1 ICR Conference January 12, 2026

2 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS & NON-GAAP MEASURES This presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). All statements other than statements of historical fact are forward- looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business, and are based on currently available operating, financial and competitive information which are subject to various risks and uncertainties, so you should not place undue reliance on forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "commit," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions and the following: • risks related to or arising from our organizational structure; • risks of food-borne illness and food safety and other health concerns about our food; • risks relating to the economy and financial markets, including in relation to trade and tax policy changes and other macroeconomic uncertainty, including, inflation, fluctuating interest rates, stock market volatility, recession concerns, and other factors; • risks associated with our recently announced search for a new Chief Executive Officer and the related transition; • the impact of unionization activities of our team members on our reputation, operations and profitability; • risks associated with our reliance on certain information technology systems, including our new enterprise resource planning system, and potential failures or interruptions; • risks associated with data, privacy, cyber security and the use and implementation of information technology systems, including our digital ordering and payment platforms for our delivery business; • risks associated with increased adoption, implementation and use of artificial intelligence technologies across our business; • the impact of competition, including from our competitors in the restaurant industry or our own restaurants; • the increasingly competitive labor market and our ability to attract and retain the best talent and qualified employees; • the impact of federal, state or local government regulations relating to privacy, data protection, advertising and consumer protection, building and zoning requirements, labor and employment matters, costs of or ability to open new restaurants, or the sale of food and alcoholic beverages; • inability to achieve our growth strategy, including as a result of, among other things, the availability of suitable new restaurant sites in existing and new markets and opening of new restaurants at the anticipated rate and on the anticipated timeline; • the impact of consumer sentiment and other economic factors on our sales; • increases in food and other operating costs, tariffs and import taxes, and supply shortages; and • other risks identified in our filings with the Securities and Exchange Commission (the “SEC”). All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in the Company’s most recent Annual Report on Form 10-K, filed with the SEC. All of the Company’s SEC filings are available on the SEC’s website at www.sec.gov. The forward-looking statements included in this press release are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. This presentation includes certain non-GAAP measures as defined under SEC rules, including Adjusted EBITDA, Restaurant-Level Adjusted EBITDA and Restaurant-Level Adjusted EBITDA Margin. Definitions are included in this presentation. All content © 2025 Portillo’s Hot Dogs. All rights reserved. Do not share or duplicate confidential content, in whole or part, without written consent.

3 MAIN TOPICS FOR TODAY PORTILLO’S: A TRULY BELOVED BRAND GROWTH: SUCCESSES AND LESSONS LEARNED STRENGTHENING OUR PROFITABLE MODEL

4 PORTILLO’S: A TRULY BELOVED BRAND

5

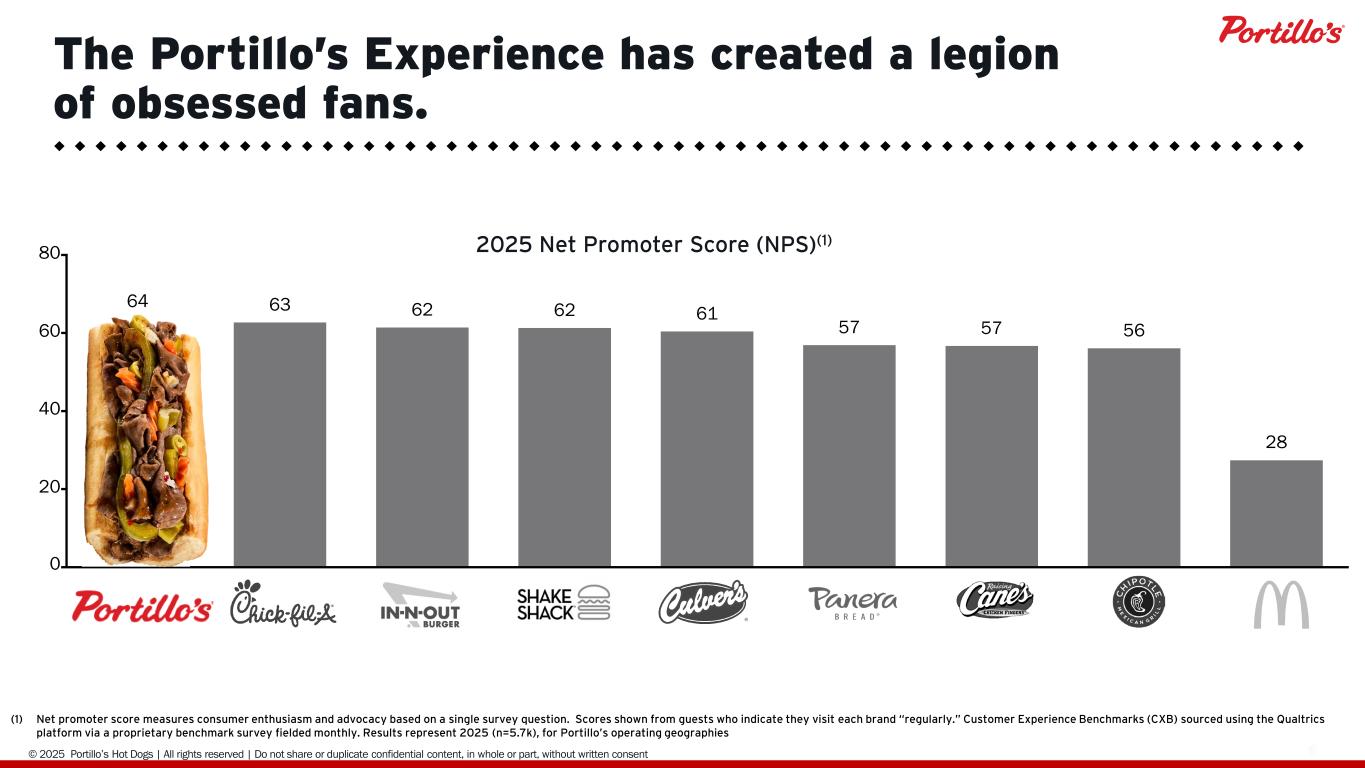

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 6 0 20 40 60 80 NPS 64 63 62 62 61 57 57 56 28 2025 Net Promoter Score (NPS)(1) (1) Net promoter score measures consumer enthusiasm and advocacy based on a single survey question. Scores shown from guests who indicate they visit each brand “regularly.” Customer Experience Benchmarks (CXB) sourced using the Qualtrics platform via a proprietary benchmark survey fielded monthly. Results represent 2025 (n=5.7k), for Portillo’s operating geographies The Portillo’s Experience has created a legion of obsessed fans.

