2023 Long-Term Incentive Plan (LTIP) Approved 29 June 2023 Amended 21 June 2024 Exhibit 10.14

www.iren.com Page 2 of 19 IRIS ENERGY LIMITED (DOING BUSINESS AS IREN) 2023 Long-Term Incentive Plan Contents 1. Purpose, Eligibility and Shares Reserved for Issuance ................................................................................ 3 2. LTIP Award Opportunity .......................................................................................................................................... 3 3. LTIP Period, Grant Frequency, Vehicles and Performance / Vesting Period ..................................... 4 4. PRSUs - Thresholds and Measures ....................................................................................................................... 5 5. Change in Control ........................................................................................................................................................ 6 6. Dividend and Voting Rights ..................................................................................................................................... 7 7. Forfeiture ........................................................................................................................................................................ 7 8. Administration .............................................................................................................................................................. 7 9. Miscellaneous ................................................................................................................................................................ 8 Appendix: Sample Award ................................................................................................................................................ 10 IREN Long-Term Incentive Plan - Addendum for Participants in Australia ............................................. 12 IREN Long-Term Incentive Plan - Addendum for Participants in the United States .............................. 14 IREN Long-Term Incentive Plan - Addendum for Participants in Canada .................................................. 16

www.iren.com Page 3 of 19 1. Purpose, Eligibility and Shares Reserved for Issuance This document sets out the Long-Term Incentive Plan approved by the Board on 29 June 2023 (“LTIP” or “2023 LTIP”) which will be used to make all future grants of LTIP awards from and including 1 July 2023. For the avoidance of doubt, no new grants shall be made under prior long-term incentive plans including the ‘2022 Long-Term Incentive Plan’ approved by the Board on 30 June 2022 and then amended on 14 December 2022. Notwithstanding anything contained in this LTIP or otherwise, the Board has full discretion to interpret, apply or not apply, amend, or modify the LTIP and any plan rules, including the modification of individual RSU granting and vesting, in its sole discretion. The Board may terminate this LTIP in any manner and at any time. Participation in the LTIP does not create any contractual or other right to receive any other benefits, nor does participation constitute a condition or right of future employment. The LTIP is designed to: • Reward performance that generates shareholder value over the long-term; • Encourage participation by key personnel in the growth and success of the Group; and • Retain key talent. Selected full-time and part-time personnel of Iris Energy Limited (doing business as IREN) (the “Company”) and its subsidiaries (together, “IREN”), which may include employees and directors (together, “Employees”), may be invited to participate in the LTIP, with the terms, eligibility and award of a LTIP payment remaining subject to approval by the Board. Unless otherwise determined by the Board, additional conditions relating to awards under the LTIP include continued employment with IREN through to the date of vesting (with date of notice of resignation deemed termination of employment for the purposes of this LTIP), provided that: • Employees who depart IREN due to retirement, injury, ill health, permanent disability, death, redundancy, termination without cause or other exceptional circumstances may have their unvested LTIP awards vest in accordance with these rules, subject to the Board’s sole discretion; and • Employees who depart IREN prior to the date of LTIP vesting due to resignation or termination for cause will forfeit of all unvested LTIP awards. 2. LTIP Award Opportunity Unless otherwise determined by the Board in its sole discretion, maximum LTIP award opportunities are intended to be set as a percentage of the participant’s Board approved Fixed Annual Remuneration (converted to US dollars) inclusive of superannuation and other analogous payments (“FAR”) (the “Award Percentage”), based on their level in the organization (an “LTIP Eligible Position”), at the date of grant. The LTIP awards will be issued in the form of Restricted Stock Units (“RSUs”). Each RSU will entitle the participant to one ordinary share of the Company (a “Share”) upon vesting and settlement of the RSU. The maximum number of RSUs granted to a participant are intended to be calculated in the manner set out in Section 3 below, that is, the product of the Award Percentage and the participant’s FAR in US dollars (such product being the “Award Numerator”), divided by the grant date valuation as determined in Section 3 below (“Grant Date Valuation”) – refer to Appendix I for a sample calculation.

