 96.8% • Operated production of 42 TWhs 9 Constellation Provides Reliable and Available Emissions-Free Power (1) Salem and STP are not included in operational metrics (outage days, capacity factor and generation) (2) Capacity factors reflect net monthly mean methodology. Capacity factors for periods in prior years may not tie to previous earnings presentations due to change in methodology for comparison purposes, however full-year reported capacity factors are not impacted. (3) Emissions-free electricity reflected at ownership. Measured using the EPA Greenhouse Gas Emissions calculator https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator 75% 80% 85% 90% 95% 100% 28 32 36 40 44 48 N u cl ea r T W h s C ap acity F acto r Q3 23 Q4 23 Q1 24 Q2 24 Q3 24 Q4 24 Q1 25 Q2 25 Q3 25 TWhs Capacity Factor Generated ~47.2 TWhs of emissions-free electricity, which avoided ~31.7 million metric tons of carbon dioxide; equivalent to over 7.4 million passenger vehicles being removed for one year (3) Historical Nuclear Fleet Capacity Factor (1,2) Strong Performance Across Our Renewable and Natural Gas Fleet • Renewable Energy Capture: 96.8% • Power Dispatch Match: 95.5%

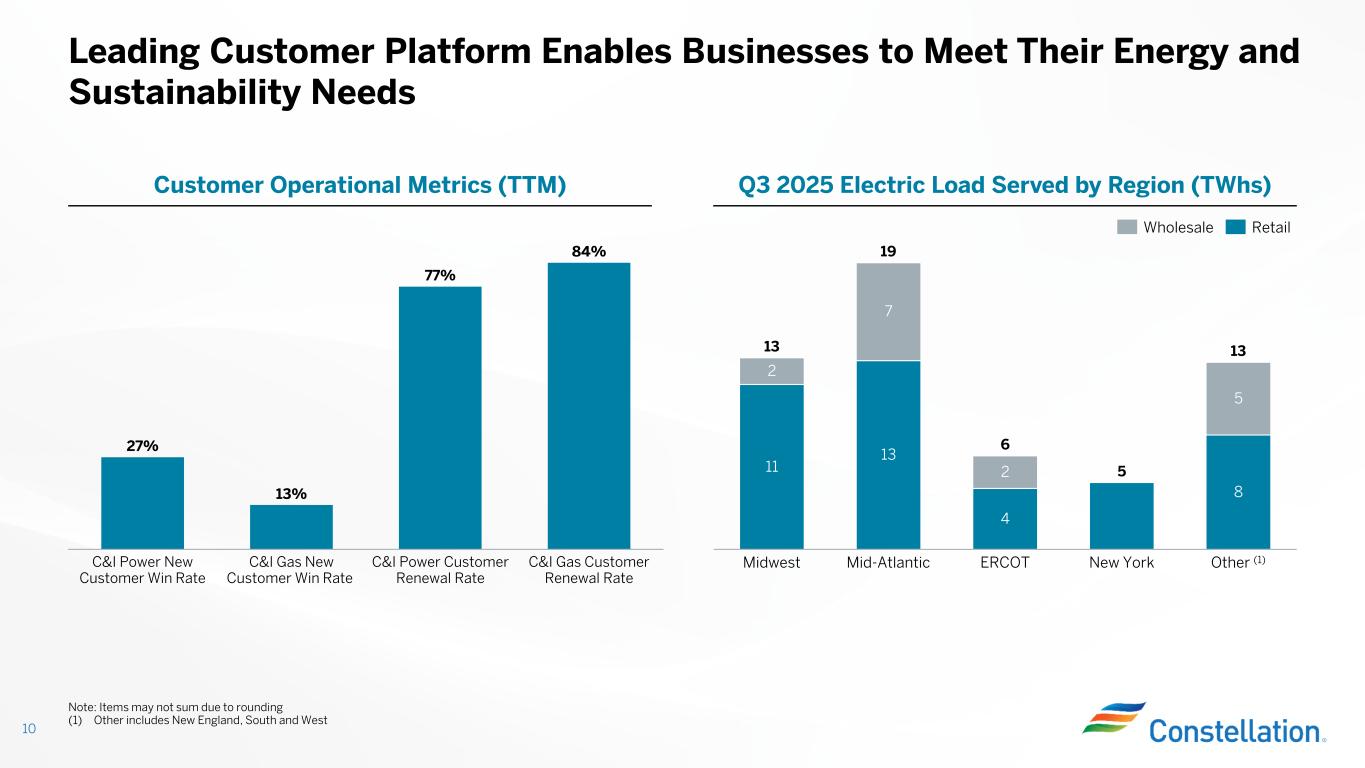

Leading Customer Platform Enables Businesses to Meet Their Energy and Sustainability Needs 10 Note: Items may not sum due to rounding (1) Other includes New England, South and West Q3 2025 Electric Load Served by Region (TWhs)Customer Operational Metrics (TTM) 11 13 4 5 8 2 7 2 5 Midwest Mid-Atlantic ERCOT New York Other (1) 13 19 6 13 Wholesale Retail 27% 13% 77% 84% C&I Power New Customer Win Rate C&I Gas New Customer Win Rate C&I Power Customer Renewal Rate C&I Gas Customer Renewal Rate

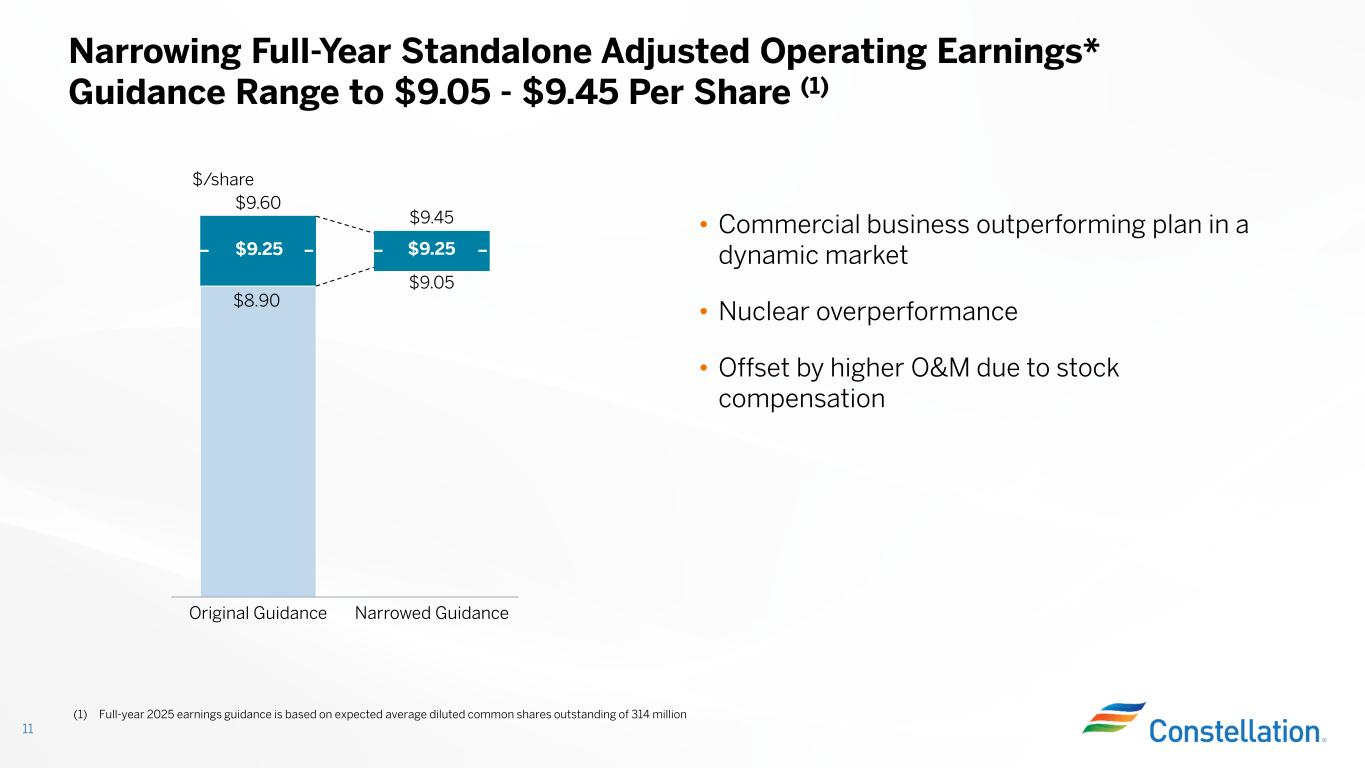

(1) Full-year 2025 earnings guidance is based on expected average diluted common shares outstanding of 314 million Narrowing Full-Year Standalone Adjusted Operating Earnings* Guidance Range to $9.05 - $9.45 Per Share (1) 11 • Commercial business outperforming plan in a dynamic market • Nuclear overperformance • Offset by higher O&M due to stock compensation $/share Original Guidance Narrowed Guidance $9.60 $8.90 $9.25 $9.05 $9.45 $9.25

