TPG Reports Fourth Quarter and Full Year 2025 Financial Results Year Ended December 31, 2025

TPG | 2 San Francisco and Fort Worth, Texas – February 5, 2026 – TPG Inc. (NASDAQ: TPG), a leading global alternative asset management firm, today reported its unaudited results for the fourth quarter and full year ended December 31, 2025. A detailed presentation is available through the Investor Relations section of TPG’s website at shareholders.tpg.com. “2025 was an outstanding year for TPG, marked by exceptional execution across our global franchise. We achieved new records, with more than $51 billion raised and $52 billion deployed, and these results – combined with the continued scaling of our business and double-digit value creation across nearly all our platforms – have driven our total AUM to more than $300 billion,” said Jon Winkelried, Chief Executive Officer. “We started 2026 with significant momentum and our increased scale and diversification, coupled with $72 billion in dry powder, position us well to navigate the evolving market landscape, while continuing to deliver sustained growth and differentiated value for our clients and shareholders.” Dividend TPG has declared a quarterly dividend of $0.61 per share of Class A common stock to holders of record at the close of business on February 19, 2026, payable on March 5, 2026. Conference Call TPG will host a conference call and live webcast at 12:00 pm ET. It may be accessed by dialing (800) 245-3047 (US toll-free) or (203) 518-9765 (international), using the conference ID TPGQ425. The number should be dialed at least ten minutes prior to the start of the call. A simultaneous webcast will also be available and can be accessed through the Investor Relations section of TPG's website at shareholders.tpg.com. A webcast replay will be made available on the Events page in the Investor Relations section of TPG's website. About TPG TPG is a leading global alternative asset management firm, founded in San Francisco in 1992, with $303 billion of assets under management and investment and operational teams around the world. TPG invests across a broadly diversified set of strategies, including private equity, impact, credit, real estate, and market solutions, and our unique strategy is driven by collaboration, innovation, and inclusion. Our teams combine deep product and sector experience with broad capabilities and expertise to develop differentiated insights and add value for our fund investors, portfolio companies, management teams, and communities. Shareholders Media Gary Stein and Evanny Huang Luke Barrett and Julia Sottosanti shareholders@tpg.com media@tpg.com TPG Reports Fourth Quarter and Full Year 2025 Results

TPG | 3 TPG Reports Fourth Quarter and Full Year 2025 Results Forward Looking Statements; No Offers; Non-GAAP Information This document may contain “forward-looking” statements. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance, estimated operational metrics, business strategy and plans and objectives of management for future operations, including, among other things, statements regarding expected growth, future capital expenditures, fund performance, dividends and dividend policy, and debt service obligations. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by any forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the inability to recognize the anticipated benefits, or unexpected costs related to the integration, of acquired companies; our ability to manage growth and execute our business plan; and regional, national or global political, economic, business, competitive, market and regulatory conditions and uncertainties, among various other risks discussed in the Company’s SEC filings. For the reasons described above, we caution you against relying on any forward-looking statements, which should be read in conjunction with the other cautionary statements included elsewhere in this document and risk factors discussed from time to time in the Company’s filings with the SEC, which can be found at the SEC’s website at http://www.sec.gov. Any forward-looking statement in this document speaks only as of the date of this document. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update or revise any forward-looking statement after the date of this document, whether as a result of new information, future developments or otherwise, except as may be required by law. No recipient should, therefore, rely on these forward-looking statements as representing the views of the Company or its management as of any date subsequent to the date of the document. This document does not constitute an offer of any TPG fund. Throughout this document, all current period amounts are preliminary and unaudited; totals may not sum due to rounding. See the Reconciliations and Disclosures Section of this document for reconciliations of Non-GAAP to the most comparable GAAP measures.

Fourth Quarter and Full Year 2025 Results

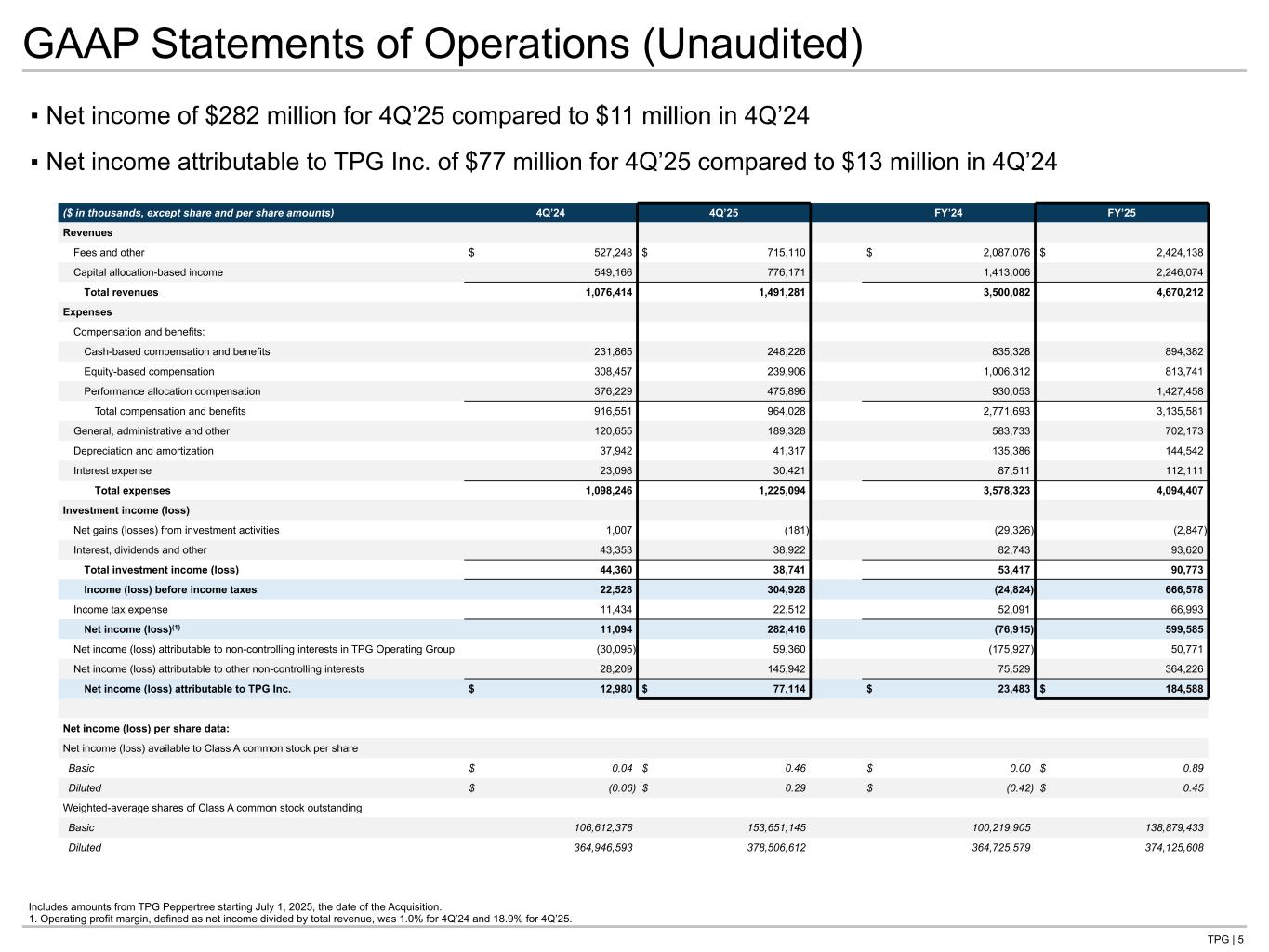

TPG | 5 ▪ Net income of $282 million for 4Q’25 compared to $11 million in 4Q’24 ▪ Net income attributable to TPG Inc. of $77 million for 4Q’25 compared to $13 million in 4Q’24 GAAP Statements of Operations (Unaudited) Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. 1. Operating profit margin, defined as net income divided by total revenue, was 1.0% for 4Q’24 and 18.9% for 4Q’25. ($ in thousands, except share and per share amounts) 4Q’24 4Q’25 FY’24 FY’25 Revenues Fees and other $ 527,248 $ 715,110 $ 2,087,076 $ 2,424,138 Capital allocation-based income 549,166 776,171 1,413,006 2,246,074 Total revenues 1,076,414 1,491,281 3,500,082 4,670,212 Expenses Compensation and benefits: Cash-based compensation and benefits 231,865 248,226 835,328 894,382 Equity-based compensation 308,457 239,906 1,006,312 813,741 Performance allocation compensation 376,229 475,896 930,053 1,427,458 Total compensation and benefits 916,551 964,028 2,771,693 3,135,581 General, administrative and other 120,655 189,328 583,733 702,173 Depreciation and amortization 37,942 41,317 135,386 144,542 Interest expense 23,098 30,421 87,511 112,111 Total expenses 1,098,246 1,225,094 3,578,323 4,094,407 Investment income (loss) Net gains (losses) from investment activities 1,007 (181) (29,326) (2,847) Interest, dividends and other 43,353 38,922 82,743 93,620 Total investment income (loss) 44,360 38,741 53,417 90,773 Income (loss) before income taxes 22,528 304,928 (24,824) 666,578 Income tax expense 11,434 22,512 52,091 66,993 Net income (loss)(1) 11,094 282,416 (76,915) 599,585 Net income (loss) attributable to non-controlling interests in TPG Operating Group (30,095) 59,360 (175,927) 50,771 Net income (loss) attributable to other non-controlling interests 28,209 145,942 75,529 364,226 Net income (loss) attributable to TPG Inc. $ 12,980 $ 77,114 $ 23,483 $ 184,588 Net income (loss) per share data: Net income (loss) available to Class A common stock per share Basic $ 0.04 $ 0.46 $ 0.00 $ 0.89 Diluted $ (0.06) $ 0.29 $ (0.42) $ 0.45 Weighted-average shares of Class A common stock outstanding Basic 106,612,378 153,651,145 100,219,905 138,879,433 Diluted 364,946,593 378,506,612 364,725,579 374,125,608 Tie to Qtrly statements at back

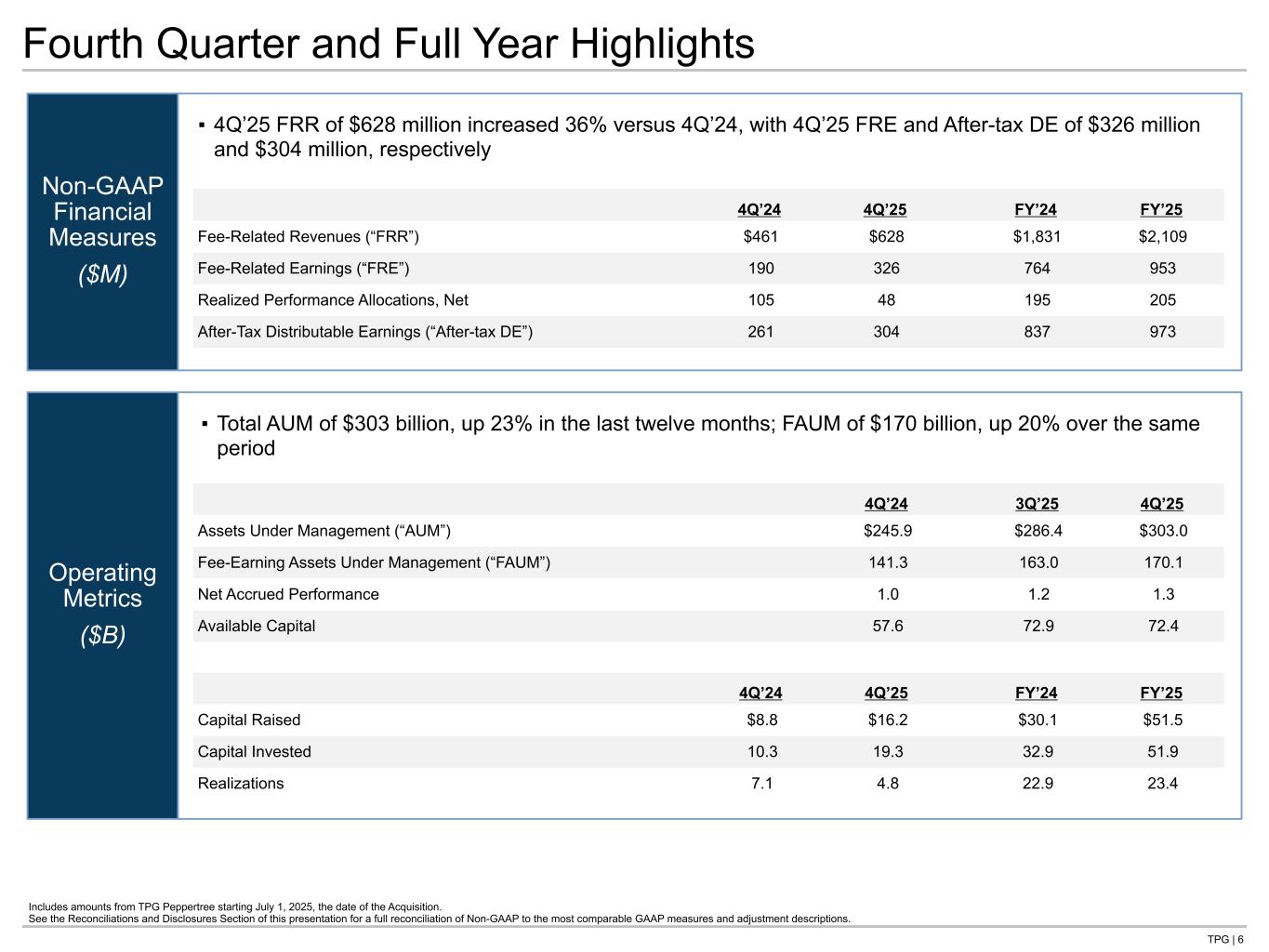

TPG | 6 Operating Metrics ($B) Non-GAAP Financial Measures ($M) Fourth Quarter and Full Year Highlights 4Q’24 4Q’25 FY’24 FY’25 Fee-Related Revenues (“FRR”) $461 $628 $1,831 $2,109 Fee-Related Earnings (“FRE”) 190 326 764 953 Realized Performance Allocations, Net 105 48 195 205 After-Tax Distributable Earnings (“After-tax DE”) 261 304 837 973 4Q’24 3Q’25 4Q’25 Assets Under Management (“AUM”) $245.9 $286.4 $303.0 Fee-Earning Assets Under Management (“FAUM”) 141.3 163.0 170.1 Net Accrued Performance 1.0 1.2 1.3 Available Capital 57.6 72.9 72.4 4Q’24 4Q’25 FY’24 FY’25 Capital Raised $8.8 $16.2 $30.1 $51.5 Capital Invested 10.3 19.3 32.9 51.9 Realizations 7.1 4.8 22.9 23.4 ▪ 4Q’25 FRR of $628 million increased 36% versus 4Q’24, with 4Q’25 FRE and After-tax DE of $326 million and $304 million, respectively ▪ Total AUM of $303 billion, up 23% in the last twelve months; FAUM of $170 billion, up 20% over the same period Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. See the Reconciliations and Disclosures Section of this presentation for a full reconciliation of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. Tie to next page Tie to OM section

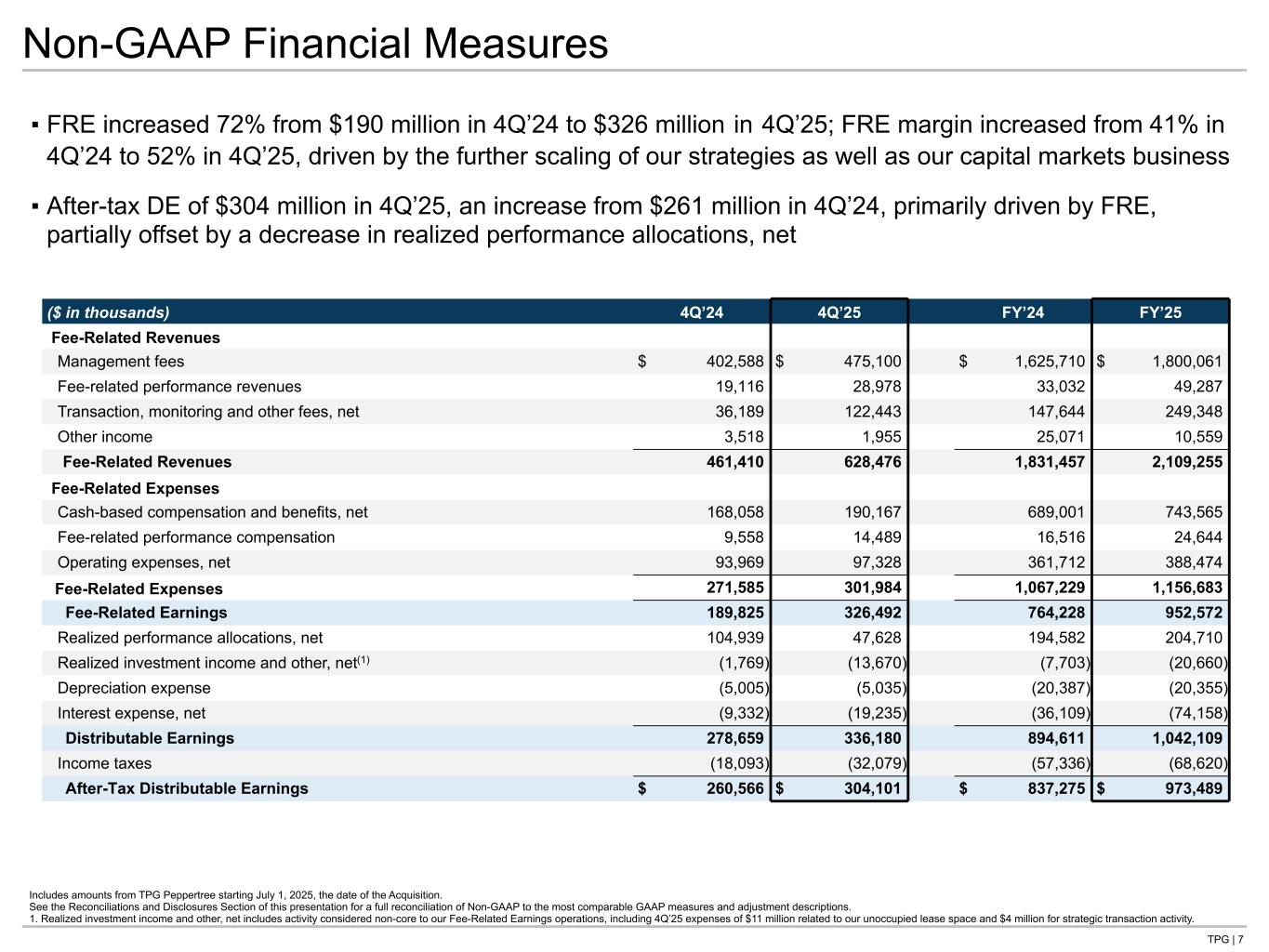

TPG | 7 Non-GAAP Financial Measures ▪ FRE increased 72% from $190 million in 4Q’24 to $326 million in 4Q’25; FRE margin increased from 41% in 4Q’24 to 52% in 4Q’25, driven by the further scaling of our strategies as well as our capital markets business ▪ After-tax DE of $304 million in 4Q’25, an increase from $261 million in 4Q’24, primarily driven by FRE, partially offset by a decrease in realized performance allocations, net Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. See the Reconciliations and Disclosures Section of this presentation for a full reconciliation of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. 1. Realized investment income and other, net includes activity considered non-core to our Fee-Related Earnings operations, including 4Q’25 expenses of $11 million related to our unoccupied lease space and $4 million for strategic transaction activity. ($ in thousands) 4Q’24 4Q’25 FY’24 FY’25 Fee-Related Revenues Management fees $ 402,588 $ 475,100 $ 1,625,710 $ 1,800,061 Fee-related performance revenues 19,116 28,978 33,032 49,287 Transaction, monitoring and other fees, net 36,189 122,443 147,644 249,348 Other income 3,518 1,955 25,071 10,559 Fee-Related Revenues 461,410 628,476 1,831,457 2,109,255 Fee-Related Expenses Cash-based compensation and benefits, net 168,058 190,167 689,001 743,565 Fee-related performance compensation 9,558 14,489 16,516 24,644 Operating expenses, net 93,969 97,328 361,712 388,474 Fee-Related Expenses 271,585 301,984 1,067,229 1,156,683 Fee-Related Earnings 189,825 326,492 764,228 952,572 Realized performance allocations, net 104,939 47,628 194,582 204,710 Realized investment income and other, net(1) (1,769) (13,670) (7,703) (20,660) Depreciation expense (5,005) (5,035) (20,387) (20,355) Interest expense, net (9,332) (19,235) (36,109) (74,158) Distributable Earnings 278,659 336,180 894,611 1,042,109 Income taxes (18,093) (32,079) (57,336) (68,620) After-Tax Distributable Earnings $ 260,566 $ 304,101 $ 837,275 $ 973,489 Tie to: -prior page -qtrly statement in back -G-NG qtrly statment in back

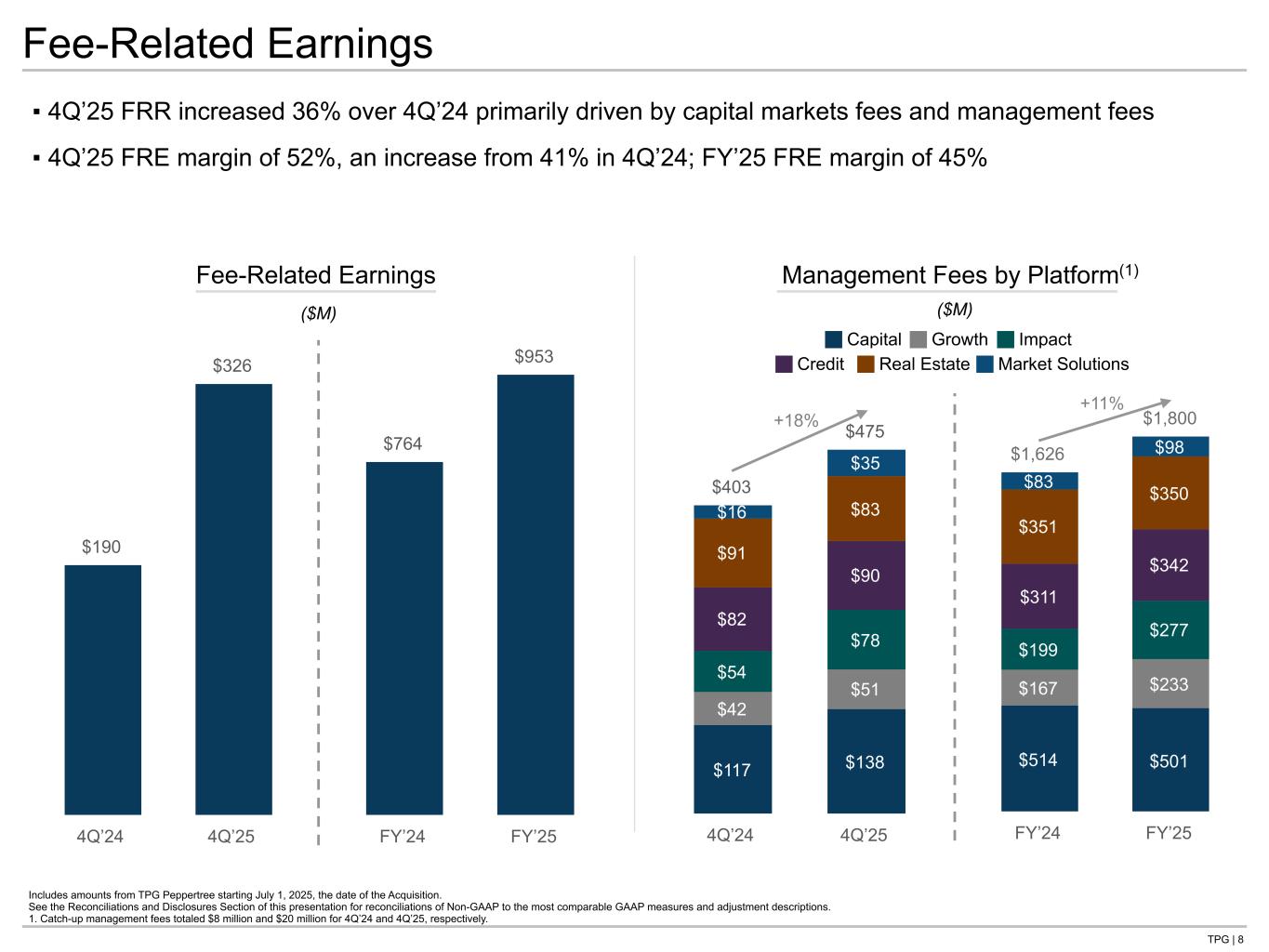

TPG | 8 $1,626 $1,800 $514 $501 $167 $233 $199 $277 $311 $342 $351 $350 $83 $98 FY’24 FY’25 $190 $326 4Q’24 4Q’25 $764 $953 FY’24 FY’25 $403 $475 $117 $138 $42 $51 $54 $78 $82 $90 $91 $83$16 $35 4Q’24 4Q’25 ▪ 4Q’25 FRR increased 36% over 4Q’24 primarily driven by capital markets fees and management fees ▪ 4Q’25 FRE margin of 52%, an increase from 41% in 4Q’24; FY’25 FRE margin of 45% Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. See the Reconciliations and Disclosures Section of this presentation for reconciliations of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. 1. Catch-up management fees totaled $8 million and $20 million for 4Q’24 and 4Q’25, respectively. Fee-Related Earnings Management Fees by Platform(1) ($M) ($M) +18% Capital Growth Impact +11% Credit Real Estate Market Solutions Fee-Related Earnings

