UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Goldman Sachs Private Credit Corp.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

GOLDMAN SACHS PRIVATE CREDIT CORP.

200 West Street

New York, New York 10282

June 2, 2025

Dear Stockholder:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders (the “Meeting”) of Goldman Sachs Private Credit Corp. (the “Company”) to be held on July 28, 2025, at 12:00 p.m. (Eastern Time). The Meeting will be conducted as a virtual meeting hosted by means of a live webcast. Stockholders will be able to listen, vote, and submit questions from their home or any location with internet connectivity.

You or your proxyholders will be able to attend the Meeting online, vote and submit questions by visiting www.virtualshareholdermeeting.com/GSPVC2025 and using a control number assigned by Broadridge Financial Solutions, Inc. To register and receive access to the virtual meeting, you will need to follow the instructions provided in the Notice of Internet Availability of Proxy Materials you received.

The following pages include a formal notice of the Meeting and our proxy statement. The Notice of Internet Availability of Proxy Materials you received and our proxy statement describe the matters on the agenda for the Meeting. Please read these materials carefully so that you will know what we intend to act on at the Meeting.

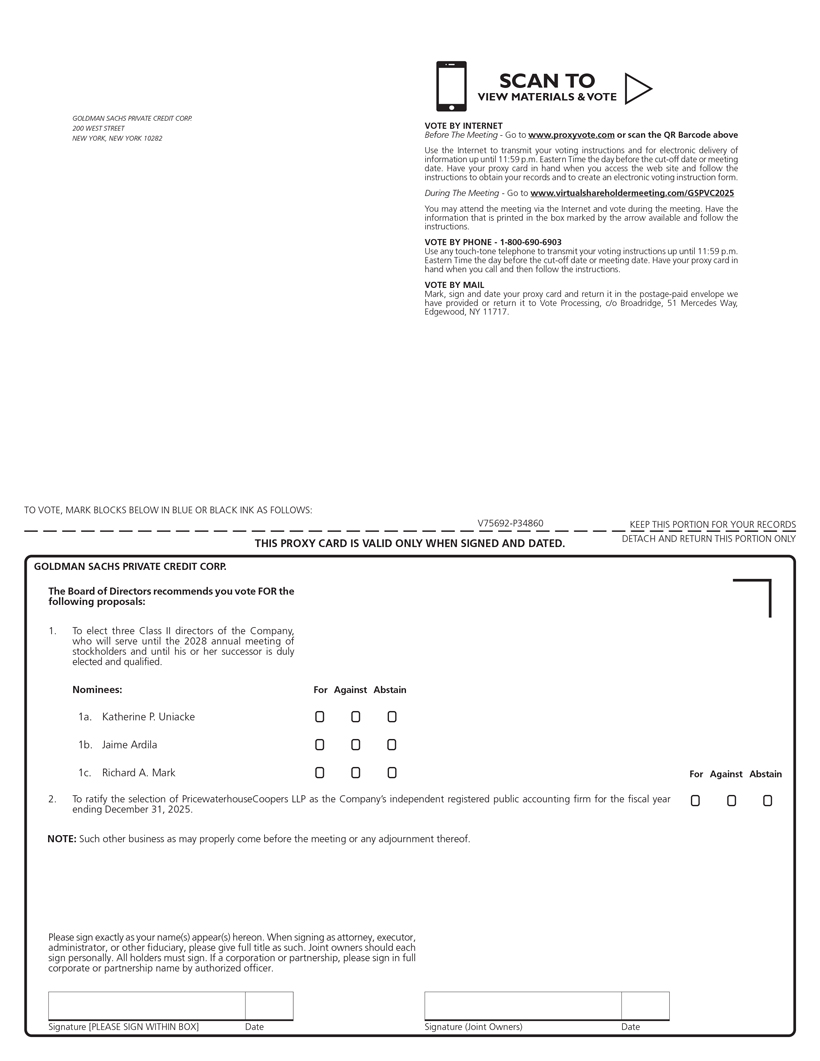

The Meeting is being held (i) to elect three Class II directors of the Company, who will serve until the 2028 annual meeting of stockholders and until his or her successor is duly elected and qualified, and (ii) to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025.

WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, YOUR VOTE IS VERY IMPORTANT. If you do not plan to be present at the virtual Meeting, you can vote by following the instructions in the Notice of Internet Availability of Proxy Materials to vote via the internet or telephone, or request, sign, date, and return a proxy card so that you may be represented at the Meeting. If you have any questions regarding the proxy materials, please contact the Company at (312) 655-4419. Your prompt response will help reduce proxy costs—which are paid by the Company and indirectly by its stockholders—and will also mean that you can avoid receiving follow-up phone calls and mailings.

| Sincerely, | ||

| /s/ Alex Chi and David Miller | ||

| Alex Chi and David Miller | ||

| Co-Chief Executive Officers and Co-Presidents | ||

PLEASE FOLLOW THE INSTRUCTIONS IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS TO VOTE VIA THE INTERNET OR TELEPHONE, OR REQUEST, SIGN, DATE, AND RETURN A PROXY CARD TO CAST YOUR VOTE AS SOON AS POSSIBLE. YOUR VOTE IS IMPORTANT.

GOLDMAN SACHS PRIVATE CREDIT CORP.

200 West Street

New York, New York 10282

NOTICE OF ANNUAL MEETING

To Be Held On July 28, 2025

June 2, 2025

Notice is hereby given to the owners of shares of common stock (the “Stockholders”) of Goldman Sachs Private Credit Corp. (the “Company”) that:

The 2025 Annual Meeting of Stockholders (the “Meeting”) will be held virtually on July 28, 2025, at 12:00 p.m. (Eastern Time), by means of a live webcast, for the following purposes (the “Proposals”):

| 1. | to elect three Class II directors of the Company, who will serve until the 2028 annual meeting of stockholders and until his or her successor is duly elected and qualified; and |

| 2. | to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. |

The matters referred to above are discussed in the Proxy Statement attached to this Notice. On May 7, 2025, the Board of Directors of the Company, including each of the independent directors, unanimously recommended that you vote “FOR” each of the Proposals.

You will be able to attend the Meeting online, submit your questions during the meeting and vote your shares electronically at the meeting by going to www.virtualshareholdermeeting.com/GSPVC2025 and entering your control number, which is included on the Notice of Internet Availability of Proxy Materials that you received.

We are furnishing the accompanying proxy statement and proxy card to our stockholders on the internet, rather than mailing printed copies of these materials to each stockholder. Since you received a Notice of Internet Availability of Proxy Materials, you will not receive printed copies of the proxy statement and proxy card unless you request them by following the instructions on the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials will instruct you as to how you may assess and review the proxy statement and vote your proxy. To receive a separate copy of the Proxy Statement, please contact the Company by calling (312) 655-4419 or by mail to the Company’s principal executive offices at Goldman Sachs Private Credit Corp., 200 West Street, New York, New York 10282. If you have not received a copy of the Notice of Internet Availability of Proxy Materials and your shares are held through a financial intermediary, such as a bank or broker, please contact your financial intermediary; otherwise, you may contact the Company at (312) 655-4419.

The meeting webcast will begin promptly at 12:00 p.m. (Eastern Time). We encourage you to access the Meeting prior to the start time. For additional information on how you can attend and participate in the virtual Meeting, please see the instructions in your Notice of Internet Availability of Proxy Materials or the instructions that accompanied your proxy materials. Because the Meeting will be a completely virtual meeting, there will be no physical location for Stockholders to attend.

Stockholders of record at the close of business on May 29, 2025 are entitled to receive notice of, and to vote at, the Meeting and at any postponements or adjournments thereof.

Your vote is extremely important to us. If you will not attend the virtual Meeting, we urge you to follow the instructions provided in the proxy statement to vote your shares via the internet or by telephone, or to request, sign, date and return promptly a proxy card. In the event there are not sufficient votes for a quorum or to approve the Proposals at the time of the Meeting, the Meeting may be postponed or adjourned in order to permit further solicitation of proxies by the Board of Directors of the Company.

| By Order of the Board of Directors of Goldman Sachs Private Credit Corp. | ||

| /s/ Caroline Kraus | ||

| Caroline Kraus | ||

| Secretary | ||

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY SHARES YOU OWN

To secure the largest possible representation at the Meeting, please follow the instructions in the Notice of Internet Availability of Proxy Materials to vote via the internet or telephone, or request, sign, date and return a proxy card so that you may be represented at the Meeting.

