Please wait

0001886878falseIn the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission.You will pay brokerage charges if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan.The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price.Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure (the “unified management fee”). Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 1.25% of the Fund’s average daily total managed assets. The Fund (and not PIMCO) will be responsible for certain fees and expenses, which are reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the unified management fee and definition of “total managed assets.”Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the period ended June 30, 2025, which represented 39.75% of the Fund’s average total managed assets, including the assets attributable to leverage (or 65.96% of the Fund’s average net assets attributable to Common Shares), as of that date, at an annual interest rate cost to the Fund of 5.605%, which is the weighted average interest rate cost during the period ended June 30, 2025. See “Effects of Leverage.” The actual amount of interest expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Expenses table above, but would be reflected in the Fund’s performance results.“Other Expenses” are estimated for the Fund’s fiscal year ending June 30, 2026.“Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Expenses are 2.09%.Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies.Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. 0001886878 2024-07-01 2025-06-30 0001886878 2023-10-01 2023-12-31 0001886878 2023-07-01 2023-09-30 0001886878 2025-04-01 2025-06-30 0001886878 2025-01-01 2025-03-31 0001886878 2024-10-01 2024-12-31 0001886878 2024-07-01 2024-09-30 0001886878 2024-04-01 2024-06-30 0001886878 2024-01-01 2024-03-31 0001886878 2025-06-30 0001886878 cik0001886878:AntiTakeoverProvisionsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:AssetAllocationRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:AutonomousOrElectricVehicleRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CallRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CertainAffiliationsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CollateralizedBondObligationsCollateralizedLoanObligationsAndCollateralizedDebtObligationsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CommoditiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ConfidentialInformationAccessRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ContingentConvertibleSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ConvertibleSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CorporateDebtSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:EnergySectorRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CyberSecurityRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:DebtSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:DerivativesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:DistressedAndDefaultedSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:DistributionRateRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:EmergingMarketsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CounterpartyRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CovenantLiteObligationsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CreditDefaultSwapsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CreditRiskOneMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CsdrRelatedRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CurrencyRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:IssuerRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LeverageRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LimitedTermRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LiquidityRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LoanOriginationRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LoansAndOtherIndebtednessLoanParticipationsAndAssignmentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ManagementRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MarketDiscountRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MarketDisruptionsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MarketRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MortgageRelatedAndOtherAssetBackedInstrumentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RiskOfInvestingInChinaMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RiskRetentionInvestmentRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SecuritiesLendingRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SeniorDebtRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ShortExposureRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SpecialPurposeAcquisitionCompaniesSpacsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SmallerCompanyRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SovereignDebtRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MortgageRelatedDerivativeInstrumentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MunicipalBondRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:NonDiversificationRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PlatformRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PortfolioTurnoverRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PotentialConflictsOfInterestRiskAllocationOfInvestmentOpportunitiesMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrivatelyIssuedMortgageRelatedSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RealEstateRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RegulationSSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:OperationalRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:OtherInvestmentCompaniesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:OtherPooledInvestmentVehiclesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PreferredSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrepaymentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrivacyAndDataSecurityRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrivateFundsRiskTaxRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrivatePlacementsAndRestrictedSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:PrivateRealEstateInvestmentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:EquitySecuritiesAndRelatedMarketRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:FocusedInvestmentRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ForeignNonUSGovernmentSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ForeignNonUSInvestmentRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ForeignLoanOriginationsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:HighYieldSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:IndustrySpecificRisksMember 2024-07-01 2025-06-30 0001886878 cik0001886878:InflationDeflationRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:InflationIndexedSecurityRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:InsurancelinkedAndOtherInstrumentsRiskMember 2024-07-01 2025-06-30 0001886878 us-gaap:InterestRateRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RegulatoryChangesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RegulatoryRiskCommodityPoolOperatorMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ReinvestmentRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ReitRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:StructuredInvestmentsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SubprimeRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SubsidiaryRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:SyntheticConvertibleSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:TaxRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:TotalReturnSwapRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:USGovernmentSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ValuationRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:ZeroCouponBondStepUpsAndPaymentInKindSecuritiesRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:UseOfDerivativesMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RepurchaseAgreementsRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RisksofDebtSecuritiesofMLPsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RisksofEquitySecuritiesofMLPsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RisksOfMlpSubordinatedUnitsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:AffiliatedPartyRiskMember 2024-07-01 2025-06-30 0001886878 cik0001886878:LackOfDiversificationOfMlpCustomersAndSuppliersMember 2024-07-01 2025-06-30 0001886878 cik0001886878:MlpGeneralPartnerAndManagingMemberInterestsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:RisksOfEtnsMember 2024-07-01 2025-06-30 0001886878 cik0001886878:CommonSharesMember 2024-07-01 2025-06-30 xbrli:pure iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number:

811-23749

PIMCO Access Income Fund

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices)

Bijal Y. Parikh

Treasurer (Principal Financial & Accounting Officer)

