Please wait

0001921963DEF 14Afalse00019219632023-01-012023-12-31iso4217:USD000192196312023-01-012023-12-310001921963atmu:ChangeInPensionValueMemberecd:PeoMember2023-01-012023-12-310001921963atmu:PensionAdjustmentsServiceCostMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsReportedValueMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ChangeInPensionValueMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963atmu:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963ecd:NonPeoNeoMemberatmu:EquityAwardsReportedValueMember2023-01-012023-12-310001921963ecd:NonPeoNeoMemberatmu:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963atmu:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963ecd:NonPeoNeoMemberatmu:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001921963atmu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963atmu:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963atmu:EquityAwardAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310001921963atmu:StephanieJ.DisherMemberatmu:A2023LTIMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LaunchGrantMemberatmu:StephanieJ.DisherMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202123StubCycleMemberatmu:StephanieJ.DisherMemberecd:PeoMember2023-01-012023-12-310001921963atmu:StephanieJ.DisherMemberatmu:ConvertedAward202224StubCycleMemberecd:PeoMember2023-01-012023-12-310001921963atmu:OffCycleSignOnEquityMemberatmu:StephanieJ.DisherMemberecd:PeoMember2023-01-012023-12-310001921963atmu:StephanieJ.DisherMemberatmu:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001921963atmu:JackKienzlerMemberatmu:A2023LTIMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LaunchGrantMemberatmu:JackKienzlerMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202123StubCycleMemberatmu:JackKienzlerMemberecd:PeoMember2023-01-012023-12-310001921963atmu:JackKienzlerMemberatmu:ConvertedAward202224StubCycleMemberecd:PeoMember2023-01-012023-12-310001921963atmu:OffCycleSignOnEquityMemberatmu:JackKienzlerMemberecd:PeoMember2023-01-012023-12-310001921963atmu:JackKienzlerMemberatmu:EquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LTIMemberatmu:ReneeSwanMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LaunchGrantMemberatmu:ReneeSwanMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202123StubCycleMemberatmu:ReneeSwanMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ReneeSwanMemberatmu:ConvertedAward202224StubCycleMemberecd:PeoMember2023-01-012023-12-310001921963atmu:OffCycleSignOnEquityMemberatmu:ReneeSwanMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardAdjustmentsMemberatmu:ReneeSwanMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LTIMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LaunchGrantMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202123StubCycleMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202224StubCycleMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:OffCycleSignOnEquityMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardAdjustmentsMemberatmu:ToniY.HickeyMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LTIMemberatmu:CharlesMastersMemberecd:PeoMember2023-01-012023-12-310001921963atmu:A2023LaunchGrantMemberatmu:CharlesMastersMemberecd:PeoMember2023-01-012023-12-310001921963atmu:ConvertedAward202123StubCycleMemberatmu:CharlesMastersMemberecd:PeoMember2023-01-012023-12-310001921963atmu:CharlesMastersMemberatmu:ConvertedAward202224StubCycleMemberecd:PeoMember2023-01-012023-12-310001921963atmu:OffCycleSignOnEquityMemberatmu:CharlesMastersMemberecd:PeoMember2023-01-012023-12-310001921963atmu:EquityAwardAdjustmentsMemberatmu:CharlesMastersMemberecd:PeoMember2023-01-012023-12-310001921963ecd:NonPeoNeoMember12023-01-012023-12-310001921963ecd:NonPeoNeoMember22023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

___________________________

| | | | | | | | | | | |

Filed by the Registrant | x | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | | | | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

x | Definitive Proxy Statement |

| | | | | |

| ☐ | Definitive Additional Materials |

| | | | | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Atmus Filtration Technologies Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| | | | | | | | | | | | | | | | | |

|

Invitation to 2024 Annual Meeting of Stockholders |

| | | | | |

Dear Fellow Stockholder:

We are pleased to invite you to join us, our Board of Directors, executive officers, associates and other stockholders at Atmus' 2024 Annual Meeting of Stockholders. The attached notice of our 2024 Annual Meeting of Stockholders and Proxy Statement, which we are providing to stockholders beginning on March 27, 2024, contain details of the stockholder business to be conducted at the meeting. |

| |

Atmus is a global leader in filtration products for on-highway commercial vehicles and off-highway vehicles and equipment. We have a strong reputation and with over 65 years of experience we bring the track record and know-how of a well-established business coupled with the energy and spirit of a new company poised and ready to unlock profitable growth. Atmus was launched through the successful Initial Public Offering (IPO) of the company in May 2023. Since then, we have continued to build trust with all our stakeholders in our first year as a publicly traded company and we have made significant progress in creating our company and establishing the way we want to operate at Atmus. |

| | | | |

| 2023 Highlights: | | |

| | | | |

| | Setting Atmus up as a fully independent company through our successful IPO and subsequent successful share exchange |

| | | | |

| | Implementing our growth strategy and delivering strong financial performance |

| | | | |

| | •Net sales in 2023 of $1,628 million, an increase of $66.0 million, 4.2% over 2022. •Expansion of margins by 300 bps to 18.6% adjusted EBITDA margin. •Strong cash flow and liquidity. Net debt to EBITDA of 1.4X leaving us well positioned to further execute our growth strategy. |

| | | | |

| | Executing a disciplined separation from Cummins |

| | | | |

| | •Well positioned to complete the separation of services from Cummins by the end of 2024. Progress in 2023 establishing independent distribution centers, technical centers, and standalone functions is aligned with our plan. |

| | | | |

| Ahead of our first Annual Meeting of Stockholders, we thank you in advance for voting and for your continued support of Atmus. |

| | | | |

|

| Steph Disher | | Steve Macadam |

| | Chief Executive Officer | | Chair of the Board |

| | | | |

For a reconciliation of non-GAAP performance measures to the most directly comparable financial measures calculated in accordance with U.S. GAAP, see Appendix A. |

| | | | | | | | |

| |

DATE May 14, 2024

TIME 10:00 a.m. Central Time

RECORD DATE March 21, 2024

VOTING

BY THE INTERNET Visit the website noted on your proxy card to vote online

BY TELEPHONE Use the toll-free telephone number on your proxy card to vote by telephone

BY MAIL Sign, date, and return your proxy card in the enclosed envelope to vote by mail. |

Notice of 2024 Annual Meeting of Stockholders |

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of the Stockholders (the “Annual Meeting”) of Atmus Filtration Technologies Inc. will be held virtually on May 14, 2024, at 10:00 a.m. Central Time, at www.virtualshareholdermeeting.com/ATMU2024. The Annual Meeting will be held for the following purposes: |

