Third Quarter 2025 Results November 6, 2025

2 Non-GAAP financial measures and forward-looking statements Non-GAAP financial measures We provide reconciliations of the non-GAAP financial measures contained in this presentation to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to this presentation. The non-GAAP financial measures in this presentation include: adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA margin”); adjusted EBITDA margin; bank-adjusted EBITDA; free cash flow and free cash flow as a percentage of adjusted EBITDA (“free cash flow conversion”); adjusted free cash flow and adjusted free cash flow as a percentage of adjusted EBITDA (“adjusted free cash flow conversion”); net debt, gross leverage and net leverage; and adjusted net income and adjusted diluted income per share (“adjusted diluted EPS”). We believe that these adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not reflect, or are unrelated to, RXO’s core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. These non-GAAP financial measures should only be used as supplemental measures of our operating performance. Adjusted EBITDA, adjusted EBITDA margin, bank-adjusted EBITDA, adjusted net income and adjusted diluted EPS include adjustments for transaction and integration costs, as well as restructuring costs and other adjustments as set forth in the attached tables. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating RXO’s ongoing performance. We believe that adjusted EBITDA, adjusted EBITDA margin and bank-adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments that management has determined do not reflect our core operating activities and thereby assist investors with assessing trends in our underlying business. We believe that adjusted net income and adjusted diluted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs that management has determined do not reflect our core operating activities, including amortization of acquisition-related intangible assets, transaction and integration costs, restructuring costs and other adjustments as set out in the attached tables, and thereby may assist investors with comparisons to prior periods and assessing trends in our underlying business. We believe that free cash flow, free cash flow conversion, adjusted free cash flow and adjusted free cash flow conversion are important measures of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value, and may assist investors with assessing trends in our underlying business. We calculate free cash flow as net cash provided by operating activities less payment for purchases of property and equipment plus proceeds from sale of property and equipment. We define adjusted free cash flow as free cash flow less cash paid for transaction, integration, restructuring and other costs. We believe that net debt, gross leverage and net leverage are important measures of our overall liquidity position. Net debt is calculated by removing cash and cash equivalents from the principal balance of our total debt. Gross leverage is calculated as the principal balance of our total debt as a ratio of trailing twelve months bank-adjusted EBITDA. Net leverage is calculated as net debt as a ratio of trailing twelve months bank-adjusted EBITDA. With respect to our financial outlook for the fourth quarter of 2025 adjusted EBITDA, a reconciliation of this non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described above that we exclude from this non-GAAP measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking statement of income and statement of cash flows prepared in accordance with GAAP that would be required to produce such a reconciliation. Forward-looking statements This presentation includes forward-looking statements, including statements relating to our outlook and 2025 assumptions and incremental cost actions. All statements other than statements of historical fact are, or may be deemed to be, forward- looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as "anticipate," "estimate," "believe," "continue," "could," "intend," "may," "plan,“ "predict," "should," "will," "expect," "project," "forecast," "goal," "outlook," "target,” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: the effect of the completion of the transaction to acquire Coyote Logistics on the parties’ business relationships and business generally; competition and pricing pressures; economic conditions generally; fluctuations in fuel prices; increased carrier prices; severe weather, natural disasters, terrorist attacks or similar incidents that cause material disruptions to our operations or the operations of the third-party carriers and independent contractors with which we contract; our dependence on third-party carriers and independent contractors; labor disputes or organizing efforts affecting our workforce and those of our third-party carriers; legal and regulatory challenges to the status of the third-party carriers with which we contract, and their delivery workers, as independent contractors, rather than employees; governmental regulation and political conditions; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; the impact of potential cyber-attacks and information technology or data security breaches; issues related to our intellectual property rights; our ability to access the capital markets and generate sufficient cash flow to satisfy our debt obligations; litigation that may adversely affect our business or reputation; increasingly stringent laws protecting the environment, including transitional risks relating to climate change, that impact our third-party carriers; our ability to attract and retain qualified personnel; our ability to successfully implement our cost and revenue initiatives and other strategies; our ability to successfully manage our growth; our reliance on certain large customers for a significant portion of our revenue; damage to our reputation through unfavorable publicity; our failure to meet performance levels required by our contracts with our customers; the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated or targeted; and the impact of the separation on our businesses, operations and results. All forward-looking statements set forth in this presentation are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this presentation speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

3 Q3 2025 highlights 1 Volume outperformance in a continued soft market 2 Continued Last Mile stop growth 3 Strong adjusted free cash flow conversion 4 Full-truckload market has tightened significantly, driven by capacity exits 5 New cost initiatives to enhance operational efficiency RXO is well positioned to deliver strong profitable growth across market cycles

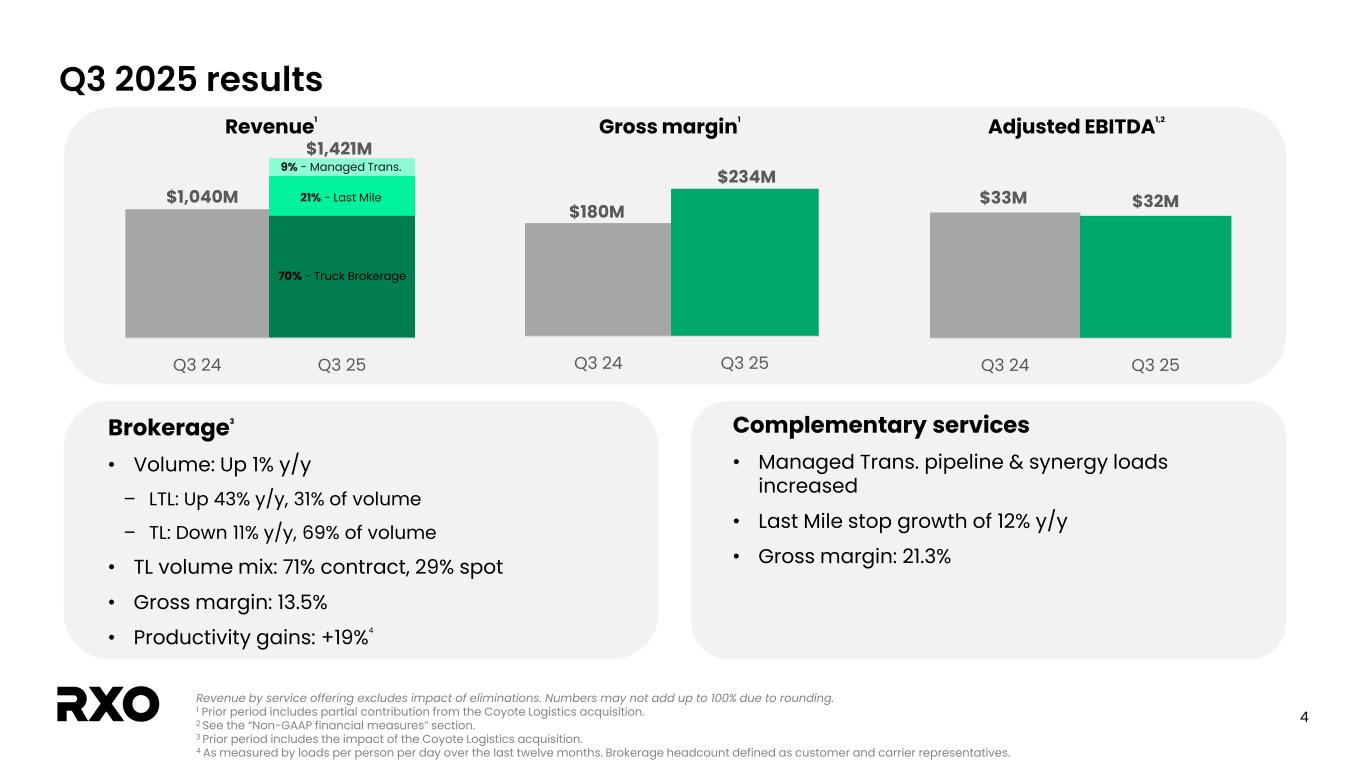

4 Q3 2025 results Revenue by service offering excludes impact of eliminations. Numbers may not add up to 100% due to rounding. 1 Prior period includes partial contribution from the Coyote Logistics acquisition. 2 See the “Non-GAAP financial measures” section. 3 Prior period includes the impact of the Coyote Logistics acquisition. 4 As measured by loads per person per day over the last twelve months. Brokerage headcount defined as customer and carrier representatives. Brokerage3 • Volume: Up 1% y/y – LTL: Up 43% y/y, 31% of volume – TL: Down 11% y/y, 69% of volume • TL volume mix: 71% contract, 29% spot • Gross margin: 13.5% • Productivity gains: +19%4 Complementary services • Managed Trans. pipeline & synergy loads increased • Last Mile stop growth of 12% y/y • Gross margin: 21.3% $1,040M Q3 24 Q3 25 $1,421M $180M $234M Q3 24 Q3 25 $33M $32M Q3 24 Q3 25 Revenue1 Gross margin1 Adjusted EBITDA1,2 70% - Truck Brokerage 21% - Last Mile 9% - Managed Trans.

