Noble Corporation plc Fourth Quarter 2025 Earnings Conference Call February 12, 2026

Disclaimer Forward-Looking Statements This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. All statements other than statements of historical facts included in this communication are forward looking statements, including, but not limited to, those regarding future guidance about Noble Corporation plc (“Noble” or the “Company”), including revenue, earnings and earnings per share, EBITDA and adjusted EBITDA, margins, leverage, operating results, expenses, tax rates and deferred taxes, the offshore drilling market and demand fundamentals, costs, amount, effect or timing of cost savings, debt, the benefits or results of asset dispositions, cash flows and free cash flow expectations, capital expenditures and capital allocations expectations, including planned dividends and share repurchases, contract backlog, including projections for the achievement of performance incentives, rig demand, contract awards and expected future contracts, options or extensions on existing contracts, anticipated contract start dates, major project schedules, dayrates and duration, customer actions, needs and the general customer landscape, projections, strategies and objectives of management for current or future operations and business, any asset sales or the retirement of rigs, access to capital, fleet condition, utilization and strategy, timing and amount of insurance recoveries, current or future market outlook and current or future economic trends or events and their impact on the Company, 2026 financial guidance and any statements or descriptions of assumptions underlying any of the above. Forward-looking statements involve risks, uncertainties and assumptions, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. When used in this communication, or in the documents incorporated by reference, the words “guidance,” “anticipate,” “aim,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “goal,” “intend,” “likely,” “likelihood,” “may,” “might,” “on track,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “achieve,” “shall,” “seek,” “strategy,” “target,” “will” and similar expressions are intended to be among the statements that identify forward looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will prove to be correct. These forward-looking statements speak only as of the date of this communication and we undertake no obligation to revise or update any forward-looking statement for any reason, except as required by law. Risks, uncertainties and assumptions that could affect our business, operating results, and financial condition include, but are not limited to, market conditions and changes in customer demand, the level of activity in the oil and gas industry and the offshore contract drilling industry, current and future prices of oil and gas, customer actions and new or substitute customer contracts, realization of our current backlog of contract drilling revenue, operating hazards, natural disasters, seasonal weather events and related damages or liabilities, risks relating to operations in international locations, upgrades, refurbishment, operation, and maintenance of our rigs and related operational interruptions and delays, sales of drilling units, supplier capacity constraints or shortages, nonperformance by third-parties, suppliers and subcontractors, regulatory changes, the impact of governmental laws and regulations on our costs and the offshore drilling industry, potential impacts, liabilities and costs from pending or potential investigations, claims and tax or other disputes, and other factors, including those detailed in Noble’s most recent Annual Report on Form 10-K, Quarterly Reports Form 10-Q and other filings with the U.S. Securities and Exchange Commission. We cannot control such risk factors and other uncertainties, and in many cases, we cannot predict the risks and uncertainties that could cause our actual results to differ materially from those indicated by the