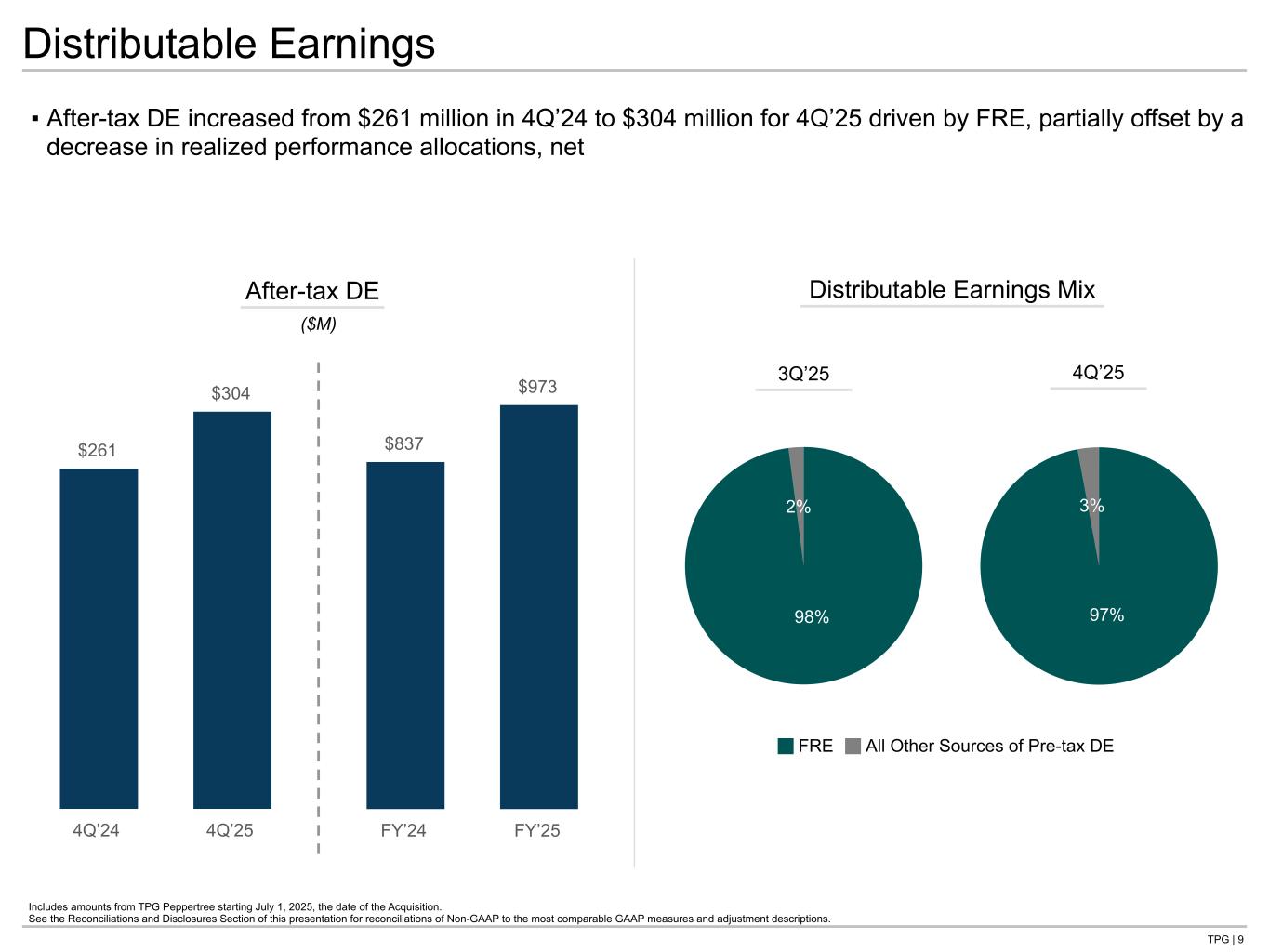

TPG | 9 $261 $304 4Q’24 4Q’25 $837 $973 FY’24 FY’25 Distributable Earnings ▪ After-tax DE increased from $261 million in 4Q’24 to $304 million for 4Q’25 driven by FRE, partially offset by a decrease in realized performance allocations, net After-tax DE ($M) Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. See the Reconciliations and Disclosures Section of this presentation for reconciliations of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. Distributable Earnings Mix FRE All Other Sources of Pre-tax DE 98% 2% 97% 3% 3Q’25 4Q’25

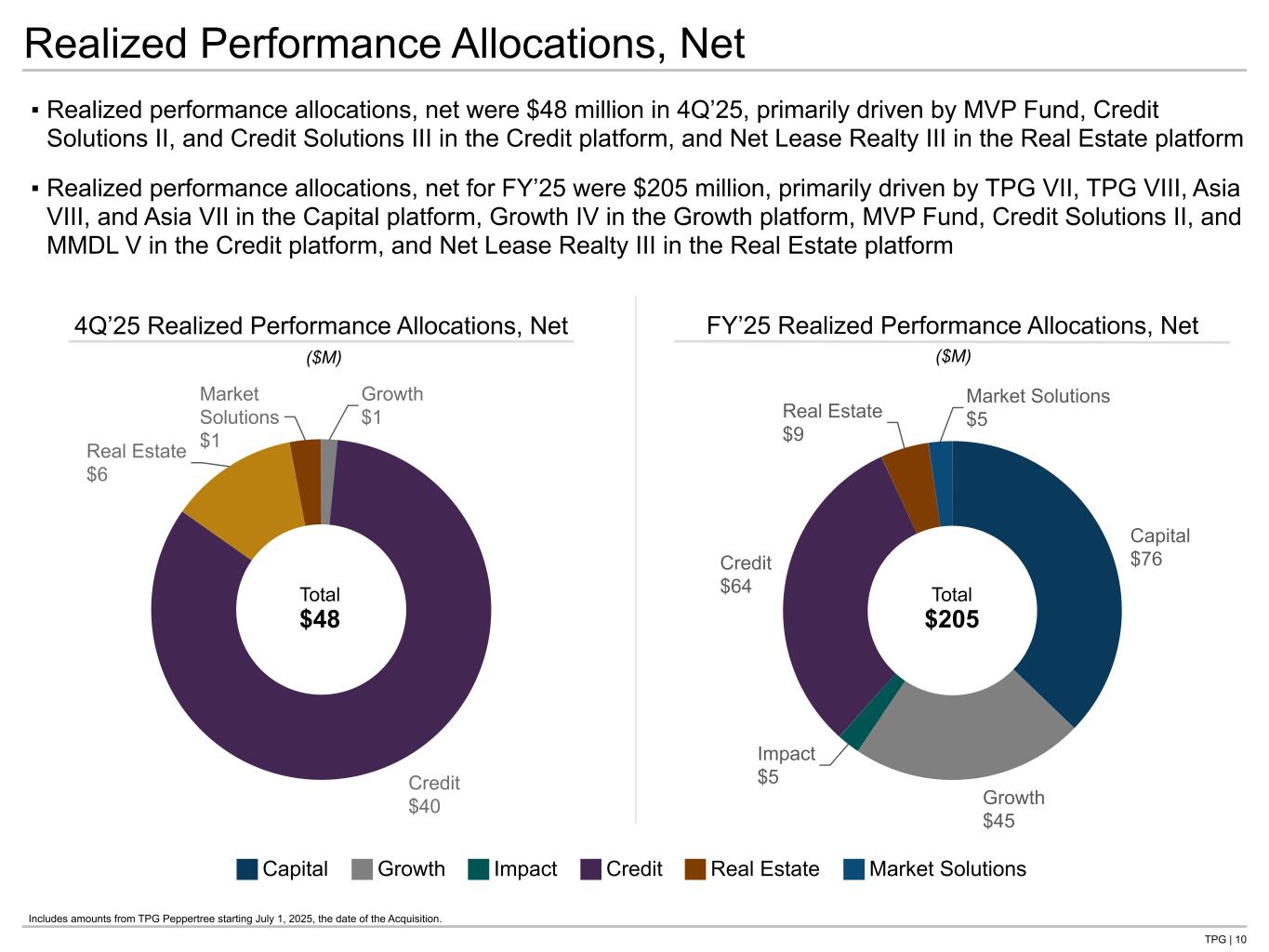

TPG | 10 Capital $76 Growth $45 Impact $5 Credit $64 Real Estate $9 Market Solutions $5 FY’25 Realized Performance Allocations, Net Growth $1 Credit $40 Real Estate $6 Market Solutions $1 ▪ Realized performance allocations, net were $48 million in 4Q’25, primarily driven by MVP Fund, Credit Solutions II, and Credit Solutions III in the Credit platform, and Net Lease Realty III in the Real Estate platform ▪ Realized performance allocations, net for FY’25 were $205 million, primarily driven by TPG VII, TPG VIII, Asia VIII, and Asia VII in the Capital platform, Growth IV in the Growth platform, MVP Fund, Credit Solutions II, and MMDL V in the Credit platform, and Net Lease Realty III in the Real Estate platform Realized Performance Allocations, Net 4Q’25 Realized Performance Allocations, Net ($M) ($M) Total $205 Total $48 Capital Growth Impact Credit Real Estate Market Solutions Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition.

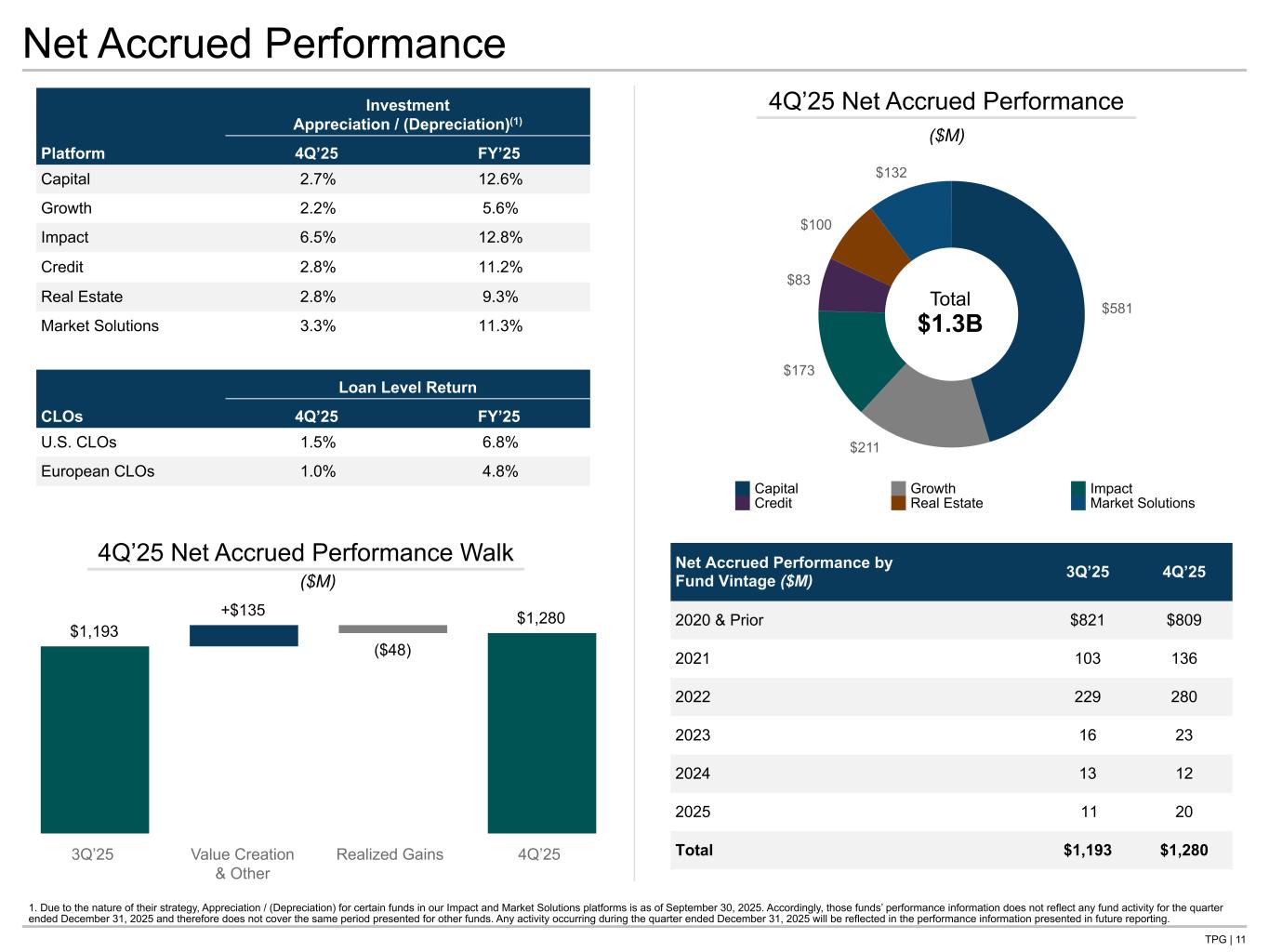

TPG | 11 $581 $211 $173 $83 $100 $132 Net Accrued Performance Net Accrued Performance by Fund Vintage ($M) 3Q’25 4Q’25 2020 & Prior $821 $809 2021 103 136 2022 229 280 2023 16 23 2024 13 12 2025 11 20 Total $1,193 $1,280 4Q’25 Net Accrued Performance Total $1.3B ($M) $1,193 +$135 ($48) $1,280 3Q’25 Value Creation & Other Realized Gains 4Q’25 4Q’25 Net Accrued Performance Walk ($M) Investment Appreciation / (Depreciation)(1) Platform 4Q’25 FY’25 Capital 2.7% 12.6% Growth 2.2% 5.6% Impact 6.5% 12.8% Credit 2.8% 11.2% Real Estate 2.8% 9.3% Market Solutions 3.3% 11.3% Loan Level Return CLOs 4Q’25 FY’25 U.S. CLOs 1.5% 6.8% European CLOs 1.0% 4.8% 1. Due to the nature of their strategy, Appreciation / (Depreciation) for certain funds in our Impact and Market Solutions platforms is as of September 30, 2025. Accordingly, those funds’ performance information does not reflect any fund activity for the quarter ended December 31, 2025 and therefore does not cover the same period presented for other funds. Any activity occurring during the quarter ended December 31, 2025 will be reflected in the performance information presented in future reporting. Capital Growth Impact Credit Real Estate Market Solutions Tie all 3 Net APF totals to NG BS

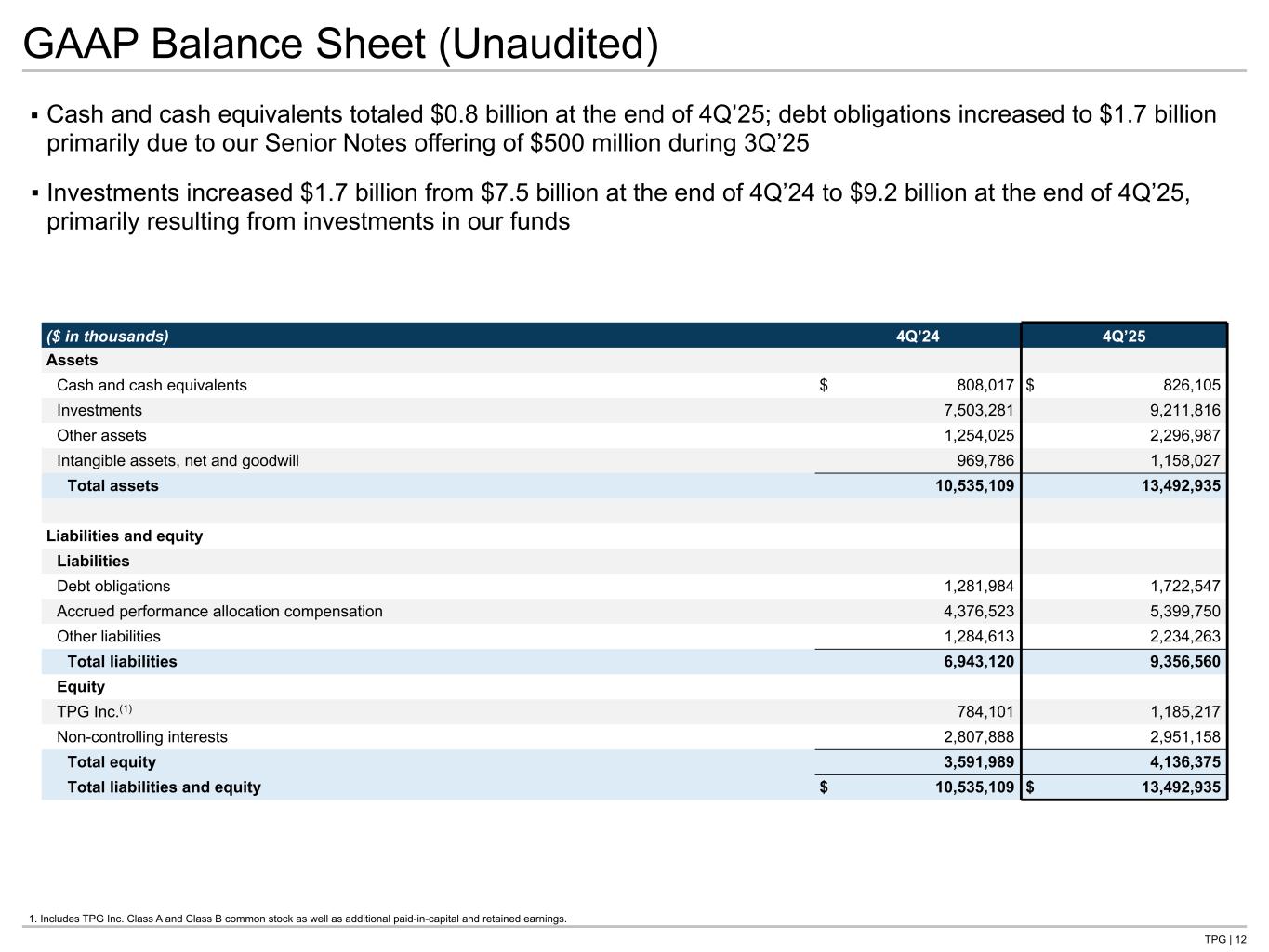

TPG | 12 GAAP Balance Sheet (Unaudited) ▪ Cash and cash equivalents totaled $0.8 billion at the end of 4Q’25; debt obligations increased to $1.7 billion primarily due to our Senior Notes offering of $500 million during 3Q’25 ▪ Investments increased $1.7 billion from $7.5 billion at the end of 4Q’24 to $9.2 billion at the end of 4Q’25, primarily resulting from investments in our funds 1. Includes TPG Inc. Class A and Class B common stock as well as additional paid-in-capital and retained earnings. ($ in thousands) 4Q’24 4Q’25 Assets Cash and cash equivalents $ 808,017 $ 826,105 Investments 7,503,281 9,211,816 Other assets 1,254,025 2,296,987 Intangible assets, net and goodwill 969,786 1,158,027 Total assets 10,535,109 13,492,935 Liabilities and equity Liabilities Debt obligations 1,281,984 1,722,547 Accrued performance allocation compensation 4,376,523 5,399,750 Other liabilities 1,284,613 2,234,263 Total liabilities 6,943,120 9,356,560 Equity TPG Inc.(1) 784,101 1,185,217 Non-controlling interests 2,807,888 2,951,158 Total equity 3,591,989 4,136,375 Total liabilities and equity $ 10,535,109 $ 13,492,935 Tie to B/S G- NG in back

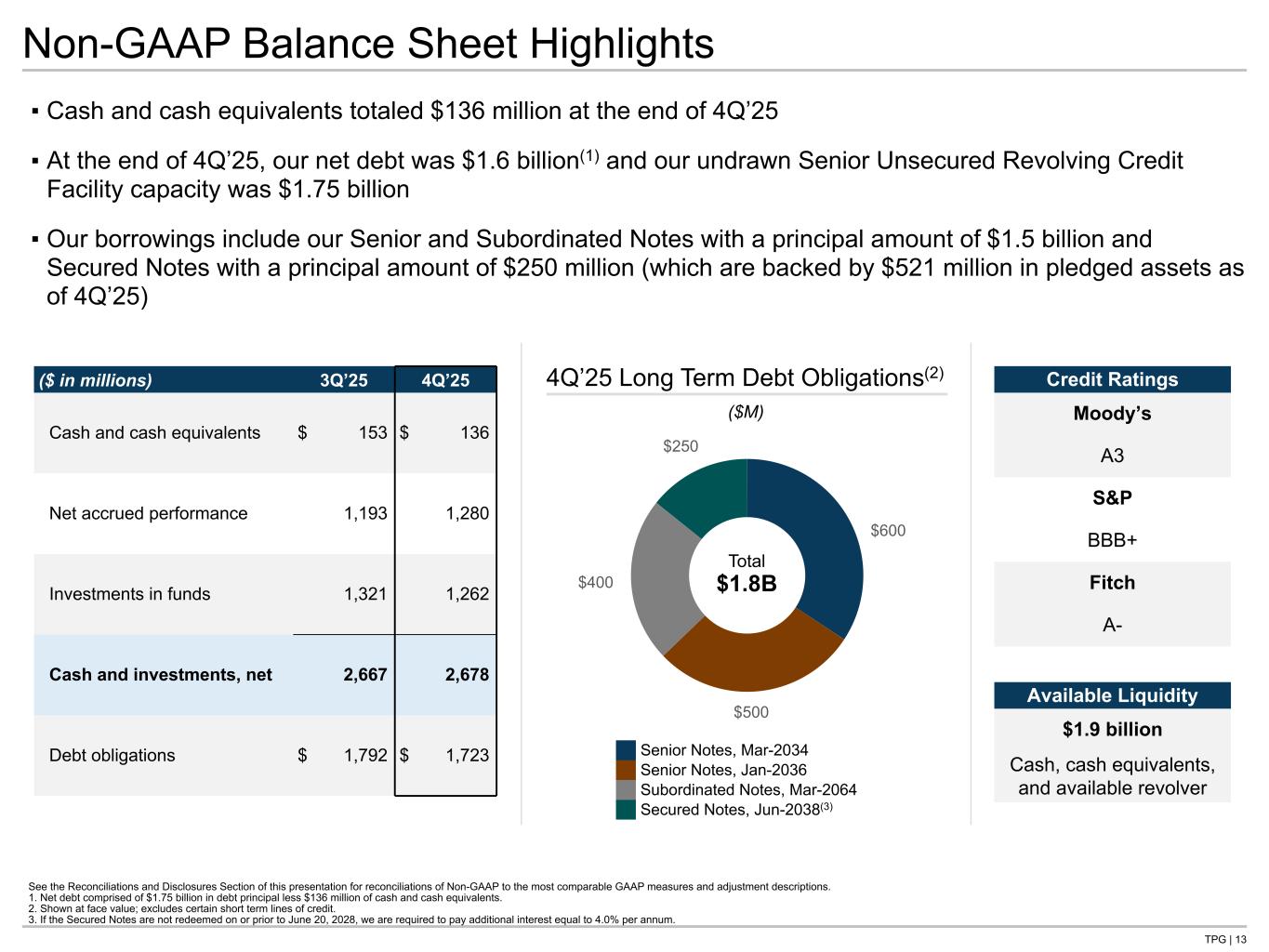

TPG | 13 ▪ Cash and cash equivalents totaled $136 million at the end of 4Q’25 ▪ At the end of 4Q’25, our net debt was $1.6 billion(1) and our undrawn Senior Unsecured Revolving Credit Facility capacity was $1.75 billion ▪ Our borrowings include our Senior and Subordinated Notes with a principal amount of $1.5 billion and Secured Notes with a principal amount of $250 million (which are backed by $521 million in pledged assets as of 4Q’25) Senior Notes, Mar-2034 Senior Notes, Jan-2036 Subordinated Notes, Mar-2064 Secured Notes, Jun-2038(3) Non-GAAP Balance Sheet Highlights See the Reconciliations and Disclosures Section of this presentation for reconciliations of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. 1. Net debt comprised of $1.75 billion in debt principal less $136 million of cash and cash equivalents. 2. Shown at face value; excludes certain short term lines of credit. 3. If the Secured Notes are not redeemed on or prior to June 20, 2028, we are required to pay additional interest equal to 4.0% per annum. ($ in millions) 3Q’25 4Q’25 Cash and cash equivalents $ 153 $ 136 Net accrued performance 1,193 1,280 Investments in funds 1,321 1,262 Cash and investments, net 2,667 2,678 Debt obligations $ 1,792 $ 1,723 $600 $500 $400 $250 4Q’25 Long Term Debt Obligations(2) Total $1.8B ($M) Credit Ratings Moody’s A3 S&P BBB+ Fitch A- Available Liquidity $1.9 billion Cash, cash equivalents, and available revolver Tie to B/S G- NG in back

Operating Metrics

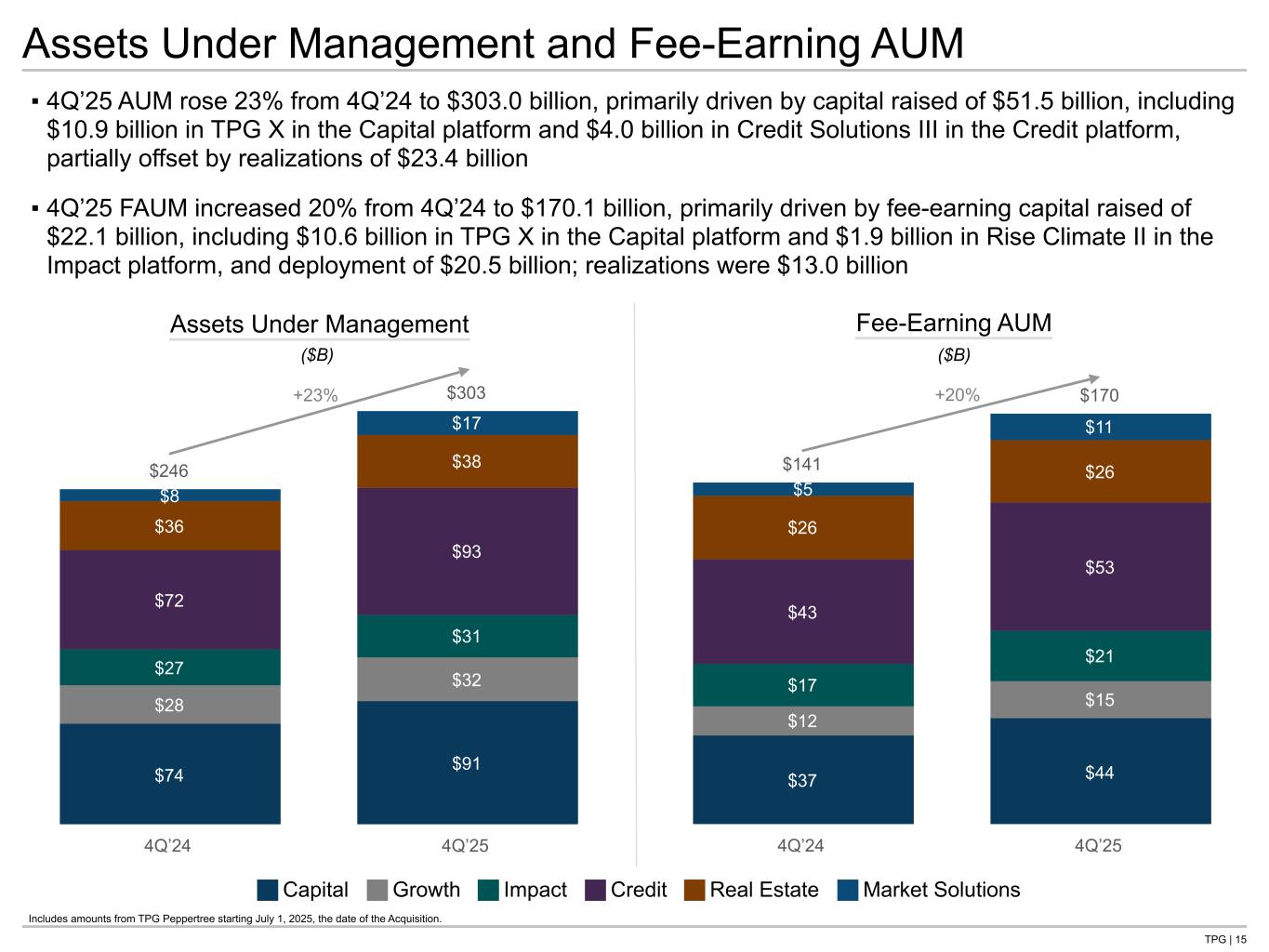

TPG | 15 $141 $170 $37 $44 $12 $15 $17 $21 $43 $53 $26 $26 $5 $11 4Q’24 4Q’25 $246 $303 $74 $91 $28 $32 $27 $31 $72 $93 $36 $38 $8 $17 4Q’24 4Q’25 Assets Under Management and Fee-Earning AUM ▪ 4Q’25 AUM rose 23% from 4Q’24 to $303.0 billion, primarily driven by capital raised of $51.5 billion, including $10.9 billion in TPG X in the Capital platform and $4.0 billion in Credit Solutions III in the Credit platform, partially offset by realizations of $23.4 billion ▪ 4Q’25 FAUM increased 20% from 4Q’24 to $170.1 billion, primarily driven by fee-earning capital raised of $22.1 billion, including $10.6 billion in TPG X in the Capital platform and $1.9 billion in Rise Climate II in the Impact platform, and deployment of $20.5 billion; realizations were $13.0 billion Assets Under Management Fee-Earning AUM ($B) ($B) +23% +20% Capital Growth Impact Credit Real Estate Market Solutions Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition.