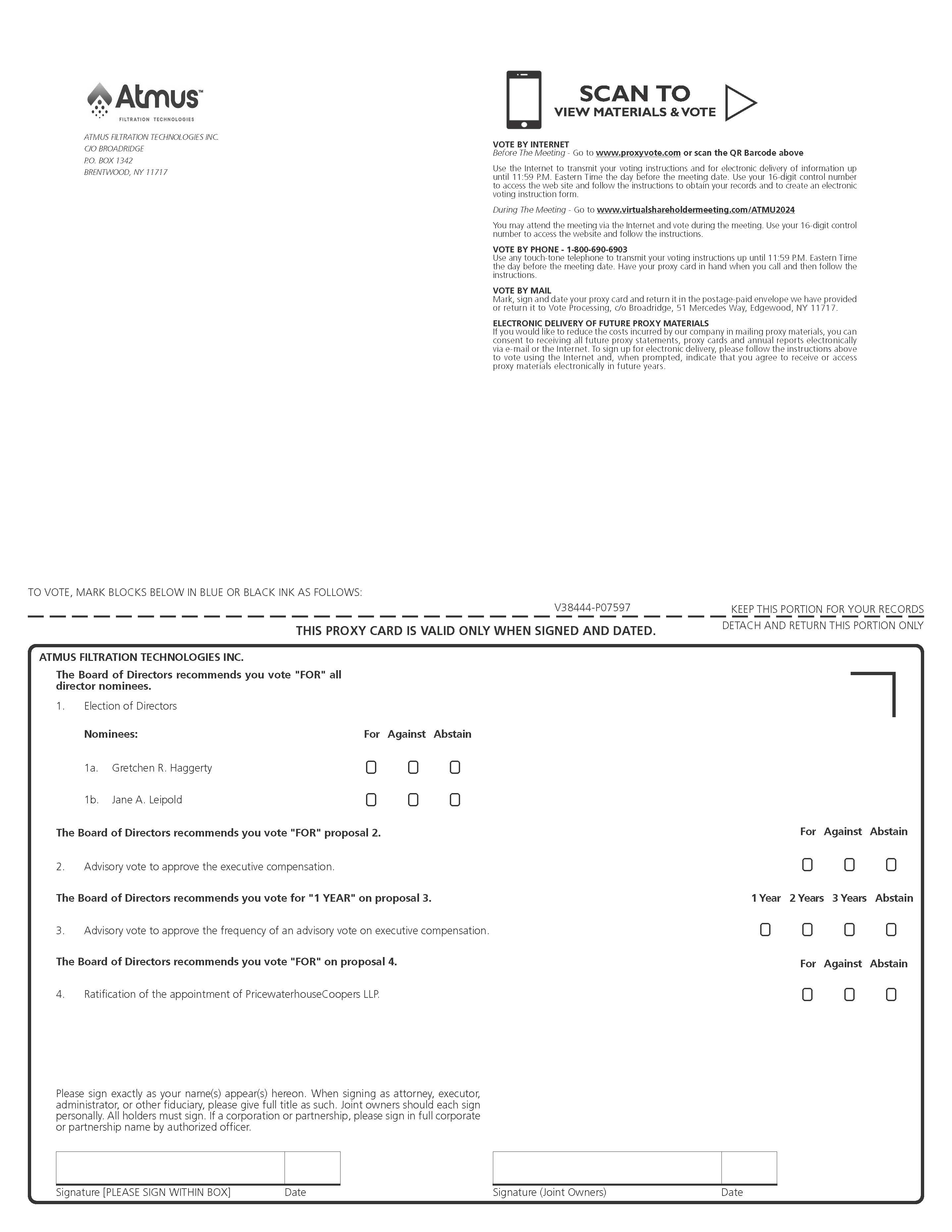

| 1 | to elect the two director nominees named in the attached Proxy Statement to serve for three-year terms expiring in 2027; |

| 2 | to consider an advisory vote to approve the compensation of our named executive officers; |

| 3 | to consider an advisory vote to approve the frequency of stockholder advisory votes on the compensation of our named executive officers; |

| 4 | to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024; and |

| 5 | to transact any other business that may properly come before the meeting or any adjournment thereof. |

The Annual Meeting, our first annual meeting as a standalone public company, will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically. We believe a virtual meeting allows broader access by our stockholders and other parties without restricting participation, while also reducing the environmental impact and cost of conducting the meeting.

To attend and vote during the Annual Meeting, please visit www.virtualshareholdermeeting.com/ATMU2024 (the “Annual Meeting Website”) and enter the control number found on your proxy card or voting instruction form (the “Control Number”). You may vote your shares and submit your questions during the Annual Meeting by entering your Control Number and following the instructions that are also available on the Annual Meeting Website. Your vote is important to us. Even if you plan on attending the Annual Meeting, we urge you to vote and submit your proxy in advance using one of the methods described in the accompanying proxy materials. Only stockholders of record at the close of business on March 21, 2024, are entitled to notice of and to vote at the Annual Meeting.

A notice of Internet availability of proxy materials, or a Proxy Statement, proxy card and Annual Report, are first being sent to stockholders on or about March 27, 2024.

By Order of the Board of Directors

Toni Y. Hickey Chief Legal Officer & Corporate Secretary |

TABLE OF CONTENTS

PROXY STATEMENT FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement contains information about the 2024 annual meeting of stockholders (the “Annual Meeting”) of Atmus Filtration Technologies Inc. (the “Company”, “Atmus”, “ATMU”, “we”, and “our”). The Company is providing proxy materials to solicit proxies on behalf of Atmus’ Board of Directors (the “Board of Directors” or the “Board”). We are sending certain stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) on or about March 27, 2024. The Notice includes instructions on how to access the Proxy Statement and 2023 Annual Report to Stockholders online. Stockholders who have previously requested a printed or electronic copy of the proxy materials will continue to receive such a copy of the proxy materials, which will be sent on or about March 27, 2024. See the About the Meeting section of this Proxy Statement for additional information.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 14, 2024. This Notice of Annual Meeting, Proxy Statement and 2023 Annual Report on Form 10-K are available at www.virtualshareholdermeeting.com/ATMU2024.

Forward Looking Statements

This Proxy Statement contains certain forward-looking statements about future events and results identified by words such as “will,” “expect,” “goals,” and similar words. Those statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially from those projected, expressed, or implied. Those risk factors are described in our 2023 Form 10-K and other reports filed with the Securities and Exchange Commission (the “SEC”).

PROXY STATEMENT SUMMARY AND HIGHLIGHTS

This summary highlights selected information contained in this Proxy Statement but does not contain all the information you should consider when casting your vote. We urge you to read the entire Proxy Statement before you vote.

| | | | | | | | | | | |

| Date:

May 14, 2024 | | Time:

10:00 a.m. Central Daylight Time |

| Virtual Meeting Site:

www.virtualshareholdermeeting.com/ATMU2024

| | Who Can Vote:

Stockholders of record at the close of business on March 21, 2024 |

| | |

| MEETING AGENDA AND VOTING MATTERS |

PROPOSALS YOU ARE ASKED TO VOTE ON

| | | | | | | | | | | |

| Proposal | Board’s Voting Recommendation | Page Reference |

| 1. | Election of the two director nominees to serve for three-year terms expiring in 2027 | “FOR” Each Nominee | 15 |

| 2. | Advisory vote to approve the 2023 compensation of our named executive officers | “FOR” | 58 |

| 3. | Advisory vote to approve the frequency of stockholder advisory votes on the compensation of our named executive officers | “ONE YEAR” | 59 |

| 4. | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024 | “FOR” | 60 |

| 5. | Such other business that may properly come before the meeting and any postponement and adjournments thereof | | |

| | |

| COMPANY OVERVIEW AND BUSINESS HIGHLIGHTS |

Atmus is one of the global leaders of filtration products for on-highway commercial vehicles and off-highway agriculture, construction, mining and power generation vehicles and equipment. We design and manufacture advanced filtration products, principally under the Fleetguard brand, that enable lower emissions and provide superior asset protection.

Atmus was founded in 1958 as part of Cummins Inc. (“Cummins”). On May 30, 2023, we completed our initial public offering (“IPO”), pursuant to which 19.5% of our total outstanding shares were sold, with Cummins retaining the remaining the shares. As of the closing of the IPO, Cummins owned approximately 80.5% of the outstanding shares of our common stock. On March 18, 2024, Cummins completed an exchange offer pursuant to which it transferred its remaining holdings in us to its stockholders in exchange for shares of Cummins common stock. We refer to this transaction in this Proxy Statement as the “Exchange Offer.” Following the Exchange Offer, Cummins no longer owns any shares in us, and we are an independent publicly traded company.

On February 13, 2024, in anticipation the Exchange Offer, Sharon R. Barner, Mark A. Smith, Cristina Burrola, L. Tony Satterthwaite, Earl Newsome and Nathan Stoner each resigned from the Board of Directors, with each such resignation conditioned and effective upon the closing of the Exchange Offer and Cummins’ beneficial ownership of shares of common stock of Atmus representing, in the aggregate, less than a majority of the total voting power of the then outstanding voting stock of Atmus. All such individuals were Cummins-designated members of the Board. In addition, on February 13, 2024, conditioned and effective upon the closing of the Exchange Offer and the effectiveness of the Cummins-designated director resignations, the Board (i) set the size of the Board at seven members and (ii) appointed each of Diego Donoso and Stuart A. Taylor II to fill the remaining Board vacancies.