forward-looking statements. You should consider these risks and uncertainties when you are evaluating us. With respect to our capital allocation policy, distributions to shareholders in the form of either dividends or share buybacks are subject to the Board of Directors’ assessment of factors such as business development, growth strategy, current leverage and financing needs. There can be no assurance that a dividend or buyback program will be declared or continued. Non-GAAP Measures This presentation includes certain financial measures that we use to describe the Company's performance that are not in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). The non-GAAP information presented herein provides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. The Company defines "Adjusted EBITDA" as net income adjusted for interest expense, net of amounts capitalized; interest income and other, net; income tax benefit (provision); and depreciation and amortization expense, as well as, if applicable, gain (loss) on extinguishment of debt, net; losses on economic impairments; restructuring and similar charges; costs related to mergers and integrations; and certain other infrequent operational events. We believe that the Adjusted EBITDA measure provides greater transparency of our core operating performance. The Company defines net debt as indebtedness minus cash and cash equivalents; free cash flow as net cash provided by (used in) operating activities less capital expenditures net of proceeds from insurance claims; adjusted EBITDA margin as adjusted EBITDA divided by total revenues; and net leverage as net debt divided by annualized adjusted EBITDA from the most recently reported quarter. Noble believes these metrics and performance measures are widely used by the investment community and are useful in comparing investments among upstream oil and gas companies in making investment decisions or recommendations. These measures may have differing calculations among companies and investment professionals and a non-GAAP measure should not be considered in isolation or as a substitute for the related GAAP measure or any other measure of a company’s financial or operating performance presented in accordance with GAAP. Please see the Appendix to this communication for more information regarding the non-GAAP measures in this communication. Additionally, due to the forward-looking nature of Adjusted EBITDA, annualized and/or run-rate EBITDA, annualized and/or run-rate free cash flow, cash taxes and capital expenditures (net of reimbursements), management cannot reliably predict certain of the necessary components of the most directly comparable forward-looking GAAP measure. Accordingly, the company is unable to present a quantitative reconciliation of such forward-looking non-GAAP financial measure to the most directly comparable forward-looking GAAP financial measure without unreasonable effort. Contract Backlog The duration and timing (including both starting and ending dates) of the customer contracts are estimates only, and customer contracts are subject to cancellation, suspension, delays for a variety of reasons, and for certain customers, reallocation of term among contracted rigs, including some beyond Noble’s control. The contract backlog represents the maximum contract drilling revenues that can be earned when only considering the contractual operating dayrate in effect during the firm contract period. The actual average dayrate will depend upon a number of factors (e.g., rig downtime, suspension of operations, etc.) including some beyond Noble’s control. The dayrates do not include revenue for mobilizations, demobilizations, upgrades, contract preparation, shipyards or recharges, unless specifically otherwise stated. Dayrates do not generally include revenue for performance incentives, with the exception of approximately 40% assumed performance revenue realized on a combined basis under certain long-term contracts with Shell (US) and TotalEnergies (Suriname). 2

