Exhibit (c)(v)

CONFIDENTIAL SPECIAL COMMITTEE UPDATE December 2024 Project Vista

CONFIDENTIALCategory C/R Position (12/06/24) Vista Verbal Proposal (12/08/24) C/R Verbal Proposal (12/08/24) Closing Conditions Unit Count ($0.10) reduction for every 500 units Starting point of 35,000 as of March 31, 2025 Thresholds to be reduced by 600 units for each additional month Buyer may terminate Transaction (without payment of any fees or expenses) at unit count below 25,000, regardless of close date ($0.10) reduction for every 500 units Reduction of starting purchase price adjustment threshold from 35,000 to 33,000 units as of January 31, 2025 Termination threshold reduces over time on same schedule as purchase price adjustment thresholds C/R to pay $10mm termination fee if termination right related to unit count is exercised For details, see page 5 ($0.10) reduction for every 500 units Starting purchase price adjustment threshold of 32,000 units as of April 30, 2025 Thresholds to be reduced by 600 units for each additional month Buyer may terminate Transaction (without payment of any fees or expenses) at unit count below 24,000, regardless of close date No termination fee For details, see page 4 Unit Quality Material changes to Seller’s policies regarding minimum quality, revenue or commission rates for new or renewing contracts must be approved by Buyer(1) Material changes (increases or decreases) to sales and marketing budget / forecast must be approved by Buyer Subject not addressed Subject not addressed Working Capital In addition, Seller’s working capital shall not fall more than $7.5 million below Seller’s current monthly forecast. Liquidity and working capital shall be calculated in accordance with GAAP and the Seller’s consolidated financial statements (C/R uses the RCF definition of liquidity to define working capital)(2) No liquidity requirement for the business at close Will require minimum liquidity at some level (C/R uses the RCF definition of liquidity to define working capital) May be open to purchase price adjustment vs. termination right

CONFIDENTIAL (1) Applies 50% monthly churn miss from ending unit count as of 11/30/24 and assumes no unit adds from Jan’25 onwards. Illustrative Unit Count Scenarios CURRENT UNIT COUNT FORECAST Latest Forecast (12/04) 36,090 35,558 35,042 34,590 34,286 34,173 (706) (532) (516) (452) (304) (113) 1/31/25 2/28/25 3/31/25 4/30/25 5/31/25 6/30/25 Units Lost: 25% Churn Miss 35,622 34,841 34,077 33,391 32,882 32,587 50% Churn Miss 35,154 34,124 33,113 32,192 31,479 31,000 50% Churn Miss without Unit Adds 34,829 33,335 31,848 30,441 29,214 28,118 Vista Proposal (12/08) 33,000 32,400 31,800 31,200 30,600 30,000 Updated C/R Proposal (12/08) 32,000 32,000 32,000 32,000 31,400 30,800 Forecasted Ending Unit Count Unit Count to Hit Price Reduction Threshold Month Units Lost Sep-24 (553) Oct-24 (745) Nov-24 (588) Total (1,886) November 2024 Ending Unit Count: 37,1273