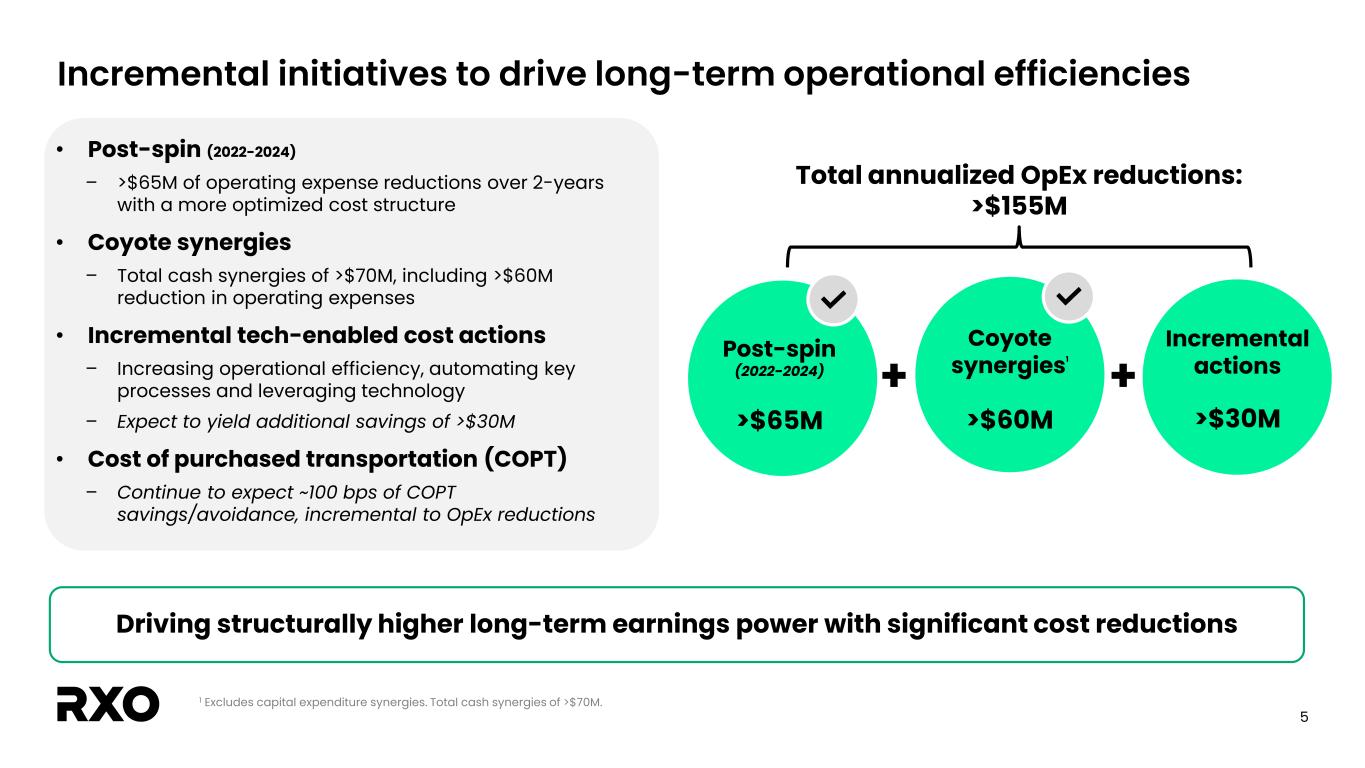

5 Incremental initiatives to drive long-term operational efficiencies Post-spin (2022-2024) >$65M Coyote synergies1 >$60M • Post-spin (2022-2024) – >$65M of operating expense reductions over 2-years with a more optimized cost structure • Coyote synergies – Total cash synergies of >$70M, including >$60M reduction in operating expenses • Incremental tech-enabled cost actions – Increasing operational efficiency, automating key processes and leveraging technology – Expect to yield additional savings of >$30M • Cost of purchased transportation (COPT) – Continue to expect ~100 bps of COPT savings/avoidance, incremental to OpEx reductions + Total annualized OpEx reductions: >$155M Driving structurally higher long-term earnings power with significant cost reductions Incremental actions >$30M + 1 Excludes capital expenditure synergies. Total cash synergies of >$70M.

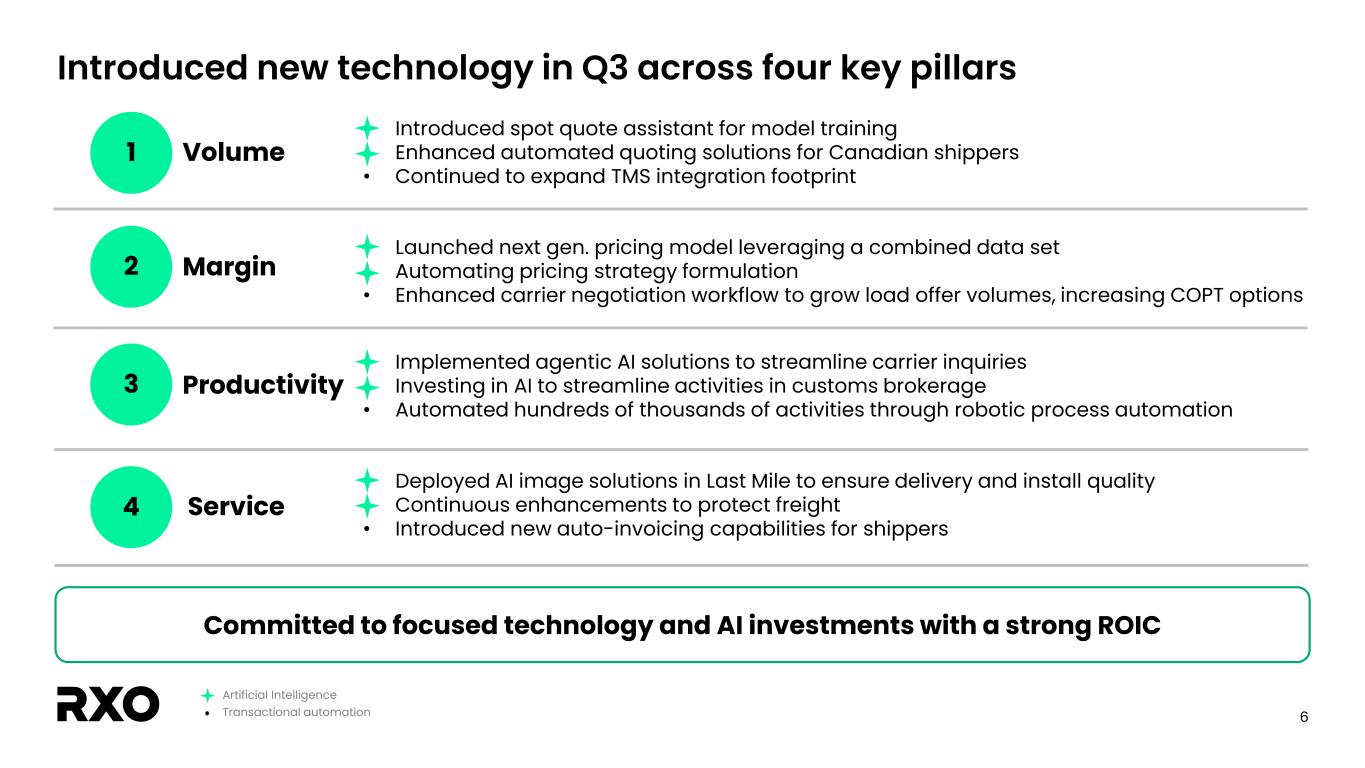

6 Introduced new technology in Q3 across four key pillars 1 2 3 4 Volume Margin Productivity Service • Introduced spot quote assistant for model training • Enhanced automated quoting solutions for Canadian shippers • Continued to expand TMS integration footprint • Launched next gen. pricing model leveraging a combined data set • Automating pricing strategy formulation • Enhanced carrier negotiation workflow to grow load offer volumes, increasing COPT options • Implemented agentic AI solutions to streamline carrier inquiries • Investing in AI to streamline activities in customs brokerage • Automated hundreds of thousands of activities through robotic process automation • Deployed AI image solutions in Last Mile to ensure delivery and install quality • Continuous enhancements to protect freight • Introduced new auto-invoicing capabilities for shippers Committed to focused technology and AI investments with a strong ROIC Artificial Intelligence Transactional automation

