| REIT | Real estate investment trust | ||||

| WPC | W. P. Carey Inc., a net-lease REIT (also our “Advisor”) | ||||

| U.S. | United States | ||||

| ABR | Contractual minimum annualized base rent | ||||

| NAREIT | National Association of Real Estate Investment Trusts (an industry trade group) | ||||

| WALT | Weighted-average lease term | ||||

| CPI | Consumer price index | ||||

| Table of Contents | |||||

| Appendix | |||||

| Summary Metrics | |||||

| Financial Results | |||||||||||||||||||||||

| Revenues, including reimbursable costs – consolidated ($000s) | $ | 29,174 | |||||||||||||||||||||

| Net loss attributable to NLOP ($000s) | (81,540) | ||||||||||||||||||||||

| Net loss attributable to NLOP per diluted share | (5.50) | ||||||||||||||||||||||

Normalized pro rata cash NOI ($000s) (a) (b) | 20,375 | ||||||||||||||||||||||

AFFO attributable to NLOP ($000s) (a) (b) | 16,909 | ||||||||||||||||||||||

AFFO attributable to NLOP per diluted share (a) (b) | 1.14 | ||||||||||||||||||||||

| Balance Sheet and Capitalization | |||||||||||||||||||||||

| Equity market capitalization – based on quarter end share price of $32.55 ($000s) | $ | 482,198 | |||||||||||||||||||||

| Total consolidated debt ($000s) | 117,170 | ||||||||||||||||||||||

Gross assets ($000s) (c) | 811,531 | ||||||||||||||||||||||

| Total consolidated debt to gross assets | 14.4 | % | |||||||||||||||||||||

| Advisory Fees and Reimbursements Paid to WPC | |||||||||||||||||||||||

Asset management fees (d) | $ | 1,209 | |||||||||||||||||||||

Administrative reimbursements (e) | 1,000 | ||||||||||||||||||||||

Portfolio (Pro Rata) (b) | |||||||||||||||||||||||

ABR (in thousands) (f) | $ | 87,987 | |||||||||||||||||||||

| Number of properties | 36 | ||||||||||||||||||||||

| Number of tenants | 39 | ||||||||||||||||||||||

| Occupancy | 88.1 | % | |||||||||||||||||||||

| Weighted-average lease term (in years) | 4.0 | ||||||||||||||||||||||

Leasable square footage (in thousands) (g) | 5,304 | ||||||||||||||||||||||

ABR from investment grade tenants as a % of total ABR (h) | 44.0 | % | |||||||||||||||||||||

| Dispositions – number of properties sold | 1 | ||||||||||||||||||||||

| Dispositions – gross proceeds (in thousands) | $ | 16,300 | |||||||||||||||||||||

| Subsequent to Quarter End | |||||||||||||||||||||||

| Dispositions – number of properties sold | 1 | ||||||||||||||||||||||

| Dispositions – gross proceeds (in thousands) | $ | 25,180 | |||||||||||||||||||||

Special cash distribution – gross distributions (in thousands) (i) | $ | 45,924 | |||||||||||||||||||||

Special cash distribution – per share (i) | 3.10 | ||||||||||||||||||||||

Net Lease Office Properties | 1 | |||||

| Components of Net Asset Value | |||||

Three Months Ended June 30, 2025 | |||||

Normalized Pro Rata Cash NOI (a) (b) | $ | 20,375 | |||

| Balance Sheet – Selected Information | As of June 30, 2025 | ||||

| Assets | |||||

Book value of select real estate (c) | $ | 13,230 | |||

| Cash and cash equivalents | 54,146 | ||||

| Restricted cash, including escrow | 2,043 | ||||

| Other assets, net: | |||||

| Straight-line rent adjustments | $ | 18,808 | |||

| Prepaid expenses | 3,608 | ||||

| Deferred charges | 2,494 | ||||

| Accounts receivable | 1,349 | ||||

| Taxes receivable | 194 | ||||

| Other | 3,512 | ||||

| Total other assets, net | $ | 29,965 | |||

| Liabilities | |||||

Non-recourse mortgages, net (d) | $ | 117,102 | |||

| Accounts payable, accrued expenses and other liabilities: | |||||

| Accounts payable and accrued expenses | $ | 11,234 | |||

| Prepaid and deferred rents | 9,133 | ||||

| Accrued taxes payable | 999 | ||||

| Tenant security deposits | 814 | ||||

| Operating lease liabilities | 222 | ||||

| Other | 21,047 | ||||

| Total accounts payable, accrued expenses and other liabilities | $ | 43,449 | |||

