30062205464-v1 21-41016128 IRIS ENERGY PTY LTD AND THE OPTIONHOLDER LISTED IN SCHEDULE 1 OPTION DEED Exhibit 10.23

30062205464-v1 21-41016128 CONTENTS Clause Page 1. Defined terms and Interpretation ....................................................................................... 1 2. Options .............................................................................................................................. 5 3. Rights of Optionholder ...................................................................................................... 5 4. Issue of Options ................................................................................................................. 6 5. Vesting of Options ............................................................................................................. 6 6. Exercise of Options ........................................................................................................... 7 7. Issue of Shares ................................................................................................................... 7 8. Flexibility on Exercise ....................................................................................................... 7 9. Lapse of Options ............................................................................................................... 8 10. Dealings with Options ....................................................................................................... 9 11. Confidentiality and Publicity ............................................................................................. 9 12. Reorganisation of Capital ................................................................................................ 10 13. Warranties ....................................................................................................................... 11 14. Tax ................................................................................................................................... 12 15. Notices ............................................................................................................................. 12 16. General ............................................................................................................................ 12 Schedule 1 Optionholder.......................................................................................................... 14 Schedule 2 Vesting Thresholds ................................................................................................ 15 Schedule 3 Exercise Notice ..................................................................................................... 16 Signing Page ............................................................................................................................ 17

30062205464-v1 - 1 - 21-41016128 THIS OPTIONS DEED is effective 2021 PARTIES (1) IRIS ENERGY PTY LTD ACN 629 842 799 of C/ Pitcher Partners, Level 13, 664 Collins Street, Docklands, VIC 3008 ("Company"); and (2) THE OPTIONHOLDER LISTED IN SCHEDULE 1 ("Optionholder"). BACKGROUND (A) The Key Person is a co-founder and director of the Group. The Optionholder is the holding vehicle for the Key Person. (B) The Company has determined to grant the Options to the Optionholder on, and subject to, the terms and conditions set out in this deed. THE PARTIES AGREE as follows 1. DEFINED TERMS AND INTERPRETATION 1.1 Defined terms In this deed: "Associated Company" means a company associated with the Key Person where: (a) the majority of the shares in that company are owned, legally and beneficially by that Key Person or legally by the trustee of an Associated Trust of that Key Person; and (b) the balance of the shares (if any) are owned, legally and beneficially, by a Privileged Relation of that Key Person; and (c) the Key Person: (i) has effective control over the conduct and affairs of that company; and (ii) controls the composition of the board of that company. "Associated Trust" means any trust associated with the Key Person being a trust under which the affairs of the trustee are controlled by no one other than the Key Person or a Privileged Relation of that Key Person or an Associated Company of that Key Person. "Bad Leaver Circumstances" means the Key Person voluntarily resigns as a director of the Company (or if an IPO has been completed, a director of the IPO Vehicle) which, for the avoidance of doubt, excludes a resignation or removal as a director which is: (a) outside the control of the Key Person; or (b) due to death, permanent disability or serious illness (or the permanent disability or serious illness of a spouse or a dependent child of the Key Person), including becoming of unsound mind or a person whose person or estate is liable to be dealt with in any way under laws relating to mental health; or (c) as a result of negligence or misconduct by a Group Company; or (d) as a result

