November 2025 NLOP Investor Presentation .2

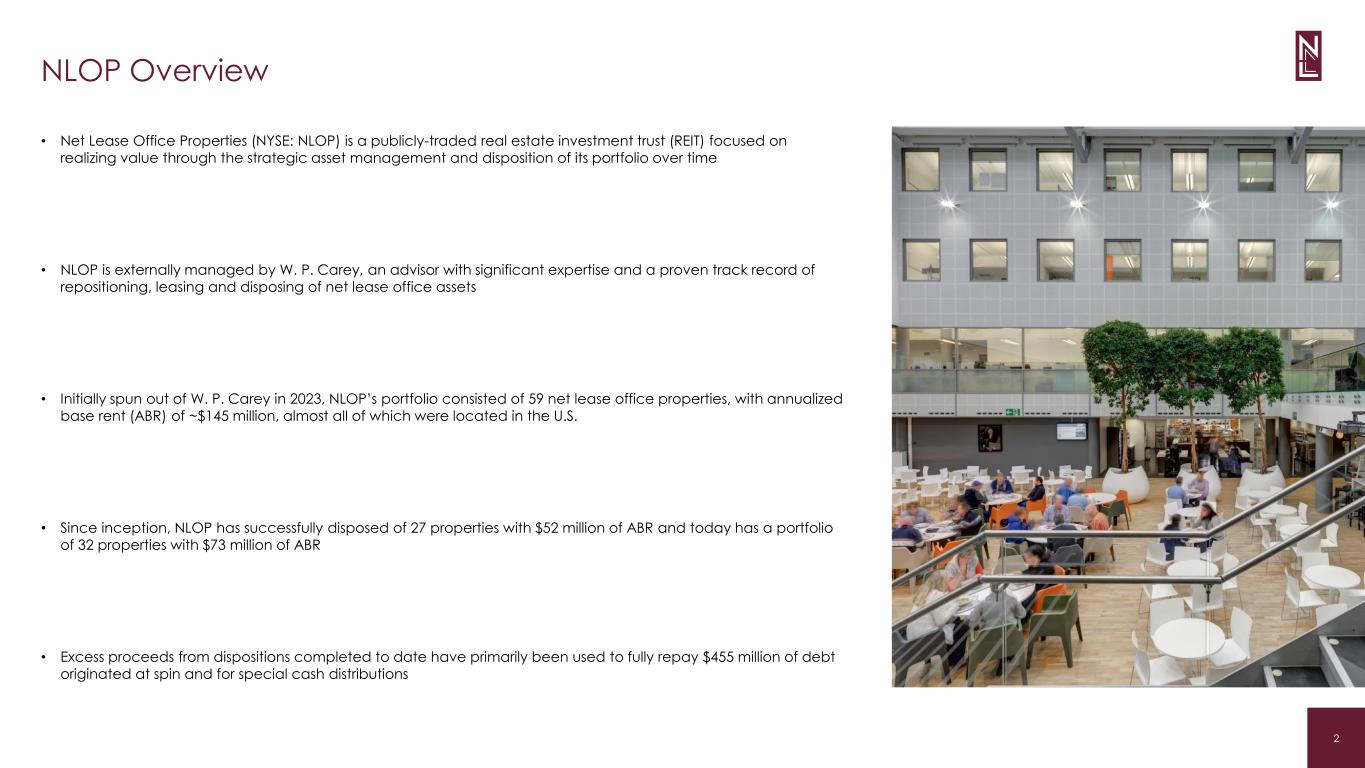

2 NLOP Overview • Net Lease Office Properties (NYSE: NLOP) is a publicly-traded real estate investment trust (REIT) focused on realizing value through the strategic asset management and disposition of its portfolio over time • NLOP is externally managed by W. P. Carey, an advisor with significant expertise and a proven track record of repositioning, leasing and disposing of net lease office assets • Initially spun out of W. P. Carey in 2023, NLOP’s portfolio consisted of 59 net lease office properties, with annualized base rent (ABR) of ~$145 million, almost all of which were located in the U.S. • Since inception, NLOP has successfully disposed of 27 properties with $52 million of ABR and today has a portfolio of 32 properties with $73 million of ABR • Excess proceeds from dispositions completed to date have primarily been used to fully repay $455 million of debt originated at spin and for special cash distributions