To vote via the internet, please access the website found on your Notice of Internet Availability of Proxy Materials and follow the on-screen instructions on the website.

To vote by telephone, stockholders within the United States should call the toll-free number found on the website set forth in your Notice of Internet Availability of Proxy Materials and follow the recorded instructions. Stockholders outside the United States should vote via the internet or by requesting a proxy card instead.

You may revoke your proxy at any time at or before the Meeting (1) by notifying the Secretary of the Company in writing at the Company’s principal executive offices, (2) by submitting a properly executed, later-dated proxy, a later-dated electronic vote via the website stated on the Notice of Internet Availability of Proxy Materials or a later-dated vote using the toll-free telephone number stated on the Notice of Internet Availability of Proxy Materials or (3) by attending the virtual Meeting and voting during the webcast.

ANNUAL MEETING

OF

GOLDMAN SACHS PRIVATE CREDIT CORP.

200 West Street

New York, New York 10282

PROXY STATEMENT

June 2, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors (the “Board”) of Goldman Sachs Private Credit Corp. (the “Company,” “we,” “our” and “us”) for use at the 2025 Annual Meeting of Stockholders (the “Meeting”), to be held virtually on July 28, 2025, at 12:00 p.m. (Eastern Time), and any postponement or adjournment thereof. Much of the information in this Proxy Statement is required under rules of the Securities and Exchange Commission (the “SEC”), and some of it is technical in nature. If there is anything you do not understand, please contact the Company at (312) 655-4419. Only holders of record of our common stock at the close of business on May 29, 2025 (the “Record Date”) will be entitled to notice of and to vote at the virtual Meeting.

In accordance with rules and regulations adopted by the SEC, we have elected to provide our stockholders (the “Stockholders”) access to our proxy materials on the internet, including the proxy statement and the form of proxy (collectively, the “Proxy Statement”) and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) was distributed on or about June 3, 2025 to our stockholders of record as of the close of business on the Record Date. Stockholders are able to (1) access the proxy materials on a website referred to in the Notice or (2) request that a printed set of the proxy materials be sent, at no cost to them, by following the instructions in the Notice. You will need the 16-digit control number that is included with the Notice to authorize your proxy for your shares through the internet. If you have not received a copy of the Notice, please contact the Company by phone at (312) 655-4419. If you have not received a copy of the Notice and your shares are held through a financial intermediary, such as a bank or broker, please contact your financial intermediary.

PURPOSE OF THE MEETING

At the Meeting, you will be asked to vote on the following proposals:

| 1. | To elect three Class II directors of the Company, who will serve until the 2028 annual meeting of stockholders and until his or her successor is duly elected and qualified (“Proposal 1”); and |

| 2. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 (“Proposal 2”). |

INFORMATION REGARDING ATTENDING THE MEETING

The Meeting will be a virtual meeting conducted exclusively via live webcast starting at 12:00 p.m. (Eastern Time). You will be able to attend the Meeting online, submit your questions during the Meeting and vote your shares electronically at the meeting by going to www.virtualshareholdermeeting.com/GSPVC2025 and entering your control number, which is included on the Notice that you received. Because the Meeting is completely virtual and being conducted via live webcast, Stockholders will not be able to attend the Meeting in person.

1

If your shares are held in “street name” through a bank, broker or other nominee, in order to vote during the live webcast of the Annual Meeting you must first obtain a “legal proxy” from your bank, broker or other nominee and register with Broadridge Financial Solutions, Inc. (“Broadridge”) in order for you to participate in the live webcast of the Annual Meeting. You then may vote by following the instructions provided to you.

We are pleased to offer our Stockholders a completely virtual Meeting, which provides worldwide access and communication, while protecting the health and safety of our Stockholders, directors, management and other stakeholders. We are committed to ensuring that Stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We will try to answer as many Stockholder-submitted questions as time permits that comply with the Meeting rules of conduct. However, we reserve the right to edit profanity or other inappropriate language, or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If substantially similar questions are received, we will group such questions together and provide a single response to avoid repetition.

INFORMATION REGARDING THIS SOLICITATION

It is expected that the solicitation of proxies will be primarily by mail. The Company’s officers, and personnel of the Company’s investment adviser, Goldman Sachs Asset Management, L.P. (“GSAM” or the “Investment Adviser”), and the Company’s transfer agent and any authorized proxy solicitation agent, may also solicit proxies by telephone, email, facsimile or internet. If the Company records votes through the internet or by telephone, it will use procedures designed to authenticate Stockholders’ identities to allow Stockholders to authorize the voting of their shares in accordance with their instructions and to confirm that their identities have been properly recorded.

The Company will pay the expenses associated with this Proxy Statement and solicitation, in a manner agreed upon by the Board. The Company has engaged Broadridge, an independent proxy solicitation firm, to assist in the distribution of the proxy materials and tabulation of proxies. The costs of such services with respect to the Company are estimated to be approximately $146,197, plus reasonable out-of-pocket expenses.

To vote by internet or telephone, please use the control number on your Notice and follow the instructions as described on your Notice. If you would like to vote by mail, please follow the instructions provided on the Notice to request, sign, date and return promptly a proxy card. If you have any questions regarding the proxy materials, please contact the Company at (312) 655-4419. If your proxy has been received prior to the Meeting and has not been revoked, the shares represented thereby will be voted in accordance with the instructions contained in your proxy. If no instructions are marked, the shares of the Company’s common stock represented by the proxy will be voted “FOR” each of the Proposals described in this Proxy Statement. In either case, shares will be voted in the discretion of the persons named as proxies in connection with any other matter that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

Any person giving a proxy may revoke it at any time before it is exercised (1) by notifying the Secretary of the Company in writing at the Company’s principal executive offices, (2) by submitting a properly executed, later-dated proxy, a later-dated electronic vote via the website stated on the Notice, or a later-dated vote using the toll-free telephone number stated on the Notice or (3) by attending the virtual Meeting and voting during the webcast.

If (i) you are a member of a household in which multiple Stockholders share the same address, (ii) your shares are held in “street name” and (iii) your broker or bank has received consent to household material, then your broker or bank may send to your household only one copy of this Proxy Statement, unless your broker or bank previously received contrary instructions from a Stockholder in your household. If you are part of a household that has received only one copy of the Notice, the Company will deliver promptly a separate copy of

2

the Notice or, if applicable, our Proxy Statement and our Annual Report on Form 10-K to you upon written or oral request. To receive a separate copy of these documents, please contact the Company by calling (312) 655-4419 or by mail to the Company’s principal executive offices at Goldman Sachs Private Credit Corp., 200 West Street, New York, New York 10282. If your shares are held with certain banks, trust companies, brokers, dealers, investment advisers and other financial intermediaries (each, an “Authorized Institution”) and you would like to receive a separate copy of future proxy statements, notices of internet availability of proxy materials, prospectuses or annual reports or you are now receiving multiple copies of these documents and would like to receive a single copy in the future, please contact your Authorized Institution.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JULY 28, 2025

This Proxy Statement is available online at www.proxyvote.com (please have the control number found on your Notice ready when you visit this website).