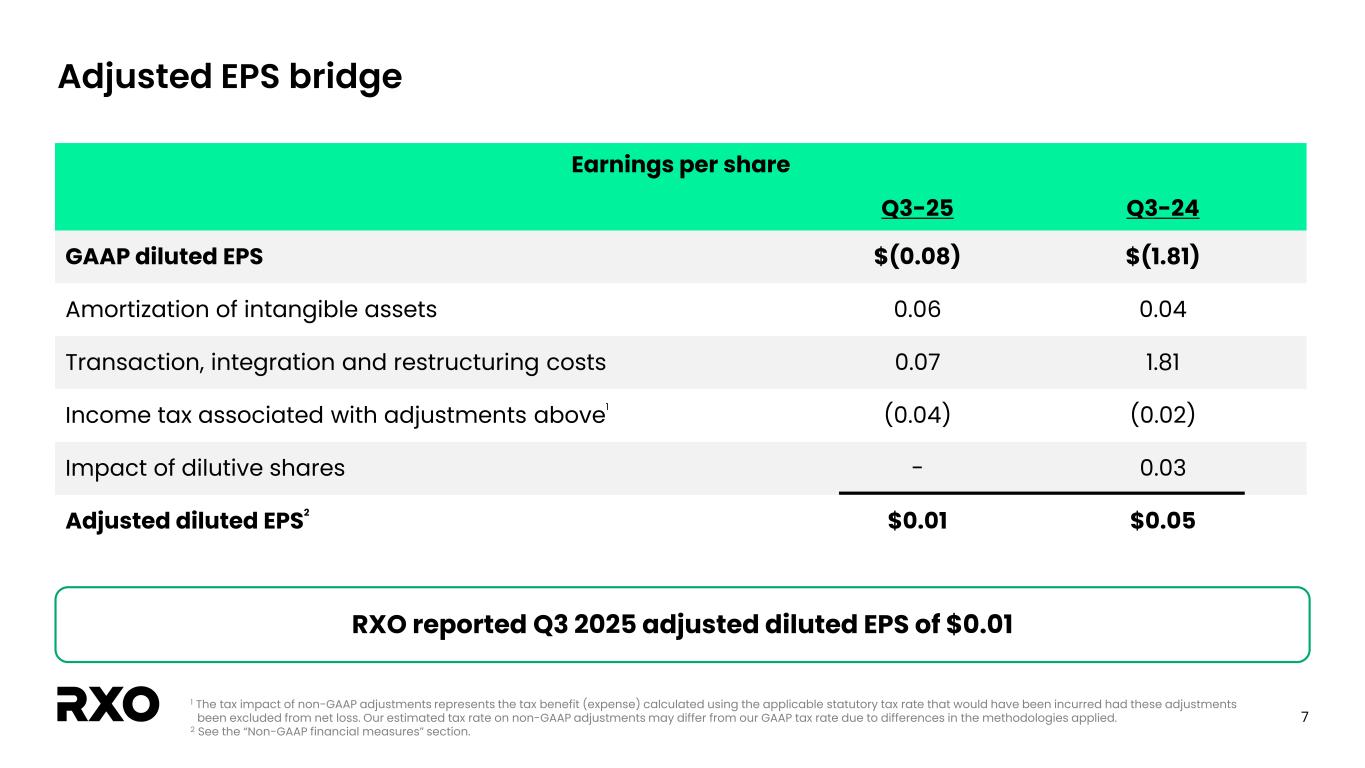

7 Adjusted EPS bridge Earnings per share Q3-25 Q3-24 GAAP diluted EPS $(0.08) $(1.81) Amortization of intangible assets 0.06 0.04 Transaction, integration and restructuring costs 0.07 1.81 Income tax associated with adjustments above1 (0.04) (0.02) Impact of dilutive shares - 0.03 Adjusted diluted EPS2 $0.01 $0.05 RXO reported Q3 2025 adjusted diluted EPS of $0.01 1 The tax impact of non-GAAP adjustments represents the tax benefit (expense) calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net loss. Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. 2 See the “Non-GAAP financial measures” section.

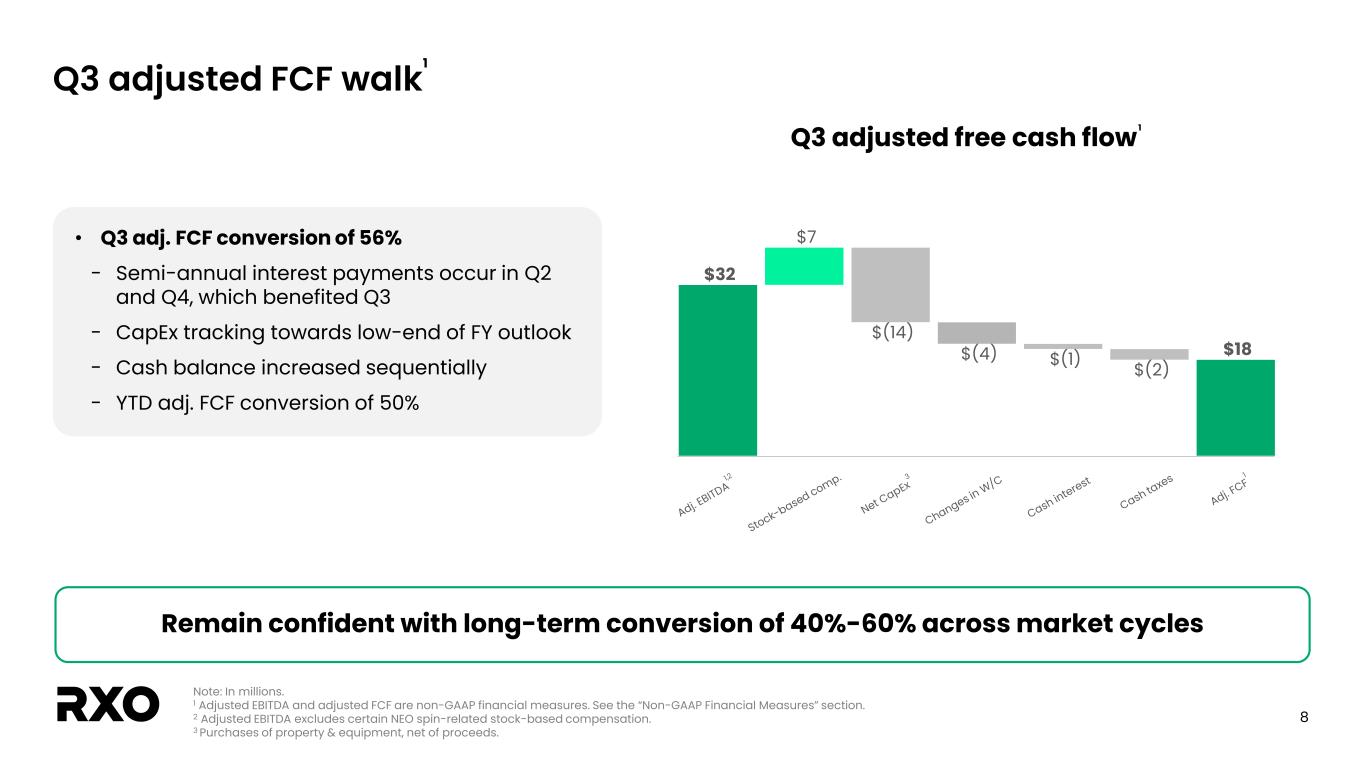

8 $7 $(14) $(4) $(1) $(2) $32 $18 Adj. EBITDA Stock-based … Net CapEx Changes in W/C Cash interest Cash taxes RXO Adj. FCF Q3 adjusted FCF walk Note: In millions. 1 Adjusted EBITDA and adjusted FCF are non-GAAP financial measures. See the “Non-GAAP Financial Measures” section. 2 Adjusted EBITDA excludes certain NEO spin-related stock-based compensation. 3 Purchases of property & equipment, net of proceeds. Remain confident with long-term conversion of 40%-60% across market cycles Q3 adjusted free cash flow1 1 • Q3 adj. FCF conversion of 56% − Semi-annual interest payments occur in Q2 and Q4, which benefited Q3 − CapEx tracking towards low-end of FY outlook − Cash balance increased sequentially − YTD adj. FCF conversion of 50%

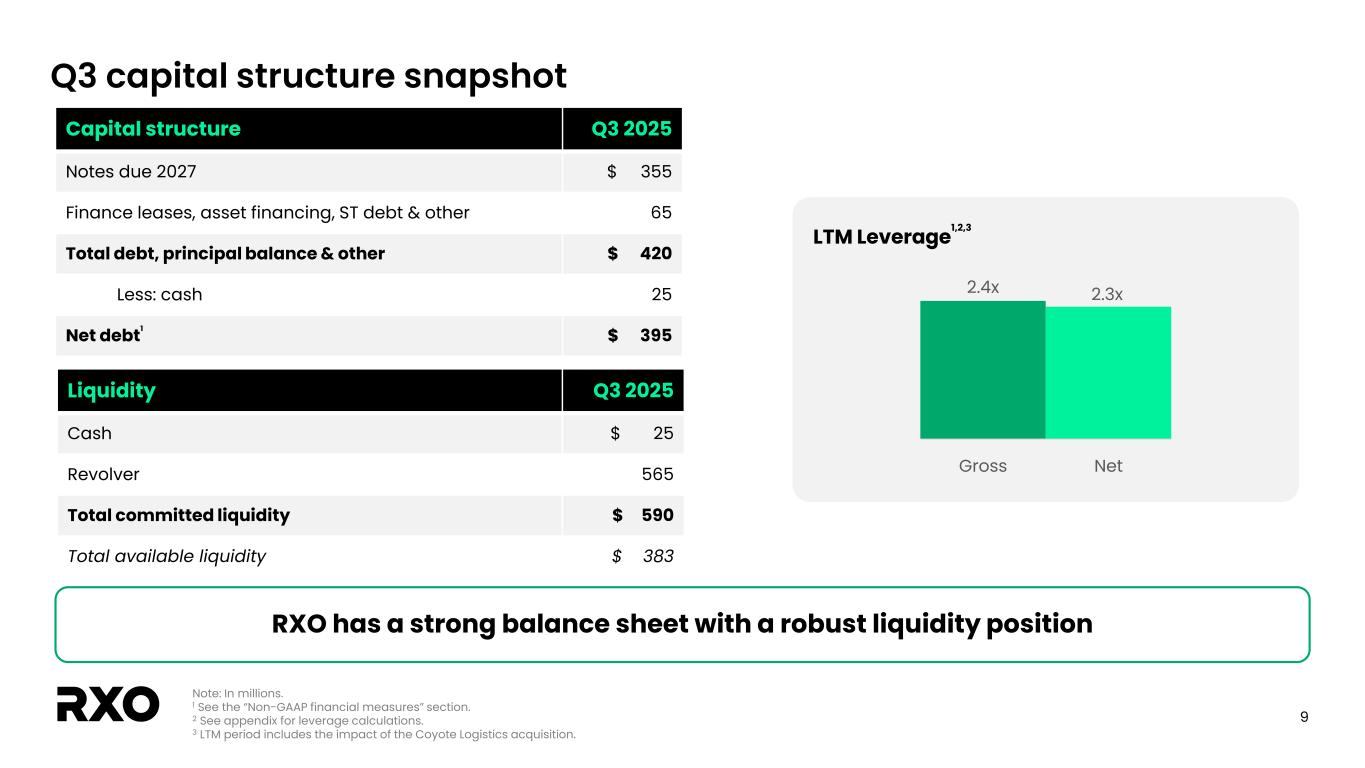

9 Q3 capital structure snapshot Capital structure Q3 2025 Notes due 2027 $ 355 Finance leases, asset financing, ST debt & other 65 Total debt, principal balance & other $ 420 Less: cash 25 Net debt1 $ 395 Note: In millions. 1 See the “Non-GAAP financial measures” section. 2 See appendix for leverage calculations. 3 LTM period includes the impact of the Coyote Logistics acquisition. LTM Leverage1,2,3 2.4x 2.3x Gross Net RXO has a strong balance sheet with a robust liquidity position Liquidity Q3 2025 Cash $ 25 Revolver 565 Total committed liquidity $ 590 Total available liquidity $ 383