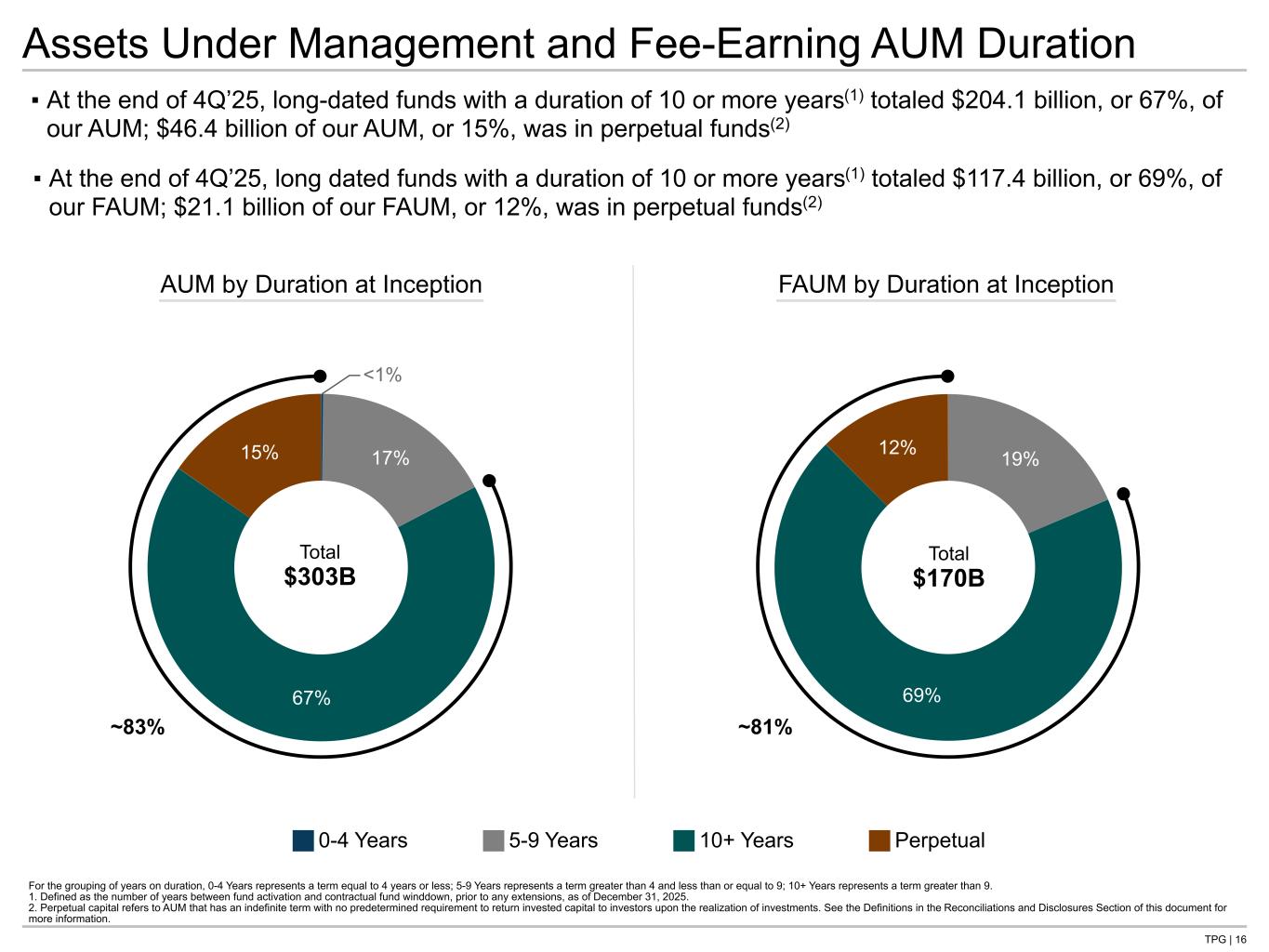

TPG | 16 Assets Under Management and Fee-Earning AUM Duration For the grouping of years on duration, 0-4 Years represents a term equal to 4 years or less; 5-9 Years represents a term greater than 4 and less than or equal to 9; 10+ Years represents a term greater than 9. 1. Defined as the number of years between fund activation and contractual fund winddown, prior to any extensions, as of December 31, 2025. 2. Perpetual capital refers to AUM that has an indefinite term with no predetermined requirement to return invested capital to investors upon the realization of investments. See the Definitions in the Reconciliations and Disclosures Section of this document for more information. ▪ At the end of 4Q’25, long-dated funds with a duration of 10 or more years(1) totaled $204.1 billion, or 67%, of our AUM; $46.4 billion of our AUM, or 15%, was in perpetual funds(2) ▪ At the end of 4Q’25, long dated funds with a duration of 10 or more years(1) totaled $117.4 billion, or 69%, of our FAUM; $21.1 billion of our FAUM, or 12%, was in perpetual funds(2) 0-4 Years 5-9 Years 10+ Years Perpetual 19% 69% 12% 0.22% 17% 67% 15% AUM by Duration at Inception Total $303B FAUM by Duration at Inception Total $170B <1% ~83% ~81%

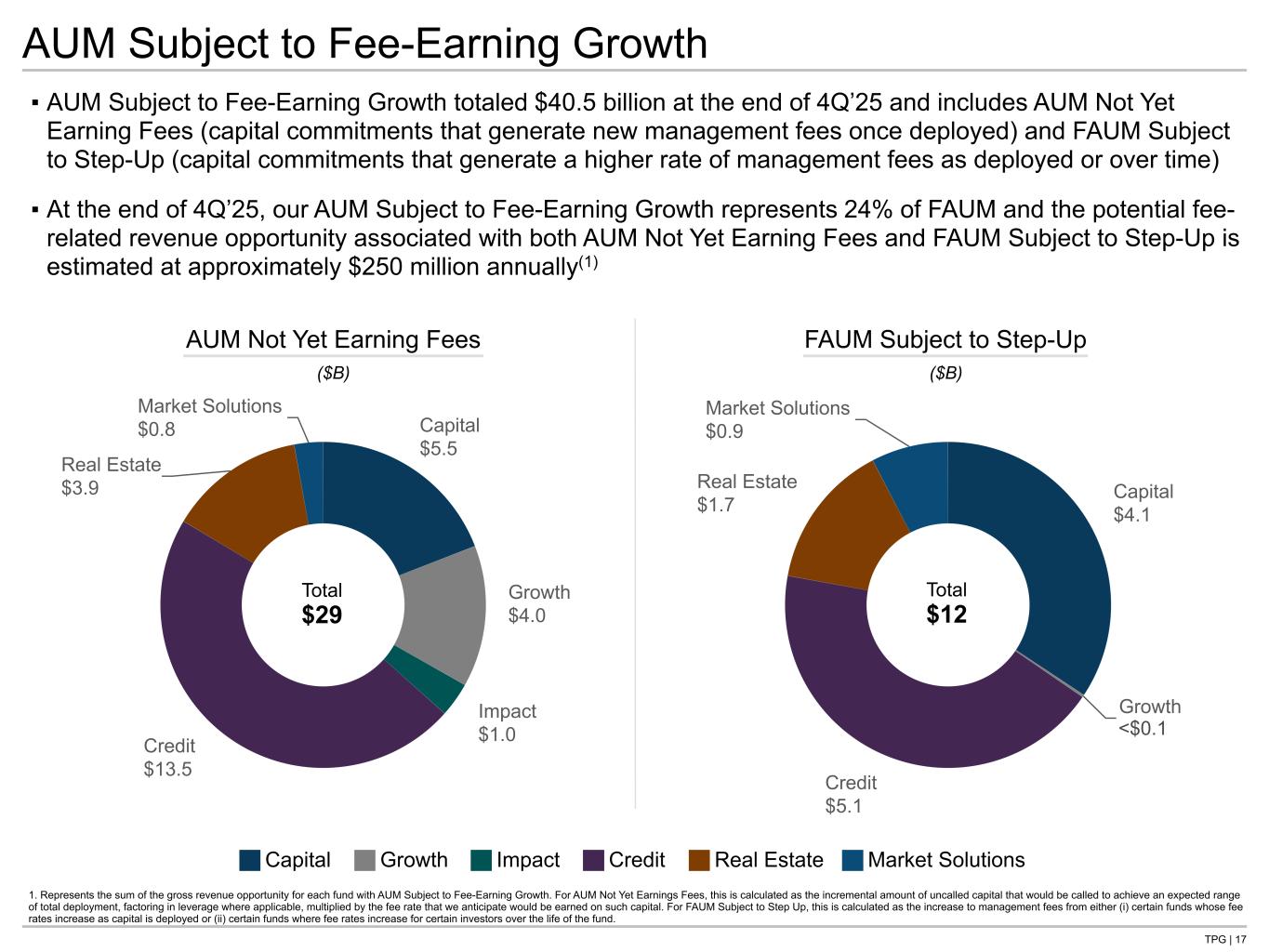

TPG | 17 Capital $4.1 Growth $0.0 Credit $5.1 Real Estate $1.7 Market Solutions $0.9Capital $5.5 Growth $4.0 Impact $1.0Credit $13.5 Real Estate $3.9 Market Solutions $0.8 ▪ AUM Subject to Fee-Earning Growth totaled $40.5 billion at the end of 4Q’25 and includes AUM Not Yet Earning Fees (capital commitments that generate new management fees once deployed) and FAUM Subject to Step-Up (capital commitments that generate a higher rate of management fees as deployed or over time) ▪ At the end of 4Q’25, our AUM Subject to Fee-Earning Growth represents 24% of FAUM and the potential fee- related revenue opportunity associated with both AUM Not Yet Earning Fees and FAUM Subject to Step-Up is estimated at approximately $250 million annually(1) AUM Not Yet Earning Fees FAUM Subject to Step-Up ($B) ($B) Total $29 Total $12 AUM Subject to Fee-Earning Growth 1. Represents the sum of the gross revenue opportunity for each fund with AUM Subject to Fee-Earning Growth. For AUM Not Yet Earnings Fees, this is calculated as the incremental amount of uncalled capital that would be called to achieve an expected range of total deployment, factoring in leverage where applicable, multiplied by the fee rate that we anticipate would be earned on such capital. For FAUM Subject to Step Up, this is calculated as the increase to management fees from either (i) certain funds whose fee rates increase as capital is deployed or (ii) certain funds where fee rates increase for certain investors over the life of the fund. Capital Growth Impact Credit Real Estate Market Solutions <$0.1

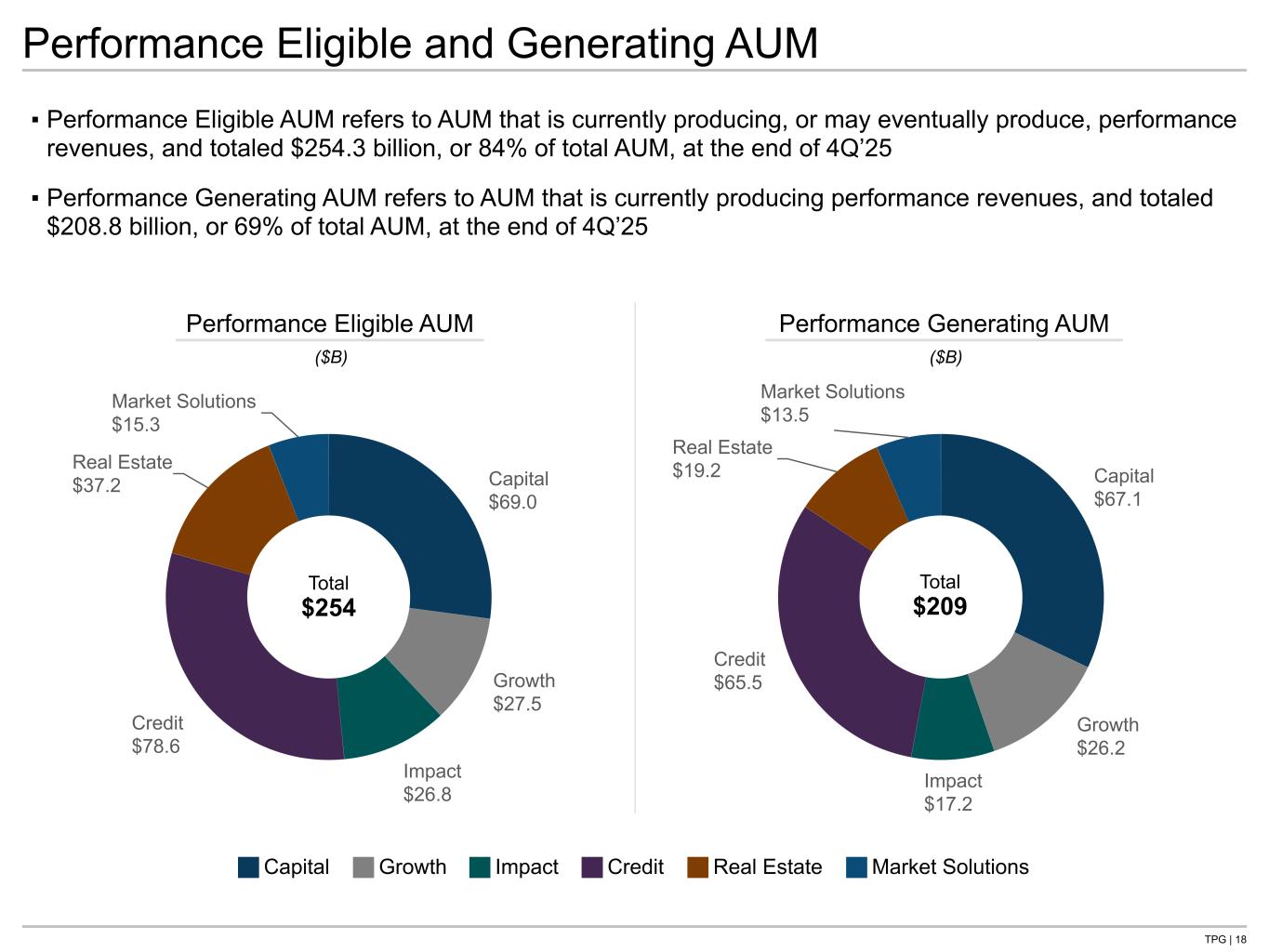

TPG | 18 Capital $67.1 Growth $26.2 Impact $17.2 Credit $65.5 Real Estate $19.2 Market Solutions $13.5 Capital $69.0 Growth $27.5 Impact $26.8 Credit $78.6 Real Estate $37.2 Market Solutions $15.3 ▪ Performance Eligible AUM refers to AUM that is currently producing, or may eventually produce, performance revenues, and totaled $254.3 billion, or 84% of total AUM, at the end of 4Q’25 ▪ Performance Generating AUM refers to AUM that is currently producing performance revenues, and totaled $208.8 billion, or 69% of total AUM, at the end of 4Q’25 Performance Eligible AUM Performance Generating AUM ($B) ($B) Total $254 Total $209 Performance Eligible and Generating AUM Capital Growth Impact Credit Real Estate Market Solutions

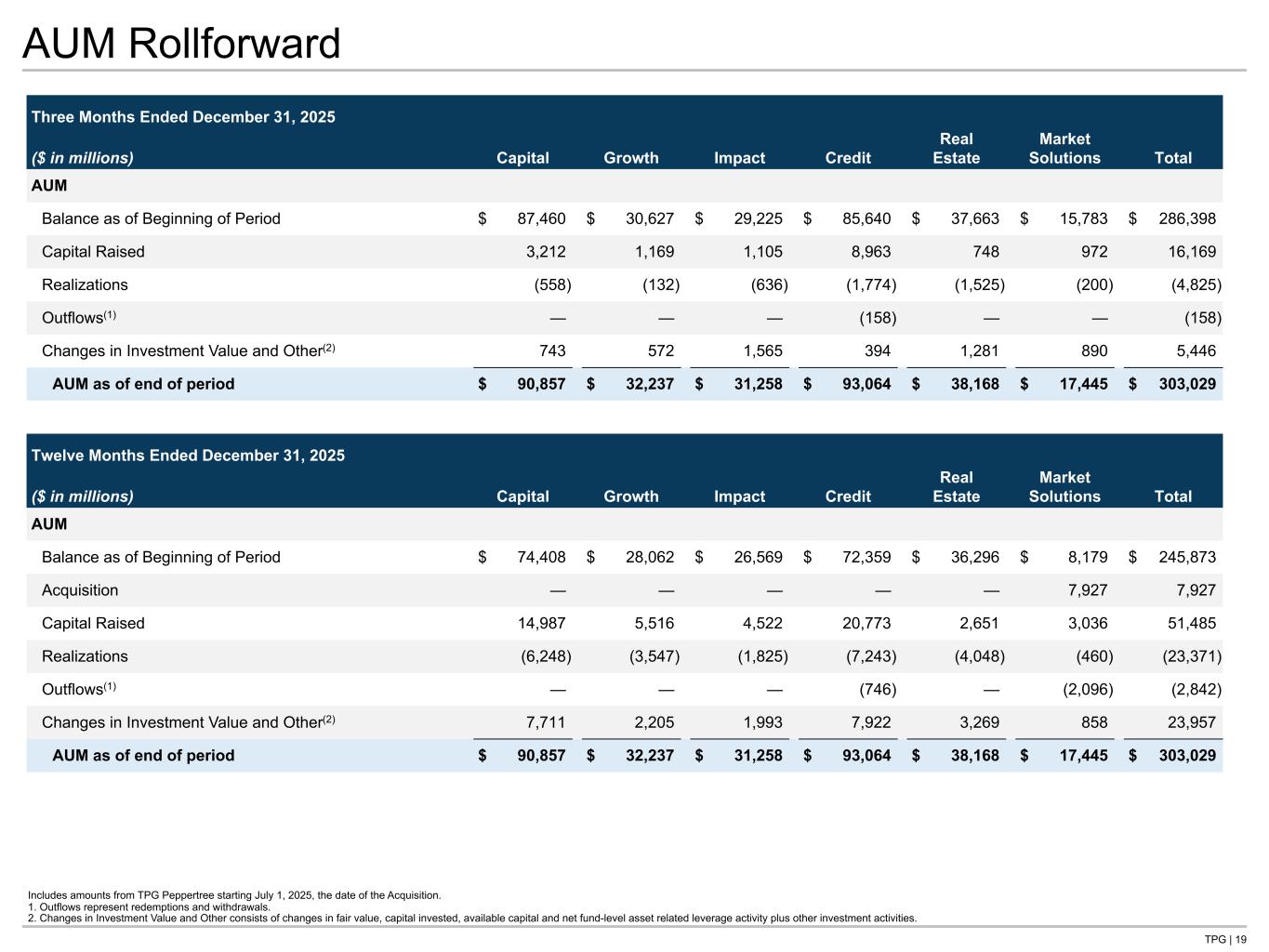

TPG | 19 AUM Rollforward Three Months Ended December 31, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total AUM Balance as of Beginning of Period $ 87,460 $ 30,627 $ 29,225 $ 85,640 $ 37,663 $ 15,783 $ 286,398 Capital Raised 3,212 1,169 1,105 8,963 748 972 16,169 Realizations (558) (132) (636) (1,774) (1,525) (200) (4,825) Outflows(1) — — — (158) — — (158) Changes in Investment Value and Other(2) 743 572 1,565 394 1,281 890 5,446 AUM as of end of period $ 90,857 $ 32,237 $ 31,258 $ 93,064 $ 38,168 $ 17,445 $ 303,029 Twelve Months Ended December 31, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total AUM Balance as of Beginning of Period $ 74,408 $ 28,062 $ 26,569 $ 72,359 $ 36,296 $ 8,179 $ 245,873 Acquisition — — — — — 7,927 7,927 Capital Raised 14,987 5,516 4,522 20,773 2,651 3,036 51,485 Realizations (6,248) (3,547) (1,825) (7,243) (4,048) (460) (23,371) Outflows(1) — — — (746) — (2,096) (2,842) Changes in Investment Value and Other(2) 7,711 2,205 1,993 7,922 3,269 858 23,957 AUM as of end of period $ 90,857 $ 32,237 $ 31,258 $ 93,064 $ 38,168 $ 17,445 $ 303,029 Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. 1. Outflows represent redemptions and withdrawals. 2. Changes in Investment Value and Other consists of changes in fair value, capital invested, available capital and net fund-level asset related leverage activity plus other investment activities. Tie to 4sq page