Summary Jackup Sales – Unlocking Capital and Sharpening Focus $360M Borr Drilling transaction closed in January | $64M Ocean Oilfield transaction pending close in Q3 (2) $1.3B in New Contracts and Strategic Entry into NCS Floater Market (1) GreatWhite, Gerry de Souza, CEA extension, Endeavor, Developer, BlackRhino 2026 Outlook: Adjusted EBITDA $940M - $1,020M Total Revenues $2,800M - $3,000M | Capital Expenditures $590M to $640M (3) Q4 Adjusted EBITDA of $232M, Free Cash Flow of $35M FY 2025: $1,106M Adjusted EBITDA, $454M Free Cash Flow 3 Consistent Return of Capital Program $340M returned to shareholders in 2025, Q1 2026 dividend maintained at $0.50 per share 1) New contracts since 10/27/2025 fleet status report. 2) 30% deposit from Ocean Oilfield transaction was received in Q4 2025. 3) Includes 50% of the estimated $160 million project capital for the Noble GreatWhite, as well as approximately $25 million of reimbursable CapEx.

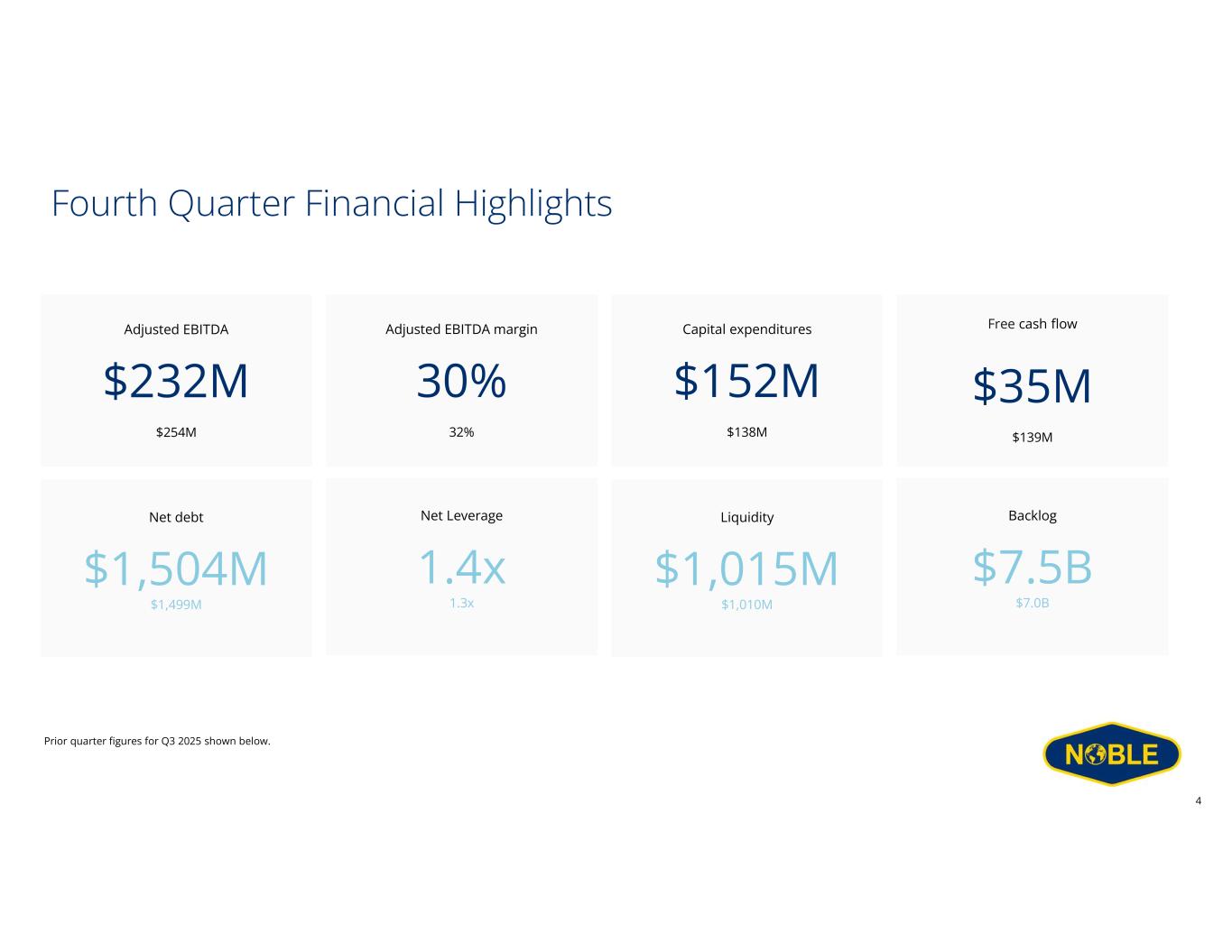

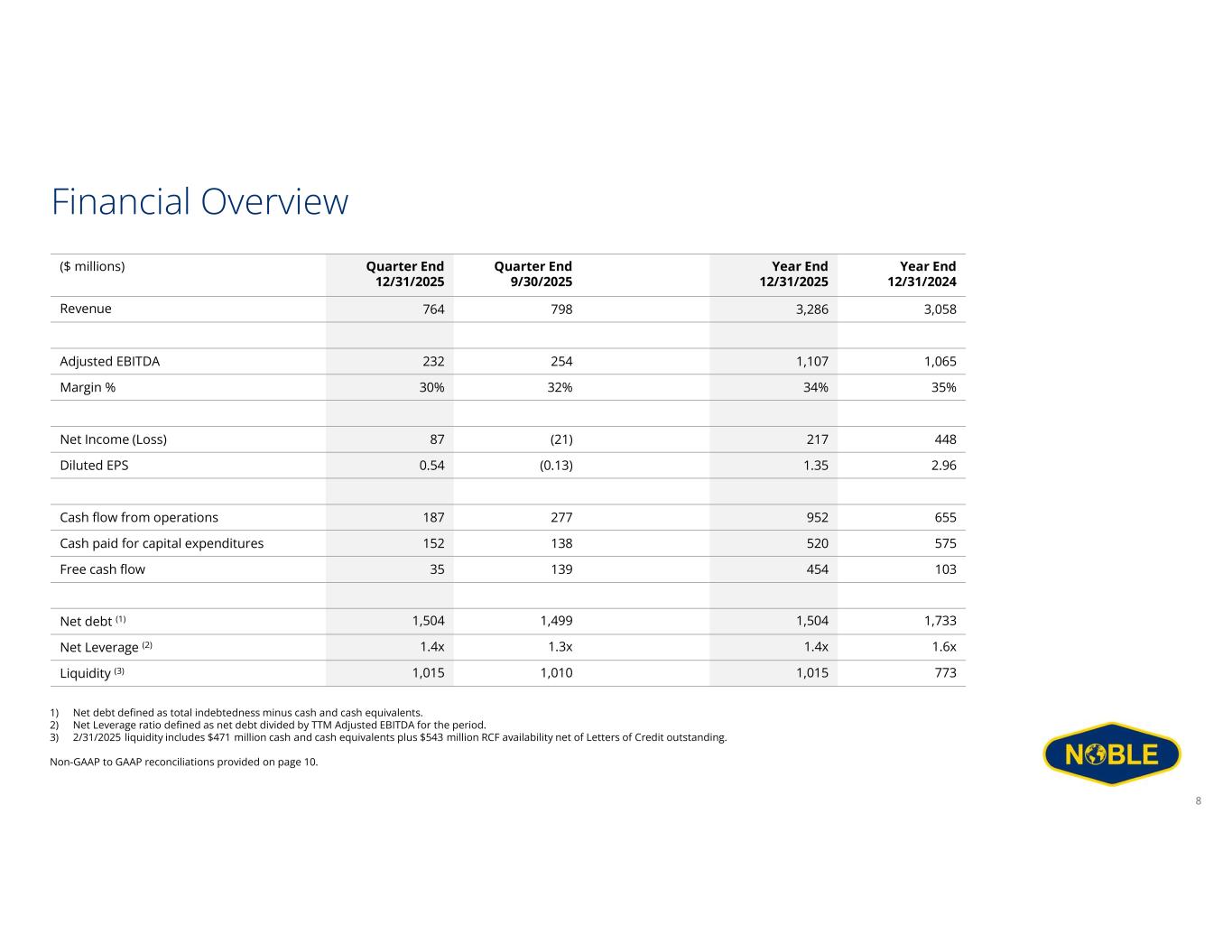

Fourth Quarter Financial Highlights Adjusted EBITDA $232M $254M Capital expenditures $152M $138M Free cash flow $35M $139M Net debt $1,504M $1,499M Backlog $7.5B $7.0B Adjusted EBITDA margin 30% 32% Net Leverage 1.4x 1.3x 4 Prior quarter figures for Q3 2025 shown below. Liquidity $1,015M $1,010M

