Casago Transaction Is in the Best Interests of Vacasa Shareholders April 2025

Cautionary Note Regarding Forward-Looking Statements The information included herein and

in any oral statements made in connection herewith contains forward-looking statements. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties,

and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements and speak only

as of the date they are made. Words such as “aim,” “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would,”

“target, ” “forecast,” “outlook,” or the negative of these terms or other similar expressions are intended to identify such forward-looking statements. Specific forward-looking statements include, among others, statements regarding forecasts

and projections; estimated costs, expenditures, cash flows, growth rates and financial results; plans and objectives for future operations, growth or initiatives; strategies or the expected outcome or impact of pending or threatened litigation;

and expected timetable for completing the proposed transaction. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to the Company. Such beliefs and assumptions may or may not

prove to be correct. Additionally, such forward-looking statements are subject to numerous risks and uncertainties that are difficult to predict and many of which are beyond the Company’s control, which could cause actual results to differ

materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: (i) the failure to obtain the required votes of the Company’s stockholders; (ii) the timing to consummate the

proposed transaction; (iii) the satisfaction of the conditions to closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction otherwise does not occur; (iv) risks related to the ability of the

Company to realize the anticipated benefits of the proposed transaction, including the possibility that the expected benefits from the proposed transaction will not be realized or will not be realized within the expected time period; (v) the

diversion of management time on transaction-related issues; (vi) results of litigation, settlements and investigations in connection with the proposed transaction; (vii) actions by third parties, including governmental agencies; (viii) global

economic conditions; (ix) potential business uncertainty, including changes to existing business and customer relationships during the pendency of the proposed transaction that could affect financial performance; (x) adverse industry

conditions; (xi) adverse credit and equity market conditions; (xii) the loss of, or reduction in business with, key customers; legal proceedings; (xiii) the ability to effectively identify and enter new markets; (xiv) governmental regulation;

(xv) the ability to retain management and other personnel; and (xvi) other economic, business, or competitive factors. Additional information concerning factors that could cause actual results to differ materially from those in the

forward-looking statements is contained from time to time in the Company’s filings with the SEC. The Company’s SEC filings may be obtained by contacting the Company, through the Company’s website at investors.vacasa.com or through the SEC’s

Electronic Data Gathering and Analysis Retrieval System at www.sec.gov. The Company undertakes no obligation to publicly update or revise any forward-looking statement. Additional Information and Where to Find It The proposed transaction

between the Company and Vacasa Holdings LLC and Casago Holdings, LLC (the “proposed transaction”) is expected to be submitted to the stockholders of the Company for their consideration. In connection with the proposed transaction, the Company

filed a definitive proxy statement on Schedule 14A with the SEC on March 28, 2025 (the “Proxy Statement”). Following the filing of the Proxy Statement, the Company mailed the Proxy Statement to the stockholders of the Company. INVESTORS AND

STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT HAVE BEEN FILED OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION. Investors and stockholders may obtain a free copy of the Proxy Statement and other documents filed with the SEC by the Company, at the Company’s website, investors.vacasa.com, or at the SEC’s website, www.sec.gov. The

Proxy Statement and other relevant documents may also be obtained for free from the Company by writing to Vacasa, Inc., 850 NW 13th Avenue, Portland, Oregon 97209, Attention: Investor Relations. Participants in the Solicitation The Company

and its directors and executive officers may be deemed, under SEC rules, to be participants in the solicitation of proxies from the stockholders of the Company in connection with the proposed transaction. Information about the compensation of

the directors and named executive officers of the Company is set forth in the “Director Compensation” and “Executive Compensation Matters” sections of the definitive proxy statement for the 2024 annual meeting of stockholders of the Company,

which was filed with the SEC on April 8, 2024, commencing on pages 16 and 30, respectively, and information regarding the participants’ holdings of the Company’s securities is set forth in the “Security Ownership of Certain Beneficial Owners

and Management” section of the Proxy Statement, commencing on page 141. The Proxy Statement can be obtained free of charge from the sources indicated above. To the extent holdings of the Company’s securities by its directors or executive

officers have changed since the amounts set forth in the Proxy Statement, such changes will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the Proxy Statement and other relevant materials filed with the

SEC. Disclaimer

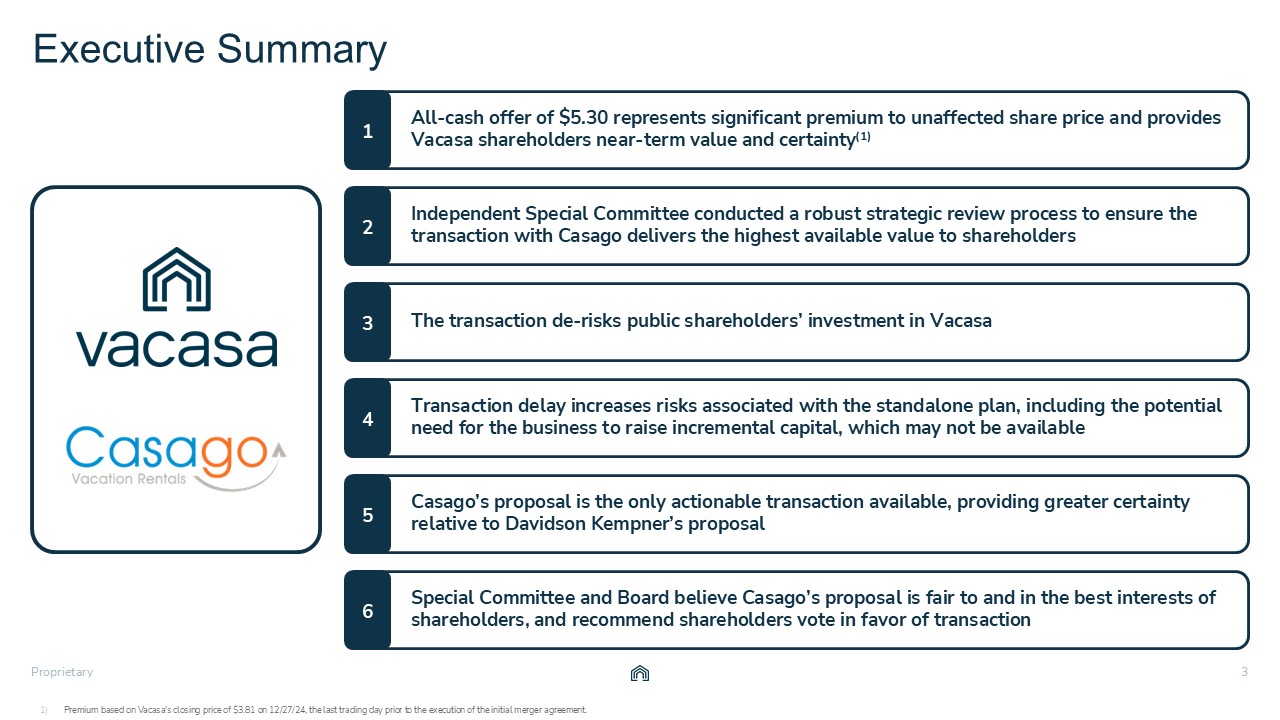

Premium based on Vacasa's closing price of $3.81 on 12/27/24, the last trading day prior to

the execution of the initial merger agreement. Executive Summary All-cash offer of $5.30 represents significant premium to unaffected share price and provides Vacasa shareholders near-term value and certainty(1) 1 Independent Special

