Please wait

Blue Owl Technology Income Corp. (“OTIC”)

2025 Year-End Shareholder Letter

Dear valued shareholder,

We are pleased to share OTIC’s 2025 year-end investor letter as part of our ongoing commitment to keeping you informed about the current market environment and the fund’s latest activities. In the third-quarter, we discussed our views on AI as a driver of innovation, and why it could be both a major investment opportunity and contributor to portfolio quality for OTIC. We noted that since the launch of ChatGPT in November 2022, which we believe is widely regarded as a turning point in AI, Blue Owl Technology Lending’s underlying borrowers have delivered meaningful growth, achieving cumulative weighted-average revenue by nearly 40% and cumulative weighted-average EBITDA by nearly 50%.1 We believe these strong results reflect our disciplined credit selection, supported by the inherently attractive attributes of enterprise software and the digitization and AI tailwinds that may continue to create high-quality investment opportunities.

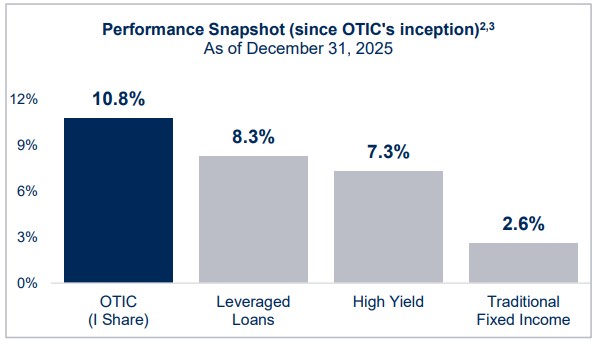

OTIC has historically delivered attractive returns for investors since its inception in May 2022. In 2025, OTIC Class I generated a strong calendar year return of 9.0%, bringing annualized inception-to-date returns to 10.8%.2

OTIC also delivered compelling relative value over public credit indices. Since inception, OTIC Class I has outperformed leveraged loans by 2.5%, high-yield bonds by 3.5%, and traditional fixed income by 8.2%. 2,3

OTIC Class I’s NAV has appreciated by nearly 4.0% since its initial NAV as of May 31, 2022, underscoring the durability of the portfolio and its ability to deliver attractive results across market environments.

In today’s market environment of declining rates and tightening spreads, disciplined credit selection and prudent leverage remain essential in seeking to generate sustainable and attractive results for investors. OTIC was intentionally designed to be a scaled, diversified portfolio of high-quality technology companies. As of December 31, 2025, OTIC’s debt investment par value was $5.9 billion, diversified across 174 companies and 39 end markets, with 92% backed by private equity sponsors. 4 Underlying borrowers are predominantly large, market leading software businesses that deliver mission-critical, recurring revenue solutions, averaging $1.2B in revenue and $388M in EBITDA. 5 OTIC also remains conservatively structured, with 93% senior secured loans and 33% loan-to-value.6,7 These fundamentals reflect our disciplined investment approach, positioning OTIC to employ thoughtful levels of leverage that can support attractive long-term results for investors.

In the fourth quarter of 2025, the BDC industry saw a notable rise in tender activity, a dynamic we have long recognized as characteristic of periods of heightened market volatility. When tender requests increase, liquidity management becomes a more active component of portfolio management. We have historically fulfilled every tender since inception, including those in this most recent period. Prior to the elevated tender period, OTIC had meaningful liquidity of $2.4 billion across cash, undrawn debt, and broadly syndicated loans, as of September 30, 2025.

With OTIC’s strong liquidity profile and in-line with our commitment to always prioritize investors’ short-term and long-term interests, we and our Board chose to increase the tender offer to meet all investor demands. We believe, our extensive experience navigating market cycles allowed us to meet the liquidity needs of redeeming investors, while also shaping portfolio mix and leverage to potentially enhance risk-adjusted returns for remaining investors. Taken from a position of strength, our actions should increase exposure to high-quality, higher-yielding directly originated loans and yield generation potential, supporting wider spreads and strong overall returns.

