#4936-1412-8007 v2 FIRST SUPPLEMENTAL INDENTURE between CALPINE LLC and WILMINGTON TRUST, NATIONAL ASSOCIATION, as Trustee Dated as of January 15, 2026 Supplementing and Amending the Indenture Dated as of August 10, 2020

This First Supplemental Indenture is dated as of January 15, 2026 (this “Supplement”), and is between Calpine LLC, a Delaware limited liability company (formerly Calpine Corporation, a Delaware corporation) (the “Company”), and Wilmington Trust, National Association, as trustee (the “Trustee”), and supplements and amends the Indenture, dated as of August 10, 2020 (as previously supplemented, the “Existing Indenture”), between the Company and the Trustee. WHEREAS, pursuant to the Existing Indenture, the Company issued its 5.000% Senior Notes due 2031 (the “Notes”); WHEREAS, pursuant to Section 9.02 (With Consent of Holders) of the Existing Indenture, the Company and the Trustee may amend or supplement the Existing Indenture and the Notes with the consent of the Holders of a majority in aggregate principal amount of the then outstanding Notes (including, without limitation, Additional Notes, if any) voting as a single class (including, without limitation, consents obtained in connection with a tender offer or exchange offer for, or purchase of, the Notes), and, subject to Sections 6.04 (Waiver of Past Defaults) and 6.07 (Rights of Holders to Receive Payment) of the Existing Indenture, any existing Default or Event of Default (other than a Default or Event of Default in the payment of the principal of, premium, if any, or interest on, the Notes, except a payment default resulting from an acceleration that has been rescinded) or compliance with any provision of the Existing Indenture or the Notes may be waived with the consent of the Holders of a majority in aggregate principal amount of the then outstanding Notes (including, without limitation, Additional Notes, if any) voting as a single class (including, without limitation, consents obtained in connection with a tender offer or exchange offer for, or purchase of, the Notes); and WHEREAS, all acts and things necessary to constitute this Supplement a valid indenture and agreement according to its terms have been done and performed, including the requisite consent of the Holders of a majority in aggregate principal amount of the then outstanding Notes, and the Company and the Trustee have duly authorized the execution and delivery of this Supplement and the amended and restated Notes. NOW, THEREFORE, the parties hereby agree as follows: Section 1. Definitions. Each capitalized term used but not otherwise defined herein has the meaning given to it in the Existing Indenture. Section 2. Amendments to Existing Indenture. From and after the date hereof: The Existing Indenture is hereby amended by deleting all references to “Calpine Corporation” therein and replacing them with “Calpine LLC”. The Existing Indenture is hereby amended by deleting all references to “a Delaware corporation” therein and replacing them with “a Delaware limited liability company”. Section 1.02 (Other Definitions) of the Existing Indenture is hereby amended by deleting the definitions of “Change of Control Offer”, “Change of Control Payment” and “Change of Control Payment Date”. Sections 4.03 (Reports), 4.04 (Compliance Certificate), 4.05 (Taxes), 4.06 (Stay, Extension and Usury Laws), 4.07 (Liens), 4.08 (Corporate Existence), 4.09 (Offer to Repurchase Upon Change of Control Triggering Event), and 5.01 (Merger, Consolidation, or Sale of Assets) of the Existing Indenture are each hereby deleted in their entirety and replaced as follows:

-2- “Section 4.03 Reserved” “Section 4.04 Reserved” “Section 4.05 Reserved” “Section 4.06 Reserved” “Section 4.07 Reserved” “Section 4.08 Reserved” “Section 4.09 Reserved” “Section 5.01 Reserved” provided further that, the Table of Contents set forth in the Existing Indenture shall be updated accordingly. Section 5.02 (Successor Corporation Substituted) of the Existing Indenture is hereby amended by deleting “in a transaction that is subject to, and that complies with the provisions of, Section 5.01 hereof” and “; provided, however, that the predecessor Company shall not be relieved from the obligation to pay the principal of and interest on the Notes except in the case of a sale of all of the Company’s assets in a transaction that is subject to, and that complies with the provisions of, Section 5.01 hereof” from such section. Clauses (3) and (4) of Section 6.01 (Events of Default) of the Existing Indenture are each hereby deleted in their entirety. The last sentence of Section 8.03 (Covenant Defeasance) of the Existing Indenture is hereby deleted in its entirety. Clause (2) of Section 9.02 (With Consent of Holders) of the Existing Indenture is hereby amended by deleting the following from such clause: “other than provisions relating to Section 4.09 hereof and”. Clause (7) of Section 9.02 (With Consent of Holders) of the Existing Indenture is hereby amended by deleting “(other than a payment required by Section 4.09 hereof)” from such clause. Section 3. Waiver. Subject to Section 6.04 (Waiver of Past Defaults) and Section 6.07 (Rights of Holders to Receive Payment) of the Existing Indenture, the Holders hereby waive (i) any existing Default or Event of Default and its consequences under the Existing Indenture and/or (ii) any current or future Default or Event of Default and its consequences under the Existing Indenture, in each case relating to the provisions of the Existing Indenture that have been deleted pursuant to this Supplement. Section 4. Authorization of Amended and Restated Notes. Upon the execution and delivery of this Supplement, the outstanding Notes shall each be, or be deemed to be, amended and restated substantially in the form attached to this Supplement as Exhibit A. Section 5. Notices. Pursuant to Section 11.01 (Notices) of the Existing Indenture, the Company hereby designates the following addresses for subsequent notices and communications:

-3- Calpine LLC c/o Constellation Energy Generation, LLC 200 Energy Way Kennett Square, PA, 19348-2473 Attention: Legal Department Email: legalnotices@constellation.com Telephone: (833) 883-0162 with a copy to (which shall not constitute notice): Ballard Spahr LLP Attention: Patrick R. Gillard, Esq. Telephone: (215) 864-8536 Email: gillard@ballardspahr.com Section 6. Execution and Authentication. Upon delivery of an executed copy of this Supplement, executed copies of an Officer’s Certificate and an Opinion of Counsel required by Section 9.05 (Trustee to Sign Amendments, etc.) of the Existing Indenture and an authentication and cancellation order, the Company may deliver amended and restated Notes to the Trustee for authentication as provided for in the Existing Indenture. Section 7. Ratification of Existing Indenture. As supplemented and amended hereby, the Existing Indenture is hereby, in all respects, ratified and confirmed and the Existing Indenture, as supplemented and amended hereby, shall be read, taken and construed as one and the same instrument. Section 8. Severability. If any provision of this Supplement shall be held invalid by any court of competent jurisdiction, such holding shall not invalidate any other provision hereof. Section 9. Counterparts. This Supplement may be executed in several counterparts, each of which together shall be an original and all of which shall constitute one instrument. Section 10. Governing Law. THE INTERNAL LAW OF THE STATE OF NEW YORK WILL GOVERN AND BE USED TO CONSTRUE THIS SUPPLEMENT AND THE NOTES WITHOUT GIVING EFFECT TO APPLICABLE PRINCIPLES OF CONFLICTS OF LAW TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION WOULD BE REQUIRED THEREBY. Section 11. The Trustee. The Trustee makes no representation or warranty as to the validity or sufficiency of this Supplement or with respect to the recitals contained herein, all of which recitals are made solely by the other parties hereto. To the extent that the requisite consents to any amendment effected by this Supplement are determined by a court of competent jurisdiction to have not been validly obtained in accordance with the Existing Indenture or applicable laws, such amendment shall not be deemed to have occurred. Section 12. Electronic Signatures. The parties may sign any number of copies of this Supplement. Signatures to this Supplement or any instrument, agreement or document necessary for the consummation of the transactions contemplated by this Supplement or related hereto or thereto (including, without limitation, addendums, amendments, notices, instructions, communications with respect to the delivery of securities or the wire transfer of funds or other communications) (“Executed Documentation”) may be manual, facsimile, or Electronic Signatures. Each signed copy shall be an original, but all of them

