F&G Investor Update Fall 2025

Disclaimer & Forward-Looking Statements 2F&G Investor Update | Fall 2025 This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. Some of the forward-looking statements can be identified by the use of terms such as “believes”, “expects”, “may”, “will”, “could”, “seeks”, “intends”, “plans”, “estimates”, “anticipates” or other comparable terms. Statements that are not historical facts, including statements regarding our expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on management's beliefs, as well as assumptions made by, and information currently available to, management. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties which forward-looking statements are subject to include, but are not limited to: general economic conditions and other factors, including prevailing interest and unemployment rate levels and stock and credit market performance; consumer spending; government spending; the volatility and strength of the capital markets; investor and consumer confidence; foreign currency exchange rates; commodity prices; inflation levels; changes in trade policy; tariffs and trade sanctions on goods; trade wars; supply chain disruptions; natural disasters, public health crises, international tensions and conflicts, geopolitical events, terrorist acts, labor strikes, political crisis, accidents and other events; concentration in certain states for distribution of our products; the impact of interest rate fluctuations; equity market volatility or disruption; the impact of credit risk of our counterparties; changes in our assumptions and estimates regarding amortization of our deferred acquisition costs, deferred sales inducements and value of business acquired balances; regulatory changes or actions, including those relating to regulation of financial services affecting (among other things) underwriting of insurance products and regulation of the sale, underwriting and pricing of products and minimum capitalization and statutory reserve requirements for insurance companies, or the ability of our insurance subsidiaries to make cash distributions to us; and other factors discussed in “Risk Factors” and other sections of F&G's Form 10-K and other filings with the Securities and Exchange Commission (SEC).

Non-GAAP Financial Measures 3F&G Investor Update | Fall 2025 Generally Accepted Accounting Principles in the U.S. ("GAAP") is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, this document includes non-GAAP financial measures, which the Company believes are useful to help investors better understand its financial performance, competitive position and prospects for the future. Management believes these non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between current results and results in prior operating periods. Our non-GAAP financial measures may not be comparable to similarly titled measures of other organizations because other organizations may not calculate such non-GAAP financial measures in the same manner as we do. The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. By disclosing these non-GAAP financial measures, the Company believes it offers investors a greater understanding of, and an enhanced level of transparency into, the means by which the Company’s management operates the Company. Any non-GAAP financial measures should be considered in context with the Company’s GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP net earnings, net earnings attributable to common shareholders, or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are provided within.

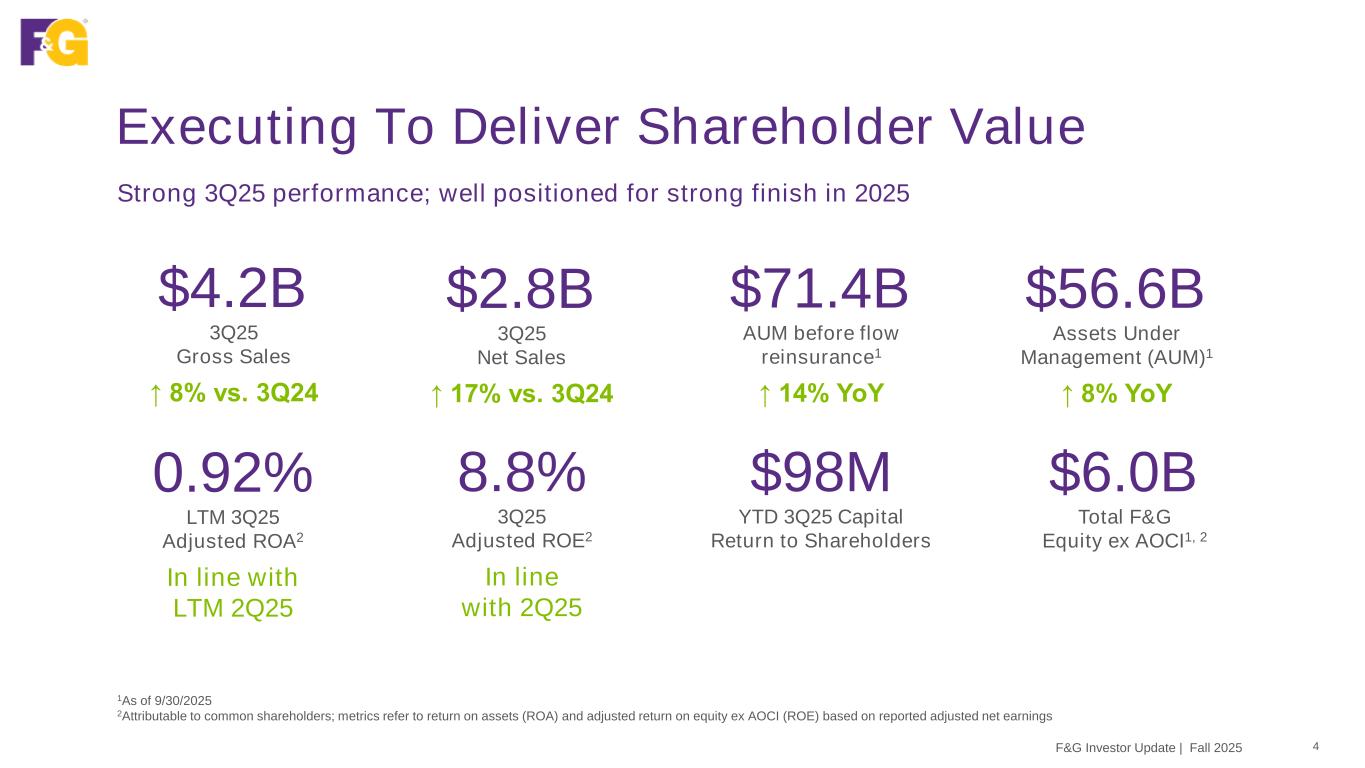

Strong 3Q25 performance; well positioned for strong finish in 2025 0.92% LTM 3Q25 Adjusted ROA2 In line with LTM 2Q25 Executing To Deliver Shareholder Value 4F&G Investor Update | Fall 2025 1As of 9/30/2025 2Attributable to common shareholders; metrics refer to return on assets (ROA) and adjusted return on equity ex AOCI (ROE) based on reported adjusted net earnings $4.2B 3Q25 Gross Sales ↑ 8% vs. 3Q24 $2.8B 3Q25 Net Sales ↑ 17% vs. 3Q24 $56.6B Assets Under Management (AUM)1 ↑ 8% YoY $71.4B AUM before flow reinsurance1 ↑ 14% YoY $98M YTD 3Q25 Capital Return to Shareholders $6.0B Total F&G Equity ex AOCI1, 2 8.8% 3Q25 Adjusted ROE2 In line with 2Q25

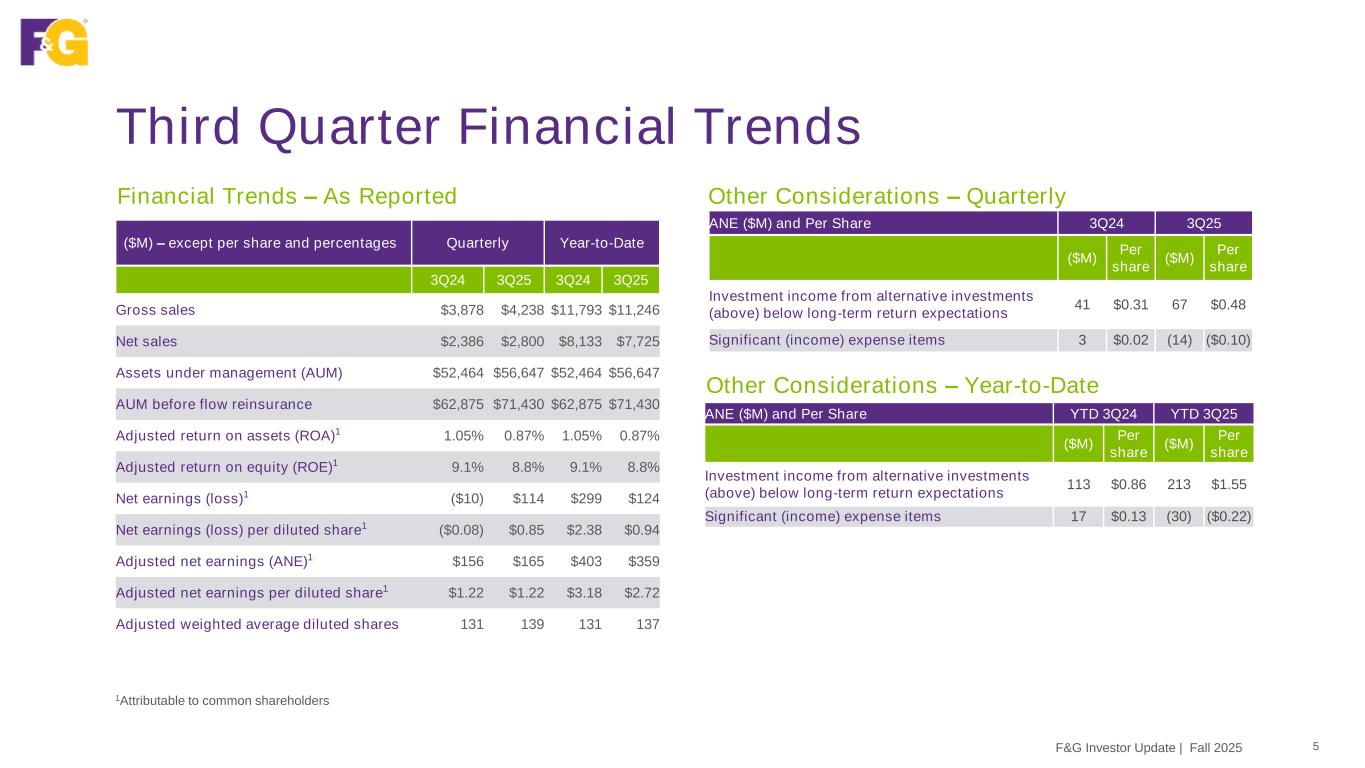

Third Quarter Financial Trends 5F&G Investor Update | Fall 2025 Other Considerations – Year-to-Date Other Considerations – Quarterly Financial Trends – As Reported ($M) – except per share and percentages Quarterly Year-to-Date 3Q24 3Q25 3Q24 3Q25 Gross sales $3,878 $4,238 $11,793 $11,246 Net sales $2,386 $2,800 $8,133 $7,725 Assets under management (AUM) $52,464 $56,647 $52,464 $56,647 AUM before flow reinsurance $62,875 $71,430 $62,875 $71,430 Adjusted return on assets (ROA)1 1.05% 0.87% 1.05% 0.87% Adjusted return on equity (ROE)1 9.1% 8.8% 9.1% 8.8% Net earnings (loss)1 ($10) $114 $299 $124 Net earnings (loss) per diluted share1 ($0.08) $0.85 $2.38 $0.94 Adjusted net earnings (ANE)1 $156 $165 $403 $359 Adjusted net earnings per diluted share1 $1.22 $1.22 $3.18 $2.72 Adjusted weighted average diluted shares 131 139 131 137 ANE ($M) and Per Share 3Q24 3Q25 ($M) Per share ($M) Per share Investment income from alternative investments (above) below long-term return expectations 41 $0.31 67 $0.48 Significant (income) expense items 3 $0.02 (14) ($0.10) ANE ($M) and Per Share YTD 3Q24 YTD 3Q25 ($M) Per share ($M) Per share Investment income from alternative investments (above) below long-term return expectations 113 $0.86 213 $1.55 Significant (income) expense items 17 $0.13 (30) ($0.22) 1Attributable to common shareholders

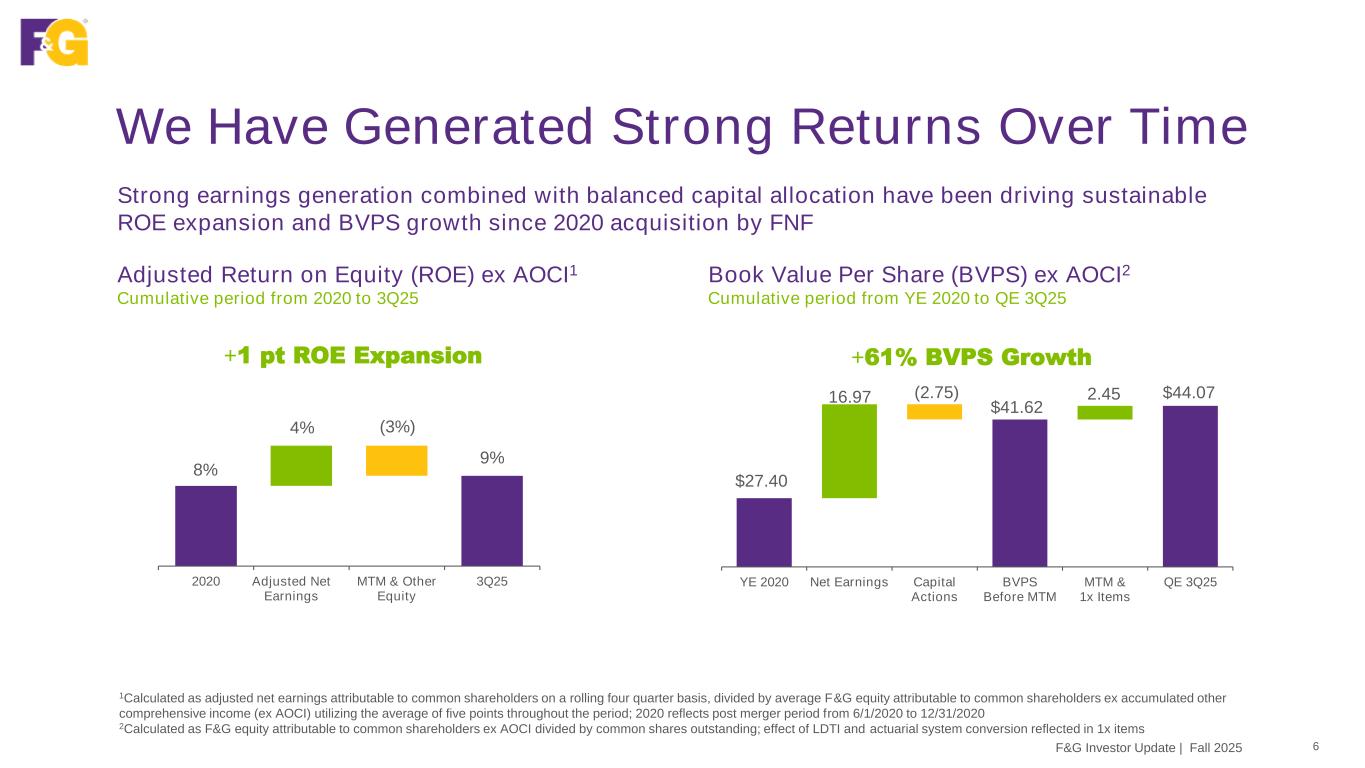

We Have Generated Strong Returns Over Time 6F&G Investor Update | Fall 2025 1Calculated as adjusted net earnings attributable to common shareholders on a rolling four quarter basis, divided by average F&G equity attributable to common shareholders ex accumulated other comprehensive income (ex AOCI) utilizing the average of five points throughout the period; 2020 reflects post merger period from 6/1/2020 to 12/31/2020 2Calculated as F&G equity attributable to common shareholders ex AOCI divided by common shares outstanding; effect of LDTI and actuarial system conversion reflected in 1x items Adjusted Return on Equity (ROE) ex AOCI1 Cumulative period from 2020 to 3Q25 Book Value Per Share (BVPS) ex AOCI2 Cumulative period from YE 2020 to QE 3Q25 8% 9% 4% (3%) 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 2020 Adjusted Net Earnings MTM & Other Equity 3Q25 $27.40 $41.62 $44.07 16.97 (2.75) 2.45 YE 2020 Net Earnings Capital Actions BVPS Before MTM MTM & 1x Items QE 3Q25 Strong earnings generation combined with balanced capital allocation have been driving sustainable ROE expansion and BVPS growth since 2020 acquisition by FNF +1 pt ROE Expansion +61% BVPS Growth