Committee conducted a robust strategic review process to ensure the transaction with Casago delivers the highest available value to shareholders 2 The transaction de-risks public shareholders’ investment in Vacasa 3 Casago’s proposal is the

only actionable transaction available, providing greater certainty relative to Davidson Kempner’s proposal 5 Special Committee and Board believe Casago’s proposal is fair to and in the best interests of shareholders, and recommend

shareholders vote in favor of transaction 6 Transaction delay increases risks associated with the standalone plan, including the potential need for the business to raise incremental capital, which may not be available 4

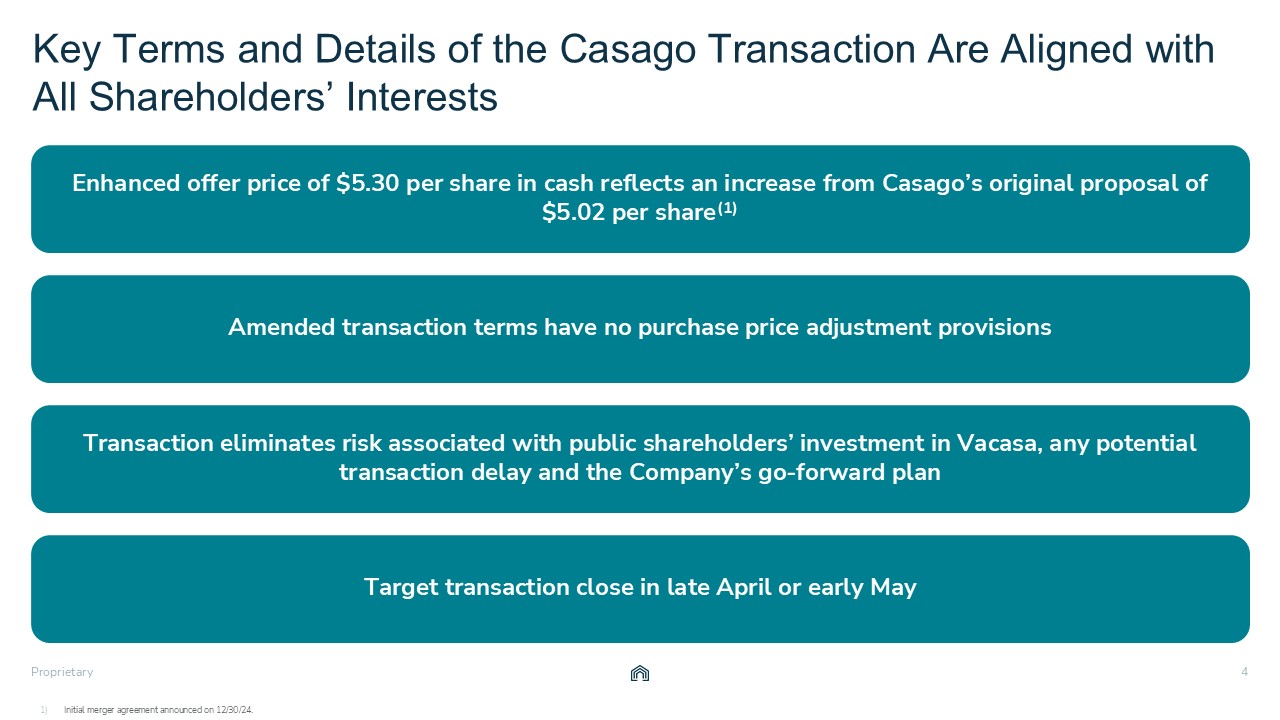

Initial merger agreement announced on 12/30/24. Enhanced offer price of $5.30 per share in

cash reflects an increase from Casago’s original proposal of $5.02 per share(1) Amended transaction terms have no purchase price adjustment provisions Transaction eliminates risk associated with public shareholders’ investment in Vacasa, any

potential transaction delay and the Company’s go-forward plan Target transaction close in late April or early May Key Terms and Details of the Casago Transaction Are Aligned with All Shareholders’ Interests

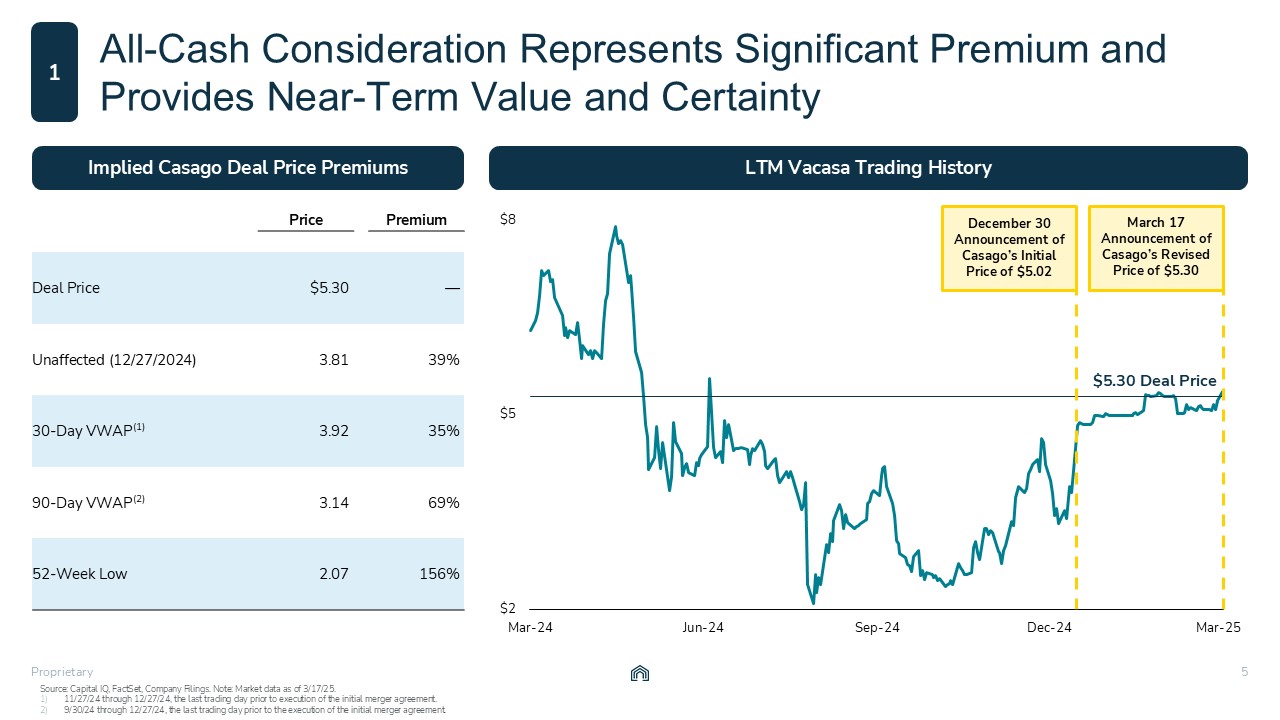

Source: Capital IQ, FactSet, Company Filings. Note: Market data as of 3/17/25. 11/27/24

through 12/27/24, the last trading day prior to execution of the initial merger agreement. 9/30/24 through 12/27/24, the last trading day prior to the execution of the initial merger agreement. Price Premium Deal Price $5.30 — Unaffected