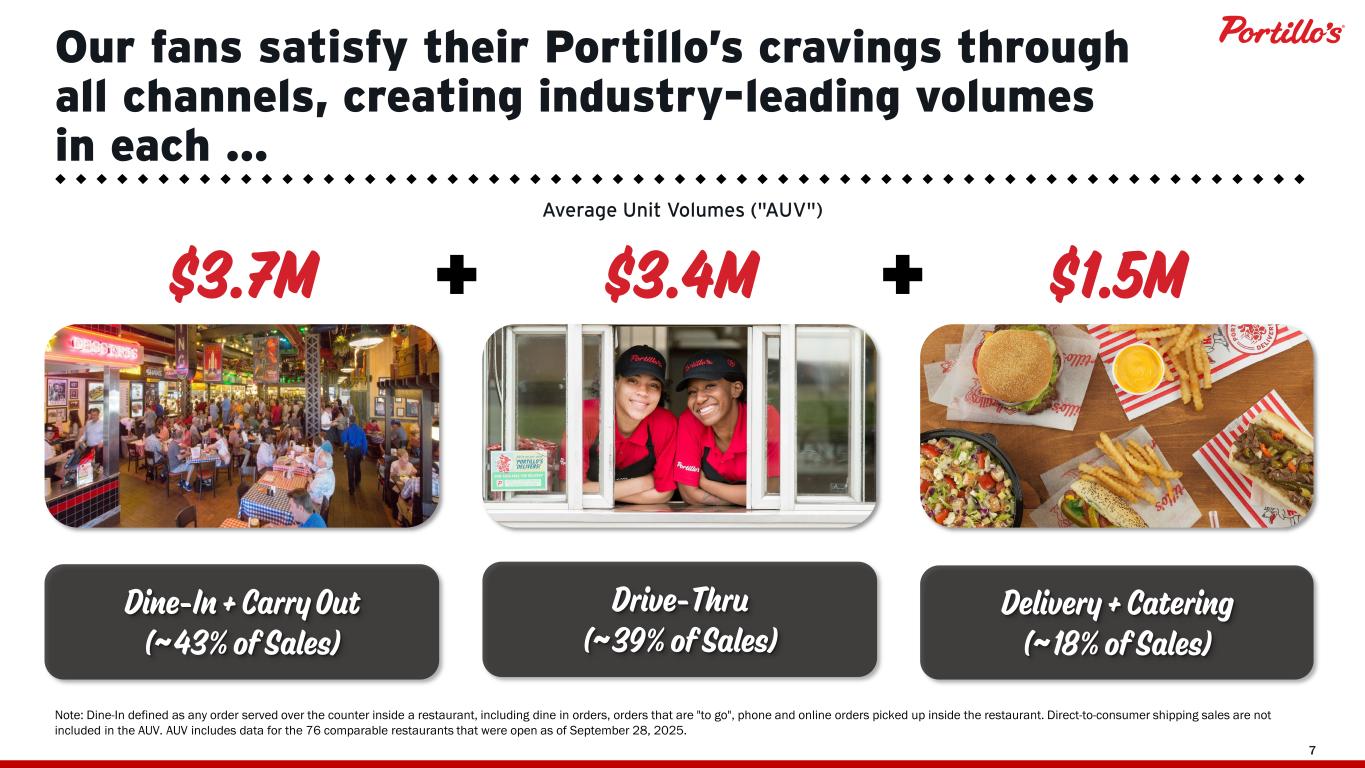

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 7 Our fans satisfy their Portillo’s cravings through all channels, creating industry-leading volumes in each … Drive-Thru (~39% of Sales) Dine-In + Carry Out (~43% of Sales) Delivery + Catering (~18% of Sales) Note: Dine-In defined as any order served over the counter inside a restaurant, including dine in orders, orders that are "to go", phone and online orders picked up inside the restaurant. Direct-to-consumer shipping sales are not included in the AUV. AUV includes data for the 76 comparable restaurants that were open as of September 28, 2025. $3.7M $3.4M $1.5M Average Unit Volumes ("AUV")

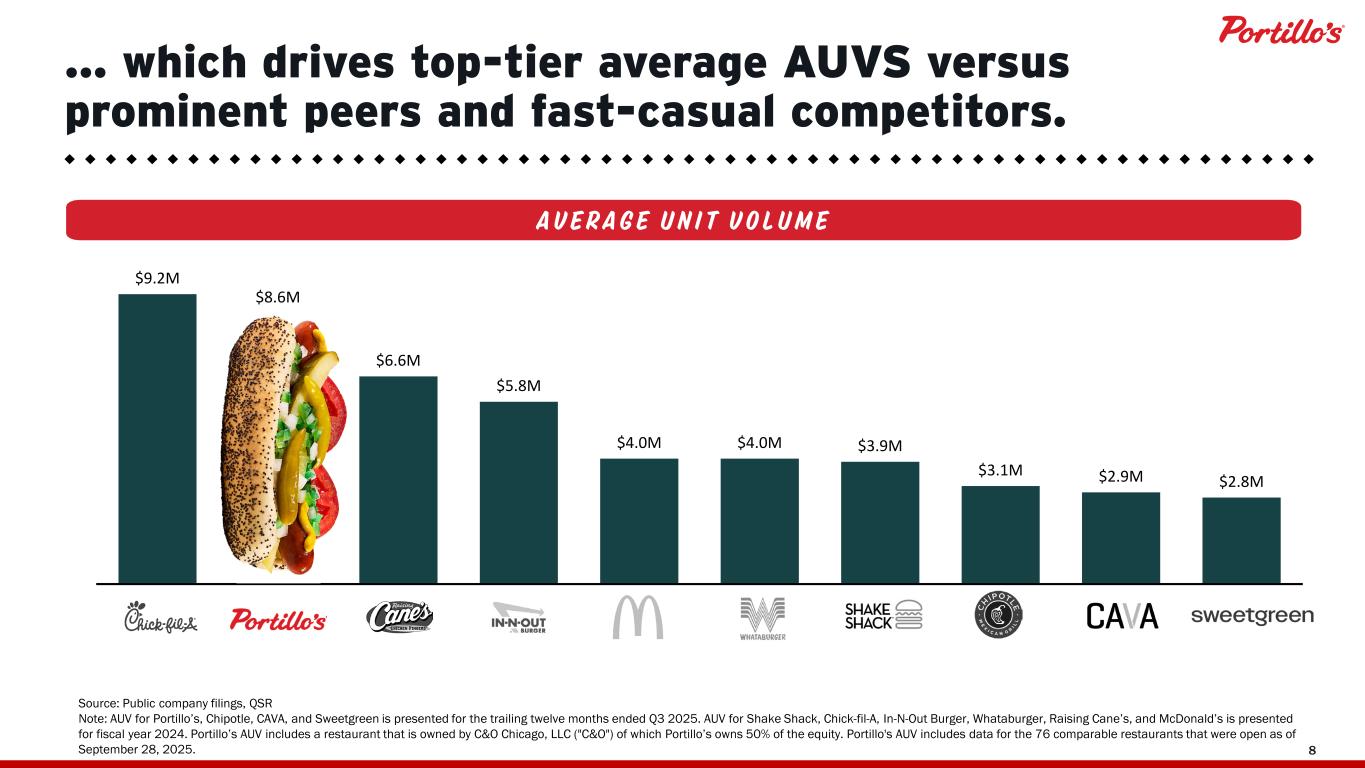

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 8 … which drives top-tier average AUVS versus prominent peers and fast-casual competitors. © 2024 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent HOME MARKET OUTSIDE HOME MARKET A V E R A G E U N I T V O L U M E $9.2M $8.6M $6.6M $5.8M $4.0M $4.0M $3.9M $3.1M $2.9M $2.8M Source: Public company filings, QSR Note: AUV for Portillo’s, Chipotle, CAVA, and Sweetgreen is presented for the trailing twelve months ended Q3 2025. AUV for Shake Shack, Chick-fil-A, In-N-Out Burger, Whataburger, Raising Cane’s, and McDonald’s is presented for fiscal year 2024. Portillo’s AUV includes a restaurant that is owned by C&O Chicago, LLC ("C&O") of which Portillo’s owns 50% of the equity. Portillo's AUV includes data for the 76 comparable restaurants that were open as of September 28, 2025.