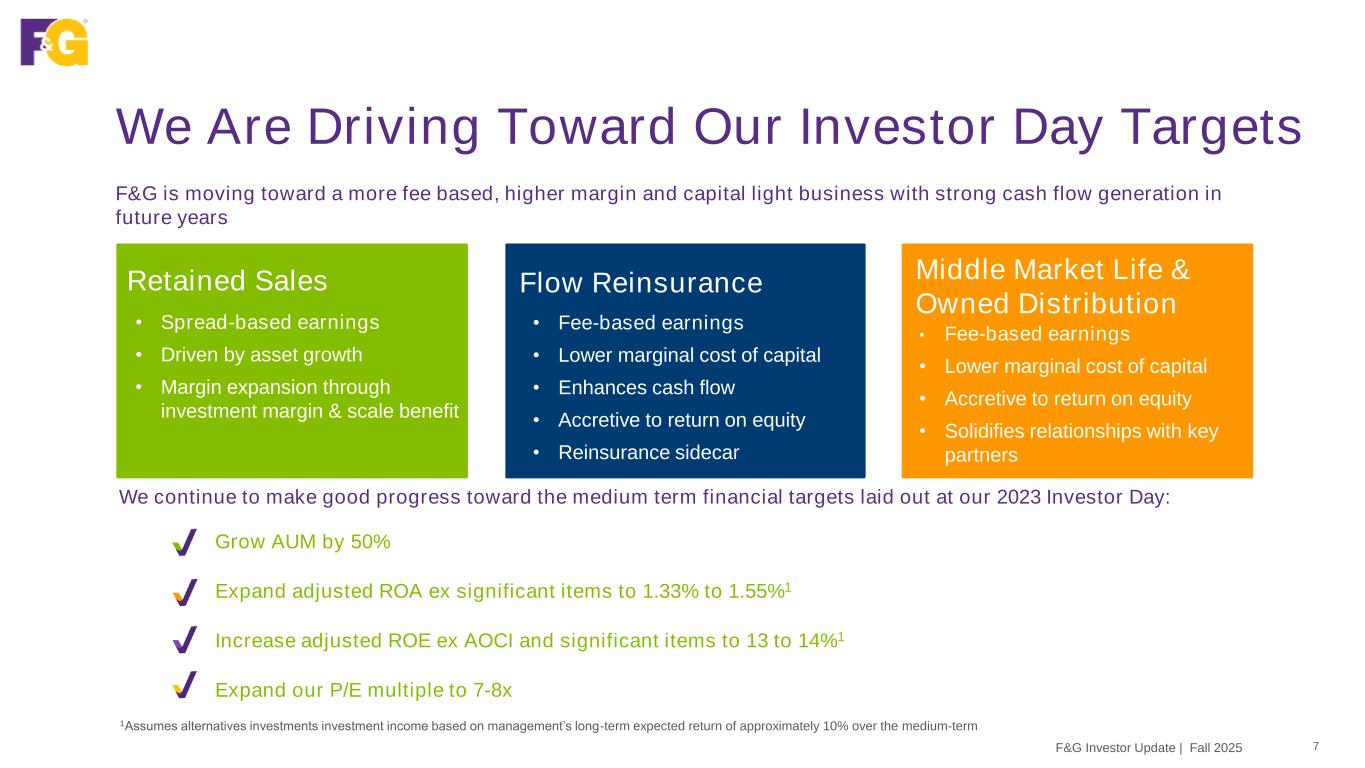

We Are Driving Toward Our Investor Day Targets • Spread-based earnings • Driven by asset growth • Margin expansion through investment margin & scale benefit Retained Sales • Fee-based earnings • Lower marginal cost of capital • Enhances cash flow • Accretive to return on equity • Reinsurance sidecar Flow Reinsurance • Fee-based earnings • Lower marginal cost of capital • Accretive to return on equity • Solidifies relationships with key partners F&G is moving toward a more fee based, higher margin and capital light business with strong cash flow generation in future years Grow AUM by 50% Expand adjusted ROA ex significant items to 1.33% to 1.55%1 Increase adjusted ROE ex AOCI and significant items to 13 to 14%1 Expand our P/E multiple to 7-8x We continue to make good progress toward the medium term financial targets laid out at our 2023 Investor Day: F&G Investor Update | Fall 2025 7 1Assumes alternatives investments investment income based on management’s long-term expected return of approximately 10% over the medium-term Middle Market Life & Owned Distribution

F&G Snapshot 8F&G Investor Update | Fall 2025 Retail Annuities • Fixed indexed annuity (FIA) • Registered index-linked annuities (RILA) • Multi-year guaranteed annuity (MYGA) Pension Risk Transfer (PRT) Life Insurance • Indexed universal life (IUL) Funding Agreements • Funding agreement backed notes (FABN) • Federal Home Loan Bank (FHLB) • Founded in 1959 as a life insurance company • Listed on the New York Stock Exchange (NYSE: FG) eff. 12/1/2022 • Fidelity National Financial (NYSE: FNF) retains ~82% ownership • Headquartered in Des Moines, IA; ~1,200 employees • Ranking as a Top Workplaces company for 7 consecutive years Retail Channels • Independent insurance agents (IMOs) • Broker Dealers • Banks Institutional Markets • Pension risk transfer • Funding agreements Our Product Lines Five Distinct Distribution Channels / Markets Background Financial Strength Ratings A Stable A.M. Best A- Stable S&P Global A- Stable Fitch Ratings A3 Stable Moody’s

A Compelling Investment Case For F&G 9F&G Investor Update | Fall 2025 v Track Record of Success We have delivered consistent top line growth and return on assets across varying market cycles v Targeting Large and Growing Markets We have long-standing relationships with multiple distribution channels, an investment edge, and a track record of attracting top talent Superior Ecosystem F&G is a nationwide leader in the large markets we play in, and we expect demographic trends will provide tailwinds to give us significant room to continue growing – including untapped Middle Market demand for Life coverage and the opportunity to migrate consumers from CDs to fixed annuities Driving Margin Expansion and Improved Returns F&G is pursuing strategies to grow earnings, while generating significant positive net cash flow and diversifying into “capital light” flow reinsurance and accretive owned distribution to generate higher ROEs

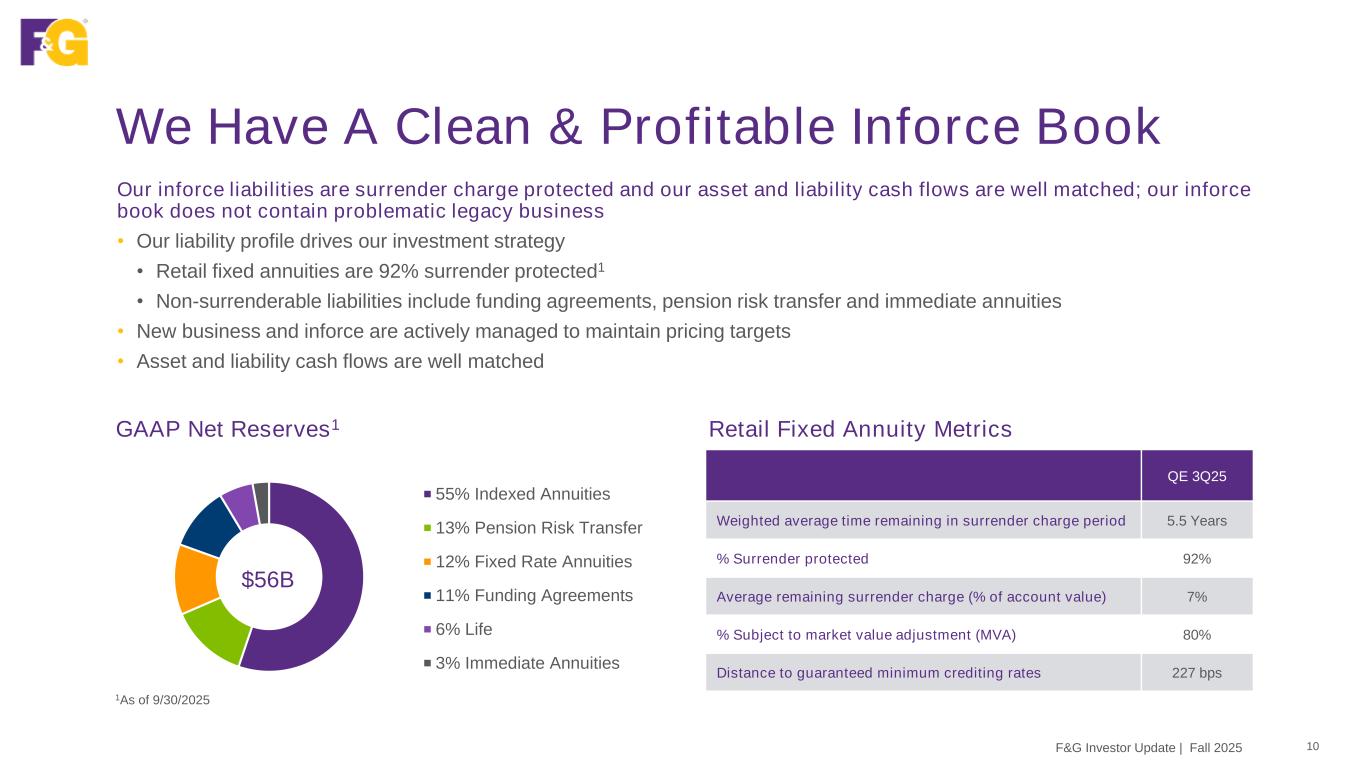

We Have A Clean & Profitable Inforce Book 10F&G Investor Update | Fall 2025 Our inforce liabilities are surrender charge protected and our asset and liability cash flows are well matched; our inforce book does not contain problematic legacy business • Our liability profile drives our investment strategy • Retail fixed annuities are 92% surrender protected1 • Non-surrenderable liabilities include funding agreements, pension risk transfer and immediate annuities • New business and inforce are actively managed to maintain pricing targets • Asset and liability cash flows are well matched 1As of 9/30/2025 GAAP Net Reserves1 55% Indexed Annuities 13% Pension Risk Transfer 12% Fixed Rate Annuities 11% Funding Agreements 6% Life 3% Immediate Annuities $56B Retail Fixed Annuity Metrics QE 3Q25 Weighted average time remaining in surrender charge period 5.5 Years % Surrender protected 92% Average remaining surrender charge (% of account value) 7% % Subject to market value adjustment (MVA) 80% Distance to guaranteed minimum crediting rates 227 bps

We Compete In Very Large Markets 11F&G Investor Update | Fall 2025 The U.S. retirement and middle markets are growing and we are both well established and well positioned for continued growth in our retail channels and institutional markets 12Q25 Quarterly Retirement Market Data, Investment Company Institute. 2Personal savings in the U.S. per Federal Reserve Bank of St. Louis as of 8/1/25. 3FY2024 U.S. retail life sales (annualized premium) and U.S. individual annuity sales per LIMRA 4Economic volatility undermines second quarter U.S. Pension Risk Transfer Sales, Source LIMRA, 9/22/25. 5Legal & General Pension Risk Transfer Monitor, 2Q25 Market Update 6Board of Governors of the Federal Reserve System, Funding Agreement-Backed Securities (FABS) as of 6/30/25. Indexed annuities provide alternative with upside potential and limited downside risk Consumers increasingly rely on personal savings for retirement income Transaction volume likely to continue5 Untapped demand for permanent life insurance, especially in the Middle Market Mutual Fund 401(k) Assets1 U.S. Consumer Savings2 Retail Life & Annuities3 Pension Risk Transfer4 Funding Agreements6 $5.7T $1.1T $343B $447B $261B

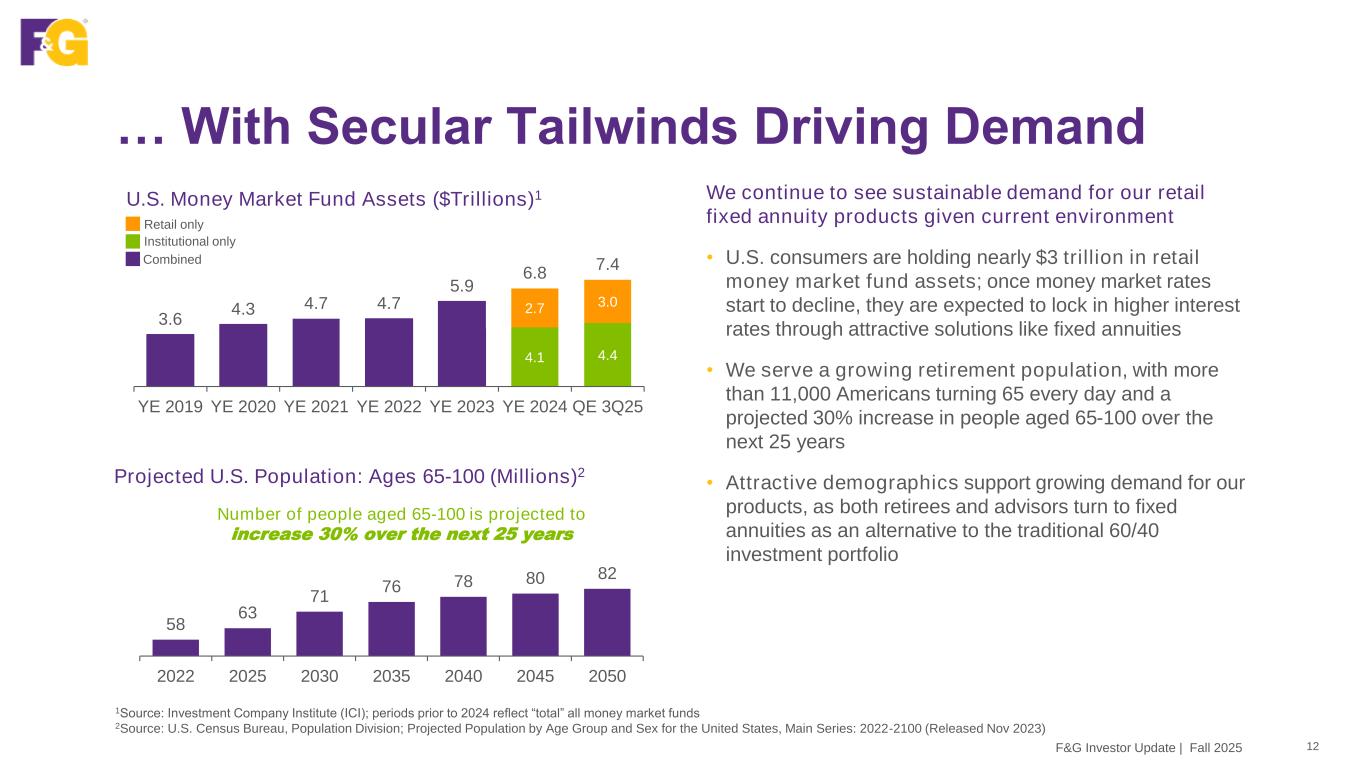

58 63 71 76 78 80 82 2022 2025 2030 2035 2040 2045 2050 … With Secular Tailwinds Driving Demand 12F&G Investor Update | Fall 2025 We continue to see sustainable demand for our retail fixed annuity products given current environment • U.S. consumers are holding nearly $3 trillion in retail money market fund assets; once money market rates start to decline, they are expected to lock in higher interest rates through attractive solutions like fixed annuities • We serve a growing retirement population, with more than 11,000 Americans turning 65 every day and a projected 30% increase in people aged 65-100 over the next 25 years • Attractive demographics support growing demand for our products, as both retirees and advisors turn to fixed annuities as an alternative to the traditional 60/40 investment portfolio 1Source: Investment Company Institute (ICI); periods prior to 2024 reflect “total” all money market funds 2Source: U.S. Census Bureau, Population Division; Projected Population by Age Group and Sex for the United States, Main Series: 2022-2100 (Released Nov 2023) U.S. Money Market Fund Assets ($Trillions)1 Projected U.S. Population: Ages 65-100 (Millions)2 Number of people aged 65-100 is projected to increase 30% over the next 25 years 4.1 4.4 2.7 3.0 3.6 4.3 4.7 4.7 5.9 6.8 7.4 YE 2019 YE 2020 YE 2021 YE 2022 YE 2023 YE 2024 QE 3Q25 Combined Institutional only Retail only

… And We’re Winning … 13F&G Investor Update | Fall 2025 1CAGR reflects 2019-2024 annual periods Annual Gross Sales by Retail Channel and Institutional Market ($B) 2019 2020 2021 2022 2023 2024 Funding Agreements Agent PRT Broker Dealer Bank $11.3B $9.6B $4.5B $3.9B FNF and F&G Merger (June 2020) $13.2B +31% CAGR1 $15.3B