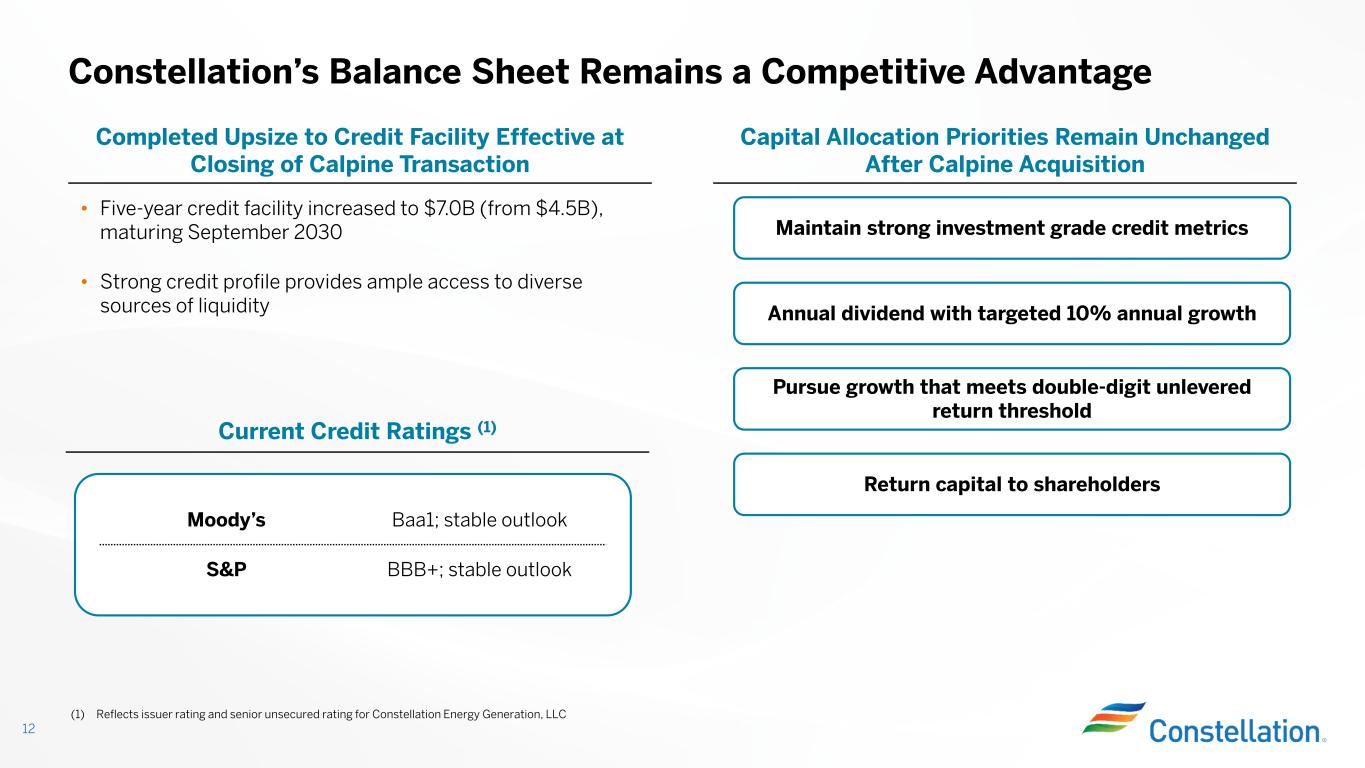

Constellation’s Balance Sheet Remains a Competitive Advantage 12 Baa1; stable outlookMoody’s BBB+; stable outlookS&P Completed Upsize to Credit Facility Effective at Closing of Calpine Transaction Capital Allocation Priorities Remain Unchanged After Calpine Acquisition • Five-year credit facility increased to $7.0B (from $4.5B), maturing September 2030 • Strong credit profile provides ample access to diverse sources of liquidity Current Credit Ratings (1) Maintain strong investment grade credit metrics Annual dividend with targeted 10% annual growth Pursue growth that meets double-digit unlevered return threshold Return capital to shareholders (1) Reflects issuer rating and senior unsecured rating for Constellation Energy Generation, LLC

Constellation – Our Assets Are Unmatched Today and Tomorrow 13 Visible, Double-Digit Long-Term Base EPS Growth Backed by Nuclear PTC, Contracts and Customer Margins Best and Leading Operator of Clean, Emissions-free and Low-emissions, Reliable Generation, with Coast-to-Coast Presence Uniquely Positioned to Support Economic Growth, Electric System Reliability and National Security Growing Product Opportunities Through Leading Customer Platform Significant Opportunities to Sell Clean Attributes, Participate in Data Economy, and Grow Clean, Reliable MWs Strong Free Cash Flows and High Investment Grade Balance Sheet

Additional Disclosures 14

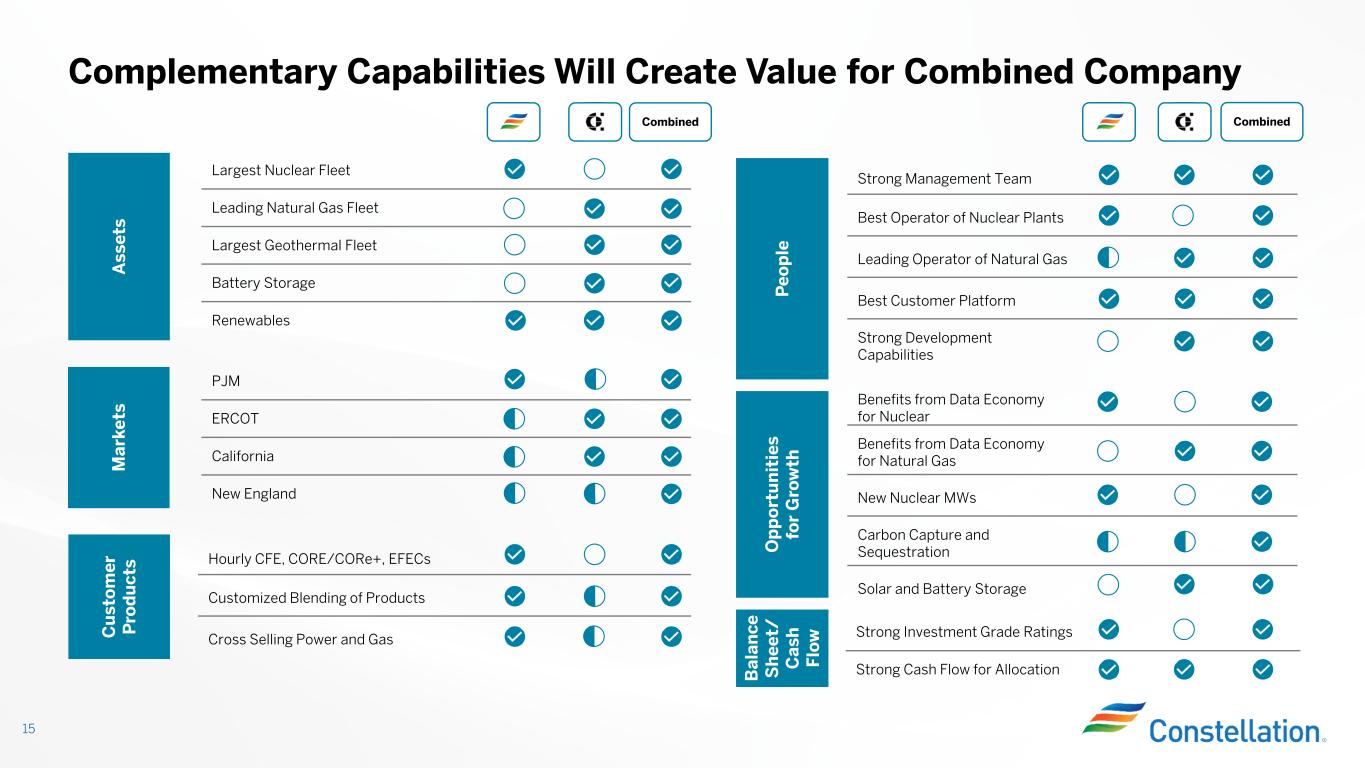

15 Complementary Capabilities Will Create Value for Combined Company A ss et s C u st o m er P ro d u ct s Largest Nuclear Fleet Leading Natural Gas Fleet Largest Geothermal Fleet Battery Storage Renewables Hourly CFE, CORE/CORe+, EFECs Customized Blending of Products Cross Selling Power and Gas Combined M ar ke ts PJM ERCOT California New England Strong Management Team Best Operator of Nuclear Plants Leading Operator of Natural Gas Best Customer Platform Strong Development Capabilities P eo p le B al an ce S h ee t/ C as h F lo w Strong Investment Grade Ratings Strong Cash Flow for Allocation O p p o rt u n it ie s fo r G ro w th Benefits from Data Economy for Nuclear Benefits from Data Economy for Natural Gas New Nuclear MWs Carbon Capture and Sequestration Solar and Battery Storage Combined

