Exhibit 15.1

TECHNICAL REPORT SUMMARY FOR TITAN PROJECT

Statement of Use and Preparation

This Technical Report Summary (TRS) serves as an amendment to a previously filed TRS, maintains an effective date of June 30, 2022 with regards to assumptions and

the knowledge of Competent/Qualified Persons (QPs), and was prepared for the sole use of IperionX Limited (IPX) and its affiliated and subsidiary companies and advisors. Copies or references to information in this report may not be used without

the written permission of IPX.

This report is intended to provide sufficient information in a single document to support the disclosure of a statement of heavy mineral sand mineral resources by

IPX, as defined under the United States Securities and Exchange Commission (SEC) Regulation S-K 1300 Modernization of Property Disclosures, as well as under the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore

Reserves (JORC Code), through the consideration of geological, mining, environmental, and other factors, and ultimately to contribute to revenues and profits in a hypothetical business plan. Certain information set forth in this report contains

“forward-looking information”, including mineral resource estimates, operating cost estimates, capital cost estimates, sales prices, and other assumptions. These statements are not guarantees of future performance and undue reliance should not

be placed on them. The assumptions used to develop the forward-looking information and the risks that could cause the actual results to differ materially are detailed in the body of this report.

By definition, “indicated” and “inferred” terminology carries a lower level of geological and engineering confidence than that which would be reflected through the

derivation of “measured” resources. Indicated definitions provide a confidence level to support broad estimates of Mineral Resource quantity and grade adequate for long-term mine planning to support Probable Reserve definitions, Resource and

reserve estimations, and their impacts on production schedules, processing recoveries, saleable product tonnages, costs, revenues, profits, and other results presented in this TRS align with the definition and accuracy of indicated resources and

probable reserves. Through future exploration campaigns, geological and engineering studies, IPX desires to elevate classifications of resources in due time.

The statement is based on information provided by IPX and reviewed by various professionals and Competent/Qualified Persons from Primero Group Americas Inc. and

Karst Geo Solutions.

Competent/Qualified professionals who contributed to the drafting of this report meet the definition of Qualified Persons (QPs), consistent with the requirements of

the SEC. The information in this TRS related to ore resources and mineral reserves is based on, and fairly represents, information compiled by the QPs as of the effective date of the report.

Page 1

TECHNICAL REPORT SUMMARY

FOR TITAN PROJECT

FOR TITAN PROJECT

Description of “Amended” Technical Report Summary

This Technical Report Summary (TRS), dated May 30, 2023, serves as an amendment to a TRS filed on August 26, 2022, effective June 30, 2022, following IperionX Limited (IPX)’s receipt of comment letters and associated dialogue with the United States Securities and Exchange Commission (SEC). While this Amended TRS incorporates changes to the original version, it maintains an effective date of June 30, 2022 with regard to assumptions and the knowledge of the Qualified/Competent

Persons (QPs). Notable revisions and changes to the previously filed TRS include:

|

|

•

|

Includes various additional clarifications as requested by the SEC:

|

|

|

o

|

Revision of the name of the report from “Scoping Study” to “Initial Assessment”.

|

|

o

|

Addition of a map showing the location of material properties containing mineral resources (Section 3.2).

|

|

o

|

Disclosure of individual prices for all of the Rare Earth Elements (REE) that contribute to the REE concentrate price along with the percentage of

each REE found in the typical concentrate sold for the calculation of the estimated breakeven economic cut-off grade of 0.4% THM (Section 11.8).

|

|

o

|

Clarification as to which resources must have reasonable prospects for economic extraction to more clearly align with the mineral resource definition

in Item 1300 of Regulation S-K (Section 11.8).

|

|

o

|

Addition of the final pit outline and (ii) disclosures of the numeric values for the annual Life of Mine (LOM) production for waste material and ore,

along with the associated grades (Sections 13.2 and 13.3).

|

|

o

|

Addition of disclosure of the modified cutoff grade used for the optimized schedule along with the associated parameters and an explanation of how and

when the remaining resources will be mined and processed (Section 13.3).

|

|

o

|

Addition of historical prices, along with spot prices and forecast prices utilized, and addition of tables for (i) historic, spot, and forecast

individual REE prices, (ii) product specification requirements and (iii) key product specifications of Titan-derived rare earth mineral concentrate (Section 16.2).

|

|

o

|

Addition of a subsection including an opinion of the Qualified Person to the adequacy of the current environmental plans to comply with Item

601(b)(96)(iii)(B)(17)(vi) of Regulation S-K (Section 17.1.6).

|

|

o

|

Addition of a detailed life-of-project cash flow analysis, including the corresponding LOM production schedule (tonnage & grade) and a line item

for royalties and a description of the results of the analysis in the accompanying text with equal prominence (Section 19.2).

|

|

o

|

Addition of separate after tax cash flow analysis excluding inferred resources, presented with equal prominence (Section 19.2)

|

Page 2

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

TECHNICAL REPORT SUMMARY FOR TITAN PROJECT

| Contents |

|

|

|

1.

|

Executive Summary

|

3

|

|

2.

|

Introduction

|

9 |

|

3.

|

Property Description

|

11 |

|

4.

|

Accessibility, Climate, Local Resources, Infrastructure and Physiography

|

14 |

|

5.

|

History

|

16 |

|

6.

|

Geological Setting, Mineralization, and Deposit

|

17 |

|

7.

|

Exploration

|

18 |

|

8.

|

Sample Preparation, Analyses, and Security

|

19 |

|

9.

|

Data Verification

|

21 |

|

10.

|

Mineral Processing and Metallurgical Testing

|

22 |

|

11.

|

Mineral Resource Estimate

|

24 |

|

12.

|

Mineral Reserve Estimate

|

33 |

|

13.

|

Mining Methods

|

34 |

|

14.

|

Processing and Recovery Methods

|

42 |

|

15.

|

Infrastructure

|

47 |

|

16.

|

Market Studies

|

50 |

|

17.

|

Environmental Studies, Permitting, and Plans, Negotiations, or Agreements with Local Individuals or Groups

|

58 |

|

18.

|

Capital and Operating Costs

|

65 |

|

19.

|

Economic Analysis

|

67 |

|

20.

|

Adjacent Properties

|

75 |

|

21.

|

Other Relevant Data and Information

|

76 |

|

22.

|

Interpretation and Conclusions

|

77 |

|

23.

|

Recommendations

|

78 |

|

24.

|

References

|

79 |

|

25.

|

Reliance on Information Provided by the Registrant

|

80 |

Page 3

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

DISCLAIMER

The following report was prepared for IperionX by Primero Group Americas Inc. (Primero) as an independent consultant and is part based on information provided by IperionX and part on information not within the

control of either IperionX or Primero. While it is believed that the information, conclusions, and recommendations will be reliable under the conditions and subject to the limitations set forth herein, Primero does not guarantee their accuracy.

The use of this report and the information contained herein shall be at the user’s sole risk, regardless of any fault or negligence of Primero.

USE OF THIS INFORMATION

This document summarizes the scope of works Primero was engaged to undertake as an independent consultant, appointed by IperionX to investigate the requirements associated with establishing the mineral processing of

the Titan Project, along with associated infrastructure in accordance with Primero’s proposals Doc No. 40501-PPL-GE-001_4.

Primero gives its permission to IperionX to use the information if it reflects the findings and understanding that are presented in this report. Use of this document, for whatever purpose, by any third party must

seek written prior approval by Primero.

Primero has relied on other experts for the study portions on mineral resource estimate (Karst Geo Solutions) and metallurgical testing (Mineral Technology). Primero engaged sub-consultants, Palaris for the mining

discipline and Keypoint for the metallurgical test work review and mineral processing method.

Page 4

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 1. |

Executive Summary

|

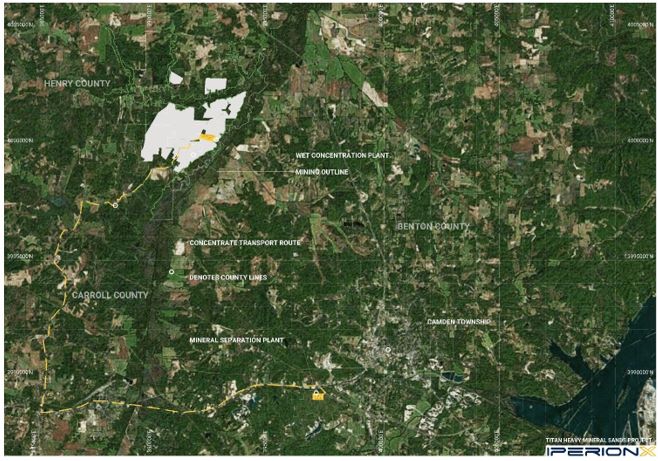

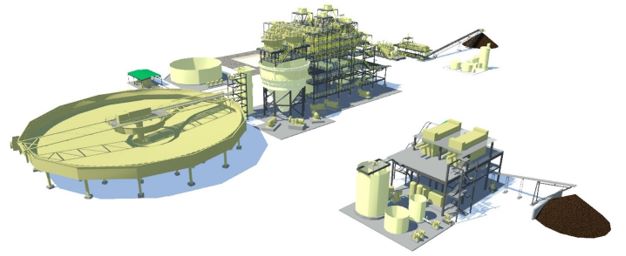

IperionX engaged Primero Group Americas Inc. (Primero) to develop a Initial Assessment for the Titan Project near Camden, TN. The Project includes a sand mineral deposit with a nearby Wet Concentrator Plant (WCP)

located approximately at 17 miles northwest from the city of Camden. The Project also includes a dry Mineral Separation Plant (MSP) located approximately 1.2 miles southwest of the city of Camden. The distance separating the two plants is

approximately 19 miles and accessed via public roads and highways. IperionX holds a 100% interest in the Titan Project.