30062205464-v1 - 2 - 21-41016128 of board rotation requirements prescribed by the Constitution or the relevant Listing Rules. "Board" means the board of directors of the Company (or if an IPO has been completed, the board of directors of the IPO Vehicle) as constituted from time to time acting as a board. "Business" means the business carried on by the Group from time to time. "Business Day" means a day that is not a Saturday, Sunday, public holiday or bank holiday in New South Wales, Australia. "Confidential Information" means any non-public information regarding the content and existence of this deed and the transactions contemplated by it. "Constitution" means the constitution of the Company (or if an IPO has been completed, the constitution of the IPO Vehicle) from time to time. "Corporations Act" means the Corporations Act 2001 (Cth). "Departing Key Person" means the Key Person once they cease to be a director of the Company (or if an IPO has been completed, a director of the IPO Vehicle). "Exercise Notice" means a notice in the form set out in Schedule 3. "Exercise Period" means the period commencing on the date of this deed and ending on the date that is 12 years after the date of this deed. "Exercise Price" means the price for exercise per Option as set out in Schedule 1, subject to any adjustment pursuant to clause 12. "Forward Looking Statements" means any forward looking statement, estimate, projection or forecast communicated to any Group Company, Key Person or Optionholder from time to time (including prior to the Optionholder being granted with the Options). "Group" mean the Company and all of its subsidiaries from time to time and "Group Company" means any one of them and includes each trust or vehicle where the Group Company is a trustee or owns or controls the majority of units or other beneficial or economic interests in that trust or vehicle. "IPO" means the initial public offering and/or listing of shares of the Company (or IPO Vehicle, if applicable) on a Stock Exchange as approved by the Board (or board of directors of the IPO Vehicle, if applicable). "IPO Vehicle" means the Company or any Group Company or a company of which the Company is a subsidiary (as the case may be) or any vehicle listed as part of the IPO that directly or indirectly owns or will own the Company. "Issue Date" means the date of this deed. "Key Person" means [•] of [•].

30062205464-v1 - 3 - 21-41016128 "Listing Rules" means the official listing rules of the Stock Exchange. "Option" means an option granted to the Optionholder to subscribe for a Share under this deed as set out in Schedule 1, subject to any adjustment pursuant to clause 12. "Privileged Relation" means the spouse and/or children of the relevant person. "Sale" means a sale (whether through a single transaction or a series of related transactions) of more than 50% of the Shares or more than 50% of the share capital or of any undertaking, business or other assets of the Company (directly or indirectly) having a value in excess of 50% of the aggregate value of that Company's (and its subsidiaries) businesses or assets at the relevant time, including via a scheme of arrangement or takeover bid process; "Sale Price" means the price per Share received by Shareholders in connection with a Sale of the Company. "Security Interest" means a mortgage, charge, pledge, lien, encumbrance or other third party interest of any nature. "Share" means a fully paid ordinary share in the capital of the Company (or where an IPO has been completed, a fully paid ordinary share (or equivalent security, such as common stock) in the capital of the IPO Vehicle). "Shareholder" means a person that holds Shares. "Shareholders Agreement" means the document entitled 'Shareholders' Agreement relating to the Iris Energy Group' dated 19 December 2019 between (amongst others) the Company and the Optionholder, as amended and restated from time to time. "Stock Exchange" means the Australian Securities Exchange operated by ASX Limited, NASDAQ, NYSE, TSX or any other stock exchange approved by the Board upon which the Company (or IPO Vehicle, if applicable) may be listed. "Tax" means includes any tax, levy, impost, goods & services tax, deduction, charge, rate, contribution, duty or withholding which is assessed (or deemed to be assessed), levied, imposed or made by any government or any governmental, semi-governmental or judicial entity or authority together with any interest, penalty, fine, charge, fee or other amount assessed (or deemed to be assessed), levied, imposed or made on or in respect of any or all of the foregoing. "Trading Day" means a day on which the Stock Exchange is open for trading and listed shares issued by the Company or the IPO Vehicle (as applicable) are not suspended from trading on the Stock Exchange. "Unvested Option" means an Option which is not a Vested Option. "Vested Option" means an Option which has vested in accordance with clause 5. "Vesting Thresholds" means as set out in Schedule 2, the applicable VWAP Share Price.