Following the full satisfaction of this quarter’s tenders, OTIC continues to maintain liquidity levels well above regular tender requirements and is well-positioned to deliver enhanced results for remaining investors. As of December 31, 2025, including the tender result, OTIC has $1.4 billion across cash, available borrowing capacity, and broadly syndicated loans. 10, Net leverage increased to 1.05x debt-to-equity, within the fund’s target range of 0.9x–1.25x, which with all else equal positions the portfolio for improved returns. 9 Looking ahead, we remain excited about OTIC’s outlook, supported by strong credit quality and thoughtful portfolio management, which we believe can enhance long-term investor value and position the fund for another year of strong performance in 2026

| | | | | | | | |

| Craig W. Packer | | Erik Bissonette |

| | |

| Head of Credit & Co-President of Blue Owl Capital | | Technology Lending Portfolio Manager & President of OTIC |

| | | | | |

| 1 |

| FOR EXISTING INVESTOR USE ONLY. NOT FOR FURTHER DISTRIBUTION. |

Footnotes

Past performance is not necessarily indicative of future performance, and there can be no assurance that we will achieve comparable investment results, or that any targeted returns will be met.

Statements contained herein that are not historical facts are based on current expectations, estimates, projections, opinions, and/or beliefs of our management. Such statements involve known and unknown risks, uncertainties, and other factors, and undue reliance should not be placed thereon. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “project”, “estimate”, “intend”, “continue”, “target”, or “believe” (or the negatives thereof) or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or our actual performance may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions.

The estimates presented above are based on management’s preliminary determinations only and, consequently, the data set forth in our Form 10-Q or 10-K may differ from these estimates, and any such differences may be material. In addition, the information presented above does not include all of the information regarding our financial condition and results of operations that may be important to investors. As a result, investors are cautioned not to place undue reliance on the information presented above. The information presented above is based on management’s current expectations that involve substantial risk and uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, such information. We assume no duty to update these preliminary estimates except as required by law.

Neither KPMG LLP, our independent registered public accounting firm, nor any other independent accountants, have audited, reviewed, compiled or performed procedures with respect to the preliminary financial data contained herein. Accordingly, KPMG LLP does not express an opinion or any form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information.

1. As of September 30, 2025. Weightings are based on fair value of investments unless otherwise noted. Borrower financials are derived from the most recently available portfolio company financial statements, have not been independently verified by Blue Owl, and may reflect a normalized or adjusted amount Accordingly, Blue Owl makes no representation or warranty in respect of this information.

2. As of December 31, 2025. Past performance is not a guarantee of future results. Returns are compounded monthly. Total return is calculated as the change in monthly NAV (assuming any dividends and distributions, net of shareholder servicing fees, are reinvested in accordance with the Company’s dividend reinvestment plan), if any, divided by the beginning NAV. Returns reflect reinvestments of distributions and the deduction of ongoing expenses that are borne by investors, such as management fees, incentive fees, servicing fees, interest expense, offering costs, professional fees, director fees and other general and administrative expenses. An investment in the Company is subject to a maximum upfront sales load (Class S: 3.5%, Class D: 1.5%, Class I: No sales load) which will reduce the amount of capital available for investment. Operating expenses may vary in the future based on the amount of capital raised, the Adviser’s election to continue expense support, and other unpredictable variables. Total returns based on the max upfront fee load for an investor starting at the inception of the respective share class: Class S – May 1, 2022, Class D – May 1, 2022, Class I – May 1, 2022. Class I does not have upfront fees.

Class S (With Max Sales Load): -2.94% (1-mo), -1.87% (3-mo), 4.42% (YTD), 4.42% (1-yr), 9.11% (3-yr), 8.82% (ITD)

Class S (No Sales Load): 0.45% (1-mo), 1.57% (3-mo), 8.08% (YTD), 8.08% (1-yr), 10.36% (3-yr), 9.85% (ITD)

Class D (With Max Sales Load): -0.98% (1-mo), 0.21% (3-mo), 7.12% (YTD), 7.12% (1-yr), 10.47% (3-yr), 10.05% (ITD)

Class D (No Sales Load): 0.51% (1-mo), 1.72% (3-mo), 8.73% (YTD), 8.73% (1-yr), 11.02% (3-yr), 10.50% (ITD)

Class I (No Sales Load): 0.53% (1-mo), 1.78% (3-mo), 9.00% (YTD), 9.00% (1-yr), 11.30% (3-yr), 10.78% (ITD)

3. Source: Bloomberg. Indices listed do not represent benchmarks for the funds but allow for comparison of a fund's performance to an Index. An investor cannot invest directly in an index. Index performance does not reflect fees and expenses. Traditional Fixed Income represented by Bloomberg Barclays U.S. Aggregate Index. High Yield represented by the Bloomberg Barclays High Yield Index. Leveraged Loans represented by Morningstar LSTA U.S. Leveraged Loan Index.