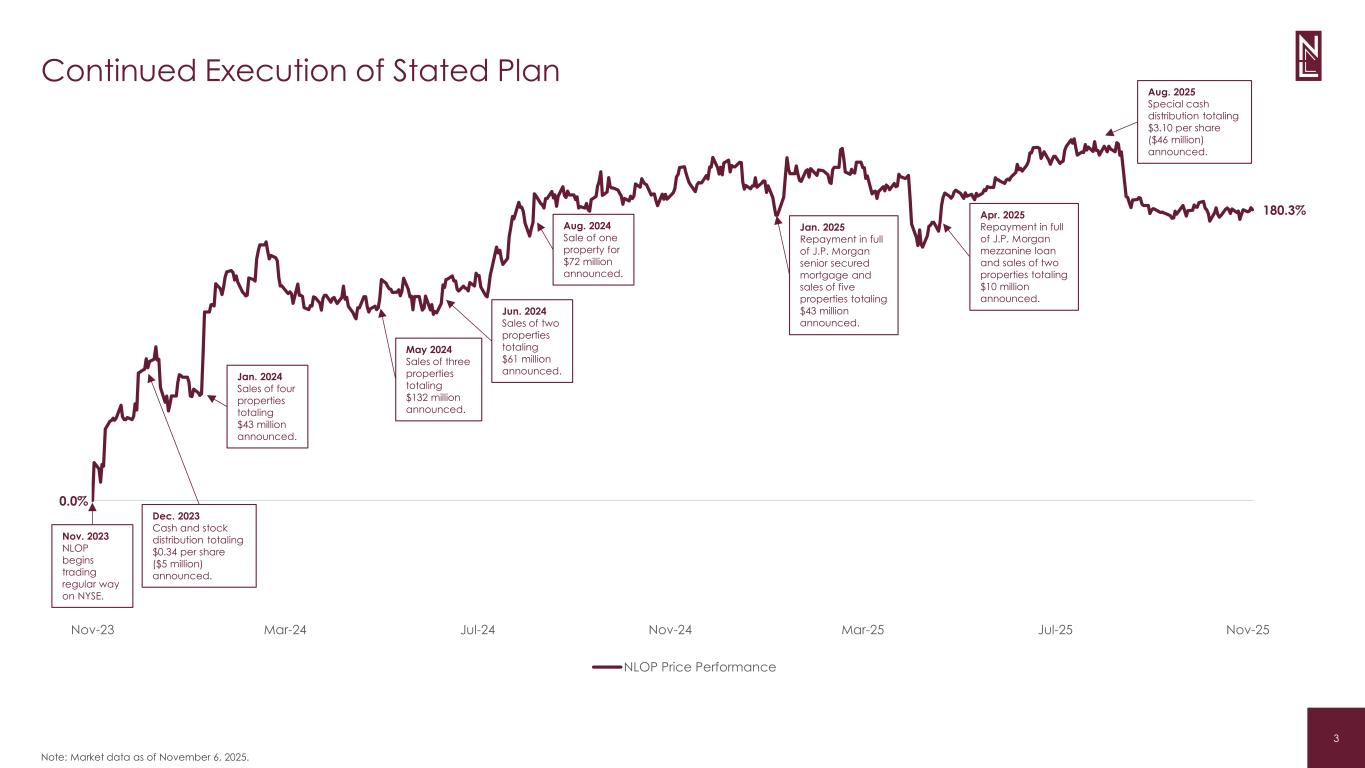

3 0.0% 180.3% Nov-23 Mar-24 Jul-24 Nov-24 Mar-25 Jul-25 Nov-25 NLOP Price Performance Continued Execution of Stated Plan Jan. 2024 Sales of four properties totaling $43 million announced. May 2024 Sales of three properties totaling $132 million announced. Jun. 2024 Sales of two properties totaling $61 million announced. Aug. 2024 Sale of one property for $72 million announced. Jan. 2025 Repayment in full of J.P. Morgan senior secured mortgage and sales of five properties totaling $43 million announced. Apr. 2025 Repayment in full of J.P. Morgan mezzanine loan and sales of two properties totaling $10 million announced. Note: Market data as of November 6, 2025. Nov. 2023 NLOP begins trading regular way on NYSE. Aug. 2025 Special cash distribution totaling $3.10 per share ($46 million) announced. Dec. 2023 Cash and stock distribution totaling $0.34 per share ($5 million) announced.