3

INFORMATION REGARDING SECURITY OWNERSHIP

Control Persons and Principal Stockholders

The following table sets forth, as of the Record Date, certain ownership information with respect to shares of the Company’s common stock for each of the Company’s current directors (including the nominees), executive officers and directors and executive officers as a group, and each person known to the Company to beneficially own 5% or more of the outstanding shares of the Company’s common stock. With respect to persons known to the Company to beneficially own 5% or more of the outstanding shares of the Company’s common stock, such knowledge is based on beneficial ownership filings made by the holders with the SEC and other information known to the Company. The percentage ownership is based on 274,884,463.57 shares of common stock outstanding as of the Record Date.

| Name and Address |

Type of Ownership(3) |

Shares Owned |

Percentage |

|||||||

| Beneficial owners of 5% or more |

||||||||||

| Nomura Asset Management Co Ltd(1) |

Beneficial | 16,590,764.35 | 6.04 | % | ||||||

| Interested Director |

||||||||||

| Katherine (“Kaysie”) P. Uniacke |

Beneficial | — | — | |||||||

| Independent Directors |

||||||||||

| Jaime Ardila |

Beneficial | 10,500.62 | * | |||||||

| Carlos E. Evans |

Beneficial | 2,421.06 | * | |||||||

| Ross J. Kari |

Beneficial | 6,400.00 | * | |||||||

| Timothy J. Leach |

Beneficial | 4,745.37 | * | |||||||

| Richard A. Mark |

Beneficial | 3,976.14 | * | |||||||

| Susan B. McGee |

Beneficial | — | — | |||||||

| Executive Officers |

||||||||||

| Alex Chi |

Beneficial | 4,842.12 | * | |||||||

| David Miller |

Beneficial | 12,252.29 | * | |||||||

| Stephanie Rader |

— | — | — | |||||||

| Tucker Greene |

Beneficial | 6,721.62 | * | |||||||

| Stanley Matuszewski |

— | — | — | |||||||

| John Lanza |

— | — | — | |||||||

| Julien Yoo |

— | — | — | |||||||

| Caroline Kraus |

— | — | — | |||||||

| Justin Betzen |

Beneficial | 7,925.59 | * | |||||||

| Greg Watts |

Beneficial | 7,351.38 | * | |||||||

| Jennifer Yang |

— | — | — | |||||||

| Matthew Carter |

— | — | — | |||||||

| All executive officers and directors as a group (19 persons)(2) |

67,136.19 | * | ||||||||

| * | Less than 1%. |

| (1) | Based on the records of the Company’s transfer agent as of May 28, 2025. The address of Nomura Asset Management Co Ltd, a Japanese limited company, is Toyosu Bayside Cross Tower, 2-2-1, Toyosu, Koto-ku, Tokyo, 135-0061, Japan. |

| (2) | The address for each of the Company’s directors and executive officers is c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282. |

| (3) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

4

Dollar Range of Equity Securities Beneficially Owned by Directors

The following table sets out the dollar range of the Company’s equity securities beneficially owned by each of the Company’s directors as of the Record Date. Beneficial ownership is determined in accordance with Rule 16a-1(a)(2) under the Exchange Act. The Company is not part of a “family of investment companies,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

| Name of Director |

Dollar Range of Equity Securities in the Company (1)(2) |

|||

| Interested Director |

||||

| Katherine (“Kaysie”) P. Uniacke |

— | |||

| Independent Directors |

||||

| Jaime Ardila |

over $100,000 | |||

| Carlos E. Evans |

$50,001 – $100,000 | |||

| Ross J. Kari |

over $100,000 | |||

| Timothy J. Leach |

over $100,000 | |||

| Richard A. Mark |

$50,001 – $100,000 | |||

| Susan B. McGee |

— | |||

| (1) | Dollar ranges are as follows: none, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000. |

| (2) | Dollar ranges were determined using the number of shares beneficially owned as of the Record Date multiplied by the net asset value (“NAV”) per share of the Company as of April 30, 2025, which was $25.03. |

5

PROPOSAL 1

ELECTION OF DIRECTORS

The Board is divided into three classes with staggered three-year terms. At each annual meeting of Stockholders, the successors to the class of directors whose term expires at such meeting will be elected to hold office for a term expiring at the annual meeting of Stockholders held in the third year following the year of their election. At the Meeting, you will be asked to elect three Class II directors to serve until the 2028 annual meeting of Stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, removal or disqualification. In addition, the Board has adopted policies which provide that (a) no director shall hold office for more than 15 years and (b) a director shall retire as of December 31st of the calendar year in which he or she reaches his or her 75th birthday, unless a waiver of such requirement has been adopted by a majority of the other directors. These policies may be changed by the directors without a stockholder vote.

Information concerning the nominees and other relevant factors is provided below. A Stockholder may vote his or her shares for or against, or abstain from voting with respect to, the election of each nominee by properly voting by proxy over the internet or by telephone following the instructions in the Notice or by requesting, signing, dating and returning a proxy card as soon as possible. Unless contrary instructions are specified, if a proxy is executed and received prior to the Meeting (and has not been revoked) but no instructions are marked, the proxies will vote “FOR” the nominees.

Each of Ms. Kaysie Uniacke, Mr. Jaime Ardila and Mr. Richard A. Mark has consented to his or her nomination and has agreed to continue to serve if elected. If, at the time of the Meeting, for any reason, Ms. Uniacke, Mr. Ardila or Mr. Mark is not available for election or is not able to serve as a director, the persons named as proxies intend to exercise their voting power in favor of such person as is nominated by the Board as a substitute.

ON MAY 7, 2025, THE BOARD, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDED THAT YOU VOTE “FOR” EACH NOMINEE LISTED ABOVE.

Information about the Nominees and Directors

Set forth below are the names of the nominees for the Class II directors, as well as each of the continuing directors, and their addresses, ages, terms of office, principal occupations for at least the past five years and any other directorships they hold in companies that are subject to the reporting requirements of the Exchange Act or are registered as investment companies under the 1940 Act. Directors who (1) are not deemed to be “interested persons,” as defined in the 1940 Act, of the Company, (2) meet the definition of “independent directors” under the corporate governance standards of the NYSE and (3) meet the independence requirements of Section 10A(m)(3) of the Exchange Act are referred to as “Independent Directors.” Ms. Uniacke is deemed to be an “interested person” of the Company and is referred to as the “Interested Director.”

Ms. Uniacke, Mr. Ardila and Mr. Mark have each been nominated for election as a Class II director to serve until the 2028 annual meeting of stockholders. None of the nominees are being proposed for election pursuant to any agreement or understanding between any such nominees and the Company.

6

Class II Director Nominees

| Name, Age and Address (1) |

Position with the Company |

Term of Office and Length of Service |

Principal Occupation(s) During Past 5 Years |

Other Directorships | ||||

| Interested Director* |

||||||||

| Katherine (“Kaysie”) P. Uniacke (64) |

Class II Director | Director since May 2022; term expires 2025 (2028 if re-elected) | Ms. Uniacke is Chair of the Board—Goldman Sachs Asset Management International (2013-Present) and Advisory Director-Goldman Sachs (2013-Present). She was formerly Director—Goldman Sachs Dublin and Luxembourg family of funds (2013-2023).

Director—the Company, Goldman Sachs BDC, Inc., a business development company (“GS BDC”); Silver Capital Holdings LLC, a privately offered business development company (“SCH”); Goldman Sachs Private Middle Market Credit II LLC, a privately offered business development company (“GS PMMC II”); Goldman Sachs Middle Market Lending Corp. II, a privately offered business development company (“GS MMLC II”); Phillip Street Middle Market Lending Fund LLC, a privately offered business development company (“PSLF”); and West Bay BDC LLC, a privately offered business development company (“West Bay”). |

Goldman Sachs Asset Management International; GS BDC; SCH; GS PMMC II; GS MMLC II; PSLF; West Bay |

7

| Name, Age and Address (1) |

Position with the Company |

Term of Office and Length of Service |

Principal Occupation(s) During Past 5 Years |

Other Directorships | ||||

| Independent Directors |

||||||||

| Jaime Ardila (69) | Class II Director | Director since May 2022; term expires 2025 (2028 if re-elected) | Mr. Ardila is retired. He is Director, Accenture plc (2013-Present), Chairperson, Nexa Resources (2019-Present), and Director, Grupo Energía Bogotá (GEB) (2024-Present). Formerly, he was Director of Ecopetrol (2016-2019); and held senior management positions with General Motors Company (an automobile manufacturer) (1984-1996 and 1998-2016), most recently as Executive Vice President, and President of General Motors’ South America region (2010-2016).

Independent Director—the Company and GS BDC.

Chair of the Board of Directors—SCH, GS PMMC II and PSLF. |

Accenture plc (a management consulting services company); Nexa Resources (a mining company); Grupo Energía Bogotá (an electric utility company); GS BDC; SCH; GS PMMC II; PSLF | ||||

| Richard A. Mark (72) | Class II Director | Director since May 2022; term expires 2025 (2028 if re-elected) | Mr. Mark is retired. He is Director, Viatris Inc. (2020-Present); and Director, Home Centered Care Institute (2021- Present). He was formerly Director, Almost Home Kids (2016-2021) and Director, Mylan N.V. (2019-2020).