(12/27/2024) 3.81 39% 30-Day VWAP(1) 3.92 35% 90-Day VWAP(2) 3.14 69% 52-Week Low 2.07 156% Implied Casago Deal Price Premiums LTM Vacasa Trading History All-Cash Consideration Represents Significant Premium and Provides

Near-Term Value and Certainty 1 December 30Announcement of Casago’s Initial Price of $5.02 $5.30 Deal Price March 17 Announcement of Casago’s Revised Price of $5.30

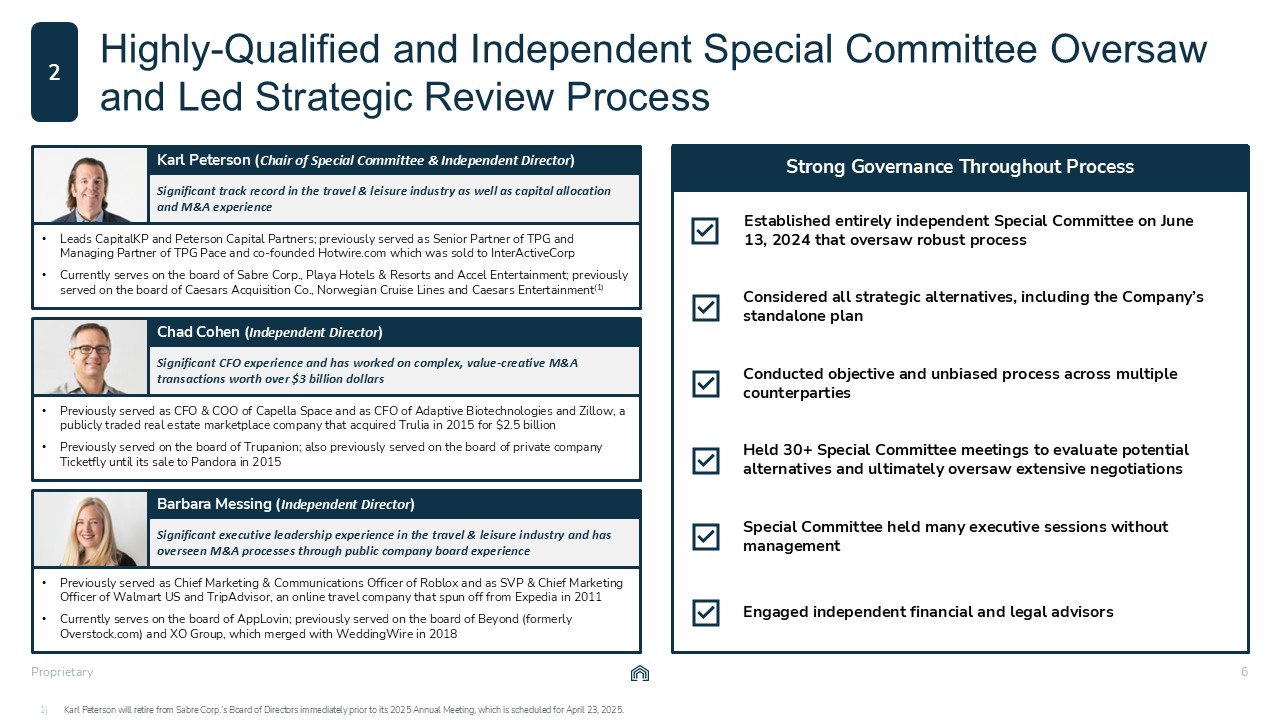

Karl Peterson will retire from Sabre Corp.’s Board of Directors immediately prior to its

2025 Annual Meeting, which is scheduled for April 23, 2025. Highly-Qualified and Independent Special Committee Oversaw and Led Strategic Review Process 2 Significant track record in the travel & leisure industry as well as capital

allocation and M&A experience Karl Peterson (Chair of Special Committee & Independent Director) Leads CapitalKP and Peterson Capital Partners; previously served as Senior Partner of TPG and Managing Partner of TPG Pace and co-founded

Hotwire.com which was sold to InterActiveCorp Currently serves on the board of Sabre Corp., Playa Hotels & Resorts and Accel Entertainment; previously served on the board of Caesars Acquisition Co., Norwegian Cruise Lines and Caesars

Entertainment(1) Significant CFO experience and has worked on complex, value-creative M&A transactions worth over $3 billion dollars Chad Cohen (Independent Director) Previously served as CFO & COO of Capella Space and as CFO of

Adaptive Biotechnologies and Zillow, a publicly traded real estate marketplace company that acquired Trulia in 2015 for $2.5 billion Previously served on the board of Trupanion; also previously served on the board of private company Ticketfly

until its sale to Pandora in 2015 Significant executive leadership experience in the travel & leisure industry and has overseen M&A processes through public company board experience Barbara Messing (Independent Director) Previously

served as Chief Marketing & Communications Officer of Roblox and as SVP & Chief Marketing Officer of Walmart US and TripAdvisor, an online travel company that spun off from Expedia in 2011 Currently serves on the board of AppLovin;

previously served on the board of Beyond (formerly Overstock.com) and XO Group, which merged with WeddingWire in 2018 Strong Governance Throughout Process Established entirely independent Special Committee on June 13, 2024 that oversaw robust

process Held 30+ Special Committee meetings to evaluate potential alternatives and ultimately oversaw extensive negotiations Engaged independent financial and legal advisors Conducted objective and unbiased process across multiple

counterparties Considered all strategic alternatives, including the Company’s standalone plan Special Committee held many executive sessions without management