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

David C. Sullivan

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199

Registrant’s telephone number, including area code: (844) 337-4626

Date of fiscal year end: June 30

Date of reporting period: June 30, 2025

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. |

Reports to Stockholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

Annual Report

June 30, 2025

PCM Fund, Inc. | PCM | NYSE

PIMCO Global StocksPLUS

& Income Fund | PGP | NYSE

PIMCO Strategic Income Fund, Inc. | RCS | NYSE

PIMCO Access Income Fund | PAXS | NYSE

PIMCO Dynamic Income Fund | PDI | NYSE

PIMCO Dynamic Income Opportunities Fund | PDO | NYSE

PIMCO Dynamic Income Strategy Fund | PDX | NYSE

Table of Contents

|

|

|

|

|

|

|

|

| |

|

|

| |

| |

|

|

|

|

Page |

|

|

| |

|

|

| |

|

| |

|

|

| |

| |

|

|

|

| |

|

2 |

|

|

|

| |

| |

|

|

|

| |

|

19 |

|

|

|

| |

| |

|

|

|

| |

|

20 |

|

|

|

| |

| |

|

|

|

| |

|

22 |

|

|

|

| |

| |

|

|

|

| |

|

23 |

|

|

|

| |

| |

|

|

|

| |

|

24 |

|

|

|

| |

| |

|

|

|

| |

|

25 |

|

|

|

| |

| |

|

|

|

| |

|

26 |

|

|

|

| |

| |

|

|

|

| |

|

28 |

|

|

|

| |

| |

|

|

|

| |

|

30 |

|

|

|

| |

| |

|

|

|

| |

|

31 |

|

|

|

| |

| |

|

|

|

| |

|

127 |

|

|

|

| |

| |

|

|

|

| |

|

167 |

|

|

|

| |

| |

|

|

|

| |

|

168 |

|

|

|

| |

| |

|

|

|

| |

|

169 |

|

|

|

| |

| |

|

|

|

| |

|

171 |

|

|

|

| |

| |

|

|

|

| |

|

172 |

|

|

|

| |

| |

|

|

|

| |

|

174 |

|

|

|

| |

| |

|

|

|

| |

|

175 |

|

|

|

| |

| |

|

|

|

| |

|

177 |

|

|

|

| |

| |

|

|

|

| |

|

178 |

|

|

|

| |

| |

|

|

|

| |

|

215 |

|

|

|

| |

| |

|

|

|

| |

|

265 |

|

|

|

| |

| |

|

|

|

| |

|

266 |

|

|

|

| |

| |

|

|

|

| |

|

267 |

|

|

|

| |

| |

|

|

|

| |

|

273 |

|

|

|

| |

| |

|

|

|

| |

|

277 |

|

|

|

| |

| |

|

|

|

| |

|

284 |

|

|

| |

|

|

| |

|

| |

|

|

| |

| Fund |

|

Fund

Summary |

|

|

Schedule of

Investments |

|

|

| |

|

|

| |

|

| |

|

|

| |

| |

|

|

6 |

|

|

|

32 |

|

|

|

| |

| |

|

|

7 |

|

|

|

41 |

|

|

|

| |

| |

|

|

8 |

|

|

|

54 |

|

|

|

| |

| |

|

|

9 |

|

|

|

67 |

|

|

|

| |

| |

|

|

12 |

|

|

|

79 |

|

|

|

| |

| |

|

|

15 |

|

|

|

103 |

|

|

|

| |

| |

|

|

18 |

|

|

|

117 |

|

| |

|

Consolidated Schedule of Investments |

|

|

|

|

| |

Important Information About the Funds |

|

|

|

|

Information regarding each Fund’s principal investment strategies, principal risks and risk management strategies, the effects of each Fund’s leverage, and each Fund’s fundamental investment restrictions, including a summary of certain changes thereto during the most recent fiscal year, can be found within the relevant sections of this report. Please refer to the Table of Contents for further information.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities and other instruments held by a Fund are likely to decrease in value. A wide variety of factors can cause interest rates or yields of U.S. Treasury securities (or yields of other types of bonds) to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. A Fund may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, remain high. In efforts to combat inflation, the U.S. Federal Reserve (the “Fed”) raised interest rates multiple times in 2022 and 2023. In September 2024, the Fed lowered interest rates for the first time since March 2020. It is uncertain whether rates will remain steady, increase or decrease in the future. As such, the Funds may face a heightened level of risk associated with changing interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for certain types of bonds or bonds generally. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets”.

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than funds or securities with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets, or negatively impact a Fund’s performance or cause a Fund to incur losses.

A Fund may enter into opposite sides of multiple interest rate swaps or other derivatives with respect to the same underlying reference instrument (e.g., a

10-year

U.S. treasury) that have different effective

dates with respect to interest accrual time periods also for the principal purpose of generating distributable gains (characterized as ordinary income for tax purposes) that are not part of a Fund’s duration or yield curve management strategies. In such a “paired swap transaction,” a Fund would generally enter into one or more interest rate swap agreements whereby a Fund agrees to make regular payments starting at the time the Fund enters into the agreements equal to a floating interest rate in return for payments equal to a fixed interest rate (the “initial leg”). A Fund would also enter into one or more interest rate swap agreements on the same underlying instrument, but take the opposite position (i.e., in this example, a Fund would make regular payments equal to a fixed interest rate in return for receiving payments equal to a floating interest rate) with respect to a contract whereby the payment obligations do not commence until a date following the commencement of the initial leg (the “forward leg”).

A Fund may engage in investment strategies, including those that employ the use of paired swaps transactions, the use of interest rate swaps to seek to capitalize on differences between short-term and long-term interest rates and other derivatives transactions, to, among other things, seek to generate current, distributable income, even if such strategies could potentially result in declines in a Fund’s net asset value (“NAV”). A Fund’s income and gain-generating strategies, including certain derivatives strategies, may generate current income and gains taxable as ordinary income sufficient to support monthly distributions even in situations when a Fund has experienced a decline in net assets due to, for example, adverse changes in the broad U.S. or non-U.S. equity markets or a Fund’s debt investments, or arising from its use of derivatives. For instance, a portion of a Fund’s monthly distributions may be sourced from paired swap transactions utilized to produce current distributable ordinary income for tax purposes on the initial leg, with a substantial possibility that a Fund will later realize a corresponding capital loss and potential decline in its NAV with respect to the forward leg (to the extent there are not corresponding offsetting capital gains being generated from other sources). Because some or all of these transactions may generate capital losses without corresponding offsetting capital gains, portions of a Fund’s distributions recognized as ordinary income for tax purposes (such as from paired swap transactions, for example) may be economically similar to a taxable return of capital when considered together with such capital losses. More generally, sales of a Fund’s portfolio holdings may result in short-term capital gains (which are generally taxed to shareholders at ordinary income tax rates when distributed net of short-term capital losses and net of long-term capital losses), potentially subjecting shareholders of a Fund to adverse tax consequences.