Independent Director—the Company, GS BDC and GS MMLC II. |

Viatris Inc.; Home Centered Care Institute; GS BDC; GS MMLC II | ||||

8

| * | Ms. Uniacke is considered to be an “Interested Director” because she holds positions with Goldman Sachs and owns securities issued by GS Group Inc. Ms. Uniacke holds comparable positions with certain other companies of which Goldman Sachs, GSAM or an affiliate thereof is the investment adviser, administrator and/or distributor. |

| (1) | Each nominee and director may be contacted by writing to the nominee or director, c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282. |

Continuing Independent Directors not up for re-election at the Meeting

| Name, Age and Address (1) |

Position with the Company |

Term of Office and Length of Service |

Principal Occupation(s) During Past 5 Years |

Other Directorships | ||||

| Carlos E. Evans (73) |

Class I Director | Director since May 2022; term expires 2027 | Mr. Evans is retired. He is Chairman, Highwoods Properties, Inc. (2018-Present); Director, National Coatings and Supplies Inc. (2015-Present); Director, Warren Oil Company, LLC (2016-Present); Director, American Welding & Gas Inc. (2015-Present); and Director, Johnson Management (2015-Present). He was formerly Director, Sykes Enterprises, Inc. (2016-2021).

Independent Director—the Company, GS BDC, GS MMLC II and West Bay. |

Highwoods Properties, Inc.; National Coatings and Supplies Inc.; Warren Oil Company, LLC; American Welding & Gas Inc.; Johnson Management; GS MMLC II; GS BDC; West Bay | ||||

| Ross J. Kari (66) |

Class III Director | Director since May 2022; term expires 2026(2) | Mr. Kari is retired. Formerly, he was Director, Summit Bank (2014-2022); Executive Vice President and Chief Financial Officer, Federal Home Loan Mortgage Corporation (Freddie Mac) (2009-2013); and was a Member of the Board of Directors of KKR | GS BDC; SCH; GS PMMC II; PSLF | ||||

9

| Name, Age and Address (1) |

Position with the Company |

Term of Office and Length of Service |

Principal Occupation(s) During Past 5 Years |

Other Directorships | ||||

| Financial Holdings, LLC (2007-2014).

Independent Director—the Company, GS BDC, SCH, GS PMMC II and PSLF. |

||||||||

| Timothy J. Leach (69) |

Class I Director | Director since May 2022; term expires 2027 | Mr. Leach is retired. He is Chairman, MN8 Energy Inc. (2021-Present); Chairman, Habitat for Humanity of Sonoma County (2019-Present); Director, Habitat for Humanity of Sonoma County (2017-2019); and Chairman, GS Renewable Power LLC (2021-Present). He was formerly Chief Investment Officer, US Bank Wealth Management (2008-2016) and Treasurer and Director, National Committee to Preserve Social Security & Medicare (2014-2019).

Chair—the Company and GS BDC.

Independent Director—GS MMLC II. |

Habitat for Humanity of Sonoma County; GS Renewable Power LLC; GS BDC; GS MMLC II | ||||

| Susan B. McGee (66) |

Class I Director | Director since May 2022; term expires 2027 | Ms. McGee is retired. She is Director, ETTL Engineers and Consultants, Inc. (2018-Present); and Director, HIVE Digital Technologies Ltd (2021-Present). She was formerly | ETTL Engineers and Consultants, Inc.; HIVE Digital Technologies Ltd; GS BDC; SCH; GS PMMC II; PSLF | ||||

10

| Name, Age and Address (1) |

Position with the Company |

Term of Office and Length of Service |

Principal Occupation(s) During Past 5 Years |

Other Directorships | ||||

| Director, Nobul Corporation (2019-2022) and held senior management positions with U.S. Global Investors, Inc. (an investment management firm), including Chief Compliance Officer (2016-2018), President (1998-2018) and General Counsel (1997-2018). She was also formerly Vice President of the U.S. Global Investors Funds (2016-2018).

Independent Director—the Company, GS BDC, SCH, GS PMMC II and PSLF. |

| (1) | Each nominee and director may be contacted by writing to the nominee or director, c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282. |

| (2) | On May 23, 2025, Ross J. Kari notified the Board that he intends to retire from the Board and all committees thereof, effective as of May 1, 2026. |

The significance or relevance of a nominee’s or director’s particular experience, qualifications, attributes and/or skills is considered by the Board on an individual basis. Experience, qualifications, attributes and/or skills common to all nominees and directors include the ability to critically review, evaluate and discuss information provided to them and to interact effectively with the other directors and with representatives of GSAM and its affiliates, other service providers, legal counsel and the Company’s independent registered public accounting firm, the capacity to address financial and legal issues and exercise reasonable business judgment, and a commitment to the representation of the interests of the Company and the Stockholders. The Governance and Nominating Committee’s charter contains certain other factors that are considered by the Governance and Nominating Committee in identifying and evaluating potential nominees to serve as Independent Directors. Based on each nominee’s experience, qualifications, attributes and/or skills, considered individually and with respect to the experience, qualifications, attributes and/or skills of the other directors, the Board has concluded that each nominee should continue to serve as a director. Below is a brief discussion of the experience, qualifications, attributes and/or skills of each nominee, as well as of the continuing directors, that led the Board to conclude that such individual should serve as a director.

Class II Director Nominees

Interested Director

Kaysie P. Uniacke. Ms. Uniacke is the sole interested director on the Board and has served in such capacity since May 2022. Ms. Uniacke is the Chairperson of the board of Goldman Sachs Asset Management International; serves on the boards of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay, and is

11

an advisory director to GS Group Inc. Previously, she was global chief operating officer of GSAM’s portfolio management business until 2012 and served on the Investment Management Division Client and Business Standards Committee. Prior to this, she was president of Goldman Sachs Trust, the GS mutual fund family, and was head of the Fiduciary Management business within Global Manager Strategies, responsible for business development and client service globally. Earlier in her career, Ms. Uniacke managed GSAM’s U.S. and Canadian Distribution groups. In that capacity, she was responsible for overseeing all North American institutional and third-party sales channels, marketing and client service functions, for which client assets exceeded $200 billion. Before that, Ms. Uniacke was head of GSAM’s Global Cash Services business, where she was responsible for overseeing the management of assets exceeding $100 billion. Ms. Uniacke worked at Goldman Sachs from 1983 to 2012, where she was named managing director in 1997 and partner in 2002. Based on the foregoing, Ms. Uniacke is experienced with financial and investment matters, which we believe makes her well qualified to serve on the Board of Directors.

Independent Directors

Jaime Ardila. Mr. Ardila is retired. Mr. Ardila has served on the Board of Directors of the Company since May 2022, including as Chair of the Board until January 2023. He also serves as a member of the Board of Directors of GS BDC and serves as Chair of the Board of Directors of SCH, GS PMMC II and PSLF. Mr. Ardila is a member of the Board of Directors of Accenture plc, a management consulting services company, where he serves as Chair of the Finance Committee, a member of the Audit Committee, and a member of the Governance and Nominations Committee. He also serves as the Chairperson of the Board of Directors of Nexa Resources S.A., a mining company, and a member of the Board of Directors of Grupo Energía Bogotá, an electric utility company. Previously, he was a member of the Board of Directors of Ola Electric Mobility, an electric vehicle manufacturer, from 2019 - 2023, and was also a member of the Board of Directors of Ecopetrol, an integrated oil company, where he served as Chair of the Audit Committee and a member of the Business Committee and the Corporate Governance and Sustainability Committee, from 2016 to 2019. Mr. Ardila also worked for 29 years at General Motors Company, an automobile manufacturer, where he held several senior management positions, most recently as Executive Vice President of the company and President of General Motors’ South America region. Mr. Ardila joined General Motors in 1984. From 1996 to 1998, Mr. Ardila served as the managing director, Colombian Operations, of N M Rothschild & Sons Ltd, before rejoining General Motors in 1998. Based on the foregoing, Mr. Ardila is experienced with financial and investment matters, which we believe makes him well qualified to serve on the Board of Directors.