-4- together represent the same agreement. Delivery of an executed counterpart of a signature page to this Supplement and other Executed Documentation by telecopier, facsimile or other electronic transmission (e.g. a “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart thereof. The exchange of copies of this Supplement and other Executed Documentation and of signature pages by telecopier, facsimile or other electronic transmission (e.g. a “pdf” or “tif”) shall constitute effective execution and delivery of this Supplement and other Executed Documentation as to the parties hereto and may be used in lieu of the original Supplement or other Executed Documentation and signature pages for all purposes. “Electronic Signatures” means any electronic signatures covered by the Electronic Signatures in Global and National Commerce Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law (e.g., www.docusign.com). [Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, the Company and the Trustee have caused this Supplement to be executed and delivered by duly authorized officers thereof as of the day and year first written above. CALPINE LLC, a Delaware limited liability company By: Name: Eugene P. Miles Title: Assistant Treasurer

WILMINGTON TRUST, NATIONAL ASSOCIATION, as Trustee By: Name: Title:

A-1 EXHIBIT A FORM OF AMENDED AND RESTATED NOTES [Face of Note] [Insert the Global Note Legend, if applicable pursuant to the provisions of the Indenture] [Insert the Private Placement Legend, if applicable pursuant to the provisions of the Indenture] CUSIP/ISIN ____________ [RULE 144A][REGULATION S][GLOBAL] NOTE 5.000% Senior Notes due 2031 No. ___ $___________ CALPINE LLC promises to pay to or registered assigns, the principal sum of DOLLARS on February 1, 2031. Interest Payment Dates: February 1 and August 1 Record Dates: January 15 and July 15 [Signature Page Follows]

A-2 IN WITNESS HEREOF, the Company has caused this Note to be signed manually or by facsimile by its duly authorized officer as of the date first written above. CALPINE LLC By: Name: Title: This is one of the Notes referred to in the within-mentioned Indenture: Dated: ______________ , ____ WILMINGTON TRUST, NATIONAL ASSOCIATION, as Trustee By: Authorized Signatory

A-3 [Back of Note] 5.000% Senior Notes due 2031 Capitalized terms used herein have the meanings assigned to them in the Indenture referred to below unless otherwise indicated. (1) INTEREST. Calpine LLC, a Delaware limited liability company (formerly Calpine Corporation, a Delaware corporation) (the “Company”), promises to pay interest on the principal amount of this Note at 5.000% per annum from August 10, 2020 1 until maturity. The Company will pay interest semi-annually in arrears on February 1 and August 1 of each year (each, an “Interest Payment Date”), or if any such day is not a Business Day, on the next succeeding Business Day. Interest on the Notes will accrue from the most recent Interest Payment Date to which interest has been paid or, if no interest has been paid, from the date of issuance; provided that if there is no existing Default in the payment of interest, and if this Note is authenticated between a record date referred to on the face hereof and the next succeeding Interest Payment Date, interest shall accrue from such next succeeding Interest Payment Date; provided further that the first Interest Payment Date shall be February 1, 2021 2 . Interest will be computed on the basis of a 360- day year of twelve 30-day months. (2) METHOD OF PAYMENT. The Company will pay interest on the Notes (except defaulted interest) to the Persons who are registered Holders at the close of business on January 15 or July 15 next preceding the Interest Payment Date, even if such Notes are canceled after such record date and on or before such Interest Payment Date, except as provided in Section 2.12 of the Indenture with respect to defaulted interest. The Notes will be payable as to principal, premium, if any, and interest at the office or agency of the Company maintained for such purpose or, at the option of the Company, payment of interest may be made by check mailed to the Holders at their addresses set forth in the register of Holders; provided that payment by wire transfer of immediately available funds will be required with respect to principal of and interest, premium on, all Global Notes and all other Notes the Holders of which will have provided wire transfer instructions to the Company or the Paying Agent. Such payment will be in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts. (3) PAYING AGENT AND REGISTRAR. Initially, Wilmington Trust, National Association, the Trustee under the Indenture, will act as Paying Agent and Registrar. The Company may change any Paying Agent or Registrar without notice to any Holder. The Company or any of its Subsidiaries may act in any such capacity. (4) INDENTURE. The Company issued the Notes under an Indenture dated as of August 10, 2020 (as amended or supplemented from time to time, including as of January [ ], 2026, the “Indenture”) among the Company and the Trustee. The Notes are subject to all such terms, and Holders are referred to the Indenture for a statement of such terms. To the extent any provision of this Note conflicts with the express provisions of the Indenture, the provisions of the Indenture shall govern and be controlling. The Notes are unsecured obligations of the Company. The indenture does not limit the aggregate principal amount of Notes that may be issued thereunder. (5) OPTIONAL REDEMPTION. (a) On or after February 1, 2026, the Company may on any one or more occasions redeem all or a part of the Notes, upon not less than 30 nor more than 60 days’ notice, at the redemption prices 1 With respect to the Initial Notes. 2 With respect to the Initial Notes.