30062205464-v1 - 4 - 21-41016128 "Vesting Date" in relation to any Option means the date upon which a Vesting Threshold is met, or such earlier date as may be determined by the Board in its sole and absolute discretion. "VWAP" means the "volume weighted average market price", as defined under the relevant Listing Rules or such other volume weighted average market price reasonably calculated by the Board, in each case in a manner consistent with the definition of "volume weighted average market price" under the Listing Rules in relation to the ASX. "VWAP Share Price" means the Sale Price, or the 20 Trading Day VWAP of the listed shares in the Company (or IPO Vehicle, if applicable) over any consecutive 20 Trading Day period, each subject to any adjustment under clause 12. 1.2 Interpretation In this document, except where the context otherwise requires: (a) the singular includes the plural and vice versa, and a gender includes other genders; (b) another grammatical form of a defined word or expression has a corresponding meaning; (c) a reference to a rule, paragraph or schedule is to a clause or paragraph of, or schedule to, this document, and a reference to this document includes any schedule; (d) a reference to a document or instrument includes the document or instrument as novated, altered, supplemented or replaced from time to time; (e) a reference to "A$" or "$" is to Australian dollar and a reference to "US$" is to the United States dollar, where the applicable exchange rate that shall be applied to any conversion of A$ to the US$ equivalent (rounded to the nearest whole number) for the purposes of this document is US$/A$ 1.36; (f) a reference to time is to time in New South Wales, Australia; (g) a reference to a person includes a natural person, partnership, body corporate, association, governmental or local authority or agency or other entity; (h) a reference to a statute, ordinance, code or other law includes regulations and other instruments under it and consolidations, amendments, re-enactments or replacements of any of them; (i) a word or expression defined in the Corporations Act has the meaning given to it in the Corporations Act; (j) the meaning of general words is not limited by specific examples introduced by including, for example or similar expressions; (k) a rule of construction does not apply to the disadvantage of a party because the party was responsible for the preparation of this document or any part of it; and

30062205464-v1 - 5 - 21-41016128 (l) if a day on or by which an obligation must be performed or an event must occur is not a Business Day, the obligation must be performed or the event must occur on or by the next Business Day. 1.3 Headings Headings are for ease of reference only and do not affect interpretation. 1.4 Listing If the Company (or IPO Vehicle, if applicable) becomes listed on any Stock Exchange: (a) the terms of this deed shall be read subject to the applicable Listing Rules; and (b) references in this deed to the "Company" shall be construed as references to the IPO Vehicle and the Company must procure that the IPO Vehicle accedes as a party to this deed prior to listing on the Stock Exchange. 1.5 Exercise of rights and powers in a manner consistent with Listing Rules The exercise of any rights or powers under this deed is subject to any restrictions, conditions or requirements imposed by any Listing Rules or the law, as the case may be, unless waived or exempted by the relevant regulator or operator of any Stock Exchange (either generally or in a particular case or class of cases and either expressly or by implication). 2. OPTIONS 2.1 Grant The Company hereby irrevocably grants to the Optionholder on the Issue Date such number of Options as set out in Schedule 1, on and subject to the terms and conditions of this deed. 2.2 Nature of the Options (a) An amount of $1 will be payable by the Optionholder for the grant of all the Options under this deed. (b) Any exercise in respect of any Option will not affect the rights of the Optionholder in respect of any other share, option or other security it holds in the Company. 3. RIGHTS OF OPTIONHOLDER 3.1 Entitlement to Shares Subject to any adjustment under clause 12, each Option confers on the Optionholder the right to subscribe for one Share at the Exercise Price, on and subject to the terms and conditions of this deed.