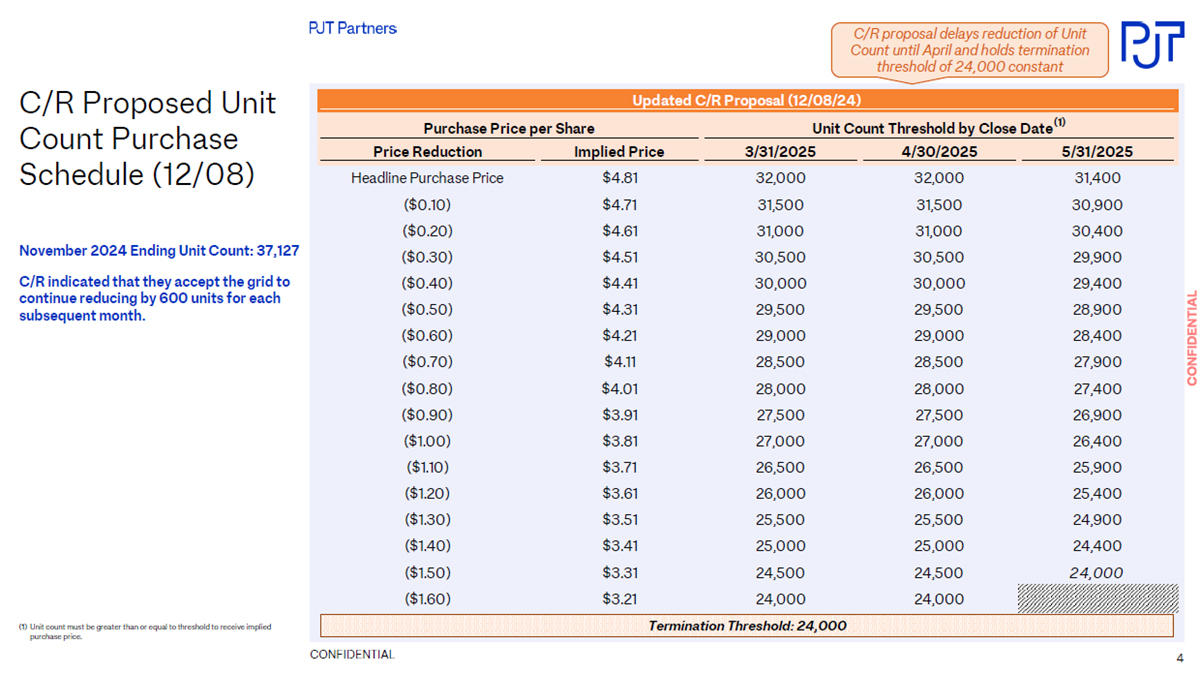

CONFIDENTIAL C/R Proposed Unit Count Purchase Schedule (12/08) (1)Unit count must be greater than or equal to threshold to receive implied purchase price. Termination Threshold: 24,000 C/R proposal delays reduction of Unit Count until April and holds termination threshold of 24,000 constant November 2024 Ending Unit Count: 37,127 C/R indicated that they accept the grid to continue reducing by 600 units for each subsequent month.Updated C/R Proposal (12/08/24)Purchase Price per ShareUnit Count Threshold by Close Date(1)Price ReductionImplied Price3/31/20254/30/20255/31/2025Headline Purchase Price$4.81 32,000 32,000 31,400 ($0.10)$4.71 31,500 31,500 30,900 ($0.20)$4.61 31,000 31,000 30,400 ($0.30)$4.51 30,500 30,500 29,900 ($0.40)$4.41 30,000 30,000 29,400 ($0.50)$4.31 29,500 29,500 28,900 ($0.60)$4.21 29,000 29,000 28,400 ($0.70)$4.11 28,500 28,500 27,900 ($0.80)$4.01 28,000 28,000 27,400 ($0.90)$3.91 27,500 27,500 26,900 ($1.00)$3.81 27,000 27,000 26,400 ($1.10)$3.71 26,500 26,500 25,900 ($1.20)$3.61 26,000 26,000 25,400 ($1.30)$3.51 25,500 25,500 24,900 ($1.40)$3.41 25,000 25,000 24,400 ($1.50)$3.31 24,500 24,500 24,000 ($1.60)$3.21 24,000 24,000 4