Net Lease Office Properties | 2 | |||||

| Consolidated Statement of Operations | |||||

Three Months Ended June 30, 2025 | |||||

| Revenues | |||||

| Lease revenues | $ | 27,508 | |||

| Other lease-related income | 1,666 | ||||

| 29,174 | |||||

| Operating Expenses | |||||

Impairment charges — real estate (a) | 81,817 | ||||

| Depreciation and amortization | 9,687 | ||||

| Reimbursable tenant costs | 6,537 | ||||

| Property expenses, excluding reimbursable tenant costs | 2,244 | ||||

General and administrative (b) | 2,144 | ||||

Asset management fees (c) | 1,209 | ||||

| 103,638 | |||||

| Other Income and Expenses | |||||

Interest expense (d) | (4,400) | ||||

| Loss on sale of real estate, net | (3,251) | ||||

| Other gains and (losses) | 697 | ||||

| (6,954) | |||||

| Loss before income taxes | (81,418) | ||||

| Provision for income taxes | (100) | ||||

| Net Loss | (81,518) | ||||

| Net income attributable to noncontrolling interests | (22) | ||||

| Net Loss Attributable to NLOP | $ | (81,540) | |||

| Basic and Diluted Loss Per Share | $ | (5.50) | |||

| Weighted-Average Shares Outstanding | |||||

| Basic and Diluted | 14,814,075 | ||||

Net Lease Office Properties | 3 | |||||

| FFO and AFFO, Consolidated | |||||

Three Months Ended June 30, 2025 | |||||

| Net loss attributable to NLOP | $ | (81,540) | |||

| Adjustments: | |||||

Impairment charges — real estate (a) | 81,817 | ||||

| Depreciation and amortization of real property | 9,688 | ||||

| Loss on sale of real estate, net | 3,251 | ||||

Proportionate share of adjustments for noncontrolling interests (b) | (52) | ||||

| Total adjustments | 94,704 | ||||

FFO (as defined by NAREIT) Attributable to NLOP (c) | 13,164 | ||||

| Adjustments: | |||||

| Amortization of deferred financing costs | 2,900 | ||||

| Straight-line and other leasing and financing adjustments | 726 | ||||

Above- and below-market rent intangible lease amortization, net | 316 | ||||

| Other (gains) and losses | (293) | ||||

| Other amortization and non-cash items | 109 | ||||

Proportionate share of adjustments for noncontrolling interests (b) | (13) | ||||

| Total adjustments | 3,745 | ||||

AFFO Attributable to NLOP (c) | $ | 16,909 | |||

| Summary | |||||

FFO (as defined by NAREIT) attributable to NLOP (c) | $ | 13,164 | |||

FFO (as defined by NAREIT) attributable to NLOP per diluted share (c) | $ | 0.89 | |||

AFFO attributable to NLOP (c) | $ | 16,909 | |||

AFFO attributable to NLOP per diluted share (c) | $ | 1.14 | |||

| Diluted weighted-average shares outstanding | 14,814,075 | ||||

Net Lease Office Properties | 4 | |||||

| Consolidated Balance Sheets | |||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| Assets | |||||||||||

| Investments in real estate: | |||||||||||

| Land, buildings and improvements | $ | 581,913 | $ | 730,345 | |||||||

| In-place lease intangible assets and other | 191,977 | 209,968 | |||||||||

| Above-market rent intangible assets | 29,742 | 30,512 | |||||||||

| Investments in real estate | 803,632 | 970,825 | |||||||||

| Accumulated depreciation and amortization | (282,999) | (292,679) | |||||||||

| Assets held for sale, net | 61,868 | 29,297 | |||||||||

| Net investments in real estate | 582,501 | 707,443 | |||||||||

| Cash and cash equivalents | 54,146 | 25,121 | |||||||||

| Restricted cash | 2,043 | 43,305 | |||||||||

| Other assets, net | 29,965 | 29,200 | |||||||||

| Total assets | $ | 668,655 | $ | 805,069 | |||||||

| Liabilities and Equity | |||||||||||

| Debt: | |||||||||||

| Non-recourse mortgages, net | $ | 117,170 | $ | 111,259 | |||||||

| NLOP Mezzanine Loan, net | — | 57,957 | |||||||||

| Debt, net | 117,170 | 169,216 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 43,449 | 44,145 | |||||||||

| Below-market rent intangible liabilities, net | 3,985 | 6,305 | |||||||||

| Total liabilities | 164,604 | 219,666 | |||||||||

Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued | — | — | |||||||||

Common stock, $0.001 par value, 45,000,000 shares authorized; 14,814,075 and 14,814,075 shares, respectively, issued and outstanding | 15 | 15 | |||||||||

| Additional paid-in capital | 855,813 | 855,813 | |||||||||

| Distributions in excess of accumulated earnings | (315,491) | (234,443) | |||||||||

| Accumulated other comprehensive loss | (40,323) | (40,157) | |||||||||

| Total shareholders' equity | 500,014 | 581,228 | |||||||||

| Noncontrolling interests | 4,037 | 4,175 | |||||||||

| Total equity | 504,051 | 585,403 | |||||||||

| Total liabilities and equity | $ | 668,655 | $ | 805,069 | |||||||

Net Lease Office Properties | 5 | |||||

| Capitalization | |||||

| Total Enterprise Value | Shares | Share Price | Market Value | |||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||