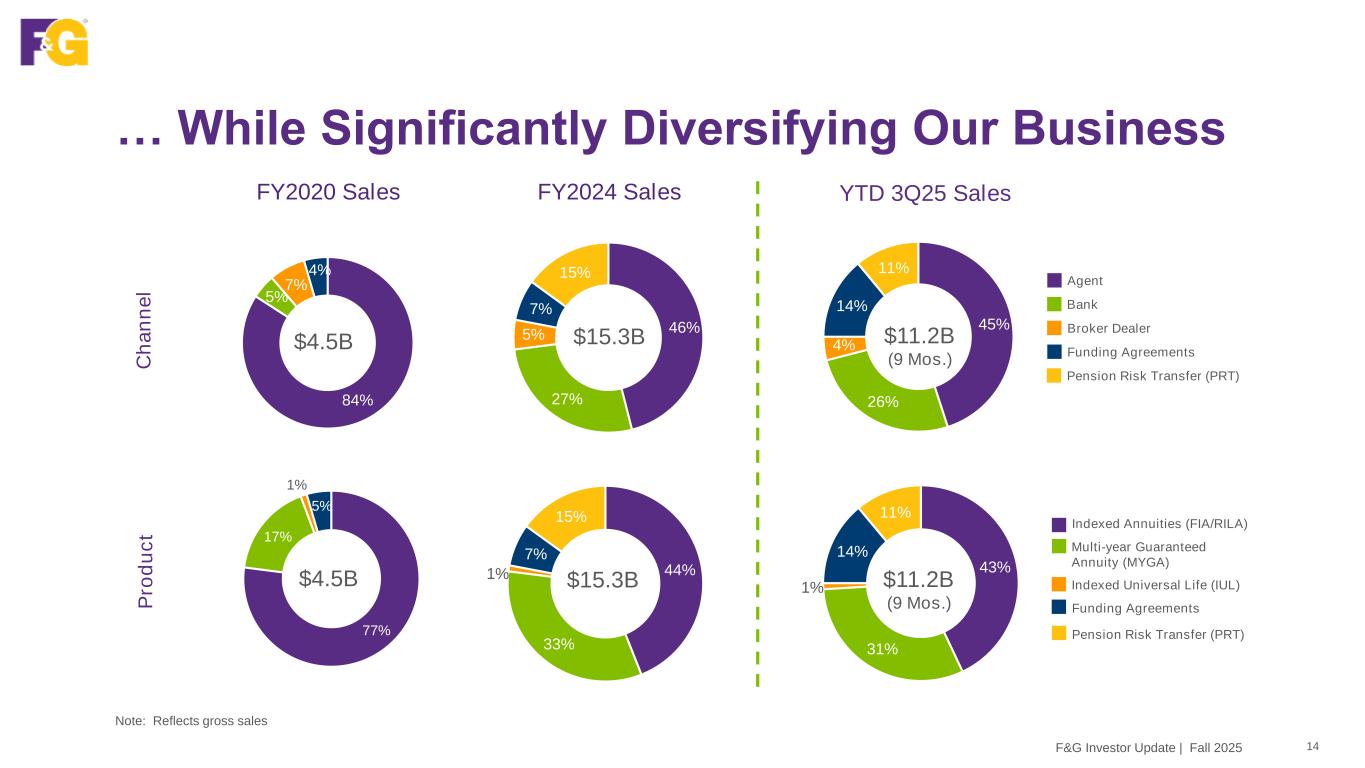

45% 26% 4% 14% 11% $11.2B (9 Mos.) … While Significantly Diversifying Our Business 14F&G Investor Update | Fall 2025 Note: Reflects gross sales 84% 5% 7% 4% $4.5B FY2024 Sales C h a n n e l P ro d u c t 77% 17% 1% 5% $4.5B FY2020 Sales YTD 3Q25 Sales 43% 31% 1% 14% 11% $11.2B (9 Mos.) Bank Broker Dealer Agent Funding Agreements Pension Risk Transfer (PRT) Multi-year Guaranteed Annuity (MYGA) Indexed Universal Life (IUL) Funding Agreements Indexed Annuities (FIA/RILA) Pension Risk Transfer (PRT) 44% 33% 1% 7% 15% $15.3B 46% 27% 5% 7% 15% $15.3B

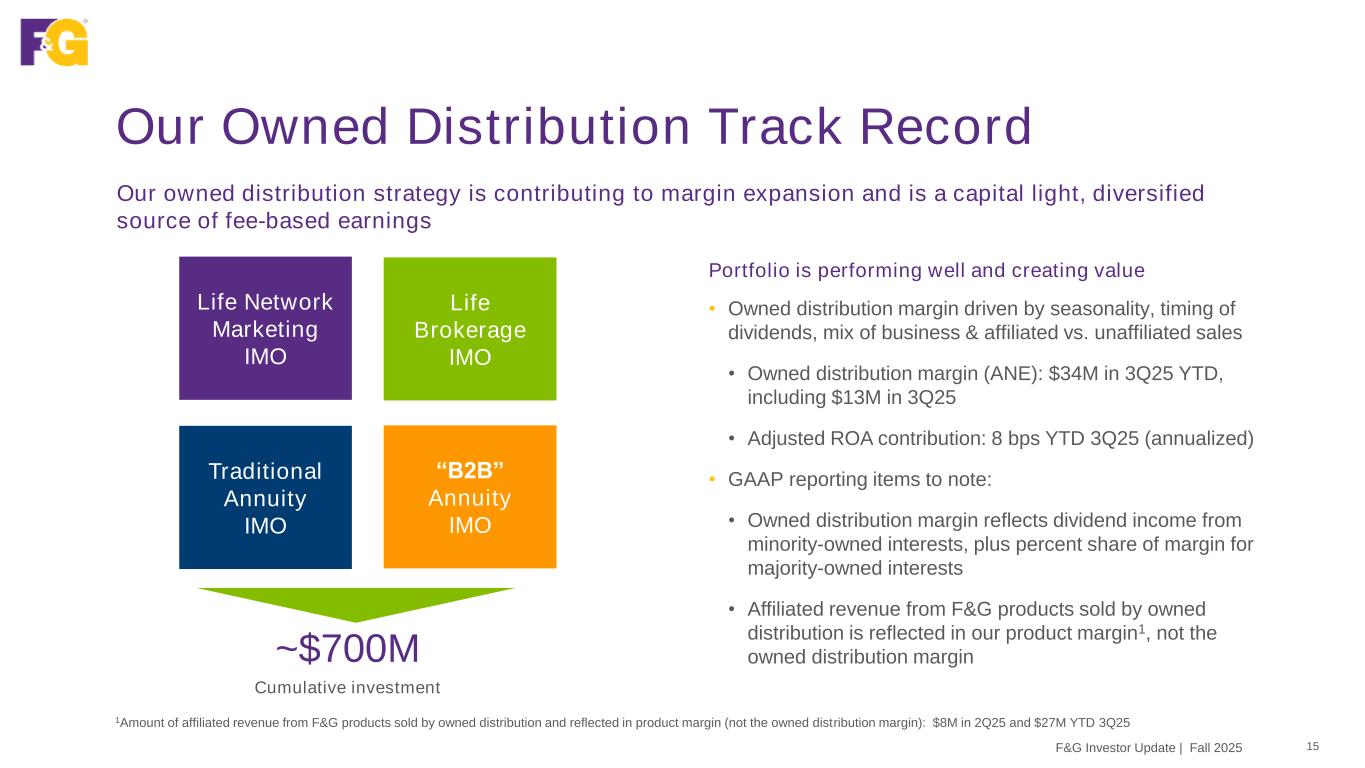

Our Owned Distribution Track Record 15F&G Investor Update | Fall 2025 Our owned distribution strategy is contributing to margin expansion and is a capital light, diversified source of fee-based earnings Portfolio is performing well and creating value • Owned distribution margin driven by seasonality, timing of dividends, mix of business & affiliated vs. unaffiliated sales • Owned distribution margin (ANE): $34M in 3Q25 YTD, including $13M in 3Q25 • Adjusted ROA contribution: 8 bps YTD 3Q25 (annualized) • GAAP reporting items to note: • Owned distribution margin reflects dividend income from minority-owned interests, plus percent share of margin for majority-owned interests • Affiliated revenue from F&G products sold by owned distribution is reflected in our product margin1, not the owned distribution margin Life Network Marketing IMO Traditional Annuity IMO “B2B” Annuity IMO Life Brokerage IMO ~$700M Cumulative investment 1Amount of affiliated revenue from F&G products sold by owned distribution and reflected in product margin (not the owned distribution margin): $8M in 2Q25 and $27M YTD 3Q25

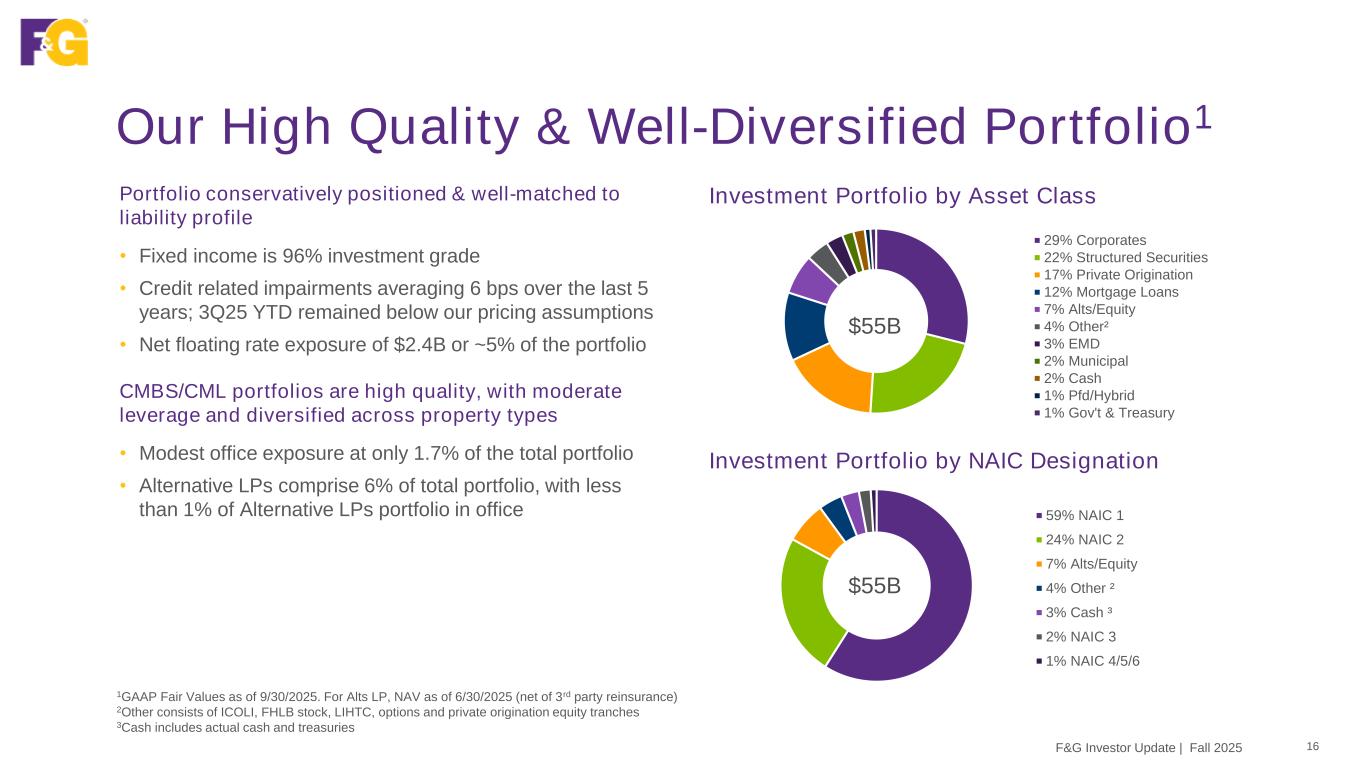

59% NAIC 1 24% NAIC 2 7% Alts/Equity 4% Other ² 3% Cash ³ 2% NAIC 3 1% NAIC 4/5/6 29% Corporates 22% Structured Securities 17% Private Origination 12% Mortgage Loans 7% Alts/Equity 4% Other² 3% EMD 2% Municipal 2% Cash 1% Pfd/Hybrid 1% Gov't & Treasury Our High Quality & Well-Diversified Portfolio1 16F&G Investor Update | Fall 2025 1GAAP Fair Values as of 9/30/2025. For Alts LP, NAV as of 6/30/2025 (net of 3rd party reinsurance) 2Other consists of ICOLI, FHLB stock, LIHTC, options and private origination equity tranches 3Cash includes actual cash and treasuries Investment Portfolio by Asset Class Investment Portfolio by NAIC Designation Portfolio conservatively positioned & well-matched to liability profile • Fixed income is 96% investment grade • Credit related impairments averaging 6 bps over the last 5 years; 3Q25 YTD remained below our pricing assumptions • Net floating rate exposure of $2.4B or ~5% of the portfolio CMBS/CML portfolios are high quality, with moderate leverage and diversified across property types • Modest office exposure at only 1.7% of the total portfolio • Alternative LPs comprise 6% of total portfolio, with less than 1% of Alternative LPs portfolio in office $55B $55B

47% Corporate Lending 27% Private Specialty Finance 17% Asset Backed & Consumer Loans 5% Triple Net Lease 4% Other 39% CLOs 33% CMBS 15% ABS 13% Non Agency RMBS <1% Agency RMBS Our Investment Portfolio Key Attributes Investment Rationale • Core fixed income: Focus remains on high grade public and private securities with strong risk adjusted returns • Structured credit: Provides access to well diversified, high-quality assets across CLOs, CMBS and ABS • Mortgage loans: Superior loss-adjusted performance relative to similar rated corporates • Direct Origination: Diversified private credit exposure to a wide spectrum of underlying collateral Fixed Income1,2 (ex. Structured, Mortgage Loan & Private Origination) 1GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) 2Excludes $7.1B total of alternatives/equity, FHLB, call options and cash 3Other consists of hotel and mixed-use properties Structured Credit Portfolio1,2 63% Residential 18% Multifamily 8% Industrial 4% Office 4% Retail 1% Student Housing 1% Data Center 1% Other ³ Private Origination Portfolio1,2 79% Corporates 7% EMD 7% Municipal 4% Pfd/Hybrid 3% Gov't & Treasury $20B $12B Mortgage Loans1,2 $6B $9B 17F&G Investor Update | Fall 2025