Classifications of the Funds’ portfolio holdings in this report are made according to financial reporting standards. The classification of a

particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments or Consolidated Schedule of Investments sections of this report may differ from the classification used for the Funds’ compliance calculations, including those used in the Funds’ then-current prospectus, investment objectives, regulatory and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. Each Fund is separately monitored for compliance with respect to investment parameters and regulatory requirements.

The geographical classification of foreign

(non-U.S.)

securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

In February 2022, Russia launched an invasion of Ukraine. As a result, Russia and other countries, persons and entities that provided material aid to Russia’s aggression against Ukraine, have been the subject of economic sanctions and import and export controls imposed by countries throughout the world, including the United States. Such measures, including the United States’ enforcement of sanctions or other similar measures on various Russian entities and persons, and the Russian government’s response, have had and may continue to have an adverse effect on the Russian, Belarusian and other securities, instruments and economies, which may, in turn, negatively impact a Fund. The extent, duration and impact of Russia’s military action in Ukraine, related sanctions and retaliatory actions are difficult to ascertain, but could be significant and have severe adverse effects on the region, including significant adverse effects on the regional, European and global economies and the markets for certain securities and commodities, such as oil and natural gas, as well as other sectors. Further, a Fund may have investments in securities and instruments that are economically tied to the region and may have been negatively impacted by the sanctions and counter-sanctions by Russia, including declines in value and reductions in liquidity. The sanctions may cause a Fund to sell portfolio holdings at a disadvantageous time or price or to continue to hold investments that a Fund may no longer seek to hold.

The United States’ enforcement of restrictions on U.S. investments in certain issuers and tariffs on goods from certain other countries has contributed to and may continue to contribute to international trade tensions and may impact portfolio securities. The U.S. government has indicated an intent to alter its approach to international trade policy, including in some cases renegotiating, modifying or terminating certain bilateral or multi-lateral trade arrangements with foreign countries, and it has proposed to take and/or taken related actions, including the imposition of or stated potential imposition of a broad range of tariffs. The imposition of tariffs, trade restrictions, currency restrictions or similar actions (or retaliatory measures taken in response) could lead

to, for example, price volatility, reduced market sentiment, and changes in inflation expectations. These and other geopolitical events may contribute to increased instability in the U.S. and global economies and markets, which may have an adverse effect on the performance of the Funds and their investments.

The common shares of the Funds trade on the New York Stock Exchange. As with any stock, the price of a Fund’s common shares will fluctuate with market conditions and other factors. If you sell your common shares of a Fund, the price received may be more or less than your original investment. Shares of closed-end management investment companies, such as the Funds, frequently trade at a discount from their NAV and may trade at a price that is less than the initial offering price and/or the NAV of such shares. Further, if a Fund’s shares trade at a price that is more than the initial offering price and/or the NAV of such shares, including at a substantial premium and/or for an extended period of time, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to NAV thereafter.

U.S. and global markets have experienced increased volatility, including as a result of the failures of certain U.S. and non-U.S. banks in 2023, which could be harmful to the Funds and issuers in which they invest. For example, if a bank at which a Fund or issuer has an account fails, any cash or other assets in bank or custody accounts, which may be substantial in size, could be temporarily inaccessible or permanently lost by the Fund or issuer. If a bank that provides a subscription line credit facility, asset-based facility, other credit facility and/or other services to an issuer or to a fund fails, the issuer or fund could be unable to draw funds under its credit facilities or obtain replacement credit facilities or other services from other lending institutions with similar terms.

Issuers in which a Fund may invest can be affected by volatility in the banking sector. Even if banks used by issuers in which the Funds invest remain solvent, volatility in the banking sector could contribute to, cause or intensify an economic recession, increase the costs of capital and banking services or result in the issuers being unable to obtain or refinance indebtedness at all or on as favorable terms as could otherwise have been obtained. Potential impacts to funds and issuers resulting from changes in the banking sector, market conditions and potential legislative or regulatory responses are uncertain. Such conditions and responses, as well as a changing interest rate environment, can contribute to decreased market liquidity and erode the value of certain holdings, including those of U.S. and non-U.S. banks. Continued market volatility and uncertainty and/or a downturn in market and economic and financial conditions, as a result of developments in the banking sector or otherwise (including as a result of delayed access to cash or credit facilities), could have an adverse impact on the Funds and issuers in which they invest.

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

ANNUAL REPORT |

|

|

| |

|

|

JUNE 30, 2025 |

|

|

3 |

|

|

|

|

| |

Important Information About the Funds |

|

|

|

|

On each Fund Summary page in this Shareholder Report, the Average Annual Total Return table and Cumulative Returns chart measure performance assuming that any dividend and capital gain distributions were reinvested. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the sale of Fund shares. Total return for a period of more than one year represents the average annual total return. Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about a Fund, market conditions, supply and demand for the Fund’s shares, or changes in the Fund’s dividends. Performance shown is net of fees and expenses. Historical NAV performance for a Fund may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The dividend rate that a Fund pays on its common shares may vary as portfolio and market conditions change, and will depend on a number of factors, including without limit the amount of a Fund’s undistributed net investment income and net short- and long-term capital gains, as well as the costs of any leverage obtained by a Fund. As portfolio and market conditions change, the rate of distributions on the common shares and a Fund’s dividend policy could change. There can be no assurance that a change in market conditions or other factors will not result in a change in a Fund’s distribution rate or that the rate will be sustainable in the future.

The following table discloses the inception date and diversification status of each Fund:

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| PCM Fund, Inc. |

|

|

|

| |

|

09/02/93 |

|

|

|

Diversified |

|

PIMCO Global StocksPLUS & Income Fund |

|

|

|

| |

|

05/31/05 |

|

|

|

Diversified |

|

| PIMCO Strategic Income Fund, Inc. |

|

|

|

| |

|

02/24/94 |

|

|

|

Diversified |

|

| PIMCO Access Income Fund |

|

|

|

| |

|

01/31/22 |

|

|

|

Diversified |

|

| PIMCO Dynamic Income Fund |

|

|

|

| |

|

05/30/12 |

|

|

|

Diversified |

|

| PIMCO Dynamic Income Opportunities Fund |

|

|

|

| |

|

01/29/21 |

|

|

|

Diversified |

|

| PIMCO Dynamic Income Strategy Fund |

|

|

|

| |

|

02/01/19 |

|

|

|

Non-Diversified |

|

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in a Fund.