| Common equity | 14,814,075 | $ | 32.55 | $ | 482,198 | |||||||||||||||||||||

| Total Equity Market Capitalization | 482,198 | |||||||||||||||||||||||||

Outstanding Balance (a) | ||||||||||||||||||||||||||

| Debt | ||||||||||||||||||||||||||

| Non-recourse mortgages | 117,102 | |||||||||||||||||||||||||

| Total Debt | 117,102 | |||||||||||||||||||||||||

| Less: Cash and cash equivalents | (54,146) | |||||||||||||||||||||||||

| Net Debt | 62,956 | |||||||||||||||||||||||||

| Total Enterprise Value | $ | 545,154 | ||||||||||||||||||||||||

Net Lease Office Properties | 6 | |||||

| Debt Overview | |||||

| Maturity Date | Fixed / Floating | Interest Rate | Total Outstanding Balance (a) | % of Total | ||||||||||||||||||||||||||||

| Mortgages (Tenant Listed) | ||||||||||||||||||||||||||||||||

Northrop Grumman Systems Corporation (b) | 1/6/2025 | Fixed | 9.2 | % | $ | 25,220 | 21.5 | % | ||||||||||||||||||||||||

| Acosta, Inc. | 8/6/2025 | Fixed | 4.4 | % | 9,768 | 8.3 | % | |||||||||||||||||||||||||

Siemens AS (c) | 12/15/2025 | Floating | 4.9 | % | 45,451 | 38.9 | % | |||||||||||||||||||||||||

| Midcontinent Independent Stm Op Inc. | 3/6/2026 | Fixed | 7.0 | % | 8,796 | 7.5 | % | |||||||||||||||||||||||||

| North American Lighting, Inc. | 5/6/2026 | Fixed | 6.3 | % | 5,967 | 5.1 | % | |||||||||||||||||||||||||

| Intuit Inc. | 7/6/2026 | Fixed | 7.0 | % | 21,900 | 18.7 | % | |||||||||||||||||||||||||

| Total Debt Outstanding | 6.4 | % | $ | 117,102 | 100.0 | % | ||||||||||||||||||||||||||

Net Lease Office Properties | 7 | |||||

| Dispositions | |||||

| Tenant / Lease Guarantor | Property Location(s) | Gross Sale Price | ABR (a) | Closing Date | Gross Square Footage | |||||||||||||||||||||||||||

| 4Q23 | ||||||||||||||||||||||||||||||||

| Raytheon Company | Tucson, AZ | $ | 24,575 | $ | 1,978 | Dec-23 | 143,650 | |||||||||||||||||||||||||

| Carhartt, Inc. | Dearborn, MI | 9,806 | 748 | Dec-23 | 58,722 | |||||||||||||||||||||||||||

| BCBSM, Inc. | Eagan, MN | 2,500 | 298 | Dec-23 | 29,916 | |||||||||||||||||||||||||||

| AVL Michigan Holding Corporation | Plymouth, MI | 6,200 | 575 | Dec-23 | 70,000 | |||||||||||||||||||||||||||

| 4Q23 Total | 43,081 | 3,599 | 302,288 | |||||||||||||||||||||||||||||

| 1Q24 | ||||||||||||||||||||||||||||||||

Undisclosed – UK insurance company (b) | Newport, United Kingdom | 10,497 | 1,761 | Jan-24 | 80,664 | |||||||||||||||||||||||||||

Total E&P Norge AS (b) | Stavanger, Norway | 33,072 | 5,185 | Mar-24 | 275,725 | |||||||||||||||||||||||||||

| 1Q24 Total | 43,569 | 6,946 | 356,389 | |||||||||||||||||||||||||||||

| 2Q24 | ||||||||||||||||||||||||||||||||

Exelon Generation Company, LLC (c) | Warrenville, IL | 19,830 | 2,935 | Apr-24 | 146,745 | |||||||||||||||||||||||||||

Vacant (formerly AVT Technology Solutions LLC) (c) | Tempe, AZ | 13,160 | — | Apr-24 | 132,070 | |||||||||||||||||||||||||||

| FedEx Corporation | Collierville, TN | 62,500 | 5,491 | Apr-24 | 390,380 | |||||||||||||||||||||||||||

| DMG MORI SEIKI U.S.A., INC. | Hoffman Estates, IL | 35,984 | 2,458 | Apr-24 | 104,598 | |||||||||||||||||||||||||||

| BCBSM, Inc. (2 properties) | Eagan, MN | 60,700 | 4,663 | Jun-24 | 347,472 | |||||||||||||||||||||||||||

| 2Q24 Total | 192,174 | 15,547 | 1,121,265 | |||||||||||||||||||||||||||||

| 3Q24 | ||||||||||||||||||||||||||||||||

| CVS Health Corporation | Scottsdale, AZ | 71,500 | 4,252 | Aug-24 | 354,888 | |||||||||||||||||||||||||||