30062205464-v1 - 6 - 21-41016128 3.2 Interest in Shares to which Options relate Other than in accordance with the terms and conditions of this deed, the Optionholder has no right to any Share in respect of an Option unless and until an Option has vested in accordance with clause 5. 3.3 Distribution The Optionholder is entitled to receive in its capacity as a holder of the Options, and the Company must pay or procure the payment of, an income distribution per Vested Option equal to any dividend, distribution, capital return or pro rata buyback proceeds ("Distribution") paid by the Company per Share as if the Vested Options were exercised and Shares issued to the Optionholder at the relevant time of such Distribution. 4. ISSUE OF OPTIONS 4.1 Certificates The Company must issue to the Optionholder within 5 Business Days of the Issue Date a certificate in respect of the number of Options issued to the Optionholder. 4.2 Options register (a) The Company must: (i) set up and maintain a register of option holders; and (ii) at the same time as giving the Optionholder a certificate in accordance with clause 4.1, update the Company's register of option holders. (b) The Company's register of option holders must contain the information required by section 170(1) of the Corporations Act. 5. VESTING OF OPTIONS 5.1 Vesting Options will vest in accordance with this clause 5 on a Vesting Date. 5.2 Options to vest following IPO Following completion of an IPO, Unvested Options will vest in tranches if the Vesting Thresholds based on VWAP Share Price are met as set out in Column 2 in Schedule 2. For the avoidance of doubt, the vesting of any Unvested Options in accordance with the tranches outlined in Schedule 2 can only occur once per tranche and, once vested, cannot then become ‘unvested’. 5.3 Eligible status as at Vesting Date Unless the Board determines otherwise, an Option will not vest under this deed (and may not be exercised) if, as at the Vesting Date:

30062205464-v1 - 7 - 21-41016128 (a) the Optionholder is not a party, or does not subsequently accede, to any Shareholders Agreement (if in force at the Vesting Date, as applicable); and (b) the Key Person in respect of the Optionholder has become a Departing Key Person in Bad Leaver Circumstances. 6. EXERCISE OF OPTIONS 6.1 Exercise of Vested Options (a) Only Vested Options may be exercised during the Exercise Period; (b) Vested Options may be issued during the Exercise Period by the Optionholder delivering an Exercise Notice to the Company and payment of the Exercise Price to the Company in cleared funds to the Company's bank account (or cashless exercise in accordance with clause 8). (c) No Options may be exercised until 5 years after the Issue Date, unless the Tranche B VWAP Share Price is achieved during that time; and (d) The Optionholder may not exercise an Option if it has lapsed in accordance with Clause 9.1. 6.2 Issue of Shares After the exercise of any Option including in accordance with clauses 6.1 or 8 (as applicable), subject to prior compliance with any applicable Listing Rules in respect of the issue of Shares, the Company must issue the number of Shares corresponding with the number of Options which have been validly exercised to the Optionholder immediately and update the register of members with the Optionholder's shareholding in the Company. 7. ISSUE OF SHARES 7.1 Shares in the capital of the Company rank equally The Shares issued on exercise of the Vested Options shall rank equally with all existing Shares on and from the Issue Date in respect of all rights issues, bonus share issues and dividends which have a record date for determining entitlements on or after the date of issue of the Shares issued on exercise of the Vested Options, and are held subject to the rights and restrictions set out in the Constitution and the Shareholders Agreement (if applicable). 8. FLEXIBILITY ON EXERCISE 8.1 Election for cashless settlement The Optionholder may elect the Company to cancel or acquire (or nominate another person to acquire) such number of Vested Options set out in the Exercise Notice ("Settlement Options") as is necessary to fund the Exercise Price, plus any Tax payable by the Optionholder on the cancellation or acquisition of the Settlement Options ("Settlement Tax Amount"), in relation to the exercise of the remaining Vested