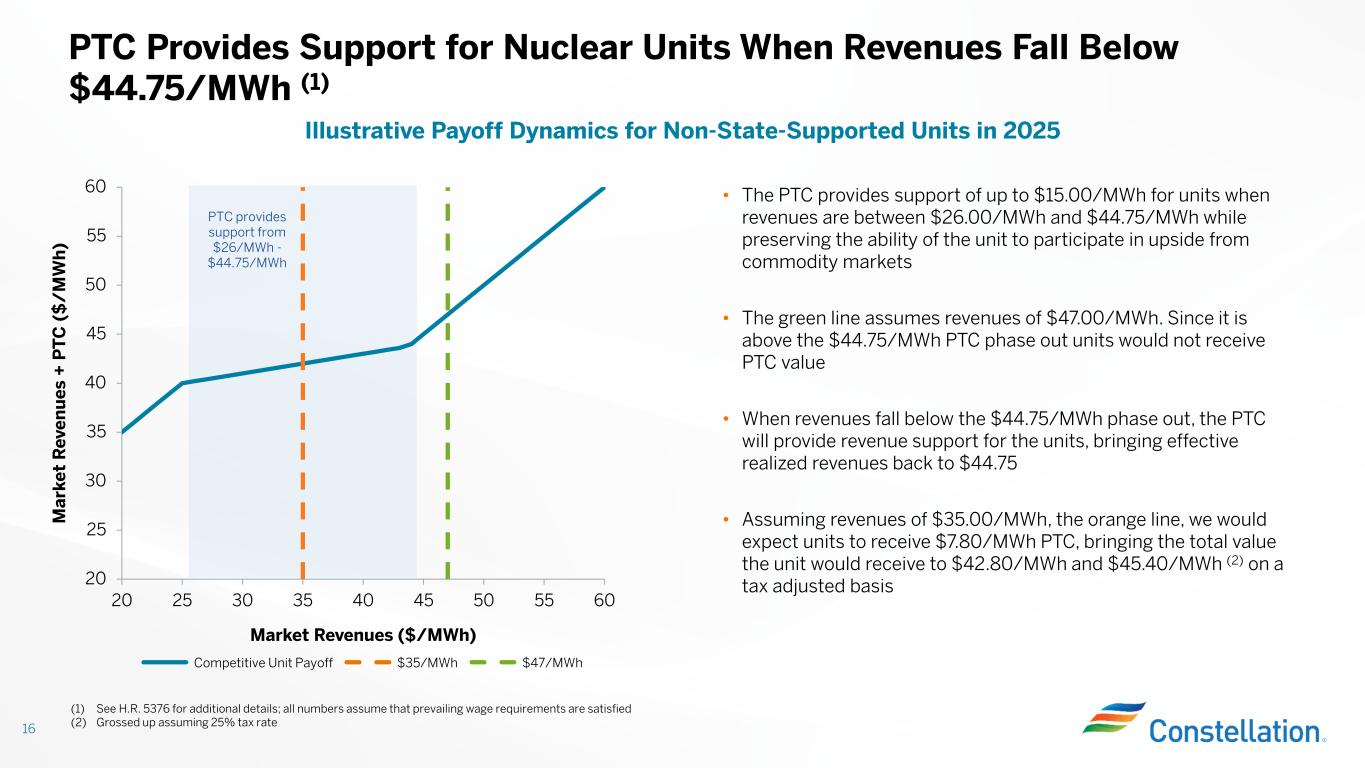

20 25 30 35 40 45 50 55 60 20 25 30 35 40 45 50 55 60 Market Revenues ($/MWh) M ar ke t R ev en u es + P T C ( $ / M W h ) 16 PTC Provides Support for Nuclear Units When Revenues Fall Below $44.75/MWh (1) Illustrative Payoff Dynamics for Non-State-Supported Units in 2025 • The PTC provides support of up to $15.00/MWh for units when revenues are between $26.00/MWh and $44.75/MWh while preserving the ability of the unit to participate in upside from commodity markets • The green line assumes revenues of $47.00/MWh. Since it is above the $44.75/MWh PTC phase out units would not receive PTC value • When revenues fall below the $44.75/MWh phase out, the PTC will provide revenue support for the units, bringing effective realized revenues back to $44.75 • Assuming revenues of $35.00/MWh, the orange line, we would expect units to receive $7.80/MWh PTC, bringing the total value the unit would receive to $42.80/MWh and $45.40/MWh (2) on a tax adjusted basis Competitive Unit Payoff $35/MWh $47/MWh PTC provides support from $26/MWh - $44.75/MWh (1) See H.R. 5376 for additional details; all numbers assume that prevailing wage requirements are satisfied (2) Grossed up assuming 25% tax rate