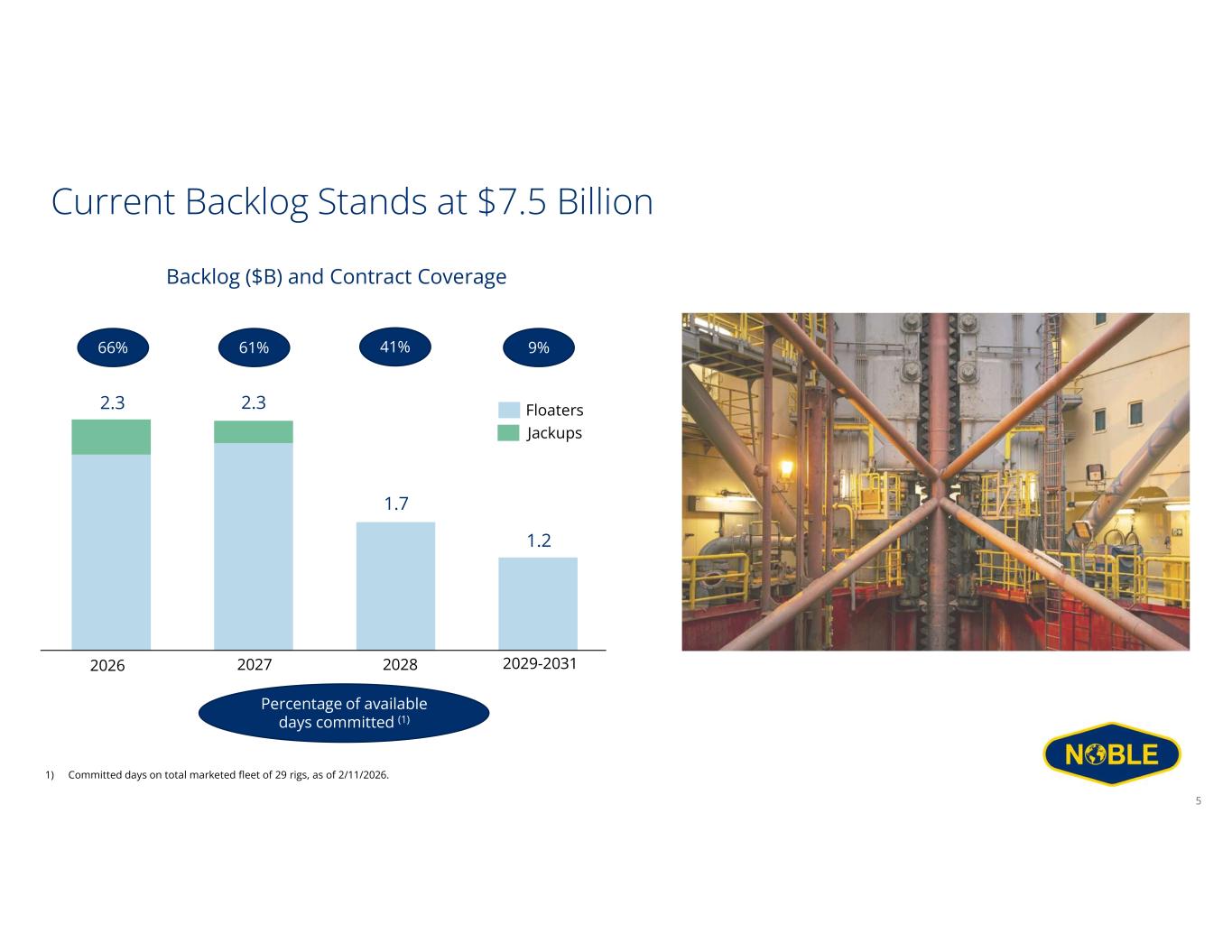

Current Backlog Stands at $7.5 Billion 2026 2027 2028 Floaters Jackups 66% 41%61% Percentage of available days committed (1) Backlog ($B) and Contract Coverage 5 2.3 2.3 1.7 1) Committed days on total marketed fleet of 29 rigs, as of 2/11/2026. 2029-2031 1.2 9%