4 NLOP Business Plan Progression # of Properties 59 32 Total Square Footage 9 MM 5 MM Number of Tenants 62 36 ABR ($MM) $145 $73 WALT (1) 5.7 years 4.3 years Geography (US / Europe) (1) 89% / 11% 100% / -- % JPM Senior Loan $335 MM $ -- JPM Mezzanine Loan $120 MM $ -- Existing Mortgage Debt $168 MM $47 MM Wtd. Avg. Interest Rate 9.6% 8.2% (1) Figures are based on September 30, 2023 and September 30, 2025 ABR, respectively. P o rt fo lio B a la n c e S h e e t At Spin Today ST. PETERSBURG, FL CORALVILLE, IA

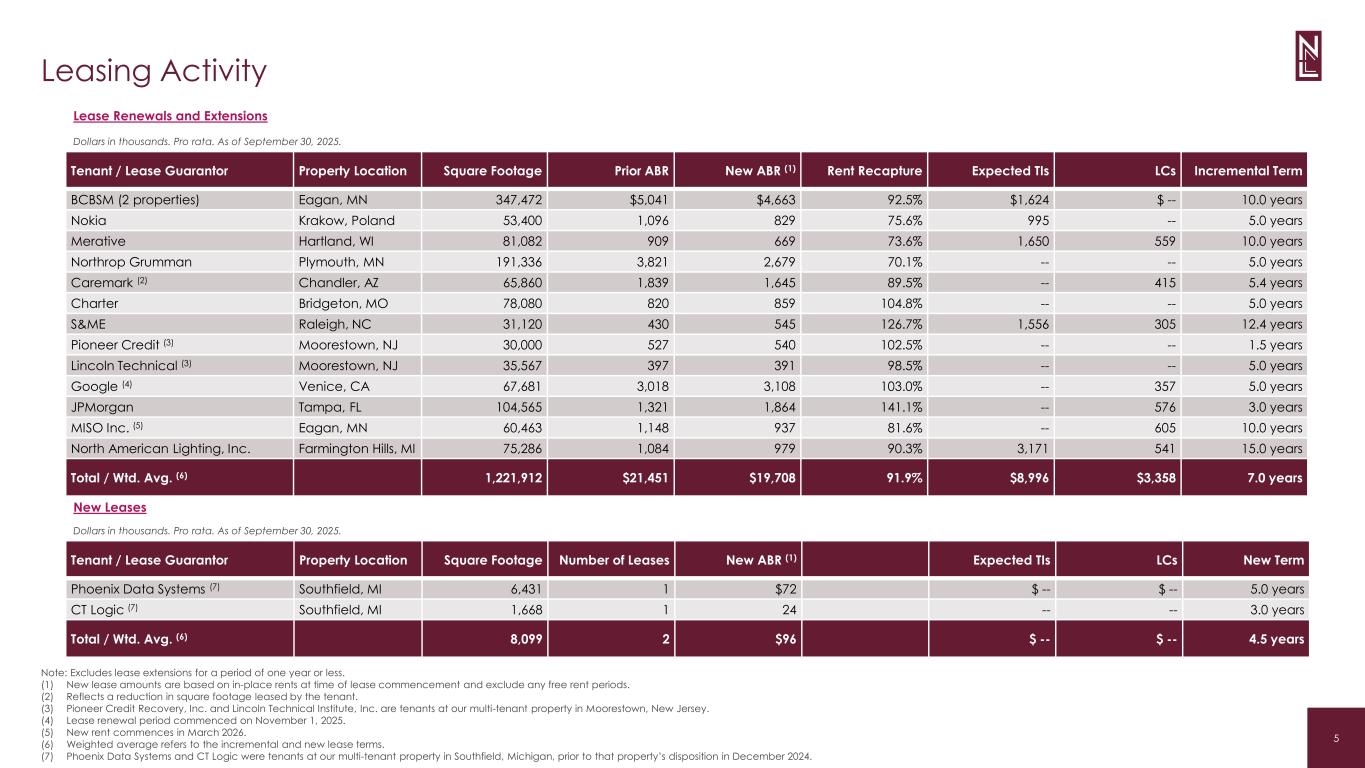

5 Leasing Activity Tenant / Lease Guarantor Property Location Square Footage Prior ABR New ABR (1) Rent Recapture Expected TIs LCs Incremental Term BCBSM (2 properties) Eagan, MN 347,472 $5,041 $4,663 92.5% $1,624 $ -- 10.0 years Nokia Krakow, Poland 53,400 1,096 829 75.6% 995 -- 5.0 years Merative Hartland, WI 81,082 909 669 73.6% 1,650 559 10.0 years Northrop Grumman Plymouth, MN 191,336 3,821 2,679 70.1% -- -- 5.0 years Caremark (2) Chandler, AZ 65,860 1,839 1,645 89.5% -- 415 5.4 years Charter Bridgeton, MO 78,080 820 859 104.8% -- -- 5.0 years S&ME Raleigh, NC 31,120 430 545 126.7% 1,556 305 12.4 years Pioneer Credit (3) Moorestown, NJ 30,000 527 540 102.5% -- -- 1.5 years Lincoln Technical (3) Moorestown, NJ 35,567 397 391 98.5% -- -- 5.0 years Google (4) Venice, CA 67,681 3,018 3,108 103.0% -- 357 5.0 years JPMorgan Tampa, FL 104,565 