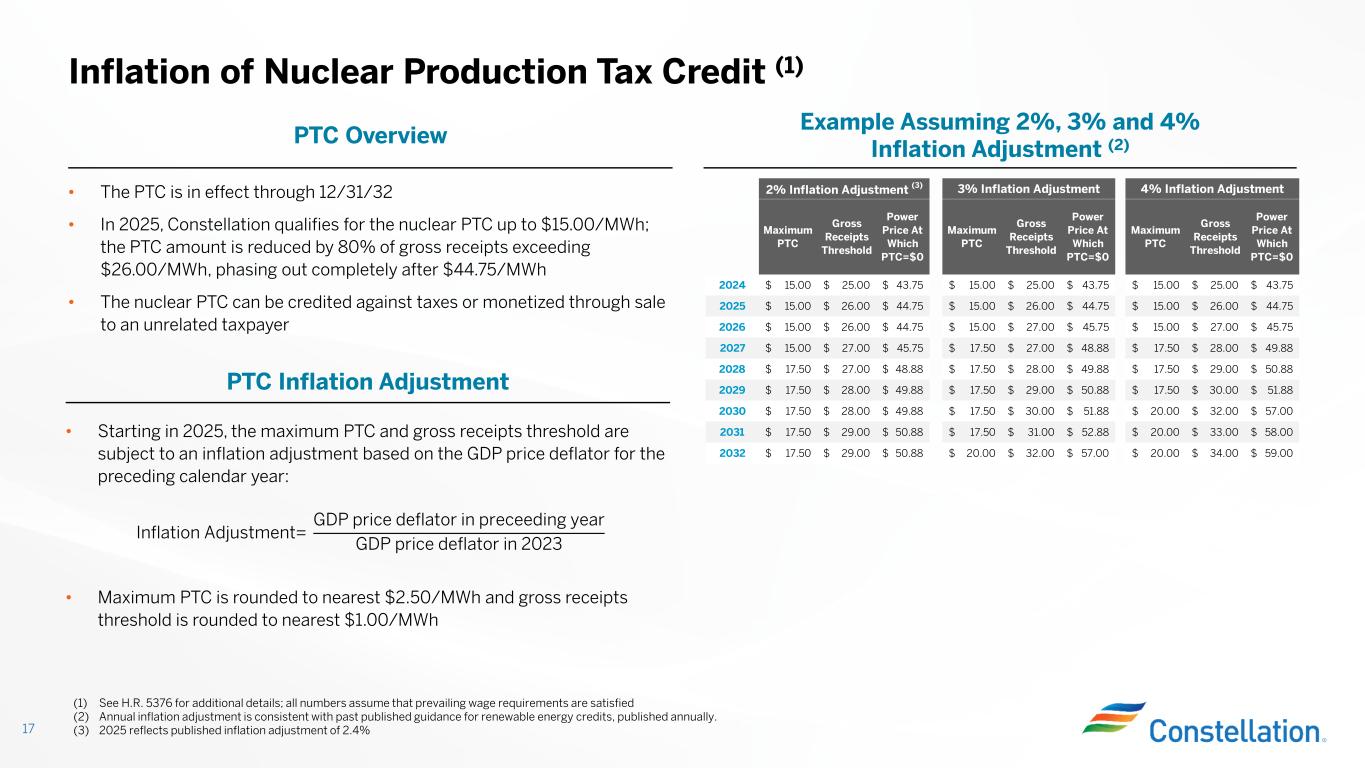

• Starting in 2025, the maximum PTC and gross receipts threshold are subject to an inflation adjustment based on the GDP price deflator for the preceding calendar year: • Maximum PTC is rounded to nearest $2.50/MWh and gross receipts threshold is rounded to nearest $1.00/MWh Inflation of Nuclear Production Tax Credit (1) 17 (1) See H.R. 5376 for additional details; all numbers assume that prevailing wage requirements are satisfied (2) Annual inflation adjustment is consistent with past published guidance for renewable energy credits, published annually. (3) 2025 reflects published inflation adjustment of 2.4% Example Assuming 2%, 3% and 4% Inflation Adjustment (2)PTC Overview Inflation Adjustment= GDP price deflator in preceeding year GDP price deflator in 2023 PTC Inflation Adjustment • The PTC is in effect through 12/31/32 • In 2025, Constellation qualifies for the nuclear PTC up to $15.00/MWh; the PTC amount is reduced by 80% of gross receipts exceeding $26.00/MWh, phasing out completely after $44.75/MWh • The nuclear PTC can be credited against taxes or monetized through sale to an unrelated taxpayer Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 Maximum PTC Gross Receipts Threshold Power Price At Which PTC=$0 2024 15.00$ 25.00$ 43.75$ 15.00$ 25.00$ 43.75$ 15.00$ 25.00$ 43.75$ 2025 15.00$ 26.00$ 44.75$ 15.00$ 26.00$ 44.75$ 15.00$ 26.00$ 44.75$ 2026 15.00$ 26.00$ 44.75$ 15.00$ 27.00$ 45.75$ 15.00$ 27.00$ 45.75$ 2027 15.00$ 27.00$ 45.75$ 17.50$ 27.00$ 48.88$ 17.50$ 28.00$ 49.88$ 2028 17.50$ 27.00$ 48.88$ 17.50$ 28.00$ 49.88$ 17.50$ 29.00$ 50.88$ 2029 17.50$ 28.00$ 49.88$ 17.50$ 29.00$ 50.88$ 17.50$ 30.00$ 51.88$ 2030 17.50$ 28.00$ 49.88$ 17.50$ 30.00$ 51.88$ 20.00$ 32.00$ 57.00$ 2031 17.50$ 29.00$ 50.88$ 17.50$ 31.00$ 52.88$ 20.00$ 33.00$ 58.00$ 2032 17.50$ 29.00$ 50.88$ 20.00$ 32.00$ 57.00$ 20.00$ 34.00$ 59.00$ 2% Inflation Adjustment (3) 3% Inflation Adjustment 4% Inflation Adjustment

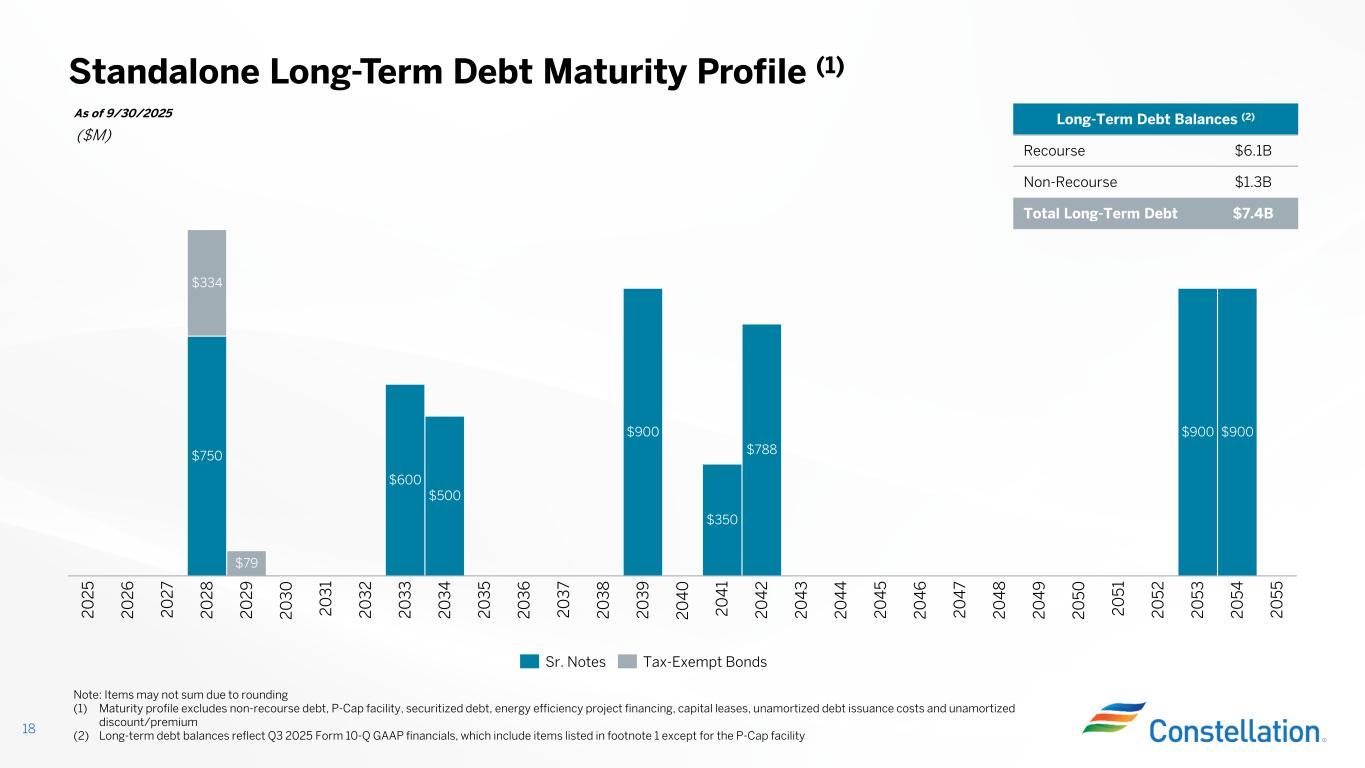

Standalone Long-Term Debt Maturity Profile (1) 18 Note: Items may not sum due to rounding (1) Maturity profile excludes non-recourse debt, P-Cap facility, securitized debt, energy efficiency project financing, capital leases, unamortized debt issuance costs and unamortized discount/premium (2) Long-term debt balances reflect Q3 2025 Form 10-Q GAAP financials, which include items listed in footnote 1 except for the P-Cap facility ($M) Long-Term Debt Balances (2) $6.1BRecourse $1.3BNon-Recourse $7.4BTotal Long-Term Debt As of 9/30/2025 $750 $79 $600 $500 $900 $350 $788 $900 $900 $334 2 0 2 5 2 0 2 6 2 0 2 7 2 0 2 8 2 0 2 9 2 0 3 0 2 0 3 1 2 0 3 2 2 0 3 3 2 0 3 4 2 0 3 5 2 0 3 6 2 0 3 7 2 0 3 8 2 0 3 9 2 0 4 0 2 0 4 1 2 0 4 2 2 0 4 3 2 0 4 4 2 0 4 5 2 0 4 6 2 0 4 7 2 0 4 8 2 0 4 9 2 0 5 0 2 0 5 1 2 0 5 2 2 0 5 3 2 0 5 4 2 0 5 5 Sr. Notes Tax-Exempt Bonds