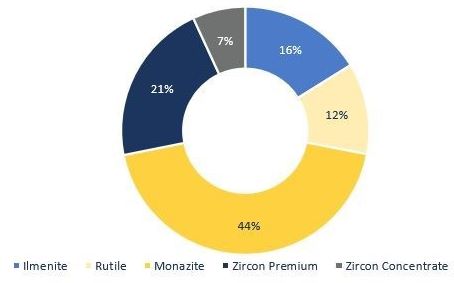

The products of the Titan Project include ilmenite, rutile, premium zircon, zircon concentrate and rare earth concentrate (mainly monazite).

Key production values are presented in Table 1. Note: All references to mass within this report are metric.

Table 1: Titan Project production average values.

|

Production Target

|

Average

Value

|

Units

|

|

|

ROM

|

9.7

|

Mt/y

|

|

|

Ilmenite

|

95,500

|

t/y

|

|

|

Rutile

|

16,700

|

t/y

|

|

|

Monazite

|

4,600

|

t/y

|

|

|

Zircon - Premium

|

22,400

|

t/y

|

|

|

Zircon - Concentrate

|

16,000

|

t/y

|

| 1.1 |

Exploration and Mineral Resource Estimate

|

IperionX engaged Karst Geo Solutions to prepare a Mineral Resource Estimate (MRE) for Total Heavy Minerals (THM), in accordance with the JORC Table 1 requirement. The content in this chapter is extracted from an ASX

release dated 6 October 2021 entitled “Maiden Resource Confirms Tennessee as Major Untapped Critical Mineral Province by IperionX”.

The Mineral Resource is based on 107 drill holes totaling 4,101 m and occupies an area roughly 6.2 km (north) by 3.6 km (east); the Mineral Resource is further broken up into several areas based on land holdings

(land agreements). These range from 0.5 km (north) by 0.9 km (east) for the smallest area to 5.1 km (north) by 3.6 km (east) for the largest area.

The maiden MRE for the Titan Project comprises 431 Mt @ 2.2% THM, containing 9.5 Mt THM at a 0.4% cut-off and includes a high-grade core of 195 Mt @ 3.7% THM, containing 7.1Mt THM at a 2.0% cut-off. Slimes (SL) and

oversize (OS) material accounts for approximately 20% and 2.5% of the in-ground material respectively SL and OS values for the Initial Assessment were derived from the metallurgical bulk sample testwork as it has been identified that the

dry-screening method utilized for the drill samples tends to under-report SL and over-report OS. It should be noted that these discrepancies do not materially impact THM and a revised method (wet screening) for drill samples has been developed and

tested for the Project moving forward in the next phase that will produce more accurate SL and OS values.

There is a high level of confidence associated with the MRE classification, with 56% (241 Mt) classified as being in the Indicated resource category. Mineralization occurs as a single, large, and coherent

near-surface deposit.

Page 5

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Table 2: Mineral Resource Estimate and THM assemblage at 0.4% cut-off grade.

|

THM Assemblage

|

||||||||||

|

Cut off

|

Tons

|

THM %

|

THM

|

Zircon

|

Rutile

|

Ilmenite

|

REE

|

Staurolite

|

||

|

(THM %)

|

(Mt)

|

(%)

|

(Mt)

|

(%)

|

(%)

|

(%)

|

(%)

|

(%)

|

||

|

Indicated

|

0.4

|

241

|

2.2

|

5.3

|

11.3

|

9.3

|

39.7

|

2.1

|

15.6

|

|

|

Inferred

|

0.4

|

190

|

2.2

|

4.2

|

11.7

|

9.7

|

41.2

|

2.2

|

13.7

|

|

|

Total

|

0.4

|

431

|

2.2

|

9.5

|

11.5

|

9.5

|

40.3

|

2.1

|

14.8

|

|

| 1.2 |

Mining Methods

|

IperionX tasked Primero and its sub-consultant Palaris for the mine design, integrating the IperionX provided Project mineral resource block model. Reconciliation of the reported MRE of the resource block model

against the MRE report was achieved and confirmed. IperionX, requested that a high-level trade off study of the mining method be undertaken. The recommendation of using mobile mining units (MMU’s) for the mineral sand and conventional loading and

trucking units for the topsoil, overburden and interburden excavation, transportation and deposition was recommended and accepted. The MMU’s will be owned by the Project owner whereas the conventional loading and trucking activities be made by a

mining contractor.

The basic mining cycle is depicted in Figure 1, which shows the mine cycle from clearing to final condition post mining. The sequential mining method allows for low cost, reduced area footprint and environmentally

logical mining process by limiting the change in final material location with the mineralized material and waste basically being returned to a similar position in the ground strata. This proposed method of mining, and mining cycle, is well proven

in the heavy mineral sands industry, incorporating progressive backfill and rehabilitation to the pre-mining state.

Figure 1: Titan Project mining cycle.

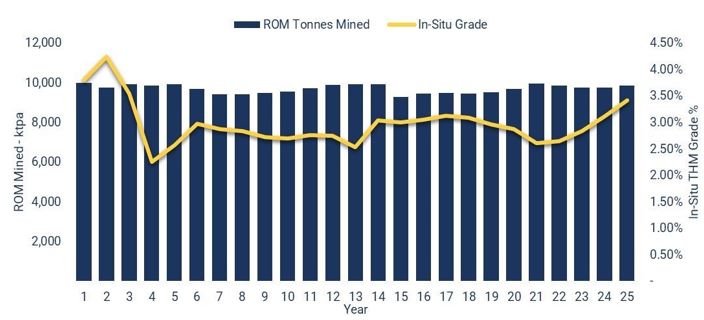

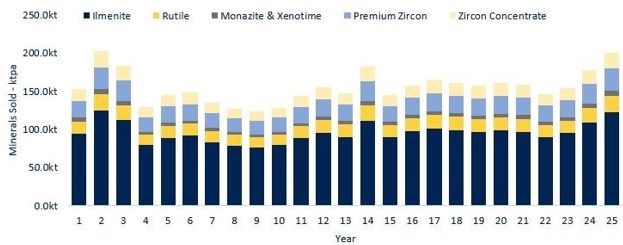

Pit optimizations were completed in order to produce a production schedule on an annual basis. This resulted in a total Production Targets of 243 Mt @ 3.0% THM In-Situ with a mine life of 25 years. The mining

schedule delivers an outcome with the first 14 years mining 100% of indicated mineralized resource only, and the remaining years mining the inferred mineralized resource, resulting in a total mine life of 25 years. The schedule is based on 57% of

the total mine ROM material being in an Indicated category.

Page 6

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Table 3: Mine production schedule with % Indicated category processed by time period.

|

Year

|

ROM Tons

|

Inferred Tons

|

Indicated Tons

|

% Indicated Tons

|

|

(Mt)

|

(Mt)

|

(Mt)

|

(%)

|

|

|

1-14

|

136.5

|

0

|

136.5

|

100%

|

|

15-25

|

106.1

|

105.3

|

0.8

|

1%

|

|

LOM

|

242.6

|

105.3

|

137.3

|

57%

|

| 1.3 |

Mineral Processing and Metallurgical Testing

|

Four bulk samples were processed by Mineral Technologies through pilot equipment designed to emulate a full-scale Feed Preparation Plant (FPP), Wet Concentrator Plant (WCP), Monazite Flotation/Concentrate Upgrade

Plant and a Mineral Separation Plant (MSP). Mineral Technologies is a reputable test laboratory with significant experience in mineral sands flowsheet development.

Assays were conducted by SGS in Lakefield, Canada and Bureau Veritas in Perth, Australia, with XRF, laser ablation / ICPMS and QEMSCAN analytical methods.

The final products and the grades of those final products that were produced form the testwork demonstrated that the Upper and Lower mineralized resource could be separated using processing stages common to most

mineral sands’ operations. Notably, the flotation test work achieved an overall 97% recovery of rare earth minerals in the final rare earth concentrate.

Based on the testwork results, it was concluded that a viable commercial operation could be established with appropriate processing options for a 10 Mtpa operation commencing in Benton area.

| 1.4 |

Processing and Recovery Methods

|

IperionX tasked Primero and its sub-consultant Keypoint for the metallurgical test work review and mineral processing method.

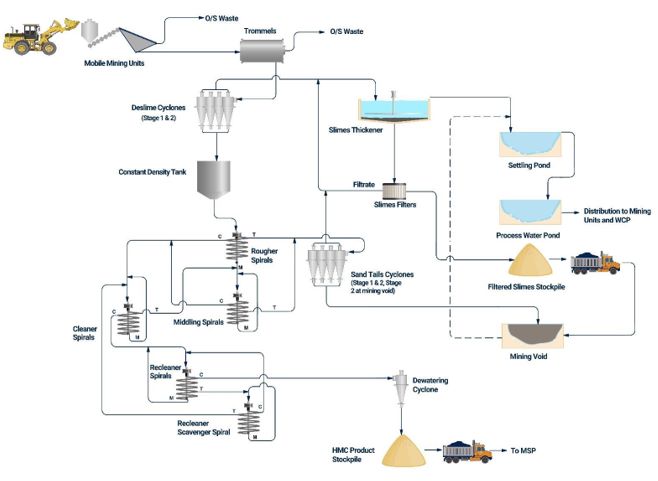

An overview of the major processing stages can be description as follows, please refer to Figure 17 & Figure 18 for simplified flow diagrams.