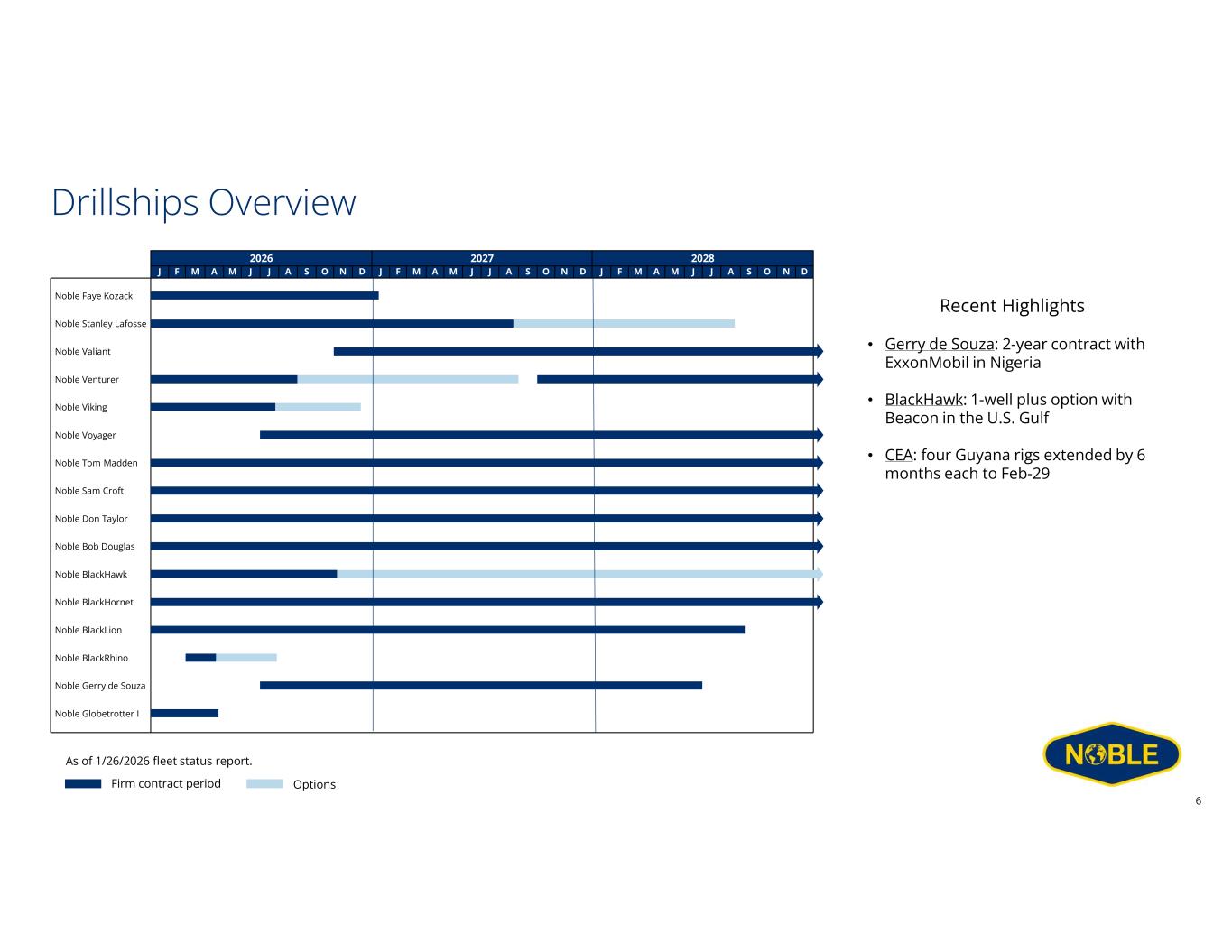

6 Drillships Overview Recent Highlights • Gerry de Souza: 2-year contract with ExxonMobil in Nigeria • BlackHawk: 1-well plus option with Beacon in the U.S. Gulf • CEA: four Guyana rigs extended by 6 months each to Feb-29 Firm contract period Options As of 1/26/2026 fleet status report. 2026 2027 2028 J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D Noble Sam Croft Noble Don Taylor Noble Bob Douglas Noble Voyager Noble BlackHawk Noble BlackHornet Noble BlackLion Noble BlackRhino Noble Globetrotter I Noble Venturer Noble Gerry de Souza Noble Tom Madden Noble Valiant Noble Viking Noble Stanley Lafosse Noble Faye Kozack