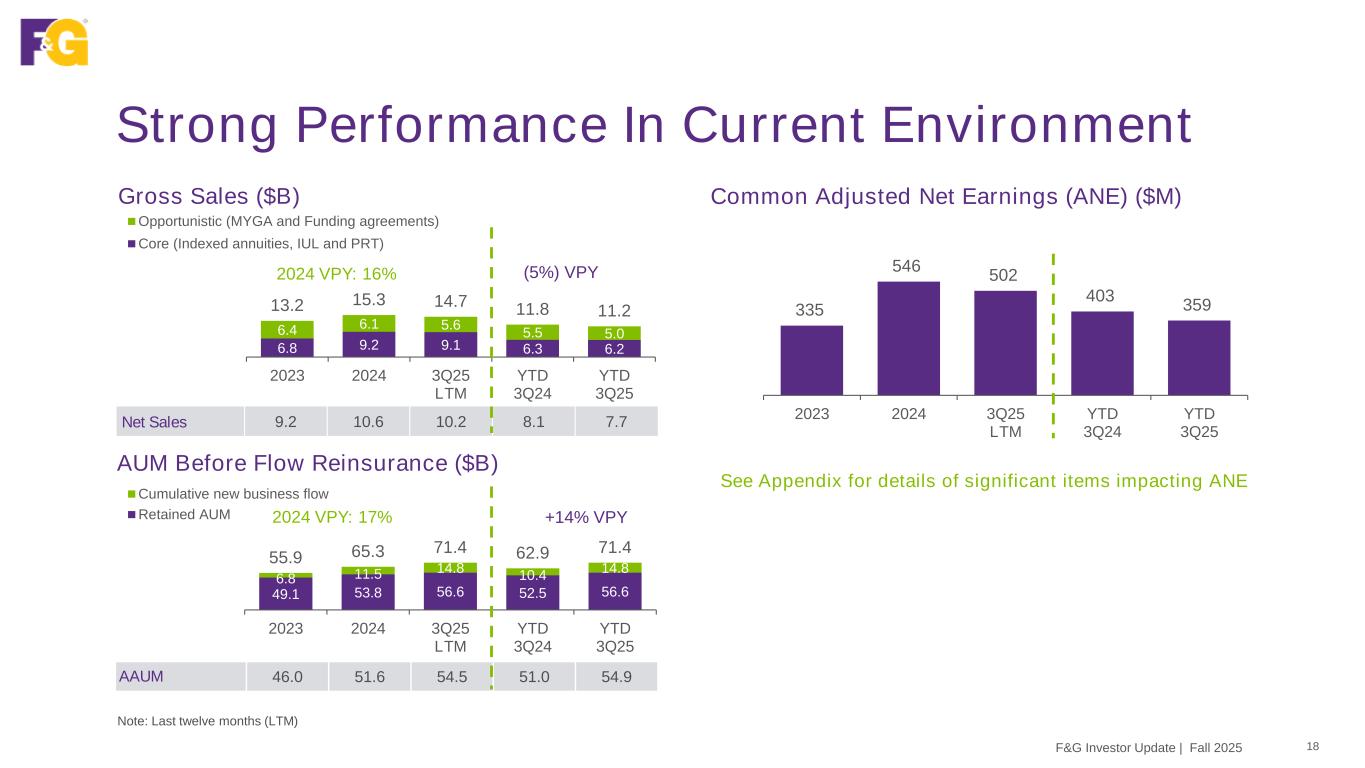

49.1 53.8 56.6 52.5 56.6 6.8 11.5 14.8 10.4 14.8 55.9 65.3 71.4 62.9 71.4 2023 2024 3Q25 LTM YTD 3Q24 YTD 3Q25 Cumulative new business flow Retained AUM 6.8 9.2 9.1 6.3 6.2 6.4 6.1 5.6 5.5 5.0 13.2 15.3 14.7 11.8 11.2 2023 2024 3Q25 LTM YTD 3Q24 YTD 3Q25 Opportunistic (MYGA and Funding agreements) Core (Indexed annuities, IUL and PRT) 335 546 502 403 359 2023 2024 3Q25 LTM YTD 3Q24 YTD 3Q25 Net Sales 9.2 10.6 10.2 8.1 7.7 Strong Performance In Current Environment Gross Sales ($B) AUM Before Flow Reinsurance ($B) Common Adjusted Net Earnings (ANE) ($M) F&G Investor Update | Fall 2025 18 2024 VPY: 17% AAUM 46.0 51.6 54.5 51.0 54.9 (5%) VPY2024 VPY: 16% Note: Last twelve months (LTM) +14% VPY See Appendix for details of significant items impacting ANE

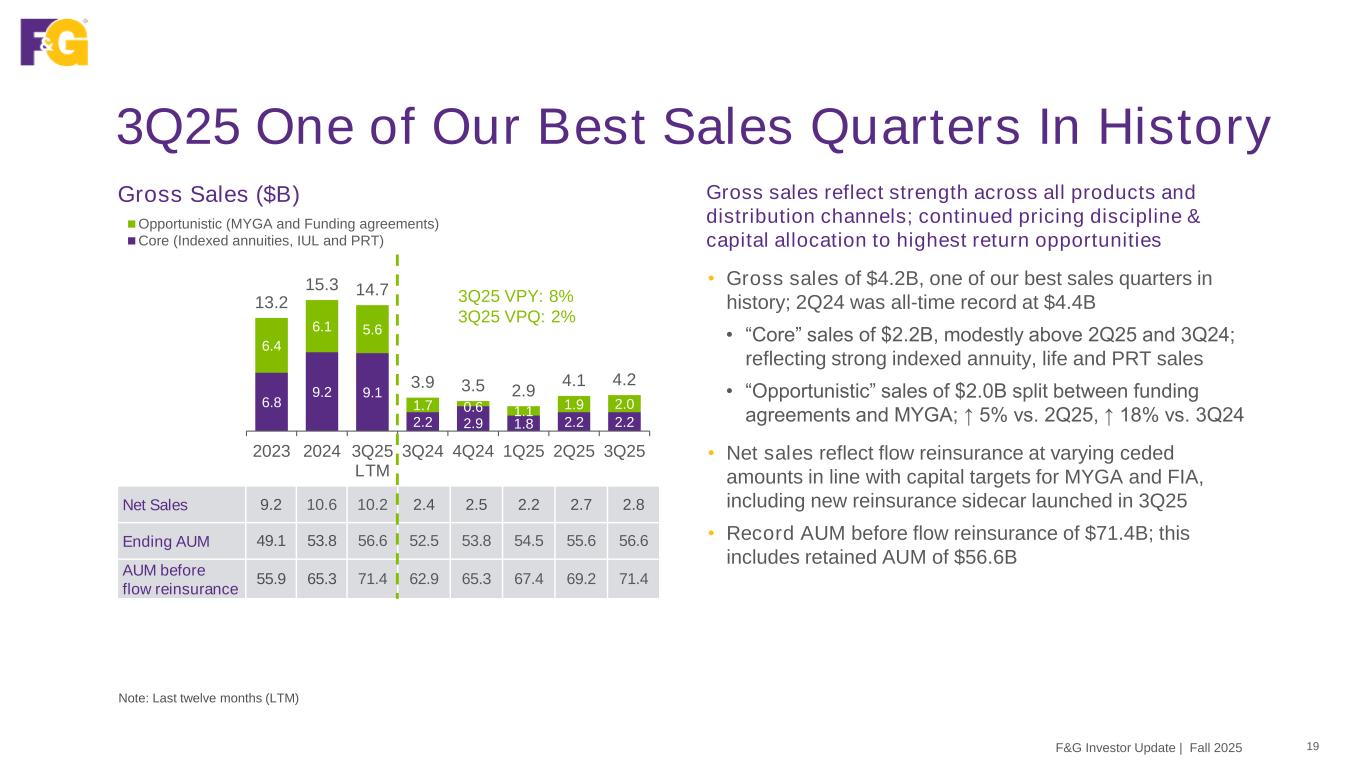

3Q25 One of Our Best Sales Quarters In History Gross Sales ($B) Gross sales reflect strength across all products and distribution channels; continued pricing discipline & capital allocation to highest return opportunities • Gross sales of $4.2B, one of our best sales quarters in history; 2Q24 was all-time record at $4.4B • “Core” sales of $2.2B, modestly above 2Q25 and 3Q24; reflecting strong indexed annuity, life and PRT sales • “Opportunistic” sales of $2.0B split between funding agreements and MYGA; ↑ 5% vs. 2Q25, ↑ 18% vs. 3Q24 • Net sales reflect flow reinsurance at varying ceded amounts in line with capital targets for MYGA and FIA, including new reinsurance sidecar launched in 3Q25 • Record AUM before flow reinsurance of $71.4B; this includes retained AUM of $56.6B F&G Investor Update | Fall 2025 19 Note: Last twelve months (LTM) Net Sales 9.2 10.6 10.2 2.4 2.5 2.2 2.7 2.8 Ending AUM 49.1 53.8 56.6 52.5 53.8 54.5 55.6 56.6 AUM before flow reinsurance 55.9 65.3 71.4 62.9 65.3 67.4 69.2 71.4 6.8 9.2 9.1 2.2 2.9 1.8 2.2 2.2 6.4 6.1 5.6 1.7 0.6 1.1 1.9 2.0 13.2 15.3 14.7 3.9 3.5 2.9 4.1 4.2 2023 2024 3Q25 LTM 3Q24 4Q24 1Q25 2Q25 3Q25 Opportunistic (MYGA and Funding agreements) Core (Indexed annuities, IUL and PRT) 3Q25 VPY: 8% 3Q25 VPQ: 2%

335 546 493 156 143 91 103 165 2023 2024 3Q25 LTM 3Q24 4Q24 1Q25 2Q25 3Q25 Net earnings (loss) (58) 622 447 (10) 323 (25) 35 114 Op Exp (bps)1 63 60 52 62 60 58 56 52 ANE per share $2.68 $4.30 NM $1.22 $1.12 $0.72 $0.77 $1.22 Adj. ROA2 0.73% 1.06% 0.92% 1.05% 1.06% 0.68% 0.71% 0.87% Adj. ROE2 6.5% 10.3% 8.8% 9.1% 10.3% 9.7% 8.8% 8.8% Core Earnings Power Remains Attractive 20F&G Investor Update | Fall 2025 Common Adjusted Net Earnings (ANE) ($M) Note: Last twelve months (LTM). Not meaningful (NM) 1Op Exp (bps): Reflects LTM operating expense to AUM before flow reinsurance (bps) 2Attributable to common shareholders; metrics refer to return on assets (ROA) and adjusted return on equity ex AOCI (ROE) based on reported adjusted net earnings F&G expects steady and growing adjusted net earnings over time, excluding significant items • 3Q25 ANE vs. 3Q24 reflects lower than expected level of alternative investments income and significant items, as well as: • asset growth, • growing fees from accretive flow reinsurance, • steady owned distribution margin, and • operating expense discipline driving scale benefit; • partially offset by higher interest expense on debt • Last twelve months (LTM) adjusted ROA at 0.92%, including 0.87% in 3Q25, vs. 0.92% in LTM 2Q25 • Adjusted ROE at 8.8%, in line with 2Q25 • See Appendix for details of significant items impacting ANE

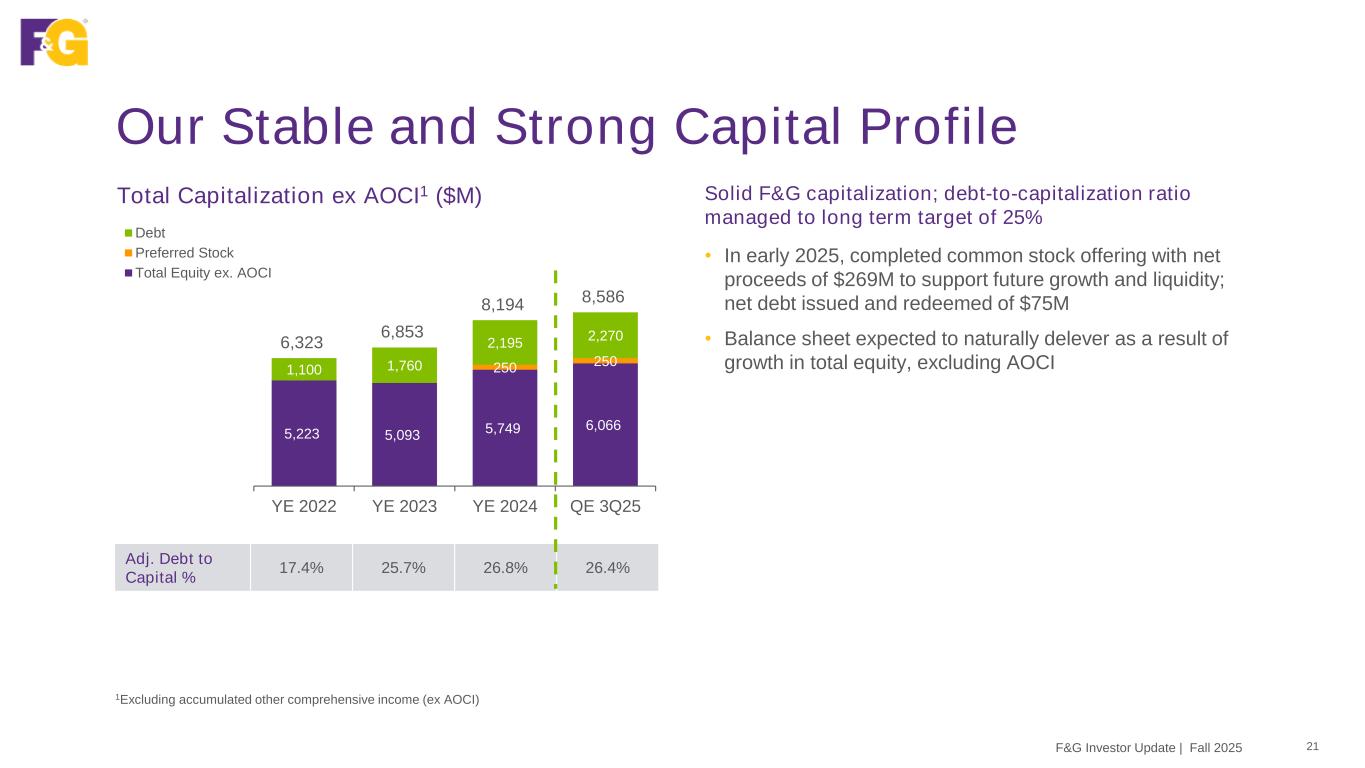

Our Stable and Strong Capital Profile 21F&G Investor Update | Fall 2025 1Excluding accumulated other comprehensive income (ex AOCI) Total Capitalization ex AOCI1 ($M) 5,223 5,093 5,749 6,066 250 250 1,100 1,760 2,195 2,270 6,323 6,853 8,194 8,586 YE 2022 YE 2023 YE 2024 QE 3Q25 Debt Preferred Stock Total Equity ex. AOCI Adj. Debt to Capital % 17.4% 25.7% 26.8% 26.4% Solid F&G capitalization; debt-to-capitalization ratio managed to long term target of 25% • In early 2025, completed common stock offering with net proceeds of $269M to support future growth and liquidity; net debt issued and redeemed of $75M • Balance sheet expected to naturally delever as a result of growth in total equity, excluding AOCI

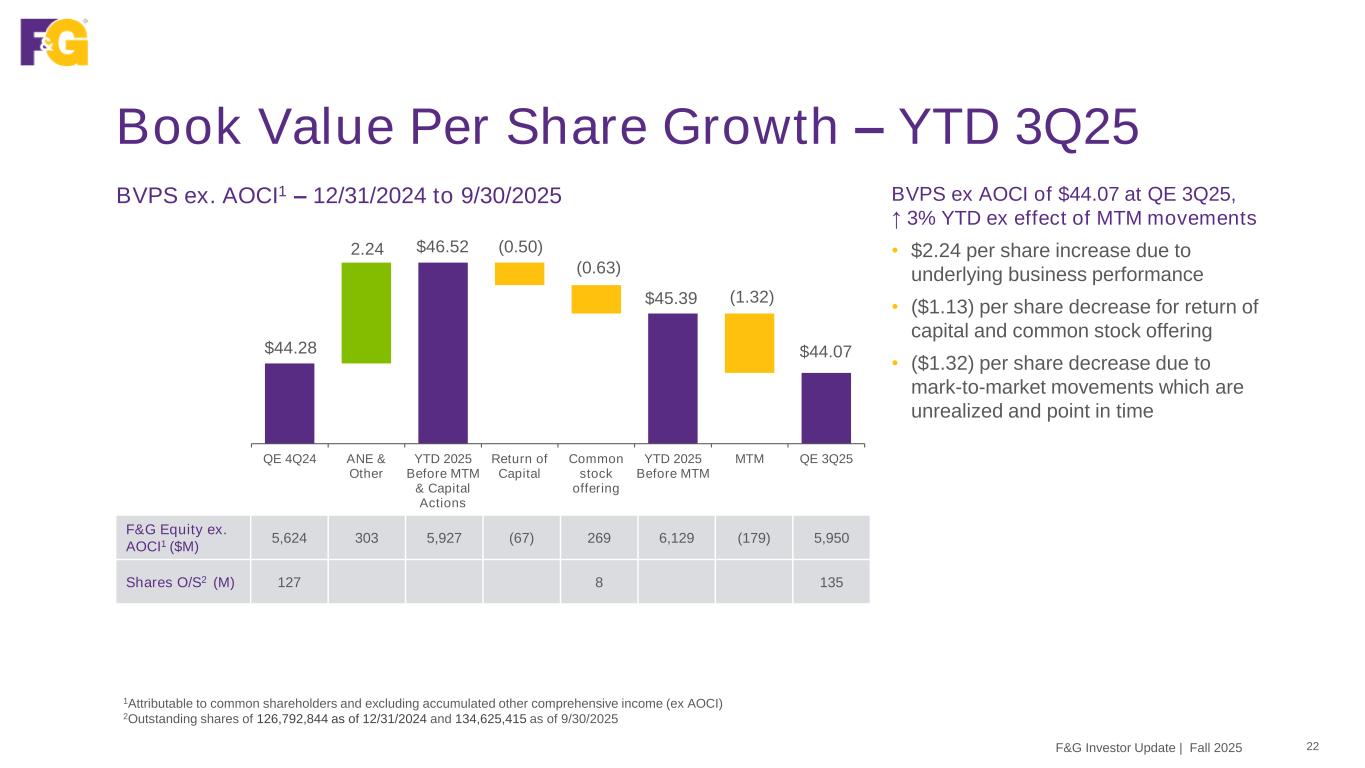

F&G Investor Update | Fall 2025 Book Value Per Share Growth – YTD 3Q25 22 BVPS ex. AOCI1 – 12/31/2024 to 9/30/2025 $44.28 $46.52 $45.39 $44.07 2.24 (0.50) (0.63) (1.32) $42.50 $43.00 $43.50 $44.00 $44.50 $45.00 $45.50 $46.00 $46.50 $47.00 QE 4Q24 ANE & Other YTD 2025 Before MTM & Capital Actions Return of Capital Common stock offering YTD 2025 Before MTM MTM QE 3Q25 F&G Equity ex. AOCI1 ($M) 5,624 303 5,927 (67) 269 6,129 (179) 5,950 Shares O/S2 (M) 127 8 135 1Attributable to common shareholders and excluding accumulated other comprehensive income (ex AOCI) 2Outstanding shares of 126,792,844 as of 12/31/2024 and 134,625,415 as of 9/30/2025 BVPS ex AOCI of $44.07 at QE 3Q25, ↑ 3% YTD ex effect of MTM movements • $2.24 per share increase due to underlying business performance • ($1.13) per share decrease for return of capital and common stock offering • ($1.32) per share decrease due to mark-to-market movements which are unrealized and point in time