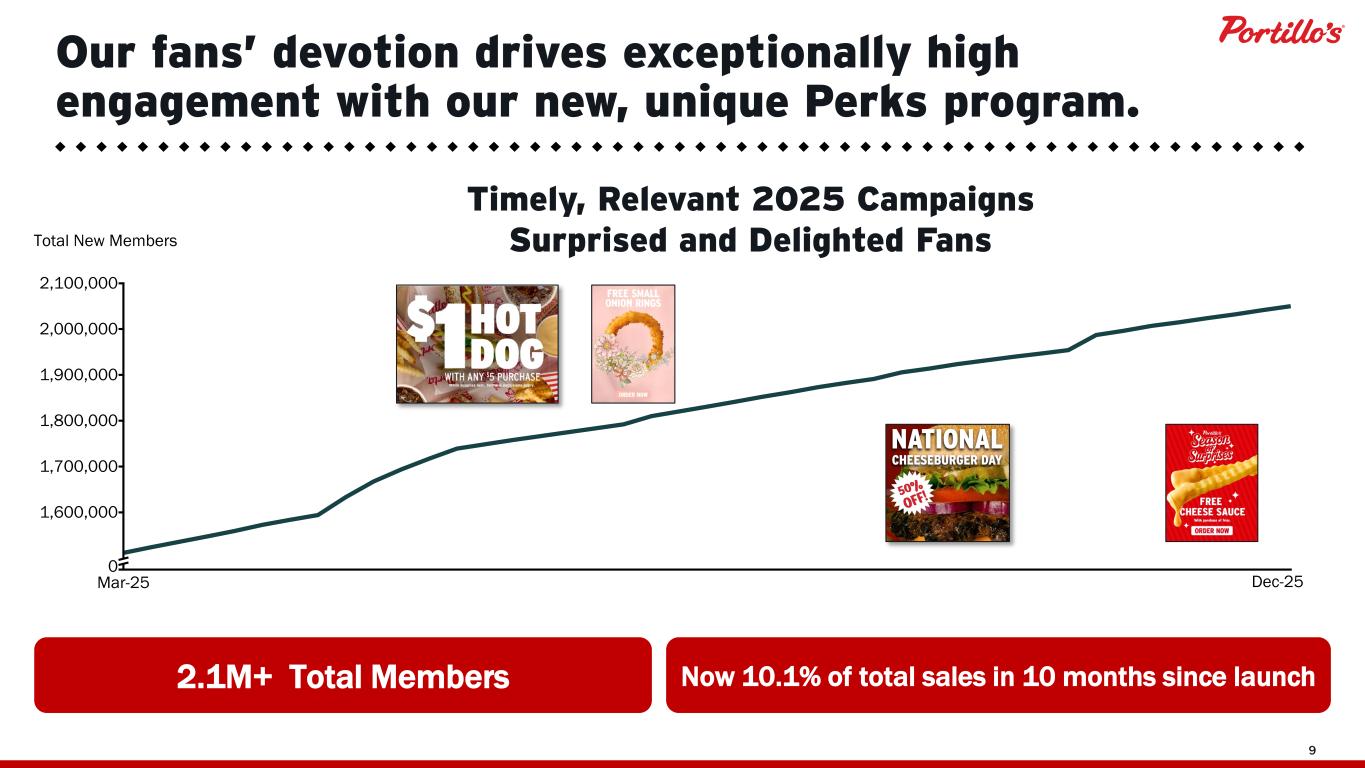

9 0 1,600,000 1,700,000 1,800,000 1,900,000 2,000,000 2,100,000 Mar-25 Total New Members Dec-25 Our fans’ devotion drives exceptionally high engagement with our new, unique Perks program. 2.1M+ Total Members Now 10.1% of total sales in 10 months since launch Timely, Relevant 2025 Campaigns Surprised and Delighted Fans

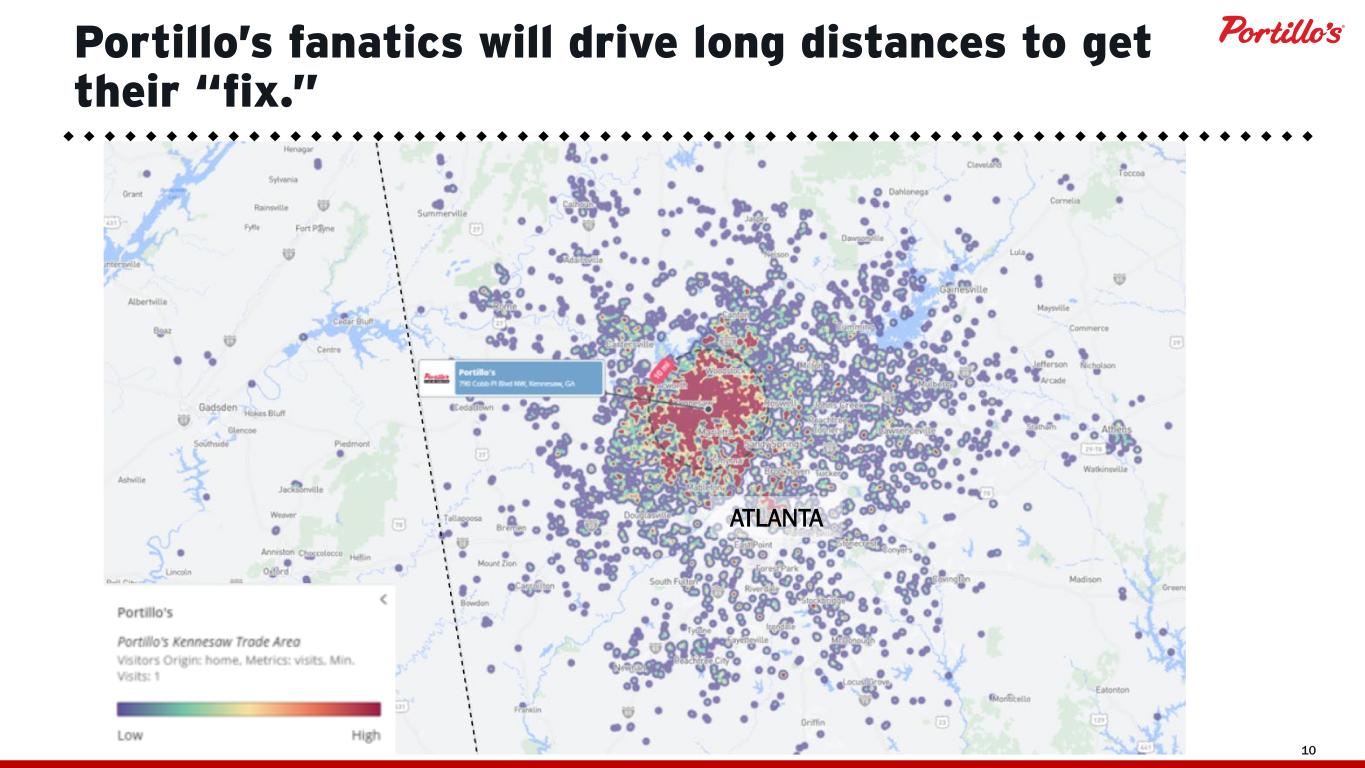

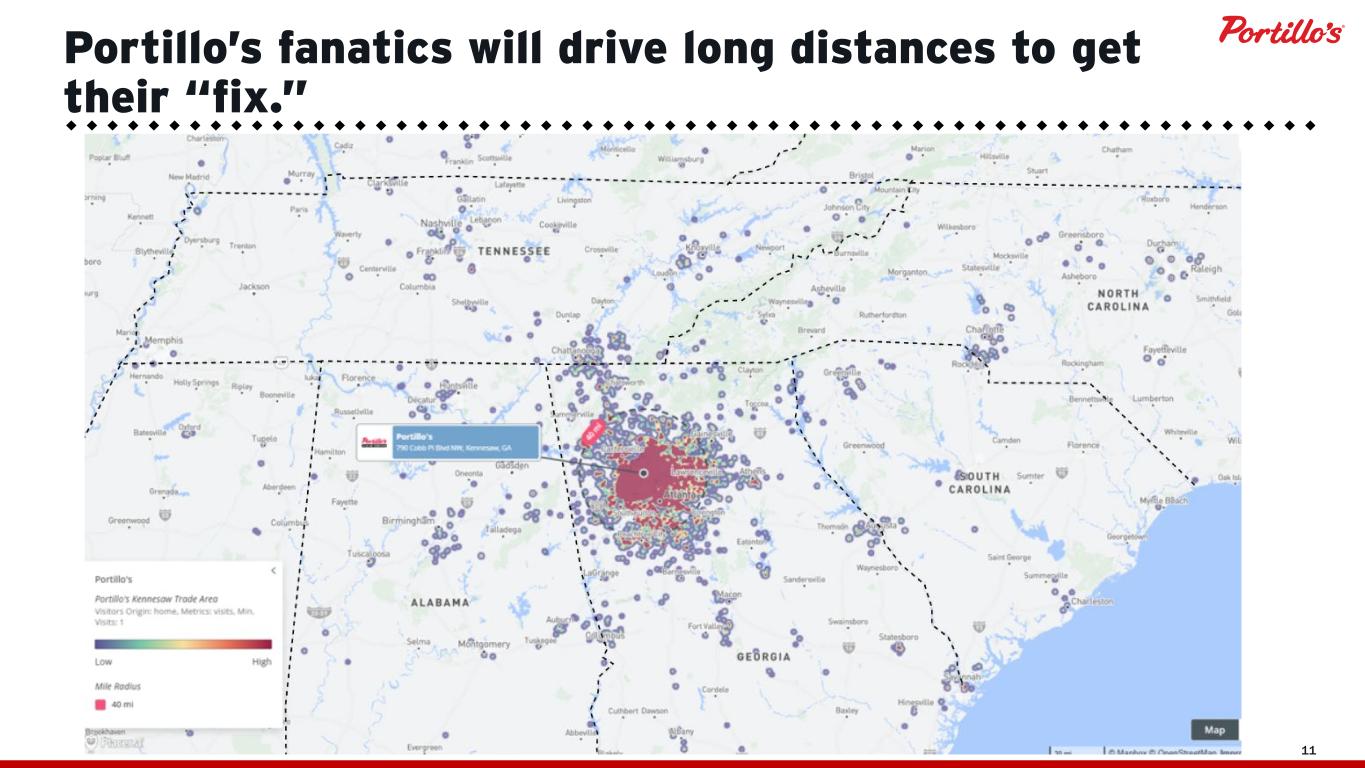

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 10 Portillo’s fanatics will drive long distances to get their “fix.” ATLANTA

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 11 Portillo’s fanatics will drive long distances to get their “fix.”