4. As of September 30, 2025. Percentage backed by private equity sponsors is based on fair value of portfolio reported in 3Q25 financials

5. As of September 30, 2025. Weightings are based on fair value of investments unless otherwise noted. Borrower financials are derived from the most recently available portfolio company financial statements, have not been independently verified by Blue Owl, and may reflect a normalized or adjusted amount Accordingly, Blue Owl makes no representation or warranty in respect of this information.

6. As of December 31, 2025. Senior secured percentage is based on par value and shown net of unfunded commitment amounts. Valuations may change over time. Based on debt portfolio only. Par value represents the face value of loans in the portfolio.

7. As of September 30, 2025. LTV is based on fair value of portfolio reported in 3Q25 financials.

8. Represents total borrowing capacity and not subject to borrow base restrictions

9. Available liquidity and net leverage reflects actuals results as of December 31, 2025, including the tender offer expected to take place on January 28, 2026. These estimates are based upon good faith estimates and assumptions believed to be reasonable at the time made. These estimates involve future events and should not be viewed as fact as actual results may differ from the projected results by a material amount.

10. The amount available reflects limitations related to each credit facility’s borrowing base.

Index definitions

Bloomberg U.S. Aggregate Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities.

Bloomberg Barclays US Corporate High Yield Index. This index measures the USD-denominated, high yield, fixed-rate corporate bond market.

Morningstar LSTA U.S. Leveraged Loan Index is an unmanaged index of the institutional leveraged loan market. Prior to August 29, 2022 the index name was S&P/LSTA Leveraged Loan Index.

| | | | | |

| 2 |

| FOR EXISTING INVESTOR USE ONLY. NOT FOR FURTHER DISTRIBUTION. |

Summary of risk factors

An investment in Blue Owl Technology Income Corp. (“OTIC”) is speculative and involves a high degree of risk, including the risk of a substantial loss of investment, as well as substantial fees and costs, all of which can impact an investor’s return. The following are some of the risks involved in an investment in OTIC’s common shares; however, an investor should carefully consider the fees and expenses and information found in the “Risk Factors” section of the OTIC prospectus before deciding to invest:

•You should not expect to be able to sell your shares regardless of how OTIC performs and you should consider that you may not have access to the money you invest for an indefinite period of time. An investment in shares of OTIC’s common stock is not suitable for you if you need access to the money you invest.

•OTIC does not intend to list its shares on any securities exchange and does not expect a secondary market in its shares to develop. As a result, you may be unable to reduce your exposure in any market downturn. If you are able to sell your shares before a liquidity event is completed, you will likely receive less than your purchase price.

•OTIC has implemented a share repurchase program pursuant to which it intends to conduct quarterly repurchases of a limited number of outstanding shares of its common stock. OTIC’s board of directors has complete discretion to determine whether OTIC will engage in any share repurchase, and if so, the terms of such repurchase. OTIC’s share repurchase program will include numerous restrictions that limit your ability to sell your shares. As a result, share repurchases may not be available each month. While OTIC intends to continue to conduct quarterly tender offers as described above, it is not required to do so and may amend or suspend the share repurchase program at any time.

•Distributions on OTIC’s common stock may exceed OTIC’s taxable earnings and profits, particularly during the period before it has substantially invested the net proceeds from its public offering. Therefore, portions of the distributions that OTIC pays may represent a return of capital to you for U.S. federal tax purposes. A return of capital is a return of a portion of your original investment in shares of OTIC common stock. As a result, a return of capital will (i) lower your tax basis in your shares and thereby increase the amount of capital gain (or decrease the amount of capital loss) realized upon a subsequent sale or redemption of such shares, and (ii) reduce the amount of funds OTIC has for investment in portfolio companies. OTIC has not established any limit on the extent to which it may use sources other than cash flows from operations to fund distributions.

