| EXECUTION VERSION 2109710.06-NYCSR07A - MSW AMENDMENT NO. 3 TO MARGIN LOAN AGREEMENT This AMENDMENT NO. 3 (this "Amendment"), dated as of January 23, 2025, to the Margin Loan Agreement, dated as of March 31, 2023 (as amended by Amendment No. 1, dated as of October 6, 2023, and Amendment No. 2, dated as of September 30, 2024 ("Amendment No. 2"), and as further amended, restated, supplemented or modified from time to time, the "Margin Loan Agreement"), by and among Star Investment Holdings SPV LLC (the "Borrower"), Morgan Stanley Bank, N.A., as initial Lender and the other Lenders party thereto from time to time, Morgan Stanley Senior Funding, Inc., as Administrative Agent (the "Administrative Agent"), and Morgan Stanley & Co. LLC, as Calculation Agent, is entered into by and among the Borrower and the Lenders, and acknowledged by the Administrative Agent. PRELIMINARY STATEMENTS: WHEREAS, at the Borrower's request and pursuant to Amendment No. 2, the Lenders previously released 600,000 Collateral Shares from the Collateral in order to facilitate the Permitted Parent Transfer (as defined below) and the Borrower subsequently completed the Permitted Parent Transfer. WHEREAS, in light of recent changes in the market value of the Collateral Shares, the Borrower has requested that Lenders allow the Borrower to pledge 600,000 Shares (which may include the Returned Shares (as defined below)) as a deposit of Collateral, whereupon they shall be treated as Collateral Shares, and Lenders are willing to accept such deposit, subject to the terms and conditions of this Amendment. NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, and subject to the conditions set forth herein, the parties hereto hereby agree as follows: SECTION 1. Defined Terms; Amendment. Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Margin Loan Agreement. For purposes of this Amendment, the following terms have the following meanings: "Amendment No. 3 Shares" means the 600,000 Collateral Shares deposited by the Borrower in accordance with this Amendment (which may include the Returned Shares). "Permitted Parent Transfer" has the meaning given such term in Amendment No. 2. "Returned Shares" means the 600,000 Collateral Shares previously released to the Borrower pursuant to Amendment No. 2. SECTION 2. Deposit of Amendment No. 3 Shares to Collateral Account; Valuation; Amendments to the Account Control Agreement. (a) The parties agree that effective as of the Effective Date, the Borrower shall cause the Amendment No. 3 Shares to be deposited to the Collateral Account specified in Annex |

| - 2 - I of the Account Control Agreement (as amended hereby) as the "Amendment No. 3 Collateral Account" in accordance with the Collateral Account instructions previously provided by the Administrative Agent to the Borrower, and upon the completion of such deposit in accordance with such instructions, the Amendment No. 3 Shares shall be treated as Collateral Shares held for the benefit of, and subject to the Lien of, the Lenders under the Margin Loan Documentation. (b) Until the date that is one year from the Effective Date, the term "Share Collateral Value," as used in the Margin Loan Documentation, shall be amended and restated as set forth below. Following such one-year anniversary, the version of such definition before giving effect to the changes shown below shall be restored and become the operative definition under the Margin Loan Documentation. "Share Collateral Value" means, at any time of determination, the sum of (1) the product of (a) the number of Collateral Shares other than Amendment No. 3 Shares then constituting Acceptable Collateral, excluding any of such Collateral Shares that have been sold pursuant to any Permitted Sale Transaction and remain in the Collateral Accounts pending settlement thereof multiplied by (b) the Reference Price at such time of determination, plus (2) the product of (a) the number of Amendment No. 3 Shares then constituting Acceptable Collateral, excluding any of such Amendment No. 3 Shares that have been sold pursuant to any Permitted Sale Transaction and remain in the Collateral Accounts pending settlement thereof, multiplied by (b) 90% of the Reference Price at such time of determination, expressed as a dollar amount (i.e., the Reference Price multiplied by 0.9). (c) The parties agree that effective as of the Effective Date, the Account Control Agreement shall be amended by: (i) deleting the definition of "Account" and replacing it with the following: ""Account" shall mean the accounts (together with any successor or replacement account or sub-account) listed on Annex I to this Agreement (as the same may be redesignated, renumbered or otherwise modified), which have been established and maintained by Custodian hereunder in the name of Pledgor. For purposes of the UCC, the Account is a "securities account" (within the meaning of Section 8-501(a) of the UCC)." (ii) deleting Annex I and replacing it with Annex I attached hereto. SECTION 3. Representations and Warranties. Borrower hereby represents and warrants to each Lender as of the Effective Date with respect to itself that: (a) this Amendment has been duly authorized, executed and delivered by the Borrower and constitutes a legal, valid and binding obligation of the Borrower enforceable against the Borrower in accordance with its terms, subject to (i) the effects of bankruptcy, insolvency, |