| Xileh Holding Inc. | Auburn Hills, MI | 9,000 | 711 | Sep-24 | 55,490 | |||||||||||||||||||||||||||

| 3Q24 Total | 80,500 | 4,963 | 410,378 | |||||||||||||||||||||||||||||

| 4Q24 | ||||||||||||||||||||||||||||||||

E.On UK PLC (b) | Houghton le Spring, United Kingdom | 3,924 | 3,819 | Oct-24 | 217,339 | |||||||||||||||||||||||||||

| Vacant (formerly BCBSM, Inc.) | Eagan, MN | 11,650 | — | Nov-24 | 227,666 | |||||||||||||||||||||||||||

| Merative L.P. | Hartland, WI | 6,750 | 669 | Dec-24 | 81,082 | |||||||||||||||||||||||||||

| Charter Communications Operating, LLC | Bridgeton, MO | 7,350 | 820 | Dec-24 | 78,080 | |||||||||||||||||||||||||||

| Caremark RX, L.L.C. | Chandler, AZ | 15,000 | 1,645 | Dec-24 | 183,000 | |||||||||||||||||||||||||||

| Cofinity, Inc./ Aetna Life Insurance Co. | Southfield, MI | 2,500 | 1,833 | Dec-24 | 94,453 | |||||||||||||||||||||||||||

| 4Q24 Total | 47,174 | 8,786 | 881,620 | |||||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||

| Emerson Electric Co. | Houston, TX | 4,180 | 1,108 | Mar-25 | 52,144 | |||||||||||||||||||||||||||

Nokia Corporation (b) | Krakow, Poland | 5,595 | 779 | Mar-25 | 53,400 | |||||||||||||||||||||||||||

| 1Q25 Total | 9,775 | 1,887 | 105,544 | |||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||

| Vacant (formerly McKesson Corporation) | The Woodlands, TX | 16,300 | — | May-25 | 204,063 | |||||||||||||||||||||||||||

| 2Q25 Total | 16,300 | — | 204,063 | |||||||||||||||||||||||||||||

Total Dispositions (d) | $ | 432,573 | $ | 41,728 | 3,381,547 | |||||||||||||||||||||||||||

Net Lease Office Properties | 8 | |||||

| Capital Expenditures and Leasing Activity | |||||

| Tenant Improvements and Leasing Costs | |||||

| Tenant Improvements (Tenant Listed) | |||||

| S&ME, Inc. | $ | 303 | |||

| 303 | |||||

| Leasing Costs (Tenant Listed) | |||||

| JPMorgan Chase Bank, N.A. | 572 | ||||

| 572 | |||||

| Tenant Improvements and Leasing Costs | 875 | ||||

| Maintenance Capital Expenditures (Tenant Listed) | |||||

| JPMorgan Chase Bank, N.A. | 195 | ||||

| Pioneer Credit Recovery, Inc. | 182 | ||||

| Thermo Fisher Scientific Inc. | 129 | ||||

| KBR, Inc. | 113 | ||||

| 619 | |||||

| Total: Tenant Improvements and Leasing Costs, and Maintenance Capital Expenditures | $ | 1,494 | |||

Lease Renewals and Extensions (a) | Expected Tenant Improvements ($000s) | Leasing Commissions ($000s) | ||||||||||||||||||||||||||||||||||||||||||||||||

| ABR | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Tenant | Location | Square Feet | Prior Lease ($000s) | New Lease ($000s) (b) | Rent Recapture | Incremental Lease Term | ||||||||||||||||||||||||||||||||||||||||||||

Midcontinent Independent Stm Op Inc. (c) | Eagan, MN | 60,463 | $ | 1,148 | $ | 937 | 81.6 | % | $ | — | $ | 605 | 10.0 years | |||||||||||||||||||||||||||||||||||||

Total / Weighted Average (d) | 60,463 | $ | 1,148 | $ | 937 | 81.6 | % | $ | — | $ | 605 | 10.0 years | ||||||||||||||||||||||||||||||||||||||

Net Lease Office Properties | 9 | |||||

| Top Ten Tenants | |||||

| Tenant / Lease Guarantor | State / Country | ABR | ABR % | Square Footage | Number of Properties | Weighted-Average Lease Term (Years) | ||||||||||||||||||||||||||||||||

KBR, Inc. (a) | Texas | $ | 20,156 | 22.9 | % | 913,713 | 1 | 5.0 | ||||||||||||||||||||||||||||||

JPMorgan Chase Bank, N.A. (b) | Florida, Texas | 9,766 | 11.1 | % | 666,869 | 3 | 4.3 | |||||||||||||||||||||||||||||||