The Trustees/Directors

1

are responsible generally for overseeing the management of the Funds. The Trustees authorize the Funds to enter into service agreements with Pacific Investment Management Company LLC (“PIMCO”) and other service providers in order to provide, and in some cases authorize service providers to procure through other parties, necessary or desirable services on behalf of the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus original or any subsequent or Statement of Additional Information (“SAI”), any press release or shareholder report, any contracts filed as exhibits to a Fund’s registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of a Fund creates a contract between or among any shareholders of a Fund, on the one hand, and the Fund, a service provider to the Fund, and/or the Trustees or officers of the Fund, on the other hand.

The Trustees (or the Funds and their officers, service providers or other delegates acting under authority of the Trustees) may amend its most recent prospectus or use a new prospectus or SAI with respect to a Fund, adopt and disclose new or amended policies and other changes in press releases and shareholder reports and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to any Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in a Fund’s then-current prospectus, SAI or shareholder report and is otherwise still in effect.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule

206(4)-6

under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Funds as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Funds at (844)

33-PIMCO,

on the Funds’ website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to

|

Hereinafter, the terms “Trustee” or “Trustees” used herein shall refer to a Director or Directors of applicable Funds. |

their reports on Form N-PORT. The Funds’ Form N-PORT reports are available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and upon request by calling PIMCO at (844) 33-PIMCO. In August 2024, the SEC adopted amendments to Form N-PORT requiring funds to file

Form N-PORT

reports on a monthly basis and within 30 days of month end, with each report being made public 60 days after month end. On April 16, 2025, the SEC extended the compliance date for Form N-PORT amendments and fund groups with $1 billion or more in net assets will be required to comply with the amendments for reports filed on or after November 17, 2027.

SEC rules allow the Funds to fulfill their obligation to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Investors may elect to receive all future reports in paper free of charge by contacting their financial intermediary or, if invested directly with a Fund, investors can inform the Fund by calling (844) 33-PIMCO. Any election to receive reports in paper will apply to all funds held with the fund complex if invested directly with a Fund or to all funds held in the investor’s account if invested through a financial intermediary. Paper copies of the Funds’ shareholder reports are required to be provided free of charge by the Fund or financial intermediary upon request.

In September 2023, the SEC adopted amendments to Rule 35d-1 under the Investment Company Act of 1940, as amended, the rule governing fund naming conventions (the “Names Rule”). In general, the Names Rule requires funds with certain types of names to adopt a policy to invest at least 80% of their assets in the type of investment suggested by the name. The amendments expand the scope of the current rule to include any term used in a fund name that suggests the fund makes investments that have, or whose issuers have, particular characteristics. Additionally, the amendments modify the circumstances under which a fund may deviate from its 80% investment policy and address the calculation methodology of derivatives instruments for purposes of the rule. Changes to a fund’s calculation methodology for derivatives instruments for purposes of Rule 35d-1 consistent with such amendments and applicable regulatory interpretations thereof will not constitute a change to a fund’s policy adopted pursuant to Rule 35d-1 and will not require notice or shareholder approval. The amendments became effective on December 11, 2023. On March 14, 2025, the SEC extended the compliance date from December 11, 2025 to June 11, 2026 for fund groups with $1 billion or more in net assets and modified the operation of the compliance dates to allow for compliance based on the timing of certain annual disclosure and reporting obligations that are tied to a fund’s fiscal year-end.