1. Run of Mine mineralized resource is processed in the Mobile Mining Unit (MMU) which removes trash & oversize. The undersize is pumped to the Feed Preparation Plant (FPP) and Wet Concentrator Plant (WCP)

2. In the FPP, the feed is de-slimed to separate clay and the sand. The slimes are directed to the thickener where they are thickened and then filtered. The sand fed into a constant density tank which is pumped to

the rougher spiral stage at 1,000 tph at the start of the WCP

3. The WCP comprises of multiple stages of spiral separators which produce a tailings and a Heavy Mineral Concentrate (HMC) stream. The WCP tailings stream is dewatered and pumped to the mining void while the HMC (at

a target grade of >85% THM) is dewatered and trucked to the Monazite Separation Plant.

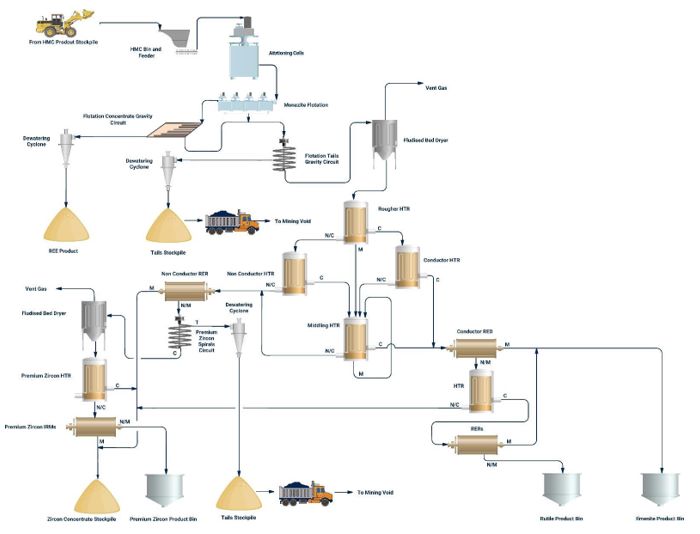

4. The Monazite Separation Plant which consists of a flotation circuit and wet gravity circuits, to produce a monazite product and an upgraded HMC which consists predominantly of the titanium minerals & zircon

minerals. The upgraded HMC is the feedstock for Mineral Separation Plant (MSP).

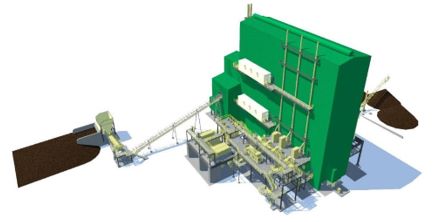

5. The MSP consists of a dryer, multiple stages of electrostatic separators, magnetic separators and wet gravity separators to produce ilmenite, rutile, premium zircon and zircon concentrate.

Page 7

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 1.5 |

Capital Cost Estimate

|

Capital Estimates for the mine and process plant have been prepared by Primero Group using a combination of cost estimates from suppliers, historical data, reference to recent comparable projects. Costs are presented

in US$ for Q2 2022 and are exclusive of escalation. The intended accuracy of the initial capital cost estimate for the Project is ± 35%. Table 4 highlights the total estimated capital expenditures for the Project.

Table 4: Titan Project capital cost estimate summary.

|

Capital Cost Estimate Breakdown

|

US$ Million

|

|

|

Mine and Wet Concentration Plant

|

94.6

|

|

|

Mineral Separation Plant

|

22.3

|

|

|

Common Services

|

12.5

|

|

|

Project Indirects

|

35.2

|

|

|

Mobile Mining Units Turnkey

|

23.3

|

|

|

Contingency (30%)

|

49.4

|

|

|

Total Initial Capital

|

237.2

|

|

|

Deferred and sustaining capital

|

198.5

|

| 1.6 |

Operating Cost Estimate

|

The processing plant operating cost estimate is based on a ±35% level of accuracy, utilizing indicative quotations where possible, and otherwise Primero database estimates and recent experience in the industry.

The OPEX is presented in USD and is current for Q1 2022. Table 5 summarizes the estimated operating costs at steady state.

Table 5: Titan Project operating cost estimate summary.

|

Operating Cost Estimate Breakdown

|

Average Annual Cost

(US$

Million/y)

|

US$/t ROM

|

|

|

Mining

|

25.8

|

2.66

|

|

|

Processing

|

28.2

|

2.91

|

|

|

Transport

|

2.1

|

0.22

|

|

|

General & Admin

|

6.9

|

0.71

|

|

|

Royalties

|

4.0

|

0.41

|

|

|

Total Operating Costs

|

67.1

|

6.91

|

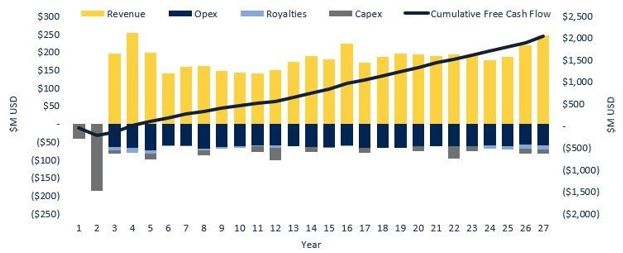

| 1.7 |

Economic Analysis

|

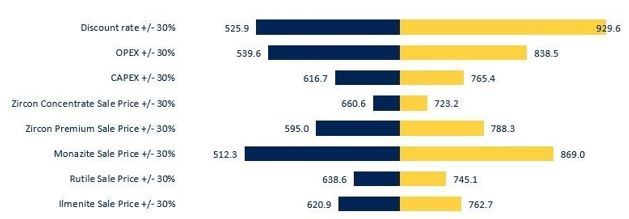

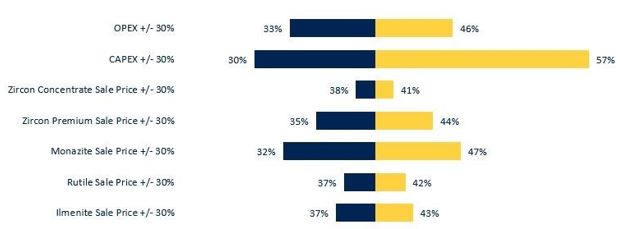

A detailed financial model and discounted yearly cash flow (DCF) has been developed to complete the economic assessment of the Project and is based on current (Q1 2022) price projections and cost estimates in U.S.

dollars. No provision was made for the effects of future inflation, but cost estimates incorporate recent 2021 inflationary price increases. The evaluation was carried out on a 100%-equity basis using an 8% discount factor. Current US federal and

Tennessee state tax regulations were applied to assess the corporate tax liabilities.

Page 8

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Table 6: Titan Project economic measures summary

|

Economic Measures Summary (After Tax)

|

Value

|

|

|

Annual EBITDA (first five years)

|

$118M

|

|

|

Project NPV (discounted at 8.0%)

|

$692M

|

|

|

Internal rate of return (IRR)

|

40%

|

|

|

Payback period (from start of operations)

|

1.9 y

|

| 1.8 |

Interpretation and Conclusions

|

The QPs are confident in the technical and economic assessment presented in this TRS.

The QPs also recognize that the results of this TRS are subject to many risks including, but not limited to: commodity prices, unanticipated inflation of capital or operating costs, geological uncertainty and

geotechnical and hydrologic assumptions.

The Initial Assessment update highlights several advantages which include:

| • |

Low complexity mining practices can be employed utilizing local service providers.

|

| • |

Mining footprint can be controlled to limit environmental and social impacts.

|

| • |

Mining approach presented returns land mass to pre-mining conditions as minimum.

|

| • |

Signed Memorandum of Understanding (MOU) for rare earth concentrate and titanium minerals (rutile and ilmenite) and zircon products.

|

| • |

Shipping advantage, given that a large proportion of the rare earth concentrate and titanium (rutile and ilmenite) products are anticipated to be sold within the U.S.

|

| • |

Exposure to high-demand, future-facing commodities experiencing increasing commodity prices.

|

| • |

The net present value of the 25-year based project is $692M at an 8% discount rate and after tax.

|

| • |

The internal rate of return (IRR) is 40%.

|

At the time of publication of this Initial Assessment report a preliminary feasibility study is planned to be completed.

| 1.9 |

Recommendations

|

The Initial Assessment demonstrates the Titan Project’s importance as a leading U.S. critical mineral project, and puts IperionX in a strong position to rapidly advance next steps in the development process,

including:

| • |

Continued exploration and expansion of the Company’s land position;

|

| • |

Advancing project permitting and development approvals;

|

| • |

Commencement of a pre-feasibility study to optimize mine and process design;

|

| • |

Performing feasibility study level flowsheet development test work (ongoing);

|

| • |

Develop a Mineral Demonstration Facility on site (completed desliming, planning wet concentration and mineral separation stages.)

|

Page 9

| • |

Investigation of product upgrading and downstream processing;

|

| • |

Undertaking a lifecycle analysis for the Company’s mineral and metal projects and operations;

|

| • |

Continue implementation of sustainable operating and rehabilitation practices with UTIA;

|

| • |

Continued stakeholder awareness and engagement; and

|

| • |

Formalizing agreements with a number of prospective strategic, technical and offtake partners.

|

Page 10

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 2. |

Introduction

|

IperionX’s mission is to be the leading developer of low-to-zero carbon, sustainable, critical material supply chains for advanced American industries including space, aerospace, electric vehicles and 3D printing.

The Company holds a 100% interest in the Titan Project, comprised of approximately 11,071 acres of surface and associated mineral rights in Tennessee prospective for heavy mineral sands (HMS), rich in minerals

critical to the U.S., including titanium, rare earth minerals, high grade silica sand and zircon in Tennessee, U.S. The Titan Project is strategically located proximal to the town of Camden in the southeast of the U.S., with low-cost road, rail and

water logistics connecting it to world class manufacturing industries and customers.