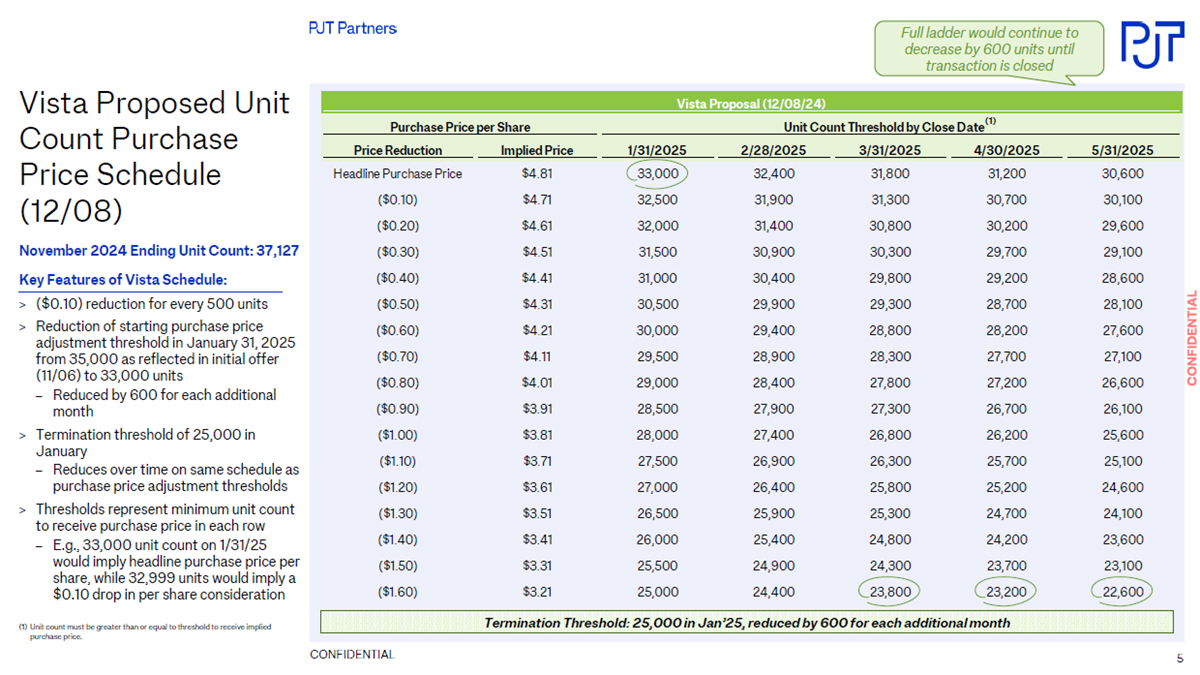

CONFIDENTIAL Vista Proposed Unit Count Purchase Price Schedule (12/08) (1) Unit count must be greater than or equal to threshold to receive implied purchase price. November 2024 Ending Unit Count: 37,127 Key Features of Vista Schedule: ($0.10) reduction for every 500 units Reduction of starting purchase price adjustment threshold in January 31, 2025 from 35,000 as reflected in initial offer (11/06) to 33,000 units Reduced by 600 for each additional month Termination threshold of 25,000 in January Reduces over time on same schedule as purchase price adjustment thresholds Thresholds represent minimum unit count to receive purchase price in each row E.g., 33,000 unit count on 1/31/25 would imply headline purchase price per share, while 32,999 units would imply a $0.10 drop in per share consideration Termination Threshold: 25,000 in Jan’25, reduced by 600 for each additional month Full ladder would continue to decrease by 600 units until transaction is closed Vista Proposal (12/08/24) Purchase Price per Share Unit Count Threshold by Close Date(1) Price Reduction Implied Price 1/31/2025 2/28/2025 3/31/2025 4/30/2025 5/31/2025 Headline Purchase Price $4.81 33,000 32,400 31,800 31,200 30,600 ($0.10) $4.71 32,500 31,900 31,300 30,700 30,100 ($0.20) $4.61 32,000 31,400 30,800 30,200 29,600 ($0.30) $4.51 31,500 30,900 30,300 29,700 29,100 ($0.40) $4.41 31,000 30,400 29,800 29,200 28,600 ($0.50) $4.31 30,500 29,900 29,300 28,700 28,100 ($0.60) $4.21 30,000 29,400 28,800 28,200 27,600 ($0.70) $4.11 29,500 28,900 28,300 27,700 27,100 ($0.80) $4.01 29,000 28,400 27,800 27,200 26,600 ($0.90) $3.91 28,500 27,900 27,300 26,700 26,100 ($1.00) $3.81 28,000 27,400 26,800 26,200 25,600 ($1.10) $3.71 27,500 26,900 26,300 25,700 25,100 ($1.20) $3.61 27,000 26,400 25,800 25,200 24,600 ($1.30) $3.51 26,500 25,900 25,300 24,700 24,100 ($1.40) $3.41 26,000 25,400 24,800 24,200 23,600 ($1.50) $3.31 25,500 24,900 24,300 23,700 23,100 ($1.60) $3.21 25,000 24,400 23,800 23,200 22,600 5