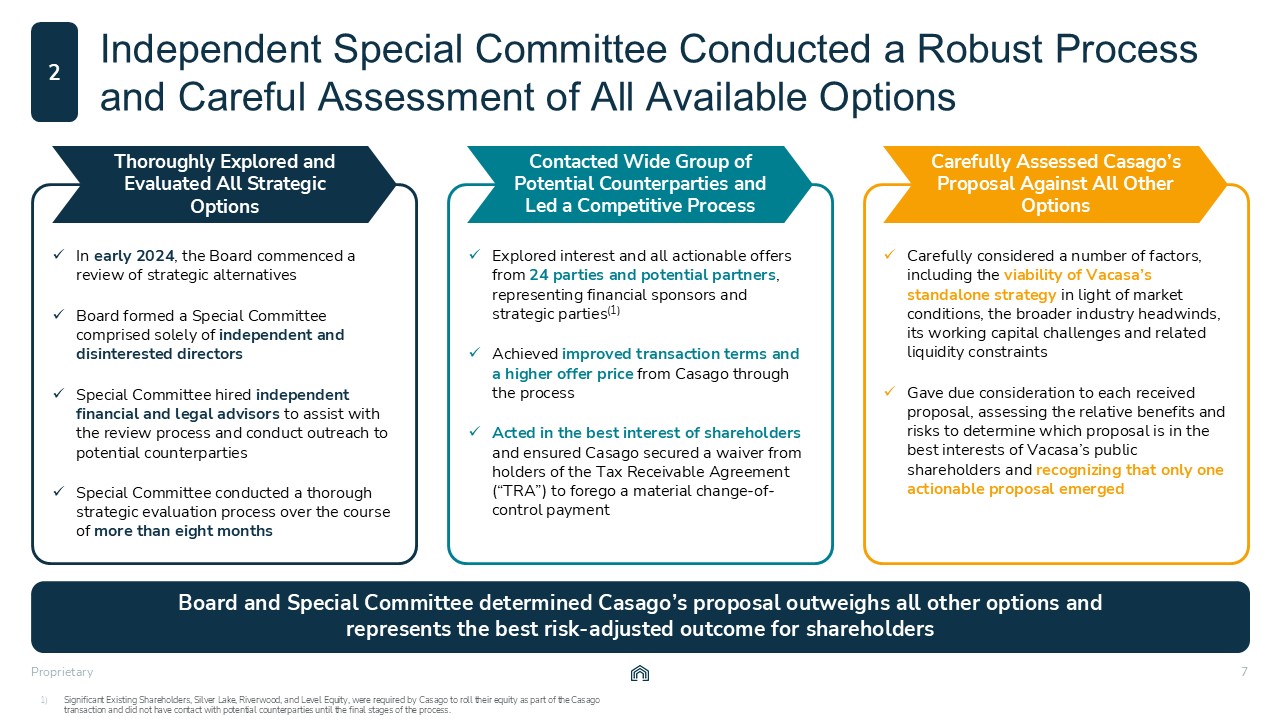

Significant Existing Shareholders, Silver Lake, Riverwood, and Level Equity, were required

by Casago to roll their equity as part of the Casago transaction and did not have contact with potential counterparties until the final stages of the process. In early 2024, the Board commenced a review of strategic alternatives Board formed

a Special Committee comprised solely of independent and disinterested directors Special Committee hired independent financial and legal advisors to assist with the review process and conduct outreach to potential counterparties Special

Committee conducted a thorough strategic evaluation process over the course of more than eight months Board and Special Committee determined Casago’s proposal outweighs all other options andrepresents the best risk-adjusted outcome for

shareholders Independent Special Committee Conducted a Robust Process and Careful Assessment of All Available Options 2 Explored interest and all actionable offers from 24 parties and potential partners, representing financial sponsors and

strategic parties(1) Achieved improved transaction terms and a higher offer price from Casago through the process Acted in the best interest of shareholders and ensured Casago secured a waiver from holders of the Tax Receivable Agreement

(“TRA”) to forego a material change-of-control payment Thoroughly Explored and Evaluated All Strategic Options Contacted Wide Group of Potential Counterparties and Led a Competitive Process Carefully considered a number of factors,

including the viability of Vacasa’s standalone strategy in light of market conditions, the broader industry headwinds, its working capital challenges and related liquidity constraints Gave due consideration to each received proposal, assessing

the relative benefits and risks to determine which proposal is in the best interests of Vacasa’s public shareholders and recognizing that only one actionable proposal emerged Carefully Assessed Casago’s Proposal Against All Other Options

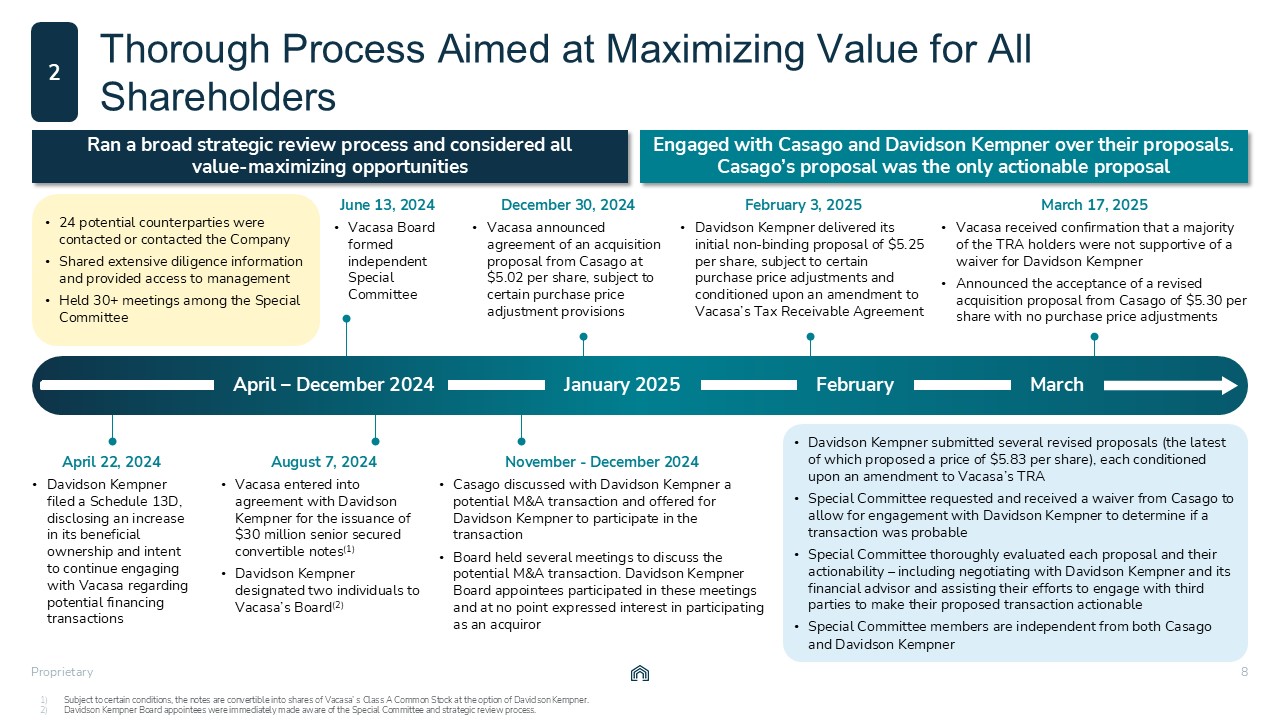

December 30, 2024 Vacasa announced agreement of an acquisition proposal from Casago at