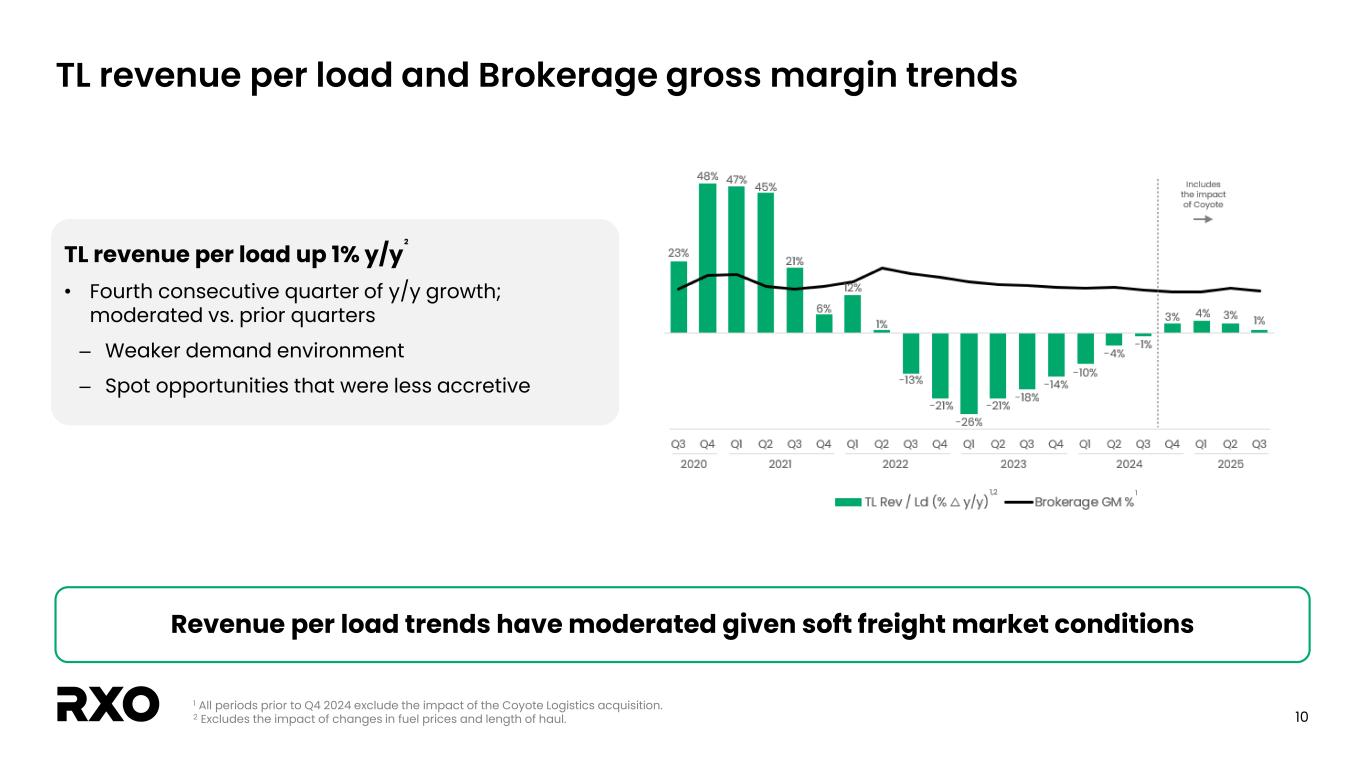

10 TL revenue per load and Brokerage gross margin trends Revenue per load trends have moderated given soft freight market conditions TL revenue per load up 1% y/y • Fourth consecutive quarter of y/y growth; moderated vs. prior quarters – Weaker demand environment – Spot opportunities that were less accretive 1 All periods prior to Q4 2024 exclude the impact of the Coyote Logistics acquisition. 2 Excludes the impact of changes in fuel prices and length of haul. 2

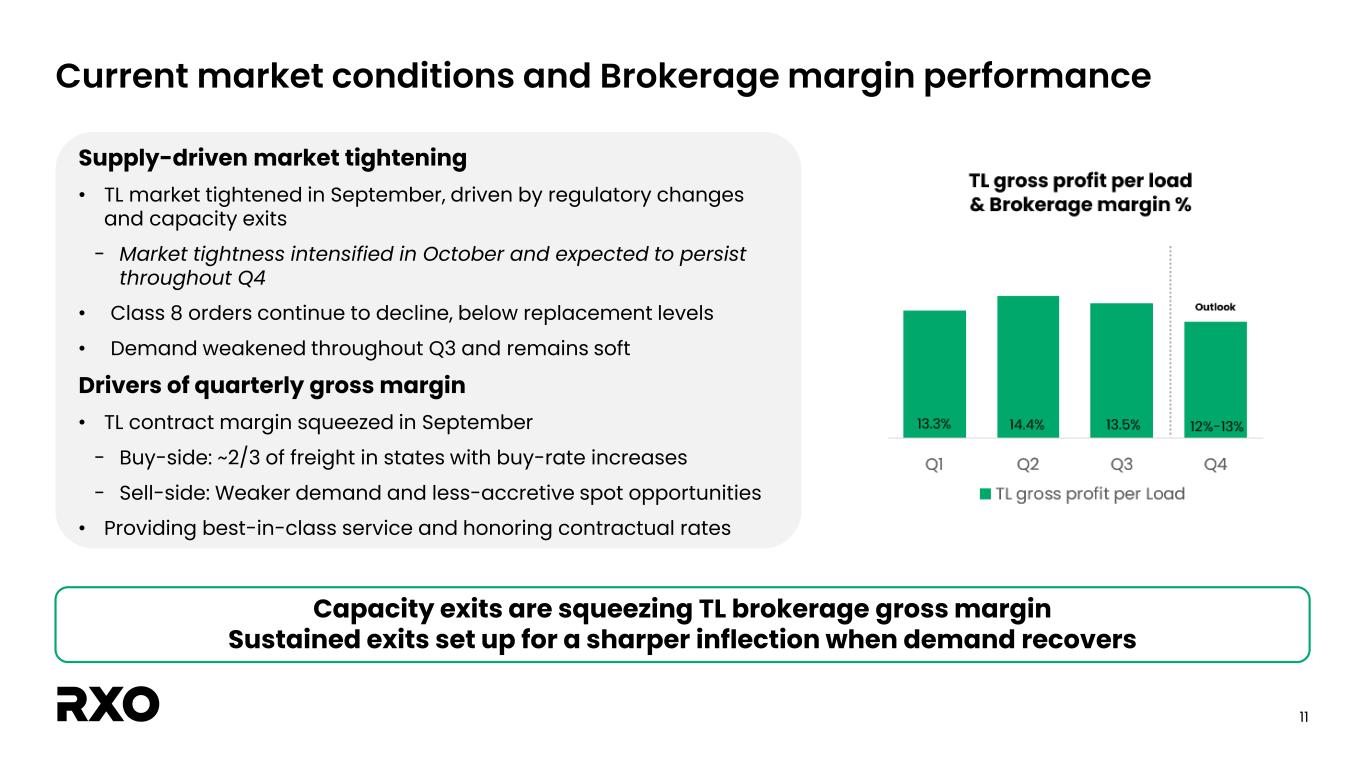

11 Current market conditions and Brokerage margin performance Supply-driven market tightening • TL market tightened in September, driven by regulatory changes and capacity exits − Market tightness intensified in October and expected to persist throughout Q4 • Class 8 orders continue to decline, below replacement levels • Demand weakened throughout Q3 and remains soft Drivers of quarterly gross margin • TL contract margin squeezed in September − Buy-side: ~2/3 of freight in states with buy-rate increases − Sell-side: Weaker demand and less-accretive spot opportunities • Providing best-in-class service and honoring contractual rates Capacity exits are squeezing TL brokerage gross margin Sustained exits set up for a sharper inflection when demand recovers