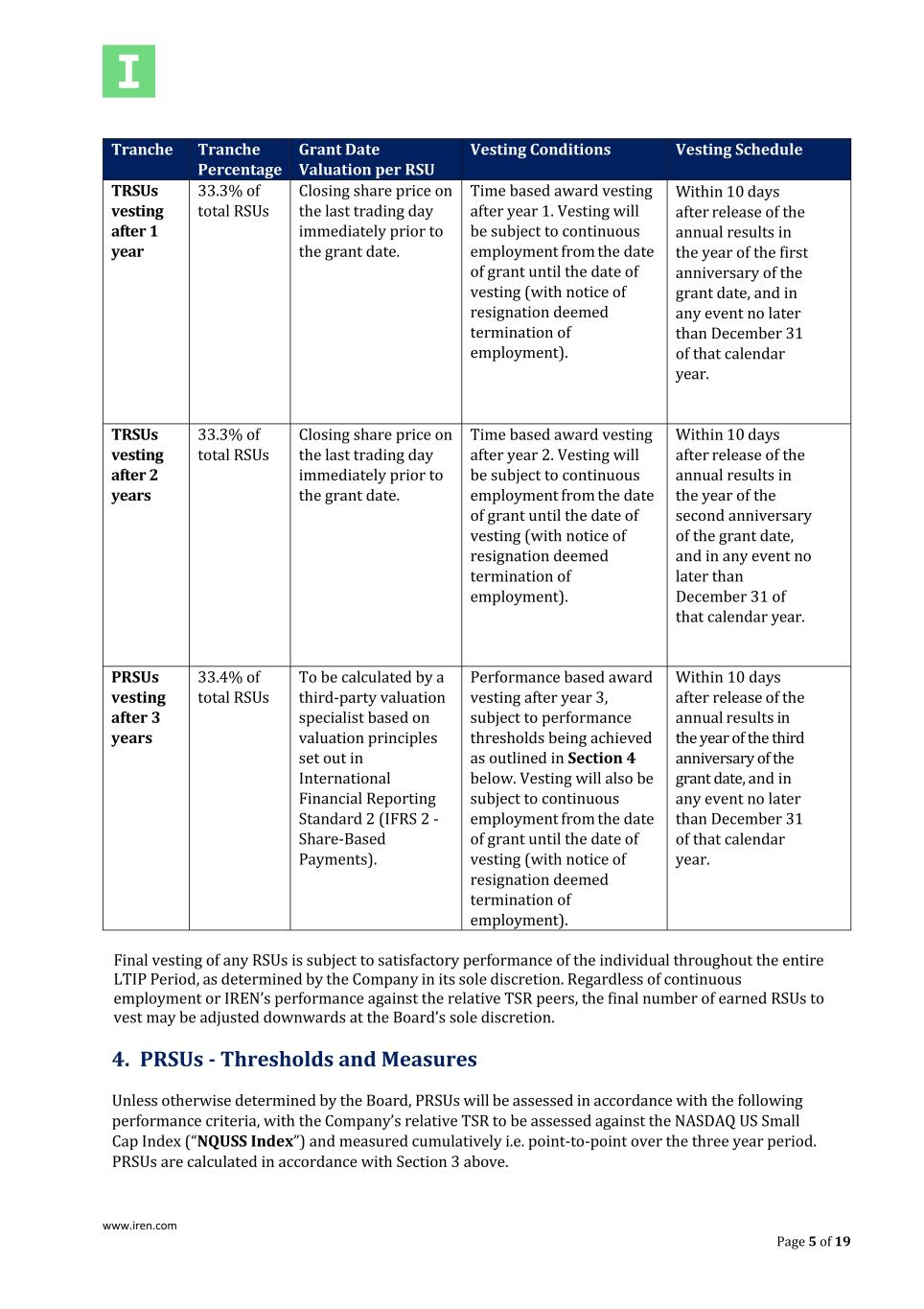

www.iren.com Page 4 of 19 RSUs will be granted to Employees who are employed by IREN as at the commencement of each LTIP performance period (being 1 July of the relevant year). With regards to Employees newly promoted or hired into a LTIP Eligible Position during the LTIP performance period, unless otherwise determined by the Board in its sole discretion the following principles will generally apply: • For those hired on or prior to 31 December of the relevant LTIP performance period: o The Employee will receive a LTIP grant pro-rated for their period of service during the LTIP period. o The grant will be made on or after 1 January of the relevant LTIP period. o The maximum number of RSUs granted will be calculated in the manner set out in Section 3. o The Vesting schedule and thresholds for both Time-based RSUs or TRSUs (defined below) and Performance-based RSUs or PRSUs (defined below) will be the same as for grants made on 1 July of the relevant LTIP period. • For those hired on or after 1 January of the relevant LTIP performance period, no LTIP grant will be made for that LTIP performance period, unless otherwise determined by the Board in its sole discretion. 3. LTIP Period, Grant Frequency, Grant Calculation, Vehicles and Performance / Vesting Period Unless otherwise determined by the Board, each LTIP award will have a vesting period of three years (the “LTIP Period”), and it is intended that a new LTIP Period will start each year, resulting in ongoing, overlapping LTIP Periods. Participants in the LTIP will be awarded grants at the beginning of each LTIP Period, with a portion of each grant (the "Time-based RSUs" or “TRSUs” described below) subject to continued employment, and a portion of each grant (the "Performance-based RSUs" or “PRSUs” described below) subject to continued employment and the achievement of pre-established performance goals (initially based on Total Shareholder Return (“TSR”) described in Section 4 below). Subject to meeting applicable conditions, LTIP awards will vest within 10 days of the release by the Board of the annual results for the LTIP Period date, and in any event no later than December 31 of that calendar year, set out within the Vesting Schedule below. The maximum number of RSUs granted to a participant is intended to be calculated by dividing the Award Numerator by the Grant Date Valuation, as follows:

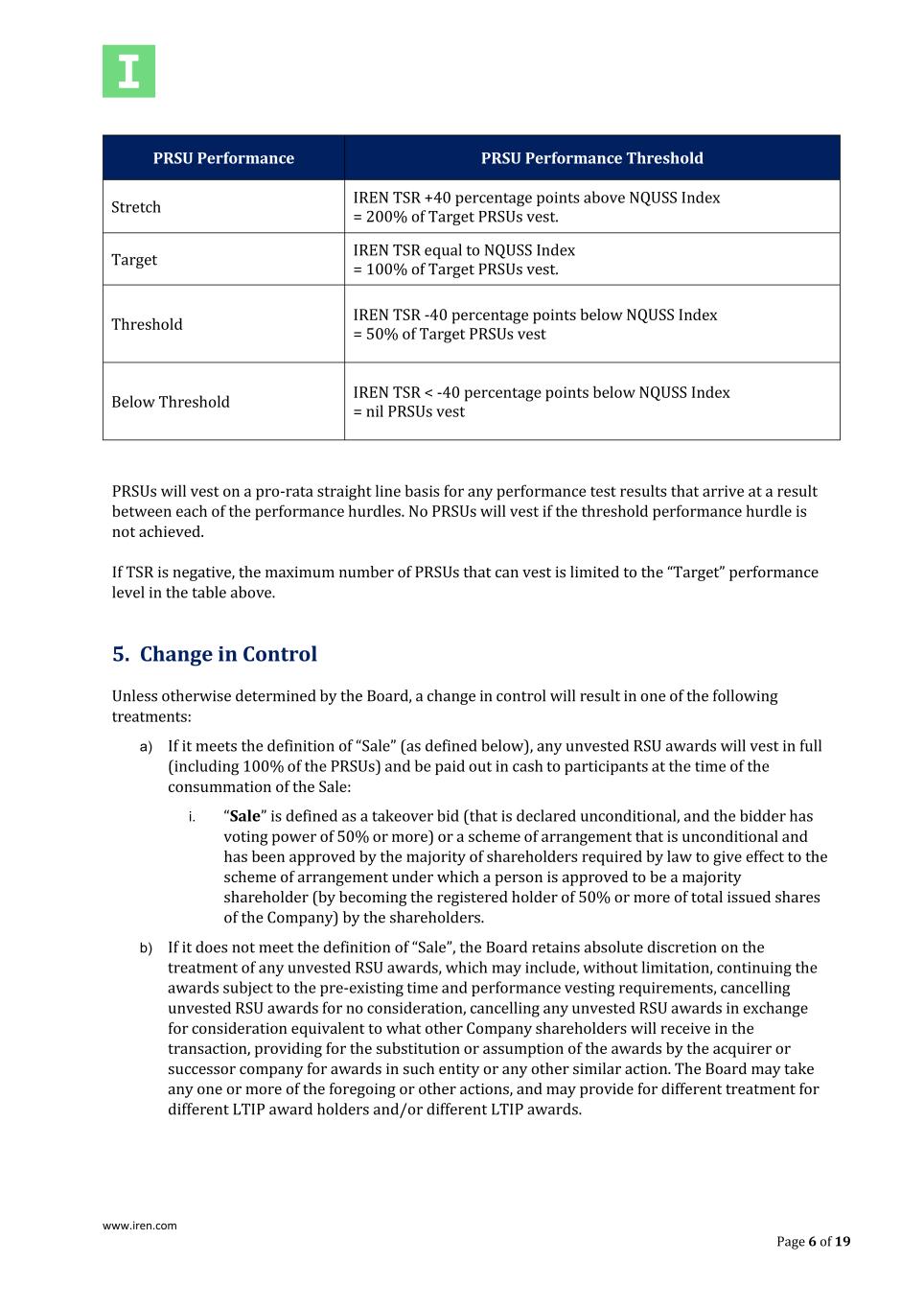

www.iren.com Page 5 of 19 Tranche Tranche Percentage Grant Date Valuation per RSU Vesting Conditions Vesting Schedule TRSUs vesting after 1 year 33.3% of total RSUs Closing share price on the last trading day immediately prior to the grant date. Time based award vesting after year 1. Vesting will be subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). Within 10 days after release of the annual results in the year of the first anniversary of the grant date, and in any event no later than December 31 of that calendar year. TRSUs vesting after 2 years 33.3% of total RSUs Closing share price on the last trading day immediately prior to the grant date. Time based award vesting after year 2. Vesting will be subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). Within 10 days after release of the annual results in the year of the second anniversary of the grant date, and in any event no later than December 31 of that calendar year. PRSUs vesting after 3 years 33.4% of total RSUs To be calculated by a third-party valuation specialist based on valuation principles set out in International Financial Reporting Standard 2 (IFRS 2 - Share-Based Payments). Performance based award vesting after year 3, subject to performance thresholds being achieved as outlined in Section 4 below. Vesting will also be subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). Within 10 days after release of the annual results in the year of the third anniversary of the grant date, and in any event no later than December 31 of that calendar year. Final vesting of any RSUs is subject to satisfactory performance of the individual throughout the entire LTIP Period, as determined by the Company in its sole discretion. Regardless of continuous employment or IREN’s performance against the relative TSR peers, the final number of earned RSUs to vest may be adjusted downwards at the Board’s sole discretion. 4. PRSUs - Thresholds and Measures Unless otherwise determined by the Board, PRSUs will be assessed in accordance with the following performance criteria, with the Company’s relative TSR to be assessed against the NASDAQ US Small Cap Index (“NQUSS Index”) and measured cumulatively i.e. point-to-point over the three year period. PRSUs are calculated in accordance with Section 3 above.

www.iren.com Page 6 of 19 PRSUs will vest on a pro-rata straight line basis for any performance test results that arrive at a result between each of the performance hurdles. No PRSUs will vest if the threshold performance hurdle is not achieved. If TSR is negative, the maximum number of PRSUs that can vest is limited to the “Target” performance level in the table above. 5. Change in Control Unless otherwise determined by the Board, a change in control will result in one of the following treatments: a) If it meets the definition of “Sale” (as defined below), any unvested RSU awards will vest in full (including 100% of the PRSUs) and be paid out in cash to participants at the time of the consummation of the Sale: i. “Sale” is defined as a takeover bid (that is declared unconditional, and the bidder has voting power of 50% or more) or a scheme of arrangement that is unconditional and has been approved by the majority of shareholders required by law to give effect to the scheme of arrangement under which a person is approved to be a majority shareholder (by becoming the registered holder of 50% or more of total issued shares of the Company) by the shareholders. b) If it does not meet the definition of “Sale”, the Board retains absolute discretion on the treatment of any unvested RSU awards, which may include, without limitation, continuing the awards subject to the pre-existing time and performance vesting requirements, cancelling unvested RSU awards for no consideration, cancelling any unvested RSU awards in exchange for consideration equivalent to what other Company shareholders will receive in the transaction, providing for the substitution or assumption of the awards by the acquirer or successor company for awards in such entity or any other similar action. The Board may take any one or more of the foregoing or other actions, and may provide for different treatment for different LTIP award holders and/or different LTIP awards. PRSU Performance PRSU Performance Threshold Stretch IREN TSR +40 percentage points above NQUSS Index = 200% of Target PRSUs vest. Target IREN TSR equal to NQUSS Index = 100% of Target PRSUs vest. Threshold IREN TSR -40 percentage points below NQUSS Index = 50% of Target PRSUs vest Below Threshold IREN TSR < -40 percentage points below NQUSS Index = nil PRSUs vest

www.iren.com Page 7 of 19 6. Dividend and Voting Rights RSUs carry no entitlement to voting or dividends prior to vesting. Upon settlement of vested RSUs, the participant is entitled to receive a dividend equivalent payment (“DEP”) in respect of any dividends paid by the Company since the start of the LTIP Period and only in relation to the vested RSUs that are settled (and not for all granted RSUs). Any DEP made to participants can be in cash or provided as additional fully paid ordinary shares in IREN (in which case, the number of shares will be determined by dividing the DEP value by the 20-day VWAP share price as of the date of settlement), as determined by the Board in its sole discretion. 7. Forfeiture All awards under the LTIP are subject to the terms of the following Malus and Clawback policies as follows: Malus: For LTIP awards that have not yet vested / been paid out (i.e. current performance periods), the Board may reduce the quantum of RSUs granted to participants or withdraw eligibility from the incentive plan. Examples where the Board may determine that Malus should be applied include: a) Termination of employment due to misconduct; b) Behaviour that is fraudulent, dishonest, disreputable, or in material breach of obligations under an employment contract or otherwise; or c) A material change in circumstances or unexpected or unintended consequences related to IREN. Clawback: For LTIP awards that have previously vested / been paid out within the previous three years, the Board may exercise clawback to recover awards previously made to a participant. Clawback provisions may be applied in the event of: a) Serious misconduct (as determined by the Board); b) Behaviour that is fraudulent and potentially impacts the organisation’s reputation; or c) Material and deliberate manipulation of financial or operational data with the intent to deceive or alter outcomes. Other: The Company may implement any additional malus, clawback, recoupment, forfeiture or similar policies from time to time, including any such policies as may be required by applicable law or by the NASDAQ listing rules or other rules or regulations, or any other such policies as may be implemented from time to time. The LTIP awards shall be subject to any such policies as may be in place from time to time including any policy adopted by the Company to comply with the requirements under Section 10D of the Exchange Act and Section 5608 of the Nasdaq Listing Rules (the “Restatement Clawback Policy”). By accepting an award under the LTIP, the Employee agrees that the award is subject to the Restatement Clawback Policy. 8. Administration The LTIP shall be administered by the Board. All decisions of the Board shall be final, conclusive and binding upon all parties, including the Company, its shareholders, recipients of awards and their beneficiaries. The Board may issue rules and regulations for administration of the LTIP. Subject to the terms of the LTIP and applicable law, the Board shall have full discretion and authority to take all actions and make all decisions under the LTIP.