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

ANNUAL REPORT |

|

|

| |

|

|

JUNE 30, 2025 |

|

|

5 |

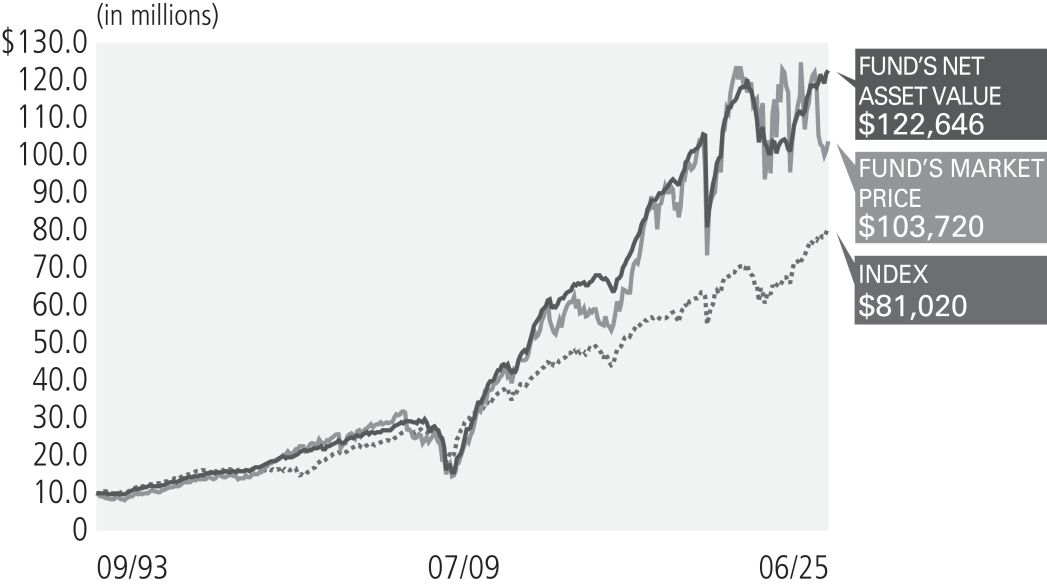

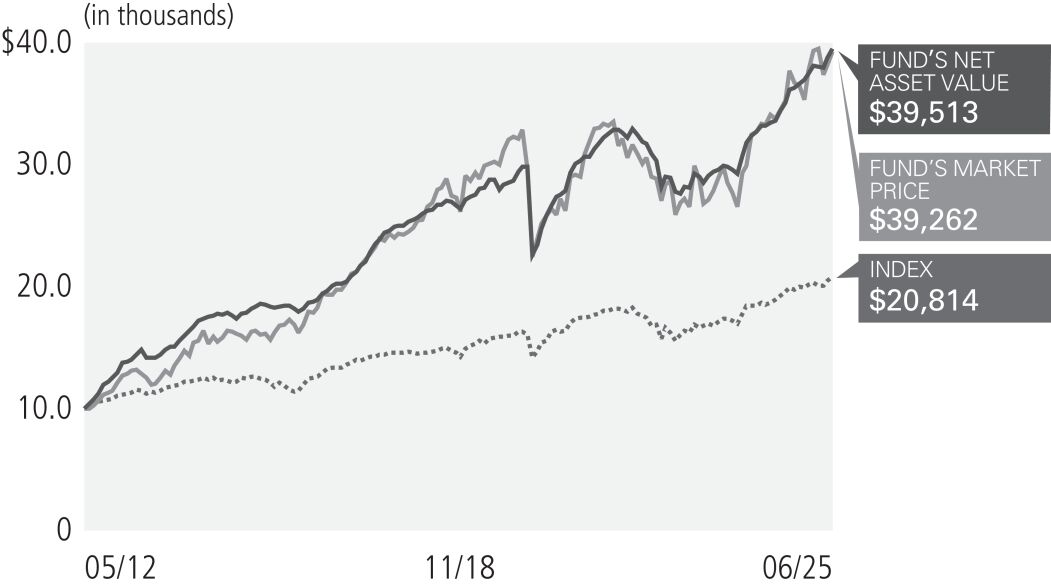

Cumulative Returns Through June 30, 2025

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2025

|

|

|

|

|

|

|

|

| |

| Asset-Backed Securities |

|

|

29.7% |

|

|

|

| |

|

|

| |

Non-Agency Mortgage-Backed Securities |

|

|

24.6% |

|

|

|

| |

|

|

| |

| Corporate Bonds & Notes |

|

|

14.1% |

|

|

|

| |

|

|

| |

| Loan Participations and Assignments |

|

|

13.5% |

|

|

|

| |

|

|

| |

| |

|

|

6.9% |

|

|

|

| |

|

|

| |

| Common Stocks |

|

|

5.8% |

|

|

|

| |

|

|

| |

| U.S. Government Agencies |

|

|

4.0% |

|

|

|

| |

|

|

| |

| Other |

|

|

1.4% |

|

|

|

|

|

| |

|

% of Investments, at value. |

| |

|

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| |

|

Includes Central Funds Used for Cash Management Purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Return (1) for the period ended June 30, 2025 |

|

|

|

|

|

|

| |

| |

|

|

|

|

|

|

5 Year |

|

|

10 Year |

|

|

Commencement

of Operations

(09/02/93) |

|

|

|

Market Price |

|

|

(3.21)% |

|

|

|

2.99% |

|

|

|

6.25% |

|

|

|

7.63% |

|

|

|

NAV |

|

|

10.06% |

|

|

|

5.82% |

|

|

|

6.05% |

|

|

|

8.20% |

|

|

|

ICE BofA US High Yield Index |

|

|

10.24% |

|

|

|

6.01% |

|

|

|

5.29% |

|

|

|

|

|

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Average Annual Return since 08/31/1993.

It is not possible to invest directly in an unmanaged index.

|

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

|

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

|

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

|

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information (as of June 30, 2025)

(

¹

)

|

|

|

|

| |

| Market Price |

|

|

$6.33 |

|

|

| |

| NAV |

|

|

$5.99 |

|

|

| |

| Premium/(Discount) to NAV |

|

|

5.68% |

|

|

| |

Market Price Distribution Rate (2) |

|

|

12.18% |

|

|

| |

| |

|

|

12.87% |

|

|

| |

Total Effective Leverage (3) |

|

|

34.50% |

|

Investment Objective and Strategy Overview

The Fund’s primary investment objective is to achieve high current income. Capital gain from the disposition of investments is a secondary objective of the Fund.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » |

|

Exposure to the residential mortgage credit sector contributed to performance, as the sector posted positive performance. |

| » |

|

Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to performance, as the securities posted positive returns. |

| » |

|

Exposure to the commercial mortgage credit sector contributed to performance, as the sector posted positive performance. |

| » |

|

Exposure to corporate credit, notably high yield credit and bank loans, contributed to performance, as the asset classes posted positive returns. |

| » |

|

The costs associated with one or more forms of leverage detracted from performance. That said, the net impact on the Fund’s performance of the cost of leverage is generally determined by comparing the return on the additional investments purchased with such leverage against the cost of such leverage. |

| » |

|

Exposure to asset backed securities detracted from performance, as select student and auto loans posted negative performance. |