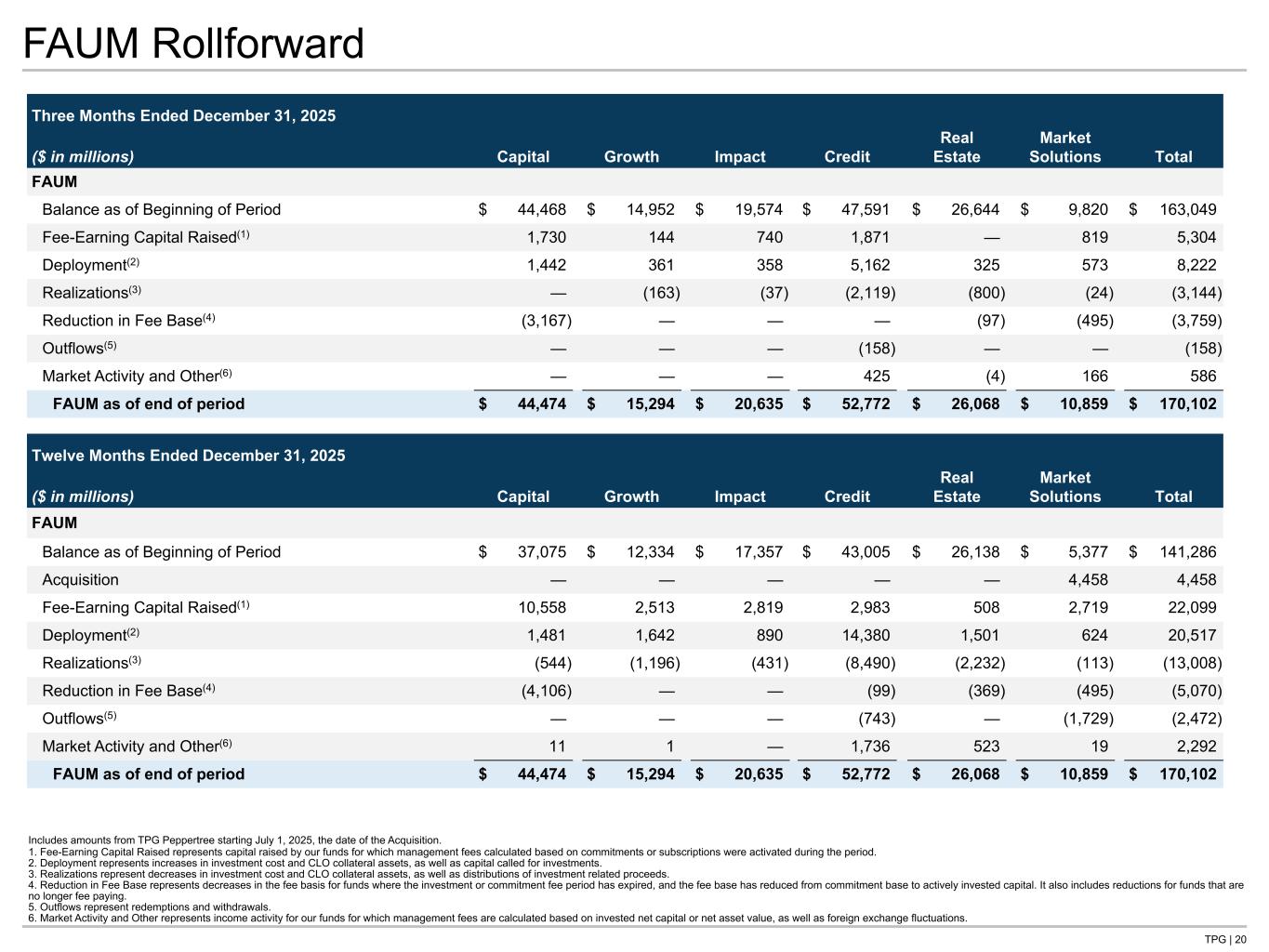

TPG | 20 FAUM Rollforward Three Months Ended December 31, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total FAUM Balance as of Beginning of Period $ 44,468 $ 14,952 $ 19,574 $ 47,591 $ 26,644 $ 9,820 $ 163,049 Fee-Earning Capital Raised(1) 1,730 144 740 1,871 — 819 5,304 Deployment(2) 1,442 361 358 5,162 325 573 8,222 Realizations(3) — (163) (37) (2,119) (800) (24) (3,144) Reduction in Fee Base(4) (3,167) — — — (97) (495) (3,759) Outflows(5) — — — (158) — — (158) Market Activity and Other(6) — — — 425 (4) 166 586 FAUM as of end of period $ 44,474 $ 15,294 $ 20,635 $ 52,772 $ 26,068 $ 10,859 $ 170,102 Twelve Months Ended December 31, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total FAUM Balance as of Beginning of Period $ 37,075 $ 12,334 $ 17,357 $ 43,005 $ 26,138 $ 5,377 $ 141,286 Acquisition — — — — — 4,458 4,458 Fee-Earning Capital Raised(1) 10,558 2,513 2,819 2,983 508 2,719 22,099 Deployment(2) 1,481 1,642 890 14,380 1,501 624 20,517 Realizations(3) (544) (1,196) (431) (8,490) (2,232) (113) (13,008) Reduction in Fee Base(4) (4,106) — — (99) (369) (495) (5,070) Outflows(5) — — — (743) — (1,729) (2,472) Market Activity and Other(6) 11 1 — 1,736 523 19 2,292 FAUM as of end of period $ 44,474 $ 15,294 $ 20,635 $ 52,772 $ 26,068 $ 10,859 $ 170,102 Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. 1. Fee-Earning Capital Raised represents capital raised by our funds for which management fees calculated based on commitments or subscriptions were activated during the period. 2. Deployment represents increases in investment cost and CLO collateral assets, as well as capital called for investments. 3. Realizations represent decreases in investment cost and CLO collateral assets, as well as distributions of investment related proceeds. 4. Reduction in Fee Base represents decreases in the fee basis for funds where the investment or commitment fee period has expired, and the fee base has reduced from commitment base to actively invested capital. It also includes reductions for funds that are no longer fee paying. 5. Outflows represent redemptions and withdrawals. 6. Market Activity and Other represents income activity for our funds for which management fees are calculated based on invested net capital or net asset value, as well as foreign exchange fluctuations.

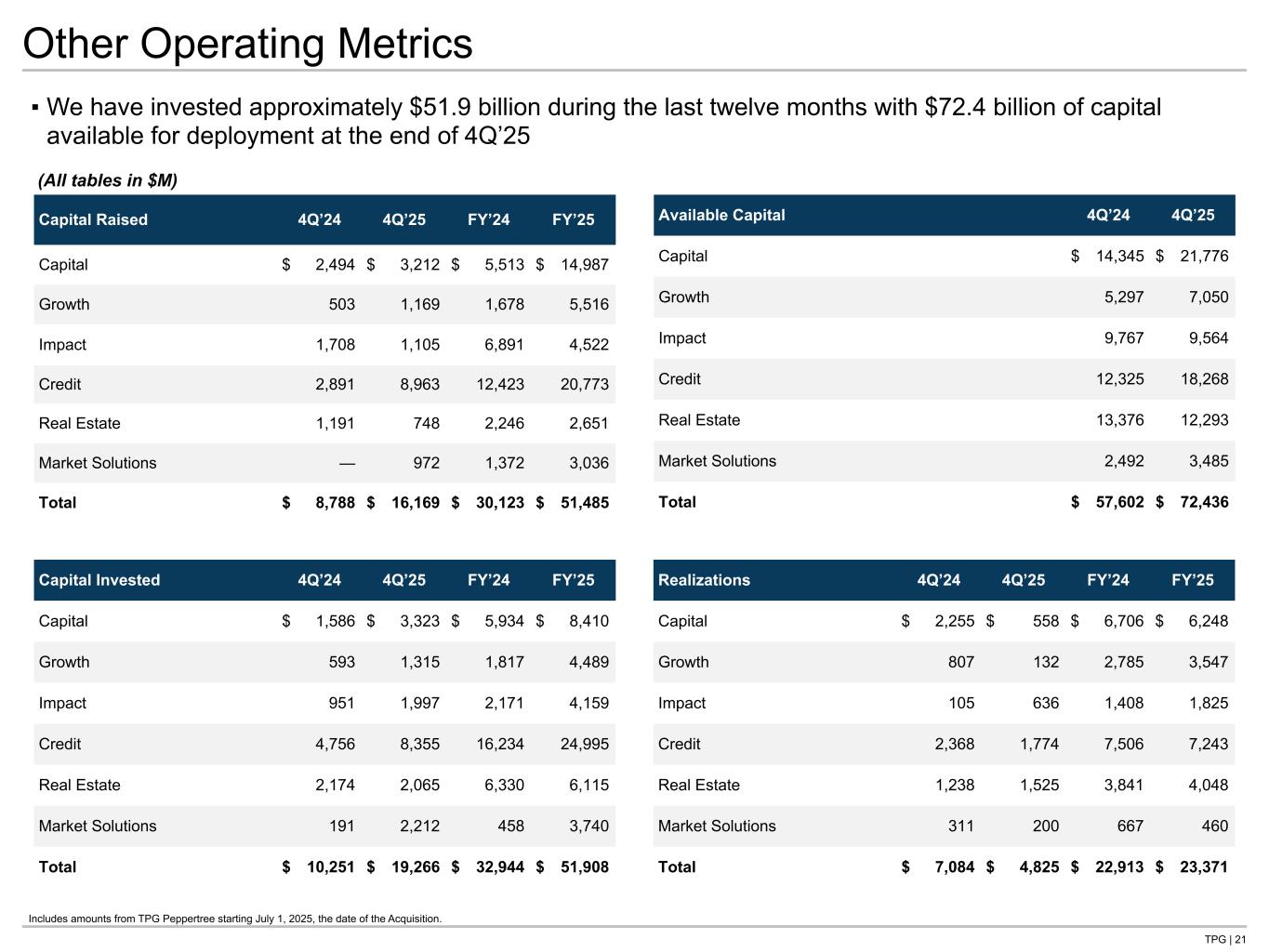

TPG | 21 Other Operating Metrics Capital Raised 4Q’24 4Q’25 FY’24 FY’25 Capital $ 2,494 $ 3,212 $ 5,513 $ 14,987 Growth 503 1,169 1,678 5,516 Impact 1,708 1,105 6,891 4,522 Credit 2,891 8,963 12,423 20,773 Real Estate 1,191 748 2,246 2,651 Market Solutions — 972 1,372 3,036 Total $ 8,788 $ 16,169 $ 30,123 $ 51,485 ▪ We have invested approximately $51.9 billion during the last twelve months with $72.4 billion of capital available for deployment at the end of 4Q’25 Available Capital 4Q’24 4Q’25 Capital $ 14,345 $ 21,776 Growth 5,297 7,050 Impact 9,767 9,564 Credit 12,325 18,268 Real Estate 13,376 12,293 Market Solutions 2,492 3,485 Total $ 57,602 $ 72,436 Capital Invested 4Q’24 4Q’25 FY’24 FY’25 Capital $ 1,586 $ 3,323 $ 5,934 $ 8,410 Growth 593 1,315 1,817 4,489 Impact 951 1,997 2,171 4,159 Credit 4,756 8,355 16,234 24,995 Real Estate 2,174 2,065 6,330 6,115 Market Solutions 191 2,212 458 3,740 Total $ 10,251 $ 19,266 $ 32,944 $ 51,908 Realizations 4Q’24 4Q’25 FY’24 FY’25 Capital $ 2,255 $ 558 $ 6,706 $ 6,248 Growth 807 132 2,785 3,547 Impact 105 636 1,408 1,825 Credit 2,368 1,774 7,506 7,243 Real Estate 1,238 1,525 3,841 4,048 Market Solutions 311 200 667 460 Total $ 7,084 $ 4,825 $ 22,913 $ 23,371 (All tables in $M) Tie to AUM roll Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition.

Supplemental Details

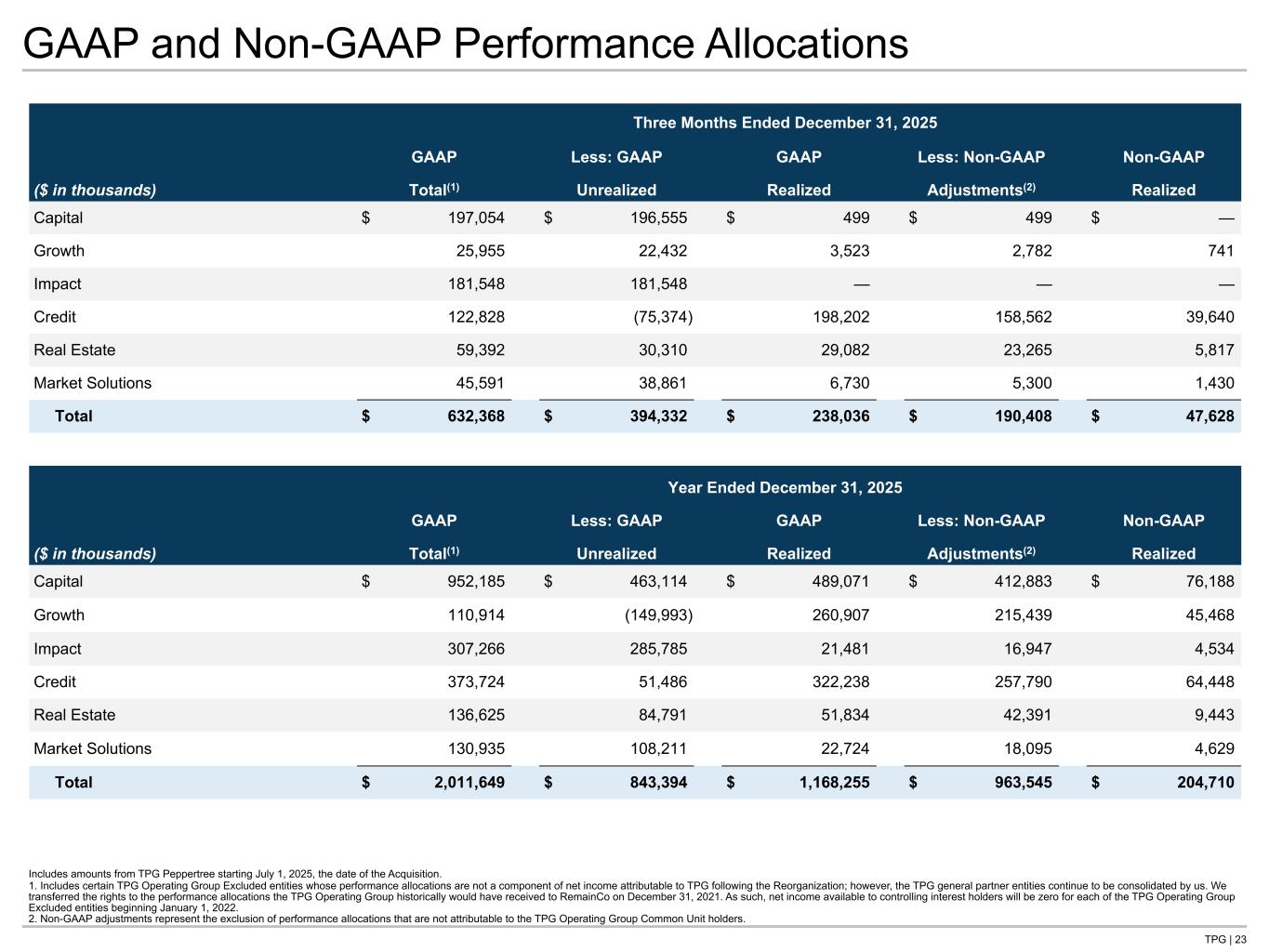

TPG | 23 GAAP and Non-GAAP Performance Allocations Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. 1. Includes certain TPG Operating Group Excluded entities whose performance allocations are not a component of net income attributable to TPG following the Reorganization; however, the TPG general partner entities continue to be consolidated by us. We transferred the rights to the performance allocations the TPG Operating Group historically would have received to RemainCo on December 31, 2021. As such, net income available to controlling interest holders will be zero for each of the TPG Operating Group Excluded entities beginning January 1, 2022. 2. Non-GAAP adjustments represent the exclusion of performance allocations that are not attributable to the TPG Operating Group Common Unit holders. Three Months Ended December 31, 2025 GAAP Less: GAAP GAAP Less: Non-GAAP Non-GAAP ($ in thousands) Total(1) Unrealized Realized Adjustments(2) Realized Capital $ 197,054 $ 196,555 $ 499 $ 499 $ — Growth 25,955 22,432 3,523 2,782 741 Impact 181,548 181,548 — — — Credit 122,828 (75,374) 198,202 158,562 39,640 Real Estate 59,392 30,310 29,082 23,265 5,817 Market Solutions 45,591 38,861 6,730 5,300 1,430 Total $ 632,368 $ 394,332 $ 238,036 $ 190,408 $ 47,628 Year Ended December 31, 2025 GAAP Less: GAAP GAAP Less: Non-GAAP Non-GAAP ($ in thousands) Total(1) Unrealized Realized Adjustments(2) Realized Capital $ 952,185 $ 463,114 $ 489,071 $ 412,883 $ 76,188 Growth 110,914 (149,993) 260,907 215,439 45,468 Impact 307,266 285,785 21,481 16,947 4,534 Credit 373,724 51,486 322,238 257,790 64,448 Real Estate 136,625 84,791 51,834 42,391 9,443 Market Solutions 130,935 108,211 22,724 18,095 4,629 Total $ 2,011,649 $ 843,394 $ 1,168,255 $ 963,545 $ 204,710 Tie to NG P&L

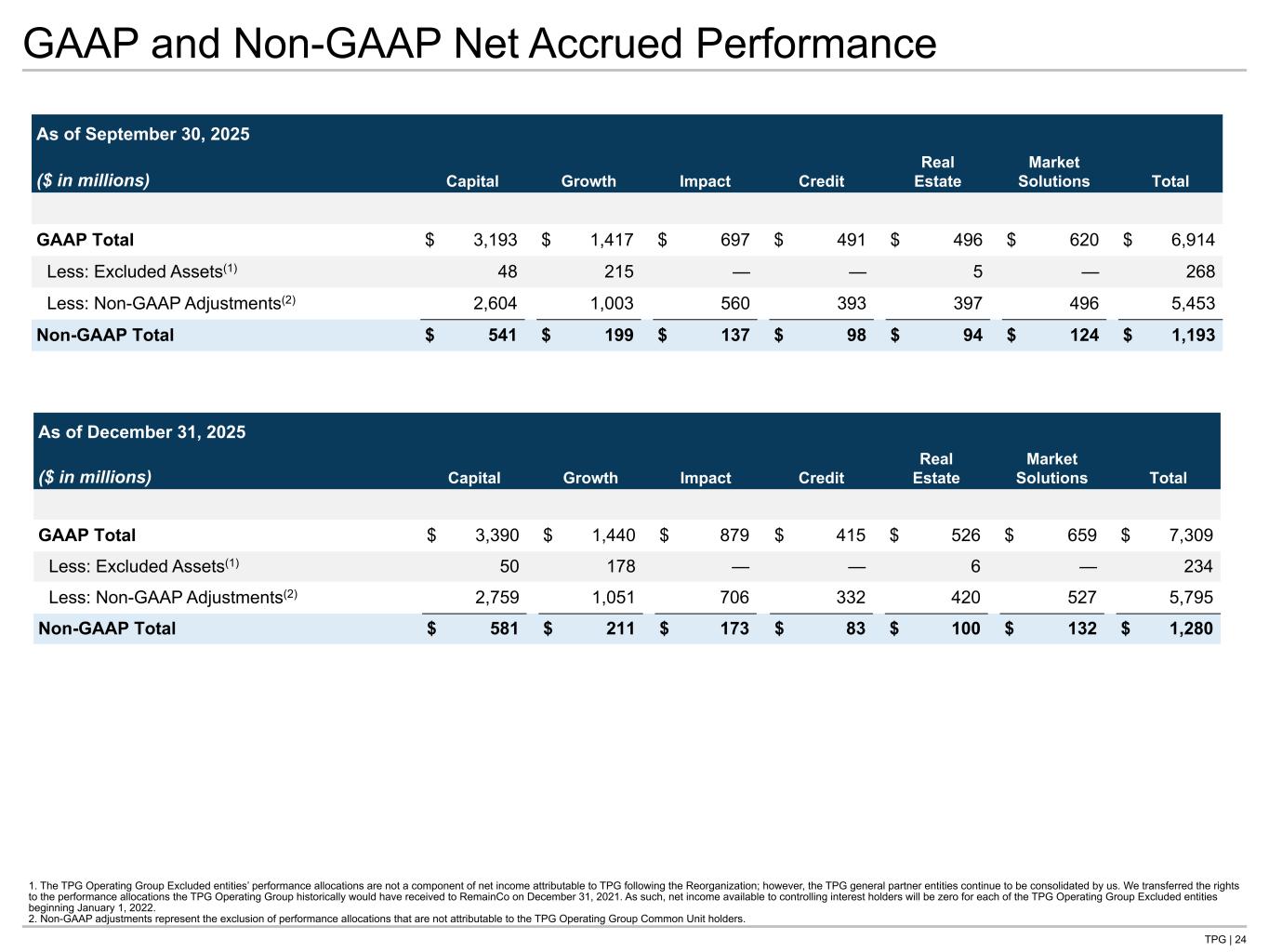

TPG | 24 GAAP and Non-GAAP Net Accrued Performance As of September 30, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total GAAP Total $ 3,193 $ 1,417 $ 697 $ 491 $ 496 $ 620 $ 6,914 Less: Excluded Assets(1) 48 215 — — 5 — 268 Less: Non-GAAP Adjustments(2) 2,604 1,003 560 393 397 496 5,453 Non-GAAP Total $ 541 $ 199 $ 137 $ 98 $ 94 $ 124 $ 1,193 1. The TPG Operating Group Excluded entities’ performance allocations are not a component of net income attributable to TPG following the Reorganization; however, the TPG general partner entities continue to be consolidated by us. We transferred the rights to the performance allocations the TPG Operating Group historically would have received to RemainCo on December 31, 2021. As such, net income available to controlling interest holders will be zero for each of the TPG Operating Group Excluded entities beginning January 1, 2022. 2. Non-GAAP adjustments represent the exclusion of performance allocations that are not attributable to the TPG Operating Group Common Unit holders. As of December 31, 2025 ($ in millions) Capital Growth Impact Credit Real Estate Market Solutions Total GAAP Total $ 3,390 $ 1,440 $ 879 $ 415 $ 526 $ 659 $ 7,309 Less: Excluded Assets(1) 50 178 — — 6 — 234 Less: Non-GAAP Adjustments(2) 2,759 1,051 706 332 420 527 5,795 Non-GAAP Total $ 581 $ 211 $ 173 $ 83 $ 100 $ 132 $ 1,280 Tie to Net Accrued Performance page

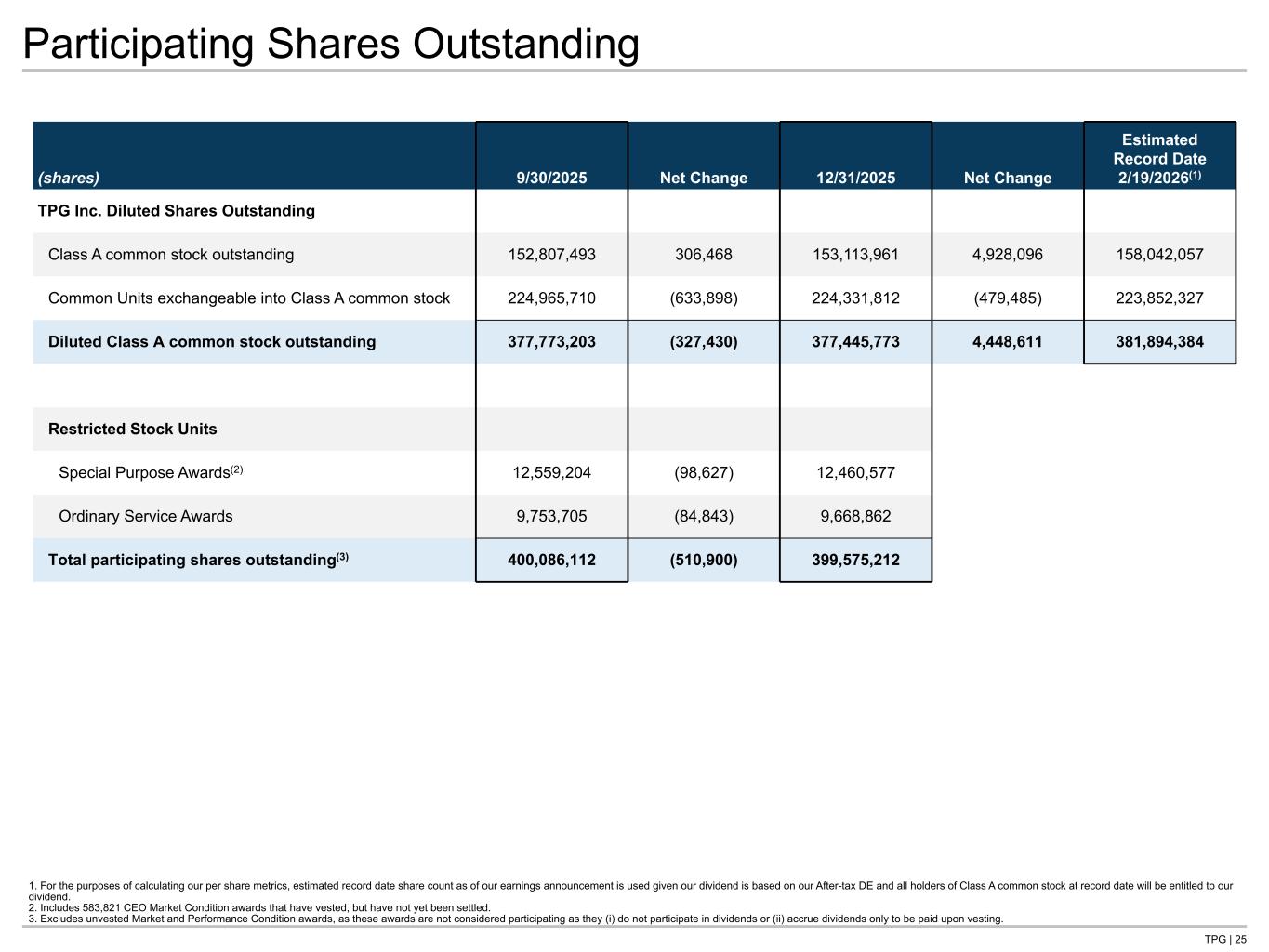

TPG | 25 Participating Shares Outstanding (shares) 9/30/2025 Net Change 12/31/2025 Net Change Estimated Record Date 2/19/2026(1) TPG Inc. Diluted Shares Outstanding Class A common stock outstanding 152,807,493 306,468 153,113,961 4,928,096 158,042,057 Common Units exchangeable into Class A common stock 224,965,710 (633,898) 224,331,812 (479,485) 223,852,327 Diluted Class A common stock outstanding 377,773,203 (327,430) 377,445,773 4,448,611 381,894,384 Restricted Stock Units Special Purpose Awards(2) 12,559,204 (98,627) 12,460,577 Ordinary Service Awards 9,753,705 (84,843) 9,668,862 Total participating shares outstanding(3) 400,086,112 (510,900) 399,575,212 1. For the purposes of calculating our per share metrics, estimated record date share count as of our earnings announcement is used given our dividend is based on our After-tax DE and all holders of Class A common stock at record date will be entitled to our dividend. 2. Includes 583,821 CEO Market Condition awards that have vested, but have not yet been settled. 3. Excludes unvested Market and Performance Condition awards, as these awards are not considered participating as they (i) do not participate in dividends or (ii) accrue dividends only to be paid upon vesting. Tie to Dividends page