Modeling Slides 19

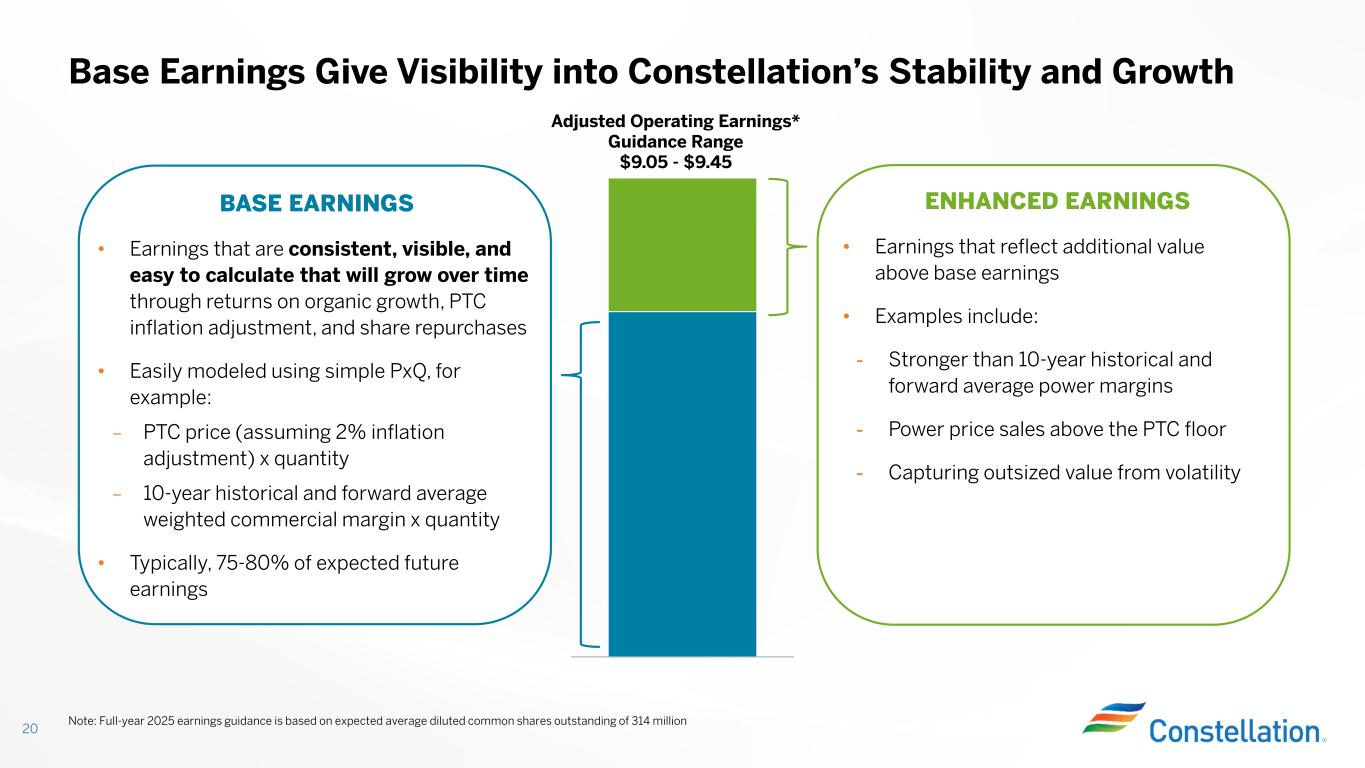

BASE EARNINGS • Earnings that are consistent, visible, and easy to calculate that will grow over time through returns on organic growth, PTC inflation adjustment, and share repurchases • Easily modeled using simple PxQ, for example: – PTC price (assuming 2% inflation adjustment) x quantity – 10-year historical and forward average weighted commercial margin x quantity • Typically, 75-80% of expected future earnings Base Earnings Give Visibility into Constellation’s Stability and Growth ENHANCED EARNINGS • Earnings that reflect additional value above base earnings • Examples include: - Stronger than 10-year historical and forward average power margins - Power price sales above the PTC floor - Capturing outsized value from volatility 20 Adjusted Operating Earnings* Guidance Range $9.05 - $9.45 Note: Full-year 2025 earnings guidance is based on expected average diluted common shares outstanding of 314 million

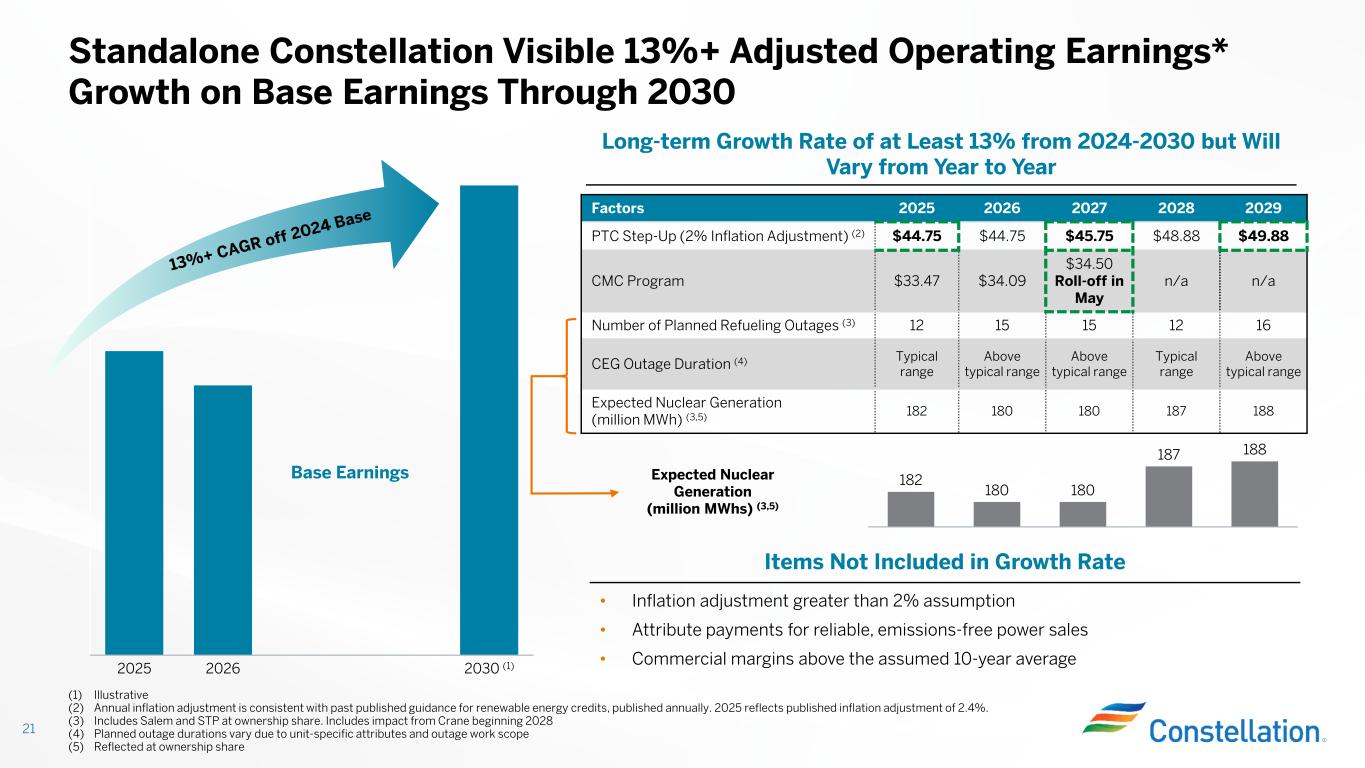

2025 2026 2030 (1) 20292028202720262025Factors $49.88$48.88$45.75$44.75$44.75PTC Step-Up (2% Inflation Adjustment) (2) n/an/a $34.50 Roll-off in May $34.09$33.47CMC Program 1612151512Number of Planned Refueling Outages (3) Above typical range Typical range Above typical range Above typical range Typical rangeCEG Outage Duration (4) 188187180180182 Expected Nuclear Generation (million MWh) (3,5) 21 Standalone Constellation Visible 13%+ Adjusted Operating Earnings* Growth on Base Earnings Through 2030 Long-term Growth Rate of at Least 13% from 2024-2030 but Will Vary from Year to Year • Inflation adjustment greater than 2% assumption • Attribute payments for reliable, emissions-free power sales • Commercial margins above the assumed 10-year average Items Not Included in Growth Rate Base Earnings 182 180 180 187 188 Expected Nuclear Generation (million MWhs) (3,5) (1) Illustrative (2) Annual inflation adjustment is consistent with past published guidance for renewable energy credits, published annually. 2025 reflects published inflation adjustment of 2.4%. (3) Includes Salem and STP at ownership share. Includes impact from Crane beginning 2028 (4) Planned outage durations vary due to unit-specific attributes and outage work scope (5) Reflected at ownership share