•Distributions are not guaranteed. Distributions may also be funded in significant part, directly or indirectly, from the deferral of certain investment advisory fees that may be subject to repayment to the Adviser and/or the reimbursement of certain operating expenses, that may be subject to repayment to the Adviser and its affiliates. Significant portions of distributions may not be based on investment performance. In the event distributions are funded from deferrals of fees and reimbursements by OTIC’s affiliates, such funding may not continue in the future. If OTIC’s affiliates do not agree to reimburse certain of its operating expenses, then significant portions of OTIC’s distributions may come from sources other than cash flows from operations. The repayment of any amounts owed to OTIC’s affiliates will reduce future distributions to which you would otherwise be entitled.

•The payment of fees and expenses will reduce the funds available for investment, the net income generated, the funds available for distribution and the book value of the common shares. In addition, the fees and expenses paid will require investors to achieve a higher total net return in order to recover their initial investment. Please see OTIC’s prospectus for details regarding its fees and expenses.

•OTIC intends to invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

•The Adviser and its affiliates face a number of conflicts with respect to OTIC. Currently, the Adviser and its affiliates manage other investment entities, including Blue Owl Capital Corporation, Blue Owl Technology Finance Corp., Blue Owl Capital Corporation II and Blue Owl Credit Income Corp., and are not prohibited from raising money for and managing future investment entities that make the same types of investments as those OTIC targets. As a result, the time and resources that the Adviser devotes to OTIC may be diverted. In addition, OTIC may compete with any such investment entity also managed by the Adviser for the same investors and investment opportunities. Furthermore, the Adviser may face conflicts of interest with respect to services it may perform for companies in which OTIC invests as it may receive fees in connection with such services that may not be shared with OTIC.

•The incentive fee payable by OTIC to the Adviser may create an incentive for the Adviser to make investments on OTIC’s behalf that are risky or more speculative than would be the case in the absence of such compensation arrangements. OTIC may be obligated to pay the Adviser incentive fees even if OTIC incurs a net loss due to a decline in the value of its portfolio and even if its earned interest income is not payable in cash.

•The information provided above is not directed at any particular investor or category of investors and is provided solely as general information about Blue Owl products and services to regulated financial intermediaries and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as Blue Owl Securities LLC, its affiliates, and OTIC are not undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity with respect to the materials presented herein.

| | | | | |

| 3 |

| FOR EXISTING INVESTOR USE ONLY. NOT FOR FURTHER DISTRIBUTION. |

Important information

Unless otherwise noted the Report Date referenced herein is as of December 31, 2025.

Past performance is not a guarantee of future results.

Assets Under Management (“AUM”) refers to the assets that we manage and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Credit and Real Assets products; and (v) par value of collateral for collateralized loan obligations (“CLOs”) and other securitizations.

The material presented is proprietary information regarding Blue Owl Capital Inc. (“Blue Owl”), its affiliates and investment program, funds sponsored by Blue Owl, including the Blue Owl Credit, Real Assets, and GP Strategic Capital Funds (collectively the “Blue Owl Funds”) as well as investment held by the Blue Owl Funds.

An investment in the Fund or other investment vehicle entails a high degree of risk. Prospective investors should consider all of the risk factors set forth in the "Certain Risk Factors and Actual and Potential Conflicts of Interest" of the PPM or Prospectus, each of which could have an adverse effect on the Fund or other investment vehicle and on the value of Interests.

An investment in the Fund or other investment vehicle is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity associated with an investment in the Fund or other investment vehicle. Investors in the Fund or other investment vehicle must be prepared to bear such risks for an indefinite period of time. There will be restrictions on transferring interests in the Fund or other investment vehicle, and the investment performance of the Fund or other investment vehicle may be volatile. Investors must be prepared to hold their interests in the Fund or other investment vehicle until its dissolution and should have the financial ability and willingness to accept the risk characteristics of the Fund's or other investment vehicle’s investments.

There can be no assurances or guarantees that the Fund's or other investment vehicles investment objectives will be realized that the Fund's or other investment vehicle investment strategy will prove successful or that investors will not lose all or a portion of their investment in the Fund.

Furthermore, investors should not construe the performance of any predecessor funds or other investment vehicle as providing any assurances or predictive value regarding future performance of the Fund.