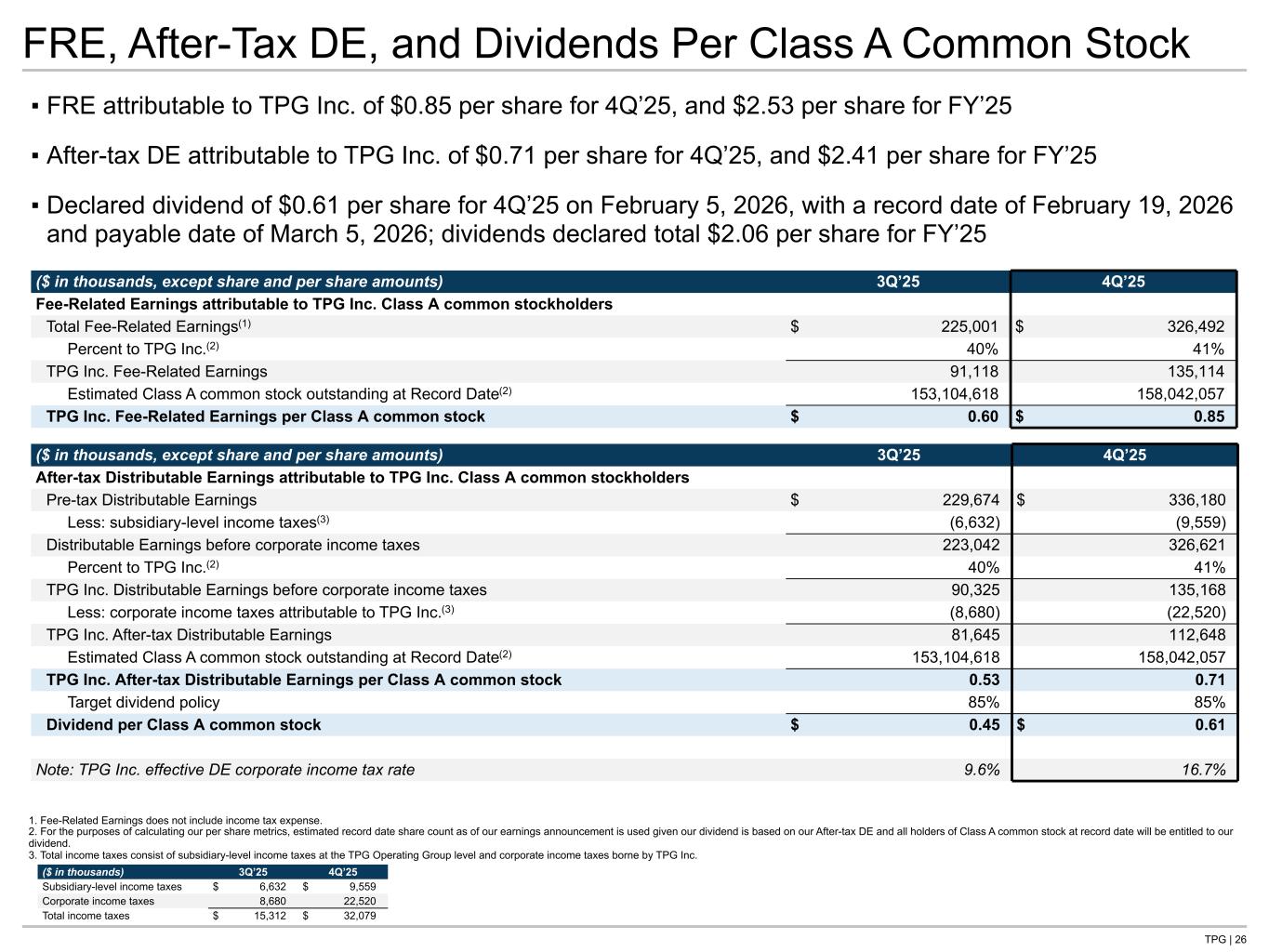

TPG | 26 FRE, After-Tax DE, and Dividends Per Class A Common Stock ▪ FRE attributable to TPG Inc. of $0.85 per share for 4Q’25, and $2.53 per share for FY’25 ▪ After-tax DE attributable to TPG Inc. of $0.71 per share for 4Q’25, and $2.41 per share for FY’25 ▪ Declared dividend of $0.61 per share for 4Q’25 on February 5, 2026, with a record date of February 19, 2026 and payable date of March 5, 2026; dividends declared total $2.06 per share for FY’25 ($ in thousands, except share and per share amounts) 3Q’25 4Q’25 After-tax Distributable Earnings attributable to TPG Inc. Class A common stockholders Pre-tax Distributable Earnings $ 229,674 $ 336,180 Less: subsidiary-level income taxes(3) (6,632) (9,559) Distributable Earnings before corporate income taxes 223,042 326,621 Percent to TPG Inc.(2) 40% 41% TPG Inc. Distributable Earnings before corporate income taxes 90,325 135,168 Less: corporate income taxes attributable to TPG Inc.(3) (8,680) (22,520) TPG Inc. After-tax Distributable Earnings 81,645 112,648 Estimated Class A common stock outstanding at Record Date(2) 153,104,618 158,042,057 TPG Inc. After-tax Distributable Earnings per Class A common stock 0.53 0.71 Target dividend policy 85% 85% Dividend per Class A common stock $ 0.45 $ 0.61 Note: TPG Inc. effective DE corporate income tax rate 9.6% 16.7% 1. Fee-Related Earnings does not include income tax expense. 2. For the purposes of calculating our per share metrics, estimated record date share count as of our earnings announcement is used given our dividend is based on our After-tax DE and all holders of Class A common stock at record date will be entitled to our dividend. 3. Total income taxes consist of subsidiary-level income taxes at the TPG Operating Group level and corporate income taxes borne by TPG Inc. ($ in thousands) 3Q’25 4Q’25 Subsidiary-level income taxes $ 6,632 $ 9,559 Corporate income taxes 8,680 22,520 Total income taxes $ 15,312 $ 32,079 ($ in thousands, except share and per share amounts) 3Q’25 4Q’25 Fee-Related Earnings attributable to TPG Inc. Class A common stockholders Total Fee-Related Earnings(1) $ 225,001 $ 326,492 Percent to TPG Inc.(2) 40% 41% TPG Inc. Fee-Related Earnings 91,118 135,114 Estimated Class A common stock outstanding at Record Date(2) 153,104,618 158,042,057 TPG Inc. Fee-Related Earnings per Class A common stock $ 0.60 $ 0.85 Tie to: -Share Roll page for Shares -NG P&L for FRE, taxes, and Pretax DE

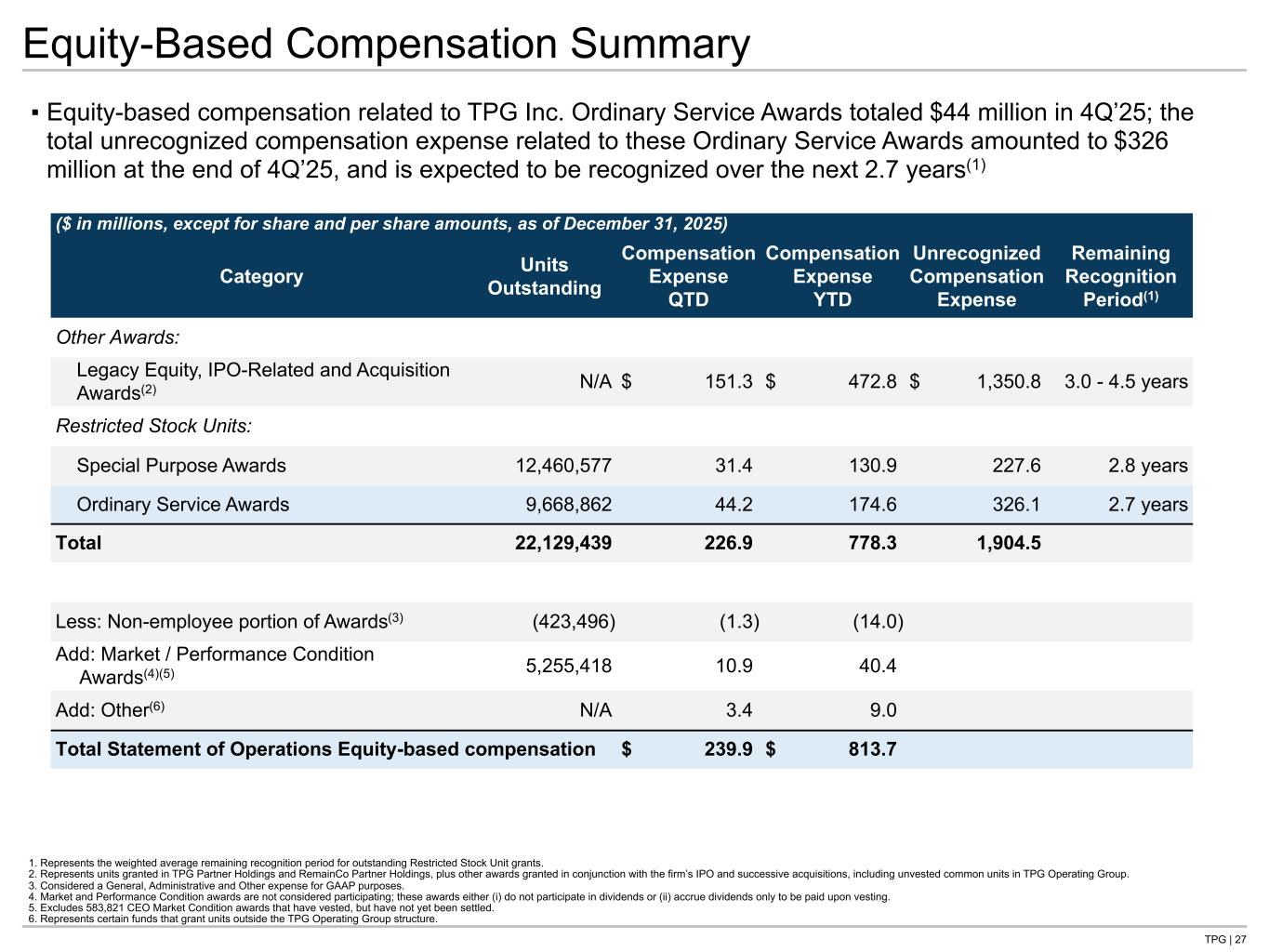

TPG | 27 Equity-Based Compensation Summary ($ in millions, except for share and per share amounts, as of December 31, 2025) Category Units Outstanding Compensation Expense QTD Compensation Expense YTD Unrecognized Compensation Expense Remaining Recognition Period(1) Other Awards: Legacy Equity, IPO-Related and Acquisition Awards(2) N/A $ 151.3 $ 472.8 $ 1,350.8 3.0 - 4.5 years Restricted Stock Units: Special Purpose Awards 12,460,577 31.4 130.9 227.6 2.8 years Ordinary Service Awards 9,668,862 44.2 174.6 326.1 2.7 years Total 22,129,439 226.9 778.3 1,904.5 Less: Non-employee portion of Awards(3) (423,496) (1.3) (14.0) Add: Market / Performance Condition Awards(4)(5) 5,255,418 10.9 40.4 Add: Other(6) N/A 3.4 9.0 Total Statement of Operations Equity-based compensation $ 239.9 $ 813.7 1. Represents the weighted average remaining recognition period for outstanding Restricted Stock Unit grants. 2. Represents units granted in TPG Partner Holdings and RemainCo Partner Holdings, plus other awards granted in conjunction with the firm’s IPO and successive acquisitions, including unvested common units in TPG Operating Group. 3. Considered a General, Administrative and Other expense for GAAP purposes. 4. Market and Performance Condition awards are not considered participating; these awards either (i) do not participate in dividends or (ii) accrue dividends only to be paid upon vesting. 5. Excludes 583,821 CEO Market Condition awards that have vested, but have not yet been settled. 6. Represents certain funds that grant units outside the TPG Operating Group structure. ▪ Equity-based compensation related to TPG Inc. Ordinary Service Awards totaled $44 million in 4Q’25; the total unrecognized compensation expense related to these Ordinary Service Awards amounted to $326 million at the end of 4Q’25, and is expected to be recognized over the next 2.7 years(1) Tie to: -Share roll for RSU awards -G P&L for total EBC

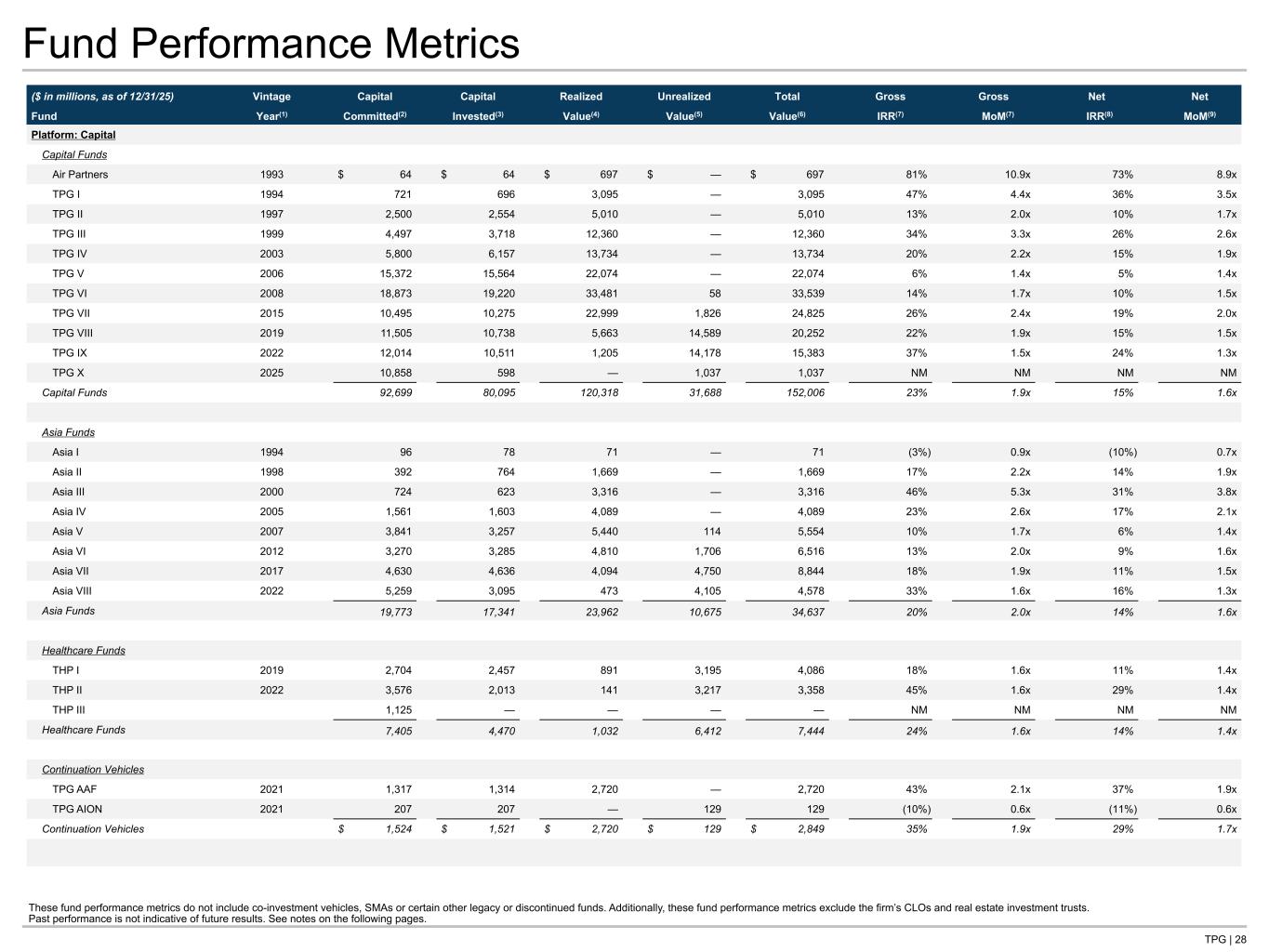

TPG | 28 Fund Performance Metrics ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) Platform: Capital Capital Funds Air Partners 1993 $ 64 $ 64 $ 697 $ — $ 697 81% 10.9x 73% 8.9x TPG I 1994 721 696 3,095 — 3,095 47% 4.4x 36% 3.5x TPG II 1997 2,500 2,554 5,010 — 5,010 13% 2.0x 10% 1.7x TPG III 1999 4,497 3,718 12,360 — 12,360 34% 3.3x 26% 2.6x TPG IV 2003 5,800 6,157 13,734 — 13,734 20% 2.2x 15% 1.9x TPG V 2006 15,372 15,564 22,074 — 22,074 6% 1.4x 5% 1.4x TPG VI 2008 18,873 19,220 33,481 58 33,539 14% 1.7x 10% 1.5x TPG VII 2015 10,495 10,275 22,999 1,826 24,825 26% 2.4x 19% 2.0x TPG VIII 2019 11,505 10,738 5,663 14,589 20,252 22% 1.9x 15% 1.5x TPG IX 2022 12,014 10,511 1,205 14,178 15,383 37% 1.5x 24% 1.3x TPG X 2025 10,858 598 — 1,037 1,037 NM NM NM NM Capital Funds 92,699 80,095 120,318 31,688 152,006 23% 1.9x 15% 1.6x Asia Funds Asia I 1994 96 78 71 — 71 (3%) 0.9x (10%) 0.7x Asia II 1998 392 764 1,669 — 1,669 17% 2.2x 14% 1.9x Asia III 2000 724 623 3,316 — 3,316 46% 5.3x 31% 3.8x Asia IV 2005 1,561 1,603 4,089 — 4,089 23% 2.6x 17% 2.1x Asia V 2007 3,841 3,257 5,440 114 5,554 10% 1.7x 6% 1.4x Asia VI 2012 3,270 3,285 4,810 1,706 6,516 13% 2.0x 9% 1.6x Asia VII 2017 4,630 4,636 4,094 4,750 8,844 18% 1.9x 11% 1.5x Asia VIII 2022 5,259 3,095 473 4,105 4,578 33% 1.6x 16% 1.3x Asia Funds 19,773 17,341 23,962 10,675 34,637 20% 2.0x 14% 1.6x Healthcare Funds THP I 2019 2,704 2,457 891 3,195 4,086 18% 1.6x 11% 1.4x THP II 2022 3,576 2,013 141 3,217 3,358 45% 1.6x 29% 1.4x THP III 1,125 — — — — NM NM NM NM Healthcare Funds 7,405 4,470 1,032 6,412 7,444 24% 1.6x 14% 1.4x Continuation Vehicles TPG AAF 2021 1,317 1,314 2,720 — 2,720 43% 2.1x 37% 1.9x TPG AION 2021 207 207 — 129 129 (10%) 0.6x (11%) 0.6x Continuation Vehicles $ 1,524 $ 1,521 $ 2,720 $ 129 $ 2,849 35% 1.9x 29% 1.7x These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

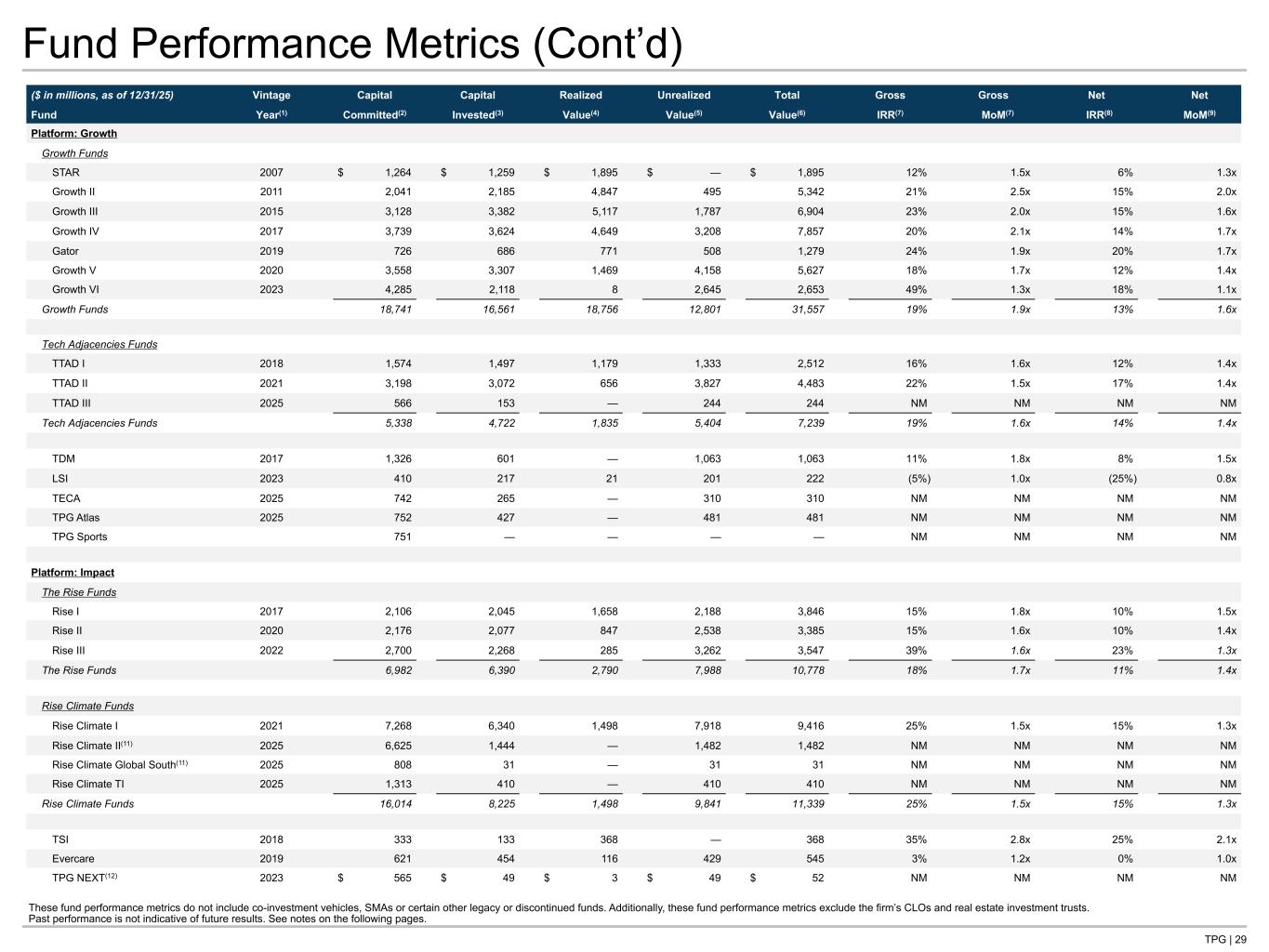

TPG | 29 Fund Performance Metrics (Cont’d) ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) Platform: Growth Growth Funds STAR 2007 $ 1,264 $ 1,259 $ 1,895 $ — $ 1,895 12% 1.5x 6% 1.3x Growth II 2011 2,041 2,185 4,847 495 5,342 21% 2.5x 15% 2.0x Growth III 2015 3,128 3,382 5,117 1,787 6,904 23% 2.0x 15% 1.6x Growth IV 2017 3,739 3,624 4,649 3,208 7,857 20% 2.1x 14% 1.7x Gator 2019 726 686 771 508 1,279 24% 1.9x 20% 1.7x Growth V 2020 3,558 3,307 1,469 4,158 5,627 18% 1.7x 12% 1.4x Growth VI 2023 4,285 2,118 8 2,645 2,653 49% 1.3x 18% 1.1x Growth Funds 18,741 16,561 18,756 12,801 31,557 19% 1.9x 13% 1.6x Tech Adjacencies Funds TTAD I 2018 1,574 1,497 1,179 1,333 2,512 16% 1.6x 12% 1.4x TTAD II 2021 3,198 3,072 656 3,827 4,483 22% 1.5x 17% 1.4x TTAD III 2025 566 153 — 244 244 NM NM NM NM Tech Adjacencies Funds 5,338 4,722 1,835 5,404 7,239 19% 1.6x 14% 1.4x TDM 2017 1,326 601 — 1,063 1,063 11% 1.8x 8% 1.5x LSI 2023 410 217 21 201 222 (5%) 1.0x (25%) 0.8x TECA 2025 742 265 — 310 310 NM NM NM NM TPG Atlas 2025 752 427 — 481 481 NM NM NM NM TPG Sports 751 — — — — NM NM NM NM Platform: Impact The Rise Funds Rise I 2017 2,106 2,045 1,658 2,188 3,846 15% 1.8x 10% 1.5x Rise II 2020 2,176 2,077 847 2,538 3,385 15% 1.6x 10% 1.4x Rise III 2022 2,700 2,268 285 3,262 3,547 39% 1.6x 23% 1.3x The Rise Funds 6,982 6,390 2,790 7,988 10,778 18% 1.7x 11% 1.4x Rise Climate Funds Rise Climate I 2021 7,268 6,340 1,498 7,918 9,416 25% 1.5x 15% 1.3x Rise Climate II(11) 2025 6,625 1,444 — 1,482 1,482 NM NM NM NM Rise Climate Global South(11) 2025 808 31 — 31 31 NM NM NM NM Rise Climate TI 2025 1,313 410 — 410 410 NM NM NM NM Rise Climate Funds 16,014 8,225 1,498 9,841 11,339 25% 1.5x 15% 1.3x TSI 2018 333 133 368 — 368 35% 2.8x 25% 2.1x Evercare 2019 621 454 116 429 545 3% 1.2x 0% 1.0x TPG NEXT(12) 2023 $ 565 $ 49 $ 3 $ 49 $ 52 NM NM NM NM These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