The Initial Assessment has confirmed that the Titan Project is one of the largest and most important critical mineral deposits in the U.S., with a high in-situ value underpinned by a product assemblage of high value

zircon, titanium minerals and heavy and light rare earth elements.

This Initial Assessment combines information and assumptions provided by a range of independent and reputable consultants, including the following consultants who have contributed to key components of the Study.

Table 7: Initial Assessment consultants & inputs.

|

Scope of Work

|

Consultant / Basis of Estimate

|

|

|

Mine design, process design, capex & opex, financial analysis

|

Primero and its sub-consultants

|

|

|

Mineral Resource Estimate

|

Karst Geo Solutions

|

|

|

Metallurgical testwork and analysis

|

Mineral Technologies & SGS

|

|

|

Pricing – Titanium feedstock and zircon products

|

TZMI

|

|

|

Pricing – Rare earth concentrates

|

Adamas Intelligence

|

|

|

Permitting

|

HDR

|

|

|

Rehabilitation program

|

University of Tennessee

|

|

|

ESG assessment and integration

|

PGS Consults

|

| 2.1 |

Registrant and Terms of Reference

|

This report was prepared for the sole use of IperionX and its affiliated and subsidiary companies and advisors. The report is intended to provide sufficient information in a single document to support the disclosure

of a statement of heavy mineral sand Mineral Resources by the Company, as defined under the United States Securities and Exchange Commission (SEC) Regulation S-K 1300 Modernization of Property Disclosures, as well as under the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code).

All units of measurement used in this report are International System of Units (SI) metric unless otherwise stated. Heavy mineral sand resources are reported in metric tons.

| 2.2 |

Information Sources

|

This document summarizes the scope of works Primero was engaged to undertake as an independent consultant, appointed by IperionX to investigate the requirements associated with establishing the mineral processing of

the Titan Heavy Mineral Sands Project, along with associated infrastructure in accordance with Primero’s proposals Doc No. 40501-PPL-GE-001_4.

Primero has relied on other experts for the study portions on mineral resource estimate (Karst Geo Solutions) and metallurgical testing (Mineral Technology). Primero engaged sub-consultants, Palaris for the mining

discipline and Keypoint for the metallurgical test work review and mineral processing method.

Page 11

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 2.3 |

Personal Inspections

|

Adam Karst P.G., CP & QP for mineral resource estimate, has made several inspections of the site from October 2020 to May 2022 to review the drilling methods, sample collection, bulk sample collection, bulk

processing and QAQC procedures.

| 2.4 |

Previously Filed Technical Report Summary

|

No previous Technical Report Summaries have been filed.

| 2.5 |

Abbreviations, Acronyms and Units of Measure

|

Table 8: Abbreviations, acronyms and units of measure.

|

Symbol

|

Description

|

||

|

B

|

Billion

|

||

|

CAPEX

|

Capital Expenditure

|

||

|

COG

|

Cut Off Grade

|

||

|

EBITDA

|

Earnings Before Interest, Taxes, Depreciation and Amortization

|

||

|

EBT

|

Earnings Before Taxes

|

||

|

FEED

|

Front End Engineering Detail

|

||

|

HMC

|

Heavy Mineral Concentrate

|

||

|

HMS

|

Heavy Mineral Sand

|

||

|

HTR

|

Electrostatic High Tension Roll Separator

|

||

|

IA

|

Initial Assessment | ||

|

IRR

|

Internal Rate of Return

|

||

|

M

|

Million

|

||

|

MMU

|

Mobile Mining Unit

|

||

|

MSP

|

Mineral Separation Plant

|

||

|

MRE

|

Mineral Resource Estimate

|

||

|

Mtpy

|

Million tons (metric) per year

|

||

|

NPAT

|

Net Profit After Tax

|

||

|

NPI

|

Non-Process Infrastructure

|

||

|

NPV

|

Net Present Value

|

||

|

OPEX

|

Operational Expenditure

|

||

|

PFDs

|

Process Flow Diagrams

|

||

|

PFS

|

Pre-feasibility Study

|

||

|

Primero

|

Primero Group

|

||

|

RED

|

Rare Earth Drum

|

||

|

REE

|

Rare Earth Element

|

||

|

RER

|

Rare Earth Rolls

|

||

|

RHF

|

Rougher Head Feed

|

||

|

ROM

|

Run of Mine

|

||

|

SL

|

Slimes

|

||

|

SMP

|

Structural Mechanical and Piping

|

||

|

$

|

United States Dollars

|

||

|

WCP

|

Wet Concentrator Plant

|

Page 12

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 3. |

Property Description

|

| 3.1 |

Location

|

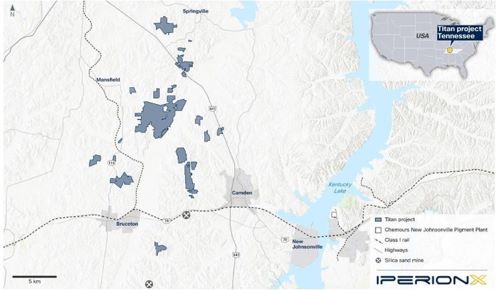

IperionX’s Titan Project is located near Camden, Tennessee, U.S., approximately 80 miles west of Nashville, Tennessee and approximately 7 miles northwest of Camden, Tennessee.

The Property is centered at approximately 36.14734997015158N, -88.20974639890532W. The Project is location on the Mansfield, Manleyville, Vale and Bruceton United States Geological Survey Quadrangles. The coordinate

system and datum used for modeling is UTMZ16N, NAD83.

Figure 2: Titan Project location.

| 3.2 |

Titles, Claims or Leases

|

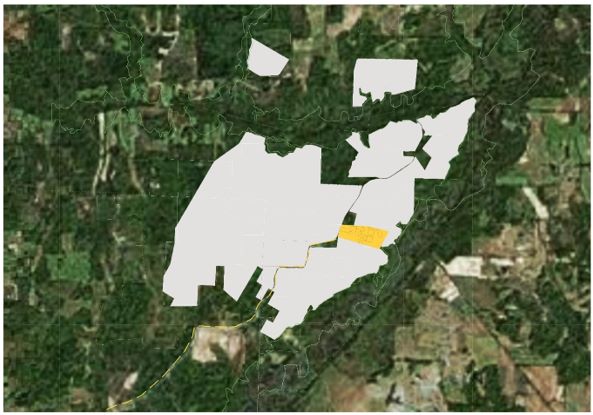

As of March 31, 2022, the Titan Project comprised of approximately 11,071 acres of surface and associated mineral rights in Tennessee within 82 separate property tracts, of which approximately 137 acres are owned

outright, approximately 1,355 acres are subject to exclusive option to purchase agreements, and approximately 9,579 acres are subject to exclusive option to lease agreements.

Our option to lease agreements, upon exercise, allow us to lease the surface property and associated mineral rights from the local landowners, and generally have expiry dates between mid-2026 to late 2027. During the

option period, our option to lease agreements provide for annual option payments and bonus payments during periods when we conduct drilling. Our annual option payments generally range between $25.00 to $75.00 per acre and our drilling bonuses

generally average approximately $1.00 per drill foot. Our obligation to make annual option payments and drilling bonus payments cease if we exercise our option to lease. Upon exercise, in the case of an option to lease, we will pay an annual

minimum royalty, generally $75 per acre, and a mining royalty, generally 5% of net revenues from products sold.

Page 13

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Our option to purchase agreements, upon exercise, allow us to purchase outright the surface property and associated mineral rights from the local landowners, and generally have expiry dates between mid-2022 to

late-2023. During the option period, our option to purchase agreements provide for annual option payments and bonus payments during periods when we conduct drilling. Our annual option payments generally range between $25.00 to $50.00 per acre and

our drilling bonuses generally average approximately $1.00 per drill foot. Our obligation to make annual option payments and drilling bonus payments cease if we exercise our option to purchase. Upon exercise, in the case of a purchase, we will pay

cash consideration approximating the fair market value of the property, excluding the value of any minerals, plus a premium.

Page 14

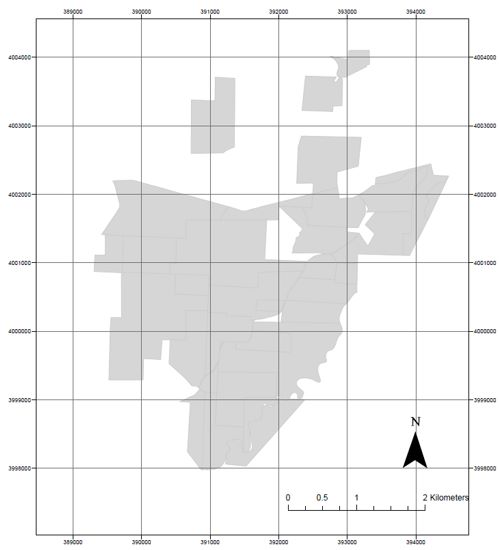

Figure 3: Titan Project location of material properties containing mineral resources (the coordinate system and datum used for modeling is UTMZ16N, NAD83)

| 3.3 |

Mineral Rights

|

IperionX provided maps to KGS of properties where IperionX controls the mineral right through Option to Purchase agreements, Option to Lease agreements or owning the land. KGS has no knowledge of the mineral rights

and or related to these properties nor does KGS possess knowledge of any previous or current boundary disputes or other concerns that would affect any future mining or processing operations.

| 3.4 |

Encumbrances

|

No Title Encumbrances are known.

| 3.5 |

Other Risks

|

All property deeds and titles are reviewed by IperionX’s legal team, no properties showed risks.