Our Capitalization Supports Growth & Dividend 23F&G Investor Update | Fall 2025 F&G is moving toward a more fee based, higher margin and capital light business with strong cash flow generation in future years • F&G has flexibility to adjust retained sales level, as a “lever” to support net cash from operations with sustained asset growth • F&G has returned $98M of capital to shareholders in YTD 3Q25 through common and preferred dividends 1Reflects company action level risk-based capital for primary insurance operating subsidiary Investing for Growth Reinvest in the Business Capital and other investments to support the growth strategy and maintain adequate capital buffer Net Cash from Operations Return to Shareholders Common Dividend Payout Upon board approval, common dividend with potential targeted increases over time • Maintain efficient capital structure • Target long-term debt-to-total capitalization excl. AOCI of approximately 25% and maintain 400% RBC1 • Maintain solvency and capital targets in line with ratings Opportunistic Share Repurchase Efficient means of returning cash to shareholders when shares trade at discount to intrinsic value Opportunistic M&A Expand value of Owned Distribution through additional investments in existing holdings or selectively adding new strategic partners

APPENDIX Appendix – Investments 24F&G Investor Update | Fall 2025

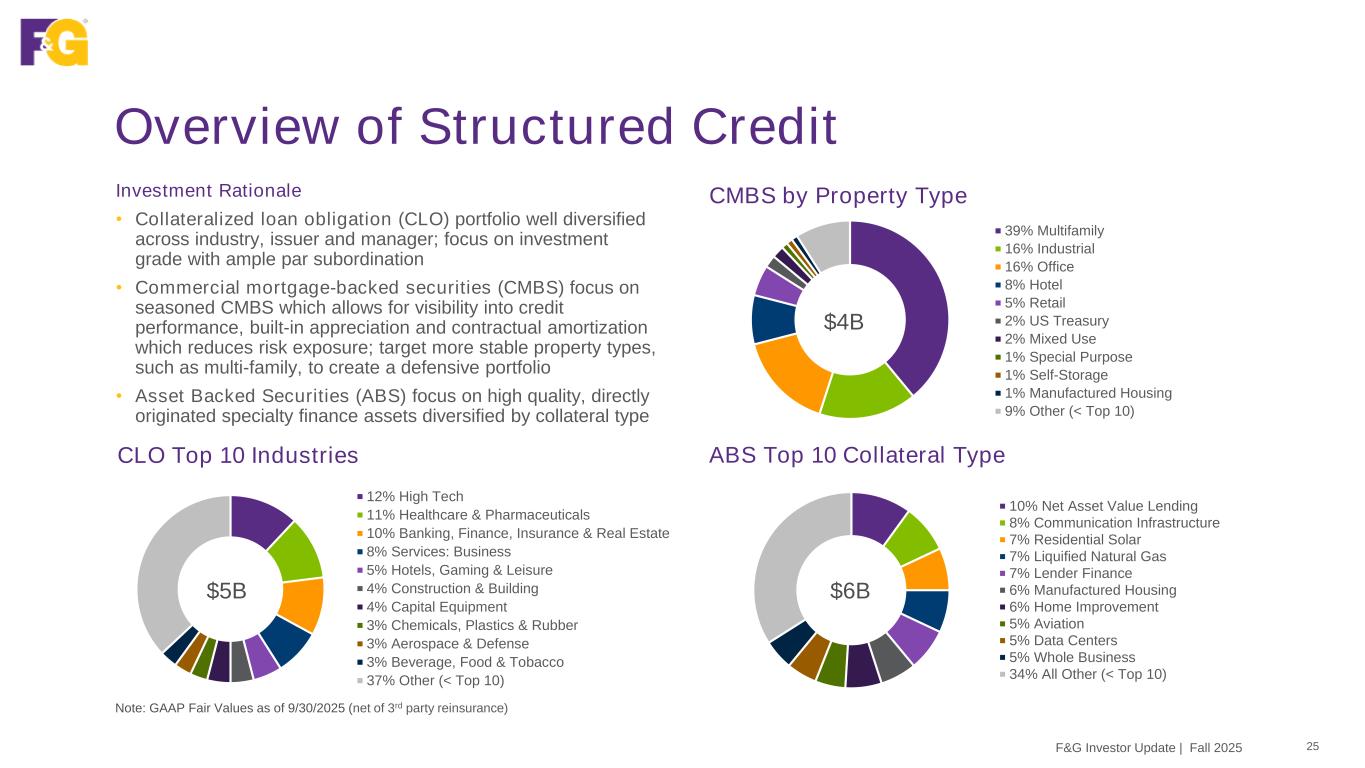

10% Net Asset Value Lending 8% Communication Infrastructure 7% Residential Solar 7% Liquified Natural Gas 7% Lender Finance 6% Manufactured Housing 6% Home Improvement 5% Aviation 5% Data Centers 5% Whole Business 34% All Other (< Top 10) Overview of Structured Credit 25 Investment Rationale • Collateralized loan obligation (CLO) portfolio well diversified across industry, issuer and manager; focus on investment grade with ample par subordination • Commercial mortgage-backed securities (CMBS) focus on seasoned CMBS which allows for visibility into credit performance, built-in appreciation and contractual amortization which reduces risk exposure; target more stable property types, such as multi-family, to create a defensive portfolio • Asset Backed Securities (ABS) focus on high quality, directly originated specialty finance assets diversified by collateral type CMBS by Property Type CLO Top 10 Industries ABS Top 10 Collateral Type Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) 12% High Tech 11% Healthcare & Pharmaceuticals 10% Banking, Finance, Insurance & Real Estate 8% Services: Business 5% Hotels, Gaming & Leisure 4% Construction & Building 4% Capital Equipment 3% Chemicals, Plastics & Rubber 3% Aerospace & Defense 3% Beverage, Food & Tobacco 37% Other (< Top 10) $5B $6B $4B 39% Multifamily 16% Industrial 16% Office 8% Hotel 5% Retail 2% US Treasury 2% Mixed Use 1% Special Purpose 1% Self-Storage 1% Manufactured Housing 9% Other (< Top 10) F&G Investor Update | Fall 2025

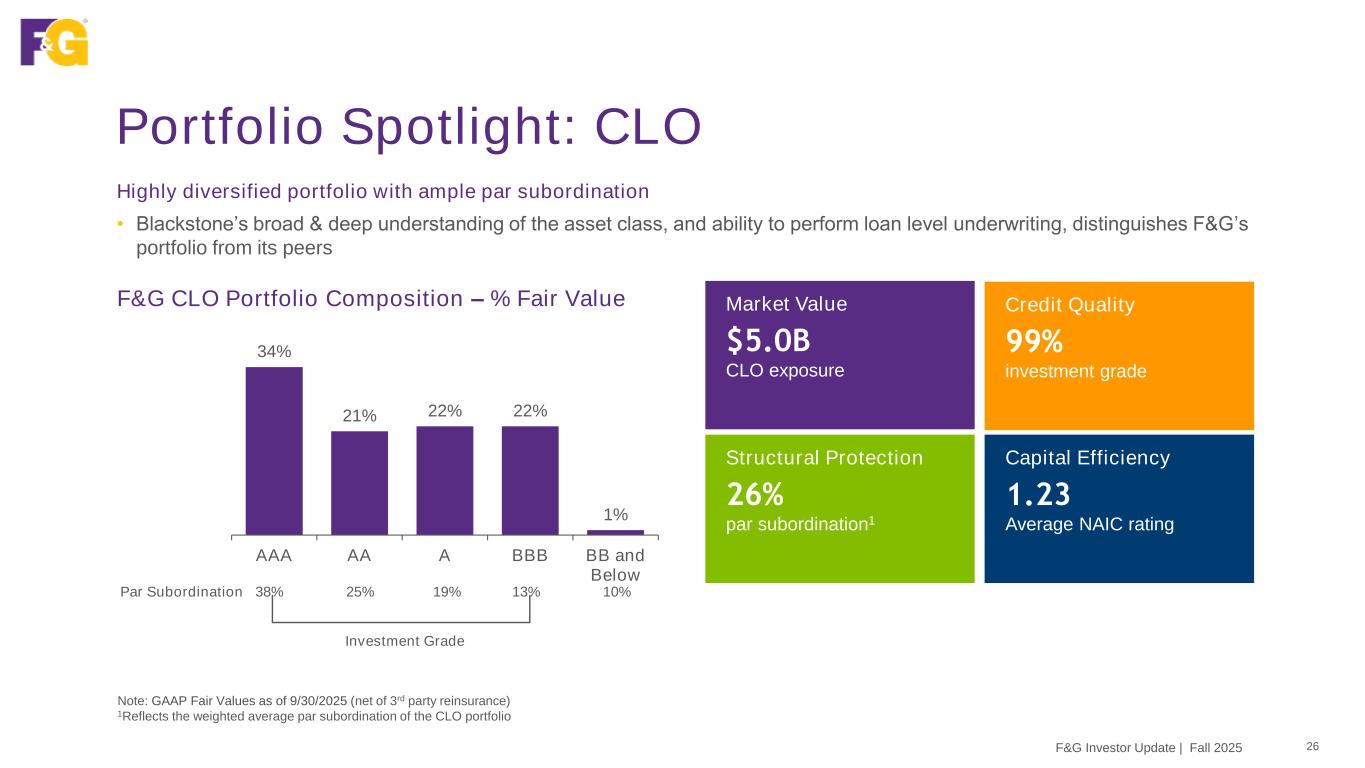

Portfolio Spotlight: CLO 26 Highly diversified portfolio with ample par subordination • Blackstone’s broad & deep understanding of the asset class, and ability to perform loan level underwriting, distinguishes F&G’s portfolio from its peers F&G CLO Portfolio Composition – % Fair Value Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) 1Reflects the weighted average par subordination of the CLO portfolio Investment Grade Credit Quality 99% investment grade Structural Protection 26% par subordination1 Capital Efficiency 1.23 Average NAIC rating Market Value $5.0B CLO exposure F&G Investor Update | Fall 2025 34% 21% 22% 22% 1% AAA AA A BBB BB and Below Par Subordination 38% 25% 19% 13% 10%

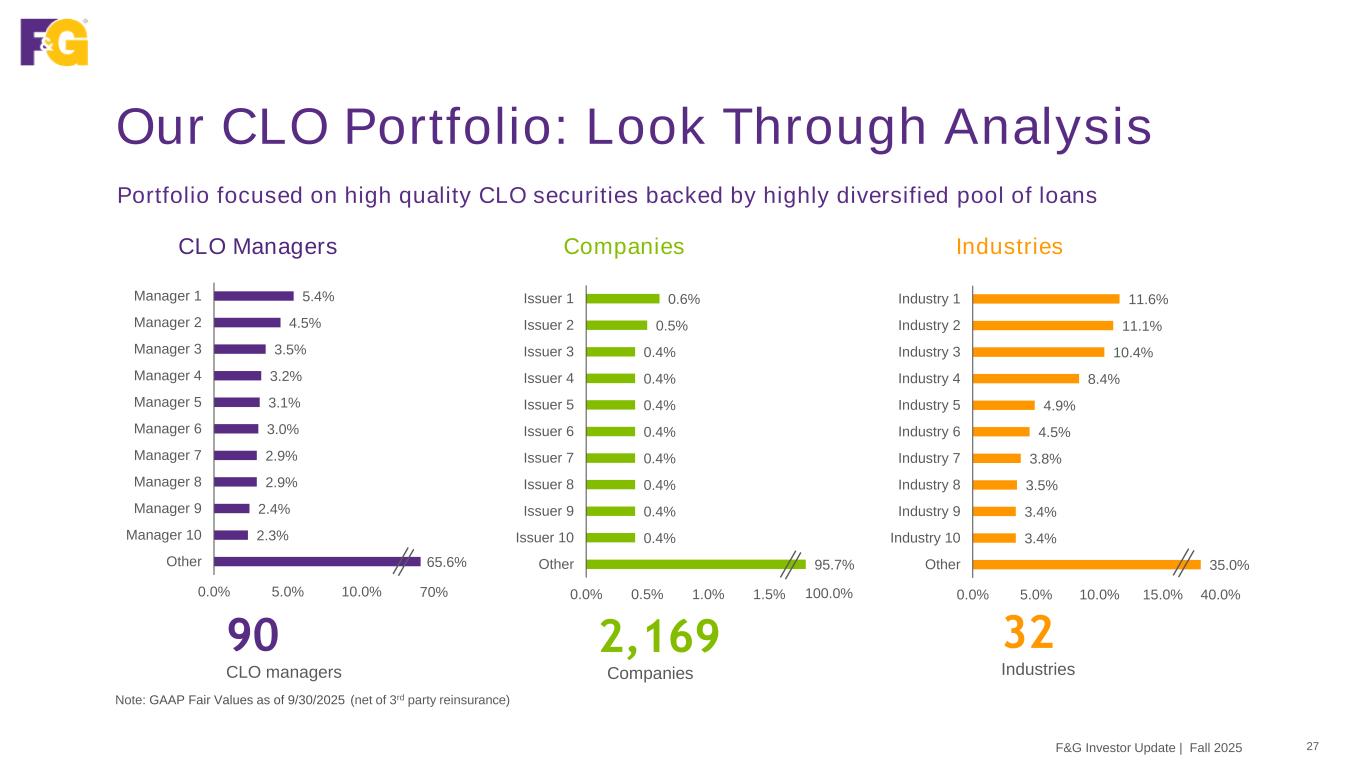

Our CLO Portfolio: Look Through Analysis 27 Portfolio focused on high quality CLO securities backed by highly diversified pool of loans Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) IndustriesCompaniesCLO Managers 90 CLO managers 2,169 Companies 32 Industries 5.4% 4.5% 3.5% 3.2% 3.1% 3.0% 2.9% 2.9% 2.4% 2.3% 65.6% 0.0% 5.0% 10.0% 15.0% Manager 1 Manager 2 Manager 3 Manager 4 Manager 5 Manager 6 Manager 7 Manager 8 Manager 9 Manager 10 Other 70% 0.6% 0.5% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 0.4% 95.7% 0.0% 0.5% 1.0% 1.5% 2.0% Issuer 1 Issuer 2 Issuer 3 Issuer 4 Issuer 5 Issuer 6 Issuer 7 Issuer 8 Issuer 9 Issuer 10 Other 100.0% 11.6% 11.1% 10.4% 8.4% 4.9% 4.5% 3.8% 3.5% 3.4% 3.4% 35.0% 0.0% 5.0% 10.0% 15.0% 20.0% Industry 1 Industry 2 Industry 3 Industry 4 Industry 5 Industry 6 Industry 7 Industry 8 Industry 9 Industry 10 Other 40.0% F&G Investor Update | Fall 2025