| » |

|

There were no other material detractors for this Fund. |

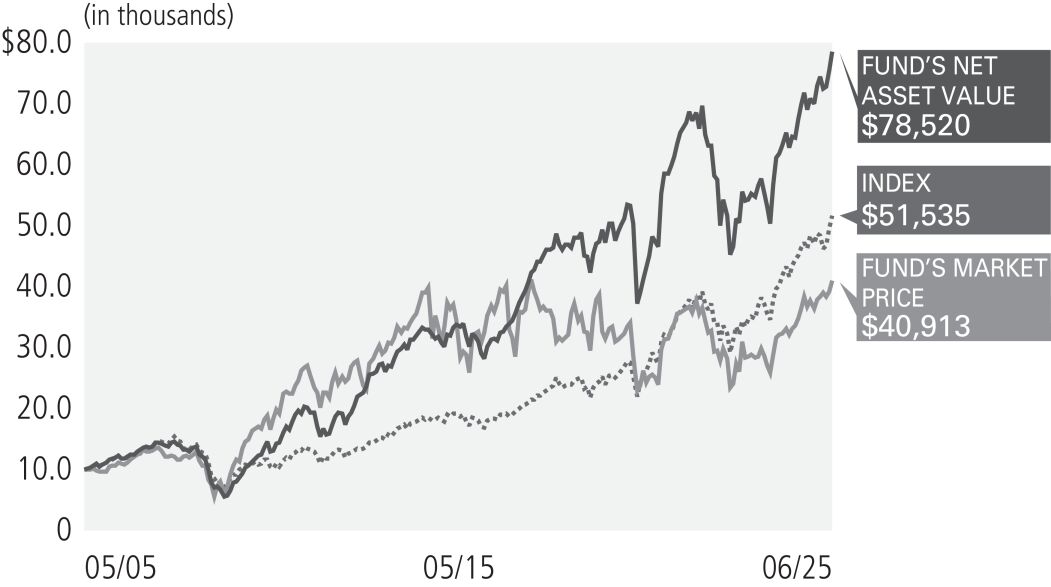

PIMCO Global StocksPLUS

& Income Fund

Cumulative Returns Through June 30, 2025

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2025

|

|

|

|

| |

| U.S. Government Agencies |

|

|

28.4% |

|

|

| |

| Corporate Bonds & Notes |

|

|

23.1% |

|

|

| |

| Loan Participations and Assignments |

|

|

16.6% |

|

|

| |

Non-Agency Mortgage-Backed Securities |

|

|

7.2% |

|

|

| |

| |

|

|

7.2% |

|

|

| |

| Common Stocks |

|

|

5.9% |

|

|

| |

| Sovereign Issues |

|

|

4.5% |

|

|

| |

| Asset-Backed Securities |

|

|

3.8% |

|

|

| |

| Preferred Securities |

|

|

1.5% |

|

|

| |

| Municipal Bonds & Notes |

|

|

1.2% |

|

|

| |

| Other |

|

|

0.6% |

|

| |

|

% of Investments, at value. |

| |

|

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| |

|

Includes Central Funds Used for Cash Management Purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Return (1) for the period ended June 30, 2025 |

|

|

|

|

|

|

| |

| |

|

|

|

1 Year |

|

|

5 Year |

|

|

10 Year |

|

|

Commencement

of Operations

(05/31/05) |

|

|

|

Market Price |

|

|

21.99% |

|

|

|

10.99% |

|

|

|

3.71% |

|

|

|

7.27% |

|

|

|

NAV |

|

|

21.79% |

|

|

|

12.78% |

|

|

|

8.91% |

|

|

|

10.81% |

|

|

|

MSCI World Index |

|

|

16.26% |

|

|

|

14.55% |

|

|

|

10.66% |

|

|

|

8.50% |

|

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

It is not possible to invest directly in an unmanaged index.

|

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

|

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

|

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

|

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information (as of June 30, 2025)

(1)

|

|

|

|

| |

| Market Price |

|

|

$8.29 |

|

|

| |

| NAV |

|

|

$8.14 |

|

|

| |

| Premium/(Discount) to NAV |

|

|

1.84% |

|

|

| |

Market Price Distribution Rate (2) |

|

|

9.99% |

|

|

| |

| |

|

|

10.17% |

|

|

| |

Total Effective Leverage (3) |

|

|

18.60% |

|

Investment Objective and Strategy Overview

PIMCO Global StocksPLUS

& Income Fund’s investment objective is to seek total return comprised of current income, current gains and long-term capital appreciation.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » |

|

Exposure to global equities contributed to performance, as the asset class posted positive returns. |

| » |

|

Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to performance, as the securities posted positive returns. |

| » |

|

Exposure to emerging market debt contributed to performance, as spreads tightened. |

| » |

|

Exposure to corporate credit, notably high yield credit and bank loans, contributed to performance, as the asset classes posted positive returns. |

| » |

|

The costs associated with one or more forms of leverage detracted from performance. That said, the net impact on the Fund’s performance of the cost of leverage is generally determined by comparing the return on the additional investments purchased with such leverage against the cost of such leverage. |

| » |

|

There were no other material detractors for this Fund. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

ANNUAL REPORT |

|

|

| |

|

|

JUNE 30, 2025 |

|

|

7 |

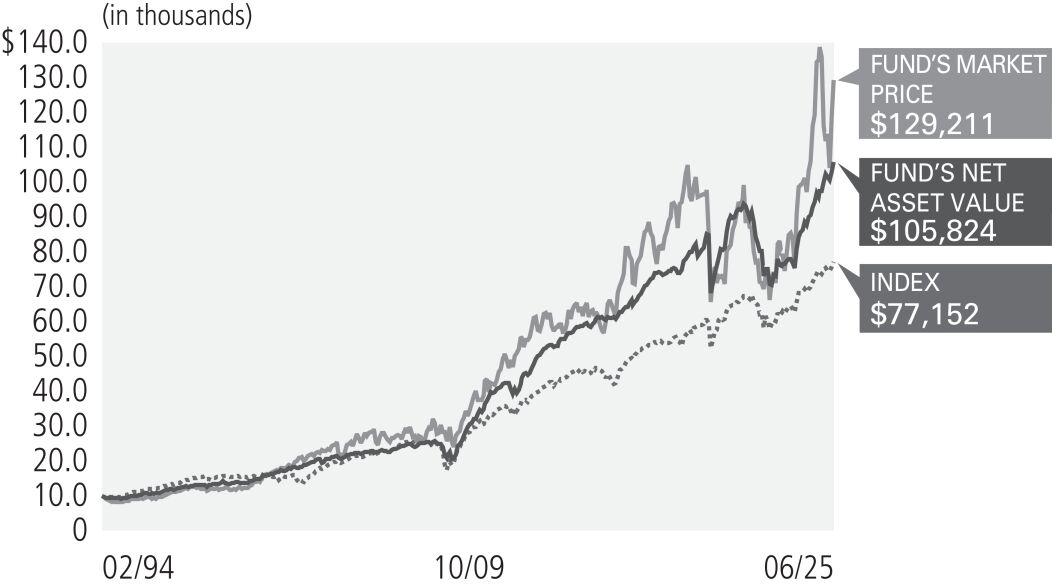

PIMCO Strategic Income Fund, Inc.