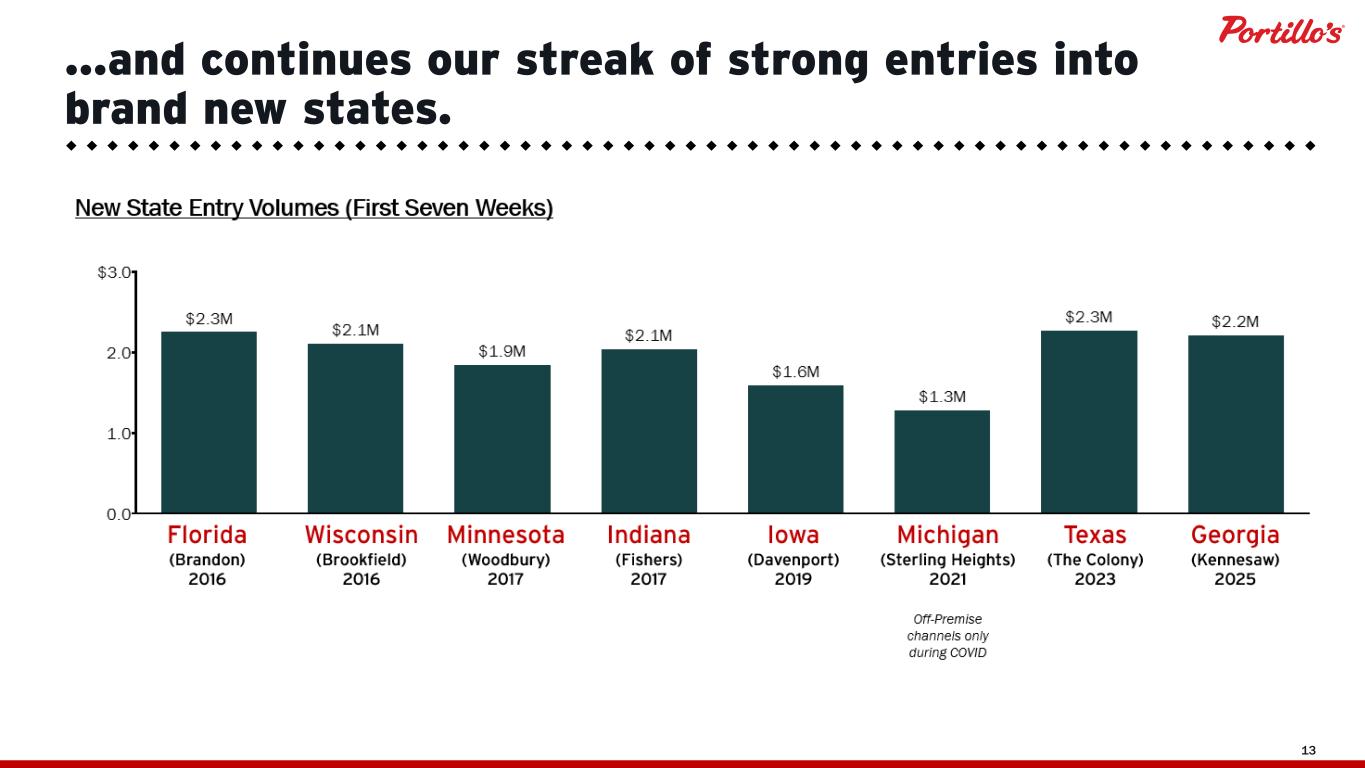

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 12 Kennesaw is the most recent example of pent-up new-market demand for Portillo’s … 3RD BIGGEST OPENING FOR PORTILLO’S #100 MILESTONE RESTAURANT OPENING $302K LAST WEEK’S SALES $2.2M SALES IN THE FIRST 7 WEEKS KENNESAW, GA, RESTAURANT (30 MINS. FROM DOWNTOWN ATLANTA) OPENED ON NOV. 14, 2025

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 13 …and continues our streak of strong entries into brand new states.

14 GROWTH: SUCCESSES AND LESSONS LEARNED

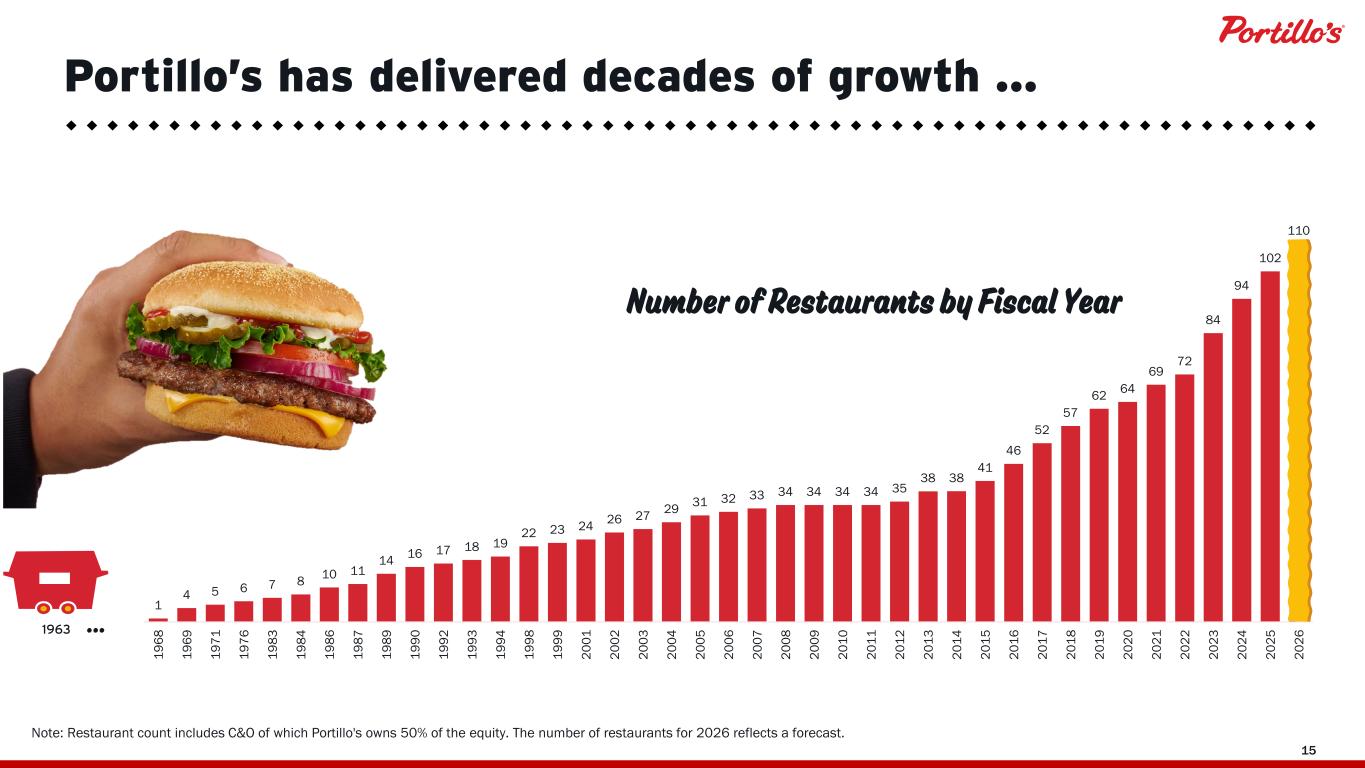

© 2019 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 15 1 4 5 6 7 8 10 11 14 16 17 18 19 22 23 24 26 27 29 31 32 33 34 34 34 34 35 38 38 41 46 52 57 62 64 69 72 84 94 102 110 19 68 19 69 19 71 19 76 19 83 19 84 19 86 19 87 19 89 19 90 19 92 19 93 19 94 19 98 19 99 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 20 26 1963 … Number of Restaurants by Fiscal Year Portillo’s has delivered decades of growth … Note: Restaurant count includes C&O of which Portillo's owns 50% of the equity. The number of restaurants for 2026 reflects a forecast.