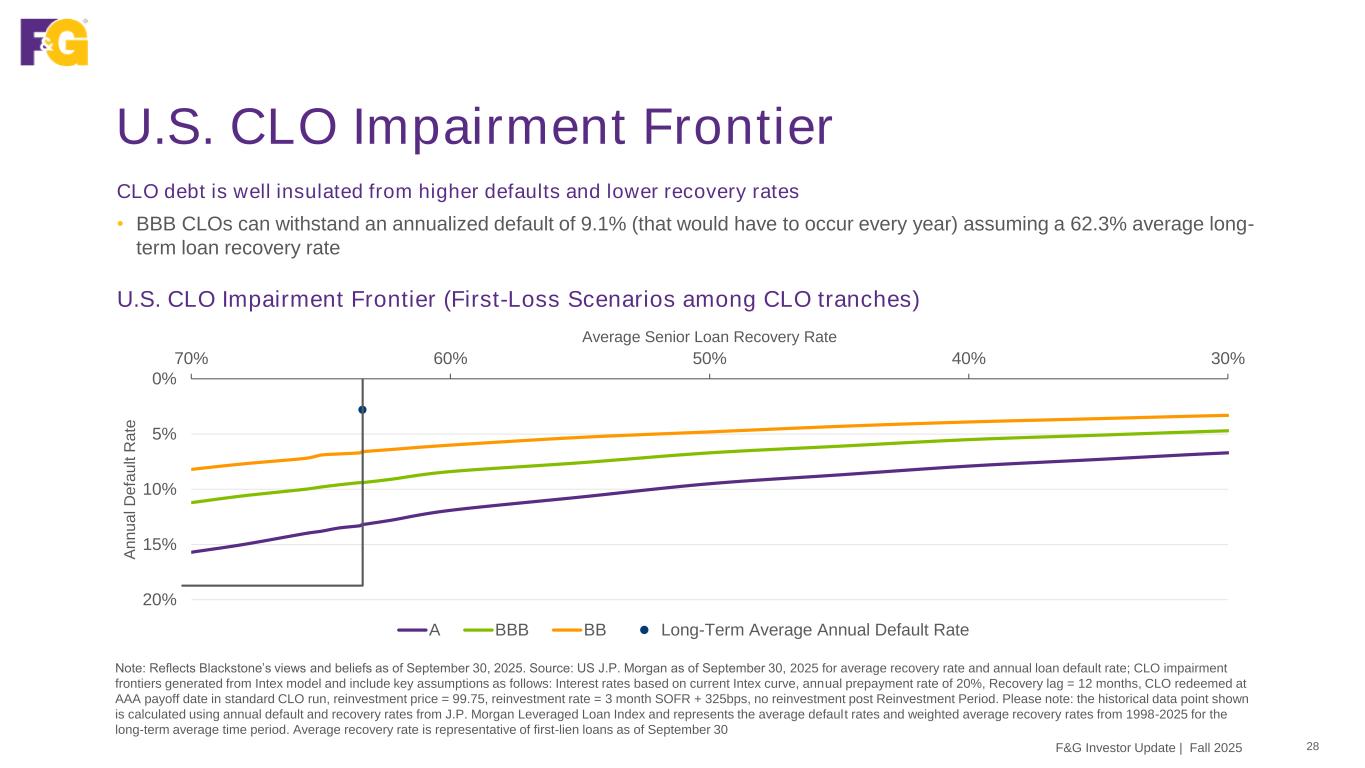

U.S. CLO Impairment Frontier 28 CLO debt is well insulated from higher defaults and lower recovery rates • BBB CLOs can withstand an annualized default of 9.1% (that would have to occur every year) assuming a 62.3% average long- term loan recovery rate U.S. CLO Impairment Frontier (First-Loss Scenarios among CLO tranches) Note: Reflects Blackstone’s views and beliefs as of September 30, 2025. Source: US J.P. Morgan as of September 30, 2025 for average recovery rate and annual loan default rate; CLO impairment frontiers generated from Intex model and include key assumptions as follows: Interest rates based on current Intex curve, annual prepayment rate of 20%, Recovery lag = 12 months, CLO redeemed at AAA payoff date in standard CLO run, reinvestment price = 99.75, reinvestment rate = 3 month SOFR + 325bps, no reinvestment post Reinvestment Period. Please note: the historical data point shown is calculated using annual default and recovery rates from J.P. Morgan Leveraged Loan Index and represents the average default rates and weighted average recovery rates from 1998-2025 for the long-term average time period. Average recovery rate is representative of first-lien loans as of September 30 0% 5% 10% 15% 20% 30%40%50%60%70% A n n u a l D e fa u lt R a te Average Senior Loan Recovery Rate A BBB BB Long-Term Average Annual Default Rate F&G Investor Update | Fall 2025

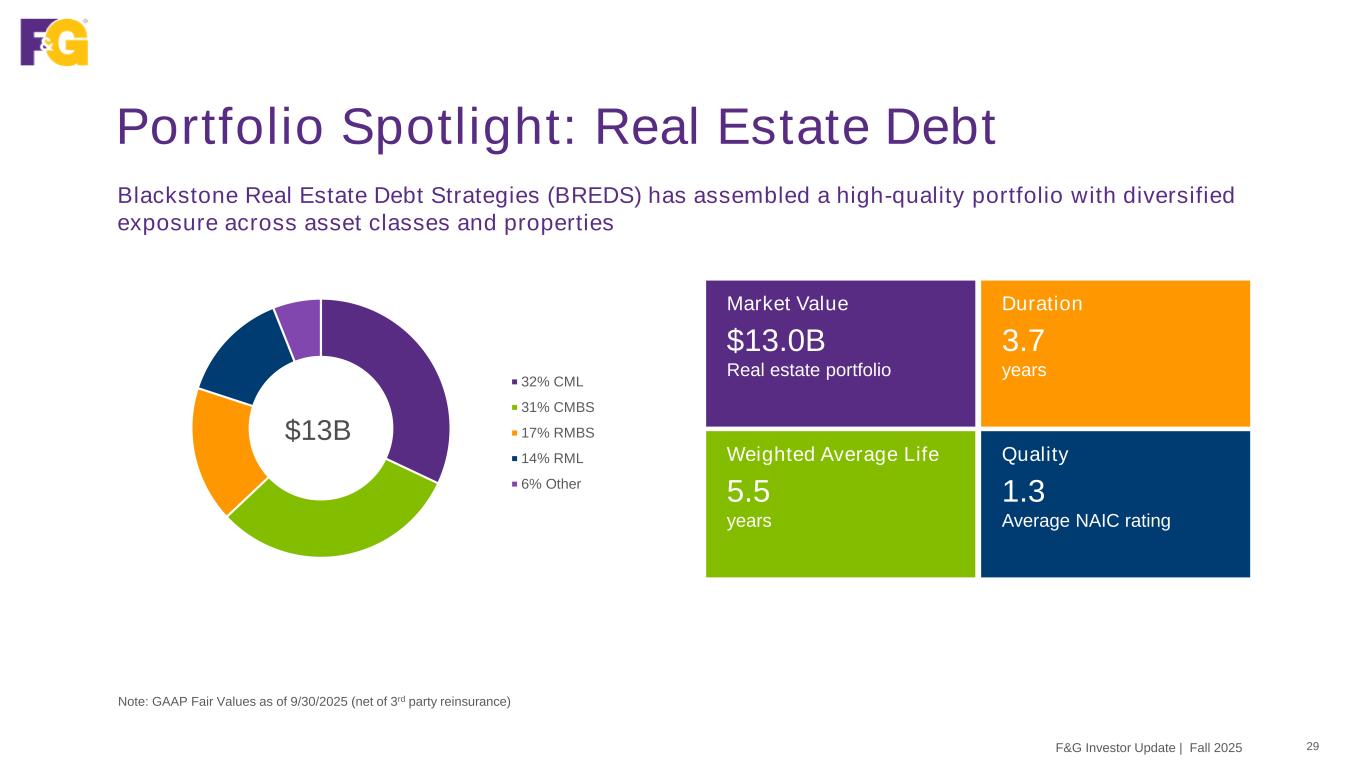

Portfolio Spotlight: Real Estate Debt 29 Blackstone Real Estate Debt Strategies (BREDS) has assembled a high-quality portfolio with diversified exposure across asset classes and properties Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) 32% CML 31% CMBS 17% RMBS 14% RML 6% Other $13B Duration 3.7 years Quality 1.3 Average NAIC rating Market Value $13.0B Real estate portfolio Weighted Average Life 5.5 years F&G Investor Update | Fall 2025

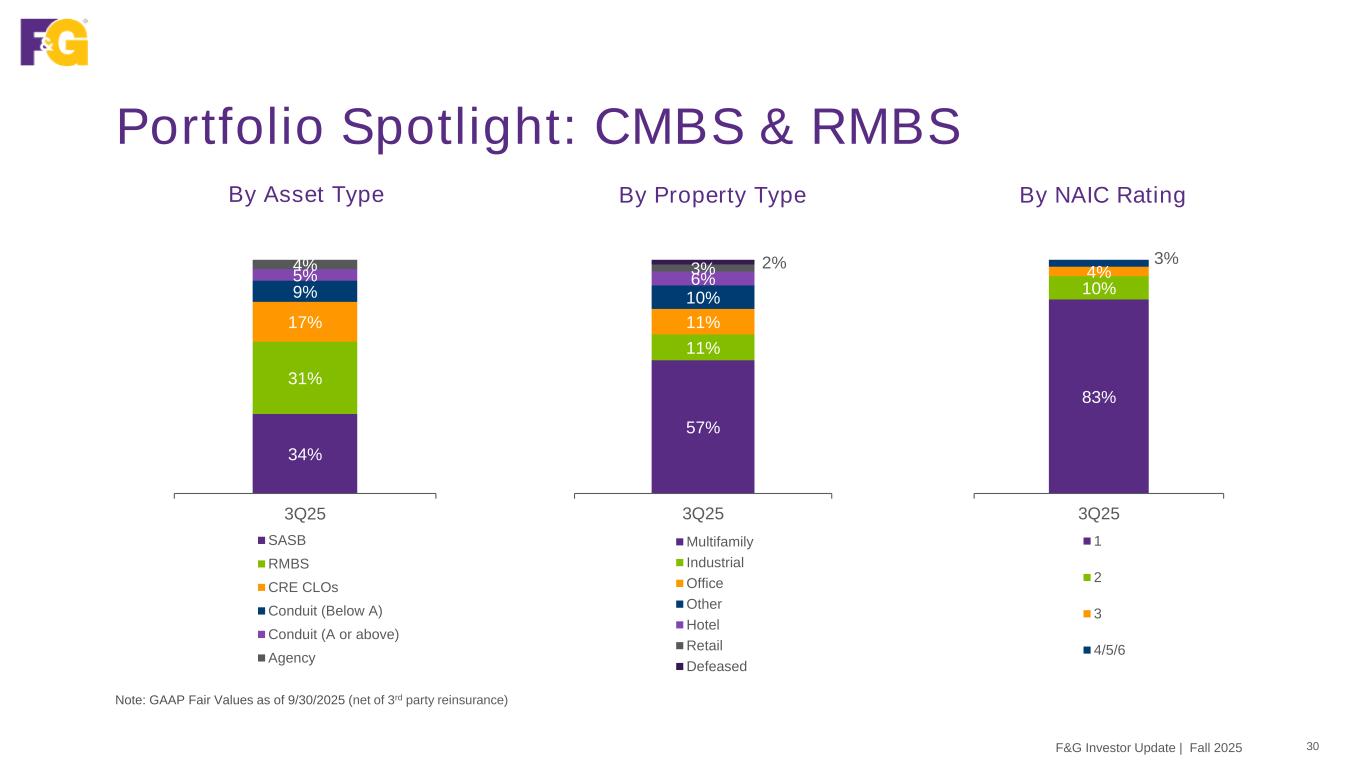

Portfolio Spotlight: CMBS & RMBS 30 Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) By Asset Type By Property Type By NAIC Rating 34% 31% 17% 9% 5% 4% 3Q25 SASB RMBS CRE CLOs Conduit (Below A) Conduit (A or above) Agency 57% 11% 11% 10% 6% 3% 2% 3Q25 Multifamily Industrial Office Other Hotel Retail Defeased 83% 10% 4% 3% 3Q25 1 2 3 4/5/6 F&G Investor Update | Fall 2025

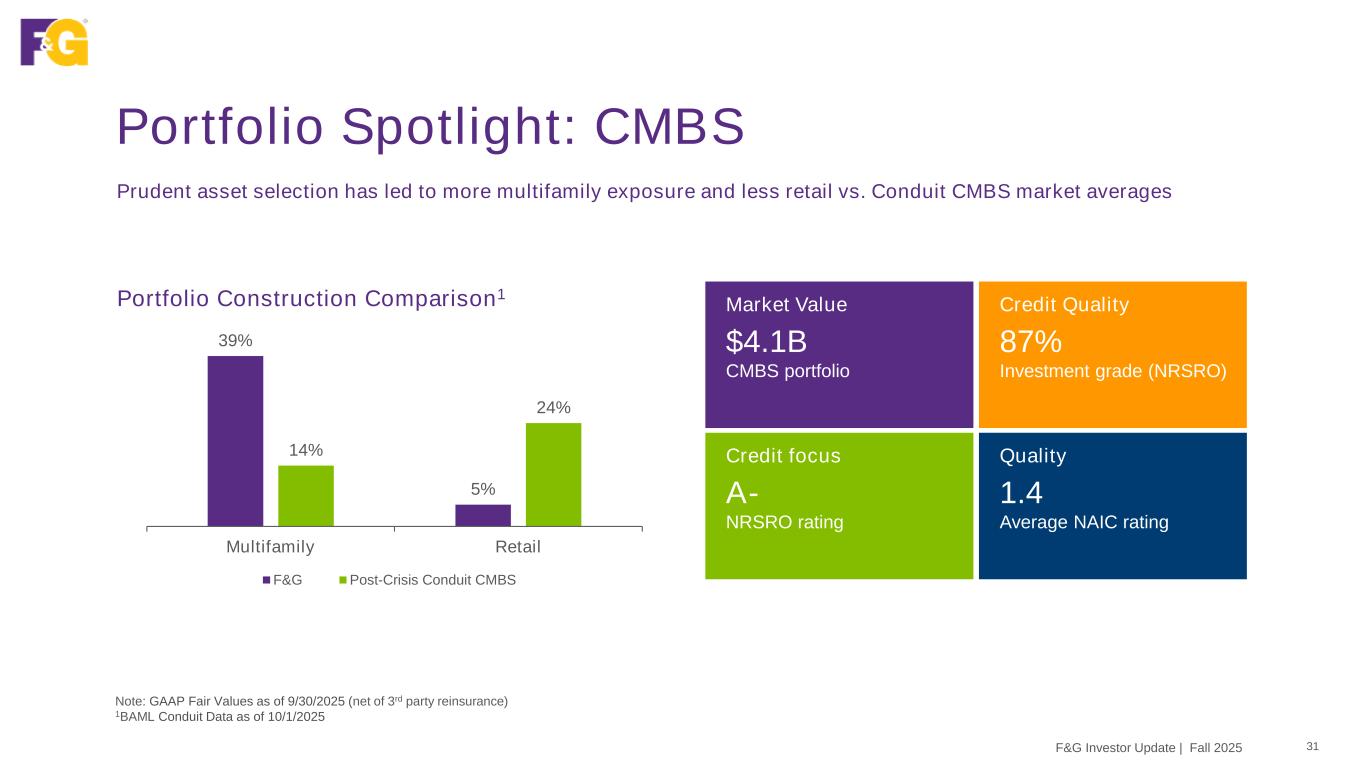

Portfolio Spotlight: CMBS 31 Prudent asset selection has led to more multifamily exposure and less retail vs. Conduit CMBS market averages Portfolio Construction Comparison1 Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) 1BAML Conduit Data as of 10/1/2025 39% 5% 14% 24% Multifamily Retail F&G Post-Crisis Conduit CMBS Credit Quality 87% Investment grade (NRSRO) Quality 1.4 Average NAIC rating Market Value $4.1B CMBS portfolio Credit focus A- NRSRO rating F&G Investor Update | Fall 2025