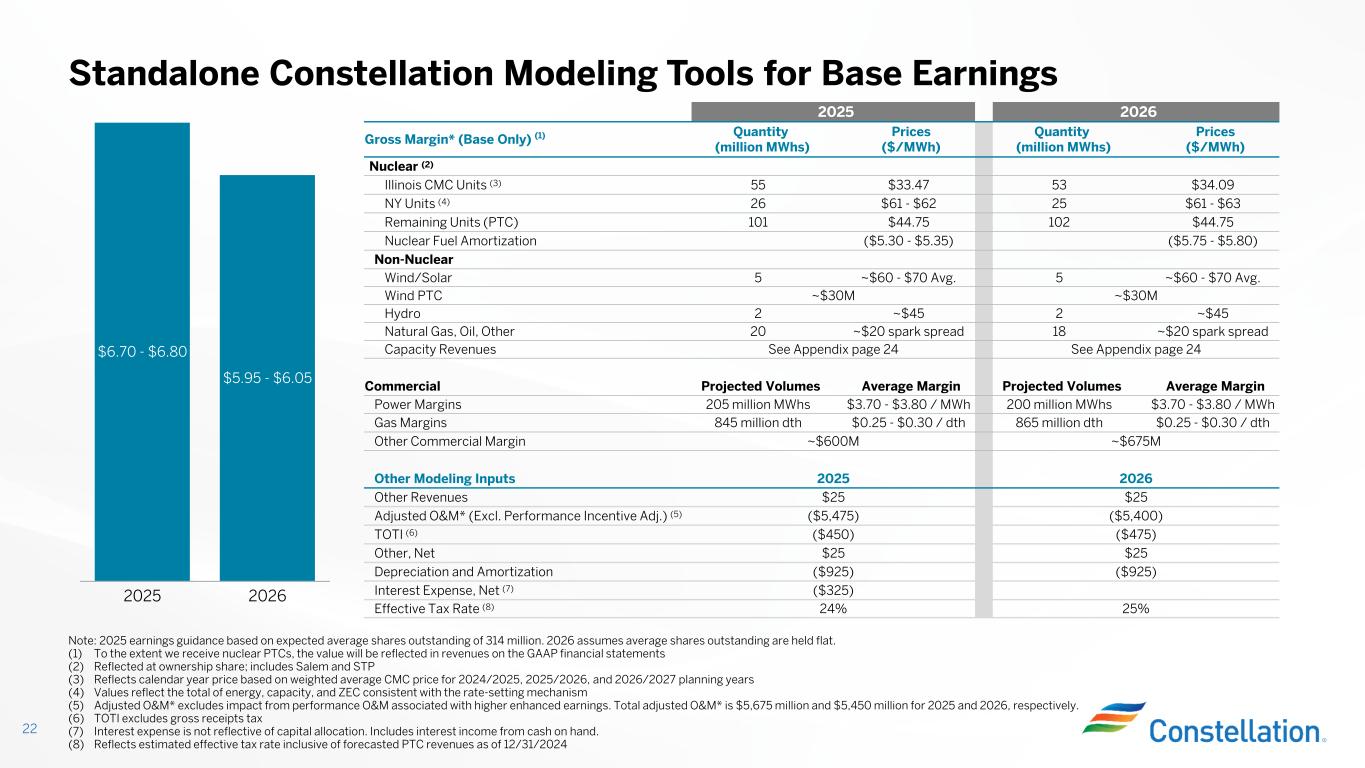

Standalone Constellation Modeling Tools for Base Earnings 22 Note: 2025 earnings guidance based on expected average shares outstanding of 314 million. 2026 assumes average shares outstanding are held flat. (1) To the extent we receive nuclear PTCs, the value will be reflected in revenues on the GAAP financial statements (2) Reflected at ownership share; includes Salem and STP (3) Reflects calendar year price based on weighted average CMC price for 2024/2025, 2025/2026, and 2026/2027 planning years (4) Values reflect the total of energy, capacity, and ZEC consistent with the rate-setting mechanism (5) Adjusted O&M* excludes impact from performance O&M associated with higher enhanced earnings. Total adjusted O&M* is $5,675 million and $5,450 million for 2025 and 2026, respectively. (6) TOTI excludes gross receipts tax (7) Interest expense is not reflective of capital allocation. Includes interest income from cash on hand. (8) Reflects estimated effective tax rate inclusive of forecasted PTC revenues as of 12/31/2024 20262025 Prices ($/MWh) Quantity (million MWhs) Prices ($/MWh) Quantity (million MWhs) Gross Margin* (Base Only) (1) Nuclear (2) $34.0953$33.4755Illinois CMC Units (3) $61 - $6325$61 - $6226NY Units (4) $44.75102$44.75101Remaining Units (PTC) ($5.75 - $5.80)($5.30 - $5.35)Nuclear Fuel Amortization Non-Nuclear ~$60 - $70 Avg. 5~$60 - $70 Avg. 5Wind/Solar ~$30M~$30MWind PTC ~$452~$452Hydro ~$20 spark spread18~$20 spark spread20Natural Gas, Oil, Other See Appendix page 24See Appendix page 24Capacity Revenues Average MarginProjected VolumesAverage MarginProjected VolumesCommercial $3.70 - $3.80 / MWh200 million MWhs$3.70 - $3.80 / MWh205 million MWhsPower Margins $0.25 - $0.30 / dth865 million dth$0.25 - $0.30 / dth845 million dthGas Margins ~$675M~$600MOther Commercial Margin 20262025Other Modeling Inputs $25$25Other Revenues ($5,400)($5,475)Adjusted O&M* (Excl. Performance Incentive Adj.) (5) ($475)($450)TOTI (6) $25$25Other, Net ($925)($925)Depreciation and Amortization ($325)Interest Expense, Net (7) 25%24%Effective Tax Rate (8) $6.70 - $6.80 2025 $5.95 - $6.05 2026

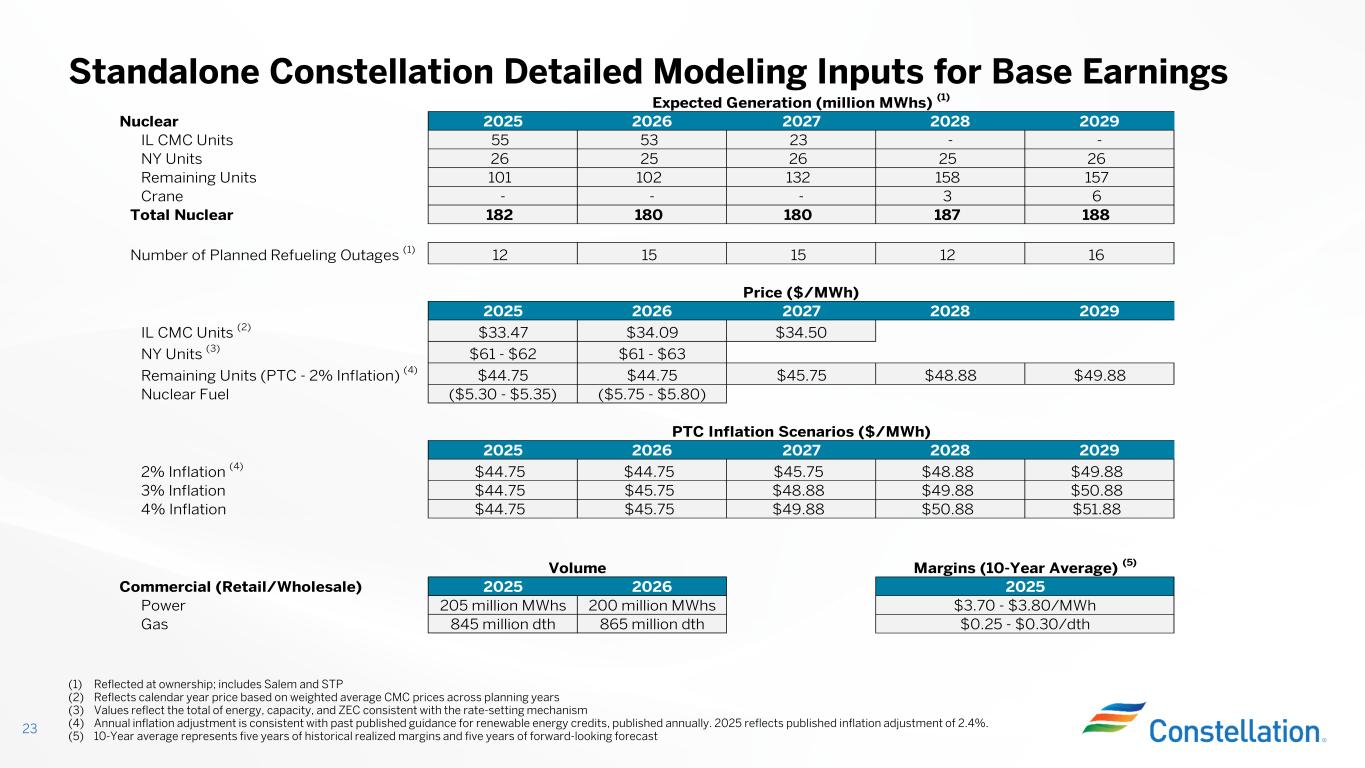

Standalone Constellation Detailed Modeling Inputs for Base Earnings 23 (1) Reflected at ownership; includes Salem and STP (2) Reflects calendar year price based on weighted average CMC prices across planning years (3) Values reflect the total of energy, capacity, and ZEC consistent with the rate-setting mechanism (4) Annual inflation adjustment is consistent with past published guidance for renewable energy credits, published annually. 2025 reflects published inflation adjustment of 2.4%. (5) 10-Year average represents five years of historical realized margins and five years of forward-looking forecast Expected Generation (million MWhs) (1) Nuclear 2025 2026 2027 2028 2029 IL CMC Units 55 53 23 - - NY Units 26 25 26 25 26 Remaining Units 101 102 132 158 157 Crane - - - 3 6 Total Nuclear 182 180 180 187 188 Number of Planned Refueling Outages (1) 12 15 15 12 16 Price ($/MWh) 2025 2026 2027 2028 2029 IL CMC Units (2) $33.47 $34.09 $34.50 NY Units (3) $61 - $62 $61 - $63 Remaining Units (PTC - 2% Inflation) (4) $44.75 $44.75 $45.75 $48.88 $49.88 Nuclear Fuel ($5.30 - $5.35) ($5.75 - $5.80) PTC Inflation Scenarios ($/MWh) 2025 2026 2027 2028 2029 2% Inflation (4) $44.75 $44.75 $45.75 $48.88 $49.88 3% Inflation $44.75 $45.75 $48.88 $49.88 $50.88 4% Inflation $44.75 $45.75 $49.88 $50.88 $51.88 Volume Margins (10-Year Average) (5) Commercial (Retail/Wholesale) 2025 2026 2025 Power 205 million MWhs 200 million MWhs $3.70 - $3.80/MWh Gas 845 million dth 865 million dth $0.25 - $0.30/dth