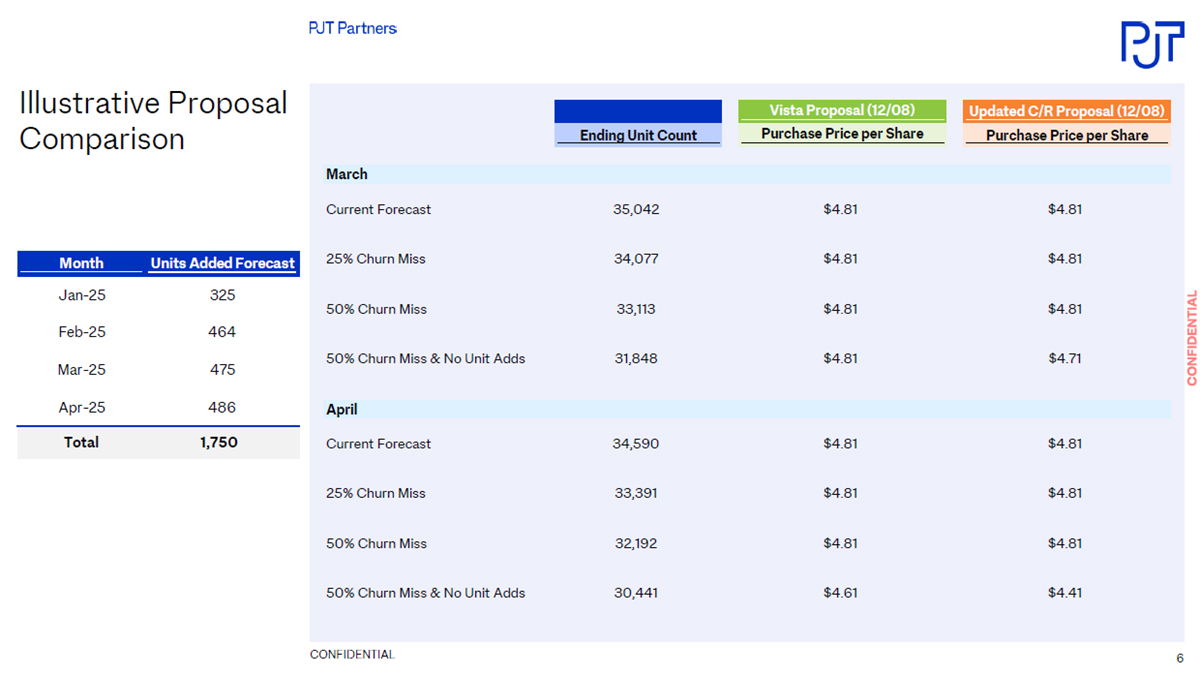

CONFIDENTIAL Illustrative Proposal Comparison Month Units Added Forecast Jan-25 325 Feb-25 464 Mar-25 475 Apr-25 486 Total 1,750 Vista Proposal (12/08) Updated C/R Proposal (12/08) Ending Unit Count Purchase Price per Share Purchase Price per Share March Current Forecast 35,042 $4.81 $4.81 25% Churn Miss 34,077 $4.81 $4.81 50% Churn Miss 33,113 $4.81 $4.81 50% Churn Miss & No Unit Adds 31,848 $4.81 $4.71 April Current Forecast 34,590 $4.81 $4.81 25% Churn Miss 33,391 $4.81 $4.81 50% Churn Miss 32,192 $4.81 $4.81 50% Churn Miss & No Unit Adds 30,441 $4.61 $4.416

CONFIDENTIAL Implied Churn to Reach C/R Proposed Termination ThresholdNo Unit Adds Starting in Jan’25 (1)Dec’24 ending unit count reflects Management forecast. (2)Last three months period represents Sep’24 – Nov’24. Assuming no units added, the required churn rates to hit C/R proposed Mar’25 and Apr’25 termination thresholds are 13.3% and 10.1% respectively. Last Three Months Average Monthly Churn and Unit Adds:(2) Gross Churn: 3.0% Net Churn: 1.6% Unit Adds: 531 Required Churn to Reach C/R Proposed Termination ThresholdDec-24Jan-25Feb-25Mar-25Apr-25Memo: C/R Proposed Termination Threshold (12/08)24,00024,00024,00024,000Required Churn for March Termination ThresholdBeginning Unit Count36,79631,91127,674(-) Churn(4,885)(4,237)(3,674)Ending Unit Count⁽¹⁾36,79631,91127,67424,000Implied Churn13.3%13.3%13.3%Required Churn for April Termination ThresholdBeginning Unit Count36,79633,06729,71726,706(-) Churn(3,728)(3,350)(3,011)(2,706)Ending Unit Count⁽¹⁾36,79633,06729,71726,70624,000Implied Churn10.1%10.1%10.1%10.1%7