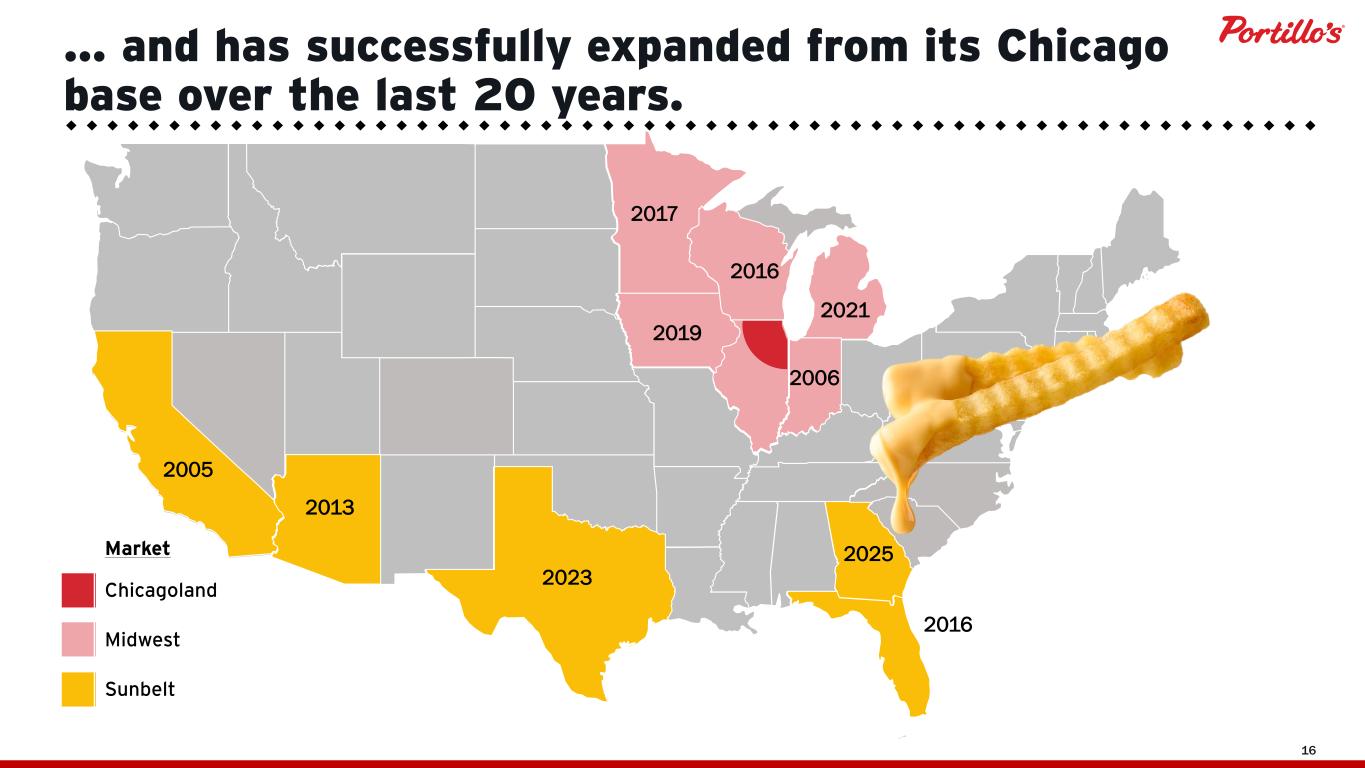

16 Market Chicagoland Midwest Sunbelt … and has successfully expanded from its Chicago base over the last 20 years. 2005 2013 2016 2006 2017 2016 2021 2023 2019 2025

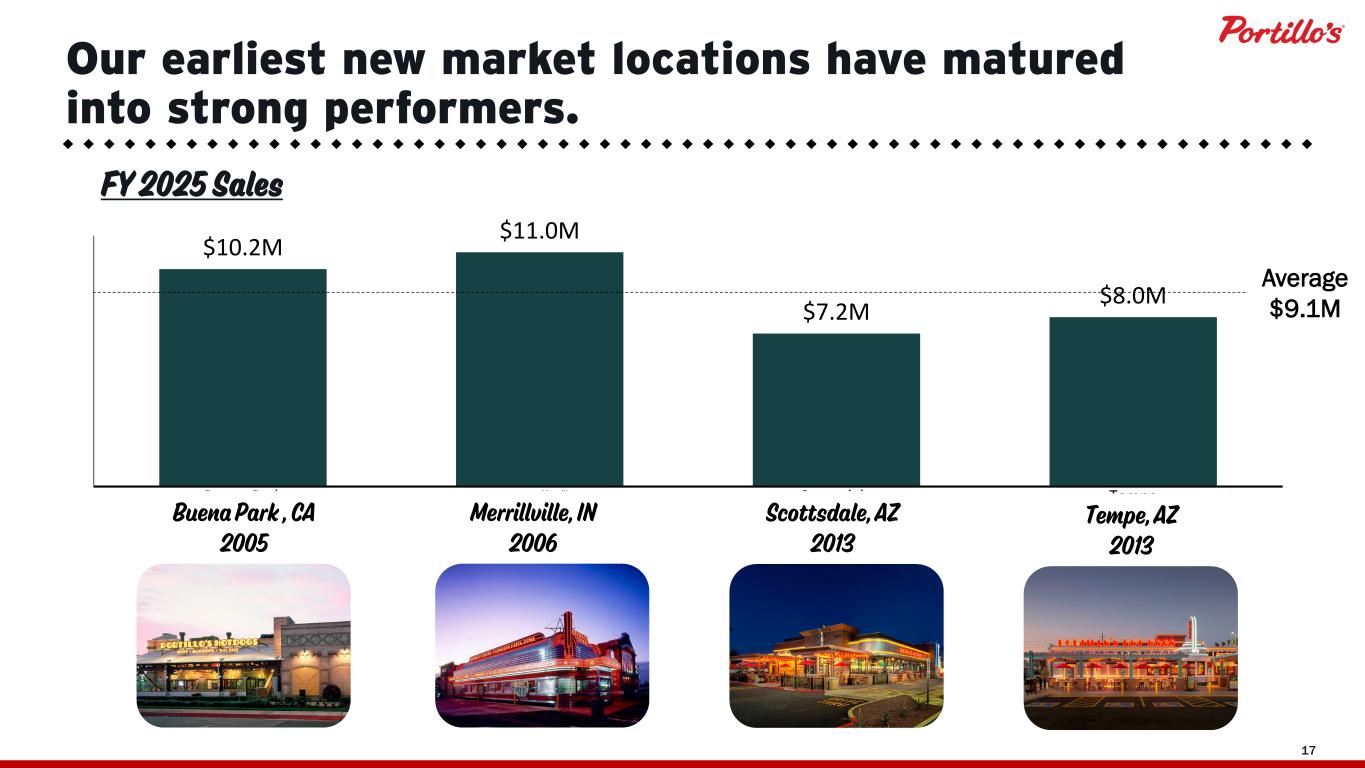

© 2025 Portillo’s Hot Dogs | All rights reserved | Do not share or duplicate confidential content, in whole or part, without written consent 17 Our earliest new market locations have matured into strong performers. Buena Park $10.2M Merrillville $11.0M Scottsdale $7.2M Tempe $8.0M Buena Park , CA 2005 Merrillville, IN 2006 Tempe, AZ 2013 Scottsdale, AZ 2013 FY 2025 Sales Average $9.1M