30062205464-v1 - 8 - 21-41016128 Options set out in the Exercise Notice net of the Settlement Options ("Exercised Options"). The consideration payable to the Optionholder to cancel or acquire such Settlement Options under this clause 8 is the "Settlement Consideration", being the aggregate VWAP Share Price of the Settlement Options (over the 20 Trading Day period immediately preceding (and including) the date of the Exercise Notice) net of the aggregate Exercise Price for the Settlement Options. 8.2 Exercise of Exercised Options If an Optionholder determines to exercise Vested Options by cashless settlement under clause 8.1, the Optionholder shall be deemed to direct the Company to: (a) apply (on behalf of the Optionholder) such portion of the Settlement Consideration necessary to exercise the Exercised Options; (b) transfer the remaining portion of the Settlement Consideration necessary for the Optionholder to procure payment of any Settlement Tax Amount payable by the Optionholder on the cancellation or acquisition of the Settlement Options; and (c) set-off the Exercise Price payable by the Optionholder for the Exercised Options against the payment of the Settlement Consideration payable to the Optionholder. The application and set-off of the Settlement Consideration by the Company under this clause 8.2 shall constitute full payment of the Exercise Price for the Exercised Options for the purposes of clause 6.1(b) and the Company shall be obligated to issue Shares to the Optionholder in accordance with clause 6.2. 9. LAPSE OF OPTIONS 9.1 Options expiry An Option lapses on the expiry of the Exercise Period. 9.2 Rights cease Subject to clause 8, if an Option lapses, all rights of the Optionholder under this deed in respect of that Option cease, and no consideration will be payable for or in relation to the lapsing of Options. 9.3 Winding up If a resolution for a members' voluntary winding up of the Company is proposed (except for the purpose of a reconstruction or amalgamation) the Board will give written notice to the Optionholder of the proposed resolution. The Optionholder may, during the period referred to in the notice (of at least 21 days), exercise their Options (whether Vested Options or Unvested Options), including utilising the mechanism outlined in Clause 8.

30062205464-v1 - 9 - 21-41016128 10. DEALINGS WITH OPTIONS 10.1 No transfers (a) Except otherwise in accordance with the terms of this deed and subject to the terms of this deed (including clause 8), the Optionholder may not sell, dispose, distribute, deal with, assign, transfer, or grant a Security Interest in an Unvested Option or any interest in an Unvested Option other than: (i) with the prior written consent of the Board; or (ii) a transfer to an Associated Company, Associated Trust or a Privileged Relation. (b) Any disposal or transfer not in accordance with this clause 10 is void and of no effect. 11. CONFIDENTIALITY AND PUBLICITY 11.1 Confidentiality Subject to clause 11.2, the Optionholder and Company must not do, and must use its best endeavours to ensure that its agents or advisers do not do, any of the following: (a) disclose any Confidential Information; (b) use any Confidential Information in any manner: (i) which may cause or be calculated to cause loss to the other party; or (ii) other than for the purpose for which it was disclosed; or (c) make any public announcement or issue any press release regarding this deed or the transactions contemplated by it. 11.2 Permitted disclosure The Optionholder and Company may disclose, and may permit its auditor, officers, employees, agents and advisers to disclose, any Confidential Information: (a) with the prior written consent of the other party; (b) to his or her or its advisers and current or prospective financiers on a confidential basis; (c) to the extent it is required to do so by law (including the relevant Listing Rules) or a governmental, judicial, supervisory or administrative body, or any reporting requirement to which it is subject under the terms of any trust deed, contract or other document in effect as at the date of this deed; and (d) in proceedings before any court arising out of, or in connection with, this deed.

30062205464-v1 - 10 - 21-41016128 12. REORGANISATION OF CAPITAL 12.1 New issues and recapitalisations Optionholders are not entitled to participate, in their capacity as holders of Options, in any new issue of securities in the Company, unless the Board determines otherwise. 12.2 New holding company If there is a restructure of the Group so that an entity other than the Company becomes the Holding Company (as defined in the Corporations Act) of the Group ("HoldCo"), or if it is proposed to conduct an IPO using an IPO Vehicle other than the Company, then the Board will provide for the grant of new options in substitution for the Options on a like for like basis, by HoldCo or the IPO Vehicle (as applicable). 12.3 Reconstruction In the event of any reorganisation of the issued capital of the Company or IPO Vehicle (including, without limitation, any share consolidation, subdivision, buy-back, bonus issue, reduction or return of capital), the Board will make such appropriate adjustments to: (a) the number and kind of Shares to which the Optionholder is entitled on exercise of an Option, (b) the Exercise Price (if any); and (c) any other term of an Option, in order (in each case) to preserve for the Optionholder the value and economic terms of their Options relative to the other equity securities of the Group. 12.4 Change in shares on issue In the event that after the Issue Date there is a change to the shares on issue of the Company (on a fully diluted basis), then the VWAP Share Prices shall be adjusted such that such prices are reflective of the total equity value of the Company. For the avoidance of doubt, where a share buyback occurs then the VWAP Share Prices shall correspondingly increase to reflect less shares on issue and, where new shares are issued (including under any bonus issue), VWAP Share Prices shall correspondingly decrease to reflect additional shares on issue. 12.5 Notice of change The Company must, as soon as practicable, give the Optionholder notice of any change under this deed to the number of Shares that, or the Exercise Price at which, the Optionholder may subscribe for on exercise of an Option.