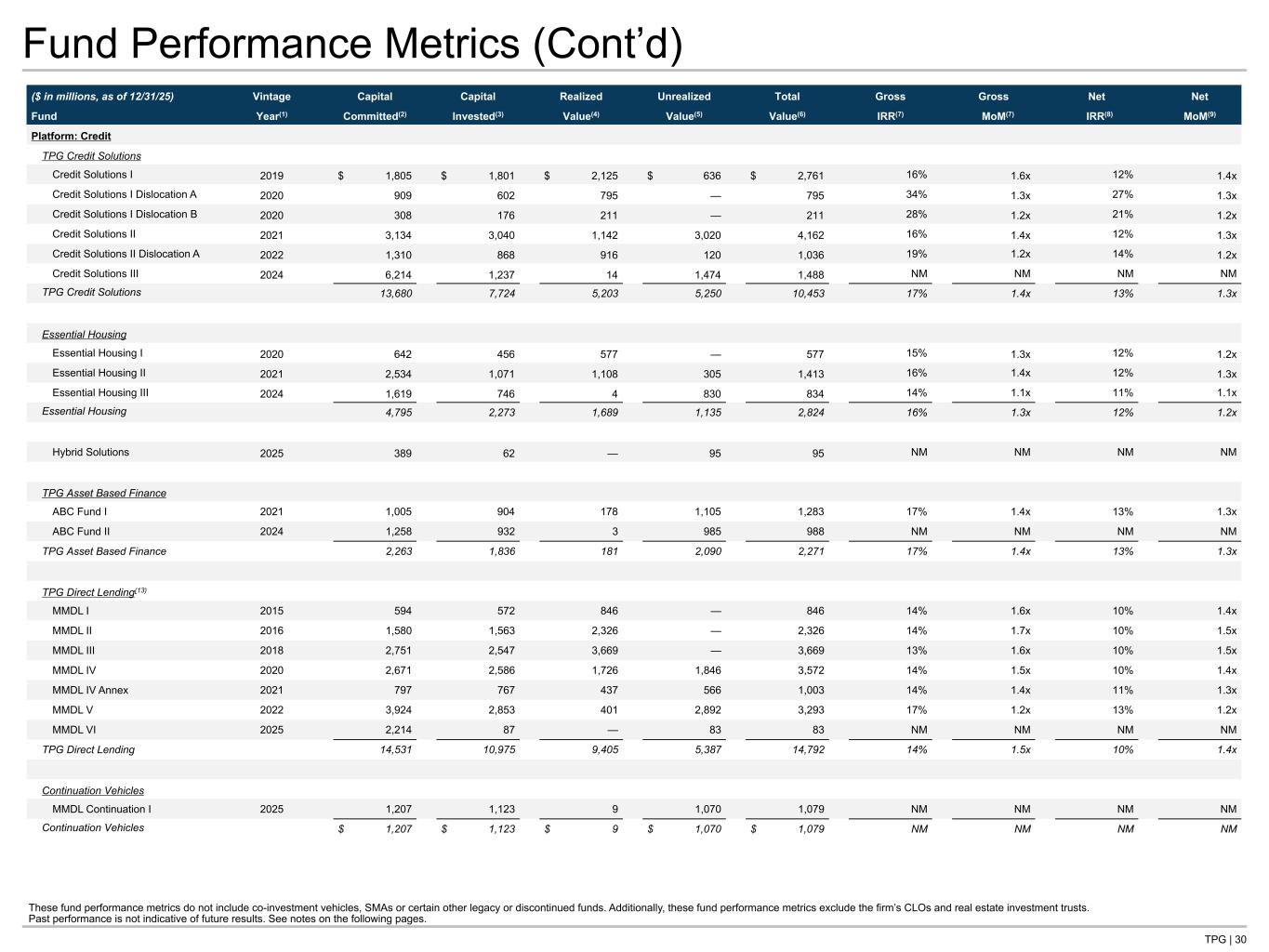

TPG | 30 Fund Performance Metrics (Cont’d) ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) Platform: Credit TPG Credit Solutions Credit Solutions I 2019 $ 1,805 $ 1,801 $ 2,125 $ 636 $ 2,761 16% 1.6x 12% 1.4x Credit Solutions I Dislocation A 2020 909 602 795 — 795 34% 1.3x 27% 1.3x Credit Solutions I Dislocation B 2020 308 176 211 — 211 28% 1.2x 21% 1.2x Credit Solutions II 2021 3,134 3,040 1,142 3,020 4,162 16% 1.4x 12% 1.3x Credit Solutions II Dislocation A 2022 1,310 868 916 120 1,036 19% 1.2x 14% 1.2x Credit Solutions III 2024 6,214 1,237 14 1,474 1,488 NM NM NM NM TPG Credit Solutions 13,680 7,724 5,203 5,250 10,453 17% 1.4x 13% 1.3x Essential Housing Essential Housing I 2020 642 456 577 — 577 15% 1.3x 12% 1.2x Essential Housing II 2021 2,534 1,071 1,108 305 1,413 16% 1.4x 12% 1.3x Essential Housing III 2024 1,619 746 4 830 834 14% 1.1x 11% 1.1x Essential Housing 4,795 2,273 1,689 1,135 2,824 16% 1.3x 12% 1.2x Hybrid Solutions 2025 389 62 — 95 95 NM NM NM NM TPG Asset Based Finance ABC Fund I 2021 1,005 904 178 1,105 1,283 17% 1.4x 13% 1.3x ABC Fund II 2024 1,258 932 3 985 988 NM NM NM NM TPG Asset Based Finance 2,263 1,836 181 2,090 2,271 17% 1.4x 13% 1.3x TPG Direct Lending(13) MMDL I 2015 594 572 846 — 846 14% 1.6x 10% 1.4x MMDL II 2016 1,580 1,563 2,326 — 2,326 14% 1.7x 10% 1.5x MMDL III 2018 2,751 2,547 3,669 — 3,669 13% 1.6x 10% 1.5x MMDL IV 2020 2,671 2,586 1,726 1,846 3,572 14% 1.5x 10% 1.4x MMDL IV Annex 2021 797 767 437 566 1,003 14% 1.4x 11% 1.3x MMDL V 2022 3,924 2,853 401 2,892 3,293 17% 1.2x 13% 1.2x MMDL VI 2025 2,214 87 — 83 83 NM NM NM NM TPG Direct Lending 14,531 10,975 9,405 5,387 14,792 14% 1.5x 10% 1.4x Continuation Vehicles MMDL Continuation I 2025 1,207 1,123 9 1,070 1,079 NM NM NM NM Continuation Vehicles $ 1,207 $ 1,123 $ 9 $ 1,070 $ 1,079 NM NM NM NM These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

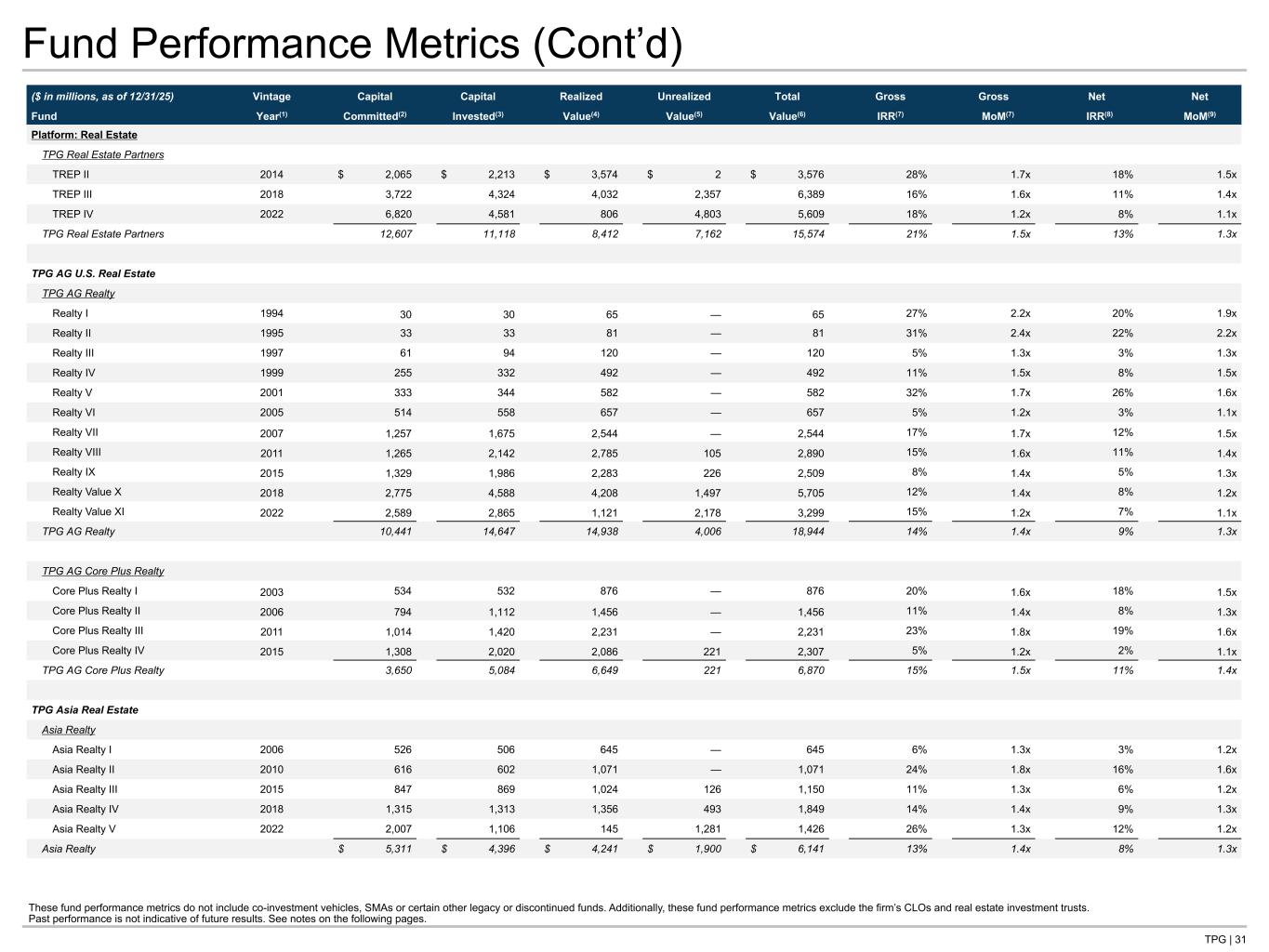

TPG | 31 Fund Performance Metrics (Cont’d) ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) Platform: Real Estate TPG Real Estate Partners TREP II 2014 $ 2,065 $ 2,213 $ 3,574 $ 2 $ 3,576 28% 1.7x 18% 1.5x TREP III 2018 3,722 4,324 4,032 2,357 6,389 16% 1.6x 11% 1.4x TREP IV 2022 6,820 4,581 806 4,803 5,609 18% 1.2x 8% 1.1x TPG Real Estate Partners 12,607 11,118 8,412 7,162 15,574 21% 1.5x 13% 1.3x TPG AG U.S. Real Estate TPG AG Realty Realty I 1994 30 30 65 — 65 27% 2.2x 20% 1.9x Realty II 1995 33 33 81 — 81 31% 2.4x 22% 2.2x Realty III 1997 61 94 120 — 120 5% 1.3x 3% 1.3x Realty IV 1999 255 332 492 — 492 11% 1.5x 8% 1.5x Realty V 2001 333 344 582 — 582 32% 1.7x 26% 1.6x Realty VI 2005 514 558 657 — 657 5% 1.2x 3% 1.1x Realty VII 2007 1,257 1,675 2,544 — 2,544 17% 1.7x 12% 1.5x Realty VIII 2011 1,265 2,142 2,785 105 2,890 15% 1.6x 11% 1.4x Realty IX 2015 1,329 1,986 2,283 226 2,509 8% 1.4x 5% 1.3x Realty Value X 2018 2,775 4,588 4,208 1,497 5,705 12% 1.4x 8% 1.2x Realty Value XI 2022 2,589 2,865 1,121 2,178 3,299 15% 1.2x 7% 1.1x TPG AG Realty 10,441 14,647 14,938 4,006 18,944 14% 1.4x 9% 1.3x TPG AG Core Plus Realty Core Plus Realty I 2003 534 532 876 — 876 20% 1.6x 18% 1.5x Core Plus Realty II 2006 794 1,112 1,456 — 1,456 11% 1.4x 8% 1.3x Core Plus Realty III 2011 1,014 1,420 2,231 — 2,231 23% 1.8x 19% 1.6x Core Plus Realty IV 2015 1,308 2,020 2,086 221 2,307 5% 1.2x 2% 1.1x TPG AG Core Plus Realty 3,650 5,084 6,649 221 6,870 15% 1.5x 11% 1.4x TPG Asia Real Estate Asia Realty Asia Realty I 2006 526 506 645 — 645 6% 1.3x 3% 1.2x Asia Realty II 2010 616 602 1,071 — 1,071 24% 1.8x 16% 1.6x Asia Realty III 2015 847 869 1,024 126 1,150 11% 1.3x 6% 1.2x Asia Realty IV 2018 1,315 1,313 1,356 493 1,849 14% 1.4x 9% 1.3x Asia Realty V 2022 2,007 1,106 145 1,281 1,426 26% 1.3x 12% 1.2x Asia Realty $ 5,311 $ 4,396 $ 4,241 $ 1,900 $ 6,141 13% 1.4x 8% 1.3x These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

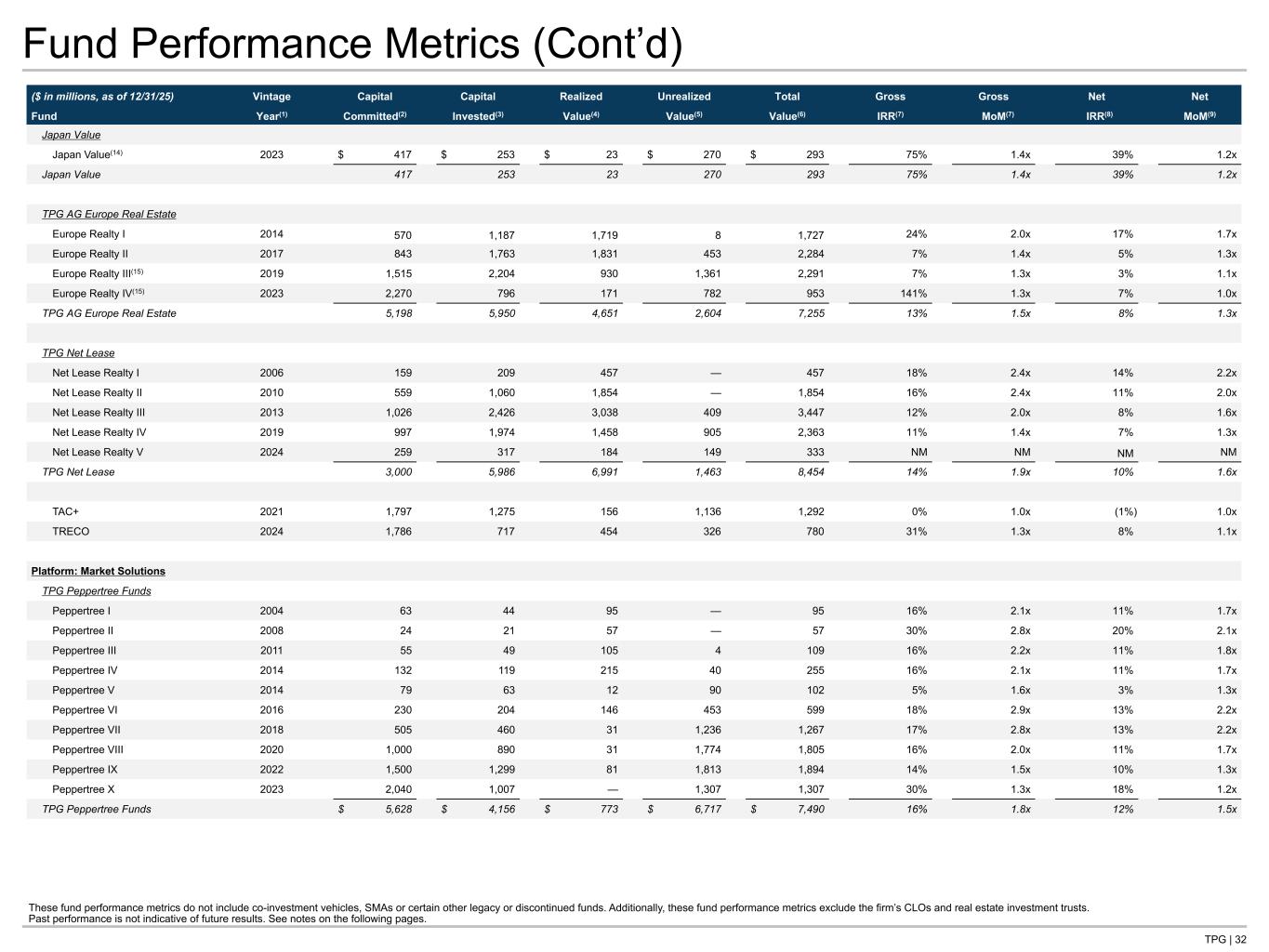

TPG | 32 Fund Performance Metrics (Cont’d) ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) Japan Value Japan Value(14) 2023 $ 417 $ 253 $ 23 $ 270 $ 293 75% 1.4x 39% 1.2x Japan Value 417 253 23 270 293 75% 1.4x 39% 1.2x TPG AG Europe Real Estate Europe Realty I 2014 570 1,187 1,719 8 1,727 24% 2.0x 17% 1.7x Europe Realty II 2017 843 1,763 1,831 453 2,284 7% 1.4x 5% 1.3x Europe Realty III(15) 2019 1,515 2,204 930 1,361 2,291 7% 1.3x 3% 1.1x Europe Realty IV(15) 2023 2,270 796 171 782 953 141% 1.3x 7% 1.0x TPG AG Europe Real Estate 5,198 5,950 4,651 2,604 7,255 13% 1.5x 8% 1.3x TPG Net Lease Net Lease Realty I 2006 159 209 457 — 457 18% 2.4x 14% 2.2x Net Lease Realty II 2010 559 1,060 1,854 — 1,854 16% 2.4x 11% 2.0x Net Lease Realty III 2013 1,026 2,426 3,038 409 3,447 12% 2.0x 8% 1.6x Net Lease Realty IV 2019 997 1,974 1,458 905 2,363 11% 1.4x 7% 1.3x Net Lease Realty V 2024 259 317 184 149 333 NM NM NM NM TPG Net Lease 3,000 5,986 6,991 1,463 8,454 14% 1.9x 10% 1.6x TAC+ 2021 1,797 1,275 156 1,136 1,292 0% 1.0x (1%) 1.0x TRECO 2024 1,786 717 454 326 780 31% 1.3x 8% 1.1x Platform: Market Solutions TPG Peppertree Funds Peppertree I 2004 63 44 95 — 95 16% 2.1x 11% 1.7x Peppertree II 2008 24 21 57 — 57 30% 2.8x 20% 2.1x Peppertree III 2011 55 49 105 4 109 16% 2.2x 11% 1.8x Peppertree IV 2014 132 119 215 40 255 16% 2.1x 11% 1.7x Peppertree V 2014 79 63 12 90 102 5% 1.6x 3% 1.3x Peppertree VI 2016 230 204 146 453 599 18% 2.9x 13% 2.2x Peppertree VII 2018 505 460 31 1,236 1,267 17% 2.8x 13% 2.2x Peppertree VIII 2020 1,000 890 31 1,774 1,805 16% 2.0x 11% 1.7x Peppertree IX 2022 1,500 1,299 81 1,813 1,894 14% 1.5x 10% 1.3x Peppertree X 2023 2,040 1,007 — 1,307 1,307 30% 1.3x 18% 1.2x TPG Peppertree Funds $ 5,628 $ 4,156 $ 773 $ 6,717 $ 7,490 16% 1.8x 12% 1.5x These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

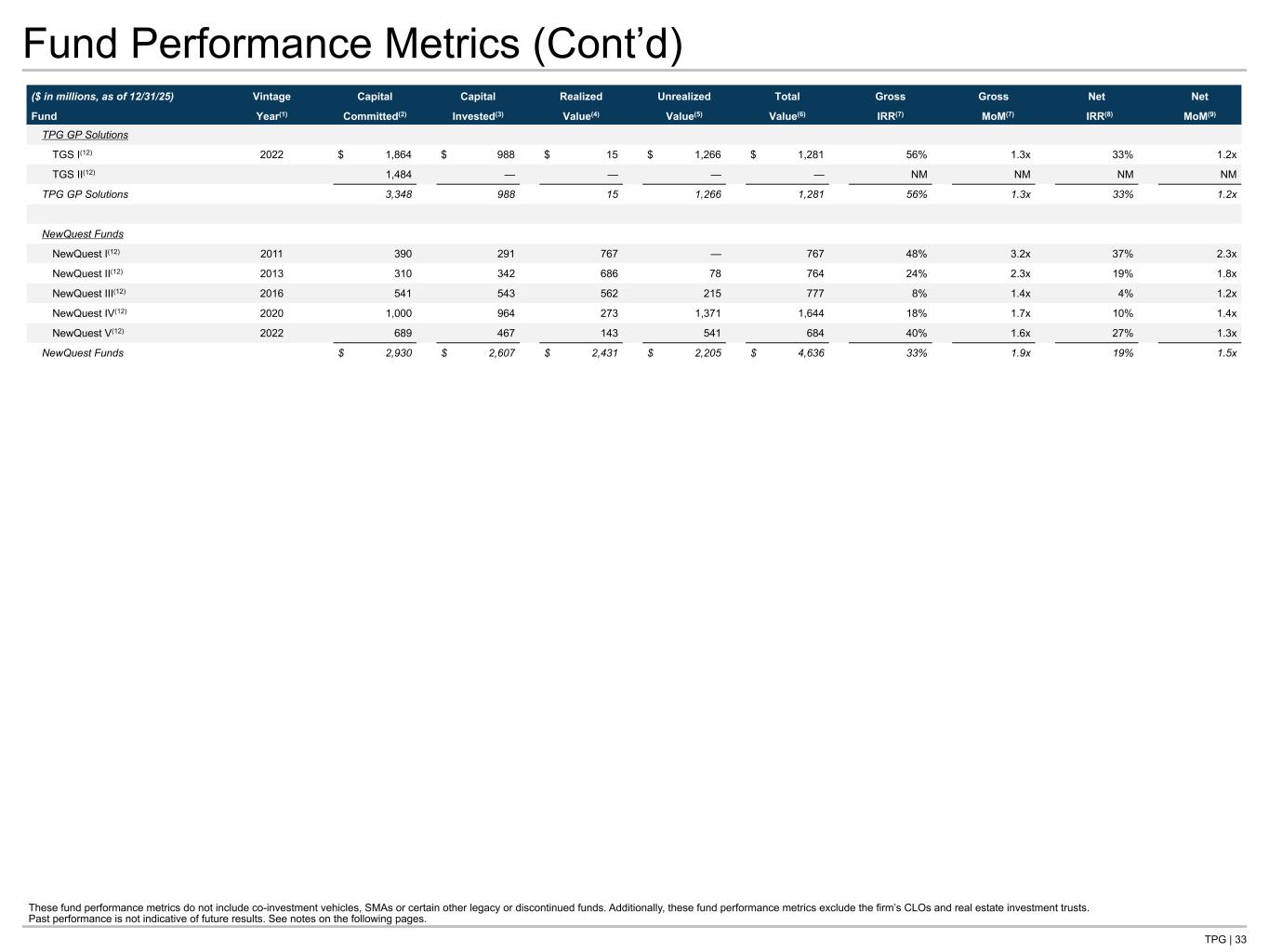

TPG | 33 Fund Performance Metrics (Cont’d) ($ in millions, as of 12/31/25) Vintage Capital Capital Realized Unrealized Total Gross Gross Net Net Fund Year(1) Committed(2) Invested(3) Value(4) Value(5) Value(6) IRR(7) MoM(7) IRR(8) MoM(9) TPG GP Solutions TGS I(12) 2022 $ 1,864 $ 988 $ 15 $ 1,266 $ 1,281 56% 1.3x 33% 1.2x TGS II(12) 1,484 — — — — NM NM NM NM TPG GP Solutions 3,348 988 15 1,266 1,281 56% 1.3x 33% 1.2x NewQuest Funds NewQuest I(12) 2011 390 291 767 — 767 48% 3.2x 37% 2.3x NewQuest II(12) 2013 310 342 686 78 764 24% 2.3x 19% 1.8x NewQuest III(12) 2016 541 543 562 215 777 8% 1.4x 4% 1.2x NewQuest IV(12) 2020 1,000 964 273 1,371 1,644 18% 1.7x 10% 1.4x NewQuest V(12) 2022 689 467 143 541 684 40% 1.6x 27% 1.3x NewQuest Funds $ 2,930 $ 2,607 $ 2,431 $ 2,205 $ 4,636 33% 1.9x 19% 1.5x These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