As of December 31, 2023, Cummins had direct holdings of approximately 80% of the voting power of the Company. As a result, the Company was a “controlled company” under the rules of the New York Stock Exchange (“NYSE”) because Cummins held more than 50% of the voting power of our outstanding voting stock. As such, the Company could avail itself of exemptions relating to the Board. As permitted by the NYSE rules for “controlled companies,” our Board was not majority independent in 2023. As of the completion of the Exchange Offer, we ceased to be a “controlled company” under the rules of the NYSE, and our Board has complied with the NYSE corporate governance rules, including appointing a majority of independent directors to the Board and fully independent committees of the Board.

In 2023, we achieved strong financial results despite the overall challenging economic environment. Our teams worked diligently throughout the year to deliver profitable growth. With a solid balance sheet and substantial liquidity, we continue to be well-positioned to fund investments to drive growth and stockholder value creation. The following are only selected measures of Company performance. For complete financial information, please see our audited financial statements included in our 2023 Annual Report to Stockholders.

| | | | | | | | | | | | | | | | | | | | | | | |

|

| Atmus 2023 FY results (in millions) | $1,628 | | $152 | | $302 | |

| Sales | | Adj. free cash flow | | Adj. EBITDA | |

| | | | | | |

| | | | | | |

| | | | | | |

The following table provides summary information about our director nominees:

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Appointed | AC | TMCC | GN |

| Gretchen R. Haggerty Retired Chief Financial Officer of U.S. Steel Corporation | 68 | 2022 | Chair | |

|

| Jane A. Leipold President of JAL Executive HR Consulting, LLC | 63 | 2022 | | Chair |

|

| | |

| OUR DIRECTORS CONTINUING IN OFFICE |

The following table provides summary information about our directors continuing in office:

Terms expiring in 2025

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Appointed | AC | TMCC | GN |

| R. Edwin Bennett Retired Vice Chair — Operations and Chief Operating Officer of Ernst and Young | 62 | 2022 | | | |

| Stephen E. Macadam Retired Chief Executive Officer and President of EnPro Industries, Inc. | 63 | 2022 | | | |

Terms expiring in 2026

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Appointed | AC | TMCC | GN |

| Stephanie J. Disher Chief Executive Officer, Atmus | 48 | 2022 | | |

|

| Diego Donoso Retired President of Packaging & Specialty Plastics of Dow Inc. | 57 | 2024 | | | |

| Stuart A. Taylor II Chief Executive Officer, The Taylor Group LLC | 63 | 2024 | |

| Chair |

Member

Member

AC = Audit Committee

TMCC = Talent Management and Compensation Committee

GN = Governance and Nominating Committee

| | |

| BOARD INDEPENDENCE AND DIVERSITY |

The Company has nominated highly qualified, independent leaders to serve on its Board of Directors. We believe that directors with different attributes, skills, experiences, and backgrounds create an effective Board focused on the long-term goals and needs of the Company’s stockholders and other stakeholders.

| | | | | |

Average Age of 60

Newly assembled Board | Gender Diversity

3 of 7 Board members identify as female |

Independence

6 of 7 Board members are independent directors |

Racial/Ethnicity Diversity

2 of 7 Board members are racially and/or ethnically diverse |

Our commitment to good corporate governance stems from our belief that a strong governance framework creates long-term value for our stockholders, strengthens Board and management accountability, and builds trust in the Company and its brand. Our governance framework includes, but is not limited to, the following highlights:

| | | | | |

Independent Board Chair | Supermajority independent Board |

| Board self-evaluation | Detailed strategy and risk oversight by Board and its committees |

Robust clawback policy for executive compensation plans | Director orientation and continuing education |

Mandatory retirement age | Annual assessment of Board leadership structure |

All committee chairs and committee members are independent | Stock ownership guidelines for directors and executive officers |

Prohibitions on hedging and pledging of Company stock | Strong Board diversity |

2024 PROXY STATEMENT | 10

| | |

| EXECUTIVE COMPENSATION HIGHLIGHTS |

Our long-term success depends on our ability to attract, motivate, focus and retain highly talented individuals committed to Atmus’ vision, strategy and corporate culture. To that end, our executive compensation program is designed to link our executives’ pay to their individual performance, to Atmus’ annual and long-term performance and to successful execution of Atmus’ business strategies. Atmus’ salary levels and incentive targets are intended to recognize individual performance and market pay levels. The Atmus compensation philosophy rewards executives for achieving financial objectives and building long-term value for stockholders and other stakeholders.

Executive Compensation Elements

| | | | | | | | | | | |

| Compensation Element | Form of Payment | Performance Metrics | Rationale |

| Base Salary | Cash | Individual Performance | Market-based to attract and retain skilled executives. Designed to recognize scope of responsibility, individual performance and experience. |

| Annual Bonus | Cash | 100% EBITDA | Rewards operational performance |

| Long-Term Incentive Compensation | Restricted stock units (RSUs) (30%) and Performance stock units (PSUs) (70%) | Return on Invested Capital (ROIC), weighted at 50% and EBITDA, weighted at 50% over a three-year period | ROIC and EBITDA provide an incentive for profitable growth and correlate well with stockholder value. |

TARGET TOTAL DIRECT COMPENSATION MIX — 2023

We are asking you to approve an advisory, nonbinding vote on compensation awarded in 2023 to our named executive officers — our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), and three additional most highly paid, currently employed executive officers as listed in the Summary Compensation Table in the Compensation Discussion and Analysis section.

2024 PROXY STATEMENT | 11

ABOUT THE MEETING

Why am I Receiving These Proxy Materials?

You have received these proxy materials because you were an Atmus stockholder of record as of March 21, 2024 (the “Record Date”), and Atmus’ Board of Directors is soliciting your authority (or proxy) to vote your shares at the Annual Meeting. This Proxy Statement includes information that we are required to provide to you under SEC rules and is designed to assist you in voting your shares.

Who Pays for the Cost of Proxy Solicitation?

The Company will pay the cost of soliciting proxies on behalf of the Board of Directors. Our directors, officers and other employees may solicit proxies by mail, personal interview, telephone or electronic communication. None of them will receive any special compensation for these efforts.

When Was the Record Date, and Who Is Entitled to Vote?

The Board of Directors set March 21, 2024, as the Record Date for the Annual Meeting. Holders of Atmus common stock as of the Record Date are entitled to one vote per share. As of the Record Date, there were 83,355,930 shares of Atmus common stock outstanding.

A list of all registered stockholders as of the Record Date will be available for examination by stockholders during normal business hours at 26 Century Blvd, Nashville, Tennessee 37214 at least five business days prior to the Annual Meeting.

How Can I Attend the Annual Meeting?

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were an Atmus stockholder as of the close of business on the Record Date or if you hold a valid proxy for the Annual Meeting. There is no physical location for this meeting. You can attend the Annual Meeting online, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ATMU2024. Please follow the registration instructions outlined below.

The online meeting will begin promptly at 10:00 a.m., Central Daylight Time. We encourage you to access the meeting prior to the start time to provide ample time for check-in.

What is the Quorum Requirement for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. Holders of at least a majority of the votes entitled to be cast at the meeting must be present in person or by proxy at the Annual Meeting to constitute a quorum. Abstentions and shares represented by broker non-votes that are present and entitled to vote at the Annual Meeting on any matter will be counted as present for establishing a quorum.

How Do I Vote Before the Meeting?

If you are a registered stockholder, which means you hold your shares in certificate form or through an account with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you have three options for voting before the Annual Meeting:

•Over the internet, at proxyvote.com, by following the instructions on the Notice or proxy card;

•By telephone, by dialing 1-800-690-6903; or

•By completing, dating, signing and returning a proxy card by mail.

If your valid proxy is received by internet, telephone or mail, before the Annual Meeting, your shares will be voted at the Annual Meeting in accordance with your instructions.

If you are a beneficial holder, meaning you hold your shares in “street name” through an account with a bank or broker, your ability to vote over the internet or by telephone depends on the voting procedures of your bank or broker. Please follow the directions on the voting instruction form that your bank or broker provides.

Can I Vote at the Meeting?

Yes, if you owned shares on the Record Date. If you attend the Annual Meeting, shares held directly in your name as the stockholder of record may be voted by entering the 16-digit control number found on your proxy card or Notice when you log into the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you vote in advance, as described above under “How Do I Vote Before the Meeting?” so that your vote will be counted if you later decide not to attend the Annual Meeting.