| - 3 - moratorium, reorganization, fraudulent conveyance or other similar laws affecting creditors' rights generally, (ii) general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law) and (iii) implied covenants of good faith and fair dealing; (b) the execution, delivery and performance by the Borrower of this Amendment (i) have been duly authorized by all partnership or limited liability company action required to be obtained by the Borrower and (ii) will not (x) violate (A) any provision of law, statute, rule or regulation applicable to the Borrower, (B) the certificate or articles of incorporation or other constitutive documents (including any partnership, limited liability company or operating agreements) or by-laws of the Borrower, (C) any applicable order of any court or any rule, regulation or order of any Governmental Authority applicable to the Borrower or (D) any provision of any indenture, certificate of designation for preferred stock, agreement or other instrument to which the Borrower is a party or by which it or any of its property is or may be bound, (y) result in a breach of or constitute (alone or with due notice or lapse of time or both) a default under, give rise to a right of or result in any cancellation or acceleration of any right or obligation (including any payment) under any such indenture, certificate of designation for preferred stock, agreement or other instrument, where any such conflict, violation, breach or default referred to in clause (x)(D) or (y) of this clause (b), would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, or (z) result in the creation or imposition of any Lien upon or with respect to (1) any property or assets now owned or hereafter acquired by the Borrower, other than the Liens created by the Margin Loan Documentation and Permitted Liens, or (2) any Equity Interests of the Borrower; (c) it has not provided any Material Nonpublic Information with respect to the Issuer and its Subsidiaries or the Shares to any Agent or Lender. Since December 31, 2023, no event has occurred or condition arisen, either individually or in the aggregate, that would reasonably be expected to result in an Issuer Material Adverse Effect; (d) Borrower owns all of its assets (including all of the Collateral credited to the Collateral Accounts) free and clear of Liens, other than Permitted Liens; and has not made nor consented to, nor is Borrower aware of, any registrations, filings or recordations in any jurisdiction evidencing a security interest in any of its properties, including the filing of a register of mortgages, charges and other encumbrances or filings of UCC-1 financing statements, other than with respect to Liens granted to Lenders under the Margin Loan Documentation and Permitted Liens; and (e) the Amendment No. 3 Shares (i) are not subject to any Transfer Restrictions (other than Existing Transfer Restrictions) or Restrictive Conditions, (ii) do not contain any restrictive legends (it being understood that the Issuer Agreement does not constitute “restrictive legends” for this purpose), and do not require any opinions from Issuer’s counsel, or the removal of any “stop transfer order,” or the delivery of any documentation, prior to the sale of such Shares, and (iii) are not subject to any shareholders’ agreement, investor rights agreement or any other similar agreement or any voting or other contractual restriction (other than the Merger Lockup). SECTION 4. Conditions to Effectiveness. This Amendment shall become effective on the date (the time of such satisfaction, the "Effective Date") on which each of the conditions set forth in this Section 4 have been satisfied. |

| - 4 - (a) The Administrative Agent has received counterparts of this Amendment duly executed by the Borrower and the Lenders and acknowledged by the Administrative Agent. (b) No Default, Event of Default, Collateral Shortfall, Mandatory Prepayment Event or Facility Adjustment Event has occurred and is continuing as of the date hereof or would result from, or after giving effect to, this Amendment. (c) The Borrower shall have deposited the Amendment No. 3 Shares to the Collateral Account in accordance with Section 2 hereof. (d) Administrative Agent and each Lender shall have received, in form and substance reasonably satisfactory to Administrative Agent and each Lender, a customary opinion of Borrower’s counsel addressed to Administrative Agent and the Lenders, dated as of the date of this Amendment. SECTION 5. Reference to and Effect on the Margin Loan Documentation. ( a ) From and after the Effective Date, each reference in the Margin Loan Agreement to "hereunder", "hereof", "Agreement", "this Agreement" or words of like import and each reference in the other Margin Loan Documentation to "Margin Loan Agreement", "thereunder", "thereof" or words of like import shall, unless the context otherwise requires, mean and be a reference to the Margin Loan Agreement as amended by this Amendment. From and after the Effective Date, this Amendment shall be Margin Loan Documentation under the Margin Loan Agreement. For the avoidance of doubt, any references to "date hereof" or "date of this Agreement" and each other similar reference in the Margin Loan Agreement shall continue to refer to March 31, 2023. (b) Each Security Agreement and other Margin Loan Documentation, as specifically amended by this Amendment, are and shall continue to be in full force and effect and are hereby in all respects ratified and confirmed, and the respective guarantees, pledges, grants of security interests and other agreements, as applicable, under the Margin Loan Documentation, notwithstanding the consummation of the transactions contemplated hereby, shall continue to be in full force and effect and shall accrue to the benefit of the Lenders under the Margin Loan Agreement. Without limiting the generality of the foregoing, the Margin Loan Documentation and all of the Collateral described therein do and shall continue to secure the payment of all Obligations of the Borrower under the Margin Loan Documentation, in each case, as amended by this Amendment. (c) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Margin Loan Documentation, nor constitute a waiver of any provision of any of the Margin Loan Documentation. SECTION 6. Execution in Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute but one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by .pdf or other electronic form shall be effective as delivery of a manually executed original counterpart of this Amendment. |