Richard A. Mark. Mr. Mark is retired. Mr. Mark has served on the Board of Directors of the Company since May 2022. Mr. Mark has been designated as the Board’s “audit committee financial expert” given his extensive accounting and finance experience. He also serves on the Board of Directors and as the chair of the audit committee of GS BDC and GS MMLC II. Prior to his retirement in 2015, Mr. Mark was a partner at Deloitte & Touche LLP, most recently leading the corporate development function of the advisory business of Deloitte. Mr. Mark began his career at Arthur Andersen & Co. and held various positions with Arthur Andersen, including audit partner, before joining Deloitte in 2002. Since November 2020, Mr. Mark has served on the Board of Directors of Viatris Inc. (“Viatris”), a global pharmaceuticals company. Prior to the closing of the transaction that combined Mylan N.V. and Pfizer Inc.’s off-patent branded and generic established medicines business, which resulted in the formation of Viatris, Mr. Mark served on the Board of Directors of Mylan N.V. from June 2019 until November 2020. Mr. Mark also served from July 2015 until August 2016 as Chairperson of the Board of Directors and as a member of the audit committee of Katy Industries, Inc., a manufacturer, importer and distributor of commercial cleaning and consumer storage products. Since December 2021, Mr. Mark has served on the Board of Directors of the Home Centered Care Institute, a nonprofit organization focused on scaling home-based primary care. From May 2016 to December 2021, Mr. Mark served as a Director of Almost Home Kids, an affiliate of Lurie Children’s Hospital of Chicago, which provides care to children with complicated health needs. Mr. Mark is a certified public accountant. Based on the foregoing, Mr. Mark is experienced with accounting, financial and investment matters, which we believe makes him well qualified to serve on the Board of Directors.

12

Continuing Independent Directors not up for re-election at the Meeting

Carlos E. Evans. Mr. Evans is retired. Mr. Evans has served on the Board of Directors of the Company since May 2022. He also serves on the Board of Directors of GS BDC, GS MMLC II and West Bay, including as Chairperson of the Board of West Bay. Mr. Evans is currently Chairperson of the Board of Directors of Highwoods Properties, Inc., a real estate investment trust, where he serves as Chairperson of the Compensation/Governance Committee and as a member of the Executive Committee. He previously served as chairman of the Compensation/Governance Committee of Highwoods Properties, Inc. Prior to his retirement in 2014, Mr. Evans worked for Wells Fargo Bank, most recently serving as executive vice president and group head of the eastern division of Wells Fargo commercial banking. From 2006 until Wachovia Corporation’s merger with Wells Fargo in 2009, Mr. Evans served as wholesale banking executive and an executive vice president for the Wachovia general banking group. Previously, he held senior management positions with First Union National Bank and with Bank of America and its predecessors, including NationsBank, North Carolina National Bank and Bankers Trust of South Carolina, which he joined in 1973. Mr. Evans is Chairman Emeritus of the Board of Spoleto Festival USA and was previously Chairperson of the Board of the Medical University of South Carolina Foundation. Mr. Evans serves on the boards of four private companies, National Coatings and Supplies Inc., Warren Oil Company, LLC, American Welding & Gas Inc. and Johnson Management. He also previously served on the Board of Directors of Sykes Enterprises, Incorporated, an international provider of outsourced customer contact management services. Based on the foregoing, Mr. Evans is experienced with financial and investment matters, which we believe makes him well qualified to serve on the Board of Directors.

Ross J. Kari. Mr. Kari is retired. Mr. Kari has served on the Board of Directors of the Company since May 2022. He also serves on the Board of Directors of GS BDC, SCH, GS PMMC II, and PSLF. Previously, Mr. Kari was Executive Vice President and Chief Financial Officer of Federal Home Loan Mortgage Corporation (Freddie Mac), where he worked for four years. Previously, he held senior management positions at SAFECO Corporation, a personal insurance company, Federal Home Loan Bank of San Francisco, and Wells Fargo & Company, where he began his career and worked for 19 years. Mr. Kari also served as a Director and a member of the Audit Committee and ALCO Chairperson of Summit Bank. Based on the foregoing, Mr. Kari is experienced with financial and investment matters, which we believe makes him well qualified to serve on the Board of Directors.

Timothy J. Leach. Mr. Leach is retired. Mr. Leach has served on the Board of Directors of the Company since May 2022 and has served as Chair of the Board since January 2023. He also serves as a member and Chair of the Board of Directors of GS BDC and GS MMLC II. Mr. Leach has served as Chairperson of the Board of Directors of MN8 Energy Inc. (f/k/a Goldman Sachs Renewable Power LLC), a renewable energy producer, since 2021. From 2008 until his retirement in July 2016, Mr. Leach served as chief investment officer of US Bank Wealth Management. Prior to joining US Bank, Mr. Leach held senior management positions with U.S. Trust Company and various investment advisers and asset managers, including Wells Fargo Private Investment Advisors, Wells Fargo Alternative Asset Management, ABN Amro Global Asset Management, ABN Amro Asset Management (USA) and Qualivest Capital Management. Based on the foregoing, Mr. Leach is experienced with financial and investment matters, which we believe makes him well qualified to serve on the Board of Directors.

Susan B. McGee. Ms. McGee is retired. Ms. McGee has served on the Board of Directors of the Company since May 2022. She also serves on the Board of Directors of GS BDC, SCH, GS PMMC II, and PSLF. Ms. McGee also serves on the Board of Directors for ETTL Engineers and Consultants Inc., and HIVE Digital Technologies Ltd. Ms. McGee formerly served as a Director for Nobul Corporation, a digital real estate company, from 2019 to 2022. Ms. McGee worked for 26 years at U.S. Global Investors, Inc., an investment management firm, until June 2018, during which time she held several senior management positions, including President, General Counsel and Chief Compliance Officer. She has also been involved in the governance of the U.S. Global Investors Funds, serving as Vice President until June 2018. In addition, Ms. McGee formerly served on the Board of Governors of the Investment Company Institute and as Chairperson of the Investment Company Institute Small Funds Committee until June 2018. She is also a member of the Board of Directors of the San

13

Antonio Sports Foundation, a not-for-profit organization. Based on the foregoing, Ms. McGee is experienced with financial and investment matters, which we believe makes her well qualified to serve on the Board of Directors.

Compensation of Directors

For the fiscal year ended December 31, 2024, each Independent Director was compensated with a $100,000 annual fee (or $50,000 upon the Company’s NAV being less than $1,500,000,000) for his or her services as director. In addition, the Chair of the Board earned an additional annual fee of $25,000 (or $12,500 upon the Company’s NAV being less than $1,500,000,000), and the director designated as the “audit committee financial expert,” as defined in Item 407 of Regulation S-K, earned an additional annual fee of $15,000 (or $7,500 upon the Company’s NAV being less than $1,500,000,000) for his or her additional services in such capacities. The Independent Directors are also reimbursed for travel and other reasonable expenses incurred in connection with attending Board and committee meetings. No compensation is paid by the Company to any directors who are “interested persons,” as that term is defined in the Investment Company Act.

In addition, the Company purchases liability insurance on behalf of the directors. The Company may also pay the incidental costs of a director to attend training or other types of conferences relating to the business development company (“BDC”) industry.

It is the responsibility of the Independent Directors to review their own compensation and recommend to all of the directors the appropriate level of compensation. This level of compensation may be adjusted from time to time. In conducting their review, the Independent Directors use such information as they deem relevant, including compensation paid to directors of other BDCs of similar size and the time and effort required of the directors in fulfilling their responsibilities to the Company.

The following table shows information regarding the compensation earned by the Independent Directors for the fiscal year ended December 31, 2024.

| Total Compensation From the Company(1) |

Total Compensation From the Goldman Sachs Fund Complex(2) |

|||||||

| Interested Director |

||||||||

| Kaysie P. Uniacke(3) |

— | — | ||||||

| Independent Directors |

||||||||

| Jaime Ardila |

$ | 100,000 | $ | 445,000 | ||||

| Carlos E. Evans |

$ | 100,000 | $ | 376,667 | ||||

| Ross Kari |

$ | 100,000 | $ | 409,000 | ||||

| Timothy J. Leach(4) |

$ | 125,000 | $ | 436,000 | ||||

| Richard A. Mark(5) |

$ | 115,000 | $ | 395,000 | ||||

| Susan B. McGee |

$ | 100,000 | $ | 385,000 | ||||

| (1) | The Company did not award any portion of the fees earned by its directors in stock or options during the year ended December 31, 2024. The Company does not have a profit-sharing plan, and directors do not receive any pension or retirement benefits from us. |

| (2) | Reflects compensation earned during the year ended December 31, 2024. For the Independent Directors, the Goldman Sachs Fund Complex includes the Company, GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. |

| (3) | Ms. Uniacke is an Interested Director and, as such, receives no compensation from the Company or the Goldman Sachs Fund Complex for her service as director or trustee. |

| (4) | Includes compensation as Chairman of the Board. |

| (5) | Includes compensation as “audit committee financial expert.” |

14

Board Composition and Leadership Structure

The Company’s business and affairs are managed under the direction of the Board. The Board consists of seven directors, six of whom are Independent Directors. The Board elects the Company’s officers, who serve at the discretion of the Board. The responsibilities of the Board include oversight of valuation of the Company’s assets, corporate governance activities, oversight of the Company’s financing arrangements and oversight of its investment activities.