Page 15

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 4. |

Accessibility, Climate, Local Resources, Infrastructure and Physiography

|

| 4.1 |

Topography, Elevation and Vegetation

|

The Project area is located in the eastern portion of the United States and contains gently rolling topography with drainages (wetlands) dissecting the Project area. Surface elevations at the Project range from

approximately 175m above sea level in the upland regions and approximately 100m at the stream level.

| 4.2 |

Access and Transport

|

General access to the Project is via a well-developed network of primary and secondary roads. Interstate I-40 lies 22 miles to the south of the Project and provides access to Nashville International Airport

approximately 85 miles to the east.

| 4.3 |

Climate and Length of Operating Season

|

The Climate is temperate with warm summers and cold winters including the potential for snow/ice; this area will support year-round mining operations. Annual rainfall for the area is 53.8 inches. Land tracts within

the Project area are primarily used for agriculture with some timbered tracts.

| 4.4 |

Infrastructure

|

The Project area is located near the towns of Camden and Paris, Tennessee with proximity to abundant infrastructure and labor. The existing infrastructure includes power and gas, with high-capacity transmission lines

near the Project area, abundant transportation infrastructure including the Norfolk Southern mainline running through Camden, the major I-40 highway just 10 miles south of Camden and a major barge-loading point 15 miles from the Titan Project

connecting to all major U.S. customers and export ports. There are two international airports at Memphis and Nashville. Potential water sources include nearby surface water bodies but will likely involve shallow groundwater.

| 4.5 |

Location

|

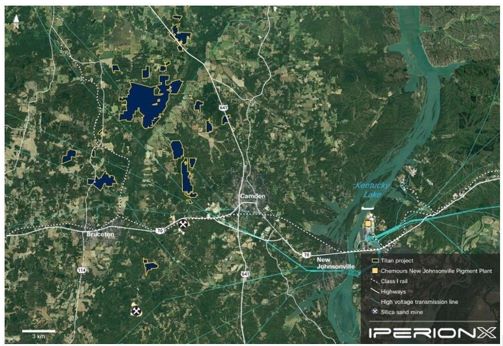

IperionX’s Titan Project is strategically located near Camden, Tennessee, and will benefit from significant cost advantages due to the location and proximity to low cost, world-class infrastructure.

95,000 miles of highway, including 8 interstate highways, put Tennessee within a day’s drive of a majority of U.S. consumer markets. Tennessee is the third largest rail center in the U.S. and there are more than

1,000 miles of navigable waterways which access all other major waterways in the eastern U.S. There are over four commercial airports near Camden, including two international airports at Memphis and Nashville.

This world class infrastructure is expected to provide material cost and logistics advantages compared to projects located in more remote areas. The existing infrastructure includes low-cost power and gas, with

high-capacity transmission lines near the Project, abundant transportation infrastructure including the Norfolk Southern mainline running through Camden, the major I-40 highway just 10 miles south of Camden and a major barge-loading point 15 miles

from the Titan Project connecting to all major U.S. customers and export ports.

Page 16

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Figure 4: Titan Project location and access to major rail, barge and port infrastructure.

Page 17

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 5. |

History

|

| 5.1 |

Previous Heavy Mineral Sand Mining in the Region

|

No previous heavy mineral sand mining has occurred in the region.

| 5.2 |

Previous Exploration

|

This area has been explored for HMS since the 1950s as the McNairy Sand was known to contain high concentrations of economic heavy minerals based on work by federal and state agencies. DuPont, Kerr-McGee, RGC,

Iluka, Altair, and Astron are known to have evaluated the McNairy deposits in the Project area at various times; however, there has been no known heavy mineral production from the McNairy Sand in Tennessee.

Page 18

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 6. |

Geological Setting, Mineralization, and Deposit

|

| 6.1 |

Regional, Local and Property Geology

|

The Titan Project’s location in western Tennessee represents the eastern flank of the Mississippi Embayment, a large, southward plunging syncline within the Gulf Coastal Plain. This feature extends from southern

Illinois to the north and to Mississippi and Alabama to the south. The embayment is filled with sediments and sedimentary rocks of Cretaceous to Quaternary age.

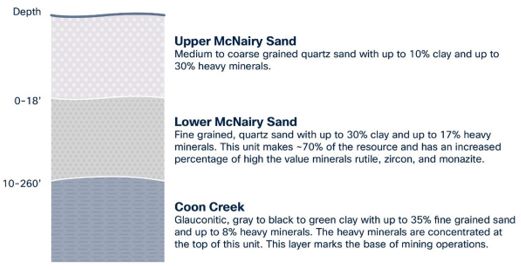

The McNairy Sand Formation represents a pro-grading deltaic environment during a regressive marine sequence. This is evidenced by the coarsening upward sequence grading from the glauconitic clay rich Coon Creek

Formation to the fine lower member of the McNairy Formation to the coarser upper member of the McNairy Formation.

The main mineralized zone at the Project is hosted stratigraphically in the lower member of the McNairy Formation, the McNairy Formation dips gently into the west in the Project area. Mineralization averages 31

meters thick and has been traced, to date, for 6.2 kilometers along strike. The upper zone is also mineralized in some areas.

| 6.2 |

Deposit Model

|

Exploration of the Project area utilizes the depositional model described in the previous section, sedimentary relationships, topography, and geological unit controls to target areas for evaluation.

Page 19

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 7. |

Exploration

|

| 7.1 |

Non-Drilling Procedures and Parameters

|

This section is not applicable to this TRS.

| 7.2 |

Drilling Procedures

|

All drilling for the Project has been roto-sonic. This method alternates advancement of a core barrel and a removeable casing (casing is used when needed to maintain sample integrity). The core barrel utilized for

this Project is 4 inches in diameter with a 6 inch diameter outer casing. The core barrel is retrieved from the ground and the samples are recovered directly from the barrel into a plastic sleeve. All holes are drilled vertically. The sonic

drilling method has been shown to provide representative unconsolidated mineral sands samples across a variety of deposits as it is a direct sampling method of the formation(s). At times water is used to create a head on the formation to help

prevent run-up.

A roto-sonic drill rig, the Geoprobe 5140LS, utilized a 10 ft core barrel to obtain direct 5 ft samples of the unconsolidated geological formations hosting the mineralization in the Project area. All holes were

drilled vertically which is essentially perpendicular to the mineralization. The sonic cores were used to produce approximately 2 kg samples for heavy liquid separation as well as further mineralogical analysis. Each core is measured, and the

recovery is calculated as length of recovered core divided by length drilled (typically 10 ft).

The Mineral Resource is based on 107 drill holes totaling 4,101 m, and occupies an area roughly 6.2 km (north) by 3.6 km (east); the Mineral Resource is further broken up into several areas based on land holdings

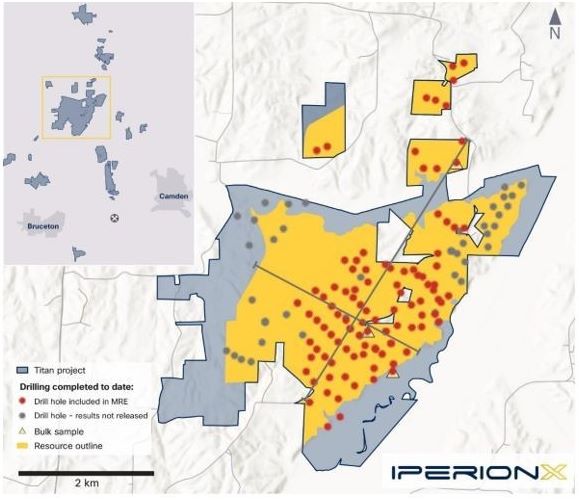

(land agreements). These range from 0.5 km (north) by 0.9 km (east) for the smallest area to 5.1 km (north) by 3.6 km (east) for the largest area. Figure 8 shows the drilling completed to date plan view, cross section and long section.

| 7.3 |

Hydrology and Hydrogeology

|

HDR is completing the one-year ground water base line study. No other hydrology and hydrogeology study has been completed.

| 7.4 |

Geotechnical Data

|

No geotechnical work has been completed.

Page 20

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 8. |

Sample Preparation, Analyses, and Security

|

| 8.1 |

Sample Collection and Security

|

Roto-sonic drill core samples, typically 1.5 m in length, are collected directly from the plastic sample sleeve at the drill site. Some interpretation is involved as the material can expand or compact as it is

recovered from the core barrel into the plastic sleeve. Each core is measured, and the recovery is calculated as length of recovered core divided by length drilled (typically 10’). Samples are logged for lithological, geological, and mineralogical

parameters in the field to help aid in determining depositional environment, major geologic units, and mineralized zones. Total depth of the drillhole is recorded as well as any drilling issues/concerns that could impact sample

representativeness. Samples are collected at regular (1.5m) intervals unless the geology/mineralogy warrant altering this as to co-mingle samples across major geological/mineralized boundaries.

All samples are panned and estimates made for the %THM and %SL. Logging is both qualitative (sorting, color, lithology) and quantitative (estimation of %THM, %SL) to help support the integrity of the Exploration

Results and Mineral Resource estimate. Photographs are taken of the sonic cores. All pertinent sample information (geology, sample ID, etc.) are collected on sequentially numbered tag books provided by the laboratory. The tag is inserted into

the sample bag and the information from the tag book is entered nightly into the Project database (GeoSpark).

The unconsolidated sonic cores are sampled by splitting the core in half lengthwise using a machete then recovering an even fillet with a trowel along the entire length of the sample interval. Sample volume is ~2 kg

and is appropriate for the analytical method(s) being used and ensure adequate sample volume is collected. Samples are collected directly to the pre-labeled/pre-tagged sample bags; the remaining sample is further split into a replicate/archival

sample and what remains is used to backfill the drillhole. A chip tray is maintained for each hole to keep a representative sample for each interval for later use during geological interpretation or between holes in the field or if any questions

arise during modelling.