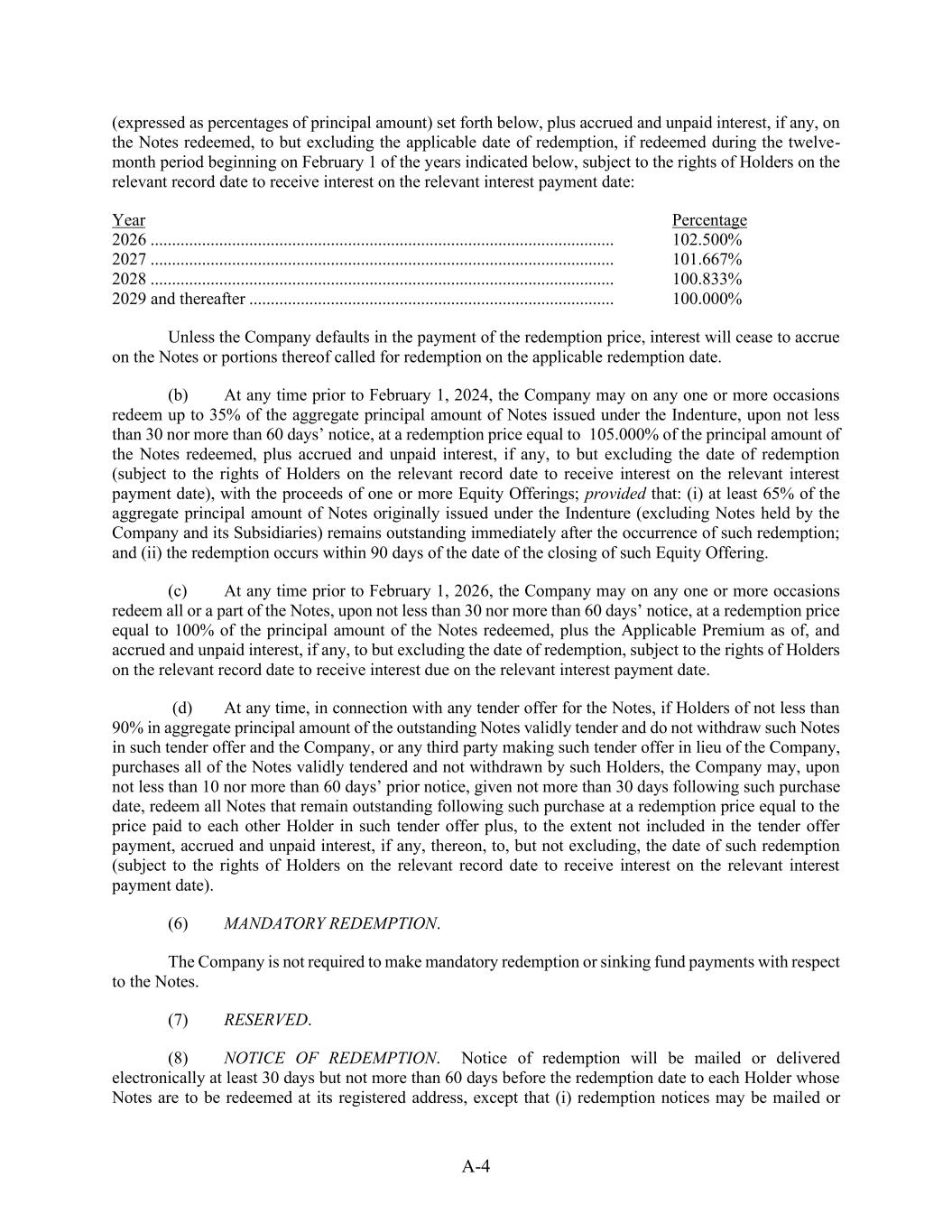

A-4 (expressed as percentages of principal amount) set forth below, plus accrued and unpaid interest, if any, on the Notes redeemed, to but excluding the applicable date of redemption, if redeemed during the twelve- month period beginning on February 1 of the years indicated below, subject to the rights of Holders on the relevant record date to receive interest on the relevant interest payment date: Year Percentage 2026 ............................................................................................................ 102.500% 2027 ............................................................................................................ 101.667% 2028 ............................................................................................................ 100.833% 2029 and thereafter ..................................................................................... 100.000% Unless the Company defaults in the payment of the redemption price, interest will cease to accrue on the Notes or portions thereof called for redemption on the applicable redemption date. (b) At any time prior to February 1, 2024, the Company may on any one or more occasions redeem up to 35% of the aggregate principal amount of Notes issued under the Indenture, upon not less than 30 nor more than 60 days’ notice, at a redemption price equal to 105.000% of the principal amount of the Notes redeemed, plus accrued and unpaid interest, if any, to but excluding the date of redemption (subject to the rights of Holders on the relevant record date to receive interest on the relevant interest payment date), with the proceeds of one or more Equity Offerings; provided that: (i) at least 65% of the aggregate principal amount of Notes originally issued under the Indenture (excluding Notes held by the Company and its Subsidiaries) remains outstanding immediately after the occurrence of such redemption; and (ii) the redemption