1,321 1,864 141.1% -- 576 3.0 years MISO Inc. (5) Eagan, MN 60,463 1,148 937 81.6% -- 605 10.0 years North American Lighting, Inc. Farmington Hills, MI 75,286 1,084 979 90.3% 3,171 541 15.0 years Total / Wtd. Avg. (6) 1,221,912 $21,451 $19,708 91.9% $8,996 $3,358 7.0 years Dollars in thousands. Pro rata. As of September 30, 2025. Note: Excludes lease extensions for a period of one year or less. (1) New lease amounts are based on in-place rents at time of lease commencement and exclude any free rent periods. (2) Reflects a reduction in square footage leased by the tenant. (3) Pioneer Credit Recovery, Inc. and Lincoln Technical Institute, Inc. are tenants at our multi-tenant property in Moorestown, New Jersey. (4) Lease renewal period commenced on November 1, 2025. (5) New rent commences in March 2026. (6) Weighted average refers to the incremental and new lease terms. (7) Phoenix Data Systems and CT Logic were tenants at our multi-tenant property in Southfield, Michigan, prior to that property’s disposition in December 2024. Lease Renewals and Extensions Tenant / Lease Guarantor Property Location Square Footage Number of Leases New ABR (1) Expected TIs LCs New Term Phoenix Data Systems (7) Southfield, MI 6,431 1 $72 $ -- $ -- 5.0 years CT Logic (7) Southfield, MI 1,668 1 24 -- -- 3.0 years Total / Wtd. Avg. (6) 8,099 2 $96 $ -- $ -- 4.5 years Dollars in thousands. Pro rata. As of September 30, 2025. New Leases