Sample bags are sealed with a zip tie at the drill site, placed in rice bags, and remain in the custody of the field geologist from time of collection until time of delivery to the Project’s temporary storage

location which is a secure third-party storage unit or within a leased barn. A red security tag is used to secure the top of each rice bag and these tags are verified by the lab to guarantee all sample bags are intact.

| 8.2 |

Laboratory Procedures

|

Drill samples are sent to SGS NA facility in Lakefield, ON, Canada. SGS is a qualified third-party laboratory not related to IperionX. Samples are subjected to standard mineral sand industry assay procedures of

size fraction analysis, heavy-liquid separation, and chemical analysis. Samples are dry-screened at 44-micron (325 mesh) for slimes and 595-micron (30 mesh) for oversize. An 85 g aliquot of the -30/+325 sand is then submitted to methylene iodide

diluted with acetone to target specific gravity of 2.95 g/cm3, the greater than 2.95 g/cm3 portion is dried and weighed to calculate the percent heavy minerals. The THM is calculated by adding the percent slimes and oversize to the total.

Composites, based on geological domains, are then submitted for QEMSCAN analysis for mineralogical assemblage data. The mineral species determined from QEMSCAN are further combined and/or divided into groups representing anticipated products based

on metallurgical test work for inclusion in the geologic block model.

| 8.3 |

QA and QC Controls

|

Accuracy monitoring has been achieved through submission of in-house heavy mineral sand standard reference materials (SRM) developed specifically for the Project. A low-grade and a high-grade SRM were produced with

materials (HMs and silica sand) from the Project area to ensure representativeness. Each SRM was analyzed by the Project laboratory to generate a mean and standard deviations. SRMs are inserted at a 2.5% rate (1 every 40 samples). These SRMs are

placed loose in a standard sample bag that is labeled sequentially as to mimic a typical drill sample and passed through the laboratory process “blind”. A record of the SRM inserted and its sample IDs is kept in the Project database so that data

can be matched up and reviewed. Standards were created multiple times during the Project and each time a new dataset was generated to compare against.

Page 21

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

A quality control sample failure is any single sample 3 standard deviations from the true value for the comparison for each sample, or two out of three consecutive samples between 2 and 3 standard deviations, on the

same side of the mean value (i.e. both above or both below the mean value). Should the errors for a particular batch exceed these limits, the section of a batch bracketed by the SRM samples (i.e. number samples on either side) are reviewed to

determine if the SRM failures are material to the overall data for that batch or if the laboratory has had any procedural issues that need to be addressed. If necessary, samples are re‐analyzed. Overall, the objective of the quality assurance

program for resource purposes is a pass rate of >95%. A lower pass rate, on the order of 90% is acceptable for exploration purposes. Eleven SRMs (6 high and 5 low grade) were submitted during the drilling campaign for analysis and results were

all within 3 standard deviations of the mean of the SRM.

Sampling precision has been monitored by selecting a sample interval at a 3% rate (3 every 100 samples) and taking a second fillet sample over the same sample interval. These samples are consecutively numbered after

the primary sample and recorded in the sample database as “field duplicates” and the primary sample number recorded. Field duplicates are collected at the rate of approximately 3 in 100 samples and ideally should be collected when sampling

mineralized sonic core intervals containing visible THM (panning). Analytical precision is also be monitored using HLS duplicates that the laboratory produces at a rate of approximately 3 in 100 samples. Data from these two types of duplicate

analyses can be used to constrain sampling variance at different stages of the sampling and preparation process.

Field duplicates should have an average coefficient of variation (CoV) <10%, whereas laboratory duplicates should have an average CoV <5%. For the drilling results reported, 83 field duplicates were submitted

to the laboratory with results showing a CoV of less than 10%.

The use of an 85 g sub-sample for heavy liquid separation (HLS) results in a relative precision of 4% based on repeat analyses of standard reference materials (SRM) at SGS. This sub-sample mass is therefore

appropriate for the grain size being sampled.

Analysis of field duplicates indicates a relative precision of 31, indicating sampling of drill material presents the greatest uncertainty in the sampling procedure.

| 8.4 |

Opinion of Qualified Person

|

The QP is comfortable that the sample preparation, security, and analytical procedures are sufficient to reasonably support the mineral resource estimate in this TRS, in the opinion of the QP.

Page 22

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 9. |

Data Verification

|

| 9.1 |

Procedures of Qualified Person

|

The QP has conducted several site visits throughout the drilling campaigns and metallurgical test programs. The site visits provided visual confirmation of mineralization, drill hole locations, bulk sample collection

and logging and sampling procedures.

| 9.2 |

Limitations

|

None.

| 9.3 |

Opinion of Qualified Person

|

The QP is comfortable that the data is of a high quality and that no systemic or procedural issues that could impact the exploration results or mineral resource estimate are present that have not been reported in

this TRS.

Page 23

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 10. |

Mineral Processing and Metallurgical Testing

|

Four bulk samples were processed by Mineral Technologies through pilot equipment designed to emulate a full-scale Feed Preparation Plant (FPP), Wet Concentrator Plant (WCP), Monazite Flotation/Concentrate Upgrade

Plant and a Mineral Separation Plant (MSP). Mineral Technologies is a reputable test laboratory with significant experience in mineral sands flowsheet development. Assays were conducted by SGS in Lakefield, Canada and Bureau Veritas in Perth,

Australia, with XRF, laser ablation / ICPMS and QEMSCAN analytical methods.

The final products and the grades of those final products that were produced form the testwork demonstrated that the Upper and Lower mineralized resource could be separated using processing stages common to most

mineral sands’ operations. Notably, the flotation test work achieved an overall 97% recovery of rare earth minerals in the final rare earth concentrate.

Based on the testwork results, it was concluded that a viable commercial operation could be established with appropriate processing options for a 10 Mtpa operation commencing in Benton area.

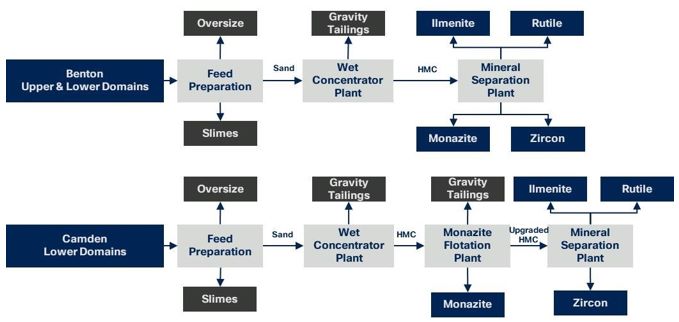

An overview of the Benton Upper and Lower and Camden Lower testwork programs are depicted in Figure 5.

Further confirmation test work is planned to proceed during the next phase of the Project development.

The QP of Exploration Results and Mineral Resources is comfortable that the samples are representative of the type and style of mineralization exhibited at the Titan Project, in the opinion of the QP.

The QP of Process Design is comfortable that the analytical procedures and data for the purposes used in this TRS are adequate, in the opinion of the QP.

Figure 5: Overview of initial metallurgical testwork program.

Page 24

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Figure 6: Rare earth (LHS) and heavy mineral concentrate (RHS) streams from wet shaking table tests after flotation.

Page 25

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 11. |

Mineral Resource Estimate

|

| 11.1 |

Assumptions, Parameters and Methods

|

The Mineral Resource occupies an area roughly 6.2 km (north) by 3.6 km (east); the MRE is further broken up into several areas based on land holdings (land agreements). These range from 0.5 km (north) by 0.9 km

(east) for the smallest area to 5.1 km (north) by 3.6 km (east) for the largest area.

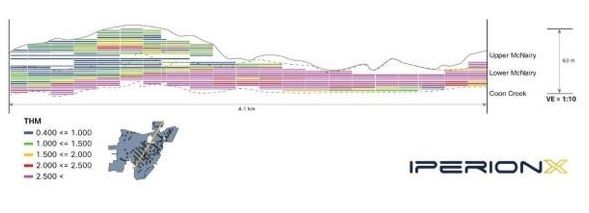

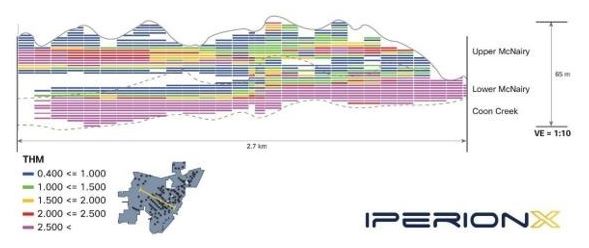

The base of mineralization ranges in RL from 90 m to 110 m above current sea level. Mineralization varies from 6 m to 51 m thick and averages 31 m thick. Mineralization resides primarily in two zones within the

primary McNairy Sand unit. The grade interpolation was carried out using Vulcan software. Grade, slimes, and assemblage estimations were completed using inverse distance cubed (ID3) which is appropriate for this style of mineralization.

No THM top cut has been used or is deemed necessary for this deposit due to the geology, style, and consistency of the mineralization. Drill hole sample data was flagged with domain (zone) codes corresponding to the

geological structure of the deposit and the domains imprinted on the model from 3-dimensional surfaces generated from geological interpretations. A primary search dimension of 212*425*3 m (X*Y*Z) was used for all assay data. Successive search

volume factors of 2 and 4 have been adopted to interpolate grade in areas of lower data density. A parent cell size of 100*200*1.5 m was used. Parent cells are typically centered on the drill holes with a floating cell centered between drill holes

along and across strike. A search orientation of 30 east of north was used to emulate the trend of the mineralization. No consistent plunge is apparent in the mineralization.