Cumulative Returns Through June 30, 2025

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2025

|

|

|

|

| |

| U.S. Government Agencies |

|

|

57.0% |

|

|

| |

| Corporate Bonds & Notes |

|

|

17.2% |

|

|

| |

Non-Agency Mortgage-Backed Securities |

|

|

7.5% |

|

|

| |

| Loan Participations and Assignments |

|

|

6.9% |

|

|

| |

| Common Stocks |

|

|

3.4% |

|

|

| |

| Sovereign Issues |

|

|

2.4% |

|

|

| |

| |

|

|

1.9% |

|

|

| |

| Asset-Backed Securities |

|

|

1.7% |

|

|

| |

| Municipal Bonds & Notes |

|

|

1.1% |

|

|

| |

| Other |

|

|

0.9% |

|

| |

|

% of Investments, at value. |

| |

|

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| |

|

Includes Central Funds Used for Cash Management Purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Return (1) for the period ended June 30, 2025 |

|

|

|

|

|

|

| |

| |

|

|

|

1 Year |

|

|

5 Year |

|

|

10 Year |

|

|

Commencement

of Operations

(02/24/94) |

|

|

|

Market Price |

|

|

21.79% |

|

|

|

12.67% |

|

|

|

8.11% |

|

|

|

8.52% |

|

|

|

NAV |

|

|

16.91% |

|

|

|

6.86% |

|

|

|

5.63% |

|

|

|

7.81% |

|

|

|

ICE BofA US High Yield Index |

|

|

10.24% |

|

|

|

6.01% |

|

|

|

5.29% |

|

|

|

|

|

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Average Annual Return since 2/28/1994.

It is not possible to invest directly in an unmanaged index.

|

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

|

The performance information shown for the Fund includes historical performance information for the periods prior to February 8, 2002, during which the Fund had a different investment manager. As of February 8, 2002, PIMCO became the Fund’s investment manager. The Fund’s performance prior to that time may have been different if the Fund were advised by PIMCO. |

|

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

|

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

|

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information (as of June 30, 2025)

(1)

|

|

|

|

| |

| Market Price |

|

|

$6.96 |

|

|

| |

| NAV |

|

|

$4.54 |

|

|

| |

| Premium/(Discount) to NAV |

|

|

53.30% |

|

|

| |

Market Price Distribution Rate (2) |

|

|

6.90% |

|

|

| |

| |

|

|

10.57% |

|

|

| |

Total Effective Leverage (3) |

|

|

33.00% |

|

Investment Objective and Strategy Overview

The Fund’s primary investment objective is to generate a level of income that is higher than that generated by high quality, intermediate-term U.S. debt securities. The Fund also seeks capital appreciation to the extent consistent with this objective.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » |

|

Exposure to the agency mortgage-backed securities sector contributed to performance, as the sector posted positive performance. |

| » |

|

Exposure to emerging markets contributed to performance, as spreads tightened. |

| » |

|

Exposure to corporate credit, notably investment grade and high yield credit, contributed to performance, as the asset classes posted positive returns. |

| » |

|

The costs associated with one or more forms of leverage detracted from performance. That said, the net impact on the Fund’s performance of the cost of leverage is generally determined by comparing the return on the additional investments purchased with such leverage against the cost of such leverage. |

| » |

|

Exposure to student loan asset backed securities detracted from performance, as select student loans posted negative performance. |