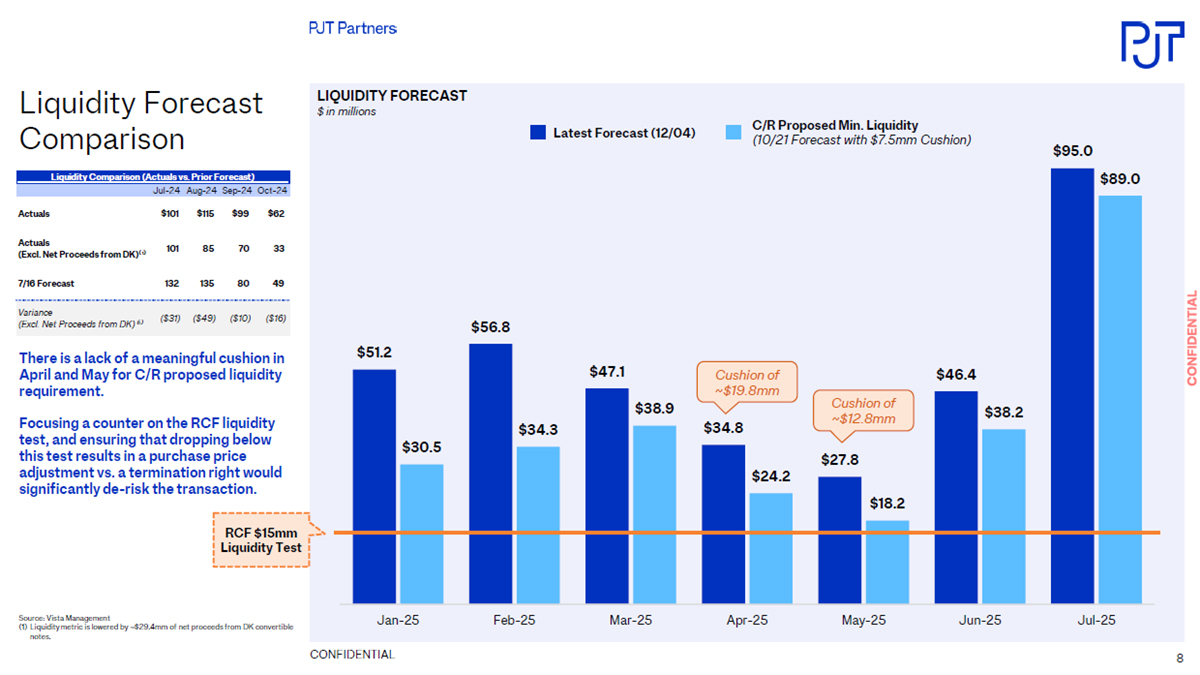

CONFIDENTIAL $51.2 $56.8 $47.1 $34.8 $27.8 $46.4 $95.0 $30.5 $34.3 $38.9 $24.2 $18.2 $38.2 $89.0 Jan-25 Feb-25 Mar-25 Apr-25 May-25 Jun-25 Jul-25 Liquidity Forecast Comparison Source: Vista Management (1) Liquidity metric is lowered by ~$29.4mm of net proceeds from DK convertible notes. LIQUIDITY FORECAST $ in millions RCF $15mm Liquidity Test Liquidity Comparison (Actuals vs. Prior Forecast) Jul-24 Aug-24 Sep-24 Oct-24 Actuals $101 $115 $99 $62 Actuals (Excl. Net Proceeds from DK)⁽¹⁾ 101 85 70 33 7/16 Forecast 132 135 80 49 Variance (Excl. Net Proceeds from DK)⁽ ¹⁾ ($31) ($49) ($10) ($16) Latest Forecast (12/04) C/R Proposed Min. Liquidity (10/21 Forecast with $7.5mm Cushion) Cushion of ~$19.8mm Cushion of ~$12.8mm There is a lack of a meaningful cushion in April and May for C/R proposed liquidity requirement. Focusing a counter on the RCF liquidity test, and ensuring that dropping below this test results in a purchase price adjustment vs. a termination right would significantly de-risk the transaction.8