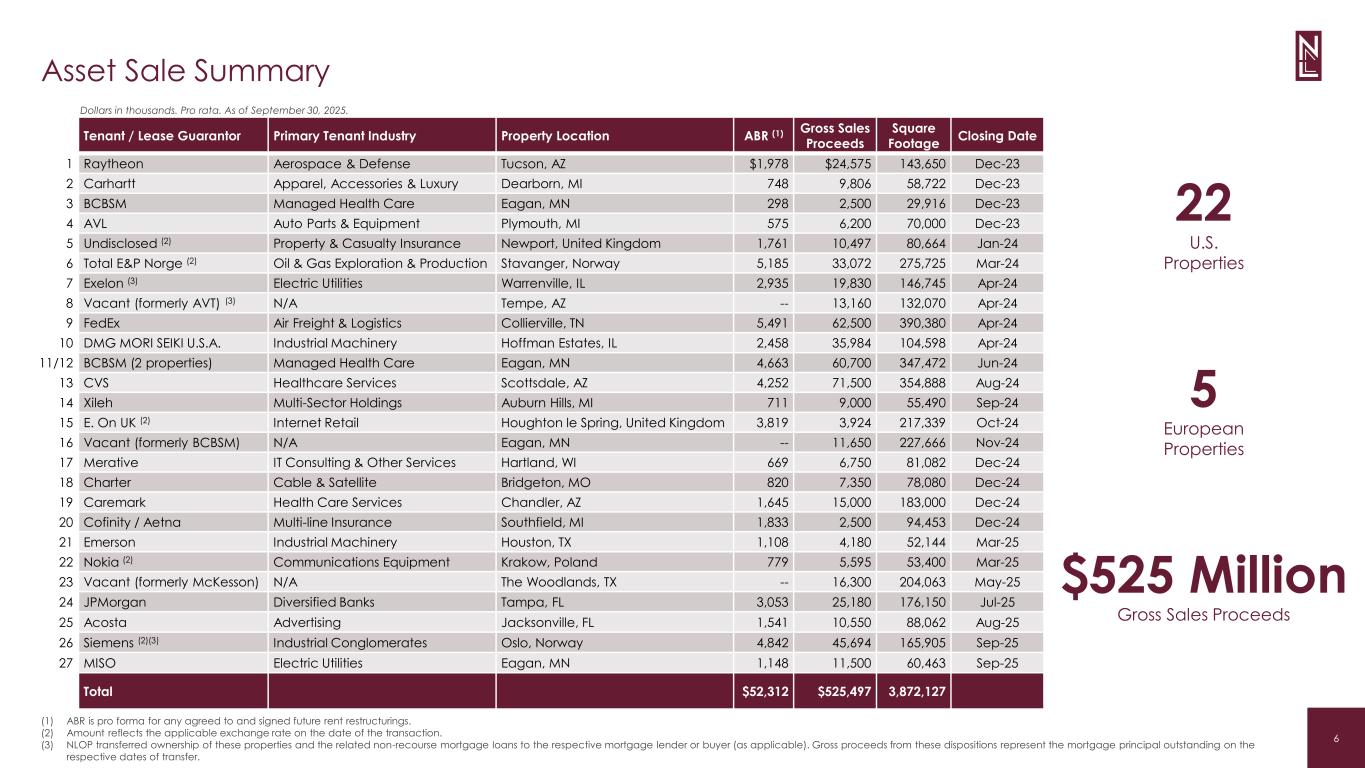

6 Asset Sale Summary Tenant / Lease Guarantor Primary Tenant Industry Property Location ABR (1) Gross Sales Proceeds Square Footage Closing Date 1 Raytheon Aerospace & Defense Tucson, AZ $1,978 $24,575 143,650 Dec-23 2 Carhartt Apparel, Accessories & Luxury Dearborn, MI 748 9,806 58,722 Dec-23 3 BCBSM Managed Health Care Eagan, MN 298 2,500 29,916 Dec-23 4 AVL Auto Parts & Equipment Plymouth, MI 575 6,200 70,000 Dec-23 5 Undisclosed (2) Property & Casualty Insurance Newport, United Kingdom 1,761 10,497 80,664 Jan-24 6 Total E&P Norge (2) Oil & Gas Exploration & Production Stavanger, Norway 5,185 33,072 275,725 Mar-24 7 Exelon (3) Electric Utilities Warrenville, IL 2,935 19,830 146,745 Apr-24 8 Vacant (formerly AVT) (3) N/A Tempe, AZ -- 13,160 132,070 Apr-24 9 FedEx Air Freight & Logistics Collierville, TN 5,491 62,500 390,380 Apr-24 10 DMG MORI SEIKI U.S.A. Industrial Machinery Hoffman Estates, IL 2,458 35,984 104,598 Apr-24 11/12 BCBSM (2 properties) Managed Health Care Eagan, MN 4,663 60,700 347,472 Jun-24 13 CVS Healthcare Services Scottsdale, AZ 4,252 71,500 354,888 Aug-24 14 Xileh Multi-Sector Holdings Auburn Hills, MI 711 9,000 55,490 Sep-24 15 E. On UK (2) Internet Retail Houghton le Spring, United Kingdom 3,819 3,924 217,339 Oct-24 16 Vacant (formerly BCBSM) N/A Eagan, MN -- 11,650 227,666 Nov-24 17 