$5.02 per share, subject to certain purchase price adjustment provisions March 17, 2025 Vacasa received confirmation that a majority of the TRA holders were not supportive of a waiver for Davidson Kempner Announced the acceptance of a

revised acquisition proposal from Casago of $5.30 per share with no purchase price adjustments February 3, 2025 Davidson Kempner delivered its initial non-binding proposal of $5.25 per share, subject to certain purchase price adjustments and

conditioned upon an amendment to Vacasa’s Tax Receivable Agreement 24 potential counterparties were contacted or contacted the Company Shared extensive diligence information and provided access to management Held 30+ meetings among the

Special Committee Subject to certain conditions, the notes are convertible into shares of Vacasa’ s Class A Common Stock at the option of Davidson Kempner. Davidson Kempner Board appointees were immediately made aware of the Special Committee

and strategic review process. Thorough Process Aimed at Maximizing Value for All Shareholders 2 April – December 2024 January 2025 February March August 7, 2024 Vacasa entered into agreement with Davidson Kempner for the issuance of $30

million senior secured convertible notes(1) Davidson Kempner designated two individuals to Vacasa’s Board(2) Davidson Kempner submitted several revised proposals (the latest of which proposed a price of $5.83 per share), each conditioned upon

an amendment to Vacasa’s TRA Special Committee requested and received a waiver from Casago to allow for engagement with Davidson Kempner to determine if a transaction was probable Special Committee thoroughly evaluated each proposal and their

actionability – including negotiating with Davidson Kempner and its financial advisor and assisting their efforts to engage with third parties to make their proposed transaction actionable Special Committee members are independent from both

Casago and Davidson Kempner Ran a broad strategic review process and considered allvalue-maximizing opportunities Engaged with Casago and Davidson Kempner over their proposals.Casago’s proposal was the only actionable proposal April 22,

2024 Davidson Kempner filed a Schedule 13D, disclosing an increase in its beneficial ownership and intent to continue engaging with Vacasa regarding potential financing transactions November - December 2024 Casago discussed with Davidson

Kempner a potential M&A transaction and offered for Davidson Kempner to participate in the transaction Board held several meetings to discuss the potential M&A transaction. Davidson Kempner Board appointees participated in these

meetings and at no point expressed interest in participating as an acquiror June 13, 2024 Vacasa Board formed independent Special Committee

The viability of Vacasa’s standalone strategy, in light of market conditions and the

broader industry headwinds The Company’s working capital challenges and liquidity constraints The need to pursue additional capital-raising transactions to continue as a standalone company over the long-term, which may not be available on

acceptable terms or at all, given market conditions and terms of Vacasa’s debt The difficulty for the Company to execute on certain value-accretive opportunities and operational initiatives in a public company setting Certainty of outcome for

public shareholders and timing of execution Key Considerations Included: Transaction De-Risks Public Shareholders’ Investment in Vacasa; Standalone Plan Subject to Market Uncertainty and Need for Incremental Capital Significant shareholder

value is at risk absent a near-term transaction 3/4

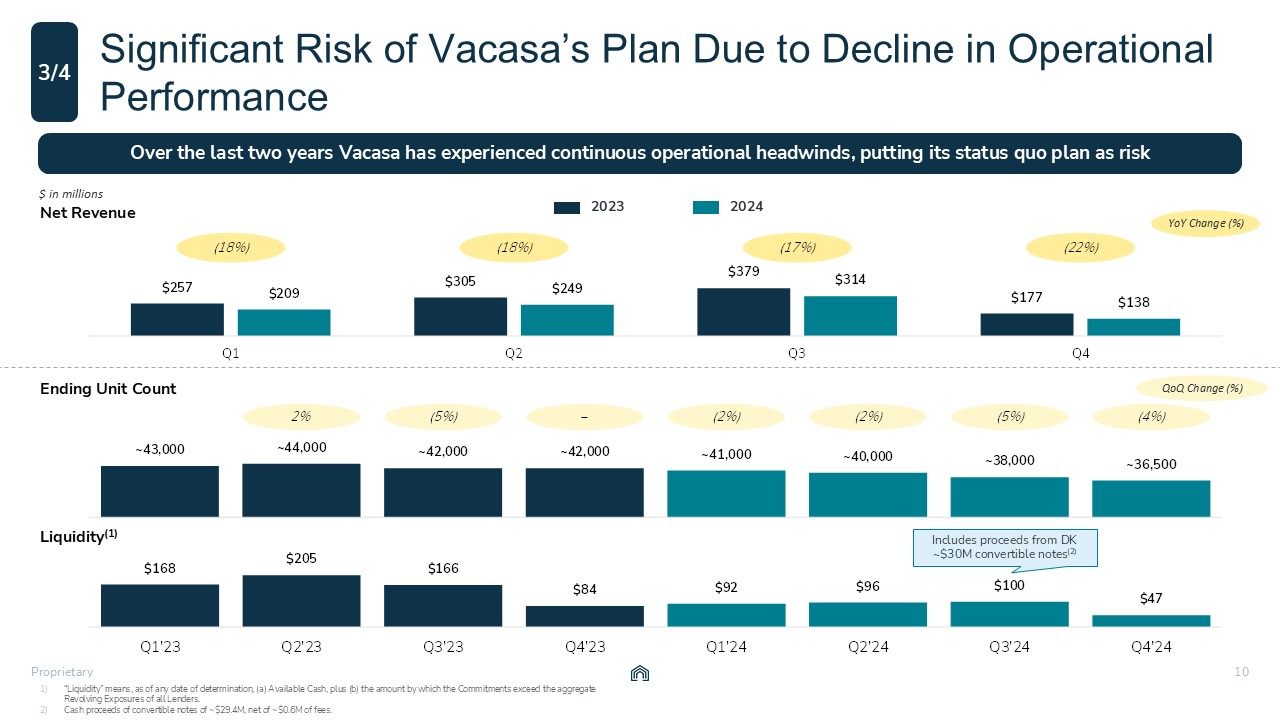

Significant Risk of Vacasa’s Plan Due to Decline in Operational Performance Net

Revenue Ending Unit Count Liquidity(1) QoQ Change (%) $ in millions Includes proceeds from DK ~$30M convertible notes(2) “Liquidity” means, as of any date of determination, (a) Available Cash, plus (b) the amount by which the Commitments

exceed the aggregate Revolving Exposures of all Lenders. Cash proceeds of convertible notes of ~$29.4M, net of ~$0.6M of fees. YoY Change (%) 2023 2024 Over the last two years Vacasa has experienced continuous operational headwinds,