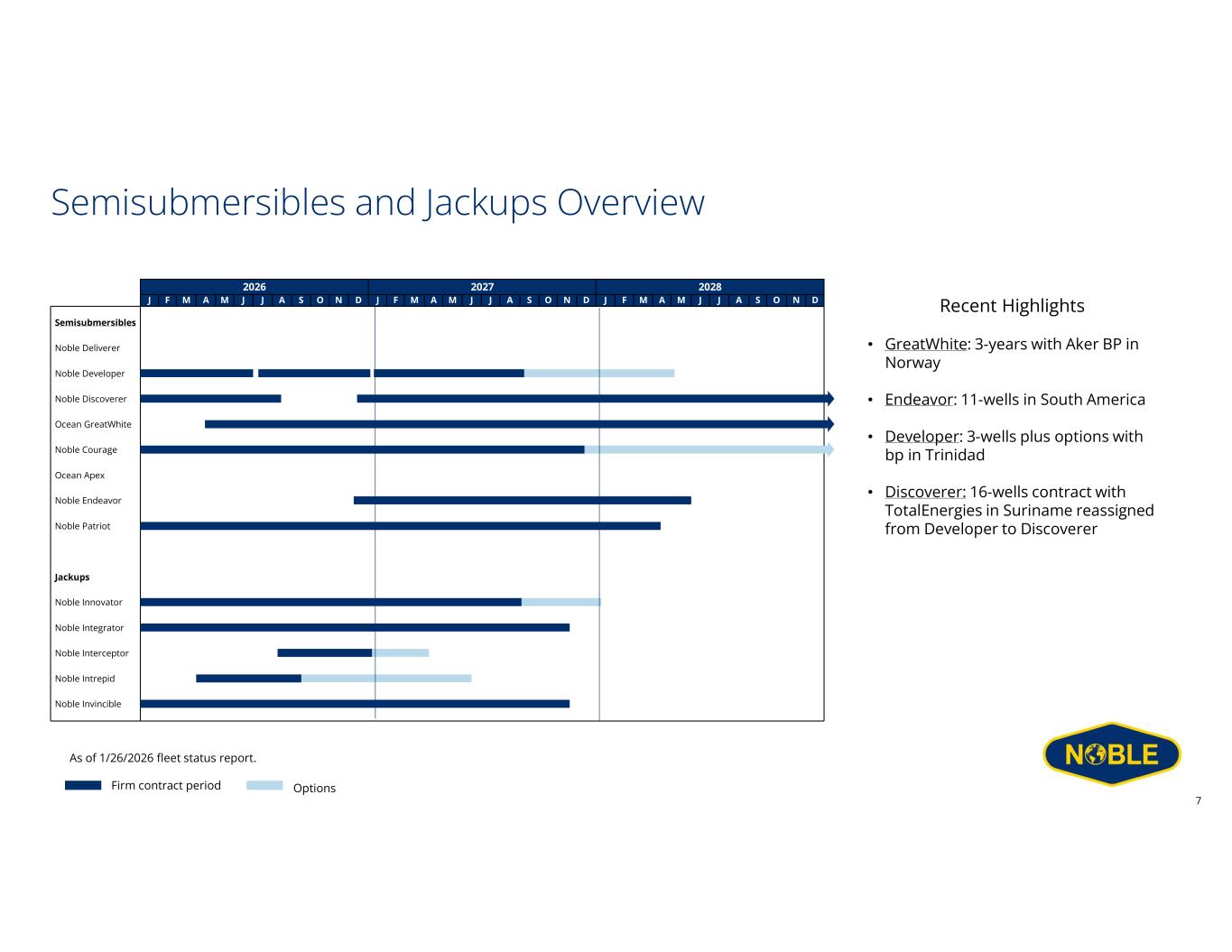

7 Semisubmersibles and Jackups Overview Firm contract period Options As of 1/26/2026 fleet status report. 2026 2027 2028 J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D Noble Integrator Noble Interceptor Noble Discoverer Noble Invincible Ocean GreatWhite Semisubmersibles Noble Developer Noble Courage Ocean Apex Noble Endeavor Noble Deliverer Noble Patriot Jackups Noble Innovator Noble Intrepid Recent Highlights • GreatWhite: 3-years with Aker BP in Norway • Endeavor: 11-wells in South America • Developer: 3-wells plus options with bp in Trinidad • Discoverer: 16-wells contract with TotalEnergies in Suriname reassigned from Developer to Discoverer

Financial Overview Year End 12/31/2024 Year End 12/31/2025 Quarter End 9/30/2025 Quarter End 12/31/2025 ($ millions) 3,0583,286798764Revenue 1,0651,107254232Adjusted EBITDA 35%34%32%30%Margin % 448217(21)87Net Income (Loss) 2.961.35(0.13)0.54Diluted EPS 655952277187Cash flow from operations 575520138152Cash paid for capital expenditures 10345413935Free cash flow 1,7331,5041,4991,504Net debt (1) 1.6x1.4x1.3x1.4xNet Leverage (2) 7731,0151,0101,015Liquidity (3) 1) Net debt defined as total indebtedness minus cash and cash equivalents. 2) Net Leverage ratio defined as net debt divided by TTM Adjusted EBITDA for the period. 3) 2/31/2025 liquidity includes $471 million cash and cash equivalents plus $543 million RCF availability net of Letters of Credit outstanding. Non-GAAP to GAAP reconciliations provided on page 10. 8

Revenue 2,800 – 3,000 Adjusted EBITDA 940 – 1,020 Capital Expenditures (1) 590 – 640 Full Year 2026 Guidance $ millions 9 1) Includes 50% of the estimated $160 million project capital for the Noble GreatWhite, as well as approximately $25 million of reimbursable CapEx.