30062205464-v1 - 11 - 21-41016128 13. WARRANTIES 13.1 Optionholder warranties The Optionholder and Company make the following representations and warranties on the date of this deed, for the benefit of the other party: (a) ("no reliance") no representation, warranty, promise or undertaking except those expressly set out in this deed has induced or influenced either party to enter into, or agree to any terms or conditions of, this deed, has been relied on in any way as being accurate by either party, or has been warranted by any person (and any of their respective officers, representatives or agents) as being true or accurate; (b) ("Forward Looking Statements") neither party has not relied on any Forward Looking Statement in relation to the Shares, any matter concerning the Shares or any of the transactions contemplated by this deed, and the parties acknowledge that no person represents (or has at any time represented) that any such Forward Looking Statements will be achieved or are accurate or are made on reasonable grounds; and (c) ("independent advice") it has obtained independent advice on the legal, financial, taxation and other consequences to it of, or relating to, the grant of Options to it, and is not relying on anything that the other party has said or done. 13.2 Trustee warranties If the Optionholder is a trustee of a trust, the Optionholder makes the following representations and warranties on the date of this deed and the date of exercise of an Option, for the benefit of the Company: (a) in respect of the trust no action has been taken or is now proposed to be taken to terminate or dissolve the relevant trust; (b) it has full and valid power and authority under the terms of the relevant trust to enter into this deed and to carry out the transactions contemplated by this deed; and (c) it has in full force and effect the authorisations necessary for it to enter into this deed and perform its obligations under it and allow them to be enforced. 13.3 Acknowledgement The parties acknowledges that the parties entered into this deed in reliance on the representations and warranties given in this deed. 13.4 Separate warranties Each of the representations and warranties set out in clause 13 is separate and independent and is not limited by reference to any other representation and warranty.

30062205464-v1 - 12 - 21-41016128 14. TAX The Company is not responsible for any Taxes which may become payable by the Optionholder in connection with the issue of the Options, the issue of Shares on the exercise of the Options or any other dealing by the Optionholder with the Options or Shares to be issued on exercise of the Options. 15. NOTICES Any notice given under this deed: (a) must be sent to: (i) in case of the Optionholder, the relevant email address set out in Schedule 1; and (ii) in case of the Company, the address or email address set out below: Address: Email: Attention: C/- Pitcher Partners, Level 13, 664 Collins Street, Docklands, VIC 3008 [email] The Board or to any other address or email address number that either party may specify in writing to the other. (b) is taken to have been given or made: (i) (in the case of delivery in person) when delivered or left at the above address; (ii) (in case of delivery by pre-paid post) at 9.00am (Sydney time) on the second Business Day after the date of posting; (iii) (in the case of delivery by email) when the sender receives an automated message confirming delivery, or 3 hours after the time sent (as recorded on the device from which the sender sent the email) unless the sender receives an automated message that the email has not been delivered (whichever happens first), but if delivery or receipt occurs on a day which is not a Business Day or is later than 4pm (Sydney local time), it will be taken to have been duly given or made at the commencement of the next Business Day. 16. GENERAL 16.1 Governing law and jurisdiction (a) This deed is governed by the laws of New South Wales.