occurs within 90 days of the date of the closing of such Equity Offering. (c) At any time prior to February 1, 2026, the Company may on any one or more occasions redeem all or a part of the Notes, upon not less than 30 nor more than 60 days’ notice, at a redemption price equal to 100% of the principal amount of the Notes redeemed, plus the Applicable Premium as of, and accrued and unpaid interest, if any, to but excluding the date of redemption, subject to the rights of Holders on the relevant record date to receive interest due on the relevant interest payment date. (d) At any time, in connection with any tender offer for the Notes, if Holders of not less than 90% in aggregate principal amount of the outstanding Notes validly tender and do not withdraw such Notes in such tender offer and the Company, or any third party making such tender offer in lieu of the Company, purchases all of the Notes validly tendered and not withdrawn by such Holders, the Company may, upon not less than 10 nor more than 60 days’ prior notice, given not more than 30 days following such purchase date, redeem all Notes that remain outstanding following such purchase at a redemption price equal to the price paid to each other Holder in such tender offer plus, to the extent not included in the tender offer payment, accrued and unpaid interest, if any, thereon, to, but not excluding, the date of such redemption (subject to the rights of Holders on the relevant record date to receive interest on the relevant interest payment date). (6) MANDATORY REDEMPTION. The Company is not required to make mandatory redemption or sinking fund payments with respect to the Notes. (7) RESERVED. (8) NOTICE OF REDEMPTION. Notice of redemption will be mailed or delivered electronically at least 30 days but not more than 60 days before the redemption date to each Holder whose Notes are to be redeemed at its registered address, except that (i) redemption notices may be mailed or

