Exhibit (c)(iii)

CONFIDENTIAL PROPOSAL RESPONSE November 2024 Project Vista

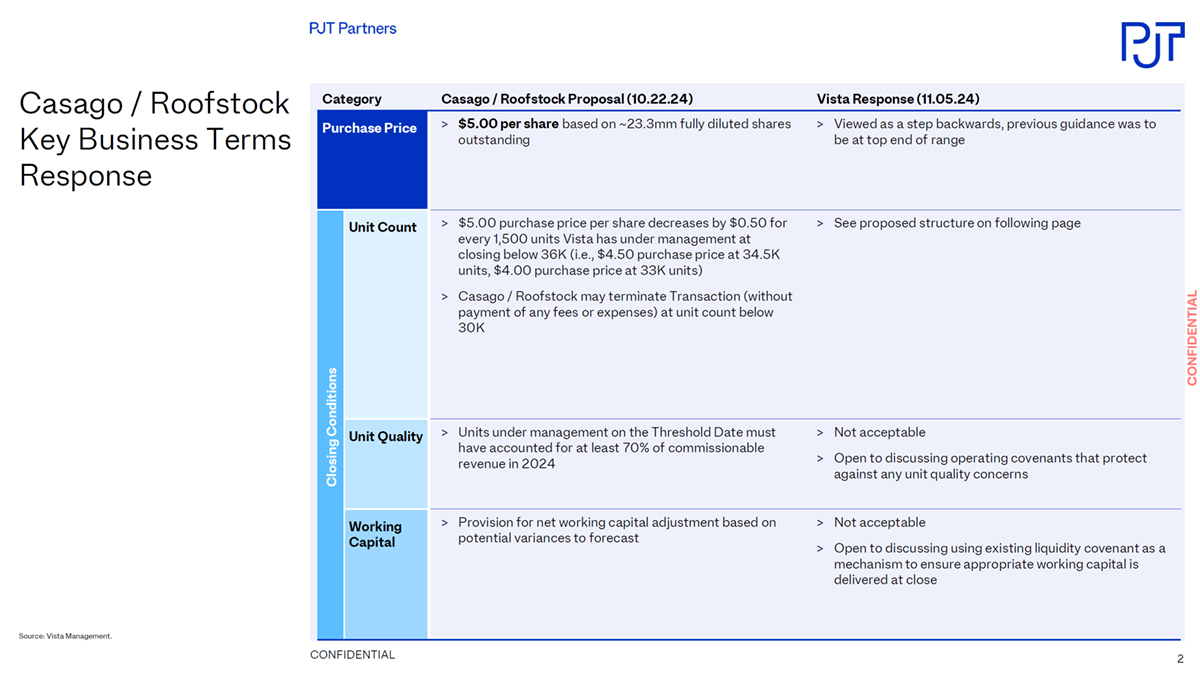

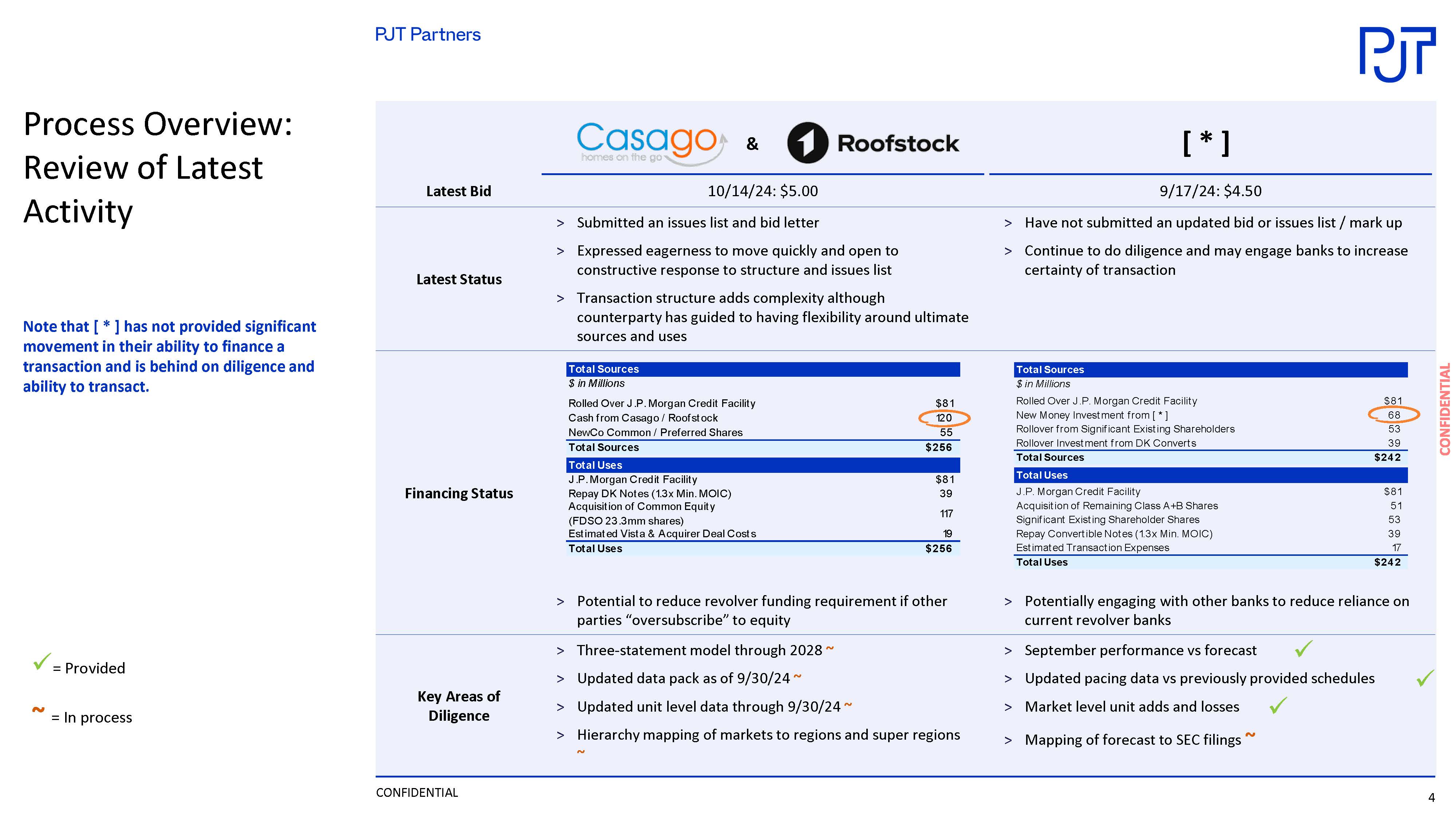

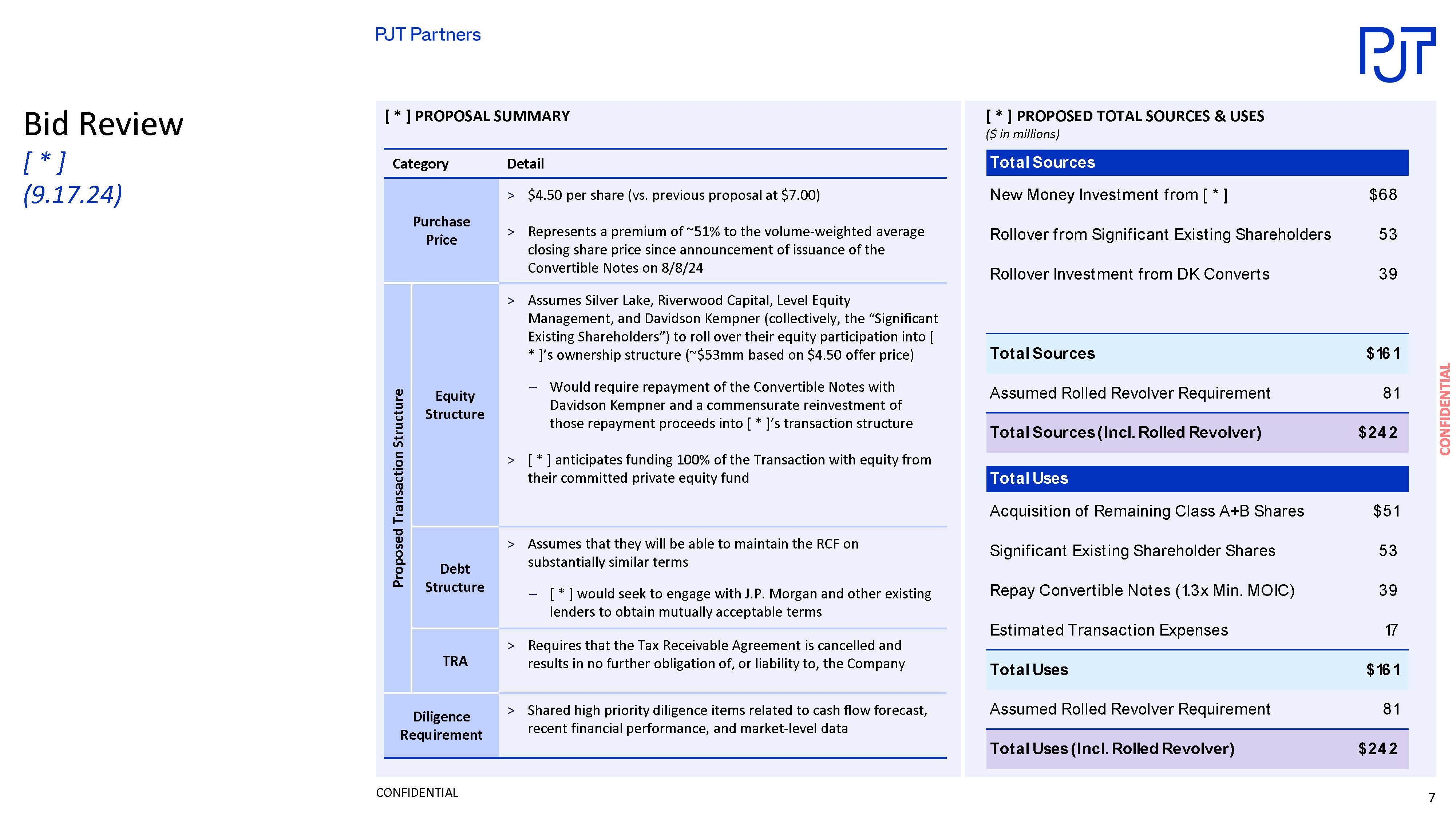

CONFIDENTIAL Casago / Roofstock Key Business Terms Response Source: Vista Management. Category Casago / Roofstock Proposal (10.22.24) Vista Response (11.05.24) Purchase Price $5.00 per share based on ~23.3mm fully diluted shares outstanding Viewed as a step backwards, previous guidance was to be at top end of range Closing Conditions Unit Count $5.00 purchase price per share decreases by $0.50 for every 1,500 units Vista has under management at closing below 36K (i.e., $4.50 purchase price at 34.5K units, $4.00 purchase price at 33K units) Casago / Roofstock may terminate Transaction (without payment of any fees or expenses) at unit count below 30K See proposed structure on following page Unit Quality Units under management on the Threshold Date must have accounted for at least 70% of commissionable revenue in 2024 Not acceptable Open to discussing operating covenants that protect against any unit quality concerns Working Capital Provision for net working capital adjustment based on potential variances to forecast Not acceptable Open to discussing using existing liquidity covenant as a mechanism to ensure appropriate working capital is delivered at close