The Board’s role in the management of the Company is one of oversight. Oversight of the Company’s investment activities extends to oversight of the risk management processes employed by GSAM as part of its day-to-day management of the Company’s investment activities. The Board reviews risk management processes at both regular and special Board meetings throughout the year, consulting with appropriate representatives of GSAM as necessary and periodically requesting the production of risk management reports or presentations. The goal of the Board’s risk oversight function is to ensure that the risks associated with the Company’s investment activities are accurately identified, thoroughly investigated and responsibly addressed. The Board’s oversight function cannot, however, eliminate all risks or ensure that particular events do not adversely affect the value of the Company’s investments. The Board also oversees the valuation of the Company’s assets.

The Board has established an Audit Committee, Governance and Nominating Committee, Compliance Committee and Contract Review Committee. The scope of each committee’s responsibilities is discussed in greater detail below.

Timothy J. Leach, an Independent Director, serves as Chairperson of the Board. The Board believes that it is in the best interests of the Stockholders for Mr. Leach to lead the Board because of his familiarity with the Company’s portfolio companies, his broad corporate background and experience with financial and investment matters and his significant senior management experience, as described above. Mr. Leach will generally act as a liaison between management, officers and attorneys between meetings of the Board and presides over all executive sessions of the Independent Directors without management. The Board believes that its leadership structure is appropriate because the structure allocates areas of responsibility among the individual directors and the committees in a manner that enhances effective oversight. The Board also believes that its size creates an efficient corporate governance structure that provides the opportunity for direct communication and interaction between management and the Board.

The Board had four formal meetings in 2024. Each director attended at least 75% of the meetings of the Board and of the respective committees on which he or she served during the fiscal year ended December 31, 2024. To promote effectiveness of the Board, under normal circumstances directors are strongly encouraged to attend regularly scheduled Board meetings in person.

Committees of the Board

Audit Committee

The members of the Audit Committee are Mr. Ardila, Mr. Evans, Mr. Kari, Mr. Leach, Mr. Mark and Ms. McGee, each of whom is an Independent Director. Mr. Ardila simultaneously serves on the audit committees of more than three public companies, and the Board has determined that his simultaneous service on the audit committees of other public companies does not impair his ability to effectively serve on the Audit Committee. Mr. Mark serves as Chairman of the Audit Committee. The Board and the Audit Committee have determined that Mr. Mark is an “audit committee financial expert,” as defined in Item 407 of Regulation S-K under the Exchange Act.

The Audit Committee is responsible for overseeing matters relating to the appointment and activities of the Company’s auditors, audit plans and procedures, various accounting and financial reporting issues and changes in accounting policies, and reviewing the results and scope of the audit and other services provided by the

15

independent public accountants. The Audit Committee is also responsible for aiding the Board in its oversight of the Investment Adviser’s fair value determinations and processes of the Company’s portfolio investments. The Audit Committee’s charter was attached as Appendix A to the Company’s Proxy Statement for its 2024 Annual Meeting of Stockholders, filed on April 3, 2024.

The Audit Committee held four formal meetings in 2024.

Governance and Nominating Committee

The members of the Governance and Nominating Committee are Mr. Ardila, Mr. Evans, Mr. Kari, Mr. Leach, Mr. Mark and Ms. McGee, each of whom is an Independent Director. Mr. Leach serves as the Chair of the Governance and Nominating Committee. The Governance and Nominating Committee is responsible for identifying, researching and nominating Independent Directors for election, selecting nominees to fill vacancies on the Board or a committee of the Board, determining, or recommending to the Board for determination, the compensation of the Independent Director, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and management.

All candidates nominated for an Independent Director position must meet applicable independence requirements and have the capacity to address financial and legal issues and exercise reasonable business judgment. The Governance and Nominating Committee considers a variety of criteria in evaluating candidates (including candidates nominated by a Stockholder), including (1) experience in business, financial or investment matters or in other fields of endeavor; (2) financial literacy and/or whether he or she is an “audit committee financial expert,” as defined in Item 407 of Regulation S-K; (3) reputation; (4) ability to attend scheduled Board and committee meetings; (5) general availability to attend to Board business on short notice; (6) actual or potential business, family or other conflicts bearing on either the candidate’s independence or the business of the Company; (7) length of potential service; (8) commitment to the representation of the interests of the Company and the Stockholders; (9) commitment to maintaining and improving his or her skills and education; (10) experience in corporate governance and best business practices; and (11) the diversity that he or she would bring to the Board’s composition.

The Governance and Nominating Committee considers nominees properly recommended by a Stockholder. The Company’s amended and restated bylaws (the “Bylaws”) provide that for any nomination to be properly brought by a Stockholder for a meeting, such Stockholder must comply with advance notice requirements and provide the Company with certain information. Generally, to be timely, a Stockholder’s notice must be received at the Company’s principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the immediately preceding annual meeting of Stockholders. The Company’s Bylaws further provide that nominations of persons for election to the Board at a special meeting may be made only by or at the direction of the Board and, provided that the Board has determined that directors will be elected at the meeting, by a Stockholder who is entitled to vote at the meeting and who has complied with the advance notice provisions of the Bylaws. The Governance and Nominating Committee’s charter was attached as Appendix B to the Company’s Proxy Statement for its 2024 Annual Meeting of Stockholders, filed on April 3, 2024.

The Governance and Nominating Committee held three formal meetings in 2024.

Compliance Committee

The members of the Compliance Committee are Mr. Ardila, Mr. Evans, Mr. Kari, Mr. Leach, Mr. Mark and Ms. McGee, each of whom is an Independent Director. Mr. Leach serves as Chair of the Compliance Committee. The Compliance Committee is responsible for overseeing the Company’s compliance processes, and insofar as they relate to services provided to us, the compliance processes of the investment adviser, underwriters (if any), administrator and transfer agent, distribution paying agent and registrar (“Transfer Agent”), except that

16

compliance processes relating to the accounting and financial reporting processes and certain related matters are overseen by the Audit Committee. In addition, the Compliance Committee provides assistance to the full Board with respect to compliance matters.

The Compliance Committee held four formal meetings in 2024.

Contract Review Committee

The members of the Contract Review Committee are Mr. Ardila, Mr. Evans, Mr. Kari, Mr. Leach, Mr. Mark and Ms. McGee, each of whom is an Independent Director. Mr. Leach serves as Chair of the Contract Review Committee. The Contract Review Committee is responsible for overseeing the processes of the Board for reviewing and monitoring performance under the Company’s investment management, placement agency, transfer agency and certain other agreements with GSAM and its affiliates. The Contract Review Committee also provides appropriate assistance to the Board in connection with the Board’s approval, oversight and review of the Company’s other service providers, including the Company’s custodian/accounting agent, Transfer Agent, printing firms, and professional firms (other than the Company’s independent auditor, which is the responsibility of the Audit Committee).

The Contract Review Committee held one formal meeting in 2024.

Information about Executive Officers who are not Directors

Set forth below is certain information about the Company’s executive officers who are not directors:

| Name |

Age |

Position(s) with the Company | ||

| Alex Chi |

52 | Co-Chief Executive Officer and Co-President | ||

| David Miller |

55 | Co-Chief Executive Officer and Co-President | ||

| Stanley Matuszewski |

39 | Chief Financial Officer and Treasurer | ||

| Tucker Greene |

50 | Chief Operating Officer | ||

| Stephanie Rader |

42 | Executive Vice President and Head of Business Development | ||

| John Lanza |

54 | Principal Accounting Officer | ||

| Julien Yoo |

53 | Chief Compliance Officer | ||

| Caroline Kraus |

48 | Chief Legal Officer and Secretary | ||

| Justin Betzen |

45 | Vice President | ||

| Greg Watts |

48 | Vice President | ||

| Jennifer Yang |

41 | Vice President | ||

| Matthew Carter |

38 | Vice President |

The address for each executive officer is c/o Goldman Sachs Asset Management, L.P., 200 West Street, New York, New York 10282. Each officer holds office at the pleasure of the Board until the next election of officers and until his or her successor is duly elected and qualifies.