www.iren.com Page 8 of 19 The Board may delegate the power to the Co-CEOs, acting jointly, to approve written RSU grant offers being made to incentivise prospective IREN employees, with conditions the Board sees fit which may include that (i) all such offers are made subject to Board approval and (ii) the grant will not take effect until the next Board approval of RSU grants and any valuation is done as at the corresponding grant date. In the event that, as a result of any extraordinary dividend or other extraordinary distribution (other than an ordinary dividend or distribution), recapitalization, stock split, reverse stock split, reorganization, merger, amalgamation, consolidation, separation, rights offering, split-up, spin-off, combination, repurchase or exchange of shares or other securities of the Company, or other similar corporate transaction or event affecting the shares of the Company or of changes in applicable laws, regulations or accounting principles, the Board determines that an adjustment is necessary in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the LTIP, then the Board shall, in a manner determined in the Board’s sole discretion, and to the extent determined appropriate by the Board, adjust equitably so as to ensure no undue enrichment or harm (including by payment of cash), any or all of: a) The number and type of shares (or other securities) subject to outstanding LTIP awards; and b) The terms and conditions of any outstanding LTIP awards, including the performance criteria of any Performance-based RSUs. 9. Miscellaneous The Company will not be obligated to deliver any Shares under the LTIP or remove restrictions from Shares previously delivered under the LTIP until (i) all award conditions have been met or removed to the Board’s satisfaction; (ii) as determined by the Board, all other legal matters regarding the issuance and delivery of such shares have been satisfied, including any applicable securities laws, stock market or listing rules and regulations or accounting or tax rules and regulations; and (iii) the participant has executed and delivered to the Company such representations or agreements as the Board deems necessary or appropriate to satisfy any applicable laws. The Company’s inability to obtain authority from any regulatory body having jurisdiction, which the Board determines is necessary to the lawful issuance and sale of any shares, will relieve the Company of any liability for failing to issue or sell such Shares as to which such requisite authority has not been obtained. Notwithstanding anything to the contrary in this LTIP, the Company has no obligation or liability to offer or invite any person to participate in the LTIP if to do so would require the Company to issue a disclosure document or a product disclosure statement under Chapter 6D or Chapter 7 of the Corporations Act 2001 (Cth) 2001 or any other applicable laws in any jurisdictions other than Australia, unless the Company agrees otherwise. The grant of an LTIP award shall not be construed as giving the participant the right to be retained in the employ of, or to continue to provide services to, the Company or any affiliate. Further, the Company or any applicable affiliate may at any time dismiss a recipient, free from any liability, or any claim under the LTIP, unless otherwise expressly provided in the LTIP or in any notice of award or in any other agreement binding on the parties. The receipt of any award under the LTIP is not intended to confer any rights on the receiving participant except as set forth in the applicable award notice. No payment pursuant to the LTIP shall be taken into account in determining any benefits under any severance, pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any affiliate, except to the extent otherwise expressly provided in writing in such other plan or an agreement thereunder. Neither the LTIP nor any award hereunder shall create or be construed to create a trust or separate fund of any kind or a fiduciary relationship between the Company and a participant or any other person. To the extent that any person acquires a right to receive payments from the Company pursuant to an award, such right shall be no greater than the right of any unsecured general creditor of the Company.

www.iren.com Page 9 of 19 Except as may be permitted by the Board or as specifically provided in an LTIP award notice, (i) no LTIP award and no right under any LTIP award shall be assignable, alienable, saleable or transferable by a participant other than by will and (ii) during a participant’s lifetime, each LTIP award, and each right under any LTIP award, shall be exercisable only by such participant or, if permissible under applicable law, by such participant’s guardian or legal representative. The provisions of this paragraph shall not apply to any award that has been fully exercised or settled, as the case may be, and shall not preclude forfeiture of an award in accordance with its terms. As it relates to non-employee directors, any references to “employment” or the “termination of employment” shall be deemed to refer to the individual’s engagement as a director and the termination of such services. The Company may, in its sole discretion, determine that any awards under the LTIP may be administered and/or held by a third-party custodian on behalf of participants. The Company may direct that all vested RSUs and all ordinary shares allocated or issuable on vesting are to be held by such third party (for example, under pooling arrangements). The Company may, in its sole discretion, set a minimum number of RSUs that are permitted to be exercised by a participant as part of a single RSU exercise and a minimum time period between partial exercise of RSU. The Board delegates to the Co-CEOs the power to determine, from time to time, the minimum thresholds which apply. Awards under this LTIP may be subject to additional country-specific provisions set forth in a country addendum, which the addendum shall govern in the case of any inconsistency between the LTIP or an award notice and the addendum. One or more country addenda may apply depending on the applicable law that the Company reasonably determines may apply under the participant's particular circumstances. The Board has the authority to determine which addendum or addenda may apply and to reconcile any inconsistencies between applicable addenda.