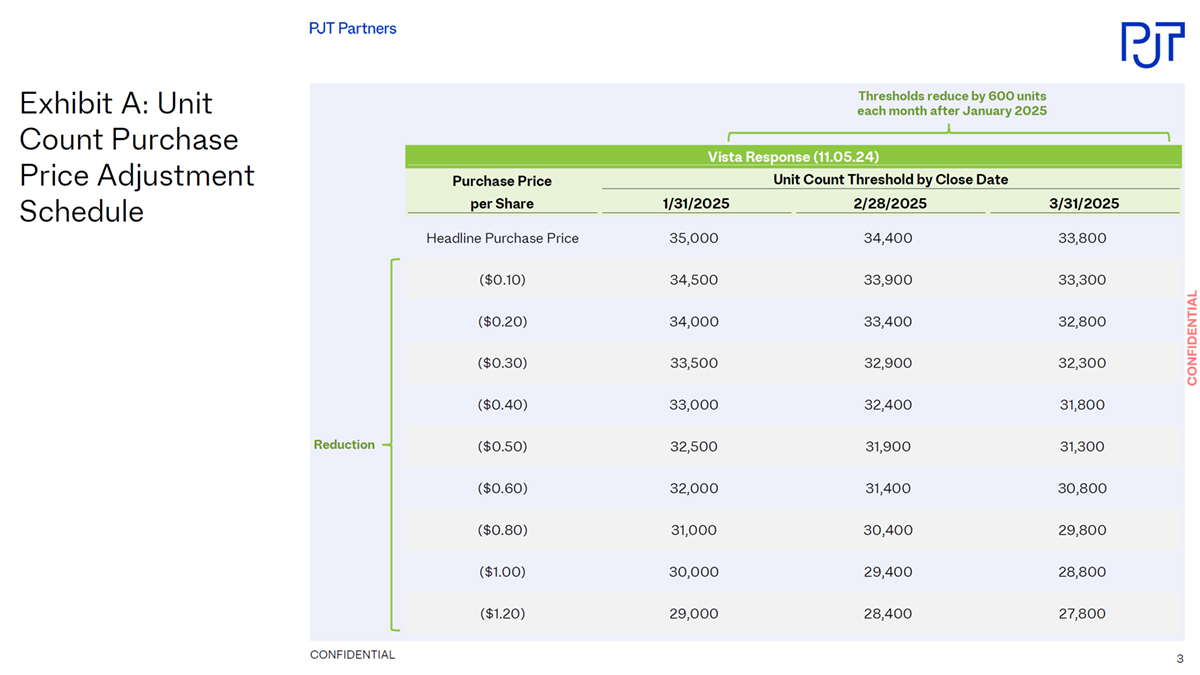

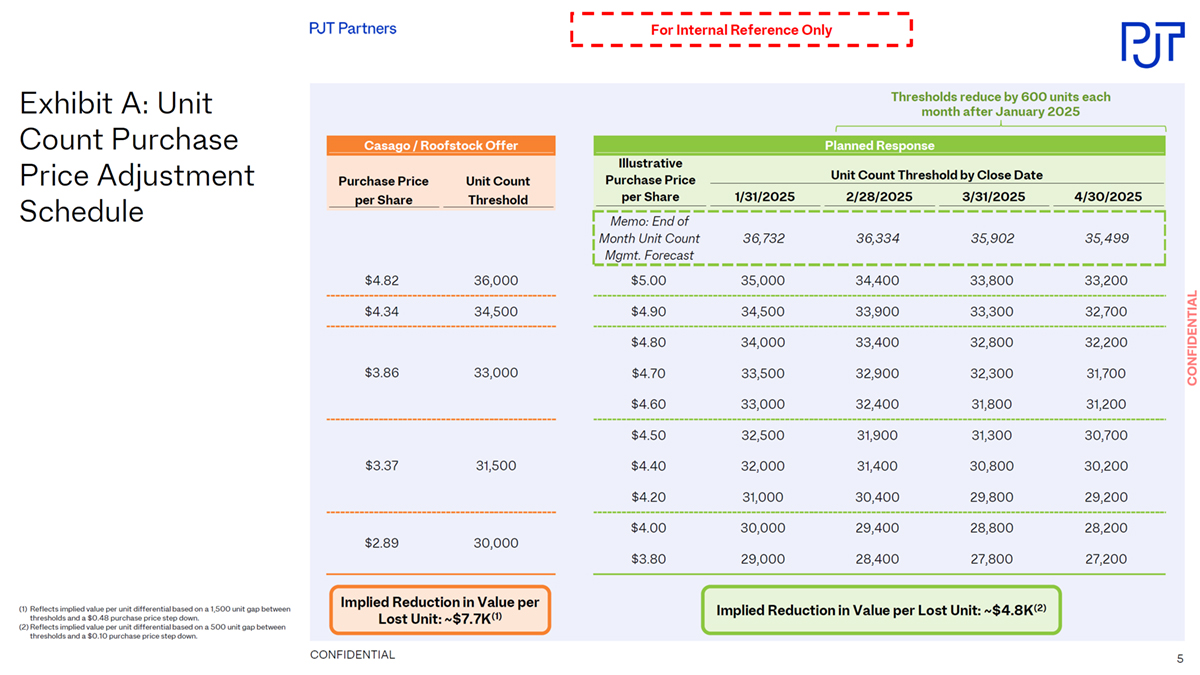

CONFIDENTIAL Exhibit A: Unit Count Purchase Price Adjustment Schedule Thresholds reduce by 600 units each month after January 2025 ReductionVista Response (11.05.24)Purchase PriceUnit Count Threshold by Close Dateper Share1/31/20252/28/20253/31/2025Headline Purchase Price 35,000 34,400 33,800 ($0.10) 34,500 33,900 33,300 ($0.20) 34,000 33,400 32,800 ($0.30) 33,500 32,900 32,300 ($0.40) 33,000 32,400 31,800 ($0.50) 32,500 31,900 31,300 ($0.60) 32,000 31,400 30,800 ($0.80) 31,000 30,400 29,800 ($1.00) 30,000 29,400 28,800 ($1.20) 29,000 28,400 27,800 3

CONFIDENTIAL Appendix 4

CONFIDENTIAL Exhibit A: Unit Count Purchase Price Adjustment Schedule (1) Reflects implied value per unit differential based on a 1,500 unit gap between thresholds and a $0.48 purchase price step down. (2)Reflects implied value per unit differential based on a 500 unit gap between thresholds and a $0.10 purchase price step down. Thresholds reduce by 600 units each month after January 2025 Implied Reduction in Value per Lost Unit: ~$7.7K(1) Implied Reduction in Value per Lost Unit: ~$4.8K(2) Casago / Roofstock Offer Purchase Price per Share Unit Count Threshold $4.82 36,000 $4.34 34,500 $3.86 33,000 $3.37 31,500 $2.89 30,000 For Internal Reference OnlyPlanned Response Illustrative Purchase Price Unit Count Threshold by Close Date per Share 1/31/2025 2/28/2025 3/31/2025 4/30/2025 Memo: End of Month Unit Count Mgmt. Forecast 36,732 36,334 35,902 35,499 $5.00 35,000 34,400 33,800 33,200 $4.90 34,500 33,900 33,300 32,700 $4.80 34,000 33,400 32,800 32,200 $4.70 33,500 32,900 32,300 31,700 $4.60 33,000 32,400 31,800 31,200 $4.50 32,500 31,900 31,300 30,700 $4.40 32,000 31,400 30,800 30,200 $4.20 31,000 30,400 29,800 29,200 $4.00 30,000 29,400 28,800 28,200 $3.80 29,000 28,400 27,800 27,2005