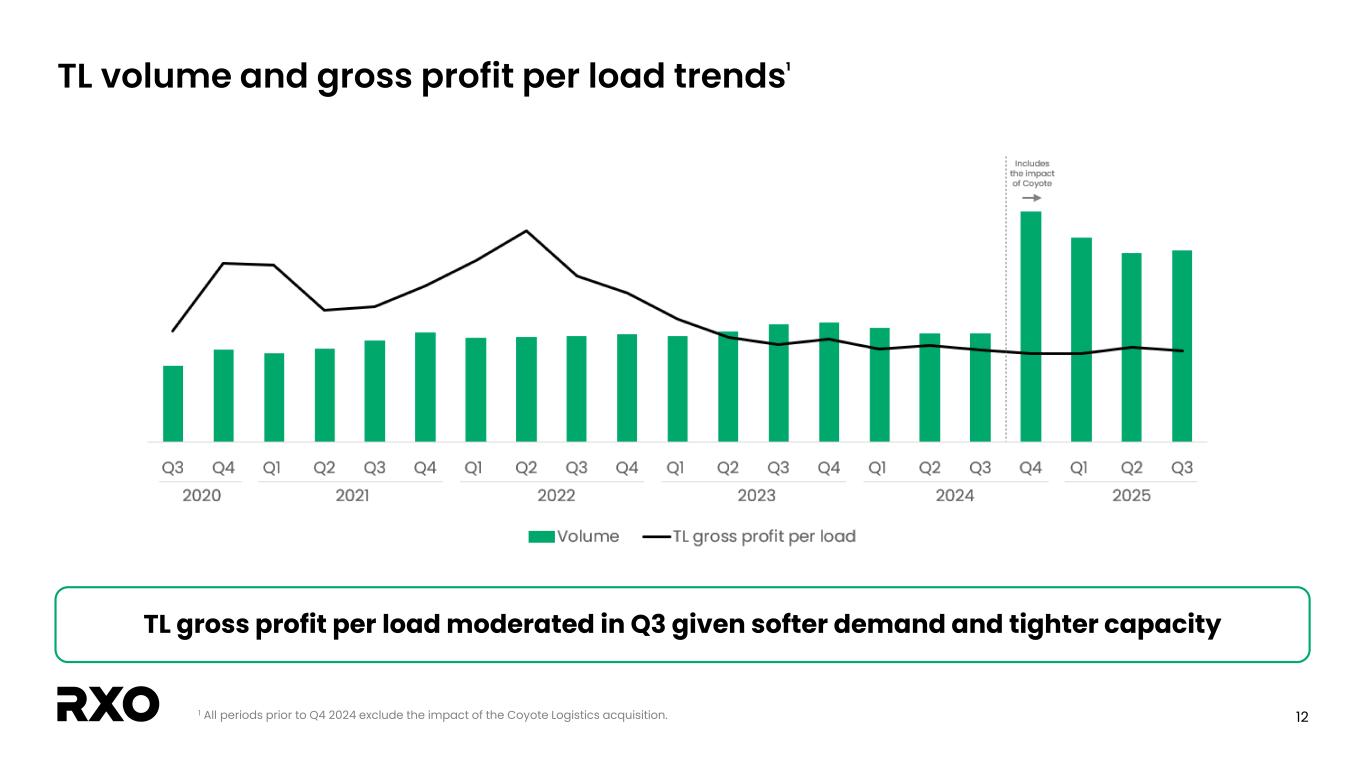

12 TL volume and gross profit per load trends1 1 All periods prior to Q4 2024 exclude the impact of the Coyote Logistics acquisition. TL gross profit per load moderated in Q3 given softer demand and tighter capacity

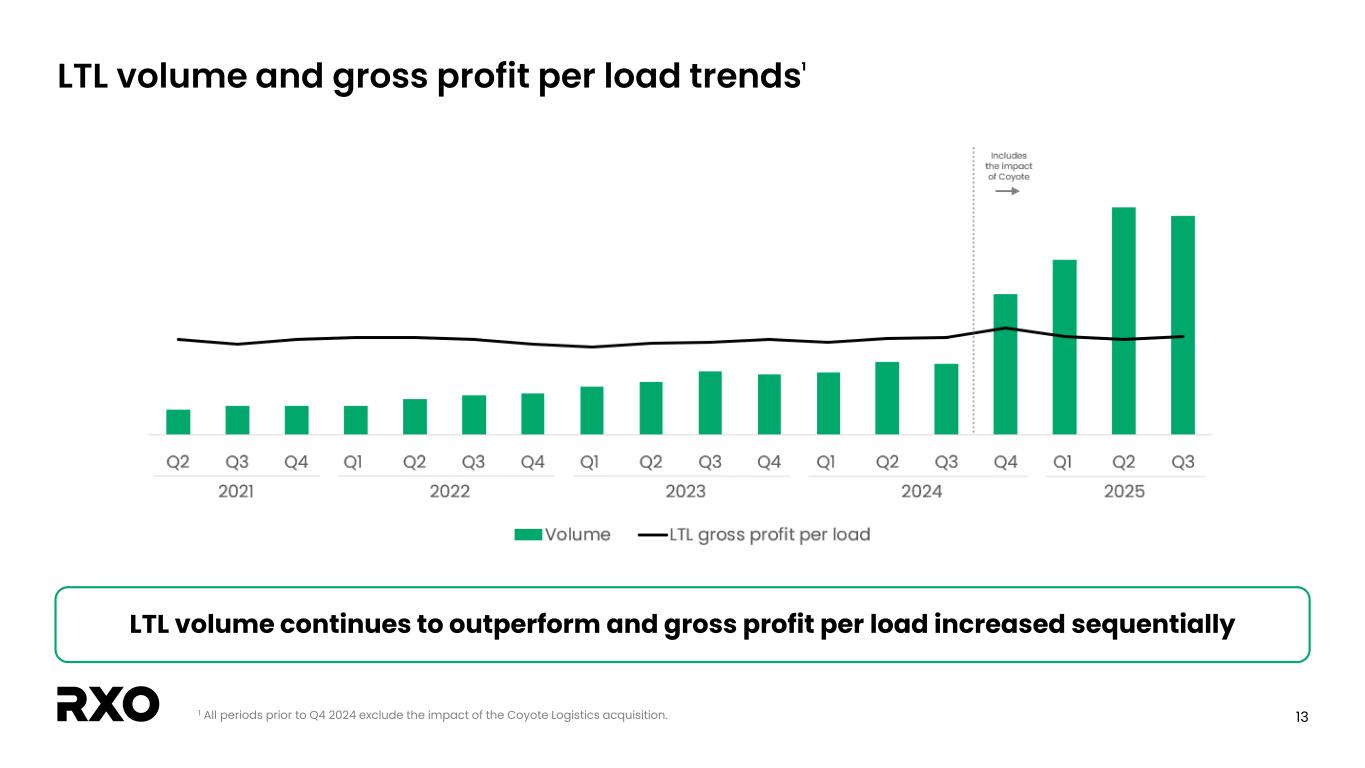

13 LTL volume and gross profit per load trends1 LTL volume continues to outperform and gross profit per load increased sequentially 1 All periods prior to Q4 2024 exclude the impact of the Coyote Logistics acquisition.

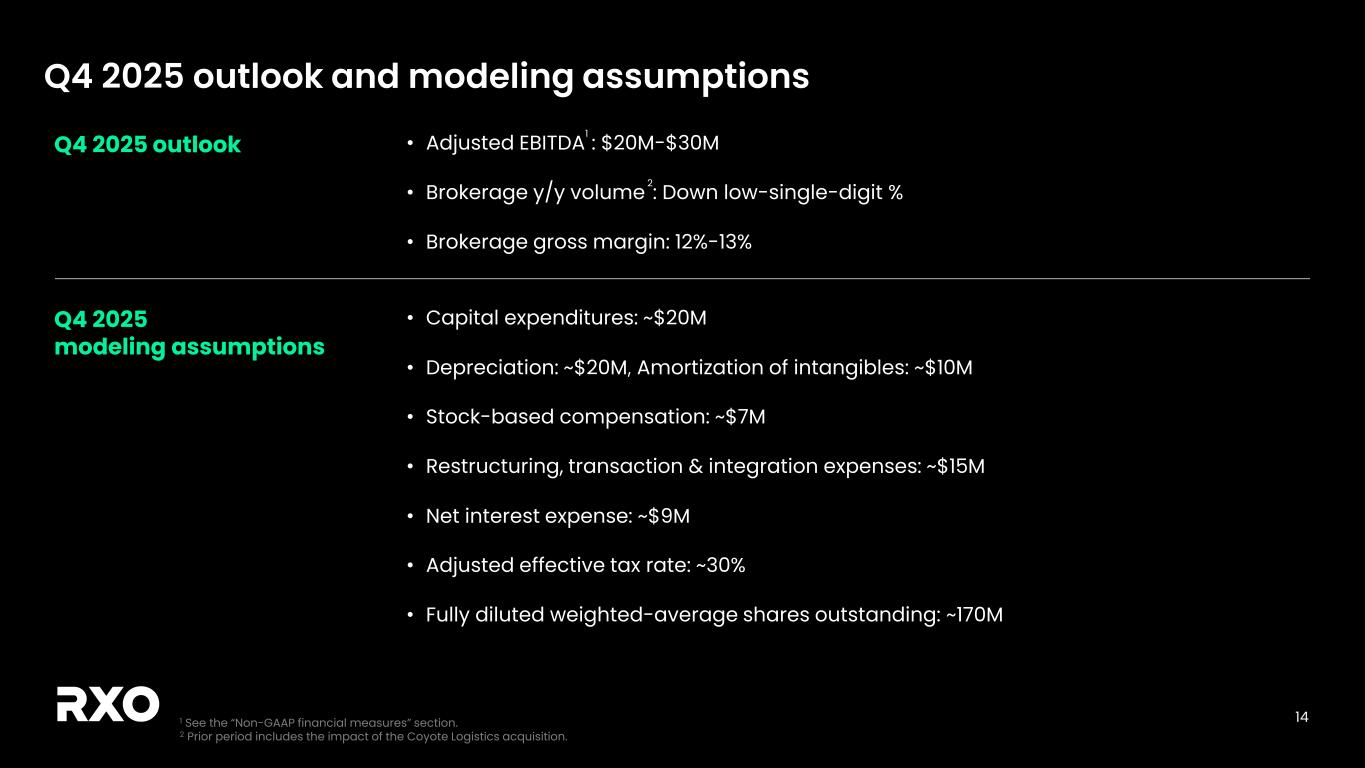

14 Q4 2025 outlook and modeling assumptions • Adjusted EBITDA1 : $20M-$30M • Brokerage y/y volume 2: Down low-single-digit % • Brokerage gross margin: 12%-13% Q4 2025 outlook Q4 2025 modeling assumptions • Capital expenditures: ~$20M • Depreciation: ~$20M, Amortization of intangibles: ~$10M • Stock-based compensation: ~$7M • Restructuring, transaction & integration expenses: ~$15M • Net interest expense: ~$9M • Adjusted effective tax rate: ~30% • Fully diluted weighted-average shares outstanding: ~170M 1 See the “Non-GAAP financial measures” section. 2 Prior period includes the impact of the Coyote Logistics acquisition.