Shares held in “street name” through a brokerage account or by a broker, bank or other nominee may be voted at the Meeting by entering the 16-digit control number found on your voter instruction form when you log into the Annual Meeting.

May I Revoke My Proxy and/or Change My Vote?

Yes. You may revoke your proxy and/or change your vote by:

•Signing another proxy card with a later date and delivering it to us before the Annual Meeting;

•Voting again over the internet or by telephone prior to 11:59 p.m., Eastern Daylight Time, on May 13, 2024;

2024 PROXY STATEMENT | 12

•Voting during the Annual Meeting before the polls close using your 16-digit control number; or

•Notifying the Company’s Corporate Secretary in writing before the Annual Meeting that you revoke your proxy.

What if I Sign and Return My Proxy but Do Not Provide Voting Instructions?

Proxies that are signed, dated and returned but do not contain voting instructions will be voted:

•“For” the election of all of the two named director nominees for three-year terms expiring in 2027;

•“For” the advisory vote to approve executive compensation;

•For a frequency of every “One Year” on the advisory vote to approve the frequency of advisory votes on executive compensation;

•“For” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024; and

•On any other matters properly brought before the Annual Meeting, in accordance with the best judgment of the named proxies.

Will My Shares be Voted if I Do Not Provide a Proxy or Voting Instruction Form?

If you are a registered stockholder and do not provide a proxy by voting over the internet, by telephone or by signing and returning a proxy card, you must attend the Annual Meeting to vote.

If you hold shares through an account with a bank or broker, the voting of the shares by the bank or broker when you do not provide voting instructions is governed by the rules of the NYSE. These rules allow banks and brokers to vote shares in their discretion on “routine” matters for which their customers do not provide voting instructions. On matters considered “non-routine,” banks and brokers may not vote shares without your instruction. Shares that banks and brokers are not authorized to vote are referred to as “broker non-votes.”

The ratification of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024 is considered a routine matter. Accordingly, banks and brokers may vote shares on this proposal without your instructions, and there will be no broker non-votes with respect to this proposal.

The other proposals will be considered non-routine, and banks and brokers therefore cannot vote shares on those proposals without your instructions. Please note that if you want your vote to be counted on those proposals, including the election of directors, you must instruct your bank or broker how to vote your shares. If you do not provide voting instructions, no votes will be cast on your behalf with respect to those proposals.

What Is the Voting Standard for Each Annual Meeting Agenda Item?

| | | | | | | | | | | | | | |

| Agenda Item | Voting Standard | Effect of Withheld Votes or Abstentions | Effect of Broker Non-Votes |

| 1. | Election of 2 directors | Plurality of Votes Cast | None | None |

| 2. | Advisory Vote to Approve Executive Compensation | Majority of Votes Cast | None | None |

| 3. | Advisory Vote on Frequency of Stockholder Advisory Vote on Executive Compensation | Majority of Votes Cast | None | None |

| 4. | Ratification of the Appointment of Independent Registered Public Accounting Firm for 2024 | Majority of Votes Cast | None | None |

•Election of Directors: As allowed under Delaware law for the election of directors, and as set forth in the Company’s bylaws, the election of directors is to be decided by a plurality vote of the Atmus common stock present or represented by proxy and entitled to vote at the Annual Meeting. Under plurality voting, director nominees are elected by a plurality of the votes cast, meaning that the nominees with the most affirmative votes are elected to fill the available seats up to the maximum number of directors to be elected

What Does it Mean if I Receive More Than One Notice, Proxy Card or Voting Instruction Form?

This means that your shares are registered in different names or are held in more than one account. To ensure that all shares are voted, please vote each account over the internet or by telephone, or sign and return by mail all proxy cards and voting instruction forms. We encourage you to register all shares in the same name and address by contacting our transfer agent, Broadridge Corporate Issuer Solutions, Inc., at 1-877-830-4932. If you hold your shares through an account with a bank or broker, you should contact your bank or broker and request consolidation.

Can I Ask Questions at The Meeting?

Yes. As part of the Annual Meeting, we will hold a question-and-answer session, which will include questions submitted both live and prior to the Annual Meeting. You may submit a question before the Annual Meeting at www.virtualshareholdermeeting.com/ATMU2024 after logging in with your 16-digit control number until the day before the Annual Meeting. Alternatively, you will be able to submit questions live during the Annual Meeting by accessing the Annual Meeting at www.virtualshareholdermeeting.com/ATMU2024 using your 16-digit control number. Questions pertinent to meeting matters will be answered during the meeting, subject to time limitations.

2024 PROXY STATEMENT | 13

Where and When Will I Be Able to Find the Voting Results?

You can find the official results of the voting at the Annual Meeting in our Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting.

2024 PROXY STATEMENT | 14

PROPOSAL 1 – ELECTION OF DIRECTORS

The Board of Directors recommends a vote FOR each of the director nominees for a three-year term expiring in 2027

The Board is divided into three classes, with the terms of office of each class ending in successive years. The terms of directors Gretchen R. Haggerty and Jane A. Leipold will expire at the Annual Meeting, and the Board has nominated each of them to serve for an additional three-year term expiring at the 2027 annual meeting of stockholders. If elected, the nominees would serve until the expiration of their terms and until their successors have been elected and qualified. Proxies cannot be voted for more than two nominees. Should any one or more of the nominees become unable or unwilling to serve (which is not expected), the proxies unless marked to the contrary will be voted for such other person or persons as the Board may recommend.

The election of directors is to be decided by a plurality vote of the Atmus common stock present or represented by proxy and entitled to vote at the Annual Meeting. Under plurality voting, director nominees are elected by a plurality of the votes cast, meaning that the nominees with the most affirmative votes are elected to fill the available seats up to the maximum number of directors to be elected. You may vote for all the director nominees, withhold authority to vote your shares for all the director nominees or withhold authority to vote your shares with respect to any one or more of the director nominees. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees.

2024 PROXY STATEMENT | 15

DIVERSITY OF SKILLS AND EXPERTISE

To assist with candidate assessment, our Governance and Nominating Committee (the “Governance Committee”) utilizes a matrix, which is reviewed annually, of the relevant attributes, skills and experiences that evolve with the Company’s business and strategy. With this in mind, the Board, led by the Governance Committee chair, identified the following attributes, skills and experiences as most relevant for the Company’s Board at this time:

| | | | | | | | | | | |

| | | |

Executive Leadership Leadership experience, including through service in public and private company executive roles or leadership | Public Company Board Insight overseeing and leading public companies and strategies for building partnerships with different customers and stakeholders |

7 out of 7 | 4 out of 7 |

| | | |

Global Experience Experience in, and exposure to, operating within complex business environments and diverse markets; engaging with international stakeholders; and navigating global regulatory regimes and frameworks | Financial and Accounting Expertise Understanding or overseeing financial reporting, disclosure controls and internal controls |

7 out of 7 | 6 out of 7 |

| | | |

M&A/Business Development Experience developing and implementing operating plans and business strategy | Spin-Off Experience Experience with the nuances of creating an independent public company from a parent company |

7 out of 7 | 5 out of 7 |

| | | |

Dealers/Distributors Leadership experience with dealers and distributors as an important part of the value chain | Information Technology Knowledge or experience with information technology, cybersecurity and related issues and risks |

3 out of 7 | 1 out of 7 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Attributes, Skills and Experiences | | | | | | | |

| Executive Leadership | • | • | • | • | • | • | • |

| Public Company Board | | | • | • | | • | • |

| Global Experience | • | • | • | • | • | • | • |

| Financial and Accounting Expertise | • | • | • | • | | • | • |

| M&A/Business Development | • | • | • | • | • | • | • |

| Spin-Off Experience | • | • | | • | • | • | |

| Dealers/Distributors | | • | • | | | | • |

Information Technology | • | | | | | | |

2024 PROXY STATEMENT | 16

NOMINEES FOR TERMS ENDING IN 2027

| | | | | |

GRETCHEN R. HAGGERTY Independent Director

Age: 68 Director since: 2022 Board Committees: Audit (Chair), Governance and Nominating | Ms. Haggerty had a 37-year career with United States Steel Corporation (NYSE:X) and its predecessor, USX Corporation, which, in addition to steel production, also managed and supervised energy operations, principally through Marathon Oil Corporation. From March 2003 until her retirement in 2013, she served as Executive Vice President & Chief Financial Officer and also served as Chairman of the U.S. Steel & Carnegie Pension Fund and its Investment Committee. Earlier, she served in various financial executive positions at U.S. Steel Corporation and USX Corporation, beginning in November 1991 when she became Vice President and Treasurer. Ms. Haggerty has served as a director of Teleflex Incorporated (NYSE: TFX), a global provider of medical technology products, since 2016 and currently serves as a member of the audit committee. Ms. Haggerty has also served as a director of Johnson Controls International plc (NYSE:JCI), since March 2018, where she serves as chair of the audit committee. She is a former director of USG Corporation, a leading manufacturer of building materials. Ms. Haggerty earned her Bachelor of Science in Accounting from Case Western Reserve University and her Juris Doctorate from Duquesne University School of Law.