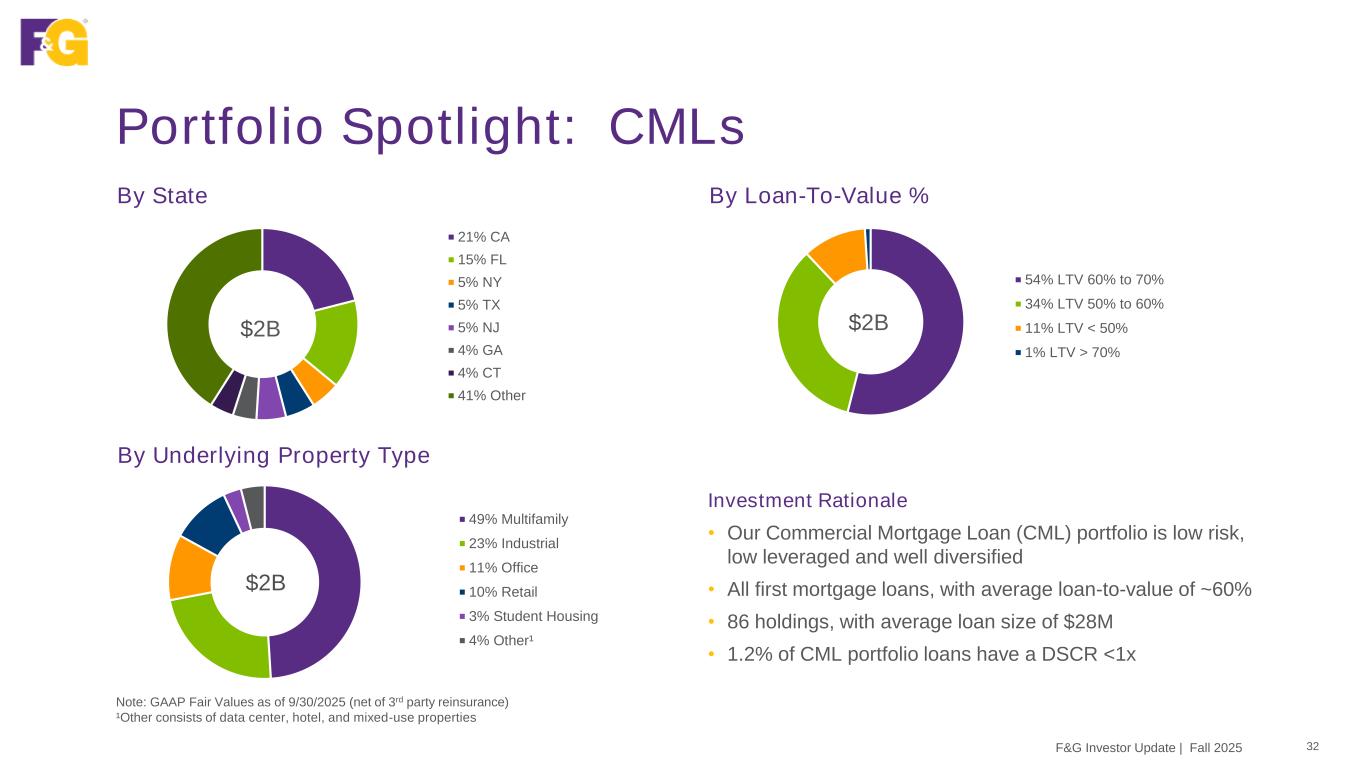

Portfolio Spotlight: CMLs 32 Investment Rationale • Our Commercial Mortgage Loan (CML) portfolio is low risk, low leveraged and well diversified • All first mortgage loans, with average loan-to-value of ~60% • 86 holdings, with average loan size of $28M • 1.2% of CML portfolio loans have a DSCR <1x By State By Loan-To-Value % By Underlying Property Type Note: GAAP Fair Values as of 9/30/2025 (net of 3rd party reinsurance) ¹Other consists of data center, hotel, and mixed-use properties 21% CA 15% FL 5% NY 5% TX 5% NJ 4% GA 4% CT 41% Other $2B 54% LTV 60% to 70% 34% LTV 50% to 60% 11% LTV < 50% 1% LTV > 70% $2B $2B 49% Multifamily 23% Industrial 11% Office 10% Retail 3% Student Housing 4% Other¹ F&G Investor Update | Fall 2025

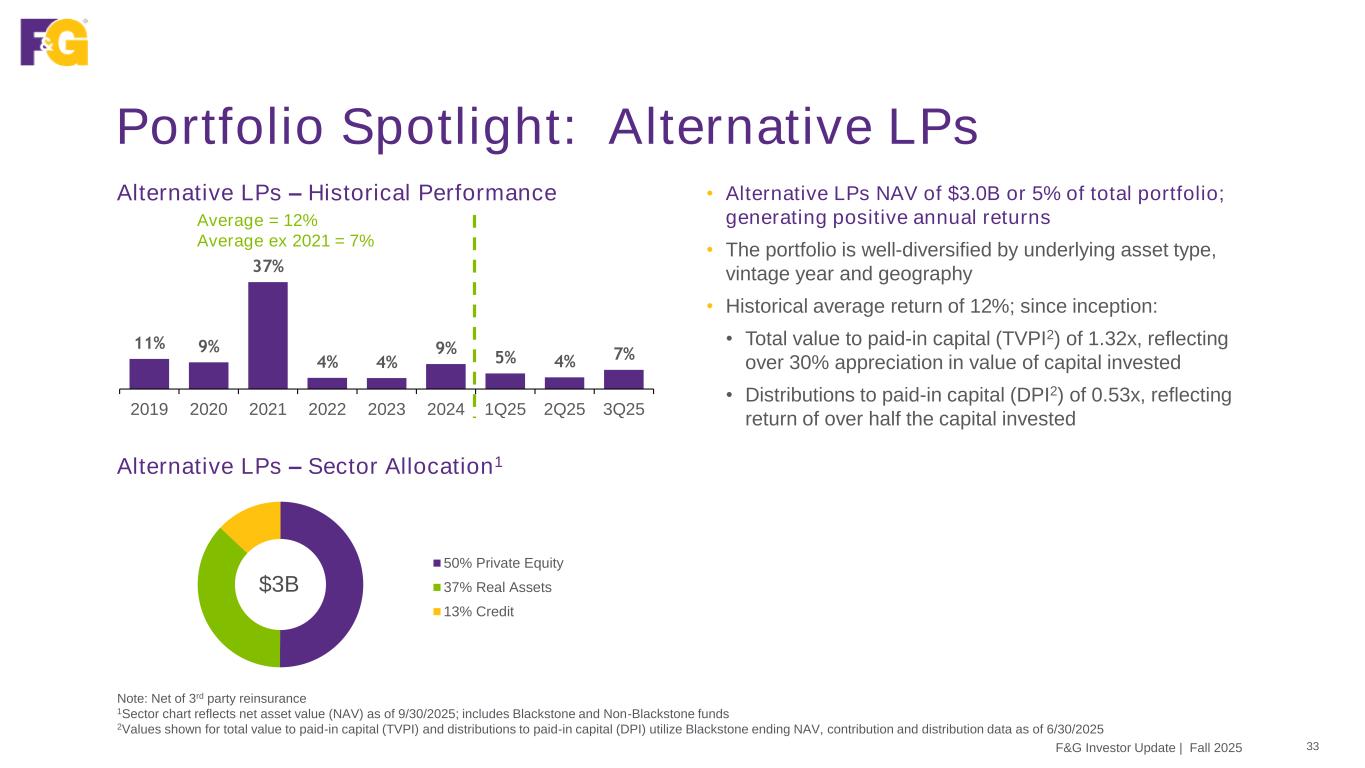

50% Private Equity 37% Real Assets 13% Credit $3B Portfolio Spotlight: Alternative LPs 33F&G Investor Update | Fall 2025 • Alternative LPs NAV of $3.0B or 5% of total portfolio; generating positive annual returns • The portfolio is well-diversified by underlying asset type, vintage year and geography • Historical average return of 12%; since inception: • Total value to paid-in capital (TVPI2) of 1.32x, reflecting over 30% appreciation in value of capital invested • Distributions to paid-in capital (DPI2) of 0.53x, reflecting return of over half the capital invested Note: Net of 3rd party reinsurance 1Sector chart reflects net asset value (NAV) as of 9/30/2025; includes Blackstone and Non-Blackstone funds 2Values shown for total value to paid-in capital (TVPI) and distributions to paid-in capital (DPI) utilize Blackstone ending NAV, contribution and distribution data as of 6/30/2025 Alternative LPs – Historical Performance 11% 9% 37% 4% 4% 9% 5% 4% 7% 2019 2020 2021 2022 2023 2024 1Q25 2Q25 3Q25 Average = 12% Average ex 2021 = 7% Alternative LPs – Sector Allocation1

Blackstone Related Important Disclosures 34 This document (together with any attachments, appendices, and related materials, the “Materials”) is provided for informational due diligence purposes only and is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell, or a solicitation of an offer to buy, any security or instrument in or to participate in any account, program, trading strategy with any Blackstone fund, account or other investment vehicle (each a “Client”) managed or advised by Blackstone Inc. or its affiliates (“Blackstone”), nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision. None of Blackstone, its funds, nor any of their affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of a Client or any other entity, transaction, or investment. All information is as of the date on the cover, unless otherwise indicated and may change materially in the future. Past Performance and Estimates / Targets. In considering any investment performance information contained in the Materials, please bear in mind that past or estimated performance is not necessarily indicative of future results and there can be no assurance that Blackstone or a Client will achieve comparable results, implement its investment strategy, achieve its objectives or avoid substantial losses or that any expected returns will be met. Any estimates and/or targets used herein are indicative of Blackstone’s analysis regarding outcome potentials and are not guarantees of future performance. They are presented solely to provide you with insight into the portfolio's anticipated risk and reward characteristics. They are based on Blackstone’s current view of future events and financial performance of potential investments and various estimations and “base case” assumptions (including about events that have not occurred) made at the time the estimates/targets are developed. While Blackstone believes that these assumptions are reasonable under the circumstances, there is no assurance that the results will be obtained, and unpredictable general economic conditions and other factors may cause actual results to vary materially from the estimates/targets. Any variations could be adverse to the actual results. Additional information regarding any estimations/targets, and relevant assumptions, is available upon request. Blackstone Proprietary Data. Certain information and data provided herein is based on Blackstone proprietary knowledge and data. Portfolio companies may provide proprietary market data to Blackstone, including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures, and valuations for multiple assets. Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and existing investments. While Blackstone currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Blackstone’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof. Third-Party Information. Certain information contained in the Materials has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. Forward-Looking Statements. Certain information contained in the Materials constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward‐looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Blackstone believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10‐K for the most recent fiscal year ended December 31 of that year and any such updated factors included in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Materials and in the filings. Blackstone undertakes no obligation to publicly update or review any forward‐looking statement, whether as a result of new information, future developments or otherwise. F&G Investor Update | Fall 2025

APPENDIX 35F&G Investor Update | Fall 2025 Appendix – Finance

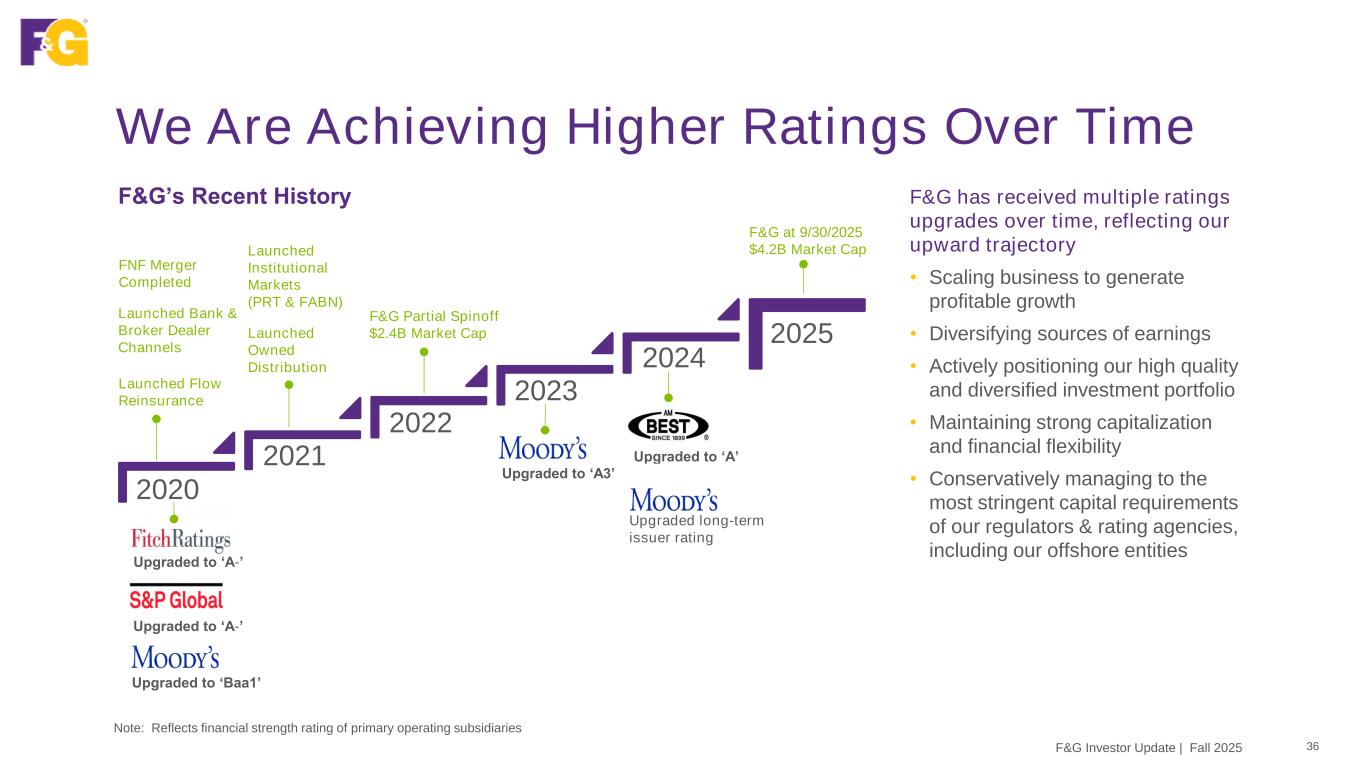

2020 2021 2022 2023 2024 2025 We Are Achieving Higher Ratings Over Time 36F&G Investor Update | Fall 2025 Upgraded to ‘A-’ FNF Merger Completed F&G Partial Spinoff $2.4B Market Cap Launched Flow Reinsurance Launched Owned Distribution F&G at 9/30/2025 $4.2B Market Cap Upgraded to ‘A-’ Upgraded to ‘Baa1’ Upgraded to ‘A3’ Upgraded to ‘A’ Launched Bank & Broker Dealer Channels Launched Institutional Markets (PRT & FABN) F&G has received multiple ratings upgrades over time, reflecting our upward trajectory • Scaling business to generate profitable growth • Diversifying sources of earnings • Actively positioning our high quality and diversified investment portfolio • Maintaining strong capitalization and financial flexibility • Conservatively managing to the most stringent capital requirements of our regulators & rating agencies, including our offshore entities Upgraded long-term issuer rating Note: Reflects financial strength rating of primary operating subsidiaries F&G’s Recent History