30062205464-v1 - 13 - 21-41016128 (b) Each party irrevocably and unconditionally submits to the non-exclusive jurisdiction of courts exercising jurisdiction in New South Wales and courts of appeal from them in respect of any proceedings arising out of or in connection with this deed. Each party irrevocably waives any objection to the venue of any legal process in these courts on the basis that the process has been brought in an inconvenient forum. 16.2 Severability Any provision of this deed which is invalid in any jurisdiction must in relation to that jurisdiction: (a) be read down to the minimum extent necessary to achieve its validity, if applicable; and (b) be severed from this deed in any other case, without invalidating or affecting the remaining provisions of this deed or the validity of that provision in any other jurisdiction. 16.3 Waiver and variation A provision of, or a right created under, this deed may not be waived or varied except in writing, signed by the parties. 16.4 Assignment A party may not assign any of its rights or obligations under this deed without the prior written consent of the other party. 16.5 Remedies cumulative The rights, powers and remedies provided in this deed are cumulative with and not exclusive of the rights, powers or remedies provided by law independently of this deed. 16.6 Entire agreement This deed contains the entire agreement between the parties with respect to its subject matter. It supersedes all earlier conduct by the parties or prior agreement between the parties with respect to its subject matter. 16.7 Counterparts This deed may be executed in any number of counterparts. All counterparts taken together are deemed to constitute one instrument.

30062205464-v1 - 14 - 21-41016128 SCHEDULE 1 OPTIONHOLDER 1 Optionholder [Insert] 2 Key Person [Insert] 3 Number of Options granted [Number] 4 Exercise Price US$[X] per Option (being the US$ equivalent of A$[X] per Option)