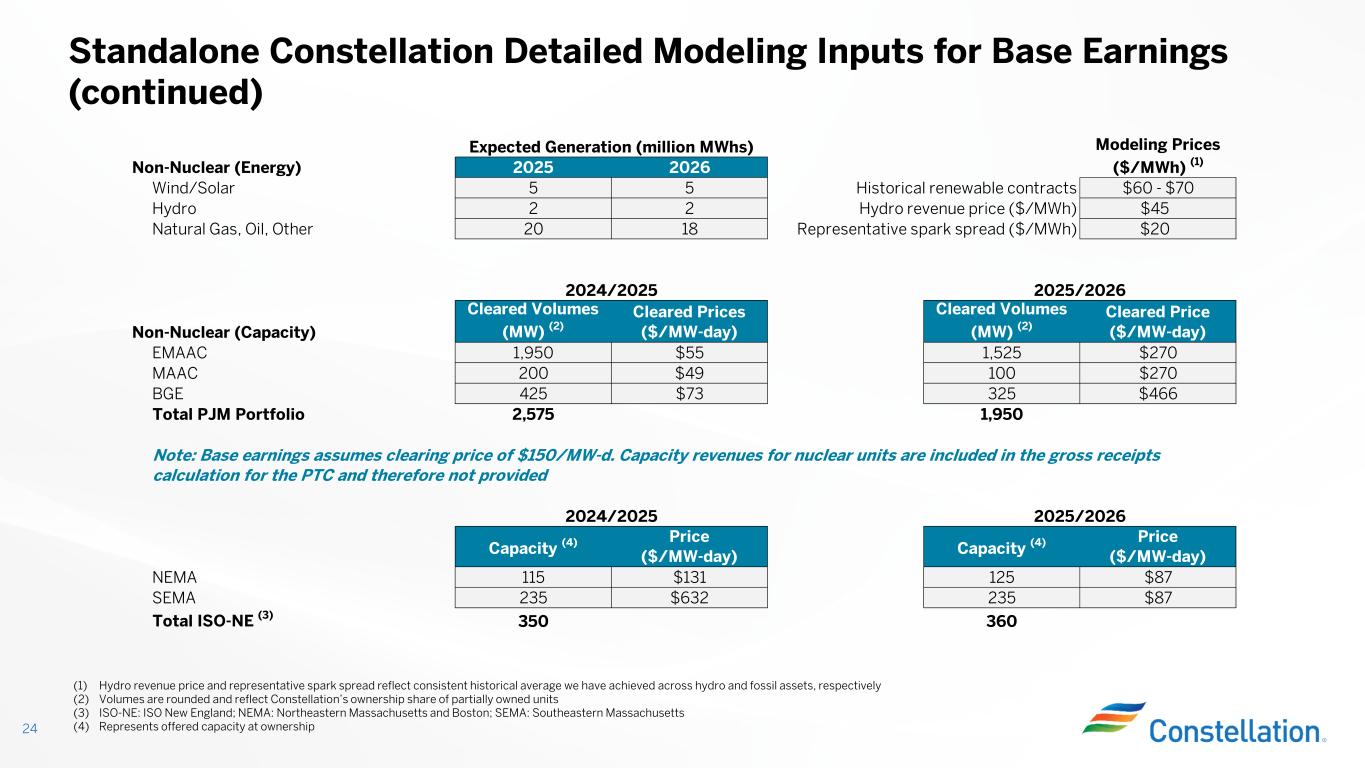

Standalone Constellation Detailed Modeling Inputs for Base Earnings (continued) 24 (1) Hydro revenue price and representative spark spread reflect consistent historical average we have achieved across hydro and fossil assets, respectively (2) Volumes are rounded and reflect Constellation’s ownership share of partially owned units (3) ISO-NE: ISO New England; NEMA: Northeastern Massachusetts and Boston; SEMA: Southeastern Massachusetts (4) Represents offered capacity at ownership Expected Generation (million MWhs) Non-Nuclear (Energy) 2025 2026 Wind/Solar 5 5 Historical renewable contracts $60 - $70 Hydro 2 2 Hydro revenue price ($/MWh) $45 Natural Gas, Oil, Other 20 18 Representative spark spread ($/MWh) $20 2024/2025 2025/2026 Non-Nuclear (Capacity) Cleared Volumes (MW) (2) Cleared Prices ($/MW-day) Cleared Volumes (MW) (2) Cleared Price ($/MW-day) EMAAC 1,950 $55 1,525 $270 MAAC 200 $49 100 $270 BGE 425 $73 325 $466 Total PJM Portfolio 2,575 1,950 2024/2025 2025/2026 Capacity (4) Price ($/MW-day) Capacity (4) Price ($/MW-day) NEMA 115 $131 125 $87 SEMA 235 $632 235 $87 Total ISO-NE (3) 350 360 Modeling Prices ($/MWh) (1) Note: Base earnings assumes clearing price of $150/MW-d. Capacity revenues for nuclear units are included in the gross receipts calculation for the PTC and therefore not provided

