www.iren.com IREN - Quality Management System 2023 Short-Term Incentive Plan Rules (STIP) Document Reference: IQMS-B4-HRS-PA-002 Revision: 1 Type Application Review Period Plan Discretionary 1 year Revisio n Date Reason for Issue Prepared Checked Approved 0 01/08/2 2 Issued for Board Approval CFO, General Counsel & Company Secretary President Board Approval 1 August 2022 1 24/08/2 2 Section 5. Change in Control revised Joanna Brand, Company Secretary Lindsay Ward, President Board Approval 24 August 2022 1 3/12/20 24 Updated to reflect name change Company Secretary Company Secretary N/A Exhibit 10.17

www.iren.com IREN LIMITED 2023 Short-Term Incentive Plan Rules (STIP) Contents 1. Purpose and Eligibility .............................................................................................................................................. 1 2. STIP Payment Opportunity ..................................................................................................................................... 1 3. Performance Period, Vehicle and Payment ...................................................................................................... 2 4. Performance Measures and Board Discretion ................................................................................................ 2 5. Change in Control ........................................................................................................................................................ 2 6. Forfeiture ........................................................................................................................................................................ 3 7. Administration ............................................................................................................................................................. 3 8. Miscellaneous ............................................................................................................................................................... 3 9. Appendix: Sample Payment .................................................................................................................................... 4

www.iren.com 1 1. Purpose and Eligibility This IREN Limited Short-Term Incentive Plan (“STIP”) will commence on a date determined by resolution of the Board of Directors (“Board”) and will supersede all prior short-term incentive plans, other than the Calendar Year 2022 short-term incentive plan (the “CY22 STIP”), which remains in place in accordance with its terms for the period 1 January 2022 until 31 December 2022. After the date of commencement, this STIP will be used to make future payments, and no new payments shall be made under prior short- term incentive plans, other than the CY22 STIP. Notwithstanding anything contained in this STIP or otherwise, the Board has full discretion to, at any time, interpret, apply or not apply, amend, modify or terminate the STIP, any plan rules and any individual payments, in its sole discretion. Participation in the STIP does not create any contractual or other right to receive any other benefits, nor does participation constitute a condition or right of future employment. The STIP is designed to: • Align participants to business outcomes; • Attract and retain key talent; and • Achieve external market remuneration competitiveness. All permanent and part-time employees of IREN Limited (the “Company”) and its subsidiaries (together, “IREN”), but not casual employees, may be invited to participate in the STIP, with the terms, eligibility and award of a STIP payment remaining subject to approval by the Board. Unless otherwise determined by the Board, additional conditions to receive a STIP payment include: • Employment for a minimum of four months immediately prior to the end of the relevant financial year; and • Continued employment through to the date of payment (with date of notice of resignation deemed termination of employment for purposes of this STIP), provided that: o Employees who depart IREN prior to the date of payment due to retirement, injury, ill health, permanent disability, death, redundancy, termination without cause or other exceptional circumstances may receive a STIP payment, subject to the Board’s sole discretion; and o Employees who depart IREN prior to the date of payment due to resignation or termination for cause will forfeit of all unpaid STIP payments. 2. STIP Payment Opportunity STIP payment opportunities will be set and communicated as both Target and Maximum percentages of the participant’s Board approved Fixed Annual Remuneration inclusive of superannuation and other analogous payments (FAR) (the “STIP percentage”), based on their level in the organization (an “STIP Eligible Position”) at the beginning of each financial year. Employees newly promoted or hired (a minimum of four months immediately prior to the end of the relevant financial year) into a STIP eligible position during the financial year may receive a STIP opportunity, which will be pro-rated based on the day of promotion or hire, subject to Board’s sole discretion.

www.iren.com 2 3. Performance Period, Vehicle and Payment The STIP performance period will span the financial year (12 months from 1 July through 30 June), with payments subject to achievement against a scorecard of corporate performance measures, outlined in the Performance Measures section. It is intended that STIP payments will be paid out in a single lump-sum cash payment on an annual basis, no later than three months following the end of the relevant financial year. STIP payments are inclusive of all applicable withholdings and taxes, as well as any applicable superannuation, 401(k) or similar. 4. Performance Measures and Board Discretion STIP payments will be subject to achievement against the corporate key performance indicators (Corporate KPIs), which are determined by the Co-CEOs and President and approved by the Board at the beginning of each financial year. The Corporate KPIs will apply to all eligible employees within the business and will include a Gateway for each Corporate KPI, below which no payment will be made for that KPI. Final payment is subject to satisfactory performance of the individual throughout the entire financial year, as determined by the Company in its sole discretion. Regardless of continuous employment or performance against the Corporate KPIs, an individual’s final payment may be adjusted downwards at the Board’s sole discretion. 4.1 Board Discretion: The determination of the actual performance against the Corporate KPIs and any STIP payment remains at the sole discretion of the Board. Additionally, the Board may adjust the percentage of any STIP payments (upwards or downwards) with reference to their satisfaction around qualitative factors linked to the delivery of the Corporate KPIs, such as: a) Safety; b) Levels of risk mitigation; c) Quality of contracts; d) Quality of facility delivery; e) Longer-term operational planning; and f) Generally behaving in the long-term interests of the business beyond meeting a specific Corporate KPI as drafted. 5. Change in Control In the event of a takeover bid or other transaction, event or state of affairs that in the Board’s opinion is likely to result in a change in control of the Company, the Board has discretion to determine that vesting of some or all of any unvested performance awards should be accelerated.