Attributes and Skills:  Executive Leadership Executive Leadership Public Company Board Public Company Board Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development Spin-Off Experience Spin-Off Experience

|

| Key Contributions to the Board: •Deep financial acumen as a former Chief Financial Officer •Experience serving on the board of directors of multiple international companies •Significant knowledge of the global marketplace gained from business experience •Experience leading global teams |

2024 PROXY STATEMENT | 17

| | | | | |

JANE A. LEIPOLD Independent Director

Age: 63 Director since: 2022 Board Committees: Talent Management and Compensation (Chair), Governance and Nominating | Ms. Leipold is an accomplished global business executive and consultant, with a variety of experiences in engineering, operations and human resources. With over twenty years of human resources leadership experience, Ms. Leipold started a consulting business, JAL Executive HR Consulting, LLC, in 2017, where she provides a wide breadth of executive human resources consulting services on an interim or project basis. From 2006 through 2016, Ms. Leipold served as Senior Vice President & Chief Human Resources Officer for TE Connectivity (NYSE: TEL), a publicly traded manufacturer of connectors and sensors. From 2001 through 2006, Ms. Leipold was Vice President of Human Resources at Tyco Electronics, in addition to other roles in the human resources department. Ms. Leipold holds a Bachelor of Science in Quantitative Business Analysis and a Master of Business Administration from Pennsylvania State University.

Attributes and Skills:  Executive Leadership Executive Leadership Global Experience Global Experience M&A/Business Development M&A/Business Development Spin-Off Experience Spin-Off Experience

|

| Key Contributions to the Board: •Knowledge of Atmus' industry •Extensive global human resources experience |

2024 PROXY STATEMENT | 18

DIRECTORS CONTINUING IN OFFICE

| | | | | |

R. EDWIN BENNETT Independent Director

Age: 62 Director since: 2022 Term Expires 2025 Board Committees: Audit and Governance and Nominating | Mr. Bennett retired from Ernst & Young (“EY”) in September 2021 after a 38-year career as a professional services partner and senior business leader. Mr. Bennett served in many senior leadership roles at EY, most recently as the Vice Chair — Operations and Chief Operating Officer from 2015 through 2021. Prior to that role, Mr. Bennett served as EY’s Deputy Vice Chair and Chief Operating Officer — Consulting Services. Mr. Bennett serves as a strategic advisor to ServiceNow and is a member of its Americas Advisory Council, which is focused on enhancing customer experiences, driving business value and accelerating transformation. Mr. Bennett earned his Bachelor of Science in Accounting from the University of Georgia and is a Certified Public Accountant. Mr. Bennett also completed the Executive Leadership Program at the Kellogg School of Management and the Global Executive Leadership Program at Harvard Business School.

Attributes and Skills:  Executive Leadership Executive Leadership Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development  Spin-Off Experience Spin-Off Experience  Information Technology Information Technology

|

| Key Contributions to the Board: •Extensive management experience developed as lead of global operations of one of the world’s largest consulting organizations •Deep accounting and cyber acumen •Experience advising other public companies |

2024 PROXY STATEMENT | 19

| | | | | |

STEPHANIE J. DISHER CEO and Director

Age: 48 Director since: 2022 Term Expires 2026 | Ms. Disher currently serves as Atmus’ Chief Executive Officer. Ms. Disher previously served as Vice President of Cummins Filtration Inc. Prior to that role, Ms. Disher served in various leadership roles since joining Cummins in 2013, including as Operations Director and Managing Director for Cummins in the South Pacific region. Ms. Disher holds a Bachelor’s degree in Commerce from the University of Western Sydney and a Master of Business Administration from the University of Melbourne.

Attributes and Skills:  Executive Leadership Executive Leadership Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development Spin-Off Experience Spin-Off Experience Dealers/Distributors Dealers/Distributors

|

| Key Contributions to the Board: •Extensive knowledge of Atmus industry and business •Leadership experience •Strategic capability •Commercial capability including deep finance expertise |

2024 PROXY STATEMENT | 20

| | | | | |

DIEGO DONOSO Independent Director

Age: 57 Director since: 2024 Term Expires 2026 Board Committees: Audit, Governance and Nominating | Mr. Donoso retired in April 2023 from Dow Inc. (“Dow”), an American multinational materials science company. From 2012 until his retirement, Mr. Donoso served as President of Packaging & Specialty Plastics (“P&SP”), one of three operating segments of Dow, which consisted of two integrated global businesses: Hydrocarbons and Packaging and Specialty Plastics. Mr. Donoso began his career with Dow more than 30 years ago when he joined Dow as a trainee in the commercial department in São Paulo, Brazil. Over the next 20 years, Mr. Donoso served in numerous business and commercial leadership positions for Dow’s resins and plastics franchise in both Latin America and Europe. In 2010, Mr. Donoso was appointed President of Dow Japan and Korea based in Tokyo, Japan, and, in 2012, transferred to Dow’s corporate headquarters in Midland, Michigan and was promoted to President of P&SP later that year. Mr. Donoso has served as a director of GrafTech International Ltd. (NYSE: EAF), a manufacturer of graphite electrodes and petroleum coke, since 2023 and currently serves as a member of the audit committee. Mr. Donoso earned his Bachelor of Science in Marketing and International Business from Babson College.

Attributes and Skills:  Executive Leadership Executive Leadership Public Company Board Public Company Board Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development Dealers/Distributors Dealers/Distributors

|

| Key Contributions to the Board: •Significant executive leadership experience •Broad-based and valuable insights on business development •Deep experience on international business issues |

2024 PROXY STATEMENT | 21

| | | | | |

STEPHEN E. MACADAM Independent Director and Chair of the Board of Directors

Age: 63 Director since: 2022 Term Expires 2025 Board Committees: Governance and Nominating, Talent Management and Compensation | Mr. Macadam served as Vice Chairman of EnPro Industries, Inc., a diversified manufacturer of industrial products (“EnPro”), from August 2019 to February 2020. From April 2008 until his retirement in July 2019, he served as Chief Executive Officer and President of EnPro. From October 2005 to March 2008, he was Chief Executive Officer of BlueLinx Inc., the largest building products distribution company in North America at that time. From August 2001 to September 2005, he served as President and CEO of Consolidated Container Company, LLC. Prior to that position, Mr. Macadam held senior leadership positions at Georgia-Pacific Corporation and was a partner at McKinsey & Company. Mr. Macadam has served as a director of Louisiana-Pacific Corp. (NYSE: LPX) since February 2019, where he is the chair of the compensation committee and a member of the governance and corporate responsibility committee, and he has served as a director of Sleep Number Corporation (NASDAQ: SNBR) since November 2023, where he is the co-chair of the capital allocation committee and a member of the corporate governance committee. From February 2020 until November 2023, Mr. Macadam served as a director of Veritiv Corporation (NYSE: VRTV), where he served as chairman of the board of directors from September 2020 to November 2023. From 2016 until January 2023, Mr. Macadam served as a director of Valvoline Inc. (NYSE: VVV), where he was a member of the compensation committee and the governance and nominating committee. Previously, Mr. Macadam also served as a director of EnPro (NYSE: NPO) from 2008 to February 2020. Mr. Macadam holds a Bachelor of Science in mechanical engineering from the University of Kentucky, a Master of Science in Finance from Boston College and a Master of Business Administration from Harvard Business School, where he was a Baker Scholar.