putting its status quo plan as risk 3/4

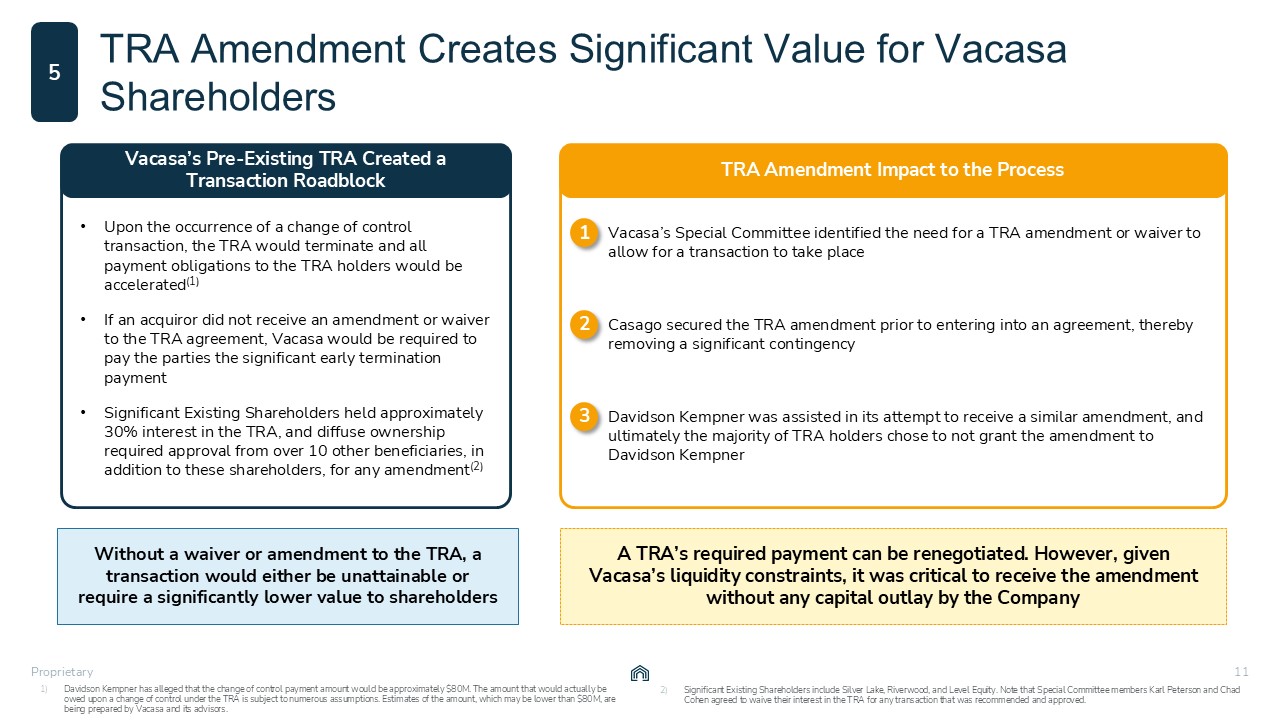

Upon the occurrence of a change of control transaction, the TRA would terminate and all

payment obligations to the TRA holders would be accelerated(1) If an acquiror did not receive an amendment or waiver to the TRA agreement, Vacasa would be required to pay the parties the significant early termination payment Significant

Existing Shareholders held approximately 30% interest in the TRA, and diffuse ownership required approval from over 10 other beneficiaries, in addition to these shareholders, for any amendment(2) Davidson Kempner has alleged that the change of

control payment amount would be approximately $80M. The amount that would actually be owed upon a change of control under the TRA is subject to numerous assumptions. Estimates of the amount, which may be lower than $80M, are being prepared by

Vacasa and its advisors. Significant Existing Shareholders include Silver Lake, Riverwood, and Level Equity. Note that Special Committee members Karl Peterson and Chad Cohen agreed to waive their interest in the TRA for any transaction that

was recommended and approved. TRA Amendment Creates Significant Value for Vacasa Shareholders 5 Without a waiver or amendment to the TRA, a transaction would either be unattainable or require a significantly lower value to

shareholders Vacasa’s Special Committee identified the need for a TRA amendment or waiver to allow for a transaction to take place Casago secured the TRA amendment prior to entering into an agreement, thereby removing a significant

contingency Davidson Kempner was assisted in its attempt to receive a similar amendment, and ultimately the majority of TRA holders chose to not grant the amendment to Davidson Kempner TRA Amendment Impact to the Process Vacasa’s

Pre-Existing TRA Created a Transaction Roadblock 1 2 3 A TRA’s required payment can be renegotiated. However, given Vacasa’s liquidity constraints, it was critical to receive the amendment without any capital outlay by the Company

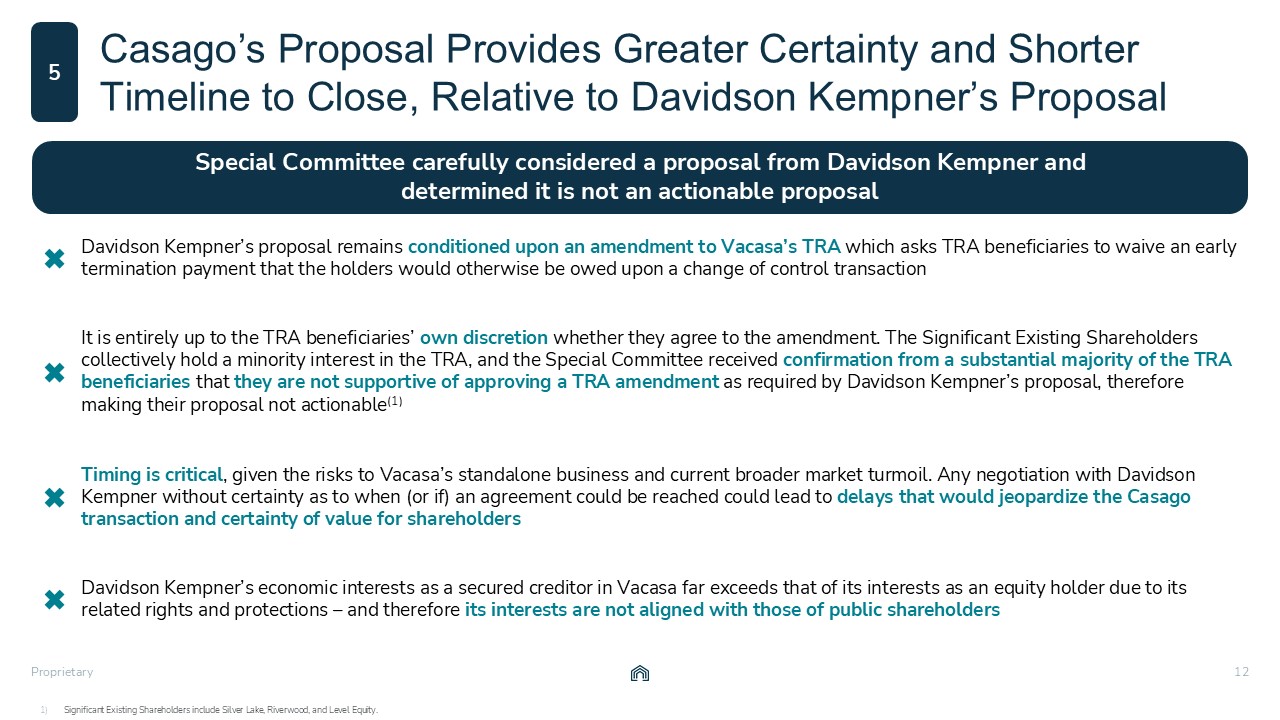

Casago’s Proposal Provides Greater Certainty and Shorter Timeline to Close, Relative to