Siemens AS (c) | Norway | 4,842 | 5.5 | % | 165,905 | 1 | 0.5 | |||||||||||||||||||||||||||||||

| Thermo Fisher Scientific Inc. | North Carolina | 4,063 | 4.6 | % | 219,812 | 1 | 8.4 | |||||||||||||||||||||||||||||||

| Omnicom Group, Inc. | California | 3,961 | 4.5 | % | 120,000 | 1 | 3.3 | |||||||||||||||||||||||||||||||

| R.R. Donnelley & Sons Company | Illinois | 3,393 | 3.9 | % | 167,215 | 1 | 2.3 | |||||||||||||||||||||||||||||||

| Board of Regents, State of Iowa | Iowa | 3,254 | 3.7 | % | 191,700 | 1 | 5.3 | |||||||||||||||||||||||||||||||

| Bankers Financial Corporation | Florida | 3,228 | 3.7 | % | 111,357 | 1 | 0.1 | |||||||||||||||||||||||||||||||

| Google, LLC | California | 3,018 | 3.4 | % | 67,681 | 1 | 5.3 | |||||||||||||||||||||||||||||||

| Northrop Grumman Systems Corporation | Minnesota | 2,679 | 3.0 | % | 191,336 | 1 | 4.4 | |||||||||||||||||||||||||||||||

Total (d) | $ | 58,360 | 66.3 | % | 2,815,588 | 12 | 4.2 | |||||||||||||||||||||||||||||||

Net Lease Office Properties | 10 | |||||

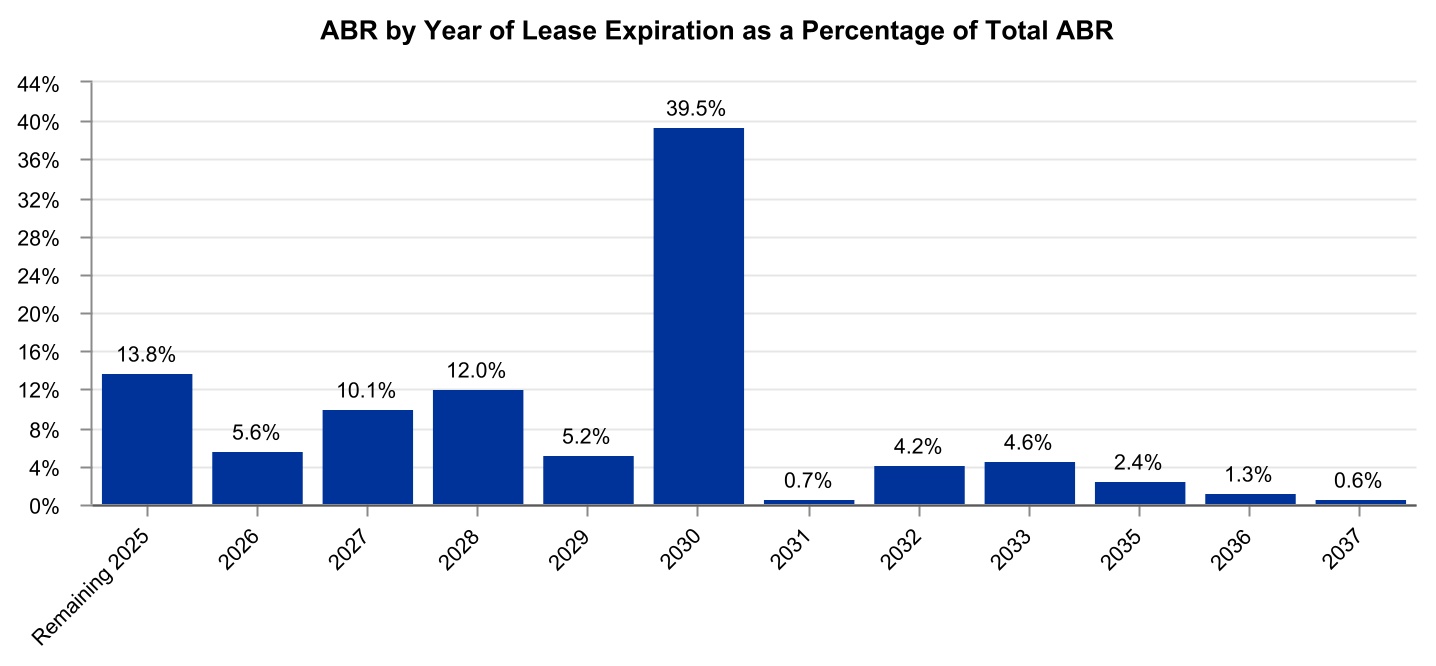

| Lease Expirations | |||||

Year of Lease Expiration (a) | Number of Leases Expiring | Number of Tenants with Leases Expiring | ABR | ABR % | Square Footage (b) | Square Footage % | ||||||||||||||||||||||||||||||||

| Remaining 2025 | 7 | 7 | $ | 12,142 | 13.8 | % | 571,125 | 10.8 | % | |||||||||||||||||||||||||||||

| 2026 | 6 | 6 | 4,940 | 5.6 | % | 308,997 | 5.8 | % | ||||||||||||||||||||||||||||||