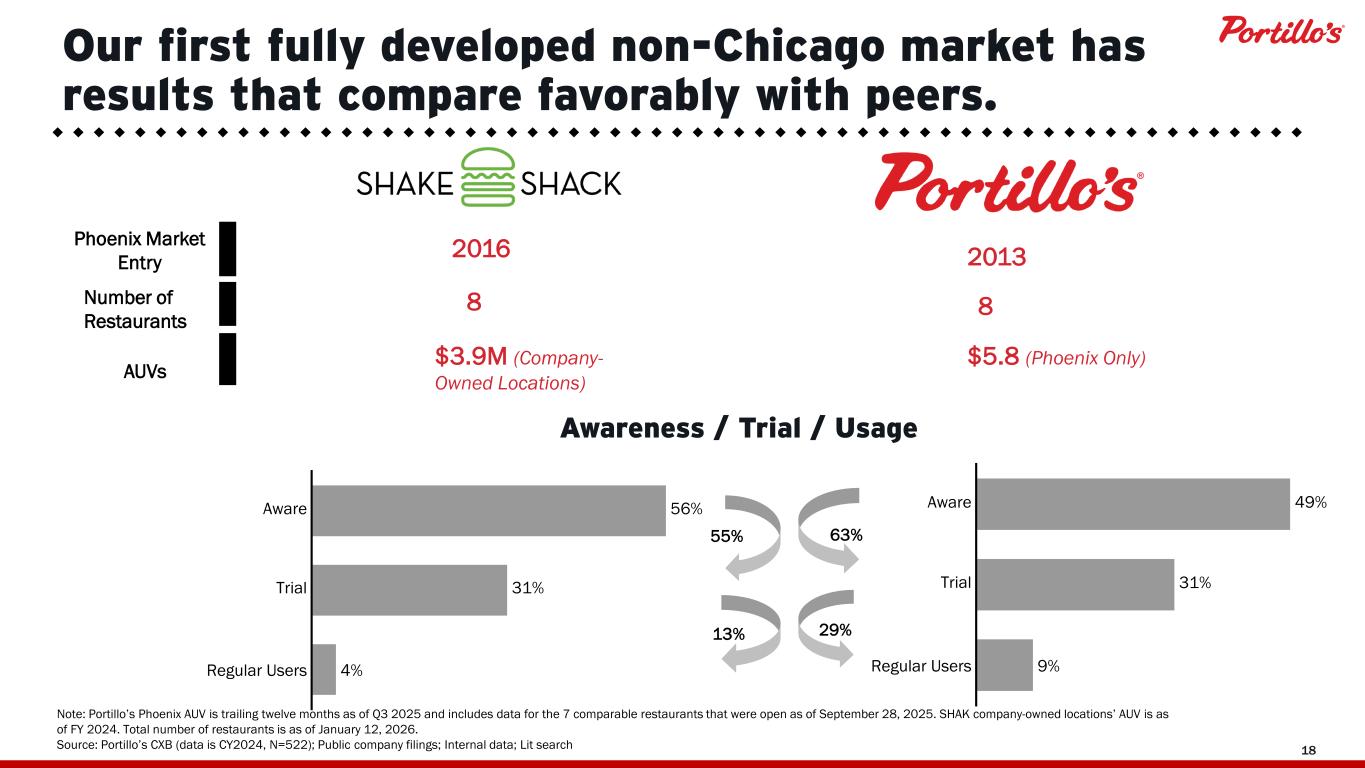

18 Our first fully developed non-Chicago market has results that compare favorably with peers. Phoenix Market Entry Number of Restaurants AUVs 2016 8 $3.9M (Company- Owned Locations) 2013 8 $5.8 (Phoenix Only) Aware 49% Trial 31% Regular Users 9% Aware 56% Trial 31% Regular Users 4% 55% 13% 63% 29% Note: Portillo’s Phoenix AUV is trailing twelve months as of Q3 2025 and includes data for the 7 comparable restaurants that were open as of September 28, 2025. SHAK company-owned locations’ AUV is as of FY 2024. Total number of restaurants is as of January 12, 2026. Source: Portillo’s CXB (data is CY2024, N=522); Public company filings; Internal data; Lit search Awareness / Trial / Usage

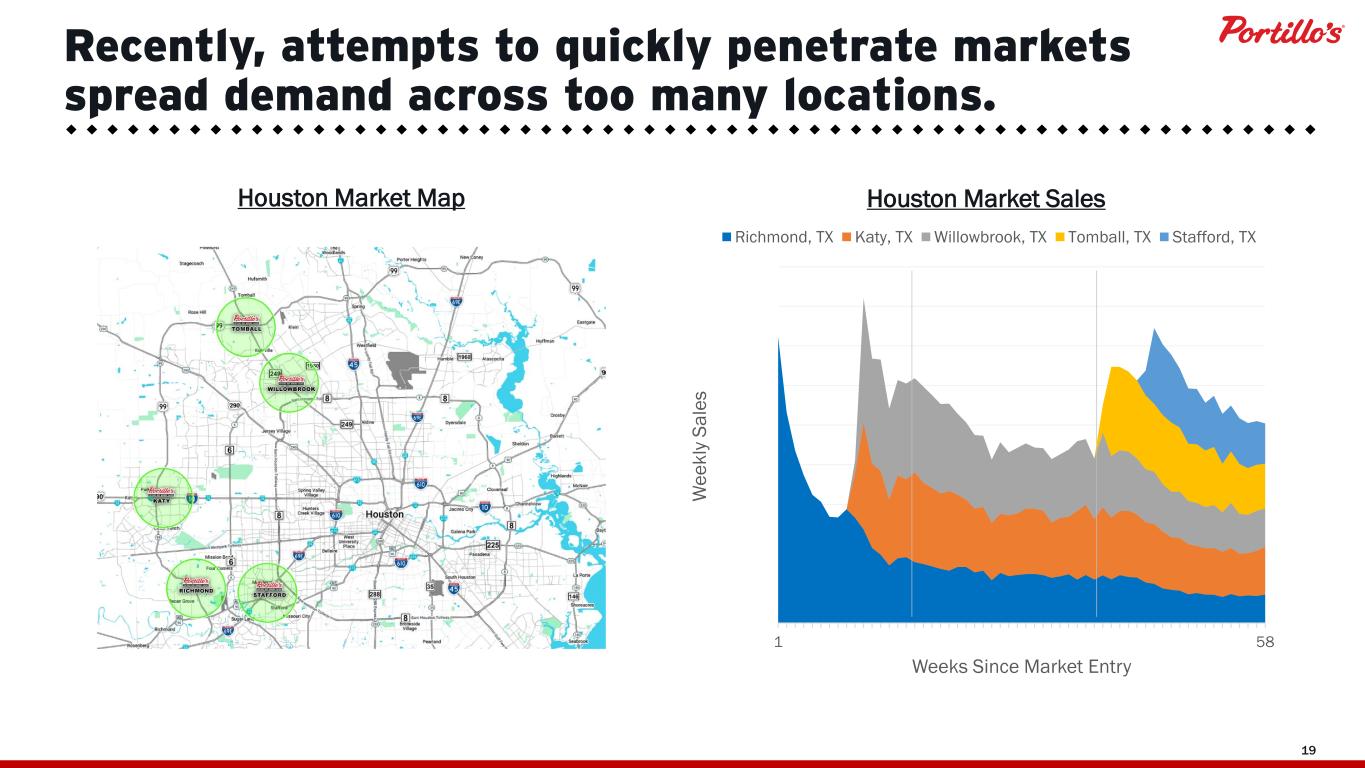

19 Recently, attempts to quickly penetrate markets spread demand across too many locations. 0K 50K 100K 150K 200K 250K 300K 350K 400K 450K 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58 W ee kl y Sa le s Weeks Since Market Entry Houston Market Sales Richmond, TX Katy, TX Willowbrook, TX Tomball, TX Stafford, TX Houston Market Map

20 We have also right-sized our restaurants to deliver better unit economics. Humble Beginnings 2016 2019 2023 2025 4,220 sq. ft. 9,300 sq. ft. 11,300 sq. ft. 7,700 sq. ft. 6,250 sq. ft. (Restaurant of the Future 1.0) Villa Park, IL Allen, TX Kennesaw, GARoseville, MNChicago (C&T), IL