www.iren.com 3 6. Forfeiture All payments under the STIP are subject to the terms of the following Malus and Clawback policies: Malus: For STIP payments that have not yet been paid out (i.e., current performance period), the Board may reduce the quantum of STIP opportunity granted to participants or withdraw eligibility from the incentive plan. Examples where the Board may determine that Malus should be applied include: • Termination of employment due to misconduct; • Behaviour that is fraudulent, dishonest, disreputable, or in material breach of obligations under an employment contract or otherwise; or • A material change in circumstances or unexpected or unintended consequences related to IREN. Clawback: For STIP payments that have been made within the prior three years, the Board may exercise clawback to recover payments previously made to a participant. Clawback provisions may be applied in the event of: • Serious misconduct (as determined by the Board); • Behaviour that is fraudulent and potentially impacts the organisation’s reputation; and • Material and deliberate manipulation of financial or operational data with the intent to deceive or alter outcomes. Other: The Company may implement any additional malus, clawback, recoupment, forfeiture or similar policies from time to time, including any such policies as may be required by applicable law or by the NASDAQ listing rules or other rules or regulations, or any other such policies as may be implemented from time to time. STIP eligibility and payments shall be subject to any such policies as may be in place from time to time. 7. Administration The STIP shall be administered by the Board. All decisions of the Board shall be final, conclusive and binding upon all parties, including the Company, its shareholders, STIP recipients and their beneficiaries. The Board may issue rules and regulations for administration of the STIP. Subject to the terms of the STIP and applicable law, the Board shall have full discretion and authority to take all actions and make all decisions under the STIP. 8. Miscellaneous Participation in the STIP shall not be construed as giving the participant the right to be retained in the employ of, or to continue to provide services to, the Company or any affiliate. Further, the Company or any applicable affiliate may at any time dismiss a recipient, free from any liability, or any claim under the STIP, unless otherwise expressly provided in the STIP or in any notice of award or in any other agreement binding on the parties. Participation in the STIP is not intended to confer any rights on the receiving participant except as set forth in the applicable STIP notice. No payment pursuant to the STIP shall be taken into account in determining any benefits under any severance, pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any affiliate, except to the extent otherwise expressly provided in writing in such other plan or an agreement thereunder.