Attributes and Skills:  Executive Leadership Executive Leadership Public Company Board Public Company Board Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development Spin-Off Experience Spin-Off Experience Dealers/Distributors Dealers/Distributors

|

| Key Contributions to the Board: •Significant experience and knowledge in the areas of executive leadership, international operations, mergers and acquisitions, business re-orientation, industrial products manufacturing, product distribution and procurement, and finance and accounting •Significant experience gained from service on the board of directors of other publicly-traded companies |

2024 PROXY STATEMENT | 22

| | | | | |

STUART A. TAYLOR II Independent Director Age: 63 Director since: 2024 Term Expires 2026 Board Committees: Talent Management and Compensation, Governance and Nominating (Chair) | Mr. Taylor is the President of The Taylor Group LLC, a non-traditional private equity firm focused on investing in private companies in partnership with high potential entrepreneurs. He previously held positions as senior managing director at Bear, Stearns & Co. Inc. (1999–2001), and managing director of CIBC World Markets and head of its Global Automotive Group and Capital Goods Group (1996–1999). He also served as managing director of the Automotive Industry Group at Bankers Trust (1993–1996), following a 10-year position in corporate finance at Morgan Stanley. Mr. Taylor has served as a director of Wabash National Corporation (NYSE: WNC), a manufacturer of motor vehicle parts, since 2019, where he chairs the finance committee and serves as a member of the audit committee, Ball Corporation (NYSE: BALL), a manufacturer of metal products, since 1999, where he chairs the nominating and corporate governance committee and is a member of the human resources committee, and Hillenbrand Industries Inc., a global industrial company, since 2008, where he chairs the mergers and acquisitions committee and serves on the compensation and management development committee and nominating and corporate governance committee. Mr. Taylor previously served as director of Essendant Inc., formerly known as United Stationers Inc., a wholesale distributor of business products, from 2011 until 2019. Mr. Taylor earned his Bachelor of Arts in History from Yale University and his Master of Business Administration from Harvard University.

Attributes and Skills:  Executive Leadership Executive Leadership Public Company Board Public Company Board Global Experience Global Experience Financial and Accounting Expertise Financial and Accounting Expertise M&A/Business Development M&A/Business Development Dealers and Distributors Dealers and Distributors

|

| Key Contributions to the Board: •Experience and knowledge in the areas of executive leadership, mergers and acquisitions, developing talent and diversity and inclusion •Significant experience gained from service on the board of directors of other publicly-traded companies |

2024 PROXY STATEMENT | 23

CORPORATE GOVERNANCE

DIRECTOR INDEPENDENCE

The Board of Directors assesses on a regular basis, at least annually, the independence of our directors and, based on the recommendation of the Governance Committee, decides which members are independent. Our Board of Directors has determined that R. Edwin Bennett, Diego Donoso, Gretchen R. Haggerty, Jane A. Leipold, Stephen E. Macadam and Stuart A. Taylor II are independent directors under the applicable rules of the SEC and NYSE.

BOARD COMPOSITION

Our directors are divided into three classes serving staggered three-year terms. Upon expiration of the term of a class of directors, directors in that class are eligible to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires. As a result of this classification of directors, it generally takes at least two annual meetings of stockholders to effect a change in a majority of the members of our Board of Directors.

Gretchen R. Haggerty and Jane A. Leipold currently serve as Class I directors, and their terms will expire at the Annual Meeting. The Board has nominated each of them to serve for an additional three-year term expiring at our 2027 annual meeting of stockholders. R. Edwin Bennett and Stephen E. Macadam currently serve as Class II directors and will serve until our 2025 annual meeting of stockholders. Stephanie J. Disher, Diego Donoso and Stuart A. Taylor II currently serve as Class III directors and will serve until our 2026 annual meeting of stockholders.

BOARD LEADERSHIP STRUCTURE

Our corporate governance principles describe in detail how our Board intends to conduct its oversight role in representing our stakeholders. As stated in the principles, our Board has the freedom to decide who our Board Chair and CEO should be based solely on the factors it believes are in the best interests of the Company and its stockholders.

Our Board evaluates its policy on whether the roles of our Board Chair and CEO should be combined on an annual basis. In doing so, our Board considers the skills, experiences and qualifications of our then-serving directors (including any newly-elected directors), the evolving needs of the Company, how well our leadership structure is functioning, and the views of our stockholders. Currently, our Board believes it is in the best interests of the Company for the roles of our Board Chair and CEO to be separate. The Board has elected Stephen E. Macadam to be the Non-Executive Chair of the Board

BOARD RISK OVERSIGHT

Our Board of Directors and its committees have oversight of our risk management processes and material enterprise-related risks. Atmus has established an enterprise risk management program that is intended to identify, categorize and analyze the relative severity and likelihood of the various types of material enterprise-related risks to which we are or may be subject. Atmus has established an executive risk council, consisting of its CFO, Chief Legal Officer and Corporate Secretary, Chief People Officer, and Vice President of Engine Products, to review and update its material enterprise-related risks and their mitigation plans. We assign ownership of our most significant enterprise risks to a member of our leadership team. The risk oversight process includes receiving regular reports from Board committees and members of senior management to enable our Board of Directors to understand Atmus’ risk identification, risk management, and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, cybersecurity, strategic, and reputational risk.

Our Audit Committee is responsible for overseeing Atmus’ risk exposure to information security, cybersecurity, and data protection, as well as the steps management has taken to monitor and control such exposures. Our Audit Committee regularly provides reports to the Board of Directors on cybersecurity risk management. Atmus’ Audit Committee charter was amended in October 2023 to explicitly set forth the Audit Committee’s responsibility for such oversight through the oversight of (i) Atmus’ global cybersecurity operations function, led by our director of global security; (ii) our Chief Information Officer; and (iii) our senior management information security council, which consists of our Chief Information Officer, CFO, Chief Technology Officer, Chief Legal Officer & Corporate Secretary, Vice President of Strategy and Director of Internal Audit & Enterprise Risk Management. As part of its oversight of Atmus’ overall enterprise risk management framework, Atmus’ Board of Directors reviews Atmus’ cybersecurity risk management on at least on an annual basis.

Our Board of Directors, Audit Committee, Talent Management and Compensation Committee, and/or Governance Committee receive periodic reports and information directly from senior leaders who have functional responsibility over our enterprise risks. Our Board of Directors and/or its appropriate committees then review such information, including management’s proposed mitigation strategies and plans, to monitor our progress on mitigating the risks.

BOARD DIVERSITY

One of our core values is ‘be inclusive.’ In evaluating candidates for our Board of Directors, our Governance Committee considers only potential directors who share this value, as well as our other core values. We believe that directors with different backgrounds and experiences make our boardroom and the Company stronger. Although our Board of Directors does not have a formal written diversity policy with respect to the evaluation of director candidates, in its evaluation of director candidates, our Governance Committee will consider factors including, without limitation, issues of character, integrity, judgment, potential conflicts of interest, other commitments, and diversity, and with respect to diversity, such factors as gender, race, ethnicity, experience, and area of expertise, as well as other individual qualities and attributes that contribute to the total diversity of viewpoints and experience represented on the Board of Directors. Additionally, as reflected

2024 PROXY STATEMENT | 24

in our corporate governance principles, we are committed to equal employment opportunities in assembling our Board of Directors. Our Governance Committee is responsible for reviewing with the Board of Directors, on an annual basis, the appropriate characteristics, skills and experience required for the Board of Directors as a whole and its individual members. We believe our Board of Directors has been effective in assembling a highly- qualified, diverse group of directors, currently consisting of three female directors and two ethnically diverse directors. We will continue to identify opportunities to enhance our board diversity as we consider future candidates.