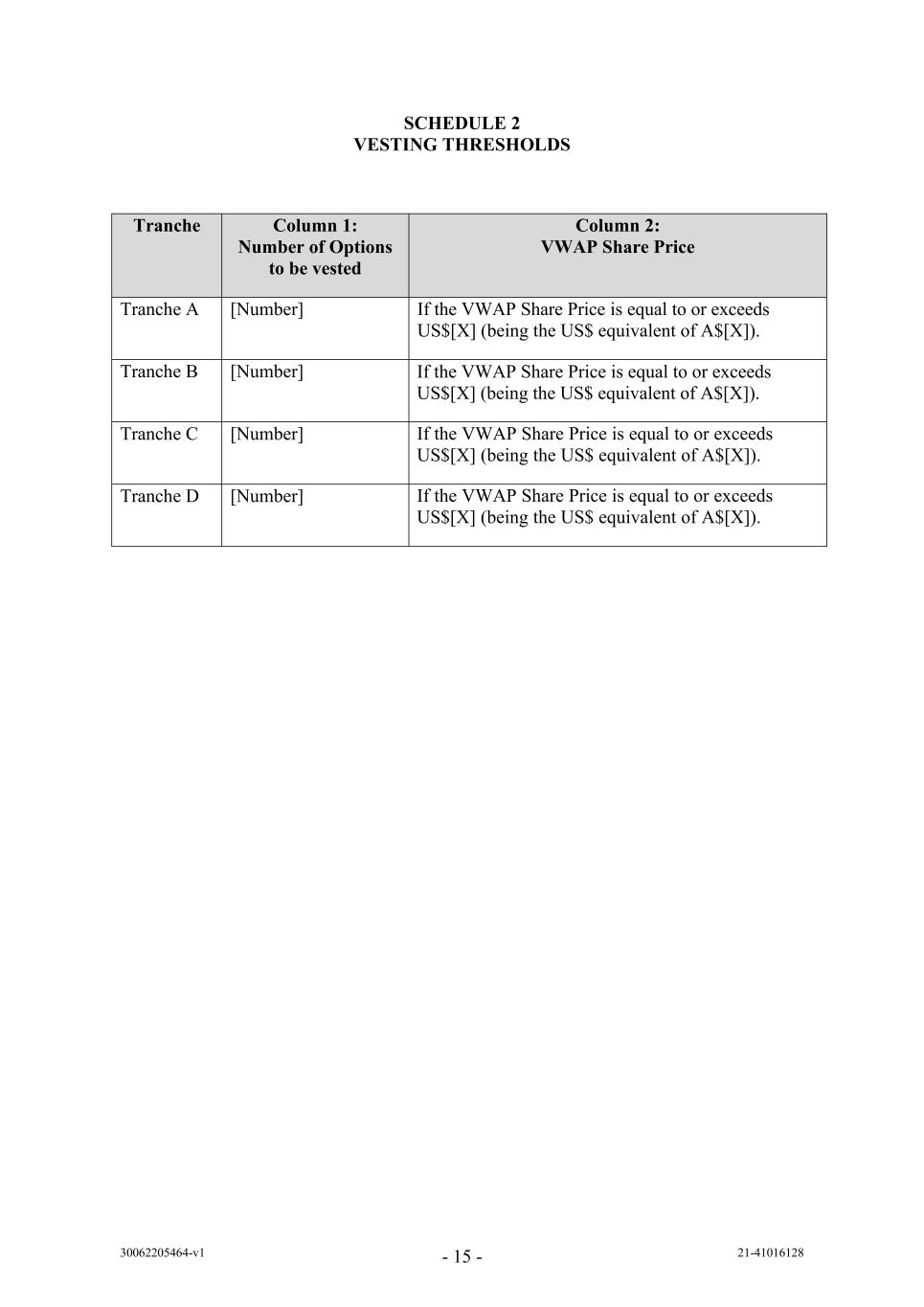

30062205464-v1 - 15 - 21-41016128 SCHEDULE 2 VESTING THRESHOLDS Tranche Column 1: Number of Options to be vested Column 2: VWAP Share Price Tranche A [Number] If the VWAP Share Price is equal to or exceeds US$[X] (being the US$ equivalent of A$[X]). Tranche B [Number] If the VWAP Share Price is equal to or exceeds US$[X] (being the US$ equivalent of A$[X]). Tranche C [Number] If the VWAP Share Price is equal to or exceeds US$[X] (being the US$ equivalent of A$[X]). Tranche D [Number] If the VWAP Share Price is equal to or exceeds US$[X] (being the US$ equivalent of A$[X]).

30062205464-v1 - 16 - 21-41016128 SCHEDULE 3 EXERCISE NOTICE TO: The Directors Iris Energy Limited ACN 629 842 799 C/ Pitcher Partners, Level 13, 664 Collins Street, Docklands, VIC 3008 ("Company") We, [insert name of Optionholder] of [insert address] (the "Optionholder") being the owner of [•] options ("Options") issued to us pursuant to the options deed dated [insert date] (the "Deed") hereby: 1. exercise [•] Vested Options; and 2. request the Company to allot (or procure the allotment of) Shares to the Optionholder in accordance with the Deed. We authorise the Company to register us as the holder of Shares to be allotted in accordance with this notice and we agree to accept such Shares subject to the Constitution. [We enclose a cheque in favour of the Company / an electronic funds transfer remittance advice] for the total Exercise Price of the Options hereby exercised by us / We elect to exercise our right of cashless exercise election under clause 8]; Date: ______________ _________________________ (Signature) _________________________ (Address) _________________________ (Print Name)

30062205464-v1 - 17 - 21-41016128 SIGNING PAGE EXECUTED AS A DEED Signed sealed and delivered by Iris Energy Pty Ltd (ACN 629 842 799) in accordance with Section 127 of the Corporations Act 2001 Signature of director Signature of director/secretary Name of director (print) Name of director/secretary (print) Signed sealed and delivered by [Insert Optionholder] in accordance with Section 127 of the Corporations Act 2001 Signature of sole director Name of sole director (print)