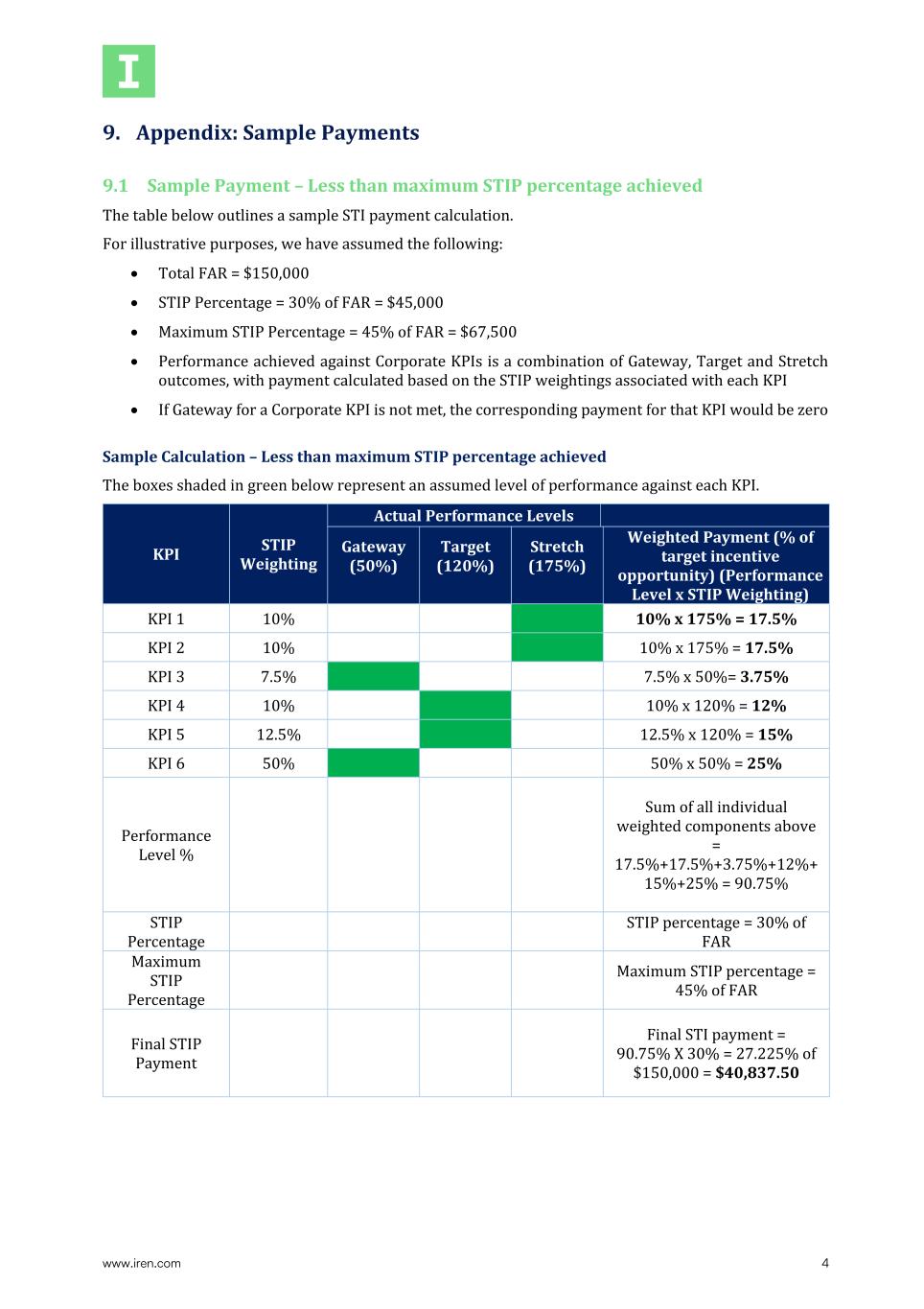

www.iren.com 4 9. Appendix: Sample Payments 9.1 Sample Payment – Less than maximum STIP percentage achieved The table below outlines a sample STI payment calculation. For illustrative purposes, we have assumed the following: • Total FAR = $150,000 • STIP Percentage = 30% of FAR = $45,000 • Maximum STIP Percentage = 45% of FAR = $67,500 • Performance achieved against Corporate KPIs is a combination of Gateway, Target and Stretch outcomes, with payment calculated based on the STIP weightings associated with each KPI • If Gateway for a Corporate KPI is not met, the corresponding payment for that KPI would be zero Sample Calculation – Less than maximum STIP percentage achieved The boxes shaded in green below represent an assumed level of performance against each KPI. KPI STIP Weighting Actual Performance Levels Gateway (50%) Target (120%) Stretch (175%) Weighted Payment (% of target incentive opportunity) (Performance Level x STIP Weighting) KPI 1 10% 10% x 175% = 17.5% KPI 2 10% 10% x 175% = 17.5% KPI 3 7.5% 7.5% x 50%= 3.75% KPI 4 10% 10% x 120% = 12% KPI 5 12.5% 12.5% x 120% = 15% KPI 6 50% 50% x 50% = 25% Performance Level % Sum of all individual weighted components above = 17.5%+17.5%+3.75%+12%+ 15%+25% = 90.75% STIP Percentage STIP percentage = 30% of FAR Maximum STIP Percentage Maximum STIP percentage = 45% of FAR Final STIP Payment Final STI payment = 90.75% X 30% = 27.225% of $150,000 = $40,837.50

www.iren.com 5 9.2 Sample Payment – Capped at maximum STIP percentage The table below outlines a sample STI payment calculation. For illustrative purposes, we have assumed the following: • Total FAR = $150,000 • STIP Percentage = 30% of FAR = $45,000 • Maximum STIP Percentage = 45% of FAR = $67,500 • Performance achieved against Corporate KPIs is a combination of Gateway, Target and Stretch outcomes, with payment calculated based on the STIP weightings associated with each KPI • If Gateway for a Corporate KPI is not met, the corresponding payment for that KPI would be zero Sample Calculation - Capped at maximum STIP percentage The boxes shaded in green below represent an assumed level of performance against each KPI. KPI STIP Weighting Actual Performance Levels Gateway (50%) Target (120%) Stretch (175%) Weighted Payment (% of target incentive opportunity) (Performance Level x STIP Weighting) KPI 1 10% 10% x 175% = 17.5% KPI 2 10% 10% x 175% = 17.5% KPI 3 7.5% 7.5% x 50%= 3.75% KPI 4 10% 10% x 175% = 17.5% KPI 5 12.5% 12.5% x 120% = 15% KPI 6 50% 50% x 175% = 87.5% Performance Level % Sum of all individual weighted components above = 17.5%+17.5%+3.75%+17.5% +15%+87.5% = 158.75% STIP Percentage STIP percentage = 30% of FAR Maximum STIP Percentage Maximum STIP percentage = 45% of FAR Final STIP Payment Final STI Percentage = 158.75% X 30% = 47.625% Exceeds Maximum STIP percentage of 45% Final STI payment capped = 45% of $150,000 = $67,500