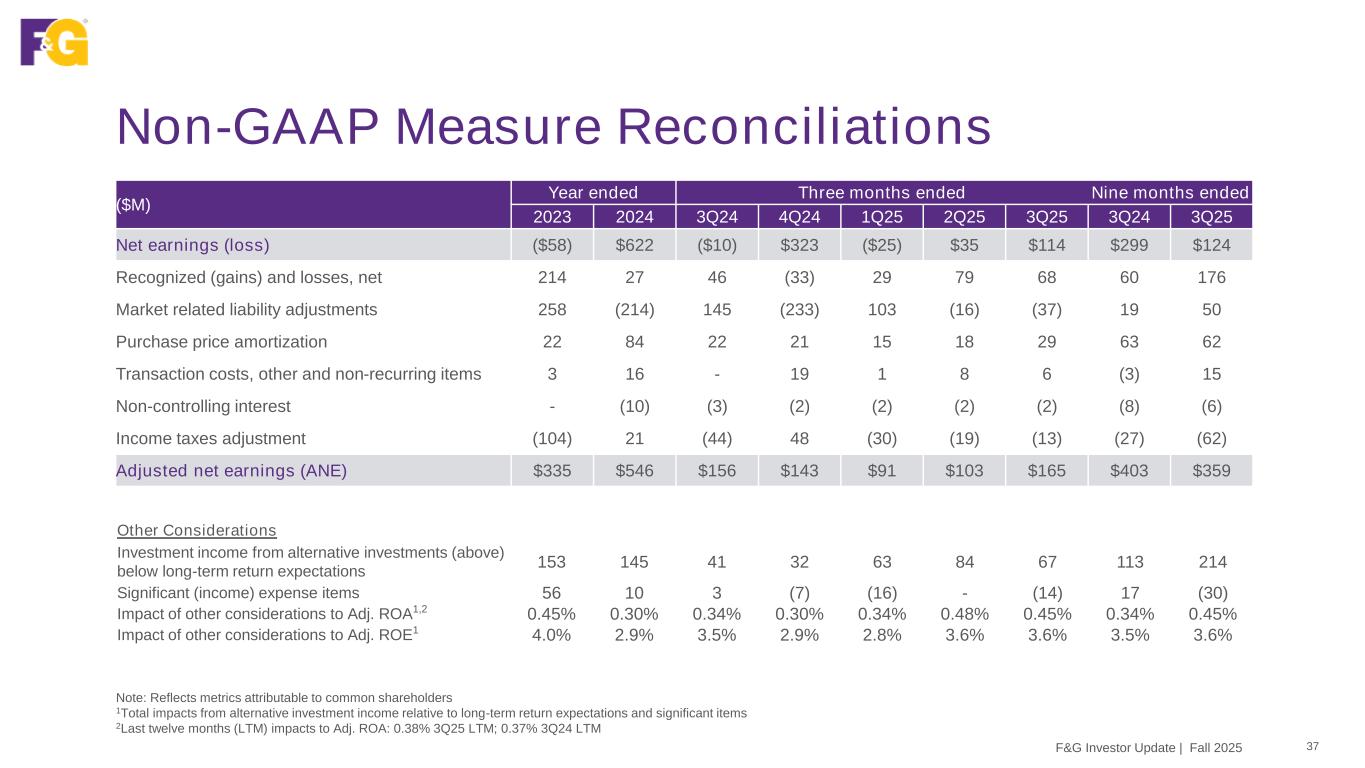

Non-GAAP Measure Reconciliations 37F&G Investor Update | Fall 2025 Note: Reflects metrics attributable to common shareholders 1Total impacts from alternative investment income relative to long-term return expectations and significant items 2Last twelve months (LTM) impacts to Adj. ROA: 0.38% 3Q25 LTM; 0.37% 3Q24 LTM ($M) Year ended Three months ended Nine months ended 2023 2024 3Q24 4Q24 1Q25 2Q25 3Q25 3Q24 3Q25 Net earnings (loss) ($58) $622 ($10) $323 ($25) $35 $114 $299 $124 Recognized (gains) and losses, net 214 27 46 (33) 29 79 68 60 176 Market related liability adjustments 258 (214) 145 (233) 103 (16) (37) 19 50 Purchase price amortization 22 84 22 21 15 18 29 63 62 Transaction costs, other and non-recurring items 3 16 - 19 1 8 6 (3) 15 Non-controlling interest - (10) (3) (2) (2) (2) (2) (8) (6) Income taxes adjustment (104) 21 (44) 48 (30) (19) (13) (27) (62) Adjusted net earnings (ANE) $335 $546 $156 $143 $91 $103 $165 $403 $359 Other Considerations Investment income from alternative investments (above) below long-term return expectations 153 145 41 32 63 84 67 113 214 Significant (income) expense items 56 10 3 (7) (16) - (14) 17 (30) Impact of other considerations to Adj. ROA1,2 0.45% 0.30% 0.34% 0.30% 0.34% 0.48% 0.45% 0.34% 0.45% Impact of other considerations to Adj. ROE1 4.0% 2.9% 3.5% 2.9% 2.8% 3.6% 3.6% 3.5% 3.6%

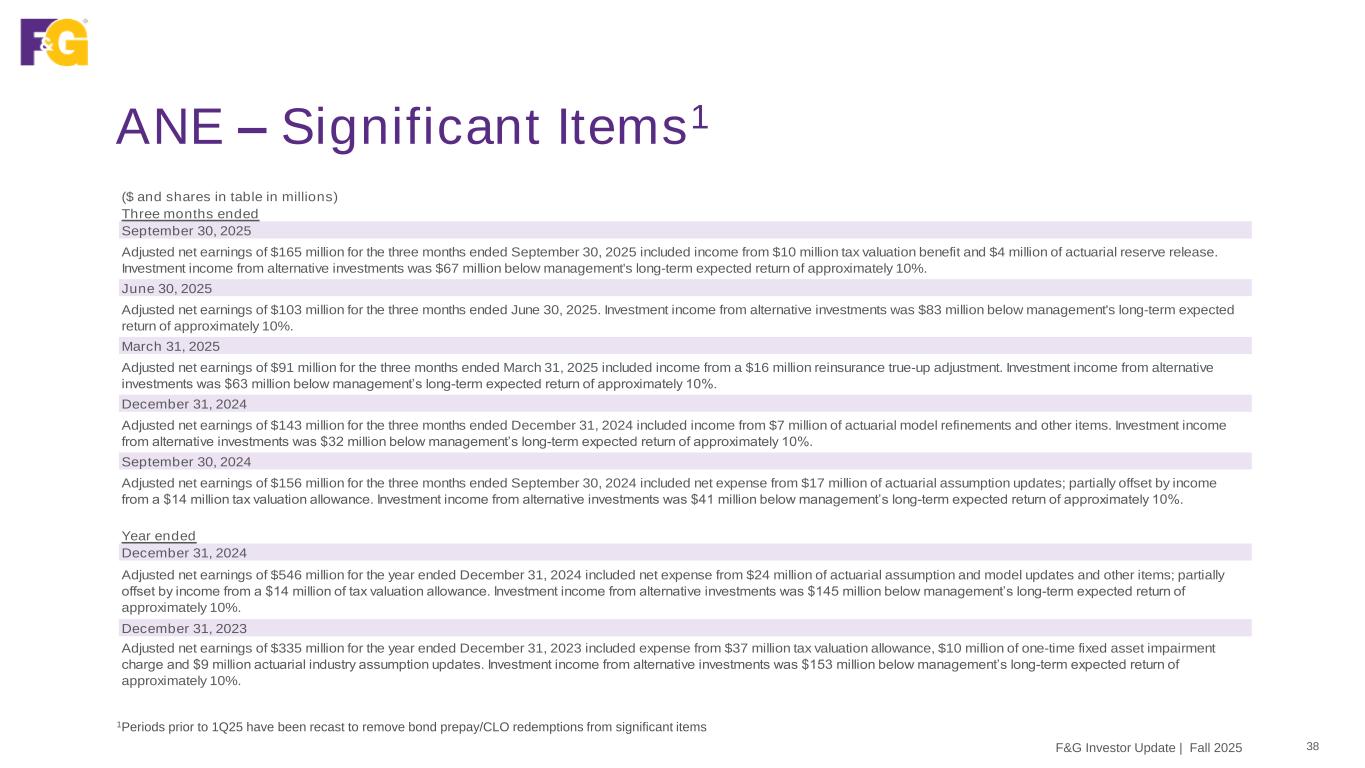

ANE – Significant Items1 38F&G Investor Update | Fall 2025 1Periods prior to 1Q25 have been recast to remove bond prepay/CLO redemptions from significant items ($ and shares in table in millions) Three months ended September 30, 2025 Adjusted net earnings of $165 million for the three months ended September 30, 2025 included income from $10 million tax valuation benefit and $4 million of actuarial reserve release. Investment income from alternative investments was $67 million below management's long-term expected return of approximately 10%. June 30, 2025 Adjusted net earnings of $103 million for the three months ended June 30, 2025. Investment income from alternative investments was $83 million below management's long-term expected return of approximately 10%. March 31, 2025 Adjusted net earnings of $91 million for the three months ended March 31, 2025 included income from a $16 million reinsurance true-up adjustment. Investment income from alternative investments was $63 million below management’s long-term expected return of approximately 10%. December 31, 2024 Adjusted net earnings of $143 million for the three months ended December 31, 2024 included income from $7 million of actuarial model refinements and other items. Investment income from alternative investments was $32 million below management’s long-term expected return of approximately 10%. September 30, 2024 Adjusted net earnings of $156 million for the three months ended September 30, 2024 included net expense from $17 million of actuarial assumption updates; partially offset by income from a $14 million tax valuation allowance. Investment income from alternative investments was $41 million below management’s long-term expected return of approximately 10%. Year ended December 31, 2024 Adjusted net earnings of $546 million for the year ended December 31, 2024 included net expense from $24 million of actuarial assumption and model updates and other items; partially offset by income from a $14 million of tax valuation allowance. Investment income from alternative investments was $145 million below management’s long-term expected return of approximately 10%. December 31, 2023 Adjusted net earnings of $335 million for the year ended December 31, 2023 included expense from $37 million tax valuation allowance, $10 million of one-time fixed asset impairment charge and $9 million actuarial industry assumption updates. Investment income from alternative investments was $153 million below management’s long-term expected return of approximately 10%.

Non-GAAP Financial Measures and Definitions 39F&G Investor Update | Fall 2025 The following represents the definitions of non-GAAP financial measures used by F&G Adjusted Net Earnings attributable to common shareholders Adjusted net earnings attributable to common shareholders is a non-GAAP economic measure we use to evaluate financial performance each period. Adjusted net earnings attributable to common shareholders is calculated by adjusting net earnings (loss) attributable to common shareholders to eliminate: (i) Recognized (gains) and losses, net: the impact of net investment gains/losses, including changes in allowance for expected credit losses and other than temporary impairment (“OTTI”) losses, recognized in operations; and the effects of changes in fair value of the reinsurance related embedded derivative and other derivatives, including interest rate swaps and forwards; (ii) Market related liability adjustments: the impacts related to changes in the fair value, including both realized and unrealized gains and losses, of index product related derivatives and embedded derivatives, net of hedging cost; the impact of initial pension risk transfer deferred profit liability losses, including amortization from previously deferred pension risk transfer deferred profit liability losses; and the changes in the fair value of market risk benefits by deferring current period changes and amortizing that amount over the life of the market risk benefit; (iii) Purchase price amortization: the impacts related to the amortization of certain intangibles (internally developed software, trademarks and value of distribution asset and the change in fair value of liabilities recognized as a result of acquisition activities); (iv) Transaction costs: the impacts related to acquisition, integration and merger related items; (v) Other and “non-recurring,” “infrequent” or “unusual items”: Other adjustments include removing any charges associated with U.S. guaranty fund assessments as these charges neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance, but result from external situations not controlled by the Company. Further, Management excludes certain items determined to be “non-recurring,” “infrequent” or “unusual” from adjusted net earnings when incurred if it is determined these expenses are not a reflection of the core business and when the nature of the item is such that it is not reasonably likely to recur within two years and/or there was not a similar item in the preceding two years; (vi) Non-controlling interest on non-GAAP adjustments: the portion of the non-GAAP adjustments attributable to the equity interest of entities that F&G does not wholly own; and (vii) Income taxes: the income tax impact related to the above-mentioned adjustments is measured using an effective tax rate, as appropriate by tax jurisdiction. While these adjustments are an integral part of the overall performance of F&G, market conditions and/or the non-operating nature of these items can overshadow the underlying performance of the core business. Accordingly, management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Adjusted net earnings should not be used as a substitute for net earnings (loss). However, we believe the adjustments made to net earnings (loss) in order to derive adjusted net earnings provide an understanding of our overall results of operations.

Non-GAAP Financial Measures and Definitions 40F&G Investor Update | Fall 2025 Adjusted Net Earnings attributable to common shareholders per Diluted Share Adjusted net earnings attributable to common shareholders per diluted share is calculated as adjusted net earnings plus preferred stock dividend (if the preferred stock has created dilution). This sum is then divided by the adjusted weighted-average diluted shares outstanding. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Adjusted Return on Assets attributable to Common Shareholders Adjusted return on assets attributable to common shareholders is calculated by dividing year-to-date annualized adjusted net earnings attributable to common shareholders by year-to-date AAUM. Return on assets is comprised of net investment income, less cost of funds, flow reinsurance fee income, owned distribution margin and less expenses (including operating expenses, interest expense and income taxes) consistent with our adjusted net earnings definition and related adjustments. Cost of funds includes liability costs related to cost of crediting as well as other liability costs. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing financial performance and profitability earned on AAUM. Adjusted Return on Average Common Shareholder Equity, excluding AOCI Adjusted return on average common shareholder equity is calculated by dividing the rolling four quarters adjusted net earnings attributable to common shareholders, by total average F&G equity attributable to common shareholders, excluding AOCI. Average equity attributable to common shareholders, excluding AOCI for the twelve month rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be a useful internally and for investors and analysts to assess the level return driven by the Company's adjusted earnings.

Non-GAAP Financial Measures and Definitions 41F&G Investor Update | Fall 2025 Adjusted Weighted Average Diluted Shares Outstanding Adjusted weighted average diluted shares outstanding is the same as weighted average diluted shares outstanding except for periods in which our preferred stocks are calculated to be dilutive to either net earnings attributable to common shareholders or adjusted net earnings attributable to common shareholders, but not both, or there is a net earnings loss attributable to common shareholders on a GAAP basis, but positive adjusted net earnings attributable to common shareholders using the non-GAAP measure. The above exceptions are made to include relevant diluted shares when dilution occurs and exclude relevant diluted shares when dilution does not occur for adjusted net earnings attributable to common shareholders. Management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Assets Under Management (AUM) AUM is comprised of the following components and is reported net of reinsurance assets ceded in accordance with GAAP: (i) total invested assets at amortized cost, excluding investments in unconsolidated affiliates, owned distribution and derivatives; (ii) investments in unconsolidated affiliates at carrying value; (iii) related party loans and investments; (iv) accrued investment income; (v) the net payable/receivable for the purchase/sale of investments; and (vi) cash and cash equivalents excluding derivative collateral at the end of the period. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio that is retained.

Non-GAAP Financial Measures and Definitions 42F&G Investor Update | Fall 2025 AUM before Flow Reinsurance AUM before Flow Reinsurance is comprised of AUM plus flow reinsured assets, including certain block reinsured assets that have the characteristics of flow reinsured assets. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the size of our investment portfolio including reinsured assets. Average Assets Under Management (AAUM) (Quarterly and YTD) AAUM is calculated as AUM at the beginning of the period and the end of each month in the period, divided by the total number of months in the period plus one. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on retained assets. Book Value per Common Share, excluding AOCI Book value per Common share, excluding AOCI is calculated as total F&G equity attributable to common shareholders divided by the total number of shares of common stock outstanding. Management considers this to be a useful measure internally and for investors and analysts to assess the capital position of the Company. Debt-to-Capital Ratio, excluding AOCI Debt-to-capitalization ratio is computed by dividing total aggregate principal amount of debt by total capitalization (total debt plus total equity, excluding AOCI). Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing its capital position. Return on Average F&G common shareholder Equity, excluding AOCI Return on average F&G common shareholder equity, excluding AOCI is calculated by dividing the rolling four quarters net earnings (loss) attributable to common shareholders, by total average F&G equity attributable to common shareholders, excluding AOCI. Average F&G equity attributable to common shareholders, excluding AOCI for the twelve month rolling period is the average of 5 points throughout the period. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders.

Non-GAAP Financial Measures and Definitions 43F&G Investor Update | Fall 2025 Sales Annuity, IUL, funding agreement and non-life contingent PRT sales are not derived from any specific GAAP income statement accounts or line items and should not be viewed as a substitute for any financial measure determined in accordance with GAAP. Sales from these products are recorded as deposit liabilities (i.e., contractholder funds) within the Company's consolidated financial statements in accordance with GAAP. Life contingent PRT sales are recorded as premiums in revenues within the consolidated financial statements. Management believes that presentation of sales, as measured for management purposes, enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition. Total Capitalization, excluding AOCI Total capitalization, excluding AOCI is based on total equity excluding the effect of AOCI and the total aggregate principal amount of debt. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts to help assess the capital position of the Company. Total Equity, excluding AOCI Total equity, excluding AOCI is based on total equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts assessing the level of earned equity on total equity.

Non-GAAP Financial Measures and Definitions 44F&G Investor Update | Fall 2025 Total F&G Equity attributable to common shareholders, excluding AOCI Total F&G equity attributable to common shareholder, excluding AOCI is based on total F&G Annuities & Life, Inc. shareholders' equity excluding the effect of AOCI and preferred stocks, including additional paid-in-capital. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, changes in instrument-specific credit risk for market risk benefits and discount rate assumption changes for the future policy benefits, management considers this non-GAAP financial measure to be useful internally and for investors and analysts to assess the level of return driven by the Company that is available to common shareholders. Yield on AAUM Yield on AAUM is calculated by dividing annualized net investment income on an adjusted net earnings basis by AAUM. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the level of return earned on AAUM.