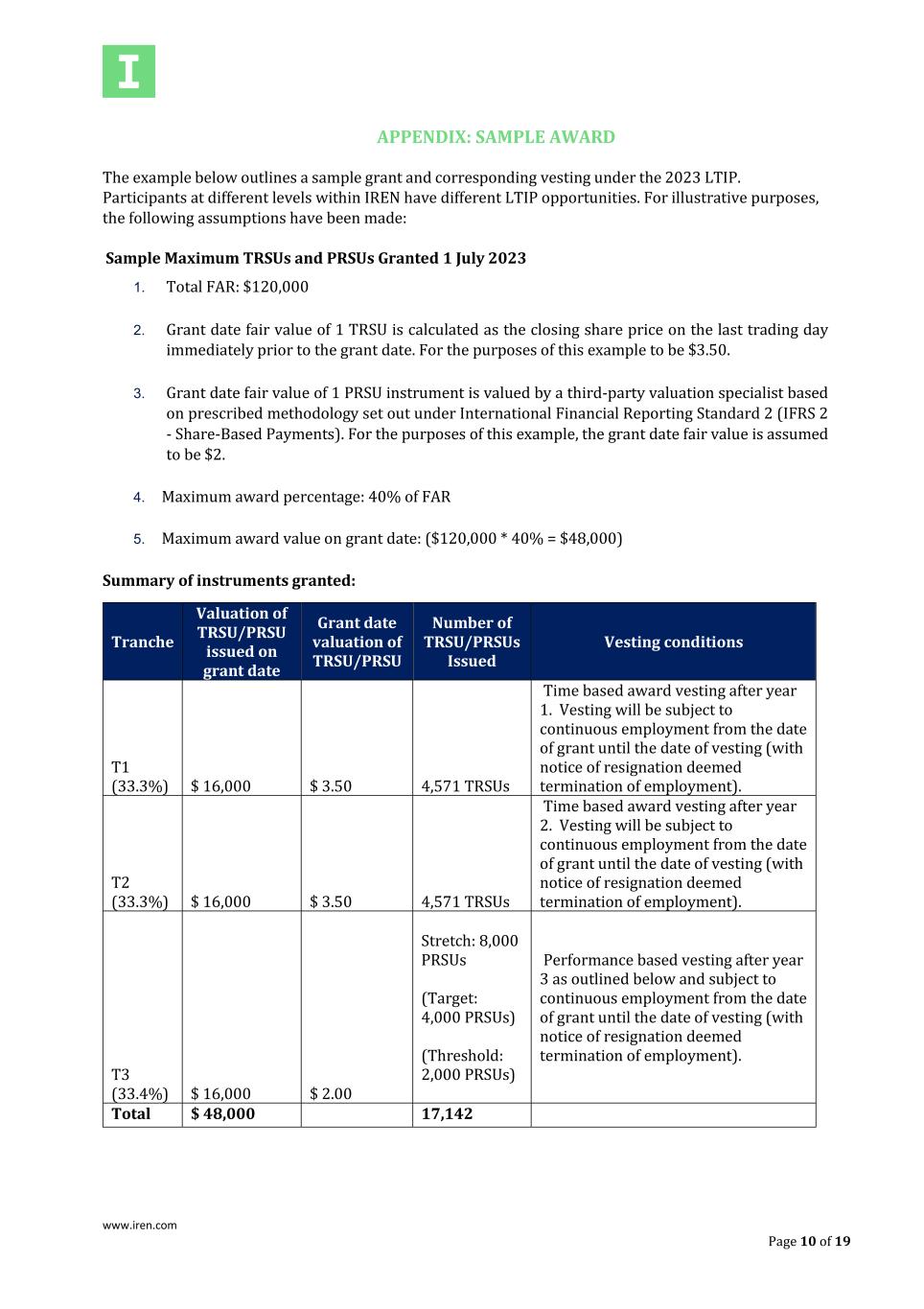

www.iren.com Page 10 of 19 APPENDIX: SAMPLE AWARD The example below outlines a sample grant and corresponding vesting under the 2023 LTIP. Participants at different levels within IREN have different LTIP opportunities. For illustrative purposes, the following assumptions have been made: Sample Maximum TRSUs and PRSUs Granted 1 July 2023 1. Total FAR: $120,000 2. Grant date fair value of 1 TRSU is calculated as the closing share price on the last trading day immediately prior to the grant date. For the purposes of this example to be $3.50. 3. Grant date fair value of 1 PRSU instrument is valued by a third-party valuation specialist based on prescribed methodology set out under International Financial Reporting Standard 2 (IFRS 2 - Share-Based Payments). For the purposes of this example, the grant date fair value is assumed to be $2. 4. Maximum award percentage: 40% of FAR 5. Maximum award value on grant date: ($120,000 * 40% = $48,000) Summary of instruments granted: Tranche Valuation of TRSU/PRSU issued on grant date Grant date valuation of TRSU/PRSU Number of TRSU/PRSUs Issued Vesting conditions T1 (33.3%) $ 16,000 $ 3.50 4,571 TRSUs Time based award vesting after year 1. Vesting will be subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). T2 (33.3%) $ 16,000 $ 3.50 4,571 TRSUs Time based award vesting after year 2. Vesting will be subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). T3 (33.4%) $ 16,000 $ 2.00 Stretch: 8,000 PRSUs (Target: 4,000 PRSUs) (Threshold: 2,000 PRSUs) Performance based vesting after year 3 as outlined below and subject to continuous employment from the date of grant until the date of vesting (with notice of resignation deemed termination of employment). Total $ 48,000 17,142