Merative IT Consulting & Other Services Hartland, WI 669 6,750 81,082 Dec-24 18 Charter Cable & Satellite Bridgeton, MO 820 7,350 78,080 Dec-24 19 Caremark Health Care Services Chandler, AZ 1,645 15,000 183,000 Dec-24 20 Cofinity / Aetna Multi-line Insurance Southfield, MI 1,833 2,500 94,453 Dec-24 21 Emerson Industrial Machinery Houston, TX 1,108 4,180 52,144 Mar-25 22 Nokia (2) Communications Equipment Krakow, Poland 779 5,595 53,400 Mar-25 23 Vacant (formerly McKesson) N/A The Woodlands, TX -- 16,300 204,063 May-25 24 JPMorgan Diversified Banks Tampa, FL 3,053 25,180 176,150 Jul-25 25 Acosta Advertising Jacksonville, FL 1,541 10,550 88,062 Aug-25 26 Siemens (2)(3) Industrial Conglomerates Oslo, Norway 4,842 45,694 165,905 Sep-25 27 MISO Electric Utilities Eagan, MN 1,148 11,500 60,463 Sep-25 Total $52,312 $525,497 3,872,127 Dollars in thousands. Pro rata. As of September 30, 2025. 22 U.S. Properties 5 European Properties $525 Million Gross Sales Proceeds (1) ABR is pro forma for any agreed to and signed future rent restructurings. (2) Amount reflects the applicable exchange rate on the date of the transaction. (3) NLOP transferred ownership of these properties and the related non-recourse mortgage loans to the respective mortgage lender or buyer (as applicable). Gross proceeds from these dispositions represent the mortgage principal outstanding on the respective dates of transfer.