| - 5 - SECTION 7. Amendments; Headings; Severability. This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by the Borrower and the Lenders party hereto. The section headings used herein are for convenience of reference only, are not part of this Amendment and are not to affect the construction of, or to be taken into consideration in interpreting this Amendment. Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof, and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction. The parties shall endeavor in good-faith negotiations to replace the invalid, illegal or unenforceable provisions with valid provisions, the economic effect of which comes as close as possible to that of the invalid, illegal or unenforceable provisions. SECTION 8. Governing Law; Etc. THIS AMENDMENT AND ANY CLAIMS, CONTROVERSY, DISPUTE OR CAUSES OF ACTION (WHETHER IN CONTRACT OR TORT OR OTHERWISE) BASED UPON, ARISING OUT OF OR RELATING TO THIS AMENDMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO ITS CONFLICT OF LAWS PROVISIONS OTHER THAN SECTION 5-1401 OF THE NEW YORK GENERAL OBLIGATIONS LAW. SECTION 9. No Novation. This Amendment shall not extinguish the obligations for the payment of money outstanding under the Margin Loan Agreement or discharge or release the Lien or priority of any Margin Loan Documentation or any other security therefor. Nothing herein contained shall be construed as a substitution or novation of the obligations outstanding under the Margin Loan Agreement or instruments securing the same, which shall remain in full force and effect, except to any extent modified hereby or by instruments executed concurrently herewith and except to the extent repaid as provided herein. Nothing implied in this Amendment or in any other document contemplated hereby shall be construed as a release or other discharge of the Borrower under any Margin Loan Documentation from any of its obligations and liabilities as a borrower or pledgor under any of the Margin Loan Documentation. SECTION 10. Notices. All notices hereunder shall be given in accordance with the provisions of Section 9.02 of the Margin Loan Agreement. [Signature Pages Follow] |

| [Signature Page to Amendment No. 3 to Margin Loan Agreement] 24012637833-v1 IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written. BORROWER: STAR INVESTMENT HOLDINGS SPV LLC, as Borrower By: ________________________________ Name: Brett Asnas Title: Chief Financial Officer Docusign Envelope ID: F88690E6-5305-4B67-97B6-313323E08EEA |