A-5 delivered electronically at least 10 days prior to the redemption date if the notice is issued in connection with a redemption pursuant to Section 3.07(c) of the Indenture and (ii) redemption notices may be mailed or delivered electronically more than 60 days prior to a redemption date if the notice is issued in connection with a defeasance of the Notes or a satisfaction or discharge of the Indenture. Notes in denominations larger than $2,000 may be redeemed in part but only in whole multiples of $1,000, unless all of the Notes held by a Holder are to be redeemed. Any redemption notice may, in the Company’s discretion, be subject to the satisfaction of one or more conditions precedent. If such redemption is subject to the satisfaction of one of more conditions precedent, such notice shall state that, in the Company’s discretion, the redemption date may be delayed until such time as any or all such conditions shall be satisfied (or waived by the Company in its sole discretion), such redemption may not occur and such notice may be rescinded in the event that any or all of such conditions shall not have been satisfied (or waived by the Company in its sole discretion) by the redemption date, or by the redemption date so delayed. (9) DENOMINATIONS, TRANSFER, EXCHANGE. The Notes are in registered form without coupons in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. The transfer of Notes may be registered and Notes may be exchanged as provided in the Indenture. The Registrar and the Trustee may require a Holder, among other things, to furnish appropriate endorsements and transfer documents and the Company may require a Holder to pay any taxes and fees required by law or permitted by the Indenture. The Company need not exchange or register the transfer of any Note or portion of a Note selected for redemption, except for the unredeemed portion of any Note being redeemed in part. Also, the Company need not exchange or register the transfer of any Notes for a period of 15 days before a selection of Notes to be redeemed or during the period between a record date and the corresponding Interest Payment Date. (10) PERSONS DEEMED OWNERS. The registered Holder of a Note may be treated as its owner for all purposes. (11) AMENDMENT, SUPPLEMENT AND WAIVER. Subject to certain exceptions, the Indenture or the Notes may be amended or supplemented with the consent of the Holders of a majority in aggregate principal amount of the then outstanding Notes including Additional Notes, if any, voting as a single class, and any existing Default or Event or Default or compliance with any provision of the Indenture or the Notes may be waived with the consent of the Holders of a majority in aggregate principal amount of the then outstanding Notes including Additional Notes, if any, voting as a single class. Without the consent of any Holder, the Indenture or the Notes, may be amended or supplemented to cure any ambiguity, defect or inconsistency in the Indenture or the Notes in a manner that does not adversely affect the rights of any Holder, to provide for uncertificated Notes in addition to or in place of certificated Notes, to provide for the assumption of the Company’s obligations to Holders in case of a merger or consolidation or sale of all or substantially all of the Company’s assets, to make any change that would provide any additional rights or benefits to the Holders or that does not adversely affect the legal rights under the Indenture of any such Holder, to conform the text of the Indenture or the Notes to any provision of the “Description of Notes” section of the Offering Memorandum, to the extent that such provision in that “Description of Notes” was intended to be a verbatim or substantially verbatim recitation of a provision of the Indenture or this Note, to evidence and provide for the acceptance and appointment under the Indenture of successor trustees pursuant to the requirements thereof or to provide for the issuance of Additional Notes of the same or an additional series in accordance with the limitations set forth in the Indenture as of the date hereof. (12) DEFAULTS AND REMEDIES. Events of Default include: (i) default for 30 days in the payment when due of interest on the Notes; (ii) default in payment when due of the principal of, or premium, if any, on, the Notes; and (iii) (a) a court of competent jurisdiction (x) enters an order or decree under any Bankruptcy Law that is for relief against the Company or any of its Material Subsidiaries in an involuntary case; (y) appoints a custodian for all or substantially all of the property of the Company or any of its Material