BOARD EVALUATION PROCESS

The Board recognizes a rigorous, ongoing evaluation process as an essential component of strong corporate governance practices that promotes continuing Board effectiveness. Each year, the Governance Committee oversees a Board evaluation process consistent with the NYSE standards. The Board’s annual evaluation process is reflective and expansive. The Governance Committee solicits feedback using a written questionnaire. Further, the Board Chair conducts one-on-one calls with directors to discuss the Board’s performance and to assess the Board’s culture, process, and discussions and their substantive content. The Board discusses the results of the annual evaluations, identifies areas for further consideration and opportunities for improvement and addresses actionable matters.

DIRECTOR CANDIDATES AND NOMINATIONS

The Governance Committee makes recommendations to the Board for nominations, identifies and screens potential new candidates, including by reviewing recommendations from other Board members, management and stockholders. The Governance Committee may also retain search firms to assist in identifying and screening candidates. Prior to the Exchange Offer, Cummins had the right to designate individuals for nomination to our Board up to a majority of the members of our Board, and Cummins had the right to designate the Chair of our Board. Following the completion of the Exchange Offer, no director remains on the Board that is a member of Cummins’ senior management team, and Cummins no longer has any right to designate individuals for nomination to our Board.

Any stockholder who would like the Governance Committee to consider a candidate for Board membership must send timely notice delivered in accordance with the requirements specified in our bylaws. Such notice shall include all information required to be disclosed in solicitations of proxies for election of directors, including the name and address of the proposing stockholder and of the proposed candidate, the business, professional and educational background of the proposed candidate, and a description of any agreement or relationship between the proposing stockholder and proposed candidate. The communication must be sent by mail or other delivery service to the attention of the Corporate Secretary at the Company’s principal executive offices. See the About the Meeting section of this Proxy Statement for more information.

BOARD AND COMMITTEE MEETINGS

The Board meets at least five times annually, adding meetings as needed. Our Board met six times in 2023. Our three standing committees, as described below, report regularly to the full Board on their activities and actions.

Attendance

Directors are expected to regularly attend Board and committee meetings, as well as to attend our annual meeting of stockholders. During 2023, each current director (who was also a director at the time) attended at least 75% of the meetings of the Board and the standing committees on which he or she sits.

Committee Structure and Composition

The members of the Board of Directors are appointed to various committees. The standing committees of the Board are the Audit Committee, the Governance Committee, and the Talent Management and Compensation Committee (the “Compensation Committee”).

Controlled Company Exemption. As of December 31, 2023, Cummins had direct holdings of approximately 80% of the voting power of the Company. The Company was a “controlled company” under the rules of the NYSE because Cummins held more than 50% of the voting power of the outstanding voting stock. As such, the Company could avail itself of exemptions relating to certain Board committees. As permitted by the NYSE rules for “controlled companies,” our Board did not require that the Governance Committee and the Compensation Committee be comprised solely of independent directors in 2023. As of the Exchange Offer, we ceased to be a “controlled company” under the rules of the NYSE, and our Board has complied with the NYSE corporate governance rules, including appointing a majority of independent directors to the Board and establishing a Compensation Committee, Governance Committee and Audit Committee each composed entirely of independent directors.

Each Committee operates under a written charter adopted by the Board of Directors. The charters are available on our website located at www.atmus.com. Website references and links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated by reference herein.

2024 PROXY STATEMENT | 25

Board Committees

| | | | | | | | |

| COMMITTEE | MEMBERS | DESCRIPTION |

Audit Committee1 Meetings held in 2023: 7 | Gretchen R. Haggerty (Chair) R. Edwin Bennett Mark A. Smith (until March 2024) Diego Donoso (as of March 2024) | •assists the Board in its oversight of the Company’s financial statements •hires, monitors and replaces our independent auditor, the independent auditor’s qualifications and independence •monitors the systems of internal control and disclosure controls that management has established •monitors the performance of internal and independent audit functions •reviews and approves related party transactions •oversees cybersecurity risk management

|

Compensation Committee2 Meetings held in 2023: 6 | Jane A. Leipold (Chair) Sharon A. Barner (until March 2024) Stephen E. Macadam L. Tony Satterthwaite (until March 2024) Stuart A. Taylor II (as of March 2024) | •assists the Board in overseeing the Company’s management compensation policies and practices •provides oversight of our compensation plans •reviews and provides oversight of the Company’s strategies for talent management •assesses talent management policies, programs and processes, including leadership, culture, diversity and inclusion and succession •the Compensation Committee engaged Farient Advisors LLC as its independent compensation consultant in 2023 to provide input and advice concerning the compensation of our officers and Board and related matters

|

Governance Committee3 Meetings held in 2023: 4 | Stephen E. Macadam (Chair) Sharon A. Barner (until March 2024) R. Edwin Bennett Cristina Burrola (until March 2024) Gretchen R. Haggerty Jane A. Leipold Earl Newsome (until March 2024) L. Tony Satterthwaite (until March 2024) Mark A. Smith (until March 2024) Nathan Stoner (until March 2024) Diego Donoso (as of March 2024) Stuart A. Taylor II (as of March 2024) | •assists the Board in identifying qualified individuals to become a member of the Board •determines the composition of the Board and its committees •assesses the annual performance of our CEO •monitors a process to assess effectiveness of the Board |

(1)The Board has affirmatively determined that each of Gretchen R. Haggerty, the Audit Committee’s chair, and R. Edwin Bennett qualifies as an “audit committee financial expert”, as such term has been defined by the SEC in Item 407(d) of Regulation S-K and all members are financially literate for the purpose of the NYSE's rules. Our Board has affirmatively determined that each of Gretchen R. Haggerty, R. Edwin Bennett and Diego Donoso meet the definition of an “independent director” for the purposes of serving on the Audit Committee under applicable NYSE rules and Rule 10A-3 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

(2)The Board has affirmatively determined that each of Jane A. Leipold, Stephen E. Macadam and Stuart A. Taylor II qualify as a “non-employee director” under Rule 16b-3 of the Exchange Act.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

We do not have any interlocking relationships between any member of our Compensation Committee and any of our executive officers that would require disclosure under the applicable Exchange Act rules.

2024 PROXY STATEMENT | 26

COMMUNICATION WITH THE BOARD OF DIRECTORS

Stockholders and other interested parties may communicate with our Board by sending written communication to the directors c/o our Corporate Secretary, 26 Century Boulevard, One Century Place, Nashville, Tennessee 37214. All such communications will be reviewed by the Corporate Secretary or her designee to determine which communications are appropriate to be forwarded to the directors. All communications will geneally be forwarded except those that are related to our products and services, are solicitations or otherwise relate to improper or irrelevant topics as determined in the sole discretion of the Corporate Secretary or her designee.

CODE OF CONDUCT

Our code of conduct is applicable to all our directors, and officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions). A copy of the code of conduct is available on our website located at www.atmus.com/governance-documents. Any amendments to or waivers from our code of conduct with respect to our officers or directors will be disclosed on our website promptly following the date of such amendment or waiver.

CORPORATE GOVERNANCE PRINCIPLES

Our corporate governance principles, adopted by our Board of Directors in accordance with the corporate governance rules of the NYSE, serve as a flexible framework within which our Board of Directors and its committees operate. These principles cover a number of areas. A copy of our corporate governance principles are available on our website located at www.atmus.com/governance-documents.

TRANSACTIONS WITH RELATED PERSONS

Relationship with Cummins

On May 29, 2023, in connection with the IPO, Atmus entered into a separation agreement and a number of other agreements with Cummins to effect the separation of Atmus’ business from Cummins and to provide a framework for Atmus’ ongoing relationship with Cummins after the IPO and the separation, each of which remain in effect following the completion of the Exchange Offer.

Procedures for Approval of Related Party Transactions

We have adopted a written policy on related party transactions. This policy was not in effect when we entered into certain agreements with Cummins prior to the completion of the IPO. Each of the agreements between us and Cummins and its subsidiaries that were entered into prior to the completion of the IPO, and any transactions contemplated thereby,were deemed to be approved and not subject to the terms of such policy. Under the written related party transactions policy, the Audit Committee of the Board is required to review and, if appropriate, approve all related party transactions, prior to consummation whenever practicable. If advance approval of a related party transaction is not practicable under the circumstances or if our management becomes aware of a related party transaction that has not been previously approved or ratified, the transaction is submitted to the Audit Committee at the Audit Committee’s next meeting. The Audit Committee is required to review and consider all relevant information available to it about each related party transaction, and a transaction is considered approved or ratified under the policy if the Audit Committee authorizes it according to the terms of the policy after full disclosure of the related party’s interests in the transaction. Related party transactions of an ongoing nature are reviewed annually by the Audit Committee. The definition of “related party transactions” for purposes of the policy covers the transactions that are required to be disclosed under the Exchange Act.