| 2027 | 7 | 6 | 8,879 | 10.1 | % | 499,571 | 9.4 | % | ||||||||||||||||||||||||||||||

| 2028 | 7 | 6 | 10,551 | 12.0 | % | 476,036 | 9.0 | % | ||||||||||||||||||||||||||||||

| 2029 | 4 | 3 | 4,597 | 5.2 | % | 304,613 | 5.7 | % | ||||||||||||||||||||||||||||||

| 2030 | 7 | 6 | 34,720 | 39.5 | % | 1,772,623 | 33.4 | % | ||||||||||||||||||||||||||||||

| 2031 | 1 | 1 | 631 | 0.7 | % | 50,600 | 1.0 | % | ||||||||||||||||||||||||||||||

| 2032 | 2 | 2 | 3,721 | 4.2 | % | 257,008 | 4.8 | % | ||||||||||||||||||||||||||||||

| 2033 | 1 | 1 | 4,063 | 4.6 | % | 219,812 | 4.2 | % | ||||||||||||||||||||||||||||||

| 2035 | 1 | 1 | 2,050 | 2.4 | % | 120,147 | 2.3 | % | ||||||||||||||||||||||||||||||

| 2036 | 1 | 1 | 1,148 | 1.3 | % | 60,463 | 1.1 | % | ||||||||||||||||||||||||||||||

| 2037 | 1 | 1 | 545 | 0.6 | % | 31,120 | 0.6 | % | ||||||||||||||||||||||||||||||

| Vacant | — | — | — | — | % | 631,438 | 11.9 | % | ||||||||||||||||||||||||||||||

Total (c) | 45 | $ | 87,987 | 100.0 | % | 5,303,553 | 100.0 | % | ||||||||||||||||||||||||||||||

Net Lease Office Properties | 11 | |||||

| Property List | |||||

| Encumbered Status | |||||||||||||||||||||||||||||||||||

| # | Primary Tenant | Industry | Credit (a) | City | State | Square Footage (b) | ABR | Rent Increase Type | Date of Next Increase | WALT (c) | In-Place Mortgage Debt | ||||||||||||||||||||||||

| 1 | KBR, Inc. (d) (e) | Construction & Engineering | Non-IG | Houston | Texas | 1,064,788 | $21,286 | Fixed: One-time 7.78% | Jan-27 | 4.9 | $— | ||||||||||||||||||||||||

| 2 | JPMorgan Chase Bank, N.A. | Diversified Banks | IG | Fort Worth | Texas | 386,154 | $4,850 | CPI: 0.0% Floor / 2.0% Cap | Mar-26 | 4.7 | $— | ||||||||||||||||||||||||

| 3 | Thermo Fisher Scientific Inc. | Pharmaceuticals | IG | Morrisville | North Carolina | 219,812 | $4,063 | Fixed: 2.00% annually | Oct-25 | 8.4 | $— | ||||||||||||||||||||||||

| 4 | Omnicom Group, Inc. | Advertising | IG | Playa Vista | California | 120,000 | $3,961 | None | N/A | 3.3 | $— | ||||||||||||||||||||||||

| 5 | R.R. Donnelley & Sons Company | Commercial Printing | Non-IG | Warrenville | Illinois | 167,215 | $3,393 | Fixed: 2.00% annually | Sep-25 | 2.3 | $— | ||||||||||||||||||||||||

| 6 | Board of Regents, State of Iowa (f) | Government Related Services | IG | Coralville | Iowa | 191,700 | $3,254 | CPI: 0.0% Floor / No Cap | Nov-25 | 5.3 | $— | ||||||||||||||||||||||||

| 7 | Bankers Financial Corporation (d) (g) | Property & Casualty Insurance | Non-IG | St. Petersburg | Florida | 167,581 | $3,228 | Fixed: 2.50% annually | N/A | 0.1 | $— | ||||||||||||||||||||||||

| 8 | JPMorgan Chase Bank, N.A. (sold on 7/18/25) | Diversified Banks | IG | Tampa | Florida | 176,150 | $3,053 | CPI: 0.0% Floor / 2.0% Cap | Mar-26 | 4.7 | $— | ||||||||||||||||||||||||

| 9 | Google, LLC | Internet Software & Services | IG | Venice | California | 67,681 | $3,018 | Fixed: 3.00% annually | Nov-25 | 5.3 | $— | ||||||||||||||||||||||||

| 10 | ICU MEDICAL, INC. (d) (h) | Health Care Supplies | Non-IG | Plymouth | Minnesota | 182,250 | $2,909 | Fixed: 3.25% annually | N/A | 0.3 | $— | ||||||||||||||||||||||||

| 11 | Northrop Grumman Systems Corporation | Aerospace & Defense | IG | Plymouth | Minnesota | 191,336 | $2,679 | Fixed: 2.00% annually | Dec-25 | 4.4 | $25,220 | ||||||||||||||||||||||||