Alex Chi. Mr. Chi is the Co-Chief Executive Officer and Co-President of the Company and has served in such capacity since May 2022. Mr. Chi is also the Co-Chief Executive Officer and Co-President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. Mr. Chi is co-head of Goldman Sachs Asset Management Private Credit in the Americas. Before assuming his current role, Mr. Chi spent 25 years in Goldman Sachs’ Investment Banking Division. Mr. Chi worked in the Financial and Strategic Investors Group from 2006 to 2019, managing Goldman Sachs’ relationships with private equity and related portfolio company clients. Prior to that, Mr. Chi worked in Leveraged Finance, where he spent six years structuring and executing leveraged loan and high yield debt financings for corporate and private equity clients across industries. He also spent three years in Asia focused on mergers and acquisitions and corporate finance transactions. Mr. Chi was named managing director in 2006 and partner in 2012.

17

David Miller. Mr. Miller is the Co-Chief Executive Officer and Co-President of the Company and has served in such capacity since May 2022. Mr. Miller is also the Co-Chief Executive Officer and Co-President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. Mr. Miller is co-head of Goldman Sachs Asset Management Private Credit in the Americas. He has spent his nearly 30-year career as an investor in middle market companies and has originated billions of dollars in commitments across all industries to companies in various stages of the lifecycle. In 2004, he co-founded Goldman Sachs’ middle market origination effort investing primarily firm capital and has led that business since 2013. Prior to joining Goldman Sachs in 2004, Mr. Miller was senior vice president of originations for GE Capital, where he was responsible for structuring and originating loans in the media and telecommunications sectors. Previously, Mr. Miller was a director at SunTrust Bank, responsible for originating and managing a portfolio of middle market loans. Mr. Miller was named managing director in 2012 and partner in 2014.

Stephanie Rader. Ms. Rader is the Executive Vice President and head of business development of the Company and has served in such capacity since May 2022. Ms. Rader is global co-head of Alternatives Capital Formation within GSAM, with responsibility for capital raising, product strategy, research and investor relations across private equity, private credit, real estate, infrastructure, sustainability and hedge funds/liquid alternatives. Prior to her current role, she served as global head of Private Credit Client Solutions for GSAM. Before that, Ms. Rader was head of Distressed and Bank Loan Sales within Global Markets. Ms. Rader joined Goldman Sachs in 2004 and was named managing director in 2015 and partner in 2018.

Tucker Greene. Mr. Greene is the Chief Operating Officer of the Company and has served in such capacity since June 2023. Mr. Greene is also the Chief Operating Officer of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. Mr. Greene previously served as a Vice President of the Company from August 2022 to June 2023, and also previously served as a Vice President of GS BDC, SCH, GS PMMC II, GS MMLC II, and PSLF. In addition, he is a managing director in Goldman Sachs Asset Management Private Credit. He is a senior portfolio manager focused on fund management. Prior to his current role, Mr. Greene was a senior originator and underwriter in Goldman Sachs Asset Management Private Credit. Mr. Greene joined Goldman Sachs in 2004 in the Specialty Lending Group, primarily investing firm capital in directly originated middle market loans. Prior to joining Goldman Sachs, Mr. Greene worked at GE Capital, focusing on underwriting loans in the media and telecommunications sector. Mr. Greene was named managing director in 2021.

Stanley Matuszewski. Mr. Matuszewski is the Chief Financial Officer and Treasurer of the Company and has served in such capacity since November 2023. Mr. Matuszewski is also the Chief Financial Officer and Treasurer of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. He is a Vice President within the Private Credit Group of GSAM. Prior to this role, he managed the Business Development Companies Asset Management Product Controllers team within the Controllers Division, which is responsible for valuation oversight. Prior to joining Goldman Sachs & Co. LLC in 2013, he worked at Morgan Stanley in the Valuation Review Group.

John Lanza. Mr. Lanza is the Principal Accounting Officer of the Company and has served in such capacity since November 2023. Mr. Lanza is also the Principal Accounting Officer of GS BDC, SCH, GS PMMC II, GS MMLC II, and PSLF. Mr. Lanza has held several positions with GSAM. Mr. Lanza currently manages the Business Development Companies and Direct Hedge Funds Asset Management Fund Controllers teams, which are responsible for accounting and financial reporting oversight. He previously served as the head of Operational Risk and Governance in the Consumer and Wealth Management Division. Prior to that, Mr. Lanza was the global head of Regulatory Reform and Control Oversight and before that he managed the Goldman Sachs Asset Management Alternative Investments Global Fund Services Group.

Caroline Kraus. Ms. Kraus is the Chief Legal Officer and Secretary of the Company and has served in such capacity since August 2022. Ms. Kraus is also a Managing Director and Senior Counsel at GSAM and the Chief Legal Officer and Secretary of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay, as well as various other Goldman Sachs funds. Ms. Kraus joined Goldman Sachs in 2006. Prior to joining Goldman Sachs, she was an associate at Weil, Gotshal & Manges, LLP.

18

Julien Yoo. Ms. Yoo is the Chief Compliance Officer of the Company and has served in such capacity since May 2022. Ms. Yoo is also the Managing Director of GSAM Compliance, Head of the U.S. Regulatory Compliance team with GSAM Compliance, and Chief Compliance Officer of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. Ms. Yoo joined Goldman Sachs in 2013. Prior to joining Goldman Sachs, Ms. Yoo was a Vice President in the legal department of Morgan Stanley Investment Management. Prior to joining Morgan Stanley, she was an associate at Shearman & Sterling, LLP and at Swidler Berlin Shereff Friedman, LLP.

Justin Betzen. Mr. Betzen is a Vice President of the Company and has served in such capacity since August 2022. Mr. Betzen is also a Vice President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. He is also a managing director and senior underwriter in Goldman Sachs Asset Management Private Credit in the Americas. Mr. Betzen initially joined Goldman Sachs in 2006 as an associate and rejoined the firm as a vice president in 2013. He was named managing director in 2019. Prior to rejoining the firm, Mr. Betzen worked at Newstone Capital Partners and was focused on second lien, mezzanine and minority equity investing. Prior to initially joining Goldman Sachs, he worked at JPMorgan Chase in the Technology Corporate Banking Group and was focused on software, services and payments companies.

Greg Watts. Mr. Watts is a Vice President of the Company and has served in such capacity since August 2022. Mr. Watts is also a Vice President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. He also serves as head of underwriting and portfolio management for Goldman Sachs Asset Management Private Credit in the Americas. He has spent greater than 20 years as a credit investor in middle market companies and has overseen billions of dollars of investments from origination to exit as well as a significant amount of experience in workouts and restructurings. Mr. Watts is a member of the Private Credit Investment Committee, which focuses on middle market lending primarily via the Goldman Sachs balance sheet. Mr. Watts joined Goldman Sachs in 2007 and was named managing director in 2015 and partner in 2022. Prior to joining Goldman Sachs, Mr. Watts spent five years with GE Capital’s Technology, Media and Telecom Finance Group as a senior vice president and risk team leader in underwriting and portfolio management. Before working at GE Capital, Mr. Watts was an associate at Investcorp International after beginning his career as an investment banking analyst in Salomon Smith Barney’s Mergers and Acquisitions Group.

Jennifer Yang. Ms. Yang is a Vice President of the Company and has served in such capacity since August 2022. Ms. Yang is also a Vice President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. She is also a managing director in Credit Alternatives within GSAM, with oversight of Healthcare. She is responsible for leading and managing the healthcare investment strategy and portfolio. Ms. Yang joined Goldman Sachs in 2018 as a Vice President and was named managing director in 2021. Prior to joining Goldman Sachs, Ms. Yang was an executive director at Varagon Capital Partners, where she was responsible for structuring, executing and managing credit investments in the healthcare sector. Previously, she was a vice president at Fifth Street Asset Management, focused on healthcare deal execution.