The Octant search option was used with minimum of 1 and a maximum of 5 samples per octant and a minimum of 2 octants being estimated to calculate the grade for a block. If the insufficient data was found within the

first search, secondary and tertiary searches were used based on the search volume factors. In addition, a minimum of 2 samples were used from any particular drill hole. Standard mineral sands industry assay procedures (sizing 44-micron [325 mesh]

for slimes and 595-micron [30 mesh] for oversize) heavy-liquid separation of an 85 g split of the -30/+325 sand using methylene iodide. For mineralogy, QEMSCAN analysis was utilized. A total of 107 drill holes for 2,626 THM assay samples (heavy

liquid) and 181 THM and composite mineralogy (QEMSCAN) have been used to inform this MRE.

| 11.2 |

Mineral Resource Estimate

|

The maiden MRE for the Titan Project comprises 431 Mt @ 2.2% THM, containing 9.5 Mt THM at a 0.4% cut-off, and includes a high-grade core of 195 Mt @ 3.7% THM, containing 7.1 Mt THM at a 2.0% cut-off. Slimes and oversize material accounts for approximately 20% and 2.5% of the in-ground material respectively SL and OS values for the Initial Assessment were derived from the metallurgical bulk sample testwork as

it has been identified that the dry-screening method utilized for the drill samples tends to under-report SL and over-report OS. It should be noted that these discrepancies do not materially impact THM and a revised method (wet screening) for

drill samples has been developed and tested for the Project moving forward in the next phase that will produce more accurate SL and OS values. There is a high level of confidence associated with the MRE classification, with 56% (241 Mt) classified

as being in the Indicated resource category. Mineralization occurs as a single, large, and coherent near-surface deposit.

The MRE incorporates results from 107 sonic core drill holes for a total of 4,101 m drilled by IperionX during 2020 and 2021. This includes 45 new holes drilled during the Phase 3 drilling campaign in 2021, which are

previously unreported. A further 109 holes totaling 3,566 m have subsequently been drilled outside of the MRE area and are in the final stages of processing. It is anticipated that these drill hole results will be incorporated into an upgraded

MRE.

Page 26

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Table 9: Mineral Resource Estimate and THM assemblage at 0.4% cut-off grade.

|

THM Assemblage

|

||||||||||

|

Cut off

|

Tons

|

THM %

|

THM

|

Zircon

|

Rutile

|

Ilmenite

|

REE

|

Staurolite

|

||

|

(THM %)

|

(Mt)

|

(%)

|

(Mt)

|

(%)

|

(%)

|

(%)

|

(%)

|

(%)

|

||

|

Indicated

|

0.4

|

241

|

2.2

|

5.3

|

11.3

|

9.3

|

39.7

|

2.1

|

15.6

|

|

|

Inferred

|

0.4

|

190

|

2.2

|

4.2

|

11.7

|

9.7

|

41.2

|

2.2

|

13.7

|

|

|

Total

|

0.4

|

431

|

2.2

|

9.5

|

11.5

|

9.5

|

40.3

|

2.1

|

14.8

|

|

Table 10: Mineral Resource Estimate and THM assemblage at 2.0% cut-off grade.

|

THM Assemblage

|

||||||||||

|

Cut off

|

Tons

|

THM %

|

THM

|

Zircon

|

Rutile

|

Ilmenite

|

REE

|

Staurolite

|

||

|

(THM %)

|

(Mt)

|

(%)

|

(Mt)

|

(%)

|

(%)

|

(%)

|

(%)

|

(%)

|

||

|

Indicated

|

2.0

|

105

|

3.8

|

3.9

|

11.7

|

9.8

|

42.0

|

2.3

|

10.7

|

|

|

Inferred

|

2.0

|

90

|

3.5

|

3.2

|

12.1

|

9.9

|

42.1

|

2.3

|

10.8

|

|

|

Total

|

2.0

|

195

|

3.7

|

7.1

|

12.1

|

9.9

|

42.0

|

2.3

|

10.7

|

|

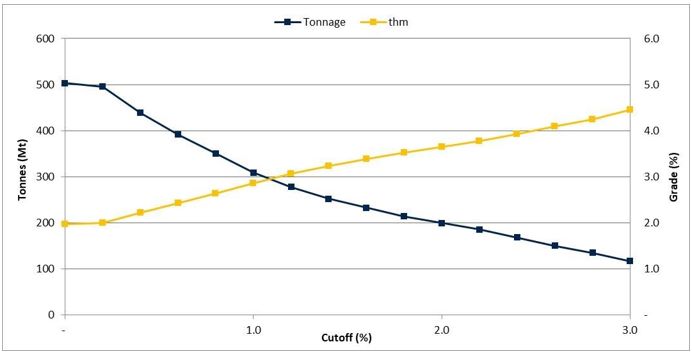

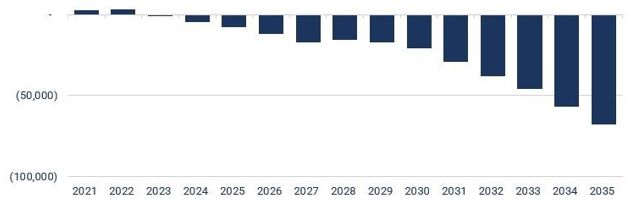

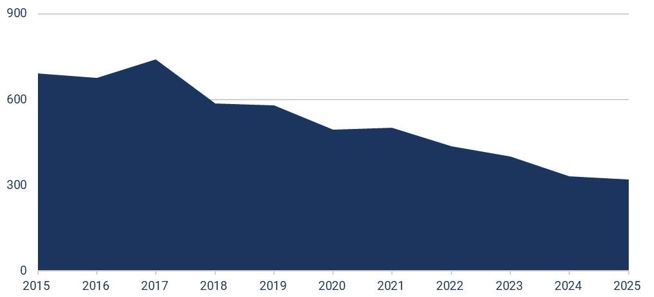

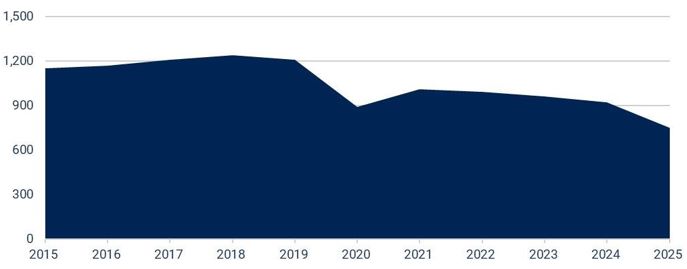

Figure 7: THM grade cutoff v. tonnage curve.

Page 27

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Page 28

Figure 8: MRE plan view, cross section and long section.

Page 29

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

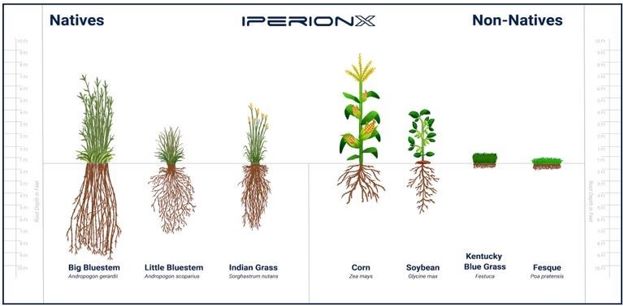

The shallow, high grade and unconsolidated nature of mineralization enables the potential for simple mining operations supported by an industry standard mineral processing flowsheet. The Company is focusing on

becoming the leading developer of low-to-zero carbon, sustainable, critical materials in the U.S., and is working with Presidio Graduate School’s expert consulting division, PGS Consults, to undertake Environmental, Sustainability and Corporate

Governance studies to define best practice mining and processing operations in this critical mineral province.

| 11.3 |

Geology and Geological Interpretation

|

The Titan Project’s location in western Tennessee represents the eastern flank of the Mississippi Embayment, a large, southward plunging syncline within the Gulf Coastal Plain. This feature extends from southern

Illinois to the north and to Mississippi and Alabama to the south. The embayment is filled with sediments and sedimentary rocks of Cretaceous to Quaternary age.

Page 30

Figure 9: Mississippi embayment & Cretaceous age coastline.

The McNairy Sand Formation represents a pro-grading deltaic environment during a regressive sequence. This is evidenced by the coarsening upward sequence grading from the glauconitic clay rich Coon Creek Formation to

the fine lower member of the McNairy Formation to the coarser upper member of the McNairy Formation.

The main mineralized zone at the Project is hosted stratigraphically in the lower member of the McNairy Formation. Mineralization averages 31 meters thick and has been traced, to date, for 6.2 kilometers along

strike.

Page 31

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Figure 10: Idealized cross-section of McNairy Sand.

| 11.4 |

Drilling and Sampling Techniques

|

All drilling for the Project has been roto-sonic. This method alternates advancement of a core barrel and a removeable casing (casing is used when needed to maintain sample integrity). The core barrel utilized for

this Project is 4 inch in diameter with a 6 inch diameter outer casing. The core barrel is retrieved from the ground and the samples are recovered directly from the barrel into a plastic sleeve. All holes are drilled vertically. The sonic drilling

method has been shown to provide representative unconsolidated mineral sands samples across a variety of deposits as it is a direct sampling method of the formation(s). At times water is used to create a head on the formation to help prevent

run-up.

A roto-sonic drill rig, the Geoprobe 5140LS, utilized a 10 ft core barrel to obtain direct 5 ft samples of the unconsolidated geological formations hosting the mineralization in the Project area. All holes were

drilled vertically which is essentially perpendicular to the mineralization. The sonic cores were used to produce approximately 2kg samples for heavy liquid separation as well as further mineralogical analysis. Each core is measured, and the

recovery is calculated as length of recovered core divided by length drilled (typically 10 ft).