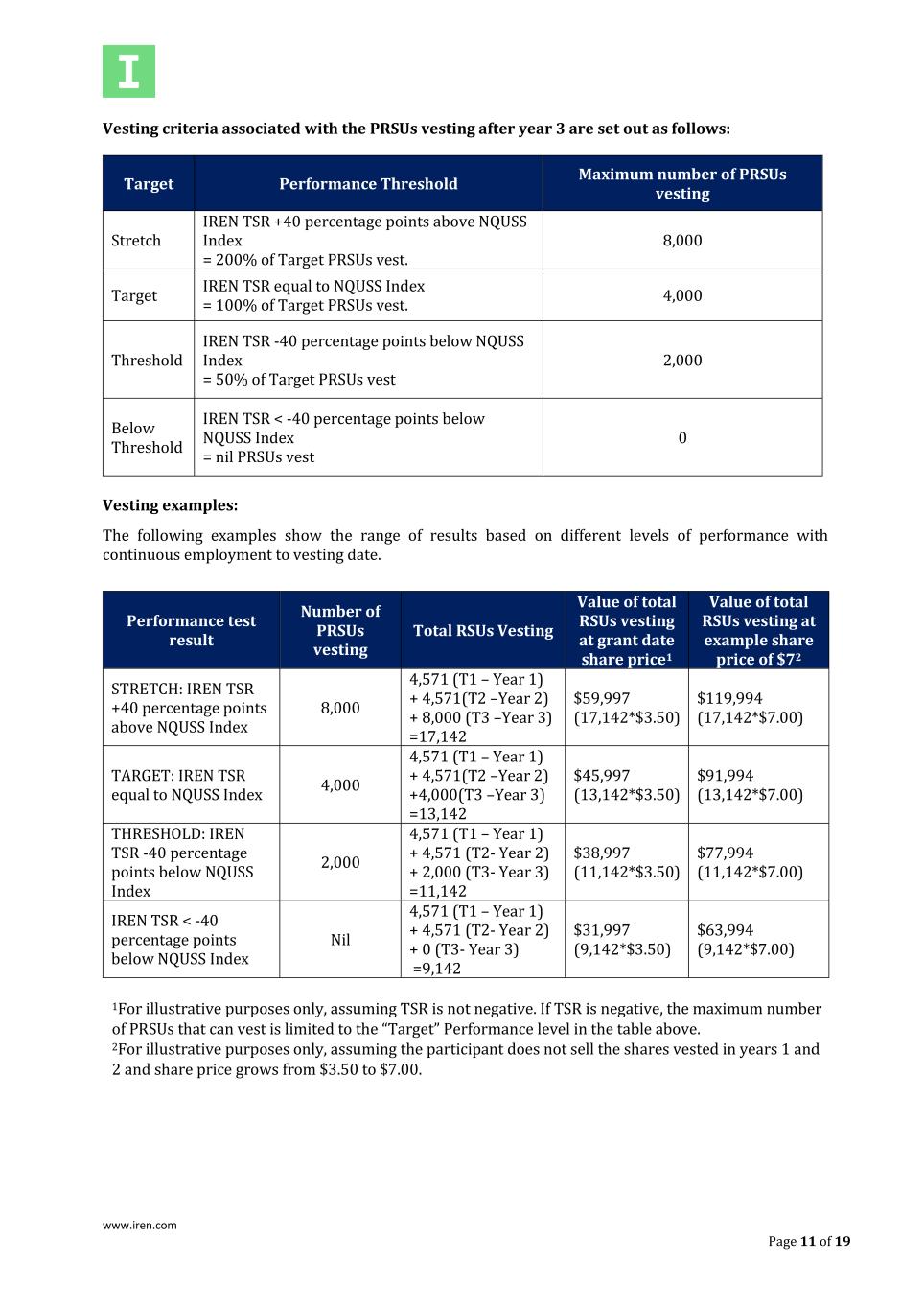

www.iren.com Page 11 of 19 Vesting criteria associated with the PRSUs vesting after year 3 are set out as follows: Vesting examples: The following examples show the range of results based on different levels of performance with continuous employment to vesting date. Performance test result Number of PRSUs vesting Total RSUs Vesting Value of total RSUs vesting at grant date share price1 Value of total RSUs vesting at example share price of $72 STRETCH: IREN TSR +40 percentage points above NQUSS Index 8,000 4,571 (T1 – Year 1) + 4,571(T2 –Year 2) + 8,000 (T3 –Year 3) =17,142 $59,997 (17,142*$3.50) $119,994 (17,142*$7.00) TARGET: IREN TSR equal to NQUSS Index 4,000 4,571 (T1 – Year 1) + 4,571(T2 –Year 2) +4,000(T3 –Year 3) =13,142 $45,997 (13,142*$3.50) $91,994 (13,142*$7.00) THRESHOLD: IREN TSR -40 percentage points below NQUSS Index 2,000 4,571 (T1 – Year 1) + 4,571 (T2- Year 2) + 2,000 (T3- Year 3) =11,142 $38,997 (11,142*$3.50) $77,994 (11,142*$7.00) IREN TSR < -40 percentage points below NQUSS Index Nil 4,571 (T1 – Year 1) + 4,571 (T2- Year 2) + 0 (T3- Year 3) =9,142 $31,997 (9,142*$3.50) $63,994 (9,142*$7.00) 1For illustrative purposes only, assuming TSR is not negative. If TSR is negative, the maximum number of PRSUs that can vest is limited to the “Target” Performance level in the table above. 2For illustrative purposes only, assuming the participant does not sell the shares vested in years 1 and 2 and share price grows from $3.50 to $7.00. Target Performance Threshold Maximum number of PRSUs vesting Stretch IREN TSR +40 percentage points above NQUSS Index = 200% of Target PRSUs vest. 8,000 Target IREN TSR equal to NQUSS Index = 100% of Target PRSUs vest. 4,000 Threshold IREN TSR -40 percentage points below NQUSS Index = 50% of Target PRSUs vest 2,000 Below Threshold IREN TSR < -40 percentage points below NQUSS Index = nil PRSUs vest 0

www.iren.com Page 12 of 19 2023 IREN Long-Term Incentive Plan - Addendum for Participants in Australia Capitalized terms used but not defined in this Addendum shall have the same meanings assigned to them in the Long-Term Incentive Plan (the “Plan”). General This Addendum includes additional terms and conditions that govern the Plan and Plan awards if the participant works and/or resides in Australia or who is an Australian taxpayer (regardless of work location or residence). The information contained herein is general in nature and may not apply to the participant’s particular situation. As a result, Iris Energy Limited (doing business as IREN) (the “Company”) and its subsidiaries are not in a position to assure the participant of an award of any particular result. Accordingly, the participant is strongly advised to seek appropriate professional advice as to how the relevant laws may apply to the participant’s individual situation. For Australian participants, subdivision 83A-C of the Income Tax Assessment Act 1997 (Cth), applies to RSUs granted under the LTIP, such that the RSUs are intended to be subject to deferred taxation. Exercise and vesting Notwithstanding anything to the contrary in the Plan or in the award notice, for a period of 15 years from the grant date, each participant may elect to exercise their vested RSUs at any time in accordance with the terms of the Plan (such date being the "Exercise Date") by giving the Company a notice in a form approved in writing by the Company from time to time. The Board may direct that a participant exercises their vested RSUs at any time in the Board's sole discretion. The participant must comply with such a direction as soon as reasonably practicable and failure to comply will amount to a material breach of the participant's obligations for the purposes of Section 7 of the Plan (Forfeiture). Upon exercise of the vested RSUs under this Plan, subject to the participant's satisfaction of any tax obligations associated with the vested RSUs and any other conditions imposed by the Board in their sole discretion, the Company shall settle such vested RSUs as soon as practicable and in any event no more than 30 days after the Exercise Date. For each vested RSU exercised by the participant, the Company shall issue one ordinary share (or cash equivalent, in the Board's discretion). On the 15-year anniversary of the grant date of each RSU, the RSUs (whether vested or unvested) shall be automatically forfeited (or otherwise dealt with by the Board in its sole discretion) in accordance with the Plan. Notwithstanding the provisions under Section 5 of the Plan (Change in Control), upon a change in control that constitutes a “Sale” (as defined in the Plan), the vesting of a participant’s RSUs will be treated in accordance with the Plan as though each vested RSU is deemed exercised and paid out in cash to participants at the time of the consummation of the Sale. Australian RSU participants By accepting the issue of RSUs under the Plan, each Australian participant will be deemed to have acknowledged that: a) They have read all of the documentation contained in the Plan and they agree to be bound by and comply with the terms of issue of the RSUs and the Plan; b) They will not do anything which could require the issue of any disclosure document by reason of the application of Chapter 6D or Chapter 7 of the Corporations Act 2001 (Cth) ("Corporations Act"); c) Any resale of securities received pursuant to the Plan within or outside Australia must be made in accordance with applicable Australian securities laws (including, without limitation, the Corporations Act), in addition to all other applicable legal and/or contractual restrictions; d) They have had the opportunity to obtain independent advice and have satisfied themselves regarding the financial and taxation consequences of their participation in the Plan and

www.iren.com Page 13 of 19 acknowledge that neither the Company nor any of its subsidiaries have provided any financial services in relation to the RSUs; e) All other terms and conditions of their employment remain those as stated in their employment agreement or service agreement (as applicable), and the rights offered to them under the Plan are limited to those expressly set out in the Plan; and f) Acknowledge that as a consequence of their participation in the Plan, the IREN group shall hold personal information about the participant and the participant consents to the Company and its subsidiaries using and disclosing this personal information for the purposes of administering the Plan.