|

|

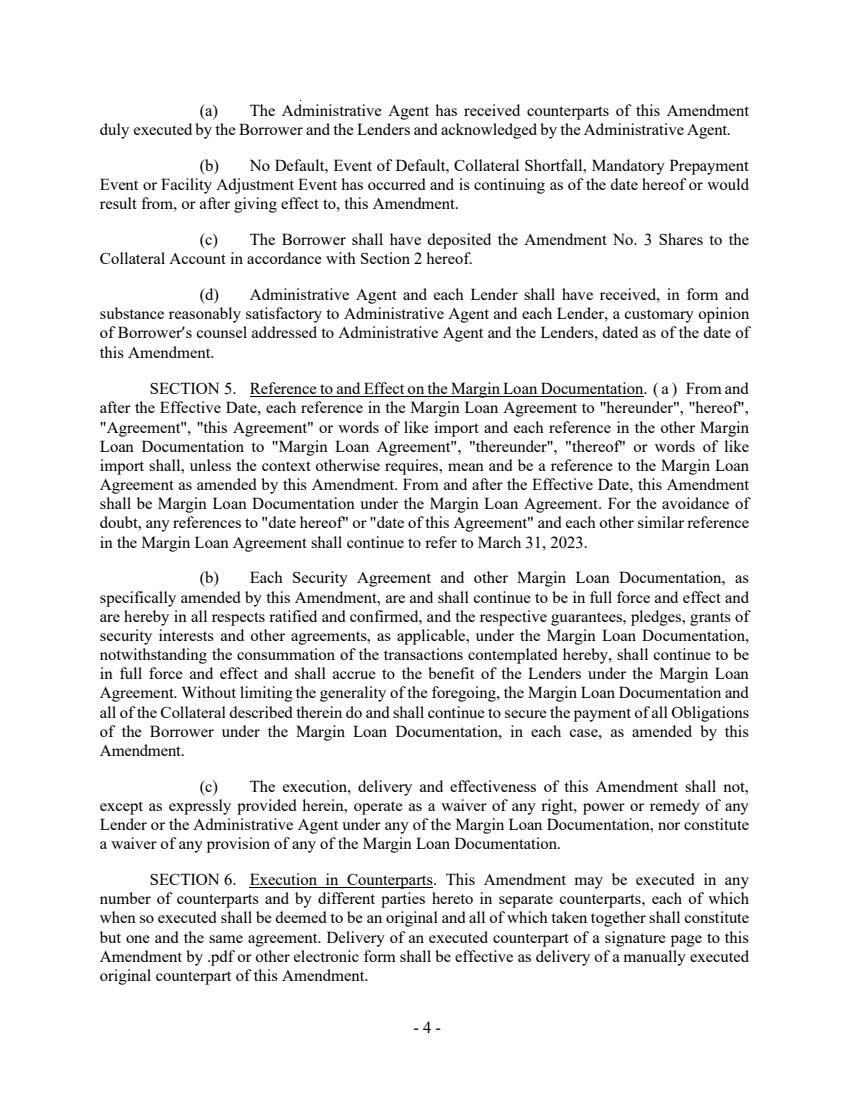

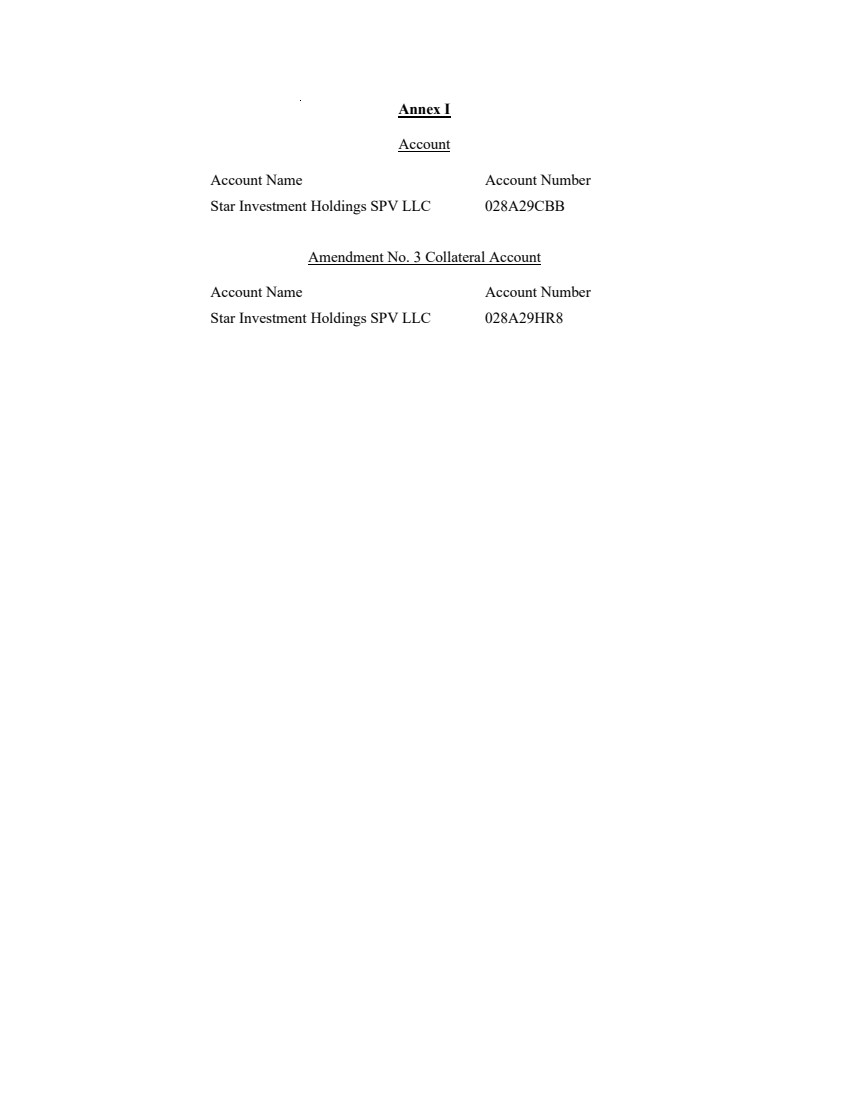

| Annex I Account Account Name Account Number Star Investment Holdings SPV LLC 028A29CBB Amendment No. 3 Collateral Account Account Name Account Number Star Investment Holdings SPV LLC 028A29HR8 |