Some interpretation is involved as the material can expand or compact as it is recovered from the core barrel into the plastic sleeve. Samples are logged for lithological, geological, and mineralogical parameters in

the field to help aid in determining depositional environment, major geologic units, and mineralized zones.

All samples are panned and estimates made for the %THM and %SL. Logging is both qualitative (sorting, color, lithology) and quantitative (estimation of %THM, %SL) to help support the integrity of the Exploration

Results and Mineral Resource estimate. Photographs are taken of the sonic cores.

The unconsolidated sonic cores are sampled by splitting the core in half lengthwise using a machete then recovering an even fillet with a trowel along the entire length of the sample interval. Samples are collected

directly to the pre-labeled/pre-tagged sample bags; the remaining sample is further split into a replicate/archival sample and what remains is used to backfill the drillhole.

| 11.5 |

Sample Analysis Methodology

|

Roto-sonic drill core samples, typically 1.5 m, are sent to SGS NA facility in Lakefield, ON, Canada. Samples are subjected to standard mineral sand industry assay procedures of size fraction analysis, heavy-liquid

separation, and chemical analysis. Samples are screened at 44-micron (325 mesh) for slimes and 595-micron (30 mesh) for oversize. An 85g aliquot of the -30/+325 sand is then submitted to methylene iodide diluted with acetone to target specific

gravity of 2.95 g/cm3, the greater than 2.95 g/cm3 portion is dried and weighed to

calculate the percent heavy minerals. The THM is calculated by adding the percent slimes and oversize to the total. Composites, based on geological domains, are then submitted for QEMSCAN analysis for mineralogical assemblage data.

Page 32

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 11.6 |

Resource Estimation Methodology

|

The Mineral Resource occupies an area roughly 6.2 km (north) by 3.6 km (east); the MRE is further broken up into several areas based on land holdings (land agreements). These range from 0.5 km (north) by 0.9 km

(east) for the smallest area to 5.1 km (north) by 3.6 km (east) for the largest area.

The base of mineralization ranges in RL from 90 m to 110 m above current sea level. Mineralization varies from 6 m to 51 m thick and averages 31 m thick. Mineralization resides primarily in two zones within the

primary McNairy Sand unit. The grade interpolation was carried out using Vulcan software. Grade, slimes, and assemblage estimations were completed using inverse distance cubed (ID3) which is appropriate for this style of mineralization.

No THM top cut has been used or is deemed necessary for this deposit due to the geology, style, and consistency of the mineralization. Drill hole sample data was flagged with domain (zone) codes corresponding to the

geological structure of the deposit and the domains imprinted on the model from 3-dimensional surfaces generated from geological interpretations. A primary search dimension of 212*425*3 m (X*Y*Z) was used for all assay data. Successive search

volume factors of 2 and 4 have been adopted to interpolate grade in areas of lower data density. A parent cell size of 100*200*1.5 m was used. Parent cells are typically centered on the drill holes with a floating cell centered between drill holes

along and across strike. A search orientation of 30 east of north was used to emulate the trend of the mineralization. No consistent plunge is apparent in the mineralization.

The Octant search option was used with minimum of 1 and a maximum of 5 samples per octant and a minimum of 2 octants being estimated to calculate the grade for a block. If the insufficient data was found within the

first search, secondary and tertiary searches were used based on the search volume factors. In addition, a maximum of 2 samples were used from any particular drill hole.

| 11.7 |

Classification Criteria

|

The resource classification has been predominantly determined by the drill hole density reflecting the geological confidence. Supporting data are of suitable quality for resource estimation. Resource material

defined by sampling with an approximate density of 212mE-W by 425mN-S by 3mRL and having sufficient mineralogy data has been assigned an Indicated Resource classification, material defined by sampling with an approximate density of 305mE-W by

610mN-S by 3mRL with some mineralogy data has been assigned an Inferred Resource classification. Approximately 56% of the Mineral Resource is classified in the Indicated Mineral Resource category and approximately 44% is classified in the Inferred

Mineral Resource category. Variograms are run to test spatial continuity within the selected geological domains. Down hole and directional variography are run using ’R’ software and Vulcan version 2021.3.

Page 33

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

Table 11: Sources of uncertainty.

|

Source of Uncertainty

|

Discussion

|

||

|

Drilling

|

All drilling has been roto-sonic drilling. The roto-sonic drill rig provides a representative sample, with sufficient recoveries of unconsolidated sand, in order to represent the in-ground material and is

suitable for use in the MRE.

|

||

|

Sampling

|

Field duplicates are taken at a rate of 3% in order to identify in biases or inconsistencies. Examination of these duplicates indicates satisfactory performance of the sampling.

|

||

|

Geological Modelling

|

The geological model is supported with sufficient drill data. The Coon Creek formation is reached in >95% of the holes used the model. This provides a sufficient base to the extractable mineralization.

Discrimination between the upper and lower members of the McNairy Sand Formation is easily identified by the relative difference in grain size and the presence of micas within the lower member.

|

||

|

Estimation

|

The estimation techniques used are suitable for the deposit type and mineralization style. All data is log transformed and shows normally distributed grade data. A validation infill program will be executed

in a future study in order to gain additional confidence in the estimation.

|

| 11.8 |

Cut-off Grade

|

A nominal bottom cut of 0.4% THM is offered, based on preliminary assessment of resource value and anticipated operational cost evaluated through preliminary engineering work.

The estimated breakeven economic cut-off grade of 0.4% THM utilized for resource reporting purposes has been calculated using on a revenue cost break even calculation and is based on the following assumptions:

| • |

historical 2017 to 2021 annual average prices for ilmenite, rutile, rare earth concentrate and zircon as set out in Tables 16 and 17;

|

| • |

recovery factors of 82.6% for ilmenite, 60.9% for rutile, 77.1% for rare earth concentrate and 90.8% for zircon;

|

| • |

operating cost estimates of $3.00/t ROM mining, $3.00/t ROM processing, $0.40/t ROM transport and $0.90/t ROM general and administrative costs; and

|

| • |

a royalty of 5% is included in the cut-off grade.

|

SEC Regulation S-K 1300 requires that all reports of Mineral Resources must have reasonable prospects for economic extraction regardless of the classification of the resource.

As detailed in the Initial Assessment, Mineral Resources are amenable to exploitation, incorporating a multi-decade mine life and the application of conventional mining and processing technology.

The QP has used this information as the basis for determining reasonable prospects for economic extraction.

| 11.9 |

Mining and Metallurgical Methods and Parameters

|

The MRE assumes that the deposit will be mined by standard mineral sands dry-mining methods and hydraulic excavator/shovel with a mobile mining unit. It has been assumed that mineralized resource will be

transported to the wet concentrator plants after extraction via slurry pipeline(s).

Metallurgical testing has been conducted, with 3 bulk samples collected from both upper and lower mineralized horizons as well as spatially throughout the deposit footprint. Each bulk sample was processed by both

wet (gravity) and dry (magnetic and electrostatic) methods to produce ilmenite, rutile, zircon, and monazite/xenotime concentrates.

Products were further analyzed by QEMSCAN, XRF and ICPMS to provide scoping-level product and quality information for use in assessing salability and markets. Product information has not been included in the block

model at this stage of the Project.

| 11.10 |

Qualified Person’s Opinion

|

Based on a review of the data, third party verification of data integrity and validation of the block model, the QP believes that this is an accurate representation of IperionX’s heavy mineral sand resource.

Page 34

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 12. |

Mineral Reserve Estimate

|

This section is not relevant to this report.

Page 35

|

IPERIONX TITAN PROJECT – INITIAL ASSESSMENT

|

| 13. |

Mining Methods

|

| 13.1 |

Geotechnical and Hydrogeology

|

For the purpose of this study, no geotechnical or hydrological test work has been completed on the Project area. Preliminary mining void designs have been provided by IperionX utilizing batter and berm configuration

have been used for the purpose of defining potential mining limits

Exploration data suggests that the water table is 5 m below ground surface, but no water flow rate information has been provided.

| 13.1.1 |

Hydrology

|

No formal hydrology work for surface or sub-surface water flows has been completed and therefore for the purpose of this study the following main assumptions have been made:

| 1. |

Restricted areas due to region surface water management have adequately been defined with the provision of surface water buffer zones.

|

| 2. |

Ground water is not expected to present a pit wall stability issue and will be managed through the use of in-pit pumping associated with the sand tailing water reclaim system.

|

| 3. |

All surface water that interacts with the active mining areas will remain in the mine water management system and all surface water that does not interact with the active mining area will be diverted to natural water ways that move the

water from the mining areas.

|

| 4. |

All mine water used for the transportation of the mineralized material to the Wet Concentrator Plant (WCP) and used in the transportation of sand tails returned to the pit working area will be controlled within the mine water management

system which will prevent mine water from leaving the boundary of the mining areas in an uncontrolled fashion.

|

| 5. |

All mine water management system components (pumps, storage dams and pump lines) are adequately sized to manage expected peak performance requirements for high flow rates.

|

| 6. |

Ancillary mine water for use in dust suppression and all WCP water supply will be drawn from the Mine Water Management System.

|

Hydrology studies to validate these assumptions are required for the next study phase to provide direct input into the design elements.

| 13.1.2 |

Geotechnical

|

The depth of the planned workings below the surface varies from 25 to 40 m below an average ground surface of 125 m Above Sea Level (ASL). The depth is increased due to the terrain in the region having hills reaching

165 m ASL. This combination could result in pit void wall extending from 165 m to 80 m, creating 85 m walls. With this potential operating face height, the geotechnical design for the wall must be considered in detail, considering the impact of the

material types, the material mechanical characterization, the moisture content, potential of hydraulic pressures and geological structures.

With these geotechnical, hydrology and material characterization test work still to be done, preliminary designs for the mining voids have used batter and berm configurations from similar mineral sands type projects.