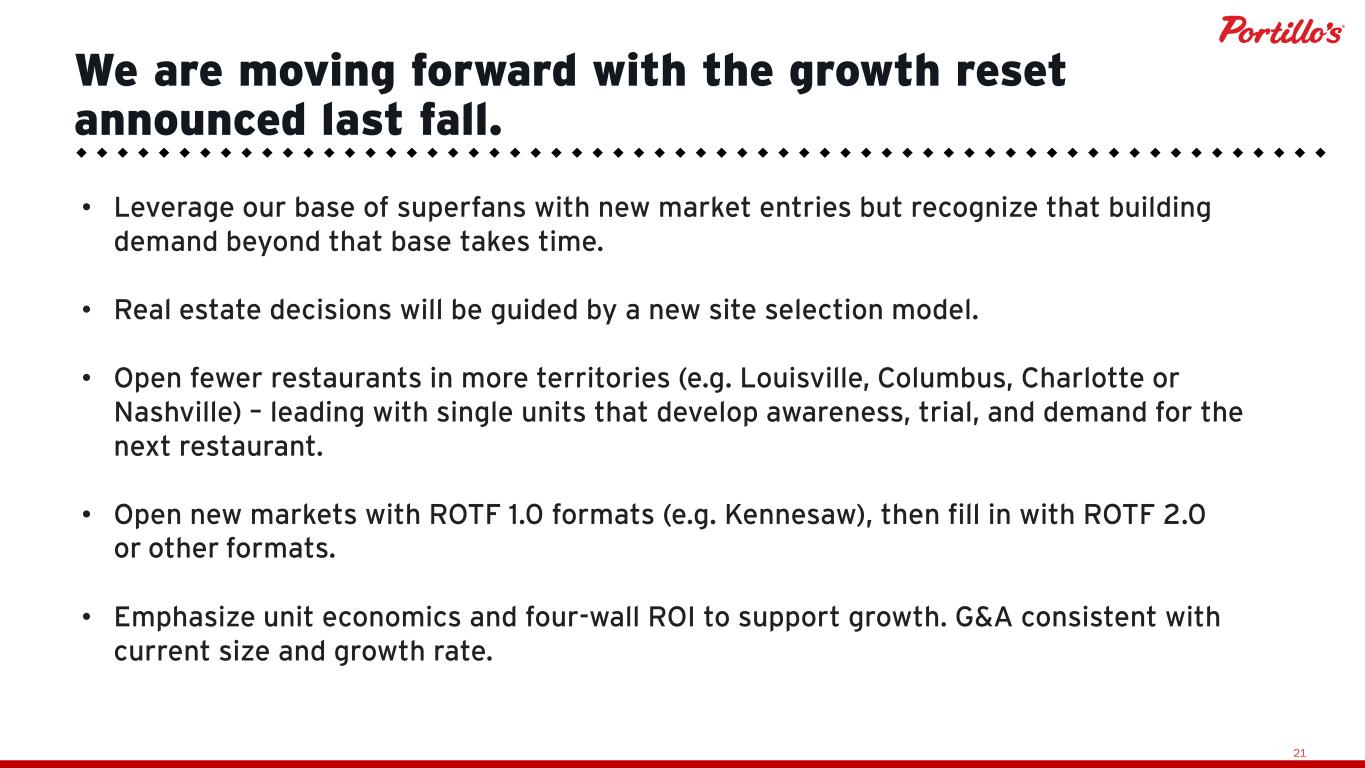

21 • Leverage our base of superfans with new market entries but recognize that building demand beyond that base takes time. • Real estate decisions will be guided by a new site selection model. • Open fewer restaurants in more territories (e.g. Louisville, Columbus, Charlotte or Nashville) – leading with single units that develop awareness, trial, and demand for the next restaurant. • Open new markets with ROTF 1.0 formats (e.g. Kennesaw), then fill in with ROTF 2.0 or other formats. • Emphasize unit economics and four-wall ROI to support growth. G&A consistent with current size and growth rate. We are moving forward with the growth reset announced last fall.

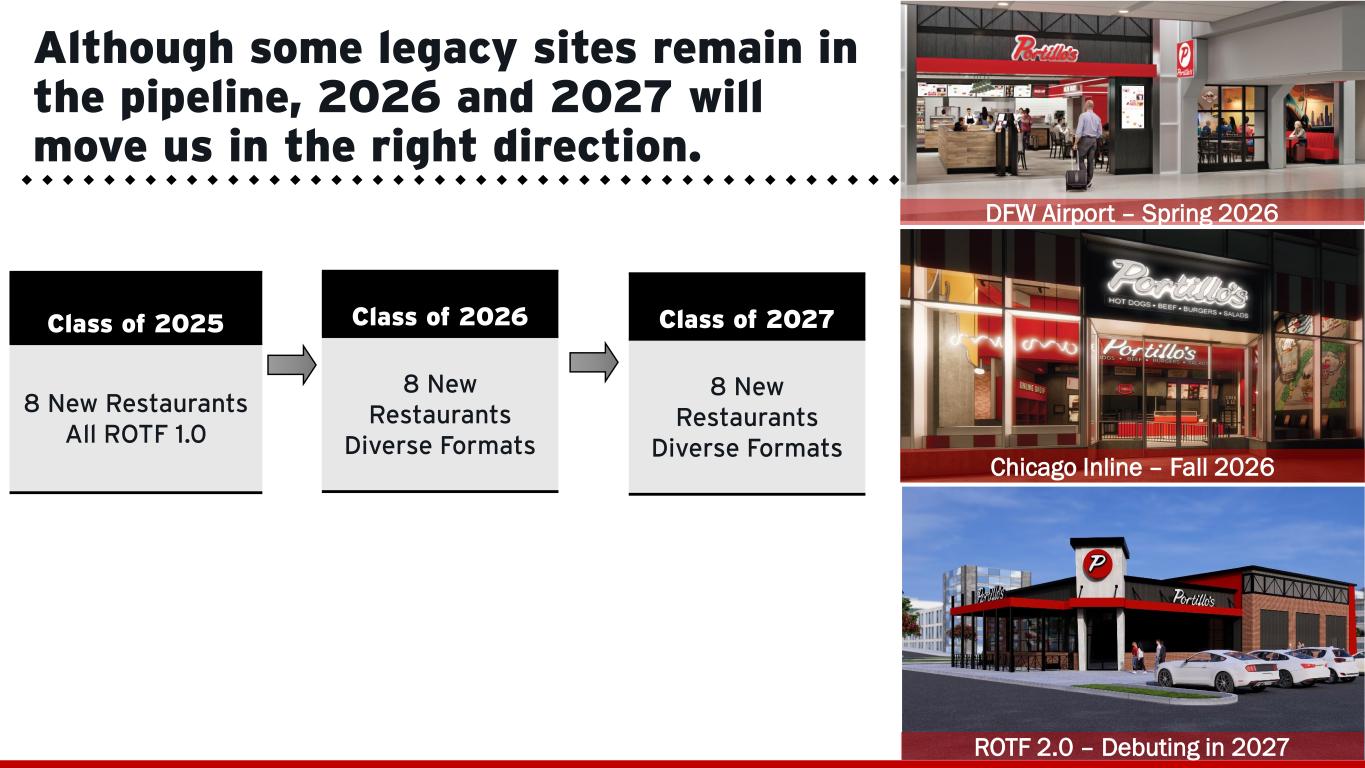

22 Although some legacy sites remain in the pipeline, 2026 and 2027 will move us in the right direction. ROTF 2.0 – Debuting in 2027 DFW Airport – Spring 2026 Class of 2025 8 New Restaurants All ROTF 1.0 Class of 2026 8 New Restaurants Diverse Formats Class of 2027 8 New Restaurants Diverse Formats Chicago Inline – Fall 2026

23 People are the Heart of Portillo’s, and are well- aligned on our new approach. FAMILY GREATNESS ENERGY FUN ~25 POINT Lower Turnover Than Fast Casual Segment(1) (1) Based on data from Blackbox for non-management positions as of December 31, 2025.