A-6 Subsidiaries; or (z) orders the liquidation of the Company or any of its Material Subsidiaries and, in each of clauses (x), (y) or (z), the order, appointment or decree remains unstayed and in effect for at least 60 consecutive days; or (b) the Company or any of its Material Subsidiaries, pursuant to or within the meaning of Bankruptcy Law, (w) commences a voluntary case; (x) consents to the entry of an order for relief against it in an involuntary case; (y) consents to the appointment of a custodian of it or for all or substantially all of its property; or (z) makes a general assignment for the benefit of its creditors. In the case of an Event of Default of the type specified in clause (iii) above, all outstanding Notes will become due and payable immediately without further action or notice. If any other Event of Default occurs and is continuing, the Trustee or the Holders of at least 25% in aggregate principal amount of the then outstanding Notes may declare all the Notes to be due and payable immediately. Holders may not enforce the Indenture or the Notes except as provided in the Indenture. Subject to certain limitations, Holders of a majority in aggregate principal amount of the then outstanding Notes may direct the Trustee in its exercise of any trust or power. The Trustee may withhold from Holders of the Notes notice of any continuing Default or Event of Default (except a Default or Event of Default relating to the payment of principal or interest or premium, if any,) if it determines that withholding notice is in their interest. The Holders of a majority in aggregate principal amount of the then outstanding Notes by notice to the Trustee may, on behalf of the Holders of all of the Notes, rescind an acceleration or waive any existing Default or Event of Default and its consequences under the Indenture except a continuing Default or Event of Default in the payment of interest or premium, if any, on, or the principal of, the Notes. The Company is required to deliver to the Trustee annually a statement regarding compliance with the Indenture, and the Company is required, upon becoming aware of any Default or Event of Default, to deliver to the Trustee a statement specifying such Default or Event of Default. (13) TRUSTEE DEALINGS WITH COMPANY. The Trustee, in its individual or any other capacity, may make loans to, accept deposits from, and perform services for the Company or its Affiliates, and may otherwise deal with the Company or its Affiliates, as if it were not the Trustee. (14) NO RECOURSE AGAINST OTHERS. A director, officer, employee, incorporator or stockholder of the Company, as such, will not have any liability for any obligations of the Company under the Notes or the Indenture or for any claim based on, in respect of, or by reason of, such obligations or their creation. Each Holder by accepting a Note waives and releases all such liability. The waiver and release are part of the consideration for the issuance of the Notes. (15) AUTHENTICATION. This Note will not be valid until authenticated by the manual signature of the Trustee or an authenticating agent. (16) ABBREVIATIONS. Customary abbreviations may be used in the name of a Holder or an assignee, such as: TEN COM (= tenants in common), TEN ENT (= tenants by the entireties), JT TEN (= joint tenants with right of survivorship and not as tenants in common), CUST (= Custodian), and U/G/M/A (= Uniform Gifts to Minors Act). (17) CUSIP NUMBERS. Pursuant to a recommendation promulgated by the Committee on Uniform Security Identification Procedures, the Company has caused CUSIP numbers to be printed on the Notes, and the Trustee may use CUSIP numbers in notices of redemption as a convenience to Holders. No representation is made as to the accuracy of such numbers either as printed on the Notes or as contained in any notice of redemption, and reliance may be placed only on the other identification numbers placed thereon. (18) GOVERNING LAW. THE INTERNAL LAW OF THE STATE OF NEW YORK WILL GOVERN AND BE USED TO CONSTRUE THE INDENTURE AND THIS NOTE WITHOUT GIVING

A-7 EFFECT TO APPLICABLE PRINCIPLES OF CONFLICTS OF LAW TO THE EXTENT THAT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION WOULD BE REQUIRED THEREBY. The Company will furnish to any Holder upon written request and without charge a copy of the Indenture. Requests may be made to: Calpine LLC c/o Constellation Energy Generation, LLC 200 Energy Way Kennett Square, PA, 19348-2473 Attention: Legal Department Email: legalnotices@constellation.com

A-8 ASSIGNMENT FORM To assign this Note, fill in the form below: (I) or (we) assign and transfer this Note to: (Insert assignee’s legal name) (Insert assignee’s soc. sec. or tax I.D. no.) (Print or type assignee’s name, address and zip code) and irrevocably appoint to transfer this Note on the books of the Company. The agent may substitute another to act for him. Date: _______________ Your Signature: (Sign exactly as your name appears on the face of this Note) Signature Guarantee*: _________________________ * Participant in a recognized Signature Guarantee Medallion Program (or other signature guarantor acceptable to the Trustee).

A-9 SCHEDULE OF EXCHANGES OF INTERESTS IN THE GLOBAL NOTE * The following exchanges of a part of this Global Note for an interest in another Global Note or for a Definitive Note, or exchanges of a part of another Global Note or Definitive Note for an interest in this Global Note, have been made: Date of Exchange Amount of decrease in Principal Amount of this Global Note Amount of increase in Principal Amount of this Global Note Principal Amount of this Global Note following such decrease (or increase) Signature of authorized officer of Trustee or Custodian * This schedule should be included only if the Note is issued in global form.