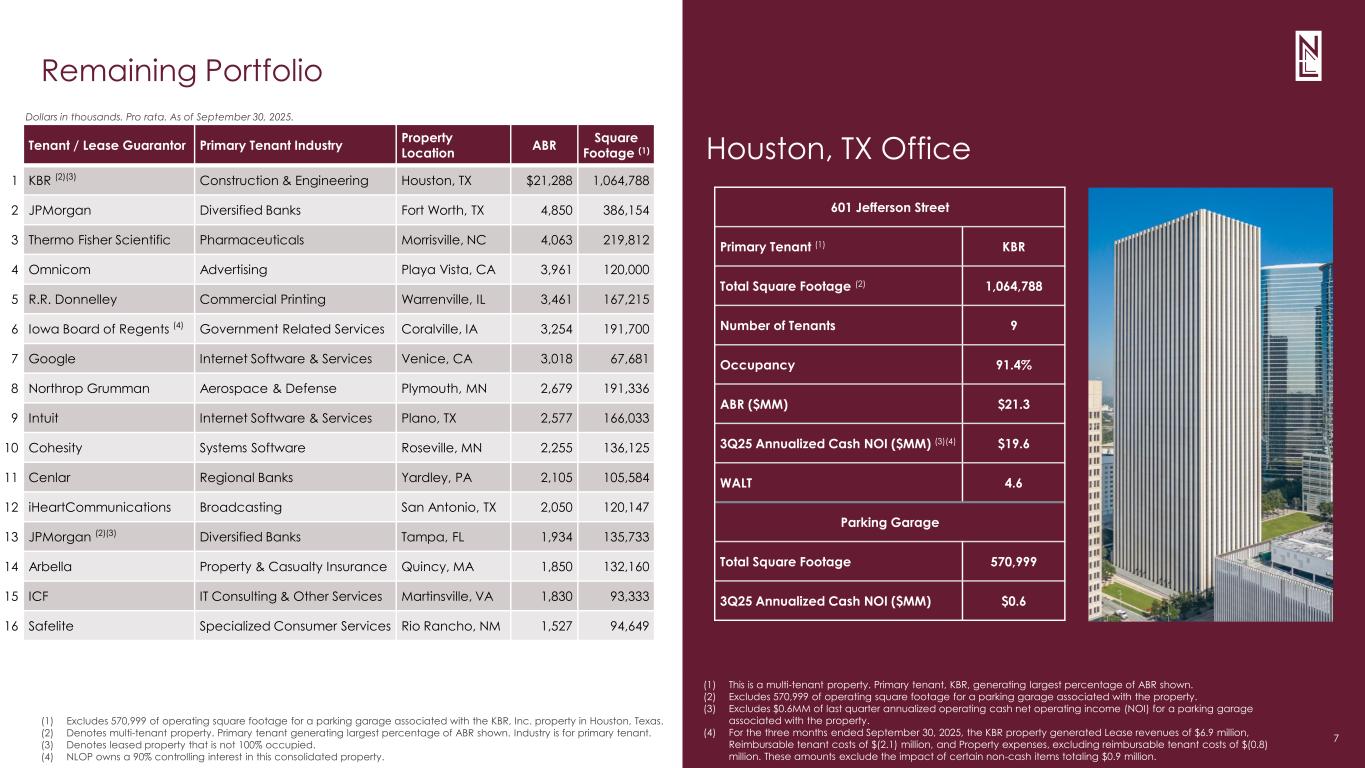

7 Remaining Portfolio Tenant / Lease Guarantor Primary Tenant Industry Property Location ABR Square Footage (1) 1 KBR (2)(3) Construction & Engineering Houston, TX $21,288 1,064,788 2 JPMorgan Diversified Banks Fort Worth, TX 4,850 386,154 3 Thermo Fisher Scientific Pharmaceuticals Morrisville, NC 4,063 219,812 4 Omnicom Advertising Playa Vista, CA 3,961 120,000 5 R.R. Donnelley Commercial Printing Warrenville, IL 3,461 167,215 6 Iowa Board of Regents (4) Government Related Services Coralville, IA 3,254 191,700 7 Google Internet Software & Services Venice, CA 3,018 67,681 8 Northrop Grumman Aerospace & Defense Plymouth, MN 2,679 191,336 9 Intuit Internet Software & Services Plano, TX 2,577 166,033 10 Cohesity Systems Software Roseville, MN 2,255 136,125 11 Cenlar Regional Banks Yardley, PA 2,105 105,584 12 iHeartCommunications Broadcasting San Antonio, TX 2,050 120,147 13 JPMorgan (2)(3) Diversified Banks Tampa, FL 1,934 135,733 14 Arbella Property & Casualty Insurance Quincy, MA 1,850 132,160 15 ICF IT Consulting & Other Services Martinsville, VA 1,830 93,333 16 Safelite Specialized Consumer Services Rio Rancho, NM 1,527 94,649 Dollars in thousands. Pro rata. As of September 30, 2025. (1) Excludes 570,999 of operating square footage for a parking garage associated with the KBR, Inc. property in Houston, Texas. (2) Denotes multi-tenant property. Primary tenant generating largest percentage of ABR shown. Industry is for primary tenant. (3) Denotes leased property that is not 100% occupied. (4) NLOP owns a 90% controlling interest in this consolidated property. Houston, TX Office (1) This is a multi-tenant property. Primary tenant, KBR, generating largest percentage of ABR shown. (2) Excludes 570,999 of operating square footage for a parking garage associated with the property. (3) Excludes $0.6MM of last quarter annualized operating cash net operating income (NOI) for a parking garage associated with the property. (4) For the three months ended September 30, 2025, the KBR property generated Lease revenues of $6.9 million, Reimbursable tenant costs of $(2.1) million, and Property expenses, excluding reimbursable tenant costs of $(0.8) million. These amounts exclude the impact of certain non-cash items totaling $0.9 million. 601 Jefferson Street Primary Tenant (1) KBR Total Square Footage (2) 1,064,788 Number of Tenants 9 Occupancy 91.4% ABR ($MM) $21.3 3Q25 Annualized Cash NOI ($MM) (3)(4) $19.6 WALT 4.6 Parking Garage Total Square Footage 570,999 3Q25 Annualized Cash NOI ($MM) $0.6