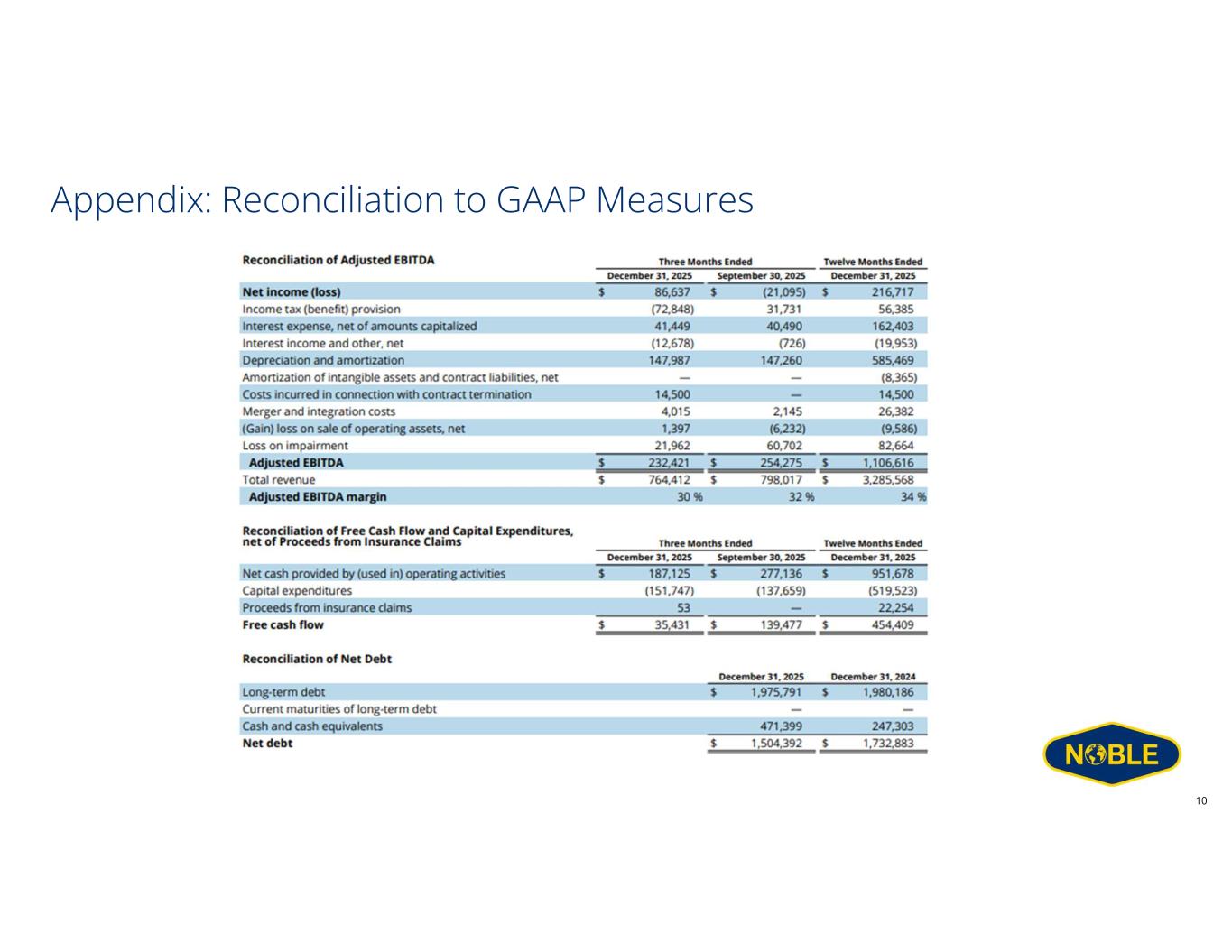

Appendix: Reconciliation to GAAP Measures $ millions 10