2024 PROXY STATEMENT | 27

EXECUTIVE AND DIRECTOR COMPENSATION OF ATMUS

COMPENSATION DISCUSSION AND ANALYSIS

For purposes of this prospectus, Atmus’ executive officers whose compensation is discussed in this Compensation Discussion and Analysis and to whom Atmus refers as Atmus’ Named Executive Officers, or “NEOs,” are:

•Stephanie J. Disher, Chief Executive Officer and a member of Atmus’ board of directors

•Jack Kienzler, Chief Financial Officer

•Renee Swan, Chief People Officer

•Toni Y. Hickey, Chief Legal Officer and Corporate Secretary

•Charles Masters, Vice President, Engine Products

Prior to the completion of Atmus’ IPO on May 30, 2023, Atmus’ business operated as a segment of Cummins’ components business. In anticipation of the IPO, Cummins initially formed Atmus’ Talent Management and Compensation Committee (the “Compensation Committee”) and designated an independent chair of the Compensation Committee. Working with Farient Advisors LLC (“Farient”), Atmus’ and Cummins’ independent compensation advisor, and with Cummins’ Talent Management and Compensation Committee (the “Cummins TMCC”), the Compensation Committee established Atmus’ executive compensation program and policies to be effective upon the IPO, largely consistent with Cummins’ principles and approach to compensation. Among other matters, the Compensation Committee ratified the pay packages, including long-term incentive compensation, of the executive officers of Atmus, including the NEOs, to be effective upon the completion of the IPO.

Purposes and Principles of Atmus’ Executive Compensation Program

Atmus’ long-term success depends on its ability to attract, motivate, focus, and retain highly talented individuals committed to Atmus’ vision, strategy and corporate culture. To that end, Atmus’ executive compensation program is designed to link executives’ pay to their individual performance, to Atmus’ annual and long-term performance and to the successful execution of Atmus’ business strategies. Atmus’ salary levels and incentive targets are intended to recognize individual performance and market pay levels. Atmus’ compensation philosophy rewards executives for achieving financial objectives and building long-term value for shareholders and other stakeholders.

Atmus’ executive compensation program is based on four key principles:

Competitive. Compensation is designed to attract, retain, focus, reward and motivate Atmus’ top leadership. The Compensation Committee benchmarks against a defined peer group and survey data generally referencing the market median, as well as the 25th and 75th percentiles, with discretion to set actual compensation based on experience and performance of the individual and size, scope and complexity of the role.

Pay-for-Performance. Compensation is linked to performance and increasing shareholder value with a balance of risk and reward. Atmus believes the compensation of its leaders should be based on Atmus’ overall financial performance and satisfaction of strategic objectives and a significant portion of their pay should be incentive-based and therefore at risk. The pay mix also balances short and long-term results based on the decision-making horizon of the role.

Alignment with Shareholder Interests. Equity-based compensation and a stock ownership requirement are a substantial part of the compensation program to link executive compensation with shareholder returns.

Simple & Transparent. The Compensation Committee has designed its program to be transparent to investors and employees alike as well as simple and easy to understand and consistent year over year.

These principles are substantially similar to the principles underlying Cummins’ executive compensation program that applied to the Atmus NEOs in 2022 and in 2023 prior to the IPO.

2024 PROXY STATEMENT | 28

Compensation Elements to Support Atmus’ Pay-for-Performance Philosophy

The Atmus compensation program is designed to support its pay-for-performance philosophy, which aligns the interests of executives with the interests of shareholders and other stakeholders. The key components of Atmus’ executive compensation program for 2023 were:

| | | | | | | | | | | | | | | | | | | | |

Compensation Element | | Form of Payment | | Performance Metrics | | Rationale |

Base salary | | Cash | | Executive’s role and individual performance within the role | | Market-based to attract and retain skilled executives. Designed to recognize scope of responsibility, individual performance and experience. |

Annual bonus | | Cash | | Earnings before interest, taxes, depreciation and amortization and certain adjustments (“Adjusted EBITDA”) | | Considered to be a significant driver of the value of Atmus’ business and appropriately balancing growth and profitability. |

Long-term incentive compensation | | Performance shares (“PSUs”) (70%) and Restricted share units (“RSUs”) (30%) | | For PSUs, cumulative Adjusted EBITDA over a three-year period and three-year average return on invested capital (“ROIC”), each weighted at 50% | | Adjusted EBITDA and ROIC provide an incentive to balance profitable growth and returns to shareholders. |

Atmus’ compensation program consisted of base salary, annual bonus and long-term incentive compensation. In light of the IPO, for the 2023 annual bonus, the Compensation Committee and Cummins’ TMCC adopted an Atmus-only performance metric based on Atmus’ Adjusted EBITDA for the full duration of the 2023 annual bonus plan for Atmus participants. Cummins’ long-term incentive compensation for the periods 2021 – 2023 and 2022 – 2024 was granted in a combination of performance shares (70%) and performance cash (30%) based on satisfaction of ROIC and cumulative EBITDA, weighted at 80% and 20%, respectively, over the three-year performance period. As discussed below, Cummins’ performance metrics for those awards were frozen as of the Atmus IPO and the awards were converted to Atmus long term incentives for the remaining performance period. For a discussion of the treatment of the Cummins long-term incentive compensation awards outstanding at the time of the IPO, see “Long-Term Incentive Compensation — Cummins Awards for the Performance Periods 2021 – 2023 and 2022 – 2024.”

Target Executive Compensation Aligned with the Market

The Compensation Committee reviews its executive compensation levels and programs on a regular basis. For pay levels, post-IPO, The Compensation Committee considered survey data for all NEOs and, in addition, peer group data for the CEO and CFO. Specific compensation levels were then determined in accordance with the individual’s performance, capabilities and experience in the role.

For making 2023 post-IPO pay decisions, Atmus’ primary compensation benchmarking sources were manufacturing companies in the Aon Radford Global Compensation Survey and the Willis Towers Watson General Executive Compensation Survey. Atmus also considered data from a Custom Peer Group (described below) regarding pay levels and pay program design, dilution and performance. Atmus believes this approach provides an appropriate representation of the market, and using multiple sources dampens the impact of fluctuations in market data over time.

The Compensation Committee reviewed and, for 2023 compensation decisions, adopted an Atmus peer group previously selected by the Cummins TMCC with assistance from its independent compensation consultant, Farient. The peer group was selected considering (i) companies that trade on the major U.S. stock exchanges and are primarily based in the U.S.; (ii) companies with an industrial machinery focus; (iii) companies with annual revenues of between $400 million and $4 billion; and (iv) companies with a similar customer type mix. Atmus’ compensation peer group for 2023 is comprised of the following companies:

2024 PROXY STATEMENT | 29

| | | | | | | | | | | | | | | | | | | | |

A.O. Smith Corporation (AOS) | | Chart Industries, Inc. (GTLS) | | CIRCOR International, Inc. (CIR) | | Donaldson Company Inc. (DCI) |

| Enerflex Ltd. (EFXT) | | EnPro Industries, Inc. (NPO) | | ESCO Technologies Inc. (ESE) | | Evoqua Water Technologies Corp. (AQUA) |

| IDEX Corporation (IEX) | | Franklin Electric Co., Inc. (FELE) | | Gates Industrial Corporation plc (GTES) | | Graco Inc. (GGG) |

Watts Water Technologies, Inc. (WTS) | | Flowserve Corporation (FLS) | | Pentair plc (PNR) | | SPX Technologies, Inc. (SPX) |

Atmus reviews its peer group on an annual basis subject to the discretion of its executive management and the Compensation Committee.

How Performance Measures and Goals Are Determined