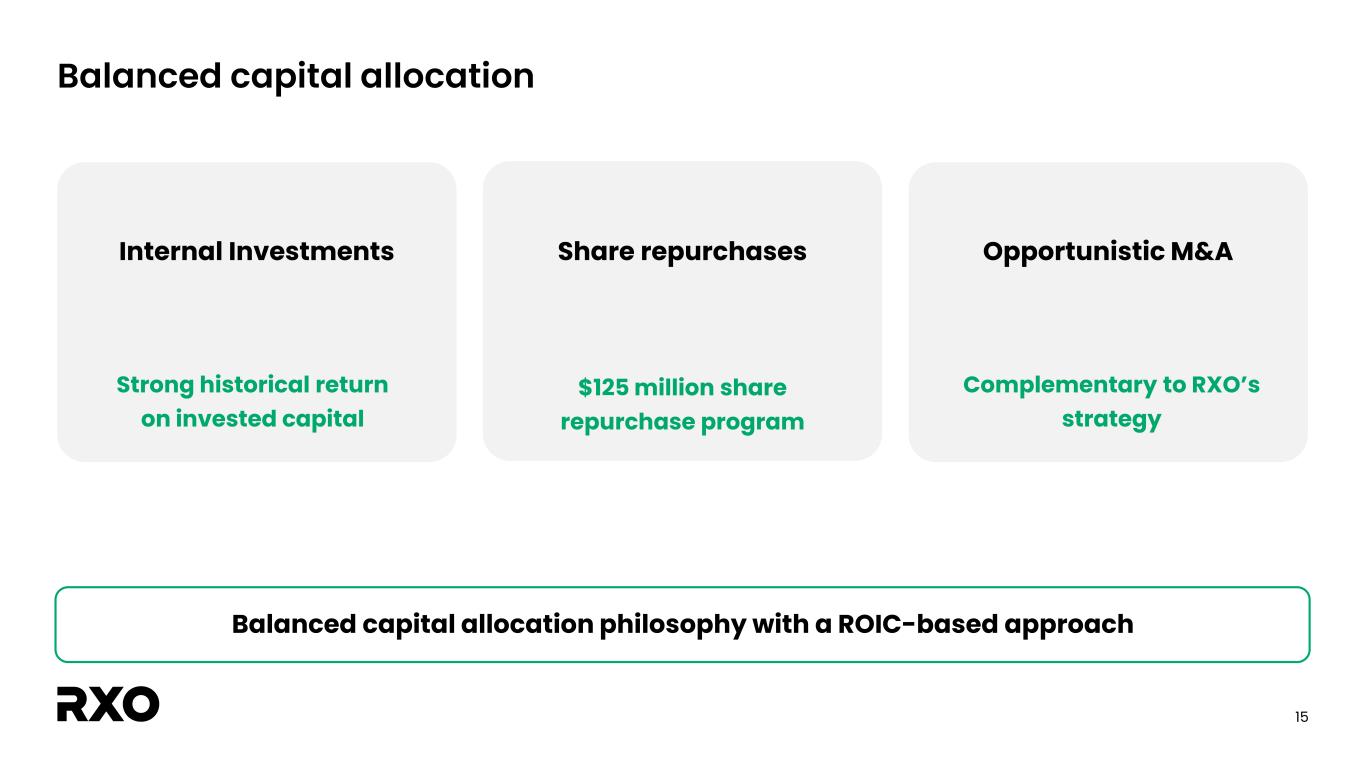

15 Balanced capital allocation Internal Investments Strong historical return on invested capital Share repurchases Opportunistic M&A Complementary to RXO’s strategy Balanced capital allocation philosophy with a ROIC-based approach $125 million share repurchase program

16 Key investment highlights 1 Large addressable market with secular tailwinds 2 Track record of above-market growth and high profitability 3 Proprietary technology drives productivity, volume and margin expansion 4 Long-term relationships with blue-chip customers 5 Market-leading platform with complementary transportation solutions 6 Tiered approach to sales drives multi-faceted growth opportunities 7 Diverse exposure across attractive end markets 8 Experienced and proven leadership team

17 Appendix

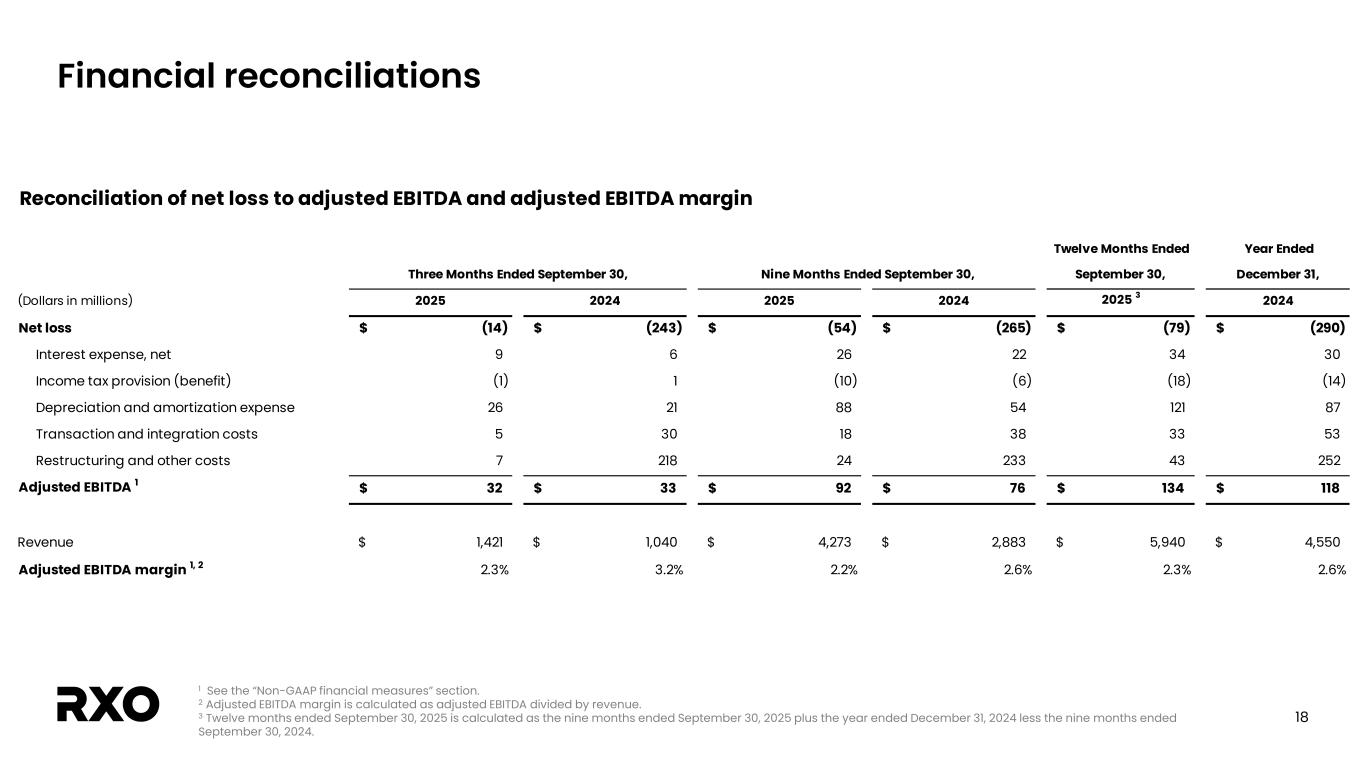

18 Financial reconciliations 1 See the “Non-GAAP financial measures” section. 2 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. 3 Twelve months ended September 30, 2025 is calculated as the nine months ended September 30, 2025 plus the year ended December 31, 2024 less the nine months ended September 30, 2024. Reconciliation of net loss to adjusted EBITDA and adjusted EBITDA margin Twelve Months Ended September 30, Year Ended December 31, (Dollars in millions) 2025 2024 2025 2024 2025 3 2024 Net loss (14)$ (243)$ (54)$ (265)$ (79)$ (290)$ Interest expense, net 9 6 26 22 34 30 Income tax provision (benefit) (1) 1 (10) (6) (18) (14) Depreciation and amortization expense 26 21 88 54 121 87 Transaction and integration costs 5 30 18 38 33 53 Restructuring and other costs 7 218 24 233 43 252 Adjusted EBITDA 1 32$ 33$ 92$ 76$ 134$ 118$ Revenue 1,421$ 1,040$ 4,273$ 2,883$ 5,940$ 4,550$ Adjusted EBITDA margin 1, 2 2.3% 3.2% 2.2% 2.6% 2.3% 2.6% Three Months Ended September 30, Nine Months Ended September 30,