| 12 | Intuit Inc. | Internet Software & Services | IG | Plano | Texas | 166,033 | $2,577 | Fixed: One-time $2.00/SF in '21 | N/A | 1.0 | $21,900 | ||||||||||||||||||||||||

| 13 | Cohesity Inc. | Systems Software | Non-IG | Roseville | Minnesota | 136,125 | $2,255 | Fixed: 2.00% annually | Dec-25 | 7.4 | $— | ||||||||||||||||||||||||

| 14 | Cenlar FSB | Regional Banks | Non-IG | Yardley | Pennsylvania | 105,584 | $2,105 | Fixed: 2.50% annually | Jan-26 | 3.0 | $— | ||||||||||||||||||||||||

| 15 | iHeartCommunications, Inc. | Broadcasting | Non-IG | San Antonio | Texas | 120,147 | $2,050 | Fixed: 2.00% annually | Feb-26 | 9.6 | $— | ||||||||||||||||||||||||

| 16 | JPMorgan Chase Bank, N.A. (d) (e) | Diversified Banks | IG | Tampa | Florida | 135,733 | $1,932 | CPI: 0.0% Floor / 2.0% Cap | Mar-26 | 2.6 | $— | ||||||||||||||||||||||||

| 17 | Arbella Service Company, Inc. | Property & Casualty Insurance | IG | Quincy | Massachusetts | 132,160 | $1,850 | Fixed: One-time $1.00/SF in '22 | N/A | 1.9 | $— | ||||||||||||||||||||||||

| 18 | ICF Consulting Group, Inc. | IT Consulting & Other Services | Non-IG | Martinsville | Virginia | 93,333 | $1,830 | CPI: 0.0% Floor / No Cap | Jan-26 | 1.6 | $— | ||||||||||||||||||||||||

| 19 | Acosta, Inc. | Advertising | Non-IG | Jacksonville | Florida | 88,062 | $1,541 | Fixed: $0.50/SF annually | Jul-25 | 2.1 | $9,768 | ||||||||||||||||||||||||

| 20 | Safelite Group, Inc. | Specialized Consumer Services | Non-IG | Rio Rancho | New Mexico | 94,649 | $1,527 | Fixed: 2.00% annually | Jan-26 | 3.9 | $— | ||||||||||||||||||||||||

| 21 | Master Lock Company, LLC | Building Products | Non-IG | Oak Creek | Wisconsin | 120,883 | $1,466 | Fixed: 2.00% annually | Jun-26 | 6.9 | $— | ||||||||||||||||||||||||

| 22 | Midcontinent Independent Stm Op Inc. (i) | Electric Utilities | IG | Eagan | Minnesota | 60,463 | $1,148 | Fixed: 2.50% annually | Mar-27 | 10.7 | $8,796 | ||||||||||||||||||||||||

| 23 | North American Lighting, Inc. | Auto Parts & Equipment | Non-IG | Farmington Hills | Michigan | 75,286 | $1,084 | Fixed: 2.50% annually | N/A | 0.8 | $5,967 | ||||||||||||||||||||||||

| 24 | Radiate Holdings, L.P. | Cable & Satellite | Non-IG | San Marcos | Texas | 47,000 | $1,074 | CPI: 0.0% Floor / 3.0% Cap | Aug-25 | 3.2 | $— | ||||||||||||||||||||||||

| 25 | Arcfield Acquisition Corporation | Aerospace & Defense | Non-IG | King of Prussia | Pennsylvania | 88,578 | $1,000 | Fixed: One-time 17.50% in '23 | N/A | 0.4 | $— | ||||||||||||||||||||||||

| 26 | Pioneer Credit Recovery, Inc. (d) | Diversified Support Services | Non-IG | Moorestown | New Jersey | 65,567 | $931 | Fixed: 2.50% annually | Jan-26 | 2.6 | $— | ||||||||||||||||||||||||

| 27 | APCO Holdings, Inc. | Property & Casualty Insurance | Non-IG | Norcross | Georgia | 50,600 | $631 | Fixed: 2.50% annually | Mar-26 | 5.7 | $— | ||||||||||||||||||||||||

Net Lease Office Properties | 12 | |||||

| 28 | Undisclosed – multi-national provider of industrial gases | Industrial Gases | IG | Houston | Texas | 49,821 | $629 | Fixed: 2.00% annually | N/A | 0.5 | $— | ||||||||||||||||||||||||

| 29 | S&ME, Inc. | Environmental & Facilities Services | Non-IG | Raleigh | North Carolina | 31,120 | $545 | Fixed: 2.75% annually | Mar-26 | 11.7 | $— | ||||||||||||||||||||||||

| 30 | Radiate Holdings, L.P. | Cable & Satellite | Non-IG | Waco | Texas | 30,699 | $473 | CPI: 0.0% Floor / 3.0% Cap | Aug-25 | 3.2 | $— | ||||||||||||||||||||||||