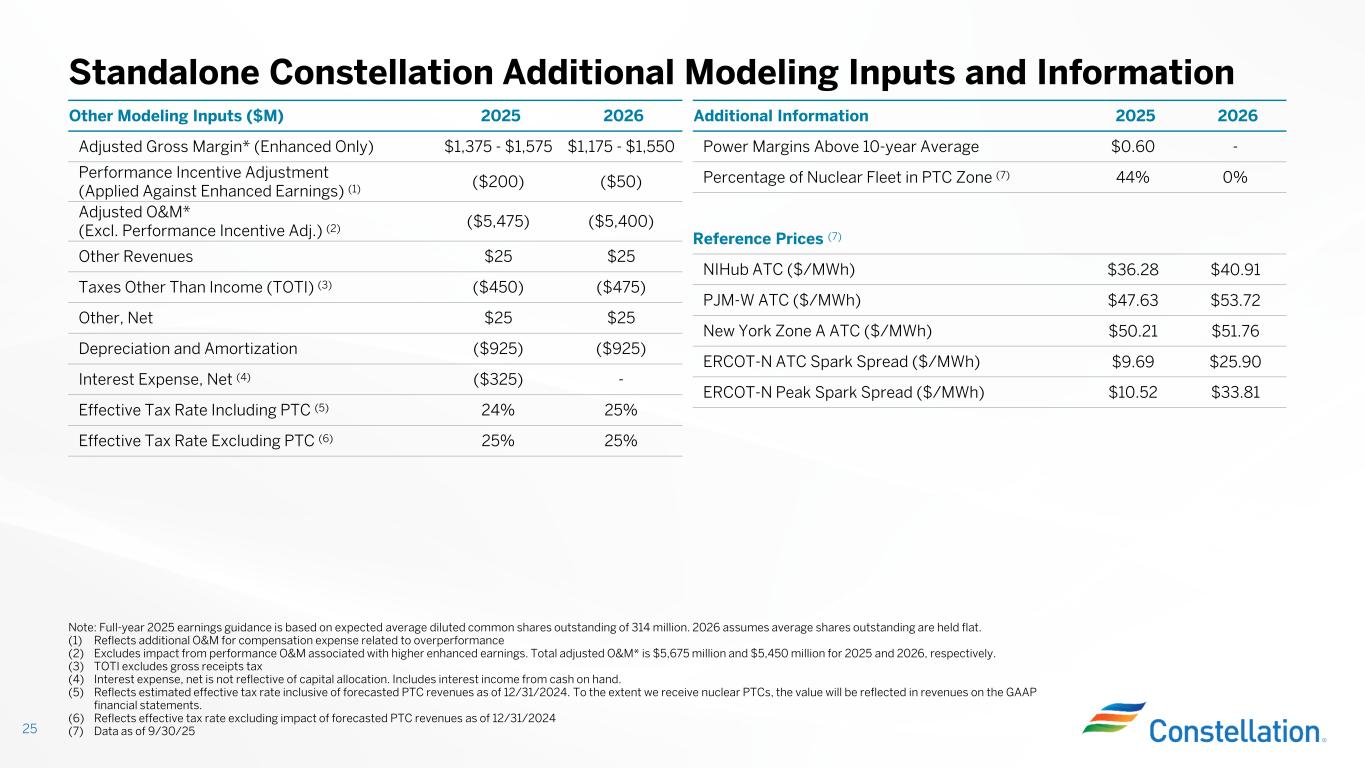

Standalone Constellation Additional Modeling Inputs and Information 25 Note: Full-year 2025 earnings guidance is based on expected average diluted common shares outstanding of 314 million. 2026 assumes average shares outstanding are held flat. (1) Reflects additional O&M for compensation expense related to overperformance (2) Excludes impact from performance O&M associated with higher enhanced earnings. Total adjusted O&M* is $5,675 million and $5,450 million for 2025 and 2026, respectively. (3) TOTI excludes gross receipts tax (4) Interest expense, net is not reflective of capital allocation. Includes interest income from cash on hand. (5) Reflects estimated effective tax rate inclusive of forecasted PTC revenues as of 12/31/2024. To the extent we receive nuclear PTCs, the value will be reflected in revenues on the GAAP financial statements. (6) Reflects effective tax rate excluding impact of forecasted PTC revenues as of 12/31/2024 (7) Data as of 9/30/25 20262025Other Modeling Inputs ($M) $1,175 - $1,550$1,375 - $1,575Adjusted Gross Margin* (Enhanced Only) ($50)($200) Performance Incentive Adjustment (Applied Against Enhanced Earnings) (1) ($5,400)($5,475) Adjusted O&M* (Excl. Performance Incentive Adj.) (2) $25$25Other Revenues ($475)($450)Taxes Other Than Income (TOTI) (3) $25$25Other, Net ($925)($925)Depreciation and Amortization -($325)Interest Expense, Net (4) 25%24%Effective Tax Rate Including PTC (5) 25%25%Effective Tax Rate Excluding PTC (6) 20262025Additional Information -$0.60Power Margins Above 10-year Average 0%44%Percentage of Nuclear Fleet in PTC Zone (7) Reference Prices (7) $40.91$36.28 NIHub ATC ($/MWh) $53.72$47.63 PJM-W ATC ($/MWh) $51.76 $50.21 New York Zone A ATC ($/MWh) $25.90 $9.69 ERCOT-N ATC Spark Spread ($/MWh) $33.81$10.52ERCOT-N Peak Spark Spread ($/MWh)

Appendix Reconciliation of Non-GAAP Measures 26

Three Months Ended September 30, 20252024 Earnings Per Share Earnings Per Share Adjusted Operating Earnings* reconciliation ($M except per share data) $2.97$930$3.82$1,200 GAAP Net Income (Loss) Attributable to Common Shareholders $0.30$94($0.67)($210)Unrealized (Gain) Loss on Fair Value (1) ($0.02)($5)$0.10$30Plant Retirements & Divestitures ($0.37)($117)($0.62)($195)Decommissioning-Related Activities (2) $0.03$9($0.01)($2)Pension & OPEB Non-Service (Credits) Costs $0.09$28--Acquisition-Related Costs (3) -$1$0.02$5Change in Environmental Liabilities ---$1ERP System Implementation Costs $0.04$13$0.11$33Income Tax Related Adjustments -($1)($0.01)($2)Noncontrolling Interests (4) $3.04$952$2.74$860Adjusted Non-GAAP Operating Earnings* GAAP to Non-GAAP Reconciliation – Adjusted Operating Earnings* 27 Note: Items may not sum due to rounding. Earnings are reflected on an after-tax basis. Earnings per share amount is based on average diluted common shares outstanding of 313 million and 314 million for the three months ended September 30, 2025 and 2024, respectively. (1) Includes mark-to-market on economic hedges, interest rate swaps, and fair value adjustments related to gas imbalances and equity investments (2) Reflects all gains and losses associated with NDTs, ARO accretion, ARC depreciation, ARO remeasurement, and impacts of contractual offset for Regulatory Agreement Units (3) In 2025, reflects acquisition-related costs associated with the proposed Calpine merger (4) Represents elimination of the noncontrolling interest related to certain adjustments

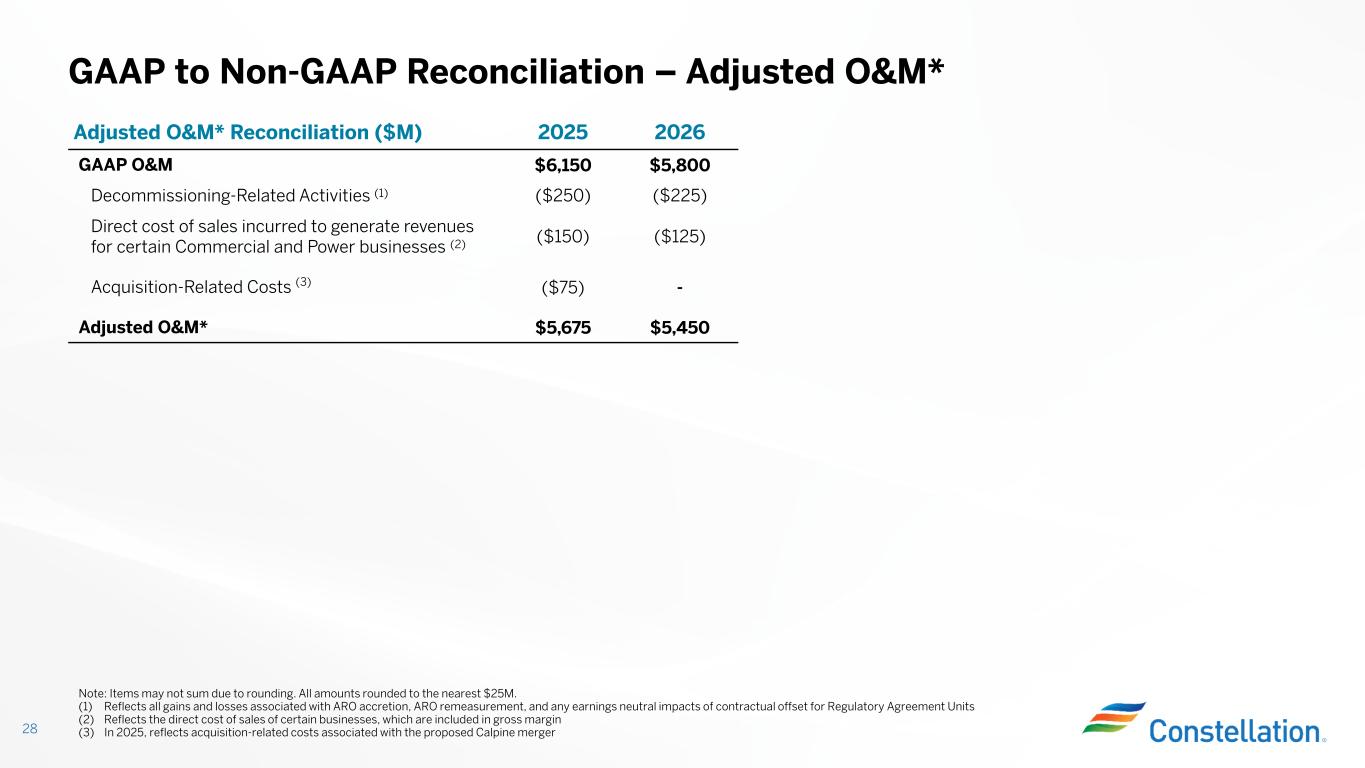

GAAP to Non-GAAP Reconciliation – Adjusted O&M* 28 Note: Items may not sum due to rounding. All amounts rounded to the nearest $25M. (1) Reflects all gains and losses associated with ARO accretion, ARO remeasurement, and any earnings neutral impacts of contractual offset for Regulatory Agreement Units (2) Reflects the direct cost of sales of certain businesses, which are included in gross margin (3) In 2025, reflects acquisition-related costs associated with the proposed Calpine merger 20262025Adjusted O&M* Reconciliation ($M) $5,800$6,150GAAP O&M ($225)($250)Decommissioning-Related Activities (1) ($125)($150) Direct cost of sales incurred to generate revenues for certain Commercial and Power businesses (2) -($75)Acquisition-Related Costs (3) $5,450$5,675Adjusted O&M*

29 Contact Information InvestorRelations@constellation.com Links Events and Presentations Reports & SEC Filings Constellation Sustainability Report Nuclear 101