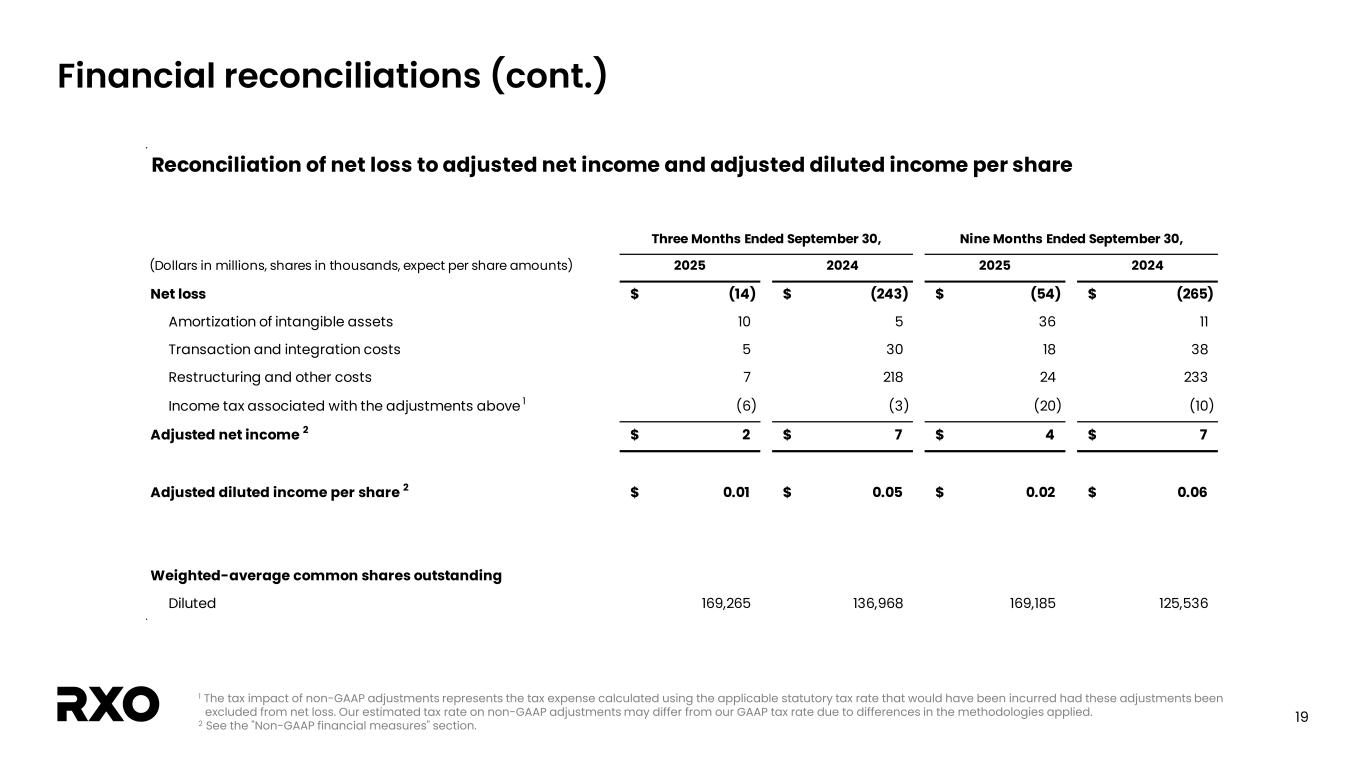

19 Financial reconciliations (cont.) 1 The tax impact of non-GAAP adjustments represents the tax expense calculated using the applicable statutory tax rate that would have been incurred had these adjustments been excluded from net loss. Our estimated tax rate on non-GAAP adjustments may differ from our GAAP tax rate due to differences in the methodologies applied. 2 See the "Non-GAAP financial measures" section. (Dollars in millions, shares in thousands, expect per share amounts) 2025 2024 2025 2024 Net loss (14)$ (243)$ (54)$ (265)$ Amortization of intangible assets 10 5 36 11 Transaction and integration costs 5 30 18 38 Restructuring and other costs 7 218 24 233 Income tax associated with the adjustments above 1 (6) (3) (20) (10) Adjusted net income 2 2$ 7$ 4$ 7$ Adjusted diluted income per share 2 0.01$ 0.05$ 0.02$ 0.06$ Weighted-average common shares outstanding Diluted 169,265 136,968 169,185 125,536 Reconciliation of net loss to adjusted net income and adjusted diluted income per share Three Months Ended September 30, Nine Months Ended September 30,

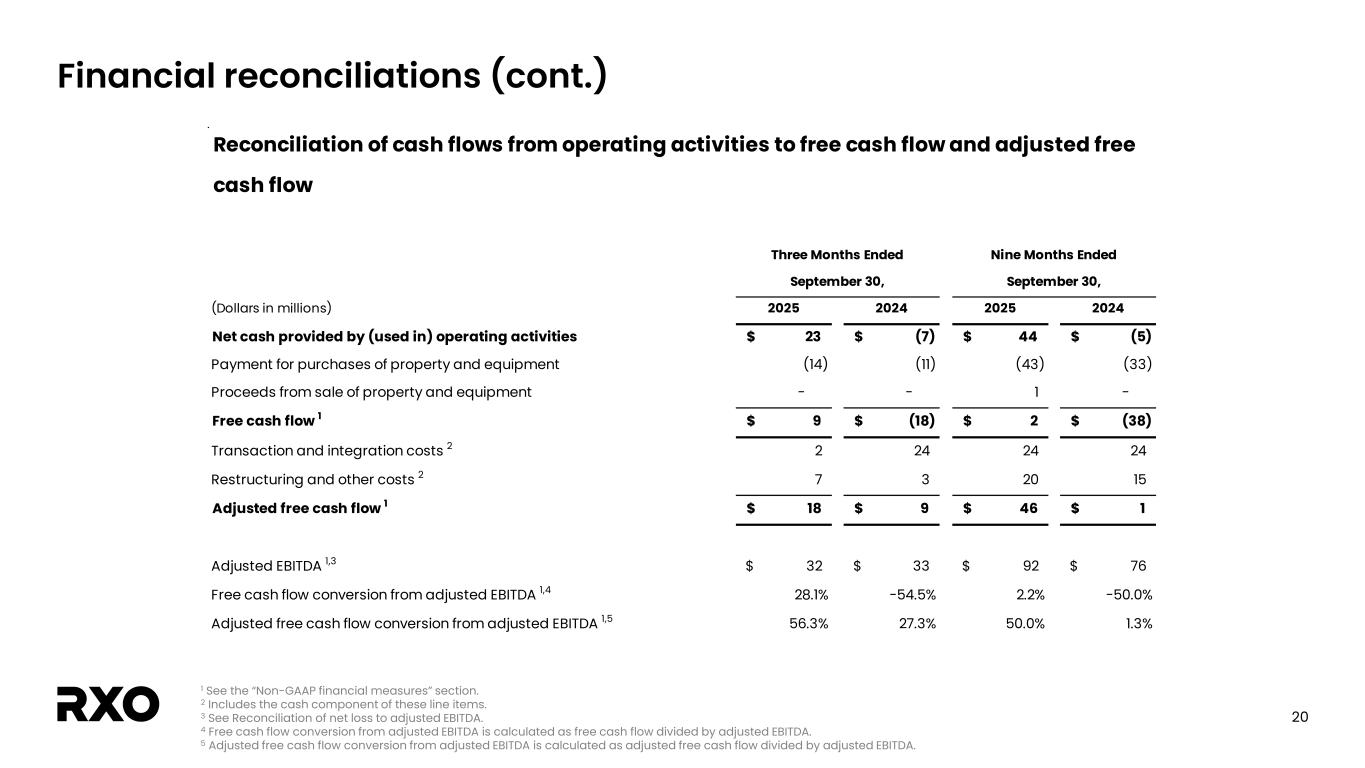

20 1 See the “Non-GAAP financial measures” section. 2 Includes the cash component of these line items. 3 See Reconciliation of net loss to adjusted EBITDA. 4 Free cash flow conversion from adjusted EBITDA is calculated as free cash flow divided by adjusted EBITDA. 5 Adjusted free cash flow conversion from adjusted EBITDA is calculated as adjusted free cash flow divided by adjusted EBITDA. Financial reconciliations (cont.) (Dollars in millions) 2025 2024 2025 2024 Net cash provided by (used in) operating activities 23$ (7)$ 44$ (5)$ Payment for purchases of property and equipment (14) (11) (43) (33) Proceeds from sale of property and equipment - - 1 - Free cash flow 1 9$ (18)$ 2$ (38)$ Transaction and integration costs 2 2 24 24 24 Restructuring and other costs 2 7 3 20 15 Adjusted free cash flow 1 18$ 9$ 46$ 1$ Adjusted EBITDA 1,3 32$ 33$ 92$ 76$ Free cash flow conversion from adjusted EBITDA 1,4 28.1% -54.5% 2.2% -50.0% Adjusted free cash flow conversion from adjusted EBITDA 1,5 56.3% 27.3% 50.0% 1.3% Nine Months Ended September 30, Reconciliation of cash flows from operating activities to free cash flow and adjusted free cash flow Three Months Ended September 30,