| 31 | Radiate Holdings, L.P. | Cable & Satellite | Non-IG | Corpus Christi | Texas | 20,717 | $355 | CPI: 0.0% Floor / 3.0% Cap | Aug-25 | 3.2 | $— | ||||||||||||||||||||||||

| 32 | Radiate Holdings, L.P. | Cable & Satellite | Non-IG | Odessa | Texas | 21,193 | $236 | CPI: 0.0% Floor / 3.0% Cap | Aug-25 | 3.2 | $— | ||||||||||||||||||||||||

| 33 | Radiate Holdings, L.P. | Cable & Satellite | Non-IG | San Marcos | Texas | 14,400 | $212 | CPI: 0.0% Floor / 3.0% Cap | Aug-25 | 3.2 | $— | ||||||||||||||||||||||||

| 34 | Vacant (formerly BCBSM, Inc.) (g) | N/A | N/A | Eagan | Minnesota | 442,542 | $0 | N/A | N/A | 0.0 | $— | ||||||||||||||||||||||||

| 35 | Vacant (formerly BCBSM, Inc.) (g) | N/A | N/A | Eagan | Minnesota | 12,286 | $0 | N/A | N/A | 0.0 | $— | ||||||||||||||||||||||||

U.S. Total (j) | 5,137,648 | $83,145 | 4.2 | $71,651 | |||||||||||||||||||||||||||||||

| Encumbered Status | |||||||||||||||||||||||||||||||||||

| # | Primary Tenant | Industry | Credit (a) | City | Country | Square Footage | ABR | Rent Increase Type | Date of Next Increase | WALT (c) | In-Place Mortgage Debt | ||||||||||||||||||||||||

| 1 | Siemens AS | Industrial Conglomerates | IG | Oslo | Norway | 165,905 | $4,842 | CPI: 0.0% Floor / No Cap | N/A | 0.5 | $45,451 | ||||||||||||||||||||||||

European Total (j) | 165,905 | $4,842 | 0.5 | $45,451 | |||||||||||||||||||||||||||||||

Net Lease Office Properties | 13 | |||||

Net Lease Office Properties | 14 | |||||

| Normalized Pro Rata Cash NOI | |||||

Three Months Ended June 30, 2025 | |||||

| Consolidated Lease Revenues and Other | |||||

| Total lease revenues – as reported | $ | 27,508 | |||

Parking garage revenues (a) | 495 | ||||

| Less: Consolidated Reimbursable and Non-Reimbursable Property Expenses | |||||

| Reimbursable property expenses – as reported | 6,537 | ||||

| Non-reimbursable property expenses – as reported | 2,244 | ||||

| 19,222 | |||||

| Adjustments for Pro Rata Ownership of Real Estate Joint Ventures: | |||||

| Less: Pro rata share of NOI attributable to noncontrolling interests | (90) | ||||

| (90) | |||||

| 19,132 | |||||

| Adjustments for Pro Rata Non-Cash Items: | |||||

| Add: Straight-line and other leasing and financing adjustments | 726 | ||||

| Add: Above- and below-market rent intangible lease amortization | 316 | ||||

| Add: Other non-cash items | 109 | ||||

| 1,151 | |||||

Pro Rata Cash NOI (b) | 20,283 | ||||

Adjustment to normalize for intra-period dispositions (c) | 92 | ||||

Normalized Pro Rata Cash NOI (b) | $ | 20,375 | |||

Net Lease Office Properties | 15 | |||||

Three Months Ended June 30, 2025 | |||||

| Net Loss Attributable to NLOP | |||||

| Net loss attributable to NLOP – as reported | $ | (81,540) | |||

| Adjustments for Consolidated Operating Expenses | |||||

| Add: Operating expenses – as reported | 103,638 | ||||

| Less: Property expenses, excluding reimbursable tenant costs – as reported | (2,244) | ||||

| 101,394 | |||||

| Adjustments for Other Consolidated Revenues and Expenses: | |||||

| Less: Other lease-related income (excluding parking garage revenues) | (1,171) | ||||

| Less: Reimbursable property expenses – as reported | (6,537) | ||||

| Add: Other income and (expenses) – as reported | 6,954 | ||||

| Add: Provision for income taxes – as reported | 100 | ||||

| (654) | |||||

| Other Adjustments: | |||||

| Add: Straight-line and other leasing and financing adjustments | 726 | ||||

| Add: Above- and below-market rent intangible lease amortization | 316 | ||||

| Add: Property expenses, excluding reimbursable tenant costs, non-cash | 109 | ||||

Adjustment to normalize for intra-period dispositions (c) | 92 | ||||

| Less: Adjustments for pro rata ownership | (68) | ||||

| 1,175 | |||||

Normalized Pro Rata Cash NOI (b) | $ | 20,375 | |||

Net Lease Office Properties | 16 | |||||

| Disclosures Regarding Non-GAAP and Other Metrics | |||||

Net Lease Office Properties | 17 | |||||

Net Lease Office Properties | 18 | |||||