8 Dollars in thousands. Pro rata. As of September 30, 2025. Tenant / Lease Guarantor Primary Tenant Industry Property Location ABR Square Footage 17 Master Lock (3)(4) Building Products Oak Creek, WI 1,466 120,883 18 Securitas Electronic (1)(2) Electronic Equipment & Instruments Plymouth, MN 1,218 182,250 19 Radiate Cable & Satellite San Marcos, TX 1,101 47,000 20 NA Lighting (5) Auto Parts & Equipment Farmington Hills, MI 1,084 75,286 21 Arcfield Aerospace & Defense King of Prussia, PA 1,000 88,578 22 Pioneer Credit (1) Diversified Support Services Moorestown, NJ 931 65,567 23 APCO Property & Casualty Insurance Norcross, GA 631 50,600 24 Undisclosed Industrial Gases Houston, TX 629 49,821 25 S&ME Environmental & Facilities Services Raleigh, NC 544 31,120 26 Radiate Cable & Satellite Waco, TX 484 30,699 27 Radiate Cable & Satellite Corpus Christi, TX 363 20,717 28 Radiate Cable & Satellite Odessa, TX 242 21,193 29 Radiate Cable & Satellite San Marcos, TX 217 14,400 30 Vacant (fmr. BCBSM) (3) N/A Eagan, MN – 442,542 31 Vacant (fmr. Bankers) (3) N/A St. Petersburg, FL – 167,581 32 Vacant (fmr. BCBSM) (3) N/A Eagan, MN – 12,286 Total $72,612 4,812,973 Remaining Portfolio (continued) (1) Denotes multi-tenant property. Primary tenant generating largest percentage of ABR shown. Industry is for primary tenant. (2) Denotes leased property that is not 100% occupied. (3) Denotes property that is vacant as of the date of this report. (4) In September 2025, NLOP entered into a lease termination agreement with the tenant to terminate the lease on October 31, 2025 (the previous lease expiration date was May 31, 2032). In connection with the agreement, the tenant paid NLOP a lease termination fee of $13.0 million in October 2025. (5) In September 2025, NLOP entered into a lease amendment with the tenant to extend the term beyond its prior lease expiration of March 2026. Rent will reset to $1.0 million effective April 2026, with 2.50% annual rent increases beginning April 2027. PLAYA VISTA, CA