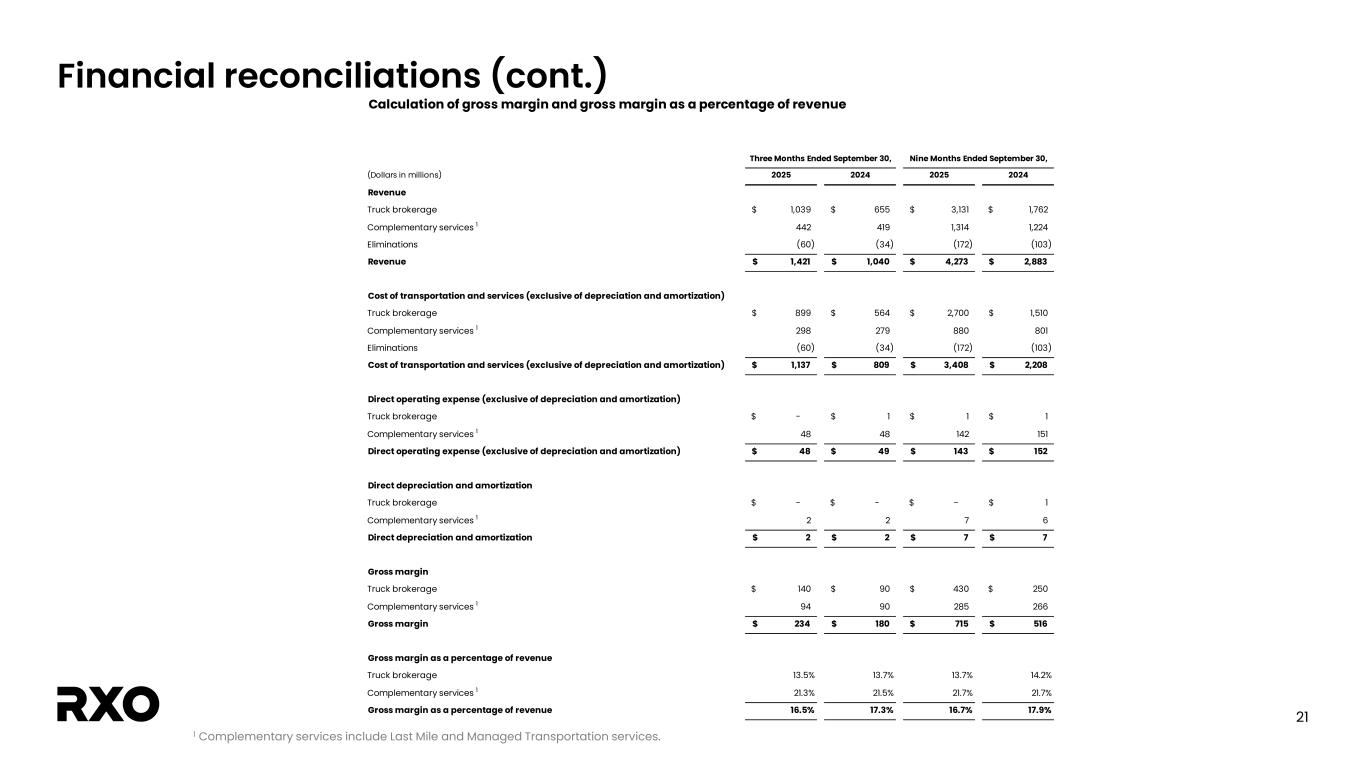

21 Financial reconciliations (cont.) 1 Complementary services include Last Mile and Managed Transportation services. Calculation of gross margin and gross margin as a percentage of revenue (Dollars in millions) 2025 2024 2025 2024 Revenue Truck brokerage 1,039$ 655$ 3,131$ 1,762$ Complementary services 1 442 419 1,314 1,224 Eliminations (60) (34) (172) (103) Revenue 1,421$ 1,040$ 4,273$ 2,883$ Cost of transportation and services (exclusive of depreciation and amortization) Truck brokerage 899$ 564$ 2,700$ 1,510$ Complementary services 1 298 279 880 801 Eliminations (60) (34) (172) (103) Cost of transportation and services (exclusive of depreciation and amortization) 1,137$ 809$ 3,408$ 2,208$ Direct operating expense (exclusive of depreciation and amortization) Truck brokerage -$ 1$ 1$ 1$ Complementary services 1 48 48 142$ 151$ Direct operating expense (exclusive of depreciation and amortization) 48$ 49$ 143$ 152$ Direct depreciation and amortization Truck brokerage -$ -$ -$ 1$ Complementary services 1 2 2 7$ 6$ Direct depreciation and amortization 2$ 2$ 7$ 7$ Gross margin Truck brokerage 140$ 90$ 430$ 250$ Complementary services 1 94 90 285$ 266$ Gross margin 234$ 180$ 715$ 516$ Gross margin as a percentage of revenue Truck brokerage 13.5% 13.7% 13.7% 14.2% Complementary services 1 21.3% 21.5% 21.7% 21.7% Gross margin as a percentage of revenue 16.5% 17.3% 16.7% 17.9% Three Months Ended September 30, Nine Months Ended September 30,

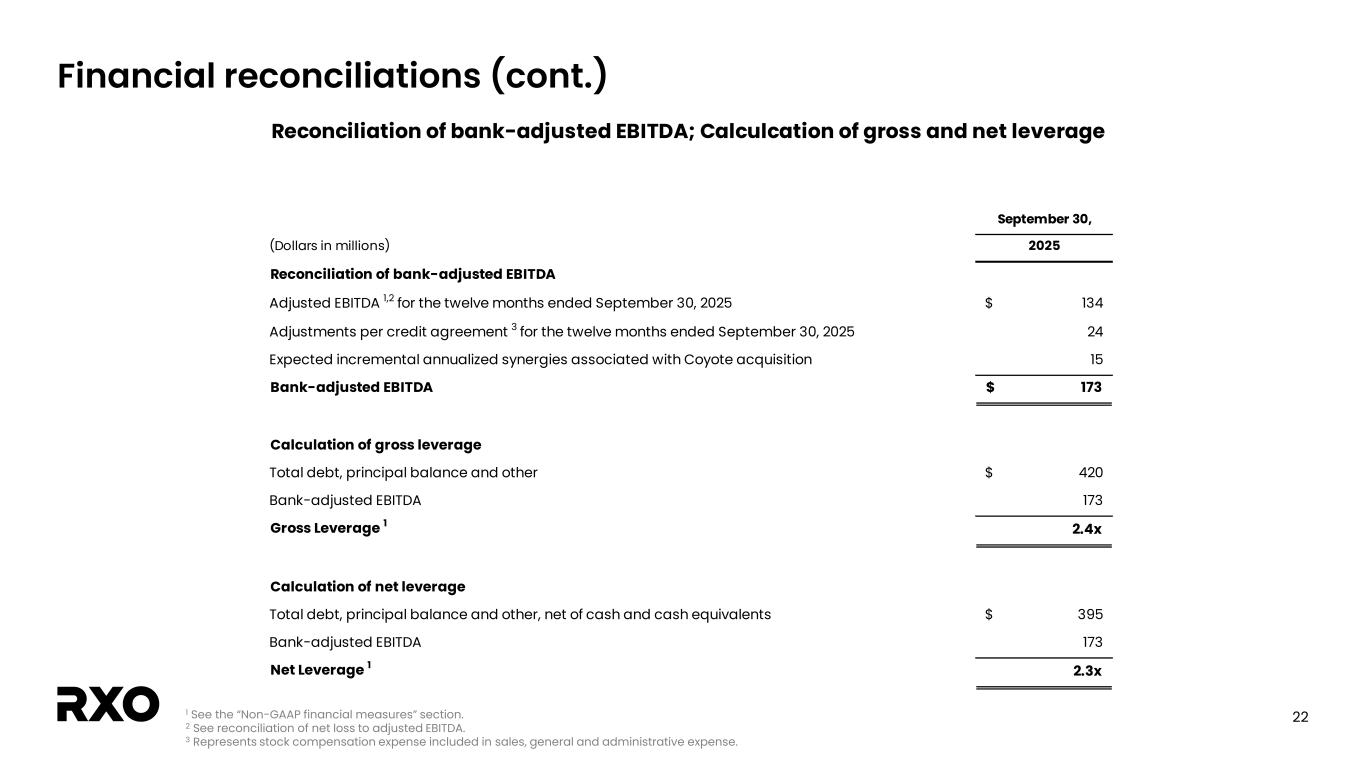

22 Financial reconciliations (cont.) 1 See the “Non-GAAP financial measures” section. 2 See reconciliation of net loss to adjusted EBITDA. 3 Represents stock compensation expense included in sales, general and administrative expense. September 30, (Dollars in millions) 2025 Reconciliation of bank-adjusted EBITDA Adjusted EBITDA 1,2 for the twelve months ended September 30, 2025 134$ Adjustments per credit agreement 3 for the twelve months ended September 30, 2025 24 Expected incremental annualized synergies associated with Coyote acquisition 15 Bank-adjusted EBITDA 173$ Calculation of gross leverage Total debt, principal balance and other 420$ Bank-adjusted EBITDA 173 Gross Leverage 1 2.4x Calculation of net leverage Total debt, principal balance and other, net of cash and cash equivalents 395$ Bank-adjusted EBITDA 173 Net Leverage 1 2.3x Reconciliation of bank-adjusted EBITDA; Calculcation of gross and net leverage