Davidson Kempner’s Proposal Significant Existing Shareholders include Silver Lake, Riverwood, and Level Equity. 5 Special Committee carefully considered a proposal from Davidson Kempner anddetermined it is not an actionable

proposal Davidson Kempner’s proposal remains conditioned upon an amendment to Vacasa’s TRA which asks TRA beneficiaries to waive an early termination payment that the holders would otherwise be owed upon a change of control transaction Timing

is critical, given the risks to Vacasa’s standalone business and current broader market turmoil. Any negotiation with Davidson Kempner without certainty as to when (or if) an agreement could be reached could lead to delays that would jeopardize

the Casago transaction and certainty of value for shareholders Davidson Kempner’s economic interests as a secured creditor in Vacasa far exceeds that of its interests as an equity holder due to its related rights and protections – and

therefore its interests are not aligned with those of public shareholders It is entirely up to the TRA beneficiaries’ own discretion whether they agree to the amendment. The Significant Existing Shareholders collectively hold a minority

interest in the TRA, and the Special Committee received confirmation from a substantial majority of the TRA beneficiaries that they are not supportive of approving a TRA amendment as required by Davidson Kempner’s proposal, therefore making

their proposal not actionable(1)

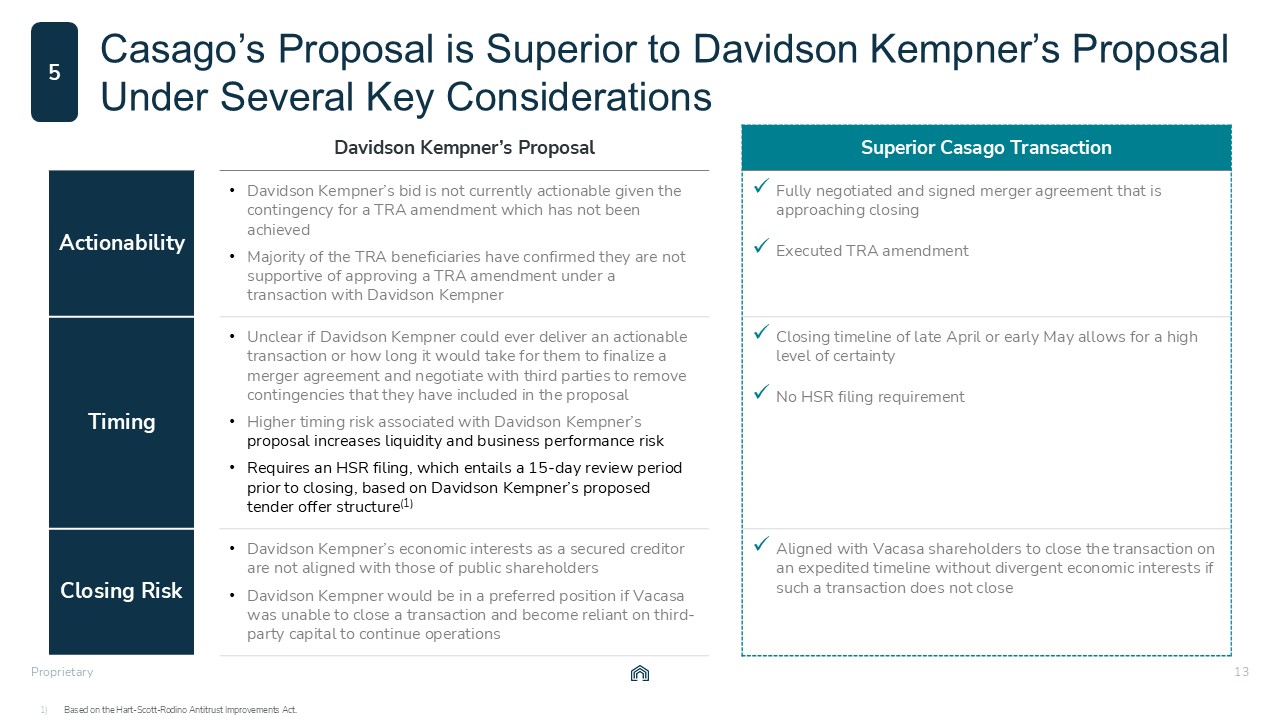

Based on the Hart-Scott-Rodino Antitrust Improvements Act. Casago’s Proposal is Superior

to Davidson Kempner’s Proposal Under Several Key Considerations 5 Davidson Kempner’s Proposal Superior Casago Transaction Actionability Davidson Kempner’s bid is not currently actionable given the contingency for a TRA amendment which has

not been achieved Majority of the TRA beneficiaries have confirmed they are not supportive of approving a TRA amendment under a transaction with Davidson Kempner Fully negotiated and signed merger agreement that is approaching

closing Executed TRA amendment Timing Unclear if Davidson Kempner could ever deliver an actionable transaction or how long it would take for them to finalize a merger agreement and negotiate with third parties to remove contingencies that

they have included in the proposal Higher timing risk associated with Davidson Kempner’s proposal increases liquidity and business performance risk Requires an HSR filing, which entails a 15-day review period prior to closing, based on

Davidson Kempner’s proposed tender offer structure(1) Closing timeline of late April or early May allows for a high level of certainty No HSR filing requirement Closing Risk Davidson Kempner’s economic interests as a secured creditor are

not aligned with those of public shareholders Davidson Kempner would be in a preferred position if Vacasa was unable to close a transaction and become reliant on third-party capital to continue operations Aligned with Vacasa shareholders to

close the transaction on an expedited timeline without divergent economic interests if such a transaction does not close