Matthew Carter. Mr. Carter is a Vice President of the Company and has served in such capacity since February 2025. Mr. Carter is also a Vice President of GS BDC, SCH, GS PMMC II, GS MMLC II, PSLF, and West Bay. Mr. Carter is a managing director and senior underwriter in Private Credit within Asset & Wealth Management at Goldman Sachs. He leads workout and restructuring activities for the U.S. direct lending business. Mr. Carter joined Goldman Sachs in 2014 as an associate in the Specialty Lending Group within the Special Situations Group and was named managing director in 2023. Prior to joining Goldman Sachs, Mr. Carter worked in the Investment Banking Division at Barclays Capital for five years and started his career in the Private Fund Investments Group at Lehman Brothers.

Certain Relationships and Related Party Transactions

Investment Management Agreement

The Company is party to an investment management agreement, pursuant to which the Company pays GSAM, a wholly owned subsidiary of GS Group Inc., a fee for investment management services consisting of a

19

management fee based on the Company’s net assets and an incentive fee based on the performance of the Company’s investments. Certain of the Company’s officers are also officers and employees of GSAM.

The management fee is calculated at an annual rate of 1.25% of the value of the Company’s net assets as of the beginning of the first calendar day of the applicable month, and the incentive fee is calculated based on (a) the amount by which our ordinary income exceeds certain “hurdle rates,” and (b) our capital gains.

For the year ended December 31, 2024, the Company paid GSAM a total of approximately $51.75 million in fees (excluding fees that are accrued but not paid and net of fee waivers by GSAM) pursuant to the investment management agreement, which consisted of $27.46 million in management fees and $24.29 million in incentive fees.

License Agreement

The Company is party to a license agreement with an affiliate of Goldman Sachs pursuant to which the Company has been granted a non-exclusive, royalty-free license to use the “Goldman Sachs” name. Under this agreement, the Company does not have a right to use the Goldman Sachs name if GSAM or another affiliate of Goldman Sachs is not the Company’s investment adviser or if the Company’s continued use of such license results in a violation of applicable law, results in a regulatory burden or has adverse regulatory consequences. Other than with respect to this limited license, the Company has no legal right to the “Goldman Sachs” name.

Co-Investment Opportunities

In certain circumstances, we and other client accounts managed by our Investment Adviser, which may include proprietary accounts of Goldman Sachs (collectively, the “Accounts”) can make negotiated co-investments pursuant to an exemptive order from the SEC permitting us to do so (the “Relief”). On May 21, 2025, the SEC granted the Relief to the Investment Adviser, the BDCs advised by the Investment Adviser and certain other affiliated applicants, which superseded the prior co-investment exemptive relief received on November 16, 2022, as amended on June 25, 2024 (the “Prior Relief”). The Relief contains certain conditions and requires the majority of our independent directors to make certain conclusions in connection with certain co-investment transactions, including co-investment transactions in which an affiliate of ours is an existing investor in the portfolio company, non-pro rata follow on investments and non-pro rata dispositions of investments, and requires the Board to maintain oversight of our participation in the co-investment program. If our Investment Adviser forms other funds in the future, we may co-invest alongside such other affiliates, subject to compliance with the Relief, applicable regulations and regulatory guidance, as well as applicable allocation procedures. As a result of the Relief, there could be significant overlap in our investment portfolio and the investment portfolios of other Accounts.

Transfer Agent Agreement

The Company has entered into a transfer agency agreement (the “Transfer Agency Agreement”) with Goldman Sachs & Co. LLC (“GS & Co.”) pursuant to which GS & Co. serves as the Company’s transfer agent (“Transfer Agent”), registrar and distribution paying agent. The Company pays the Transfer Agent at an annual rate of 0.05% of the Company’s average NAV at the end of the then-current quarter and the prior calendar quarter (and, in the case of the Company’s first quarter, its NAV as of such quarter-end) for serving as the Company’s transfer agent.

For the year ended December 31, 2024, the Company incurred expenses for services provided by the Transfer Agent under the Transfer Agency Agreement of approximately $1.57 million. As of December 31, 2024, approximately $553,000 remained payable.

20

Placement Agent Agreement

The Company has entered into an agreement with GS & Co. (the “Placement Agent”) pursuant to which GS & Co. assists the Company in conducting the continuous private offering of the Company’s shares (the “Offering”). GS & Co. has entered into or will enter into sub-placement agreements (together with the agreements with GS & Co., the “Placement Agent Agreements”) with various sub-placement agents to assist in conducting the Offering. Stockholder servicing and/or distribution fees will be payable to the Placement Agent. The Placement Agent may also be compensated by GSAM, in its discretion, for certain services including promotional and marketing support, shareholder servicing, operational and recordkeeping, sub-accounting, networking or administrative services. These payments are made out of GSAM’s own resources and/or assets, including from the revenues or profits derived from the advisory fees GSAM receives from the Company.

Related Party Transaction Review Policy

The Audit Committee will review any potential related party transactions brought to its attention, and, during these reviews, will consider any conflicts of interest brought to its attention pursuant to the Company’s Code of Ethics. Each of the Company’s directors and executive officers is instructed and periodically reminded to inform GSAM Compliance of any potential related party transactions. In addition, each such director and executive officer completes a questionnaire on an annual basis designed to elicit information about any potential related party transactions.

21

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At a meeting held on February 26, 2025, the Audit Committee selected and recommended, and at a meeting held on February 26, 2025, the Board, including a majority of the Independent Directors approved, the selection of PricewaterhouseCoopers LLP to act as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2025. This selection is presented for ratification by the Stockholders. If the Stockholders fail to ratify the selection of PricewaterhouseCoopers LLP to serve as the independent registered public accounting firm for the year ending December 31, 2025, the Audit Committee and the Board will reconsider the continued retention of PricewaterhouseCoopers LLP.

Representatives of PricewaterhouseCoopers LLP are expected to be available telephonically during the Meeting and will be available to respond to appropriate questions from Stockholders if necessary. Representatives of PricewaterhouseCoopers LLP will be given the opportunity to make statements at the Meeting, if they so desire.

Audit Fees

The aggregate audit fees billed by PricewaterhouseCoopers LLP for the year ended December 31, 2024 and for the year ended December 31, 2023 were $637,800 and $454,200, respectively.

Fees included in the audit fees category are those associated with the annual audits of financial statements, review of the financial statements included in the Company’s Quarterly Reports on Form 10-Q and services that are normally provided in connection with statutory and regulatory filings.

Audit-Related Fees

No audit-related fees were billed by PricewaterhouseCoopers LLP to the Company for the year ended December 31, 2024 and for the year ended December 31, 2023.

Audit-related fees are for any services rendered to the Company that are reasonably related to the performance of the audits or reviews of the Company’s consolidated financial statements (but not reported as audit fees above). These services include attestation services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards.

The aggregate audit-related fees billed by PricewaterhouseCoopers LLP to GSAM, and any entity controlling, controlled by, or under common control with, GSAM, that provides ongoing services to the Company, for engagements directly related to the Company’s operations and financial reporting, for the year ended December 31, 2024 and for the year ended December 31, 2023 were $1,578,918 and $1,555,770, respectively. These amounts represent fees PricewaterhouseCoopers LLP billed to GSAM for services related to the SSAE 18 report and Goldman Sachs & Co. LLC for services related to the 17Ad-13 report.

Tax Fees

No fees were billed by PricewaterhouseCoopers LLP for services rendered to the Company for tax compliance, tax advice and tax planning for the year ended December 31, 2024 and for the year ended December 31, 2023.

Fees included in the tax fees category comprise all services performed by professional staff in the independent registered public accountant’s tax division except those services related to the audits. This category comprises fees for tax compliance services provided in connection with the preparation and review of the Company’s tax returns.

22

No tax fees were billed by the Company’s independent registered public accountant to GSAM, and any entity controlling, controlled by, or under common control with, GSAM, that provides ongoing services to the Company, for engagements directly related to the Company’s operations and financial reporting, for the year ended December 31, 2024 and for the year ended December 31, 2023.

All Other Fees

No fees were billed by PricewaterhouseCoopers LLP to the Company for products and services provided to the Company, other than the services reported in “Audit Fees” above, for the year ended December 31, 2024 and for the year ended December 31, 2023.