CONFIDENTIAL $56.8 $47.1 $34.8 $27.8 $54.2 $43.5 $30.8 $23.5 $51.0 $39.0 $25.7 $17.7 $34.3 $38.9 $24.2 $18.2 Feb-25 Mar-25 Apr-25 May-25 Liquidity Forecast Comparison Downside Churn Scenario Source: Vista Management (1) Liquidity metric is lowered by ~$29.4mm of net proceeds from DK convertible notes. (2)Reflects FDSO of 24.2mm as of 9/30/2024. LIQUIDITY FORECAST $ in millions RCF $15mm Liquidity Test Liquidity Comparison (Actuals vs. Prior Forecast) Jul-24 Aug-24 Sep-24 Oct-24 Actuals $101 $115 $99 $62 Actuals (Excl. Net Proceeds from DK)⁽¹⁾ 101 85 70 33 7/16 Forecast 132 135 80 49 Variance (Excl. Net Proceeds from DK)⁽ ¹⁾ ($31) ($49) ($10) ($16) Latest Forecast (12/04) C/R Proposed Min. Liquidity (10/21 Forecast with $7.5mm Cushion) Latest Forecast w/ 25% Churn Miss Latest Forecast w/ 50% Churn Miss Purchase Price Adjustment Implied Purchase Price⁽²⁾ No Adjustment $4.81 ($1mm) $4.76 ($2mm) $4.72 ($3mm) $4.68 ($4mm) $4.64 ($5mm) $4.609

CONFIDENTIAL This document contains highly confidential information and is solely for informational purposes. You should not rely upon it or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. You and your affiliates and agents must hold this document and any oral information provided in connection with this document, as well as any information derived by you from the information contained herein, in strict confidence and may not communicate, reproduce or disclose it to any other person, or refer to it publicly, in whole or in part at any time, except with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately. This document is “as is” and is based, in part, on information obtained from other sources. We have assumed and relied upon the accuracy and completeness of such information for purposes of this document and have not independently verified any such information. Neither we nor any of our affiliates or agents, makes any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. Any views or terms contained herein are preliminary, and are based on financial, economic, market and other conditions prevailing as of the date of this document and are subject to change. We undertake no obligation or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance. This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of financial opinion or recommendation by us or any of our affiliates. This document is not a research report nor should it be construed as such. This document may include information from the S&P Capital IQ Platform Service. Such information is subject to the following: “Copyright © 2024, S&P Capital IQ (and its affiliates, as applicable). This may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.” This document may include information from SNL Financial LC. Such information is subject to the following: “CONTAINS COPYRIGHTED AND TRADE SECRET MATERIAL DISTRIBUTED UNDER LICENSE FROM SNL. FOR RECIPIENT’S INTERNAL USE ONLY.” PJT Partners is an SEC registered broker-dealer and is a member of FINRA and SIPC.PJT Partners is represented in the United Kingdom by PJT Partners (UK) Limited.PJT Partners (UK) Limited is authorised and regulated by the Financial Conduct Authority (Ref No. 678983) and is a company registered in England and Wales (No. 9424559).PJT Partners is represented in the European Economic Union by PJT Partners Park Hill (Spain) A.V., S.A.U., a firm authorized and regulated by the Comision Nacional del Mercado de Valores (“CNMV”). PJT Partners is represented in Hong Kong by PJT Partners (HK) Limited, authorised and regulated by the Securities and Futures Commission, and in Australia, by PJT Partners (HK) Limited, by relying on a passport license approved by the Australia Securities and Investment Commission. PJT Partners is represented in Japan by PJT Partners Japan K.K., a registered Type II Financial Instruments Business Operator (Registration Number: Director of Kanto Local Finance Bureau Kin-sho No. 3409), authorised and regulated by the Financial Services Agency and the Kanto Local Finance Bureau. In connection with our capital raising services in Canada, PJT Partners relies on the international dealer exemption pursuant to subsection 8.18(2) of National Instrument 31-103 Registration Requirements.Please see https://pjtpartners.com/regulatory-disclosure for more information. Copyright © 2024, PJT Partners LP (and its affiliates, as applicable). Disclaimer 10