www.iren.com Page 14 of 19 2023 IREN Long-Term Incentive Plan - Addendum for Participants in the United States Capitalized terms used but not defined in this Addendum shall have the same meanings assigned to them in the 2023 Long-Term Incentive Plan (the “Plan”). General This Addendum includes additional terms and conditions that govern the Plan and LTIP awards if the participant works and/or resides in the United States or who is a United States taxpayer (regardless of work location or residence). The information contained herein is general in nature and may not apply to the participant’s particular situation. As a result, Iris Energy Limited (doing business as IREN) (the “Company”) and its subsidiaries are not in a position to assure the participant of an award of any particular result. Accordingly, the participant is strongly advised to seek appropriate professional advice as to how the relevant laws may apply to the participant’s individual situation. Section 409A of the Internal Revenue Code With respect to LTIP awards subject to Section 409A of the Internal Revenue Code of 1986, as amended, and the rules and regulations thereunder (the “Code”), the Plan is intended to comply with the requirements of Section 409A of the Code and the provisions of the Plan and any notice of award shall be interpreted in a manner that satisfies the requirements of Section 409A of the Code, and the Plan shall be operated accordingly. If any provision of the Plan or any term or condition of any LTIP award would otherwise frustrate or conflict with this intent, the provision, term or condition will be interpreted and deemed amended so as to avoid this conflict. If an amount payable under an LTIP award as a result of the participant terminating from employment (other than due to death) at a time when the participant is a “specified employee” under Section 409A of the Code constitutes a deferral of compensation subject to Section 409A of the Code, then payment of such amount shall not occur until six months and one day after the date of the participant’s termination date, except as permitted under Section 409A of the Code. If the LTIP award includes a “series of installment payments” (within the meaning of Section 1.409A-2(b)(2)(iii) of the Treasury Regulations), the participant’s right to the series of installment payments shall be treated as a right to a series of separate payments and not as a right to a single payment, and if the LTIP award includes “dividend equivalents” (within the meaning of Section 1.409A-3(e) of the Treasury Regulations), the participant’s right to the dividend equivalents shall be treated separately from the right to other amounts under the LTIP award. Notwithstanding the foregoing, the tax treatment of the benefits provided under the Plan or any applicable notice of award is not warranted or guaranteed, and in no event shall the Company or its subsidiaries be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the participant on account of non-compliance with Section 409A of the Code. Settlement/Payment of Vested RSUs Notwithstanding anything to the contrary in the Plan or in the award notice, except in the case of a 409A Change in Control (as defined below), a participant’s RSUs, to the extent earned and vested, shall in all events settle on or within 30 days following the original scheduled vesting dates as set forth in the Plan, regardless of whether vesting of any of the participant’s RSUs may be accelerated for any reason. Tax Withholding The Company will have the right to deduct any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such amount due to the participant, including deducting such amount from the delivery of shares or cash issued upon settlement of the RSUs, or DEP, that gives rise to the withholding requirement. In addition, the Board may implement other procedures as it may specify from time to time, to permit the participant to satisfy any such tax withholding requirements through other means, which may include any of the following: (i) the participant paying cash, (ii) the Company's withholding from the participant otherwise deliverable Shares or cash (i.e., net settlement), (iii) the participant's delivery to the Company already owned Shares, (iv) the participant's participation in a broker assisted cashless program adopted by the Company to sell Shares into the market to cover such obligations or (v) any combination of the foregoing.

www.iren.com Page 15 of 19 Change of Control Notwithstanding the provisions under Section 5 of the Plan (Change in Control), upon a change in control that constitutes a “Sale” (as defined in the Plan), the vesting of a participant’s RSUs will be treated in accordance with the Plan; however, the timing of the settlement/payment of the participant’s RSUs (to the extent that they vest) will be treated as follows: a) To the extent that the Sale constitutes a “change in the ownership or effective control” of the Company, or a “change in the ownership of a substantial portion of the Company assets” (in each case, as defined in Section 409A of the Code) (any such Sale, a “409A Change in Control”), then the vested RSUs will settle or be paid upon or within 60 days after the 409A Change in Control. b) To the extent that the Sale does not constitute a 409A Change in Control, then the vested RSUs will not settle or be paid upon the Change in Control, but rather will settle or be paid out on the originally scheduled vesting date. In the event of a change in control transaction that does not meet the definition of a Sale, regardless of the treatment of outstanding unvested RSUs, the settlement or payment of any RSUs that become vested shall occur on the originally scheduled vesting date.

www.iren.com Page 16 of 19 2023 IREN Long-Term Incentive Plan - Addendum for Participants in Canada Capitalized terms used but not defined in this Addendum shall have the same meanings assigned to them in the Long-Term Incentive Plan (the “LTIP”). General This Addendum includes additional terms and conditions that govern the LTIP and LTIP awards if the participant is subject to Canadian taxation under the Income Tax Act (Canada) and/or the taxing legislation of any province or territory of Canada (each, a “Canadian Participant”). The information contained herein is general in nature and may not apply to the Canadian Participant’s particular situation. As a result, Iris Energy Limited (doing business as IREN) (the “Company”) and its subsidiaries are not in a position to assure the Canadian Participant receiving an award of any particular result. Accordingly, the Canadian Participant is strongly advised to seek appropriate professional advice as to how the relevant laws may apply to the Canadian Participant’s individual situation. Settlement/Payment of Vested RSUs Notwithstanding anything to the contrary in the Plan or in the award notice, for a period of 15 years from the grant date, each participant may elect to exercise their vested RSUs at any time in accordance with the terms of the Plan (such date being the "Exercise Date") by giving the Company a notice in a form approved in writing by the Company from time to time. On the 15-year anniversary of the grant date of each RSU, the RSUs (whether vested or unvested) shall be automatically forfeited (or otherwise dealt with by the Board in its sole discretion). Each RSU awarded to a Canadian Participant, and any DEP in respect of such RSU, shall be settled solely in the form of Shares. Notwithstanding the foregoing, in the event of an actual or anticipated Sale or in such other circumstances as may be determined by the Company in its sole discretion, the Company may provide a Canadian Participant with the right, but not the obligation, to elect to have any or all of his or her RSUs or DEP settled through consideration other than Shares (including cash). Such right may, at the sole discretion of the Company, be time-limited and subject to one or more conditions. In no circumstances shall the Company have the right to cause any RSU or DEP to be surrendered or otherwise cancelled for consideration other than Shares, subject to the first paragraph of Section 9 of the LTIP. Tax Withholding The Company will have the right to deduct any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such amount due to the participant, including deducting such amount from the delivery of shares or cash issued upon settlement of the RSUs, or DEP, that gives rise to the withholding requirement. In addition, the Board may implement other procedures as it may specify from time to time, to permit the participant to satisfy any such tax withholding requirements through other means, which may include any of the following: (i) the participant paying cash, (ii) the Company's withholding from the participant otherwise deliverable Shares or cash (iii) the participant's delivery to the Company already owned Shares, (iv) the participant's participation in a broker assisted cashless program adopted by the Company to sell Shares into the market to cover such obligations or (v) any combination of the foregoing. Non-Qualified Securities In the event that the Company is at any time a “specified person” as defined in subsection 110(0.1) of the Income Tax Act (Canada), the Canadian Participant acknowledges and agrees that each Share subject to an RSU (or DEP) will be, and is hereby designated, a “non-qualified security” within the meaning of section 110 of the Income Tax Act (Canada). The Canadian Participant acknowledges and agrees that the Company or the Canadian Participant’s employer (if different) has statutory reporting obligations to the Canada Revenue Agency or Revenu Québec, as applicable, in respect of any “non- qualified securities” subject to RSUs (or DEP).