24 STRENGTHENING OUR PROFITABLE MODEL

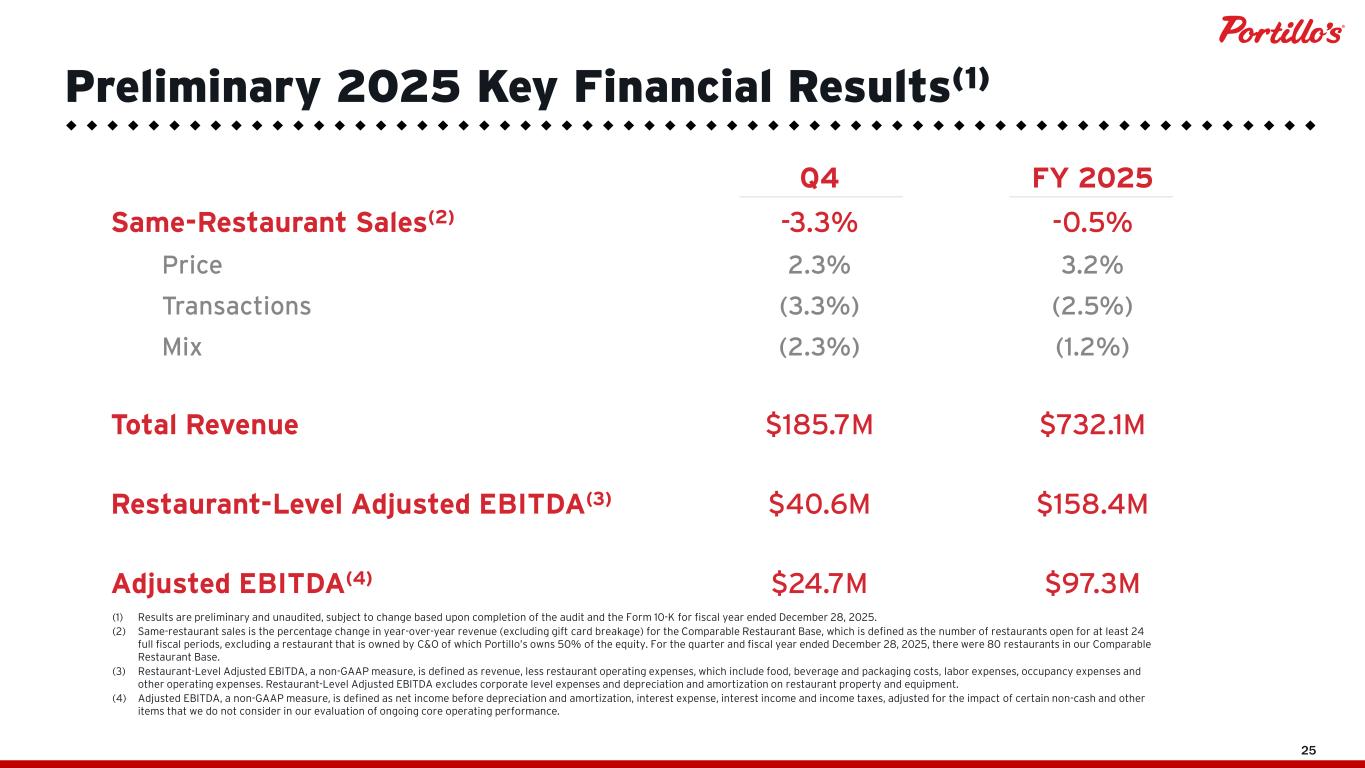

25 Q4 FY 2025 Same-Restaurant Sales(2) -3.3% -0.5% Price 2.3% 3.2% Transactions (3.3%) (2.5%) Mix (2.3%) (1.2%) Total Revenue $185.7M $732.1M Restaurant-Level Adjusted EBITDA(3) $40.6M $158.4M Adjusted EBITDA(4) $24.7M $97.3M (1) Results are preliminary and unaudited, subject to change based upon completion of the audit and the Form 10-K for fiscal year ended December 28, 2025. (2) Same-restaurant sales is the percentage change in year-over-year revenue (excluding gift card breakage) for the Comparable Restaurant Base, which is defined as the number of restaurants open for at least 24 full fiscal periods, excluding a restaurant that is owned by C&O of which Portillo’s owns 50% of the equity. For the quarter and fiscal year ended December 28, 2025, there were 80 restaurants in our Comparable Restaurant Base. (3) Restaurant-Level Adjusted EBITDA, a non-GAAP measure, is defined as revenue, less restaurant operating expenses, which include food, beverage and packaging costs, labor expenses, occupancy expenses and other operating expenses. Restaurant-Level Adjusted EBITDA excludes corporate level expenses and depreciation and amortization on restaurant property and equipment. (4) Adjusted EBITDA, a non-GAAP measure, is defined as net income before depreciation and amortization, interest expense, interest income and income taxes, adjusted for the impact of certain non-cash and other items that we do not consider in our evaluation of ongoing core operating performance. Preliminary 2025 Key Financial Results(1)

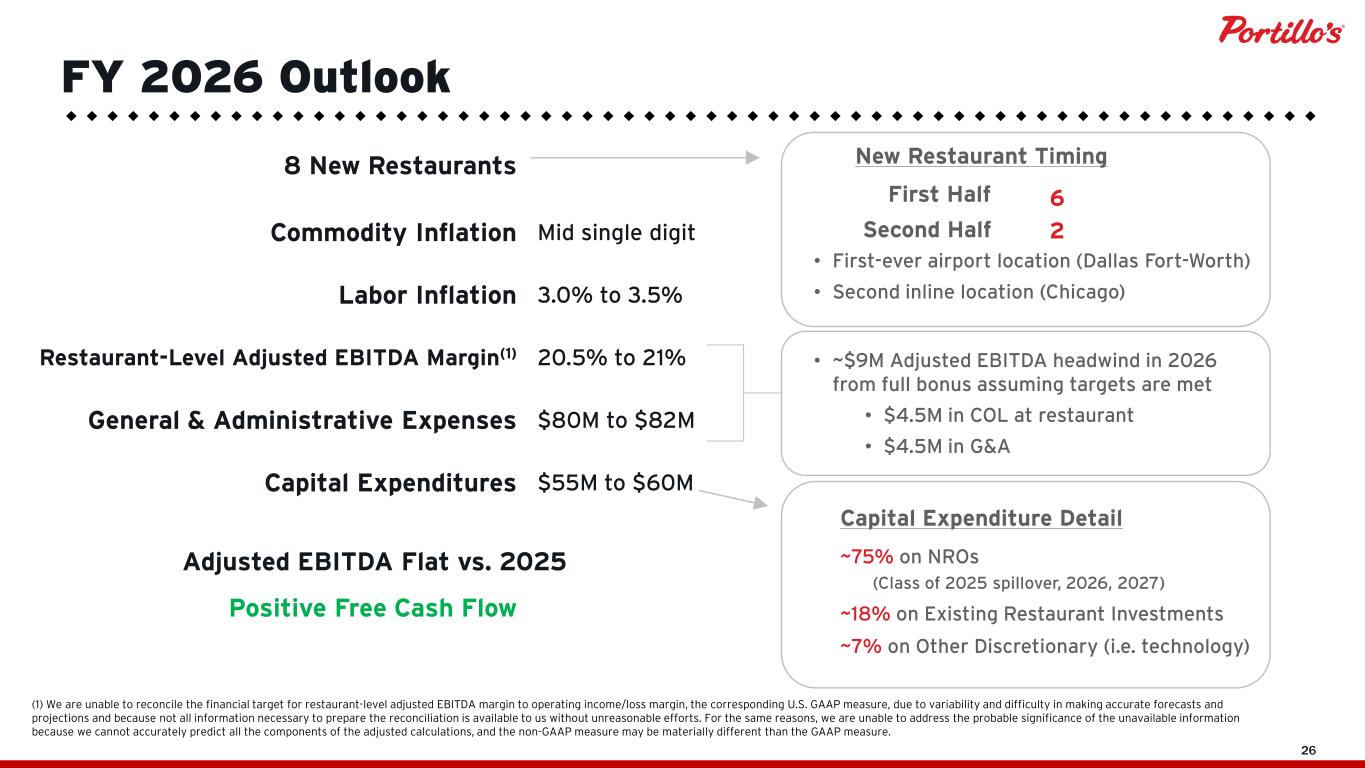

26 8 New Restaurants Commodity Inflation Mid single digit Labor Inflation 3.0% to 3.5% Restaurant-Level Adjusted EBITDA Margin(1) 20.5% to 21% General & Administrative Expenses $80M to $82M Capital Expenditures $55M to $60M Positive Free Cash Flow FY 2026 Outlook 6First Half New Restaurant Timing • First-ever airport location (Dallas Fort-Worth) • Second inline location (Chicago) (1) We are unable to reconcile the financial target for restaurant-level adjusted EBITDA margin to operating income/loss margin, the corresponding U.S. GAAP measure, due to variability and difficulty in making accurate forecasts and projections and because not all information necessary to prepare the reconciliation is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information because we cannot accurately predict all the components of the adjusted calculations, and the non-GAAP measure may be materially different than the GAAP measure. ~75% on NROs (Class of 2025 spillover, 2026, 2027) ~18% on Existing Restaurant Investments ~7% on Other Discretionary (i.e. technology) Capital Expenditure Detail Second Half 2 • ~$9M Adjusted EBITDA headwind in 2026 from full bonus assuming targets are met • $4.5M in COL at restaurant • $4.5M in G&A Adjusted EBITDA Flat vs. 2025

27 10 MINUTE DRIVE TO 7715 PALM PKWY Come visit us here in Orlando!