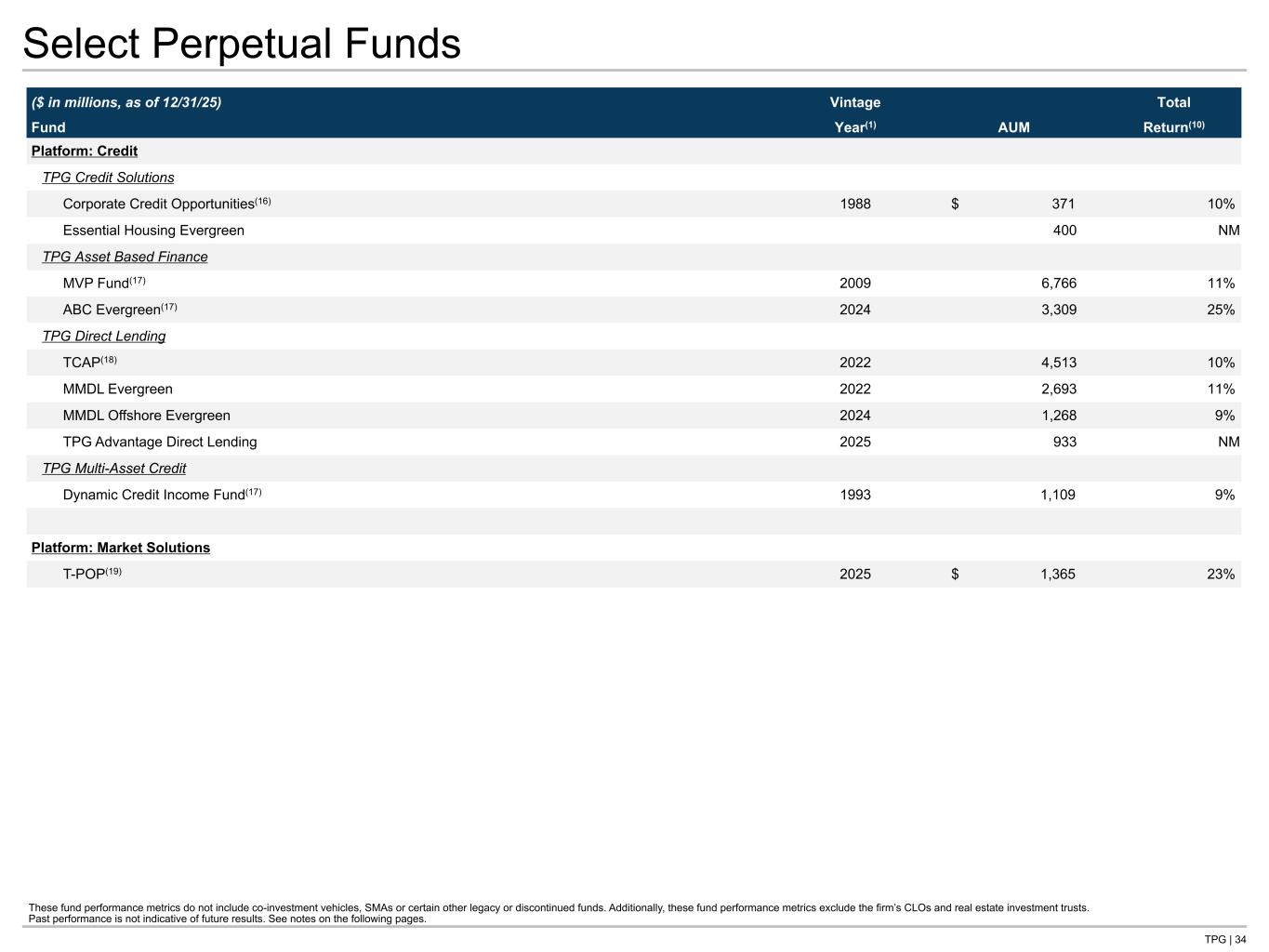

TPG | 34 Select Perpetual Funds ($ in millions, as of 12/31/25) Vintage AUM Total Fund Year(1) Return(10) Platform: Credit TPG Credit Solutions Corporate Credit Opportunities(16) 1988 $ 371 10% Essential Housing Evergreen 400 NM TPG Asset Based Finance MVP Fund(17) 2009 6,766 11% ABC Evergreen(17) 2024 3,309 25% TPG Direct Lending TCAP(18) 2022 4,513 10% MMDL Evergreen 2022 2,693 11% MMDL Offshore Evergreen 2024 1,268 9% TPG Advantage Direct Lending 2025 933 NM TPG Multi-Asset Credit Dynamic Credit Income Fund(17) 1993 1,109 9% Platform: Market Solutions T-POP(19) 2025 $ 1,365 23% These fund performance metrics do not include co-investment vehicles, SMAs or certain other legacy or discontinued funds. Additionally, these fund performance metrics exclude the firm’s CLOs and real estate investment trusts. Past performance is not indicative of future results. See notes on the following pages.

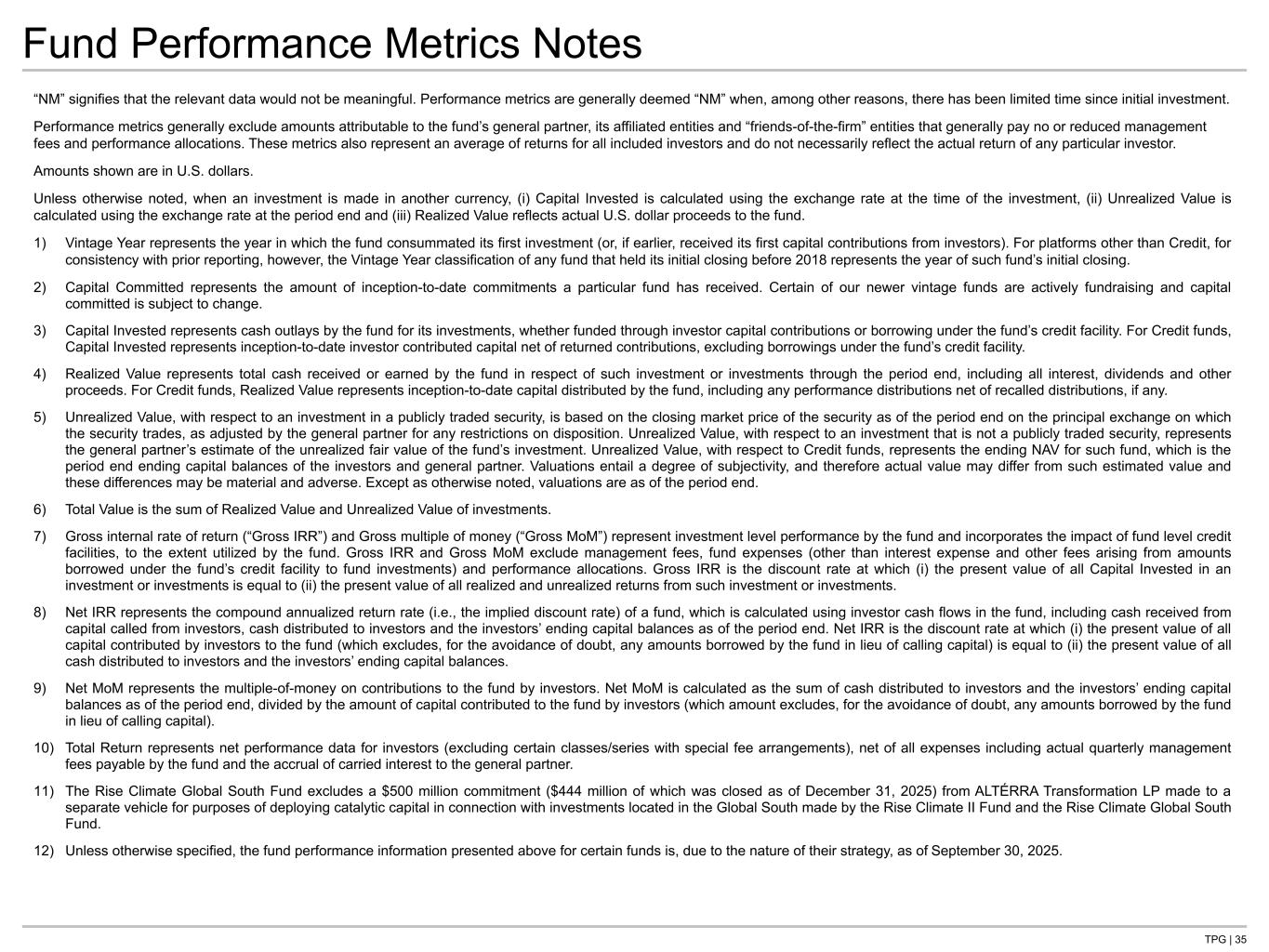

TPG | 35 Fund Performance Metrics Notes “NM” signifies that the relevant data would not be meaningful. Performance metrics are generally deemed “NM” when, among other reasons, there has been limited time since initial investment. Performance metrics generally exclude amounts attributable to the fund’s general partner, its affiliated entities and “friends-of-the-firm” entities that generally pay no or reduced management fees and performance allocations. These metrics also represent an average of returns for all included investors and do not necessarily reflect the actual return of any particular investor. Amounts shown are in U.S. dollars. Unless otherwise noted, when an investment is made in another currency, (i) Capital Invested is calculated using the exchange rate at the time of the investment, (ii) Unrealized Value is calculated using the exchange rate at the period end and (iii) Realized Value reflects actual U.S. dollar proceeds to the fund. 1) Vintage Year represents the year in which the fund consummated its first investment (or, if earlier, received its first capital contributions from investors). For platforms other than Credit, for consistency with prior reporting, however, the Vintage Year classification of any fund that held its initial closing before 2018 represents the year of such fund’s initial closing. 2) Capital Committed represents the amount of inception-to-date commitments a particular fund has received. Certain of our newer vintage funds are actively fundraising and capital committed is subject to change. 3) Capital Invested represents cash outlays by the fund for its investments, whether funded through investor capital contributions or borrowing under the fund’s credit facility. For Credit funds, Capital Invested represents inception-to-date investor contributed capital net of returned contributions, excluding borrowings under the fund’s credit facility. 4) Realized Value represents total cash received or earned by the fund in respect of such investment or investments through the period end, including all interest, dividends and other proceeds. For Credit funds, Realized Value represents inception-to-date capital distributed by the fund, including any performance distributions net of recalled distributions, if any. 5) Unrealized Value, with respect to an investment in a publicly traded security, is based on the closing market price of the security as of the period end on the principal exchange on which the security trades, as adjusted by the general partner for any restrictions on disposition. Unrealized Value, with respect to an investment that is not a publicly traded security, represents the general partner’s estimate of the unrealized fair value of the fund’s investment. Unrealized Value, with respect to Credit funds, represents the ending NAV for such fund, which is the period end ending capital balances of the investors and general partner. Valuations entail a degree of subjectivity, and therefore actual value may differ from such estimated value and these differences may be material and adverse. Except as otherwise noted, valuations are as of the period end. 6) Total Value is the sum of Realized Value and Unrealized Value of investments. 7) Gross internal rate of return (“Gross IRR”) and Gross multiple of money (“Gross MoM”) represent investment level performance by the fund and incorporates the impact of fund level credit facilities, to the extent utilized by the fund. Gross IRR and Gross MoM exclude management fees, fund expenses (other than interest expense and other fees arising from amounts borrowed under the fund’s credit facility to fund investments) and performance allocations. Gross IRR is the discount rate at which (i) the present value of all Capital Invested in an investment or investments is equal to (ii) the present value of all realized and unrealized returns from such investment or investments. 8) Net IRR represents the compound annualized return rate (i.e., the implied discount rate) of a fund, which is calculated using investor cash flows in the fund, including cash received from capital called from investors, cash distributed to investors and the investors’ ending capital balances as of the period end. Net IRR is the discount rate at which (i) the present value of all capital contributed by investors to the fund (which excludes, for the avoidance of doubt, any amounts borrowed by the fund in lieu of calling capital) is equal to (ii) the present value of all cash distributed to investors and the investors’ ending capital balances. 9) Net MoM represents the multiple-of-money on contributions to the fund by investors. Net MoM is calculated as the sum of cash distributed to investors and the investors’ ending capital balances as of the period end, divided by the amount of capital contributed to the fund by investors (which amount excludes, for the avoidance of doubt, any amounts borrowed by the fund in lieu of calling capital). 10) Total Return represents net performance data for investors (excluding certain classes/series with special fee arrangements), net of all expenses including actual quarterly management fees payable by the fund and the accrual of carried interest to the general partner. 11) The Rise Climate Global South Fund excludes a $500 million commitment ($444 million of which was closed as of December 31, 2025) from ALTÉRRA Transformation LP made to a separate vehicle for purposes of deploying catalytic capital in connection with investments located in the Global South made by the Rise Climate II Fund and the Rise Climate Global South Fund. 12) Unless otherwise specified, the fund performance information presented above for certain funds is, due to the nature of their strategy, as of September 30, 2025. Remember to check with PFT/FF on ALTERRA amount

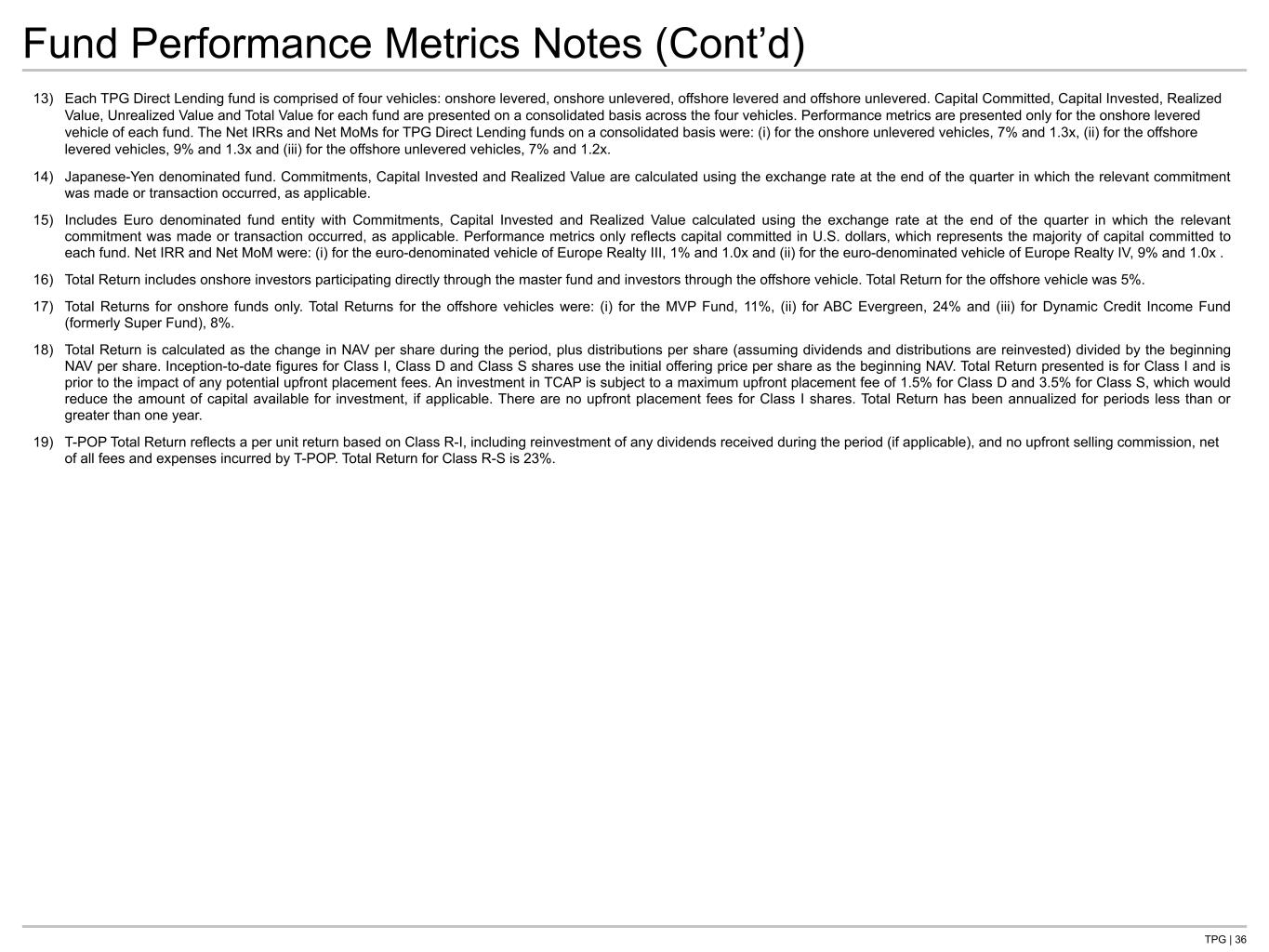

TPG | 36 Fund Performance Metrics Notes (Cont’d) 13) Each TPG Direct Lending fund is comprised of four vehicles: onshore levered, onshore unlevered, offshore levered and offshore unlevered. Capital Committed, Capital Invested, Realized Value, Unrealized Value and Total Value for each fund are presented on a consolidated basis across the four vehicles. Performance metrics are presented only for the onshore levered vehicle of each fund. The Net IRRs and Net MoMs for TPG Direct Lending funds on a consolidated basis were: (i) for the onshore unlevered vehicles, 7% and 1.3x, (ii) for the offshore levered vehicles, 9% and 1.3x and (iii) for the offshore unlevered vehicles, 7% and 1.2x. 14) Japanese-Yen denominated fund. Commitments, Capital Invested and Realized Value are calculated using the exchange rate at the end of the quarter in which the relevant commitment was made or transaction occurred, as applicable. 15) Includes Euro denominated fund entity with Commitments, Capital Invested and Realized Value calculated using the exchange rate at the end of the quarter in which the relevant commitment was made or transaction occurred, as applicable. Performance metrics only reflects capital committed in U.S. dollars, which represents the majority of capital committed to each fund. Net IRR and Net MoM were: (i) for the euro-denominated vehicle of Europe Realty III, 1% and 1.0x and (ii) for the euro-denominated vehicle of Europe Realty IV, 9% and 1.0x . 16) Total Return includes onshore investors participating directly through the master fund and investors through the offshore vehicle. Total Return for the offshore vehicle was 5%. 17) Total Returns for onshore funds only. Total Returns for the offshore vehicles were: (i) for the MVP Fund, 11%, (ii) for ABC Evergreen, 24% and (iii) for Dynamic Credit Income Fund (formerly Super Fund), 8%. 18) Total Return is calculated as the change in NAV per share during the period, plus distributions per share (assuming dividends and distributions are reinvested) divided by the beginning NAV per share. Inception-to-date figures for Class I, Class D and Class S shares use the initial offering price per share as the beginning NAV. Total Return presented is for Class I and is prior to the impact of any potential upfront placement fees. An investment in TCAP is subject to a maximum upfront placement fee of 1.5% for Class D and 3.5% for Class S, which would reduce the amount of capital available for investment, if applicable. There are no upfront placement fees for Class I shares. Total Return has been annualized for periods less than or greater than one year. 19) T-POP Total Return reflects a per unit return based on Class R-I, including reinvestment of any dividends received during the period (if applicable), and no upfront selling commission, net of all fees and expenses incurred by T-POP. Total Return for Class R-S is 23%.

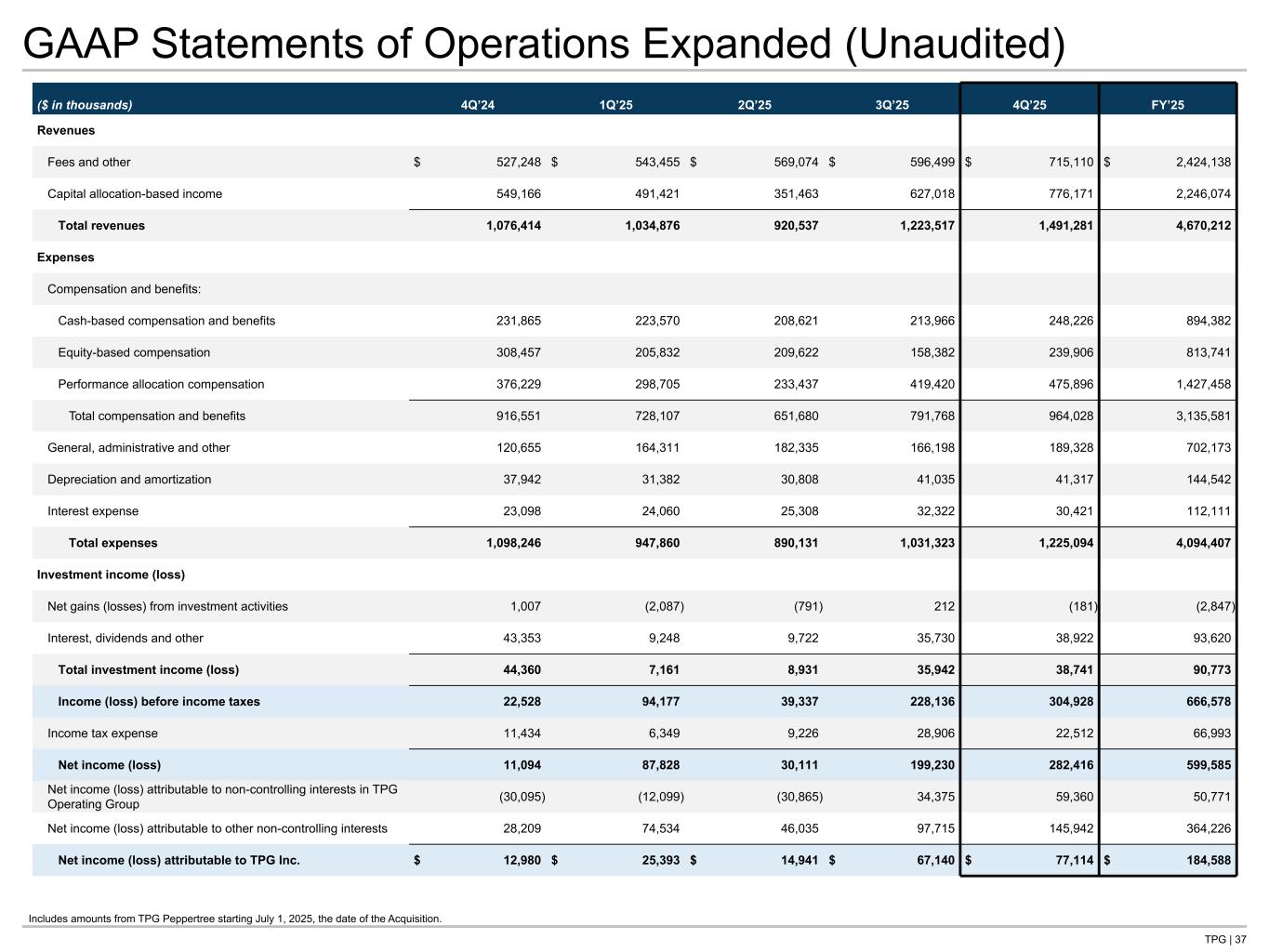

TPG | 37 GAAP Statements of Operations Expanded (Unaudited) ($ in thousands) 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 FY’25 Revenues Fees and other $ 527,248 $ 543,455 $ 569,074 $ 596,499 $ 715,110 $ 2,424,138 Capital allocation-based income 549,166 491,421 351,463 627,018 776,171 2,246,074 Total revenues 1,076,414 1,034,876 920,537 1,223,517 1,491,281 4,670,212 Expenses Compensation and benefits: Cash-based compensation and benefits 231,865 223,570 208,621 213,966 248,226 894,382 Equity-based compensation 308,457 205,832 209,622 158,382 239,906 813,741 Performance allocation compensation 376,229 298,705 233,437 419,420 475,896 1,427,458 Total compensation and benefits 916,551 728,107 651,680 791,768 964,028 3,135,581 General, administrative and other 120,655 164,311 182,335 166,198 189,328 702,173 Depreciation and amortization 37,942 31,382 30,808 41,035 41,317 144,542 Interest expense 23,098 24,060 25,308 32,322 30,421 112,111 Total expenses 1,098,246 947,860 890,131 1,031,323 1,225,094 4,094,407 Investment income (loss) Net gains (losses) from investment activities 1,007 (2,087) (791) 212 (181) (2,847) Interest, dividends and other 43,353 9,248 9,722 35,730 38,922 93,620 Total investment income (loss) 44,360 7,161 8,931 35,942 38,741 90,773 Income (loss) before income taxes 22,528 94,177 39,337 228,136 304,928 666,578 Income tax expense 11,434 6,349 9,226 28,906 22,512 66,993 Net income (loss) 11,094 87,828 30,111 199,230 282,416 599,585 Net income (loss) attributable to non-controlling interests in TPG Operating Group (30,095) (12,099) (30,865) 34,375 59,360 50,771 Net income (loss) attributable to other non-controlling interests 28,209 74,534 46,035 97,715 145,942 364,226 Net income (loss) attributable to TPG Inc. $ 12,980 $ 25,393 $ 14,941 $ 67,140 $ 77,114 $ 184,588 Tie to: -G P&L at front of deck -G-NG recon Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition.