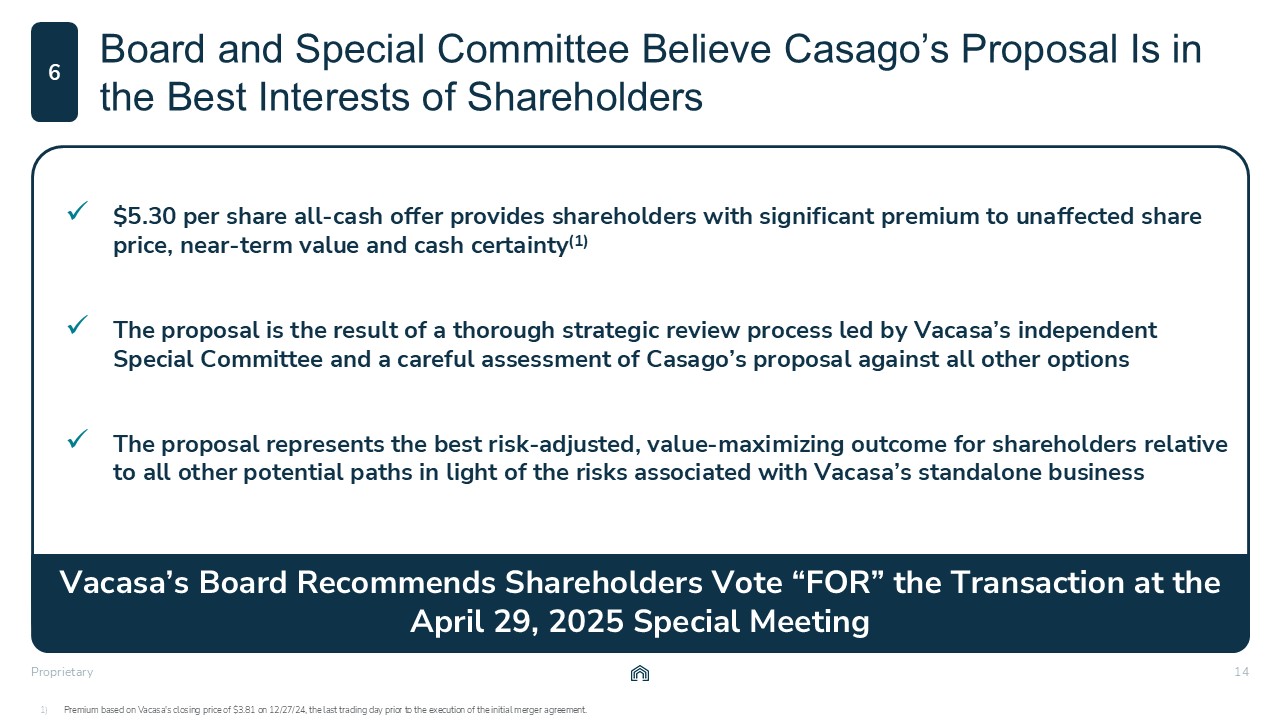

$5.30 per share all-cash offer provides shareholders with significant premium to unaffected

share price, near-term value and cash certainty(1) The proposal is the result of a thorough strategic review process led by Vacasa’s independent Special Committee and a careful assessment of Casago’s proposal against all other options The

proposal represents the best risk-adjusted, value-maximizing outcome for shareholders relative to all other potential paths in light of the risks associated with Vacasa’s standalone business Premium based on Vacasa's closing price of $3.81 on

12/27/24, the last trading day prior to the execution of the initial merger agreement. Board and Special Committee Believe Casago’s Proposal Is in the Best Interests of Shareholders 6 Vacasa’s Board Recommends Shareholders Vote “FOR” the

Transaction at the April 29, 2025 Special Meeting

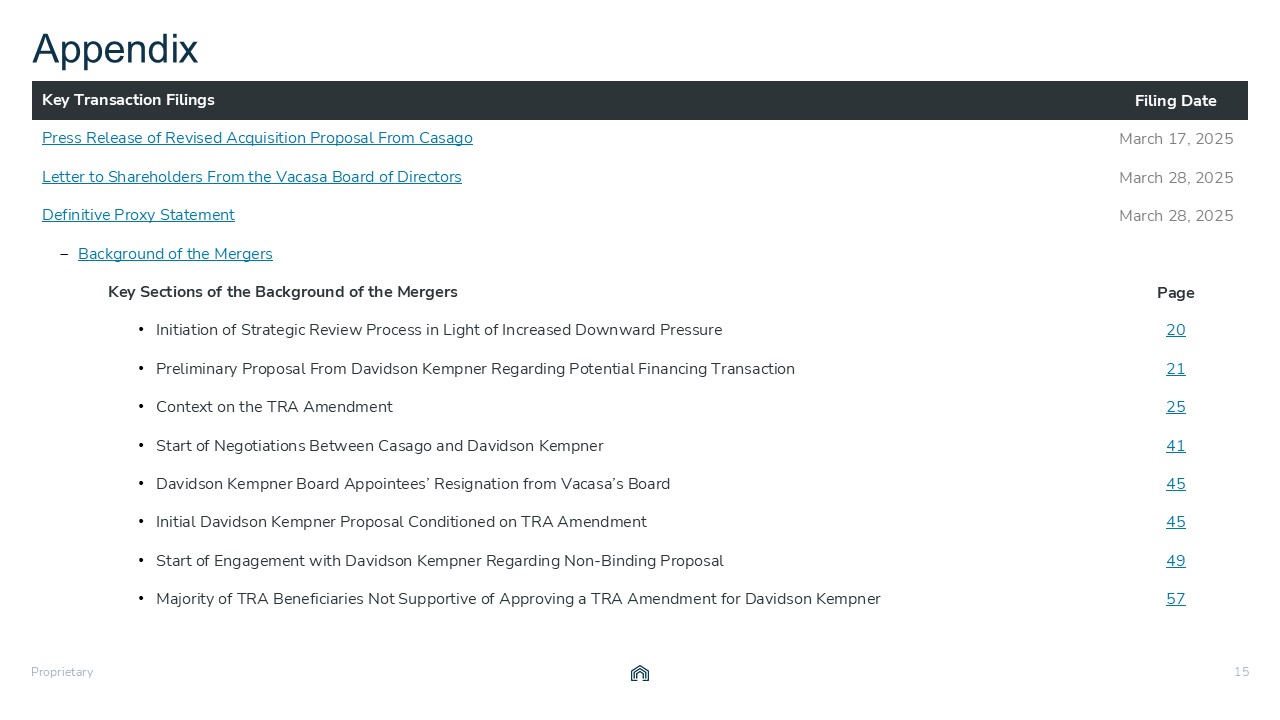

Appendix Key Transaction Filings Filing Date Press Release of Revised Acquisition

Proposal From Casago March 17, 2025 Letter to Shareholders From the Vacasa Board of Directors March 28, 2025 Definitive Proxy Statement March 28, 2025 Background of the Mergers Key Sections of the Background of the Mergers Page

Initiation of Strategic Review Process in Light of Increased Downward Pressure 20 Preliminary Proposal From Davidson Kempner Regarding Potential Financing Transaction 21 Context on the TRA Amendment 25 Start of Negotiations Between

Casago and Davidson Kempner 41 Davidson Kempner Board Appointees’ Resignation from Vacasa’s Board 45 Initial Davidson Kempner Proposal Conditioned on TRA Amendment 45 Start of Engagement with Davidson Kempner Regarding Non-Binding

Proposal 49 Majority of TRA Beneficiaries Not Supportive of Approving a TRA Amendment for Davidson Kempner 57

Thank You