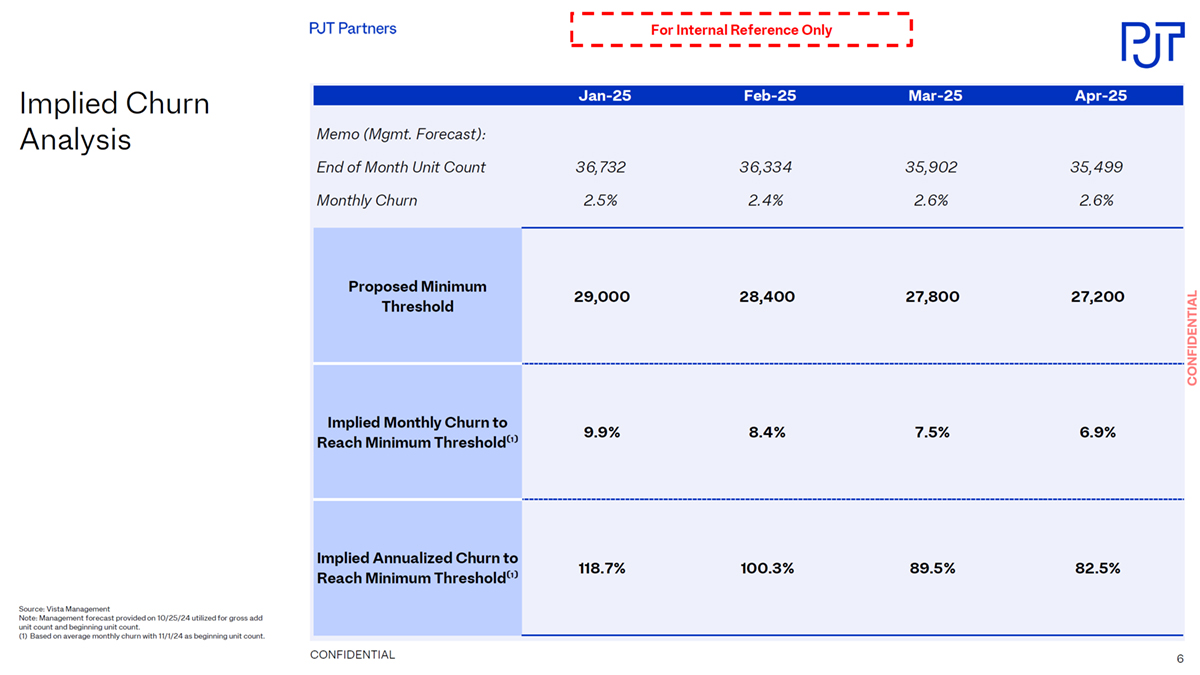

CONFIDENTIAL Implied Churn Analysis Source: Vista Management Note: Management forecast provided on 10/25/24 utilized for gross add unit count and beginning unit count. (1) Based on average monthly churn with 11/1/24 as beginning unit count. Jan-25 Feb-25 Mar-25 Apr-25 Memo (Mgmt. Forecast): End of Month Unit Count 36,732 36,334 35,902 35,499 Monthly Churn 2.5% 2.4% 2.6% 2.6% Proposed Minimum Threshold 29,000 28,400 27,800 27,200 Implied Monthly Churn to Reach Minimum Threshold⁽¹⁾ 9.9% 8.4% 7.5% 6.9% Implied Annualized Churn to Reach Minimum Threshold⁽¹⁾ 118.7% 100.3% 89.5% 82.5% For Internal Reference Only6

CONFIDENTIAL This document contains highly confidential information and is solely for informational purposes. You should not rely upon it or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. You and your affiliates and agents must hold this document and any oral information provided in connection with this document, as well as any information derived by you from the information contained herein, in strict confidence and may not communicate, reproduce or disclose it to any other person, or refer to it publicly, in whole or in part at any time, except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately. This document is “as is” and is based, in part, on information obtained from other sources. We have assumed and relied upon the accuracy and completeness of such information for purposes of this document and have not independently verified any such information. Neither we nor any of our affiliates or agents, makes any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. Any views or terms contained herein are preliminary, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are subject to change. We undertake no obligation or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance. This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report nor should it be construed as such. This document may include information from the S&P Capital IQ Platform Service. Such information is subject to the following: “Copyright © 2024, S&P Capital IQ (and its affiliates, as applicable). This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.” This document may include information from SNL Financial LC. Such information is subject to the following: “CONTAINS COPYRIGHTED AND TRADE SECRET MATERIAL DISTRIBUTED UNDER LICENSE FROM SNL. FOR RECIPIENT’S INTERNAL USE ONLY.” PJT Partners is an SEC registered broker-dealer and is a member of FINRA and SIPC.PJT Partners is represented in the United Kingdom by PJT Partners (UK) Limited.PJT Partners (UK) Limited is authorised and regulated by the Financial Conduct Authority (Ref No. 678983) and is a company registered in England and Wales (No. 9424559).PJT Partners is represented in the European Economic Union by PJT Partners Park Hill (Spain) A.V., S.A.U., a firm authorized and regulated by the Comision Nacional del Mercado de Valores (“CNMV”). PJT Partners is represented in Hong Kong by PJT Partners (HK) Limited, authorised and regulated by the Securities and Futures Commission, and in Australia, by PJT Partners (HK) Limited, by relying on a passport license approved by the Australia Securities and Investment Commission. PJT Partners is represented in Japan by PJT Partners Japan K.K., a registered Type II Financial Instruments Business Operator (Registration Number: Director of Kanto Local Finance Bureau Kin-sho No. 3409), authorised and regulated by the Financial Services Agency and the Kanto Local Finance Bureau. In connection with our capital raising services in Canada, PJT Partners relies on the international dealer exemption pursuant to subsection 8.18(2) of National Instrument 31-103 Registration Requirements.Please see https://pjtpartners.com/regulatory-disclosure for more information. Copyright © 2024, PJT Partners LP (and its affiliates, as applicable). Disclaimer 7

www.pjtpartners.com 8