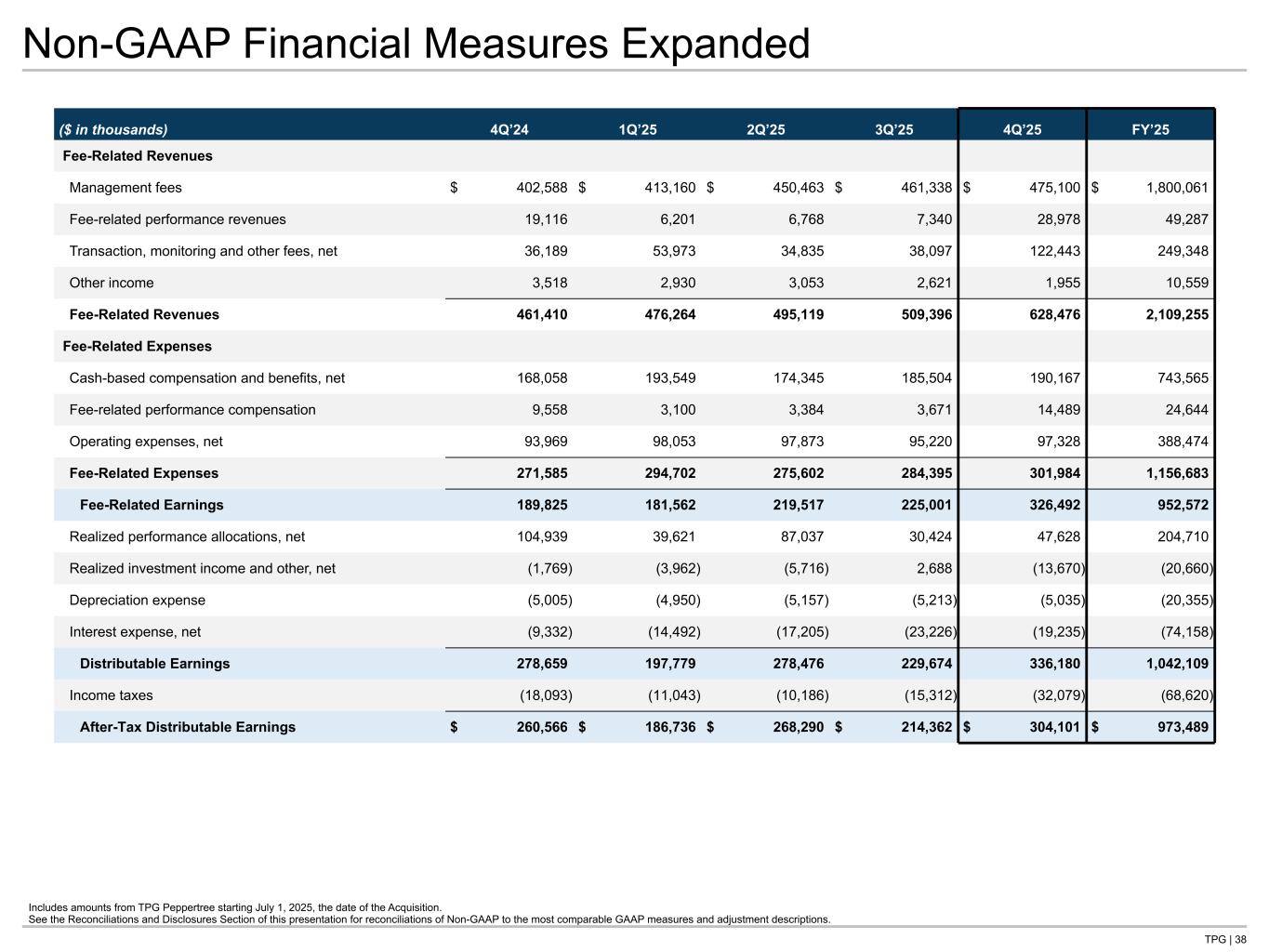

TPG | 38 Non-GAAP Financial Measures Expanded Includes amounts from TPG Peppertree starting July 1, 2025, the date of the Acquisition. See the Reconciliations and Disclosures Section of this presentation for reconciliations of Non-GAAP to the most comparable GAAP measures and adjustment descriptions. ($ in thousands) 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 FY’25 Fee-Related Revenues Management fees $ 402,588 $ 413,160 $ 450,463 $ 461,338 $ 475,100 $ 1,800,061 Fee-related performance revenues 19,116 6,201 6,768 7,340 28,978 49,287 Transaction, monitoring and other fees, net 36,189 53,973 34,835 38,097 122,443 249,348 Other income 3,518 2,930 3,053 2,621 1,955 10,559 Fee-Related Revenues 461,410 476,264 495,119 509,396 628,476 2,109,255 Fee-Related Expenses Cash-based compensation and benefits, net 168,058 193,549 174,345 185,504 190,167 743,565 Fee-related performance compensation 9,558 3,100 3,384 3,671 14,489 24,644 Operating expenses, net 93,969 98,053 97,873 95,220 97,328 388,474 Fee-Related Expenses 271,585 294,702 275,602 284,395 301,984 1,156,683 Fee-Related Earnings 189,825 181,562 219,517 225,001 326,492 952,572 Realized performance allocations, net 104,939 39,621 87,037 30,424 47,628 204,710 Realized investment income and other, net (1,769) (3,962) (5,716) 2,688 (13,670) (20,660) Depreciation expense (5,005) (4,950) (5,157) (5,213) (5,035) (20,355) Interest expense, net (9,332) (14,492) (17,205) (23,226) (19,235) (74,158) Distributable Earnings 278,659 197,779 278,476 229,674 336,180 1,042,109 Income taxes (18,093) (11,043) (10,186) (15,312) (32,079) (68,620) After-Tax Distributable Earnings $ 260,566 $ 186,736 $ 268,290 $ 214,362 $ 304,101 $ 973,489 Tie to: -NG P&L at front -G-NG qtrly in recon section

Reconciliations and Disclosures

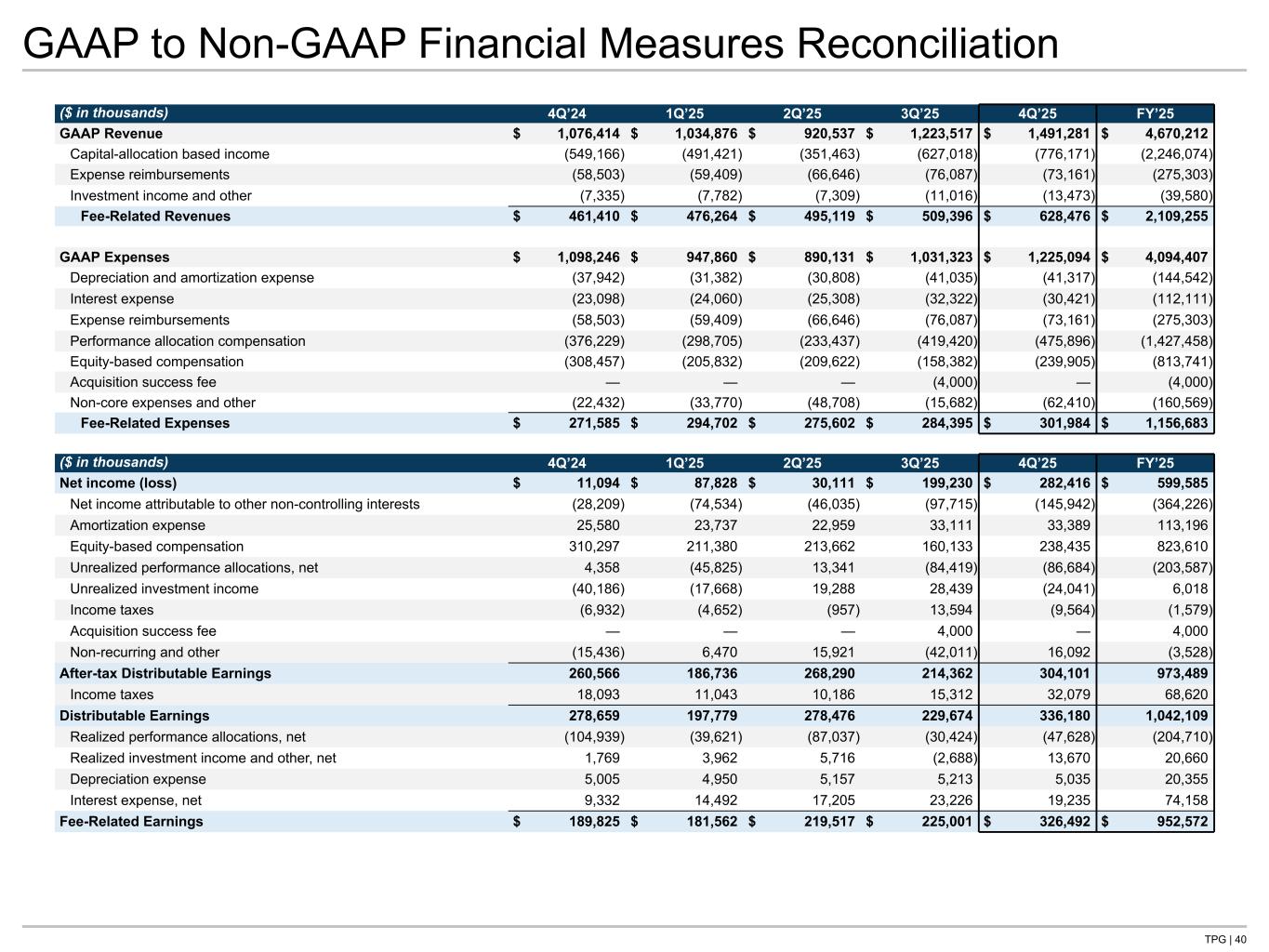

TPG | 40 GAAP to Non-GAAP Financial Measures Reconciliation ($ in thousands) 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 FY’25 GAAP Revenue $ 1,076,414 $ 1,034,876 $ 920,537 $ 1,223,517 $ 1,491,281 $ 4,670,212 Capital-allocation based income (549,166) (491,421) (351,463) (627,018) (776,171) (2,246,074) Expense reimbursements (58,503) (59,409) (66,646) (76,087) (73,161) (275,303) Investment income and other (7,335) (7,782) (7,309) (11,016) (13,473) (39,580) Fee-Related Revenues $ 461,410 $ 476,264 $ 495,119 $ 509,396 $ 628,476 $ 2,109,255 GAAP Expenses $ 1,098,246 $ 947,860 $ 890,131 $ 1,031,323 $ 1,225,094 $ 4,094,407 Depreciation and amortization expense (37,942) (31,382) (30,808) (41,035) (41,317) (144,542) Interest expense (23,098) (24,060) (25,308) (32,322) (30,421) (112,111) Expense reimbursements (58,503) (59,409) (66,646) (76,087) (73,161) (275,303) Performance allocation compensation (376,229) (298,705) (233,437) (419,420) (475,896) (1,427,458) Equity-based compensation (308,457) (205,832) (209,622) (158,382) (239,905) (813,741) Acquisition success fee — — — (4,000) — (4,000) Non-core expenses and other (22,432) (33,770) (48,708) (15,682) (62,410) (160,569) Fee-Related Expenses $ 271,585 $ 294,702 $ 275,602 $ 284,395 $ 301,984 $ 1,156,683 ($ in thousands) 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 FY’25 Net income (loss) $ 11,094 $ 87,828 $ 30,111 $ 199,230 $ 282,416 $ 599,585 Net income attributable to other non-controlling interests (28,209) (74,534) (46,035) (97,715) (145,942) (364,226) Amortization expense 25,580 23,737 22,959 33,111 33,389 113,196 Equity-based compensation 310,297 211,380 213,662 160,133 238,435 823,610 Unrealized performance allocations, net 4,358 (45,825) 13,341 (84,419) (86,684) (203,587) Unrealized investment income (40,186) (17,668) 19,288 28,439 (24,041) 6,018 Income taxes (6,932) (4,652) (957) 13,594 (9,564) (1,579) Acquisition success fee — — — 4,000 — 4,000 Non-recurring and other (15,436) 6,470 15,921 (42,011) 16,092 (3,528) After-tax Distributable Earnings 260,566 186,736 268,290 214,362 304,101 973,489 Income taxes 18,093 11,043 10,186 15,312 32,079 68,620 Distributable Earnings 278,659 197,779 278,476 229,674 336,180 1,042,109 Realized performance allocations, net (104,939) (39,621) (87,037) (30,424) (47,628) (204,710) Realized investment income and other, net 1,769 3,962 5,716 (2,688) 13,670 20,660 Depreciation expense 5,005 4,950 5,157 5,213 5,035 20,355 Interest expense, net 9,332 14,492 17,205 23,226 19,235 74,158 Fee-Related Earnings $ 189,825 $ 181,562 $ 219,517 $ 225,001 $ 326,492 $ 952,572 Tie to: -NG P&L at front -NG qtrly P&L -G P&L at front -G qtrly P&L

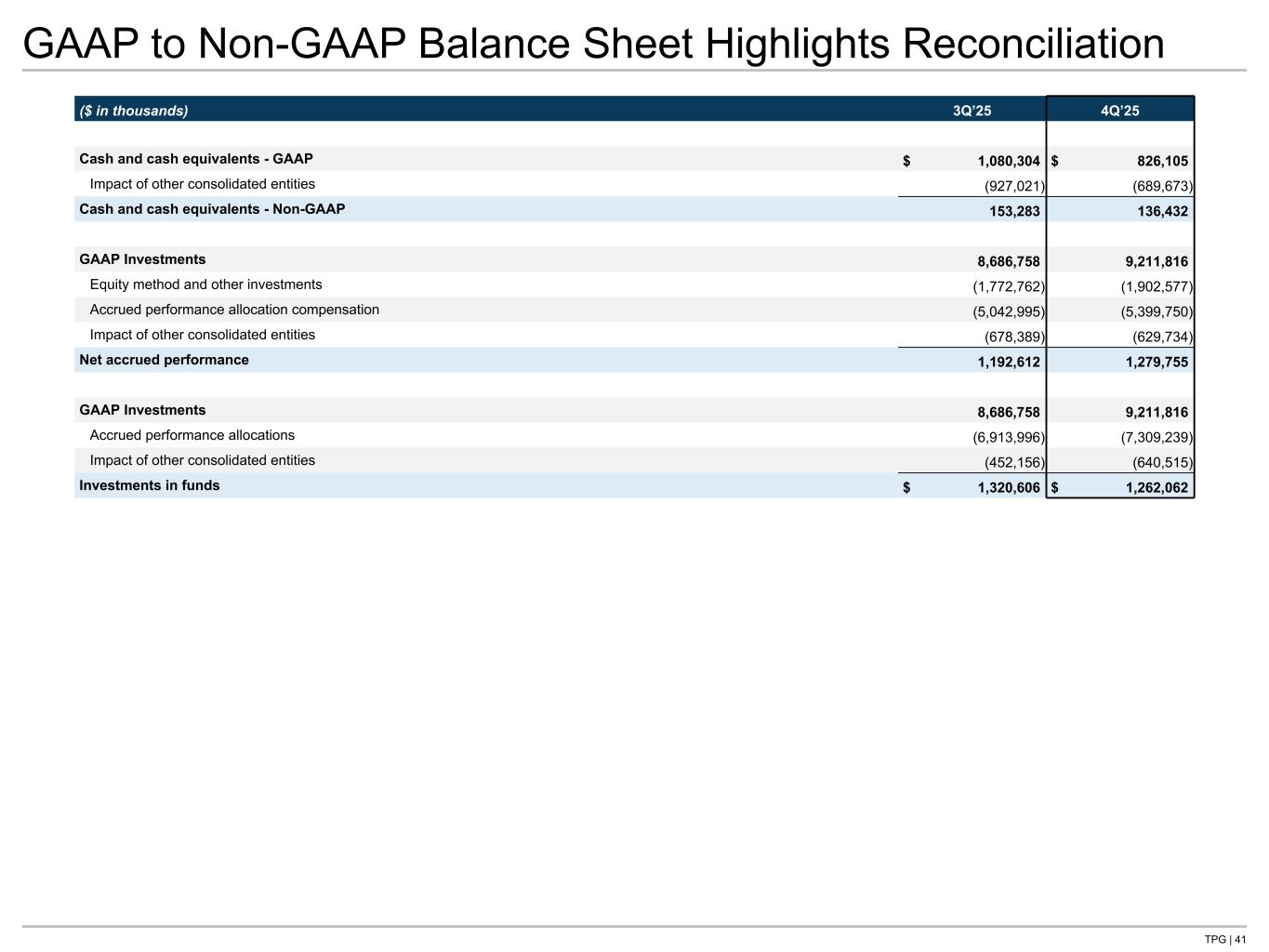

TPG | 41 GAAP to Non-GAAP Balance Sheet Highlights Reconciliation ($ in thousands) 3Q’25 4Q’25 Cash and cash equivalents - GAAP $ 1,080,304 $ 826,105 Impact of other consolidated entities (927,021) (689,673) Cash and cash equivalents - Non-GAAP 153,283 136,432 GAAP Investments 8,686,758 9,211,816 Equity method and other investments (1,772,762) (1,902,577) Accrued performance allocation compensation (5,042,995) (5,399,750) Impact of other consolidated entities (678,389) (629,734) Net accrued performance 1,192,612 1,279,755 GAAP Investments 8,686,758 9,211,816 Accrued performance allocations (6,913,996) (7,309,239) Impact of other consolidated entities (452,156) (640,515) Investments in funds $ 1,320,606 $ 1,262,062 Tie to: -G B/S page -NG B/S page

TPG | 42 Additional Information Dividend Policy Our current intention is to pay holders of our Class A common stock and nonvoting Class A common stock a quarterly dividend representing at least 85% of TPG Inc.’s share of distributable earnings attributable to the TPG Operating Group, subject to adjustment as determined by our board of directors and, until the Sunset, our Executive Committee to be necessary or appropriate to provide for the conduct of our business, to make appropriate investments in our business and funds, to comply with applicable law, any of our debt instruments or other agreements, or to provide for future cash requirements such as tax-related payments and clawback obligations. Although we expect to pay at least 85% of our DE as a dividend, the percentage of our DE paid out as a dividend could fall below that target minimum. All of the foregoing is subject to the further qualification that the declaration and payment of any dividends are at the sole discretion of our board of directors and, until the Sunset, our Executive Committee and the board of directors and Executive Committee may change our dividend policy at any time, including, without limitation, to reduce such dividends or even to eliminate such dividends entirely. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and, until the Sunset, our Executive Committee after taking into account various factors, including our business, operating results and financial condition, current and anticipated cash needs, plans for expansion and any legal or contractual limitations on our ability to pay dividends. Certain of our existing credit facilities include, and any financing arrangement that we enter into in the future may include restrictive covenants that limit our ability to pay dividends. In addition, the TPG Operating Group is generally prohibited under Delaware law from making a distribution to a limited partner to the extent that, at the time of the distribution, after giving effect to the distribution, liabilities of the TPG Operating Group (with certain exceptions) exceed the fair value of its assets. Subsidiaries of the TPG Operating Group are generally subject to similar legal limitations on their ability to make distributions to the TPG Operating Group. Non-GAAP Financial Measures In this presentation, we disclose non-GAAP financial measures, including Distributable Earnings (“DE”), After-tax DE, Fee-Related Earnings (“FRE”), Fee-Related Earnings margin (“FRE Margin”), fee-related revenues (“FRR”), and fee-related expenses. These measures are not financial measures under GAAP and should not be considered as substitutes for net income, revenues or total expenses, and they may not be comparable to similarly titled measures reported by other companies. These measures should be considered in addition to GAAP measures. We use these measures to assess the core operating performance of our business, and further definitions can be found on the following pages.

TPG | 43 Definitions Acquisition refers to the Company’s acquisition of the business of Peppertree Capital Management, Inc. (“Peppertree” and, after the Acquisition, “TPG Peppertree”) on July 1, 2025. After-tax Distributable Earnings (“After-tax DE”) is a non-GAAP performance measure of our distributable earnings after reflecting the impact of income taxes. We use it to assess how income tax expense affects amounts available to be distributed to our Class A common stockholders and Common Unit holders. After-tax DE differs from U.S. GAAP net income computed in accordance with U.S. GAAP in that it does not include the items described in the definition of DE herein; however, unlike DE, it does reflect the impact of income taxes. Income taxes, for purposes of determining After-tax DE, represent the total U.S. GAAP income tax expense adjusted to include only the current tax expense (benefit) calculated on U.S. GAAP net income before income tax and includes the current payable under our Tax Receivable Agreement. Further, the current tax expense (benefit) utilized when determining After-tax DE reflects the benefit of deductions available to the Company on certain expense items that are excluded from the underlying calculation of DE, such as equity-based compensation charges. We believe that including the amount currently payable under the Tax Receivable Agreement and utilizing the current income tax expense (benefit), as described above, when determining After-tax DE is meaningful as it increases comparability between periods and more accurately reflects earnings that are available for distribution to shareholders. Assets Under Management (“AUM”) represents the sum of: i) fair value of the investments and financial instruments held by our private equity, credit and real estate funds (including fund-level asset-related leverage), other than as described below, as well as related co-investment vehicles managed or advised by us, plus the capital that we are entitled to call from investors in those funds and vehicles, pursuant to the terms of their respective capital commitments, net of outstanding leverage associated with subscription-related credit facilities, and including capital commitments to funds that have yet to commence their investment periods; ii) the gross amount of assets (including leverage where applicable) for our real estate investment trusts and BDCs; iii) the net asset value of certain of our hedge funds; and iv) the aggregate par amount of collateral assets, including principal cash, for our collateralized loan obligation vehicles. Our definition of AUM is not based on any definition of AUM that may be set forth in the agreements governing the investment funds that we manage, or calculated pursuant to any regulatory definitions. AUM Not Yet Earning Fees represents the amount of capital commitments to TPG’s funds and co-investment vehicles that has not yet been invested or considered active, and as this capital is invested or activated, the fee-paying portion will be included in FAUM. AUM Subject to Fee-Earning Growth represents capital commitments that when deployed have the ability to grow our fees through earning new management fees (AUM Not Yet Earning Fees) or when management fees can be charged at a higher rate as capital is invested or for certain funds as management fee rates increase during the life of a fund (FAUM Subject to Step- Up). Available capital is the aggregate amount of unfunded capital commitments and recallable distributions that partners have committed to our funds and co-investment vehicles to fund future investments. Available capital is reduced for investments completed using fund-level subscription-related credit facilities. We believe this measure is useful to investors as it provides additional insight into the amount of capital that is available to our investment funds and co-investment vehicles to make future investments. Capital invested is the aggregate amount of capital invested during a given period by our investment funds, co-investment vehicles and CLOs, as well as increases in gross assets of certain perpetual funds. It excludes certain hedge fund activity, but includes investments made using investment financing arrangements like credit facilities, as applicable. We believe this measure is useful to investors as it measures capital deployment across the firm. Capital raised is the aggregate amount of subscriptions and capital raised by our investment funds and co-investment vehicles during a given period, as well as the senior and subordinated notes issued through our CLOs and equity raised through our perpetual vehicles. We believe this measure is useful to investors as it measures access to capital across TPG and our ability to grow our management fee base. Catch-up fees, also known as out of period management fees, represent fees paid in any given period that are related to a prior period, usually due to a new limited partner coming into a fund in a subsequent close.

TPG | 44 Definitions (Cont’d) Distributable Earnings (“DE”) is used to assess performance and amounts potentially available for distributions to partners. DE is derived from and reconciled to, but not equivalent to, its most directly comparable U.S. GAAP measure of net income. DE differs from U.S. GAAP net income computed in accordance with U.S. GAAP in that it does not include (i) unrealized performance allocations and related compensation expense, (ii) unrealized investment income, (iii) equity-based compensation expense, (iv) amortization, (v) net income (loss) attributable to non-controlling interests in consolidated entities, or (vi) certain other items, such as contingent reserves. Excluded Assets refers to the assets and economic entitlements transferred to RemainCo listed in Schedule A to the master contribution agreement entered into in connection with the Reorganization (as defined herein), which primarily include (i) minority interests in certain sponsors unaffiliated with TPG, (ii) the right to certain performance allocations in TPG funds, (iii) certain co-invest interests and (iv) cash. FAUM Subject to Step-Up represents capital raised within certain funds where the management fee rate increases once capital is invested or as a fund reaches a certain point in its life where the fee rate for certain investors increases. FAUM Subject to Step-Up is included within FAUM. Fee-Related Earnings (“FRE”) is a supplemental performance measure and is used to evaluate our business and make resource deployment and other operational decisions. FRE differs from net income computed in accordance with U.S. GAAP in that it adjusts for the items included in the calculation of DE and also adjusts to exclude (i) realized performance allocations and related compensation expense, (ii) realized investment income from investments and financial instruments, (iii) net interest (interest expense less interest income), (iv) depreciation, and (v) certain non-core income and expenses. We use FRE to measure the ability of our business to cover compensation and operating expenses from fee revenues other than capital allocation- based income. The use of FRE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. Fee-Related Earnings margin (“FRE margin”) is defined as Fee-Related Earnings divided by fee-related revenues. Fee-related expenses is a component of FRE. Fee-related expenses differs from expenses computed in accordance with U.S. GAAP in that it is net of certain reimbursement arrangements and does not include performance allocation compensation. Fee-related expenses is used in management’s review of the business. Fee-related revenues (“FRR”) is a component of FRE. Fee-related revenues is comprised of (i) management fees, (ii) fee-related performance revenues, (iii) transaction, monitoring and other fees, net, and (iv) other income. Fee-related performance revenues refers to incentive fees from perpetual capital vehicles that are: (i) measured and expected to be received on a recurring basis and (ii) not dependent on realization events from the underlying investments. Fee-related revenues differs from revenue computed in accordance with U.S. GAAP in that it excludes certain reimbursement expense arrangements. Fee-earning AUM (“FAUM”) represents only the AUM from which we are entitled to receive management fees. FAUM is the sum of all the individual fee bases that are used to calculate our management fees and differs from AUM in the following respects: (i) assets and commitments from which we are not entitled to receive a management fee are excluded (e.g., assets and commitments with respect to which we are entitled to receive only performance allocations or are otherwise not currently entitled to receive a management fee) and (ii) certain assets, primarily in our credit and real estate funds, have different methodologies for calculating management fees that are not based on the fair value of the respective funds’ underlying investments. We believe this measure is useful to investors as it provides additional insight into the capital base upon which we earn management fees. Our definition of FAUM is not based on any definition of AUM or FAUM that is set forth in the agreements governing the investment funds and products that we manage. Investment Appreciation / (Depreciation) represents fund appreciation for our private equity and real estate funds and gross returns for our credit funds. IPO refers to our initial public offering of Class A common stock of TPG Inc. that was completed on January 18, 2022. Loan Level Return, with respect to our CLOs, represents gross returns which are presented on a total return basis for invested assets held, excluding any financing costs or operating fees incurred and using a time-weighted return methodology. Returns over multiple periods are calculated by geometrically linking each period’s return over time. Net accrued performance represents both unrealized and undistributed performance allocations and fee-related performance revenues resulting from our general partner interests in investment funds that we manage. We believe this measure is useful to investors as it provides additional insight into the accrued performance to which the TPG Operating Group Common Unit holders are expected to receive. Non-GAAP Financial Measures represent financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America. These non-GAAP financial measures should be considered in addition to and not as a substitute for, or superior to, financial measures presented in accordance with U.S. GAAP. We use these measures to assess the core operating performance of our business.