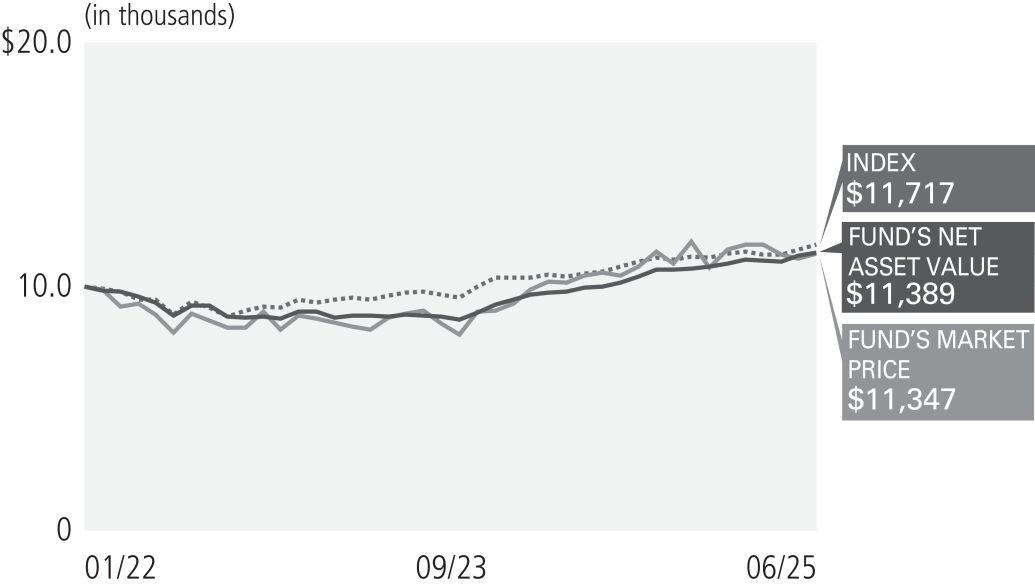

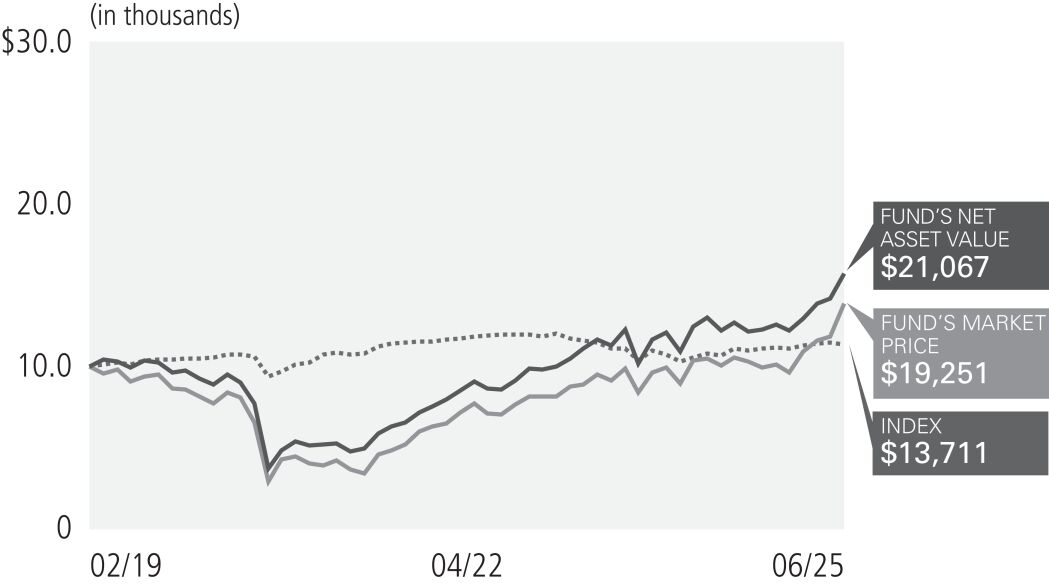

Cumulative Returns Through June 30, 2025

$10,000 invested at the end of the month when the Fund commenced operations.

Allocation Breakdown as of June 30, 2025

|

|

|

|

| |

Loan Participations and Assignments |

|

|

21.9% |

|

|

| |

Non-Agency Mortgage-Backed Securities |

|

|

20.9% |

|

|

| |

Asset-Backed Securities |

|

|

18.7% |

|

|

| |

Corporate Bonds & Notes |

|

|

17.4% |

|

|

| |

|

|

|

6.8% |

|

|

| |

Common Stocks |

|

|

4.8% |

|

|

| |

Sovereign Issues |

|

|

4.3% |

|

|

| |

U.S. Government Agencies |

|

|

3.5% |

|

|

| |

Preferred Securities |

|

|

1.7% |

|

|

| |

Other |

|

|

0.0% |

|

| |

|

% of Investments, at value. |

| |

|

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| |

|

Includes Central Funds Used for Cash Management Purposes. |

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Return ( ¹ ) for the period ended June 30, 2025 |

|

|

|

|

| |

| |

|

|

|

1 Year |

|

|

Commencement

of Operations

(01/31/22) |

|

|

|

Market Price |

|

|

7.30% |

|

|

|

3.78% |

|

|

|

NAV |

|

|

13.97% |

|

|

|

3.93% |

|

|

|

ICE BofA US High Yield Index |

|

|

10.24% |

|

|

|

4.75% |

|

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

It is not possible to invest directly in an unmanaged index.

|

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

|

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

|

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or Market Price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be provided to shareholders when such information is available. |

|

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Fund Information (as of June 30, 2025)

(

¹

)

|

|

|

|

| |

Market Price |

|

|

$15.11 |

|

|

| |

NAV |

|

|

$15.23 |

|

|

| |

Premium/(Discount) to NAV |

|

|

(0.79)% |

|

|

| |

Market Price Distribution Rate (2) |

|

|

11.86% |

|

|

| |

|

|

|

11.77% |

|

|

| |

Total Effective Leverage (3) |

|

|

40.10% |

|

Investment Objective and Strategy Overview

PIMCO Access Income Fund’s investment objective is to seek current income as a primary objective and capital appreciation as a secondary objective.

Fund Insights at NAV

The following affected performance (on a gross basis) during the reporting period:

| » |

|

Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to performance, as the securities posted positive returns. |

| » |

|

Exposures to the residential mortgage credit sector contributed to performance, as the sector posted positive performance. |

| » |

|

Exposure to emerging market debt contributed to performance, as spreads tightened. |

| » |

|

Exposure to corporate credit, notably bank loans and high yield credit, contributed to performance, as the asset classes posted positive returns. |

| » |

|

The costs associated with one or more forms of leverage detracted from performance. That said, the net impact on the Fund’s performance of the cost of leverage is generally determined by comparing the return on the additional investments purchased with such leverage against the cost of such leverage. |

| » |

|

Exposure to holdings related to emerging markets special situations detracted from performance, as holdings of a Brazilian telecommunications operator posted negative returns. |

| » |

|

There were no other material detractors for this Fund. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

|

|

ANNUAL REPORT |

|

|

| |

|

|

JUNE 30, 2025 |

|

|

9 |

|

|

|

|

| |

Market and Net Asset Value Information |

|

|

|

|

The Fund’s common shares are listed on the NYSE under the trading or “ticker” symbol “PAXS”. The Fund’s common shares commenced trading on the NYSE in January 2022. The conduct of any offering and the issuance of additional common shares pursuant to any offering may have an adverse effect on prices in the secondary market for the Fund’s common shares by increasing the number of shares available, which may put downward pressure on the market price for the common shares. The NAV of the Fund’s common shares will be reduced immediately following an offering by the sales load, commissions and offering expenses paid or reimbursed by the Fund in connection with such offering. The completion of an offering may result in an immediate dilution of the NAV per common share for all existing common shareholders.

The following table sets forth, for each of the periods indicated, the high and low closing market prices of the Fund’s Common Shares on the NYSE, the high and low NAV per Common Share and the high and low premium/discount to NAV per Common Share. See Note 3, Investment Valuation and Fair Value Measurements in the Notes to Financial Statements for information as to how the Fund’s NAV is determined.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Common share market price (1) |

|

|

Common share

net asset value |

|

|

Premium (discount) as

a % of net asset value |

|

|

|

|

|