www.iren.com Page 17 of 19 Securities Laws As used herein, “Canadian securities laws” means securities laws in each of the provinces and territories of Canada and the respective instruments, rules, regulations, written policies, blanket orders and blanket rulings under such laws. Requirements under Canadian securities laws LTIP awards may only be made to a prospective Canadian Participant resident in a province or territory of Canada or subject to Canadian securities laws if such prospective Canadian Participant is an employee, executive officer, director or consultant of the Company or of a related entity of the Company (as such terms are defined in National Instrument 45-106 – Prospectus Exemptions of the Canadian Securities Administrators). Furthermore, by accepting LTIP awards, each Canadian Participant will be deemed to have acknowledged that: a) His or her participation in the LTIP is voluntary, and such participation has not been induced by expectation of engagement, appointment, employment or continued engagement, appointment or employment; b) The Company is not presently, and does not intend to become, a “reporting issuer” (as such term is defined under applicable Canadian securities laws) in any province or territory of Canada; c) The distribution of awards or other securities pursuant to the LTIP is exempt from the prospectus requirements of applicable Canadian securities laws and, as a result, the Canadian Participant may not receive information that would otherwise be contained in a prospectus prepared in accordance with Canadian securities laws and is restricted from using most of the protections, rights and remedies available under Canadian securities laws; and d) Any resale of securities received pursuant to the LTIP within or outside Canada must be made in accordance with applicable Canadian securities laws, in addition to all other applicable legal and/or contractual restrictions. Notwithstanding anything to the contrary in the LTIP or any document related to the LTIP, the distribution to the Canadian Participant of any awards or other securities pursuant to the LTIP is subject to the availability under Canadian securities laws of prospectus and dealer registration exemptions that are acceptable to the Company in its sole discretion. Where required by applicable Canadian securities laws, the participant shall execute, deliver, file and otherwise assist the Company in filing any reports, undertakings and other documents in connection with the distribution of the awards or other securities pursuant to the LTIP. Eligibility and Conditions For purposes of this section “Eligibility and Conditions”, “Company” shall refer to the Company or the Canadian Participant’s employer (if different). Unless otherwise determined by the Board, additional conditions to receive an award under the LTIP include continued employment with the Company through to the date of vesting provided that, employees who depart the Company due to retirement, disability, death or other exceptional circumstances may have their unvested LTIP awards vest in accordance with the LTIP, subject to the Board’s sole discretion; and employees who depart the Company prior to the date of LTIP vesting due to resignation or termination for cause will forfeit all unvested LTIP awards. "Cause" with respect to a Canadian Participant: i) has the meaning ascribed to such term (or words of like import) in any written employment agreement in effect between the Canadian Participant and the Company that contains an enforceable contractual termination provision; or ii) in the absence of such agreement (or where there is such an agreement but it does not contain an enforceable contractual termination provision or does not define “cause” (or words of like import)), means: (i) a material breach by the Canadian Participant of any of their contractual obligations to the Company concerning their employment or the Company’s written policies and procedures from time to time; (ii) gross

www.iren.com Page 18 of 19 negligence, serious misconduct, or a material failure by the Canadian Participant in connection with the discharge of their duties or otherwise relating to their employment by the Company (including insubordinate, harassing or insulting behaviour); (iii) Canadian Participant’s conviction of any charge involving moral turpitude; or (iv) any act or omission of the Canadian Participant which would in law permit an employer to, without notice or payment in lieu of notice, terminate the employment of an employee. “Continued employment” means the period during which a Canadian Participant actively renders services to the Company, but shall exclude any period that follows or ought to have followed, as applicable, the later of: (i) the Canadian Participant's last day of actively rendering services to the Company, or (ii) the end of the minimum notice of termination period that is required to be provided to an employee pursuant to applicable employment standards legislation (if any), whether that period arises from a contractual or common law right. For certainty, “Continued employment” shall be deemed to include, as applicable, (i) any period of vacation, disability, or other leave permitted by legislation, and (ii) any period constituting the minimum notice of termination that is required to be provided to an employee pursuant to applicable employment standards legislation (if any). "Disability" has the meaning attributed to such term (or words of like import) in any written employment agreement or other similar agreement in effect between a Canadian Participant and the Company, and if there is no defined term, means the Canadian Participant’s inability to substantially fulfil their duties on behalf of the Company as a result of illness or injury for a continuous period of nine (9) months or more or for an aggregate period of twelve (12) months or more during any consecutive twenty-four (24) month period, with the Canadian Participant being unable to resume their duties on behalf of the Company on a full-time basis at the expiration of such period. Forfeiture Except as otherwise provided in any LTIP award or other written agreement between a Canadian Participant and the Company, if a Canadian Participant’s Continued employment terminates for any reason, any portion of the Canadian Participant’s LTIP awards that have not vested will be forfeited upon the termination date and the Canadian Participant will have no further right, title, or interest in the LTIP awards, the Shares issuable pursuant to LTIP awards, or any consideration in respect of the LTIP awards. Further, a Canadian Participant shall have no entitlement to damages or other compensation whatsoever arising from, in lieu of, or related to not receiving any LTIP award which would have vested or been granted after the termination date including but not limited to damages in lieu of notice of termination at common law. As used in herein, “termination date” means the date on which a Canadian Participant ceases to be eligible to receive LTIP awards under the Plan as a result of the termination of their employment with the Company for any reason, including death, resignation, or termination with cause, without cause or as a result of disability. For the purposes of this definition and the LTIP, a Canadian Participant’s Continued employment shall be considered to be terminated on the last day of the Canadian Participant’s Continued employment, whether such day is selected by agreement with the Canadian Participant, or unilaterally by the Canadian Participant or the Company (or the Canadian Participant’s employer (if different)), and whether with or without advance notice to the Canadian Participant. All awards under the LTIP are subject to the terms of the following Clawback policies as follows: a) For LTIP awards that have not yet vested / been paid out (i.e. current performance periods), the Board may reduce the quantum of RSUs granted to Canadian Participants or withdraw eligibility from the LTIP. Examples where the Board may determine that clawback should be applied include: i. Behaviour that is fraudulent, dishonest, disreputable, or in material breach of obligations under an employment contract or otherwise; or ii. A material change in circumstances or unexpected or unintended consequences related to IREN. b) For LTIP awards that have previously vested / been paid out, the Board may exercise clawback

www.iren.com Page 19 of 19 to recover awards previously made to a Canadian Participant. Clawback provisions may be applied in the event of: i. Serious misconduct (as determined by the Board); ii. Behaviour that is fraudulent and potentially impacts the organisation’s reputation; and iii. Material and deliberate manipulation of financial or operational data with the intent to deceive or alter outcomes. c) The Company may implement any additional clawback, recoupment, forfeiture or similar policies from time to time, including any such policies as may be required by applicable law or by the NASDAQ listing rules or other rules or regulations, or any other such policies as may be implemented from time to time. The LTIP awards shall be subject to any such policies as may be in place from time to time.