The views expressed and, except as otherwise indicated, the information provided are as of the report date and are subject to change, update, revision, verification, and amendment, materially or otherwise, without notice, as market or other conditions change. Since these conditions can change frequently, there can be no assurance that the trends described herein will continue or that any forecasts are accurate. In addition, certain of the statements contained in this material may be statements of future expectations and other forward-looking statements that are based on the current views and assumptions of Blue Owl and involve known and unknown risks and uncertainties (including those discussed below) that could cause actual results, performance, or events to differ materially from those expressed or implied in such statements. These statements may be forward-looking by reason of context or identified by words such as “may, will, should, expects, plans, intends, anticipates, believes, estimates, predicts, potential or continue” and other similar expressions. Neither Blue Owl, its affiliates, nor any of Blue Owl’s or its affiliates' respective advisers, members, directors, officers, partners, agents, representatives or employees or any other person (collectively the “Blue Owl Entities”) is under any obligation to update or keep current the information contained in this document.

The information presented contains case studies and other discussions of selected investments made by Blue Owl Funds and other investment vehicles. These discussions provide descriptions and certain key aspects of such investments presented for informational purposes only and are intended to illustrate Blue Owl’s sourcing experience and the profile and types of investments and investment strategies which may be pursued by Blue Owl. The types and performance of these investments (i) are not representative of the types and performance of all investments or investment strategies that have been made or recommended by Blue Owl and (ii) are not necessarily indicative of the types and performance of investments that Blue Owl may seek to make, or be able to make, in the future. Any future investment vehicle that Blue Owl may sponsor or advise in the future, may pursue and consummate different types of investments in different concentrations, than those selected for illustrative purposes in this material. Further, references to investments included in illustrative case studies are presented to illustrate Blue Owl’s investment processes only and should not be construed as a recommendation of any particular investment. Past performance of any investment described in these illustrative case studies is not indicative of future results that may be obtained by any Blue Owl funds and other investment vehicles, and there can be no assurance that any such fund or other vehicle will achieve comparable results.

This material contains information from third party sources which Blue Owl has not verified. No representation or warranty, express or implied, is given by or on behalf of the Blue Owl Entities as to the accuracy, fairness, correctness or completeness of the information or opinions contained in this material and no liability whatsoever (in negligence or otherwise) is accepted by the Blue Owl Entities for any loss howsoever arising, directly or indirectly, from any use of this material or its contents, or otherwise arising in connection therewith.

All investments are subject to risk, including the loss of the principal amount invested. These risks may include limited operating history, uncertain distributions, inconsistent valuation of the portfolio, changing interest rates, leveraging of assets, reliance on the investment advisor, potential conflicts of interest, payment of substantial fees to the investment advisor and the dealer manager, potential illiquidity, and liquidation at more or less than the original amount invested. Diversification will not guarantee profitability or protection against loss. Performance may be volatile, and the NAV may fluctuate.

Performance Information: Where performance returns have been included in this material, Blue Owl has included herein important information relating to the calculation of these returns as well as other pertinent performance related definitions.

NAV: We intend to sell our shares at a net offering price that we believe reflects the net asset value per share as determined in accordance with the Company’s share pricing policy.

This material is for informational purposes only and is not an offer or a solicitation to sell or subscribe for any fund or other investment vehicle and does not constitute investment, legal, regulatory, business, tax, financial, accounting, or other advice or a recommendation regarding any securities of Blue Owl, of any fund or investment vehicle managed by Blue Owl, or of any other issuer of securities. Only a definitive offering document (i.e.: Prospectus or Private Placement Memorandum or other offering material) can make such an offer. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus, Private Placement Memorandum or other offering material is truthful or complete. Any representation to the contrary is a criminal offense. Within the United States and Canada, securities are offered through Blue Owl Securities LLC, member of FINRA/SIPC, as Dealer Manager.

Copyright© Blue Owl Capital Inc. 2026. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Blue Owl. It is delivered on an “as is” basis without warranty or liability by accepting the information, you agree to abide by all applicable copyright and other laws, as well as any additional copyright notices or restrictions contained in the information.

| | | | | |

| 8679142.2 | 4 |

| FOR EXISTING INVESTOR USE ONLY. NOT FOR FURTHER DISTRIBUTION. |